Class 9 Cash-flow based valuation

Review for cash-flow based method, most notably, PVFCF or PVFCFE or PVED • The defintion and calculation of FCF • The general process • The advantages and disadvantages of PVFCF

Question 1 • Which of the following items affect free cash flows to debt and equity holders? Which affect free cash flows to equity alone?

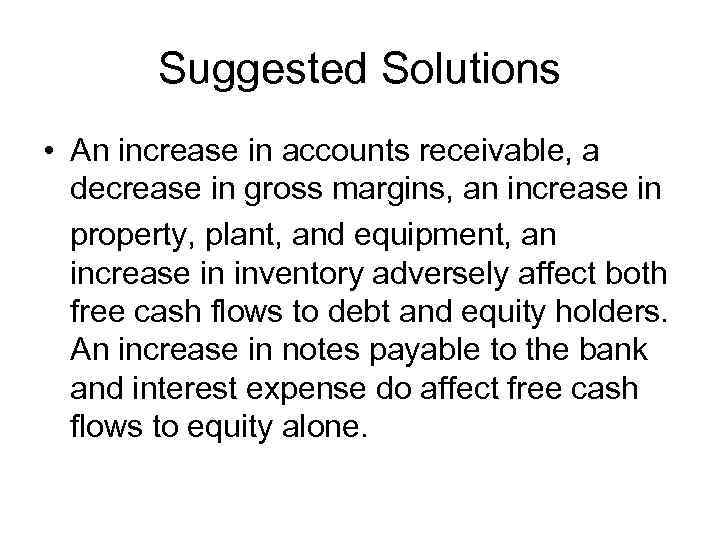

Question 1 • An increase in accounts receivable; • A decrease in gross margins; • An increase in property, plant, and equipment; • An increase in inventory; • Interest expense; • An increase in notes payable to the bank.

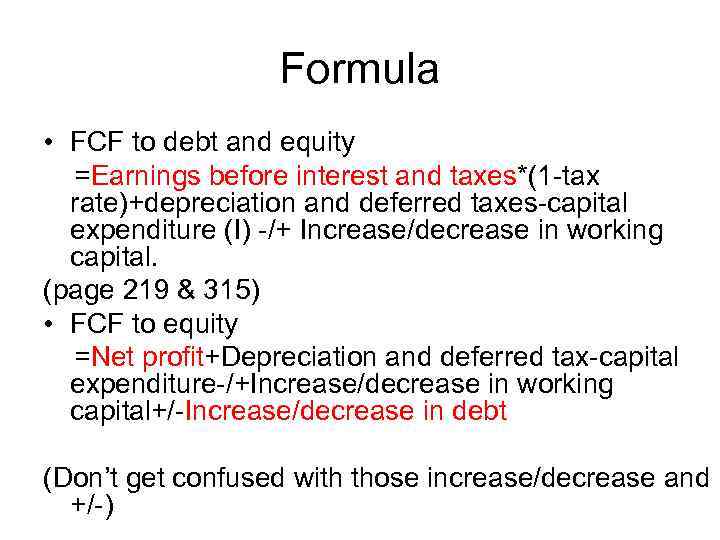

Formula • FCF to debt and equity =Earnings before interest and taxes*(1 -tax rate)+depreciation and deferred taxes-capital expenditure (I) -/+ Increase/decrease in working capital. (page 219 & 315) • FCF to equity =Net profit+Depreciation and deferred tax-capital expenditure-/+Increase/decrease in working capital+/-Increase/decrease in debt (Don’t get confused with those increase/decrease and +/-)

Suggested Solutions • An increase in accounts receivable, a decrease in gross margins, an increase in property, plant, and equipment, an increase in inventory adversely affect both free cash flows to debt and equity holders. An increase in notes payable to the bank and interest expense do affect free cash flows to equity alone.

