082810fa6b0ea24a6fd6d6c01966bee6.ppt

- Количество слайдов: 38

Click to edit Master title style FALKLAND ISLANDS HOLDINGS Results Year ended 31 March 2014 Continued growth

Click to edit Master title style FALKLAND ISLANDS HOLDINGS Results Year ended 31 March 2014 Continued growth

FKL : Overview Record Pre-Tax profits £ 3. 65 m ( 2013: £ 3. 29 m ) Benefits of diversified interests demonstrated FIC: Quieter trading year , continued investment Momart: Record trading performance PHFC: Stable trading – new ferry under construction FOGL : Awaiting 2015 drilling campaign with 5 wells funded 2 2

FKL : Overview Record Pre-Tax profits £ 3. 65 m ( 2013: £ 3. 29 m ) Benefits of diversified interests demonstrated FIC: Quieter trading year , continued investment Momart: Record trading performance PHFC: Stable trading – new ferry under construction FOGL : Awaiting 2015 drilling campaign with 5 wells funded 2 2

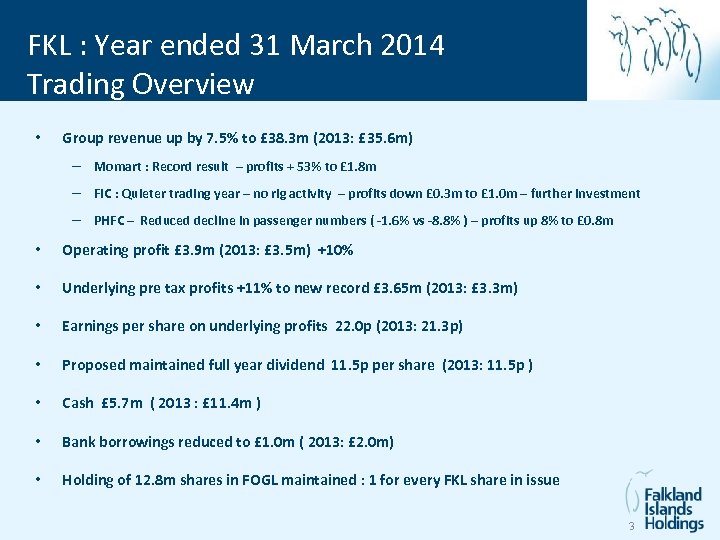

FKL : Year ended 31 March 2014 Trading Overview • Group revenue up by 7. 5% to £ 38. 3 m (2013: £ 35. 6 m) — Momart : Record result – profits + 53% to £ 1. 8 m — FIC : Quieter trading year – no rig activity – profits down £ 0. 3 m to £ 1. 0 m – further investment — PHFC – Reduced decline in passenger numbers ( -1. 6% vs -8. 8% ) – profits up 8% to £ 0. 8 m • Operating profit £ 3. 9 m (2013: £ 3. 5 m) +10% • Underlying pre tax profits +11% to new record £ 3. 65 m (2013: £ 3. 3 m) • Earnings per share on underlying profits 22. 0 p (2013: 21. 3 p) • Proposed maintained full year dividend 11. 5 p per share (2013: 11. 5 p ) • Cash £ 5. 7 m ( 2013 : £ 11. 4 m ) • Bank borrowings reduced to £ 1. 0 m ( 2013: £ 2. 0 m) • Holding of 12. 8 m shares in FOGL maintained : 1 for every FKL share in issue 3

FKL : Year ended 31 March 2014 Trading Overview • Group revenue up by 7. 5% to £ 38. 3 m (2013: £ 35. 6 m) — Momart : Record result – profits + 53% to £ 1. 8 m — FIC : Quieter trading year – no rig activity – profits down £ 0. 3 m to £ 1. 0 m – further investment — PHFC – Reduced decline in passenger numbers ( -1. 6% vs -8. 8% ) – profits up 8% to £ 0. 8 m • Operating profit £ 3. 9 m (2013: £ 3. 5 m) +10% • Underlying pre tax profits +11% to new record £ 3. 65 m (2013: £ 3. 3 m) • Earnings per share on underlying profits 22. 0 p (2013: 21. 3 p) • Proposed maintained full year dividend 11. 5 p per share (2013: 11. 5 p ) • Cash £ 5. 7 m ( 2013 : £ 11. 4 m ) • Bank borrowings reduced to £ 1. 0 m ( 2013: £ 2. 0 m) • Holding of 12. 8 m shares in FOGL maintained : 1 for every FKL share in issue 3

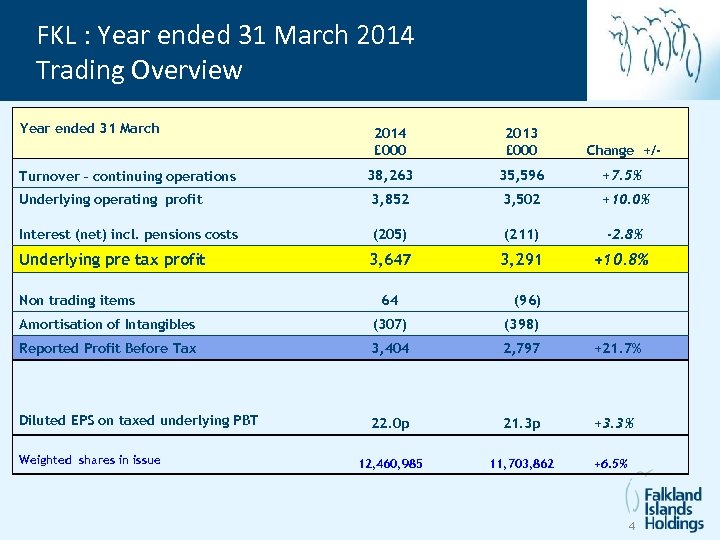

FKL : Year ended 31 March 2014 Trading Overview Year ended 31 March 2014 £ 000 2013 £ 000 Change +/- Turnover – continuing operations 38, 263 35, 596 +7. 5% Underlying operating profit 3, 852 3, 502 +10. 0% Interest (net) incl. pensions costs (205) (211) -2. 8% 3, 647 3, 291 +10. 8% Underlying pre tax profit Non trading items 64 (96) Amortisation of Intangibles (307) (398) Reported Profit Before Tax 3, 404 2, 797 +21. 7% Diluted EPS on taxed underlying PBT 22. 0 p 21. 3 p +3. 3% 12, 460, 985 11, 703, 862 +6. 5% Weighted shares in issue 4

FKL : Year ended 31 March 2014 Trading Overview Year ended 31 March 2014 £ 000 2013 £ 000 Change +/- Turnover – continuing operations 38, 263 35, 596 +7. 5% Underlying operating profit 3, 852 3, 502 +10. 0% Interest (net) incl. pensions costs (205) (211) -2. 8% 3, 647 3, 291 +10. 8% Underlying pre tax profit Non trading items 64 (96) Amortisation of Intangibles (307) (398) Reported Profit Before Tax 3, 404 2, 797 +21. 7% Diluted EPS on taxed underlying PBT 22. 0 p 21. 3 p +3. 3% 12, 460, 985 11, 703, 862 +6. 5% Weighted shares in issue 4

