Class_8.ppt

- Количество слайдов: 17

Class 8 Accounting Based Valuation and Implications for Price-Multiples

Review • Cash flow based valuation method: PVFCF, PVFCFE, PVED • Accounting-based valuation method: PVAE, PVAOI

Accounting-Based Valuation: • Various valuation methods • The definition and features of accounting-based valuation • Different versions of valuation formula under assumptions regarding the post-forecast period • The benefits and limits of using accountingbased valuation Price multiples: (Please refer to the formula in your course pack) • MV(E)/BV(E) ratio • PE ratio

Question 1 • I do not know why anyone would ever want to value earnings. Obviously, the market knows that earnings can be manipulated and therefore only values cash flows. Discuss.

Suggested Solutions 1. The present value of abnormal earnings obtains as long as earnings are comprehensive and expectations of future abnormal earnings are unbiased regardless of how biased the accounting. (Examples: the impact of different R&D methods in 2 periods. Or depreciation. The total amount of depreciation is the same, no matter how to allocate it across years. ) Underlying Reason-the reversal of accounting distortions. Accruals are not sustainable. In long-term, the nature of the company will reveal. No matter which accounting method is used, you should get the same value under accounting-based method. (In theory. )

Suggested Solutions However, accounting analysis is still important. 1. insights from financial statements on management incentives, etc. 2. discount factor matters in real life, so companies tend to recognise revenue aggressively in current period 3. identify accounting distortion and avoid it in forecasting 4. decide how many years the forecasting should last. For high accounting quality companies, short forecast period. For low accounting quality companies, longer. Because for those companies, analysts may not have enough information to undo the accounting distortion by themselves and should wait for longer time until the accounting distortion cancells out.

Suggested Solutions 2. Expectations of abnormal earnings may however be biased if the analyst is unaware of accounting manipulations; But, expectations of future free cash flows can also be biased if the analyst is unaware of accounting manipulations (both future abnormal earnings and free cash flows result from forecasts of future financial statements. Usually we forecast the earnings first and then balance sheet. The calculation of FCFs is based on the forecasted income statement and balance sheet. )

Suggested Solutions 3. Empirical studies furthermore suggest that accounting based valuation methods perform better than cash flow based valuation methods. (In theory, different valuation methods should lead to the same result if we can forecast reliably into infinity. But in real life, we just make detailed forecast for several years and assumptions are subjective. ) Penman and Sougiannis(1998), the prediction errors for 4 -year forecast period under the assumption-terminal value with growth: AE method: -7. 6%, FCF method: 76. 1%.

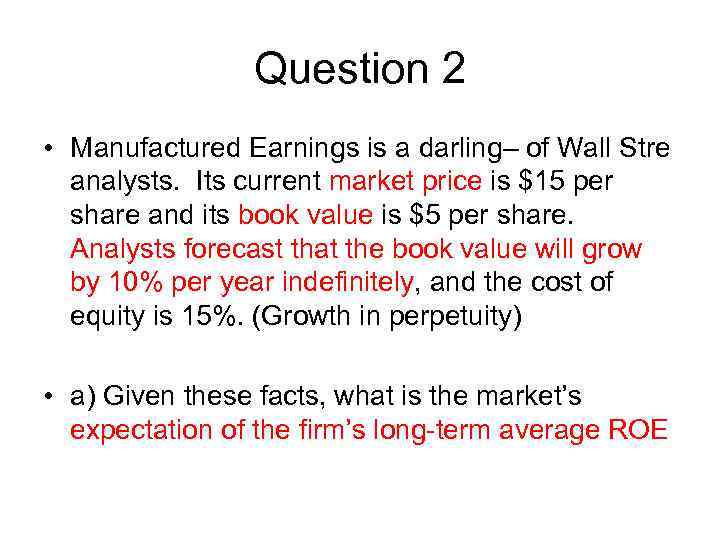

Question 2 • Manufactured Earnings is a darling– of Wall Stre analysts. Its current market price is $15 per share and its book value is $5 per share. Analysts forecast that the book value will grow by 10% per year indefinitely, and the cost of equity is 15%. (Growth in perpetuity) • a) Given these facts, what is the market’s expectation of the firm’s long-term average ROE

