169ca007a676401d71a99edf81fa2e7e.ppt

- Количество слайдов: 61

Click to edit Master title style Introduction to Company Law & Commercial Law An Examination of Business Enterprises J. Robert Stoll David Curry Aaron Gavant Mayer Brown LLP Visiting Professor University of Belgrade Faculty of Law U. S. Workout/Insolvency Law Course University of Belgrade Faculty of Law FALL 2015

Click to edit Master title style Introduction to Company Law & Commercial Law An Examination of Business Enterprises J. Robert Stoll David Curry Aaron Gavant Mayer Brown LLP Visiting Professor University of Belgrade Faculty of Law U. S. Workout/Insolvency Law Course University of Belgrade Faculty of Law FALL 2015

Examination of Business Enterprises Click to edit Master title style • Part I: Introduction to the Legal Forms for Business Enterprises – Selecting the legal form for a business enterprise, and the key attributes – sole proprietorship, corporation and partnership • Part II: Focus on the Corporation – Characteristics of the corporation, role of shareholders, directors and management – Capitalization of a corporation and use of equity and debt capital • Part III: Limited Liability for Shareholders and “Piercing the Veil” – Meaning and significance of “Limited Liability” – Abuse of corporation and “piercing” the corporate veil; examples 1

Examination of Business Enterprises Click to edit Master title style • Part I: Introduction to the Legal Forms for Business Enterprises – Selecting the legal form for a business enterprise, and the key attributes – sole proprietorship, corporation and partnership • Part II: Focus on the Corporation – Characteristics of the corporation, role of shareholders, directors and management – Capitalization of a corporation and use of equity and debt capital • Part III: Limited Liability for Shareholders and “Piercing the Veil” – Meaning and significance of “Limited Liability” – Abuse of corporation and “piercing” the corporate veil; examples 1

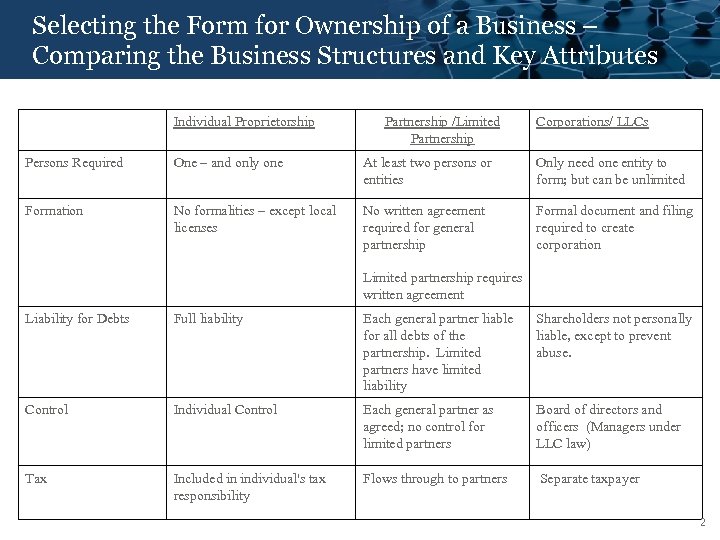

Selecting the Form for Ownership of a Business – Click to edit Master title style Comparing the Business Structures and Key Attributes Individual Proprietorship Partnership /Limited Partnership Corporations/ LLCs Persons Required One – and only one At least two persons or entities Only need one entity to form; but can be unlimited Formation No formalities – except local licenses No written agreement required for general partnership Formal document and filing required to create corporation Limited partnership requires written agreement Liability for Debts Full liability Each general partner liable for all debts of the partnership. Limited partners have limited liability Shareholders not personally liable, except to prevent abuse. Control Individual Control Each general partner as agreed; no control for limited partners Board of directors and officers (Managers under LLC law) Tax Included in individual's tax responsibility Flows through to partners Separate taxpayer 2

Selecting the Form for Ownership of a Business – Click to edit Master title style Comparing the Business Structures and Key Attributes Individual Proprietorship Partnership /Limited Partnership Corporations/ LLCs Persons Required One – and only one At least two persons or entities Only need one entity to form; but can be unlimited Formation No formalities – except local licenses No written agreement required for general partnership Formal document and filing required to create corporation Limited partnership requires written agreement Liability for Debts Full liability Each general partner liable for all debts of the partnership. Limited partners have limited liability Shareholders not personally liable, except to prevent abuse. Control Individual Control Each general partner as agreed; no control for limited partners Board of directors and officers (Managers under LLC law) Tax Included in individual's tax responsibility Flows through to partners Separate taxpayer 2

Sole/Individual Proprietorships Click to edit Master title style • Sole/Individual Proprietorships – Advantages • Easiest and least expensive form of business enterprise • Owner reaps all the rewards of ownership • Owner has complete control over business decisions – Disadvantages • No protection from liability for business failure • No ability to attract “equity” capital from 3 rd parties interested in investing in the business • Limited duration – ceases upon death of the owner 3

Sole/Individual Proprietorships Click to edit Master title style • Sole/Individual Proprietorships – Advantages • Easiest and least expensive form of business enterprise • Owner reaps all the rewards of ownership • Owner has complete control over business decisions – Disadvantages • No protection from liability for business failure • No ability to attract “equity” capital from 3 rd parties interested in investing in the business • Limited duration – ceases upon death of the owner 3

Click to edit Partnerships Master title style • Partnerships – Advantages • Ability to add capital by increasing number of partners – e. g. , law firms; accounting firms • Recognized as a separate legal entity – may help in raising funds • Not separately taxed – Disadvantages • No protection from liability for business failure – except for limited partners • Death or bankruptcy of one partner may cause termination – unless otherwise agreed • Shared control may cause disputes – complexity to draft around 4

Click to edit Partnerships Master title style • Partnerships – Advantages • Ability to add capital by increasing number of partners – e. g. , law firms; accounting firms • Recognized as a separate legal entity – may help in raising funds • Not separately taxed – Disadvantages • No protection from liability for business failure – except for limited partners • Death or bankruptcy of one partner may cause termination – unless otherwise agreed • Shared control may cause disputes – complexity to draft around 4

Click to Form of Ownership Selectingedit Master title style • Corporations – Advantages • Shareholders not liable for business failure – more later • Can have perpetual existence • Great flexibility to expand – by raising equity and debt capital – Disadvantages • • Relative expense and complexity to form and maintain Complexity in withdrawing capital from the business Shared control may lead to owner disputes – same as partnership Taxed as a separate entity 5

Click to Form of Ownership Selectingedit Master title style • Corporations – Advantages • Shareholders not liable for business failure – more later • Can have perpetual existence • Great flexibility to expand – by raising equity and debt capital – Disadvantages • • Relative expense and complexity to form and maintain Complexity in withdrawing capital from the business Shared control may lead to owner disputes – same as partnership Taxed as a separate entity 5

Click on the Corporation Focus to edit Master title style • More on key characteristics of a corporation – – – Corporation is a “statutorily” created “entity” Owns assets and has liabilities as separate legal entity Enters into contracts and conducts its own business Can sue and be sued - same as an individual Can have perpetual existence Subject to civil and criminal laws 6

