2c933e444018b53f16f72554c6daa317.ppt

- Количество слайдов: 20

CIGNA Corporation UBS Global Healthcare Services Conference Jon Rubin February 12, 2008 All Rights Reserved. These materials may not be reproduced, in whole or in part, without the express written permission of the owner, CIGNA.

FORWARD LOOKING STATEMENTS CAUTIONARY STATEMENT FOR PURPOSES OF THE “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 CIGNA and its representatives may from time to time make written and oral forward-looking statements, including statements contained in press releases, in CIGNA’s filings with the Securities and Exchange Commission, in its reports to shareholders and in meetings with analysts and investors. Forward-looking statements may contain information about financial prospects, economic conditions, trends and other uncertainties. These forward-looking statements are based on management’s beliefs and assumptions and on information available to management at the time the statements are or were made. Forward-looking statements include but are not limited to the information concerning possible or assumed future business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, trends, and, in particular, CIGNA’s productivity initiatives, litigation and other legal matters, operational improvement in the health care operations, and the outlook for CIGNA’s full year 2007 and 2008 results. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe”, “expect”, “plan”, “intend”, “anticipate”, “estimate”, “predict”, “potential”, “may”, “should” or similar expressions. You should not place undue reliance on these forward-looking statements. CIGNA cautions that actual results could differ materially from those that management expects, depending on the outcome of certain factors. Some factors that could cause actual results to differ materially from the forward-looking statements include: 1. increased medical costs that are higher than anticipated in establishing premium rates in CIGNA’s health care operations, including increased use and costs of medical services; 2. increased medical, administrative, technology or other costs resulting from new legislative and regulatory requirements imposed on CIGNA’s employee benefits businesses; 3. challenges and risks associated with implementing operational improvement initiatives and strategic actions in the health care operations, including those related to: (i) offering products that meet emerging market needs, (ii) strengthening underwriting and pricing effectiveness, (iii) strengthening medical cost and medical membership results, (iv) delivering quality member and provider service using effective technology solutions, and (v) lowering administrative costs; 4. risks associated with pending and potential state and federal class action lawsuits, purported securities class action lawsuits, disputes regarding reinsurance arrangements, other litigation and regulatory actions challenging CIGNA’s businesses and the outcome of pending government proceedings and federal tax audits; 5. heightened competition, particularly price competition, which could reduce product margins and constrain growth in CIGNA’s businesses, primarily the health care business; 6. significant changes in interest rates; 7. downgrades in the financial strength ratings of CIGNA’s insurance subsidiaries, which could, among other things, adversely affect new sales and retention of current business; 8. limitations on the ability of CIGNA’s insurance subsidiaries to dividend capital to the parent company as a result of downgrades in the subsidiaries’ financial strength ratings, changes in statutory reserve or capital requirements or other financial constraints; 9. inability of the program adopted by CIGNA to substantially reduce equity market risks for reinsurance contracts that guarantee minimum death benefits under certain variable annuities (including possible market difficulties in entering into appropriate futures contracts and in matching such contracts to the underlying equity risk); 10. . . adjustments to the reserve assumptions (including lapse, partial surrender, mortality, interest rates and volatility) used in estimating CIGNA’s liabilities for reinsurance contracts covering guaranteed minimum death benefits under certain variable annuities; 11. adjustments to the assumptions (including annuity election rates and reinsurance recoverables) used in estimating CIGNA’s assets and liabilities for reinsurance contracts that guarantee minimum income benefits under certain variable annuities; 12. significant stock market declines, which could, among other things, result in increased pension expenses of CIGNA’s pension plan in future periods and the recognition of additional pension obligations; 13. unfavorable claims experience related to workers’ compensation and personal accident exposures of the run-off reinsurance business, including losses attributable to the inability to recover claims from retrocessionaires; 14. significant deterioration in economic conditions, which could have an adverse effect on CIGNA’s operations and investments; 15. changes in public policy and in the political environment, which could affect state and federal law, including legislative and regulatory proposals related to health care issues, which could increase cost and affect the market for CIGNA’s health care products and services; and amendments to income tax laws, which could affect the taxation of employer provided benefits, and pension legislation, which could increase pension cost; 16. potential public health epidemics and bio-terrorist activity, which could, among other things, cause CIGNA’s covered medical and disability expenses, pharmacy costs and mortality experience to rise significantly, and cause operational disruption, depending on the severity of the event and number of individuals affected; 17. risks associated with security or interruption of information systems, which could, among other things, cause operational disruption; 18. challenges and risks associated with the successful management of CIGNA’s outsourcing projects or key vendors, including the agreement with IBM for provision of technology infrastructure and related services; 19. the ability of the parties to satisfy conditions to the closing of the Great-West transaction, including obtaining required regulatory approvals; 20. the ability to successfully integrate and operate the businesses being acquired from Great-West by, among other things, renewing insurance and administrative services contracts on competitive terms, retaining and growing membership, realizing revenue, expense and other synergies, successfully leveraging the information technology platform of the acquired businesses, and retaining key personnel; 21. the ability of CIGNA to execute its growth plans by successfully leveraging its capabilities and those of the business being acquired from Great-West to further enhance the combined organization’s network access position, underwriting effectiveness, delivery of quality member and provider service, and increased penetration of its membership base with differentiated product offerings; and 22. any adverse effect to CIGNA's business or the business being acquired from Great-West due to uncertainty relating to the acquisition transactions. This list of important factors is not intended to be exhaustive. Other sections of CIGNA’s most recent Annual Report on Form 10 -K, including the “Risk Factors” section, the Cautionary Statement in Management’s Discussion and Analysis of Financial Condition and Results of Operations, CIGNA's Forms 10 -Q for the quarters ended March 31, 2007, June 30, 2007, and September 30, 2007, and other documents filed with the Securities and Exchange Commission include both expanded discussion of these factors and additional risk factors and uncertainties that could preclude CIGNA from realizing the forward-looking statements. CIGNA does not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. 2

