ceab4f4151d39634752a75257a140b26.ppt

- Количество слайдов: 27

Click to edit Master conference title Textile and Apparel Strategy Constraints and Solutions

Click to edit Master conference title Textile and Apparel Strategy Constraints and Solutions

Overview of Major Constraints • Internal Constraints to Investment and business: ― Getting goods to market reliably and rapidly; ― Putting labor laws on a comparable basis with major producers of textiles and apparel that are growing; ― Taxes and incentives in line with industry and global norm; ― Shortage of factory shells free of government legacy costs (green field investments); ― Targeting the right investors (products and markets) • Market Constraints ― Changing market access: • USA, EU, SADC ― Current status of global competition in major textile and apparel markets;

Overview of Major Constraints • Internal Constraints to Investment and business: ― Getting goods to market reliably and rapidly; ― Putting labor laws on a comparable basis with major producers of textiles and apparel that are growing; ― Taxes and incentives in line with industry and global norm; ― Shortage of factory shells free of government legacy costs (green field investments); ― Targeting the right investors (products and markets) • Market Constraints ― Changing market access: • USA, EU, SADC ― Current status of global competition in major textile and apparel markets;

Shipping and Delivery Times • Getting goods to market reliably and efficiently: • Reducing the customs and shipping time variability • Rationalizing the supply chain (Maputo Corridor) • Establishing credibility (shipping times) • Textiles and apparel are perishable goods • Global manufactures and buyers are moving to a lean manufacturing model, which means reducing time in the supply chain • Reliability for delivery is as important as cost

Shipping and Delivery Times • Getting goods to market reliably and efficiently: • Reducing the customs and shipping time variability • Rationalizing the supply chain (Maputo Corridor) • Establishing credibility (shipping times) • Textiles and apparel are perishable goods • Global manufactures and buyers are moving to a lean manufacturing model, which means reducing time in the supply chain • Reliability for delivery is as important as cost

Speed of Delivery Asia, Lesotho and Mozambique Compared • The average turn around time for goods ordered and shipped from Asia to Europe or the US is 10 -12 weeks from order to delivery ―With Asian fabrics, Lesotho averages a turn around time of 10. 4 weeks from order to a South African port (Port Elizabeth) and it still requires shipping from there to the market – it is, therefore, uncompetitive to make garments in Lesotho of Asian fabrics but-for the duty preferences provided by AGOA ―Mozambique’s turn around time for the same garment made in Lesotho, is, at best, 11. 6 weeks

Speed of Delivery Asia, Lesotho and Mozambique Compared • The average turn around time for goods ordered and shipped from Asia to Europe or the US is 10 -12 weeks from order to delivery ―With Asian fabrics, Lesotho averages a turn around time of 10. 4 weeks from order to a South African port (Port Elizabeth) and it still requires shipping from there to the market – it is, therefore, uncompetitive to make garments in Lesotho of Asian fabrics but-for the duty preferences provided by AGOA ―Mozambique’s turn around time for the same garment made in Lesotho, is, at best, 11. 6 weeks

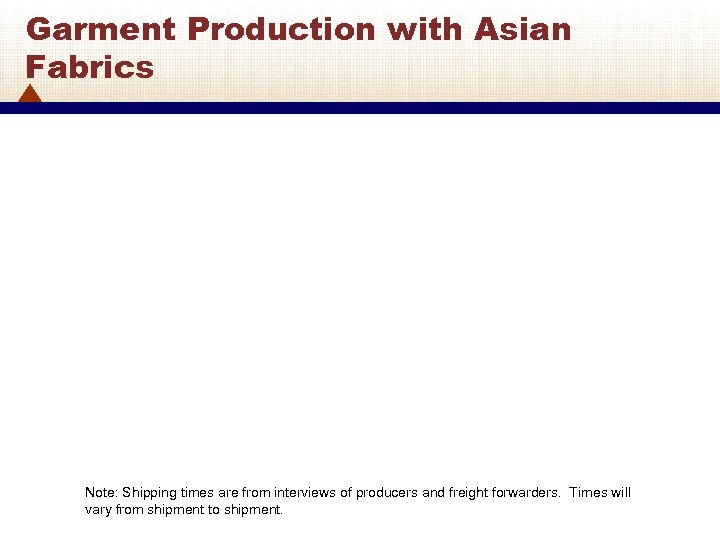

Garment Production with Asian Fabrics Note: Shipping times are from interviews of producers and freight forwarders. Times will vary from shipment to shipment.

Garment Production with Asian Fabrics Note: Shipping times are from interviews of producers and freight forwarders. Times will vary from shipment to shipment.

