4dd739398f1ca40874bc40c52f168b85.ppt

- Количество слайдов: 39

Collateral Management Framework & Collateral trends in Europe and the Netherlands 2 nd Conference Financial Sector of Macedonia on Payments and Securities Settlement Systems Richard Derksen Ohrid, 30 June 2009

Collateral Management Framework & Collateral trends in Europe and the Netherlands 2 nd Conference Financial Sector of Macedonia on Payments and Securities Settlement Systems Richard Derksen Ohrid, 30 June 2009

Topics • The Eurosystem collateral framework (ESCB) • Collateral management at de Nederlandsche Bank • European and NL collateral trends • Mobilising collateral • CCBM 2

Topics • The Eurosystem collateral framework (ESCB) • Collateral management at de Nederlandsche Bank • European and NL collateral trends • Mobilising collateral • CCBM 2

The ESCB framework: Basics • All liquidity providing credit operations of the ESCB based on adequate collateral (art. 18. 1. ESCB statute) (= no cash collateral) • Collateral needed for monetary loans (MRO´s + LTRO´s) and intraday credit + other purposes (guarantees, margin obligations stock exchange) • No separate collateral-lists for monetary policy purposes or payment system operations

The ESCB framework: Basics • All liquidity providing credit operations of the ESCB based on adequate collateral (art. 18. 1. ESCB statute) (= no cash collateral) • Collateral needed for monetary loans (MRO´s + LTRO´s) and intraday credit + other purposes (guarantees, margin obligations stock exchange) • No separate collateral-lists for monetary policy purposes or payment system operations

The ESCB framework: Basics Conditions of the collateral framework -> uniform eligibility criteria: • Protecting the ESCB from incurring losses in it's monetary policy operations • Ensuring equal treatment of counterparties • Enhancing operational efficiency and transparency

The ESCB framework: Basics Conditions of the collateral framework -> uniform eligibility criteria: • Protecting the ESCB from incurring losses in it's monetary policy operations • Ensuring equal treatment of counterparties • Enhancing operational efficiency and transparency

Single list of collateral • Operational on January 2007 • Drawbacks 2 -tiers list (1999 -2006): heterogeneity and no transparency • 2 asset classes: – marketable assets and – non-marketable assets (no quality difference) • Marketable assets: high credit standards (single A↑), located in the euro area, denomination euro

Single list of collateral • Operational on January 2007 • Drawbacks 2 -tiers list (1999 -2006): heterogeneity and no transparency • 2 asset classes: – marketable assets and – non-marketable assets (no quality difference) • Marketable assets: high credit standards (single A↑), located in the euro area, denomination euro

Single list of collateral • Marketable assets: listed on regulated markets or certain accepted non-regulated markets • Non-marketable assets: credit claims and Irish non-marketable retail mortgage backed debt instruments, no market criterion • For both asset classes -> Eurosystem credit assessment framework (ECAF)

Single list of collateral • Marketable assets: listed on regulated markets or certain accepted non-regulated markets • Non-marketable assets: credit claims and Irish non-marketable retail mortgage backed debt instruments, no market criterion • For both asset classes -> Eurosystem credit assessment framework (ECAF)

Eurosystem Credit Assessment Framework ECAF principles: consistency, accuracy and comparability ECAF sources: • ECAI – External Credit Assessment Institutions • ICAS – NCBs in-house credit assessment systems • IRB – counterparties internal ratings-based systems • RT – third-party providers rating tools. Additionally: • Public Sector Entities-list and guarantees

Eurosystem Credit Assessment Framework ECAF principles: consistency, accuracy and comparability ECAF sources: • ECAI – External Credit Assessment Institutions • ICAS – NCBs in-house credit assessment systems • IRB – counterparties internal ratings-based systems • RT – third-party providers rating tools. Additionally: • Public Sector Entities-list and guarantees

ECAF benchmark/threshold • ´Single A` (A-Fitch and S&P, A 3 Moody´s) or • Probability of default (PD) over a one-year horizon of 0. 10% Definition default stems from EU Capital Requirements Directive (CRD)

ECAF benchmark/threshold • ´Single A` (A-Fitch and S&P, A 3 Moody´s) or • Probability of default (PD) over a one-year horizon of 0. 10% Definition default stems from EU Capital Requirements Directive (CRD)

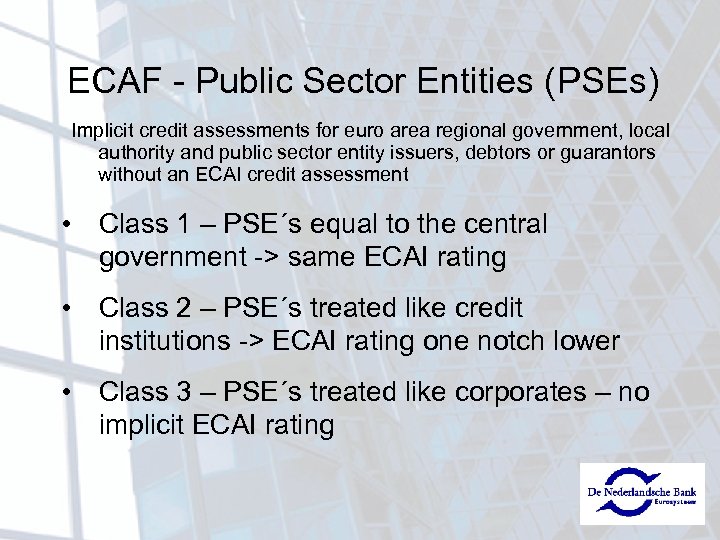

ECAF - Public Sector Entities (PSEs) Implicit credit assessments for euro area regional government, local authority and public sector entity issuers, debtors or guarantors without an ECAI credit assessment • Class 1 – PSE´s equal to the central government -> same ECAI rating • Class 2 – PSE´s treated like credit institutions -> ECAI rating one notch lower • Class 3 – PSE´s treated like corporates – no implicit ECAI rating

