bafe47bff036a5b37c89bd8af67690e8.ppt

- Количество слайдов: 52

CMTA Advanced Treasury Workshop Floating Rate Notes, Fixed to Float Securities, Step Down Bonds and Convexity Presented by: Tony Garcia, CFA Vice President Pomona, CA January 31, 2012

CMTA Advanced Treasury Workshop Floating Rate Notes, Fixed to Float Securities, Step Down Bonds and Convexity Presented by: Tony Garcia, CFA Vice President Pomona, CA January 31, 2012

If you can’t explain it to a six year old, you don’t understand it yourself. -Albert Einstein 1

If you can’t explain it to a six year old, you don’t understand it yourself. -Albert Einstein 1

On the Agenda § Floating Rate Securities § A security where the coupon floats relative to an index § Fixed to Float Securities § A security that has a fixed coupon for a period and then converts to a floating rate security § Step Down Bonds § A callable security where the coupon declines § Negative Convexity § The bane of callable buyers 2

On the Agenda § Floating Rate Securities § A security where the coupon floats relative to an index § Fixed to Float Securities § A security that has a fixed coupon for a period and then converts to a floating rate security § Step Down Bonds § A callable security where the coupon declines § Negative Convexity § The bane of callable buyers 2

Floating Rate Securities

Floating Rate Securities

Floating Rate Securities § Coupon Floats Relative to Index (Benchmark or Reference rate) Coupon Rate = reference rate (index) +/- quoted margin § Indexes § § § § Fed Funds – Daily Reset Libor – O/N, 1 Month, 3 Month, 6 Month, 12 Month CMT – Spread to Constant Maturity Treasury with regular resets Commercial Paper Prime Rate Treasury Bill – 1 Month, 3 Month, 6 Month TIPS – Inflation Indexed § Inverse Floaters – Where the coupon moves in the opposite direction to the reference rate *You cannot buy these* 4

Floating Rate Securities § Coupon Floats Relative to Index (Benchmark or Reference rate) Coupon Rate = reference rate (index) +/- quoted margin § Indexes § § § § Fed Funds – Daily Reset Libor – O/N, 1 Month, 3 Month, 6 Month, 12 Month CMT – Spread to Constant Maturity Treasury with regular resets Commercial Paper Prime Rate Treasury Bill – 1 Month, 3 Month, 6 Month TIPS – Inflation Indexed § Inverse Floaters – Where the coupon moves in the opposite direction to the reference rate *You cannot buy these* 4

Floating Rate Securities § Issuers § § Treasury – TIPS Agencies – Debentures and Asset Backed Municipalities Corporations § Discount Margin § Effective spread to index § Caps and Floor § Cap – The limit to which a coupon can float § Floor – Minimum possible coupon § Collar – When security has both a cap and a floor 5

Floating Rate Securities § Issuers § § Treasury – TIPS Agencies – Debentures and Asset Backed Municipalities Corporations § Discount Margin § Effective spread to index § Caps and Floor § Cap – The limit to which a coupon can float § Floor – Minimum possible coupon § Collar – When security has both a cap and a floor 5

Components Of Pricing § Spread to Index determines coupon § Reset Frequency § Maturity § Change in Basis 6

Components Of Pricing § Spread to Index determines coupon § Reset Frequency § Maturity § Change in Basis 6

Discount Margin § Discount margin is the inferred change in spread to Index § Price changes to reflect change in market § Price change = PV of change in DM § As with YTM 7

Discount Margin § Discount margin is the inferred change in spread to Index § Price changes to reflect change in market § Price change = PV of change in DM § As with YTM 7

Basis Risk § Change in DM to reflect adjustments in market § § If credit quality improves DM should decline If credit quality deteriorates DM will widen If spreads narrow DM will decline May also change due to change absolute level of interest rates 8

Basis Risk § Change in DM to reflect adjustments in market § § If credit quality improves DM should decline If credit quality deteriorates DM will widen If spreads narrow DM will decline May also change due to change absolute level of interest rates 8

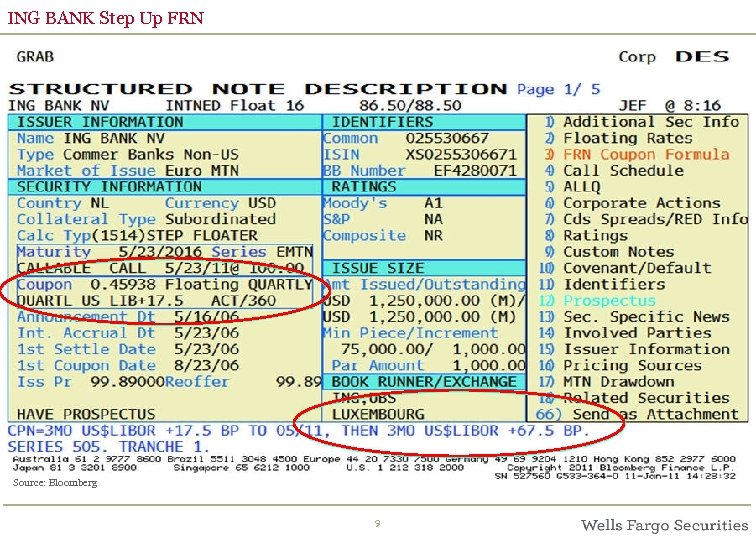

ING BANK Step Up FRN Source: Bloomberg 9

ING BANK Step Up FRN Source: Bloomberg 9

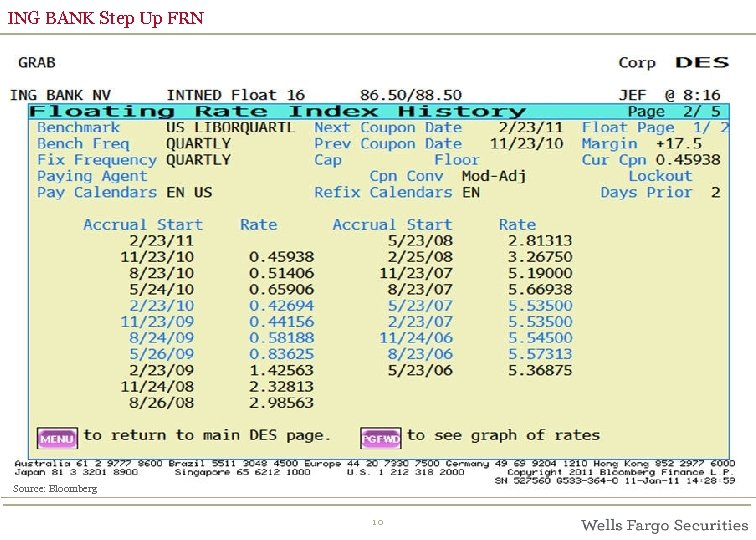

ING BANK Step Up FRN Source: Bloomberg 10

ING BANK Step Up FRN Source: Bloomberg 10

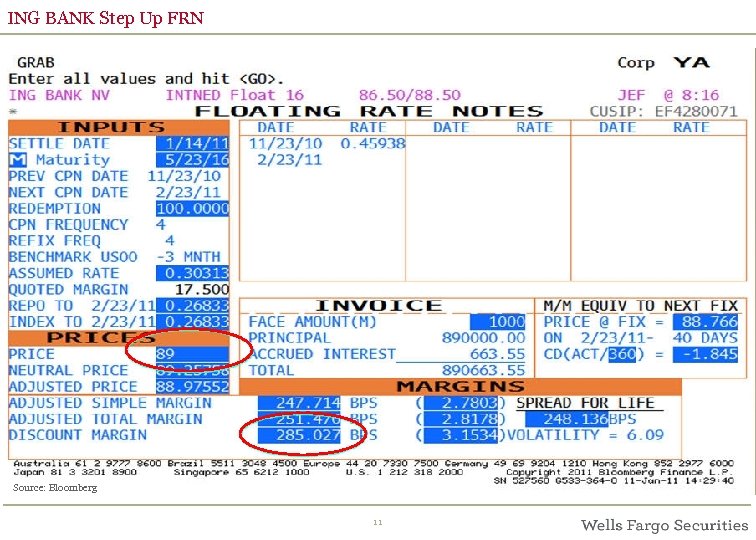

ING BANK Step Up FRN Source: Bloomberg 11

ING BANK Step Up FRN Source: Bloomberg 11

Value To A Portfolio § Lower Duration § Reset frequency lowers effective duration § Lower Price volatility § Yield will move in direction of underlying index 12

Value To A Portfolio § Lower Duration § Reset frequency lowers effective duration § Lower Price volatility § Yield will move in direction of underlying index 12

