BF1_CFall2011_RR.ppt

- Количество слайдов: 63

Class Risk and Return Historical returns in the USA. Sigma. CV. Security Characteristic Line (SCL). Beta. Security Market Line (SML). CAPM formula. Security Market Line (SML). Study materials: KR: Ch. 11, 12. RWJ: Ch. 9, 10 BM: Ch. 7, 8 WIUU BF 1, v. 4/2010, A. Zaporozhetz 1

Class Risk and Return Historical returns in the USA. Sigma. CV. Security Characteristic Line (SCL). Beta. Security Market Line (SML). CAPM formula. Security Market Line (SML). Study materials: KR: Ch. 11, 12. RWJ: Ch. 9, 10 BM: Ch. 7, 8 WIUU BF 1, v. 4/2010, A. Zaporozhetz 1

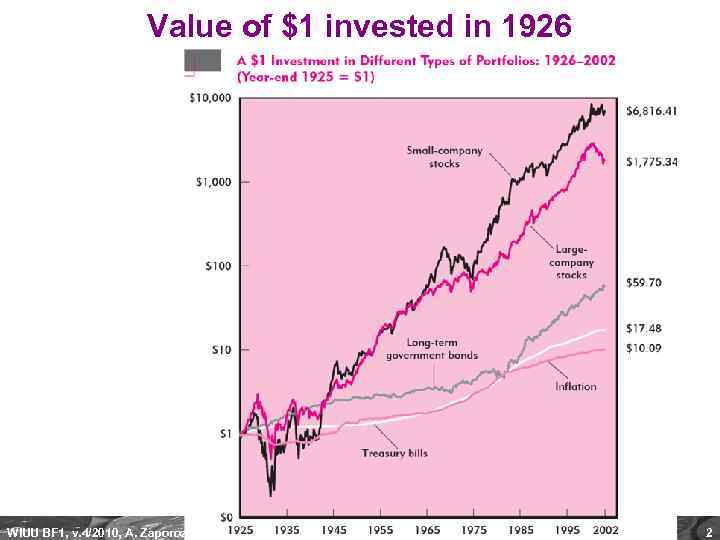

Value of $1 invested in 1926 WIUU BF 1, v. 4/2010, A. Zaporozhetz 2

Value of $1 invested in 1926 WIUU BF 1, v. 4/2010, A. Zaporozhetz 2

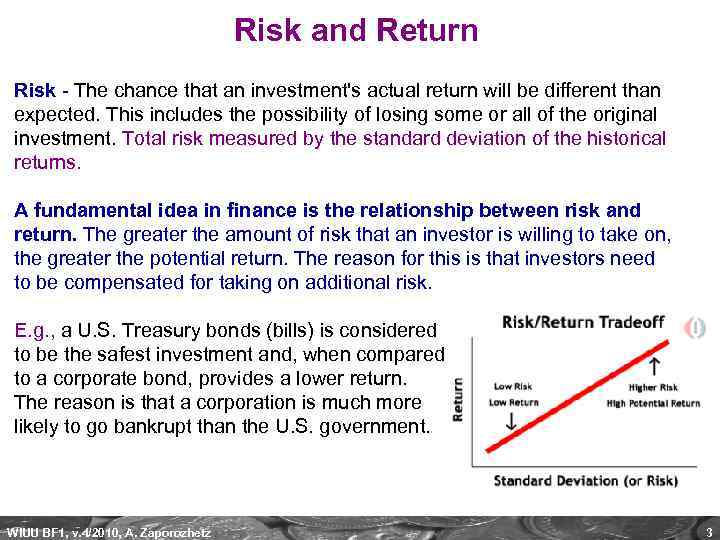

Risk and Return Risk - The chance that an investment's actual return will be different than expected. This includes the possibility of losing some or all of the original investment. Total risk measured by the standard deviation of the historical returns. A fundamental idea in finance is the relationship between risk and return. The greater the amount of risk that an investor is willing to take on, the greater the potential return. The reason for this is that investors need to be compensated for taking on additional risk. E. g. , a U. S. Treasury bonds (bills) is considered to be the safest investment and, when compared to a corporate bond, provides a lower return. The reason is that a corporation is much more likely to go bankrupt than the U. S. government. WIUU BF 1, v. 4/2010, A. Zaporozhetz 3

Risk and Return Risk - The chance that an investment's actual return will be different than expected. This includes the possibility of losing some or all of the original investment. Total risk measured by the standard deviation of the historical returns. A fundamental idea in finance is the relationship between risk and return. The greater the amount of risk that an investor is willing to take on, the greater the potential return. The reason for this is that investors need to be compensated for taking on additional risk. E. g. , a U. S. Treasury bonds (bills) is considered to be the safest investment and, when compared to a corporate bond, provides a lower return. The reason is that a corporation is much more likely to go bankrupt than the U. S. government. WIUU BF 1, v. 4/2010, A. Zaporozhetz 3

Total Risk vs. Returns WIUU BF 1, v. 4/2010, A. Zaporozhetz 4

Total Risk vs. Returns WIUU BF 1, v. 4/2010, A. Zaporozhetz 4

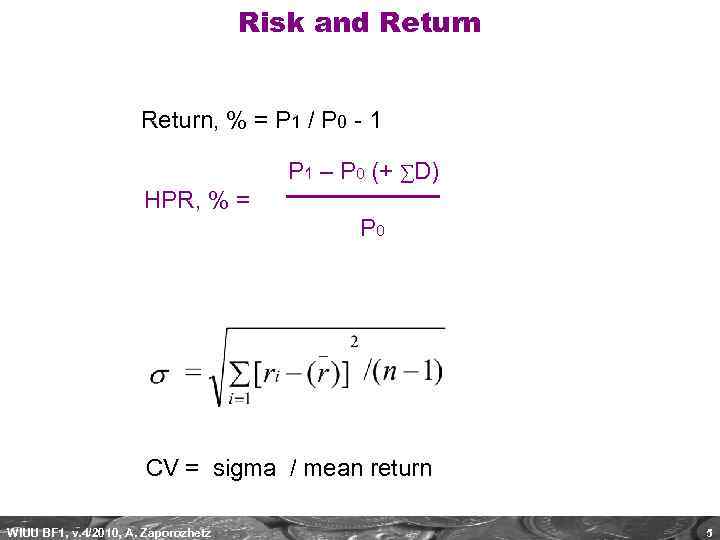

Risk and Return, % = P 1 / P 0 - 1 P 1 – P 0 (+ ∑D) HPR, % = P 0 CV = sigma / mean return WIUU BF 1, v. 4/2010, A. Zaporozhetz 5

Risk and Return, % = P 1 / P 0 - 1 P 1 – P 0 (+ ∑D) HPR, % = P 0 CV = sigma / mean return WIUU BF 1, v. 4/2010, A. Zaporozhetz 5

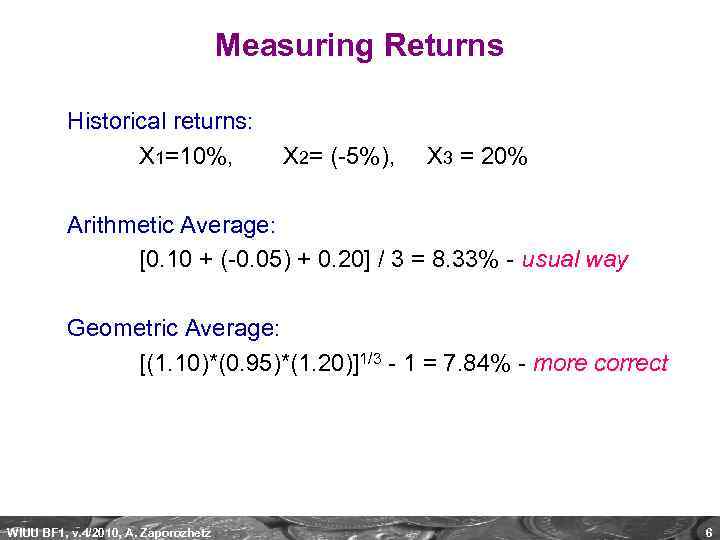

Measuring Returns Historical returns: X 1=10%, X 2= (-5%), X 3 = 20% Arithmetic Average: [0. 10 + (-0. 05) + 0. 20] / 3 = 8. 33% - usual way Geometric Average: [(1. 10)*(0. 95)*(1. 20)]1/3 - 1 = 7. 84% - more correct WIUU BF 1, v. 4/2010, A. Zaporozhetz 6

Measuring Returns Historical returns: X 1=10%, X 2= (-5%), X 3 = 20% Arithmetic Average: [0. 10 + (-0. 05) + 0. 20] / 3 = 8. 33% - usual way Geometric Average: [(1. 10)*(0. 95)*(1. 20)]1/3 - 1 = 7. 84% - more correct WIUU BF 1, v. 4/2010, A. Zaporozhetz 6

Общий риск: стандартное отклонение WIUU BF 1, v. 4/2010, A. Zaporozhetz 7

Общий риск: стандартное отклонение WIUU BF 1, v. 4/2010, A. Zaporozhetz 7

Общий риск: стандартное отклонение 2. Risk and return relationship WIUU BF 1, v. 4/2010, A. Zaporozhetz 8

Общий риск: стандартное отклонение 2. Risk and return relationship WIUU BF 1, v. 4/2010, A. Zaporozhetz 8

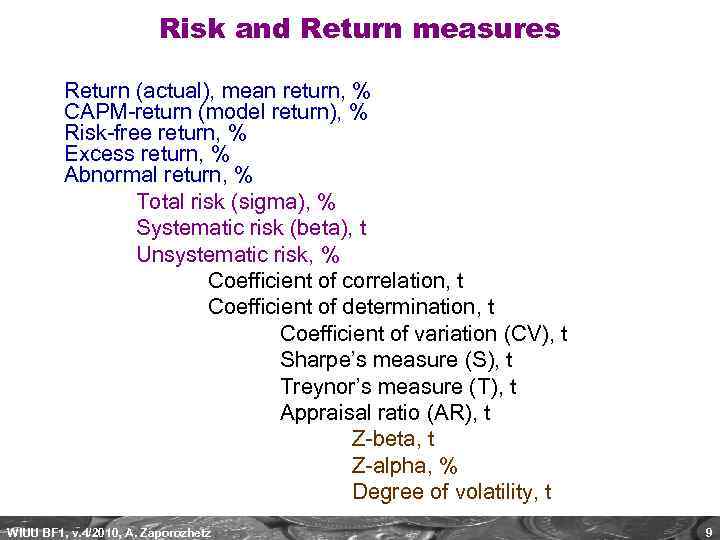

Risk and Return measures Return (actual), mean return, % CAPM-return (model return), % Risk-free return, % Excess return, % Abnormal return, % Total risk (sigma), % Systematic risk (beta), t Unsystematic risk, % Coefficient of correlation, t Coefficient of determination, t Coefficient of variation (CV), t Sharpe’s measure (S), t Treynor’s measure (T), t Appraisal ratio (AR), t Z-beta, t Z-alpha, % Degree of volatility, t WIUU BF 1, v. 4/2010, A. Zaporozhetz 9

Risk and Return measures Return (actual), mean return, % CAPM-return (model return), % Risk-free return, % Excess return, % Abnormal return, % Total risk (sigma), % Systematic risk (beta), t Unsystematic risk, % Coefficient of correlation, t Coefficient of determination, t Coefficient of variation (CV), t Sharpe’s measure (S), t Treynor’s measure (T), t Appraisal ratio (AR), t Z-beta, t Z-alpha, % Degree of volatility, t WIUU BF 1, v. 4/2010, A. Zaporozhetz 9

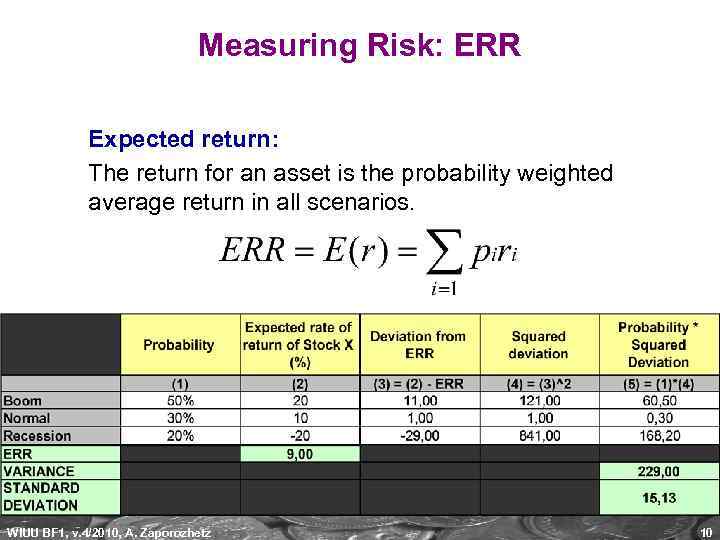

Measuring Risk: ERR Expected return: The return for an asset is the probability weighted average return in all scenarios. WIUU BF 1, v. 4/2010, A. Zaporozhetz 10

