59e1574b32eb95bae814a7bde7f7e9bf.ppt

- Количество слайдов: 19

CLS Group Meeting Joseph De Feo CEO, CLS Group President & CEO, CLS Bank International 3 October 2003 Istanbul

CLS Group Meeting Joseph De Feo CEO, CLS Group President & CEO, CLS Bank International 3 October 2003 Istanbul

CLS Bank: a unique achievement Creating a global industry standard Unprecedented co-operation across the industry Growing number of providers of third party services Extends finality of domestic RTGS settlement globally 2 First global banking settlement system 67 shareholders, 27 vendors, eleven central banks Major business & technical achievement Level playing field – target of one price for all

CLS Bank: a unique achievement Creating a global industry standard Unprecedented co-operation across the industry Growing number of providers of third party services Extends finality of domestic RTGS settlement globally 2 First global banking settlement system 67 shareholders, 27 vendors, eleven central banks Major business & technical achievement Level playing field – target of one price for all

CLS Shareholders Australia - Australia & New Zealand Banking Group * Commonwealth Bank of Australia * National Australia Bank * Westpac Banking Corporation * Belgium- Fortis Bank * KBC Bank * Canada - Bank of Montreal * The Bank of Nova Scotia * CIBC * Royal Bank of Canada * The Toronto-Dominion Bank * Denmark - Danske Bank * Nordea * France - BNP Paribas * Caisse Nationale De Credit Agricole * Credit Lyonnais * Société Générale * Germany - Bayerische Landesbank * Commerzbank * Deutsche Bank * DZ Bank * Dresdner Bank * Hypo Vereinsbank * Westdeutsche Landesbank * Italy – Banca Intesa * Uni. Credito * Japan - The Bank of Tokyo-Mitsubishi, Ltd * Mizuho Corporate Bank * Norinchukin Bank * Sumitomo Mitsui Banking Corporation * The Sumitomo Trust & Banking Co. , Ltd. * UFJ Bank * Luxembourg – Dexia Banque Internationale a Luxembourg * Netherlands - ABN AMRO Bank * ING Bank * Rabobank Nederland * Norway - Den norske Bank *Singapore - Development Bank Of Singapore * Oversea-Chinese Banking Corporation * United Overseas Bank * Spain - BBVA * Banco Popular Espanol * Banco Santander Central Hispano* Sweden - Skandinaviska Enskilda Banken * Svenska Handelsbanken * Switzerland - Credit Suisse * UBS * Zurcher Kantonalbank * United Kingdom - Barclays Bank * HSBC Holdings * Royal Bank of Scotland * Standard Chartered Bank * United States - American International Group * Bank of America * The Bank of New York * Bank One * Bear Stearns Securities * Citibank * The Goldman Sachs Group * JPMorgan Chase * Lehman Brothers * Mellon Bank * Merrill Lynch * Morgan Stanley & Co. * Northern Trust Corporation * State Street Bank and Trust Co. 3

CLS Shareholders Australia - Australia & New Zealand Banking Group * Commonwealth Bank of Australia * National Australia Bank * Westpac Banking Corporation * Belgium- Fortis Bank * KBC Bank * Canada - Bank of Montreal * The Bank of Nova Scotia * CIBC * Royal Bank of Canada * The Toronto-Dominion Bank * Denmark - Danske Bank * Nordea * France - BNP Paribas * Caisse Nationale De Credit Agricole * Credit Lyonnais * Société Générale * Germany - Bayerische Landesbank * Commerzbank * Deutsche Bank * DZ Bank * Dresdner Bank * Hypo Vereinsbank * Westdeutsche Landesbank * Italy – Banca Intesa * Uni. Credito * Japan - The Bank of Tokyo-Mitsubishi, Ltd * Mizuho Corporate Bank * Norinchukin Bank * Sumitomo Mitsui Banking Corporation * The Sumitomo Trust & Banking Co. , Ltd. * UFJ Bank * Luxembourg – Dexia Banque Internationale a Luxembourg * Netherlands - ABN AMRO Bank * ING Bank * Rabobank Nederland * Norway - Den norske Bank *Singapore - Development Bank Of Singapore * Oversea-Chinese Banking Corporation * United Overseas Bank * Spain - BBVA * Banco Popular Espanol * Banco Santander Central Hispano* Sweden - Skandinaviska Enskilda Banken * Svenska Handelsbanken * Switzerland - Credit Suisse * UBS * Zurcher Kantonalbank * United Kingdom - Barclays Bank * HSBC Holdings * Royal Bank of Scotland * Standard Chartered Bank * United States - American International Group * Bank of America * The Bank of New York * Bank One * Bear Stearns Securities * Citibank * The Goldman Sachs Group * JPMorgan Chase * Lehman Brothers * Mellon Bank * Merrill Lynch * Morgan Stanley & Co. * Northern Trust Corporation * State Street Bank and Trust Co. 3