Click on the Corporation Focus to edit Master title style • More on key characteristics of a corporation – – – Corporation is a “statutorily” created “entity” Owns assets and has liabilities as separate legal entity Enters into contracts and conducts its own business Can sue and be sued - same as an individual Can have perpetual existence Subject to civil and criminal laws 6

Click to edit Master title style Perpetual Existence of Corporate Businesses • The Coca-Cola Company – incorporated in 1892 • Procter & Gamble – founded in 1837, and is now one of the largest sellers of consumer products in the world • Lehman Brothers – formed 150 years ago, but now being liquidated, due to managerial failure 7

Click to edit Master title style Perpetual Existence of Corporate Businesses • The Coca-Cola Company – incorporated in 1892 • Procter & Gamble – founded in 1837, and is now one of the largest sellers of consumer products in the world • Lehman Brothers – formed 150 years ago, but now being liquidated, due to managerial failure 7

Click to Liability for Corporations Criminaledit Master title style • Corporation can’t be imprisoned, but can be fined for criminal conduct • Botox maker, Allergan, pleads guilty to criminal charges for marketing Botox for unauthorized uses; must pay $600 million fine • Accounting firm, Arthur Andersen, found guilty in criminal jury trial 8

Click to Liability for Corporations Criminaledit Master title style • Corporation can’t be imprisoned, but can be fined for criminal conduct • Botox maker, Allergan, pleads guilty to criminal charges for marketing Botox for unauthorized uses; must pay $600 million fine • Accounting firm, Arthur Andersen, found guilty in criminal jury trial 8

Click to edit Master – Capitalization The Corporate Form title style • What is Capitalization? – Exchange between owners and the corporation – Shareholder “contributes” assets – cash or other assets – to company and receives, in return, shares representing ownership • What does it mean to “contribute” assets to corporation? – An irrevocable transfer by shareholder to the corporation; similar to a “sale”, except shareholder receives ownership in return 9

Click to edit Master – Capitalization The Corporate Form title style • What is Capitalization? – Exchange between owners and the corporation – Shareholder “contributes” assets – cash or other assets – to company and receives, in return, shares representing ownership • What does it mean to “contribute” assets to corporation? – An irrevocable transfer by shareholder to the corporation; similar to a “sale”, except shareholder receives ownership in return 9

Click to edit Master – Capitalization The Corporate Form title style • What are shares of “common” equity? – Represents ownership of the corporate entity • What are the characteristics of “common” shares? – Common shares have the right to the profits the corporation distributes to shareholders – the “dividends” – Have the right to control certain aspects of the corporation – Common shares have “residual” value of the corporation • Its residual because it’s the value left after creditors are paid • The residual value is called the “equity” of the corporation 10

Click to edit Master – Capitalization The Corporate Form title style • What are shares of “common” equity? – Represents ownership of the corporate entity • What are the characteristics of “common” shares? – Common shares have the right to the profits the corporation distributes to shareholders – the “dividends” – Have the right to control certain aspects of the corporation – Common shares have “residual” value of the corporation • Its residual because it’s the value left after creditors are paid • The residual value is called the “equity” of the corporation 10

Cardinal Rule of Commercial Law: Click to edit Master title style Creditors’ Claims Come Before Owners • Fundamental rule of law is that creditors are given priority in right to payment over the rights of ownership – So, if corporation is liquidated debts owed to creditors must first be paid – in full – before any value can be returned to owners – Same rule limits right of corporation to make distributions to owners if doing so will impair ability to repay creditors 11

Cardinal Rule of Commercial Law: Click to edit Master title style Creditors’ Claims Come Before Owners • Fundamental rule of law is that creditors are given priority in right to payment over the rights of ownership – So, if corporation is liquidated debts owed to creditors must first be paid – in full – before any value can be returned to owners – Same rule limits right of corporation to make distributions to owners if doing so will impair ability to repay creditors 11

Click to edit Master title style Role of Debt in the Capital Structure • Owners often add debt to the capital structure • Why add debt to the capital structure? – Because debt is paid only an interest rate, while equity capital gets all increase in business’s value • So, debt capital can create greater profits and returns for owners 12

Click to edit Master title style Role of Debt in the Capital Structure • Owners often add debt to the capital structure • Why add debt to the capital structure? – Because debt is paid only an interest rate, while equity capital gets all increase in business’s value • So, debt capital can create greater profits and returns for owners 12

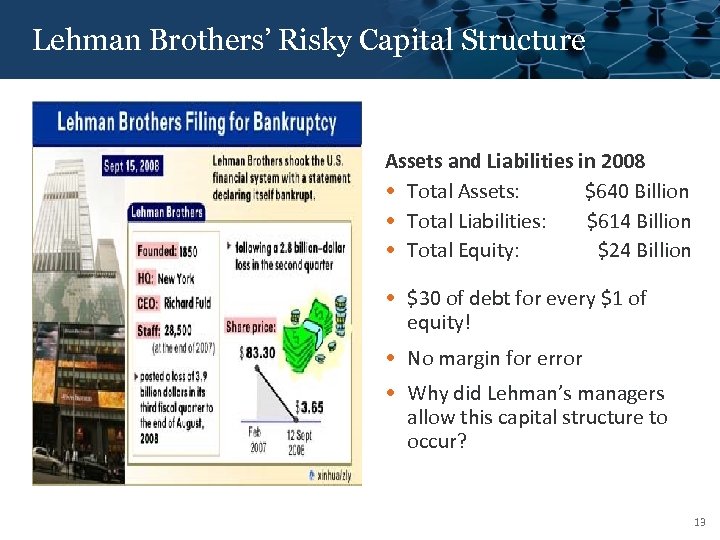

Click to Brothers’ Risky style Lehman edit Master title Capital Structure Assets and Liabilities in 2008 • Total Assets: $640 Billion • Total Liabilities: $614 Billion • Total Equity: $24 Billion • $30 of debt for every $1 of equity! • No margin for error • Why did Lehman’s managers allow this capital structure to occur? 13

Click to Brothers’ Risky style Lehman edit Master title Capital Structure Assets and Liabilities in 2008 • Total Assets: $640 Billion • Total Liabilities: $614 Billion • Total Equity: $24 Billion • $30 of debt for every $1 of equity! • No margin for error • Why did Lehman’s managers allow this capital structure to occur? 13

Click to edit Master title style Debt in the Capital Structure – Owner Debt • Owners often invest as debt to better protect their investment – particularly when banks won’t lend – If owners’ capital is invested as debt, then – as a general rule – they are entitled to be paid the same as other creditors if the company fails • However, abuse of the corporate form by inadequately capitalizing the corporation can adversely affect the owner 14

Click to edit Master title style Debt in the Capital Structure – Owner Debt • Owners often invest as debt to better protect their investment – particularly when banks won’t lend – If owners’ capital is invested as debt, then – as a general rule – they are entitled to be paid the same as other creditors if the company fails • However, abuse of the corporate form by inadequately capitalizing the corporation can adversely affect the owner 14