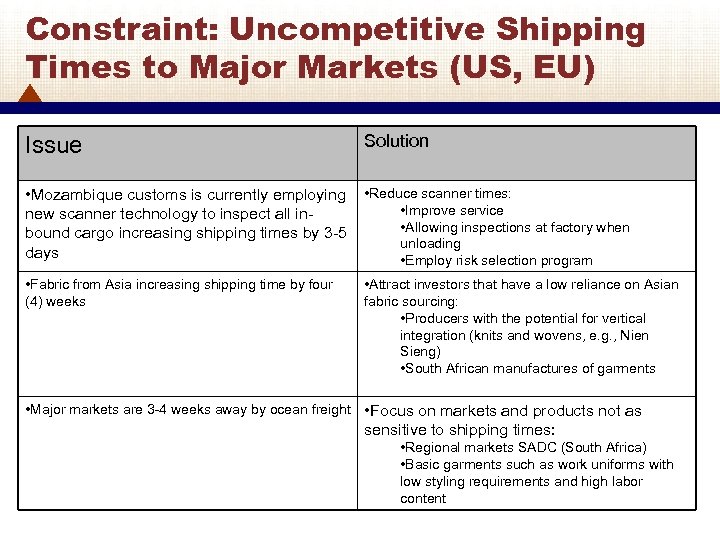

Constraint: Uncompetitive Shipping Times to Major Markets (US, EU) Issue Solution • Mozambique customs is currently employing new scanner technology to inspect all inbound cargo increasing shipping times by 3 -5 days • Reduce scanner times: • Improve service • Allowing inspections at factory when unloading • Employ risk selection program • Fabric from Asia increasing shipping time by four (4) weeks • Attract investors that have a low reliance on Asian fabric sourcing: • Producers with the potential for vertical integration (knits and wovens, e. g. , Nien Sieng) • South African manufactures of garments • Major markets are 3 -4 weeks away by ocean freight • Focus on markets and products not as sensitive to shipping times: • Regional markets SADC (South Africa) • Basic garments such as work uniforms with low styling requirements and high labor content

Constraint: Uncompetitive Shipping Times to Major Markets (US, EU) Issue Solution • Mozambique customs is currently employing new scanner technology to inspect all inbound cargo increasing shipping times by 3 -5 days • Reduce scanner times: • Improve service • Allowing inspections at factory when unloading • Employ risk selection program • Fabric from Asia increasing shipping time by four (4) weeks • Attract investors that have a low reliance on Asian fabric sourcing: • Producers with the potential for vertical integration (knits and wovens, e. g. , Nien Sieng) • South African manufactures of garments • Major markets are 3 -4 weeks away by ocean freight • Focus on markets and products not as sensitive to shipping times: • Regional markets SADC (South Africa) • Basic garments such as work uniforms with low styling requirements and high labor content

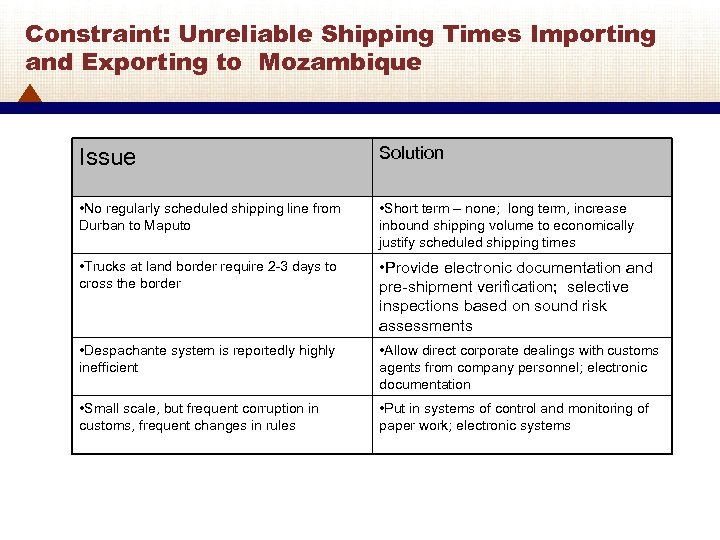

Constraint: Unreliable Shipping Times Importing and Exporting to Mozambique Issue Solution • No regularly scheduled shipping line from Durban to Maputo • Short term – none; long term, increase inbound shipping volume to economically justify scheduled shipping times • Trucks at land border require 2 -3 days to cross the border • Provide electronic documentation and pre-shipment verification; selective inspections based on sound risk assessments • Despachante system is reportedly highly inefficient • Allow direct corporate dealings with customs agents from company personnel; electronic documentation • Small scale, but frequent corruption in customs, frequent changes in rules • Put in systems of control and monitoring of paper work; electronic systems

Constraint: Unreliable Shipping Times Importing and Exporting to Mozambique Issue Solution • No regularly scheduled shipping line from Durban to Maputo • Short term – none; long term, increase inbound shipping volume to economically justify scheduled shipping times • Trucks at land border require 2 -3 days to cross the border • Provide electronic documentation and pre-shipment verification; selective inspections based on sound risk assessments • Despachante system is reportedly highly inefficient • Allow direct corporate dealings with customs agents from company personnel; electronic documentation • Small scale, but frequent corruption in customs, frequent changes in rules • Put in systems of control and monitoring of paper work; electronic systems

