88fca4878f8adf0eaa478a08759c6bed.ppt

- Количество слайдов: 39

CITY OF ROANOKE DOWN PAYMENT ASSISTANCE PROGRAM

CITY OF ROANOKE DOWN PAYMENT ASSISTANCE PROGRAM

BRENDA THORNTON CITY OF ROANOKE HUD COMMUNITY RESOURCES 215 CHURCH AVENUE, S. W. ROOM 305 NORTH ROANOKE, VA 24011 540 -853 -6879 BRENDA. THORNTON@ROANOKEV A. GOV

BRENDA THORNTON CITY OF ROANOKE HUD COMMUNITY RESOURCES 215 CHURCH AVENUE, S. W. ROOM 305 NORTH ROANOKE, VA 24011 540 -853 -6879 BRENDA. THORNTON@ROANOKEV A. GOV

WHAT IS THE DPA? The City of Roanoke’s Down Payment Assistance (DPA) Program provides financial assistance to low- to moderate-income first time homebuyers seeking to purchase a home in Roanoke’s City Limits. The City administers the program using CDBG (Community Development Block Grant) funds that are provided by the Department of Housing and Urban Development (HUD).

WHAT IS THE DPA? The City of Roanoke’s Down Payment Assistance (DPA) Program provides financial assistance to low- to moderate-income first time homebuyers seeking to purchase a home in Roanoke’s City Limits. The City administers the program using CDBG (Community Development Block Grant) funds that are provided by the Department of Housing and Urban Development (HUD).

AVAILABLE FUNDING The City of Roanoke will offer $35, 000 in down payment assistance for the 2015 -2016 fiscal year. The funds will be available in by September and be on a first come, first served basis until funding is exhausted for qualified participants.

AVAILABLE FUNDING The City of Roanoke will offer $35, 000 in down payment assistance for the 2015 -2016 fiscal year. The funds will be available in by September and be on a first come, first served basis until funding is exhausted for qualified participants.

OVERVIEW This program offers a five (5) year forgivable loan that will cover 50% of the down payment plus closing costs (up to $8, 000). * *The City will pay up to $1, 000 on the origination fee and the City will not pay pre-paid items (Please refer to the DPA guidelines for more information).

OVERVIEW This program offers a five (5) year forgivable loan that will cover 50% of the down payment plus closing costs (up to $8, 000). * *The City will pay up to $1, 000 on the origination fee and the City will not pay pre-paid items (Please refer to the DPA guidelines for more information).

HOW THE PROGRAM WORKS… The homebuyer must use one of the City’s participating lenders to use the City’s Down Payment Assistance Program. The homebuyer may contact the participating lender to get more information on loans rates and to prequalify for a loan with the lender before shopping for a house, or: If the homebuyer has already found the home they would like to purchase, the homebuyer would need to contact the participating lender to qualify for a loan and at that time the lender will qualify the homebuyer for the City’s Down Payment Assistance Program.

HOW THE PROGRAM WORKS… The homebuyer must use one of the City’s participating lenders to use the City’s Down Payment Assistance Program. The homebuyer may contact the participating lender to get more information on loans rates and to prequalify for a loan with the lender before shopping for a house, or: If the homebuyer has already found the home they would like to purchase, the homebuyer would need to contact the participating lender to qualify for a loan and at that time the lender will qualify the homebuyer for the City’s Down Payment Assistance Program.

HOW LONG TO CLOSE? If the loan is for a house that is post 1978, the normal time frame to close a loan is 10 business days from the date that all required documentation is received. If the house is pre 1978, a lead assessment is required and it can take up to 30 days to close the loan.

HOW LONG TO CLOSE? If the loan is for a house that is post 1978, the normal time frame to close a loan is 10 business days from the date that all required documentation is received. If the house is pre 1978, a lead assessment is required and it can take up to 30 days to close the loan.