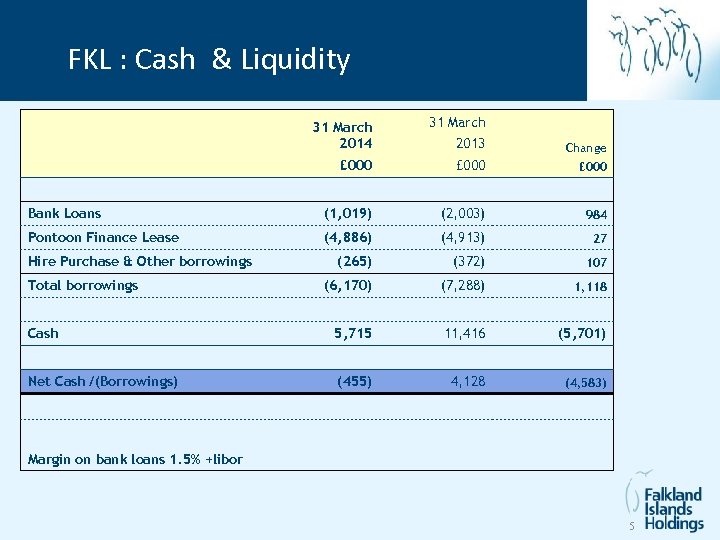

FKL : Cash & Liquidity 31 March 2014 31 March 2013 Change £ 000 Bank Loans (1, 019) (2, 003) 984 Pontoon Finance Lease (4, 886) (4, 913) 27 (265) (372) 107 (6, 170) (7, 288) 1, 118 Cash 5, 715 11, 416 (5, 701) Net Cash /(Borrowings) (455) 4, 128 (4, 583) Hire Purchase & Other borrowings Total borrowings Margin on bank loans 1. 5% +libor 5

FKL : Cash & Liquidity 31 March 2014 31 March 2013 Change £ 000 Bank Loans (1, 019) (2, 003) 984 Pontoon Finance Lease (4, 886) (4, 913) 27 (265) (372) 107 (6, 170) (7, 288) 1, 118 Cash 5, 715 11, 416 (5, 701) Net Cash /(Borrowings) (455) 4, 128 (4, 583) Hire Purchase & Other borrowings Total borrowings Margin on bank loans 1. 5% +libor 5

FIC : Further progress to First Oil

FIC : Further progress to First Oil

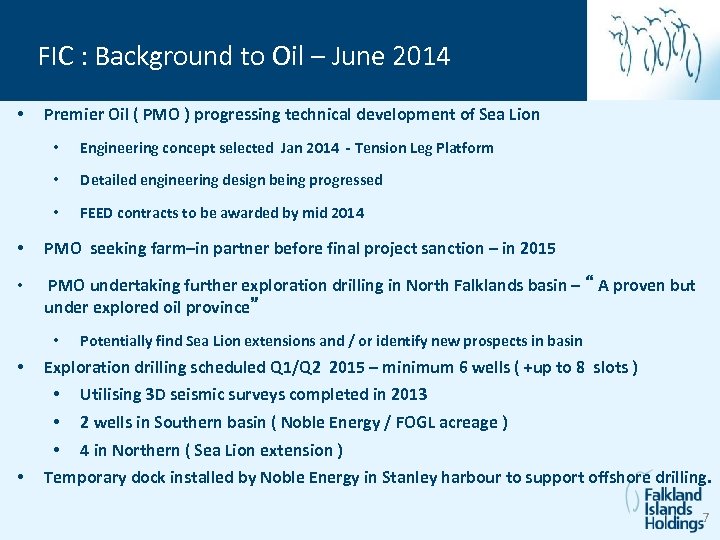

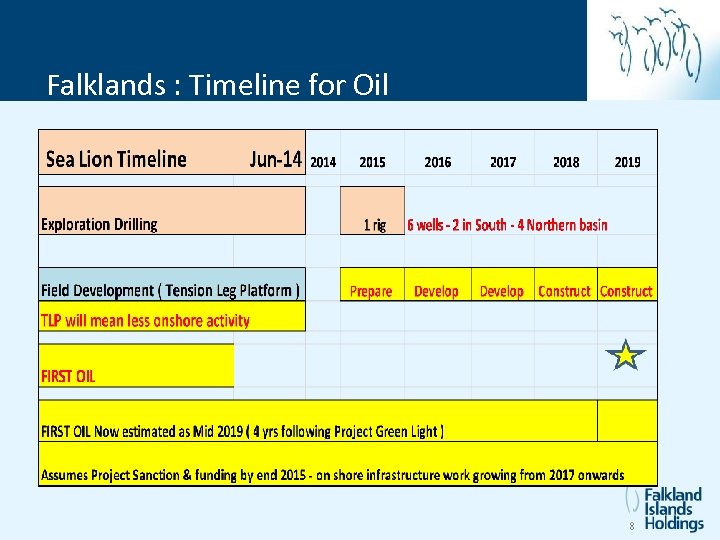

FIC : Background to Oil – June 2014 • Premier Oil ( PMO ) progressing technical development of Sea Lion • Engineering concept selected Jan 2014 - Tension Leg Platform • Detailed engineering design being progressed • FEED contracts to be awarded by mid 2014 • PMO seeking farm–in partner before final project sanction – in 2015 • PMO undertaking further exploration drilling in North Falklands basin – “ A proven but under explored oil province” • Potentially find Sea Lion extensions and / or identify new prospects in basin • Exploration drilling scheduled Q 1/Q 2 2015 – minimum 6 wells ( +up to 8 slots ) • • Utilising 3 D seismic surveys completed in 2013 • 2 wells in Southern basin ( Noble Energy / FOGL acreage ) • 4 in Northern ( Sea Lion extension ) Temporary dock installed by Noble Energy in Stanley harbour to support offshore drilling. 7

FIC : Background to Oil – June 2014 • Premier Oil ( PMO ) progressing technical development of Sea Lion • Engineering concept selected Jan 2014 - Tension Leg Platform • Detailed engineering design being progressed • FEED contracts to be awarded by mid 2014 • PMO seeking farm–in partner before final project sanction – in 2015 • PMO undertaking further exploration drilling in North Falklands basin – “ A proven but under explored oil province” • Potentially find Sea Lion extensions and / or identify new prospects in basin • Exploration drilling scheduled Q 1/Q 2 2015 – minimum 6 wells ( +up to 8 slots ) • • Utilising 3 D seismic surveys completed in 2013 • 2 wells in Southern basin ( Noble Energy / FOGL acreage ) • 4 in Northern ( Sea Lion extension ) Temporary dock installed by Noble Energy in Stanley harbour to support offshore drilling. 7

