Class 3. Derivatives 1

Class 3. Derivatives 1

Why should we study derivatives? q Second level securities – Payoff depends on the value of other (underlying) securities / variables – Possibility for an arbitrage in case of price disparity between derivative and underlying q Huge volume of financial derivatives – Notional over $700 trln q Many instruments are like derivatives – Bonuses are tied to performance – Prices of stocks and bonds depend on the company’s value – Value of the investment project depends on future cash flows FMI 3 -2

Why should we study derivatives? q Second level securities – Payoff depends on the value of other (underlying) securities / variables – Possibility for an arbitrage in case of price disparity between derivative and underlying q Huge volume of financial derivatives – Notional over $700 trln q Many instruments are like derivatives – Bonuses are tied to performance – Prices of stocks and bonds depend on the company’s value – Value of the investment project depends on future cash flows FMI 3 -2

How it started q Antiquity: first contracts (written on clay tablets) appeared in Mesopotamia around 2000 BC as contracts for future delivery of goods – E. g. merchant receives 6 shekels of silver and, in exchange, will repay it in 6 months with sesame, at the going rate – Played an important role in financing long-distance trade q Middle ages: most contracts were private, between parties – Byzantine Roman emperors Theodosian and Justinian (~400 AD) developed laws which allowed contracts to be traded q Renaissance: shares and bills of exchange were first issued by Italian city-states and then by other European cities – Amsterdam: emergence of cash-settled contracts (like CFD, contracts for difference), options on shares, and short-selling – 1637: crash of tulip market (largely consisting of CFD and options, OTC) FMI 3 -3

How it started q Antiquity: first contracts (written on clay tablets) appeared in Mesopotamia around 2000 BC as contracts for future delivery of goods – E. g. merchant receives 6 shekels of silver and, in exchange, will repay it in 6 months with sesame, at the going rate – Played an important role in financing long-distance trade q Middle ages: most contracts were private, between parties – Byzantine Roman emperors Theodosian and Justinian (~400 AD) developed laws which allowed contracts to be traded q Renaissance: shares and bills of exchange were first issued by Italian city-states and then by other European cities – Amsterdam: emergence of cash-settled contracts (like CFD, contracts for difference), options on shares, and short-selling – 1637: crash of tulip market (largely consisting of CFD and options, OTC) FMI 3 -3

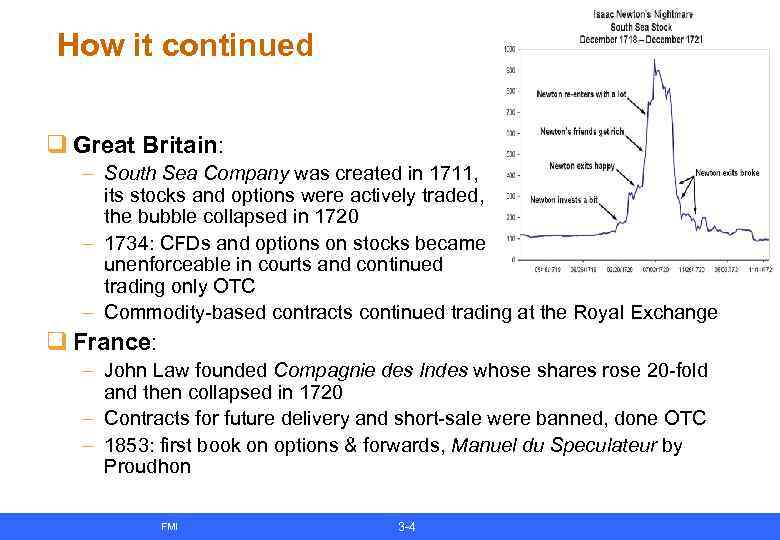

How it continued q Great Britain: – South Sea Company was created in 1711, its stocks and options were actively traded, the bubble collapsed in 1720 – 1734: CFDs and options on stocks became unenforceable in courts and continued trading only OTC – Commodity-based contracts continued trading at the Royal Exchange q France: – John Law founded Compagnie des Indes whose shares rose 20 -fold and then collapsed in 1720 – Contracts for future delivery and short-sale were banned, done OTC – 1853: first book on options & forwards, Manuel du Speculateur by Proudhon FMI 3 -4

How it continued q Great Britain: – South Sea Company was created in 1711, its stocks and options were actively traded, the bubble collapsed in 1720 – 1734: CFDs and options on stocks became unenforceable in courts and continued trading only OTC – Commodity-based contracts continued trading at the Royal Exchange q France: – John Law founded Compagnie des Indes whose shares rose 20 -fold and then collapsed in 1720 – Contracts for future delivery and short-sale were banned, done OTC – 1853: first book on options & forwards, Manuel du Speculateur by Proudhon FMI 3 -4

How it evolved q 1848: creation of the Chicago Board of Trade, with `To-Arrive’ contract for grains q 1925: first futures clearinghouse q 1970 s: currency and interest rate futures, equity options q 1980 s: interest rate swaps traded OTC q 1983: Freddie Mac issues first Collateralized Mortgage Obligation q 1990 s: credit derivatives (CDS, CDO = Collateralized Debt Obligations) q 2008: subprime global financial crisis

How it evolved q 1848: creation of the Chicago Board of Trade, with `To-Arrive’ contract for grains q 1925: first futures clearinghouse q 1970 s: currency and interest rate futures, equity options q 1980 s: interest rate swaps traded OTC q 1983: Freddie Mac issues first Collateralized Mortgage Obligation q 1990 s: credit derivatives (CDS, CDO = Collateralized Debt Obligations) q 2008: subprime global financial crisis

