e3933044847366c7ea05752dd9a4d09e.ppt

- Количество слайдов: 35

CLS Group: Magyar Nemzeti Bank Sarah Medlar Relationship Manager CLS Services 9 October 2003

Agenda l l CLS – how it works l CLS – how it’s working l 2 CLS – structure CLS - next steps

CLS Shareholders Australia - Australia & New Zealand Banking Group * Commonwealth Bank of Australia * National Australia Bank * Westpac Banking Corporation * Belgium- Fortis Bank * KBC Bank * Canada - Bank of Montreal * The Bank of Nova Scotia * CIBC * Royal Bank of Canada * The Toronto-Dominion Bank * Denmark - Danske Bank * Nordea * France - BNP Paribas * Caisse Nationale De Credit Agricole * Credit Lyonnais * Société Générale * Germany - Bayerische Landesbank * Commerzbank * Deutsche Bank * DZ Bank * Dresdner Bank * Hypo Vereinsbank * Westdeutsche Landesbank * Italy – Banca Intesa * Uni. Credito * Japan - The Bank of Tokyo-Mitsubishi, Ltd * Mizuho Corporate Bank * Norinchukin Bank * Sumitomo Mitsui Banking Corporation * The Sumitomo Trust & Banking Co. , Ltd. * UFJ Bank * Luxembourg – Dexia Banque Internationale a Luxembourg * Netherlands - ABN AMRO Bank * ING Bank * Rabobank Nederland * Norway - Den norske Bank *Singapore – DBS Bank * Oversea-Chinese Banking Corporation * United Overseas Bank * Spain - BBVA * Banco Popular Espanol * Banco Santander Central Hispano* Sweden - Skandinaviska Enskilda Banken * Svenska Handelsbanken * Switzerland - Credit Suisse * UBS * Zurcher Kantonalbank * United Kingdom - Barclays Bank * HSBC Holdings * Royal Bank of Scotland * Standard Chartered Bank * United States - American International Group * Bank of America * The Bank of New York * Bank One * Bear Stearns Securities * Citibank * The Goldman Sachs Group * JPMorgan Chase * Lehman Brothers * Mellon Bank * Merrill Lynch * Morgan Stanley & Co. * Northern Trust Corporation * State Street Bank and Trust Co. 3

Structure l CLS Group Holdings - parent company l NY: CLS Bank International Edge Act Bank - Lead Regulator the Federal Reserve Bank of New York l London: CLS Services Ltd. Facilities Management/ Operations l 4 Tokyo: Representative office

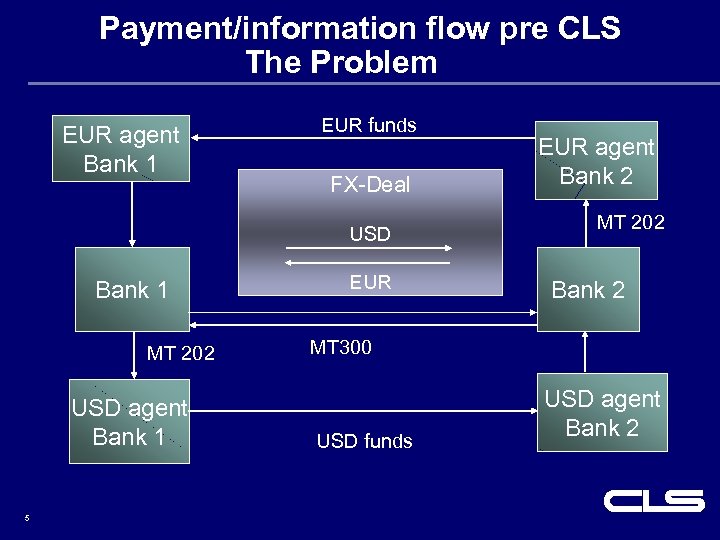

Payment/information flow pre CLS The Problem EUR agent Bank 1 EUR funds FX-Deal USD Bank 1 MT 202 USD agent Bank 1 5 EUR agent Bank 2 MT 202 Bank 2 MT 300 USD funds USD agent Bank 2