CLS has changed market practice Normal - 2 day contract Possible same day settlement Normal - 2 day risk CLS eliminates Settlement risk (temporal risk) Historical information 1 day funding Real-time information Intraday - Timed payments Extends domestic settlement finality globally 4

CLS has changed market practice Normal - 2 day contract Possible same day settlement Normal - 2 day risk CLS eliminates Settlement risk (temporal risk) Historical information 1 day funding Real-time information Intraday - Timed payments Extends domestic settlement finality globally 4

CLS Bank is unique Corporate structure and governance model Legal governance and regulation 5 Bankers’ Bank for FX Settlement Real-time links to Central Banks

CLS Bank is unique Corporate structure and governance model Legal governance and regulation 5 Bankers’ Bank for FX Settlement Real-time links to Central Banks

CLS now 54 banks settling live transactions in 11 currencies Over 80 Third party customers of Member banks Settling over 80, 000 sides a day, around $1 trillion value 6 27 Registered Vendors using CLS brand 14 million sides settled in 1 year with a gross value of $160 trillion

CLS now 54 banks settling live transactions in 11 currencies Over 80 Third party customers of Member banks Settling over 80, 000 sides a day, around $1 trillion value 6 27 Registered Vendors using CLS brand 14 million sides settled in 1 year with a gross value of $160 trillion

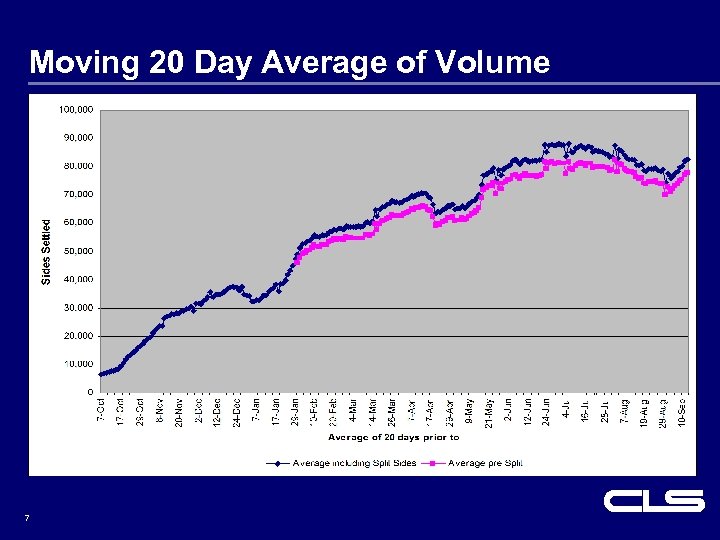

Moving 20 Day Average of Volume 7

Moving 20 Day Average of Volume 7

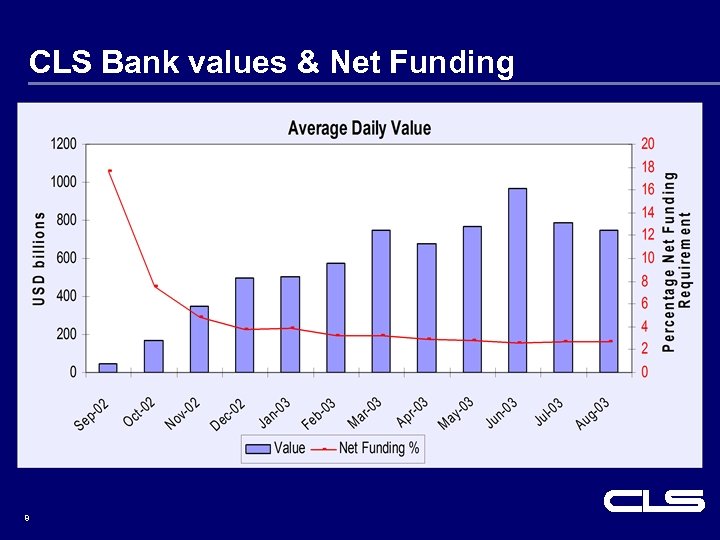

CLS Bank values & Net Funding 8

CLS Bank values & Net Funding 8

CLS Market Potential (Sides per day) Planned CLS Market Share after 5 Years 500 Other 3 rd Party 20% 350 Matching Field for Custody 50% - Future potential 290 Other Currencies - 2004 plans 260 Financial Institutions as 3 rd Party 50% - Very early days 100 Intra-Shareholder Transactions - Good progress 9 90%