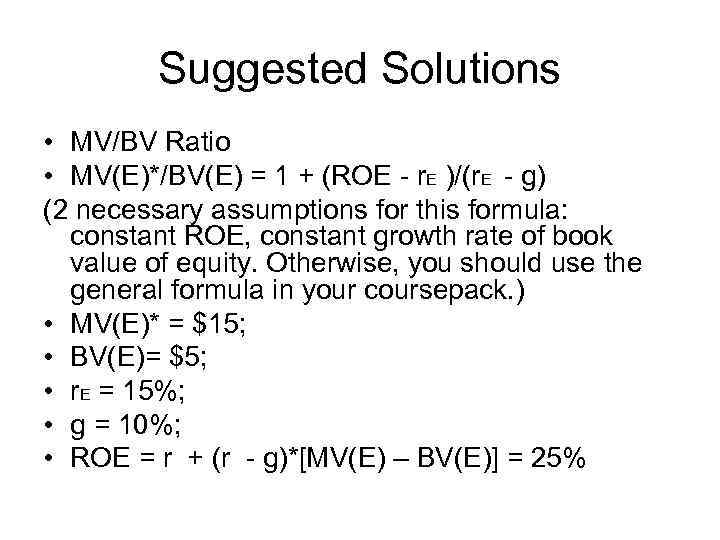

Suggested Solutions • MV/BV Ratio • MV(E)*/BV(E) = 1 + (ROE - r. E )/(r. E - g) (2 necessary assumptions for this formula: constant ROE, constant growth rate of book value of equity. Otherwise, you should use the general formula in your coursepack. ) • MV(E)* = $15; • BV(E)= $5; • r. E = 15%; • g = 10%; • ROE = r + (r - g)*[MV(E) – BV(E)] = 25%

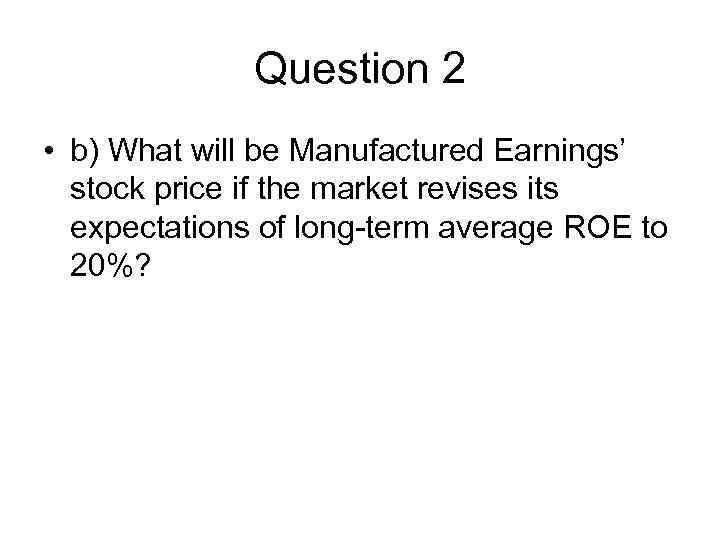

Question 2 • b) What will be Manufactured Earnings’ stock price if the market revises its expectations of long-term average ROE to 20%?