Timeline for Oil Falklands : Timeline for Oil 8

Timeline for Oil Falklands : Timeline for Oil 8

FIC : Further progress to First Oil The Noble Energy temporary port facility

FIC : Further progress to First Oil The Noble Energy temporary port facility

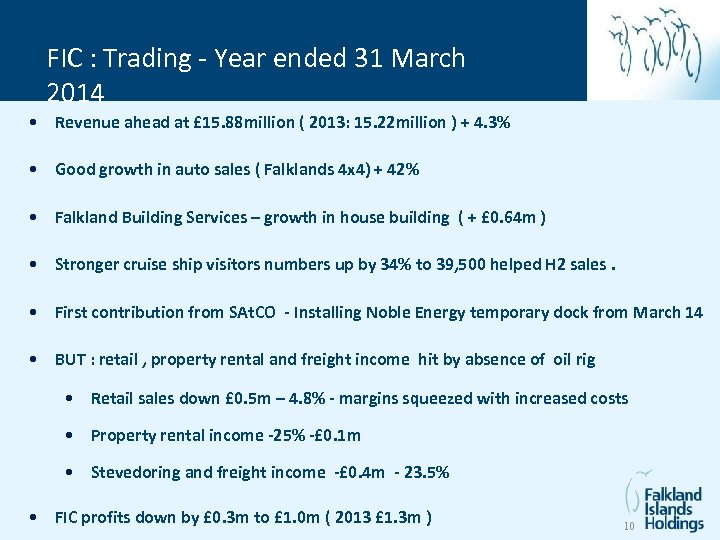

FIC : Trading - Year ended 31 March 2014 • Revenue ahead at £ 15. 88 million ( 2013: 15. 22 million ) + 4. 3% • Good growth in auto sales ( Falklands 4 x 4) + 42% • Falkland Building Services – growth in house building ( + £ 0. 64 m ) • Stronger cruise ship visitors numbers up by 34% to 39, 500 helped H 2 sales. • First contribution from SAt. CO - Installing Noble Energy temporary dock from March 14 • BUT : retail , property rental and freight income hit by absence of oil rig • Retail sales down £ 0. 5 m – 4. 8% - margins squeezed with increased costs • Property rental income -25% -£ 0. 1 m • Stevedoring and freight income -£ 0. 4 m - 23. 5% • FIC profits down by £ 0. 3 m to £ 1. 0 m ( 2013 £ 1. 3 m ) 10

FIC : Trading - Year ended 31 March 2014 • Revenue ahead at £ 15. 88 million ( 2013: 15. 22 million ) + 4. 3% • Good growth in auto sales ( Falklands 4 x 4) + 42% • Falkland Building Services – growth in house building ( + £ 0. 64 m ) • Stronger cruise ship visitors numbers up by 34% to 39, 500 helped H 2 sales. • First contribution from SAt. CO - Installing Noble Energy temporary dock from March 14 • BUT : retail , property rental and freight income hit by absence of oil rig • Retail sales down £ 0. 5 m – 4. 8% - margins squeezed with increased costs • Property rental income -25% -£ 0. 1 m • Stevedoring and freight income -£ 0. 4 m - 23. 5% • FIC profits down by £ 0. 3 m to £ 1. 0 m ( 2013 £ 1. 3 m ) 10

FIC : Further progress to First Oil • Airport Road foundations • Hebe Street Houses 11

FIC : Further progress to First Oil • Airport Road foundations • Hebe Street Houses 11

FIC : Further progress to First Oil

FIC : Further progress to First Oil

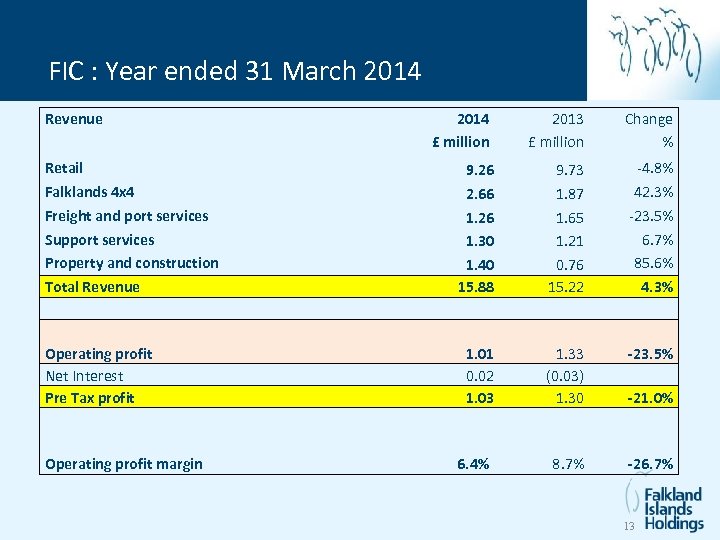

– FIC : Year ended 31 March 2014 Revenue Retail Falklands 4 x 4 Freight and port services Support services Property and construction Total Revenue Operating profit Net Interest Pre Tax profit Operating profit margin 2014 £ million 2013 £ million Change % 9. 26 2. 66 1. 26 1. 30 1. 40 15. 88 9. 73 1. 87 1. 65 1. 21 0. 76 15. 22 -4. 8% 42. 3% -23. 5% 6. 7% 85. 6% 4. 3% 1. 01 0. 02 1. 03 1. 33 (0. 03) 1. 30 -23. 5% 8. 7% -26. 7% 6. 4% -21. 0% 13

– FIC : Year ended 31 March 2014 Revenue Retail Falklands 4 x 4 Freight and port services Support services Property and construction Total Revenue Operating profit Net Interest Pre Tax profit Operating profit margin 2014 £ million 2013 £ million Change % 9. 26 2. 66 1. 26 1. 30 1. 40 15. 88 9. 73 1. 87 1. 65 1. 21 0. 76 15. 22 -4. 8% 42. 3% -23. 5% 6. 7% 85. 6% 4. 3% 1. 01 0. 02 1. 03 1. 33 (0. 03) 1. 30 -23. 5% 8. 7% -26. 7% 6. 4% -21. 0% 13

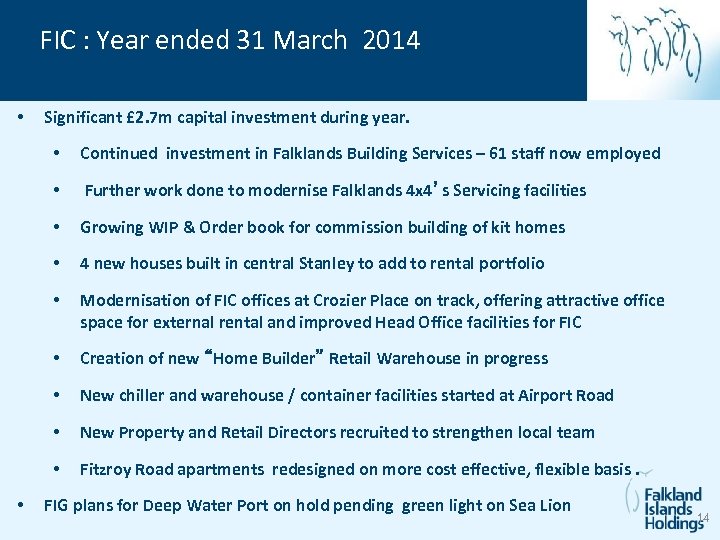

FIC : Year ended 31 March 2014 • Significant £ 2. 7 m capital investment during year. • • Further work done to modernise Falklands 4 x 4’s Servicing facilities • Growing WIP & Order book for commission building of kit homes • 4 new houses built in central Stanley to add to rental portfolio • Modernisation of FIC offices at Crozier Place on track, offering attractive office space for external rental and improved Head Office facilities for FIC • Creation of new “Home Builder” Retail Warehouse in progress • New chiller and warehouse / container facilities started at Airport Road • New Property and Retail Directors recruited to strengthen local team • • Continued investment in Falklands Building Services – 61 staff now employed Fitzroy Road apartments redesigned on more cost effective, flexible basis. FIG plans for Deep Water Port on hold pending green light on Sea Lion 14

FIC : Year ended 31 March 2014 • Significant £ 2. 7 m capital investment during year. • • Further work done to modernise Falklands 4 x 4’s Servicing facilities • Growing WIP & Order book for commission building of kit homes • 4 new houses built in central Stanley to add to rental portfolio • Modernisation of FIC offices at Crozier Place on track, offering attractive office space for external rental and improved Head Office facilities for FIC • Creation of new “Home Builder” Retail Warehouse in progress • New chiller and warehouse / container facilities started at Airport Road • New Property and Retail Directors recruited to strengthen local team • • Continued investment in Falklands Building Services – 61 staff now employed Fitzroy Road apartments redesigned on more cost effective, flexible basis. FIG plans for Deep Water Port on hold pending green light on Sea Lion 14