ECAF - Public Sector Entities (PSEs) Implicit credit assessments for euro area regional government, local authority and public sector entity issuers, debtors or guarantors without an ECAI credit assessment • Class 1 – PSE´s equal to the central government -> same ECAI rating • Class 2 – PSE´s treated like credit institutions -> ECAI rating one notch lower • Class 3 – PSE´s treated like corporates – no implicit ECAI rating

MARKETABLE ASSETS Type of assets ECB debt certificates; other marketable debt instruments Credit standards Asset of high credit standard; ECAF rules Place of issue European Economic Area Settlement/handling procedures Settled in euro area; centrally deposited in bookentry form with central banks or SSS fulfilling ECB’s minimum standards Type of issuer/debtor/guarantor Central banks; public sector; private sector; international and supranational institutions Place of establishment of Issuer/debtor/guarantor Issuer: EEA or non-EEA G 10 countries; Guarantor EEA Acceptable markets Regulated markets; non-regulated market accepted by ECB Currency Euro (No minimum size; governing law restricted to EEA)

MARKETABLE ASSETS Type of assets ECB debt certificates; other marketable debt instruments Credit standards Asset of high credit standard; ECAF rules Place of issue European Economic Area Settlement/handling procedures Settled in euro area; centrally deposited in bookentry form with central banks or SSS fulfilling ECB’s minimum standards Type of issuer/debtor/guarantor Central banks; public sector; private sector; international and supranational institutions Place of establishment of Issuer/debtor/guarantor Issuer: EEA or non-EEA G 10 countries; Guarantor EEA Acceptable markets Regulated markets; non-regulated market accepted by ECB Currency Euro (No minimum size; governing law restricted to EEA)

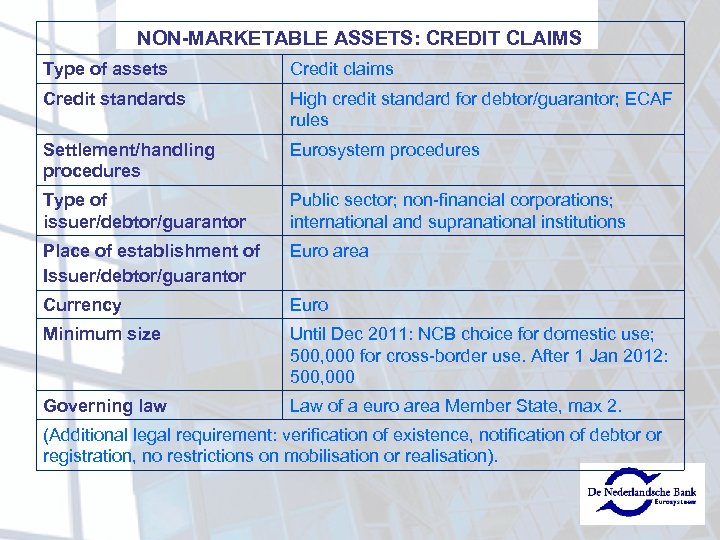

NON-MARKETABLE ASSETS: CREDIT CLAIMS Type of assets Credit claims Credit standards High credit standard for debtor/guarantor; ECAF rules Settlement/handling procedures Eurosystem procedures Type of issuer/debtor/guarantor Public sector; non-financial corporations; international and supranational institutions Place of establishment of Issuer/debtor/guarantor Euro area Currency Euro Minimum size Until Dec 2011: NCB choice for domestic use; 500, 000 for cross-border use. After 1 Jan 2012: 500, 000 Governing law Law of a euro area Member State, max 2. (Additional legal requirement: verification of existence, notification of debtor or registration, no restrictions on mobilisation or realisation).

NON-MARKETABLE ASSETS: CREDIT CLAIMS Type of assets Credit claims Credit standards High credit standard for debtor/guarantor; ECAF rules Settlement/handling procedures Eurosystem procedures Type of issuer/debtor/guarantor Public sector; non-financial corporations; international and supranational institutions Place of establishment of Issuer/debtor/guarantor Euro area Currency Euro Minimum size Until Dec 2011: NCB choice for domestic use; 500, 000 for cross-border use. After 1 Jan 2012: 500, 000 Governing law Law of a euro area Member State, max 2. (Additional legal requirement: verification of existence, notification of debtor or registration, no restrictions on mobilisation or realisation).