How the world worked before CLS 2 days PLUS 6

Solving the Problem l 1995 Allsopp report —Banks should review their internal control processes —Industry groups should take collective action —Central Bank measures to encourage risk reduction l l 1996 - Produced the CLS concept - Preferred Solution l July 1997 New company CLS Services Ltd. l Today 67 shareholders l 7 led to industry initiative 2 September 2002 “GO LIVE”

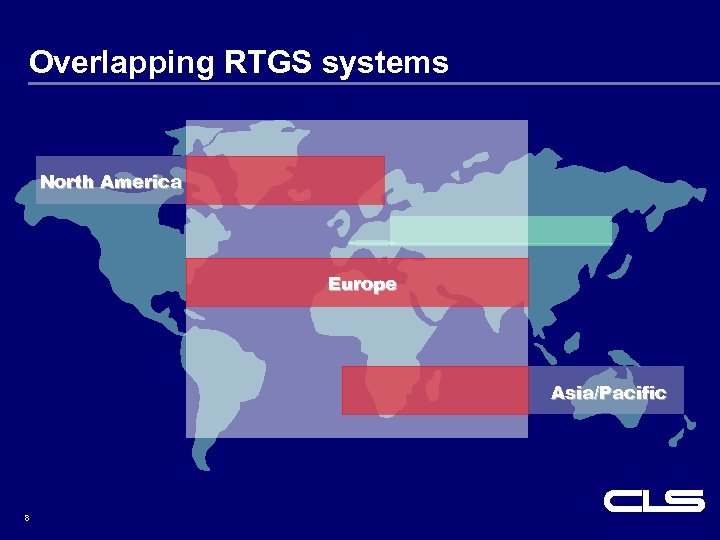

Overlapping RTGS systems North America Europe Asia/Pacific 8

CLS Settlement – How it Works

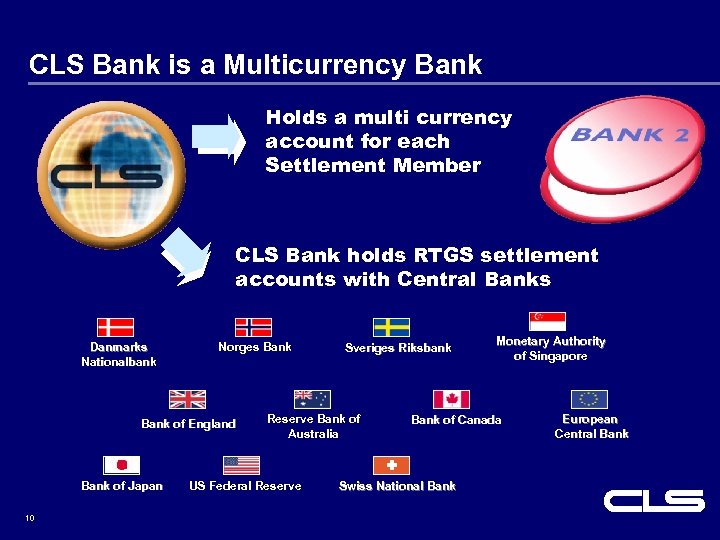

CLS Bank is a Multicurrency Bank Holds a multi currency account for each Settlement Member CLS Bank holds RTGS settlement accounts with Central Banks Danmarks Nationalbank Norges Bank of England Bank of Japan 10 Sveriges Riksbank Reserve Bank of Australia US Federal Reserve Monetary Authority of Singapore Bank of Canada Swiss National Bank European Central Bank

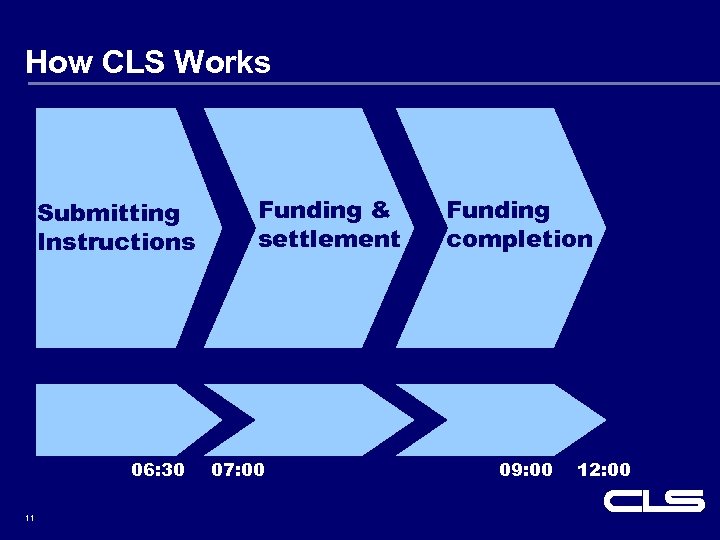

How CLS Works Submitting Instructions 06: 30 11 Funding & settlement 07: 00 Funding completion 09: 00 12: 00

