1f902b078c6380f670350f59e4d2b539.ppt

- Количество слайдов: 12

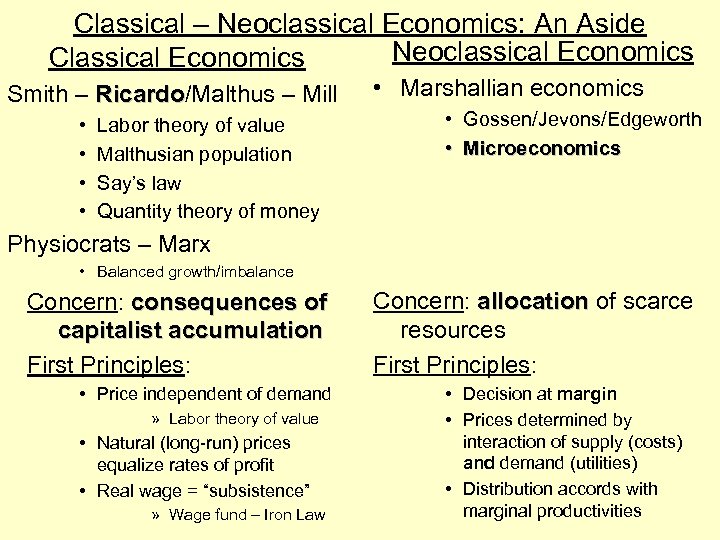

Classical – Neoclassical Economics: An Aside Neoclassical Economics Classical Economics Smith – Ricardo/Malthus – Mill Ricardo • • Labor theory of value Malthusian population Say’s law Quantity theory of money • Marshallian economics • Gossen/Jevons/Edgeworth • Microeconomics Physiocrats – Marx • Balanced growth/imbalance Concern: consequences of capitalist accumulation First Principles: • Price independent of demand » Labor theory of value • Natural (long-run) prices equalize rates of profit • Real wage = “subsistence” » Wage fund – Iron Law Concern: allocation of scarce resources First Principles: • Decision at margin • Prices determined by interaction of supply (costs) and demand (utilities) • Distribution accords with marginal productivities

Classical – Neoclassical Economics: An Aside Neoclassical Economics Classical Economics Smith – Ricardo/Malthus – Mill Ricardo • • Labor theory of value Malthusian population Say’s law Quantity theory of money • Marshallian economics • Gossen/Jevons/Edgeworth • Microeconomics Physiocrats – Marx • Balanced growth/imbalance Concern: consequences of capitalist accumulation First Principles: • Price independent of demand » Labor theory of value • Natural (long-run) prices equalize rates of profit • Real wage = “subsistence” » Wage fund – Iron Law Concern: allocation of scarce resources First Principles: • Decision at margin • Prices determined by interaction of supply (costs) and demand (utilities) • Distribution accords with marginal productivities