Momart : Building on its Reputation

Momart : Building on its Reputation

FIC – Year ended 31 Momart : Overview • Specialist Art Logistics company serving fine art market in the UK & overseas • Market leading position with reputation for quality - high barriers to entry • 3 business streams : • Museum Exhibitions –planning, case making , packing, transport and installation • Commercial Galleries –Logistics services for galleries , artists and auction houses • Storage – 70, 000 sq ft of secure warehousing for client storage in East London. • 125 staff – 65 South Quay Canary Wharf , 60 in Leyton. • Fleet of 17 specialist art transport vehicles • Experienced and committed workforce - Royal Warrant holder 16

FIC – Year ended 31 Momart : Overview • Specialist Art Logistics company serving fine art market in the UK & overseas • Market leading position with reputation for quality - high barriers to entry • 3 business streams : • Museum Exhibitions –planning, case making , packing, transport and installation • Commercial Galleries –Logistics services for galleries , artists and auction houses • Storage – 70, 000 sq ft of secure warehousing for client storage in East London. • 125 staff – 65 South Quay Canary Wharf , 60 in Leyton. • Fleet of 17 specialist art transport vehicles • Experienced and committed workforce - Royal Warrant holder 16

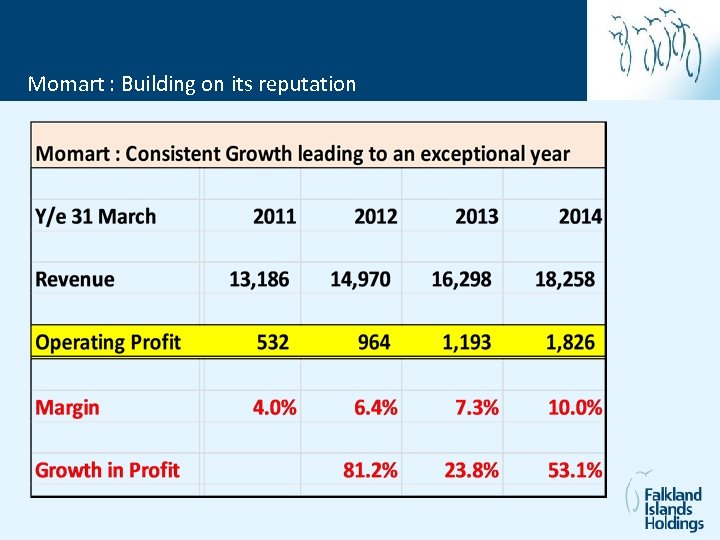

Momart : Building on its reputation

Momart : Building on its reputation

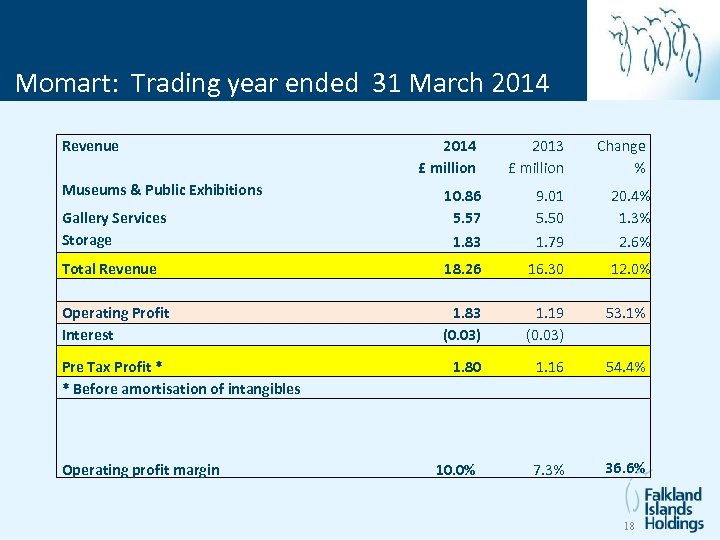

Momart: Trading year ended 31 March 2014 Revenue Museums & Public Exhibitions 2014 £ million 2013 £ million Change % Gallery Services Storage 10. 86 5. 57 1. 83 9. 01 5. 50 1. 79 20. 4% 1. 3% 2. 6% Total Revenue 18. 26 16. 30 12. 0% Operating Profit Interest 1. 83 (0. 03) 1. 19 (0. 03) 53. 1% 1. 80 1. 16 54. 4% 7. 3% 36. 6% Pre Tax Profit * * Before amortisation of intangibles Operating profit margin 10. 0% 18

Momart: Trading year ended 31 March 2014 Revenue Museums & Public Exhibitions 2014 £ million 2013 £ million Change % Gallery Services Storage 10. 86 5. 57 1. 83 9. 01 5. 50 1. 79 20. 4% 1. 3% 2. 6% Total Revenue 18. 26 16. 30 12. 0% Operating Profit Interest 1. 83 (0. 03) 1. 19 (0. 03) 53. 1% 1. 80 1. 16 54. 4% 7. 3% 36. 6% Pre Tax Profit * * Before amortisation of intangibles Operating profit margin 10. 0% 18

Momart: Trading year ended 31 March 2014 • Record result in an exceptional year o Revenue up 12% to £ 18. 3 m ( 2013: £ 16. 3 m ) o Profits up 53% to £ 1. 83 m ( 2013: £ 1. 16 m ) • Record Exhibitions revenues + 20% to £ 10. 9 m o • Wide range of UK and higher margin international shows Gallery Services – Revenue + 1. 3% growth £ 5. 57 m o Commercial art market still buoyant o Improved asset utilisation and more selective contract selection lead to improved margins • Storage revenues up 2. 6% to £ 1. 83 m : facilities effectively full at +93% capacity. • New Finance & Commercial Director recruited September 2013 to strengthen team. • New ERP system leading to faster turnaround of estimates and more commercial pricing – more to come in 2014 with full roll out. • Notable exhibitions : Manet : Royal Academy , Ellen Gallagher : Tate Modern , Reunion ( Walpole collection from Hermitage ) , David Bowie , Chinese Painting : V&A , Vikings : British Museum and Vienna : National Gallery. 19

Momart: Trading year ended 31 March 2014 • Record result in an exceptional year o Revenue up 12% to £ 18. 3 m ( 2013: £ 16. 3 m ) o Profits up 53% to £ 1. 83 m ( 2013: £ 1. 16 m ) • Record Exhibitions revenues + 20% to £ 10. 9 m o • Wide range of UK and higher margin international shows Gallery Services – Revenue + 1. 3% growth £ 5. 57 m o Commercial art market still buoyant o Improved asset utilisation and more selective contract selection lead to improved margins • Storage revenues up 2. 6% to £ 1. 83 m : facilities effectively full at +93% capacity. • New Finance & Commercial Director recruited September 2013 to strengthen team. • New ERP system leading to faster turnaround of estimates and more commercial pricing – more to come in 2014 with full roll out. • Notable exhibitions : Manet : Royal Academy , Ellen Gallagher : Tate Modern , Reunion ( Walpole collection from Hermitage ) , David Bowie , Chinese Painting : V&A , Vikings : British Museum and Vienna : National Gallery. 19

mart: Building on its reputation Momart: Building on its reputation • Closer relationships with major auction houses • Technically demanding, complex , international exhibitions an increasing source of business • Working closely with high quality international partners • New offices and introduction of ERP system set to increase productivity • Substantial increase in storage capacity planned for 2015 20

mart: Building on its reputation Momart: Building on its reputation • Closer relationships with major auction houses • Technically demanding, complex , international exhibitions an increasing source of business • Working closely with high quality international partners • New offices and introduction of ERP system set to increase productivity • Substantial increase in storage capacity planned for 2015 20