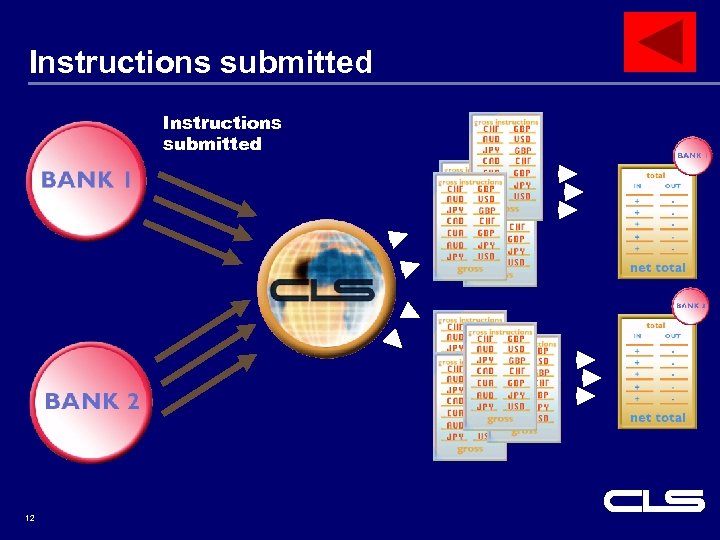

Instructions submitted 12

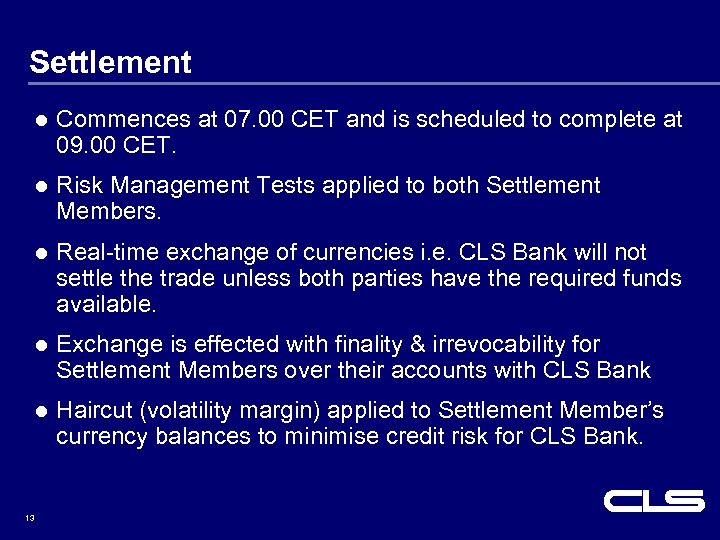

Settlement l Commences at 07. 00 CET and is scheduled to complete at 09. 00 CET. l Risk Management Tests applied to both Settlement Members. l Real-time exchange of currencies i. e. CLS Bank will not settle the trade unless both parties have the required funds available. l Exchange is effected with finality & irrevocability for Settlement Members over their accounts with CLS Bank l Haircut (volatility margin) applied to Settlement Member’s currency balances to minimise credit risk for CLS Bank. 13