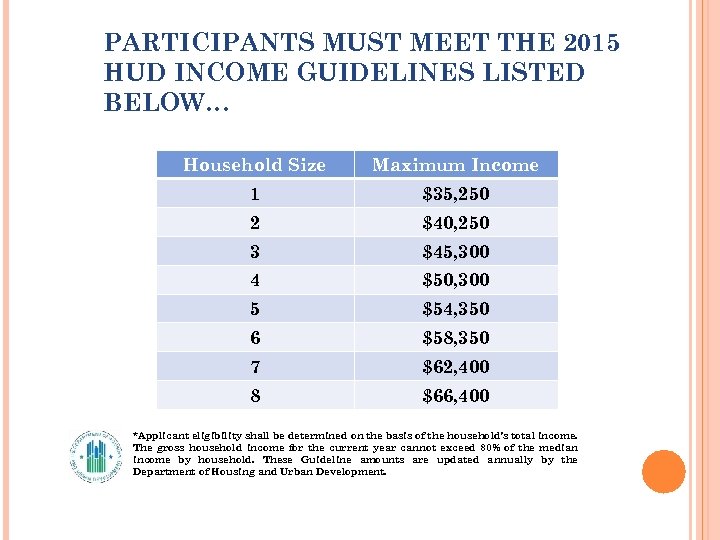

PARTICIPANTS MUST MEET THE 2015 HUD INCOME GUIDELINES LISTED BELOW… Household Size Maximum Income 1 $35, 250 2 $40, 250 3 $45, 300 4 $50, 300 5 $54, 350 6 $58, 350 7 $62, 400 8 $66, 400 *Applicant eligibility shall be determined on the basis of the household’s total income. The gross household income for the current year cannot exceed 80% of the median income by household. These Guideline amounts are updated annually by the Department of Housing and Urban Development.

PARTICIPANTS MUST MEET THE 2015 HUD INCOME GUIDELINES LISTED BELOW… Household Size Maximum Income 1 $35, 250 2 $40, 250 3 $45, 300 4 $50, 300 5 $54, 350 6 $58, 350 7 $62, 400 8 $66, 400 *Applicant eligibility shall be determined on the basis of the household’s total income. The gross household income for the current year cannot exceed 80% of the median income by household. These Guideline amounts are updated annually by the Department of Housing and Urban Development.

DETERMINING INCOME Gross household Income is defined as all income from any source to any person residing at the applicable property. Inclusions: Wages, salaries, tips, alimony, investment income and interest, retirement, social security, SSI, veteran’s administration, public assistance such as unemployment compensation, food stamps, welfare, aid-to dependent children, and other sources. See Attachment 1 for a full listing Exclusions: Income of children under 18 years of age, foster care payments, medical reimbursements, live in aid, scholarships, hostile fire pay, training payments, disabled PASS, gifts and housing assistance payments. See Attachment 1 for a full listing.

DETERMINING INCOME Gross household Income is defined as all income from any source to any person residing at the applicable property. Inclusions: Wages, salaries, tips, alimony, investment income and interest, retirement, social security, SSI, veteran’s administration, public assistance such as unemployment compensation, food stamps, welfare, aid-to dependent children, and other sources. See Attachment 1 for a full listing Exclusions: Income of children under 18 years of age, foster care payments, medical reimbursements, live in aid, scholarships, hostile fire pay, training payments, disabled PASS, gifts and housing assistance payments. See Attachment 1 for a full listing.

DETERMINING INCOME Financial Assets including (but not limited to) checking and savings will be verified. The current HUD passbook rate (e. g. 2%) will be applied to the total financial assets and interested earned on these accounts will be added to the households total income. This total adjusted income will be weighed against the income limits noted on the income guidelines (these income guidelines change annually) for eligibility.

DETERMINING INCOME Financial Assets including (but not limited to) checking and savings will be verified. The current HUD passbook rate (e. g. 2%) will be applied to the total financial assets and interested earned on these accounts will be added to the households total income. This total adjusted income will be weighed against the income limits noted on the income guidelines (these income guidelines change annually) for eligibility.