Click to edit Master title style Ownership and Management of a Corporation • A key feature: ownership is separated from management • Right to control is shared by: (1) shareholders, (2) directors, and (3) officers • Shareholders: – Own corporation – benefit from distributions of profits and increase in value of shares – Have right to elect directors, and to vote to remove directors – Have right to vote on major transactions – such as sale of business, merger, liquidation – But don’t have right to operate the business as shareholder 15

Click to edit Master title style Ownership and Management of a Corporation • A key feature: ownership is separated from management • Right to control is shared by: (1) shareholders, (2) directors, and (3) officers • Shareholders: – Own corporation – benefit from distributions of profits and increase in value of shares – Have right to elect directors, and to vote to remove directors – Have right to vote on major transactions – such as sale of business, merger, liquidation – But don’t have right to operate the business as shareholder 15

Click to edit Master title style Ownership and Management of a Corporation • Board of Directors: – Elected by shareholders – annual or “staggered” terms; majority or “cumulative” voting – Have the right to control the business and affairs of the corporation – Model Act: “All corporate powers shall be exercised by or under the authority of the board of directors. . . And the business and affairs of the corporation shall be managed by or under the direction, and subject to the oversight of, its board of directors” – Board selects the CEO, President and key officers of the corporation – Mostly serve a supervisory role – but must be actively engaged to meet duties 16

Click to edit Master title style Ownership and Management of a Corporation • Board of Directors: – Elected by shareholders – annual or “staggered” terms; majority or “cumulative” voting – Have the right to control the business and affairs of the corporation – Model Act: “All corporate powers shall be exercised by or under the authority of the board of directors. . . And the business and affairs of the corporation shall be managed by or under the direction, and subject to the oversight of, its board of directors” – Board selects the CEO, President and key officers of the corporation – Mostly serve a supervisory role – but must be actively engaged to meet duties 16

Click to edit Master title style Ownership and Management of a Corporation • Officers – Executive officers appointed by directors – Carry out the corporation’s business on day-to-day basis – Model Act: “Each officer has the authority and shall perform the duties set forth in the Bylaws or, to the extent consistent with the Bylaws, the duties prescribed by the board of directors. . . ” • Corporate Governance and Duties: – Directors and officers have duty of care and duty and loyalty, requiring them to act in best interests of corporation and shareholders 17

Click to edit Master title style Ownership and Management of a Corporation • Officers – Executive officers appointed by directors – Carry out the corporation’s business on day-to-day basis – Model Act: “Each officer has the authority and shall perform the duties set forth in the Bylaws or, to the extent consistent with the Bylaws, the duties prescribed by the board of directors. . . ” • Corporate Governance and Duties: – Directors and officers have duty of care and duty and loyalty, requiring them to act in best interests of corporation and shareholders 17

Click to edit Master title style Voting Rights • Voting common shares – Usual rule is “one share – one vote” – Usually, only a majority is required; but can require a super majority (e. g. , 66%) for some decisions (e. g. , to merge or liquidate) – Some laws OK different classes of shares with “super” voting rights • Zuckerberg has “iron grip” control of Facebook • It has two class of shares: “Class A” with one vote per share and “Class B” with 10 votes per share • He also gets control through voting agreements with others • Zuckerberg owns under 20% of Facebook, but has control over almost all shareholder decisions – director elections, merger, sale. • Voting rights for director decisions – Usual rule is to require majority vote of directors, but can require a super majority vote of directors for some decisions (e. g. , to merge or liquidate) 18

Click to edit Master title style Voting Rights • Voting common shares – Usual rule is “one share – one vote” – Usually, only a majority is required; but can require a super majority (e. g. , 66%) for some decisions (e. g. , to merge or liquidate) – Some laws OK different classes of shares with “super” voting rights • Zuckerberg has “iron grip” control of Facebook • It has two class of shares: “Class A” with one vote per share and “Class B” with 10 votes per share • He also gets control through voting agreements with others • Zuckerberg owns under 20% of Facebook, but has control over almost all shareholder decisions – director elections, merger, sale. • Voting rights for director decisions – Usual rule is to require majority vote of directors, but can require a super majority vote of directors for some decisions (e. g. , to merge or liquidate) 18

Separation of Ownership and Management: Click to edit Master title style Examples of “Good” and “Ugly” • For a company with many shareholders, this separation can be significant – If no shareholder is able to control voting for directors – If one or a few shareholders control director selection – If management’s decisions are influenced by their own interests • The Ugly: Yahoo’s debacle in rejecting Microsoft • The Good: Google’s history as a public company 19

Separation of Ownership and Management: Click to edit Master title style Examples of “Good” and “Ugly” • For a company with many shareholders, this separation can be significant – If no shareholder is able to control voting for directors – If one or a few shareholders control director selection – If management’s decisions are influenced by their own interests • The Ugly: Yahoo’s debacle in rejecting Microsoft • The Good: Google’s history as a public company 19

Click to edit The “Ugly” Master title style • Yahoo receives $50 Billion bid from Microsoft – a 60% premium over then market value – Feb 2008 • CEO and founder (Jerry Yang) fights bid, allegedly because of his desire to retain control and keep Yahoo independent • Directors reject bid, and offer multibillion severance to employees to deter Microsoft bid • Microsoft complains it is being “stonewalled” by Yahoo’s directors, drops bid – June 2008; Yahoo loses more than 50% of its value; Microsoft later buys a part of business for small fraction of original bid 20

Click to edit The “Ugly” Master title style • Yahoo receives $50 Billion bid from Microsoft – a 60% premium over then market value – Feb 2008 • CEO and founder (Jerry Yang) fights bid, allegedly because of his desire to retain control and keep Yahoo independent • Directors reject bid, and offer multibillion severance to employees to deter Microsoft bid • Microsoft complains it is being “stonewalled” by Yahoo’s directors, drops bid – June 2008; Yahoo loses more than 50% of its value; Microsoft later buys a part of business for small fraction of original bid 20

Click to edit The “Ugly” Master title style • Shareholders feel betrayed by management, and lawsuits are filed: – Contend that Board and Yang breached duty to shareholders in rejecting bid • From owners’ perspective, Yang and Board judgment was questionable – showing the risks to owners from the separation of ownership and management 21

Click to edit The “Ugly” Master title style • Shareholders feel betrayed by management, and lawsuits are filed: – Contend that Board and Yang breached duty to shareholders in rejecting bid • From owners’ perspective, Yang and Board judgment was questionable – showing the risks to owners from the separation of ownership and management 21

Click to edit The Good Master title style • Separation often works well • Google founded in 1998 by the “Google Guys” Larry Page and Sergey Brin • Google became a public company in 2004, with its initial sale of shares to the public • The Google Guys added excellent outside directors and management to help grow Google’s business – Eric Schmidt became CEO • Shareholders have benefited tremendously over the last 8 years – Sales have grown from $5 Billion a year to $30 Billion; and earnings have grown from under $1 Billion to over $8 Billion – Stock trading value has gone up from about $150 in 2004 – and now trades for $700 per share 22

