7235446c73759529b00870a8a8568861.ppt

- Количество слайдов: 38

Cognitive Economics and Financial Choices Miles Kimball Tyler Shumway

Cognitive Economics • The economics of what is in people’s minds • Explicitly allows people to have limited cognitive abilities – Mistakes and folk theories – Limited knowledge of economic realities – Bounded rationality, rational ignorance • We measure knowledge and correlate it with behavior that appears suboptimal

Cognitive and Behavioral Econ • Behavioral economics and finance have found lots of anomalous behavior – Weird preferences? – Cognitive limitations? • Answer matters for welfare and policy • Cognitive economics: see how much we can explain with cognitive limitations before invoking weird preferences

Dimensions of Cognition • We explore three dimensions of cognition • Sophistication (some say literacy) – Distance from truth • Overconfidence – Awareness of distance from truth • Folk theories – Direction of departure from truth

Financial Sophistication • We hypothesize that sophistication can explain numerous behavioral regularities – People make mistakes • Simpler explanation than alternatives – Information structure – Unusual incentives or weird preferences

Measuring Sophistication • Previous work of Hilgert, Hogarth and Beverly (2003), Lusardi and Mitchell (2007) • Questions on the April 2005 Survey of Consumers – Kimball and Shumway (2007) • Fox Run Survey, ALP used for development • Cognitive Economics Survey – About 15 sophistication questions – Many outcome variables – attitudes & actions

Measuring Sophistication • We count “correct” answers to sophistication questions to form an index • This index is extremely highly correlated with the first component in a factor analysis • We omit “attitudinal outcome” questions (we use Cog. Econ questions 15 -30 and 41)

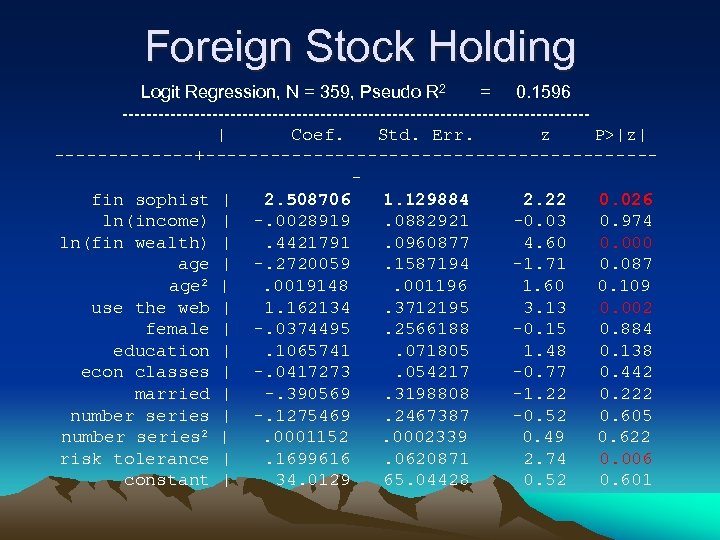

Foreign Stock Holding Logit Regression, N = 359, Pseudo R 2 = 0. 1596 ---------------------------------------| Coef. Std. Err. z P>|z| -------+---------------------fin sophist | 2. 508706 1. 129884 2. 22 0. 026 ln(income) | -. 0028919. 0882921 -0. 03 0. 974 ln(fin wealth) |. 4421791. 0960877 4. 60 0. 000 age | -. 2720059. 1587194 -1. 71 0. 087 age 2 |. 0019148. 001196 1. 60 0. 109 use the web | 1. 162134. 3712195 3. 13 0. 002 female | -. 0374495. 2566188 -0. 15 0. 884 education |. 1065741. 071805 1. 48 0. 138 econ classes | -. 0417273. 054217 -0. 77 0. 442 married | -. 390569. 3198808 -1. 22 0. 222 number series | -. 1275469. 2467387 -0. 52 0. 605 number series 2 |. 0001152. 0002339 0. 49 0. 622 risk tolerance |. 1699616. 0620871 2. 74 0. 006 constant | 34. 0129 65. 04428 0. 52 0. 601