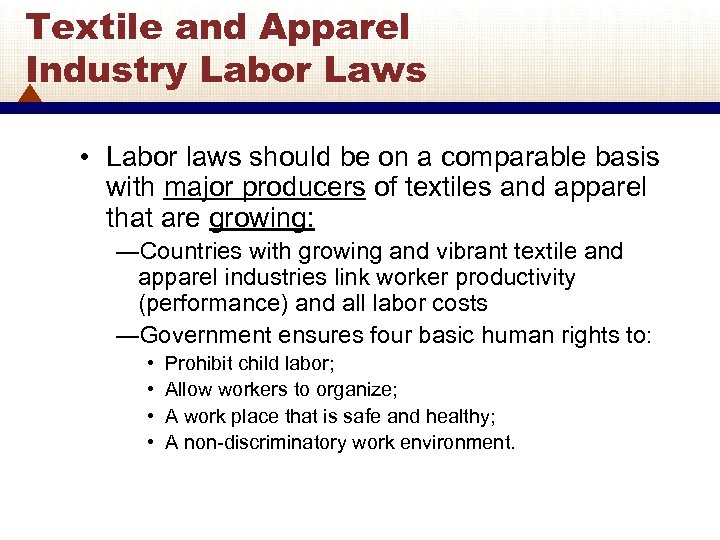

Textile and Apparel Industry Labor Laws • Labor laws should be on a comparable basis with major producers of textiles and apparel that are growing: ―Countries with growing and vibrant textile and apparel industries link worker productivity (performance) and all labor costs ―Government ensures four basic human rights to: • • Prohibit child labor; Allow workers to organize; A work place that is safe and healthy; A non-discriminatory work environment.

Textile and Apparel Industry Labor Laws • Labor laws should be on a comparable basis with major producers of textiles and apparel that are growing: ―Countries with growing and vibrant textile and apparel industries link worker productivity (performance) and all labor costs ―Government ensures four basic human rights to: • • Prohibit child labor; Allow workers to organize; A work place that is safe and healthy; A non-discriminatory work environment.

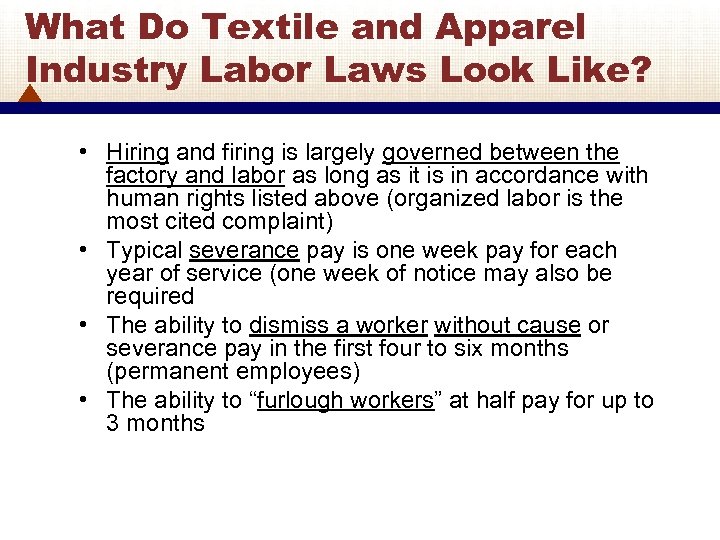

What Do Textile and Apparel Industry Labor Laws Look Like? • Hiring and firing is largely governed between the factory and labor as long as it is in accordance with human rights listed above (organized labor is the most cited complaint) • Typical severance pay is one week pay for each year of service (one week of notice may also be required • The ability to dismiss a worker without cause or severance pay in the first four to six months (permanent employees) • The ability to “furlough workers” at half pay for up to 3 months

What Do Textile and Apparel Industry Labor Laws Look Like? • Hiring and firing is largely governed between the factory and labor as long as it is in accordance with human rights listed above (organized labor is the most cited complaint) • Typical severance pay is one week pay for each year of service (one week of notice may also be required • The ability to dismiss a worker without cause or severance pay in the first four to six months (permanent employees) • The ability to “furlough workers” at half pay for up to 3 months

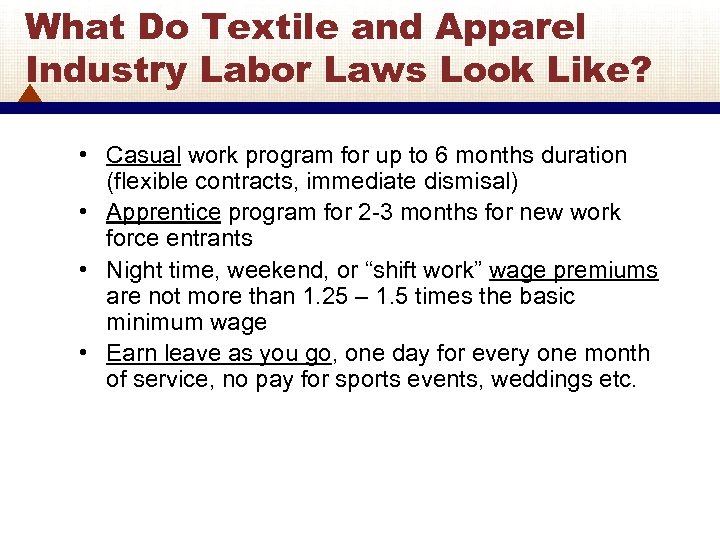

What Do Textile and Apparel Industry Labor Laws Look Like? • Casual work program for up to 6 months duration (flexible contracts, immediate dismisal) • Apprentice program for 2 -3 months for new work force entrants • Night time, weekend, or “shift work” wage premiums are not more than 1. 25 – 1. 5 times the basic minimum wage • Earn leave as you go, one day for every one month of service, no pay for sports events, weddings etc.