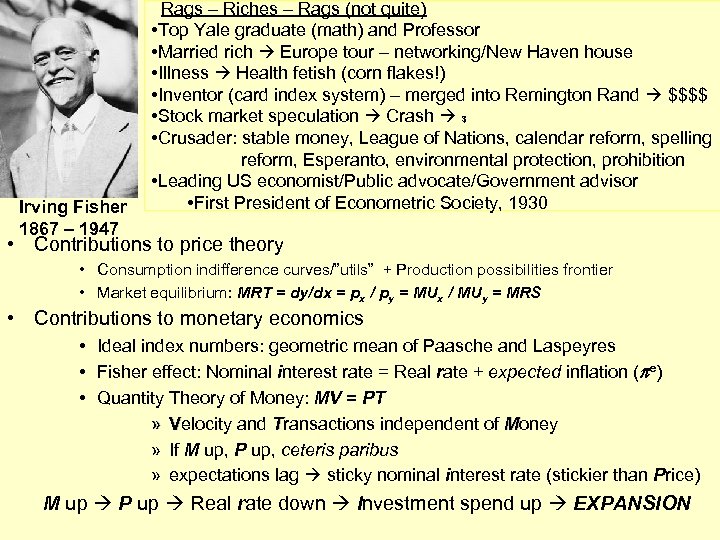

Irving Fisher 1867 – 1947 Rags – Riches – Rags (not quite) • Top Yale graduate (math) and Professor • Married rich Europe tour – networking/New Haven house • Illness Health fetish (corn flakes!) • Inventor (card index system) – merged into Remington Rand $$$$ • Stock market speculation Crash $ • Crusader: stable money, League of Nations, calendar reform, spelling reform, Esperanto, environmental protection, prohibition • Leading US economist/Public advocate/Government advisor • First President of Econometric Society, 1930 • Contributions to price theory • Consumption indifference curves/”utils” + Production possibilities frontier • Market equilibrium: MRT = dy/dx = px / py = MUx / MUy = MRS • Contributions to monetary economics • Ideal index numbers: geometric mean of Paasche and Laspeyres • Fisher effect: Nominal interest rate = Real rate + expected inflation ( e) • Quantity Theory of Money: MV = PT » Velocity and Transactions independent of Money » If M up, P up, ceteris paribus » expectations lag sticky nominal interest rate (stickier than Price) M up P up Real rate down Investment spend up EXPANSION

Irving Fisher 1867 – 1947 Rags – Riches – Rags (not quite) • Top Yale graduate (math) and Professor • Married rich Europe tour – networking/New Haven house • Illness Health fetish (corn flakes!) • Inventor (card index system) – merged into Remington Rand $$$$ • Stock market speculation Crash $ • Crusader: stable money, League of Nations, calendar reform, spelling reform, Esperanto, environmental protection, prohibition • Leading US economist/Public advocate/Government advisor • First President of Econometric Society, 1930 • Contributions to price theory • Consumption indifference curves/”utils” + Production possibilities frontier • Market equilibrium: MRT = dy/dx = px / py = MUx / MUy = MRS • Contributions to monetary economics • Ideal index numbers: geometric mean of Paasche and Laspeyres • Fisher effect: Nominal interest rate = Real rate + expected inflation ( e) • Quantity Theory of Money: MV = PT » Velocity and Transactions independent of Money » If M up, P up, ceteris paribus » expectations lag sticky nominal interest rate (stickier than Price) M up P up Real rate down Investment spend up EXPANSION

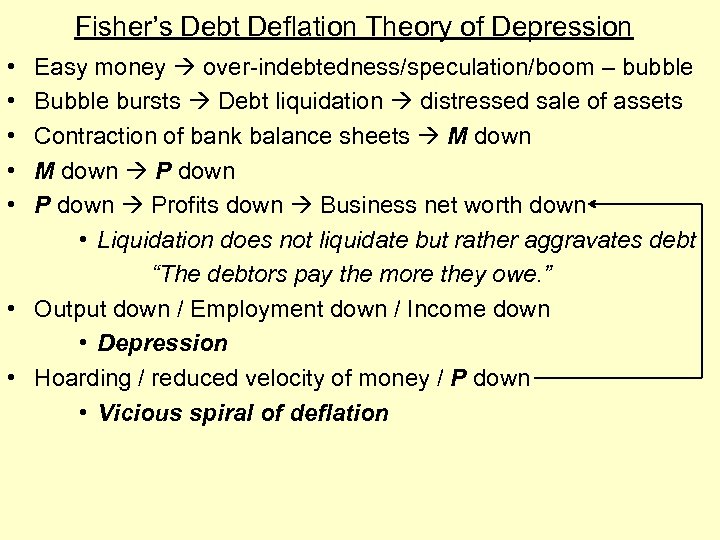

Fisher’s Debt Deflation Theory of Depression • • • Easy money over-indebtedness/speculation/boom – bubble Bubble bursts Debt liquidation distressed sale of assets Contraction of bank balance sheets M down Profits down Business net worth down • Liquidation does not liquidate but rather aggravates debt “The debtors pay the more they owe. ” • Output down / Employment down / Income down • Depression • Hoarding / reduced velocity of money / P down • Vicious spiral of deflation

Fisher’s Debt Deflation Theory of Depression • • • Easy money over-indebtedness/speculation/boom – bubble Bubble bursts Debt liquidation distressed sale of assets Contraction of bank balance sheets M down Profits down Business net worth down • Liquidation does not liquidate but rather aggravates debt “The debtors pay the more they owe. ” • Output down / Employment down / Income down • Depression • Hoarding / reduced velocity of money / P down • Vicious spiral of deflation

