bb79983e2930bff2020ebdb006f6c020.ppt

- Количество слайдов: 50

Closing the infrastructure gap: The role of public-private partnerships P R Srinivas Industry Lead – THL Deloitte Touche Tohmatsu India Private Limited

Organization • Introduction • The Case for Public Private Partnerships • PPP Market Maturity Curve • Moving Up the Maturity Curve • Conclusion on PPP • Tourism and PPP © 2008 Deloitte Touche Tohmatsu India

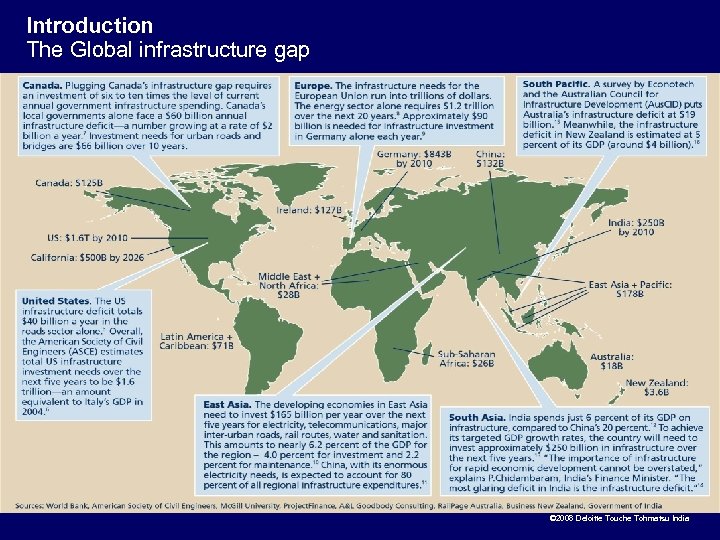

Introduction The Global infrastructure gap © 2008 Deloitte Touche Tohmatsu India

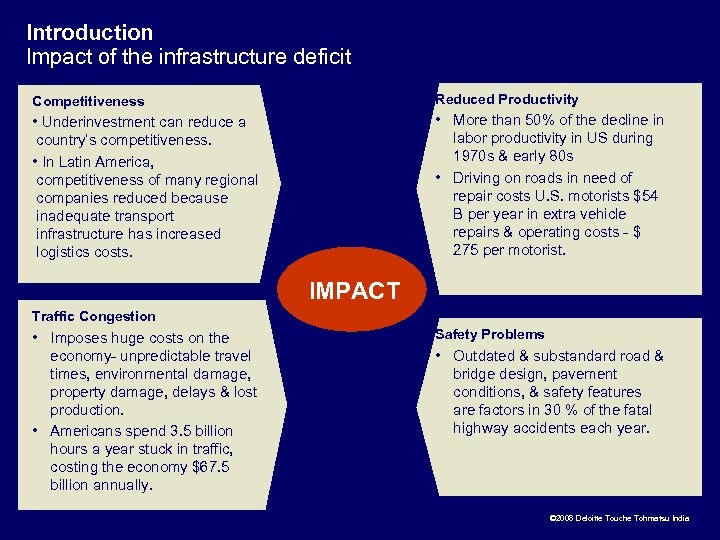

Introduction Impact of the infrastructure deficit Competitiveness Reduced Productivity • Underinvestment can reduce a country’s competitiveness. • In Latin America, competitiveness of many regional companies reduced because inadequate transport infrastructure has increased logistics costs. • More than 50% of the decline in labor productivity in US during 1970 s & early 80 s • Driving on roads in need of repair costs U. S. motorists $54 B per year in extra vehicle repairs & operating costs - $ 275 per motorist. IMPACT Traffic Congestion • Imposes huge costs on the economy- unpredictable travel times, environmental damage, property damage, delays & lost production. • Americans spend 3. 5 billion hours a year stuck in traffic, costing the economy $67. 5 billion annually. Safety Problems • Outdated & substandard road & bridge design, pavement conditions, & safety features are factors in 30 % of the fatal highway accidents each year. © 2008 Deloitte Touche Tohmatsu India

Introduction : Putting PPPs in Context Traditional Funding vs. Public-Private Partnerships PUBLIC-PRIVATE PARTNERSHIPS • The public sector procures a service, not an asset, from the private sector • The public sector requirements are defined in output terms as part of the procurement providing opportunity for innovation and risk transfer • Private sector generally responsible for design, build, finance, operation and maintenance over long term contract period • Payments linked with performance. Revenue earned through a mix of direct tolls, availability payments and/or performance payments. • Significant levels of risk transfer to the private sector over life of contract. Risks are allocated to the party that is best able to manage them. © 2008 Deloitte Touche Tohmatsu India

