cc7cdd359d74e58318dbf716c59292ef.ppt

- Количество слайдов: 15

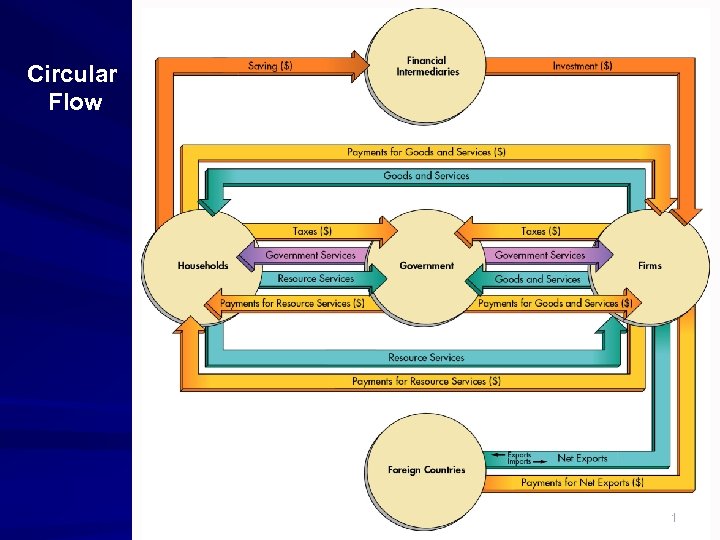

Circular Flow 1

Circular Flow 1

Markets Can Fail Government Can Help Technical efficiency: maximum value of output from a resource base Economic efficiency: when one person cannot be made better off without making someone else worse off. 2

Markets Can Fail Government Can Help Technical efficiency: maximum value of output from a resource base Economic efficiency: when one person cannot be made better off without making someone else worse off. 2

The Government’s Role Correct for: l l l Imperfect Information Externalities Public Goods Lack of Competition Business Cycles 3

The Government’s Role Correct for: l l l Imperfect Information Externalities Public Goods Lack of Competition Business Cycles 3

Poor Information Inefficiency l False information l Asymmetric information l Either the buyer or the seller has better information: he knows his situation best … and the other guy flees Dealing with information problems l Private solutions: Brand names, franchises, and product warranties l Public solutions: Government may require full and correct disclosure. (Food labels, stock prospectuses, etc. ) 4

Poor Information Inefficiency l False information l Asymmetric information l Either the buyer or the seller has better information: he knows his situation best … and the other guy flees Dealing with information problems l Private solutions: Brand names, franchises, and product warranties l Public solutions: Government may require full and correct disclosure. (Food labels, stock prospectuses, etc. ) 4

Externalities: External Benefits Someone outside a transaction benefits from the transaction. . . and doesn’t pay – Buyers will demand less than the socially optimal amount. – Sellers will produce less than the socially optimal amount. – Examples: Mowing your lawn, painting your house, getting educated. 5

Externalities: External Benefits Someone outside a transaction benefits from the transaction. . . and doesn’t pay – Buyers will demand less than the socially optimal amount. – Sellers will produce less than the socially optimal amount. – Examples: Mowing your lawn, painting your house, getting educated. 5

Externalities: External Costs Someone outside a transaction incurs costs because of it. . . but isn’t paid – If buyers don’t bear all the costs of their purchase, they buy too much. – If producers don’t bear all the costs of production, they produce too much. – Examples: A nightclub next door to your house, pollution by a manufacturer. 6

Externalities: External Costs Someone outside a transaction incurs costs because of it. . . but isn’t paid – If buyers don’t bear all the costs of their purchase, they buy too much. – If producers don’t bear all the costs of production, they produce too much. – Examples: A nightclub next door to your house, pollution by a manufacturer. 6

Public Goods l Consumption by one person does not diminish the quantity or quality available to others. Public goods can be jointly consumed Individuals can simultaneously enjoy consumption of same product or service. Public goods are non-excludable Consumption of the good cannot be restricted to just those who pay for it. No one has a private property right to the good. • Everybody has incentive to be a free rider • When everyone free rides, too little (or none) is produced. 7

Public Goods l Consumption by one person does not diminish the quantity or quality available to others. Public goods can be jointly consumed Individuals can simultaneously enjoy consumption of same product or service. Public goods are non-excludable Consumption of the good cannot be restricted to just those who pay for it. No one has a private property right to the good. • Everybody has incentive to be a free rider • When everyone free rides, too little (or none) is produced. 7

Examples of Public Goods • National defense • Public radio and television stations • Clean air • Unpolluted ground water • Markets may develop ways of providing some public goods • use advertising to support radio and television … but then you’re “paying” by listening to the ads. 8

Examples of Public Goods • National defense • Public radio and television stations • Clean air • Unpolluted ground water • Markets may develop ways of providing some public goods • use advertising to support radio and television … but then you’re “paying” by listening to the ads. 8

Lack of Competition Sellers may gain by restricting output and raising price – Earn more by doing less. – Too little is produced. Monopoly: only one producer – Example: utility companies Oligopoly: only a few producers (who may operate jointly as a monopolist through a cartel or otherwise collude). – Example: OPEC Monopsony: only one buyer 9

Lack of Competition Sellers may gain by restricting output and raising price – Earn more by doing less. – Too little is produced. Monopoly: only one producer – Example: utility companies Oligopoly: only a few producers (who may operate jointly as a monopolist through a cartel or otherwise collude). – Example: OPEC Monopsony: only one buyer 9

Public Choice Analysis • Gov’t actions result from self-interested behaviors of voters and politicians. • Gov’t may intervene to benefit specific individuals or groups who do not like a market outcome. • This is rent-seeking—the use of resources to transfer wealth from one individual to another without increasing output. Gov’t intervention may not intend efficiency gains. Gov’t intervention may result in efficiency losses. 10

