Colpe de Cola Lessons from Venezuela Jared Fragin Katherine Friedman 3/18/2018 November 20, 2001 Gabriel Tam Vatnak Vat-Ho

Colpe de Cola Lessons from Venezuela Jared Fragin Katherine Friedman 3/18/2018 November 20, 2001 Gabriel Tam Vatnak Vat-Ho

Agenda v v v Current State of the Industry August 22 nd, 1996 Vertical Restraints Legal Implications What has Pepsi done? Next Steps

Agenda v v v Current State of the Industry August 22 nd, 1996 Vertical Restraints Legal Implications What has Pepsi done? Next Steps

Current State of the Industry v Coke: America, Asia, and Europe • Minimal market share in Venezuela and most Latin American countries • Looking for a way to gain market share v Pepsi: Latin America • Soft drink of choice in Venezuela by more than a 4: 1 margin over Coke

Current State of the Industry v Coke: America, Asia, and Europe • Minimal market share in Venezuela and most Latin American countries • Looking for a way to gain market share v Pepsi: Latin America • Soft drink of choice in Venezuela by more than a 4: 1 margin over Coke

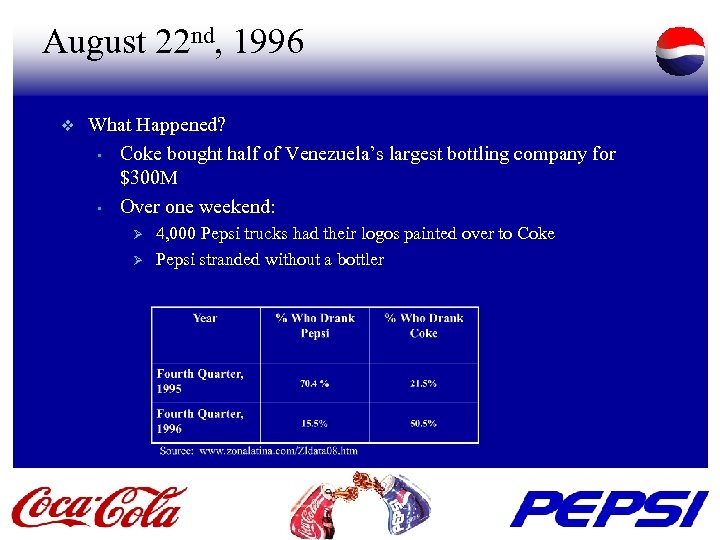

August 22 nd, 1996 v What Happened? • Coke bought half of Venezuela’s largest bottling company for $300 M • Over one weekend: Ø Ø 4, 000 Pepsi trucks had their logos painted over to Coke Pepsi stranded without a bottler

August 22 nd, 1996 v What Happened? • Coke bought half of Venezuela’s largest bottling company for $300 M • Over one weekend: Ø Ø 4, 000 Pepsi trucks had their logos painted over to Coke Pepsi stranded without a bottler

Vertical Restraints v v Vertical Restraints • Arrangements to reinforce vertical relations without explicit integration Cisneros had significant power • Near distribution monopoly in Venezuela • Hard to penetrate the market for newcomers

Vertical Restraints v v Vertical Restraints • Arrangements to reinforce vertical relations without explicit integration Cisneros had significant power • Near distribution monopoly in Venezuela • Hard to penetrate the market for newcomers

Vertical Restraints v v Pepsi refused to help Cisneros expand • Cisneros turned to Coke for capital • Coke achieved in two years what Pepsi had built over 50 years • Market share eventually exploded to 81% Tapered integration to arrange vertical restraints • Wield influence in input markets, enjoy competition • Vulnerable to competitors buying out your supplier and distributor

Vertical Restraints v v Pepsi refused to help Cisneros expand • Cisneros turned to Coke for capital • Coke achieved in two years what Pepsi had built over 50 years • Market share eventually exploded to 81% Tapered integration to arrange vertical restraints • Wield influence in input markets, enjoy competition • Vulnerable to competitors buying out your supplier and distributor

Legal Implications v Venezuelan Law • Any business activity which alone increased market share significantly must be approved by Government v Cisneros controlled 80% of the bottling market v Coke’s market share increased from 10 to 50% overnight ü Merger did not increase bottler’s market share and was therefore legal

Legal Implications v Venezuelan Law • Any business activity which alone increased market share significantly must be approved by Government v Cisneros controlled 80% of the bottling market v Coke’s market share increased from 10 to 50% overnight ü Merger did not increase bottler’s market share and was therefore legal

Legal Implications v Coke placed six bottling plants and other assets (or ‘junk’ according to Pepsi) for sale to Pepsi v Cisneros offered to continue Pepsi production at 25% of output for one month to give Pepsi a chance to sign up other bottlers (Cisneros is near monopoly bottler in Venezuela) v Pepsi refuses both options ü Coke argues Pepsi is not interested in Venezuelan soft drink market v International arbitration court forced Coke to pay Pepsi $94 M

Legal Implications v Coke placed six bottling plants and other assets (or ‘junk’ according to Pepsi) for sale to Pepsi v Cisneros offered to continue Pepsi production at 25% of output for one month to give Pepsi a chance to sign up other bottlers (Cisneros is near monopoly bottler in Venezuela) v Pepsi refuses both options ü Coke argues Pepsi is not interested in Venezuelan soft drink market v International arbitration court forced Coke to pay Pepsi $94 M

What has Pepsi done? v Marketing Blitz • Installed 50, 000 refrigerated display cases: “visi-coolers” • 1, 000 delivery routes with 200 more added in 1998 v Polar (SOPRESA) vs. Panamco (Cisneros) • 30% share in SOPRESA • $400 M over 3 years v Price War • Discount to retailers • Coca-Cola decided to match aggressive discounting

What has Pepsi done? v Marketing Blitz • Installed 50, 000 refrigerated display cases: “visi-coolers” • 1, 000 delivery routes with 200 more added in 1998 v Polar (SOPRESA) vs. Panamco (Cisneros) • 30% share in SOPRESA • $400 M over 3 years v Price War • Discount to retailers • Coca-Cola decided to match aggressive discounting

Next Steps v In Venezuela… • Discontinue price war • Continue aggressive marketing • “Power of One” v Globally… • Defensive Ø • Respect distributor power Offensive Ø Look for joint ventures, esp. with distributors

Next Steps v In Venezuela… • Discontinue price war • Continue aggressive marketing • “Power of One” v Globally… • Defensive Ø • Respect distributor power Offensive Ø Look for joint ventures, esp. with distributors

Questions?

Questions?