PARTICIPANT ELIGIBILITY The applicant must be a first time homebuyer (has not owned a home in the past 3 years) The buyer must contribute a minimum of $500 or 50% of the required down payment, whichever is greater. These funds can be contributed as an earnest money deposit, appraisal fees, or credit reports, etc. The required down payment must exceed $2, 000 to use this program. Applicant eligibility must be determined based on the Section 8 Part 5 income definition (See above “Determining Income” Section). Home being purchased must be homebuyer’s principal residence. The property cannot be abandoned, rented, or conveyed after purchase for a minimum of 5 years from the date of closing.

PARTICIPANT ELIGIBILITY The applicant must be a first time homebuyer (has not owned a home in the past 3 years) The buyer must contribute a minimum of $500 or 50% of the required down payment, whichever is greater. These funds can be contributed as an earnest money deposit, appraisal fees, or credit reports, etc. The required down payment must exceed $2, 000 to use this program. Applicant eligibility must be determined based on the Section 8 Part 5 income definition (See above “Determining Income” Section). Home being purchased must be homebuyer’s principal residence. The property cannot be abandoned, rented, or conveyed after purchase for a minimum of 5 years from the date of closing.

PARTICIPANT ELIGIBILITY The applicant must have citizenship or permanent residency status as evidenced by a completed I-9 Form Applicant must complete a first time homebuyer workshop in person The applicant must not exceed a front end ratio of 32% and a “back end” or debt-to-income ratio of 45%.

PARTICIPANT ELIGIBILITY The applicant must have citizenship or permanent residency status as evidenced by a completed I-9 Form Applicant must complete a first time homebuyer workshop in person The applicant must not exceed a front end ratio of 32% and a “back end” or debt-to-income ratio of 45%.

PARTICIPANT ELIGIBILITY Homebuyer workshops are offered by TAP. Classes are offered once a month so if you have someone is interested in the program you will want to go online to VHDA. com and sign up for the class as soon as possible.

PARTICIPANT ELIGIBILITY Homebuyer workshops are offered by TAP. Classes are offered once a month so if you have someone is interested in the program you will want to go online to VHDA. com and sign up for the class as soon as possible.

PROPERTY ELIGIBILITY Homes in the corporate limits of the City of Roanoke are eligible. The maximum purchase price may not exceed the HUD limit of $138, 000 (determined by appraisal). Mobile homes, travel trailers, or other non-permanent structures are not eligible. Multi-family structures must receive approval from the City’s HUD Community Resources Office. No funds will be allocated to homes in a flood plain. Homes built prior to 1978 must pass a lead-based paint assessment or clearance.

PROPERTY ELIGIBILITY Homes in the corporate limits of the City of Roanoke are eligible. The maximum purchase price may not exceed the HUD limit of $138, 000 (determined by appraisal). Mobile homes, travel trailers, or other non-permanent structures are not eligible. Multi-family structures must receive approval from the City’s HUD Community Resources Office. No funds will be allocated to homes in a flood plain. Homes built prior to 1978 must pass a lead-based paint assessment or clearance.

LEAD BASED PAINT The City of Roanoke is required to assess homes built prior to 1978 for the potential of lead-based paint hazards. The inspection will cover a visual assessment of the property for peeling, chipping, and flaking paint. If lead based paint is visualized, additional X-Ray Fluorescence testing will be conducted. The city will provide all parties a disclosure of the inspection procedure for informational purposes to assist with the preparation of visual assessment. The City of Roanoke will cover the cost(s) of one lead-based paint inspection and/or one lead based paint clearance test. All restoration, cleanup, and additional clearance testing costs are the responsibility of the buyer or seller.

