2 market risk.pptx

- Количество слайдов: 42

Class 2 Measuring Market Risk

Class 2 Measuring Market Risk

What does the company measure risk for? 2

What does the company measure risk for? 2

What can we say about Sberbank shares? What can we predict? 120 100 80 60 40 20 3 Ja n 14 Ja n 13 Ja n 12 Ja n 11 Ja n 10 Ja n 09 Ja n 08 Ja n 07 Ja n 06 Ja n 05 0

What can we say about Sberbank shares? What can we predict? 120 100 80 60 40 20 3 Ja n 14 Ja n 13 Ja n 12 Ja n 11 Ja n 10 Ja n 09 Ja n 08 Ja n 07 Ja n 06 Ja n 05 0

What can we say about Sberbank shares? What can we predict? q Movements in asset prices are (almost) unpredictable – If someone could predict tomorrow’s price, (s)he would trade on this information and move today’s price to fair value – This is the basis for the Efficient Markets hypothesis q Prices move due to economic news arriving – Positive and negative news move the market up and down q Although we can’t predict future prices q …we can predict risk! 4

What can we say about Sberbank shares? What can we predict? q Movements in asset prices are (almost) unpredictable – If someone could predict tomorrow’s price, (s)he would trade on this information and move today’s price to fair value – This is the basis for the Efficient Markets hypothesis q Prices move due to economic news arriving – Positive and negative news move the market up and down q Although we can’t predict future prices q …we can predict risk! 4

How to measure risk? q Size of the position – $XXX mln q Magnitude of price changes – Volatility: st. deviation / EWMA / GARCH q Sensitivity (exposure) to risk factors (indices) – Beta / duration / delta q Potential losses – Va. R / CVa. R (Expected Shortfall) 5

How to measure risk? q Size of the position – $XXX mln q Magnitude of price changes – Volatility: st. deviation / EWMA / GARCH q Sensitivity (exposure) to risk factors (indices) – Beta / duration / delta q Potential losses – Va. R / CVa. R (Expected Shortfall) 5

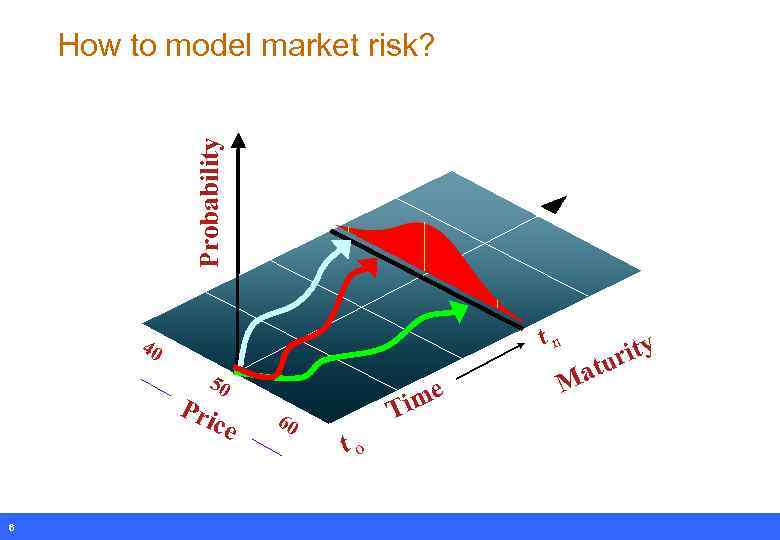

Probability How to model market risk? tn 40 50 Pri 6 ce 60 me Ti to Ma rity tu

Probability How to model market risk? tn 40 50 Pri 6 ce 60 me Ti to Ma rity tu

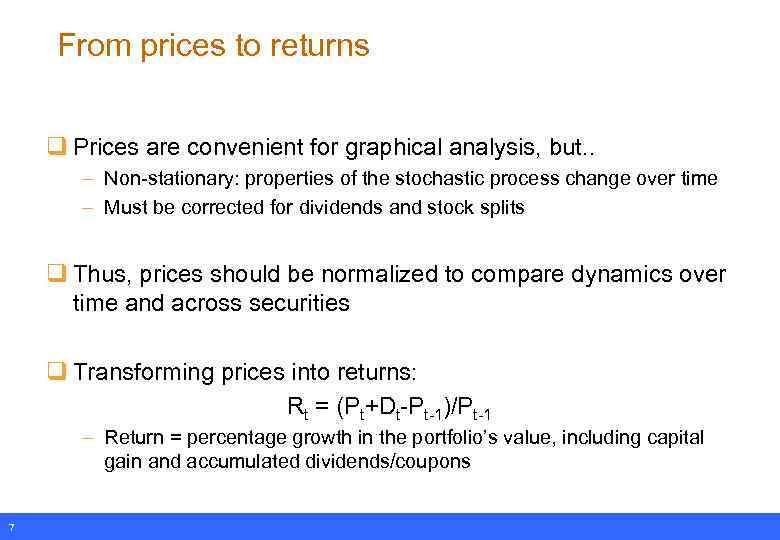

From prices to returns q Prices are convenient for graphical analysis, but. . – Non-stationary: properties of the stochastic process change over time – Must be corrected for dividends and stock splits q Thus, prices should be normalized to compare dynamics over time and across securities q Transforming prices into returns: Rt = (Pt+Dt-Pt-1)/Pt-1 – Return = percentage growth in the portfolio’s value, including capital gain and accumulated dividends/coupons 7

From prices to returns q Prices are convenient for graphical analysis, but. . – Non-stationary: properties of the stochastic process change over time – Must be corrected for dividends and stock splits q Thus, prices should be normalized to compare dynamics over time and across securities q Transforming prices into returns: Rt = (Pt+Dt-Pt-1)/Pt-1 – Return = percentage growth in the portfolio’s value, including capital gain and accumulated dividends/coupons 7

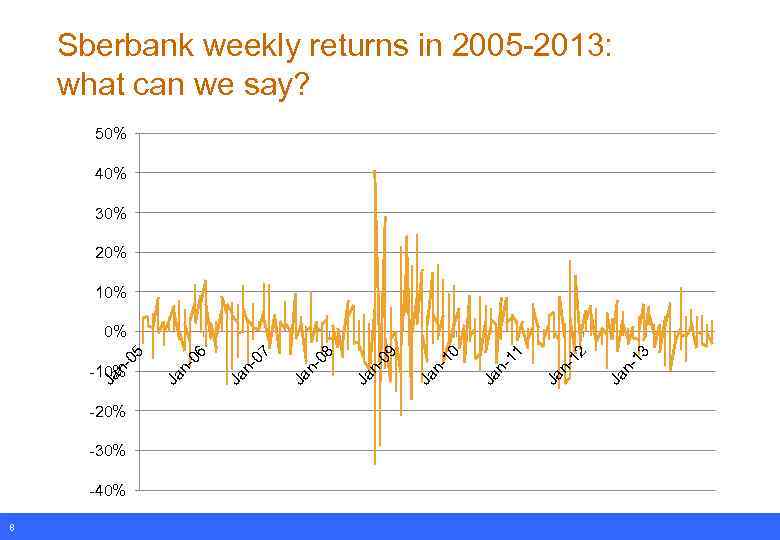

Sberbank weekly returns in 2005 -2013: what can we say? 50% 40% 30% 20% 10% -20% -30% -40% 8 Ja n 1 3 2 n 1 Ja 11 Ja n- 0 n 1 Ja 9 n 0 Ja 8 n 0 Ja 7 n 0 Ja 6 n 0 Ja -10% Ja n 0 5 0%

Sberbank weekly returns in 2005 -2013: what can we say? 50% 40% 30% 20% 10% -20% -30% -40% 8 Ja n 1 3 2 n 1 Ja 11 Ja n- 0 n 1 Ja 9 n 0 Ja 8 n 0 Ja 7 n 0 Ja 6 n 0 Ja -10% Ja n 0 5 0%