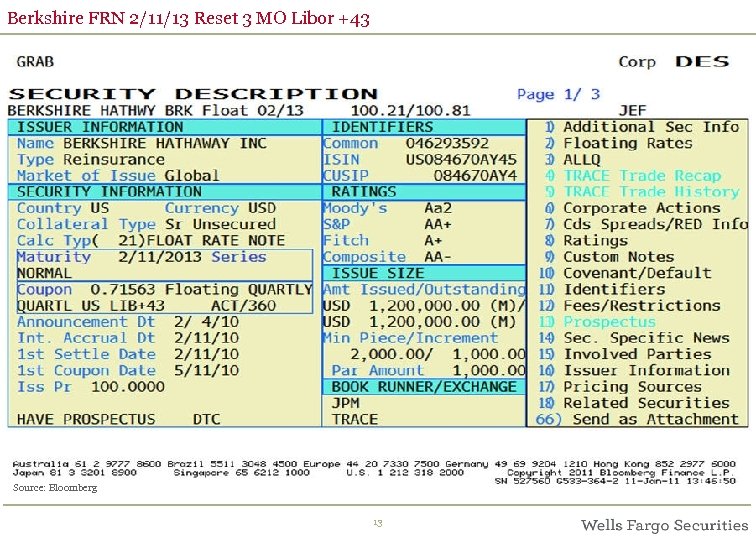

Berkshire FRN 2/11/13 Reset 3 MO Libor +43 Source: Bloomberg 13

Berkshire FRN 2/11/13 Reset 3 MO Libor +43 Source: Bloomberg 13

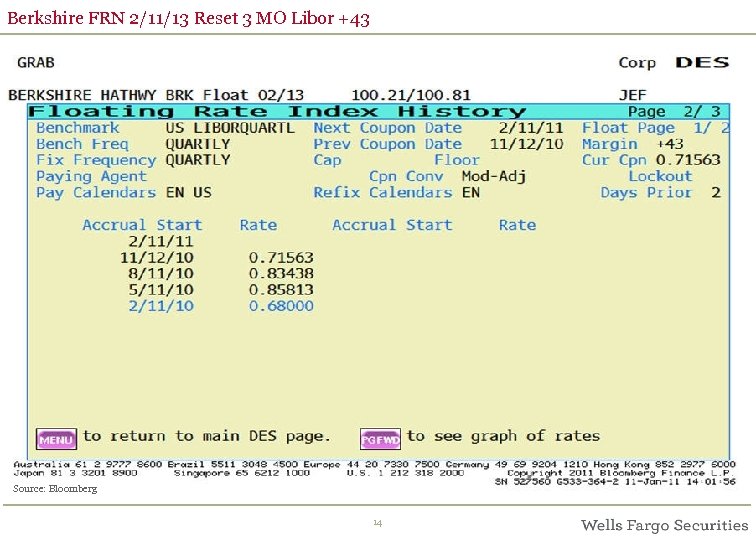

Berkshire FRN 2/11/13 Reset 3 MO Libor +43 Source: Bloomberg 14

Berkshire FRN 2/11/13 Reset 3 MO Libor +43 Source: Bloomberg 14

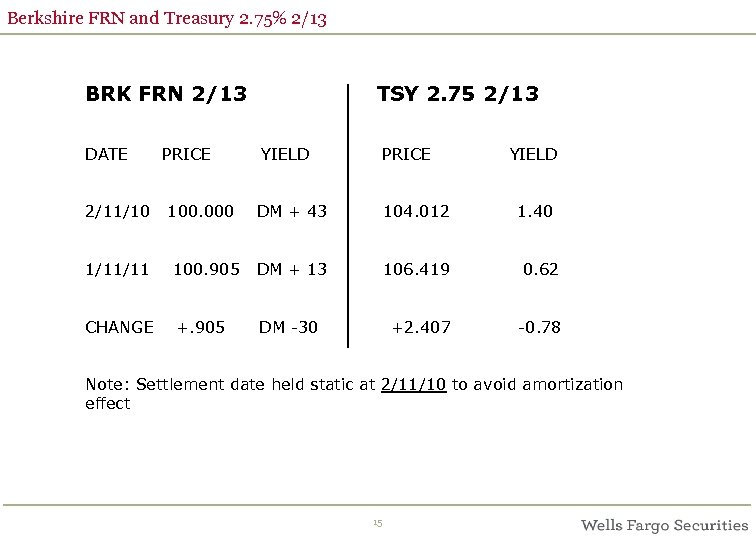

Berkshire FRN and Treasury 2. 75% 2/13 BRK FRN 2/13 DATE 2/11/10 PRICE 100. 000 TSY 2. 75 2/13 YIELD PRICE DM + 43 104. 012 YIELD 1. 40 1/11/11 100. 905 DM + 13 106. 419 0. 62 CHANGE +. 905 DM -30 +2. 407 -0. 78 Note: Settlement date held static at 2/11/10 to avoid amortization effect 15

Berkshire FRN and Treasury 2. 75% 2/13 BRK FRN 2/13 DATE 2/11/10 PRICE 100. 000 TSY 2. 75 2/13 YIELD PRICE DM + 43 104. 012 YIELD 1. 40 1/11/11 100. 905 DM + 13 106. 419 0. 62 CHANGE +. 905 DM -30 +2. 407 -0. 78 Note: Settlement date held static at 2/11/10 to avoid amortization effect 15

Fixed to float securities

Fixed to float securities

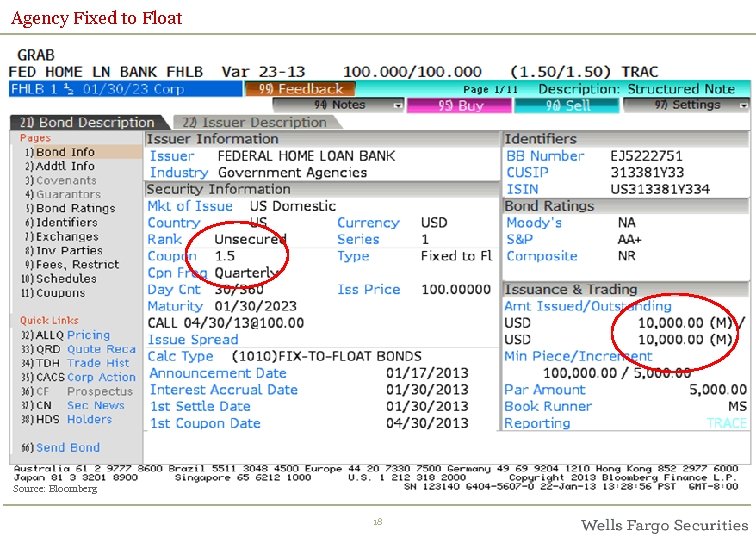

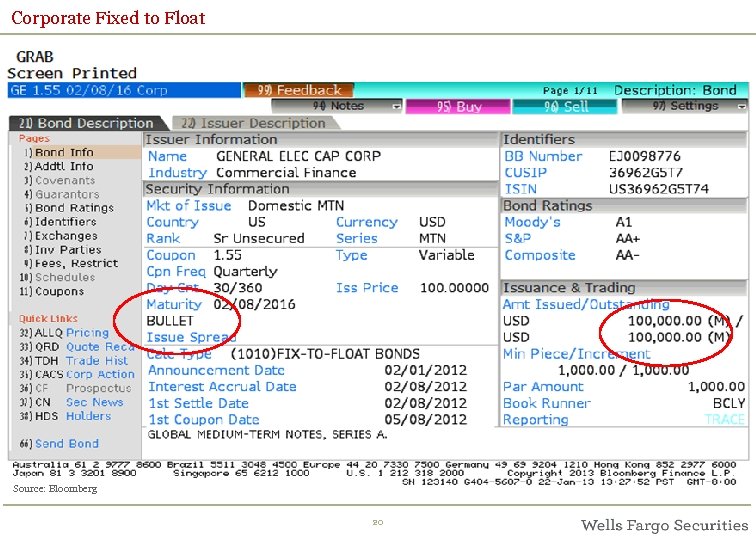

Fixed to Floating Rate Securities § Securities begin with a Fixed Coupon rate for specified period then will switch to a Floating Rate Coupon § May be bulleted or callable § Issued by Agencies and Corporations § Can provide protection against rising rates § Basis shift out of a low volatility environment can be a concern 17

Fixed to Floating Rate Securities § Securities begin with a Fixed Coupon rate for specified period then will switch to a Floating Rate Coupon § May be bulleted or callable § Issued by Agencies and Corporations § Can provide protection against rising rates § Basis shift out of a low volatility environment can be a concern 17