Click to edit The Good Master title style • Separation often works well • Google founded in 1998 by the “Google Guys” Larry Page and Sergey Brin • Google became a public company in 2004, with its initial sale of shares to the public • The Google Guys added excellent outside directors and management to help grow Google’s business – Eric Schmidt became CEO • Shareholders have benefited tremendously over the last 8 years – Sales have grown from $5 Billion a year to $30 Billion; and earnings have grown from under $1 Billion to over $8 Billion – Stock trading value has gone up from about $150 in 2004 – and now trades for $700 per share 22

Dividends and Distributions – Click to edit Master title style Taking Money Out • What are dividends? – Distributions of cash or property made by the company to its owners – made “on account” of their ownership • What does company get in return for a dividend? • Payment of dividends requires approval of directors – Directors must determine payment of dividend is prudent for the company – Dividends must be lawful under corporate and fraudulent transfer laws 23

Dividends and Distributions – Click to edit Master title style Taking Money Out • What are dividends? – Distributions of cash or property made by the company to its owners – made “on account” of their ownership • What does company get in return for a dividend? • Payment of dividends requires approval of directors – Directors must determine payment of dividend is prudent for the company – Dividends must be lawful under corporate and fraudulent transfer laws 23

Dividends and Distributions – Click to edit Master title style Taking Money Out • To simplify a complex area, a dividend is lawful if the company is not rendered insolvent by the dividend – it is made from surplus or profits – What does “insolvent” mean? • Assets are less than the amount of its liabilities, or • Inability of a company to pay its debts when due – Creditors can recover unlawful dividends • Why are dividends so limited? • Directors may be liable for approving unlawful dividends 24

Dividends and Distributions – Click to edit Master title style Taking Money Out • To simplify a complex area, a dividend is lawful if the company is not rendered insolvent by the dividend – it is made from surplus or profits – What does “insolvent” mean? • Assets are less than the amount of its liabilities, or • Inability of a company to pay its debts when due – Creditors can recover unlawful dividends • Why are dividends so limited? • Directors may be liable for approving unlawful dividends 24

Click to edit the News Dividends in Master title style • Apple announces it will pay dividends – Cash hoard of $100 B is not necessary for business – Shareholders want it – but can’t directly force it – Payment is clearly lawful and prudent • BP suspends dividends after Gulf oil spill disaster – Funds needed to pay costs of cleanup – Dividends have now been restored • Dynegy is sued over dividends – Suit charges that the electric generation company caused its subsidiary to declare a dividend – of coal-fired power facilities – at a time when the subsidiary was insolvent 25

Click to edit the News Dividends in Master title style • Apple announces it will pay dividends – Cash hoard of $100 B is not necessary for business – Shareholders want it – but can’t directly force it – Payment is clearly lawful and prudent • BP suspends dividends after Gulf oil spill disaster – Funds needed to pay costs of cleanup – Dividends have now been restored • Dynegy is sued over dividends – Suit charges that the electric generation company caused its subsidiary to declare a dividend – of coal-fired power facilities – at a time when the subsidiary was insolvent 25

A Fundamental Benefit of the Corporate Form: Click to edit Master title style Limited Liability • Limited Liability: What does it mean? – Corporation is liable for its own debts as a separate entity – Shareholders’ liability is limited to their capital contribution – If corporation becomes insolvent, shareholders are not liable to corporate creditors – absent abuse – Creditors may only look to the assets of the corporation – What if shareholder had agreed to contribute more capital? – Creditors cannot recover from directors or management – absent breach of duty 26

A Fundamental Benefit of the Corporate Form: Click to edit Master title style Limited Liability • Limited Liability: What does it mean? – Corporation is liable for its own debts as a separate entity – Shareholders’ liability is limited to their capital contribution – If corporation becomes insolvent, shareholders are not liable to corporate creditors – absent abuse – Creditors may only look to the assets of the corporation – What if shareholder had agreed to contribute more capital? – Creditors cannot recover from directors or management – absent breach of duty 26

A Fundamental Benefit of the Corporate Form: Click to edit Master title style Limited Liability “I weigh my words when I say that in my judgment the limited liability corporation is the greatest single discovery of modern times. . Even steam and electricity are far less important than the limited liability corporation, and they would be reduced to comparative impotence without it. ” —Nicholas Butler, President Columbia Univ. , 1911 • What does this mean? • Why is limited liability so important? 27

A Fundamental Benefit of the Corporate Form: Click to edit Master title style Limited Liability “I weigh my words when I say that in my judgment the limited liability corporation is the greatest single discovery of modern times. . Even steam and electricity are far less important than the limited liability corporation, and they would be reduced to comparative impotence without it. ” —Nicholas Butler, President Columbia Univ. , 1911 • What does this mean? • Why is limited liability so important? 27

Benefits edit Master. Liability Click to aof Limited failure for Motorola title style Iridium – big start-up • Motorola invents a satellite-based portable phone • Motorola incorporated Iridium to develop the business • Capital structure for Iridium – Motorola had Iridium sell shares to raise $1 B equity – Iridium raised $3 B from debt issuance to lenders – Motorola made an equity investment of some $250 MM • But the phones were “bricks, ” and lost out to sleek, sexy cell phones • Soon after the launch, Iridium collapsed into bankruptcy and was sold for only $20 million – creditors lose billions; shareholders recover zero • Motorola is sued by investors to try to recoup losses • What is the result? 28

Benefits edit Master. Liability Click to aof Limited failure for Motorola title style Iridium – big start-up • Motorola invents a satellite-based portable phone • Motorola incorporated Iridium to develop the business • Capital structure for Iridium – Motorola had Iridium sell shares to raise $1 B equity – Iridium raised $3 B from debt issuance to lenders – Motorola made an equity investment of some $250 MM • But the phones were “bricks, ” and lost out to sleek, sexy cell phones • Soon after the launch, Iridium collapsed into bankruptcy and was sold for only $20 million – creditors lose billions; shareholders recover zero • Motorola is sued by investors to try to recoup losses • What is the result? 28

Click on Limited Liability – More to edit Master title style Euro. Disney • Disney used a corporation to develop and own Euro. Disney – It was 49% owned by Disney; 51% owned by new shareholders – raising around $500 million in equity capital from new shareholders • Euro. Disney borrowed more than $1 Billion from Banks to finance construction • Euro. Disney soon encountered severe financial problems, and faced collapse 29

Click on Limited Liability – More to edit Master title style Euro. Disney • Disney used a corporation to develop and own Euro. Disney – It was 49% owned by Disney; 51% owned by new shareholders – raising around $500 million in equity capital from new shareholders • Euro. Disney borrowed more than $1 Billion from Banks to finance construction • Euro. Disney soon encountered severe financial problems, and faced collapse 29

Click on Limited Liability – More to edit Master title style Euro. Disney • Disney, the Banks and Euro. Disney reached an agreement on a “restructuring”: – The Banks gave Euro. Disney concessions and agreed to make new loans – Disney invested new equity capital in return for new stock – The old owners were greatly diluted by shares given to Disney and Banks • Euro. Disney, now Disneyland Paris, is Europe’s most visited tourist site • How did limited liability help Disney? 30