Measuring Risk: ERR Expected return: The return for an asset is the probability weighted average return in all scenarios. WIUU BF 1, v. 4/2010, A. Zaporozhetz 10

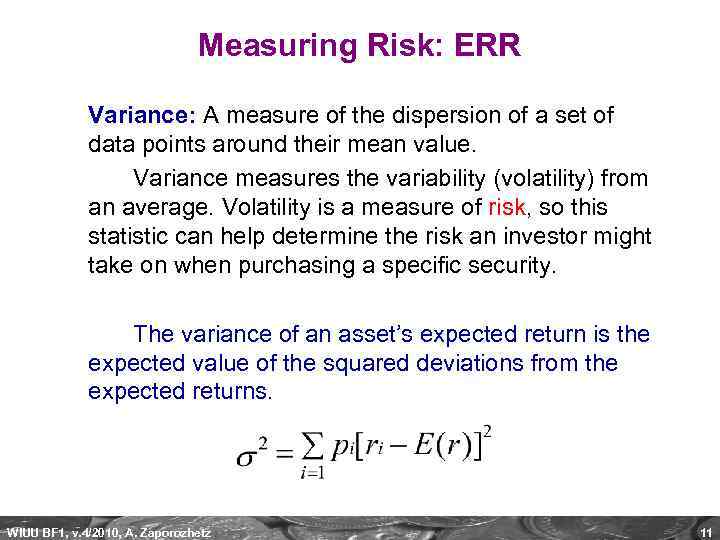

Measuring Risk: ERR Variance: A measure of the dispersion of a set of data points around their mean value. Variance measures the variability (volatility) from an average. Volatility is a measure of risk, so this statistic can help determine the risk an investor might take on when purchasing a specific security. The variance of an asset’s expected return is the expected value of the squared deviations from the expected returns. WIUU BF 1, v. 4/2010, A. Zaporozhetz 11

Measuring Risk: ERR Variance: A measure of the dispersion of a set of data points around their mean value. Variance measures the variability (volatility) from an average. Volatility is a measure of risk, so this statistic can help determine the risk an investor might take on when purchasing a specific security. The variance of an asset’s expected return is the expected value of the squared deviations from the expected returns. WIUU BF 1, v. 4/2010, A. Zaporozhetz 11

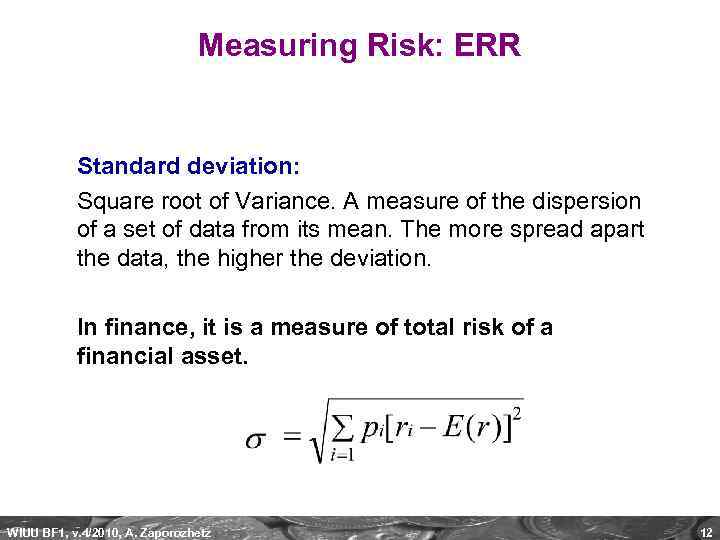

Measuring Risk: ERR Standard deviation: Square root of Variance. A measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. In finance, it is a measure of total risk of a financial asset. WIUU BF 1, v. 4/2010, A. Zaporozhetz 12

Measuring Risk: ERR Standard deviation: Square root of Variance. A measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. In finance, it is a measure of total risk of a financial asset. WIUU BF 1, v. 4/2010, A. Zaporozhetz 12

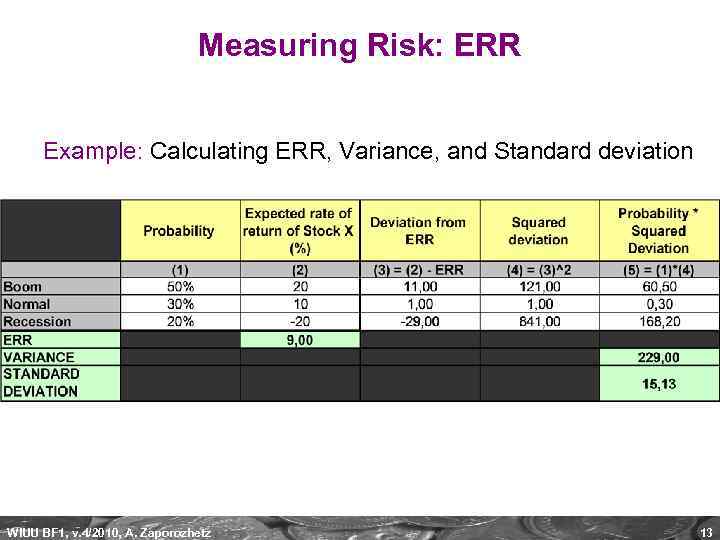

Measuring Risk: ERR Example: Calculating ERR, Variance, and Standard deviation WIUU BF 1, v. 4/2010, A. Zaporozhetz 13

Measuring Risk: ERR Example: Calculating ERR, Variance, and Standard deviation WIUU BF 1, v. 4/2010, A. Zaporozhetz 13

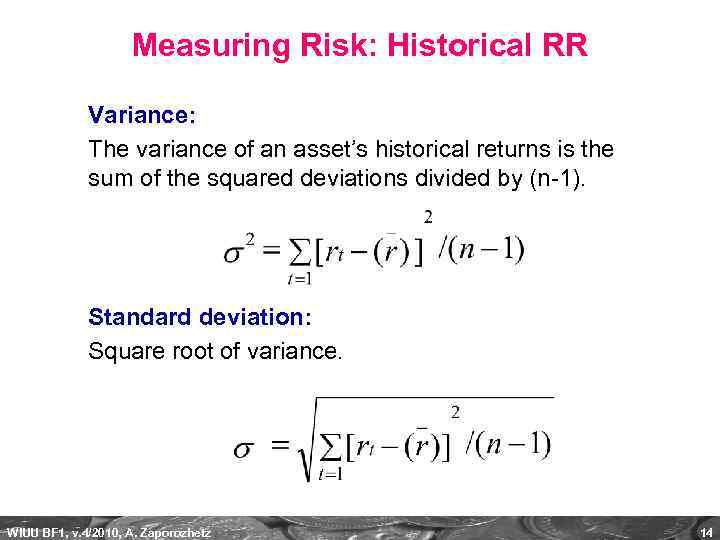

Measuring Risk: Historical RR Variance: The variance of an asset’s historical returns is the sum of the squared deviations divided by (n-1). Standard deviation: Square root of variance. WIUU BF 1, v. 4/2010, A. Zaporozhetz 14

Measuring Risk: Historical RR Variance: The variance of an asset’s historical returns is the sum of the squared deviations divided by (n-1). Standard deviation: Square root of variance. WIUU BF 1, v. 4/2010, A. Zaporozhetz 14

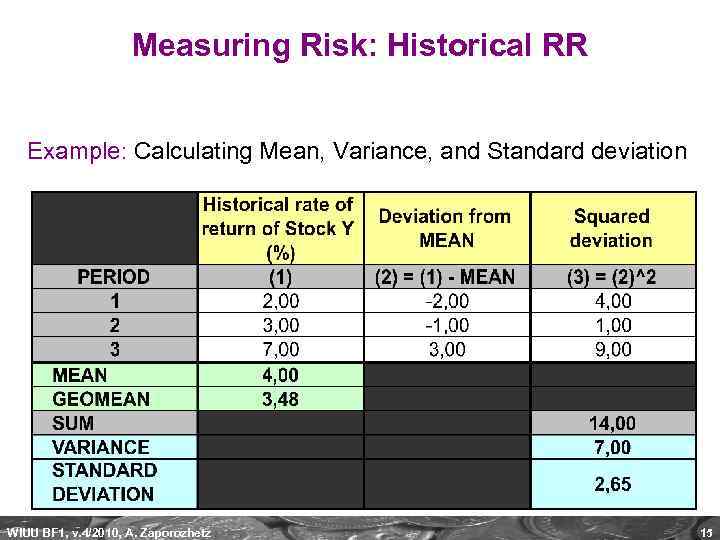

Measuring Risk: Historical RR Example: Calculating Mean, Variance, and Standard deviation WIUU BF 1, v. 4/2010, A. Zaporozhetz 15

Measuring Risk: Historical RR Example: Calculating Mean, Variance, and Standard deviation WIUU BF 1, v. 4/2010, A. Zaporozhetz 15

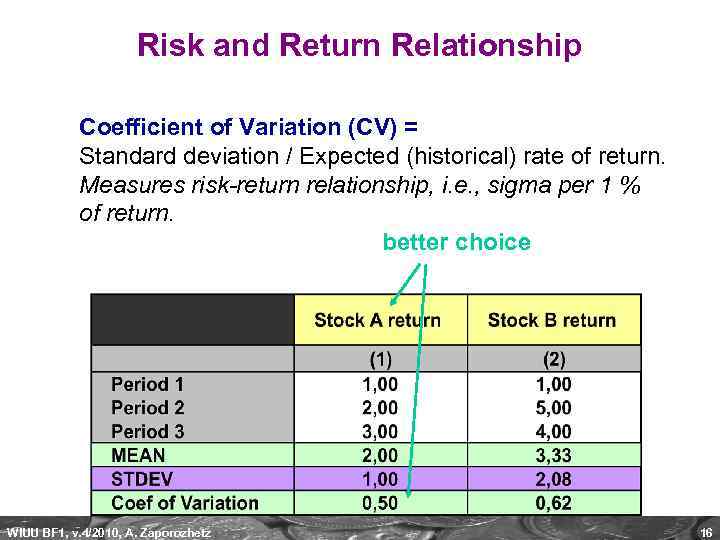

Risk and Return Relationship Coefficient of Variation (CV) = Standard deviation / Expected (historical) rate of return. Measures risk-return relationship, i. e. , sigma per 1 % of return. better choice WIUU BF 1, v. 4/2010, A. Zaporozhetz 16

Risk and Return Relationship Coefficient of Variation (CV) = Standard deviation / Expected (historical) rate of return. Measures risk-return relationship, i. e. , sigma per 1 % of return. better choice WIUU BF 1, v. 4/2010, A. Zaporozhetz 16

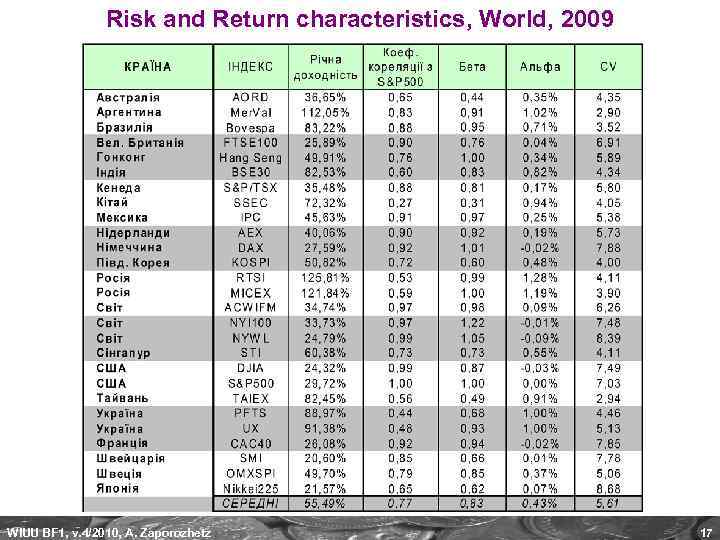

Risk and Return characteristics, World, 2009 WIUU BF 1, v. 4/2010, A. Zaporozhetz 17

Risk and Return characteristics, World, 2009 WIUU BF 1, v. 4/2010, A. Zaporozhetz 17