Agency Fixed to Float Source: Bloomberg 18

Agency Fixed to Float Source: Bloomberg 18

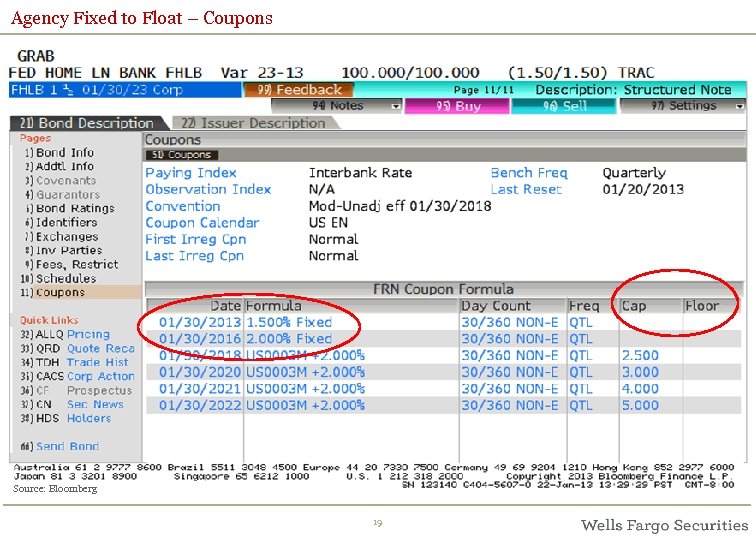

Agency Fixed to Float – Coupons Source: Bloomberg 19

Agency Fixed to Float – Coupons Source: Bloomberg 19

Corporate Fixed to Float Source: Bloomberg 20

Corporate Fixed to Float Source: Bloomberg 20

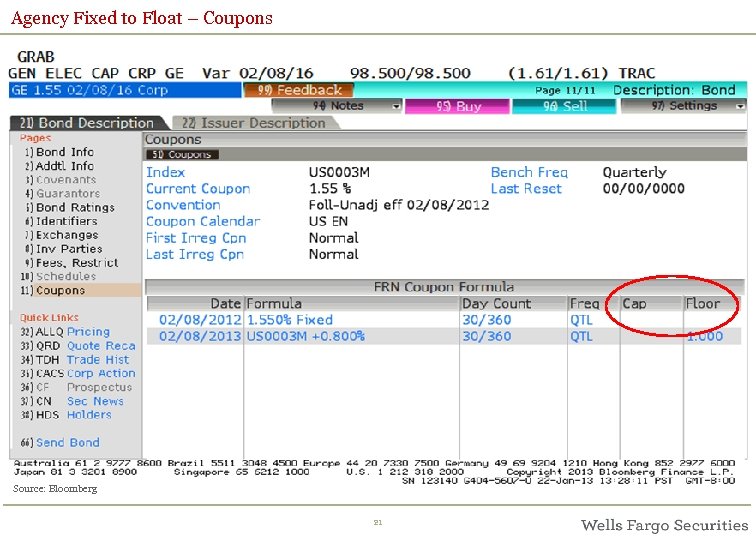

Agency Fixed to Float – Coupons Source: Bloomberg 21

Agency Fixed to Float – Coupons Source: Bloomberg 21

Step down bonds

Step down bonds

Step Down Callable § Security structure where coupon steps down if bond not called § Likelihood of call is very small § Short term cash flow is the focus 23

Step Down Callable § Security structure where coupon steps down if bond not called § Likelihood of call is very small § Short term cash flow is the focus 23