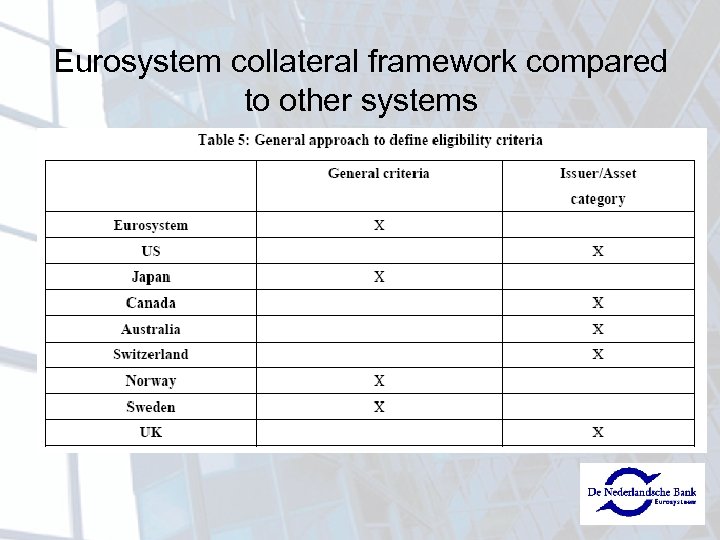

Eurosystem collateral framework compared to other systems

Eurosystem collateral framework compared to other systems

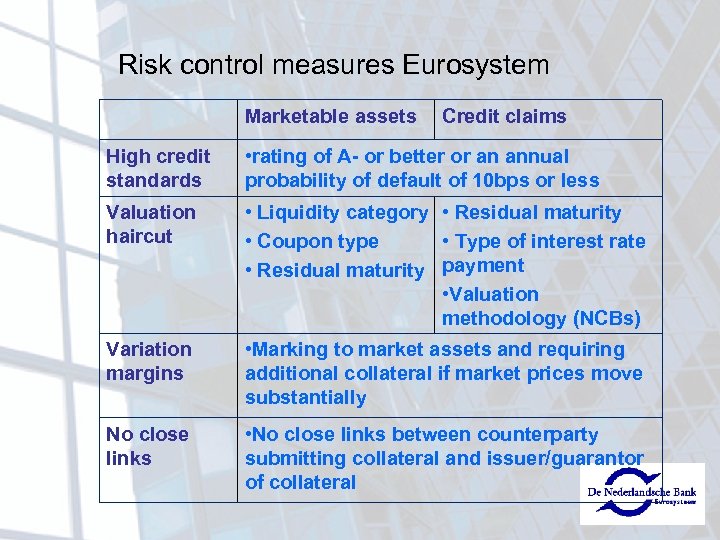

Risk control measures Eurosystem Marketable assets Credit claims High credit standards • rating of A- or better or an annual probability of default of 10 bps or less Valuation haircut • Liquidity category • Residual maturity • Coupon type • Type of interest rate • Residual maturity payment • Valuation methodology (NCBs) Variation margins • Marking to market assets and requiring additional collateral if market prices move substantially No close links • No close links between counterparty submitting collateral and issuer/guarantor of collateral

Risk control measures Eurosystem Marketable assets Credit claims High credit standards • rating of A- or better or an annual probability of default of 10 bps or less Valuation haircut • Liquidity category • Residual maturity • Coupon type • Type of interest rate • Residual maturity payment • Valuation methodology (NCBs) Variation margins • Marking to market assets and requiring additional collateral if market prices move substantially No close links • No close links between counterparty submitting collateral and issuer/guarantor of collateral

Valuation principles • Valuation on a daily basis • Marketable assets – Define the most representative price source (market price) – Rules for non-availability of prices -> theoretical price (based on discounted cash flows) – Two hubs provide theoretical prices, Banque de France for ABS, Deutsche Bundesbank for other complex debt instruments • Non-marketable assets – Theoretical price or outstanding amount

Valuation principles • Valuation on a daily basis • Marketable assets – Define the most representative price source (market price) – Rules for non-availability of prices -> theoretical price (based on discounted cash flows) – Two hubs provide theoretical prices, Banque de France for ABS, Deutsche Bundesbank for other complex debt instruments • Non-marketable assets – Theoretical price or outstanding amount

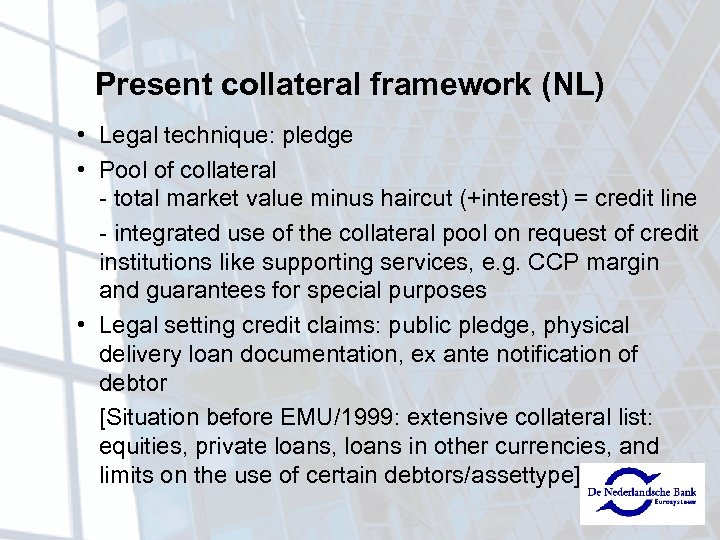

Present collateral framework (NL) • Legal technique: pledge • Pool of collateral - total market value minus haircut (+interest) = credit line - integrated use of the collateral pool on request of credit institutions like supporting services, e. g. CCP margin and guarantees for special purposes • Legal setting credit claims: public pledge, physical delivery loan documentation, ex ante notification of debtor [Situation before EMU/1999: extensive collateral list: equities, private loans, loans in other currencies, and limits on the use of certain debtors/assettype]

Present collateral framework (NL) • Legal technique: pledge • Pool of collateral - total market value minus haircut (+interest) = credit line - integrated use of the collateral pool on request of credit institutions like supporting services, e. g. CCP margin and guarantees for special purposes • Legal setting credit claims: public pledge, physical delivery loan documentation, ex ante notification of debtor [Situation before EMU/1999: extensive collateral list: equities, private loans, loans in other currencies, and limits on the use of certain debtors/assettype]

Topics • The ESCB (Euro System of Central Banks) collateral framework • Collateral management at DNB (De Nederlandsche Bank) • Trends in collateral: European and NL • Mobilising collateral

Topics • The ESCB (Euro System of Central Banks) collateral framework • Collateral management at DNB (De Nederlandsche Bank) • Trends in collateral: European and NL • Mobilising collateral