Click on Limited Liability – More to edit Master title style Euro. Disney • Disney, the Banks and Euro. Disney reached an agreement on a “restructuring”: – The Banks gave Euro. Disney concessions and agreed to make new loans – Disney invested new equity capital in return for new stock – The old owners were greatly diluted by shares given to Disney and Banks • Euro. Disney, now Disneyland Paris, is Europe’s most visited tourist site • How did limited liability help Disney? 30

Contract Exception to Click to edit Master title style Limited Liability • The Guaranty – Contract by which one person – the “guarantor” – promises (“guarantees”) to pay the debt of another person in favor of a creditor – If the principal obligor defaults in making payment, then the holder of the guaranty can demand payment directly from the guarantor – Lenders often insist on a guaranty from the owners as a condition to making a loan to a corporation – in order to get around the protections of limited liability – What if Motorola and Disney had given guarantees? 31

Contract Exception to Click to edit Master title style Limited Liability • The Guaranty – Contract by which one person – the “guarantor” – promises (“guarantees”) to pay the debt of another person in favor of a creditor – If the principal obligor defaults in making payment, then the holder of the guaranty can demand payment directly from the guarantor – Lenders often insist on a guaranty from the owners as a condition to making a loan to a corporation – in order to get around the protections of limited liability – What if Motorola and Disney had given guarantees? 31

Limited Liability – The Negative Consequences Click to edit Master title style And The Potential for Abuse 32

Limited Liability – The Negative Consequences Click to edit Master title style And The Potential for Abuse 32

Click to Exception title style Judicial edit Master to Limited Liability • “Piercing the Corporate Veil”: Doctrine that eliminates limited liability and makes an owner liable for debts of the company • In the US, it is a judge created remedy; in many countries, it is statutory • The standard: (1) Domination of the corporation by the owner, and (2) use of that domination to perpetuate a fraud or similar injustice on creditors of the company – Both must be present – domination and use of it to commit an injustice • Factors that may support shareholder liability – Corporation is grossly inadequately capitalized – Siphoning off corporate funds to an owner – “asset stripping” – Company is a sham entity used by owner to harm creditors 33

Click to Exception title style Judicial edit Master to Limited Liability • “Piercing the Corporate Veil”: Doctrine that eliminates limited liability and makes an owner liable for debts of the company • In the US, it is a judge created remedy; in many countries, it is statutory • The standard: (1) Domination of the corporation by the owner, and (2) use of that domination to perpetuate a fraud or similar injustice on creditors of the company – Both must be present – domination and use of it to commit an injustice • Factors that may support shareholder liability – Corporation is grossly inadequately capitalized – Siphoning off corporate funds to an owner – “asset stripping” – Company is a sham entity used by owner to harm creditors 33

BEYOND FORMATION: Legal Techniques for Click to edit Master title style Corporate Growth and its Financing • Raising debt capital and borrowings – Commercial law and secured lending principles – Equipment loans – Bank loans and bond financing • Raising equity capital – Issuance of new common shares – Issuance of preferred shares; sale of warrants – The IPO – going “Public” • Mergers and acquisitions 34

BEYOND FORMATION: Legal Techniques for Click to edit Master title style Corporate Growth and its Financing • Raising debt capital and borrowings – Commercial law and secured lending principles – Equipment loans – Bank loans and bond financing • Raising equity capital – Issuance of new common shares – Issuance of preferred shares; sale of warrants – The IPO – going “Public” • Mergers and acquisitions 34

Click to edit Debt Capital. Master title style • Two important commercial law principles: – First, debts owed to creditors come before ownership – Second, secured creditors have priority over unsecured creditors – but only as to their collateral • Debt financings have the advantage of not diluting ownership, and “leverage” can increase profits • But they bring the disadvantage of greater risks of default and insolvency 35

Click to edit Debt Capital. Master title style • Two important commercial law principles: – First, debts owed to creditors come before ownership – Second, secured creditors have priority over unsecured creditors – but only as to their collateral • Debt financings have the advantage of not diluting ownership, and “leverage” can increase profits • But they bring the disadvantage of greater risks of default and insolvency 35

Click to edit Master title style Commercial Law: Secured Lending Principles • What is a “lien”, “mortgage” or “security interest”? – They all refer to a special interest in property that a borrower can give to a lender – given to hold as security for borrower’s promise to repay the debt owed to the lender – The nature of that special interest in property is that the lender can cause the property to be sold to generate cash to repay the loan owed to him, if the borrower defaults in payment of the loan • So, for example, when a company obtains a secured loan to build a factory, it gives the lender a lien on the factory, and if the company later fails to pay the loan, the lender can enforce the lien by causing the factory to be sold to obtain payment of the loan • In contrast, an unsecured creditor has no special right to look to specific property of the borrower to assure payment of a debt 36

Click to edit Master title style Commercial Law: Secured Lending Principles • What is a “lien”, “mortgage” or “security interest”? – They all refer to a special interest in property that a borrower can give to a lender – given to hold as security for borrower’s promise to repay the debt owed to the lender – The nature of that special interest in property is that the lender can cause the property to be sold to generate cash to repay the loan owed to him, if the borrower defaults in payment of the loan • So, for example, when a company obtains a secured loan to build a factory, it gives the lender a lien on the factory, and if the company later fails to pay the loan, the lender can enforce the lien by causing the factory to be sold to obtain payment of the loan • In contrast, an unsecured creditor has no special right to look to specific property of the borrower to assure payment of a debt 36

Click to edit Master title style Commercial Law: Secured Lending Principles • How does a Lender obtain a lien? – The borrower must enter into an agreement with lender to give the lien; and to describe collateral, the obligation secured and provisions to protect collateral – Have provisions to authorize the lender to enforce the lien upon default – Called a “security agreement” or “mortgage” • The lender must take steps to “perfect” that lien – By “filing” with the government to register the lien – Or, for some collateral, by taking possession of the asset 37

Click to edit Master title style Commercial Law: Secured Lending Principles • How does a Lender obtain a lien? – The borrower must enter into an agreement with lender to give the lien; and to describe collateral, the obligation secured and provisions to protect collateral – Have provisions to authorize the lender to enforce the lien upon default – Called a “security agreement” or “mortgage” • The lender must take steps to “perfect” that lien – By “filing” with the government to register the lien – Or, for some collateral, by taking possession of the asset 37

Click to edit Master title style Secured Lending • How do you enforce the lien? – Process is triggered by a default by borrower – Lender must first give notice of default to borrower – If no cure of default, lender may “foreclose” the lien by • A court-ordered sale of the collateral; or • If permitted by law, by a private sale or auction by the lender – Lender may take possession of the collateral to conduct the sale – but can’t “breach the peace” – Lender must follow procedures required by law – intended to have a commercially reasonable sale – such as advertising the sale – The sale proceeds are used to pay expenses of the sale, then to repay the loan, with any surplus paid to borrower • The buyer becomes the owner of the collateral, free of the borrower’s ownership 38

Click to edit Master title style Secured Lending • How do you enforce the lien? – Process is triggered by a default by borrower – Lender must first give notice of default to borrower – If no cure of default, lender may “foreclose” the lien by • A court-ordered sale of the collateral; or • If permitted by law, by a private sale or auction by the lender – Lender may take possession of the collateral to conduct the sale – but can’t “breach the peace” – Lender must follow procedures required by law – intended to have a commercially reasonable sale – such as advertising the sale – The sale proceeds are used to pay expenses of the sale, then to repay the loan, with any surplus paid to borrower • The buyer becomes the owner of the collateral, free of the borrower’s ownership 38