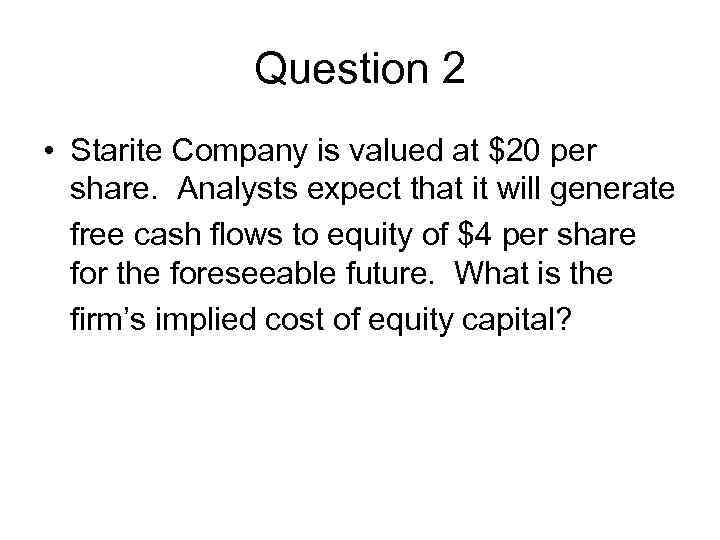

Question 2 • Starite Company is valued at $20 per share. Analysts expect that it will generate free cash flows to equity of $4 per share for the foreseeable future. What is the firm’s implied cost of equity capital?

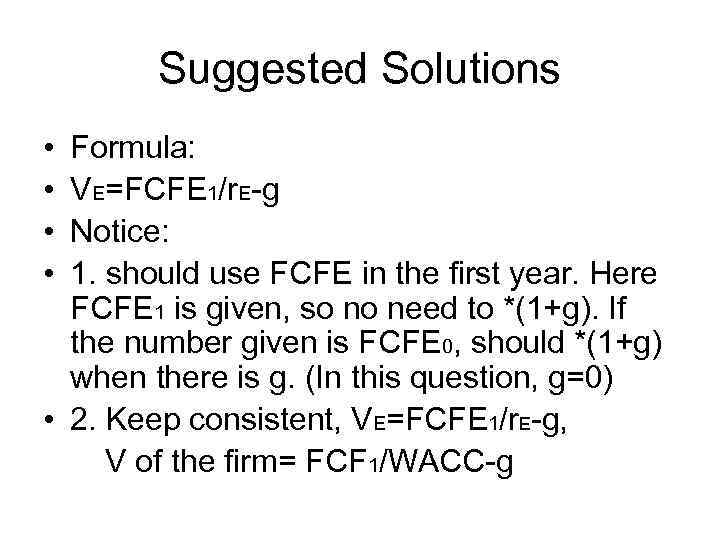

Suggested Solutions • • Formula: VE=FCFE 1/r. E-g Notice: 1. should use FCFE in the first year. Here FCFE 1 is given, so no need to *(1+g). If the number given is FCFE 0, should *(1+g) when there is g. (In this question, g=0) • 2. Keep consistent, VE=FCFE 1/r. E-g, V of the firm= FCF 1/WACC-g

Question 3 • How would your answer to the previous question change if analysts expected free cash-flows to equity to grow by 5% per year forever starting from $4 per share next year?

Suggested Solutions • Same firm, so cost of equity capital doesn’t change, and the question is asking about the new value you can get after you revise your forecast of future FCFEs. • VE=FCFE 1/r. E-g • FCFE 1=4 (it’s clear in the question that this is FCFE in the next year. ) • G=5%, r. E– the implied one we get from question 2

Question 4 • In some cases, the rate of sales growth does not affect a firm’s value using DCF valuation. Explain how this may happen.

Suggested Solutions • NPV is a cash-flow value concept. • NPV= -Initial investment (and –PV of any future cash outflow) + sum of PV of all future cash inflow • 0 NPV means no value can be generated from the project. Under DCF method, it means no value added to the firm. • If sales growth comes from investments in 0 NPV projects, the firm’s value will ne unaffected by the rate of sales growth.