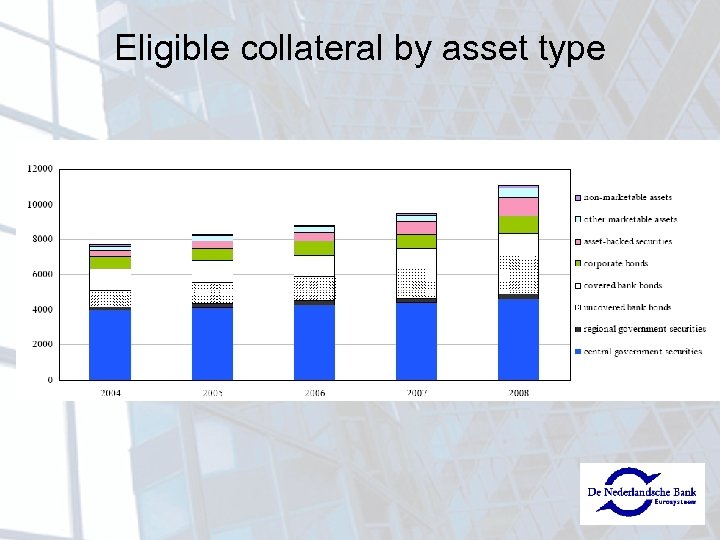

Eligible collateral by asset type

Eligible collateral by asset type

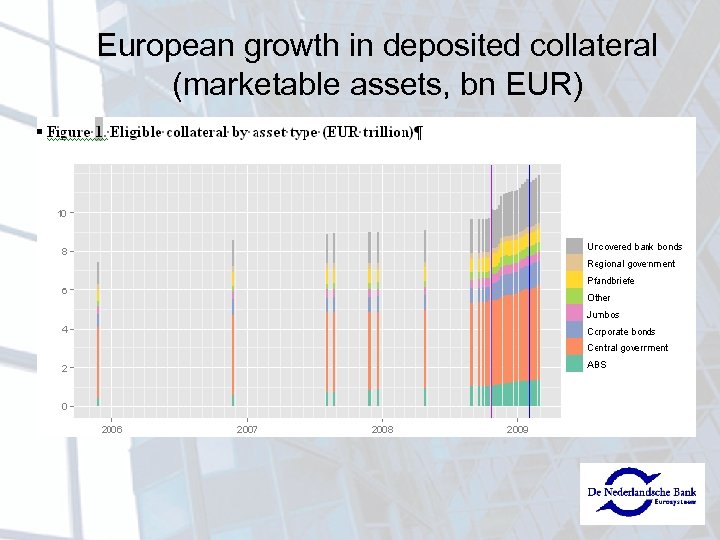

European growth in deposited collateral (marketable assets, bn EUR)

European growth in deposited collateral (marketable assets, bn EUR)