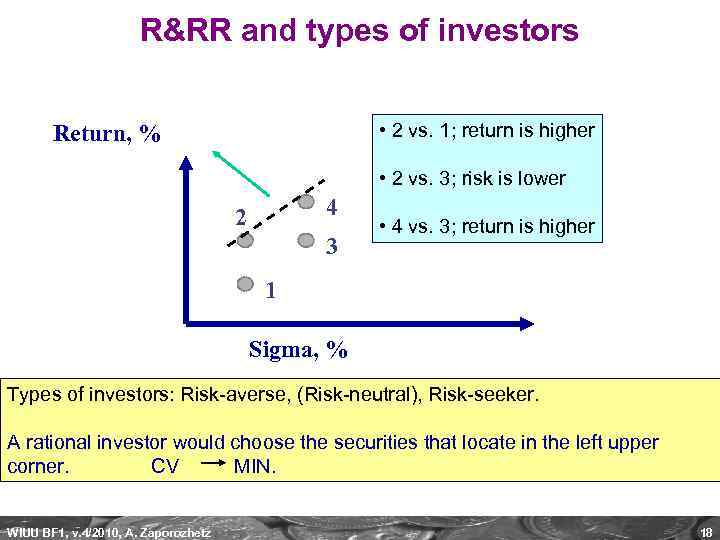

R&RR and types of investors • 2 vs. 1; return is higher Return, % • 2 vs. 3; risk is lower 4 2 3 • 4 vs. 3; return is higher 1 Sigma, % Types of investors: Risk-averse, (Risk-neutral), Risk-seeker. A rational investor would choose the securities that locate in the left upper corner. CV MIN. WIUU BF 1, v. 4/2010, A. Zaporozhetz 18

R&RR and types of investors • 2 vs. 1; return is higher Return, % • 2 vs. 3; risk is lower 4 2 3 • 4 vs. 3; return is higher 1 Sigma, % Types of investors: Risk-averse, (Risk-neutral), Risk-seeker. A rational investor would choose the securities that locate in the left upper corner. CV MIN. WIUU BF 1, v. 4/2010, A. Zaporozhetz 18

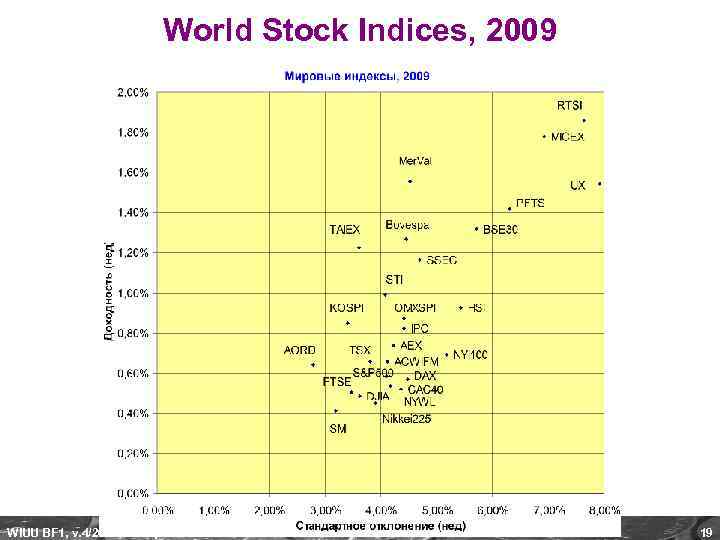

World Stock Indices, 2009 WIUU BF 1, v. 4/2010, A. Zaporozhetz 19

World Stock Indices, 2009 WIUU BF 1, v. 4/2010, A. Zaporozhetz 19

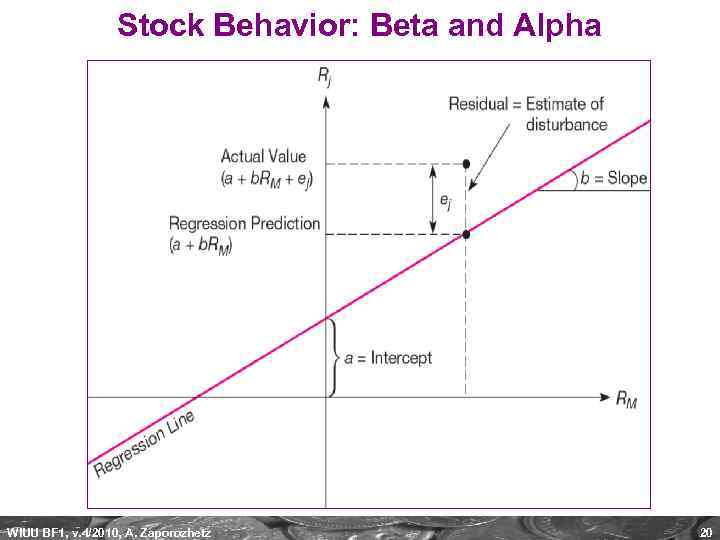

Stock Behavior: Beta and Alpha WIUU BF 1, v. 4/2010, A. Zaporozhetz 20

Stock Behavior: Beta and Alpha WIUU BF 1, v. 4/2010, A. Zaporozhetz 20

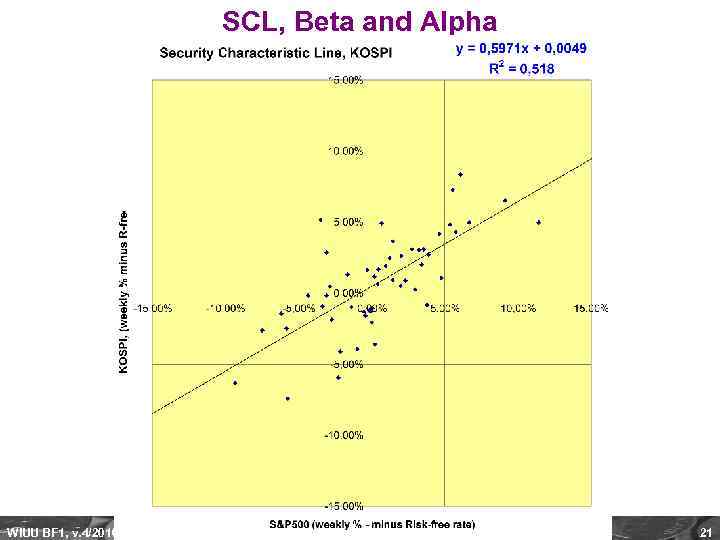

SCL, Beta and Alpha WIUU BF 1, v. 4/2010, A. Zaporozhetz 21

SCL, Beta and Alpha WIUU BF 1, v. 4/2010, A. Zaporozhetz 21

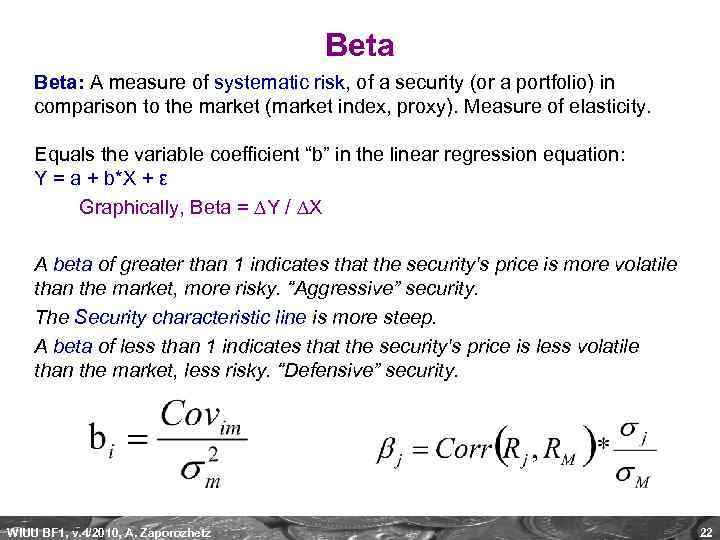

Beta: A measure of systematic risk, of a security (or a portfolio) in comparison to the market (market index, proxy). Measure of elasticity. Equals the variable coefficient “b” in the linear regression equation: Y = a + b*X + ε Graphically, Beta = Y / X A beta of greater than 1 indicates that the security's price is more volatile than the market, more risky. “Aggressive” security. The Security characteristic line is more steep. A beta of less than 1 indicates that the security's price is less volatile than the market, less risky. “Defensive” security. WIUU BF 1, v. 4/2010, A. Zaporozhetz 22

Beta: A measure of systematic risk, of a security (or a portfolio) in comparison to the market (market index, proxy). Measure of elasticity. Equals the variable coefficient “b” in the linear regression equation: Y = a + b*X + ε Graphically, Beta = Y / X A beta of greater than 1 indicates that the security's price is more volatile than the market, more risky. “Aggressive” security. The Security characteristic line is more steep. A beta of less than 1 indicates that the security's price is less volatile than the market, less risky. “Defensive” security. WIUU BF 1, v. 4/2010, A. Zaporozhetz 22

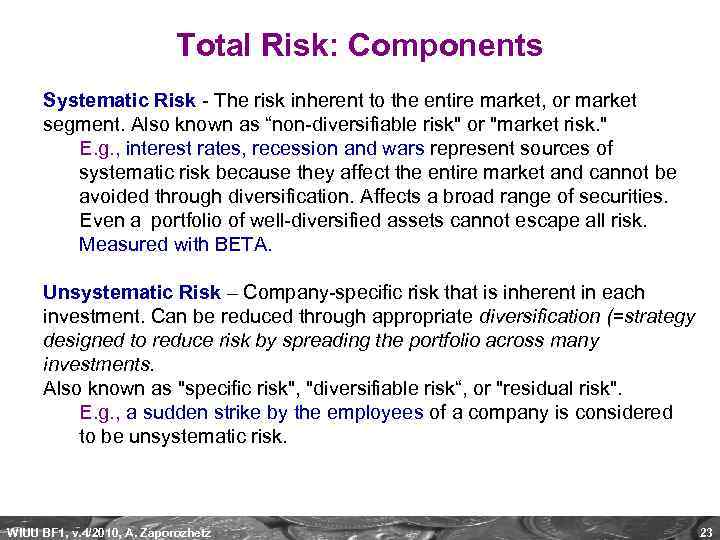

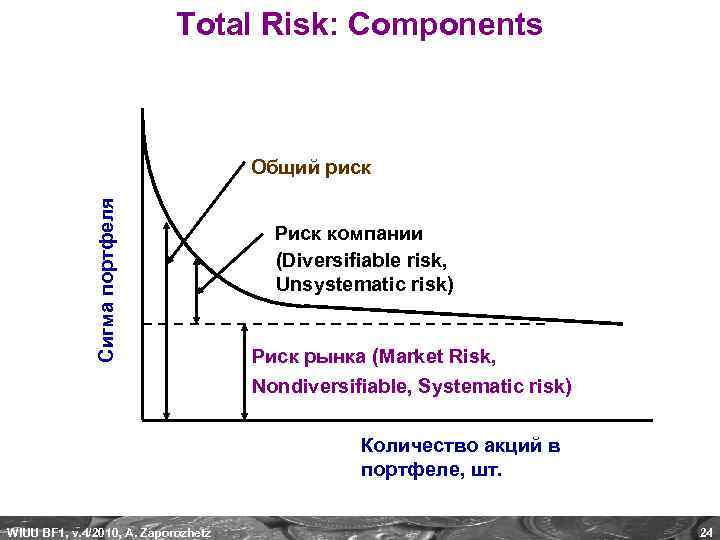

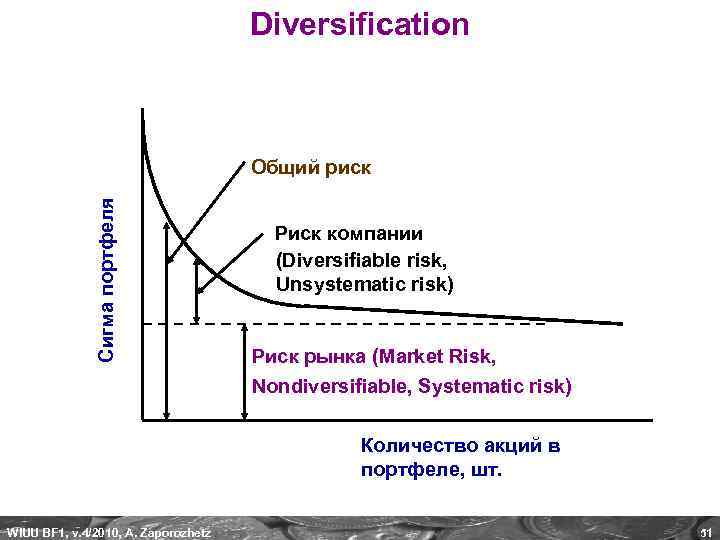

Total Risk: Components Systematic Risk - The risk inherent to the entire market, or market segment. Also known as “non-diversifiable risk" or "market risk. " E. g. , interest rates, recession and wars represent sources of systematic risk because they affect the entire market and cannot be avoided through diversification. Affects a broad range of securities. Even a portfolio of well-diversified assets cannot escape all risk. Measured with BETA. Unsystematic Risk – Company-specific risk that is inherent in each investment. Can be reduced through appropriate diversification (=strategy designed to reduce risk by spreading the portfolio across many investments. Also known as "specific risk", "diversifiable risk“, or "residual risk". E. g. , a sudden strike by the employees of a company is considered to be unsystematic risk. WIUU BF 1, v. 4/2010, A. Zaporozhetz 23