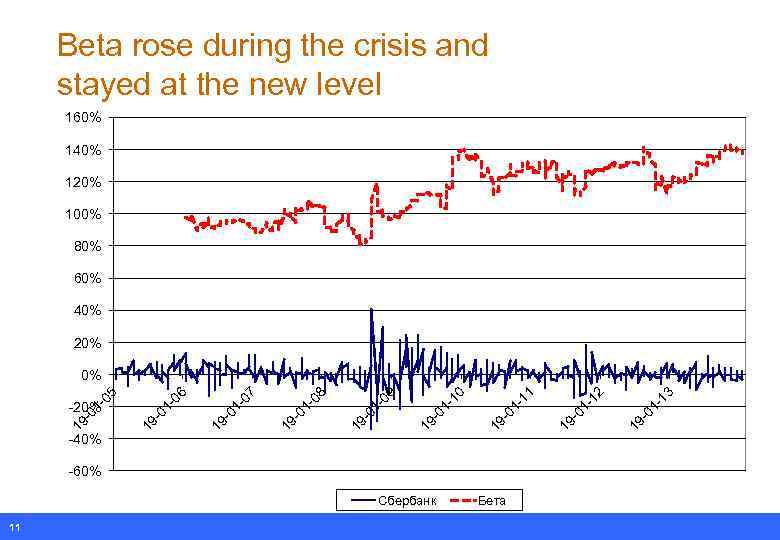

Sberbank’s risks in 2005 -2013 q Average weekly return: 0. 64% (33% per annum) ravg = (1/T) Σt=1: T rt – rt is return, T is length of the sample period q Total risk = volatility – Variance: σ2 t = (1/T) Σt=1: T (rt -ravg)2 – Standard deviation σ: 6. 6% (47% p. a. ) q Systematic risk = beta – In the market model Ri, t = αi + βi *RM, t + εi, t • RM, t : market index return, εi, t : error – βсбер = 1. 1 q However, risks change over time! – Let’s compute risks based on the rolling window of 1 year 9

Sberbank’s risks in 2005 -2013 q Average weekly return: 0. 64% (33% per annum) ravg = (1/T) Σt=1: T rt – rt is return, T is length of the sample period q Total risk = volatility – Variance: σ2 t = (1/T) Σt=1: T (rt -ravg)2 – Standard deviation σ: 6. 6% (47% p. a. ) q Systematic risk = beta – In the market model Ri, t = αi + βi *RM, t + εi, t • RM, t : market index return, εi, t : error – βсбер = 1. 1 q However, risks change over time! – Let’s compute risks based on the rolling window of 1 year 9

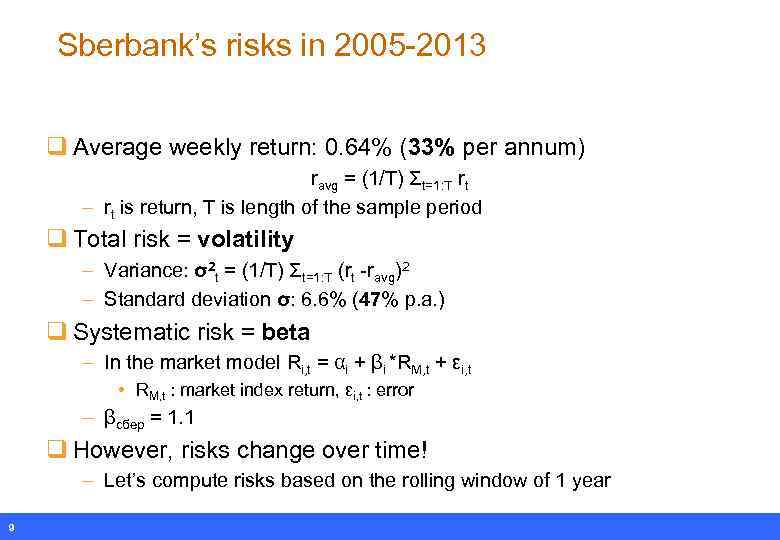

Volatility was higher in 2008 -2009 because of the crisis 50% 40% 30% 20% 10% -20% -30% -40% Сбербанк 10 Волатильность -1 3 19 -0 1 -1 2 19 -0 1 -1 1 -0 1 19 01 -1 0 19 - 01 -0 9 19 - 01 -0 8 19 - -0 7 19 -0 1 01 -0 6 19 - -10% 19 - 01 -0 5 0%

Volatility was higher in 2008 -2009 because of the crisis 50% 40% 30% 20% 10% -20% -30% -40% Сбербанк 10 Волатильность -1 3 19 -0 1 -1 2 19 -0 1 -1 1 -0 1 19 01 -1 0 19 - 01 -0 9 19 - 01 -0 8 19 - -0 7 19 -0 1 01 -0 6 19 - -10% 19 - 01 -0 5 0%

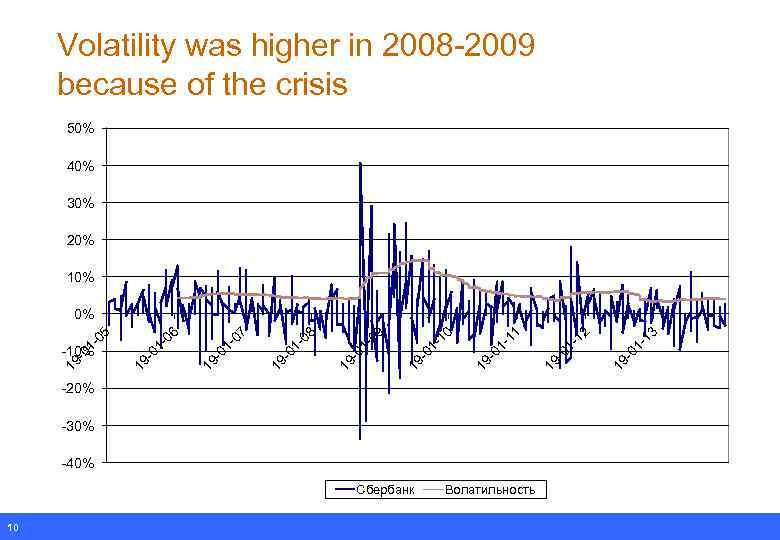

Beta rose during the crisis and stayed at the new level 160% 140% 120% 100% 80% 60% 40% 20% -60% Сбербанк 11 Бета 01 -1 3 19 - 01 -1 2 19 - 01 -1 1 19 - -1 0 19 -0 1 -0 9 19 -0 1 -0 8 19 -0 1 -0 7 -0 1 19 -40% 01 -0 6 19 -0 1 -20% 19 - -0 5 0%

Beta rose during the crisis and stayed at the new level 160% 140% 120% 100% 80% 60% 40% 20% -60% Сбербанк 11 Бета 01 -1 3 19 - 01 -1 2 19 - 01 -1 1 19 - -1 0 19 -0 1 -0 9 19 -0 1 -0 8 19 -0 1 -0 7 -0 1 19 -40% 01 -0 6 19 -0 1 -20% 19 - -0 5 0%

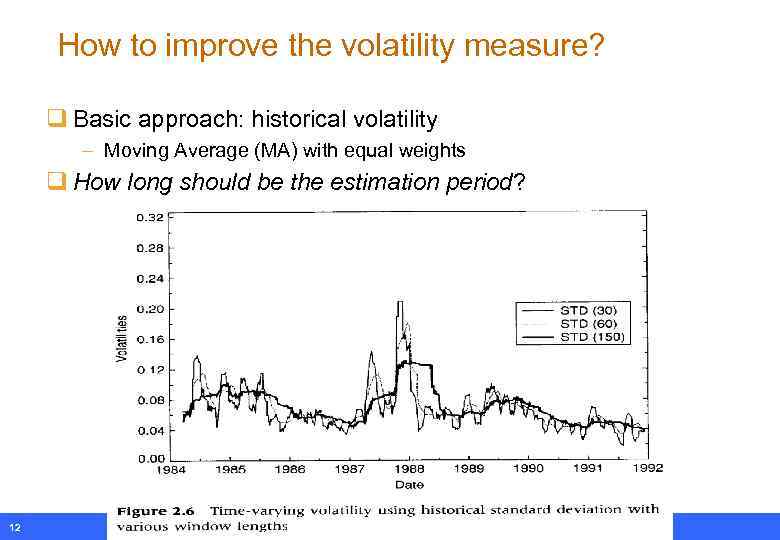

How to improve the volatility measure? q Basic approach: historical volatility – Moving Average (MA) with equal weights q How long should be the estimation period? 12