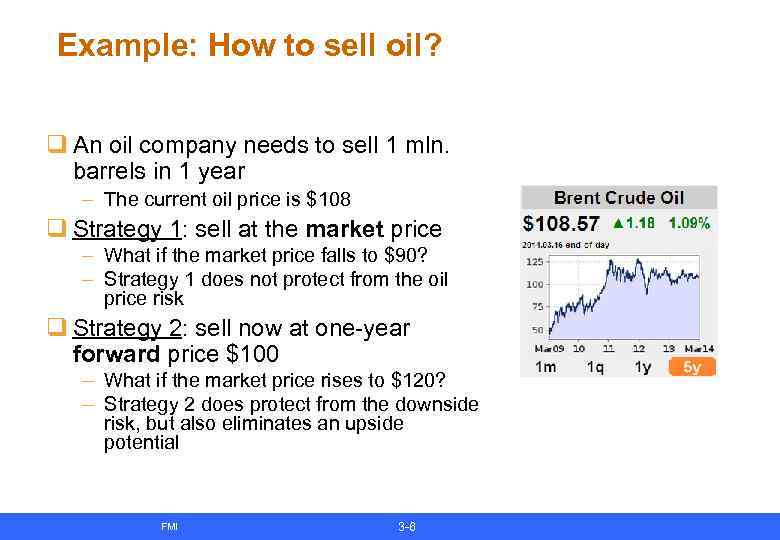

Example: How to sell oil? q An oil company needs to sell 1 mln. barrels in 1 year – The current oil price is $108 q Strategy 1: sell at the market price – What if the market price falls to $90? – Strategy 1 does not protect from the oil price risk q Strategy 2: sell now at one-year forward price $100 – What if the market price rises to $120? – Strategy 2 does protect from the downside risk, but also eliminates an upside potential FMI 3 -6

Example: How to sell oil? q An oil company needs to sell 1 mln. barrels in 1 year – The current oil price is $108 q Strategy 1: sell at the market price – What if the market price falls to $90? – Strategy 1 does not protect from the oil price risk q Strategy 2: sell now at one-year forward price $100 – What if the market price rises to $120? – Strategy 2 does protect from the downside risk, but also eliminates an upside potential FMI 3 -6

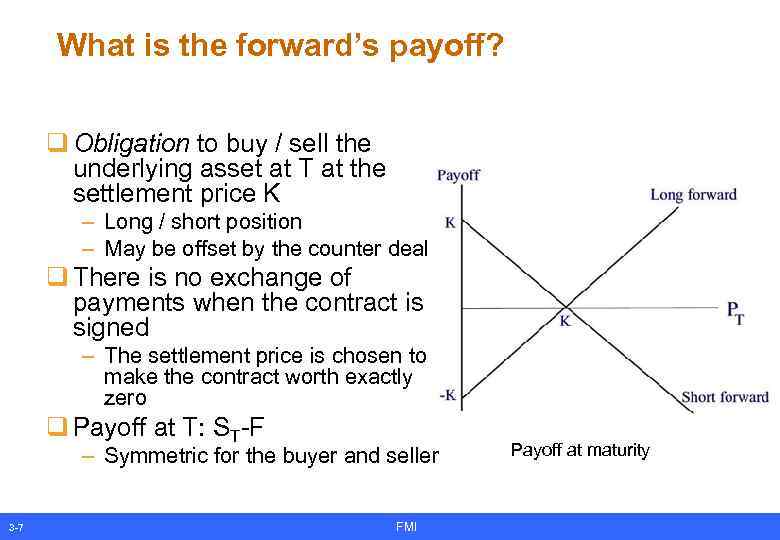

What is the forward’s payoff? q Obligation to buy / sell the underlying asset at T at the settlement price K – Long / short position – May be offset by the counter deal q There is no exchange of payments when the contract is signed – The settlement price is chosen to make the contract worth exactly zero q Payoff at T: ST-F – Symmetric for the buyer and seller 3 -7 FMI Payoff at maturity

What is the forward’s payoff? q Obligation to buy / sell the underlying asset at T at the settlement price K – Long / short position – May be offset by the counter deal q There is no exchange of payments when the contract is signed – The settlement price is chosen to make the contract worth exactly zero q Payoff at T: ST-F – Symmetric for the buyer and seller 3 -7 FMI Payoff at maturity

How can one apply forward (futures)? q Hedging: reducing undesirable risks arising from the underlying business activity – E. g. , the farmer grows grain to sell in September – By selling September forward on grain in spring, he can eliminate the price risk (though not the risk of a poor crop) q Speculating: taking risky position in hope for profit – If you expect bullish market, buy futures on the stock market index – Derivatives give leverage and increase both expected return and risk q Arbitrage: finding a riskless profit opportunity – Buy an undervalued asset and sell an overvalued asset with the same risk characteristics: e. g. , buy oil and sell oil futures – However, pure arbitrage is very rare: there always some risks FMI 3 -8

How can one apply forward (futures)? q Hedging: reducing undesirable risks arising from the underlying business activity – E. g. , the farmer grows grain to sell in September – By selling September forward on grain in spring, he can eliminate the price risk (though not the risk of a poor crop) q Speculating: taking risky position in hope for profit – If you expect bullish market, buy futures on the stock market index – Derivatives give leverage and increase both expected return and risk q Arbitrage: finding a riskless profit opportunity – Buy an undervalued asset and sell an overvalued asset with the same risk characteristics: e. g. , buy oil and sell oil futures – However, pure arbitrage is very rare: there always some risks FMI 3 -8