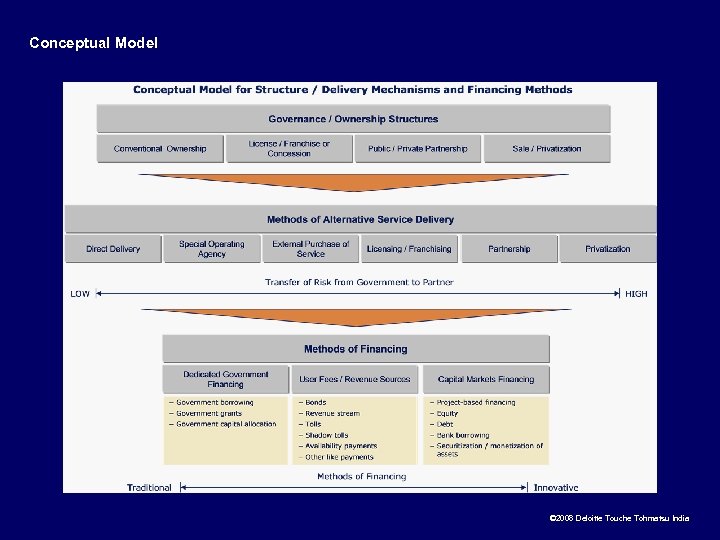

Conceptual Model © 2008 Deloitte Touche Tohmatsu India

The case for PPPs Benefits of PPPs Bring Construction Forward • PPPs enable public sector to spread cost of infrastructure investment over the lifetime of the asset. Private sector has strong incentive to complete the project ASAP because they need the stream of revenues to repay the capital costs. On-Time & On. Budget Delivery • Payments are aligned to the delivery of project objectives- thus PPPs have a solid track record of on-time or early construction completion. Ensuring that assets are properly maintained • Well-designed PPPs help maintain infrastructure by transferring maintenance requirements for a facility to the private partner. Cost Savings • Shifting long-term operation & maintenance responsibilities to the private firm creates incentive to ensure long term construction quality as it is responsible for those costs many years down the road. Experience from several countries has demonstrated savings from PPPs during the construction phase of the contract. Strong Customer Service Orientation • Private-sector infrastructure providers - rely on user fees from customers for revenue –thus have a strong incentive to provide superior customer service. Enables the Public Sector to Focus on Outcomes & Core Business • Properly structured PPPs enable governments to focus on outcomes, instead of inputs. Governments can focus leadership attention on the outcome-based public value they are trying to create. © 2008 Deloitte Touche Tohmatsu India

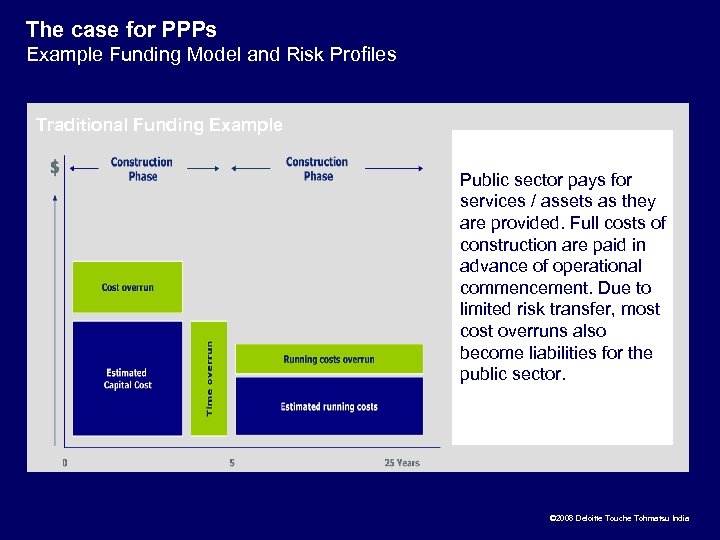

The case for PPPs Example Funding Model and Risk Profiles Traditional Funding Example Public sector pays for services / assets as they are provided. Full costs of construction are paid in advance of operational commencement. Due to limited risk transfer, most cost overruns also become liabilities for the public sector. © 2008 Deloitte Touche Tohmatsu India

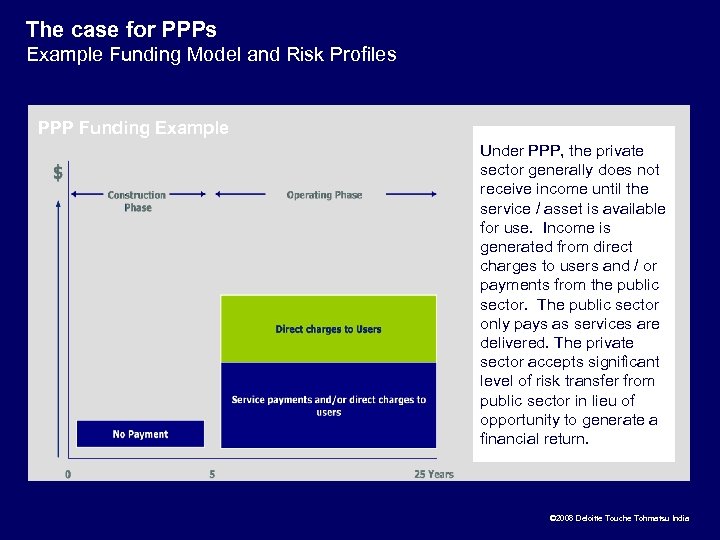

The case for PPPs Example Funding Model and Risk Profiles PPP Funding Example Under PPP, the private sector generally does not receive income until the service / asset is available for use. Income is generated from direct charges to users and / or payments from the public sector. The public sector only pays as services are delivered. The private sector accepts significant level of risk transfer from public sector in lieu of opportunity to generate a financial return. © 2008 Deloitte Touche Tohmatsu India