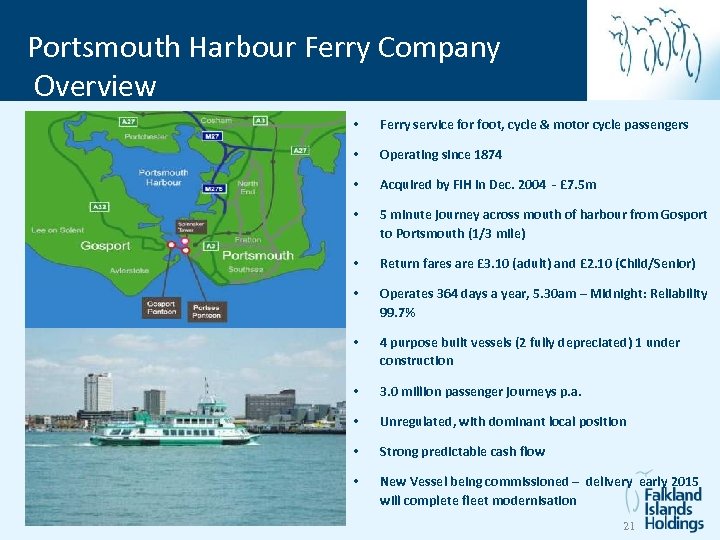

Portsmouth Harbour Ferry Company (PHFC) Overview Portsmouth Harbour Ferry Company Overview • Ferry service for foot, cycle & motor cycle passengers • Operating since 1874 • Acquired by FIH in Dec. 2004 - £ 7. 5 m • 5 minute journey across mouth of harbour from Gosport to Portsmouth (1/3 mile) • Return fares are £ 3. 10 (adult) and £ 2. 10 (Child/Senior) • Operates 364 days a year, 5. 30 am – Midnight: Reliability 99. 7% • 4 purpose built vessels (2 fully depreciated) 1 under construction • 3. 0 million passenger journeys p. a. • Unregulated, with dominant local position • Strong predictable cash flow • New Vessel being commissioned – delivery early 2015 will complete fleet modernisation 21

Portsmouth Harbour Ferry Company (PHFC) Overview Portsmouth Harbour Ferry Company Overview • Ferry service for foot, cycle & motor cycle passengers • Operating since 1874 • Acquired by FIH in Dec. 2004 - £ 7. 5 m • 5 minute journey across mouth of harbour from Gosport to Portsmouth (1/3 mile) • Return fares are £ 3. 10 (adult) and £ 2. 10 (Child/Senior) • Operates 364 days a year, 5. 30 am – Midnight: Reliability 99. 7% • 4 purpose built vessels (2 fully depreciated) 1 under construction • 3. 0 million passenger journeys p. a. • Unregulated, with dominant local position • Strong predictable cash flow • New Vessel being commissioned – delivery early 2015 will complete fleet modernisation 21

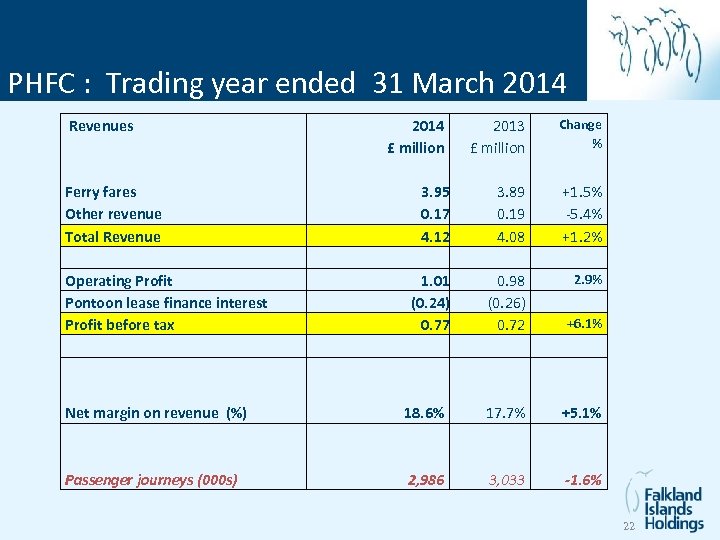

PHFC : -Trading year 31 March 2013 2014 PHFC Year ended 31 March Revenues Ferry fares Other revenue Total Revenue Operating Profit Pontoon lease finance interest Profit before tax 2013 £ million Change % 3. 95 0. 17 4. 12 3. 89 0. 19 4. 08 +1. 5% -5. 4% +1. 2% 1. 01 (0. 24) 0. 77 0. 98 (0. 26) 0. 72 2. 9% +6. 1% 2014 £ million Net margin on revenue (%) 18. 6% 17. 7% +5. 1% Passenger journeys (000 s) 2, 986 3, 033 -1. 6% 22

PHFC : -Trading year 31 March 2013 2014 PHFC Year ended 31 March Revenues Ferry fares Other revenue Total Revenue Operating Profit Pontoon lease finance interest Profit before tax 2013 £ million Change % 3. 95 0. 17 4. 12 3. 89 0. 19 4. 08 +1. 5% -5. 4% +1. 2% 1. 01 (0. 24) 0. 77 0. 98 (0. 26) 0. 72 2. 9% +6. 1% 2014 £ million Net margin on revenue (%) 18. 6% 17. 7% +5. 1% Passenger journeys (000 s) 2, 986 3, 033 -1. 6% 22

PHFC : Trading year ended 31 March 2014 P • Passenger journey decline slowed to -1. 6% to c. 2. 99 million ( 2013: 8. 9% ) • Fares increased 3 -4 % June 2013 ( and June 2014 ) — Adult Return fares £ 2. 80 > £ 2. 90, Child / OAP unchanged £ 1. 80> £ 1. 90 — 10 Trip Ticket £ 13. 00 > £ 13. 50 • Ferry reliability maintained at >99% • PBT £ 0. 77 m ( 2013 £ 0. 72 m ) + 6. 1% • New vessel due from Croatia Q 1 2015 –cost £ 3. 3 million – 30 year life • No further vessel investment for 15 -20 years • Mo. D agreement May 2014 to reimburse staff ferry expenses should mitigate impact BAE job losses • Medium term outlook for Portsmouth positive – QE 2 carriers - 2016 -17 23

PHFC : Trading year ended 31 March 2014 P • Passenger journey decline slowed to -1. 6% to c. 2. 99 million ( 2013: 8. 9% ) • Fares increased 3 -4 % June 2013 ( and June 2014 ) — Adult Return fares £ 2. 80 > £ 2. 90, Child / OAP unchanged £ 1. 80> £ 1. 90 — 10 Trip Ticket £ 13. 00 > £ 13. 50 • Ferry reliability maintained at >99% • PBT £ 0. 77 m ( 2013 £ 0. 72 m ) + 6. 1% • New vessel due from Croatia Q 1 2015 –cost £ 3. 3 million – 30 year life • No further vessel investment for 15 -20 years • Mo. D agreement May 2014 to reimburse staff ferry expenses should mitigate impact BAE job losses • Medium term outlook for Portsmouth positive – QE 2 carriers - 2016 -17 23

