d2525387f2b8f11b2a75b92ce2eeee1d.ppt

- Количество слайдов: 59

COLLECTION LAWS AND COMPLIANCE IN COLLECTING HIGHER EDUCATION DEBT Presented by: Karen Reddick VP Business Development Panelist: Cary Geil Director of Collections 1

COLLECTION LAWS AND COMPLIANCE IN COLLECTING HIGHER EDUCATION DEBT Presented by: Karen Reddick VP Business Development Panelist: Cary Geil Director of Collections 1

Ask Your Legal Counsel Legal Advise is tailored to the specific circumstances of each case. Always consult with your own legal counsel to ensure you are following not only federal, but also state and local laws. 2

Ask Your Legal Counsel Legal Advise is tailored to the specific circumstances of each case. Always consult with your own legal counsel to ensure you are following not only federal, but also state and local laws. 2

Critical Topics CFPB/ UDAP Collection Fees Telephone Consumer Protection Act Bankruptcy Credit Bureau Reporting Time Barred Debt Choice of Law/Venue Selection 3

Critical Topics CFPB/ UDAP Collection Fees Telephone Consumer Protection Act Bankruptcy Credit Bureau Reporting Time Barred Debt Choice of Law/Venue Selection 3

Regulations to Comply With § Consumer Financial Protection Bureau FDCPA § § Collection Cost § Time Barred Debt § Leaving Messages § § SCRA § FCRA § GLBA § § Red Flag Rules TILA Telephone Consumer Protection Act 4

Regulations to Comply With § Consumer Financial Protection Bureau FDCPA § § Collection Cost § Time Barred Debt § Leaving Messages § § SCRA § FCRA § GLBA § § Red Flag Rules TILA Telephone Consumer Protection Act 4

Consumer Financial Protection Bureau Created by Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 § § Independent bureau within Federal Reserve System, run by Director who is Presidential Appointee, confirmed by Senate. Authority to issue rules for all financial institutions, including rules under Truth in Lending Act, Fair Debt Collection Practices Act, Equal Credit Opportunity and Real Estate Settlement Procedures Act. 5

Consumer Financial Protection Bureau Created by Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 § § Independent bureau within Federal Reserve System, run by Director who is Presidential Appointee, confirmed by Senate. Authority to issue rules for all financial institutions, including rules under Truth in Lending Act, Fair Debt Collection Practices Act, Equal Credit Opportunity and Real Estate Settlement Procedures Act. 5

Consumer Financial Protection Bureau has huge authority Rulemaking – Perhaps the most significant authority of the Bureau Supervisory Enforcement* Student Loans are a top priority CFPB has access to consumer complaints within the FTC Consumer Sentinel database (In the past only accessible through law enforcement agencies. ) Funded by the US Treasury-No Appropriations No oversight 6

Consumer Financial Protection Bureau has huge authority Rulemaking – Perhaps the most significant authority of the Bureau Supervisory Enforcement* Student Loans are a top priority CFPB has access to consumer complaints within the FTC Consumer Sentinel database (In the past only accessible through law enforcement agencies. ) Funded by the US Treasury-No Appropriations No oversight 6

Schools: In or Out? Schools are “financial institutions” under federal law (Gramm Leach Bliley) 7

Schools: In or Out? Schools are “financial institutions” under federal law (Gramm Leach Bliley) 7

The CFPB and You Consumer Financial Protection Bureau is very important to schools, servicers Regulates institutional loans, other private loans, collection practices, contacts with students – and has great powers of enforcement Director-Richard Cordray Ombudsman – Rohit Chopra – coordinating with Dept of Education COHEAO is working closely with CFPB has new regulations are being written 8

The CFPB and You Consumer Financial Protection Bureau is very important to schools, servicers Regulates institutional loans, other private loans, collection practices, contacts with students – and has great powers of enforcement Director-Richard Cordray Ombudsman – Rohit Chopra – coordinating with Dept of Education COHEAO is working closely with CFPB has new regulations are being written 8

CFPB Focus on Higher Ed UDAP Service Providers Collections and Collection Agencies Complaint Process Updating FDCPA Financial Literacy 9

CFPB Focus on Higher Ed UDAP Service Providers Collections and Collection Agencies Complaint Process Updating FDCPA Financial Literacy 9

UDAAP and the CFPB It is unlawful to engage in any Unfair, Deceptive, or Abusive Act or Practices FDCPA makes it illegal for debt collectors to engage in this activity Consumer Financial Protection Bureau Has authority to protect consumers against UDAAP violations Original creditor and debt collectors

UDAAP and the CFPB It is unlawful to engage in any Unfair, Deceptive, or Abusive Act or Practices FDCPA makes it illegal for debt collectors to engage in this activity Consumer Financial Protection Bureau Has authority to protect consumers against UDAAP violations Original creditor and debt collectors