Total Risk: Components Systematic Risk - The risk inherent to the entire market, or market segment. Also known as “non-diversifiable risk" or "market risk. " E. g. , interest rates, recession and wars represent sources of systematic risk because they affect the entire market and cannot be avoided through diversification. Affects a broad range of securities. Even a portfolio of well-diversified assets cannot escape all risk. Measured with BETA. Unsystematic Risk – Company-specific risk that is inherent in each investment. Can be reduced through appropriate diversification (=strategy designed to reduce risk by spreading the portfolio across many investments. Also known as "specific risk", "diversifiable risk“, or "residual risk". E. g. , a sudden strike by the employees of a company is considered to be unsystematic risk. WIUU BF 1, v. 4/2010, A. Zaporozhetz 23

Total Risk: Components Сигма портфеля Общий риск Риск компании (Diversifiable risk, Unsystematic risk) Риск рынка (Market Risk, Nondiversifiable, Systematic risk) Количество акций в портфеле, шт. WIUU BF 1, v. 4/2010, A. Zaporozhetz 24

Total Risk: Components Сигма портфеля Общий риск Риск компании (Diversifiable risk, Unsystematic risk) Риск рынка (Market Risk, Nondiversifiable, Systematic risk) Количество акций в портфеле, шт. WIUU BF 1, v. 4/2010, A. Zaporozhetz 24

Безрисковая доходность WIUU BF 1, v. 4/2010, A. Zaporozhetz 25

Безрисковая доходность WIUU BF 1, v. 4/2010, A. Zaporozhetz 25

Безрисковая доходность WIUU BF 1, v. 4/2010, A. Zaporozhetz 26

Безрисковая доходность WIUU BF 1, v. 4/2010, A. Zaporozhetz 26

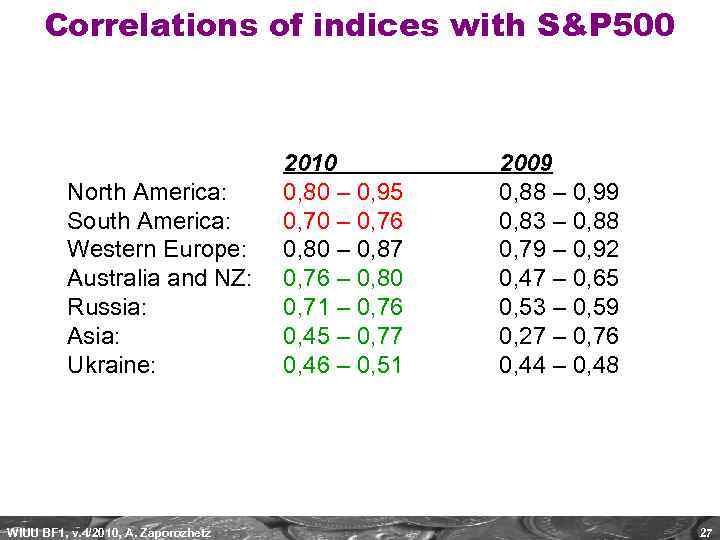

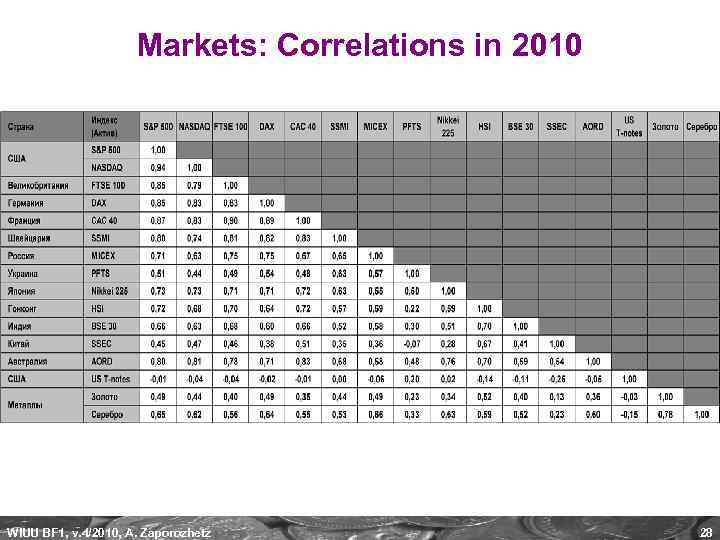

Correlations of indices with S&P 500 2010 North America: 0, 80 – 0, 95 South America: 0, 70 – 0, 76 Western Europe: 0, 80 – 0, 87 Australia and NZ: 0, 76 – 0, 80 Russia: 0, 71 – 0, 76 Asia: 0, 45 – 0, 77 Ukraine: 0, 46 – 0, 51 WIUU BF 1, v. 4/2010, A. Zaporozhetz 2009 0, 88 – 0, 99 0, 83 – 0, 88 0, 79 – 0, 92 0, 47 – 0, 65 0, 53 – 0, 59 0, 27 – 0, 76 0, 44 – 0, 48 27

Correlations of indices with S&P 500 2010 North America: 0, 80 – 0, 95 South America: 0, 70 – 0, 76 Western Europe: 0, 80 – 0, 87 Australia and NZ: 0, 76 – 0, 80 Russia: 0, 71 – 0, 76 Asia: 0, 45 – 0, 77 Ukraine: 0, 46 – 0, 51 WIUU BF 1, v. 4/2010, A. Zaporozhetz 2009 0, 88 – 0, 99 0, 83 – 0, 88 0, 79 – 0, 92 0, 47 – 0, 65 0, 53 – 0, 59 0, 27 – 0, 76 0, 44 – 0, 48 27

Markets: Correlations in 2010 WIUU BF 1, v. 4/2010, A. Zaporozhetz 28

Markets: Correlations in 2010 WIUU BF 1, v. 4/2010, A. Zaporozhetz 28

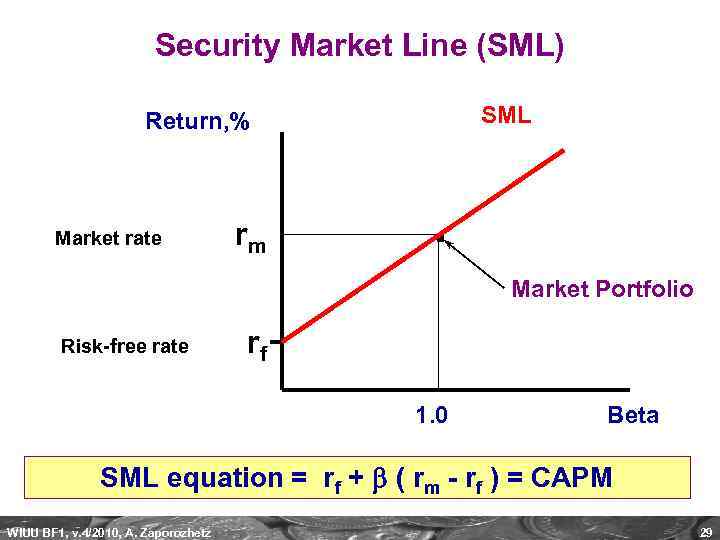

Security Market Line (SML) SML Return, % Market rate rm . Market Portfolio Risk-free rate rf 1. 0 Beta SML equation = rf + ( rm - rf ) = CAPM WIUU BF 1, v. 4/2010, A. Zaporozhetz 29

Security Market Line (SML) SML Return, % Market rate rm . Market Portfolio Risk-free rate rf 1. 0 Beta SML equation = rf + ( rm - rf ) = CAPM WIUU BF 1, v. 4/2010, A. Zaporozhetz 29

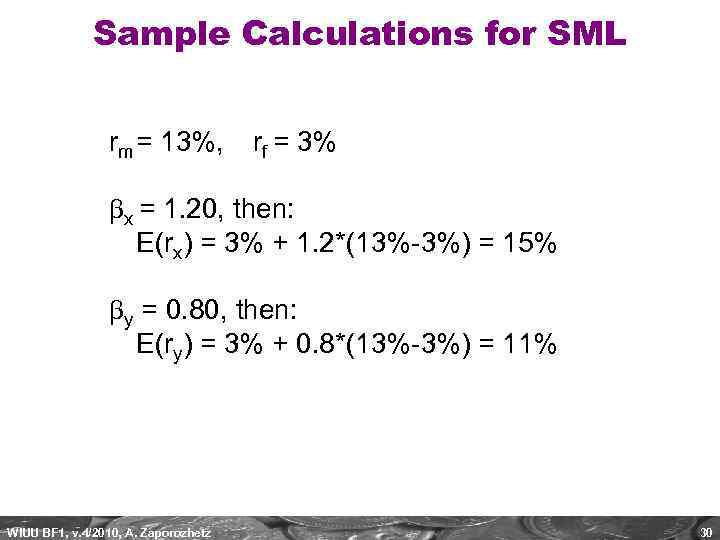

Sample Calculations for SML rm = 13%, rf = 3% x = 1. 20, then: E(rx) = 3% + 1. 2*(13%-3%) = 15% y = 0. 80, then: E(ry) = 3% + 0. 8*(13%-3%) = 11% WIUU BF 1, v. 4/2010, A. Zaporozhetz 30

Sample Calculations for SML rm = 13%, rf = 3% x = 1. 20, then: E(rx) = 3% + 1. 2*(13%-3%) = 15% y = 0. 80, then: E(ry) = 3% + 0. 8*(13%-3%) = 11% WIUU BF 1, v. 4/2010, A. Zaporozhetz 30

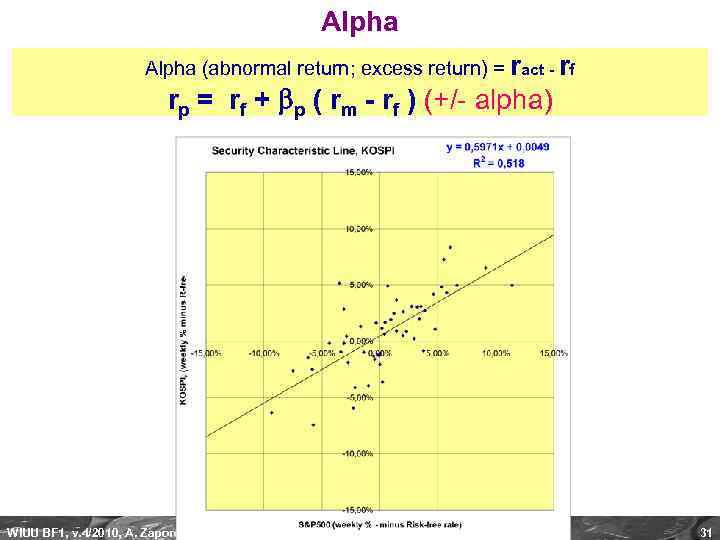

Alpha (abnormal return; excess return) = ract - rf rp = rf + p ( rm - rf ) (+/- alpha) WIUU BF 1, v. 4/2010, A. Zaporozhetz 31

Alpha (abnormal return; excess return) = ract - rf rp = rf + p ( rm - rf ) (+/- alpha) WIUU BF 1, v. 4/2010, A. Zaporozhetz 31