Click to edit Master Preferred Shares title style • Preferred shares – are an equity ownership interest, but are a “hybrid” between equity and debt – Contribution of cash or assets in return for preferred shares – Preferred shares have a priority over common shares in liquidation; but they only receive back the capital invested, plus unpaid dividends – Unlike common shares, preferred shares do not share in the potential “upside” – the increase in the value of the company – Usually have limited voting rights – unless defaults – Usually receive a higher dividend – Usually must be “redeemed” by company within a stated time – But preferred shares are junior to debt in an insolvency – creditors must be paid in full before preferred shares receive any distribution, and no distributions are permitted if insolvent conditions exists • Why invest in preferred shares? 39

Click to edit Master Preferred Shares title style • Preferred shares – are an equity ownership interest, but are a “hybrid” between equity and debt – Contribution of cash or assets in return for preferred shares – Preferred shares have a priority over common shares in liquidation; but they only receive back the capital invested, plus unpaid dividends – Unlike common shares, preferred shares do not share in the potential “upside” – the increase in the value of the company – Usually have limited voting rights – unless defaults – Usually receive a higher dividend – Usually must be “redeemed” by company within a stated time – But preferred shares are junior to debt in an insolvency – creditors must be paid in full before preferred shares receive any distribution, and no distributions are permitted if insolvent conditions exists • Why invest in preferred shares? 39

Click to edit Master Issuing Warrants title style • How do warrants work? – Company sells to buyer the right – but not the obligation – to buy shares at an agreed price, which right can be exercised over a specified period (e. g. , 3 years) – Company gets consideration in return for sale of warrant, and also gets cash equal to exercise price if the buyer later exercises warrant – Buyer gets an option to buy new shares from company at a set price and need not exercise the right unless the value of the shares exceed the exercise price. 40

Click to edit Master Issuing Warrants title style • How do warrants work? – Company sells to buyer the right – but not the obligation – to buy shares at an agreed price, which right can be exercised over a specified period (e. g. , 3 years) – Company gets consideration in return for sale of warrant, and also gets cash equal to exercise price if the buyer later exercises warrant – Buyer gets an option to buy new shares from company at a set price and need not exercise the right unless the value of the shares exceed the exercise price. 40

Click to edit Master title style Preferred Shares and Warrants in the News • Warren Buffett’s Berkshire buys preferred shares during the Financial Crisis – – GE: $3 Billion @ 10% dividend Goldman: $5 B @ 10% dividend Buffett also received warrants to purchase common shares GE and Goldman each got needed capital infusion, and Buffett got a rich dividend and warrants • More recently, Buffett did the same for Bank of America – buying $5 B preferred Shares @ 6% dividend 41

Click to edit Master title style Preferred Shares and Warrants in the News • Warren Buffett’s Berkshire buys preferred shares during the Financial Crisis – – GE: $3 Billion @ 10% dividend Goldman: $5 B @ 10% dividend Buffett also received warrants to purchase common shares GE and Goldman each got needed capital infusion, and Buffett got a rich dividend and warrants • More recently, Buffett did the same for Bank of America – buying $5 B preferred Shares @ 6% dividend 41

Click Public Offering Initialto edit Master title style • What is an Initial Public Offering? – An IPO is the issuance of shares by the company to the public – as compared to a “private placement” made to specific persons – Shares issued can be existing shares – to raise funds for owners, and/or newly issued – to raise funds for the company – Shares are traded on an exchange – IPO is a transformational event for the company 42

Click Public Offering Initialto edit Master title style • What is an Initial Public Offering? – An IPO is the issuance of shares by the company to the public – as compared to a “private placement” made to specific persons – Shares issued can be existing shares – to raise funds for owners, and/or newly issued – to raise funds for the company – Shares are traded on an exchange – IPO is a transformational event for the company 42

Click to edit Master title Public How do you do an Initial style Offering? • It’s a complex process – generally goes as follows – Hire investment bank and lawyers – Prepare and file “Registration Statement” with adequate information, and obtain approval from government /SEC – Arrange for listing and trading of shares on stock exchange – NYSE; NASDAQ – must comply with exchange rules – Have “road shows” – pre-sale meetings with potential investors – Sign “underwriting agreement” to set IPO share price – firm commitment or best efforts arrangement – Closing the offering – with company to issue shares and receive the offering proceeds – Shares then trade on the stock market 43

Click to edit Master title Public How do you do an Initial style Offering? • It’s a complex process – generally goes as follows – Hire investment bank and lawyers – Prepare and file “Registration Statement” with adequate information, and obtain approval from government /SEC – Arrange for listing and trading of shares on stock exchange – NYSE; NASDAQ – must comply with exchange rules – Have “road shows” – pre-sale meetings with potential investors – Sign “underwriting agreement” to set IPO share price – firm commitment or best efforts arrangement – Closing the offering – with company to issue shares and receive the offering proceeds – Shares then trade on the stock market 43

Click to edit Master title style IPOs in the News: Facebook • Facebook IPO called “failure” and “fiasco” • Facebook agreed to issue shares at $38/share (valuing it at > $100 Billion), and raised $16 B in cash – with $7 B going to Facebook and $9 B going to selling shareholders • Three months later, price falls to $20/share, on fears of slowing revenue growth due to migration to mobile • Lawsuits are filed – but if FB disclosed risks and followed rules, it should have no liability 44

Click to edit Master title style IPOs in the News: Facebook • Facebook IPO called “failure” and “fiasco” • Facebook agreed to issue shares at $38/share (valuing it at > $100 Billion), and raised $16 B in cash – with $7 B going to Facebook and $9 B going to selling shareholders • Three months later, price falls to $20/share, on fears of slowing revenue growth due to migration to mobile • Lawsuits are filed – but if FB disclosed risks and followed rules, it should have no liability 44

GM – IPO to Limit Gov’t Ownership Click to edit Master title style & Raise Capital • GM’s ownership (post-bankruptcy): U. S. 60%; Canada 15%; Unions, etc. 25% • GM’s IPO: – Completed only 16 months after emerging from bankruptcy reorganization – IPO sold shares owned by U. S. , so that its ownership was reduced to approx 30% – and this allowed US to recoup $16 B of the bailout funds it gave during the bankruptcy – GM also sold new preferred shares to the public – which raised $4. 5 B new equity capital for GM 45

GM – IPO to Limit Gov’t Ownership Click to edit Master title style & Raise Capital • GM’s ownership (post-bankruptcy): U. S. 60%; Canada 15%; Unions, etc. 25% • GM’s IPO: – Completed only 16 months after emerging from bankruptcy reorganization – IPO sold shares owned by U. S. , so that its ownership was reduced to approx 30% – and this allowed US to recoup $16 B of the bailout funds it gave during the bankruptcy – GM also sold new preferred shares to the public – which raised $4. 5 B new equity capital for GM 45