Attitude Questions • It is a good idea to own stocks of foreign companies • An employee of a company with publicly traded stock should have little or none of his or her retirement savings in the company’s stock • Even older retired people should hold some stocks • You should invest in either mutual funds or a large number of different stocks instead of just a few stocks

Attitude Questions • To make money in the stock market, you should not buy and sell stocks too often • It is important to take a look at your investments periodically to see if you need to make changes • If inflation is not an issue, it is better for young people saving for retirement to combine stocks with long-term bonds than with short-term bonds

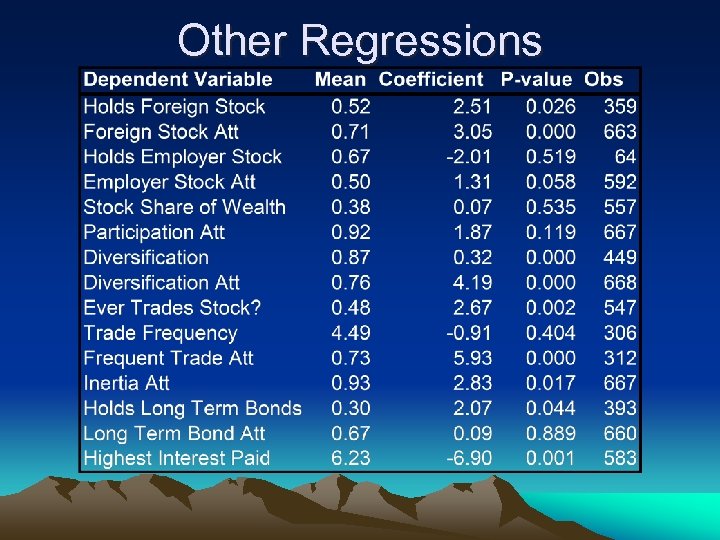

Other Regressions

Sophistication and Choice • Portfolio choice appears to be significantly affected by sophistication • Less sophisticated people make mistakes • Causality may be an issue for some of these, but not for all of them • Education may help to remedy this, or better policy (defaults, etc)

Overconfidence • Overconfidence is thought to be a significant factor in financial decisions • Typically not measured very well – Gender (Barber and Odean, 2001) – Excessive trading – Old military records (Grinblatt and Keloharju, 2008)

