c0a084fb1b00ff126230f9b63e96af86.ppt

- Количество слайдов: 48

Citigroup Global Transaction Services ® Global Transaction Services Kathy Lin GTS Taiwan Head April 13, 2005 go to View, Header and Footer to set Copyright © 2003. Citibank, N. A. All rights reserved. CITIGROUP and the Umbrella Device are trademarks date and service marks of Citicorp and its affiliates and are used and registered throughout the world.

Agenda q Citigroup Global Transaction Services Overview q Experience Sharing for Transaction Banking Management 2

Citigroup Global Transaction Services Overview 3

Global Transaction Service (GTS) Mission Statement To be the world’s leading provider of Cash Management, Trade, and Securities Services to enable our clients to manage their treasury needs, and financial and commercial flows and assets. 4

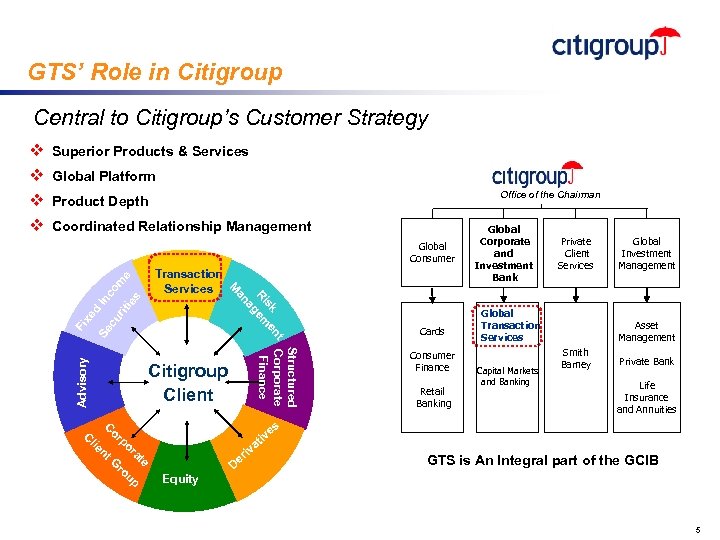

GTS’ Role in Citigroup Central to Citigroup’s Customer Strategy Superior Products & Services Global Platform Office of the Chairman Product Depth Coordinated Relationship Management Structured nt Corporate sk e Finance Ri gem a Citigroup Client C C or lie nt po r G ro up Equity Global Investment Management r De Cards Consumer Finance Retail Banking Global Transaction Services Capital Markets and Banking Asset Management Smith Barney Private Bank Life Insurance and Annuities es iv t a iv at e Private Client Services an Transaction Services Global Corporate and Investment Bank M Fi xe d Se In co cu m rit e ie s Global Consumer Advisory v v GTS is An Integral part of the GCIB 5

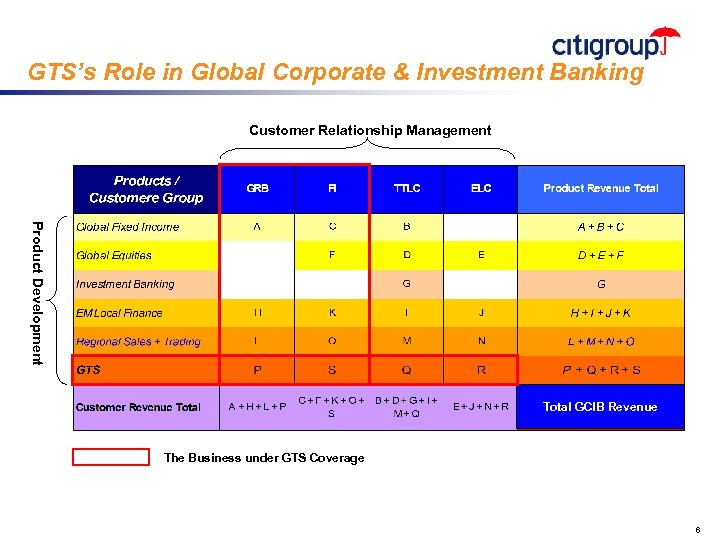

GTS’s Role in Global Corporate & Investment Banking Customer Relationship Management Product Development Total GCIB Revenue The Business under GTS Coverage 6

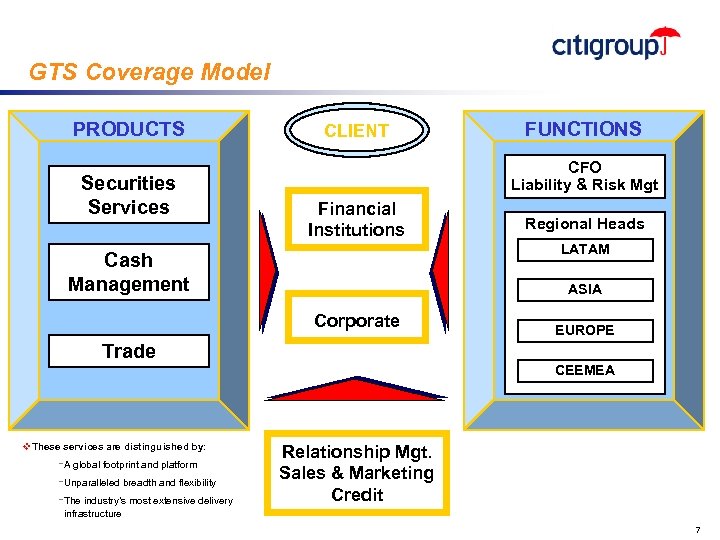

GTS Coverage Model PRODUCTS Securities Services CLIENT FUNCTIONS CFO Liability & Risk Mgt Financial Institutions Regional Heads LATAM Cash Management ASIA Corporate EUROPE Trade CEEMEA v. These services are distinguished by: -A global footprint and platform -Unparalleled breadth and flexibility -The industry’s most extensive delivery Relationship Mgt. Sales & Marketing Credit infrastructure 7

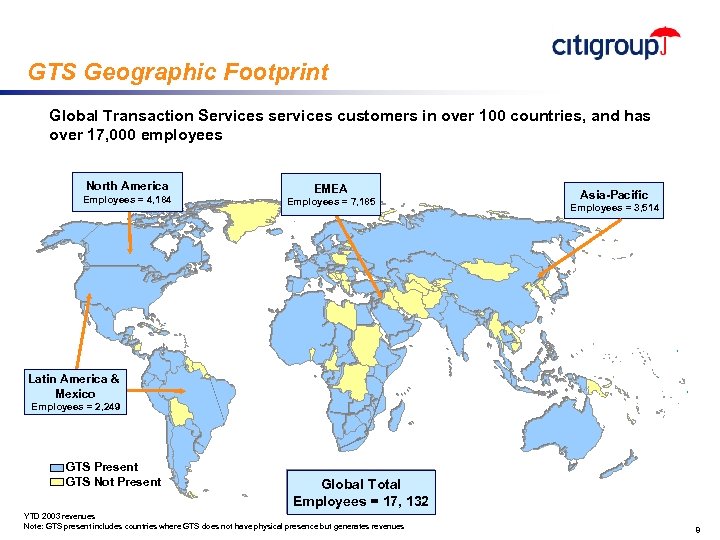

GTS Geographic Footprint Global Transaction Services services customers in over 100 countries, and has over 17, 000 employees North America Employees = 4, 184 EMEA Employees = 7, 185 Asia-Pacific Employees = 3, 514 Latin America & Mexico Employees = 2, 249 GTS Present GTS Not Present Global Total Employees = 17, 132 YTD 2003 revenues Note: GTS present includes countries where GTS does not have physical presence but generates revenues 8