How to improve the volatility measure? q Basic approach: historical volatility – Moving Average (MA) with equal weights q How long should be the estimation period? 12

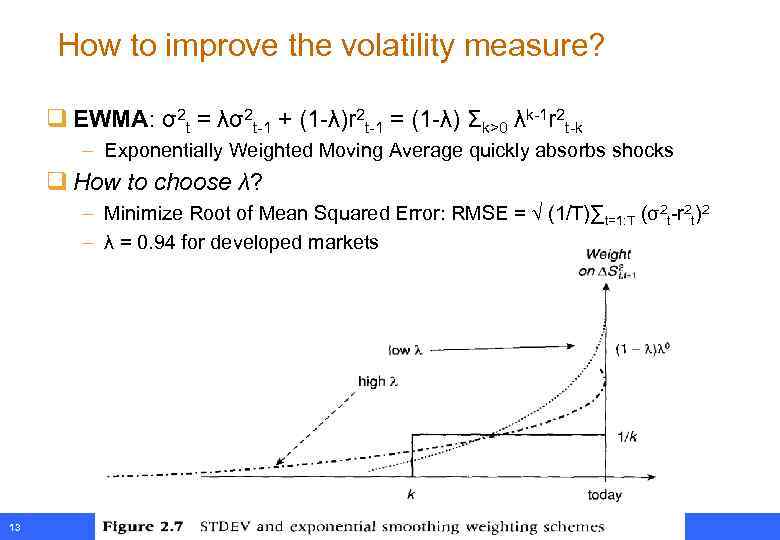

How to improve the volatility measure? q EWMA: σ2 t = λσ2 t-1 + (1 -λ)r 2 t-1 = (1 -λ) Σk>0 λk-1 r 2 t-k – Exponentially Weighted Moving Average quickly absorbs shocks q How to choose λ? – Minimize Root of Mean Squared Error: RMSE = √ (1/T)∑t=1: T (σ2 t-r 2 t)2 – λ = 0. 94 for developed markets 13

How to improve the volatility measure? q EWMA: σ2 t = λσ2 t-1 + (1 -λ)r 2 t-1 = (1 -λ) Σk>0 λk-1 r 2 t-k – Exponentially Weighted Moving Average quickly absorbs shocks q How to choose λ? – Minimize Root of Mean Squared Error: RMSE = √ (1/T)∑t=1: T (σ2 t-r 2 t)2 – λ = 0. 94 for developed markets 13

How to improve the volatility measure? q GARCH(1, 1): σ2 t = a + bσ2 t-1 + cε 2 t-1 – Generalized Auto. Regressive Conditional Heteroskedasticity model is more general and flexible than EWMA – Can include additional effects: • More lags • Stronger reaction to negative shocks (leverage effect) q Is more general model always good? – More parameters leads to larger estimation error – GARCH is used less frequently in risk management than EWMA 14

How to improve the volatility measure? q GARCH(1, 1): σ2 t = a + bσ2 t-1 + cε 2 t-1 – Generalized Auto. Regressive Conditional Heteroskedasticity model is more general and flexible than EWMA – Can include additional effects: • More lags • Stronger reaction to negative shocks (leverage effect) q Is more general model always good? – More parameters leads to larger estimation error – GARCH is used less frequently in risk management than EWMA 14

How to improve the volatility measure? q Implied volatility: based on options’ market prices and (Black-Sholes) model 15 q Realized volatility: based on intraday data

How to improve the volatility measure? q Implied volatility: based on options’ market prices and (Black-Sholes) model 15 q Realized volatility: based on intraday data

How to improve the volatility measure? q Implied volatility: based on options’ market prices and (Black-Sholes) model – Forward-looking! – But depends on the model – Only for assets with liquid options 16 q Realized volatility: based on intraday data – E. g. , prices over hourly intervals – May be biased by trading effects – Only for liquid assets

How to improve the volatility measure? q Implied volatility: based on options’ market prices and (Black-Sholes) model – Forward-looking! – But depends on the model – Only for assets with liquid options 16 q Realized volatility: based on intraday data – E. g. , prices over hourly intervals – May be biased by trading effects – Only for liquid assets

How to improve the beta measure? q Historical beta – Estimation error: if you estimated beta of 2, true beta is probably 1. 5 – Low prediction ability • Trade-off when choosing the estimation period q Non-linear effects – E. g. , allow beta depend on the market index q More factors: multi-factor model – – 17 Ri, t = αi + Σkβki. Ikt + εi, t Global / regional / country market indices Industry indices Macro-factors: oil price, inflation, exchange rates, interest rates, … Investment styles: small-cap, value (low P/E), momentum (past winners)

How to improve the beta measure? q Historical beta – Estimation error: if you estimated beta of 2, true beta is probably 1. 5 – Low prediction ability • Trade-off when choosing the estimation period q Non-linear effects – E. g. , allow beta depend on the market index q More factors: multi-factor model – – 17 Ri, t = αi + Σkβki. Ikt + εi, t Global / regional / country market indices Industry indices Macro-factors: oil price, inflation, exchange rates, interest rates, … Investment styles: small-cap, value (low P/E), momentum (past winners)

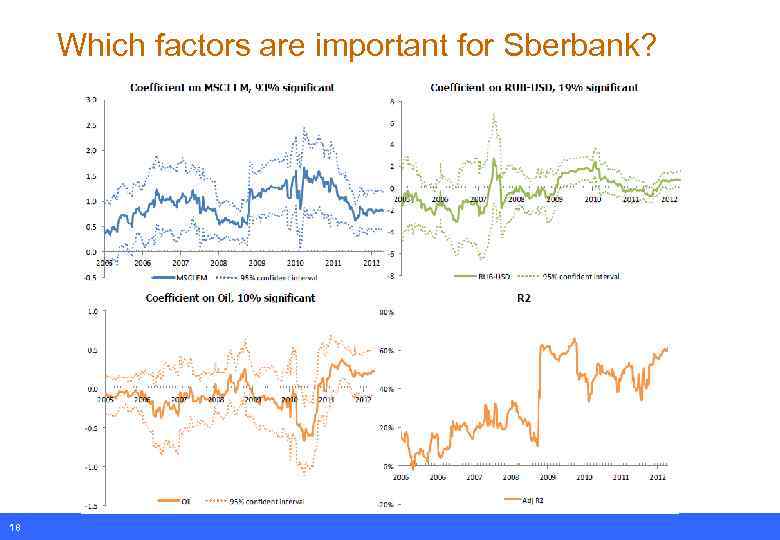

Which factors are important for Sberbank? 18

Which factors are important for Sberbank? 18

How to apply beta approach to other assets? q Bonds: – Duration D measures elasticity of the bond’s price to interest rates – Convexity C measures the second-order effect – For a small change in the interest rate y: ΔP/P ≈ -D Δy/y + ½ C (Δy/y)2 19 q Derivatives: – Delta δ measures sensitivity to the underlying asset’s price – Gamma γ measures the second-order effect – Vega measures sensitivity to volatility