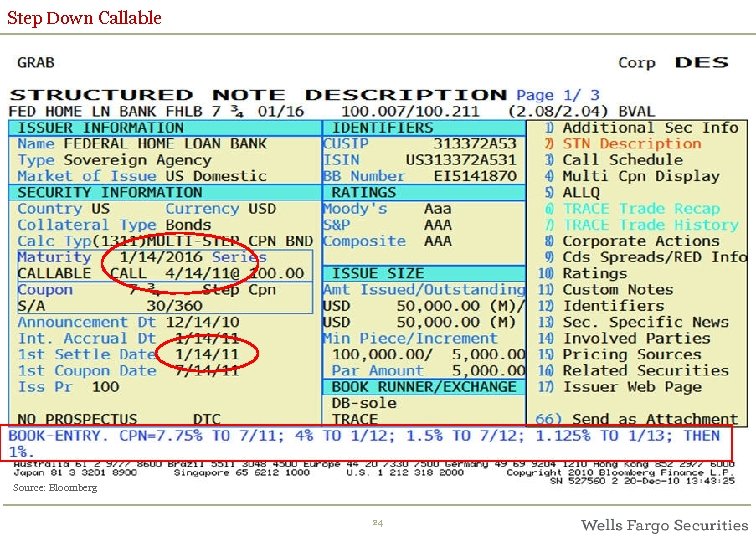

Step Down Callable Source: Bloomberg 24

Step Down Callable Source: Bloomberg 24

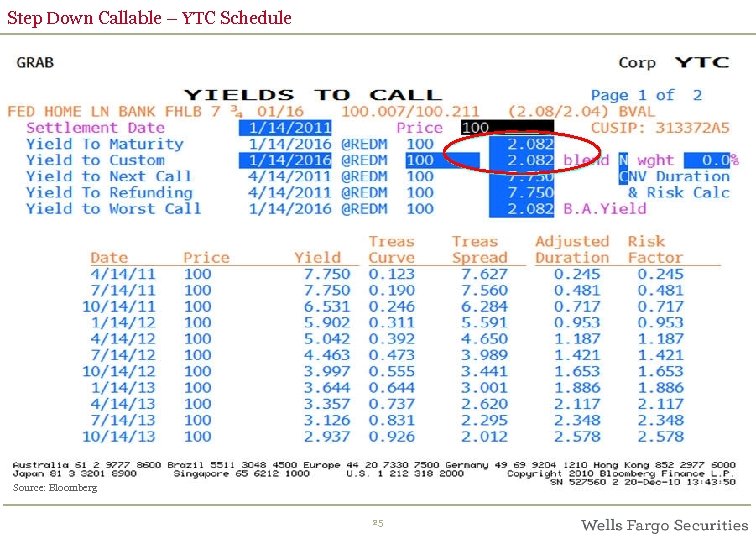

Step Down Callable – YTC Schedule Source: Bloomberg 25

Step Down Callable – YTC Schedule Source: Bloomberg 25

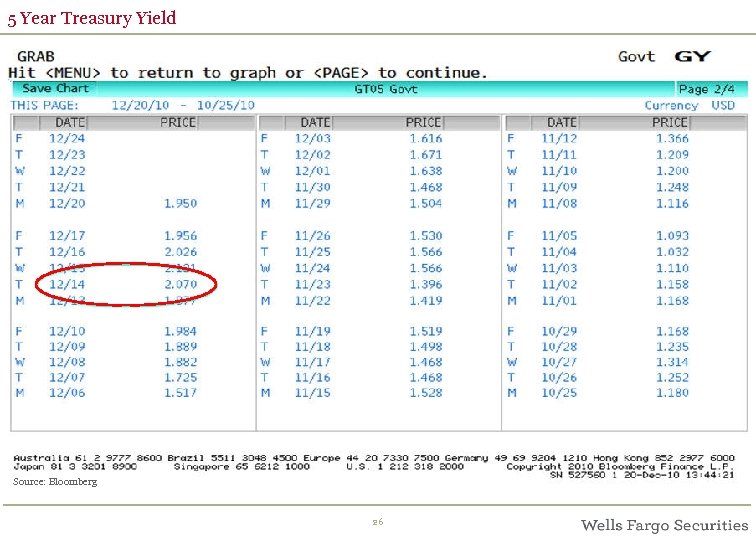

5 Year Treasury Yield Source: Bloomberg 26

5 Year Treasury Yield Source: Bloomberg 26

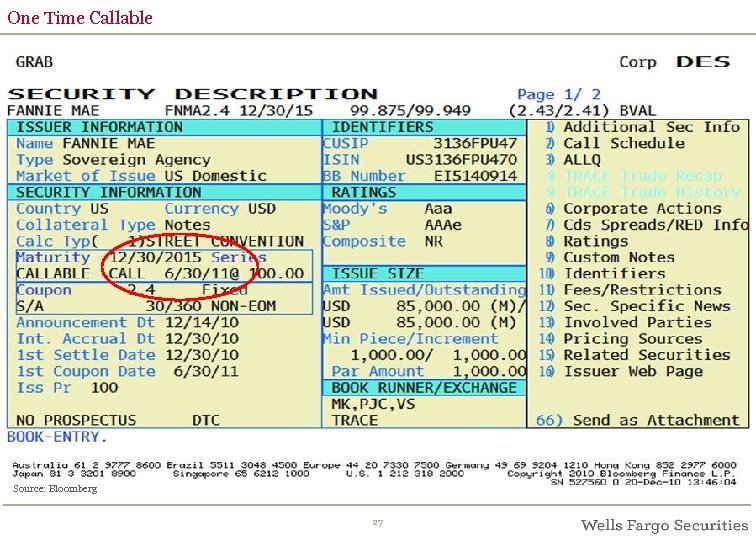

One Time Callable Source: Bloomberg 27

One Time Callable Source: Bloomberg 27

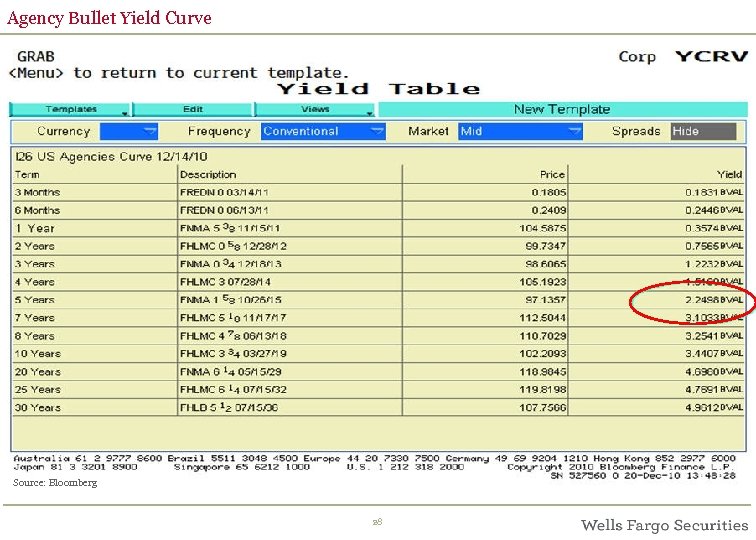

Agency Bullet Yield Curve Source: Bloomberg 28

Agency Bullet Yield Curve Source: Bloomberg 28

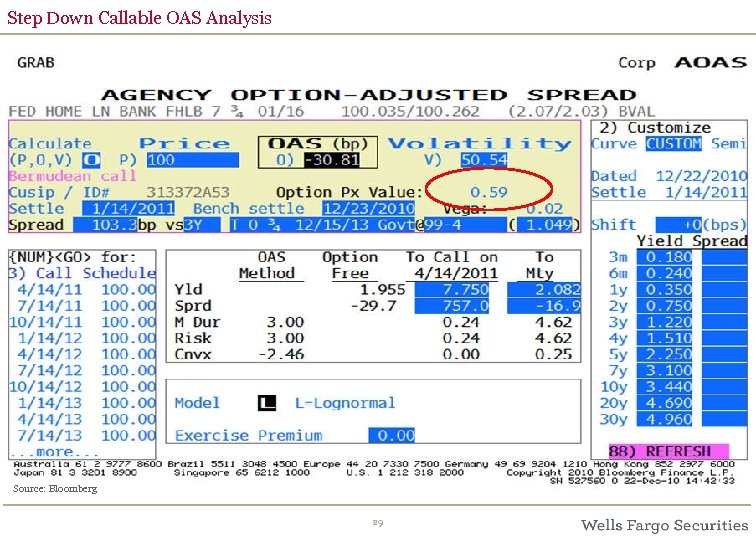

Step Down Callable OAS Analysis Source: Bloomberg 29

Step Down Callable OAS Analysis Source: Bloomberg 29

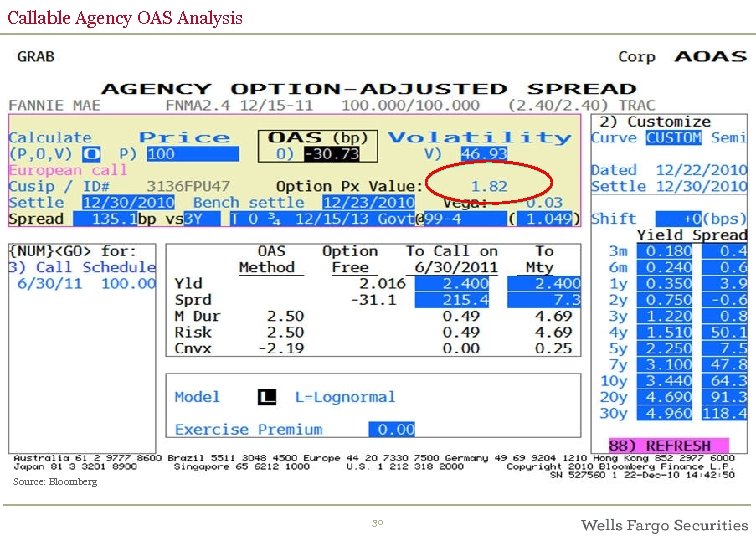

Callable Agency OAS Analysis Source: Bloomberg 30

Callable Agency OAS Analysis Source: Bloomberg 30

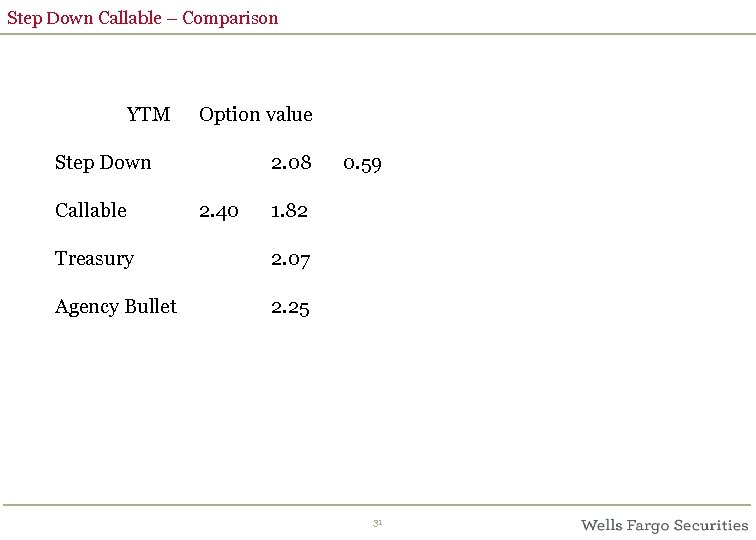

Step Down Callable – Comparison YTM Option value Step Down 2. 08 Callable 1. 82 2. 40 Treasury 2. 07 Agency Bullet 0. 59 2. 25 31

Step Down Callable – Comparison YTM Option value Step Down 2. 08 Callable 1. 82 2. 40 Treasury 2. 07 Agency Bullet 0. 59 2. 25 31

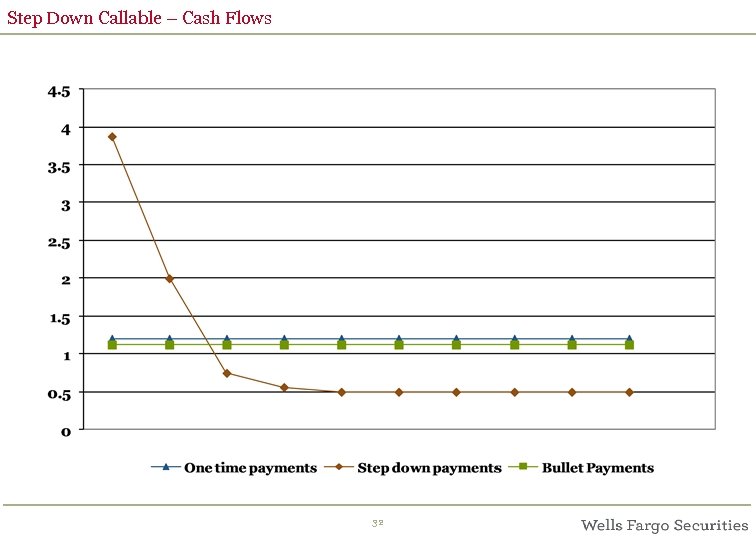

Step Down Callable – Cash Flows 32

Step Down Callable – Cash Flows 32

Convexity

Convexity

Convexity/Negative Convexity § A Measure of how curved the price-yield curve is § The second derivative of the price-yield function § Low coupon and long maturity bonds tend to have high convexities § High coupon and short maturity bonds tend to have low convexities § Negative Convexity § Where the rate of change of the price of a bond slows as rates fall § Generally due to embedded option(s) 34

Convexity/Negative Convexity § A Measure of how curved the price-yield curve is § The second derivative of the price-yield function § Low coupon and long maturity bonds tend to have high convexities § High coupon and short maturity bonds tend to have low convexities § Negative Convexity § Where the rate of change of the price of a bond slows as rates fall § Generally due to embedded option(s) 34