What Do Textile and Apparel Industry Labor Laws Look Like? • Casual work program for up to 6 months duration (flexible contracts, immediate dismisal) • Apprentice program for 2 -3 months for new work force entrants • Night time, weekend, or “shift work” wage premiums are not more than 1. 25 – 1. 5 times the basic minimum wage • Earn leave as you go, one day for every one month of service, no pay for sports events, weddings etc.

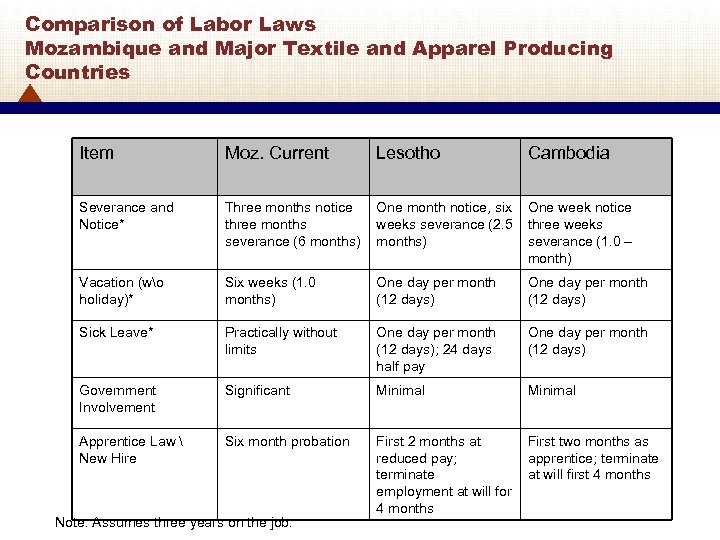

Comparison of Labor Laws Mozambique and Major Textile and Apparel Producing Countries Item Moz. Current Lesotho Cambodia Severance and Notice* Three months notice three months severance (6 months) One month notice, six weeks severance (2. 5 months) One week notice three weeks severance (1. 0 – month) Vacation (wo holiday)* Six weeks (1. 0 months) One day per month (12 days) Sick Leave* Practically without limits One day per month (12 days); 24 days half pay One day per month (12 days) Government Involvement Significant Minimal Apprentice Law New Hire Six month probation First 2 months at reduced pay; terminate employment at will for 4 months First two months as apprentice; terminate at will first 4 months Note: Assumes three years on the job.

Comparison of Labor Laws Mozambique and Major Textile and Apparel Producing Countries Item Moz. Current Lesotho Cambodia Severance and Notice* Three months notice three months severance (6 months) One month notice, six weeks severance (2. 5 months) One week notice three weeks severance (1. 0 – month) Vacation (wo holiday)* Six weeks (1. 0 months) One day per month (12 days) Sick Leave* Practically without limits One day per month (12 days); 24 days half pay One day per month (12 days) Government Involvement Significant Minimal Apprentice Law New Hire Six month probation First 2 months at reduced pay; terminate employment at will for 4 months First two months as apprentice; terminate at will first 4 months Note: Assumes three years on the job.