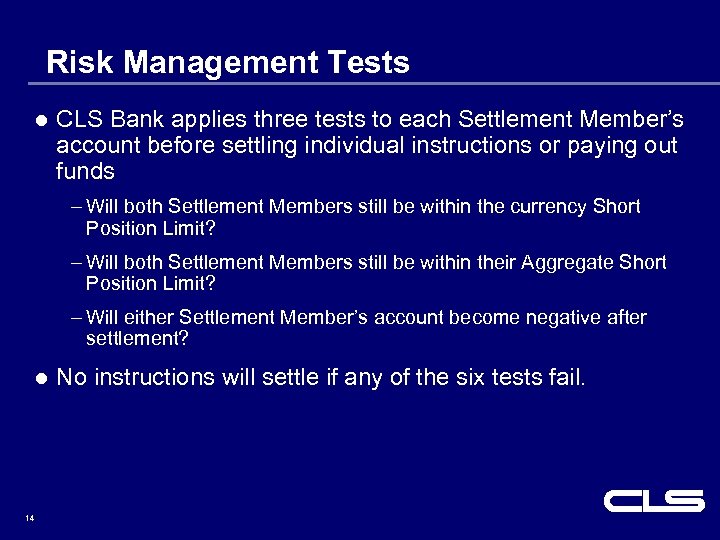

Risk Management Tests l CLS Bank applies three tests to each Settlement Member’s account before settling individual instructions or paying out funds – Will both Settlement Members still be within the currency Short Position Limit? – Will both Settlement Members still be within their Aggregate Short Position Limit? – Will either Settlement Member’s account become negative after settlement? l 14 No instructions will settle if any of the six tests fail.

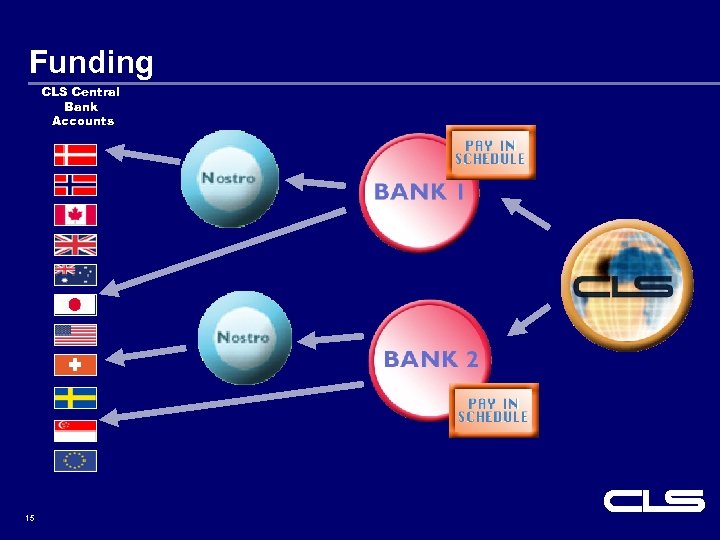

Funding CLS Central Bank Accounts 15

Pay-In Schedule l Multilateral net amount of Settlement Member’s obligations on a given value date. l Short position currencies to be paid in over a period of 5 hours (3 hours for Asia Pacific currencies) commencing at 07. 00 CET. l Long position currencies to be paid out by CLS Bank. l Includes all matched Instructions submitted by the Settlement Member and any User Members & Customers (3 rd Parties) that the Settlement Member is sponsoring. 16

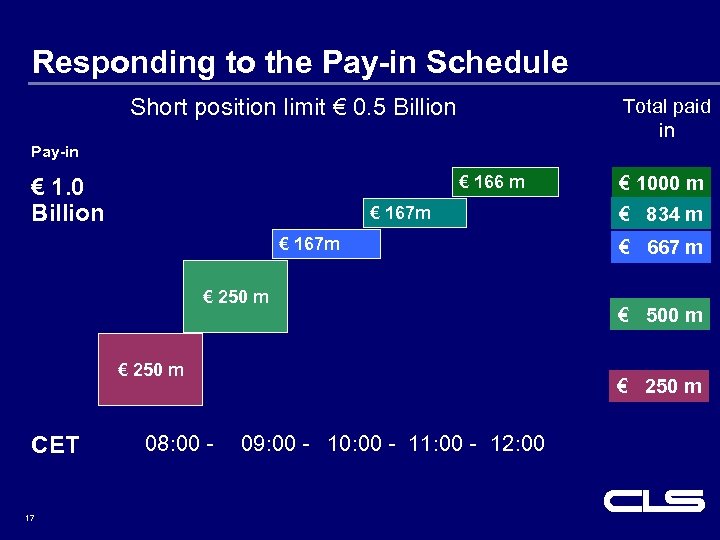

Responding to the Pay-in Schedule Short position limit € 0. 5 Billion Total paid in Pay-in € 166 m € 1. 0 Billion € 167 m € 250 m CET 17 08: 00 - € 1000 m € 834 m € 667 m € 500 m € 250 m 09: 00 - 10: 00 - 11: 00 - 12: 00