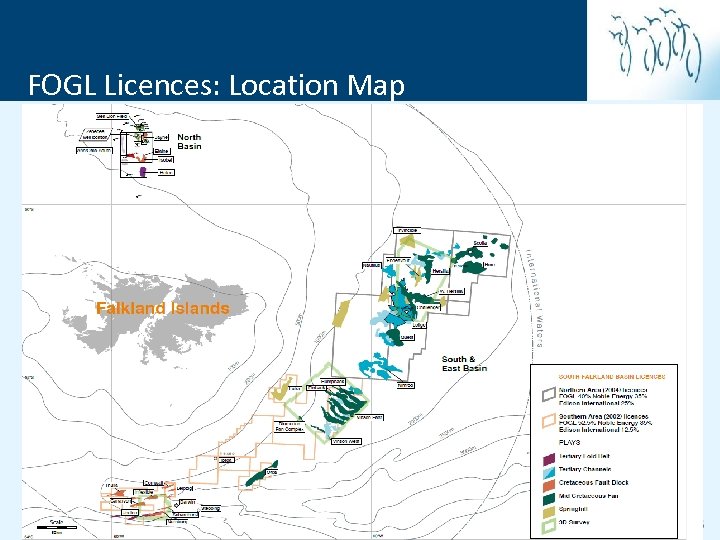

FO FOGL Licences: Location Map 24

FO FOGL Licences: Location Map 24

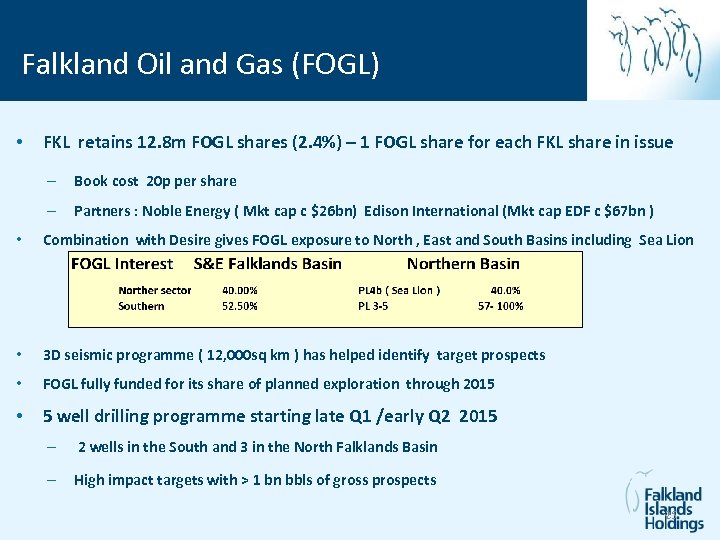

Falkland Oil and Gas (FOGL) • FKL retains 12. 8 m FOGL shares (2. 4%) – 1 FOGL share for each FKL share in issue – Book cost 20 p per share – Partners : Noble Energy ( Mkt cap c $26 bn) Edison International (Mkt cap EDF c $67 bn ) • Combination with Desire gives FOGL exposure to North , East and South Basins including Sea Lion • 3 D seismic programme ( 12, 000 sq km ) has helped identify target prospects • FOGL fully funded for its share of planned exploration through 2015 • 5 well drilling programme starting late Q 1 /early Q 2 2015 – 2 wells in the South and 3 in the North Falklands Basin – High impact targets with > 1 bn bbls of gross prospects 25

Falkland Oil and Gas (FOGL) • FKL retains 12. 8 m FOGL shares (2. 4%) – 1 FOGL share for each FKL share in issue – Book cost 20 p per share – Partners : Noble Energy ( Mkt cap c $26 bn) Edison International (Mkt cap EDF c $67 bn ) • Combination with Desire gives FOGL exposure to North , East and South Basins including Sea Lion • 3 D seismic programme ( 12, 000 sq km ) has helped identify target prospects • FOGL fully funded for its share of planned exploration through 2015 • 5 well drilling programme starting late Q 1 /early Q 2 2015 – 2 wells in the South and 3 in the North Falklands Basin – High impact targets with > 1 bn bbls of gross prospects 25

FKL: Strategy • FIC : Leverage property assets and support services to maximise long term returns • Momart : Expand storage capacity and develop sales & marketing to capitalise on brand reputation. • PHFC : Modernise fleet and maintain steady growth in profits • FOGL : Maintain shareholding through next drilling campaign • Group : Maintain/ grow dividend and maximise shareholder returns 26 26

FKL: Strategy • FIC : Leverage property assets and support services to maximise long term returns • Momart : Expand storage capacity and develop sales & marketing to capitalise on brand reputation. • PHFC : Modernise fleet and maintain steady growth in profits • FOGL : Maintain shareholding through next drilling campaign • Group : Maintain/ grow dividend and maximise shareholder returns 26 26

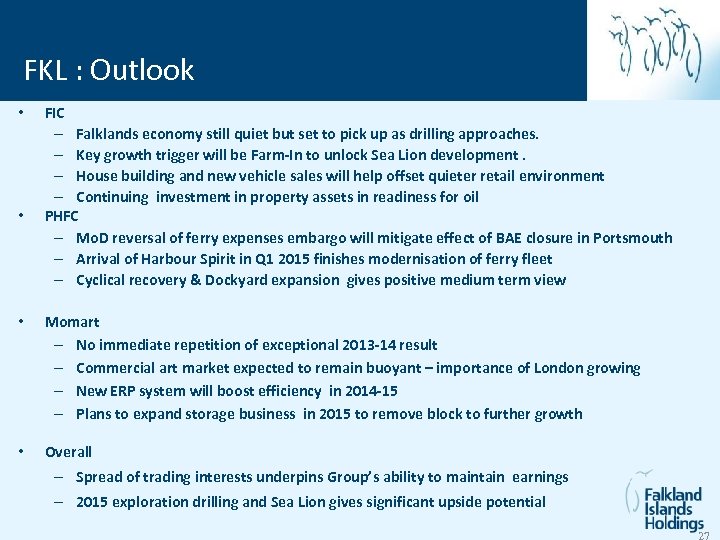

FKL : Outlook • • FIC – Falklands economy still quiet but set to pick up as drilling approaches. – Key growth trigger will be Farm-In to unlock Sea Lion development. – House building and new vehicle sales will help offset quieter retail environment – Continuing investment in property assets in readiness for oil PHFC – Mo. D reversal of ferry expenses embargo will mitigate effect of BAE closure in Portsmouth – Arrival of Harbour Spirit in Q 1 2015 finishes modernisation of ferry fleet – Cyclical recovery & Dockyard expansion gives positive medium term view • Momart – No immediate repetition of exceptional 2013 -14 result – Commercial art market expected to remain buoyant – importance of London growing – New ERP system will boost efficiency in 2014 -15 – Plans to expand storage business in 2015 to remove block to further growth • Overall – Spread of trading interests underpins Group’s ability to maintain earnings – 2015 exploration drilling and Sea Lion gives significant upside potential 27