Mergers and Acquisitions Click to edit Master title style Legal Tools for Growth and Expansion 46

Mergers and Acquisitions Click to edit Master title style Legal Tools for Growth and Expansion 46

Click to edit Master or Asset Acquisitions – Stock title style. Purchase • Stock purchase agreement – Purchase stock of target company – Advantages: speed and simplicity of transaction; fewer consents – Disadvantages: liabilities of target company are retained, and so buyer takes risk of there being unknown liabilities • Asset purchase agreement – Buyer buys assets, and liabilities remain at target company – Advantages: buyer can acquire assets free of the liabilities, unless buyer agrees by contract to assume specific liabilities (exception for Liens and some debts) – Disadvantages: more complexity as each asset must be transferred – e. g. , deeds and assignments; more consents required 47

Click to edit Master or Asset Acquisitions – Stock title style. Purchase • Stock purchase agreement – Purchase stock of target company – Advantages: speed and simplicity of transaction; fewer consents – Disadvantages: liabilities of target company are retained, and so buyer takes risk of there being unknown liabilities • Asset purchase agreement – Buyer buys assets, and liabilities remain at target company – Advantages: buyer can acquire assets free of the liabilities, unless buyer agrees by contract to assume specific liabilities (exception for Liens and some debts) – Disadvantages: more complexity as each asset must be transferred – e. g. , deeds and assignments; more consents required 47

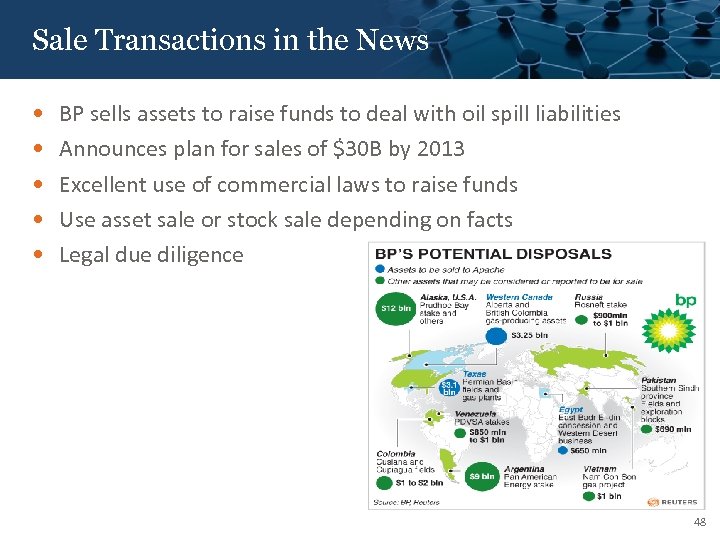

Click to edit Master the style Sale Transactions in title. News • • • BP sells assets to raise funds to deal with oil spill liabilities Announces plan for sales of $30 B by 2013 Excellent use of commercial laws to raise funds Use asset sale or stock sale depending on facts Legal due diligence 48

Click to edit Master the style Sale Transactions in title. News • • • BP sells assets to raise funds to deal with oil spill liabilities Announces plan for sales of $30 B by 2013 Excellent use of commercial laws to raise funds Use asset sale or stock sale depending on facts Legal due diligence 48

Click to Mergers edit Master title style • What is a merger transaction? – Its an agreement by two or more corporations to combine, so that they become a single corporation – By law • The assets and liabilities are combined into a single entity • One corporation is the “surviving” corporation, with the other being “merged into” the surviving entity – Merger agreement specifies the consideration to be paid: • Shares of the surviving corporation; or • Other consideration – cash or shares and cash – Also, by law, surviving corporation becomes liable for all liabilities of the corporation that is merged into it 49

Click to Mergers edit Master title style • What is a merger transaction? – Its an agreement by two or more corporations to combine, so that they become a single corporation – By law • The assets and liabilities are combined into a single entity • One corporation is the “surviving” corporation, with the other being “merged into” the surviving entity – Merger agreement specifies the consideration to be paid: • Shares of the surviving corporation; or • Other consideration – cash or shares and cash – Also, by law, surviving corporation becomes liable for all liabilities of the corporation that is merged into it 49

Click to edit Master Mergers– Continuedtitle style • Legal steps and requirements: – Agreement of merger signed by corporations – Boards of directors must approve the merger agreement – Shareholders approve the merger agreement – sometimes a super majority is required – Government filings are made to give effect to the merger and create the combined legal entity – In some cases, there are special rights for minority shareholders that refused to vote for the merger 50

Click to edit Master Mergers– Continuedtitle style • Legal steps and requirements: – Agreement of merger signed by corporations – Boards of directors must approve the merger agreement – Shareholders approve the merger agreement – sometimes a super majority is required – Government filings are made to give effect to the merger and create the combined legal entity – In some cases, there are special rights for minority shareholders that refused to vote for the merger 50

High Profile Merger: Click to edit Master title style Procter & Gamble and Gillette • In 2005, P&G and Gillette agreed to merge, under agreement whereby P&G was the surviving corporation, and Gillette shareholders received stock of P&G – giving them about 25% ownership of the combined entity • Allowed P&G to grow its business – acquiring a business valued at $57 B, without expending cash – Gillette shareholders were paid in shares of P&G • But merger diluted ownership of P&G shareholders • According to Warren Buffett: “This merger is going to create the greatest consumer products company in the world. " "It's a dream deal. " 51

High Profile Merger: Click to edit Master title style Procter & Gamble and Gillette • In 2005, P&G and Gillette agreed to merge, under agreement whereby P&G was the surviving corporation, and Gillette shareholders received stock of P&G – giving them about 25% ownership of the combined entity • Allowed P&G to grow its business – acquiring a business valued at $57 B, without expending cash – Gillette shareholders were paid in shares of P&G • But merger diluted ownership of P&G shareholders • According to Warren Buffett: “This merger is going to create the greatest consumer products company in the world. " "It's a dream deal. " 51

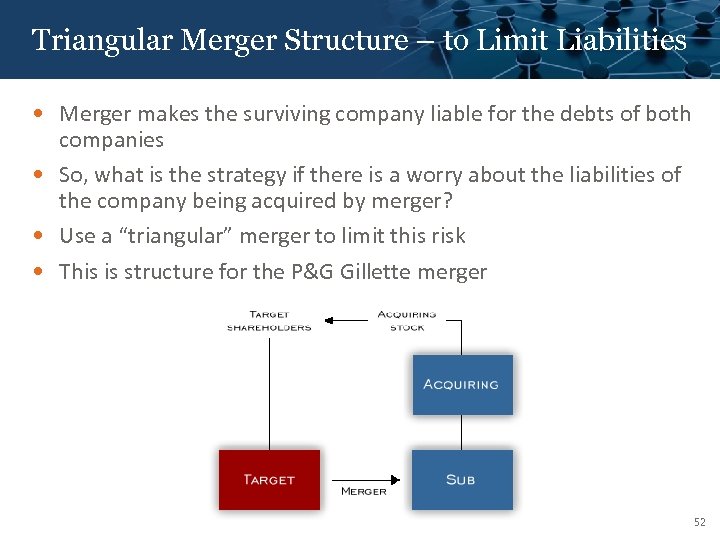

Click to edit Master title style Triangular Merger Structure – to Limit Liabilities • Merger makes the surviving company liable for the debts of both companies • So, what is the strategy if there is a worry about the liabilities of the company being acquired by merger? • Use a “triangular” merger to limit this risk • This is structure for the P&G Gillette merger 52