How to apply beta approach to other assets? q Bonds: – Duration D measures elasticity of the bond’s price to interest rates – Convexity C measures the second-order effect – For a small change in the interest rate y: ΔP/P ≈ -D Δy/y + ½ C (Δy/y)2 19 q Derivatives: – Delta δ measures sensitivity to the underlying asset’s price – Gamma γ measures the second-order effect – Vega measures sensitivity to volatility

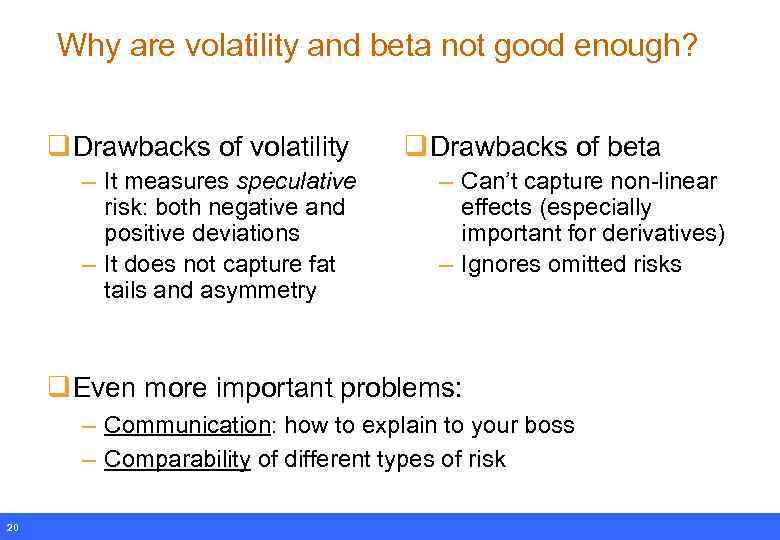

Why are volatility and beta not good enough? q Drawbacks of volatility – It measures speculative risk: both negative and positive deviations – It does not capture fat tails and asymmetry q Drawbacks of beta – Can’t capture non-linear effects (especially important for derivatives) – Ignores omitted risks q Even more important problems: – Communication: how to explain to your boss – Comparability of different types of risk 20

Why are volatility and beta not good enough? q Drawbacks of volatility – It measures speculative risk: both negative and positive deviations – It does not capture fat tails and asymmetry q Drawbacks of beta – Can’t capture non-linear effects (especially important for derivatives) – Ignores omitted risks q Even more important problems: – Communication: how to explain to your boss – Comparability of different types of risk 20

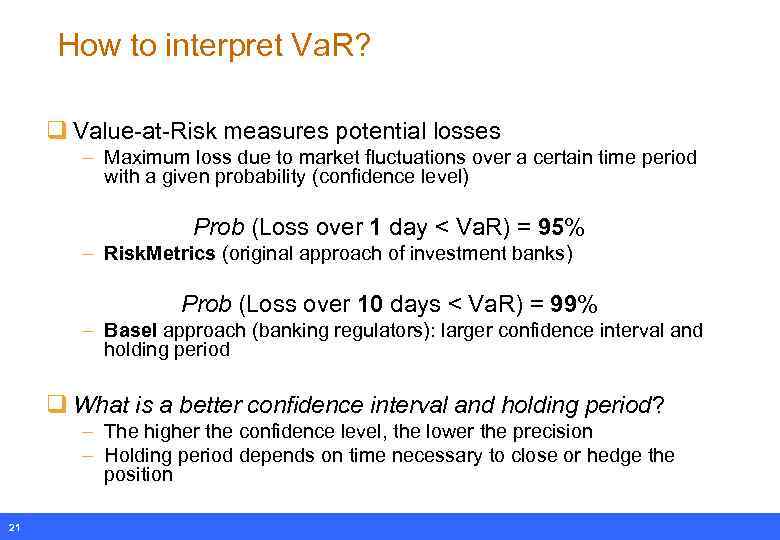

How to interpret Va. R? q Value-at-Risk measures potential losses – Maximum loss due to market fluctuations over a certain time period with a given probability (confidence level) Prob (Loss over 1 day < Va. R) = 95% – Risk. Metrics (original approach of investment banks) Prob (Loss over 10 days < Va. R) = 99% – Basel approach (banking regulators): larger confidence interval and holding period q What is a better confidence interval and holding period? – The higher the confidence level, the lower the precision – Holding period depends on time necessary to close or hedge the position 21

How to interpret Va. R? q Value-at-Risk measures potential losses – Maximum loss due to market fluctuations over a certain time period with a given probability (confidence level) Prob (Loss over 1 day < Va. R) = 95% – Risk. Metrics (original approach of investment banks) Prob (Loss over 10 days < Va. R) = 99% – Basel approach (banking regulators): larger confidence interval and holding period q What is a better confidence interval and holding period? – The higher the confidence level, the lower the precision – Holding period depends on time necessary to close or hedge the position 21

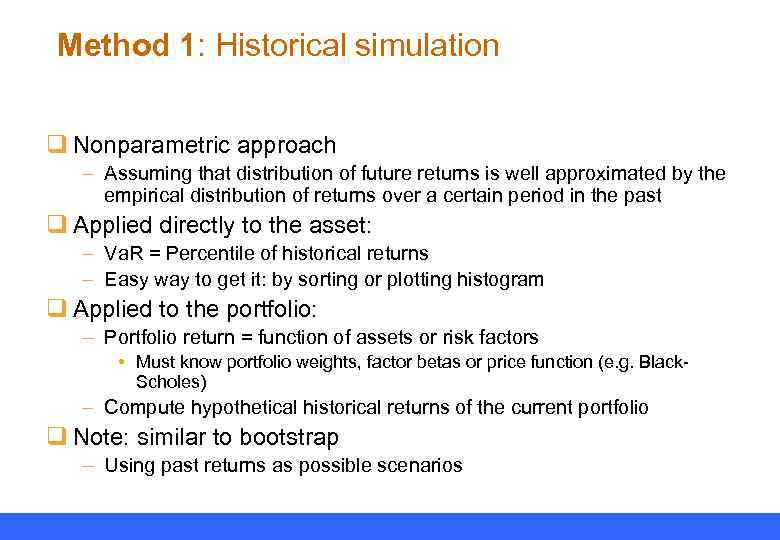

Method 1: Historical simulation q Nonparametric approach – Assuming that distribution of future returns is well approximated by the empirical distribution of returns over a certain period in the past q Applied directly to the asset: – Va. R = Percentile of historical returns – Easy way to get it: by sorting or plotting histogram q Applied to the portfolio: – Portfolio return = function of assets or risk factors • Must know portfolio weights, factor betas or price function (e. g. Black. Scholes) – Compute hypothetical historical returns of the current portfolio q Note: similar to bootstrap – Using past returns as possible scenarios

Method 1: Historical simulation q Nonparametric approach – Assuming that distribution of future returns is well approximated by the empirical distribution of returns over a certain period in the past q Applied directly to the asset: – Va. R = Percentile of historical returns – Easy way to get it: by sorting or plotting histogram q Applied to the portfolio: – Portfolio return = function of assets or risk factors • Must know portfolio weights, factor betas or price function (e. g. Black. Scholes) – Compute hypothetical historical returns of the current portfolio q Note: similar to bootstrap – Using past returns as possible scenarios