FKL : Outlook • • FIC – Falklands economy still quiet but set to pick up as drilling approaches. – Key growth trigger will be Farm-In to unlock Sea Lion development. – House building and new vehicle sales will help offset quieter retail environment – Continuing investment in property assets in readiness for oil PHFC – Mo. D reversal of ferry expenses embargo will mitigate effect of BAE closure in Portsmouth – Arrival of Harbour Spirit in Q 1 2015 finishes modernisation of ferry fleet – Cyclical recovery & Dockyard expansion gives positive medium term view • Momart – No immediate repetition of exceptional 2013 -14 result – Commercial art market expected to remain buoyant – importance of London growing – New ERP system will boost efficiency in 2014 -15 – Plans to expand storage business in 2015 to remove block to further growth • Overall – Spread of trading interests underpins Group’s ability to maintain earnings – 2015 exploration drilling and Sea Lion gives significant upside potential 27

Appendices Additional Information on Falkland Islands Holdings

Appendices Additional Information on Falkland Islands Holdings

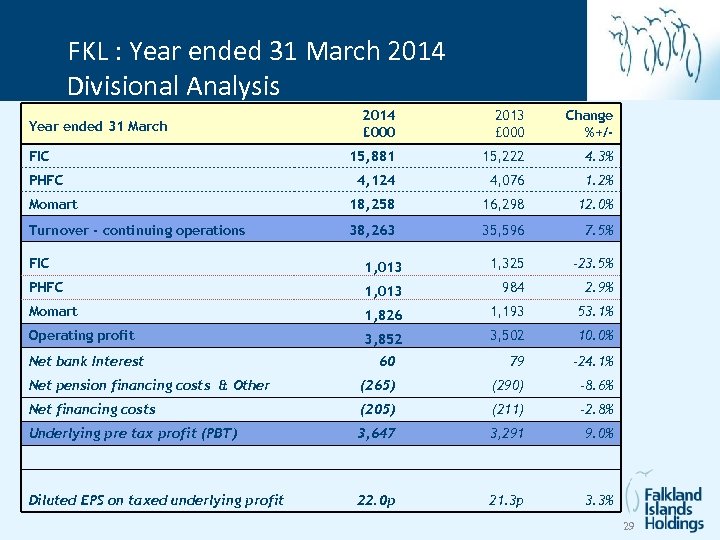

FKLFKL : Year ended 31 March 2014 Divisional Analysis by company 2014 £ 000 2013 £ 000 Change %+/- 15, 881 15, 222 4. 3% 4, 124 4, 076 1. 2% Momart 18, 258 16, 298 12. 0% Turnover - continuing operations 38, 263 35, 596 7. 5% Year ended 31 March FIC PHFC FIC 1, 013 1, 325 -23. 5% PHFC 1, 013 984 2. 9% Momart 1, 826 1, 193 53. 1% Operating profit 3, 852 3, 502 10. 0% 60 79 -24. 1% Net pension financing costs & Other (265) (290) -8. 6% Net financing costs (205) (211) -2. 8% Underlying pre tax profit (PBT) 3, 647 3, 291 9. 0% Diluted EPS on taxed underlying profit 22. 0 p 21. 3 p 3. 3% Net bank Interest 29

FKLFKL : Year ended 31 March 2014 Divisional Analysis by company 2014 £ 000 2013 £ 000 Change %+/- 15, 881 15, 222 4. 3% 4, 124 4, 076 1. 2% Momart 18, 258 16, 298 12. 0% Turnover - continuing operations 38, 263 35, 596 7. 5% Year ended 31 March FIC PHFC FIC 1, 013 1, 325 -23. 5% PHFC 1, 013 984 2. 9% Momart 1, 826 1, 193 53. 1% Operating profit 3, 852 3, 502 10. 0% 60 79 -24. 1% Net pension financing costs & Other (265) (290) -8. 6% Net financing costs (205) (211) -2. 8% Underlying pre tax profit (PBT) 3, 647 3, 291 9. 0% Diluted EPS on taxed underlying profit 22. 0 p 21. 3 p 3. 3% Net bank Interest 29

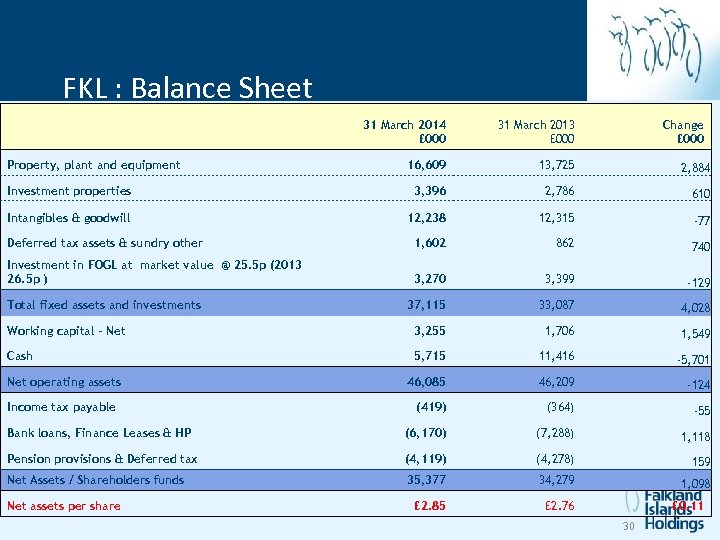

FKL Group balance sheet FKL : Balance Sheet 31 March 2014 £ 000 31 March 2013 £ 000 16, 609 13, 725 2, 884 Investment properties 3, 396 2, 786 610 Intangibles & goodwill 12, 238 12, 315 -77 Deferred tax assets & sundry other 1, 602 862 740 Investment in FOGL at market value @ 25. 5 p (2013 26. 5 p ) 3, 270 3, 399 -129 37, 115 33, 087 4, 028 Working capital - Net 3, 255 1, 706 1, 549 Cash 5, 715 11, 416 -5, 701 46, 085 46, 209 -124 (419) (364) -55 Bank loans, Finance Leases & HP (6, 170) (7, 288) 1, 118 Pension provisions & Deferred tax (4, 119) (4, 278) 159 Net Assets / Shareholders funds 35, 377 34, 279 1, 098 £ 2. 85 £ 2. 76 Property, plant and equipment Total fixed assets and investments Net operating assets Income tax payable Net assets per share Change £ 000 £ 0. 11 30

FKL Group balance sheet FKL : Balance Sheet 31 March 2014 £ 000 31 March 2013 £ 000 16, 609 13, 725 2, 884 Investment properties 3, 396 2, 786 610 Intangibles & goodwill 12, 238 12, 315 -77 Deferred tax assets & sundry other 1, 602 862 740 Investment in FOGL at market value @ 25. 5 p (2013 26. 5 p ) 3, 270 3, 399 -129 37, 115 33, 087 4, 028 Working capital - Net 3, 255 1, 706 1, 549 Cash 5, 715 11, 416 -5, 701 46, 085 46, 209 -124 (419) (364) -55 Bank loans, Finance Leases & HP (6, 170) (7, 288) 1, 118 Pension provisions & Deferred tax (4, 119) (4, 278) 159 Net Assets / Shareholders funds 35, 377 34, 279 1, 098 £ 2. 85 £ 2. 76 Property, plant and equipment Total fixed assets and investments Net operating assets Income tax payable Net assets per share Change £ 000 £ 0. 11 30