CLS Market Potential (Sides per day) Planned CLS Market Share after 5 Years 500 Other 3 rd Party 20% 350 Matching Field for Custody 50% - Future potential 290 Other Currencies - 2004 plans 260 Financial Institutions as 3 rd Party 50% - Very early days 100 Intra-Shareholder Transactions - Good progress 9 90%

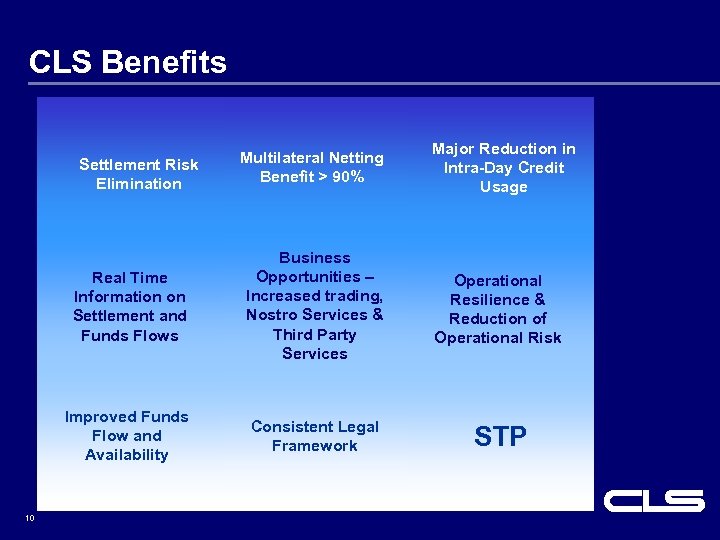

CLS Benefits Settlement Risk Elimination Multilateral Netting Benefit > 90% Major Reduction in Intra-Day Credit Usage Real Time Information on Settlement and Funds Flows Operational Resilience & Reduction of Operational Risk Improved Funds Flow and Availability 10 Business Opportunities – Increased trading, Nostro Services & Third Party Services Consistent Legal Framework STP

CLS Benefits Settlement Risk Elimination Multilateral Netting Benefit > 90% Major Reduction in Intra-Day Credit Usage Real Time Information on Settlement and Funds Flows Operational Resilience & Reduction of Operational Risk Improved Funds Flow and Availability 10 Business Opportunities – Increased trading, Nostro Services & Third Party Services Consistent Legal Framework STP

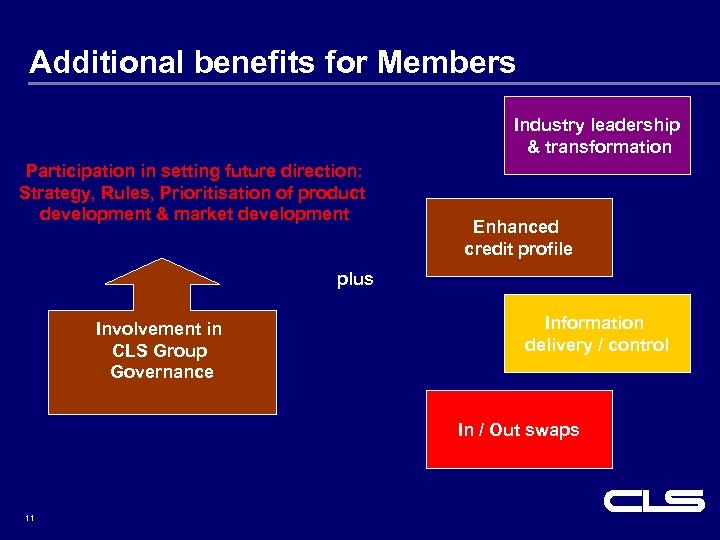

Additional benefits for Members Industry leadership & transformation Participation in setting future direction: Strategy, Rules, Prioritisation of product development & market development Enhanced credit profile plus Involvement in CLS Group Governance Information delivery / control In / Out swaps 11

Additional benefits for Members Industry leadership & transformation Participation in setting future direction: Strategy, Rules, Prioritisation of product development & market development Enhanced credit profile plus Involvement in CLS Group Governance Information delivery / control In / Out swaps 11

Opportunities for new Settlement Members l Industry transformation – Settlement finality – Leadership role in local & global market – Board & working group participation – Access to I/O Swap to further improve currency cash management – Access to Member experience and knowledge base – Settlement Member web site l Risk & Operational Benefits – Risk reduction – Improved cash management – Increased trading revenues – Improved operational efficiency and cost reduction – Real time information 12