How to make forward an exchange-traded contract? Forward q Specific terms Futures q Standardized exchange-traded contract – Very flexible for the initiating side q Low liquidity – Amount, quality, delivery date, place, and conditions of the settlement q High liquidity → popular among speculators – Spot settlement – Hard to find the counterparty q Credit risk – Usually, cash settlement – Can be offset by taking an opposite position – Most contracts are eliminated before the delivery q Credit risk taken by the exchange – The possibility of the counterparty’s default – The exchange clearing-house is a counterparty – Collateral: the initial / maintenance margin • The margin account guarantees the settlement for the exchange – Marking to market daily • E. g. , long position: receive A*(Ft-Ft-1) into account • A is the position size, Ft is the settlement price at t 3 -9 FMI

How to make forward an exchange-traded contract? Forward q Specific terms Futures q Standardized exchange-traded contract – Very flexible for the initiating side q Low liquidity – Amount, quality, delivery date, place, and conditions of the settlement q High liquidity → popular among speculators – Spot settlement – Hard to find the counterparty q Credit risk – Usually, cash settlement – Can be offset by taking an opposite position – Most contracts are eliminated before the delivery q Credit risk taken by the exchange – The possibility of the counterparty’s default – The exchange clearing-house is a counterparty – Collateral: the initial / maintenance margin • The margin account guarantees the settlement for the exchange – Marking to market daily • E. g. , long position: receive A*(Ft-Ft-1) into account • A is the position size, Ft is the settlement price at t 3 -9 FMI

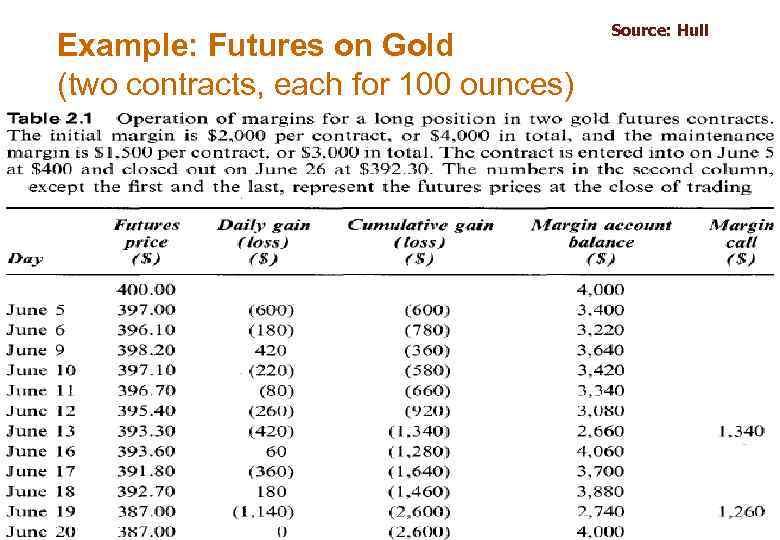

Example: Futures on Gold (two contracts, each for 100 ounces) FMI 3 -10 Source: Hull

Example: Futures on Gold (two contracts, each for 100 ounces) FMI 3 -10 Source: Hull

Discussion topic Are futures markets driven by speculators driving prices away from the fundamentals?

Discussion topic Are futures markets driven by speculators driving prices away from the fundamentals?

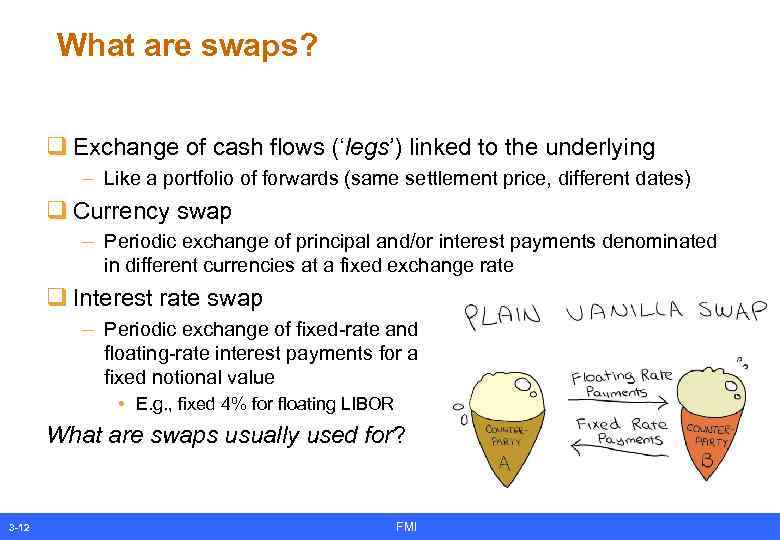

What are swaps? q Exchange of cash flows (‘legs’) linked to the underlying – Like a portfolio of forwards (same settlement price, different dates) q Currency swap – Periodic exchange of principal and/or interest payments denominated in different currencies at a fixed exchange rate q Interest rate swap – Periodic exchange of fixed-rate and floating-rate interest payments for a fixed notional value • E. g. , fixed 4% for floating LIBOR What are swaps usually used for? 3 -12 FMI

What are swaps? q Exchange of cash flows (‘legs’) linked to the underlying – Like a portfolio of forwards (same settlement price, different dates) q Currency swap – Periodic exchange of principal and/or interest payments denominated in different currencies at a fixed exchange rate q Interest rate swap – Periodic exchange of fixed-rate and floating-rate interest payments for a fixed notional value • E. g. , fixed 4% for floating LIBOR What are swaps usually used for? 3 -12 FMI