LEAD BASED PAINT The City of Roanoke is required to assess homes built prior to 1978 for the potential of lead-based paint hazards. The inspection will cover a visual assessment of the property for peeling, chipping, and flaking paint. If lead based paint is visualized, additional X-Ray Fluorescence testing will be conducted. The city will provide all parties a disclosure of the inspection procedure for informational purposes to assist with the preparation of visual assessment. The City of Roanoke will cover the cost(s) of one lead-based paint inspection and/or one lead based paint clearance test. All restoration, cleanup, and additional clearance testing costs are the responsibility of the buyer or seller.

LOAN TERMS The Down Payment Assistance Program funds are in the form of a 0% interest deferred payment loan for 5 years. The loan does not allow forgiveness annually. If the property is transferred prior to 5 years from the date of purchase, the entire amount of the loan is due and payable, as well as a portion of shared appreciation based on the percentage of money granted. The homeowner must reside in the property as their principal address for a minimum of 9 months of the calendar year. If the homeowner resides in the property for the 5 year period, the entire loan will be forgiven.

LOAN TERMS The Down Payment Assistance Program funds are in the form of a 0% interest deferred payment loan for 5 years. The loan does not allow forgiveness annually. If the property is transferred prior to 5 years from the date of purchase, the entire amount of the loan is due and payable, as well as a portion of shared appreciation based on the percentage of money granted. The homeowner must reside in the property as their principal address for a minimum of 9 months of the calendar year. If the homeowner resides in the property for the 5 year period, the entire loan will be forgiven.

LOAN TERMS In addition to the foregoing provisions, the homebuyer agrees to comply with the terms and conditions stated in the following City of Roanoke Ordinances: Chapter 7, Article II, Building Code; Chapter 36. 2, Zoning; Chapter 20, Article VI, Keeping of Inoperable Motor Vehicles; and Chapter 33, Article II, Weed and Trash Abatement, of the Code of the City of Roanoke (1979) as amended, and as such provisions may be amended from time to time. Noncompliance by Grantor of such ordinances resulting in a conviction shall be considered an act of default.

LOAN TERMS In addition to the foregoing provisions, the homebuyer agrees to comply with the terms and conditions stated in the following City of Roanoke Ordinances: Chapter 7, Article II, Building Code; Chapter 36. 2, Zoning; Chapter 20, Article VI, Keeping of Inoperable Motor Vehicles; and Chapter 33, Article II, Weed and Trash Abatement, of the Code of the City of Roanoke (1979) as amended, and as such provisions may be amended from time to time. Noncompliance by Grantor of such ordinances resulting in a conviction shall be considered an act of default.

LOAN TERMS The requirements and conditions of participation in the program are set forth below and are fully outlined in the Homebuyer Agreement and Deed of Trust and are not limited to the following: The property must be occupied by the borrower as their principal residence. The property cannot be rented, abandoned, or conveyed after the purchase. The property owner cannot be convicted in general district court for any of the pre-determined code violations. The balance of the DPA loan will be due and payable immediately, if a violation of any of the above instances occur.

LOAN TERMS The requirements and conditions of participation in the program are set forth below and are fully outlined in the Homebuyer Agreement and Deed of Trust and are not limited to the following: The property must be occupied by the borrower as their principal residence. The property cannot be rented, abandoned, or conveyed after the purchase. The property owner cannot be convicted in general district court for any of the pre-determined code violations. The balance of the DPA loan will be due and payable immediately, if a violation of any of the above instances occur.

LOAN TERMS The homeowner will be responsible for all fees associated with recording the Certificate of Satisfaction for the release of the property records. The buyer must execute a Deed of Trust, Promissory Note, Contract, Application, I-9, and all other forms required for program.

LOAN TERMS The homeowner will be responsible for all fees associated with recording the Certificate of Satisfaction for the release of the property records. The buyer must execute a Deed of Trust, Promissory Note, Contract, Application, I-9, and all other forms required for program.

LOAN TERMS The homeowner’s insurance policy must list the City of Roanoke as an additional insured on the hazard policy and provide annual renewals. The additional amount to have this insurance policy is a closing cost that is covered if listed on the GFE provided to the City.