Abusive Acts or Practices Materially interferes with the ability of a consumer to understand a term or condition of a consumer financial product or service; or Take reasonable advantage of Lack of understanding of material risks, costs or conditions Inability to protect his/her interests; or Reasonable reliance on a covered person to act in his/her interests

Abusive Acts or Practices Materially interferes with the ability of a consumer to understand a term or condition of a consumer financial product or service; or Take reasonable advantage of Lack of understanding of material risks, costs or conditions Inability to protect his/her interests; or Reasonable reliance on a covered person to act in his/her interests

Service Providers Supervision of Service Providers Financial institutions under Bureau supervision may be held responsible for their contractors. Bureau’s expects that supervised financial institutions have an effective process for managing the risks of service provider relationships. A service provider is defined in the Dodd-Frank Act as “any person that provides a material service to a covered person in connection with the offering or provision by such covered person of a consumer financial product or service. ” Institutions must ensure that business arrangements with service providers do not present unwarranted risks to consumers. ” 12

Service Providers Supervision of Service Providers Financial institutions under Bureau supervision may be held responsible for their contractors. Bureau’s expects that supervised financial institutions have an effective process for managing the risks of service provider relationships. A service provider is defined in the Dodd-Frank Act as “any person that provides a material service to a covered person in connection with the offering or provision by such covered person of a consumer financial product or service. ” Institutions must ensure that business arrangements with service providers do not present unwarranted risks to consumers. ” 12

Collection Agency Focus By CFPB Dodd-Frank Act requires supervision of certain nonbank covered persons: All providers of private student loans ‘‘larger participant[s] of a market for other consumer financial products or services, as the Bureau defines by rule. ” Complaint database also launched for public complaints – both on student loans and collections in general Default problem is SL category 13

Collection Agency Focus By CFPB Dodd-Frank Act requires supervision of certain nonbank covered persons: All providers of private student loans ‘‘larger participant[s] of a market for other consumer financial products or services, as the Bureau defines by rule. ” Complaint database also launched for public complaints – both on student loans and collections in general Default problem is SL category 13

Complaint Portals Bank account or service Credit card Credit reporting Debt collection Money transfer Mortgage Student loan Vehicle or consumer loan 14

Complaint Portals Bank account or service Credit card Credit reporting Debt collection Money transfer Mortgage Student loan Vehicle or consumer loan 14

Complaint Portal Process 1. 2. 3. 4. 5. 6. Complaint submitted Review and route Company response Consumer review Review and investigate Analyze and report 15

Complaint Portal Process 1. 2. 3. 4. 5. 6. Complaint submitted Review and route Company response Consumer review Review and investigate Analyze and report 15

Complaint Process The CFPB received nearly 2, 900 private student loan complaints in the first year. This is a relatively small number given that there are more than $150 billion in outstanding private student loans. The vast majority of the complaints were related to loan servicing and loan modification issues. Active duty service members and their families reported that they sometimes experience difficulty exercising their rights under the Service Members’ Civil Relief Act. Solution Have a written policy to resolve complaints Monitor and request your Service Providers written policy Don’t let complaints escalate to the Attorney General or CFPB Sign up to receive Debt Collection Complaints registered with CFPB at http: //www. consumerfinance. gov/complaint/ 16

Complaint Process The CFPB received nearly 2, 900 private student loan complaints in the first year. This is a relatively small number given that there are more than $150 billion in outstanding private student loans. The vast majority of the complaints were related to loan servicing and loan modification issues. Active duty service members and their families reported that they sometimes experience difficulty exercising their rights under the Service Members’ Civil Relief Act. Solution Have a written policy to resolve complaints Monitor and request your Service Providers written policy Don’t let complaints escalate to the Attorney General or CFPB Sign up to receive Debt Collection Complaints registered with CFPB at http: //www. consumerfinance. gov/complaint/ 16

Service Members Civil Relieve Act (SCRA) SCRA does not excuse the member from any legal obligation, it simply delays it The protection is not automatic, member must apply for it Protection will only apply if the obligation was entered into prior to active duty Protection extends from first day of active duty through 30 -90 days after discharge Interest rate may be reduced to flat rate of 6% The burden is on creditor to seek relief by proving service member is not materially affected by service

Service Members Civil Relieve Act (SCRA) SCRA does not excuse the member from any legal obligation, it simply delays it The protection is not automatic, member must apply for it Protection will only apply if the obligation was entered into prior to active duty Protection extends from first day of active duty through 30 -90 days after discharge Interest rate may be reduced to flat rate of 6% The burden is on creditor to seek relief by proving service member is not materially affected by service

Who Does SCRA Apply To All active members of the U. S. armed services All officers of the Public Health Service detailed for duty with either the Army or Navy Members in basic training or boot camp Members of the Reserves and National Guard who are called to active duty for one of the following reasons: mobilized for federal service annual training military school National emergency for 30+ days

