0da8f325f1fa825249cf1bbdb7d35a80.ppt

- Количество слайдов: 13

Client: Title: Clearstream Entering New Markets: Challenges for Emerging Securities Markets Gaining ICSD access Jan Willems Vice President Sales and Relationship Manager Clearstream Banking Luxembourg

Client: Title: Clearstream Entering New Markets: Challenges for Emerging Securities Markets Gaining ICSD access Jan Willems Vice President Sales and Relationship Manager Clearstream Banking Luxembourg

Client: Title: The “Markets Company” Integrated solutions for clients Excellent and stable credit rating Credit rating of Clearstream AA/Stable/A-1+ Deutsche Börse Group Cash markets Derivatives markets On exchange Central Counterparty Services (CCP) Eurex Clearinghouse Open settlement model Investment Fund markets Fixed income markets ETFs OTC Settlement, custody and securities financing Trading, listing, infrastructure partnerships across the globe The 1 st International Joint Conference of AECSD and IAEx of CIS Current ratings Counterparty credit AA/Stable/A-1+ Certificate of deposit AA/A-1+ Commercial paper Local currency A-1+ Foreign currency Sovereign rating Luxembourg AAA/Stable/A-1+ Related entities Deutsche Börse Group AA/Stable/A-1+ October 6, 2011 2

Client: Title: The “Markets Company” Integrated solutions for clients Excellent and stable credit rating Credit rating of Clearstream AA/Stable/A-1+ Deutsche Börse Group Cash markets Derivatives markets On exchange Central Counterparty Services (CCP) Eurex Clearinghouse Open settlement model Investment Fund markets Fixed income markets ETFs OTC Settlement, custody and securities financing Trading, listing, infrastructure partnerships across the globe The 1 st International Joint Conference of AECSD and IAEx of CIS Current ratings Counterparty credit AA/Stable/A-1+ Certificate of deposit AA/A-1+ Commercial paper Local currency A-1+ Foreign currency Sovereign rating Luxembourg AAA/Stable/A-1+ Related entities Deutsche Börse Group AA/Stable/A-1+ October 6, 2011 2

Client: Title: 40 years in brief 1970: Cedel (as we were initially called) was established by 66 financial institutions from 11 countries to reduce the costs and risks of settling securities transactions in the Eurobond market. 1995: in January, a new corporate structure was introduced, establishing a parent company – Cedel International – with a subsidiary company, Cedelbank; two years later, a new subsidiary – Cedel Global Services – was established. 2000: Clearstream International was formed through the merger of Cedel International & Deutsche Börse Clearing, a Deutsche Börse AG subsidiary. 2002: in July, Clearstream became a wholly owned subsidiary of Deutsche Börse Group. 2010: “Clearstream 2013” sets out strategic goals that will enable us to effectively differentiate our company in the future competitive environment. The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 3

Client: Title: 40 years in brief 1970: Cedel (as we were initially called) was established by 66 financial institutions from 11 countries to reduce the costs and risks of settling securities transactions in the Eurobond market. 1995: in January, a new corporate structure was introduced, establishing a parent company – Cedel International – with a subsidiary company, Cedelbank; two years later, a new subsidiary – Cedel Global Services – was established. 2000: Clearstream International was formed through the merger of Cedel International & Deutsche Börse Clearing, a Deutsche Börse AG subsidiary. 2002: in July, Clearstream became a wholly owned subsidiary of Deutsche Börse Group. 2010: “Clearstream 2013” sets out strategic goals that will enable us to effectively differentiate our company in the future competitive environment. The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 3

Client: Title: Clearstream today Settlement ‒ Delivery of securities v payment for over 114 million transactions pa ‒ Reassignment of the ownership of the security and payment ‒ 94 currencies eligible (42 eligible for settlement) Asset services ‒ Assets under custody exceeding € 11 trillion ‒ More than 400, 000 securities holdings ‒ Servicing income, corporate actions and tax events Global Securities Financing ‒ Securities lending and borrowing ‒ Tripartite repo and collateral management ‒ More than € 576 billion monthly average outstandings Investment Funds Services ‒ Series of solutions for investment funds (Vestima+, Central Facility for Funds ‒ 5. 2 million transactions pa over 82, 000 investment funds Other services ‒ Complete suite of connectivity for customers and providers to access the Creation platform ‒ Cash management The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 4

Client: Title: Clearstream today Settlement ‒ Delivery of securities v payment for over 114 million transactions pa ‒ Reassignment of the ownership of the security and payment ‒ 94 currencies eligible (42 eligible for settlement) Asset services ‒ Assets under custody exceeding € 11 trillion ‒ More than 400, 000 securities holdings ‒ Servicing income, corporate actions and tax events Global Securities Financing ‒ Securities lending and borrowing ‒ Tripartite repo and collateral management ‒ More than € 576 billion monthly average outstandings Investment Funds Services ‒ Series of solutions for investment funds (Vestima+, Central Facility for Funds ‒ 5. 2 million transactions pa over 82, 000 investment funds Other services ‒ Complete suite of connectivity for customers and providers to access the Creation platform ‒ Cash management The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 4