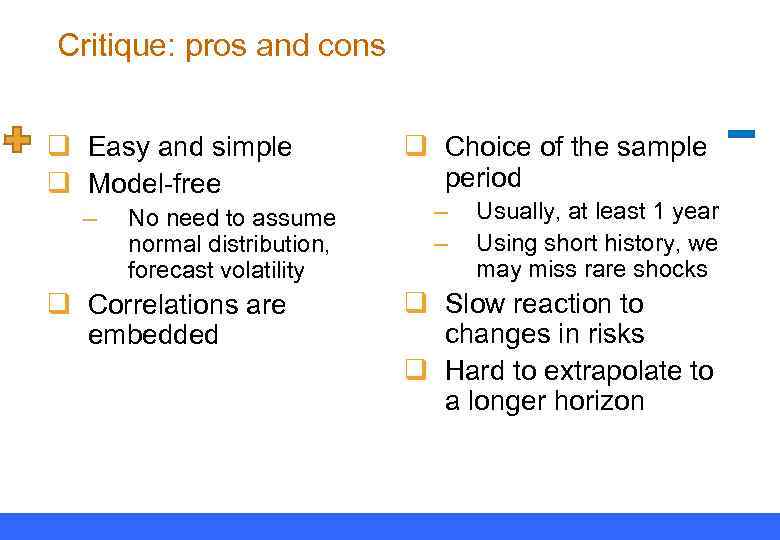

Critique: pros and cons q Easy and simple q Model-free – No need to assume normal distribution, forecast volatility q Correlations are embedded q Choice of the sample period – – Usually, at least 1 year Using short history, we may miss rare shocks q Slow reaction to changes in risks q Hard to extrapolate to a longer horizon

Critique: pros and cons q Easy and simple q Model-free – No need to assume normal distribution, forecast volatility q Correlations are embedded q Choice of the sample period – – Usually, at least 1 year Using short history, we may miss rare shocks q Slow reaction to changes in risks q Hard to extrapolate to a longer horizon