LOAN TERMS The homeowner’s insurance policy must list the City of Roanoke as an additional insured on the hazard policy and provide annual renewals. The additional amount to have this insurance policy is a closing cost that is covered if listed on the GFE provided to the City.

LOAN TERMS The Mortgage obtained cannot wrap in any other debt or predatory product. If the homebuyer sells the property within the five (5) year affordability period the funds shall be repaid from net proceeds. Net proceeds are defined as the sales price minus superior non-CDBG loan repayments and any closing costs. If there are insufficient net proceeds to repay the full amount of the CDBG loan then a partial repayment shall be made and the balance of the loan forgiven.

LOAN TERMS The Mortgage obtained cannot wrap in any other debt or predatory product. If the homebuyer sells the property within the five (5) year affordability period the funds shall be repaid from net proceeds. Net proceeds are defined as the sales price minus superior non-CDBG loan repayments and any closing costs. If there are insufficient net proceeds to repay the full amount of the CDBG loan then a partial repayment shall be made and the balance of the loan forgiven.

LOAN TERMS Funds provided under this Down Payment Assistance Program are provided as a "recapture" activity per the CDBG Program. "Recapture" means funds are provided and forgivable as long as the requirements of the program are met. If the requirements are not met, the funds must be returned to the City of Roanoke per the Deed of Trust and Promissory Note.

LOAN TERMS Funds provided under this Down Payment Assistance Program are provided as a "recapture" activity per the CDBG Program. "Recapture" means funds are provided and forgivable as long as the requirements of the program are met. If the requirements are not met, the funds must be returned to the City of Roanoke per the Deed of Trust and Promissory Note.

RECAPTURE EXAMPLE Purchase Price: $100, 000 Required Down Payment (3. 5%): $3, 500 Minimum DP from homebuyer: $1, 750 Closing Costs: $3, 000 Maximum DPA Loan: $4, 750 (aka CDBG loan) Repayment example: Home sells in year 4. Sales Price: $110, 000 First Mortgage Payoff: $90, 000 Net Proceeds: $20, 000 (110, 000 -90, 000) Payoff CDBG Loan: $4, 750 Amount returned to homebuyer: $1, 750 Remaining Net Proceeds: $13, 500 ($20, 000 -4, 750 -1, 750) Shared Appreciation for the City: $9, 855 (73%) Shared Appreciation for the homeowner: $3, 645 (27%)

RECAPTURE EXAMPLE Purchase Price: $100, 000 Required Down Payment (3. 5%): $3, 500 Minimum DP from homebuyer: $1, 750 Closing Costs: $3, 000 Maximum DPA Loan: $4, 750 (aka CDBG loan) Repayment example: Home sells in year 4. Sales Price: $110, 000 First Mortgage Payoff: $90, 000 Net Proceeds: $20, 000 (110, 000 -90, 000) Payoff CDBG Loan: $4, 750 Amount returned to homebuyer: $1, 750 Remaining Net Proceeds: $13, 500 ($20, 000 -4, 750 -1, 750) Shared Appreciation for the City: $9, 855 (73%) Shared Appreciation for the homeowner: $3, 645 (27%)

ANNUAL VERIFICATION An Annual Verification Letter is mailed out to confirm that the participant is residing at the address that received funding. The Annual Verification consists of several questions that the DPA participant must answer, sign and send back with a copy of the current electric bill.

ANNUAL VERIFICATION An Annual Verification Letter is mailed out to confirm that the participant is residing at the address that received funding. The Annual Verification consists of several questions that the DPA participant must answer, sign and send back with a copy of the current electric bill.

FAIR HOUSING All transactions must comply with Fair Housing Laws (Federal and State) Roanoke All City Fair Housing Board participating lenders and realtors must complete Fair Housing Training annually.

FAIR HOUSING All transactions must comply with Fair Housing Laws (Federal and State) Roanoke All City Fair Housing Board participating lenders and realtors must complete Fair Housing Training annually.