Who Does SCRA Apply To All active members of the U. S. armed services All officers of the Public Health Service detailed for duty with either the Army or Navy Members in basic training or boot camp Members of the Reserves and National Guard who are called to active duty for one of the following reasons: mobilized for federal service annual training military school National emergency for 30+ days

Fair Debt Collection Practices Act (FDCPA) Established in 1977 Legal protection from abusive debt collection practices To promote fair debt collection Ensure an avenue for disputing and obtaining validation of debt ensure the accuracy Guidelines for debt collectors Works in junction with FCRA 19

Fair Debt Collection Practices Act (FDCPA) Established in 1977 Legal protection from abusive debt collection practices To promote fair debt collection Ensure an avenue for disputing and obtaining validation of debt ensure the accuracy Guidelines for debt collectors Works in junction with FCRA 19

FDCPA Requires debt collectors to treat debtors fairly Prohibits certain methods of debt collection Addresses issue of proper and appropriate debt collection practices and techniques Does not erase any legitimate consumer debt owed Consumer protection act Strict liability statute Allegations of improper and inappropriate methods of collection may lead to filing of a lawsuit

FDCPA Requires debt collectors to treat debtors fairly Prohibits certain methods of debt collection Addresses issue of proper and appropriate debt collection practices and techniques Does not erase any legitimate consumer debt owed Consumer protection act Strict liability statute Allegations of improper and inappropriate methods of collection may lead to filing of a lawsuit

Verification of Debts If debtor requests verification of debt, collector must cease all collection activities until requested verification is mailed by debt collector to consumer

Verification of Debts If debtor requests verification of debt, collector must cease all collection activities until requested verification is mailed by debt collector to consumer

Dispute Process Statement of Account (Showing Amount Due) Copy of Registration (Time/Date) and E-signature Financial Disclosure Form (Agree to Terms) Copy of Invoice/Bill Notes (Appeals, reason for loss of Financial Aid) Proof of Grades received Copy of Withdrawal Policy Prom Note 22

Dispute Process Statement of Account (Showing Amount Due) Copy of Registration (Time/Date) and E-signature Financial Disclosure Form (Agree to Terms) Copy of Invoice/Bill Notes (Appeals, reason for loss of Financial Aid) Proof of Grades received Copy of Withdrawal Policy Prom Note 22

Ceasing Communication If debtor notifies in writing refusal to pay debt or wishes debt collector to cease further communication, debt collector shall not communicate further except: To advise that although the debt collector's further efforts are being terminated, the debt still exists To notify that debt collector or creditor may or will invoke specified remedies that are ordinarily invoked by them If debtor notifies or debt collector is aware that debtor is represented by an attorney, direct contact is prohibited unless the attorney specifies otherwise

Ceasing Communication If debtor notifies in writing refusal to pay debt or wishes debt collector to cease further communication, debt collector shall not communicate further except: To advise that although the debt collector's further efforts are being terminated, the debt still exists To notify that debt collector or creditor may or will invoke specified remedies that are ordinarily invoked by them If debtor notifies or debt collector is aware that debtor is represented by an attorney, direct contact is prohibited unless the attorney specifies otherwise

FDCPA-Collection Costs The Fair Debt Collection Practices Act states that it is a violation to collect any amount that is not “expressly authorized by the agreement creating the debt or permitted by law. ” See 15 U. S. C. 1692 f. Further, state consumer protection statutes and unfair trade practices statutes may implicate creditors (schools) that are not compliant with state requirements regarding the addition of student paid fees. Agencies and Schools demand compliance in the contracts that govern the relationship. 24

FDCPA-Collection Costs The Fair Debt Collection Practices Act states that it is a violation to collect any amount that is not “expressly authorized by the agreement creating the debt or permitted by law. ” See 15 U. S. C. 1692 f. Further, state consumer protection statutes and unfair trade practices statutes may implicate creditors (schools) that are not compliant with state requirements regarding the addition of student paid fees. Agencies and Schools demand compliance in the contracts that govern the relationship. 24

Collection Costs – the mutually agreed upon contract amount that the institution pays the collection agency for collecting accounts on the school’s behalf. Institutionally Assessed Fees – The amount charged to a student subject to an agreement between the student and the school or the amount permitted by law (i. e. the Higher Education Act and Perkins Regulations) 25

Collection Costs – the mutually agreed upon contract amount that the institution pays the collection agency for collecting accounts on the school’s behalf. Institutionally Assessed Fees – The amount charged to a student subject to an agreement between the student and the school or the amount permitted by law (i. e. the Higher Education Act and Perkins Regulations) 25