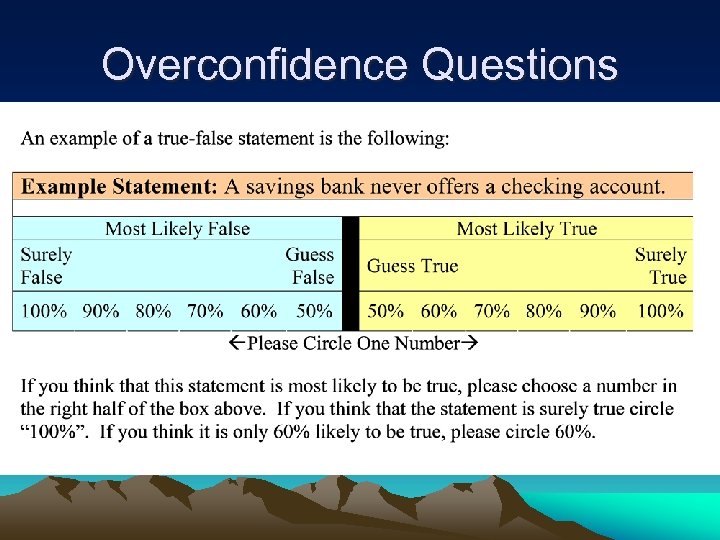

Overconfidence Questions

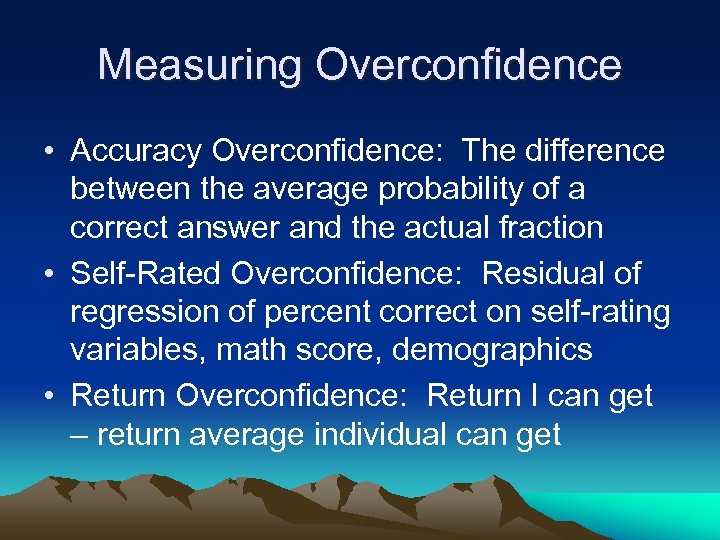

Measuring Overconfidence • Accuracy Overconfidence: The difference between the average probability of a correct answer and the actual fraction • Self-Rated Overconfidence: Residual of regression of percent correct on self-rating variables, math score, demographics • Return Overconfidence: Return I can get – return average individual can get

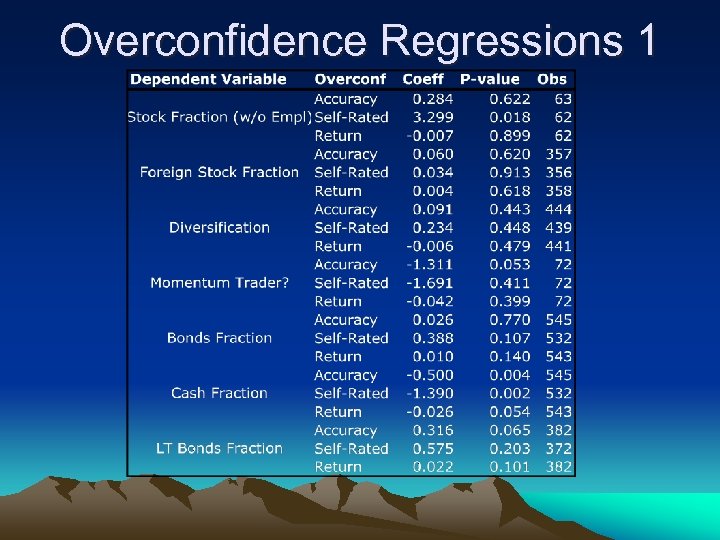

Overconfidence Regressions 1

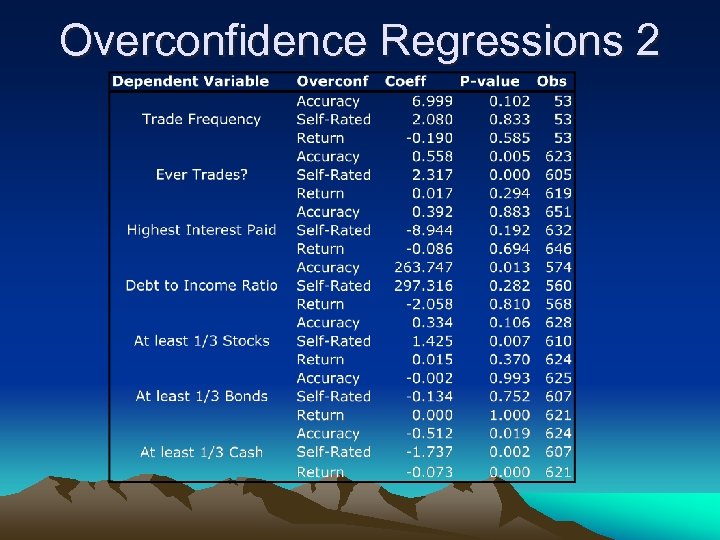

Overconfidence Regressions 2

Overconfidence and Choice • Overconfidence is clearly related to a number of portfolio choices – Stock and cash holdings – Trading frequency • Contrary to other findings, not significantly related to gender or momentum trading