Public Choice Analysis • Gov’t actions result from self-interested behaviors of voters and politicians. • Gov’t may intervene to benefit specific individuals or groups who do not like a market outcome. • This is rent-seeking—the use of resources to transfer wealth from one individual to another without increasing output. Gov’t intervention may not intend efficiency gains. Gov’t intervention may result in efficiency losses. 10

Microeconomic Policy Government provides public goods to avoid the free rider problem in the private production of certain goods. Government taxes or subsidizes activities that create externalities. Government ensures competitive markets where possible and regulates noncompetitive industries in the public interest. But there’s problem of regulatory capture. 11

Microeconomic Policy Government provides public goods to avoid the free rider problem in the private production of certain goods. Government taxes or subsidizes activities that create externalities. Government ensures competitive markets where possible and regulates noncompetitive industries in the public interest. But there’s problem of regulatory capture. 11

Macroeconomic Policy Monetary Policy – Policies that influence money and credit (money supply and interest rates). – In the U. S. , the Federal Reserve Board (“the Fed”) is responsible for this. Fiscal Policy – Policies that control government spending and taxation. – In the U. S. federal government, Congress enacts these policies and the President signs them into law. 12

Macroeconomic Policy Monetary Policy – Policies that influence money and credit (money supply and interest rates). – In the U. S. , the Federal Reserve Board (“the Fed”) is responsible for this. Fiscal Policy – Policies that control government spending and taxation. – In the U. S. federal government, Congress enacts these policies and the President signs them into law. 12

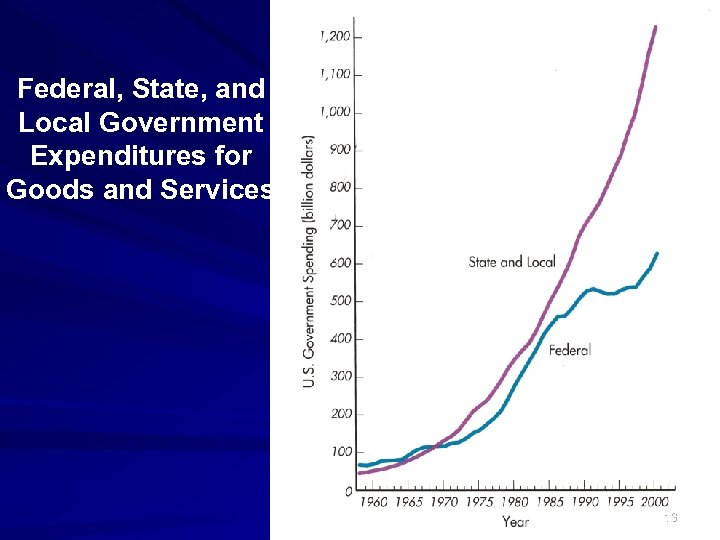

Federal, State, and Local Government Expenditures for Goods and Services 13

Federal, State, and Local Government Expenditures for Goods and Services 13

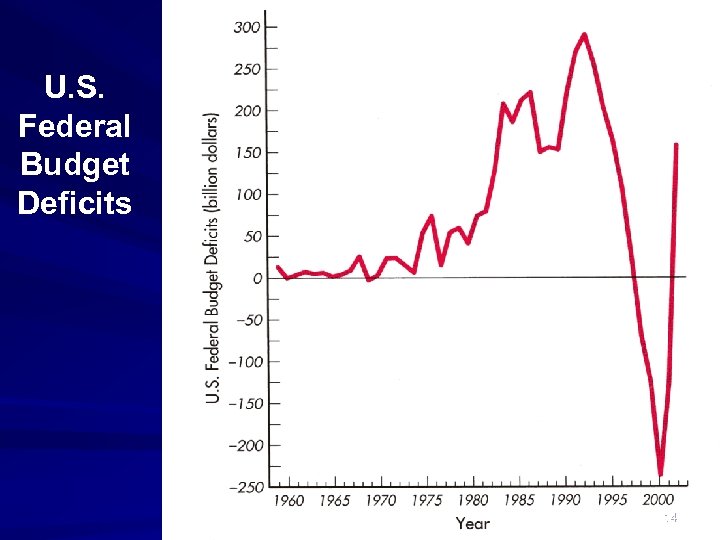

U. S. Federal Budget Deficits 14

U. S. Federal Budget Deficits 14

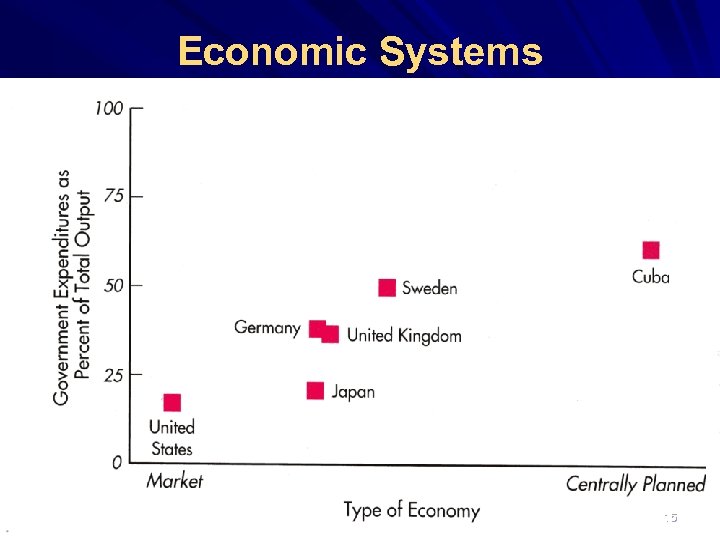

Economic Systems 15

Economic Systems 15