c6efcbca4f7c551d1ff1ee688e24686f.ppt

- Количество слайдов: 16

Citigroup Security and Investigative Services Loan Application Fraud Robert Stanton Sr Investigator 410 -332 -7745

Citigroup Security and Investigative Services Loan Application Fraud Robert Stanton Sr Investigator 410 -332 -7745

• Citi Investigative and Security Services (CSIS) – North America/LATAM/Mexico/Asia Pacific (APAC) • Eastern Europe Middle (EMEA) and Central Eastern Europe, Middle East and Africa (CEMEA) • Investigations and physical security • Corporate Investigators cover Citi entities globally • Citi. Financial, Citibank, Citi Mortgage, Citi Auto, Primerica, Citi Cards, Citi. Financial Retail Sales, etc. • External and Internal Fraud and policy violations • Forensic capabilities – ECrimes – Electromagnetic and Digital Media – Digital Forensic Examinations

• Citi Investigative and Security Services (CSIS) – North America/LATAM/Mexico/Asia Pacific (APAC) • Eastern Europe Middle (EMEA) and Central Eastern Europe, Middle East and Africa (CEMEA) • Investigations and physical security • Corporate Investigators cover Citi entities globally • Citi. Financial, Citibank, Citi Mortgage, Citi Auto, Primerica, Citi Cards, Citi. Financial Retail Sales, etc. • External and Internal Fraud and policy violations • Forensic capabilities – ECrimes – Electromagnetic and Digital Media – Digital Forensic Examinations

• CSIS Units and Subsidiaries – • AML – Anti Money Laundering • Due Diligence Unit • FICA – Financial Crimes Analysis Support • Fraud Management Program – Zero Tolerance to fraud • Employee Pre-screening

• CSIS Units and Subsidiaries – • AML – Anti Money Laundering • Due Diligence Unit • FICA – Financial Crimes Analysis Support • Fraud Management Program – Zero Tolerance to fraud • Employee Pre-screening

Fraudulent Loan Applications • Know your customer. • Reviewing loan applications isn’t “Rocket Surgery” ? • Look for the obvious – behavior (rushing/anxious time of sale (store closing/peak season/sales event) • Perform your due diligence/“Do your homework”. • Verify information independently when possible, two Forms of photo ID. • Look for consistency.

Fraudulent Loan Applications • Know your customer. • Reviewing loan applications isn’t “Rocket Surgery” ? • Look for the obvious – behavior (rushing/anxious time of sale (store closing/peak season/sales event) • Perform your due diligence/“Do your homework”. • Verify information independently when possible, two Forms of photo ID. • Look for consistency.

• Insure employees are familiar with identification used (driver’s licenses) during loan closings. • Obtain CURRENT month ORIGINALS of utility bill, bank Statement, credit card statement in the applicant’s name. • Identify abnormalities, poor quality, out of focus finish, No holograms, state seals, etc. • Recent issue dates, expiration dates don’t match dob. • Cropped photo, no overlapping codes, seals, etc.

• Insure employees are familiar with identification used (driver’s licenses) during loan closings. • Obtain CURRENT month ORIGINALS of utility bill, bank Statement, credit card statement in the applicant’s name. • Identify abnormalities, poor quality, out of focus finish, No holograms, state seals, etc. • Recent issue dates, expiration dates don’t match dob. • Cropped photo, no overlapping codes, seals, etc.

• Do the numbers make sense? • Pay stub reflects bi-weekly pay period? • Indicates 336 total hours worked during that time period. • There are only 336 total hours in a two week period? • Taxes, Social Security, fonts, cut and paste, etc.

• Do the numbers make sense? • Pay stub reflects bi-weekly pay period? • Indicates 336 total hours worked during that time period. • There are only 336 total hours in a two week period? • Taxes, Social Security, fonts, cut and paste, etc.

• Female applicant using the same name with multiple ID’s, with various photo’s at different branches located in the same general metropolitan /geographic area. • Branches failed to note recent multiple credit bureau inquires or new accounts on the credit bureau reporting. • Fraud Alerts/Warnings/SSN issued in the last five years. • Red Flag - Victim has excellent credit and qualifies for Maximum level loan (Premier). • Red Flag - Applicant purchases “ALL” of the available insurance packages offered by the lender – quick to agree to extended warranty or not concerned with the price.

• Female applicant using the same name with multiple ID’s, with various photo’s at different branches located in the same general metropolitan /geographic area. • Branches failed to note recent multiple credit bureau inquires or new accounts on the credit bureau reporting. • Fraud Alerts/Warnings/SSN issued in the last five years. • Red Flag - Victim has excellent credit and qualifies for Maximum level loan (Premier). • Red Flag - Applicant purchases “ALL” of the available insurance packages offered by the lender – quick to agree to extended warranty or not concerned with the price.

ORGANIZED FRAUD RINGS • Ring targeted Citi. Financial branches in GA, FL, NC, CA, IN and LA. • Suspects recruited from homeless shelters in CA. • Suspects would register at local hotels/motels and await Fed. Ex package that would contain ID and other necessary materials (paystub/SSN card/DL/etc). • Premier Loans (15 K) Insurance products/single Loan Proceeds Checks. • Two suspects almost every time – applicant and driver (lookout) waiting in parking. • Cell phone communications back and forth – warning on the arrival of law enforcement. • Buffer maintained between operators and organizers. • Suspects would cash checks at local check cashing stores.