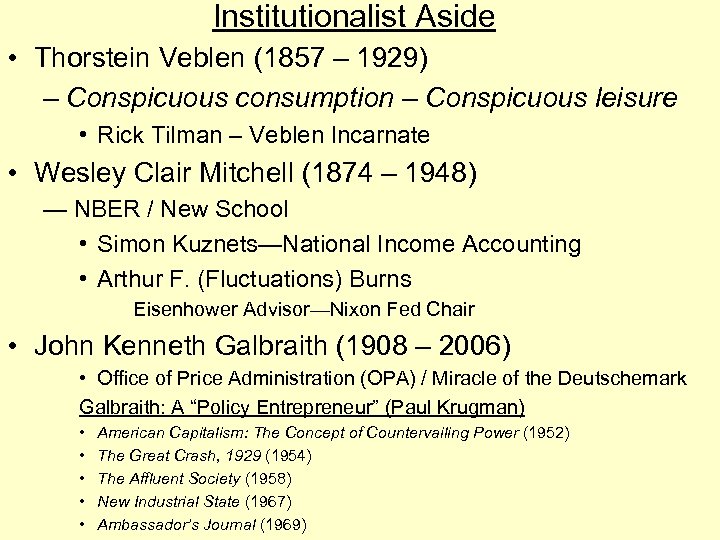

Institutionalist Aside • Thorstein Veblen (1857 – 1929) – Conspicuous consumption – Conspicuous leisure • Rick Tilman – Veblen Incarnate • Wesley Clair Mitchell (1874 – 1948) — NBER / New School • Simon Kuznets—National Income Accounting • Arthur F. (Fluctuations) Burns Eisenhower Advisor—Nixon Fed Chair • John Kenneth Galbraith (1908 – 2006) • Office of Price Administration (OPA) / Miracle of the Deutschemark Galbraith: A “Policy Entrepreneur” (Paul Krugman) • • • American Capitalism: The Concept of Countervailing Power (1952) The Great Crash, 1929 (1954) The Affluent Society (1958) New Industrial State (1967) Ambassador’s Journal (1969)

Institutionalist Aside • Thorstein Veblen (1857 – 1929) – Conspicuous consumption – Conspicuous leisure • Rick Tilman – Veblen Incarnate • Wesley Clair Mitchell (1874 – 1948) — NBER / New School • Simon Kuznets—National Income Accounting • Arthur F. (Fluctuations) Burns Eisenhower Advisor—Nixon Fed Chair • John Kenneth Galbraith (1908 – 2006) • Office of Price Administration (OPA) / Miracle of the Deutschemark Galbraith: A “Policy Entrepreneur” (Paul Krugman) • • • American Capitalism: The Concept of Countervailing Power (1952) The Great Crash, 1929 (1954) The Affluent Society (1958) New Industrial State (1967) Ambassador’s Journal (1969)

Monetary Theory • David Hume – specie flow, prices, and trade balance • David Ricardo – The High Price of Corn : • Alfred Marshall – Cambridge oral tradition: M = k PY Professor Irving Fisher has been the first, in several instances, to publish in book form ideas analogous to those which had been worked out by Marshall at much earlier dates. J. M. Keynes, Alfred Marshall, 1842 – 1924, p. 336 fn. • • • Irving Fisher – Quantity Theory and Real Interest Rate Knut Wicksell – Natural rate of interest/cumulative process Gustav Cassel – Quantity Theory Purchasing Power Parity Gunnar Myrdal – Monetary Equilibrium: Ex ante – ex post John Maynard Keynes – – Tract on Monetary Reform (1924) Treatise on Money (1930) The General Theory of Employment, Interest and Money (1936) The General Theory of Employment, QJE, 1937.

Monetary Theory • David Hume – specie flow, prices, and trade balance • David Ricardo – The High Price of Corn : • Alfred Marshall – Cambridge oral tradition: M = k PY Professor Irving Fisher has been the first, in several instances, to publish in book form ideas analogous to those which had been worked out by Marshall at much earlier dates. J. M. Keynes, Alfred Marshall, 1842 – 1924, p. 336 fn. • • • Irving Fisher – Quantity Theory and Real Interest Rate Knut Wicksell – Natural rate of interest/cumulative process Gustav Cassel – Quantity Theory Purchasing Power Parity Gunnar Myrdal – Monetary Equilibrium: Ex ante – ex post John Maynard Keynes – – Tract on Monetary Reform (1924) Treatise on Money (1930) The General Theory of Employment, Interest and Money (1936) The General Theory of Employment, QJE, 1937.