GTS Geographic Footprint 2004 GTS FY Revenue - Total of $ 3, 816 MM North America $846 MM Europe $800 MM Japan $73 MM CEEMEA GTS Taiwan is ranked 7 th among GTS countries $700 MM from the view of 2004 Net Income Latin America $430 MM Asia Pacific $967 MM 9

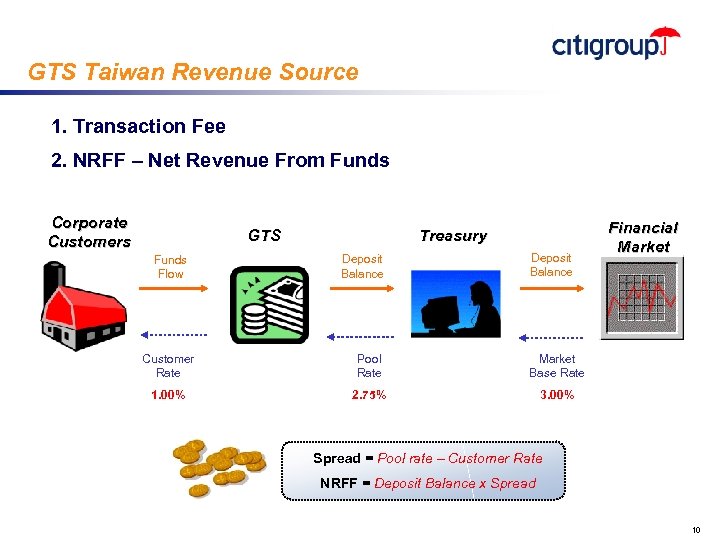

GTS Taiwan Revenue Source 1. Transaction Fee 2. NRFF – Net Revenue From Funds Corporate Customers GTS Funds Flow Treasury Deposit Balance Customer Rate Pool Rate Market Base Rate 1. 00% 2. 75% Financial Market 3. 00% Spread = Pool rate – Customer Rate NRFF = Deposit Balance x Spread 10

GTS Experience Sharing 11

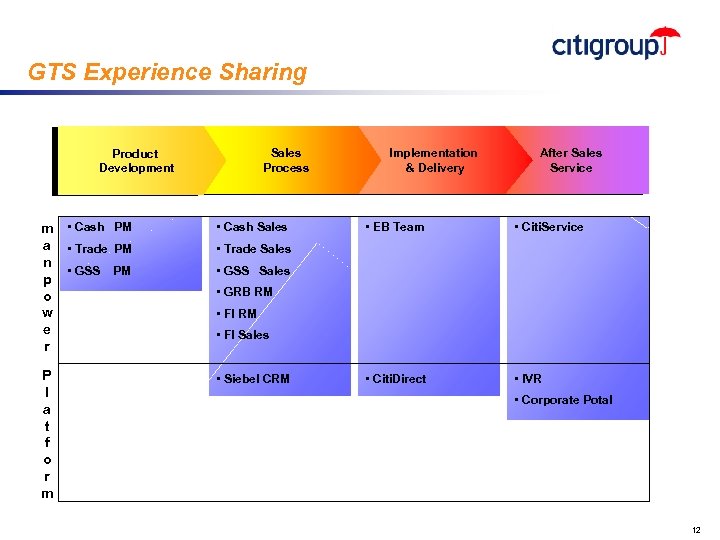

GTS Experience Sharing Sales Process Product Development m • Cash PM a • Trade PM n • GSS PM p o w e r • Cash Sales P l a t f o r m • Siebel CRM Implementation & Delivery After Sales Service • EB Team • Citi. Service • Citi. Direct • IVR • Trade Sales • GSS Sales • GRB RM • FI Sales • Corporate Potal 12

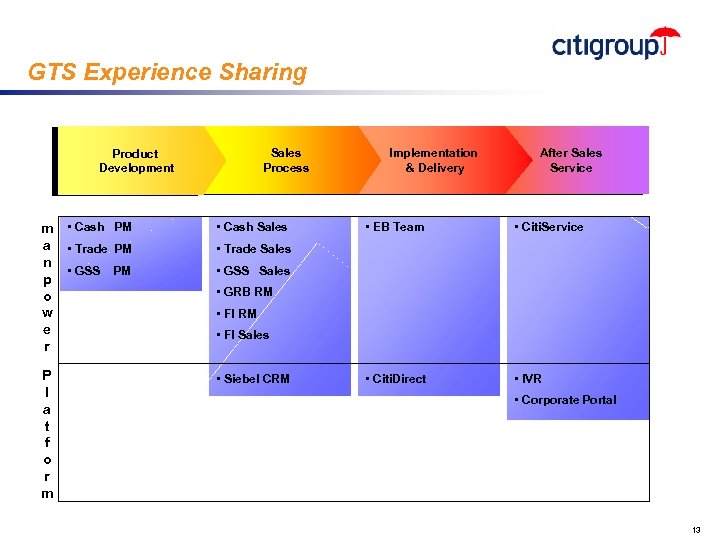

GTS Experience Sharing Sales Process Product Development m • Cash PM a • Trade PM n • GSS PM p o w e r • Cash Sales P l a t f o r m • Siebel CRM Implementation & Delivery After Sales Service • EB Team • Citi. Service • Citi. Direct • IVR • Trade Sales • GSS Sales • GRB RM • FI Sales • Corporate Portal 13

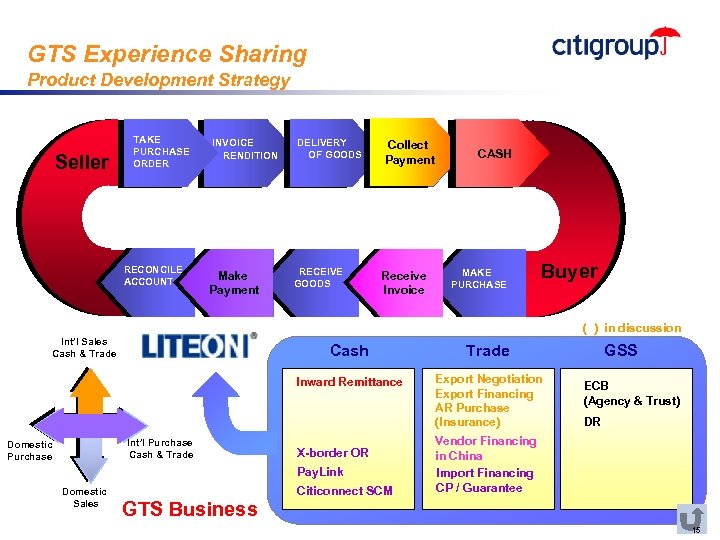

GTS Experience Sharing Product Development Strategy q Value-added Solution Provider q Participation in commercial and financial Funds Flow Proactively q Innovation Success Transfer q Product Offerings to Follow Economic Evolution, Local Deregulation and Technology Transformation q Seek good growth not bad growth (both revenue and profit margin) in a sustainable way 14

GTS Experience Sharing Product Development Strategy Seller TAKE PURCHASE ORDER RECONCILE ACCOUNT INVOICE RENDITION MAKE Make PAYMENT Payment DELIVERY OF GOODS RECEIVE GOODS COLLECT Collect PAYMENT Payment RECEIVE Receive INVOICE Invoice CASH MAKE PURCHASE Buyer ( ) in discussion Int’l Sales Cash & Trade Cash Inward Remittance Int’l Purchase Cash & Trade Domestic Purchase Trade Export Negotiation Export Financing AR Purchase (Insurance) X-border OR Pay. Link Domestic Sales Citiconnect SCM GSS ECB (Agency & Trust) DR Vendor Financing in China Import Financing CP / Guarantee GTS Business 15