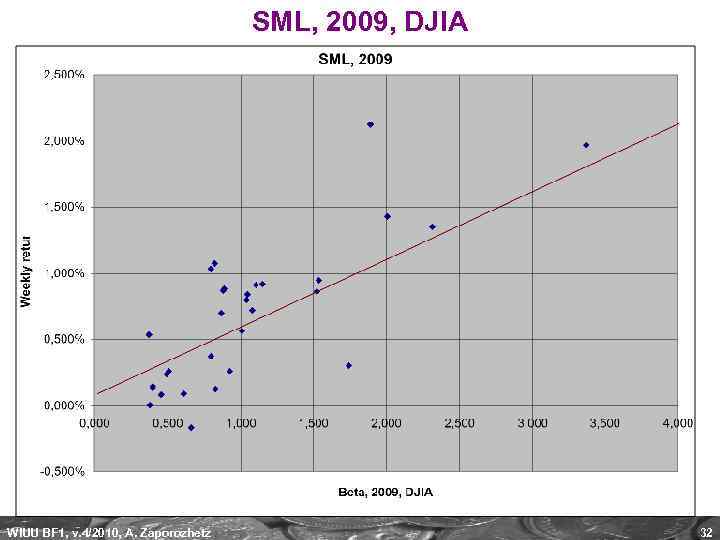

SML, 2009, DJIA WIUU BF 1, v. 4/2010, A. Zaporozhetz 32

SML, 2009, DJIA WIUU BF 1, v. 4/2010, A. Zaporozhetz 32

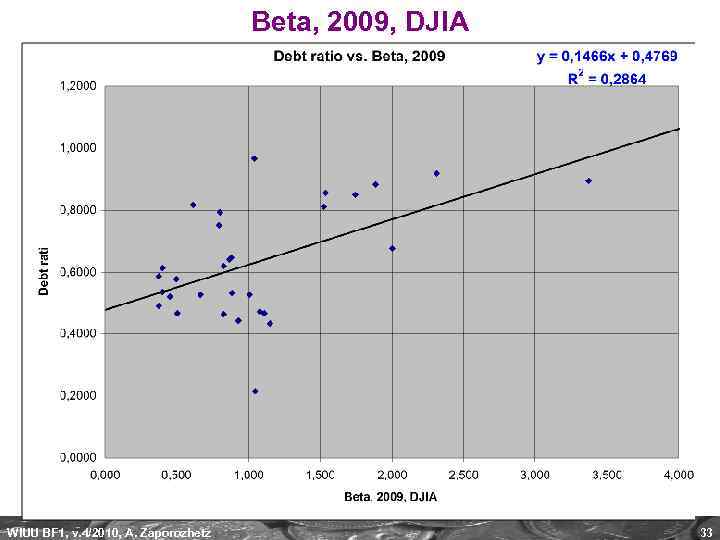

Beta, 2009, DJIA WIUU BF 1, v. 4/2010, A. Zaporozhetz 33

Beta, 2009, DJIA WIUU BF 1, v. 4/2010, A. Zaporozhetz 33

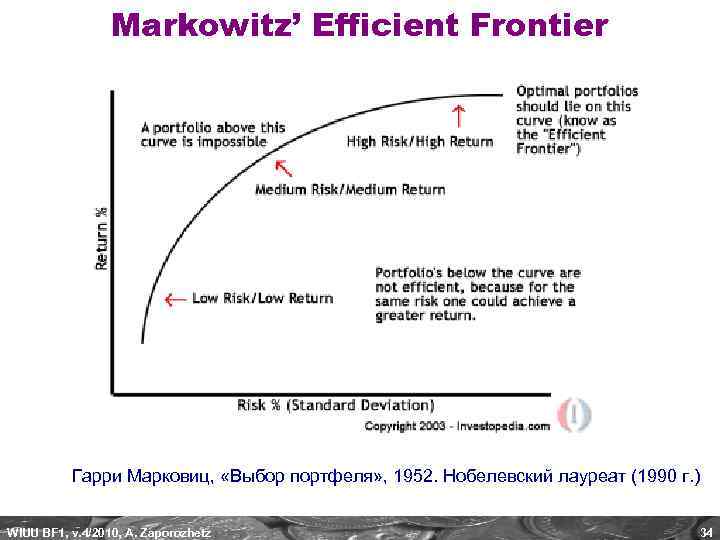

Markowitz’ Efficient Frontier Гарри Марковиц, «Выбор портфеля» , 1952. Нобелевский лауреат (1990 г. ) WIUU BF 1, v. 4/2010, A. Zaporozhetz 34

Markowitz’ Efficient Frontier Гарри Марковиц, «Выбор портфеля» , 1952. Нобелевский лауреат (1990 г. ) WIUU BF 1, v. 4/2010, A. Zaporozhetz 34

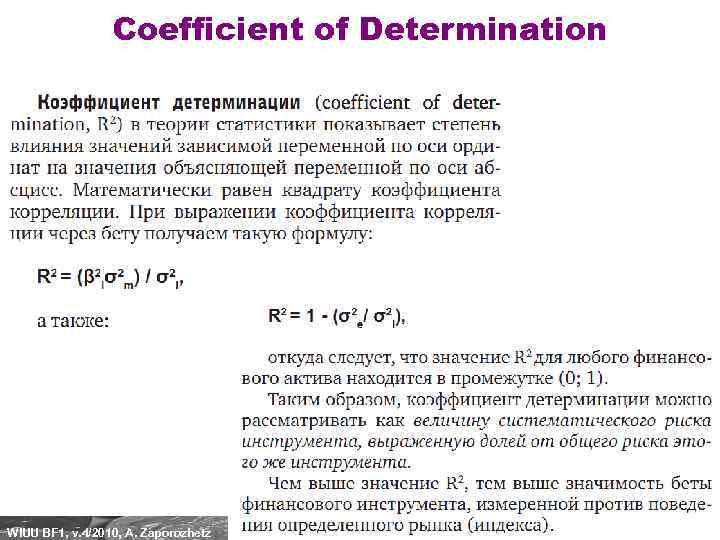

Coefficient of Determination WIUU BF 1, v. 4/2010, A. Zaporozhetz 35

Coefficient of Determination WIUU BF 1, v. 4/2010, A. Zaporozhetz 35

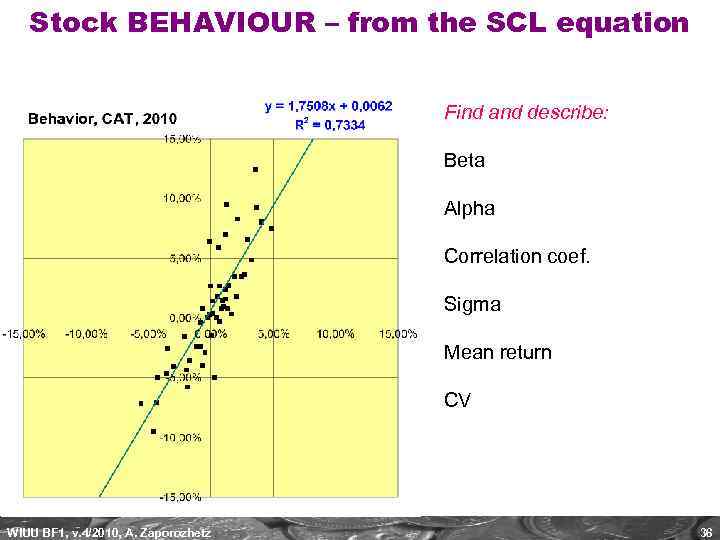

Stock BEHAVIOUR – from the SCL equation Find and describe: Beta Alpha Correlation coef. Sigma Mean return CV WIUU BF 1, v. 4/2010, A. Zaporozhetz 36

Stock BEHAVIOUR – from the SCL equation Find and describe: Beta Alpha Correlation coef. Sigma Mean return CV WIUU BF 1, v. 4/2010, A. Zaporozhetz 36

Class Risk and Return Additional materials (Advanced level) WIUU BF 1, v. 4/2010, A. Zaporozhetz 37

Class Risk and Return Additional materials (Advanced level) WIUU BF 1, v. 4/2010, A. Zaporozhetz 37

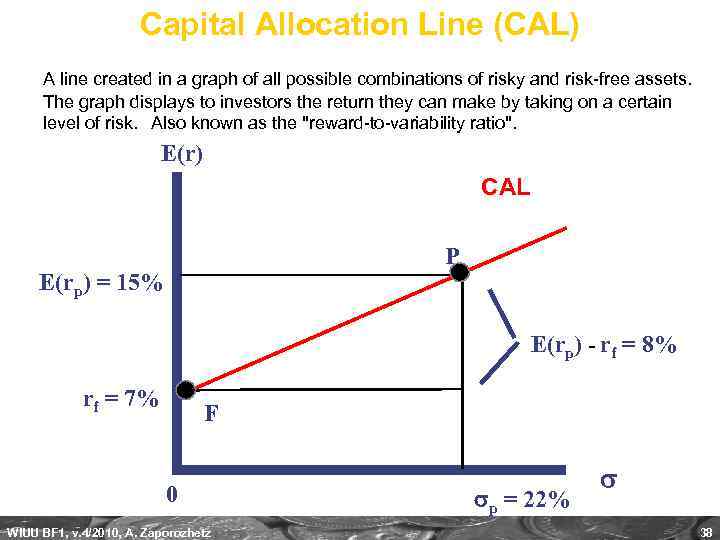

Capital Allocation Line (CAL) A line created in a graph of all possible combinations of risky and risk-free assets. The graph displays to investors the return they can make by taking on a certain level of risk. Also known as the "reward-to-variability ratio". E(r) CAL P E(rp) = 15% E(rp) - rf = 8% rf = 7% F 0 WIUU BF 1, v. 4/2010, A. Zaporozhetz p = 22% 38

Capital Allocation Line (CAL) A line created in a graph of all possible combinations of risky and risk-free assets. The graph displays to investors the return they can make by taking on a certain level of risk. Also known as the "reward-to-variability ratio". E(r) CAL P E(rp) = 15% E(rp) - rf = 8% rf = 7% F 0 WIUU BF 1, v. 4/2010, A. Zaporozhetz p = 22% 38

Portfolio risk and return: Return The rate of return on a portfolio is a weighted average of the rates of return of each asset comprising the portfolio, with the portfolio proportions ($) as weights. rp = w 1 r 1 + w 2 r 2 w 1 = Proportion of funds in Security 1, % w 2 = Proportion of funds in Security 2, % r 1 = Expected return on Security 1, % r 2 = Expected return on Security 2, % WIUU BF 1, v. 4/2010, A. Zaporozhetz 39

Portfolio risk and return: Return The rate of return on a portfolio is a weighted average of the rates of return of each asset comprising the portfolio, with the portfolio proportions ($) as weights. rp = w 1 r 1 + w 2 r 2 w 1 = Proportion of funds in Security 1, % w 2 = Proportion of funds in Security 2, % r 1 = Expected return on Security 1, % r 2 = Expected return on Security 2, % WIUU BF 1, v. 4/2010, A. Zaporozhetz 39

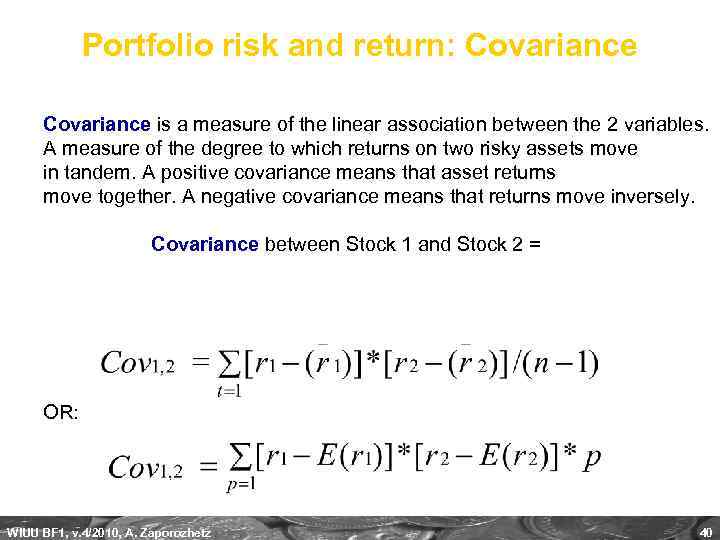

Portfolio risk and return: Covariance is a measure of the linear association between the 2 variables. A measure of the degree to which returns on two risky assets move in tandem. A positive covariance means that asset returns move together. A negative covariance means that returns move inversely. Covariance between Stock 1 and Stock 2 = OR: WIUU BF 1, v. 4/2010, A. Zaporozhetz 40

Portfolio risk and return: Covariance is a measure of the linear association between the 2 variables. A measure of the degree to which returns on two risky assets move in tandem. A positive covariance means that asset returns move together. A negative covariance means that returns move inversely. Covariance between Stock 1 and Stock 2 = OR: WIUU BF 1, v. 4/2010, A. Zaporozhetz 40