ORGANIZED FRAUD RINGS • Ring targeted Citi. Financial branches in GA, FL, NC, CA, IN and LA. • Suspects recruited from homeless shelters in CA. • Suspects would register at local hotels/motels and await Fed. Ex package that would contain ID and other necessary materials (paystub/SSN card/DL/etc). • Premier Loans (15 K) Insurance products/single Loan Proceeds Checks. • Two suspects almost every time – applicant and driver (lookout) waiting in parking. • Cell phone communications back and forth – warning on the arrival of law enforcement. • Buffer maintained between operators and organizers. • Suspects would cash checks at local check cashing stores.

What is more valuable than your own good name? Identity Theft is the fastest growing whitecollar crime in the country. • It is estimated that 5 -10 million Americans are touched by the effects of Identity Theft a year. • Experts estimate that it takes customers approximately 600 hours and $1, 495 in possible direct losses to restore one’s good name and credit.

What is more valuable than your own good name? Identity Theft is the fastest growing whitecollar crime in the country. • It is estimated that 5 -10 million Americans are touched by the effects of Identity Theft a year. • Experts estimate that it takes customers approximately 600 hours and $1, 495 in possible direct losses to restore one’s good name and credit.

Interception Where does the fraudster get the information? • • • Dumpster Diving Public Record Information Skimming Phishing/Hacking Theft of information from a workplace Purchased information Social engineering Mail theft/Phony postal change of address Theft of wallets containing personal information

Interception Where does the fraudster get the information? • • • Dumpster Diving Public Record Information Skimming Phishing/Hacking Theft of information from a workplace Purchased information Social engineering Mail theft/Phony postal change of address Theft of wallets containing personal information

USE Once the information is obtained, how can it be put to use? “Show me the money!” • • Credit/Debit/ATM/Gift Cards Consumer Loans Fraudulent Applications Wire transfers Stolen or false Driver’s License Full identity take-over Utilities/Cell Phones

USE Once the information is obtained, how can it be put to use? “Show me the money!” • • Credit/Debit/ATM/Gift Cards Consumer Loans Fraudulent Applications Wire transfers Stolen or false Driver’s License Full identity take-over Utilities/Cell Phones

How Can I Tell if I’m a Victim of Identity Theft? • Monitor the balances of your financial accounts. • Look for unexplained charges or withdrawals. Other indications of identity theft can be: • Failing to receive bills or other mail signaling an address change by the identity thief. • Receiving credit cards for which you did not apply. • Receiving calls from debt collectors or companies about merchandise or services you did not buy. • Denial of credit for no apparent reason.

How Can I Tell if I’m a Victim of Identity Theft? • Monitor the balances of your financial accounts. • Look for unexplained charges or withdrawals. Other indications of identity theft can be: • Failing to receive bills or other mail signaling an address change by the identity thief. • Receiving credit cards for which you did not apply. • Receiving calls from debt collectors or companies about merchandise or services you did not buy. • Denial of credit for no apparent reason.

What can you do to avoid becoming a victim? • • • Don’t Carry Social Security Card, passports or birth certificates Use a blue Postal mailbox for outgoing mail Limit your Credit Cards Do not give account number over the phone Shred all credit card receipts Order a credit report at least once per year Remove Social Security number from your DL or checks Cancel unused cards Call your credit card company if you did not receive a new one

What can you do to avoid becoming a victim? • • • Don’t Carry Social Security Card, passports or birth certificates Use a blue Postal mailbox for outgoing mail Limit your Credit Cards Do not give account number over the phone Shred all credit card receipts Order a credit report at least once per year Remove Social Security number from your DL or checks Cancel unused cards Call your credit card company if you did not receive a new one

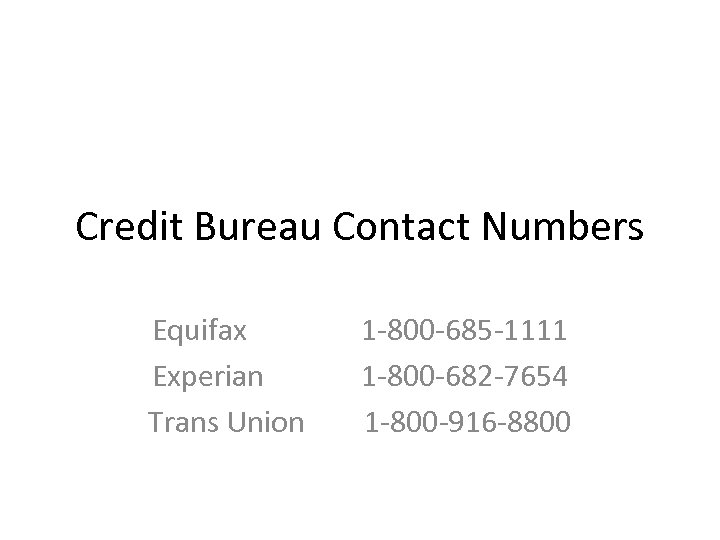

Credit Bureau Contact Numbers Equifax Experian Trans Union 1 -800 -685 -1111 1 -800 -682 -7654 1 -800 -916 -8800

Credit Bureau Contact Numbers Equifax Experian Trans Union 1 -800 -685 -1111 1 -800 -682 -7654 1 -800 -916 -8800