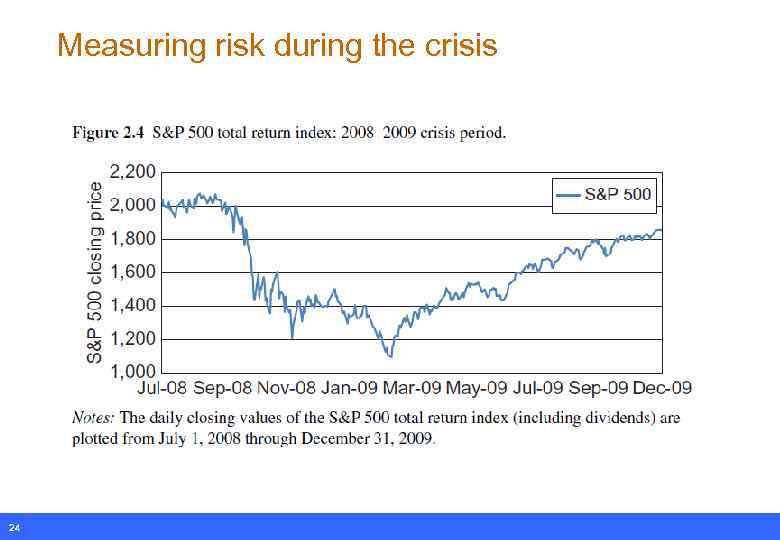

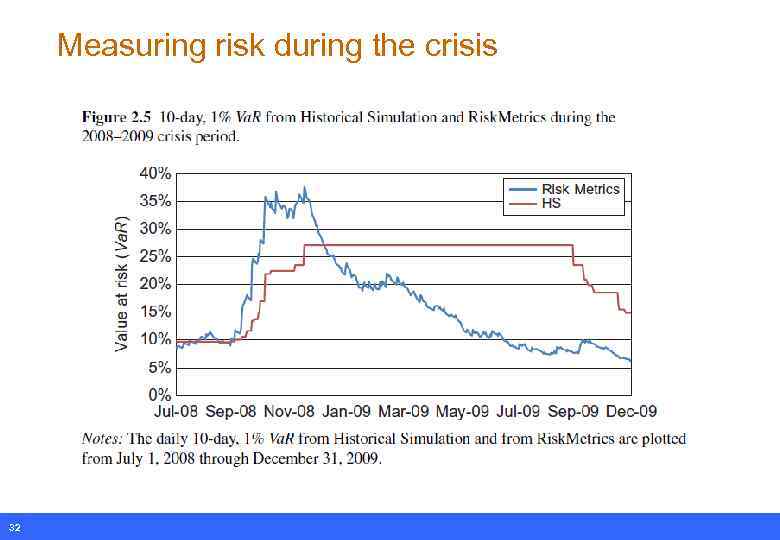

Measuring risk during the crisis 24

Measuring risk during the crisis 24

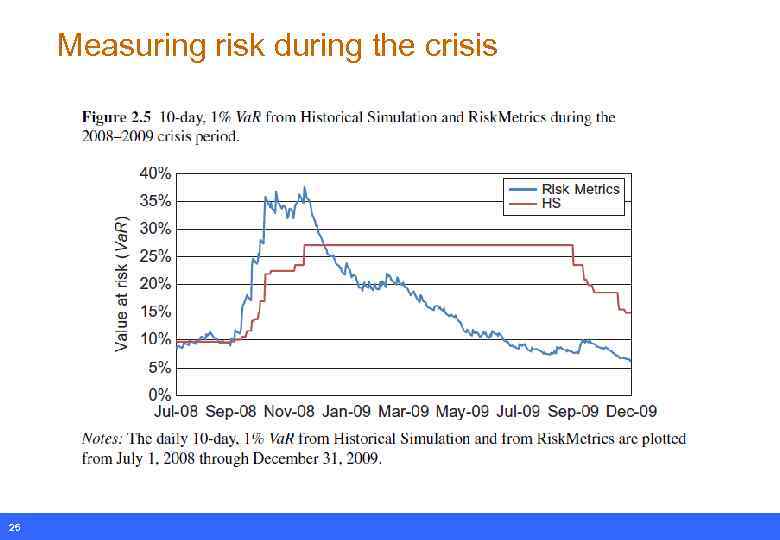

Measuring risk during the crisis 25

Measuring risk during the crisis 25

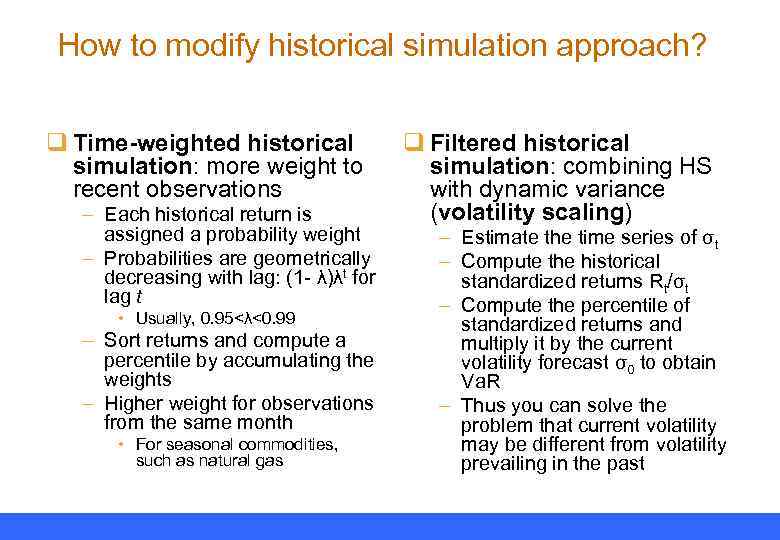

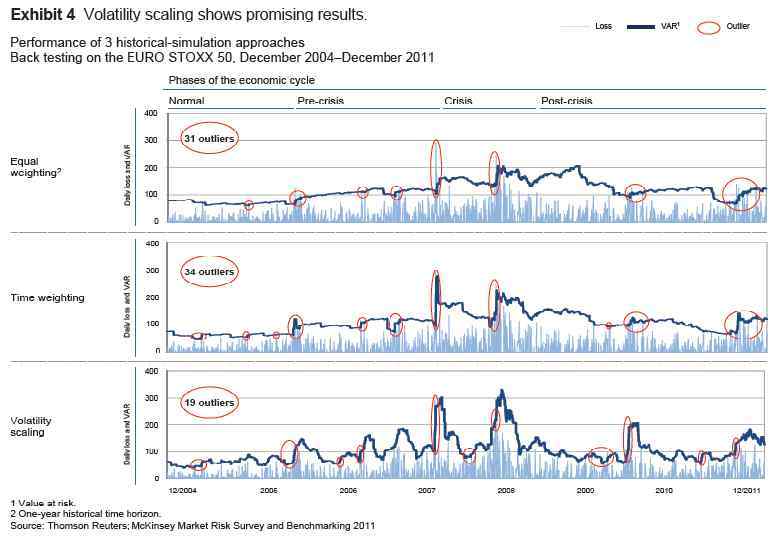

How to modify historical simulation approach? q Time-weighted historical simulation: more weight to recent observations – Each historical return is assigned a probability weight – Probabilities are geometrically decreasing with lag: (1 - λ)λt for lag t • Usually, 0. 95<λ<0. 99 – Sort returns and compute a percentile by accumulating the weights – Higher weight for observations from the same month • For seasonal commodities, such as natural gas q Filtered historical simulation: combining HS with dynamic variance (volatility scaling) – Estimate the time series of σt – Compute the historical standardized returns Rt/σt – Compute the percentile of standardized returns and multiply it by the current volatility forecast σ0 to obtain Va. R – Thus you can solve the problem that current volatility may be different from volatility prevailing in the past

How to modify historical simulation approach? q Time-weighted historical simulation: more weight to recent observations – Each historical return is assigned a probability weight – Probabilities are geometrically decreasing with lag: (1 - λ)λt for lag t • Usually, 0. 95<λ<0. 99 – Sort returns and compute a percentile by accumulating the weights – Higher weight for observations from the same month • For seasonal commodities, such as natural gas q Filtered historical simulation: combining HS with dynamic variance (volatility scaling) – Estimate the time series of σt – Compute the historical standardized returns Rt/σt – Compute the percentile of standardized returns and multiply it by the current volatility forecast σ0 to obtain Va. R – Thus you can solve the problem that current volatility may be different from volatility prevailing in the past

27

27

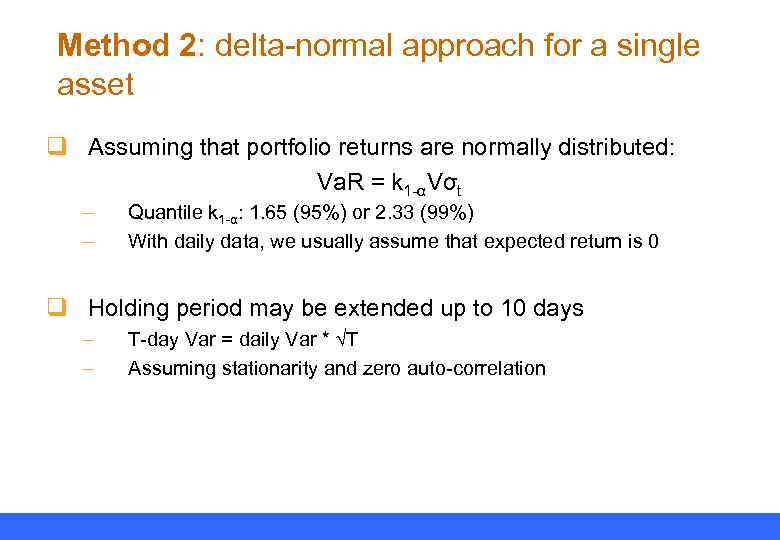

Method 2: delta-normal approach for a single asset q Assuming that portfolio returns are normally distributed: Va. R = k 1 -αVσt – – Quantile k 1 -α: 1. 65 (95%) or 2. 33 (99%) With daily data, we usually assume that expected return is 0 q Holding period may be extended up to 10 days – – T-day Var = daily Var * √T Assuming stationarity and zero auto-correlation

Method 2: delta-normal approach for a single asset q Assuming that portfolio returns are normally distributed: Va. R = k 1 -αVσt – – Quantile k 1 -α: 1. 65 (95%) or 2. 33 (99%) With daily data, we usually assume that expected return is 0 q Holding period may be extended up to 10 days – – T-day Var = daily Var * √T Assuming stationarity and zero auto-correlation

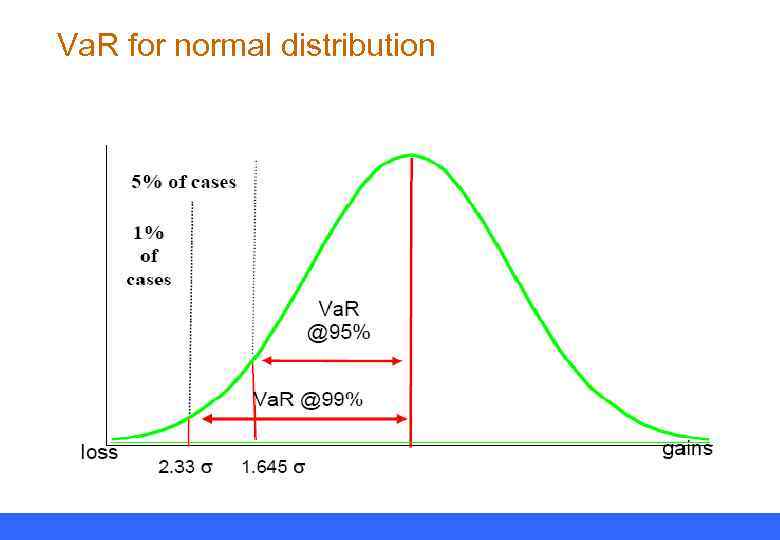

Va. R for normal distribution

Va. R for normal distribution

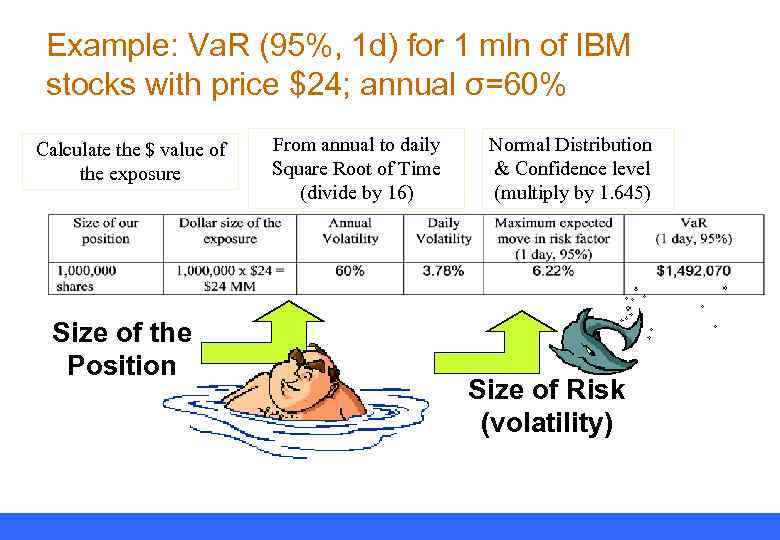

Example: Va. R (95%, 1 d) for 1 mln of IBM stocks with price $24; annual σ=60% Calculate the $ value of the exposure Size of the Position From annual to daily Square Root of Time (divide by 16) Normal Distribution & Confidence level (multiply by 1. 645) Size of Risk (volatility)

Example: Va. R (95%, 1 d) for 1 mln of IBM stocks with price $24; annual σ=60% Calculate the $ value of the exposure Size of the Position From annual to daily Square Root of Time (divide by 16) Normal Distribution & Confidence level (multiply by 1. 645) Size of Risk (volatility)