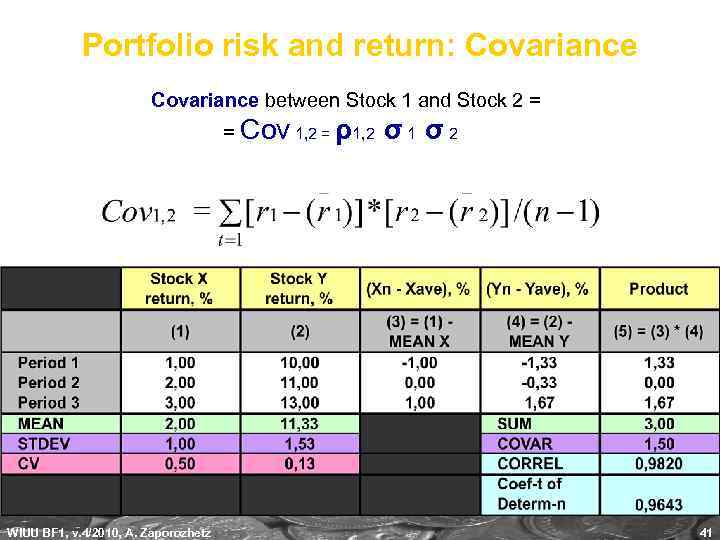

Portfolio risk and return: Covariance between Stock 1 and Stock 2 = = Cov 1, 2 = ρ1, 2 σ 1 σ 2 WIUU BF 1, v. 4/2010, A. Zaporozhetz 41

Portfolio risk and return: Covariance between Stock 1 and Stock 2 = = Cov 1, 2 = ρ1, 2 σ 1 σ 2 WIUU BF 1, v. 4/2010, A. Zaporozhetz 41

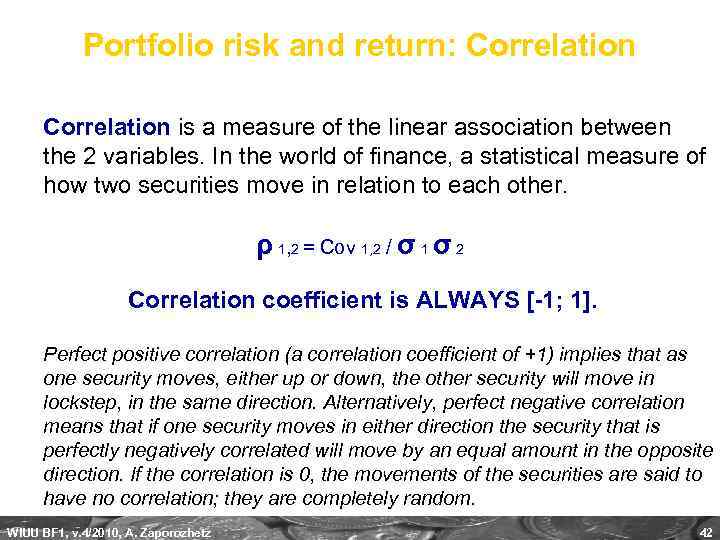

Portfolio risk and return: Correlation is a measure of the linear association between the 2 variables. In the world of finance, a statistical measure of how two securities move in relation to each other. ρ 1, 2 = Cov 1, 2 / σ 1 σ 2 Correlation coefficient is ALWAYS [-1; 1]. Perfect positive correlation (a correlation coefficient of +1) implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move by an equal amount in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random. WIUU BF 1, v. 4/2010, A. Zaporozhetz 42

Portfolio risk and return: Correlation is a measure of the linear association between the 2 variables. In the world of finance, a statistical measure of how two securities move in relation to each other. ρ 1, 2 = Cov 1, 2 / σ 1 σ 2 Correlation coefficient is ALWAYS [-1; 1]. Perfect positive correlation (a correlation coefficient of +1) implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move by an equal amount in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random. WIUU BF 1, v. 4/2010, A. Zaporozhetz 42

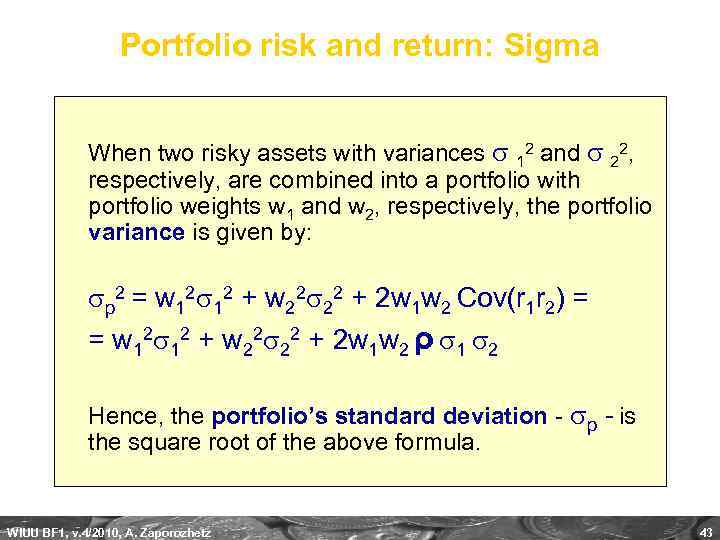

Portfolio risk and return: Sigma When two risky assets with variances 12 and 22, respectively, are combined into a portfolio with portfolio weights w 1 and w 2, respectively, the portfolio variance is given by: p 2 = w 12 12 + w 22 22 + 2 w 1 w 2 Cov(r 1 r 2) = = w 12 12 + w 22 22 + 2 w 1 w 2 ρ 1 2 Hence, the portfolio’s standard deviation - p - is the square root of the above formula. WIUU BF 1, v. 4/2010, A. Zaporozhetz 43

Portfolio risk and return: Sigma When two risky assets with variances 12 and 22, respectively, are combined into a portfolio with portfolio weights w 1 and w 2, respectively, the portfolio variance is given by: p 2 = w 12 12 + w 22 22 + 2 w 1 w 2 Cov(r 1 r 2) = = w 12 12 + w 22 22 + 2 w 1 w 2 ρ 1 2 Hence, the portfolio’s standard deviation - p - is the square root of the above formula. WIUU BF 1, v. 4/2010, A. Zaporozhetz 43

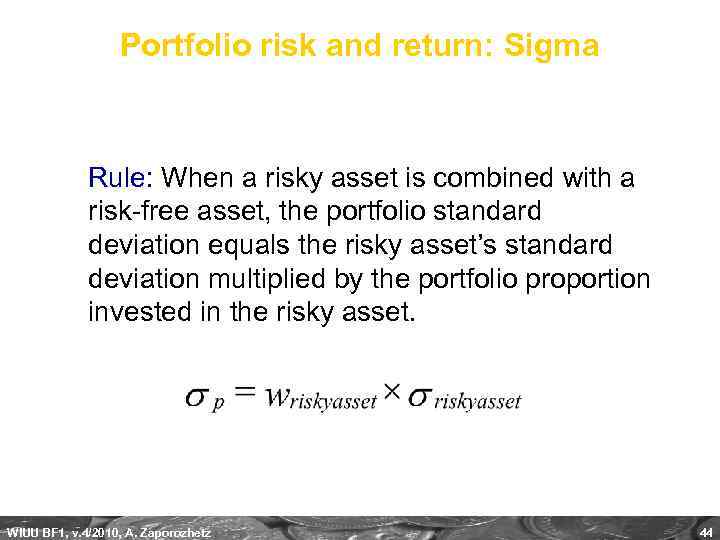

Portfolio risk and return: Sigma Rule: When a risky asset is combined with a risk-free asset, the portfolio standard deviation equals the risky asset’s standard deviation multiplied by the portfolio proportion invested in the risky asset. WIUU BF 1, v. 4/2010, A. Zaporozhetz 44

Portfolio risk and return: Sigma Rule: When a risky asset is combined with a risk-free asset, the portfolio standard deviation equals the risky asset’s standard deviation multiplied by the portfolio proportion invested in the risky asset. WIUU BF 1, v. 4/2010, A. Zaporozhetz 44

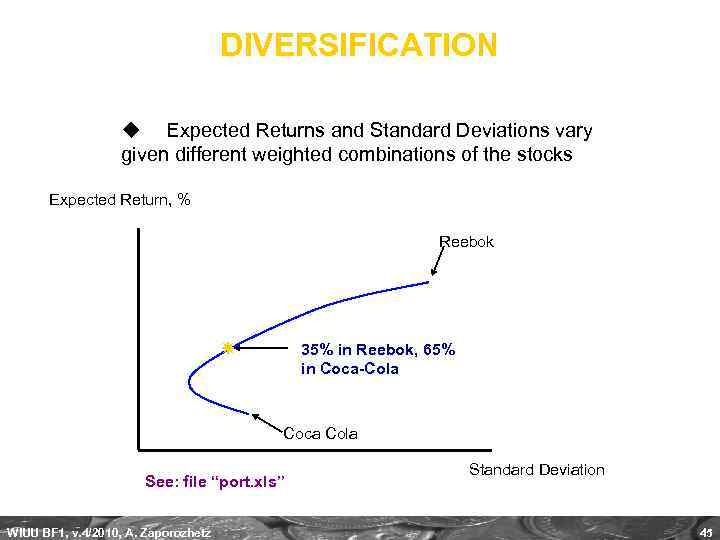

DIVERSIFICATION u Expected Returns and Standard Deviations vary given different weighted combinations of the stocks Expected Return, % Reebok 35% in Reebok, 65% in Coca-Cola Coca Cola See: file “port. xls” WIUU BF 1, v. 4/2010, A. Zaporozhetz Standard Deviation 45

DIVERSIFICATION u Expected Returns and Standard Deviations vary given different weighted combinations of the stocks Expected Return, % Reebok 35% in Reebok, 65% in Coca-Cola Coca Cola See: file “port. xls” WIUU BF 1, v. 4/2010, A. Zaporozhetz Standard Deviation 45

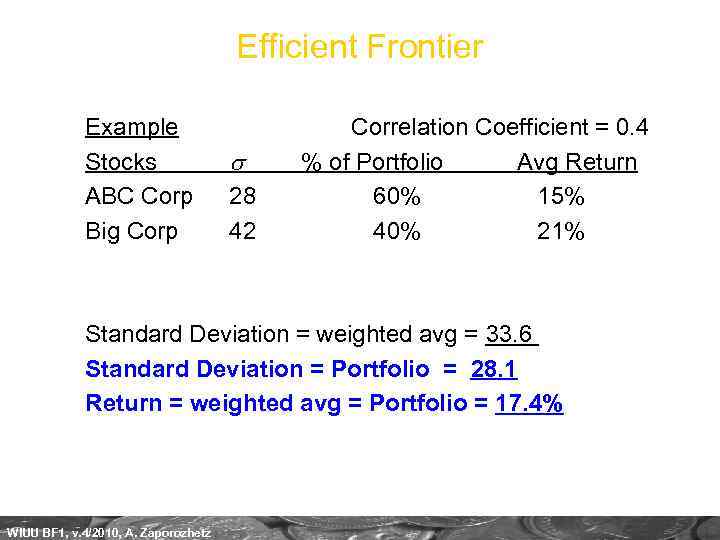

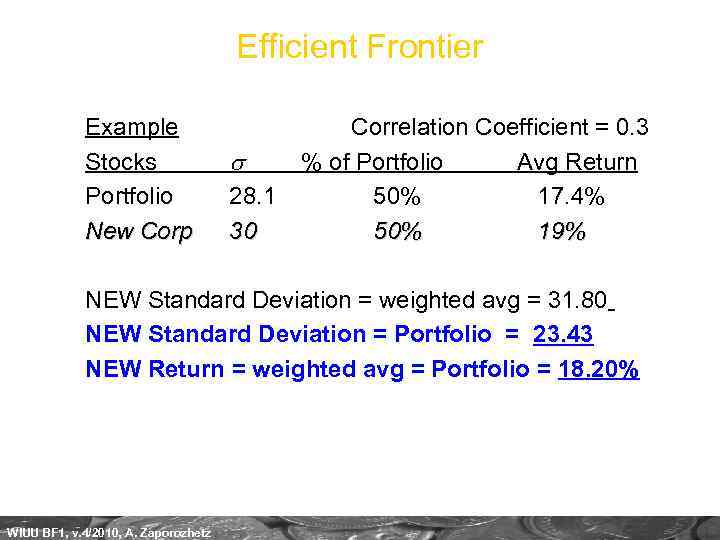

Efficient Frontier Example Correlation Coefficient = 0. 4 Stocks s % of Portfolio Avg Return ABC Corp 28 60% 15% Big Corp 42 40% 21% Standard Deviation = weighted avg = 33. 6 Standard Deviation = Portfolio = 28. 1 Return = weighted avg = Portfolio = 17. 4% WIUU BF 1, v. 4/2010, A. Zaporozhetz