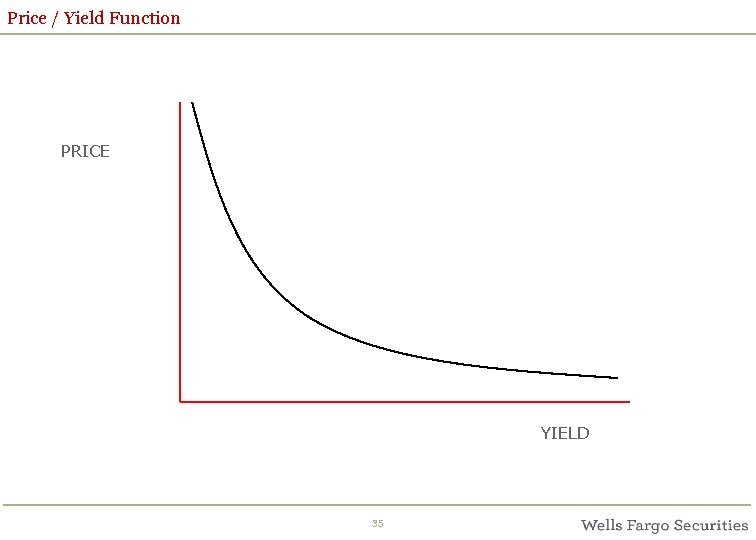

Price / Yield Function PRICE YIELD 35

Price / Yield Function PRICE YIELD 35

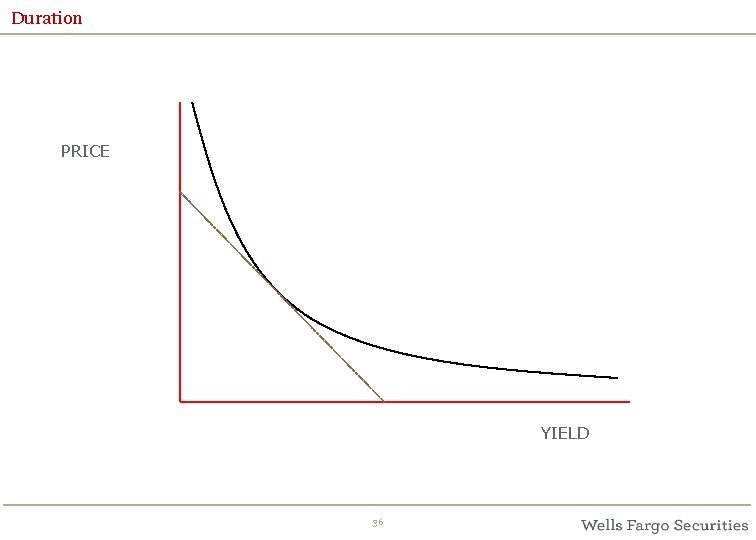

Duration PRICE YIELD 36

Duration PRICE YIELD 36

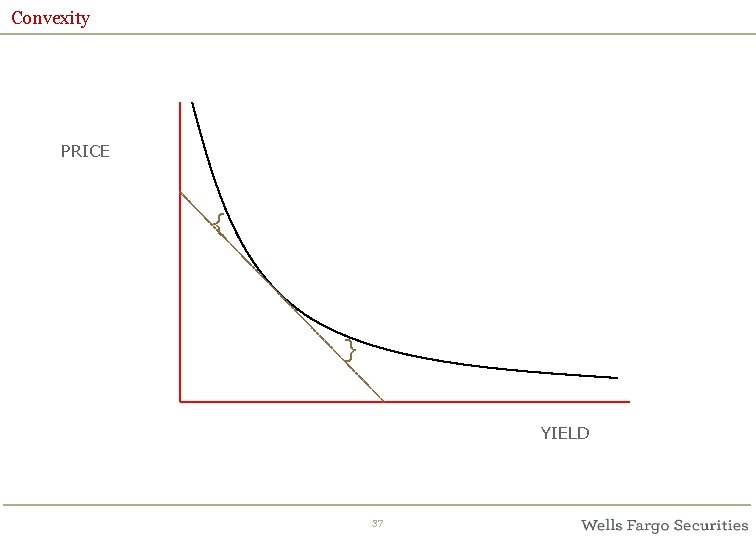

Convexity PRICE { } YIELD 37

Convexity PRICE { } YIELD 37

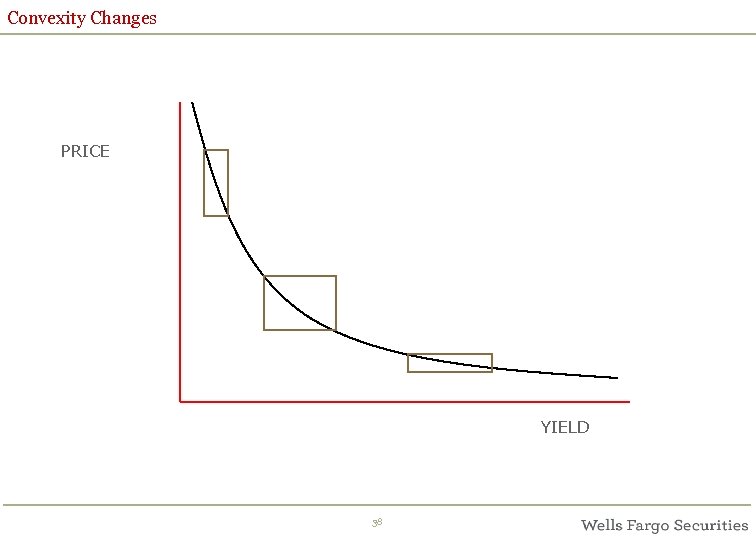

Convexity Changes PRICE YIELD 38

Convexity Changes PRICE YIELD 38

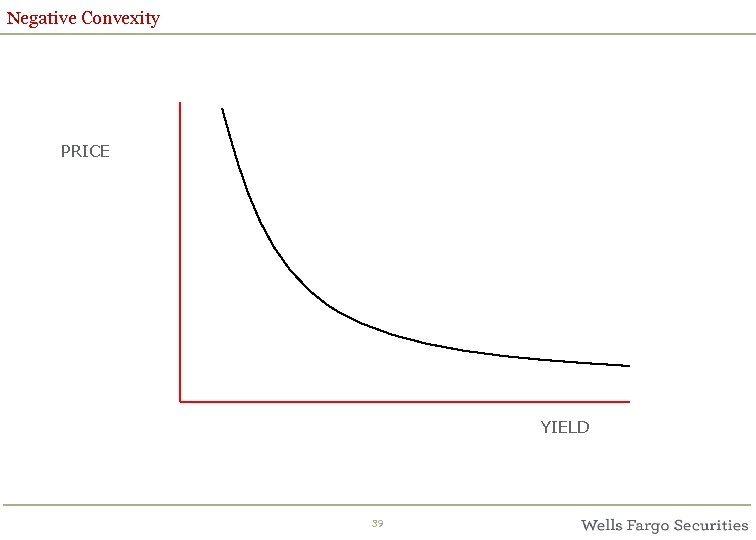

Negative Convexity PRICE YIELD 39

Negative Convexity PRICE YIELD 39

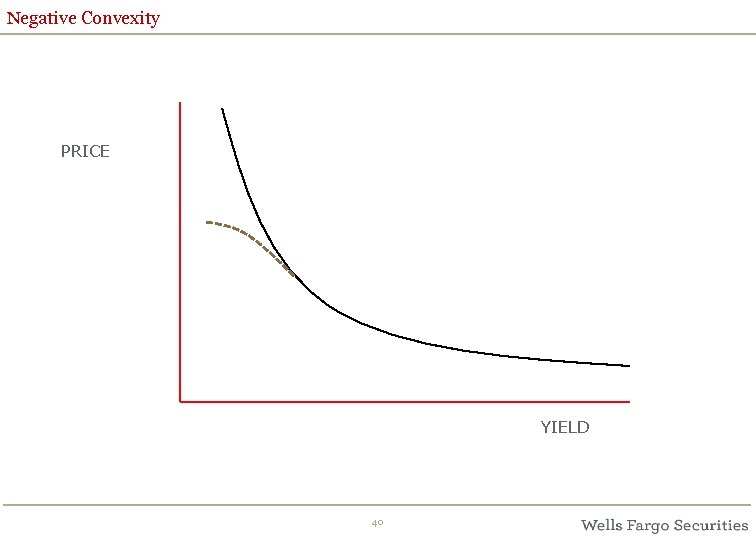

Negative Convexity PRICE YIELD 40

Negative Convexity PRICE YIELD 40

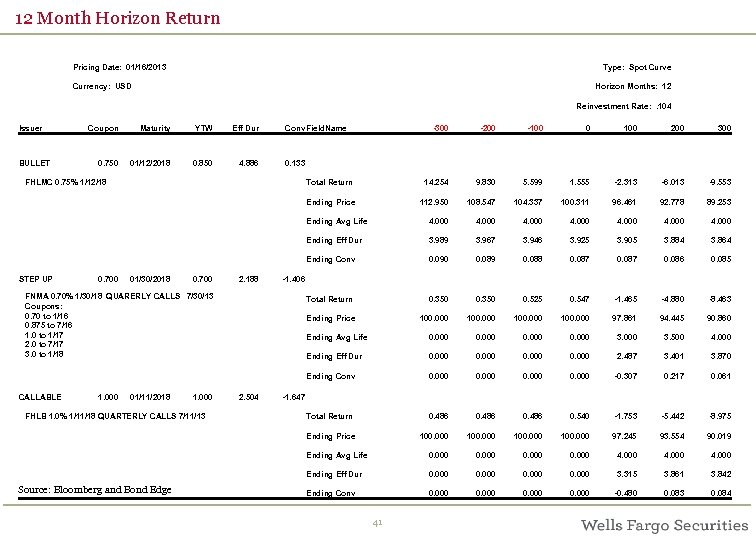

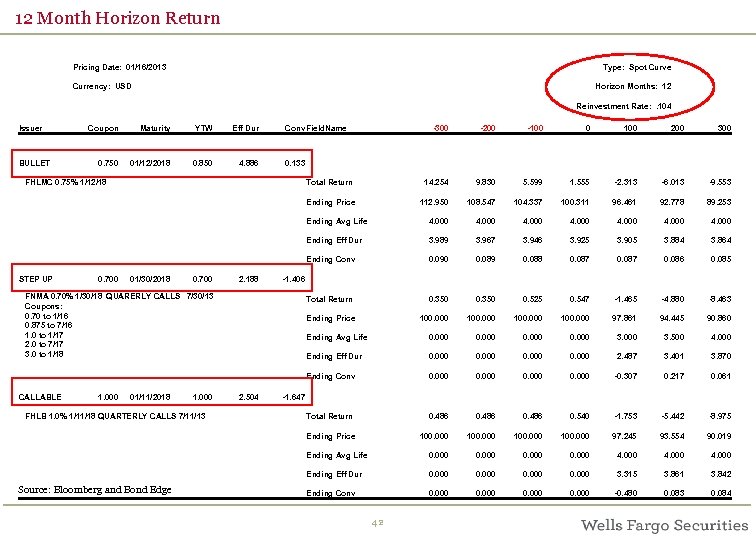

12 Month Horizon Return Pricing Date: 01/16/2013 Type: Spot Curve Horizon Months: 12 Currency: USD Reinvestment Rate: . 104 Issuer Coupon Maturity YTW Eff Dur -300 -200 -100 0 100 200 300 0. 750 01/12/2018 0. 850 4. 886 FHLMC 0. 75% 1/12/18 Total Return 14. 254 9. 830 5. 599 1. 555 -2. 313 -6. 013 -9. 553 Ending Price 112. 950 108. 547 104. 337 100. 311 96. 461 92. 778 89. 253 Ending Avg Life 4. 000 4. 000 Ending Eff Dur 3. 989 3. 967 3. 946 3. 925 3. 905 3. 884 3. 864 Ending Conv 0. 090 0. 089 0. 088 0. 087 0. 086 0. 085 0. 700 01/30/2018 0. 700 2. 188 FNMA 0. 70% 1/30/18 QUARERLY CALLS 7/30/13 Coupons: 0. 70 to 1/16 0. 875 to 7/16 1. 0 to 1/17 2. 0 to 7/17 3. 0 to 1/18 Total Return 0. 350 0. 525 0. 547 -1. 465 -4. 880 -8. 463 Ending Price 100. 000 97. 861 94. 445 90. 860 Ending Avg Life 0. 000 3. 500 4. 000 Ending Eff Dur 0. 000 2. 487 3. 401 3. 870 Ending Conv 0. 000 -0. 307 0. 217 0. 061 BULLET STEP UP Conv Field. Name 0. 133 -1. 406 1. 000 01/11/2018 1. 000 2. 504 FHLB 1. 0% 1/11/18 QUARTERLY CALLS 7/11/13 Total Return 0. 486 0. 540 -1. 753 -5. 442 -8. 975 Ending Price 100. 000 97. 245 93. 554 90. 019 Ending Avg Life 0. 000 4. 000 Ending Eff Dur 0. 000 3. 315 3. 861 3. 842 Source: Bloomberg and Bond Edge Ending Conv 0. 000 -0. 480 0. 083 0. 084 CALLABLE -1. 647 41