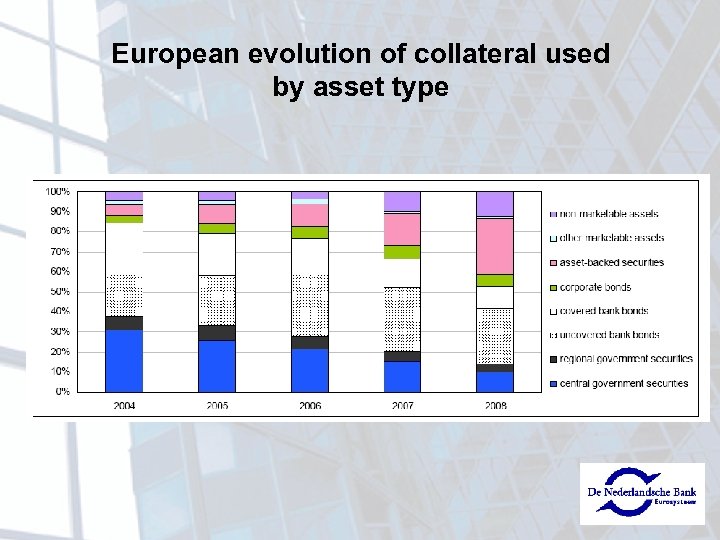

European evolution of collateral used by asset type

European evolution of collateral used by asset type

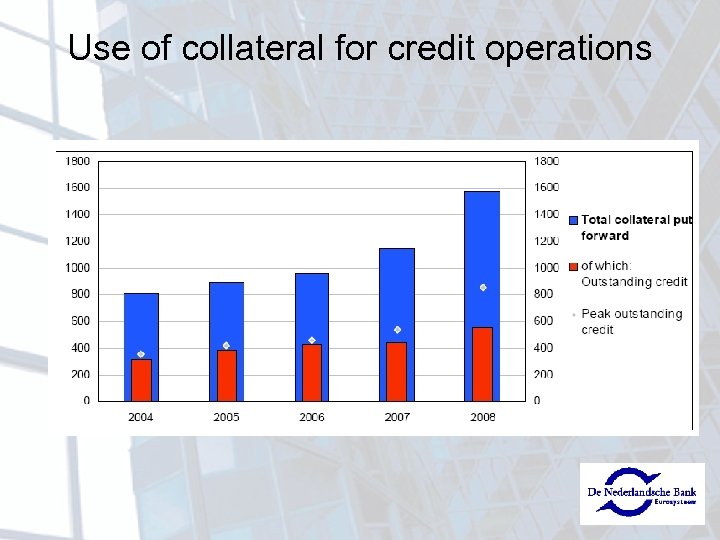

Use of collateral for credit operations

Use of collateral for credit operations

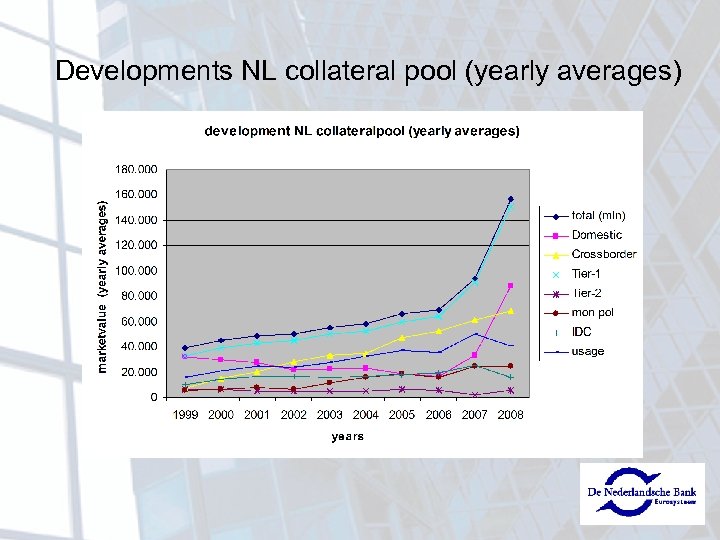

Developments NL collateral pool (yearly averages)

Developments NL collateral pool (yearly averages)

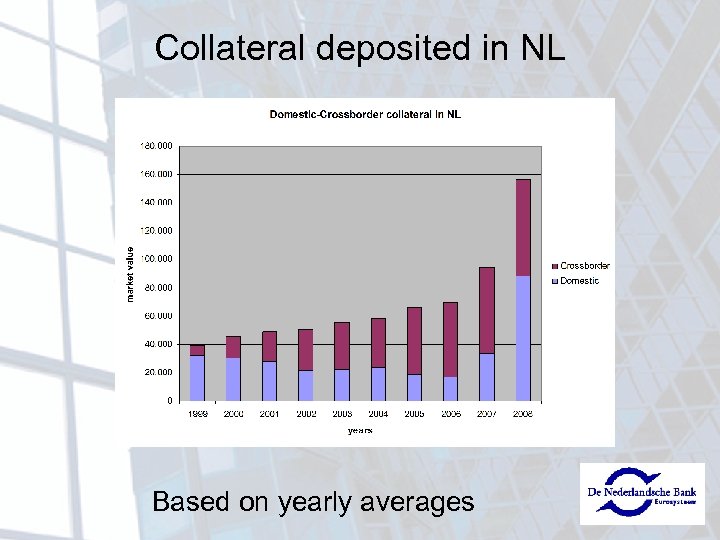

Collateral deposited in NL Based on yearly averages

Collateral deposited in NL Based on yearly averages

NL collateral pool – place of deposit (March 2009) Total (Market value = before haircuts) € 211 bn vault Credit claims ± € 24 bn ENL Domestic ± € 99 bn EB Eurobonds € 58 bn CCBM € 30 bn

NL collateral pool – place of deposit (March 2009) Total (Market value = before haircuts) € 211 bn vault Credit claims ± € 24 bn ENL Domestic ± € 99 bn EB Eurobonds € 58 bn CCBM € 30 bn

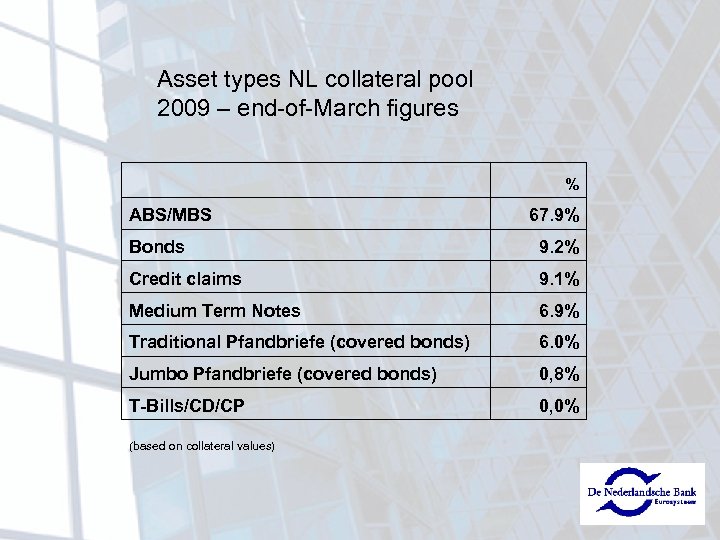

Asset types NL collateral pool 2009 – end-of-March figures ABS/MBS % 67. 9% Bonds 9. 2% Credit claims 9. 1% Medium Term Notes 6. 9% Traditional Pfandbriefe (covered bonds) 6. 0% Jumbo Pfandbriefe (covered bonds) 0, 8% T-Bills/CD/CP 0, 0% (based on collateral values)

Asset types NL collateral pool 2009 – end-of-March figures ABS/MBS % 67. 9% Bonds 9. 2% Credit claims 9. 1% Medium Term Notes 6. 9% Traditional Pfandbriefe (covered bonds) 6. 0% Jumbo Pfandbriefe (covered bonds) 0, 8% T-Bills/CD/CP 0, 0% (based on collateral values)