Collection Costs/Fees and Perkins Loan Federal regulation supersedes state laws restricting the assessment and collection of collection costs Federal regulation allows reasonable collection costs 30% for first placement 40% for second placement and litigation placement Despite federal regulation, state courts may still attempt to limit the amount of collection costs assessed to an account May request proof of costs and reasonableness

Collection Costs/Fees and Perkins Loan Federal regulation supersedes state laws restricting the assessment and collection of collection costs Federal regulation allows reasonable collection costs 30% for first placement 40% for second placement and litigation placement Despite federal regulation, state courts may still attempt to limit the amount of collection costs assessed to an account May request proof of costs and reasonableness

Federal & State Statutes Federal: The Fair Debt Collection Practices Act states that it is a violation to collect any amount that is not “expressly authorized by the agreement creating the debt or permitted by law. ” See 15 U. S. C. 1692 f. State: Follow which law is more restrictive 27

Federal & State Statutes Federal: The Fair Debt Collection Practices Act states that it is a violation to collect any amount that is not “expressly authorized by the agreement creating the debt or permitted by law. ” See 15 U. S. C. 1692 f. State: Follow which law is more restrictive 27

Collection Costs-Recent Case Law Bradley v Franklin Collection Service, Inc. (2014) Eleventh Circuit ruling Medical debt where 30% collection cost/fee was added Agreement said “I agree to pay all costs of collection. . . and reasonable collection agency fees” Kojetin v CU Recovery, Inc. (2000) – Eighth Circuit ruling Violation of FDCPA to add collection cost/fee based on percentage of the principal balance Only entitled to actual cost of collection Seeger v AFNI, Inc. (2008) – Seventh Circuit ruling Percentage based fee can be appropriate if the parties agree to it in the contract

Collection Costs-Recent Case Law Bradley v Franklin Collection Service, Inc. (2014) Eleventh Circuit ruling Medical debt where 30% collection cost/fee was added Agreement said “I agree to pay all costs of collection. . . and reasonable collection agency fees” Kojetin v CU Recovery, Inc. (2000) – Eighth Circuit ruling Violation of FDCPA to add collection cost/fee based on percentage of the principal balance Only entitled to actual cost of collection Seeger v AFNI, Inc. (2008) – Seventh Circuit ruling Percentage based fee can be appropriate if the parties agree to it in the contract

Collection Costs/Fees – Recent Case law Seeger continued Contractual language stated the following “You agree to reimburse us the fees of any collection agency, which may be based on a percentage at a maximum of 33% of the debt, and all costs and expenses, including reasonable attorneys’ fees, we incur in such collection efforts. ” Bradley’s contract did not specify the collection agency fee to be charged FDCPA violated when added 30% fee Future?

Collection Costs/Fees – Recent Case law Seeger continued Contractual language stated the following “You agree to reimburse us the fees of any collection agency, which may be based on a percentage at a maximum of 33% of the debt, and all costs and expenses, including reasonable attorneys’ fees, we incur in such collection efforts. ” Bradley’s contract did not specify the collection agency fee to be charged FDCPA violated when added 30% fee Future?

True or False Collection costs = the amount the student pays the agency The federal regulations allow for collection costs on Perkins loans so it is okay to set up institutional debt the same way Agreements have to be promissory notes Notifying the student in collection letters that a fee will be added if the account is sent to an agency is sufficient There is a “right” to be “made whole” on institutional debt 30

True or False Collection costs = the amount the student pays the agency The federal regulations allow for collection costs on Perkins loans so it is okay to set up institutional debt the same way Agreements have to be promissory notes Notifying the student in collection letters that a fee will be added if the account is sent to an agency is sufficient There is a “right” to be “made whole” on institutional debt 30

More True or False A handbook is sufficient for disclosing information An electronic signatures counts and can be used as validation? Notification via collection letters that a fee will be added if the account is sent to an agency is sufficient? 31

More True or False A handbook is sufficient for disclosing information An electronic signatures counts and can be used as validation? Notification via collection letters that a fee will be added if the account is sent to an agency is sufficient? 31

TCPA The Telephone Consumer Protection Act, 47 U. S. C. § 227, et seq. Think about cell phones in 1991 Significant penalties It is important to understand that the TCPA applies to all entities – not just collection agencies. Need Consent (HELP) 32

TCPA The Telephone Consumer Protection Act, 47 U. S. C. § 227, et seq. Think about cell phones in 1991 Significant penalties It is important to understand that the TCPA applies to all entities – not just collection agencies. Need Consent (HELP) 32

TCPA-Telephone Consumer Protection Act The use of predictive dialers to call cell phones. Petition Filed Clarification of the FCC rules, last updated in 2003, with some other changes in 2008 based on a court decision, regarding the use of auto-dialers to call cell phones. The issue is to clarify the FCC rules and guidance on what a restricted-use “audio dialer” is and to hopefully convince them to distinguish predictive dialers tailored and used just for permitted purposes (not telemarketing, e. g. ) from auto-dialers that randomly dial numbers or dial from lists where there is no pre-established relationship with the consumer. 33

