40b84075bc31ed558718e7be9fca18fd.ppt

- Количество слайдов: 9

CISI – Financial Products, Markets & Services Topic – Derivatives (6. 5) Derivatives and Commodity Markets cisi. org

CISI – Financial Products, Markets & Services Topic – Derivatives (6. 5) Derivatives and Commodity Markets cisi. org

Derivatives and Commodity Markets A derivative is a financial instrument whose price is derived from that of another asset, and the other asset is generally referred to as the ‘underlying asset’, or sometimes just ‘the underlying’. Physical Markets Simply the buying, selling and subsequent delivery of commodities like oil, wheat, barley and aluminium. Derivatives Markets Exists in parallel and enables the participants in the physical markets to hedge the risk of adverse price movements. Dominated by major international trading houses, governments, and the major producers and consumers. cisi. org

Derivatives and Commodity Markets A derivative is a financial instrument whose price is derived from that of another asset, and the other asset is generally referred to as the ‘underlying asset’, or sometimes just ‘the underlying’. Physical Markets Simply the buying, selling and subsequent delivery of commodities like oil, wheat, barley and aluminium. Derivatives Markets Exists in parallel and enables the participants in the physical markets to hedge the risk of adverse price movements. Dominated by major international trading houses, governments, and the major producers and consumers. cisi. org

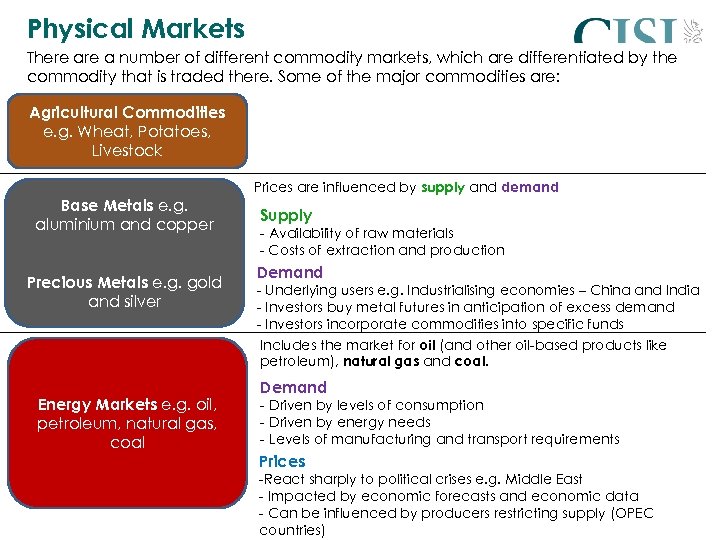

Physical Markets There a number of different commodity markets, which are differentiated by the commodity that is traded there. Some of the major commodities are: Agricultural Commodities e. g. Wheat, Potatoes, Livestock Base Metals e. g. aluminium and copper Precious Metals e. g. gold and silver Energy Markets e. g. oil, petroleum, natural gas, coal Prices are influenced by supply and demand Supply - Availability of raw materials - Costs of extraction and production Demand - Underlying users e. g. Industrialising economies – China and India - Investors buy metal futures in anticipation of excess demand - Investors incorporate commodities into specific funds Includes the market for oil (and other oil-based products like petroleum), natural gas and coal. Demand - Driven by levels of consumption - Driven by energy needs - Levels of manufacturing and transport requirements Prices -React sharply to political crises e. g. Middle East - Impacted by economic forecasts and economic data - Can be influenced by producers restricting supply (OPEC countries) cisi. org

Physical Markets There a number of different commodity markets, which are differentiated by the commodity that is traded there. Some of the major commodities are: Agricultural Commodities e. g. Wheat, Potatoes, Livestock Base Metals e. g. aluminium and copper Precious Metals e. g. gold and silver Energy Markets e. g. oil, petroleum, natural gas, coal Prices are influenced by supply and demand Supply - Availability of raw materials - Costs of extraction and production Demand - Underlying users e. g. Industrialising economies – China and India - Investors buy metal futures in anticipation of excess demand - Investors incorporate commodities into specific funds Includes the market for oil (and other oil-based products like petroleum), natural gas and coal. Demand - Driven by levels of consumption - Driven by energy needs - Levels of manufacturing and transport requirements Prices -React sharply to political crises e. g. Middle East - Impacted by economic forecasts and economic data - Can be influenced by producers restricting supply (OPEC countries) cisi. org