Total Savings and Folk Theories • We hypothesize that total savings rates and stocks are affected by folk theories – Survey Practicum course – Focus groups • Savings questions on the Survey of Consumers for June

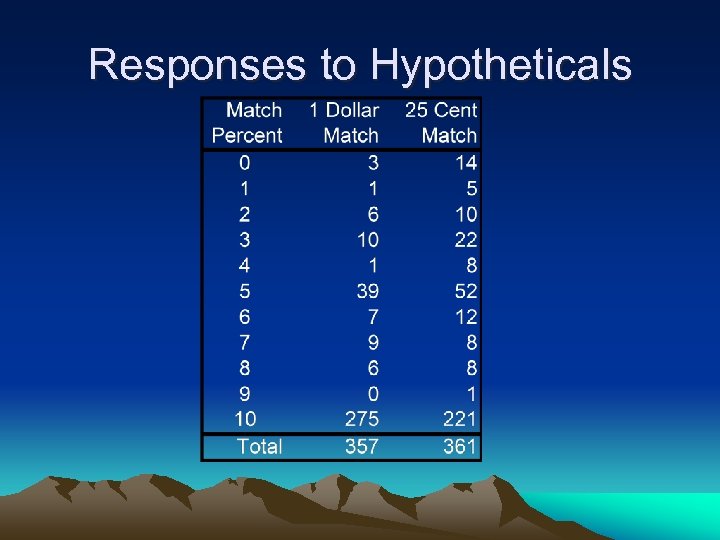

Measuring Propensity to Save • Make an index of many “outcome variables” • 79% of variance is explained with responses to two hypothetical questions: – Suppose you got a (new) job that has a 401(k) retirement savings plan. You can contribute up to 10% of your pay. For every dollar you put in, your (new) employer will put in a dollar. What percentage of your pay would you choose to contribute? – Same question with a twenty-five cent match

Responses to Hypotheticals

Folk Theories we Examine • • • Trust of institutions and others Planning Others will take care of me Saving is inherently good (almost morally) Fatalism Social pressure Psychological tricks Self control Budgeting skill Control

Institutional Trust • All regressions use a savings index as the dependent variable, no other controls • If I try to save through financial institutions, someone is likely to figure out a way to cheat me out of the money. • Coefficient = -0. 67, t-stat = -3. 38

Planning • I enjoy planning for activities like vacations well in advance. (strongly agree. . ) • Coefficient = 0. 53, t-stat = 2. 66 • Thinking about money stresses me out. • Coefficient = -1. 25, t-stat = -6. 53 • I am good at seeing the big picture • Coefficient = 0. 72, t-stat = 2. 43

Others Will Take Care of Me • Whether for political or other reasons, the US government will always make sure that senior citizens have basic food, shelter, clothing, and medical care. • Coefficient = 0. 26, t-stat = 1. 47 • Even in the worst case, I will be okay financially when I am old because I will have government programs to fall back on. • Coefficient = -0. 02, t-stat = -0. 07 • My children will make sure I am okay financially when I am old. • Coefficient = -0. 16, t-stat = -0. 73

Saving is Good (1) • People who don’t save for retirement are being irresponsible • Coefficient = 1. 04, t-stat = 5. 14 • Money doesn’t buy happiness • Coefficient = 0. 43, t-stat = 1. 82 • Using a credit card without paying off the balance every month is really stupid • Coefficient = 0. 63, t-stat = 3. 19

Saving is Good (2) • Thinking about money all the time, even when you have enough, is a terrible way to live • Coefficient = 0. 30, t-stat = 1. 28 • Most Americans save too little • Coefficient = 0. 96, t-stat = 3. 13 • Most Americans borrow too much • Coefficient = 0. 30, t-stat = 0. 93

Saving is Good (3) • I really respect people who have managed to save a lot of money • Coefficient = -0. 27, t-stat =-0. 89 • It is nice to have money saved up, but you have to live • Coefficient = -0. 85, t-stat = -2. 84