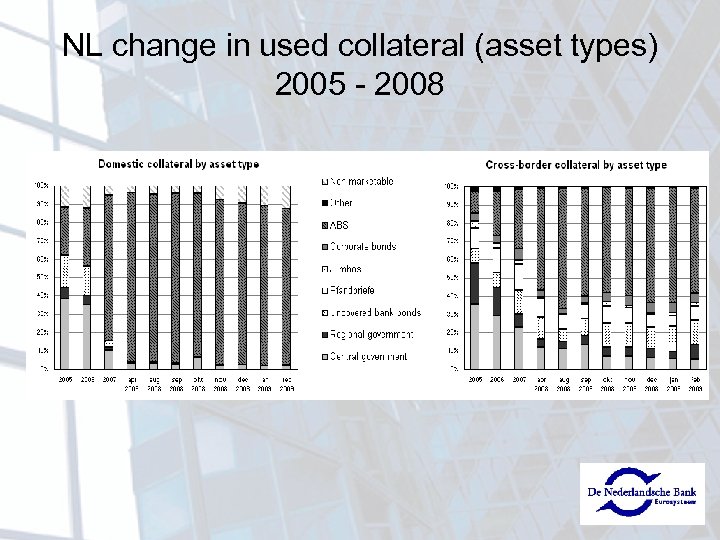

NL change in used collateral (asset types) 2005 - 2008

NL change in used collateral (asset types) 2005 - 2008

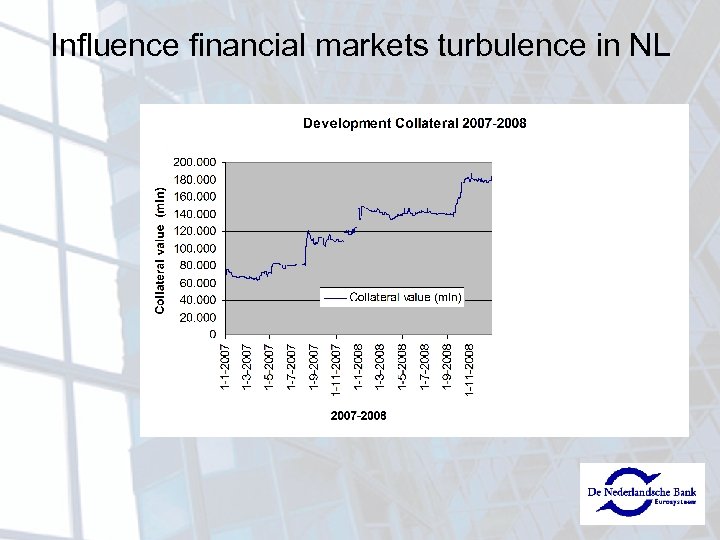

Influence financial markets turbulence in NL

Influence financial markets turbulence in NL

Topics • The ESCB (Euro System of Central Banks) collateral framework • Collateral management at DNB (De Nederlandsche Bank) • Trends in collateral: European and NL • Mobilising collateral

Topics • The ESCB (Euro System of Central Banks) collateral framework • Collateral management at DNB (De Nederlandsche Bank) • Trends in collateral: European and NL • Mobilising collateral

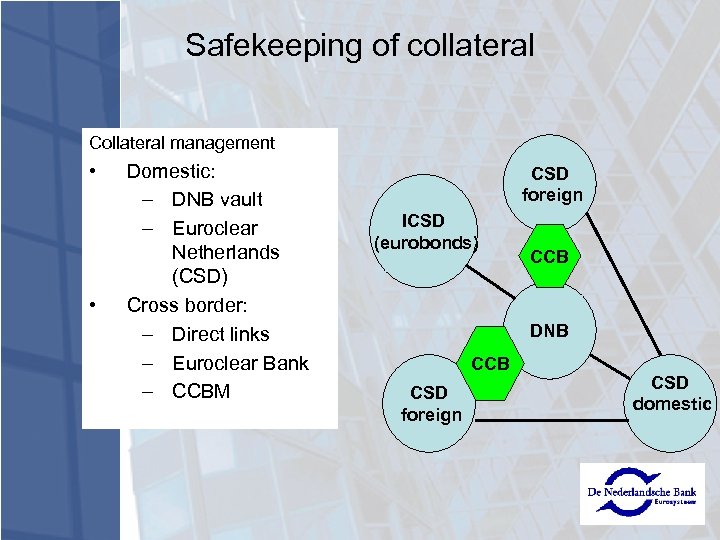

Safekeeping of collateral Collateral management • • Domestic: – DNB vault – Euroclear Netherlands (CSD) Cross border: – Direct links – Euroclear Bank – CCBM CSD foreign ICSD (eurobonds) CCB DNB CCB CSD foreign CSD domestic

Safekeeping of collateral Collateral management • • Domestic: – DNB vault – Euroclear Netherlands (CSD) Cross border: – Direct links – Euroclear Bank – CCBM CSD foreign ICSD (eurobonds) CCB DNB CCB CSD foreign CSD domestic