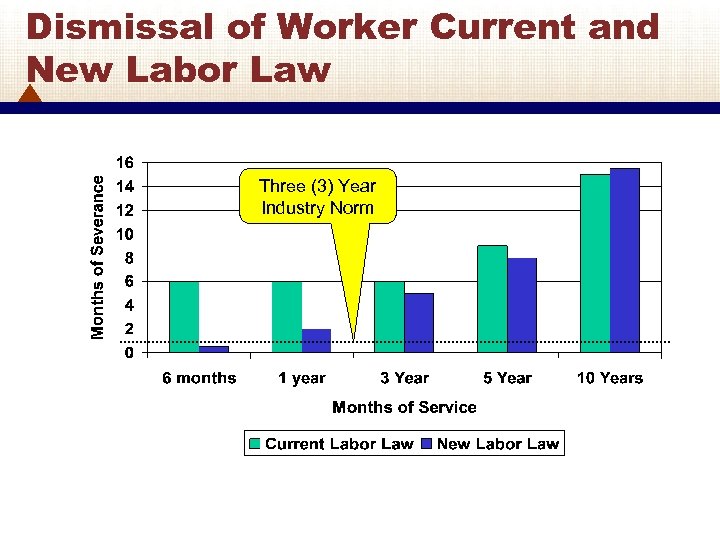

Dismissal of Worker Current and New Labor Law Three (3) Year Industry Norm

Dismissal of Worker Current and New Labor Law Three (3) Year Industry Norm

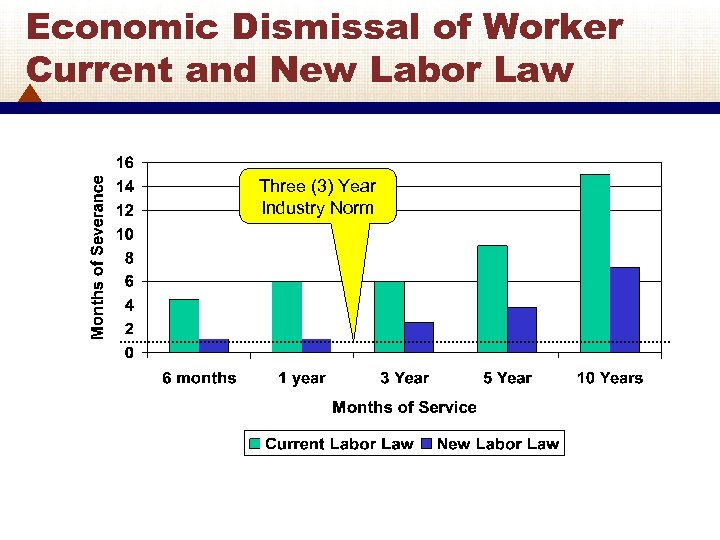

Economic Dismissal of Worker Current and New Labor Law Three (3) Year Industry Norm

Economic Dismissal of Worker Current and New Labor Law Three (3) Year Industry Norm

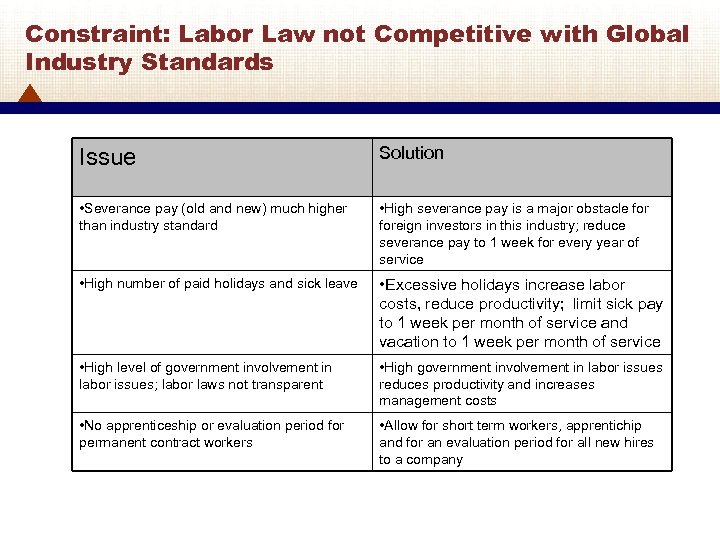

Constraint: Labor Law not Competitive with Global Industry Standards Issue Solution • Severance pay (old and new) much higher than industry standard • High severance pay is a major obstacle foreign investors in this industry; reduce severance pay to 1 week for every year of service • High number of paid holidays and sick leave • Excessive holidays increase labor costs, reduce productivity; limit sick pay to 1 week per month of service and vacation to 1 week per month of service • High level of government involvement in labor issues; labor laws not transparent • High government involvement in labor issues reduces productivity and increases management costs • No apprenticeship or evaluation period for permanent contract workers • Allow for short term workers, apprentichip and for an evaluation period for all new hires to a company

Constraint: Labor Law not Competitive with Global Industry Standards Issue Solution • Severance pay (old and new) much higher than industry standard • High severance pay is a major obstacle foreign investors in this industry; reduce severance pay to 1 week for every year of service • High number of paid holidays and sick leave • Excessive holidays increase labor costs, reduce productivity; limit sick pay to 1 week per month of service and vacation to 1 week per month of service • High level of government involvement in labor issues; labor laws not transparent • High government involvement in labor issues reduces productivity and increases management costs • No apprenticeship or evaluation period for permanent contract workers • Allow for short term workers, apprentichip and for an evaluation period for all new hires to a company

Taxes and Incentives • Reduce corporate tax on industry profits to the industry norm of zero for the first 5 years of operation for firms exporting • Encourage worker training with a matching government industry fund; • Creating a transparent environment for business operations free of corruption, including rapid and efficient ownership and bankruptcy law

Taxes and Incentives • Reduce corporate tax on industry profits to the industry norm of zero for the first 5 years of operation for firms exporting • Encourage worker training with a matching government industry fund; • Creating a transparent environment for business operations free of corruption, including rapid and efficient ownership and bankruptcy law