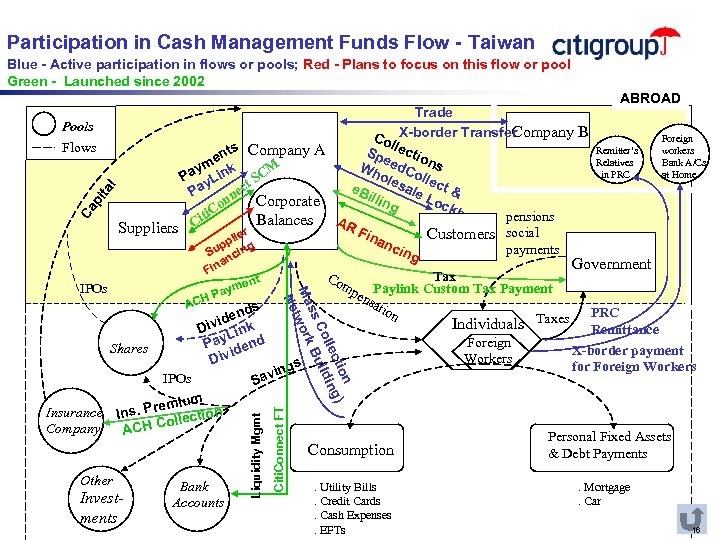

Participation in Cash Management Funds Flow - Taiwan Blue - Active participation in flows or pools; Red - Plans to focus on this flow or pool Green - Launched since 2002 Pools Ca p ita l Flows Trade Company B Co X-border Transfer llec ts Company A Sp tio en e m k Wh ed. Co ns M y ole l Pa y. Lin t SC sal lect & a e. B ec P e. L illin n Corporate ock on g bo ti. C pensions x Balances AR Ci Suppliers r Fin Customers social lie anc pp ng payments ing Su nci Fin ent aym HP AC Co m Bank Accounts Citi. Connect FT Investments Liquidity Mgmt s end id Div Link Pay dend Shares i Div ngs avi IPOs S mium Insurance Ins. Pre ection oll Company ACH C Other Tax pen Paylink Custom Tax Payment sat ion Individuals Taxes n tio ) llec ing Co Build ss Ma work t Ne IPOs a Consumption. Utility Bills. Credit Cards. Cash Expenses. EFTs Foreign Workers ABROAD Remitter’s Relatives in PRC Foreign workers Bank A/Cs at Home Government PRC Remittance X-border payment for Foreign Workers Personal Fixed Assets & Debt Payments. Mortgage. Car 16

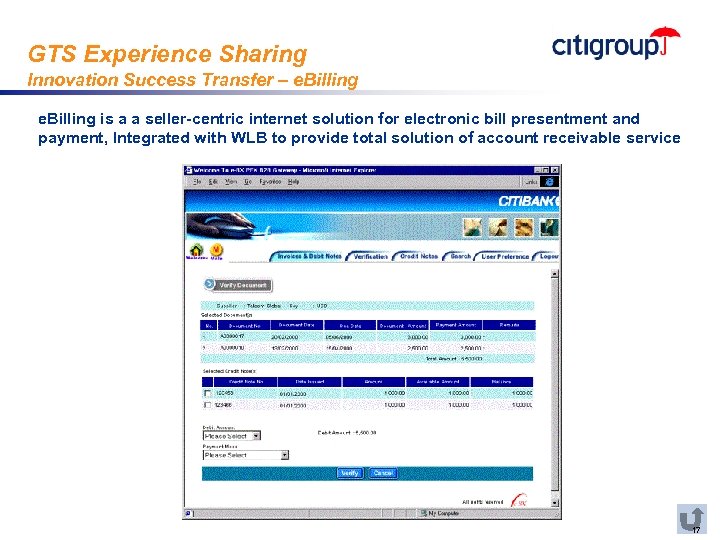

GTS Experience Sharing Innovation Success Transfer – e. Billing is a a seller-centric internet solution for electronic bill presentment and payment, Integrated with WLB to provide total solution of account receivable service 17

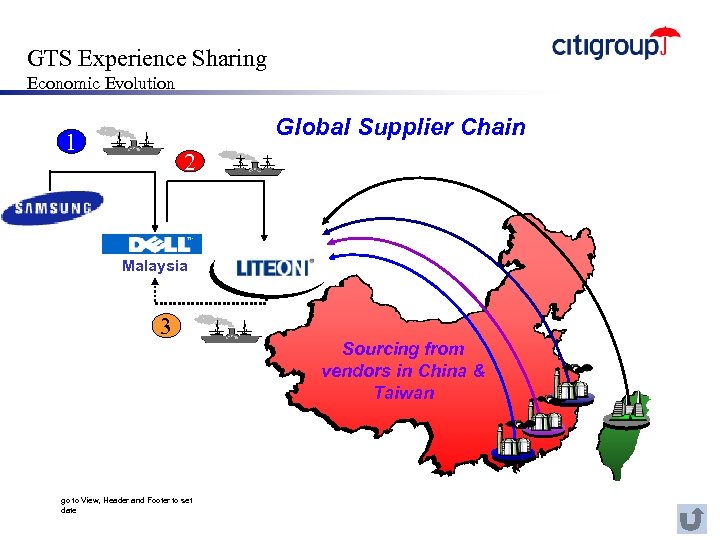

GTS Experience Sharing Economic Evolution Global Supplier Chain 1 2 Malaysia 3 go to View, Header and Footer to set date Sourcing from vendors in China & Taiwan

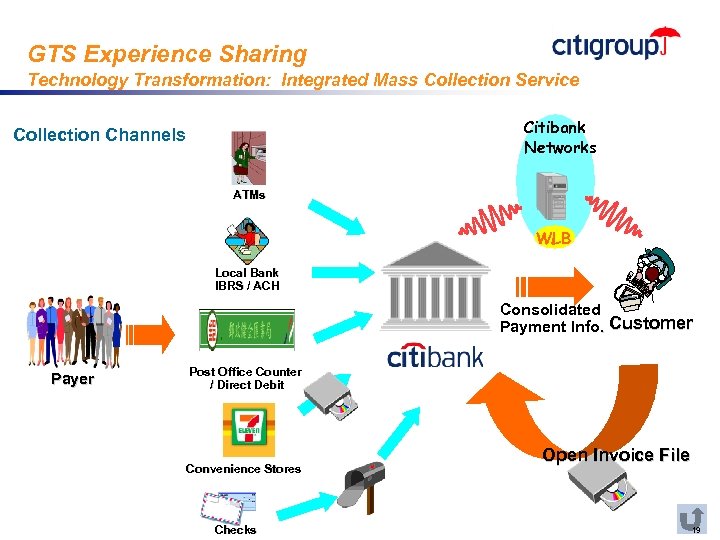

GTS Experience Sharing Technology Transformation: Integrated Mass Collection Service Citibank Networks Collection Channels ATMs WLB Local Bank IBRS / ACH Consolidated Payment Info. Customer Payer Post Office Counter / Direct Debit Convenience Stores Checks Open Invoice File 19

GTS Experience Sharing Robust Sales Process q Implement a world leading web-based Customer Relationship Management system developed by Siebel to track sales performance q Define individual sales goal to ensure that all sales goals surpass the country product revenue q Set benchmark for # of customer calls per week per sales q Publish “top 10 deals win and loss” to increase peer competition and drive sales momentum q Launch selling campaign to accelerate revenue materialization 20