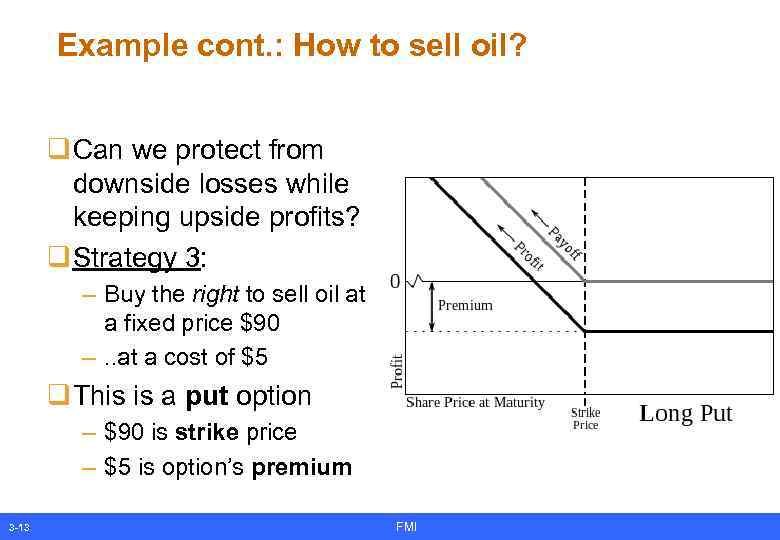

Example cont. : How to sell oil? q Can we protect from downside losses while keeping upside profits? q Strategy 3: – Buy the right to sell oil at a fixed price $90 –. . at a cost of $5 q This is a put option – $90 is strike price – $5 is option’s premium 3 -13 FMI

Example cont. : How to sell oil? q Can we protect from downside losses while keeping upside profits? q Strategy 3: – Buy the right to sell oil at a fixed price $90 –. . at a cost of $5 q This is a put option – $90 is strike price – $5 is option’s premium 3 -13 FMI

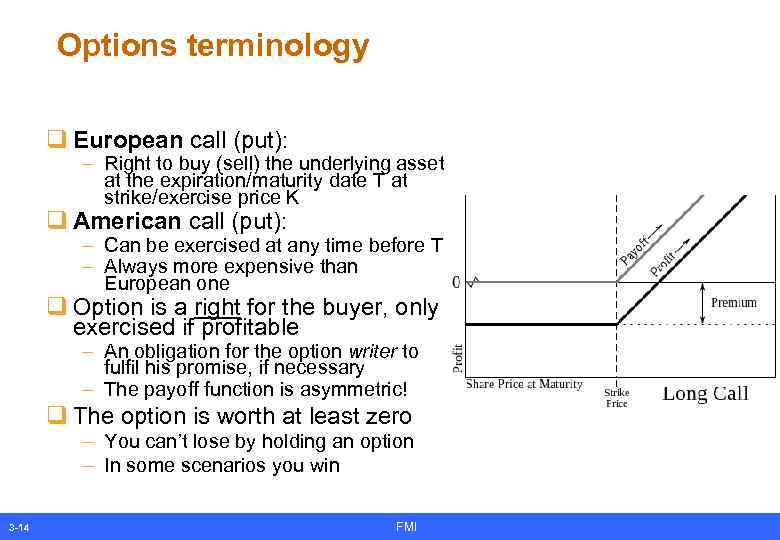

Options terminology q European call (put): – Right to buy (sell) the underlying asset at the expiration/maturity date T at strike/exercise price K q American call (put): – Can be exercised at any time before T – Always more expensive than European one q Option is a right for the buyer, only exercised if profitable – An obligation for the option writer to fulfil his promise, if necessary – The payoff function is asymmetric! q The option is worth at least zero – You can’t lose by holding an option – In some scenarios you win 3 -14 FMI

Options terminology q European call (put): – Right to buy (sell) the underlying asset at the expiration/maturity date T at strike/exercise price K q American call (put): – Can be exercised at any time before T – Always more expensive than European one q Option is a right for the buyer, only exercised if profitable – An obligation for the option writer to fulfil his promise, if necessary – The payoff function is asymmetric! q The option is worth at least zero – You can’t lose by holding an option – In some scenarios you win 3 -14 FMI

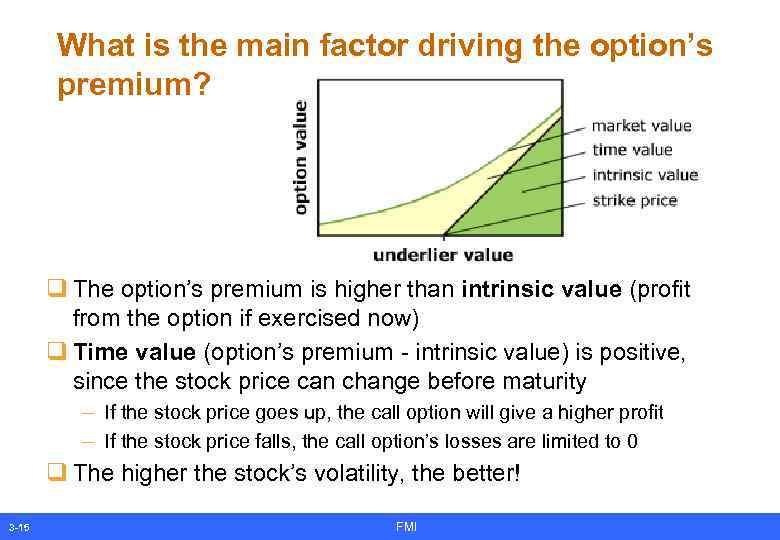

What is the main factor driving the option’s premium? q The option’s premium is higher than intrinsic value (profit from the option if exercised now) q Time value (option’s premium - intrinsic value) is positive, since the stock price can change before maturity – If the stock price goes up, the call option will give a higher profit – If the stock price falls, the call option’s losses are limited to 0 q The higher the stock’s volatility, the better! 3 -15 FMI