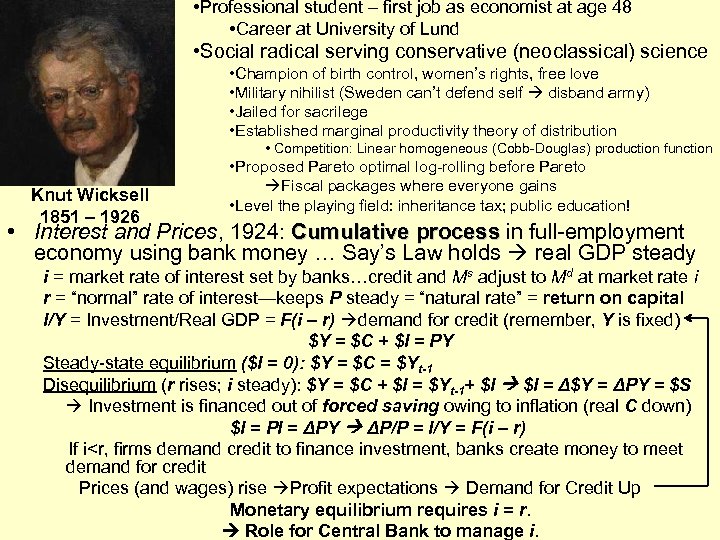

• Professional student – first job as economist at age 48 • Career at University of Lund • Social radical serving conservative (neoclassical) science • Champion of birth control, women’s rights, free love • Military nihilist (Sweden can’t defend self disband army) • Jailed for sacrilege • Established marginal productivity theory of distribution • Competition: Linear homogeneous (Cobb-Douglas) production function Knut Wicksell 1851 – 1926 • Proposed Pareto optimal log-rolling before Pareto Fiscal packages where everyone gains • Level the playing field: inheritance tax; public education! • Interest and Prices, 1924: Cumulative process in full-employment economy using bank money … Say’s Law holds real GDP steady i = market rate of interest set by banks…credit and Ms adjust to Md at market rate i r = “normal” rate of interest—keeps P steady = “natural rate” = return on capital I/Y = Investment/Real GDP = F(i – r) demand for credit (remember, Y is fixed) $Y = $C + $I = PY Steady-state equilibrium ($I = 0): $Y = $C = $Yt-1 Disequilibrium (r rises; i steady): $Y = $C + $I = $Yt-1+ $I = Δ$Y = ΔPY = $S Investment is financed out of forced saving owing to inflation (real C down) $I = PI = ΔPY ΔP/P = I/Y = F(i – r) If i

• Professional student – first job as economist at age 48 • Career at University of Lund • Social radical serving conservative (neoclassical) science • Champion of birth control, women’s rights, free love • Military nihilist (Sweden can’t defend self disband army) • Jailed for sacrilege • Established marginal productivity theory of distribution • Competition: Linear homogeneous (Cobb-Douglas) production function Knut Wicksell 1851 – 1926 • Proposed Pareto optimal log-rolling before Pareto Fiscal packages where everyone gains • Level the playing field: inheritance tax; public education! • Interest and Prices, 1924: Cumulative process in full-employment economy using bank money … Say’s Law holds real GDP steady i = market rate of interest set by banks…credit and Ms adjust to Md at market rate i r = “normal” rate of interest—keeps P steady = “natural rate” = return on capital I/Y = Investment/Real GDP = F(i – r) demand for credit (remember, Y is fixed) $Y = $C + $I = PY Steady-state equilibrium ($I = 0): $Y = $C = $Yt-1 Disequilibrium (r rises; i steady): $Y = $C + $I = $Yt-1+ $I = Δ$Y = ΔPY = $S Investment is financed out of forced saving owing to inflation (real C down) $I = PI = ΔPY ΔP/P = I/Y = F(i – r) If i

Wicksell’s interest rate rule for monetary equilibrium: Precursor of inflation targeting So long as prices remain unaltered the (central) bank’s rate of interest is to remain unaltered. If prices rise, the rate of interest is to be raised; and if prices fall, the rate of interest is to be lowered; and the rate interest is henceforth to be maintained at its new level until a further movement of prices calls for a further change in one direction or another. Wicksell, Interest and Prices, p. 189 quoted in Michael Woodford, Interest and Prices: Foundations of a Theory of Monetary Policy, p. 38