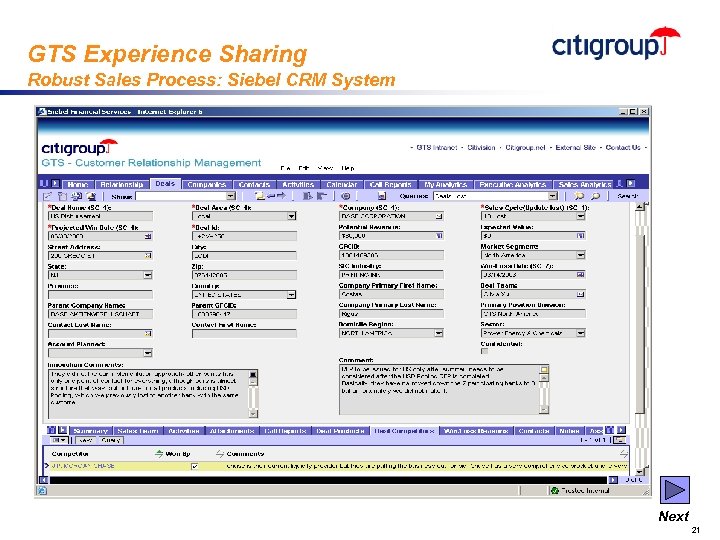

GTS Experience Sharing Robust Sales Process: Siebel CRM System Next 21

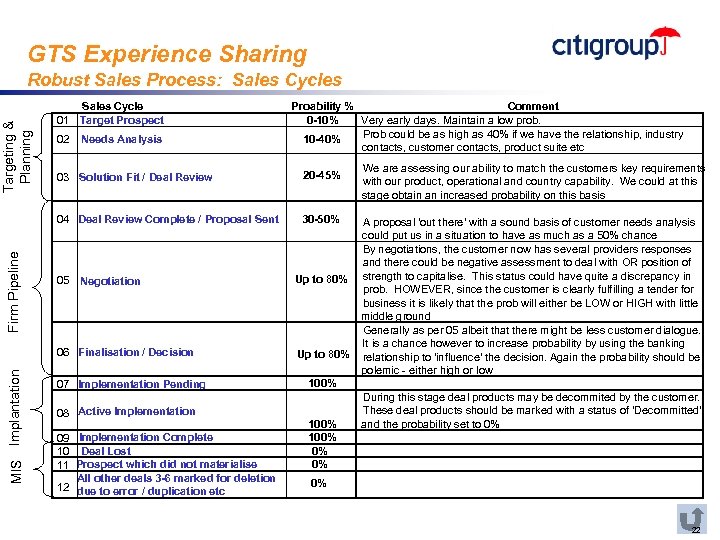

GTS Experience Sharing Targeting & Planning Robust Sales Process: Sales Cycles Sales Cycle 01 Target Prospect 02 Needs Analysis Proability % Comment 0 -10% Very early days. Maintain a low prob. Prob could be as high as 40% if we have the relationship, industry 10 -40% contacts, customer contacts, product suite etc 20 -45% 04 Deal Review Complete / Proposal Sent Firm Pipeline 03 Solution Fit / Deal Review 30 -50% Up to 80% 06 Finalisation / Decision MIS Implantation 05 Negotiation Up to 80% 07 Implementation Pending 08 Active Implementation 09 Implementation Complete 10 Deal Lost 11 Prospect which did not materialise All other deals 3 -6 marked for deletion 12 due to error / duplication etc We are assessing our ability to match the customers key requirements with our product, operational and country capability. We could at this stage obtain an increased probability on this basis A proposal 'out there' with a sound basis of customer needs analysis could put us in a situation to have as much as a 50% chance By negotiations, the customer now has several providers responses and there could be negative assessment to deal with OR position of strength to capitalise. This status could have quite a discrepancy in prob. HOWEVER, since the customer is clearly fulfilling a tender for business it is likely that the prob will either be LOW or HIGH with little middle ground Generally as per 05 albeit that there might be less customer dialogue. It is a chance however to increase probability by using the banking relationship to 'influence' the decision. Again the probability should be polemic - either high or low 100% 0% 0% During this stage deal products may be decommited by the customer. These deal products should be marked with a status of 'Decommitted' and the probability set to 0% 0% 22

Citi. Direct ® Online Banking Citi. Direct® Online Banking deliver international corporate and financial institutions the most secure, efficient and real time banking services Citi. Direct® Online Banking were presented as World Best Internet Bank and World’s Best Corporate Institutional Bank from Global Finance 23

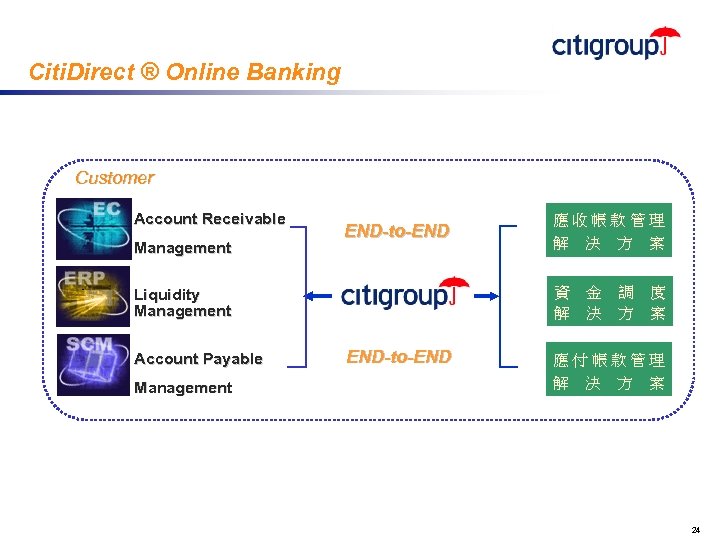

Citi. Direct ® Online Banking Customer Account Receivable Management END-to-END 資 金 調 度 解 決 方 案 Liquidity Management Account Payable Management 應收帳款管理 解 決 方 案 END-to-END 應付帳款管理 解 決 方 案 24

Citi. Direct ® Online Banking Today 6, 000, 000 4, 000 Total Transaction Value in USD Total Transaction Volume 140, 000 Total Active Users 26, 000 Corporations Use 100+ Currencies 90 Countries 21 Languages 18 Countries in Asia 1 Platform 25

Why Citi. Direct ? v Internet Advantage ü Access Account Information at everywhere and any time ü Real-time Account Information v Enhanced Internal Operation Efficiency ü Easy to monitor transaction process and status ü Remove Cross boarder/region barries v Simple System Installation and Automatic Update ü Download and install directly from website ü System Automatic Update v Easier to Use ü Online Help and training v Safest Internet Banking 26

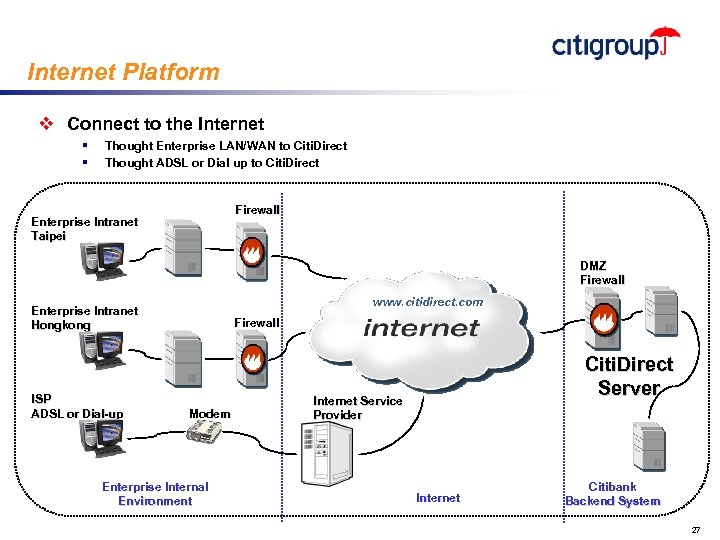

Internet Platform v Connect to the Internet § § Thought Enterprise LAN/WAN to Citi. Direct Thought ADSL or Dial up to Citi. Direct Firewall Enterprise Intranet Taipei DMZ Firewall www. citidirect. com Enterprise Intranet Hongkong ISP ADSL or Dial-up Firewall Modem Enterprise Internal Environment Citi. Direct Server Internet Service Provider Internet Citibank Backend System 27