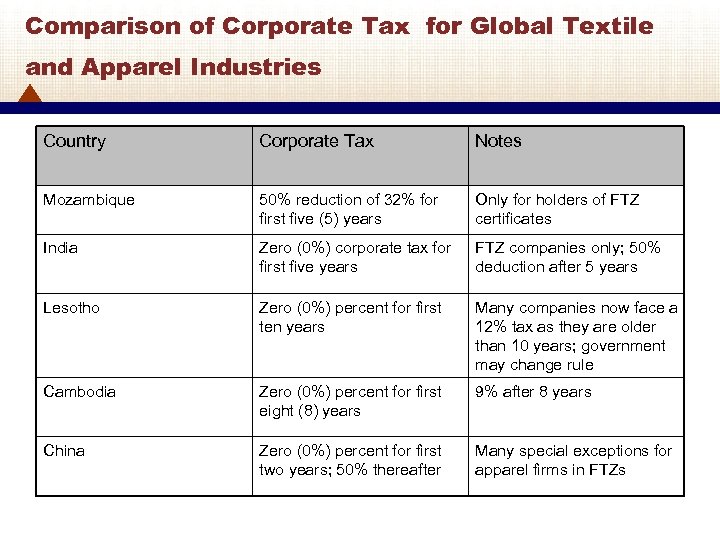

Comparison of Corporate Tax for Global Textile and Apparel Industries Country Corporate Tax Notes Mozambique 50% reduction of 32% for first five (5) years Only for holders of FTZ certificates India Zero (0%) corporate tax for first five years FTZ companies only; 50% deduction after 5 years Lesotho Zero (0%) percent for first ten years Many companies now face a 12% tax as they are older than 10 years; government may change rule Cambodia Zero (0%) percent for first eight (8) years 9% after 8 years China Zero (0%) percent for first two years; 50% thereafter Many special exceptions for apparel firms in FTZs

Comparison of Corporate Tax for Global Textile and Apparel Industries Country Corporate Tax Notes Mozambique 50% reduction of 32% for first five (5) years Only for holders of FTZ certificates India Zero (0%) corporate tax for first five years FTZ companies only; 50% deduction after 5 years Lesotho Zero (0%) percent for first ten years Many companies now face a 12% tax as they are older than 10 years; government may change rule Cambodia Zero (0%) percent for first eight (8) years 9% after 8 years China Zero (0%) percent for first two years; 50% thereafter Many special exceptions for apparel firms in FTZs

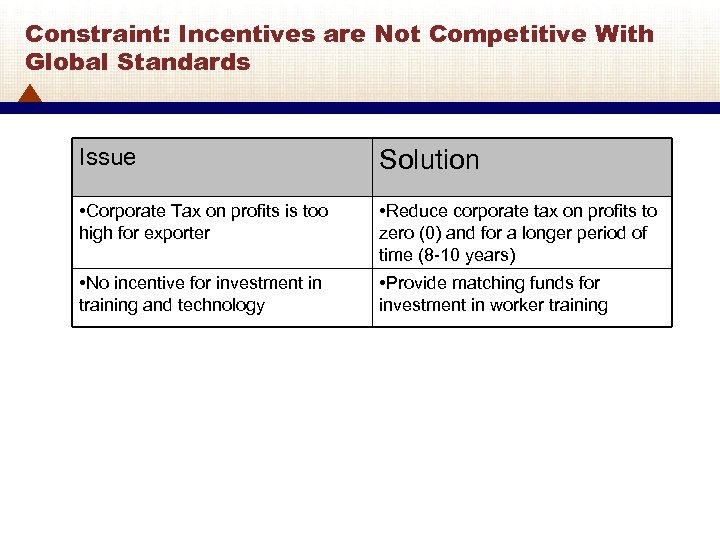

Constraint: Incentives are Not Competitive With Global Standards Issue Solution • Corporate Tax on profits is too high for exporter • Reduce corporate tax on profits to zero (0) and for a longer period of time (8 -10 years) • No incentive for investment in training and technology • Provide matching funds for investment in worker training

Constraint: Incentives are Not Competitive With Global Standards Issue Solution • Corporate Tax on profits is too high for exporter • Reduce corporate tax on profits to zero (0) and for a longer period of time (8 -10 years) • No incentive for investment in training and technology • Provide matching funds for investment in worker training

Market Access • AGOA Rules are Changing • EU-Cotonou to expire at the end of 2008 and be replaced by an EPA • Mozambique will still have access under EU-EBA • SADC is looking into new rule of origin

Market Access • AGOA Rules are Changing • EU-Cotonou to expire at the end of 2008 and be replaced by an EPA • Mozambique will still have access under EU-EBA • SADC is looking into new rule of origin