Client: Title: Clearstream’s core business Clearstream Banking Luxembourg (ICSD) Customers 2, 500 customers in 100 countries Securities Eurobonds, domestic bonds, equities, investment funds, etc 52 markets worldwide via Markets network of sub-custodians & direct CSD links Asset Full range of custody and services collateral management services The 1 st International Joint Conference of AECSD and IAEx of CIS Clearstream Banking Frankfurt (CSD) 400 German banks & remote international partners Domestic German equities and bonds, international assets 9 CSD links & international business with ICSD Custody and collateral management services October 6, 2011 5

Client: Title: Clearstream’s core business Clearstream Banking Luxembourg (ICSD) Customers 2, 500 customers in 100 countries Securities Eurobonds, domestic bonds, equities, investment funds, etc 52 markets worldwide via Markets network of sub-custodians & direct CSD links Asset Full range of custody and services collateral management services The 1 st International Joint Conference of AECSD and IAEx of CIS Clearstream Banking Frankfurt (CSD) 400 German banks & remote international partners Domestic German equities and bonds, international assets 9 CSD links & international business with ICSD Custody and collateral management services October 6, 2011 5

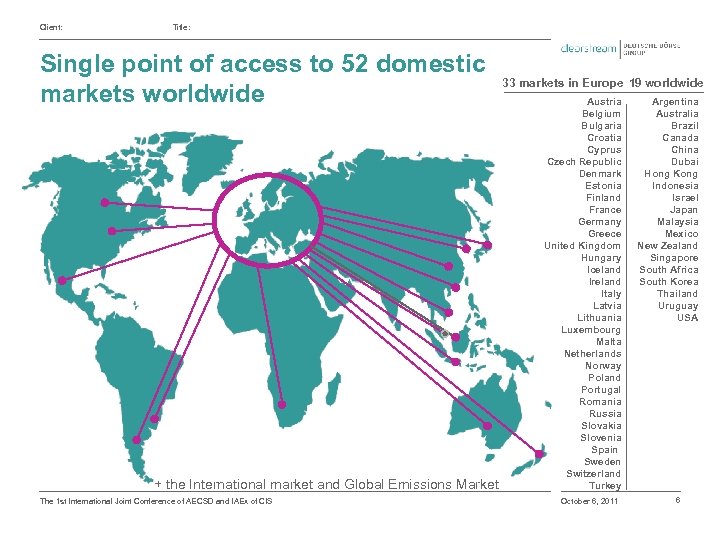

Client: Title: Single point of access to 52 domestic markets worldwide + the International market and Global Emissions Market The 1 st International Joint Conference of AECSD and IAEx of CIS 33 markets in Europe 19 worldwide Austria Belgium Bulgaria Croatia Cyprus Czech Republic Denmark Estonia Finland France Germany Greece United Kingdom Hungary Iceland Ireland Italy Latvia Lithuania Luxembourg Malta Netherlands Norway Poland Portugal Romania Russia Slovakia Slovenia Spain Sweden Switzerland Turkey October 6, 2011 Argentina Australia Brazil Canada China Dubai Hong Kong Indonesia Israel Japan Malaysia Mexico New Zealand Singapore South Africa South Korea Thailand Uruguay USA 6

Client: Title: Single point of access to 52 domestic markets worldwide + the International market and Global Emissions Market The 1 st International Joint Conference of AECSD and IAEx of CIS 33 markets in Europe 19 worldwide Austria Belgium Bulgaria Croatia Cyprus Czech Republic Denmark Estonia Finland France Germany Greece United Kingdom Hungary Iceland Ireland Italy Latvia Lithuania Luxembourg Malta Netherlands Norway Poland Portugal Romania Russia Slovakia Slovenia Spain Sweden Switzerland Turkey October 6, 2011 Argentina Australia Brazil Canada China Dubai Hong Kong Indonesia Israel Japan Malaysia Mexico New Zealand Singapore South Africa South Korea Thailand Uruguay USA 6

Client: Title: What Clearstream and foreign investors are looking for ‒ ‒ ‒ Omnibus concept, nominee concept Freely transferable and fungible shares No restrictions on FX of income proceeds Maximum Withholding at Source possibilities Maximum security through accounts in local CSD operated by local bank (in emerging markets, subsidiary of G 20 bank) ‒ Absence of Stamp Duty ‒ Swift compliant market ‒ AML/KYC robust The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 7

Client: Title: What Clearstream and foreign investors are looking for ‒ ‒ ‒ Omnibus concept, nominee concept Freely transferable and fungible shares No restrictions on FX of income proceeds Maximum Withholding at Source possibilities Maximum security through accounts in local CSD operated by local bank (in emerging markets, subsidiary of G 20 bank) ‒ Absence of Stamp Duty ‒ Swift compliant market ‒ AML/KYC robust The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 7

Client: Title: Challenges for Clearstream ‒ Upfront investment of over EUR 400 K in IT and system development for a full securities link and recurrent annual costs for each link (compliance, due diligence, etc …) ‒ Run-up period of over 1 -2 years (from RFI to RFP to validation and testing to implementation) ‒ Changing appetite of investors ( «flavour of the day» ) ‒ Local rules change during the set-up process ‒ Correct prices and correct collateral validation ‒ Finding a reliable local partner or finding a local CSD that allows accounts of ICSDs ‒ Geo-political market risks linked to a link, threatening our client’s interests The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 8