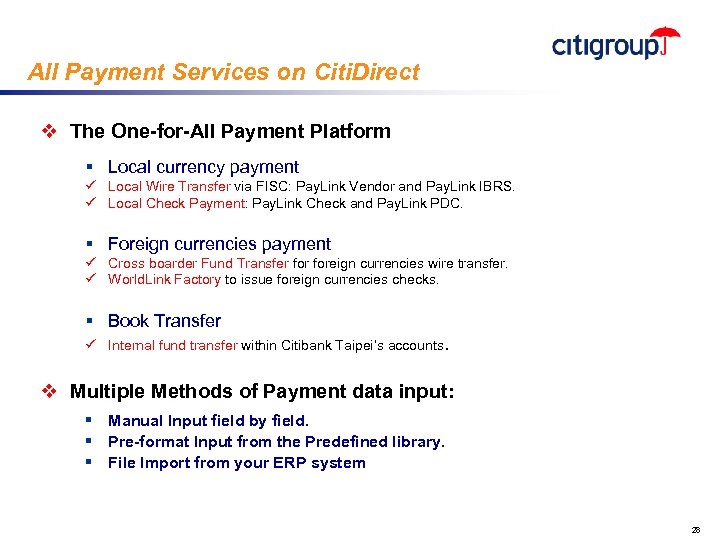

All Payment Services on Citi. Direct v The One-for-All Payment Platform § Local currency payment ü Local Wire Transfer via FISC: Pay. Link Vendor and Pay. Link IBRS. ü Local Check Payment: Pay. Link Check and Pay. Link PDC. § Foreign currencies payment ü Cross boarder Fund Transfer foreign currencies wire transfer. ü World. Link Factory to issue foreign currencies checks. § Book Transfer ü Internal fund transfer within Citibank Taipei’s accounts. v Multiple Methods of Payment data input: § Manual Input field by field. § Pre-format Input from the Predefined library. § File Import from your ERP system 28

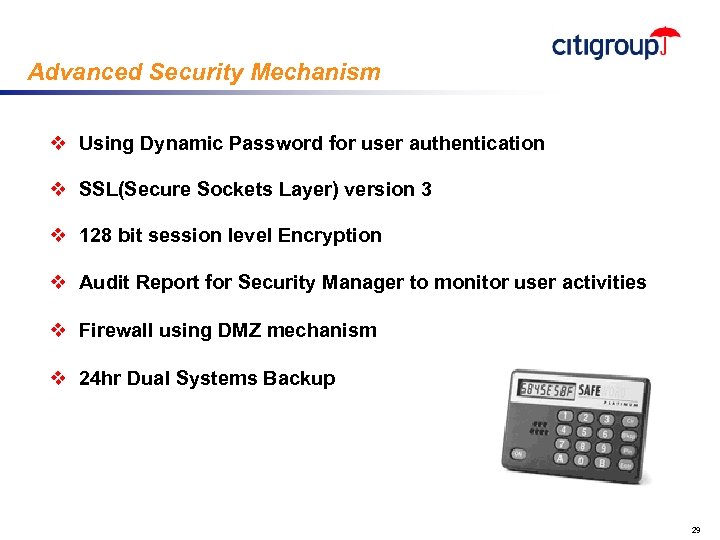

Advanced Security Mechanism v Using Dynamic Password for user authentication v SSL(Secure Sockets Layer) version 3 v 128 bit session level Encryption v Audit Report for Security Manager to monitor user activities v Firewall using DMZ mechanism v 24 hr Dual Systems Backup 29

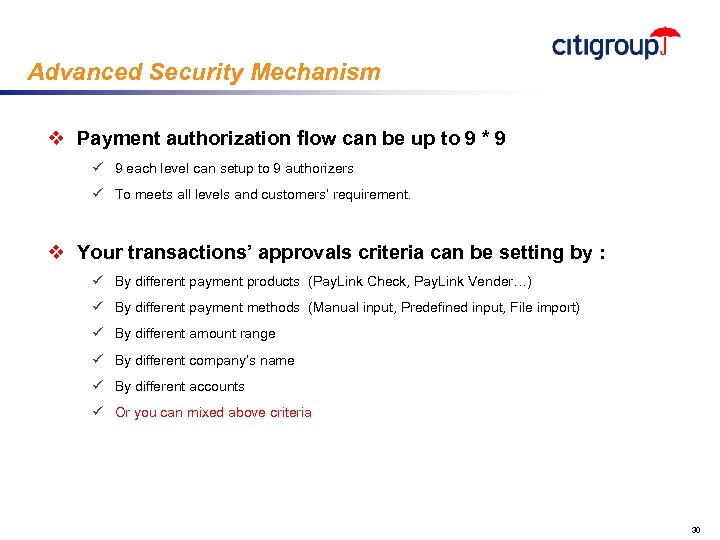

Advanced Security Mechanism v Payment authorization flow can be up to 9 * 9 ü 9 each level can setup to 9 authorizers ü To meets all levels and customers’ requirement. v Your transactions’ approvals criteria can be setting by : ü By different payment products (Pay. Link Check, Pay. Link Vender…) ü By different payment methods (Manual input, Predefined input, File import) ü By different amount range ü By different company’s name ü By different accounts ü Or you can mixed above criteria 30

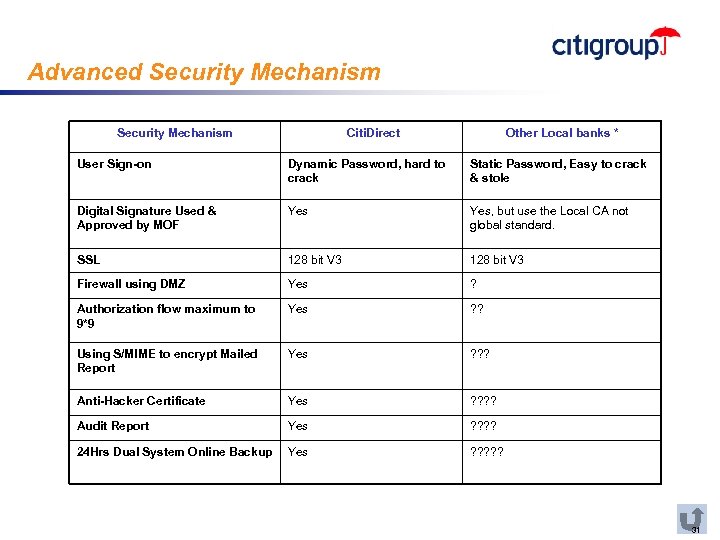

Advanced Security Mechanism Citi. Direct Other Local banks * User Sign-on Dynamic Password, hard to crack Static Password, Easy to crack & stole Digital Signature Used & Approved by MOF Yes, but use the Local CA not global standard. SSL 128 bit V 3 Firewall using DMZ Yes ? Authorization flow maximum to 9*9 Yes ? ? Using S/MIME to encrypt Mailed Report Yes ? ? ? Anti-Hacker Certificate Yes ? ? Audit Report Yes ? ? 24 Hrs Dual System Online Backup Yes ? ? ? 31