Opportunities for new Settlement Members l Industry transformation – Settlement finality – Leadership role in local & global market – Board & working group participation – Access to I/O Swap to further improve currency cash management – Access to Member experience and knowledge base – Settlement Member web site l Risk & Operational Benefits – Risk reduction – Improved cash management – Increased trading revenues – Improved operational efficiency and cost reduction – Real time information 12

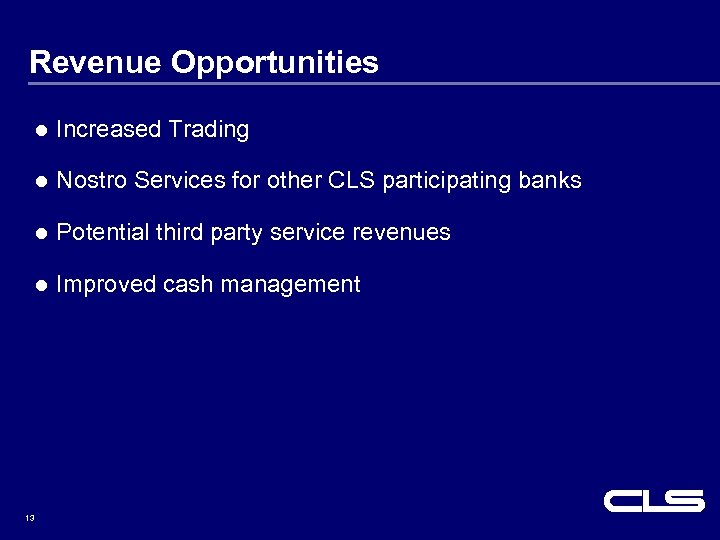

Revenue Opportunities l Increased Trading l Nostro Services for other CLS participating banks l Potential third party service revenues l Improved cash management 13

Revenue Opportunities l Increased Trading l Nostro Services for other CLS participating banks l Potential third party service revenues l Improved cash management 13

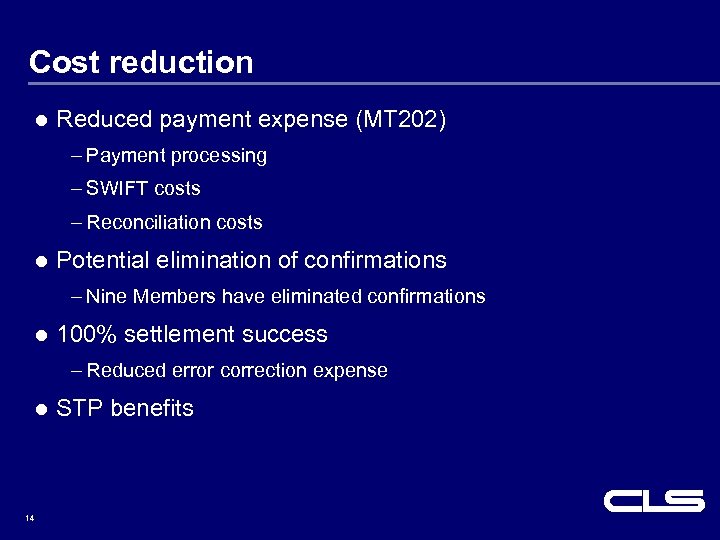

Cost reduction l Reduced payment expense (MT 202) – Payment processing – SWIFT costs – Reconciliation costs l Potential elimination of confirmations – Nine Members have eliminated confirmations l 100% settlement success – Reduced error correction expense l 14 STP benefits

Cost reduction l Reduced payment expense (MT 202) – Payment processing – SWIFT costs – Reconciliation costs l Potential elimination of confirmations – Nine Members have eliminated confirmations l 100% settlement success – Reduced error correction expense l 14 STP benefits

CLS Benefits – what our members say Eliminates Settlement Risk Increased trading Reduces error rates Post-Settlement Reporting Pre-Settlement Information Reduction or elimination of credit (settlement) limits 15 Source: Tower. Group

CLS Benefits – what our members say Eliminates Settlement Risk Increased trading Reduces error rates Post-Settlement Reporting Pre-Settlement Information Reduction or elimination of credit (settlement) limits 15 Source: Tower. Group