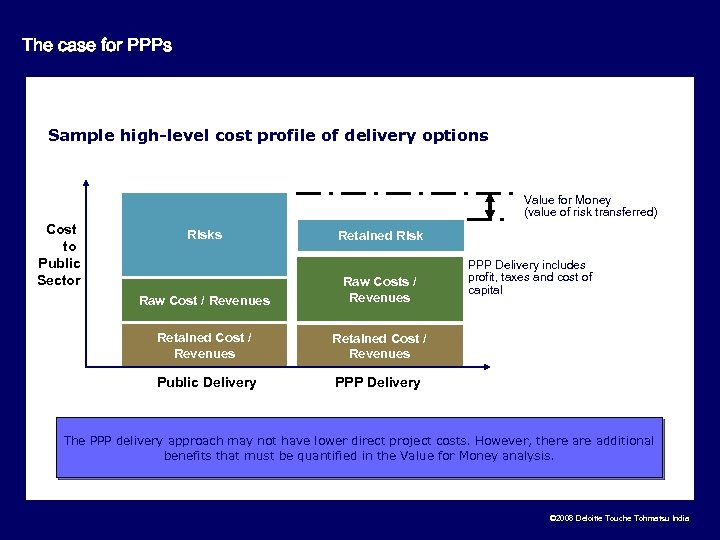

The case for PPPs PPP projects require a careful management of risks during construction and operation Sample high-level cost profile of delivery options Value for Money (value of risk transferred) Cost to Public Sector Risks Retained Risk Raw Cost / Revenues Raw Costs / Revenues Retained Cost / Revenues Public Delivery PPP Delivery includes profit, taxes and cost of capital PPP Delivery The PPP delivery approach may not have lower direct project costs. However, there additional benefits that must be quantified in the Value for Money analysis. © 2008 Deloitte Touche Tohmatsu India

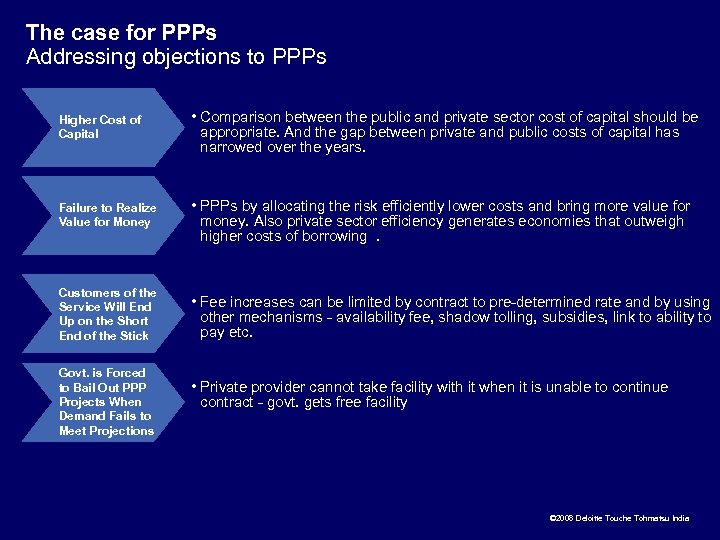

The case for PPPs Addressing objections to PPPs Higher Cost of Capital • Comparison between the public and private sector cost of capital should be appropriate. And the gap between private and public costs of capital has narrowed over the years. Failure to Realize Value for Money • PPPs by allocating the risk efficiently lower costs and bring more value for money. Also private sector efficiency generates economies that outweigh higher costs of borrowing. Customers of the Service Will End Up on the Short End of the Stick • Fee increases can be limited by contract to pre-determined rate and by using other mechanisms - availability fee, shadow tolling, subsidies, link to ability to pay etc. Govt. is Forced to Bail Out PPP Projects When Demand Fails to Meet Projections • Private provider cannot take facility with it when it is unable to continue contract - govt. gets free facility © 2008 Deloitte Touche Tohmatsu India