Fatalism • If you don’t let yourself get too worried, everything tends to work out in the end. • Coefficient = -0. 40, t-stat = -2. 02 • No one can predict the future, so trying to save doesn’t do much good. • Coefficient = -1. 51, t-stat = -5. 64

Social Pressure (1) • My parents or guardians encouraged me to save. • Coefficient = 0. 24, t-stat = 1. 17 • I would hate to have people think I am careless with money. • Coefficient = -0. 08, t-stat = -0. 36 • I would feel guilty about going bankrupt, even if I had to. • Coefficient = 0. 45, t-stat = 2. 22

Social Pressure (2) • When I was growing up, my parents were good at saving their money. • Coefficient = 0. 17, t-stat = 0. 98 • I would hate to have someone think that I am stingy with my money. • Coefficient = 0. 03, t-stat = 0. 15

Psychological Tricks • Before I buy something, I ask myself if I am really going to use it. • Coefficient = 0. 33, t-stat = 1. 31 • Pretending to yourself that you have less money than you really do is a good idea. • Coefficient = -0. 21, t-stat = -1. 06 • Before I buy something, I think twice to make sure it is something I really need. • Coefficient = 0. 01, t-stat = 0. 02

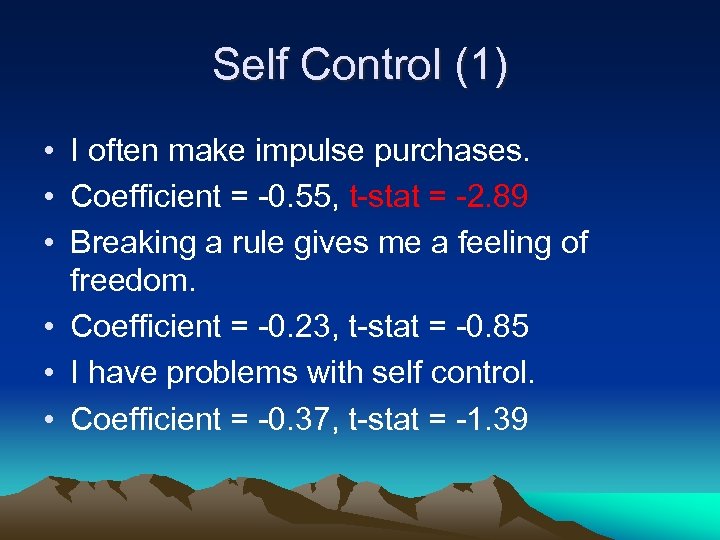

Self Control (1) • I often make impulse purchases. • Coefficient = -0. 55, t-stat = -2. 89 • Breaking a rule gives me a feeling of freedom. • Coefficient = -0. 23, t-stat = -0. 85 • I have problems with self control. • Coefficient = -0. 37, t-stat = -1. 39

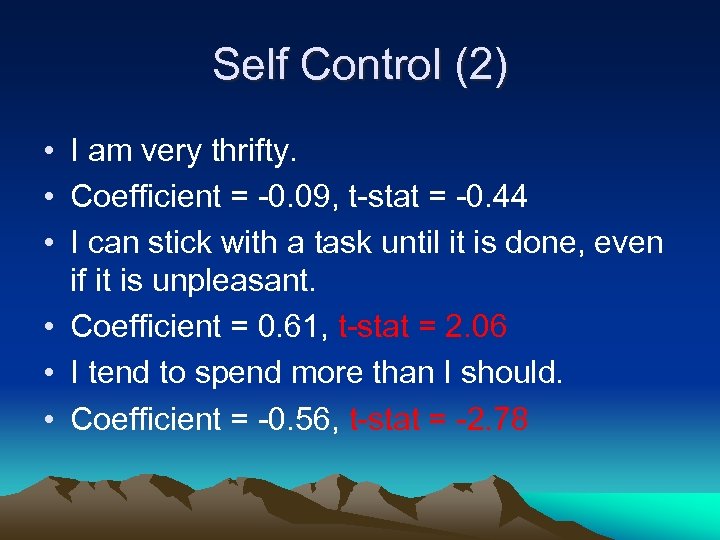

Self Control (2) • I am very thrifty. • Coefficient = -0. 09, t-stat = -0. 44 • I can stick with a task until it is done, even if it is unpleasant. • Coefficient = 0. 61, t-stat = 2. 06 • I tend to spend more than I should. • Coefficient = -0. 56, t-stat = -2. 78