TCPA-Telephone Consumer Protection Act The use of predictive dialers to call cell phones. Petition Filed Clarification of the FCC rules, last updated in 2003, with some other changes in 2008 based on a court decision, regarding the use of auto-dialers to call cell phones. The issue is to clarify the FCC rules and guidance on what a restricted-use “audio dialer” is and to hopefully convince them to distinguish predictive dialers tailored and used just for permitted purposes (not telemarketing, e. g. ) from auto-dialers that randomly dial numbers or dial from lists where there is no pre-established relationship with the consumer. 33

TCPA, FCC and FTC COHEAO in Meetings with FCC Staff with TCPA group FCC seeking to harmonize Telephone Consumer Protection Act (TCPA) regs with FTC Telemarketing Sales Rule Good idea, but proposal affects non-telemarketing calls Use of auto-dialers, cell phones, and obtaining consent from consumer the key issues here FCC proposal calls for “express written consent” not only from new consumers (students), but also EXISTING CUSTOMERS for use of pre-recorded calls to cell phones Definition of “auto-dialer” vs. “predictive-dialer” is concern under review by FCC now – Petitions seek clarification from Commission 34

TCPA, FCC and FTC COHEAO in Meetings with FCC Staff with TCPA group FCC seeking to harmonize Telephone Consumer Protection Act (TCPA) regs with FTC Telemarketing Sales Rule Good idea, but proposal affects non-telemarketing calls Use of auto-dialers, cell phones, and obtaining consent from consumer the key issues here FCC proposal calls for “express written consent” not only from new consumers (students), but also EXISTING CUSTOMERS for use of pre-recorded calls to cell phones Definition of “auto-dialer” vs. “predictive-dialer” is concern under review by FCC now – Petitions seek clarification from Commission 34

TCPA Presidents Deficit Reduction Plan (aka Job’s Bill) Plans to amend the Communications Act of 1934 Allow the use of cell phones to contact debtors who owe money to the government The provision is expected to provide substantial increase in collections The Mobile Informational Call Act of 2011 (H. R. 3035) Bipartisan coalition (Rep Terry, R-NE and Rep Town, D-NY) Allows the use of predicative dialers in contact cell phones were “existing business relationship exists” Modernizes the TCAP by exempting informational calls to wireless phone from auto-dialer restrictions Clarifies the “prior express consent” requirement (a) for the initiation of a call on behalf of entity with a person where an established business relationship exists (b) that is provided when person purchases a good or service States’ Attorney general killed the bill 35

TCPA Presidents Deficit Reduction Plan (aka Job’s Bill) Plans to amend the Communications Act of 1934 Allow the use of cell phones to contact debtors who owe money to the government The provision is expected to provide substantial increase in collections The Mobile Informational Call Act of 2011 (H. R. 3035) Bipartisan coalition (Rep Terry, R-NE and Rep Town, D-NY) Allows the use of predicative dialers in contact cell phones were “existing business relationship exists” Modernizes the TCAP by exempting informational calls to wireless phone from auto-dialer restrictions Clarifies the “prior express consent” requirement (a) for the initiation of a call on behalf of entity with a person where an established business relationship exists (b) that is provided when person purchases a good or service States’ Attorney general killed the bill 35

TCPA FCC Committee Hearings Reviewing whether to adopt express written consent for all autodialed or prerecorded calls. Commission adopts prior express written consent for autodialed or prerecorded telemarketing calls only. The final rules do not address informational calls, meaning nothing has changed for the calls made by colleges and their 3 rd party companies 36

TCPA FCC Committee Hearings Reviewing whether to adopt express written consent for all autodialed or prerecorded calls. Commission adopts prior express written consent for autodialed or prerecorded telemarketing calls only. The final rules do not address informational calls, meaning nothing has changed for the calls made by colleges and their 3 rd party companies 36

Bankruptcy-Current Law Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCA) Expanded definition of student loans for purposes of section 523(a)(8) exception to discharge. Adds qualified educational loans as defined under section 221 of the Internal Revenue Code to those educational loans currently considered to be non-dischargeable. 37

Bankruptcy-Current Law Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCA) Expanded definition of student loans for purposes of section 523(a)(8) exception to discharge. Adds qualified educational loans as defined under section 221 of the Internal Revenue Code to those educational loans currently considered to be non-dischargeable. 37

Bankruptcy Automatic Stay Provision Halts all action by school to collect debt Starts when student/consumer filed bankruptcy Discharge Injunction Fresh start Education Loans generally presumed nondischargeable Perkins Loan Institutional and other education loans