What is the main factor driving the option’s premium? q The option’s premium is higher than intrinsic value (profit from the option if exercised now) q Time value (option’s premium - intrinsic value) is positive, since the stock price can change before maturity – If the stock price goes up, the call option will give a higher profit – If the stock price falls, the call option’s losses are limited to 0 q The higher the stock’s volatility, the better! 3 -15 FMI

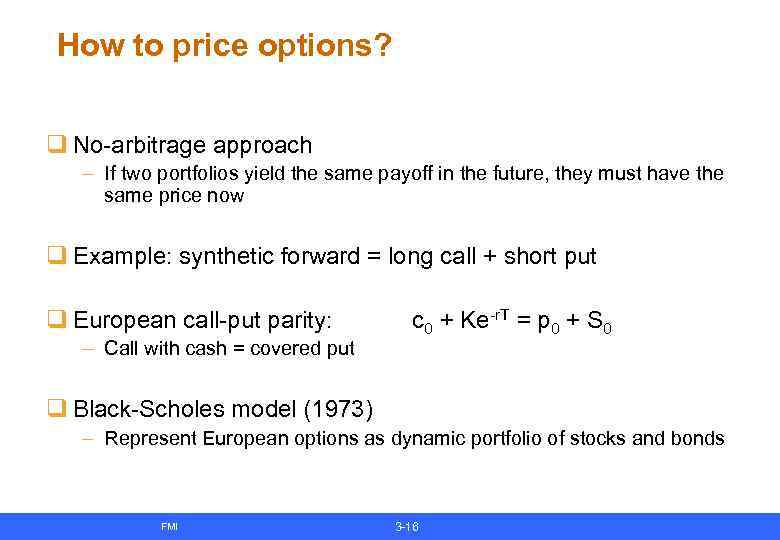

How to price options? q No-arbitrage approach – If two portfolios yield the same payoff in the future, they must have the same price now q Example: synthetic forward = long call + short put q European call-put parity: – Call with cash = covered put c 0 + Ke-r. T = p 0 + S 0 q Black-Scholes model (1973) – Represent European options as dynamic portfolio of stocks and bonds FMI 3 -16

How to price options? q No-arbitrage approach – If two portfolios yield the same payoff in the future, they must have the same price now q Example: synthetic forward = long call + short put q European call-put parity: – Call with cash = covered put c 0 + Ke-r. T = p 0 + S 0 q Black-Scholes model (1973) – Represent European options as dynamic portfolio of stocks and bonds FMI 3 -16

Are options used for hedging oil? q Mexico hedged its oil exports for year 2014 – Options locked in a price of just over $90 per barrel – “Despite the shale oil boom, the reality is that today we are in a high cost environment, and that will find its ways into long-term price arrangements” q Most producers tend to sell oil at market prices. Mexico uses options to ensure a minimum price for its exports. q The country’s oil hedging programme is the largest of its kind in commodity markets, creating significant downward pressure on futures prices. q This year’s trades took place over the past four weeks as oil prices climbed to more than $115 per barrel. – “The price was high and volatility was low by historical standards so the moment was right” q The fees paid for the investment banks ranged from $750 m to $1. 2 bn in recent years.

Are options used for hedging oil? q Mexico hedged its oil exports for year 2014 – Options locked in a price of just over $90 per barrel – “Despite the shale oil boom, the reality is that today we are in a high cost environment, and that will find its ways into long-term price arrangements” q Most producers tend to sell oil at market prices. Mexico uses options to ensure a minimum price for its exports. q The country’s oil hedging programme is the largest of its kind in commodity markets, creating significant downward pressure on futures prices. q This year’s trades took place over the past four weeks as oil prices climbed to more than $115 per barrel. – “The price was high and volatility was low by historical standards so the moment was right” q The fees paid for the investment banks ranged from $750 m to $1. 2 bn in recent years.

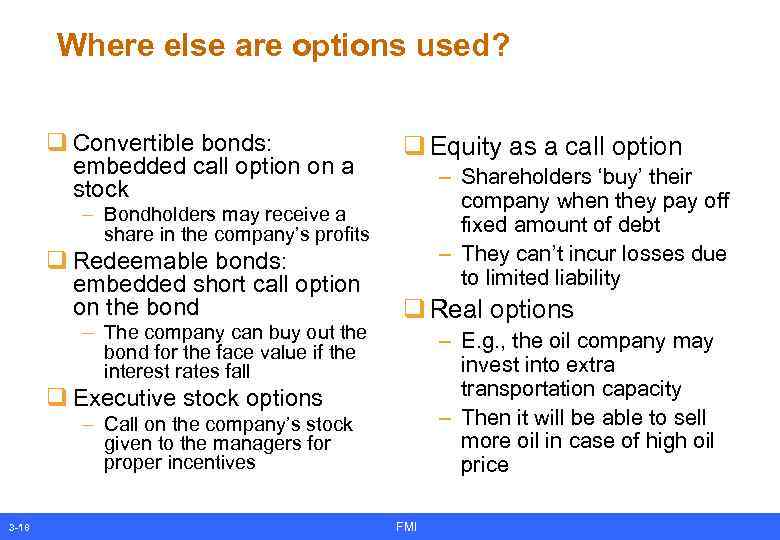

Where else are options used? q Convertible bonds: embedded call option on a stock q Equity as a call option – Shareholders ‘buy’ their company when they pay off fixed amount of debt – They can’t incur losses due to limited liability – Bondholders may receive a share in the company’s profits q Redeemable bonds: embedded short call option on the bond – The company can buy out the bond for the face value if the interest rates fall q Real options – E. g. , the oil company may invest into extra transportation capacity – Then it will be able to sell more oil in case of high oil price q Executive stock options – Call on the company’s stock given to the managers for proper incentives 3 -18 FMI