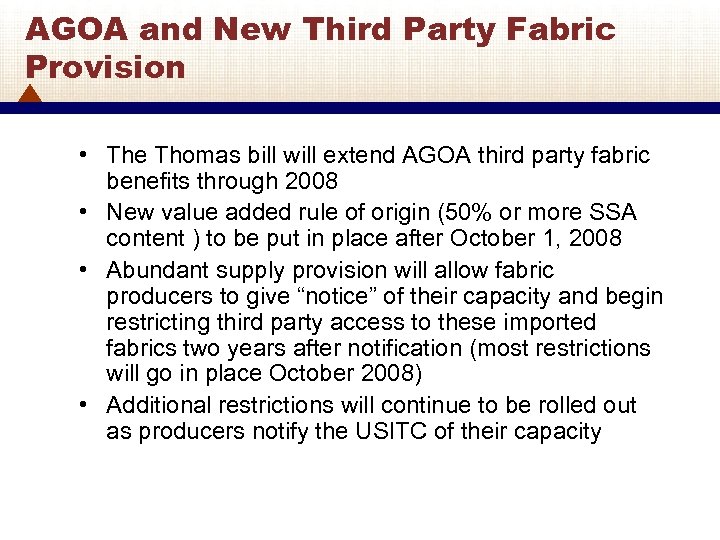

AGOA and New Third Party Fabric Provision • The Thomas bill will extend AGOA third party fabric benefits through 2008 • New value added rule of origin (50% or more SSA content ) to be put in place after October 1, 2008 • Abundant supply provision will allow fabric producers to give “notice” of their capacity and begin restricting third party access to these imported fabrics two years after notification (most restrictions will go in place October 2008) • Additional restrictions will continue to be rolled out as producers notify the USITC of their capacity

AGOA and New Third Party Fabric Provision • The Thomas bill will extend AGOA third party fabric benefits through 2008 • New value added rule of origin (50% or more SSA content ) to be put in place after October 1, 2008 • Abundant supply provision will allow fabric producers to give “notice” of their capacity and begin restricting third party access to these imported fabrics two years after notification (most restrictions will go in place October 2008) • Additional restrictions will continue to be rolled out as producers notify the USITC of their capacity

Value Added in Apparel Industry by Product

Value Added in Apparel Industry by Product

EU Market Access • The EU is now exploring a value added rule of origin for textile and apparel products covered under their proposed EPA agreements • Allow the “cumulation” of origin within subcountry groups such as SADC-7 (South Africa) • No definition of value added rule • Generally better than Cotonou and EBA rules, which are highly restrictive

EU Market Access • The EU is now exploring a value added rule of origin for textile and apparel products covered under their proposed EPA agreements • Allow the “cumulation” of origin within subcountry groups such as SADC-7 (South Africa) • No definition of value added rule • Generally better than Cotonou and EBA rules, which are highly restrictive

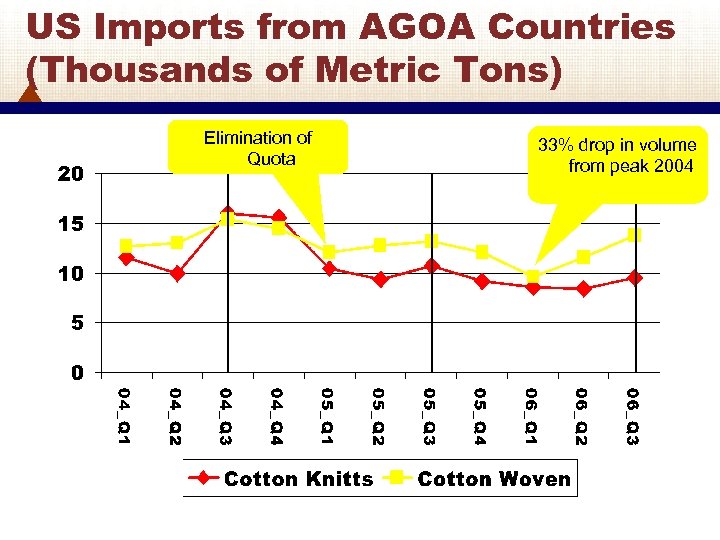

US Imports from AGOA Countries (Thousands of Metric Tons) Elimination of Quota 33% drop in volume from peak 2004

US Imports from AGOA Countries (Thousands of Metric Tons) Elimination of Quota 33% drop in volume from peak 2004

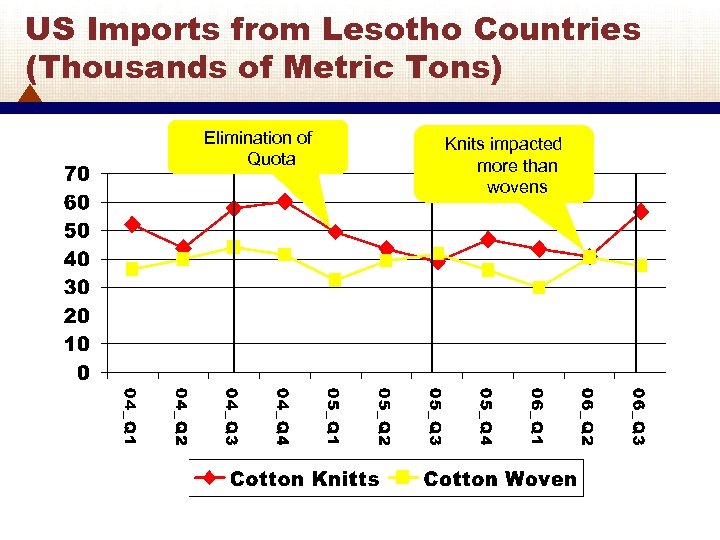

US Imports from Lesotho Countries (Thousands of Metric Tons) Elimination of Quota Knits impacted more than wovens