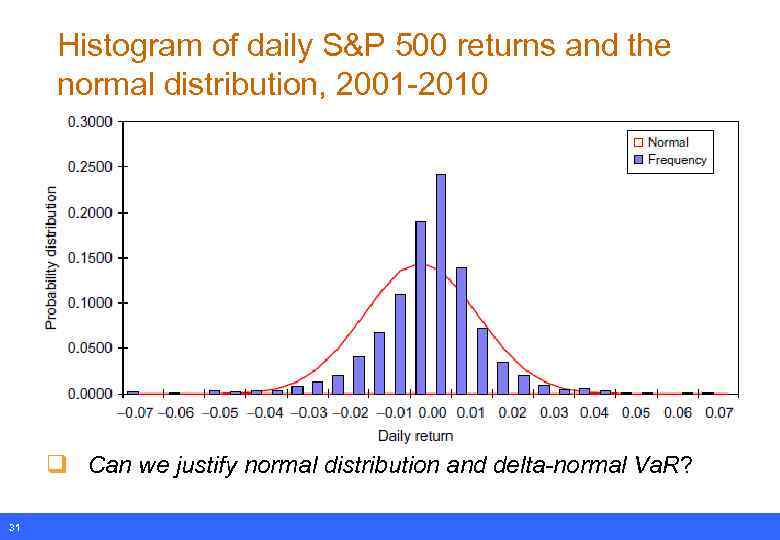

Histogram of daily S&P 500 returns and the normal distribution, 2001 -2010 q Can we justify normal distribution and delta-normal Va. R? 31

Histogram of daily S&P 500 returns and the normal distribution, 2001 -2010 q Can we justify normal distribution and delta-normal Va. R? 31

Measuring risk during the crisis 32

Measuring risk during the crisis 32

Delta-normal method for a portfolio: risk mapping q Decomposition of the portfolio to multiple risk factors: Rp=β’F+ε Va. R = k 1 -αV√β’ΣFβ – Rp is decomposed based on Taylor series – β: vector of portfolio weights or sensitivities of portfolio return to factor returns – ΣF: covariance matrix of risk factors

Delta-normal method for a portfolio: risk mapping q Decomposition of the portfolio to multiple risk factors: Rp=β’F+ε Va. R = k 1 -αV√β’ΣFβ – Rp is decomposed based on Taylor series – β: vector of portfolio weights or sensitivities of portfolio return to factor returns – ΣF: covariance matrix of risk factors

Critique: pros and cons q Strong assumption q Quick computations about normal distribution q Easy to extrapolate to q Cannot properly handle a longer horizon complicated derivatives q Quick reaction to with non-linear payoffs changes in risks q Computations rise geometrically with the number of assets/factors

Critique: pros and cons q Strong assumption q Quick computations about normal distribution q Easy to extrapolate to q Cannot properly handle a longer horizon complicated derivatives q Quick reaction to with non-linear payoffs changes in risks q Computations rise geometrically with the number of assets/factors

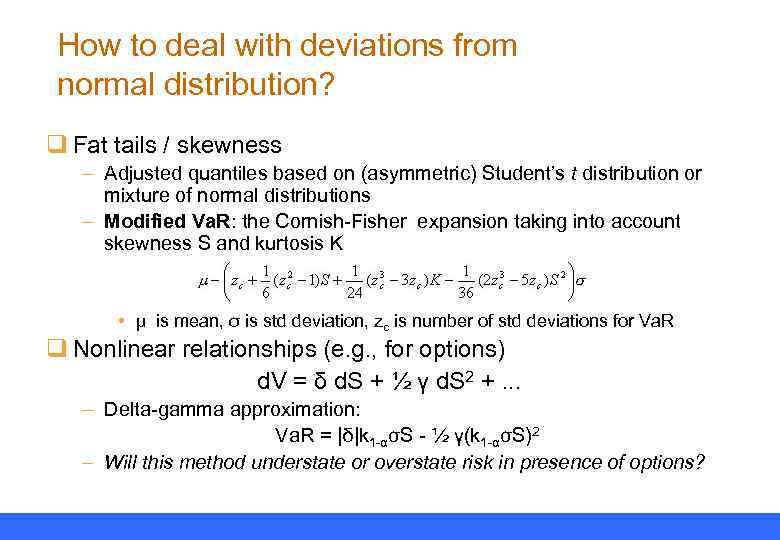

How to deal with deviations from normal distribution? q Fat tails / skewness – Adjusted quantiles based on (asymmetric) Student’s t distribution or mixture of normal distributions – Modified Va. R: the Cornish-Fisher expansion taking into account skewness S and kurtosis K • μ is mean, σ is std deviation, zc is number of std deviations for Va. R q Nonlinear relationships (e. g. , for options) d. V = δ d. S + ½ γ d. S 2 +. . . – Delta-gamma approximation: Va. R = |δ|k 1 -ασS - ½ γ(k 1 -ασS)2 – Will this method understate or overstate risk in presence of options?

How to deal with deviations from normal distribution? q Fat tails / skewness – Adjusted quantiles based on (asymmetric) Student’s t distribution or mixture of normal distributions – Modified Va. R: the Cornish-Fisher expansion taking into account skewness S and kurtosis K • μ is mean, σ is std deviation, zc is number of std deviations for Va. R q Nonlinear relationships (e. g. , for options) d. V = δ d. S + ½ γ d. S 2 +. . . – Delta-gamma approximation: Va. R = |δ|k 1 -ασS - ½ γ(k 1 -ασS)2 – Will this method understate or overstate risk in presence of options?

Method 3: Monte Carlo simulation q Model (multivariate) factor distributions – – Stocks: Geometric Brownian Motion / with jumps Interest rates: Vasicek / CIR / multifactor models q Generate scenarios and compute the realized P&L – Using factor innovations from the model q Plot and analyze the empirical distribution of P&L

Method 3: Monte Carlo simulation q Model (multivariate) factor distributions – – Stocks: Geometric Brownian Motion / with jumps Interest rates: Vasicek / CIR / multifactor models q Generate scenarios and compute the realized P&L – Using factor innovations from the model q Plot and analyze the empirical distribution of P&L

Critique: pros and cons q Most powerful and flexible q Intellectual and technological skills required Can be applied to most complicated q Complexity – instruments • – E. g. path-dependent options Allows to model tail risk with higher precision – Looks like a black box q Lengthy computations – Longer reaction q Model risk – E. g. , estimating crossfactor dependencies

Critique: pros and cons q Most powerful and flexible q Intellectual and technological skills required Can be applied to most complicated q Complexity – instruments • – E. g. path-dependent options Allows to model tail risk with higher precision – Looks like a black box q Lengthy computations – Longer reaction q Model risk – E. g. , estimating crossfactor dependencies

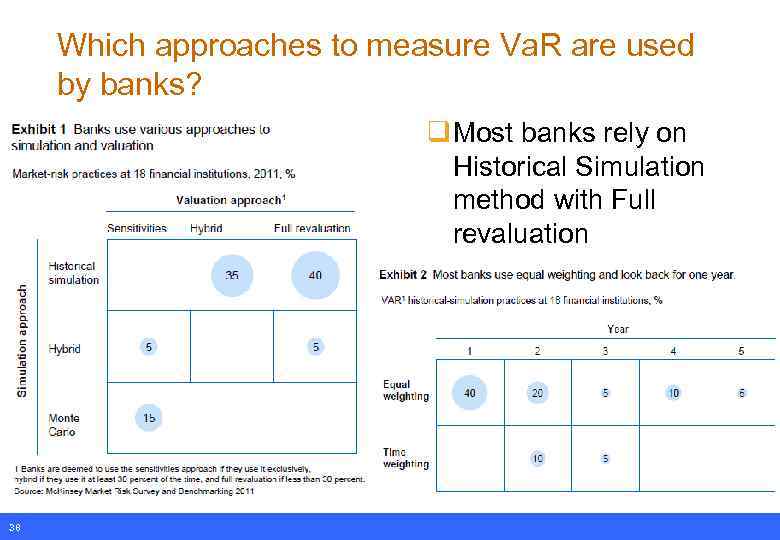

Which approaches to measure Va. R are used by banks? q Most banks rely on Historical Simulation method with Full revaluation 38