Click to edit Master title style Triangular Merger Structure – to Limit Liabilities • Merger makes the surviving company liable for the debts of both companies • So, what is the strategy if there is a worry about the liabilities of the company being acquired by merger? • Use a “triangular” merger to limit this risk • This is structure for the P&G Gillette merger 52

Click to edit Master Structure Joint Venture: Legal title style for Growth • JV is an arrangement between two or more entities to jointly pursue business objective • Venture can be a separate legal entity or just a contract arrangement • Allows companies to pool capital and share risk • Essential to document the JV properly, so operations and finances managed 53

Click to edit Master Structure Joint Venture: Legal title style for Growth • JV is an arrangement between two or more entities to jointly pursue business objective • Venture can be a separate legal entity or just a contract arrangement • Allows companies to pool capital and share risk • Essential to document the JV properly, so operations and finances managed 53

Click to edit Corporate Governance Returning to Master title style • Duties of directors and officers – Directors and officers owe duties to shareholders and the corporation – “duty of loyalty” and “duty of care” – Why? 54

Click to edit Corporate Governance Returning to Master title style • Duties of directors and officers – Directors and officers owe duties to shareholders and the corporation – “duty of loyalty” and “duty of care” – Why? 54

Click to edit Master title style Corporate Governance – Duty of Loyalty • Directors and Officers owe the corporation a duty of loyalty – This duty requires directors and officers to act in the company’s best interest, and not to act to further his or her own personal interests • This duty is breached, for example, if a director causes the company to lease property owned by the director at unfair, excessive rent • It is breached if an officer “steals” a corporate opportunity 55

Click to edit Master title style Corporate Governance – Duty of Loyalty • Directors and Officers owe the corporation a duty of loyalty – This duty requires directors and officers to act in the company’s best interest, and not to act to further his or her own personal interests • This duty is breached, for example, if a director causes the company to lease property owned by the director at unfair, excessive rent • It is breached if an officer “steals” a corporate opportunity 55

Click to edit Master title style Duty of Loyalty: Enron Case • Enron CFO Fastow breached duty of loyalty as director and officer – Caused Enron to engage in transactions grossly unfavorable to Enron with entities owned by Fastow – guaranteeing him many tens of millions in profits at Enron’s loss – the “Raptor” entities – Fastow incurred civil liabilities for breach of duty and criminal liability for his fraud • How do you protect directors who want to do deals with the Company – e. g. , a lease of property? 56

Click to edit Master title style Duty of Loyalty: Enron Case • Enron CFO Fastow breached duty of loyalty as director and officer – Caused Enron to engage in transactions grossly unfavorable to Enron with entities owned by Fastow – guaranteeing him many tens of millions in profits at Enron’s loss – the “Raptor” entities – Fastow incurred civil liabilities for breach of duty and criminal liability for his fraud • How do you protect directors who want to do deals with the Company – e. g. , a lease of property? 56

Click to edit Master title Corporate Governance style • Duty of Care and the Business Judgment Rule – Duty of care requires the directors: • First, to inform themselves “fully and in a deliberate manner” of all information reasonably available (i. e. , understand study the transaction; consult experts as appropriate); and • Second, after becoming so informed, directors must use the care of a “careful and prudent” person in making a decision – Protection of the Business Judgment Rule: If directors properly inform themselves, they are protected from liability for honest mistakes made in good faith. Standard approximates “gross negligence” – But if directors fail to properly inform themselves – by failing to take into account facts reasonably available – liability can arise from a negligent decision 57

Click to edit Master title Corporate Governance style • Duty of Care and the Business Judgment Rule – Duty of care requires the directors: • First, to inform themselves “fully and in a deliberate manner” of all information reasonably available (i. e. , understand study the transaction; consult experts as appropriate); and • Second, after becoming so informed, directors must use the care of a “careful and prudent” person in making a decision – Protection of the Business Judgment Rule: If directors properly inform themselves, they are protected from liability for honest mistakes made in good faith. Standard approximates “gross negligence” – But if directors fail to properly inform themselves – by failing to take into account facts reasonably available – liability can arise from a negligent decision 57

Click to edit – Yahoo Revisited Duty of Care Master title style • Yahoo receives $50 Billion bid from Microsoft – a 60% premium over share price • CEO and founder (Jerry Yang) rejects bid, allegedly because of desire to retain control and keep Yahoo independent • Directors reject bid, and allegedly propose multi-billion severance to employees to deter Microsoft’s bid • Microsoft drops bid and Yahoo looses more than 60% of market value • Shareholders file lawsuits: – Contend directors and Yang breached duty of care in rejecting bid – What should be the outcome – are directors and Yang liable? 58

Click to edit – Yahoo Revisited Duty of Care Master title style • Yahoo receives $50 Billion bid from Microsoft – a 60% premium over share price • CEO and founder (Jerry Yang) rejects bid, allegedly because of desire to retain control and keep Yahoo independent • Directors reject bid, and allegedly propose multi-billion severance to employees to deter Microsoft’s bid • Microsoft drops bid and Yahoo looses more than 60% of market value • Shareholders file lawsuits: – Contend directors and Yang breached duty of care in rejecting bid – What should be the outcome – are directors and Yang liable? 58

MF Global: Large Global Futures Broker, dealing Click to edit Master title style in derivatives, commodities, currencies • Very leveraged: $40 B debt to $1. 3 B equity; 97% debt • It made risky $14 B bet on European Sovereign Debt • When MF collapsed into bankruptcy, $1. 2 B in customer funds were missing – despite rules requiring segregation 59

MF Global: Large Global Futures Broker, dealing Click to edit Master title style in derivatives, commodities, currencies • Very leveraged: $40 B debt to $1. 3 B equity; 97% debt • It made risky $14 B bet on European Sovereign Debt • When MF collapsed into bankruptcy, $1. 2 B in customer funds were missing – despite rules requiring segregation 59

Click to edit How Did This Happen? MF Global – Master title style • Directors were told by CEO, Corzine, about MF’s bet on sovereign debt, and knew about leverage • How could this happen only 3 years after Lehman • Are Corzine and directors liable under the law? • If not, does the law need changing? • Warren Buffett offers common sense advice “The CEO has to be the chief risk officer. And I think the directors should have compensation policies that make sure that if the CEO fails in the risk job then that CEO goes away poor. ” 60

Click to edit How Did This Happen? MF Global – Master title style • Directors were told by CEO, Corzine, about MF’s bet on sovereign debt, and knew about leverage • How could this happen only 3 years after Lehman • Are Corzine and directors liable under the law? • If not, does the law need changing? • Warren Buffett offers common sense advice “The CEO has to be the chief risk officer. And I think the directors should have compensation policies that make sure that if the CEO fails in the risk job then that CEO goes away poor. ” 60