Wicksell’s interest rate rule for monetary equilibrium: Precursor of inflation targeting So long as prices remain unaltered the (central) bank’s rate of interest is to remain unaltered. If prices rise, the rate of interest is to be raised; and if prices fall, the rate of interest is to be lowered; and the rate interest is henceforth to be maintained at its new level until a further movement of prices calls for a further change in one direction or another. Wicksell, Interest and Prices, p. 189 quoted in Michael Woodford, Interest and Prices: Foundations of a Theory of Monetary Policy, p. 38

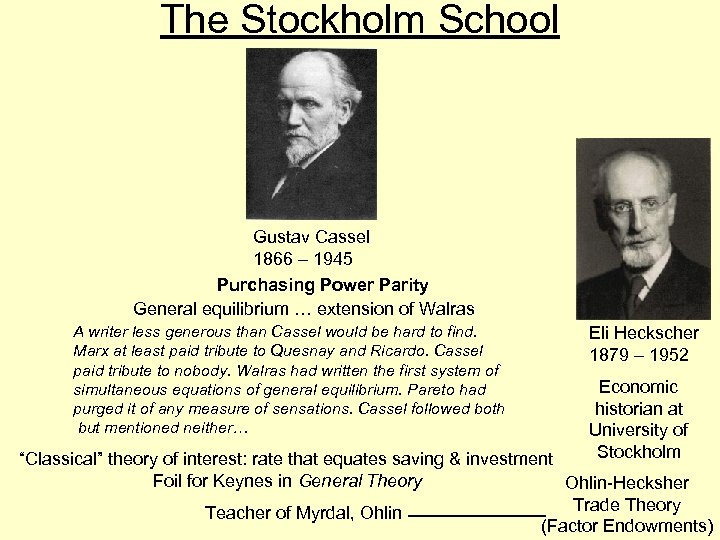

The Stockholm School Gustav Cassel 1866 – 1945 Purchasing Power Parity General equilibrium … extension of Walras A writer less generous than Cassel would be hard to find. Marx at least paid tribute to Quesnay and Ricardo. Cassel paid tribute to nobody. Walras had written the first system of simultaneous equations of general equilibrium. Pareto had purged it of any measure of sensations. Cassel followed both but mentioned neither… Eli Heckscher 1879 – 1952 Economic historian at University of Stockholm “Classical” theory of interest: rate that equates saving & investment Foil for Keynes in General Theory Ohlin-Hecksher Trade Theory Teacher of Myrdal, Ohlin (Factor Endowments)

The Stockholm School Gustav Cassel 1866 – 1945 Purchasing Power Parity General equilibrium … extension of Walras A writer less generous than Cassel would be hard to find. Marx at least paid tribute to Quesnay and Ricardo. Cassel paid tribute to nobody. Walras had written the first system of simultaneous equations of general equilibrium. Pareto had purged it of any measure of sensations. Cassel followed both but mentioned neither… Eli Heckscher 1879 – 1952 Economic historian at University of Stockholm “Classical” theory of interest: rate that equates saving & investment Foil for Keynes in General Theory Ohlin-Hecksher Trade Theory Teacher of Myrdal, Ohlin (Factor Endowments)

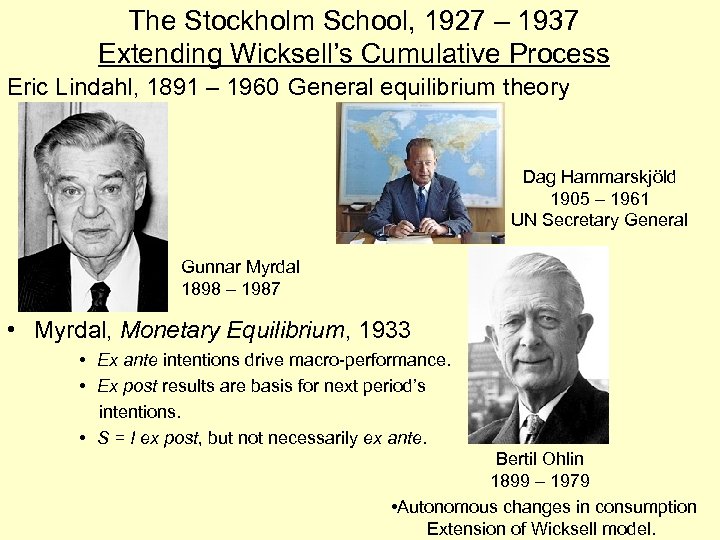

The Stockholm School, 1927 – 1937 Extending Wicksell’s Cumulative Process Eric Lindahl, 1891 – 1960 General equilibrium theory Dag Hammarskjöld 1905 – 1961 UN Secretary General Gunnar Myrdal 1898 – 1987 • Myrdal, Monetary Equilibrium, 1933 • Ex ante intentions drive macro-performance. • Ex post results are basis for next period’s intentions. • S = I ex post, but not necessarily ex ante. Bertil Ohlin 1899 – 1979 • Autonomous changes in consumption Extension of Wicksell model.