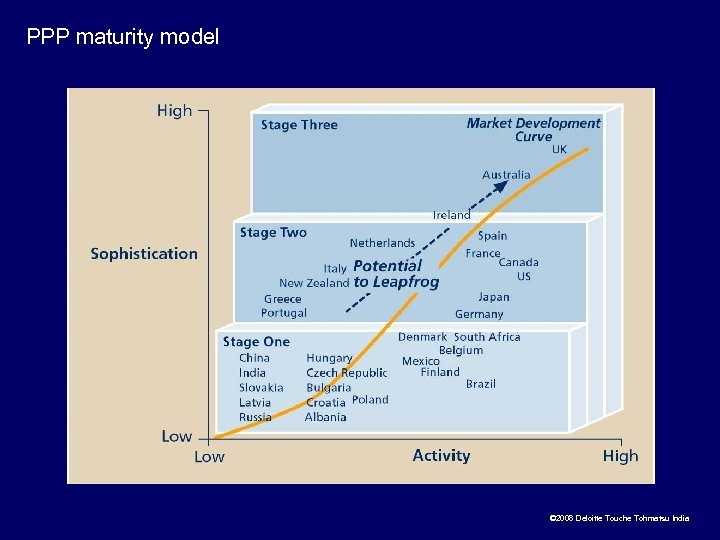

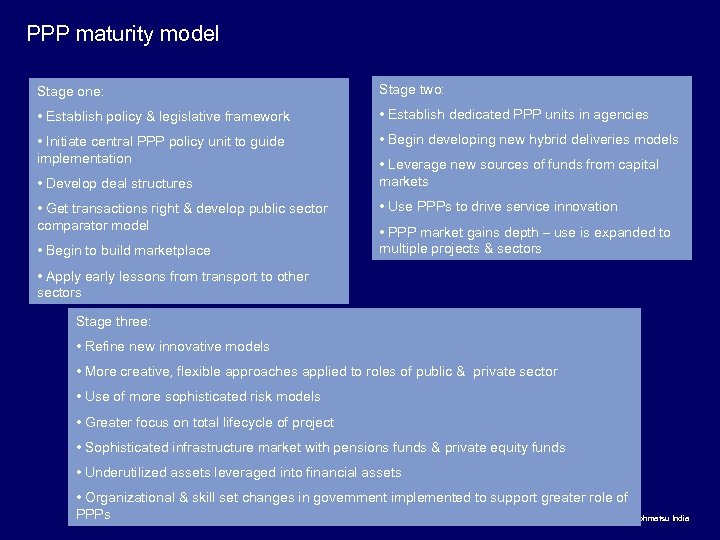

PPP maturity model © 2008 Deloitte Touche Tohmatsu India

PPP maturity model Stage one: Stage two: • Establish policy & legislative framework • Establish dedicated PPP units in agencies • Initiate central PPP policy unit to guide implementation • Begin developing new hybrid deliveries models • Develop deal structures • Get transactions right & develop public sector comparator model • Begin to build marketplace • Leverage new sources of funds from capital markets • Use PPPs to drive service innovation • PPP market gains depth – use is expanded to multiple projects & sectors • Apply early lessons from transport to other sectors Stage three: • Refine new innovative models • More creative, flexible approaches applied to roles of public & private sector • Use of more sophisticated risk models • Greater focus on total lifecycle of project • Sophisticated infrastructure market with pensions funds & private equity funds • Underutilized assets leveraged into financial assets • Organizational & skill set changes in government implemented to support greater role of PPPs © 2008 Deloitte Touche Tohmatsu India

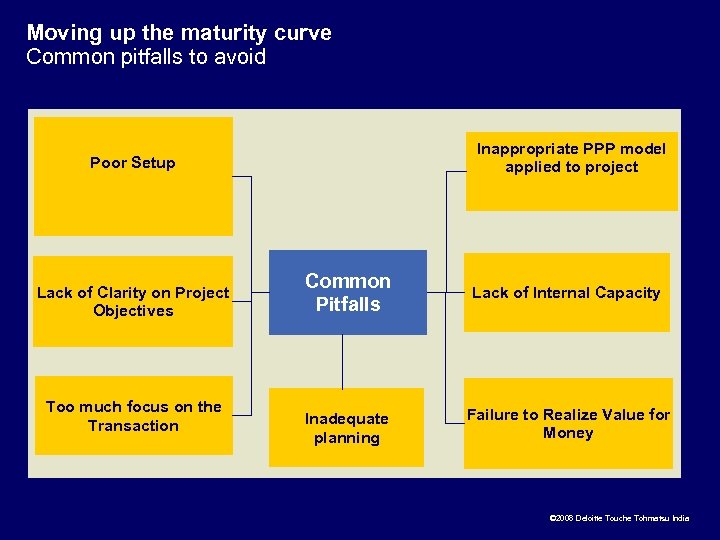

Moving up the maturity curve Common pitfalls to avoid Inappropriate PPP model applied to project Poor Setup Lack of Clarity on Project Objectives Too much focus on the Transaction Common Pitfalls Lack of Internal Capacity Inadequate planning Failure to Realize Value for Money © 2008 Deloitte Touche Tohmatsu India

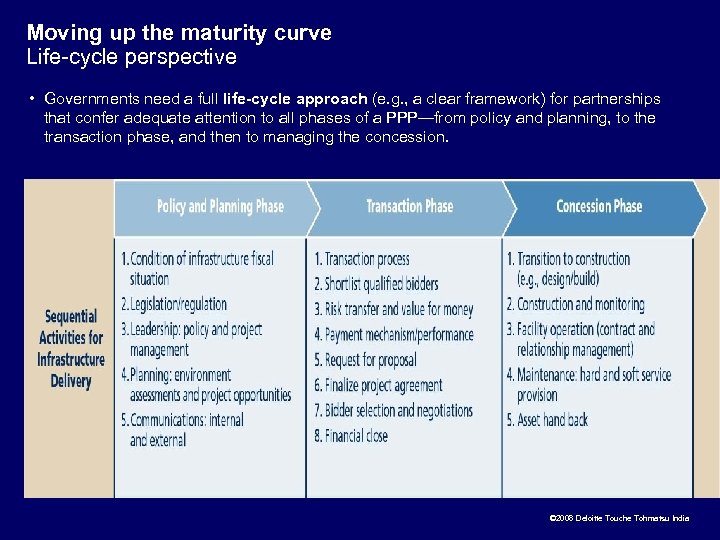

Moving up the maturity curve Life-cycle perspective • Governments need a full life-cycle approach (e. g. , a clear framework) for partnerships that confer adequate attention to all phases of a PPP—from policy and planning, to the transaction phase, and then to managing the concession. © 2008 Deloitte Touche Tohmatsu India