Where else are options used? q Convertible bonds: embedded call option on a stock q Equity as a call option – Shareholders ‘buy’ their company when they pay off fixed amount of debt – They can’t incur losses due to limited liability – Bondholders may receive a share in the company’s profits q Redeemable bonds: embedded short call option on the bond – The company can buy out the bond for the face value if the interest rates fall q Real options – E. g. , the oil company may invest into extra transportation capacity – Then it will be able to sell more oil in case of high oil price q Executive stock options – Call on the company’s stock given to the managers for proper incentives 3 -18 FMI

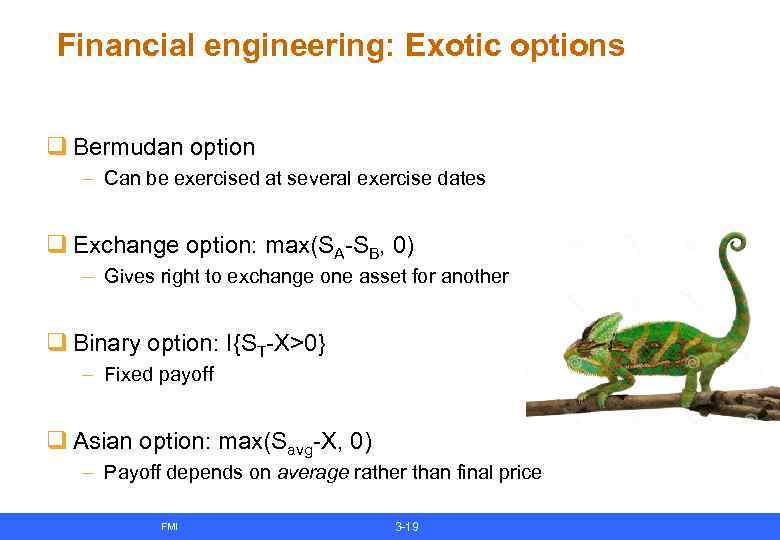

Financial engineering: Exotic options q Bermudan option – Can be exercised at several exercise dates q Exchange option: max(SA-SB, 0) – Gives right to exchange one asset for another q Binary option: I{ST-X>0} – Fixed payoff q Asian option: max(Savg-X, 0) – Payoff depends on average rather than final price FMI 3 -19

Financial engineering: Exotic options q Bermudan option – Can be exercised at several exercise dates q Exchange option: max(SA-SB, 0) – Gives right to exchange one asset for another q Binary option: I{ST-X>0} – Fixed payoff q Asian option: max(Savg-X, 0) – Payoff depends on average rather than final price FMI 3 -19

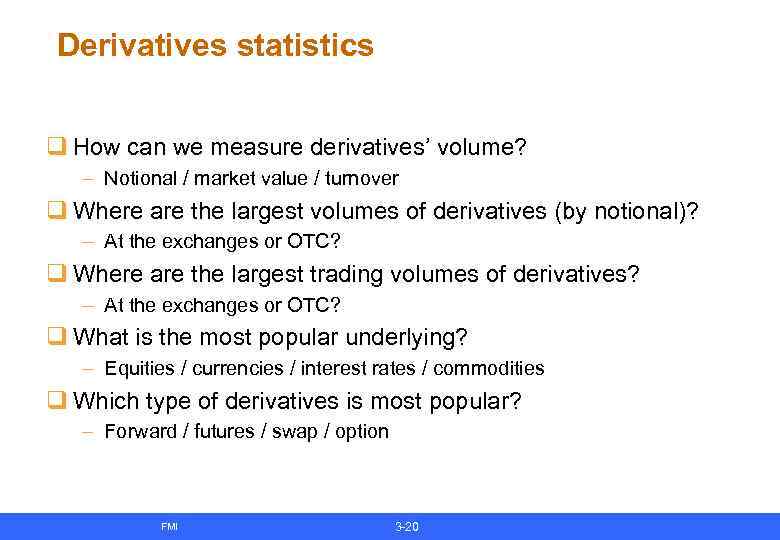

Derivatives statistics q How can we measure derivatives’ volume? – Notional / market value / turnover q Where are the largest volumes of derivatives (by notional)? – At the exchanges or OTC? q Where are the largest trading volumes of derivatives? – At the exchanges or OTC? q What is the most popular underlying? – Equities / currencies / interest rates / commodities q Which type of derivatives is most popular? – Forward / futures / swap / option FMI 3 -20

Derivatives statistics q How can we measure derivatives’ volume? – Notional / market value / turnover q Where are the largest volumes of derivatives (by notional)? – At the exchanges or OTC? q Where are the largest trading volumes of derivatives? – At the exchanges or OTC? q What is the most popular underlying? – Equities / currencies / interest rates / commodities q Which type of derivatives is most popular? – Forward / futures / swap / option FMI 3 -20