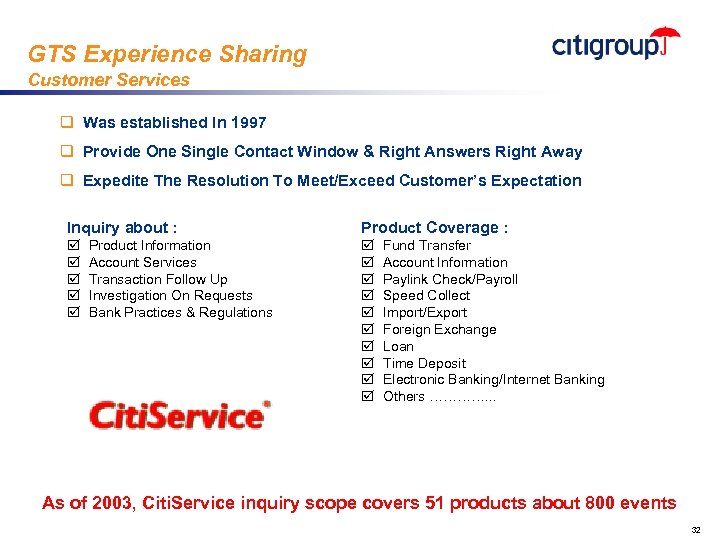

GTS Experience Sharing Customer Services q Was established In 1997 q Provide One Single Contact Window & Right Answers Right Away q Expedite The Resolution To Meet/Exceed Customer’s Expectation Inquiry about : Product Coverage : þ þ þ þ Product Information Account Services Transaction Follow Up Investigation On Requests Bank Practices & Regulations Fund Transfer Account Information Paylink Check/Payroll Speed Collect Import/Export Foreign Exchange Loan Time Deposit Electronic Banking/Internet Banking Others …………. . . As of 2003, Citi. Service inquiry scope covers 51 products about 800 events 32

GTS Experience Sharing Investment On Customer Service q Total Investment during 2002 ~ 2003 : NTD 35 millions (USD 1. 2 millions) q Investment in Systems/Infrastructure - Set up CTI (Computer Telephony Integration) System Implement Exceller Systerm Upgrade IVR (Interactive Voice Response) System Increase toll-free service line capacity from 24 lines to 72 lines q Investment in Manpower Resources & Training - Improve service with investment on sufficient and qualified manpower - 3 -month pre-job training and CSO qualification certification - Provide weekly 2 -hour training q Service Quality Certification - Acquired ISO 9001: 2000 certificate in 2001 and became the first financial institution call center with ISO certification in Taiwan. Next 33

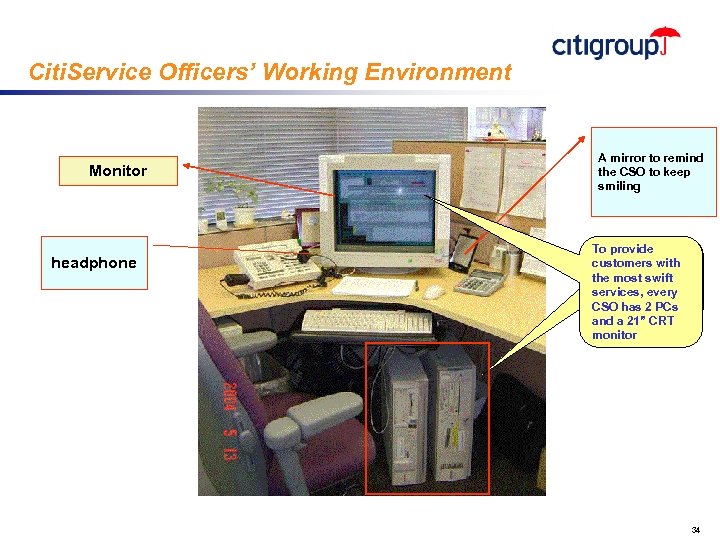

Citi. Service Officers’ Working Environment Monitor headphone A mirror to remind the CSO to keep smiling To provide customers with the most swift services, every CSO has 2 PCs and a 21” CRT monitor 34

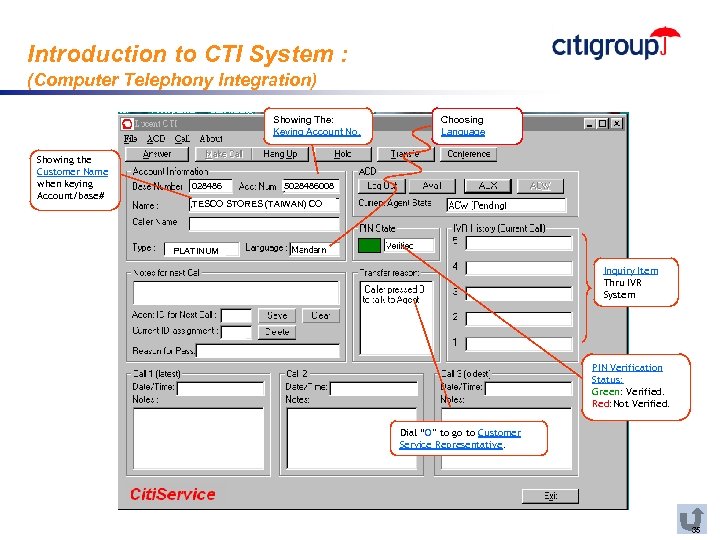

Introduction to CTI System : (Computer Telephony Integration) Showing The: Keying Account No. Showing the Customer Name when keying Account/base# 028486 Choosing Language 5028486008 TESCO STORES (TAIWAN) CO PLATINUM Inquiry Item Thru IVR System PIN Verification Status: Green: Verified. Red: Not Verified. Dial “O” to go to Customer Service Representative. 35

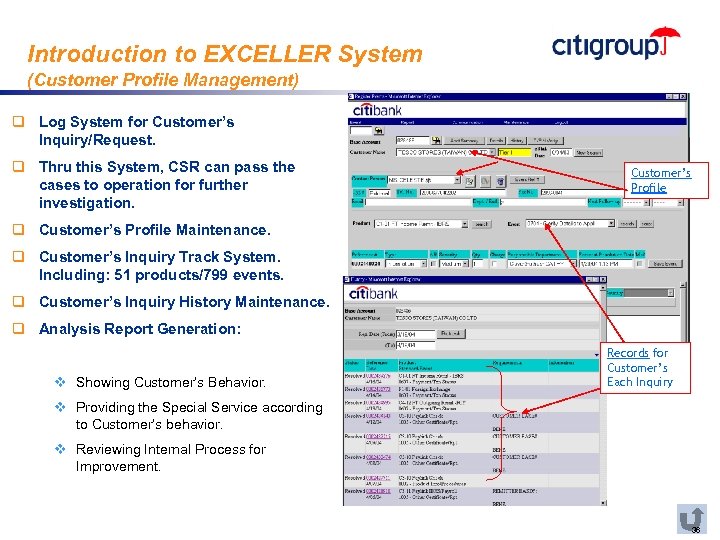

Introduction to EXCELLER System (Customer Profile Management) q Log System for Customer’s Inquiry/Request. q Thru this System, CSR can pass the cases to operation for further investigation. Customer’s Profile q Customer’s Profile Maintenance. q Customer’s Inquiry Track System. Including: 51 products/799 events. q Customer’s Inquiry History Maintenance. q Analysis Report Generation: v Showing Customer’s Behavior. Records for Customer’s Each Inquiry v Providing the Special Service according to Customer’s behavior. v Reviewing Internal Process for Improvement. 36

Upgraded IVR System q 72 Service Lines - Provide quick and easy access to our 24 -hour phone inquiry service q High Customer Information Security - After selecting system language, customers have to input account / base number and pin number for identification; then system will transfer the call to designated Customer Service Officer. q Provide Useful Inquiry/Fax Functions : * Account Statement Inquiry * Indicative Exchange Rate * Account Statement Fax * Incoming/Outgoing Remittance Advice Fax * Cash/ Trade Form Fax (16 Items) 37