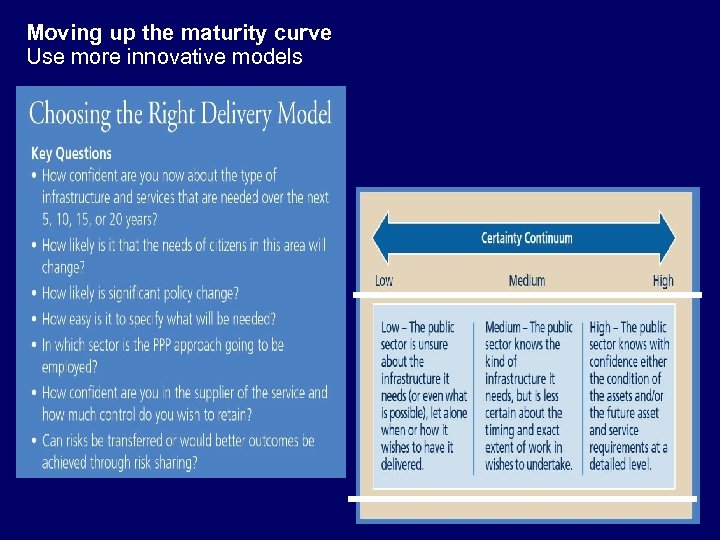

Moving up the maturity curve Use more innovative models © 2008 Deloitte Touche Tohmatsu India

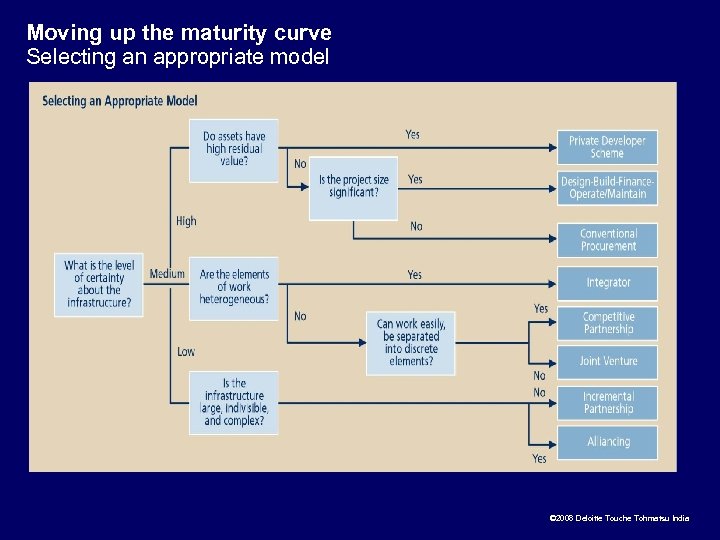

Moving up the maturity curve Selecting an appropriate model Source: Building Flexibility: New Delivery Models for Public Infrastructure Projects, Deloitte Research, 2005. © 2008 Deloitte Touche Tohmatsu India

Moving up the maturity curve Unlocking value from assets • Governments are increasingly looking at their portfolio of assets to determine how to realise the maximum value from these assets by exchanging them for other assets or services that might serve more pressing needs. • Public assets tend to be sited in prime locations; often have excess land or control of adjacent properties. The government can use these as equity to partner with the private sector to create new facilities and develop the existing assets. This not only unlocks value from these assets but also helps to meet critical infrastructure needs. © 2008 Deloitte Touche Tohmatsu India

Conclusion on PPP • The infrastructure challenge before governments today may seem overwhelming. Slowly governments are realizing that inaction is simply not an option. • PPPs alone are not a panacea. Rather, they are one tool governments have at their disposal for infrastructure delivery—a tool that requires careful application. By making the best use of the full range of delivery models that are available and continuing to innovate, the public sector can maximize the likelihood of meeting its infrastructure objectives and take PPPs to the next stage of development. • This development, in turn, will enable this relatively new delivery model to play a far larger role in closing the infrastructure gaps bedeviling governments across the world. © 2008 Deloitte Touche Tohmatsu India

Tourism and PPP 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

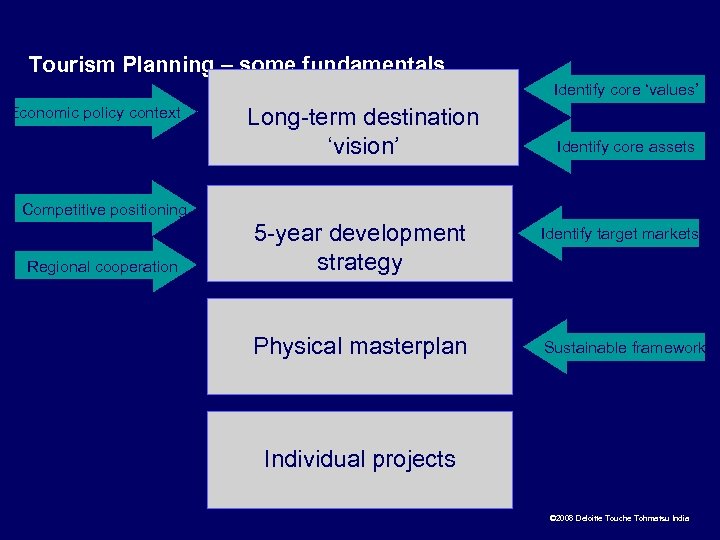

Tourism Planning – some fundamentals Identify core ‘values’ Economic policy context Long-term destination ‘vision’ Identify core assets Competitive positioning Regional cooperation 5 -year development strategy Identify target markets Physical masterplan Sustainable framework Individual projects © 2008 Deloitte Touche Tohmatsu India

New paradigms in destination development and marketing 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