12 Month Horizon Return Pricing Date: 01/16/2013 Type: Spot Curve Horizon Months: 12 Currency: USD Reinvestment Rate: . 104 Issuer Coupon Maturity YTW Eff Dur -300 -200 -100 0 100 200 300 0. 750 01/12/2018 0. 850 4. 886 FHLMC 0. 75% 1/12/18 Total Return 14. 254 9. 830 5. 599 1. 555 -2. 313 -6. 013 -9. 553 Ending Price 112. 950 108. 547 104. 337 100. 311 96. 461 92. 778 89. 253 Ending Avg Life 4. 000 4. 000 Ending Eff Dur 3. 989 3. 967 3. 946 3. 925 3. 905 3. 884 3. 864 Ending Conv 0. 090 0. 089 0. 088 0. 087 0. 086 0. 085 0. 700 01/30/2018 0. 700 2. 188 FNMA 0. 70% 1/30/18 QUARERLY CALLS 7/30/13 Coupons: 0. 70 to 1/16 0. 875 to 7/16 1. 0 to 1/17 2. 0 to 7/17 3. 0 to 1/18 Total Return 0. 350 0. 525 0. 547 -1. 465 -4. 880 -8. 463 Ending Price 100. 000 97. 861 94. 445 90. 860 Ending Avg Life 0. 000 3. 500 4. 000 Ending Eff Dur 0. 000 2. 487 3. 401 3. 870 Ending Conv 0. 000 -0. 307 0. 217 0. 061 BULLET STEP UP Conv Field. Name 0. 133 -1. 406 1. 000 01/11/2018 1. 000 2. 504 FHLB 1. 0% 1/11/18 QUARTERLY CALLS 7/11/13 Total Return 0. 486 0. 540 -1. 753 -5. 442 -8. 975 Ending Price 100. 000 97. 245 93. 554 90. 019 Ending Avg Life 0. 000 4. 000 Ending Eff Dur 0. 000 3. 315 3. 861 3. 842 Source: Bloomberg and Bond Edge Ending Conv 0. 000 -0. 480 0. 083 0. 084 CALLABLE -1. 647 41

12 Month Horizon Return Pricing Date: 01/16/2013 Type: Spot Curve Horizon Months: 12 Currency: USD Reinvestment Rate: . 104 Issuer Coupon Maturity YTW Eff Dur -300 -200 -100 0 100 200 300 0. 750 01/12/2018 0. 850 4. 886 FHLMC 0. 75% 1/12/18 Total Return 14. 254 9. 830 5. 599 1. 555 -2. 313 -6. 013 -9. 553 Ending Price 112. 950 108. 547 104. 337 100. 311 96. 461 92. 778 89. 253 Ending Avg Life 4. 000 4. 000 Ending Eff Dur 3. 989 3. 967 3. 946 3. 925 3. 905 3. 884 3. 864 Ending Conv 0. 090 0. 089 0. 088 0. 087 0. 086 0. 085 0. 700 01/30/2018 0. 700 2. 188 FNMA 0. 70% 1/30/18 QUARERLY CALLS 7/30/13 Coupons: 0. 70 to 1/16 0. 875 to 7/16 1. 0 to 1/17 2. 0 to 7/17 3. 0 to 1/18 Total Return 0. 350 0. 525 0. 547 -1. 465 -4. 880 -8. 463 Ending Price 100. 000 97. 861 94. 445 90. 860 Ending Avg Life 0. 000 3. 500 4. 000 Ending Eff Dur 0. 000 2. 487 3. 401 3. 870 Ending Conv 0. 000 -0. 307 0. 217 0. 061 BULLET STEP UP Conv Field. Name 0. 133 -1. 406 1. 000 01/11/2018 1. 000 2. 504 FHLB 1. 0% 1/11/18 QUARTERLY CALLS 7/11/13 Total Return 0. 486 0. 540 -1. 753 -5. 442 -8. 975 Ending Price 100. 000 97. 245 93. 554 90. 019 Ending Avg Life 0. 000 4. 000 Ending Eff Dur 0. 000 3. 315 3. 861 3. 842 Source: Bloomberg and Bond Edge Ending Conv 0. 000 -0. 480 0. 083 0. 084 CALLABLE -1. 647 42