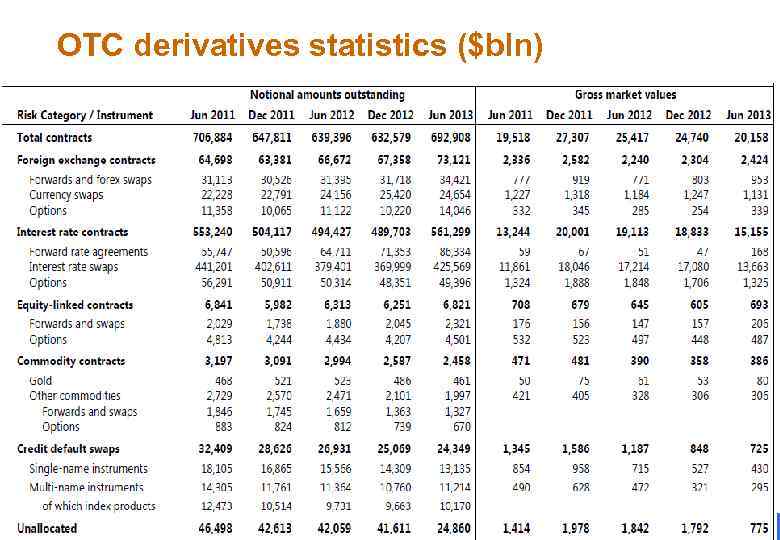

OTC derivatives statistics ($bln) FMI 3 -21

OTC derivatives statistics ($bln) FMI 3 -21

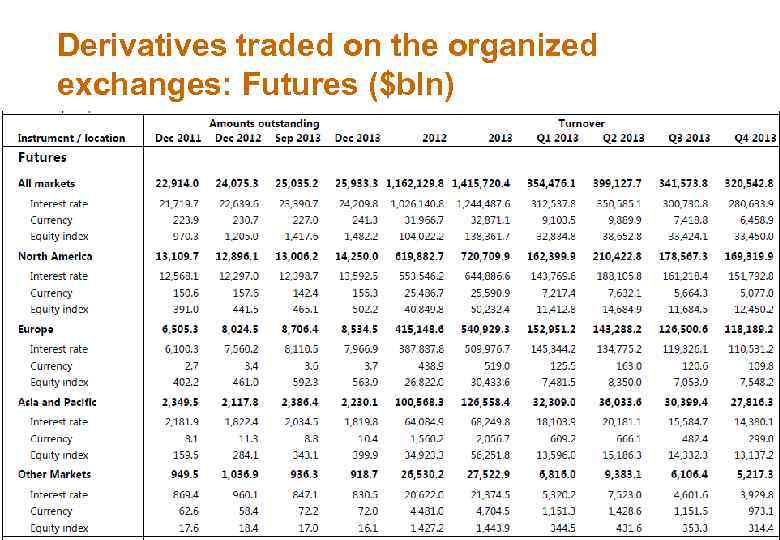

Derivatives traded on the organized exchanges: Futures ($bln) FMI 3 -22

Derivatives traded on the organized exchanges: Futures ($bln) FMI 3 -22

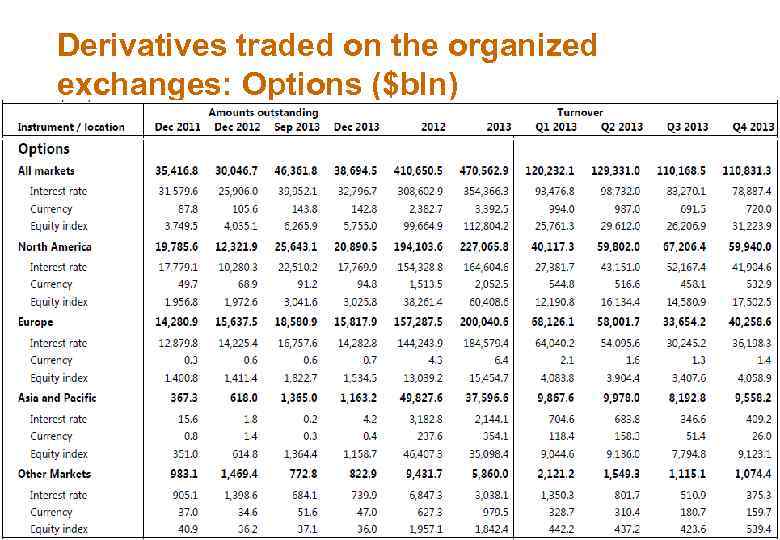

Derivatives traded on the organized exchanges: Options ($bln) FMI 3 -23

Derivatives traded on the organized exchanges: Options ($bln) FMI 3 -23

Discussion topic What are main benefits and main costs of derivatives?

Discussion topic What are main benefits and main costs of derivatives?

![Mini-case: Warren Buffet’s view on derivatives in 2002 q We view [derivatives] as time Mini-case: Warren Buffet’s view on derivatives in 2002 q We view [derivatives] as time](https://present5.com/presentation/34008_282666480/image-25.jpg) Mini-case: Warren Buffet’s view on derivatives in 2002 q We view [derivatives] as time bombs, both for the parties that deal in them and the economic system. q Derivatives business [is] like hell …easy to enter and almost impossible to exit. Once you write a contract - which may require a large payment decades later - you are usually stuck with it. q. . . the macro picture is dangerous. Large amounts of risk …concentrated in the hands of relatively few derivatives dealers. q had [the Fed] not intervened, …the LTCM could well have posed a serious threat to the stability of American markets. q The derivatives genie is now well out of the bottle. …derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal. FMI 3 -25