Visioning 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

What is a ‘vision? • An inspired view of the long-term future – a destination’s “place in the sun” at the end of the 21 st century • Aspirational – Must appeal to aspirations and emotions of all stakeholders © 2008 common A vision provides the inspiration that binds all stakeholders to a Deloitte Touche Tohmatsu India

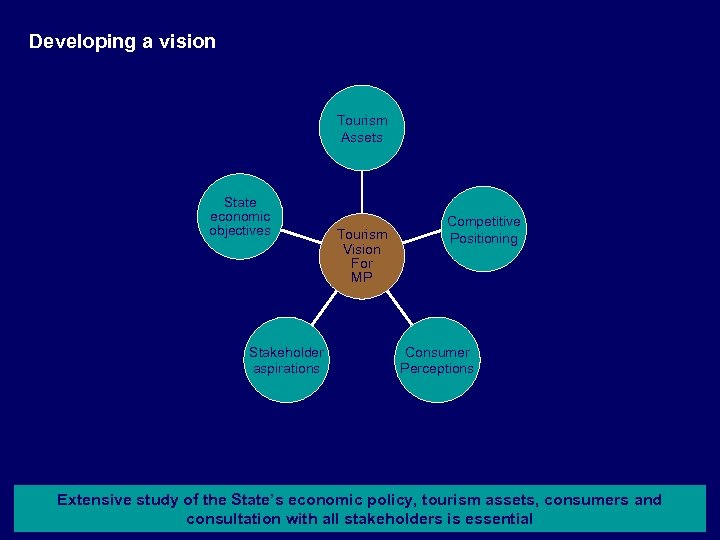

Developing a vision Tourism Assets State economic objectives Stakeholder aspirations Tourism Vision For MP Competitive Positioning Consumer Perceptions Extensive study of the State’s economic policy, tourism assets, consumers and consultation with all stakeholders is essential © 2008 Deloitte Touche Tohmatsu India

Tourism and Economic Development 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

Tourism and economic development • Today, tourism and economic development are inseparable and mutually supportive • “the images that a nation has in tourism, inward investment and …export inevitably overlap and coalesce…Success will depend on handling this in a sophisticated and coordinated fashion…” • “The creation of celebrity and emotional appeal through …(destination development and marketing)… opens the way for other economic development-oriented agencies to communicate to would-be investors. . . ” © 2008 Deloitte Touche Tohmatsu India

Core values and assets 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

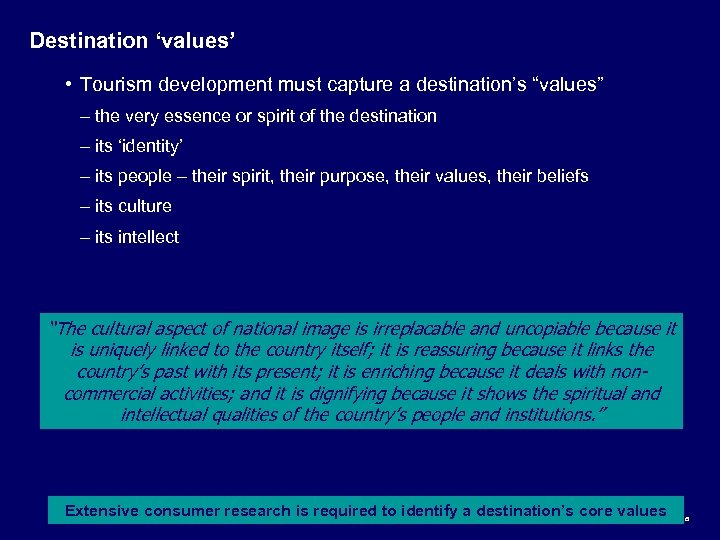

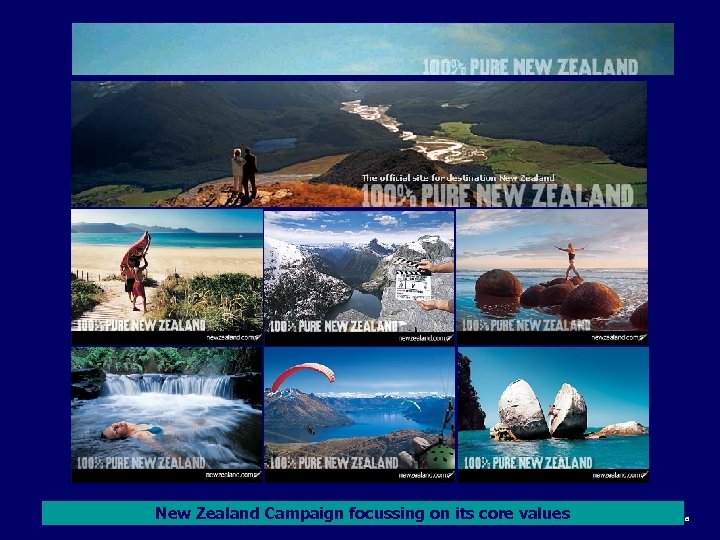

Destination ‘values’ • Tourism development must capture a destination’s “values” – the very essence or spirit of the destination – its ‘identity’ – its people – their spirit, their purpose, their values, their beliefs – its culture – its intellect “The cultural aspect of national image is irreplacable and uncopiable because it is uniquely linked to the country itself; it is reassuring because it links the country’s past with its present; it is enriching because it deals with noncommercial activities; and it is dignifying because it shows the spiritual and intellectual qualities of the country’s people and institutions. ” Extensive consumer research is required to identify a destination’s Deloitte Touche Tohmatsu India core values © 2008