Bankruptcy Automatic Stay Provision Halts all action by school to collect debt Starts when student/consumer filed bankruptcy Discharge Injunction Fresh start Education Loans generally presumed nondischargeable Perkins Loan Institutional and other education loans

Bankruptcy Adversary Proceeding Proper procedure to determine discharge ability Need to establish undue hardship Proof of claim File if there assets in Chapter 7 and monitor File in Chapter 13 Plan Repayment plan, generally over five years Review and object if plan discharges education related debts Espinosa Case (2010) – US Supreme Court

Bankruptcy Adversary Proceeding Proper procedure to determine discharge ability Need to establish undue hardship Proof of claim File if there assets in Chapter 7 and monitor File in Chapter 13 Plan Repayment plan, generally over five years Review and object if plan discharges education related debts Espinosa Case (2010) – US Supreme Court

Bankruptcy – Tuition Receivable Presumed non-dischargeable? Presumed non-discharge ability depends on certain factors Bankruptcy court will need to recognize the obligation as a loan Is there a written agreement? Is credit extended? Make the decision easier for a court

Bankruptcy – Tuition Receivable Presumed non-dischargeable? Presumed non-discharge ability depends on certain factors Bankruptcy court will need to recognize the obligation as a loan Is there a written agreement? Is credit extended? Make the decision easier for a court

Bankruptcy – Transcript and Registration Withholding Transcripts Likely viewed as violation of automatic stay provision Serves no purpose other than to compel repayment Ok to withhold after bankruptcy, as long as not discharged Registration Refusal to allow registration likely viewed as violation of automatic stay If bankruptcy is pending, cannot force student to pay past-due debt before allowing them to register However, can make student pay in full for the semester he/she is registering

Bankruptcy – Transcript and Registration Withholding Transcripts Likely viewed as violation of automatic stay provision Serves no purpose other than to compel repayment Ok to withhold after bankruptcy, as long as not discharged Registration Refusal to allow registration likely viewed as violation of automatic stay If bankruptcy is pending, cannot force student to pay past-due debt before allowing them to register However, can make student pay in full for the semester he/she is registering

Bankruptcy Law Proposals in Congress Current law: all education loans as defined by tax law are dischargeable in bankruptcy when there is undue hardship to debtor or dependents Recent study: very few try to discharge, thinking it’s impossible, but it’s not! Bills call for dropping undue hardship requirement for private loans only Government loans would remain non-dischargeable including from any “government units” Make private loans dischargeable 42

Bankruptcy Law Proposals in Congress Current law: all education loans as defined by tax law are dischargeable in bankruptcy when there is undue hardship to debtor or dependents Recent study: very few try to discharge, thinking it’s impossible, but it’s not! Bills call for dropping undue hardship requirement for private loans only Government loans would remain non-dischargeable including from any “government units” Make private loans dischargeable 42

Even More True or False You can hold a transcript when a student is in bankruptcy You can require a student to pay cash up front if they have filed bankruptcy Non federal student debt is non dischargeable 43

Even More True or False You can hold a transcript when a student is in bankruptcy You can require a student to pay cash up front if they have filed bankruptcy Non federal student debt is non dischargeable 43

Credit Bureau Reporting The FACT Act Furnisher Rules were passed in 2010 by the federal banking agencies and the FTC and consist of: Accuracy and Integrity Rule requires companies that provide information to credit bureaus to establish written policies regarding the "accuracy and integrity" of information furnished to the credit bureaus. Direct Dispute Rule allows consumers to take their disputes directly to the furnishers of credit report information rather than acting solely through a credit bureau. These latest rules impose major new duties for lenders, servicers, collectors and other financial institutions that report, or "furnish, " information to credit bureaus. 44

Credit Bureau Reporting The FACT Act Furnisher Rules were passed in 2010 by the federal banking agencies and the FTC and consist of: Accuracy and Integrity Rule requires companies that provide information to credit bureaus to establish written policies regarding the "accuracy and integrity" of information furnished to the credit bureaus. Direct Dispute Rule allows consumers to take their disputes directly to the furnishers of credit report information rather than acting solely through a credit bureau. These latest rules impose major new duties for lenders, servicers, collectors and other financial institutions that report, or "furnish, " information to credit bureaus. 44

Statute of Limitations (SOL) What is it? Are debt collectors bound by the statute of limitations when requesting payment on an outstanding debt? Is the debt more or less recoverable once the SOL runs? How can the creditor assist with the collection of moderate and older debts? Default Dates SOL and Credit bureau reporting When does SOL calculation begin Date of last payment Date of default Date payment became due 45

Statute of Limitations (SOL) What is it? Are debt collectors bound by the statute of limitations when requesting payment on an outstanding debt? Is the debt more or less recoverable once the SOL runs? How can the creditor assist with the collection of moderate and older debts? Default Dates SOL and Credit bureau reporting When does SOL calculation begin Date of last payment Date of default Date payment became due 45