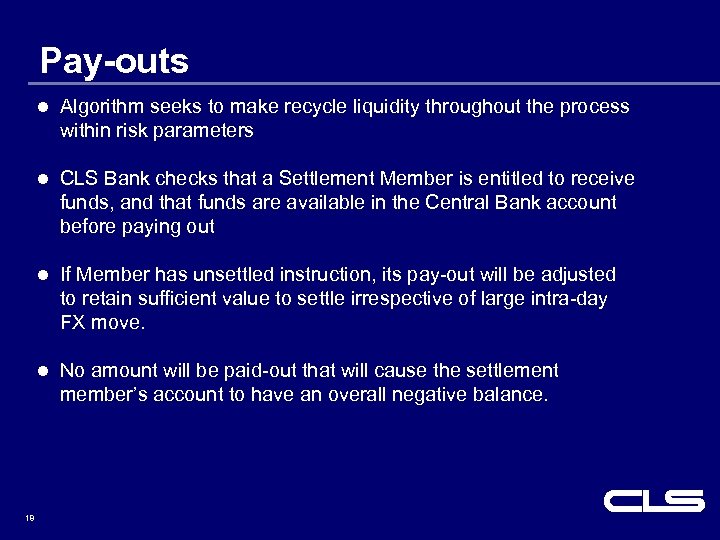

Pay-outs l l CLS Bank checks that a Settlement Member is entitled to receive funds, and that funds are available in the Central Bank account before paying out l If Member has unsettled instruction, its pay-out will be adjusted to retain sufficient value to settle irrespective of large intra-day FX move. l 18 Algorithm seeks to make recycle liquidity throughout the process within risk parameters No amount will be paid-out that will cause the settlement member’s account to have an overall negative balance.

Funding and Pay-out C ET C 00 2: 1 19

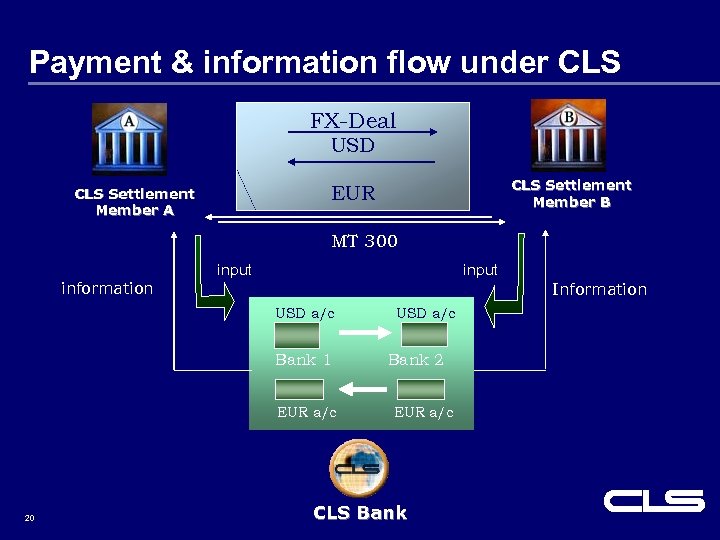

Payment & information flow under CLS FX-Deal USD CLS Settlement Member B EUR CLS Settlement Member A MT 300 information input Input input USD a/c Bank 1 EUR a/c USD a/c Bank 2 EUR a/c CLS Bank 20 CLS Bank Information

CLS has changed market practice Normal - 2 day contract Possible same day settlement Normal - 2 day risk CLS eliminates Settlement risk (temporal risk) Historical information Real-time information 1 day funding Timed payments intraday requirement Extends domestic settlement finality globally 21

CLS Features – a summary l Linked to CB (RTGS) l Finality in PVP settlement l Multilateral Netted Funding l Real Time settlement and funds flow information l Intra-day Capability l Universal: Global Shareholders/Customers l Independent (Utility) l Not a Central Counterparty l Provides Crisis Management Support 22