New Zealand Campaign focussing on its core values Deloitte Touche Tohmatsu India © 2008

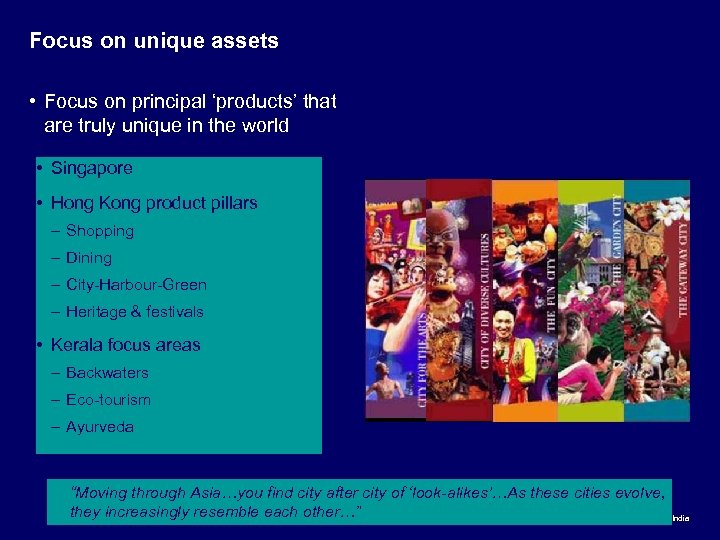

Focus on unique assets • Focus on principal ‘products’ that are truly unique in the world • Singapore • Hong Kong product pillars – Shopping – Dining – City-Harbour-Green – Heritage & festivals • Kerala focus areas – Backwaters – Eco-tourism – Ayurveda “Moving through Asia…you find city after city of ‘look-alikes’…As these cities evolve, they increasingly resemble each other…” © 2008 Deloitte Touche Tohmatsu India

But what is today’s tourism product? • Facilities and attractive urban environments, while necessary, are no longer differentiators • Today’s destination winners are: – ‘experiences’ that meet aesthetic needs – rich in emotional meaning – ‘how do we want to feel on our holiday’ – provide symbolic and self-expressive benefits: – ‘who can we be on holiday’ – lifestyle indicator “One such destination… campaign which transcended the commodity nature of product and which promised a unique (yet credible) experience was the ‘India Changes You’ campaign…It’s breathtaking. ” © 2008 Deloitte Touche Tohmatsu India

Identification of target markets • Target markets not based on regions or countries • Example - Life Stage segments as target markets: • Extensive and ongoing consumer research – perceptions, image, experience, satisfaction, competition – Young Couples, age 26 -35 yrs, no kids – Mid-Career Married With Kids, 31 -45 yrs – Achievers Married With Kids, 46 -60 yrs • Today’s target markets are prioritised by sub-segments: – purpose of visit – geographic sub-regions – demographics and life stage – behaviour and psychographics © 2008 Deloitte Touche Tohmatsu India

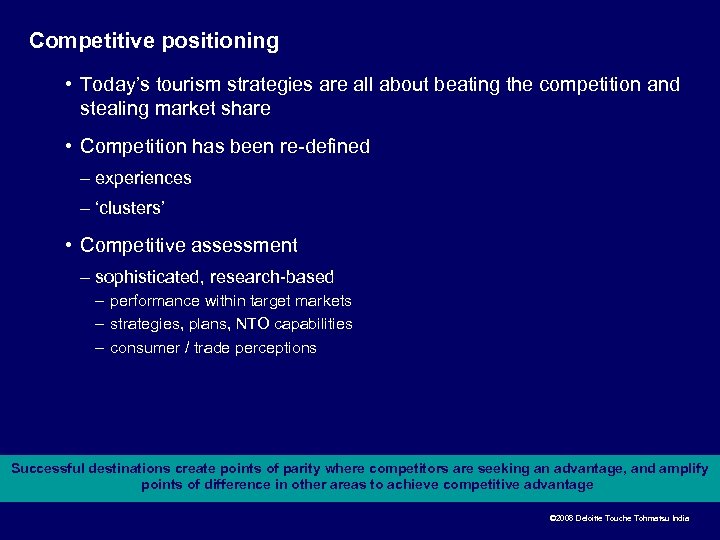

Competitive positioning • Today’s tourism strategies are all about beating the competition and stealing market share • Competition has been re-defined – experiences – ‘clusters’ • Competitive assessment – sophisticated, research-based – performance within target markets – strategies, plans, NTO capabilities – consumer / trade perceptions Successful destinations create points of parity where competitors are seeking an advantage, and amplify points of difference in other areas to achieve competitive advantage © 2008 Deloitte Touche Tohmatsu India

Regional cooperation • Cooperation, even with competitors, is becoming crucial for survival • “Together in Asia” – TAT, STB, . HKTB • Asean Tourism Forum © 2008 Deloitte Touche Tohmatsu India