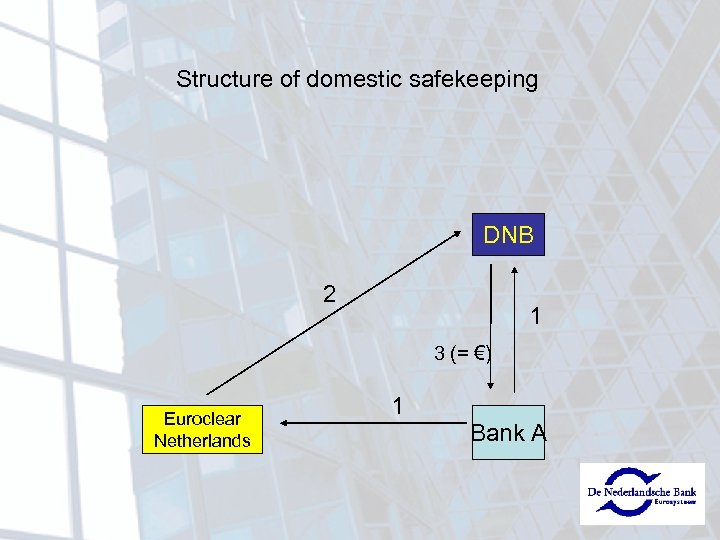

Structure of domestic safekeeping DNB 2 1 3 (= €) Euroclear Netherlands 1 Bank A

Structure of domestic safekeeping DNB 2 1 3 (= €) Euroclear Netherlands 1 Bank A

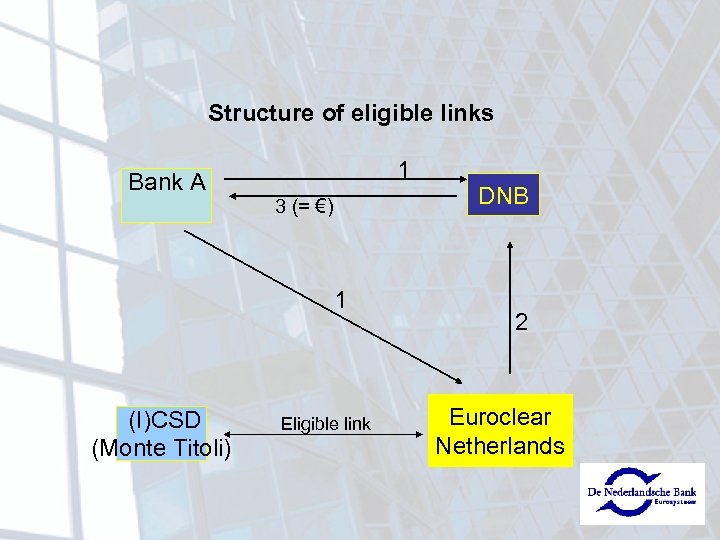

Structure of eligible links 1 Bank A 3 (= €) 1 (I)CSD (Monte Titoli) Eligible link DNB 2 Euroclear Netherlands

Structure of eligible links 1 Bank A 3 (= €) 1 (I)CSD (Monte Titoli) Eligible link DNB 2 Euroclear Netherlands

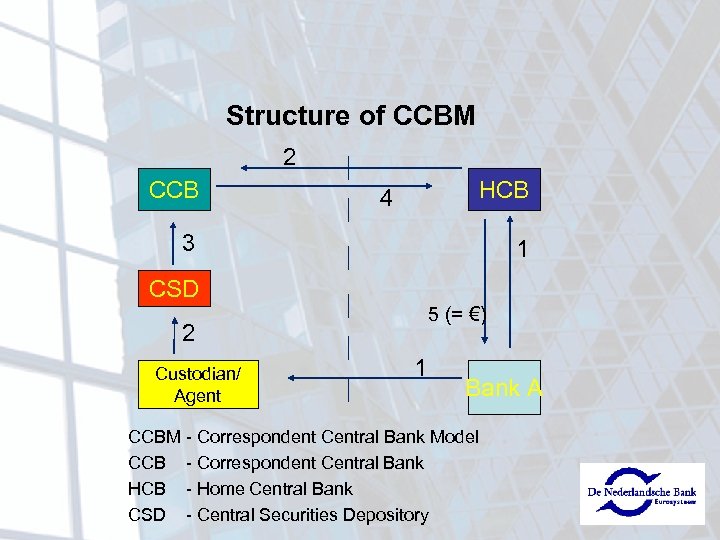

CCBM = Correspondent Central Bank Model • Dutch Eurosystem counterparty sends SWIFT MT 540 to DNB (and MT 542 to its own custodian) • DNB sends MT 540 to the respective CCB • Upon receipt of the securities, the CCB sends an MT 544 to DNB • DNB updates its collateral management system and increases the credit facility for the Dutch Eurosystem counterparty

CCBM = Correspondent Central Bank Model • Dutch Eurosystem counterparty sends SWIFT MT 540 to DNB (and MT 542 to its own custodian) • DNB sends MT 540 to the respective CCB • Upon receipt of the securities, the CCB sends an MT 544 to DNB • DNB updates its collateral management system and increases the credit facility for the Dutch Eurosystem counterparty

Structure of CCBM 2 CCB HCB 4 3 1 CSD 5 (= €) 2 Custodian/ Agent 1 Bank A CCBM - Correspondent Central Bank Model CCB - Correspondent Central Bank HCB - Home Central Bank CSD - Central Securities Depository

Structure of CCBM 2 CCB HCB 4 3 1 CSD 5 (= €) 2 Custodian/ Agent 1 Bank A CCBM - Correspondent Central Bank Model CCB - Correspondent Central Bank HCB - Home Central Bank CSD - Central Securities Depository

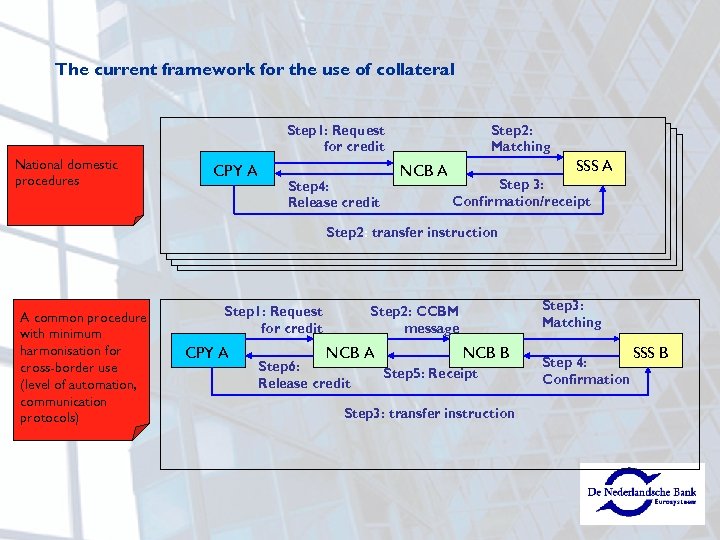

The current framework for the use of collateral Step 1: Request for credit National domestic procedures CPY A Step 4: Release credit Step 2: Matching NCB A SSS A Step 3: Confirmation/receipt Step 2: transfer instruction A common procedure with minimum harmonisation for cross-border use (level of automation, communication protocols) Step 1: Request for credit CPY A Step 3: Matching Step 2: CCBM message NCB A Step 6: Release credit NCB B Step 5: Receipt Step 3: transfer instruction Step 4: Confirmation SSS B