CLS – How it’s Working

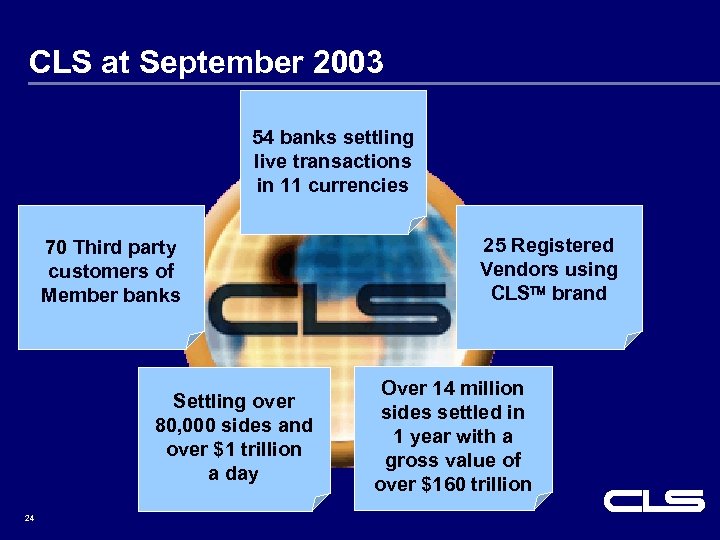

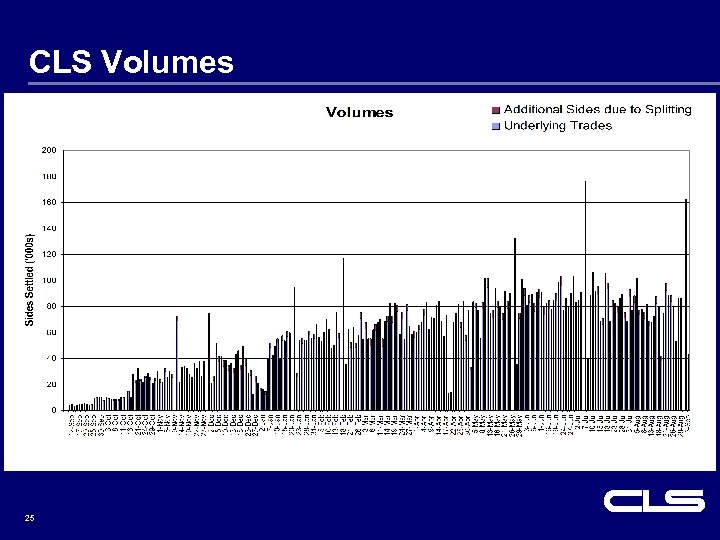

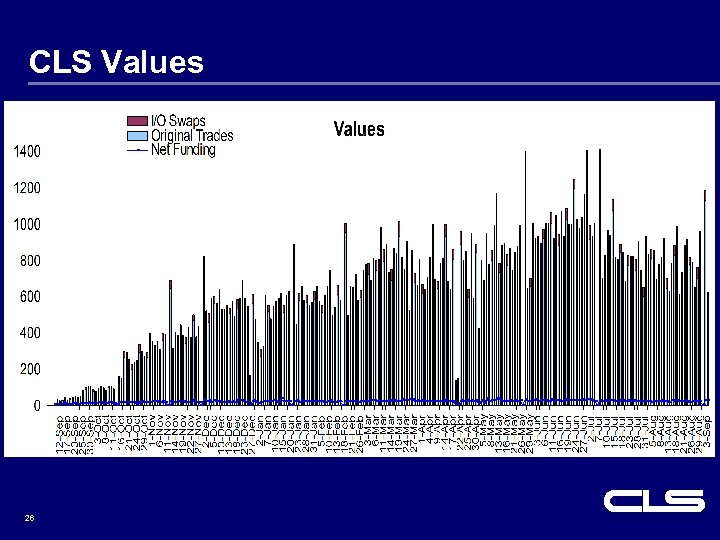

CLS at September 2003 54 banks settling live transactions in 11 currencies 70 Third party customers of Member banks Settling over 80, 000 sides and over $1 trillion a day 24 25 Registered Vendors using CLS brand Over 14 million sides settled in 1 year with a gross value of over $160 trillion