Tourism Strategy 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

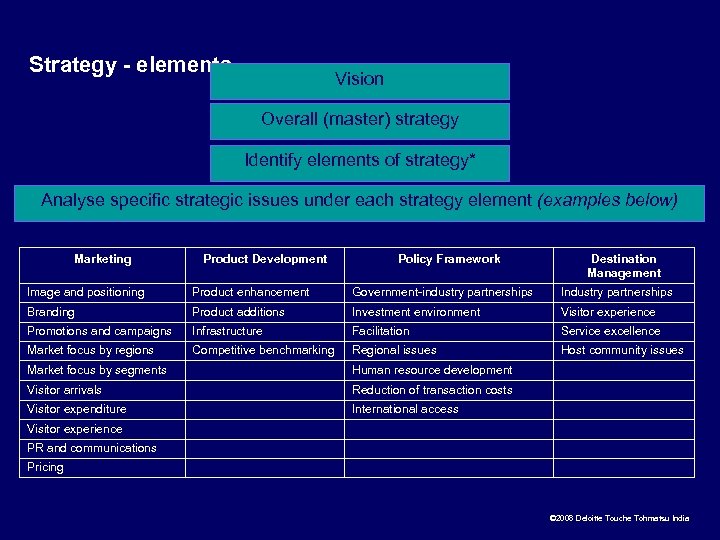

Strategy - elements Vision Overall (master) strategy Identify elements of strategy* Analyse specific strategic issues under each strategy element (examples below) Marketing Product Development Policy Framework Destination Management Image and positioning Product enhancement Government-industry partnerships Industry partnerships Branding Product additions Investment environment Visitor experience Promotions and campaigns Infrastructure Facilitation Service excellence Market focus by regions Competitive benchmarking Regional issues Host community issues Market focus by segments Human resource development Visitor arrivals Reduction of transaction costs Visitor expenditure International access Visitor experience PR and communications Pricing © 2008 Deloitte Touche Tohmatsu India

The Master Planning Approach Master Plans and Projects 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

Applicability • State, regional, or local level • Macro to micro • Physical and institutional elements © 2008 Deloitte Touche Tohmatsu India

Overall approach • Regional, competitive perspective • Phased development – Long term vision – Short term implementation • Intensive research – Destinations and attractions – Market • Impact Scoping – Environmental – Economic • Implementation oriented – Investment / project / site specific – Private sector participation © 2008 Deloitte Touche Tohmatsu India

Paramount objective • Enhance economic benefits in a sustainable model: – Increase visitation – Increase length of stay – Increase expenditure • Increase investment (private) in tourism projects © 2008 Deloitte Touche Tohmatsu India

Regional and destination level planning 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

Centres for development • Regional development strategy: – Destination hubs for development – Attractions for improvement – Bankable projects © 2008 Deloitte Touche Tohmatsu India

Site and micro level planning for bankable projects 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

Site development micro plans • Conceptual Plans • Development Briefs • Project Profiles • Feasibility Studies • Implementation Frameworks © 2008 Deloitte Touche Tohmatsu India

Way forward to implementation 2 nd Deloitte Central Europe PPP Training Seminar, Prague 12 & 13 April 2006

Private sector participation • Identification and availability of sites and projects • Concepts, Feasibility Studies, Project Profiles • Recommendations on ideal publicprivate partnership structure, per project • Valuation, public-private partnership financial terms • Terms of reference © 2008 Deloitte Touche Tohmatsu India

Other micro plans • Economic and Financial Analysis • Environmental Scoping • Marketing Plan © 2008 Deloitte Touche Tohmatsu India

Strategy recommendations • Infrastructure and Transport • Other New Projects • Investment and Financing • Policy, Organisation, Institutions • Human Resources and Training • Linkages with other Sectors of Economy • Conservation • Environmental enhancements © 2008 Deloitte Touche Tohmatsu India

About Deloitte refers to one or more of Deloitte Touche Tohmatsu, a Swiss Verein, its member firms and their respective subsidiaries and affiliates. Deloitte Touche Tohmatsu is an organization of member firms around the world devoted to excellence in providing professional services and advice, focused on client service through a global strategy executed locally in nearly 140 countries. With access to the deep intellectual capital of approximately 135, 000 people worldwide, Deloitte delivers services in four professional areas, audit, tax, consulting and financial advisory services, and serves more than 80 percent of the world’s largest companies, as well as large national enterprises, public institutions, locally important clients, and successful, fast-growing global growth companies. Services are not provided by the Deloitte Touche Tohmatsu Verein and, for regulatory and other reasons, certain member firms do not provide services in all four professional areas. As a Swiss Verein (association), neither Deloitte Touche Tohmatsu nor any of its member firms has any liability for each other’s acts or omissions. Each of the member firms is a separate and independent legal entity operating under the names “Deloitte”, “Deloitte & Touche”, “Deloitte Touche Tohmatsu” or other related names. In the United States, Deloitte & Touche USA LLP is the U. S. member firm of Deloitte Touche Tohmatsu and services are provided by the subsidiaries of Deloitte & Touche USA LLP (Deloitte & Touche LLP, Deloitte Consulting LLP, Deloitte Financial Advisory Services LLP, Deloitte Tax LLP, and their subsidiaries), and not by Deloitte & Touche USA LLP. The subsidiaries of the U. S. member firm are among the nation’s leading professional services firms, providing audit, tax, consulting, and financial advisory services through nearly 40, 000 people in more than 90 cities. Known as employers of choice for innovative human resources programs, they are dedicated to helping their clients and their people excel. For more information, please visit the U. S. member firm’s Web site at www. deloitte. com Copyright © 2006 Deloitte Development LLC. All rights reserved. Member of Deloitte Touche Tohmatsu

bb79983e2930bff2020ebdb006f6c020.ppt