Efficient Frontier Example Correlation Coefficient = 0. 4 Stocks s % of Portfolio Avg Return ABC Corp 28 60% 15% Big Corp 42 40% 21% Standard Deviation = weighted avg = 33. 6 Standard Deviation = Portfolio = 28. 1 Return = weighted avg = Portfolio = 17. 4% WIUU BF 1, v. 4/2010, A. Zaporozhetz

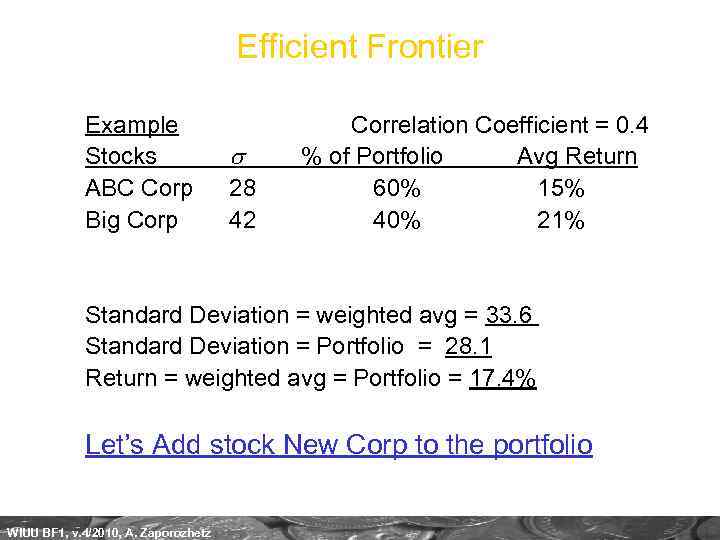

Efficient Frontier Example Correlation Coefficient = 0. 4 Stocks s % of Portfolio Avg Return ABC Corp 28 60% 15% Big Corp 42 40% 21% Standard Deviation = weighted avg = 33. 6 Standard Deviation = Portfolio = 28. 1 Return = weighted avg = Portfolio = 17. 4% Let’s Add stock New Corp to the portfolio WIUU BF 1, v. 4/2010, A. Zaporozhetz

Efficient Frontier Example Correlation Coefficient = 0. 4 Stocks s % of Portfolio Avg Return ABC Corp 28 60% 15% Big Corp 42 40% 21% Standard Deviation = weighted avg = 33. 6 Standard Deviation = Portfolio = 28. 1 Return = weighted avg = Portfolio = 17. 4% Let’s Add stock New Corp to the portfolio WIUU BF 1, v. 4/2010, A. Zaporozhetz

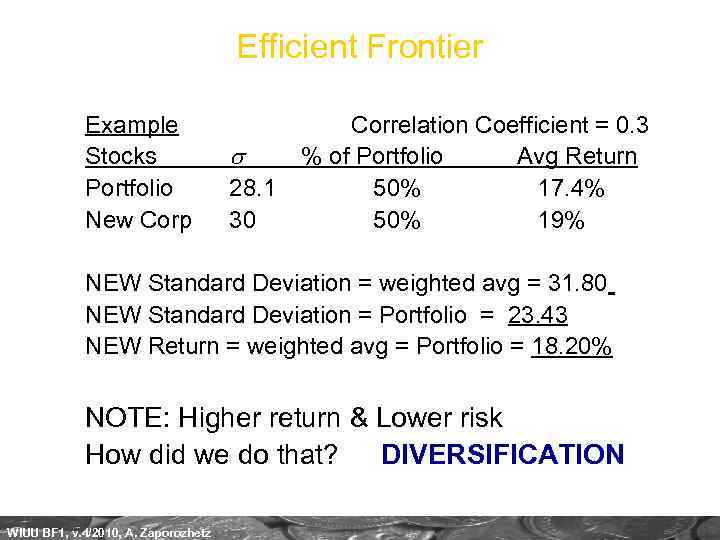

Efficient Frontier Example Correlation Coefficient = 0. 3 Stocks s % of Portfolio Avg Return Portfolio 28. 1 50% 17. 4% New Corp 30 50% 19% NEW Standard Deviation = weighted avg = 31. 80 NEW Standard Deviation = Portfolio = 23. 43 NEW Return = weighted avg = Portfolio = 18. 20% WIUU BF 1, v. 4/2010, A. Zaporozhetz

Efficient Frontier Example Correlation Coefficient = 0. 3 Stocks s % of Portfolio Avg Return Portfolio 28. 1 50% 17. 4% New Corp 30 50% 19% NEW Standard Deviation = weighted avg = 31. 80 NEW Standard Deviation = Portfolio = 23. 43 NEW Return = weighted avg = Portfolio = 18. 20% WIUU BF 1, v. 4/2010, A. Zaporozhetz

Efficient Frontier Example Correlation Coefficient = 0. 3 Stocks s % of Portfolio Avg Return Portfolio 28. 1 50% 17. 4% New Corp 30 50% 19% NEW Standard Deviation = weighted avg = 31. 80 NEW Standard Deviation = Portfolio = 23. 43 NEW Return = weighted avg = Portfolio = 18. 20% NOTE: Higher return & Lower risk How did we do that? DIVERSIFICATION WIUU BF 1, v. 4/2010, A. Zaporozhetz

Efficient Frontier Example Correlation Coefficient = 0. 3 Stocks s % of Portfolio Avg Return Portfolio 28. 1 50% 17. 4% New Corp 30 50% 19% NEW Standard Deviation = weighted avg = 31. 80 NEW Standard Deviation = Portfolio = 23. 43 NEW Return = weighted avg = Portfolio = 18. 20% NOTE: Higher return & Lower risk How did we do that? DIVERSIFICATION WIUU BF 1, v. 4/2010, A. Zaporozhetz

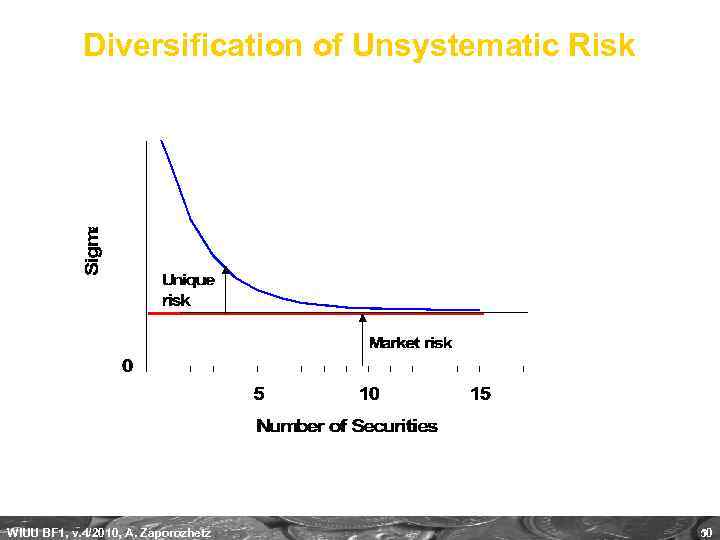

Diversification of Unsystematic Risk WIUU BF 1, v. 4/2010, A. Zaporozhetz 50

Diversification of Unsystematic Risk WIUU BF 1, v. 4/2010, A. Zaporozhetz 50

Diversification Сигма портфеля Общий риск Риск компании (Diversifiable risk, Unsystematic risk) Риск рынка (Market Risk, Nondiversifiable, Systematic risk) Количество акций в портфеле, шт. WIUU BF 1, v. 4/2010, A. Zaporozhetz 51

Diversification Сигма портфеля Общий риск Риск компании (Diversifiable risk, Unsystematic risk) Риск рынка (Market Risk, Nondiversifiable, Systematic risk) Количество акций в портфеле, шт. WIUU BF 1, v. 4/2010, A. Zaporozhetz 51

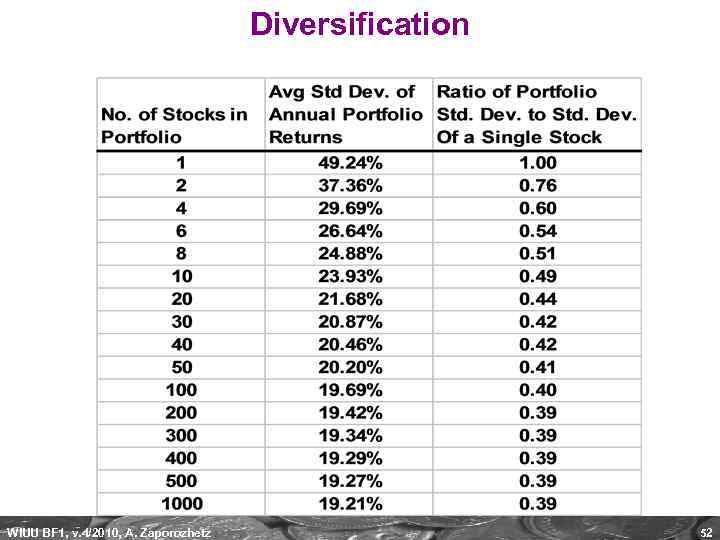

Diversification WIUU BF 1, v. 4/2010, A. Zaporozhetz 52

Diversification WIUU BF 1, v. 4/2010, A. Zaporozhetz 52

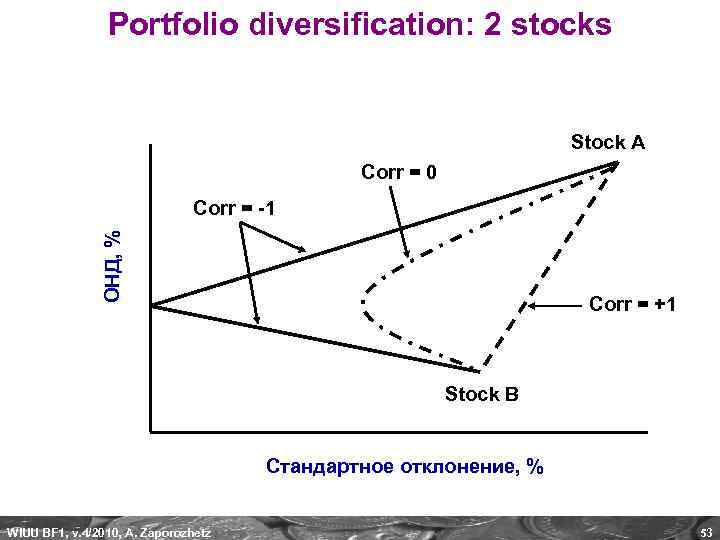

Portfolio diversification: 2 stocks Stock A Corr = 0 ОНД, % Corr = -1 Corr = +1 Stock B Стандартное отклонение, % WIUU BF 1, v. 4/2010, A. Zaporozhetz 53

Portfolio diversification: 2 stocks Stock A Corr = 0 ОНД, % Corr = -1 Corr = +1 Stock B Стандартное отклонение, % WIUU BF 1, v. 4/2010, A. Zaporozhetz 53

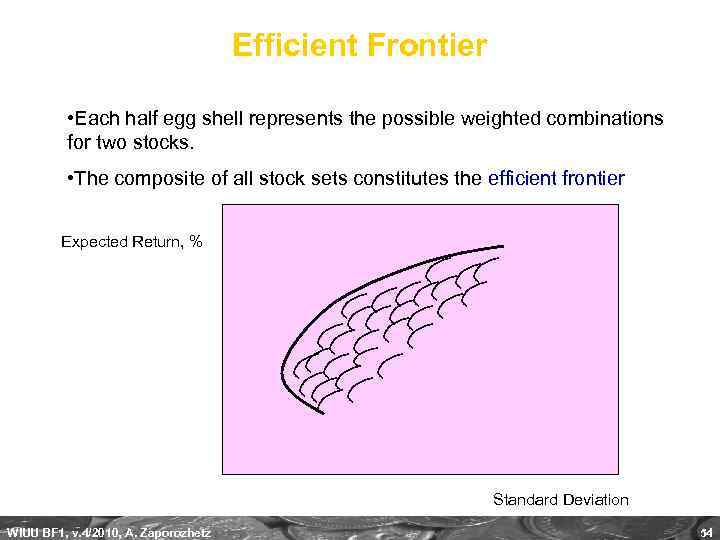

Efficient Frontier • Each half egg shell represents the possible weighted combinations for two stocks. • The composite of all stock sets constitutes the efficient frontier Expected Return, % Standard Deviation WIUU BF 1, v. 4/2010, A. Zaporozhetz 54