Which approaches to measure Va. R are used by banks? q Most banks rely on Historical Simulation method with Full revaluation 38

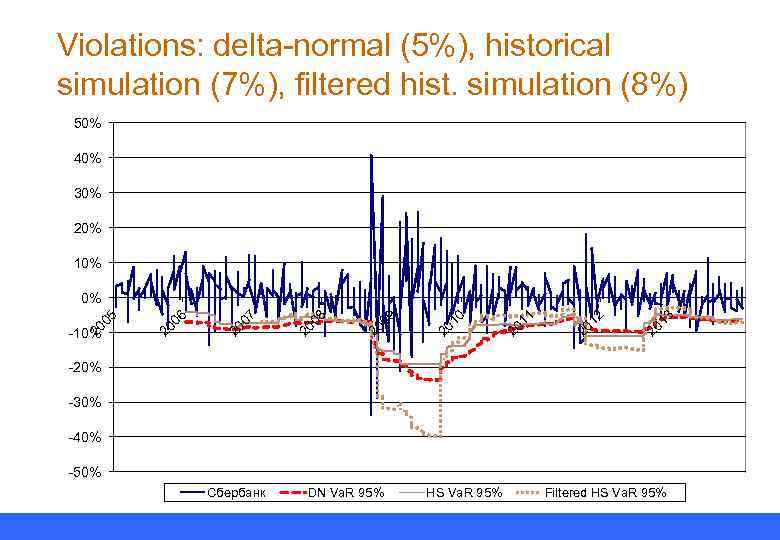

Back-testing Va. R q Verification of how precisely Va. R is measured – – Compare % violations (cases when the losses exceed Va. R) with the predicted frequency Testing whether the difference is significant: • H 0: % violations = expected frequency • p-value = 1 - binomdist(#violations, #obs. , exp. freq. , TRUE) • E. g. , 1 - binomdist(18, 252, 0. 05, TRUE) = 0. 07 q Historical approach: based on the actual P&L – – Required by Basel Helps to identify the model’s weaknesses, mistakes in the data, and intra-day trading • Often, actual P&L produces lower than expected frequency of Va. R violations due to day trading

Back-testing Va. R q Verification of how precisely Va. R is measured – – Compare % violations (cases when the losses exceed Va. R) with the predicted frequency Testing whether the difference is significant: • H 0: % violations = expected frequency • p-value = 1 - binomdist(#violations, #obs. , exp. freq. , TRUE) • E. g. , 1 - binomdist(18, 252, 0. 05, TRUE) = 0. 07 q Historical approach: based on the actual P&L – – Required by Basel Helps to identify the model’s weaknesses, mistakes in the data, and intra-day trading • Often, actual P&L produces lower than expected frequency of Va. R violations due to day trading

Violations: delta-normal (5%), historical simulation (7%), filtered hist. simulation (8%) 50% 40% 30% 20% 13 20 12 20 11 20 10 20 09 20 08 20 07 06 20 20 -10% 20 05 0% -20% -30% -40% -50% Сбербанк DN Va. R 95% HS Va. R 95% Filtered HS Va. R 95%

Violations: delta-normal (5%), historical simulation (7%), filtered hist. simulation (8%) 50% 40% 30% 20% 13 20 12 20 11 20 10 20 09 20 08 20 07 06 20 20 -10% 20 05 0% -20% -30% -40% -50% Сбербанк DN Va. R 95% HS Va. R 95% Filtered HS Va. R 95%

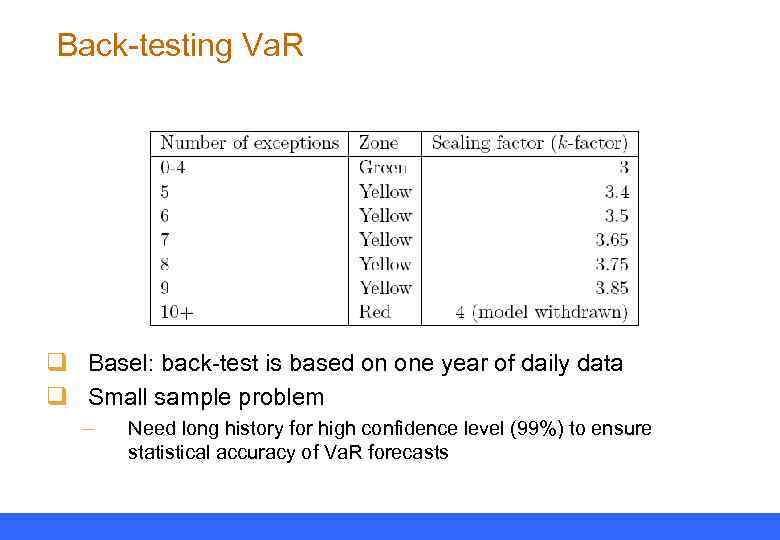

Back-testing Va. R q Basel: back-test is based on one year of daily data q Small sample problem – Need long history for high confidence level (99%) to ensure statistical accuracy of Va. R forecasts

Back-testing Va. R q Basel: back-test is based on one year of daily data q Small sample problem – Need long history for high confidence level (99%) to ensure statistical accuracy of Va. R forecasts

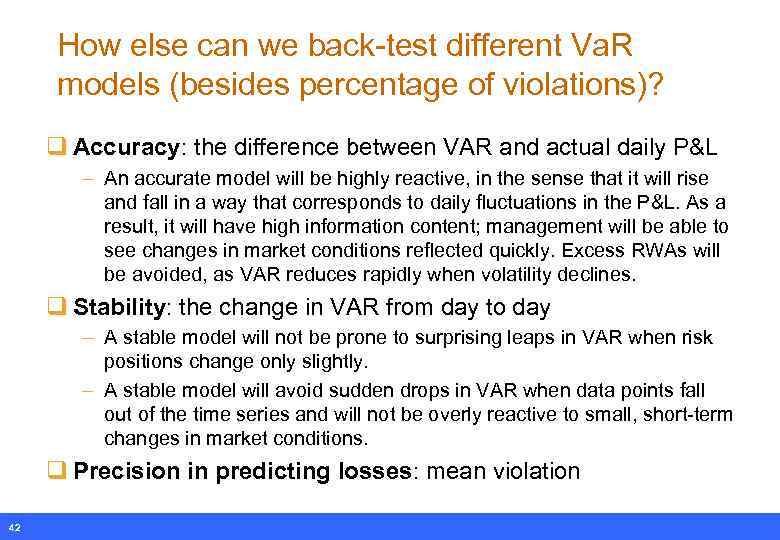

How else can we back-test different Va. R models (besides percentage of violations)? q Accuracy: the difference between VAR and actual daily P&L – An accurate model will be highly reactive, in the sense that it will rise and fall in a way that corresponds to daily fluctuations in the P&L. As a result, it will have high information content; management will be able to see changes in market conditions reflected quickly. Excess RWAs will be avoided, as VAR reduces rapidly when volatility declines. q Stability: the change in VAR from day to day – A stable model will not be prone to surprising leaps in VAR when risk positions change only slightly. – A stable model will avoid sudden drops in VAR when data points fall out of the time series and will not be overly reactive to small, short-term changes in market conditions. q Precision in predicting losses: mean violation 42

How else can we back-test different Va. R models (besides percentage of violations)? q Accuracy: the difference between VAR and actual daily P&L – An accurate model will be highly reactive, in the sense that it will rise and fall in a way that corresponds to daily fluctuations in the P&L. As a result, it will have high information content; management will be able to see changes in market conditions reflected quickly. Excess RWAs will be avoided, as VAR reduces rapidly when volatility declines. q Stability: the change in VAR from day to day – A stable model will not be prone to surprising leaps in VAR when risk positions change only slightly. – A stable model will avoid sudden drops in VAR when data points fall out of the time series and will not be overly reactive to small, short-term changes in market conditions. q Precision in predicting losses: mean violation 42