GTS Experience Sharing Customer Services Directions q Implement customer segmentation - Differentiate customer service based on revenue impact (Platinum, Gold, Priority, regular and walk-in customers) q Strive for call reduction/ alternative channels offload to better utilize the resources - Launched Corporate Portal to offload the volume of calls - Promote IVR/Internet banking/fax service q Conduct Citi-tour and service review to ensure customer satisfaction - 6 Citi. Tour and 23 onsite service reviews for key customers were done in 2003 - Achieve 100% VOC in 2003 q Support account / transaction management and cross-selling campaign - Pliot anchor calls for ELC - FI bank volume promotion - Walk-in LC advising customer cross-selling Next 38

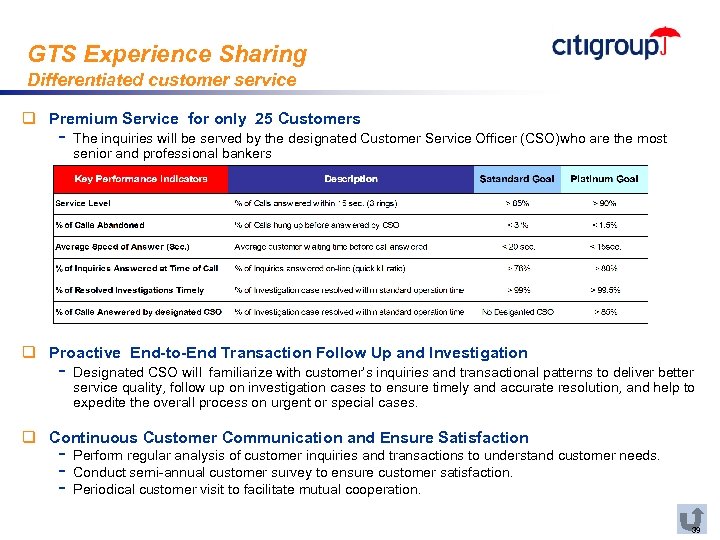

GTS Experience Sharing Differentiated customer service q Premium Service for only 25 Customers - The inquiries will be served by the designated Customer Service Officer (CSO)who are the most senior and professional bankers q Proactive End-to-End Transaction Follow Up and Investigation - Designated CSO will familiarize with customer’s inquiries and transactional patterns to deliver better service quality, follow up on investigation cases to ensure timely and accurate resolution, and help to expedite the overall process on urgent or special cases. q Continuous Customer Communication and Ensure Satisfaction - Perform regular analysis of customer inquiries and transactions to understand customer needs. Conduct semi-annual customer survey to ensure customer satisfaction. Periodical customer visit to facilitate mutual cooperation. 39

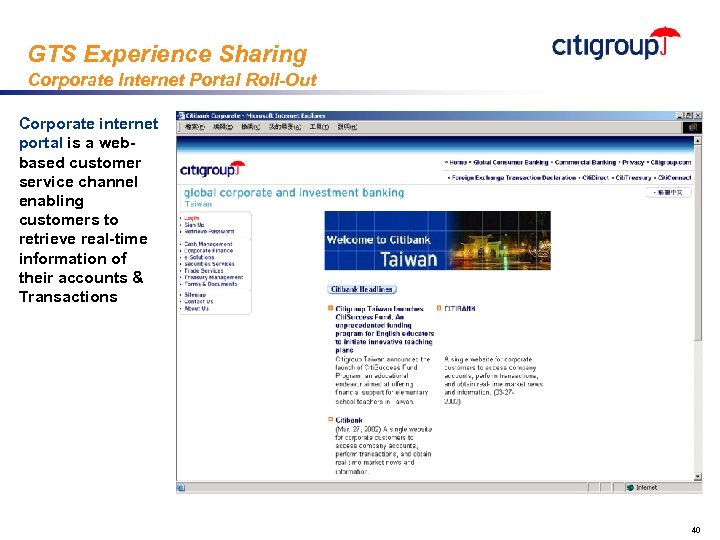

GTS Experience Sharing Corporate Internet Portal Roll-Out Corporate internet portal is a webbased customer service channel enabling customers to retrieve real-time information of their accounts & Transactions 40

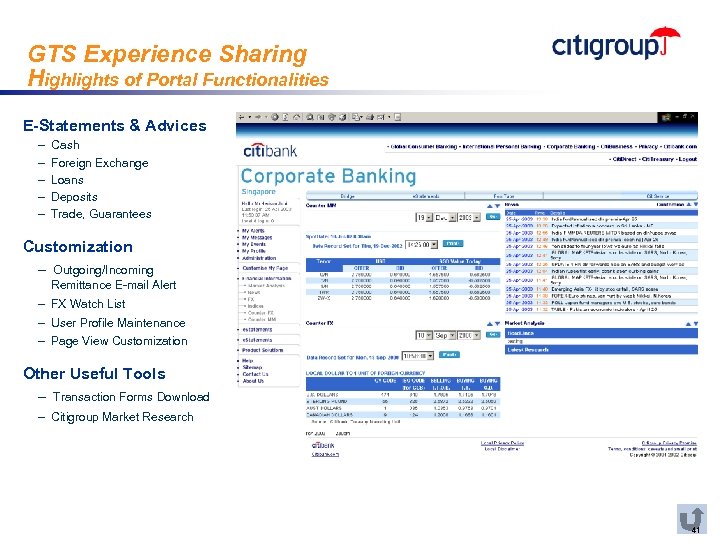

GTS Experience Sharing Highlights of Portal Functionalities E-Statements & Advices - Cash Foreign Exchange Loans Deposits Trade, Guarantees Customization - Outgoing/Incoming Remittance E-mail Alert - FX Watch List - User Profile Maintenance - Page View Customization Other Useful Tools - Transaction Forms Download - Citigroup Market Research 41

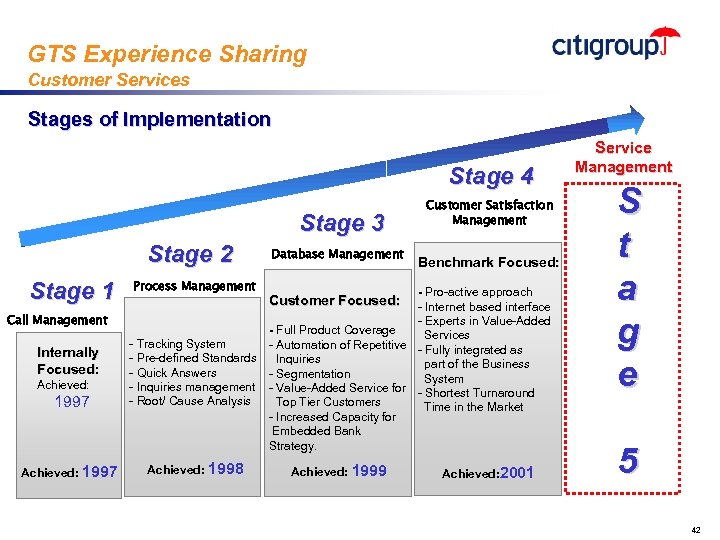

GTS Experience Sharing Customer Services Stages of Implementation Stage 4 Stage 3 Stage 2 Stage 1 Process Management Call Management 1997 - Tracking System - Pre-defined Standards - Quick Answers - Inquiries management - Root/ Cause Analysis Achieved: 1997 Achieved: 1998 Internally Focused: Achieved: Database Management Customer Satisfaction Management Benchmark Focused: - Pro-active approach - Internet based interface - Experts in Value-Added - Full Product Coverage Services - Automation of Repetitive - Fully integrated as Inquiries part of the Business - Segmentation System - Value-Added Service for - Shortest Turnaround Top Tier Customers Time in the Market - Increased Capacity for Embedded Bank Strategy. Customer Focused: Achieved: 1999 Achieved: 2001 Service Management S t a g e 5 42