The New View of SOL States and federal regulators are now using the statute of limitations to make it increasingly difficult to collect older debt obligations. This trend is, in my opinion, being driven by the purchase and collection of older debt that is completely unrelated to higher education. Nevertheless, this niche’ of the collection industry will be directly impacted. These changes will require specific action to prevent a great deal of debt from becoming virtually uncollectable. New Laws New Mexico North Carolina New York Wisconsin Mississippi California New York City 46

The New View of SOL States and federal regulators are now using the statute of limitations to make it increasingly difficult to collect older debt obligations. This trend is, in my opinion, being driven by the purchase and collection of older debt that is completely unrelated to higher education. Nevertheless, this niche’ of the collection industry will be directly impacted. These changes will require specific action to prevent a great deal of debt from becoming virtually uncollectable. New Laws New Mexico North Carolina New York Wisconsin Mississippi California New York City 46

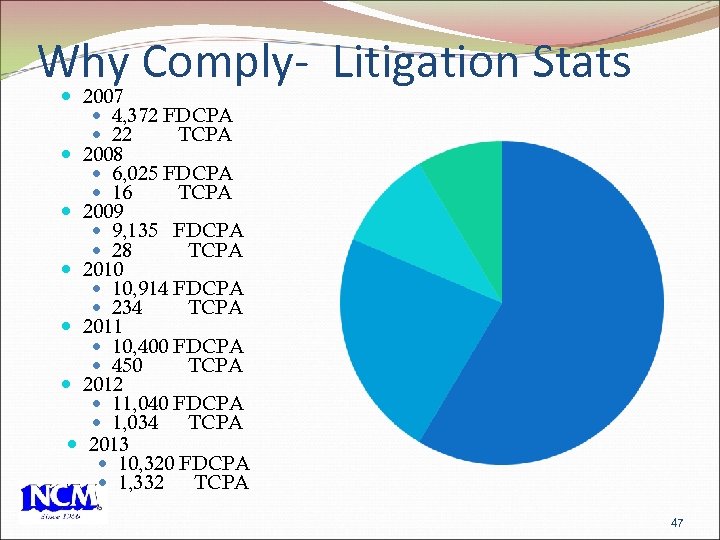

Why Comply- Litigation Stats 2007 4, 372 FDCPA 22 TCPA 2008 6, 025 FDCPA 16 TCPA 2009 9, 135 FDCPA 28 TCPA 2010 10, 914 FDCPA 234 TCPA 2011 10, 400 FDCPA 450 TCPA 2012 11, 040 FDCPA 1, 034 TCPA 2013 10, 320 FDCPA 1, 332 TCPA 47

Why Comply- Litigation Stats 2007 4, 372 FDCPA 22 TCPA 2008 6, 025 FDCPA 16 TCPA 2009 9, 135 FDCPA 28 TCPA 2010 10, 914 FDCPA 234 TCPA 2011 10, 400 FDCPA 450 TCPA 2012 11, 040 FDCPA 1, 034 TCPA 2013 10, 320 FDCPA 1, 332 TCPA 47

FINANCIAL RESPONSIBILITY STATEMENTS 48

FINANCIAL RESPONSIBILITY STATEMENTS 48

Collection Cost In the event I default on this agreement and it becomes necessary to place this account for collection, I also agree to pay collection agency fees, which maybe based on a percentage at a maximum of 33%, and all costs and expenses, including reasonable attorney’s fees, that are incurred by the University in such collection efforts. 49

Collection Cost In the event I default on this agreement and it becomes necessary to place this account for collection, I also agree to pay collection agency fees, which maybe based on a percentage at a maximum of 33%, and all costs and expenses, including reasonable attorney’s fees, that are incurred by the University in such collection efforts. 49

Credit Bureau Reporting As further part of this agreement I also understand, agree and authorize (Name of School) to use my social security number for internal and external credit reporting and collection purposes for all charges incurred against this account for the duration of my enrollment at (Name of School). 50

Credit Bureau Reporting As further part of this agreement I also understand, agree and authorize (Name of School) to use my social security number for internal and external credit reporting and collection purposes for all charges incurred against this account for the duration of my enrollment at (Name of School). 50

Bankruptcy All outstanding tuition account balances are considered qualified educational loans under I. R. C. 221 and are extended with the express understanding that future repayment shall be made to the university. I further understand that my acceptance of these terms represents my acknowledgement and acceptance of my tuition account balance qualifying as a qualified education loan under I. R. C. 221, and as such, its exemption from discharge under the federal bankruptcy code, 11 U. S. C. 523(a) (8). 51