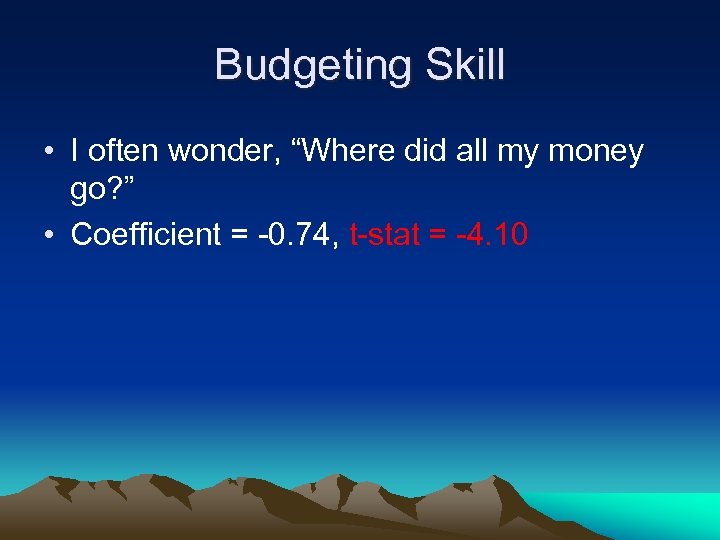

Budgeting Skill • I often wonder, “Where did all my money go? ” • Coefficient = -0. 74, t-stat = -4. 10

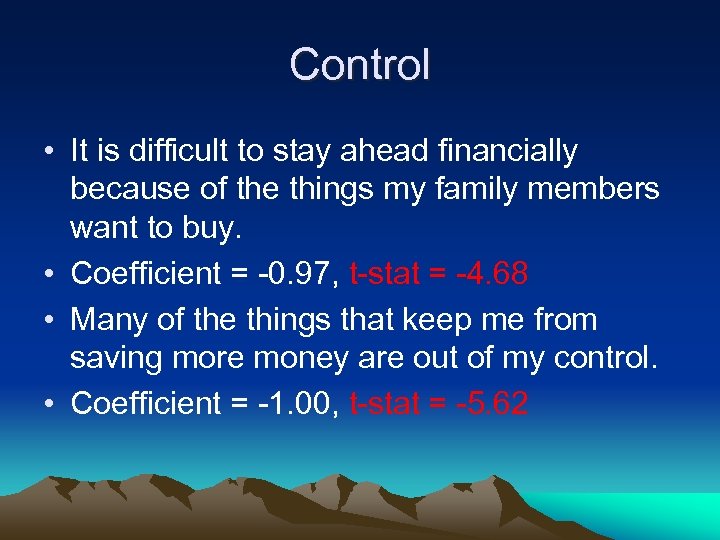

Control • It is difficult to stay ahead financially because of the things my family members want to buy. • Coefficient = -0. 97, t-stat = -4. 68 • Many of the things that keep me from saving more money are out of my control. • Coefficient = -1. 00, t-stat = -5. 62

Folk Theories • These results are preliminary – Need to adjust for income – Create factors for different theories to explore • Still, we can see some things – Trust, planning, fatalism and control important – People are not hypocritical (at least in surveys) • Folk theories appear to matter

Conclusion • Cognitive economics posits that cognition is an important consideration in economic decision making • We have good evidence that sophistication, overconfidence, and folk theories drive some decisions • This has important implications

7235446c73759529b00870a8a8568861.ppt