CLS Volumes 25

CLS Values 26

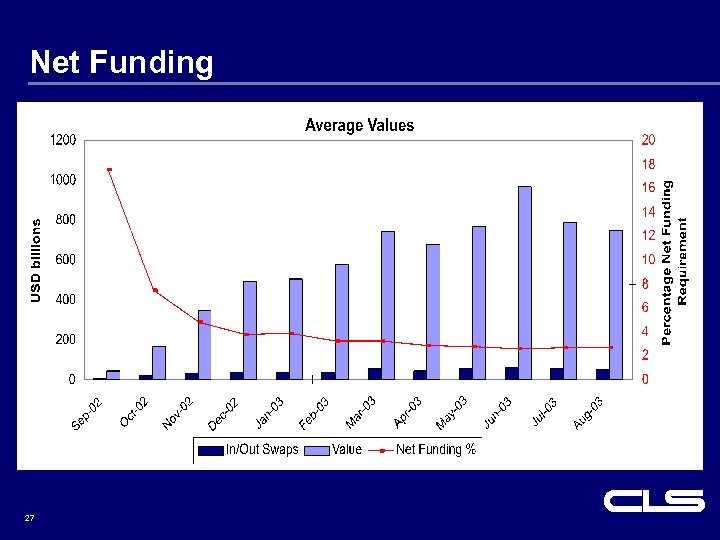

Net Funding 27

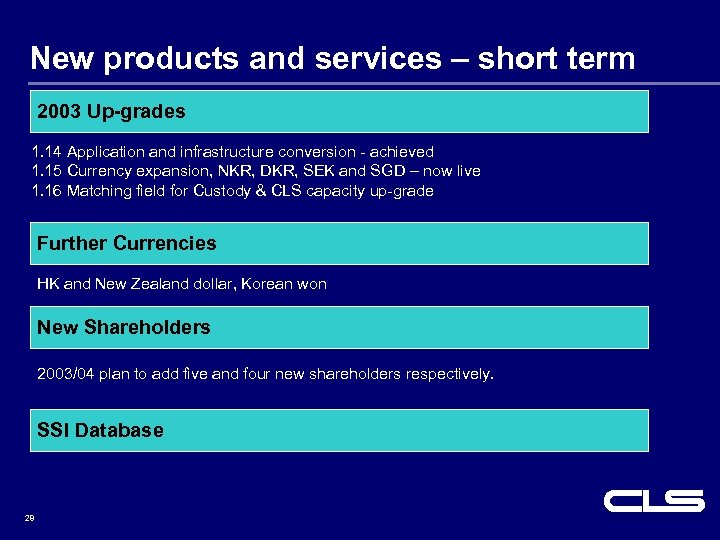

New products and services – short term 2003 Up-grades 1. 14 Application and infrastructure conversion - achieved 1. 15 Currency expansion, NKR, DKR, SEK and SGD – now live 1. 16 Matching field for Custody & CLS capacity up-grade Further Currencies HK and New Zealand dollar, Korean won New Shareholders 2003/04 plan to add five and four new shareholders respectively. SSI Database 28

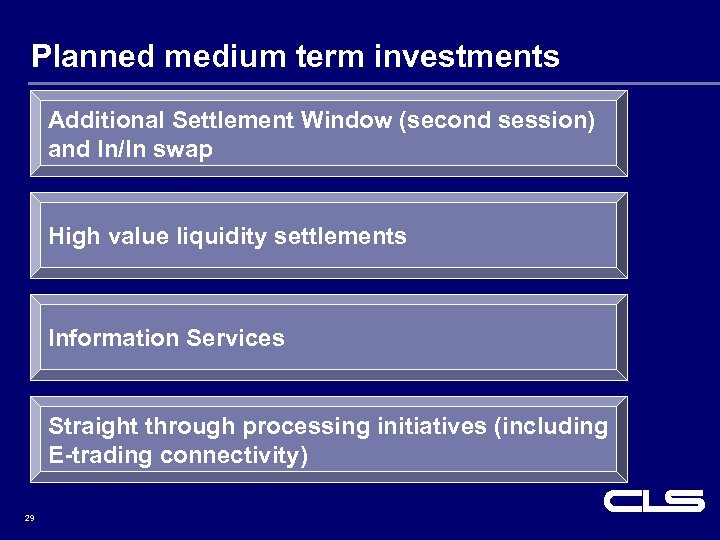

Planned medium term investments Additional Settlement Window (second session) and In/In swap High value liquidity settlements Information Services Straight through processing initiatives (including E-trading connectivity) 29