Client: Title: Challenges for Clearstream ‒ Upfront investment of over EUR 400 K in IT and system development for a full securities link and recurrent annual costs for each link (compliance, due diligence, etc …) ‒ Run-up period of over 1 -2 years (from RFI to RFP to validation and testing to implementation) ‒ Changing appetite of investors ( «flavour of the day» ) ‒ Local rules change during the set-up process ‒ Correct prices and correct collateral validation ‒ Finding a reliable local partner or finding a local CSD that allows accounts of ICSDs ‒ Geo-political market risks linked to a link, threatening our client’s interests The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 8

Client: Title: Malta model Background: ‒ Small market, but nonetheless foreign interest ‒ Challenge: avoid set-up costs (+/- EUR 400 K), but nonetheless provide link to foreign investors Solution: ‒ Clearstream Banking Frankfurt opens account on the books of Maltese CSD and Maltese CSD opens account on the books of Clearstream Banking Frankfurt ‒ Maltese CSD operates both accounts. ‒ Free of payment transactions only at first stage The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 9

Client: Title: Malta model Background: ‒ Small market, but nonetheless foreign interest ‒ Challenge: avoid set-up costs (+/- EUR 400 K), but nonetheless provide link to foreign investors Solution: ‒ Clearstream Banking Frankfurt opens account on the books of Maltese CSD and Maltese CSD opens account on the books of Clearstream Banking Frankfurt ‒ Maltese CSD operates both accounts. ‒ Free of payment transactions only at first stage The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 9

Client: Title: Malta model continued ‒ All securities are created book-entry in Malta and reflected in Maltese CSD account in Clearstream Banking Frankfurt ‒ From Maltese CSD account in Clearstream Banking Frankfurt, all securities are moved across both CSD and ICSD accounts ‒ All Maltese isin code become Clearstream Banking Frankfurt and Clearstream Banking Luxembourg eligible ‒ Clearstream Banking Luxembourg uses Clearstream Banking Frankfurt as sub-custodian ‒ Constant reconciliation between omnibus account of CBF at Maltese CSD and Maltese positions in CBF (1/1) The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 10

Client: Title: Malta model continued ‒ All securities are created book-entry in Malta and reflected in Maltese CSD account in Clearstream Banking Frankfurt ‒ From Maltese CSD account in Clearstream Banking Frankfurt, all securities are moved across both CSD and ICSD accounts ‒ All Maltese isin code become Clearstream Banking Frankfurt and Clearstream Banking Luxembourg eligible ‒ Clearstream Banking Luxembourg uses Clearstream Banking Frankfurt as sub-custodian ‒ Constant reconciliation between omnibus account of CBF at Maltese CSD and Maltese positions in CBF (1/1) The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 10

Client: Title: Pre-requisities of model ‒ Legal opinion to see if no issues with neither the securities nor the remote CSD under German Law ‒ Possibility of remote CSD to work either with SWIFT or with propriety system, CASCADE ‒ If non-EUR securities, possibility to pay income in either EUR, USD or CHF The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 11

Client: Title: Pre-requisities of model ‒ Legal opinion to see if no issues with neither the securities nor the remote CSD under German Law ‒ Possibility of remote CSD to work either with SWIFT or with propriety system, CASCADE ‒ If non-EUR securities, possibility to pay income in either EUR, USD or CHF The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 11

Client: Title: Benefits of model ‒ Easy and cheap to implement ‒ Much faster time-to-market ‒ Secure infrastructure of Clearstream Banking Frankfurt, giving access to Clearstream Banking Luxembourg ‒ Local shares can become Xetra eligible ‒ Access to over 2, 500 different world-wide financial institutions The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 12

Client: Title: Benefits of model ‒ Easy and cheap to implement ‒ Much faster time-to-market ‒ Secure infrastructure of Clearstream Banking Frankfurt, giving access to Clearstream Banking Luxembourg ‒ Local shares can become Xetra eligible ‒ Access to over 2, 500 different world-wide financial institutions The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 12

Client: Title: Conclusion: what does this all mean for my market? ‒ Think ahead: it takes market infrastructures like ICSDs months (or years) to link to emerging/frontier markets ‒ Consult with ICSDs, making use of 40 years expertise in creating technical, operational and regulatory conditions to offer ICSD access ‒ Keep your market as operationally simple as possible. Successfull emerging/frontier securities markets are those with a simple, straight-forward set-up The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 13

Client: Title: Conclusion: what does this all mean for my market? ‒ Think ahead: it takes market infrastructures like ICSDs months (or years) to link to emerging/frontier markets ‒ Consult with ICSDs, making use of 40 years expertise in creating technical, operational and regulatory conditions to offer ICSD access ‒ Keep your market as operationally simple as possible. Successfull emerging/frontier securities markets are those with a simple, straight-forward set-up The 1 st International Joint Conference of AECSD and IAEx of CIS October 6, 2011 13