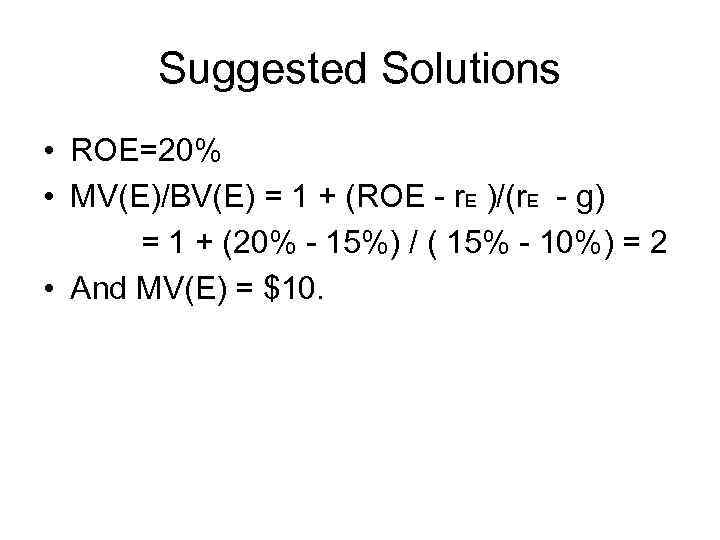

Suggested Solutions • ROE=20% • MV(E)/BV(E) = 1 + (ROE - r. E )/(r. E - g) = 1 + (20% - 15%) / ( 15% - 10%) = 2 • And MV(E) = $10.

Question 3 • How can a firm with a high ROE trade on a low price-to-earnings (PE) ratio?

Suggested Solutions The formula of PE in your course pack, 3 components A firm with a high ROE may trade on a low PE ratio if: • the cost of equity capital is high ü ü discount factor; AE results from the different between ROE and cost of equity capital. • future expected abnormal earnings are expected to decline. - Sharp decline in future ROEs (high current earnings level doesn’t mean future ROE will remain high) - Low growth in the investment base; (no good investment opportunity) (notice that it’s expected growth of future abnormal earnings in the PE formula, rather than expected abnormal earnings level (in PB formula) • current earnings are exceptionally high– large denominator will lead to a low ratio

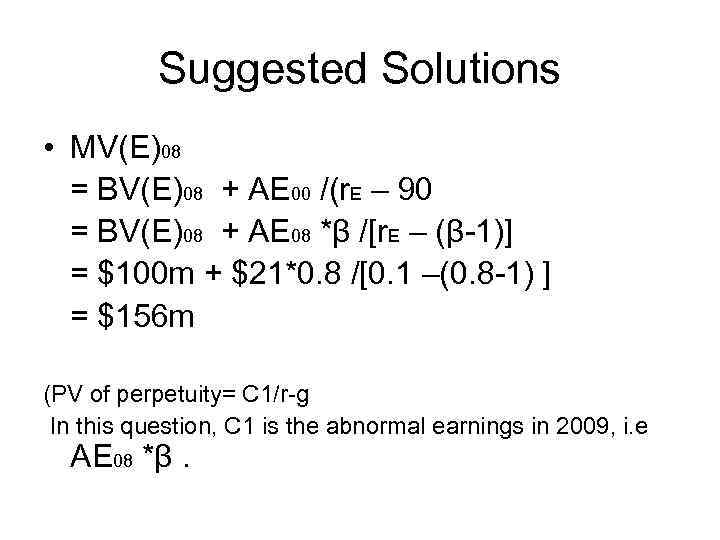

Question 4 • Consider Sirius Inc again. The current book value of equity as of the end of June 2008 is $100 m. The abnormal earnings generated in the year ending in June 2008 are $21 m. The cost of equity capital is 10%. What is Sirius Inc’s intrinsic value of equity as of the end of June 2008?

Question 3 in class 7 • AEt+1 = βAEt +εt+1 for all t with E(εt+1 ) = 0 and β = 0. 8 E(AEt+1) = βAEt =0. 8*AEt 2 approaches: 1. Use auto regression model of AE directly, you can find the formula in your course pack. 2. Growth rate is [E(AEt+1) /AEt]-1= β-1=-0. 2

Suggested Solutions • MV(E)08 = BV(E)08 + AE 00 /(r. E – 90 = BV(E)08 + AE 08 *β /[r. E – (β-1)] = $100 m + $21*0. 8 /[0. 1 –(0. 8 -1) ] = $156 m (PV of perpetuity= C 1/r-g In this question, C 1 is the abnormal earnings in 2009, i. e AE 08 *β.

Class_8.ppt