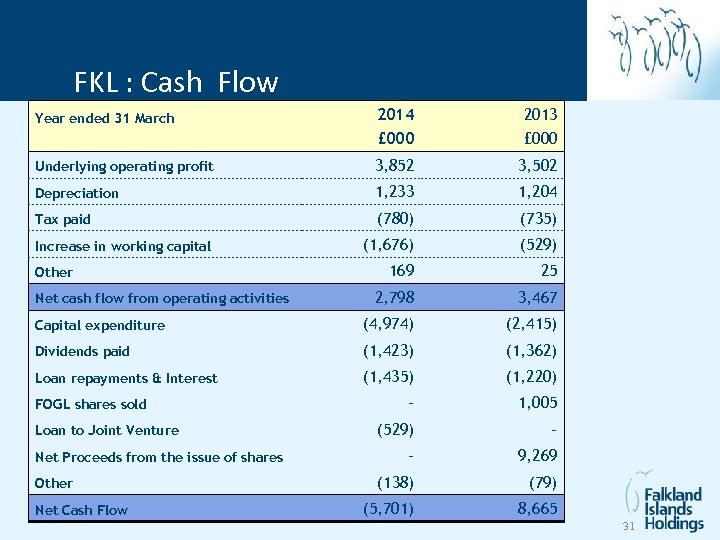

FKL : Cash Flow Group cash flow 2014 2013 £ 000 Underlying operating profit 3, 852 3, 502 Depreciation 1, 233 1, 204 Tax paid (780) (735) (1, 676) (529) 169 25 2, 798 3, 467 Capital expenditure (4, 974) (2, 415) Dividends paid (1, 423) (1, 362) Loan repayments & Interest (1, 435) (1, 220) - 1, 005 (529) - - 9, 269 (138) (79) (5, 701) 8, 665 Year ended 31 March Increase in working capital Other Net cash flow from operating activities FOGL shares sold Loan to Joint Venture Net Proceeds from the issue of shares Other Net Cash Flow 31

FKL : Cash Flow Group cash flow 2014 2013 £ 000 Underlying operating profit 3, 852 3, 502 Depreciation 1, 233 1, 204 Tax paid (780) (735) (1, 676) (529) 169 25 2, 798 3, 467 Capital expenditure (4, 974) (2, 415) Dividends paid (1, 423) (1, 362) Loan repayments & Interest (1, 435) (1, 220) - 1, 005 (529) - - 9, 269 (138) (79) (5, 701) 8, 665 Year ended 31 March Increase in working capital Other Net cash flow from operating activities FOGL shares sold Loan to Joint Venture Net Proceeds from the issue of shares Other Net Cash Flow 31

Plan Current Sea Lion Development Plans • • Phased Development proposed for Sea • Lion Tension Leg Platform (TLP) selected Jan 2014 Phase 1 recovers 293 mm stb over 25 years from 32 wells • Initial development in the north Phase 2 development plan will incorporate results • from exploration Award of FEED contracts imminent • • • $5. 2 bn project costs for Phase 1 • Premier seeking farm in partner to share costs Source: Premier Oil website May 2014 Minimal subsea infrastructure Better economics than a new build FPSO scheme Greater flexibility for infill drilling • 4 year project timeline • First Oil targeted for 2019 32

Plan Current Sea Lion Development Plans • • Phased Development proposed for Sea • Lion Tension Leg Platform (TLP) selected Jan 2014 Phase 1 recovers 293 mm stb over 25 years from 32 wells • Initial development in the north Phase 2 development plan will incorporate results • from exploration Award of FEED contracts imminent • • • $5. 2 bn project costs for Phase 1 • Premier seeking farm in partner to share costs Source: Premier Oil website May 2014 Minimal subsea infrastructure Better economics than a new build FPSO scheme Greater flexibility for infill drilling • 4 year project timeline • First Oil targeted for 2019 32

FIC : Further progress to First Oil • SAt. CO Crane in Operation • Work starts behind Marmont Row 33

FIC : Further progress to First Oil • SAt. CO Crane in Operation • Work starts behind Marmont Row 33

FIC: Sites for development Site Location & size Development Potential 1 Fitzroy Road 2 acres , Central Stanley 26 x 2 bed apartments. Work starts July 2013 2 Dairy Paddock Western Stanley 36 acres Planning for 350 houses / Work camp 3 YPF site Central Stanley, 2. 25 acres Offices , high quality residential 4 East Jetty Waterfront Stanley , 3. 0 acres FIC warehousing – prime site for redevelopment 5 “Coastel” Road FIPASS area, 7. 5 acres Warehousing & lay down areas with planning 6 Airport Road/FIPASS , 11. 0 acres Warehousing & lay down areas with planning 7 Fairy Cove North side of Stanley Harbour, 301 acres Adjoins site for proposed new deep water port at Navy Point 34

FIC: Sites for development Site Location & size Development Potential 1 Fitzroy Road 2 acres , Central Stanley 26 x 2 bed apartments. Work starts July 2013 2 Dairy Paddock Western Stanley 36 acres Planning for 350 houses / Work camp 3 YPF site Central Stanley, 2. 25 acres Offices , high quality residential 4 East Jetty Waterfront Stanley , 3. 0 acres FIC warehousing – prime site for redevelopment 5 “Coastel” Road FIPASS area, 7. 5 acres Warehousing & lay down areas with planning 6 Airport Road/FIPASS , 11. 0 acres Warehousing & lay down areas with planning 7 Fairy Cove North side of Stanley Harbour, 301 acres Adjoins site for proposed new deep water port at Navy Point 34

Map of FIC Development Sites 35

Map of FIC Development Sites 35

Map of FIC Development Sites 36

Map of FIC Development Sites 36

Management Team David Hudd, Chairman David joined the Board in March 2002. He is a Chartered Accountant and was a partner in Price Waterhouse until 1982. Since then, he has been Chairman or Chief Executive of a number of listed companies. He is currently also anon-executive Director of Falklands Oil and Gas Limited. John Foster, Managing Director John joined the Board in January 2005. He is a Chartered Accountant and previously served as a Finance Director and Corporate Finance Director in a number of public companies and before that worked for nine years as a venture capitalist with a leading investment bank in the City. Mike Killingley, Non Executive – Chairman of the Audit Committee Mike was appointed to the board in July 2005. He is a chartered accountant and was a partner of KPMG (and predecessor firms) from 1984 to 1998. Jeremy Brade, Non Executive Jeremy was appointed to the board in September 2009. He is a Director of Harwood Capital ( formerly J. O. Hambro Capital Management ) and a non-executive director of a number of quoted and unquoted companies. Edmund Rowland, Non Executive Edmund joined the Board in April 2013. He currently serves as a Director of Blackfish Capital Management, having gained experience in London and Hong Kong, as an analyst and investment manager with BNP Paribas and Blackfish. 37

Management Team David Hudd, Chairman David joined the Board in March 2002. He is a Chartered Accountant and was a partner in Price Waterhouse until 1982. Since then, he has been Chairman or Chief Executive of a number of listed companies. He is currently also anon-executive Director of Falklands Oil and Gas Limited. John Foster, Managing Director John joined the Board in January 2005. He is a Chartered Accountant and previously served as a Finance Director and Corporate Finance Director in a number of public companies and before that worked for nine years as a venture capitalist with a leading investment bank in the City. Mike Killingley, Non Executive – Chairman of the Audit Committee Mike was appointed to the board in July 2005. He is a chartered accountant and was a partner of KPMG (and predecessor firms) from 1984 to 1998. Jeremy Brade, Non Executive Jeremy was appointed to the board in September 2009. He is a Director of Harwood Capital ( formerly J. O. Hambro Capital Management ) and a non-executive director of a number of quoted and unquoted companies. Edmund Rowland, Non Executive Edmund joined the Board in April 2013. He currently serves as a Director of Blackfish Capital Management, having gained experience in London and Hong Kong, as an analyst and investment manager with BNP Paribas and Blackfish. 37

38

38