12 Month Horizon Return Pricing Date: 01/16/2013 Type: Spot Curve Horizon Months: 12 Currency: USD Reinvestment Rate: . 104 Issuer Coupon Maturity YTW Eff Dur -300 -200 -100 0 100 200 300 0. 750 01/12/2018 0. 850 4. 886 FHLMC 0. 75% 1/12/18 Total Return 14. 254 9. 830 5. 599 1. 555 -2. 313 -6. 013 -9. 553 Ending Price 112. 950 108. 547 104. 337 100. 311 96. 461 92. 778 89. 253 Ending Avg Life 4. 000 4. 000 Ending Eff Dur 3. 989 3. 967 3. 946 3. 925 3. 905 3. 884 3. 864 Ending Conv 0. 090 0. 089 0. 088 0. 087 0. 086 0. 085 0. 700 01/30/2018 0. 700 2. 188 FNMA 0. 70% 1/30/18 QUARERLY CALLS 7/30/13 Coupons: 0. 70 to 1/16 0. 875 to 7/16 1. 0 to 1/17 2. 0 to 7/17 3. 0 to 1/18 Total Return 0. 350 0. 525 0. 547 -1. 465 -4. 880 -8. 463 Ending Price 100. 000 97. 861 94. 445 90. 860 Ending Avg Life 0. 000 3. 500 4. 000 Ending Eff Dur 0. 000 2. 487 3. 401 3. 870 Ending Conv 0. 000 -0. 307 0. 217 0. 061 BULLET STEP UP Conv Field. Name 0. 133 -1. 406 1. 000 01/11/2018 1. 000 2. 504 FHLB 1. 0% 1/11/18 QUARTERLY CALLS 7/11/13 Total Return 0. 486 0. 540 -1. 753 -5. 442 -8. 975 Ending Price 100. 000 97. 245 93. 554 90. 019 Ending Avg Life 0. 000 4. 000 Ending Eff Dur 0. 000 3. 315 3. 861 3. 842 Source: Bloomberg and Bond Edge Ending Conv 0. 000 -0. 480 0. 083 0. 084 CALLABLE -1. 647 42

12 Month Horizon Return Pricing Date: 01/16/2013 Type: Spot Curve Horizon Months: 12 Currency: USD Reinvestment Rate: . 104 Issuer Coupon Maturity YTW Eff Dur -300 -200 -100 0 100 200 300 0. 750 01/12/2018 0. 850 4. 886 FHLMC 0. 75% 1/12/18 Total Return 14. 254 9. 830 5. 599 1. 555 -2. 313 -6. 013 -9. 553 Ending Price 112. 950 108. 547 104. 337 100. 311 96. 461 92. 778 89. 253 Ending Avg Life 4. 000 4. 000 Ending Eff Dur 3. 989 3. 967 3. 946 3. 925 3. 905 3. 884 3. 864 Ending Conv 0. 090 0. 089 0. 088 0. 087 0. 086 0. 085 0. 700 01/30/2018 0. 700 2. 188 FNMA 0. 70% 1/30/18 QUARERLY CALLS 7/30/13 Coupons: 0. 70 to 1/16 0. 875 to 7/16 1. 0 to 1/17 2. 0 to 7/17 3. 0 to 1/18 Total Return 0. 350 0. 525 0. 547 -1. 465 -4. 880 -8. 463 Ending Price 100. 000 97. 861 94. 445 90. 860 Ending Avg Life 0. 000 3. 500 4. 000 Ending Eff Dur 0. 000 2. 487 3. 401 3. 870 Ending Conv 0. 000 -0. 307 0. 217 0. 061 BULLET STEP UP Conv Field. Name 0. 133 -1. 406 1. 000 01/11/2018 1. 000 2. 504 FHLB 1. 0% 1/11/18 QUARTERLY CALLS 7/11/13 Total Return 0. 486 0. 540 -1. 753 -5. 442 -8. 975 Ending Price 100. 000 97. 245 93. 554 90. 019 Ending Avg Life 0. 000 4. 000 Ending Eff Dur 0. 000 3. 315 3. 861 3. 842 Source: Bloomberg and Bond Edge Ending Conv 0. 000 -0. 480 0. 083 0. 084 CALLABLE -1. 647 43

12 Month Horizon Return Pricing Date: 01/16/2013 Type: Spot Curve Horizon Months: 12 Currency: USD Reinvestment Rate: . 104 Issuer Coupon Maturity YTW Eff Dur -300 -200 -100 0 100 200 300 0. 750 01/12/2018 0. 850 4. 886 FHLMC 0. 75% 1/12/18 Total Return 14. 254 9. 830 5. 599 1. 555 -2. 313 -6. 013 -9. 553 Ending Price 112. 950 108. 547 104. 337 100. 311 96. 461 92. 778 89. 253 Ending Avg Life 4. 000 4. 000 Ending Eff Dur 3. 989 3. 967 3. 946 3. 925 3. 905 3. 884 3. 864 Ending Conv 0. 090 0. 089 0. 088 0. 087 0. 086 0. 085 0. 700 01/30/2018 0. 700 2. 188 FNMA 0. 70% 1/30/18 QUARERLY CALLS 7/30/13 Coupons: 0. 70 to 1/16 0. 875 to 7/16 1. 0 to 1/17 2. 0 to 7/17 3. 0 to 1/18 Total Return 0. 350 0. 525 0. 547 -1. 465 -4. 880 -8. 463 Ending Price 100. 000 97. 861 94. 445 90. 860 Ending Avg Life 0. 000 3. 500 4. 000 Ending Eff Dur 0. 000 2. 487 3. 401 3. 870 Ending Conv 0. 000 -0. 307 0. 217 0. 061 BULLET STEP UP Conv Field. Name 0. 133 -1. 406 1. 000 01/11/2018 1. 000 2. 504 FHLB 1. 0% 1/11/18 QUARTERLY CALLS 7/11/13 Total Return 0. 486 0. 540 -1. 753 -5. 442 -8. 975 Ending Price 100. 000 97. 245 93. 554 90. 019 Ending Avg Life 0. 000 4. 000 Ending Eff Dur 0. 000 3. 315 3. 861 3. 842 Source: Bloomberg and Bond Edge Ending Conv 0. 000 -0. 480 0. 083 0. 084 CALLABLE -1. 647 43

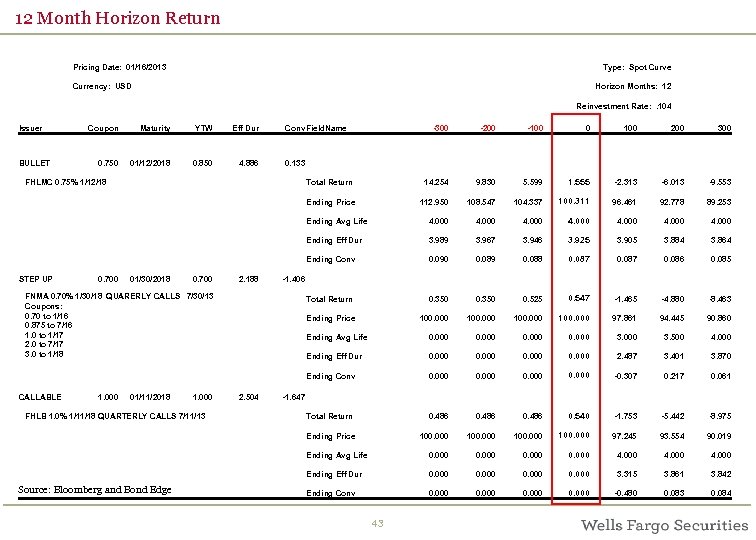

Portfolio Comparison – Bullets vs Callables Portfolio Bullets Portfolio Callables Par Market Value $71, 085, 000 Market Value $70, 225, 000 Average Life 1. 328 Average Life 1. 246 YTM 0. 517 YTM 0. 918 Modified Duration 1. 31 Modified Duration 3. 32 Effective Duration Security detail $70, 000 1. 16 Effective Duration 1. 30 Convexity 0. 10 TSY 6% Convexity $70, 000 -0. 77 Porfolio distribution CORP 45% AGY 50% Agency 100% Source: Bloomberg and Bond Edge 44

Portfolio Comparison – Bullets vs Callables Portfolio Bullets Portfolio Callables Par Market Value $71, 085, 000 Market Value $70, 225, 000 Average Life 1. 328 Average Life 1. 246 YTM 0. 517 YTM 0. 918 Modified Duration 1. 31 Modified Duration 3. 32 Effective Duration Security detail $70, 000 1. 16 Effective Duration 1. 30 Convexity 0. 10 TSY 6% Convexity $70, 000 -0. 77 Porfolio distribution CORP 45% AGY 50% Agency 100% Source: Bloomberg and Bond Edge 44