US Imports from Lesotho Countries (Thousands of Metric Tons) Elimination of Quota Knits impacted more than wovens

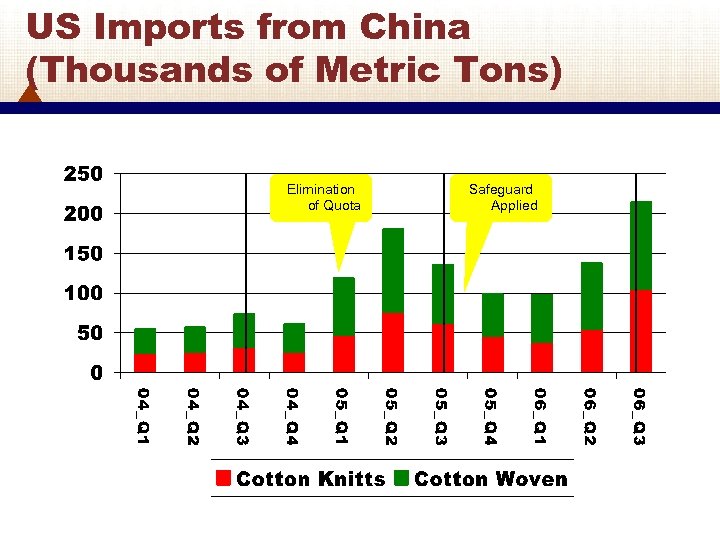

US Imports from China (Thousands of Metric Tons) Elimination of Quota Safeguard Applied

US Imports from China (Thousands of Metric Tons) Elimination of Quota Safeguard Applied

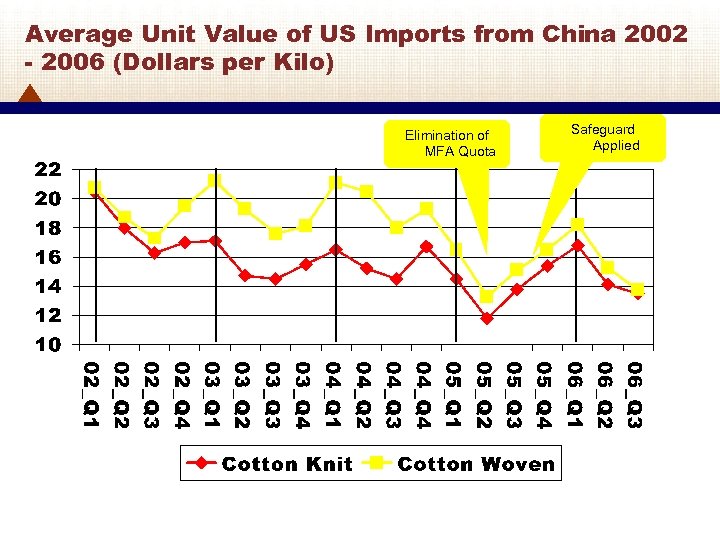

Average Unit Value of US Imports from China 2002 - 2006 (Dollars per Kilo) Elimination of MFA Quota Safeguard Applied

Average Unit Value of US Imports from China 2002 - 2006 (Dollars per Kilo) Elimination of MFA Quota Safeguard Applied

Interviews and Resources • Peter Young of Maputo clothing and his accounting office; • IPEX (Joao Macaringue, CTI (Sattii Rohit, and Mrs. Belarmina Capinte, Jorge Sequeira) • Cary Davis, formally of Belita Clothing • Simon Fellingham, of Marcena lines shipping (Dubai Based, but local shipper) • Nelson, USAID—labor law • John Richotte--International Labor Organizatoin, Cambodia) • Mark Bennett--Co. Mark Trust, Lesotho

Interviews and Resources • Peter Young of Maputo clothing and his accounting office; • IPEX (Joao Macaringue, CTI (Sattii Rohit, and Mrs. Belarmina Capinte, Jorge Sequeira) • Cary Davis, formally of Belita Clothing • Simon Fellingham, of Marcena lines shipping (Dubai Based, but local shipper) • Nelson, USAID—labor law • John Richotte--International Labor Organizatoin, Cambodia) • Mark Bennett--Co. Mark Trust, Lesotho

Controlling Imported Materials • In the textile and apparel industries, access to imported materials without the burden of domestic taxes is a requirement for export firms to compete • Most countries control imported materials by: ―Securing all containers and inspecting them at the factory site before and after shipping; ―Weighing materials imported and balancing them with goods exported (including packaging materials) ―Allowances for waste must be determinedhandled

Controlling Imported Materials • In the textile and apparel industries, access to imported materials without the burden of domestic taxes is a requirement for export firms to compete • Most countries control imported materials by: ―Securing all containers and inspecting them at the factory site before and after shipping; ―Weighing materials imported and balancing them with goods exported (including packaging materials) ―Allowances for waste must be determinedhandled