Mini-case: Warren Buffet’s view on derivatives in 2002 q We view [derivatives] as time bombs, both for the parties that deal in them and the economic system. q Derivatives business [is] like hell …easy to enter and almost impossible to exit. Once you write a contract - which may require a large payment decades later - you are usually stuck with it. q. . . the macro picture is dangerous. Large amounts of risk …concentrated in the hands of relatively few derivatives dealers. q had [the Fed] not intervened, …the LTCM could well have posed a serious threat to the stability of American markets. q The derivatives genie is now well out of the bottle. …derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal. FMI 3 -25

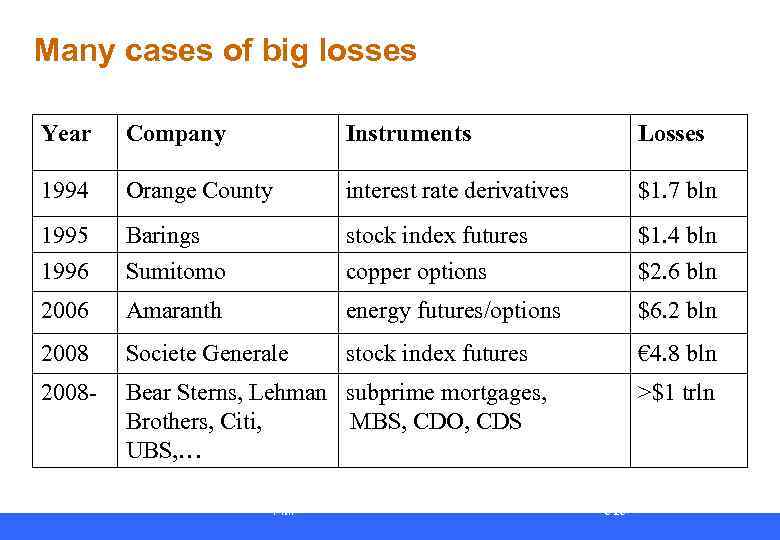

Many cases of big losses Year Company Instruments Losses 1994 Orange County interest rate derivatives $1. 7 bln 1995 Barings stock index futures $1. 4 bln 1996 Sumitomo copper options $2. 6 bln 2006 Amaranth energy futures/options $6. 2 bln 2008 Societe Generale stock index futures € 4. 8 bln 2008 - Bear Sterns, Lehman subprime mortgages, Brothers, Citi, MBS, CDO, CDS UBS, … FMI >$1 trln 3 -26

Many cases of big losses Year Company Instruments Losses 1994 Orange County interest rate derivatives $1. 7 bln 1995 Barings stock index futures $1. 4 bln 1996 Sumitomo copper options $2. 6 bln 2006 Amaranth energy futures/options $6. 2 bln 2008 Societe Generale stock index futures € 4. 8 bln 2008 - Bear Sterns, Lehman subprime mortgages, Brothers, Citi, MBS, CDO, CDS UBS, … FMI >$1 trln 3 -26

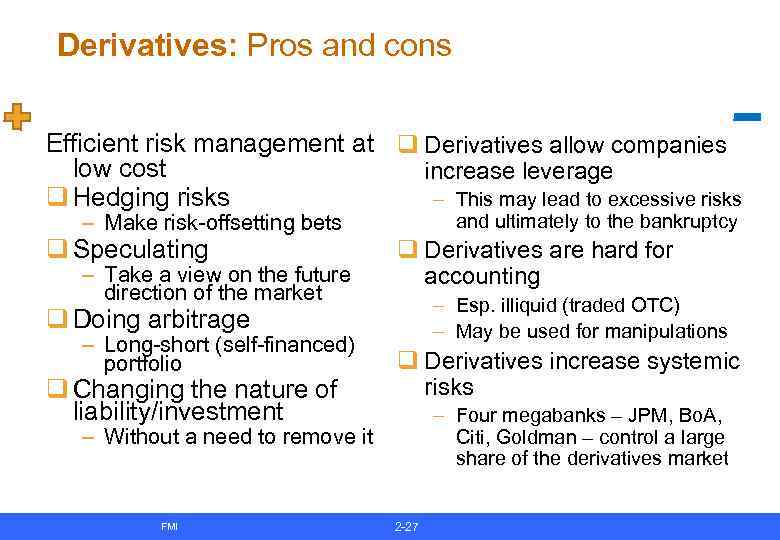

Derivatives: Pros and cons Efficient risk management at q Derivatives allow companies low cost increase leverage q Hedging risks – This may lead to excessive risks and ultimately to the bankruptcy – Make risk-offsetting bets q Speculating – Take a view on the future direction of the market q Derivatives are hard for accounting – Esp. illiquid (traded OTC) – May be used for manipulations q Doing arbitrage – Long-short (self-financed) portfolio q Changing the nature of liability/investment q Derivatives increase systemic risks – Four megabanks – JPM, Bo. A, Citi, Goldman – control a large share of the derivatives market – Without a need to remove it FMI 2 -27

Derivatives: Pros and cons Efficient risk management at q Derivatives allow companies low cost increase leverage q Hedging risks – This may lead to excessive risks and ultimately to the bankruptcy – Make risk-offsetting bets q Speculating – Take a view on the future direction of the market q Derivatives are hard for accounting – Esp. illiquid (traded OTC) – May be used for manipulations q Doing arbitrage – Long-short (self-financed) portfolio q Changing the nature of liability/investment q Derivatives increase systemic risks – Four megabanks – JPM, Bo. A, Citi, Goldman – control a large share of the derivatives market – Without a need to remove it FMI 2 -27