CITY’S DPA WEBSITE PAGE… If you are looking online to learn more about the City’s Down Payment Assistance Program here is the link… Roanokeva. gov “Departments” “Planning, Building and Development” “HUD Community Resources” On the left will be the link to click on for DPA.

CITY’S DPA WEBSITE PAGE… If you are looking online to learn more about the City’s Down Payment Assistance Program here is the link… Roanokeva. gov “Departments” “Planning, Building and Development” “HUD Community Resources” On the left will be the link to click on for DPA.

CITY’S DPA WEBSITE PAGE… The DPA page is where you will find out what you need to know about the program. There are guidelines for the program, listings of participating realtors and lenders, and lender forms that are used for closing. There also brochures for lenders or realtors who would like to have them available.

CITY’S DPA WEBSITE PAGE… The DPA page is where you will find out what you need to know about the program. There are guidelines for the program, listings of participating realtors and lenders, and lender forms that are used for closing. There also brochures for lenders or realtors who would like to have them available.

REALTORS Completing the sign in sheet will add you to our participating lenders list on the website and brochures. Brochures are available online to be printed or contact Brenda. thornton@roanokeva. gov if you would to pick up brochures.

REALTORS Completing the sign in sheet will add you to our participating lenders list on the website and brochures. Brochures are available online to be printed or contact Brenda. thornton@roanokeva. gov if you would to pick up brochures.

LENDER’S ROLE The Lender’s role is to administer the program on behalf of the City of Roanoke in accordance with HOME regulations. The Lender will pre-qualify the applicant based on the income guidelines set within the documented parameters and provide documentation to justify the eligibility of each applicant.

LENDER’S ROLE The Lender’s role is to administer the program on behalf of the City of Roanoke in accordance with HOME regulations. The Lender will pre-qualify the applicant based on the income guidelines set within the documented parameters and provide documentation to justify the eligibility of each applicant.

LENDER PARTICIPATION AGREEMENT Each lender who would like to become a participating lender with the City’s Down Payment Assistance Program must complete a City of Roanoke Lender Agreement and attend one of the City’s training sessions. Once you are a participating lender, you will have to complete a lender participation form each new fiscal year (July 1).

LENDER PARTICIPATION AGREEMENT Each lender who would like to become a participating lender with the City’s Down Payment Assistance Program must complete a City of Roanoke Lender Agreement and attend one of the City’s training sessions. Once you are a participating lender, you will have to complete a lender participation form each new fiscal year (July 1).

DOWN PAYMENT ASSISTANCE CONTRACT Each homebuyer must sign two contracts at closing. After closing both contracts will be returned to the City and the City Manager will sign both originals. The City will mail one original back to the homebuyer.

DOWN PAYMENT ASSISTANCE CONTRACT Each homebuyer must sign two contracts at closing. After closing both contracts will be returned to the City and the City Manager will sign both originals. The City will mail one original back to the homebuyer.

EXHIBITS TO THE CONTRACT Exhibit A – Down Payment Assistance Guidelines Exhibit B - Promissory Note Exhibit C – Deed of Trust Exhibit D – Truth in Lending Disclosure Exhibit E – Notice of Right of Rescission Exhibit F – ECOA Form Exhibit G – “Protect Your Family From Lead in Your Home” Brochure Exhibit H – Confirmation of Lead Pamphlet Exhibit I – Lead Based Paint Acknowledgement Exhibit J – I-9 Form * City prepares for closing

EXHIBITS TO THE CONTRACT Exhibit A – Down Payment Assistance Guidelines Exhibit B - Promissory Note Exhibit C – Deed of Trust Exhibit D – Truth in Lending Disclosure Exhibit E – Notice of Right of Rescission Exhibit F – ECOA Form Exhibit G – “Protect Your Family From Lead in Your Home” Brochure Exhibit H – Confirmation of Lead Pamphlet Exhibit I – Lead Based Paint Acknowledgement Exhibit J – I-9 Form * City prepares for closing