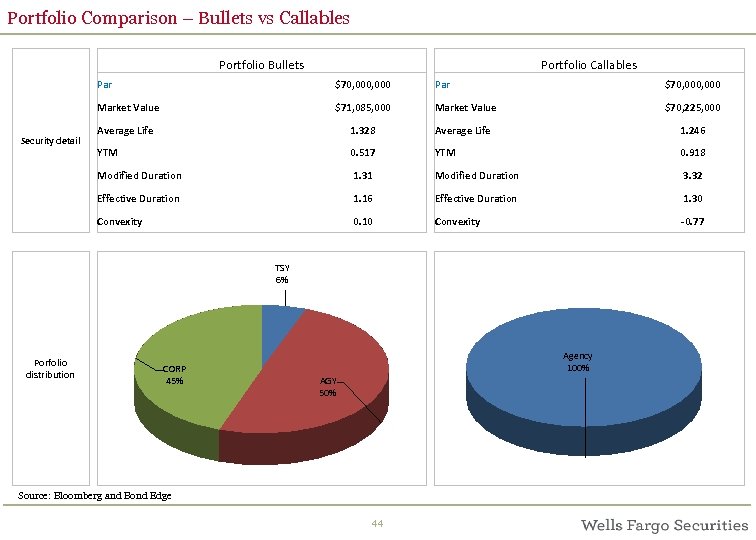

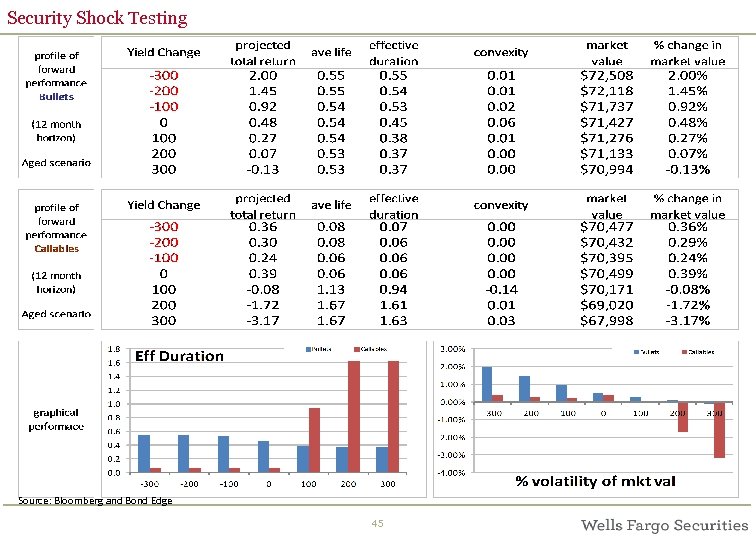

Security Shock Testing Source: Bloomberg and Bond Edge 45

Security Shock Testing Source: Bloomberg and Bond Edge 45

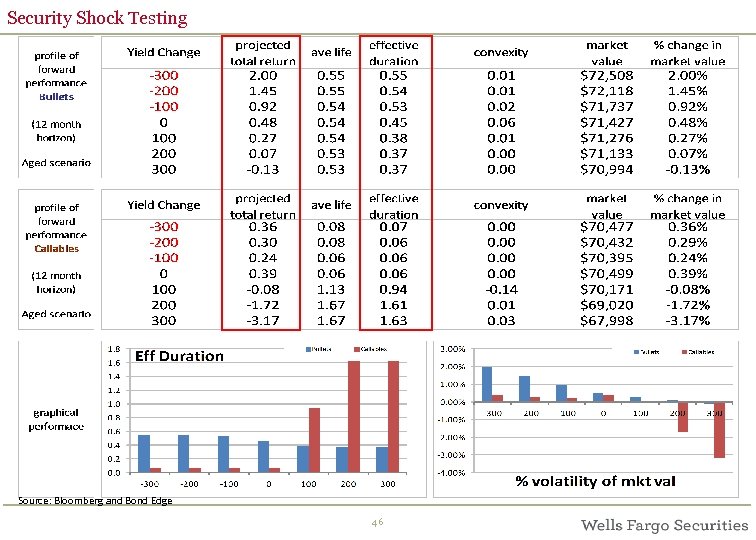

Security Shock Testing Source: Bloomberg and Bond Edge 46

Security Shock Testing Source: Bloomberg and Bond Edge 46

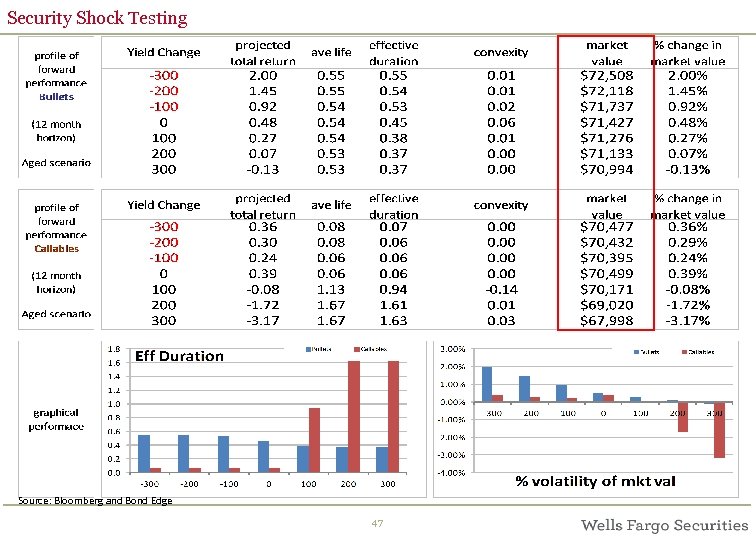

Security Shock Testing Source: Bloomberg and Bond Edge 47

Security Shock Testing Source: Bloomberg and Bond Edge 47

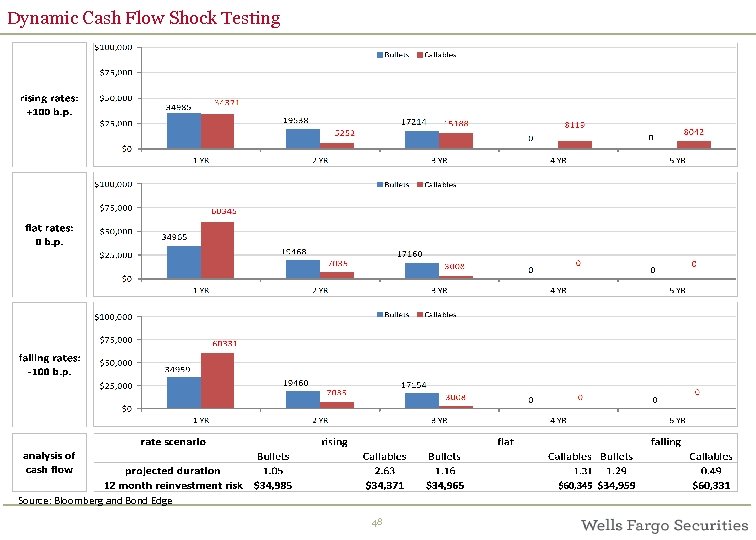

Dynamic Cash Flow Shock Testing Source: Bloomberg and Bond Edge 48

Dynamic Cash Flow Shock Testing Source: Bloomberg and Bond Edge 48

I love deadlines. I love the whooshing noise they make as they go by. -Douglas Adams 49

I love deadlines. I love the whooshing noise they make as they go by. -Douglas Adams 49

Contact Information Tony Garcia, CFA Vice President MAC A 0716 -07 T 400 Capitol Mall, 7 th Floor Sacramento, CA 95814 Phone: (888) 267 -9113 FAX: (916) 442 -2750 Email: tgarcia@wellsfargo. com 50

Contact Information Tony Garcia, CFA Vice President MAC A 0716 -07 T 400 Capitol Mall, 7 th Floor Sacramento, CA 95814 Phone: (888) 267 -9113 FAX: (916) 442 -2750 Email: tgarcia@wellsfargo. com 50

The opinions expressed in this presentation are general in nature and not intended to provide specific advice or recommendations. Contact your investment representative, attorney, accountant or tax advisor with regard to your specific situation. The opinions of the author do not necessarily reflect those of Wells Fargo Institutional Securities, LLC or any other Wells Fargo entity. Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Institutional Securities, LLC, a member of FINRA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC and Wells Fargo Bank, National Association. Wells Fargo Securities, LLC carries and provides clearing services for Wells Fargo Institutional Securities, LLC customer accounts. Investments offered are not FDIC insured · May lose value · No bank guarantee © 2013 Wells Fargo Securities. All rights reserved. 51

The opinions expressed in this presentation are general in nature and not intended to provide specific advice or recommendations. Contact your investment representative, attorney, accountant or tax advisor with regard to your specific situation. The opinions of the author do not necessarily reflect those of Wells Fargo Institutional Securities, LLC or any other Wells Fargo entity. Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Institutional Securities, LLC, a member of FINRA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC and Wells Fargo Bank, National Association. Wells Fargo Securities, LLC carries and provides clearing services for Wells Fargo Institutional Securities, LLC customer accounts. Investments offered are not FDIC insured · May lose value · No bank guarantee © 2013 Wells Fargo Securities. All rights reserved. 51