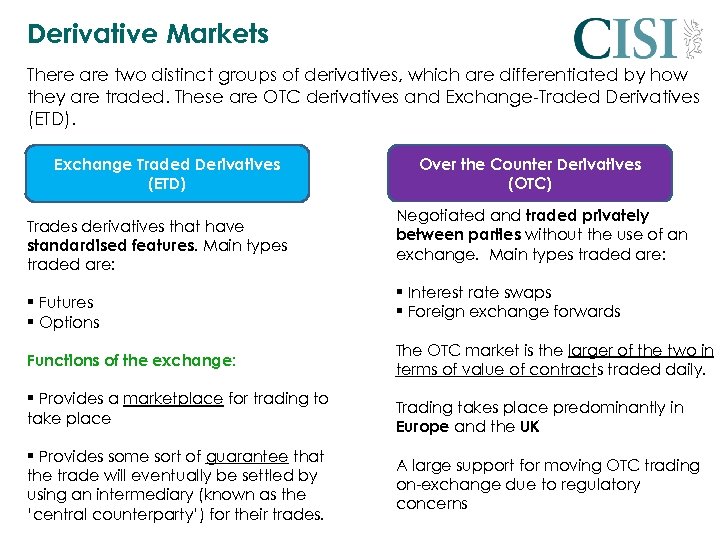

Derivative Markets There are two distinct groups of derivatives, which are differentiated by how they are traded. These are OTC derivatives and Exchange-Traded Derivatives (ETD). Exchange Traded Derivatives (ETD) Trades derivatives that have standardised features. Main types traded are: § Futures § Options Functions of the exchange: § Provides a marketplace for trading to take place § Provides some sort of guarantee that the trade will eventually be settled by using an intermediary (known as the ‘central counterparty’) for their trades. Over the Counter Derivatives (OTC) Negotiated and traded privately between parties without the use of an exchange. Main types traded are: § Interest rate swaps § Foreign exchange forwards The OTC market is the larger of the two in terms of value of contracts traded daily. Trading takes place predominantly in Europe and the UK A large support for moving OTC trading on-exchange due to regulatory concerns cisi. org

Derivative Markets There are two distinct groups of derivatives, which are differentiated by how they are traded. These are OTC derivatives and Exchange-Traded Derivatives (ETD). Exchange Traded Derivatives (ETD) Trades derivatives that have standardised features. Main types traded are: § Futures § Options Functions of the exchange: § Provides a marketplace for trading to take place § Provides some sort of guarantee that the trade will eventually be settled by using an intermediary (known as the ‘central counterparty’) for their trades. Over the Counter Derivatives (OTC) Negotiated and traded privately between parties without the use of an exchange. Main types traded are: § Interest rate swaps § Foreign exchange forwards The OTC market is the larger of the two in terms of value of contracts traded daily. Trading takes place predominantly in Europe and the UK A large support for moving OTC trading on-exchange due to regulatory concerns cisi. org

Derivative Exchanges ICE Futures Europe was previously called LIFFE (London International Financial Futures and Options Exchange). It was originally set-up in 1982 In 2001, Euronext bought LIFFE and renamed it Euronext. Liffe. It is now part of ICE following the takeover of NYSE Euronext. It is the main exchange for trading financial derivatives in the UK including futures and options on: § Interest rates and bonds § Equity indices (e. g. FTSE) § Individual equities (e. g. BP, HSBC) Also trades derivatives on soft commodities e. g. Sugar, wheat, and cocoa. It also runs futures and options markets in Amsterdam, Brussels, Lisbon and Paris. cisi. org

Derivative Exchanges ICE Futures Europe was previously called LIFFE (London International Financial Futures and Options Exchange). It was originally set-up in 1982 In 2001, Euronext bought LIFFE and renamed it Euronext. Liffe. It is now part of ICE following the takeover of NYSE Euronext. It is the main exchange for trading financial derivatives in the UK including futures and options on: § Interest rates and bonds § Equity indices (e. g. FTSE) § Individual equities (e. g. BP, HSBC) Also trades derivatives on soft commodities e. g. Sugar, wheat, and cocoa. It also runs futures and options markets in Amsterdam, Brussels, Lisbon and Paris. cisi. org

Derivative Exchanges World’s leading International derivatives exchange based in Frankfurt. § Principal products are German bond futures and options (Bund – German government bond). § Also trades index products for a range of European markets Trades on a fully computerised Eurex platform. The platform enables members from across Europe and the US to access Eurex outside Switzerland Germany. cisi. org