CLS Bank: a unique achievement Creates a global industry standard Unprecedented co-operation across the industry Growing number of providers of third party services Extends finality of domestic RTGS settlement globally 30 First global banking settlement system 67 shareholders, 25 vendors, 11 central banks Major business & technical achievement Level playing field – target of one price for all

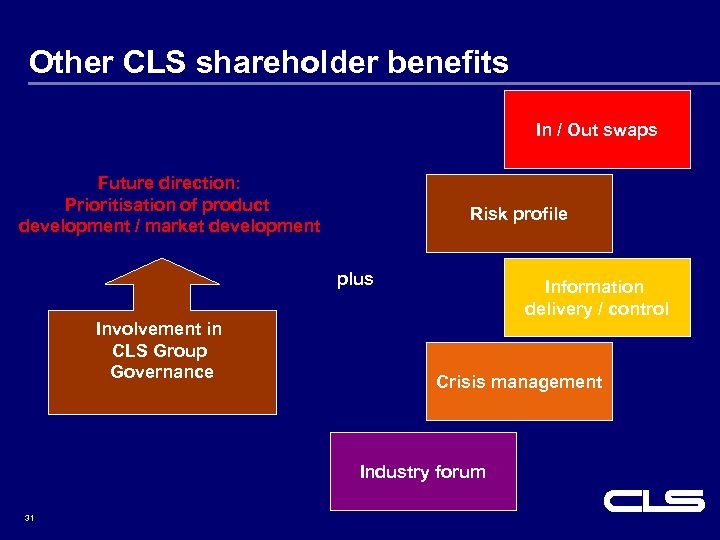

Other CLS shareholder benefits In / Out swaps Future direction: Prioritisation of product development / market development Risk profile plus Involvement in CLS Group Governance Information delivery / control Crisis management Industry forum 31

Other CLS shareholder benefits CLS Bank membership Gateway to the provision of third party services 32

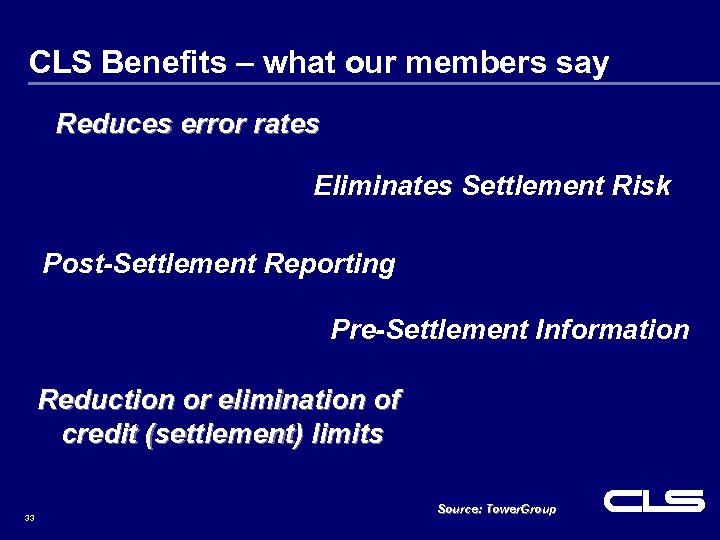

CLS Benefits – what our members say Reduces error rates Eliminates Settlement Risk Post-Settlement Reporting Pre-Settlement Information Reduction or elimination of credit (settlement) limits 33 Source: Tower. Group

CLS Market Potential (Sides per day) Planned CLS Market Share after 5 Years 500 Other 3 rd Party 20% 350 Matching Field for Custody 50% - Future potential 290 Other Currencies - 2004 plans 260 Financial Institutions as 3 rd Party 50% - Very early days 100 Intra-Shareholder Transactions - Good progress 34 90%

Questions? www. cls-group. com 35

e3933044847366c7ea05752dd9a4d09e.ppt