The Stockholm School, 1927 – 1937 Extending Wicksell’s Cumulative Process Eric Lindahl, 1891 – 1960 General equilibrium theory Dag Hammarskjöld 1905 – 1961 UN Secretary General Gunnar Myrdal 1898 – 1987 • Myrdal, Monetary Equilibrium, 1933 • Ex ante intentions drive macro-performance. • Ex post results are basis for next period’s intentions. • S = I ex post, but not necessarily ex ante. Bertil Ohlin 1899 – 1979 • Autonomous changes in consumption Extension of Wicksell model.

The Stockholm School Beyond Macrodynamics • Dag Hammarskjold – Secretary General of UN • Gunnar Myrdal … extensions of cumulative process • Cumulative causation – vicious circles » An American Dilemma, 1944 Brown v. Board of Education » Rich Lands and Poor, 1957 » Asian Drama, 1968 • Wife, Nobel Laureate Alva Myrdal » Director of UNESCO » Swedish Ambassador to India • Bertil Ohlin • Transfer problem (1929): income adjustment » Keynesian analysis vs. pre – General Theory Keynes • Head of opposition social – liberal People’s Party

The Stockholm School Beyond Macrodynamics • Dag Hammarskjold – Secretary General of UN • Gunnar Myrdal … extensions of cumulative process • Cumulative causation – vicious circles » An American Dilemma, 1944 Brown v. Board of Education » Rich Lands and Poor, 1957 » Asian Drama, 1968 • Wife, Nobel Laureate Alva Myrdal » Director of UNESCO » Swedish Ambassador to India • Bertil Ohlin • Transfer problem (1929): income adjustment » Keynesian analysis vs. pre – General Theory Keynes • Head of opposition social – liberal People’s Party

Sweden’s Commission on Unemployment • 1924: Return to gold standard at overvalued rate • 1927: Recession … formation of Commission • Ohlin (1934) Monetary Policy, Public Works, Subsidies and Tariffs as Means for Reducing Unemployment • Focus on Aggregate Demand, not wage reduction to get out of depression • Deficit finance of Public Works + Easy Money for Investment + Price Supports for Farmers Spending Multiplier and Investment Accelerator • Myrdal (1934) The Effects of Fiscal Policy • Countercyclical policies … balance budget over cycle » Build infrastructure in depression … not US “leaf-raking” » Easy money in recession … tight money in expansion • 1936: Swedish depression ended

Sweden’s Commission on Unemployment • 1924: Return to gold standard at overvalued rate • 1927: Recession … formation of Commission • Ohlin (1934) Monetary Policy, Public Works, Subsidies and Tariffs as Means for Reducing Unemployment • Focus on Aggregate Demand, not wage reduction to get out of depression • Deficit finance of Public Works + Easy Money for Investment + Price Supports for Farmers Spending Multiplier and Investment Accelerator • Myrdal (1934) The Effects of Fiscal Policy • Countercyclical policies … balance budget over cycle » Build infrastructure in depression … not US “leaf-raking” » Easy money in recession … tight money in expansion • 1936: Swedish depression ended

Vicious Spirals of Note • Fisher – Minsky: Debt Deflation Spiral • Foreclosure “Death Spiral” • • Wicksell: Loan rate < Real rate hyperinflation J. H. Williams: Depreciation – Inflation Spiral Myrdal: Discrimination – Poverty Spiral Debtor “Death Spiral” • Budget “Death Spiral” • Insurance “Death Spiral”

Vicious Spirals of Note • Fisher – Minsky: Debt Deflation Spiral • Foreclosure “Death Spiral” • • Wicksell: Loan rate < Real rate hyperinflation J. H. Williams: Depreciation – Inflation Spiral Myrdal: Discrimination – Poverty Spiral Debtor “Death Spiral” • Budget “Death Spiral” • Insurance “Death Spiral”