Efficient Frontier • Each half egg shell represents the possible weighted combinations for two stocks. • The composite of all stock sets constitutes the efficient frontier Expected Return, % Standard Deviation WIUU BF 1, v. 4/2010, A. Zaporozhetz 54

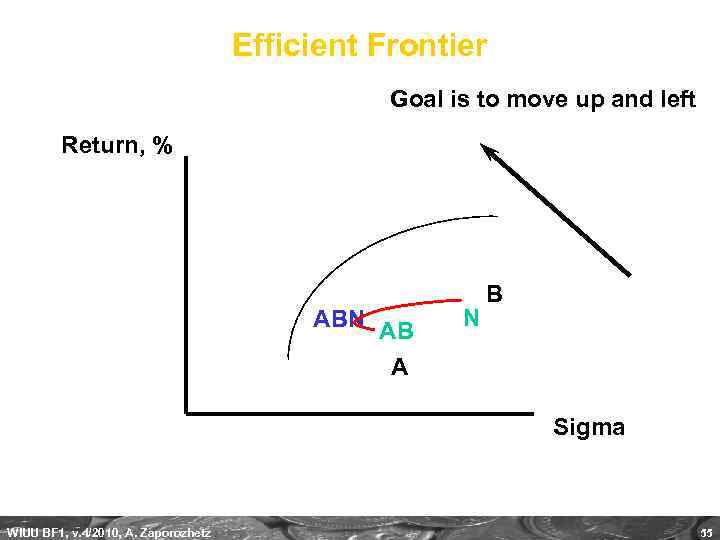

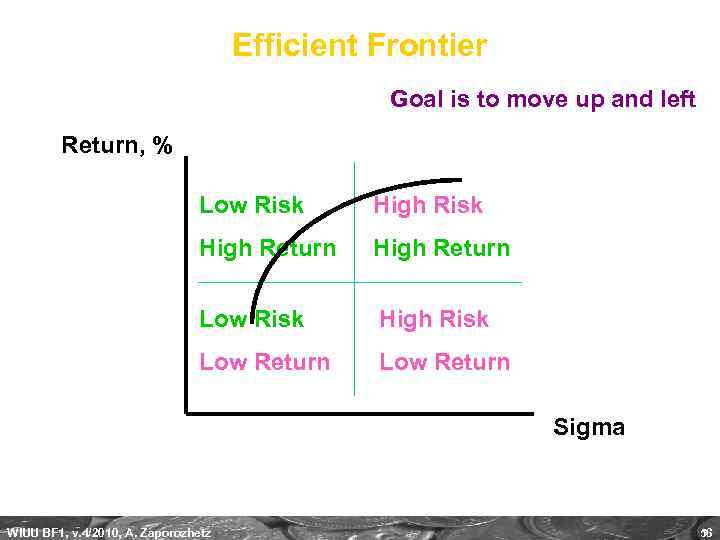

Efficient Frontier Goal is to move up and left Return, % ABN AB A N B Sigma WIUU BF 1, v. 4/2010, A. Zaporozhetz 55

Efficient Frontier Goal is to move up and left Return, % ABN AB A N B Sigma WIUU BF 1, v. 4/2010, A. Zaporozhetz 55

Efficient Frontier Goal is to move up and left Return, % Low Risk High Return Low Risk High Risk Low Return Sigma WIUU BF 1, v. 4/2010, A. Zaporozhetz 56

Efficient Frontier Goal is to move up and left Return, % Low Risk High Return Low Risk High Risk Low Return Sigma WIUU BF 1, v. 4/2010, A. Zaporozhetz 56

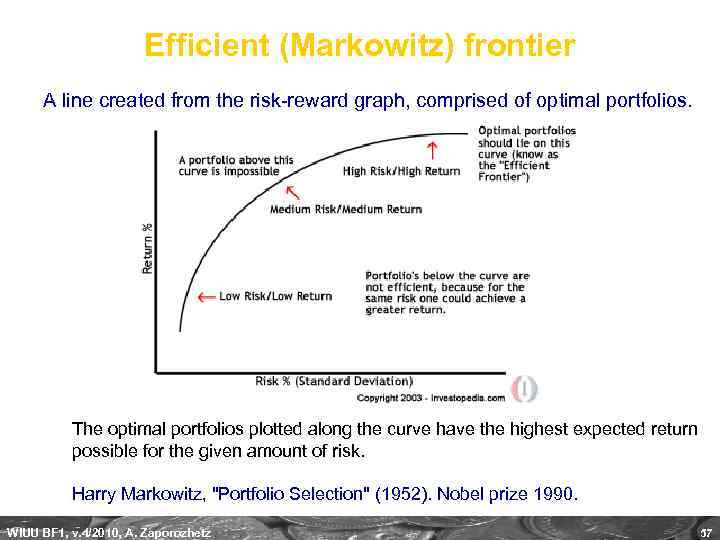

Efficient (Markowitz) frontier A line created from the risk-reward graph, comprised of optimal portfolios. The optimal portfolios plotted along the curve have the highest expected return possible for the given amount of risk. Harry Markowitz, "Portfolio Selection" (1952). Nobel prize 1990. WIUU BF 1, v. 4/2010, A. Zaporozhetz 57

Efficient (Markowitz) frontier A line created from the risk-reward graph, comprised of optimal portfolios. The optimal portfolios plotted along the curve have the highest expected return possible for the given amount of risk. Harry Markowitz, "Portfolio Selection" (1952). Nobel prize 1990. WIUU BF 1, v. 4/2010, A. Zaporozhetz 57

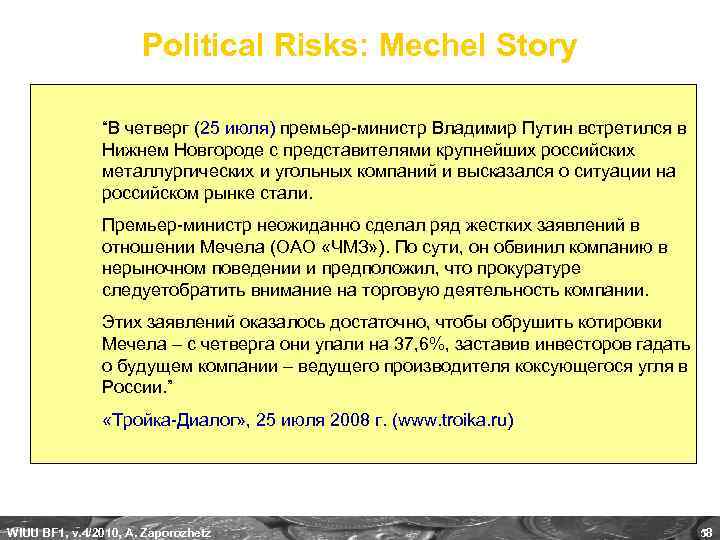

Political Risks: Mechel Story “В четверг (25 июля) премьер-министр Владимир Путин встретился в Нижнем Новгороде с представителями крупнейших российских металлургических и угольных компаний и высказался о ситуации на российском рынке стали. Премьер-министр неожиданно сделал ряд жестких заявлений в отношении Мечела (ОАО «ЧМЗ» ). По сути, он обвинил компанию в нерыночном поведении и предположил, что прокуратуре следуетобратить внимание на торговую деятельность компании. Этих заявлений оказалось достаточно, чтобы обрушить котировки Мечела – с четверга они упали на 37, 6%, заставив инвесторов гадать о будущем компании – ведущего производителя коксующегося угля в России. ” «Тройка-Диалог» , 25 июля 2008 г. (www. troika. ru) WIUU BF 1, v. 4/2010, A. Zaporozhetz 58

Political Risks: Mechel Story “В четверг (25 июля) премьер-министр Владимир Путин встретился в Нижнем Новгороде с представителями крупнейших российских металлургических и угольных компаний и высказался о ситуации на российском рынке стали. Премьер-министр неожиданно сделал ряд жестких заявлений в отношении Мечела (ОАО «ЧМЗ» ). По сути, он обвинил компанию в нерыночном поведении и предположил, что прокуратуре следуетобратить внимание на торговую деятельность компании. Этих заявлений оказалось достаточно, чтобы обрушить котировки Мечела – с четверга они упали на 37, 6%, заставив инвесторов гадать о будущем компании – ведущего производителя коксующегося угля в России. ” «Тройка-Диалог» , 25 июля 2008 г. (www. troika. ru) WIUU BF 1, v. 4/2010, A. Zaporozhetz 58

Political Risks WIUU BF 1, v. 4/2010, A. Zaporozhetz 59

Political Risks WIUU BF 1, v. 4/2010, A. Zaporozhetz 59

Political Risks: MICEX Index, 2008 Putin accuses “Mechel” of fishy business Inauguration of president Medvedev Russian intrusion into Georgia WIUU BF 1, v. 4/2010, A. Zaporozhetz Putin’s speech in Sochi, VII Economics Forum Medvedev: to establish a missile complex in Kaliningrad 60

Political Risks: MICEX Index, 2008 Putin accuses “Mechel” of fishy business Inauguration of president Medvedev Russian intrusion into Georgia WIUU BF 1, v. 4/2010, A. Zaporozhetz Putin’s speech in Sochi, VII Economics Forum Medvedev: to establish a missile complex in Kaliningrad 60

Portfolio risk and return: Beta Systematic Risk - The risk inherent to the entire market, or market segment. Also known as "un-diversifiable risk" or "market risk. " E. g. , interest rates, recession and wars represent sources of systematic risk because they affect the entire market and cannot be avoided through diversification. Affects a broad range of securities. Even a portfolio of welldiversified assets cannot escape all risk. Measured with BETA. Still, one can diversify the systematic risk – in the sense that one can choose securities with different betas (defensive vs. aggressive stocks) and combine them. WIUU BF 1, v. 4/2010, A. Zaporozhetz 61

Portfolio risk and return: Beta Systematic Risk - The risk inherent to the entire market, or market segment. Also known as "un-diversifiable risk" or "market risk. " E. g. , interest rates, recession and wars represent sources of systematic risk because they affect the entire market and cannot be avoided through diversification. Affects a broad range of securities. Even a portfolio of welldiversified assets cannot escape all risk. Measured with BETA. Still, one can diversify the systematic risk – in the sense that one can choose securities with different betas (defensive vs. aggressive stocks) and combine them. WIUU BF 1, v. 4/2010, A. Zaporozhetz 61

Portfolio risk and return: Beta The Beta of a portfolio is the weighted average of the rates of return of each asset comprising the portfolio, with the portfolio proportions ($) as weights. bp = w 1 b 1 + w 2 b 2 w 1 = Proportion of funds in Security 1, % w 2 = Proportion of funds in Security 2, % b 1 = Beta of Security 1 b 2 = Beta of Security 2 WIUU BF 1, v. 4/2010, A. Zaporozhetz 62

Portfolio risk and return: Beta The Beta of a portfolio is the weighted average of the rates of return of each asset comprising the portfolio, with the portfolio proportions ($) as weights. bp = w 1 b 1 + w 2 b 2 w 1 = Proportion of funds in Security 1, % w 2 = Proportion of funds in Security 2, % b 1 = Beta of Security 1 b 2 = Beta of Security 2 WIUU BF 1, v. 4/2010, A. Zaporozhetz 62

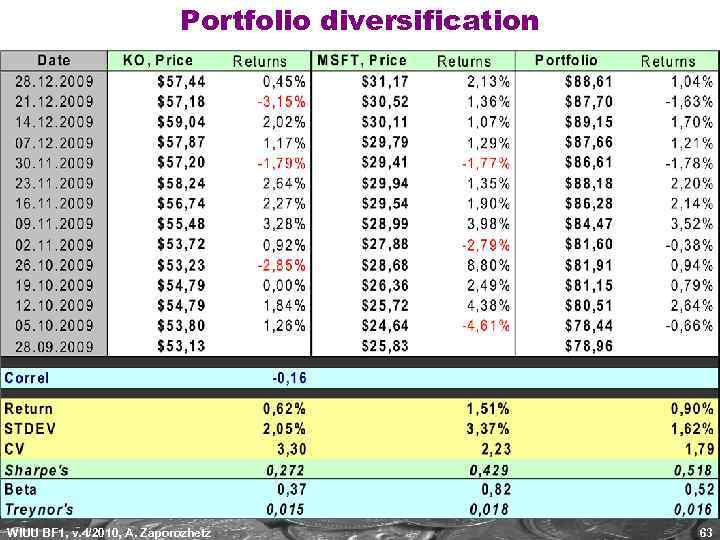

Portfolio diversification WIUU BF 1, v. 4/2010, A. Zaporozhetz 63

Portfolio diversification WIUU BF 1, v. 4/2010, A. Zaporozhetz 63