The current framework for the use of collateral Step 1: Request for credit National domestic procedures CPY A Step 4: Release credit Step 2: Matching NCB A SSS A Step 3: Confirmation/receipt Step 2: transfer instruction A common procedure with minimum harmonisation for cross-border use (level of automation, communication protocols) Step 1: Request for credit CPY A Step 3: Matching Step 2: CCBM message NCB A Step 6: Release credit NCB B Step 5: Receipt Step 3: transfer instruction Step 4: Confirmation SSS B

Today’s situation in the field of Eurosystem collateral management • Eurosystem collateral management is technically decentralised with different national procedures – Domestic level: different conditions exist across the euro area (procedures, communication interfaces, level of automation) – Cross-border level: CCBM, the specific arrangement at Eurosystem level for cross-border use, where there are up to five players (and related procedures) involved – Domestic/cross-border level: Different conditions for crossborder (CCBM) and domestic transfers (in terms of execution time, timing and costs) • Slow cross-border links

Today’s situation in the field of Eurosystem collateral management • Eurosystem collateral management is technically decentralised with different national procedures – Domestic level: different conditions exist across the euro area (procedures, communication interfaces, level of automation) – Cross-border level: CCBM, the specific arrangement at Eurosystem level for cross-border use, where there are up to five players (and related procedures) involved – Domestic/cross-border level: Different conditions for crossborder (CCBM) and domestic transfers (in terms of execution time, timing and costs) • Slow cross-border links

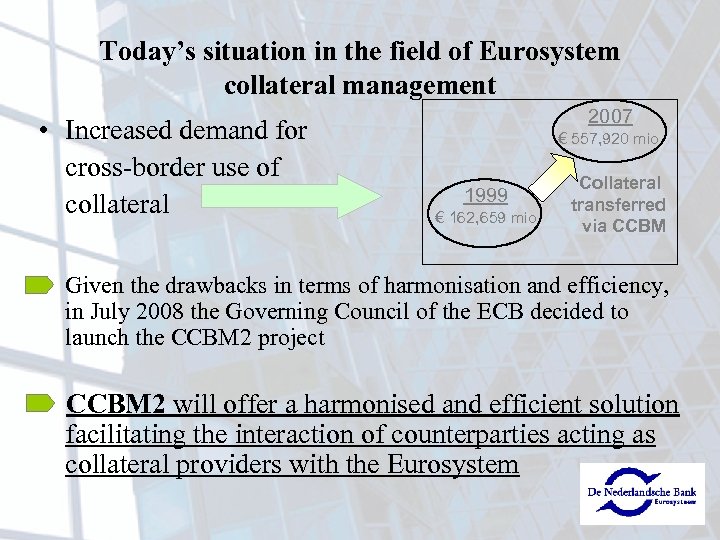

Today’s situation in the field of Eurosystem collateral management • Increased demand for cross-border use of collateral 2007 € 557, 920 mio 1999 € 162, 659 mio Collateral transferred via CCBM Given the drawbacks in terms of harmonisation and efficiency, in July 2008 the Governing Council of the ECB decided to launch the CCBM 2 project CCBM 2 will offer a harmonised and efficient solution facilitating the interaction of counterparties acting as collateral providers with the Eurosystem

Today’s situation in the field of Eurosystem collateral management • Increased demand for cross-border use of collateral 2007 € 557, 920 mio 1999 € 162, 659 mio Collateral transferred via CCBM Given the drawbacks in terms of harmonisation and efficiency, in July 2008 the Governing Council of the ECB decided to launch the CCBM 2 project CCBM 2 will offer a harmonised and efficient solution facilitating the interaction of counterparties acting as collateral providers with the Eurosystem

Benefits of CCBM 2 • Consolidation – Single technical platform for domestic and cross-border use of collateral – Centralised IT solution while preserving decentralised business relations between NCBs and counterparties (access to credit) • Harmonisation – Harmonised service level for all accepted collateral (marketable assets and credit claims), covering existing collateral legal techniques (pledge and repo) – Harmonised interface with market participants • Efficiency – Lower costs for consolidated solution which will be based on existing central bank systems (the one jointly operated by National Bank of Belgium/De Nederlandsche Bank) – Adoption of real-time and straight-through-processing; direct interfacing with TARGET 2 (cash settlement) and TARGET 2 -Securities (securities settlement)

Benefits of CCBM 2 • Consolidation – Single technical platform for domestic and cross-border use of collateral – Centralised IT solution while preserving decentralised business relations between NCBs and counterparties (access to credit) • Harmonisation – Harmonised service level for all accepted collateral (marketable assets and credit claims), covering existing collateral legal techniques (pledge and repo) – Harmonised interface with market participants • Efficiency – Lower costs for consolidated solution which will be based on existing central bank systems (the one jointly operated by National Bank of Belgium/De Nederlandsche Bank) – Adoption of real-time and straight-through-processing; direct interfacing with TARGET 2 (cash settlement) and TARGET 2 -Securities (securities settlement)

Thank you. Qu€stions?

Thank you. Qu€stions?