LENDER ITEMS FOR EACH PARTICIPANT: Completed Lender Checklist DPA Application HUD Income Calculation (Printed & Signed) Bank Statements – 3 Months Pay Stubs – 2 Months Good Faith Estimate Title Search

LENDER ITEMS FOR EACH PARTICIPANT: Completed Lender Checklist DPA Application HUD Income Calculation (Printed & Signed) Bank Statements – 3 Months Pay Stubs – 2 Months Good Faith Estimate Title Search

LENDER ITEMS FOR EACH PARTICIPANT: Exhibit J - I-9 Form Housing Workshop Certificate (for each person on the loan) Exhibit H -Confirmation of Lead Pamphlet Exhibit I - City of Roanoke Lead Based Paint Acknowledgement Form Appraisal

LENDER ITEMS FOR EACH PARTICIPANT: Exhibit J - I-9 Form Housing Workshop Certificate (for each person on the loan) Exhibit H -Confirmation of Lead Pamphlet Exhibit I - City of Roanoke Lead Based Paint Acknowledgement Form Appraisal

HUD INCOME CALCULATOR The HUD Income Calculator is a calculator that determines income eligibility. There are step by step instructions online at City’s website and in the packets you receive today. Every DPA file sent to the City must contain printed copy of the page that show Roanoke as the income page (Step 8) of instructions and a printed and signed copy (by preparer and homebuyer) of the completed calculation worksheet. This is step 29 of the step by step instruction manual. Make sure you hit “Download PDF File” to print this report.

HUD INCOME CALCULATOR The HUD Income Calculator is a calculator that determines income eligibility. There are step by step instructions online at City’s website and in the packets you receive today. Every DPA file sent to the City must contain printed copy of the page that show Roanoke as the income page (Step 8) of instructions and a printed and signed copy (by preparer and homebuyer) of the completed calculation worksheet. This is step 29 of the step by step instruction manual. Make sure you hit “Download PDF File” to print this report.

CLOSING DOCUMENTS Down Payment Assistance Contract (2) Exhibit B - Promissory Note Exhibit C – Deed of Trust Exhibit D – Truth in Lending Disclosure Exhibit E – Notice of Right of Rescission Exhibit F – ECOA Form

CLOSING DOCUMENTS Down Payment Assistance Contract (2) Exhibit B - Promissory Note Exhibit C – Deed of Trust Exhibit D – Truth in Lending Disclosure Exhibit E – Notice of Right of Rescission Exhibit F – ECOA Form

CLOSING INFORMATION… After the closing the title company will return the closing documents to the City for the Assistant City Attorney to sign the deed. The City will then record the deed. The closing agent will provide a check for the City to record the second deed (City’s deed).

CLOSING INFORMATION… After the closing the title company will return the closing documents to the City for the Assistant City Attorney to sign the deed. The City will then record the deed. The closing agent will provide a check for the City to record the second deed (City’s deed).

AFTER CLOSING… Copy of final executed HUD 1 Form Copy of Title insurance with : City of Roanoke, C/O Department of Planning, Building & Development listed as additional insured Copy of homeowner’s insurance with City of Roanoke, C/O Department of Planning, Building & Development listed as additional insured Recorded Deed of Trust Exhibit B – Promissory Note, Exhibit C- Deed of Trust, Exhibit D –Truth in Lending Disclosure, Exhibit E – Notice of Right of Rescission, Exhibit F – ECOA Form

AFTER CLOSING… Copy of final executed HUD 1 Form Copy of Title insurance with : City of Roanoke, C/O Department of Planning, Building & Development listed as additional insured Copy of homeowner’s insurance with City of Roanoke, C/O Department of Planning, Building & Development listed as additional insured Recorded Deed of Trust Exhibit B – Promissory Note, Exhibit C- Deed of Trust, Exhibit D –Truth in Lending Disclosure, Exhibit E – Notice of Right of Rescission, Exhibit F – ECOA Form

QUESTIONS?

QUESTIONS?