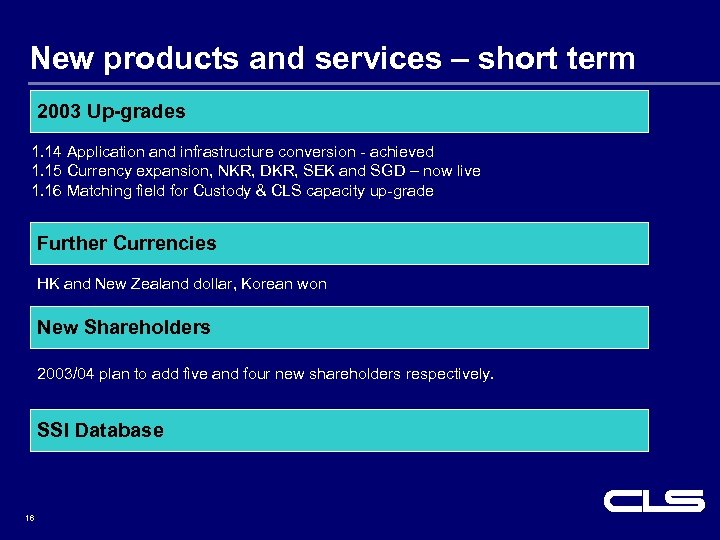

New products and services – short term 2003 Up-grades 1. 14 Application and infrastructure conversion - achieved 1. 15 Currency expansion, NKR, DKR, SEK and SGD – now live 1. 16 Matching field for Custody & CLS capacity up-grade Further Currencies HK and New Zealand dollar, Korean won New Shareholders 2003/04 plan to add five and four new shareholders respectively. SSI Database 16

New products and services – short term 2003 Up-grades 1. 14 Application and infrastructure conversion - achieved 1. 15 Currency expansion, NKR, DKR, SEK and SGD – now live 1. 16 Matching field for Custody & CLS capacity up-grade Further Currencies HK and New Zealand dollar, Korean won New Shareholders 2003/04 plan to add five and four new shareholders respectively. SSI Database 16

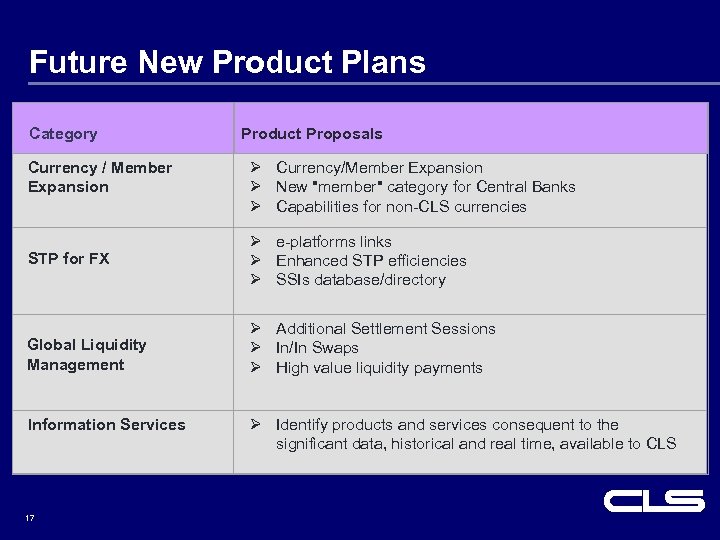

Future New Product Plans Category Currency / Member Expansion STP for FX Product Proposals Ø Currency/Member Expansion Ø New "member" category for Central Banks Ø Capabilities for non-CLS currencies Ø e-platforms links Ø Enhanced STP efficiencies Ø SSIs database/directory Global Liquidity Management Information Global Liquidity Management Services 17 Ø Additional Settlement Sessions Ø In/In Swaps Ø High value liquidity payments Ø Identify products and services consequent to the significant data, historical and real time, available to CLS

Future New Product Plans Category Currency / Member Expansion STP for FX Product Proposals Ø Currency/Member Expansion Ø New "member" category for Central Banks Ø Capabilities for non-CLS currencies Ø e-platforms links Ø Enhanced STP efficiencies Ø SSIs database/directory Global Liquidity Management Information Global Liquidity Management Services 17 Ø Additional Settlement Sessions Ø In/In Swaps Ø High value liquidity payments Ø Identify products and services consequent to the significant data, historical and real time, available to CLS

CLS tomorrow New products and services New currencies New shareholders “To make CLS Bank the premier means by which financial institutions settle foreign exchange” exchange Custody enhancement Leverage the infrastructure 18

CLS tomorrow New products and services New currencies New shareholders “To make CLS Bank the premier means by which financial institutions settle foreign exchange” exchange Custody enhancement Leverage the infrastructure 18

19

19