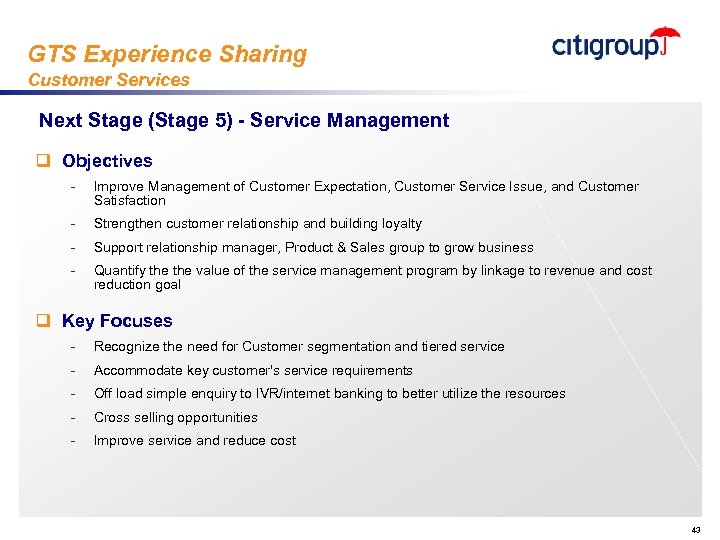

GTS Experience Sharing Customer Services Next Stage (Stage 5) - Service Management q Objectives - Improve Management of Customer Expectation, Customer Service Issue, and Customer Satisfaction - Strengthen customer relationship and building loyalty - Support relationship manager, Product & Sales group to grow business - Quantify the value of the service management program by linkage to revenue and cost reduction goal q Key Focuses - Recognize the need for Customer segmentation and tiered service - Accommodate key customer's service requirements - Off load simple enquiry to IVR/internet banking to better utilize the resources - Cross selling opportunities - Improve service and reduce cost 43

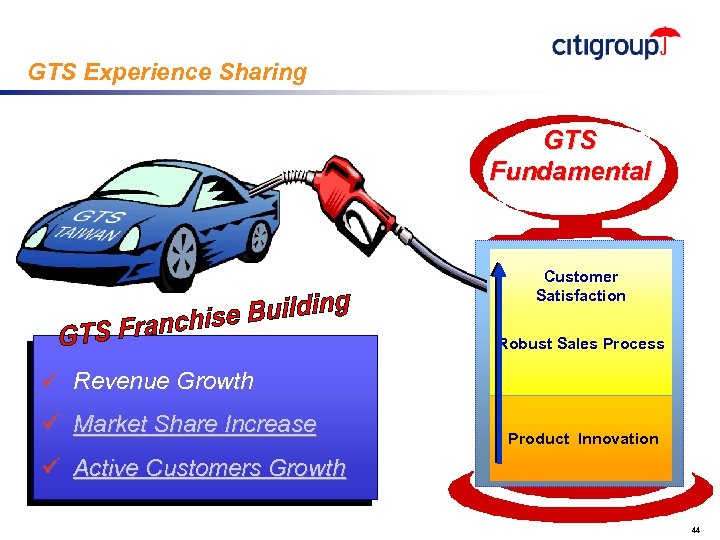

GTS Experience Sharing GTS Fundamental Customer Satisfaction Robust Sales Process ü Revenue Growth ü Market Share Increase Product Innovation ü Active Customers Growth 44

Q&A 45

Copyright © 2004. Citigroup, Inc. All rights reserved. CITIGROUP and the Umbrella Device are trademarks and service marks of Citicorp or its affiliates and are used and registered throughout the world. 46

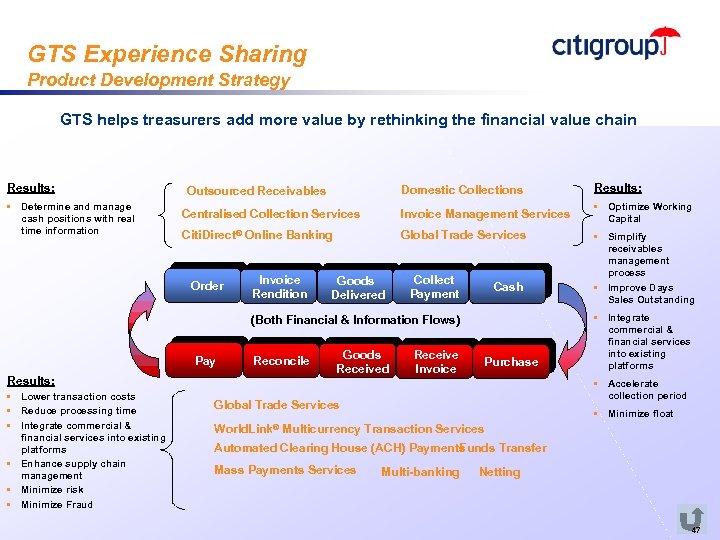

GTS Experience Sharing Product Development Strategy GTS helps treasurers add more value by rethinking the financial value chain Results: • Determine and manage cash positions with real time information Domestic Collections Results: Centralised Collection Services Invoice Management Services • Optimize Working Capital Citi. Direct® Online Banking Global Trade Services Outsourced Receivables Order Invoice Rendition Goods Delivered Collect Payment Cash (Both Financial & Information Flows) Pay Reconcile Results: • Lower transaction costs • Reduce processing time • Integrate commercial & financial services into existing platforms • Enhance supply chain management • Minimize risk • Minimize Fraud Goods Received Receive Invoice Purchase • Integrate commercial & financial services into existing platforms • Accelerate collection period Global Trade Services World. Link® • Simplify receivables management process • Improve Days Sales Outstanding • Minimize float Multicurrency Transaction Services Automated Clearing House (ACH) Payments unds Transfer F Mass Payments Services Multi-banking Netting 47

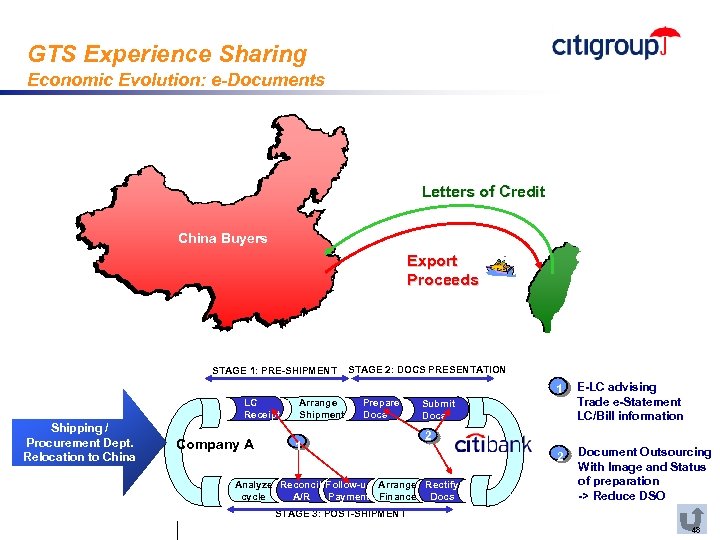

GTS Experience Sharing Economic Evolution: e-Documents Letters of Credit China Buyers Export Proceeds STAGE 1: PRE-SHIPMENT STAGE 2: DOCS PRESENTATION 1 LC Receipt Shipping / Procurement Dept. Relocation to China Company A Arrange Shipment Prepare Docs 1 E-LC advising Trade e-Statement LC/Bill information 2 Document Outsourcing With 2 Image and Status of preparation -> Reduce DSO Submit Docs 2 Analyze Reconcile. Follow-up Arrange Rectify Payment Finance Docs cycle A/R STAGE 3: POST-SHIPMENT 48

c0a084fb1b00ff126230f9b63e96af86.ppt