Bankruptcy All outstanding tuition account balances are considered qualified educational loans under I. R. C. 221 and are extended with the express understanding that future repayment shall be made to the university. I further understand that my acceptance of these terms represents my acknowledgement and acceptance of my tuition account balance qualifying as a qualified education loan under I. R. C. 221, and as such, its exemption from discharge under the federal bankruptcy code, 11 U. S. C. 523(a) (8). 51

Choice of Law • If there is a dispute or problem with this agreement then the University will follow the law of the state of (Name of State)* *This is irrelevant depending on if the state is Substantive or Procedural-will always honor the shortage one. Pennsylvania is procedural. So if you have a contract in KY and SOL is 15 years. Debt incurred in KY but Student moves to PA where the SOL is 4 year and there is choice of law provision. The courts would follow the state of PA and SOL would be 4 years. 52

Choice of Law • If there is a dispute or problem with this agreement then the University will follow the law of the state of (Name of State)* *This is irrelevant depending on if the state is Substantive or Procedural-will always honor the shortage one. Pennsylvania is procedural. So if you have a contract in KY and SOL is 15 years. Debt incurred in KY but Student moves to PA where the SOL is 4 year and there is choice of law provision. The courts would follow the state of PA and SOL would be 4 years. 52

TCPA I understand agree that should I leave (Name of School) under any circumstance with a balance due, I hereby authorize (Name of School) and/or its agents, including attorneys and/or collection agencies, to contact me via cellular telephone and/or all forms of electronic technology (to include text messaging and e-mail) to collect such outstanding debt, unless I notify such party in writing to cease such communication. MPN AUTHORIZATION: - I authorize the School, the Department, and their respective agents and contractors to contact me regarding my loan request or my loan(s), including repayment of my loan(s), at the current or any future number that I provide for my cellular phone or other wireless device using automated telephone dialing equipment or artificial or pre-recorded voice or text messages. 53

TCPA I understand agree that should I leave (Name of School) under any circumstance with a balance due, I hereby authorize (Name of School) and/or its agents, including attorneys and/or collection agencies, to contact me via cellular telephone and/or all forms of electronic technology (to include text messaging and e-mail) to collect such outstanding debt, unless I notify such party in writing to cease such communication. MPN AUTHORIZATION: - I authorize the School, the Department, and their respective agents and contractors to contact me regarding my loan request or my loan(s), including repayment of my loan(s), at the current or any future number that I provide for my cellular phone or other wireless device using automated telephone dialing equipment or artificial or pre-recorded voice or text messages. 53

In Conclusion…. Understand where the industry is headed and better position your institution to maximize bad debt recovery Review your policy regarding the critical topics: Collection Fees Bankruptcy Telephone Consumer Protection Act Credit Bureau Reporting Choice of Law/Venue Selection Others? Ensure student acknowledgments are not passive and clearly documented to avoid gaps 54

In Conclusion…. Understand where the industry is headed and better position your institution to maximize bad debt recovery Review your policy regarding the critical topics: Collection Fees Bankruptcy Telephone Consumer Protection Act Credit Bureau Reporting Choice of Law/Venue Selection Others? Ensure student acknowledgments are not passive and clearly documented to avoid gaps 54

COHEAO 55

COHEAO 55

COHEAO Priorities 2014 Perkins Preserve and Improve Perkins in Higher Education Act Reauthorization Campus Based Flex Program Restore funding for loan cancellations for Perkins TCPA Work on improvements to Telephone Consumer Protection Act enforcement CFPB Work with CFPB on campus-related issues Neg Reg Work with ED on cash management 56

COHEAO Priorities 2014 Perkins Preserve and Improve Perkins in Higher Education Act Reauthorization Campus Based Flex Program Restore funding for loan cancellations for Perkins TCPA Work on improvements to Telephone Consumer Protection Act enforcement CFPB Work with CFPB on campus-related issues Neg Reg Work with ED on cash management 56

Grass Roots Efforts We must work to fund and extend the Perkins Loan Program COHEAO is working on new ideas to preserve the program Support appropriations Support Perkins Loan Program See www. coheao. org for details Become a member of COHEAO Stay in touch with your congressional representatives 57

Grass Roots Efforts We must work to fund and extend the Perkins Loan Program COHEAO is working on new ideas to preserve the program Support appropriations Support Perkins Loan Program See www. coheao. org for details Become a member of COHEAO Stay in touch with your congressional representatives 57

Contact Information Karen Reddick kreddick@ncmstl. com CFPB www. consumerfinance. gov COHEAO www. coheao. org ACA http: //www. acainternational. org 58

Contact Information Karen Reddick kreddick@ncmstl. com CFPB www. consumerfinance. gov COHEAO www. coheao. org ACA http: //www. acainternational. org 58

QUESTIONS ? ? ? 59

QUESTIONS ? ? ? 59