Derivative Exchanges World’s leading International derivatives exchange based in Frankfurt. § Principal products are German bond futures and options (Bund – German government bond). § Also trades index products for a range of European markets Trades on a fully computerised Eurex platform. The platform enables members from across Europe and the US to access Eurex outside Switzerland Germany. cisi. org

Derivative Exchanges Intercontinental Exchange (ICE) Electronic global futures and OTC marketplace for trading energy commodity contracts e. g. natural gas, crude oil, power and emissions ICE Futures is Europe’s leading energy futures and options exchange – includes derivative contracts based on crude oil, refined oil products, jet fuel, natural gas and electric power. ICE Futures introduced Europe’s leading emissions futures contract in conjunction with the European Climate Exchange (ECX). ICE’s other markets are centred in North America and include trading of agricultural, currency and stock index futures and options. It also took over NYSE Euronext and, as a result, by acquiring LIFFE, became the world’s largest derivatives exchange operator. cisi. org

Derivative Exchanges Intercontinental Exchange (ICE) Electronic global futures and OTC marketplace for trading energy commodity contracts e. g. natural gas, crude oil, power and emissions ICE Futures is Europe’s leading energy futures and options exchange – includes derivative contracts based on crude oil, refined oil products, jet fuel, natural gas and electric power. ICE Futures introduced Europe’s leading emissions futures contract in conjunction with the European Climate Exchange (ECX). ICE’s other markets are centred in North America and include trading of agricultural, currency and stock index futures and options. It also took over NYSE Euronext and, as a result, by acquiring LIFFE, became the world’s largest derivatives exchange operator. cisi. org

Derivative Exchanges World’s premier non-ferrous metals market Based in London but a global market with international membership. More than 95% of its business is from overseas. Futures and options traded on aluminium, copper, nickel, tin, zinc and lead. Trading happens in 3 -ways: §open outcry in the ‘ring’, §through an inter-office telephone market § through LME Select, the exchange’s electronic trading platform. cisi. org

Derivative Exchanges World’s premier non-ferrous metals market Based in London but a global market with international membership. More than 95% of its business is from overseas. Futures and options traded on aluminium, copper, nickel, tin, zinc and lead. Trading happens in 3 -ways: §open outcry in the ‘ring’, §through an inter-office telephone market § through LME Select, the exchange’s electronic trading platform. cisi. org

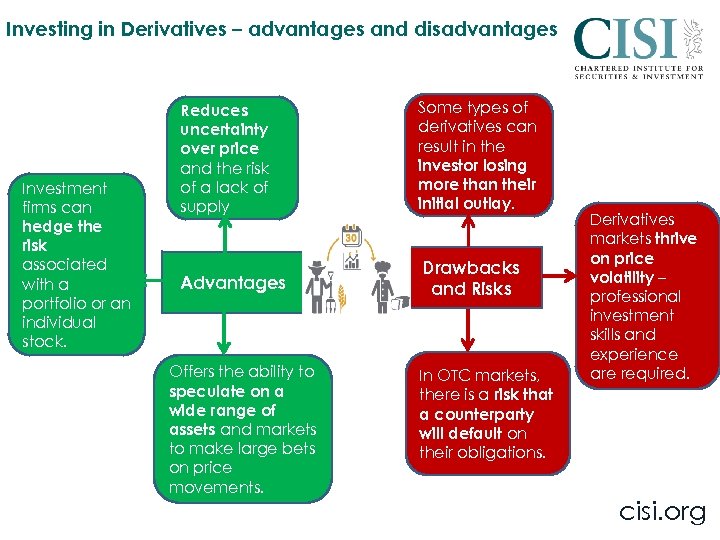

Investing in Derivatives – advantages and disadvantages Investment firms can hedge the risk associated with a portfolio or an individual stock. Reduces uncertainty over price and the risk of a lack of supply Some types of derivatives can result in the investor losing more than their initial outlay. Advantages Drawbacks and Risks Offers the ability to speculate on a wide range of assets and markets to make large bets on price movements. In OTC markets, there is a risk that a counterparty will default on their obligations. Derivatives markets thrive on price volatility – professional investment skills and experience are required. cisi. org

Investing in Derivatives – advantages and disadvantages Investment firms can hedge the risk associated with a portfolio or an individual stock. Reduces uncertainty over price and the risk of a lack of supply Some types of derivatives can result in the investor losing more than their initial outlay. Advantages Drawbacks and Risks Offers the ability to speculate on a wide range of assets and markets to make large bets on price movements. In OTC markets, there is a risk that a counterparty will default on their obligations. Derivatives markets thrive on price volatility – professional investment skills and experience are required. cisi. org