Agenda Ø CIGNA Overview Ø 2007 Results Ø Health. Care’s competitive strengths Ø Health. Care growth strategy Ø 2008 Outlook Ø Acquisition of Great-West Health. Care Business Ø Long-Term outlook Ø Investor Considerations Financial information is provided as of February 12, 2008 only. CIGNA does not undertake to revise or update this information. 3

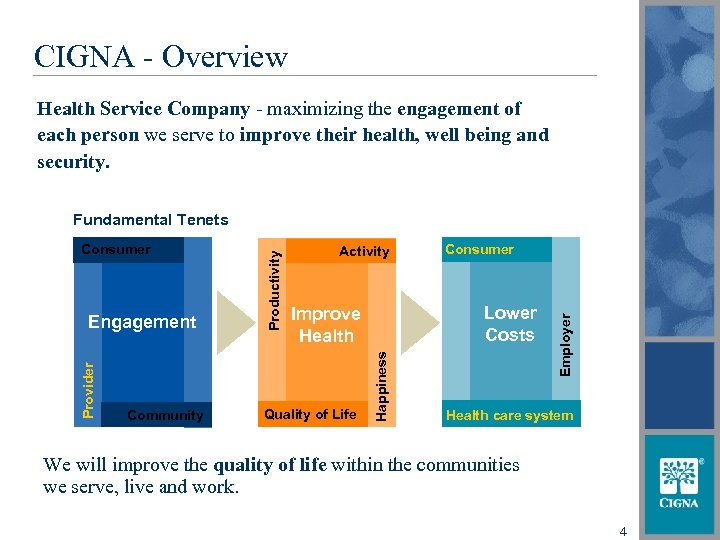

Our Mission CIGNA - Overview Health Service Company - maximizing the engagement of each person we serve to improve their health, well being and security. Community Lower Costs Improve Health Quality of Life Consumer Employer Provider Engagement Activity Happiness Consumer Productivity Fundamental Tenets Health care system We will improve the quality of life within the communities we serve, live and work. 4

CIGNA Overview Ø Health. Care business with strong competitive position q Industry leading health advocacy and clinical mgmt capabilities q Award winning consumer engagement capabilities q Broad range of specialty and disease mgmt capabilities q Integrated solutions Ø Leading Group Insurance and International businesses Ø Strong cash flow generation 5

2007 Results Ø Medical membership growth of 8% q Ø Includes organic membership growth of ~ 5% EPS¹ growth of 26% q q Ø Strong earnings contribution from all ongoing businesses Repurchased shares - $1. 16 B Financial position continues to remain strong q Well-capitalized operating subsidiaries ¹ Reflects adjusted income from operations, which is income from continuing operations excluding realized investment results and special items. See CIGNA’s February 6, 2008 press release for a reconciliation of this non-GAAP measure to GAAP measures of income from continuing operations and net income. 6

Investment Portfolio – December 31, 2007 Ø Strong underwriting discipline – focus on high quality investments Ø Total portfolio is $17. 5 B Ø Ø Ø Diversified portfolio – corporate & government bonds, private placements, and commercial mortgages No Subprime exposure Mortgage loans of $3. 3 B q All related to commercial loans, no residential mortgages q All loans are fully performing, LTV ratio ~62% q Loans are diversified by property type / location / borrower 7

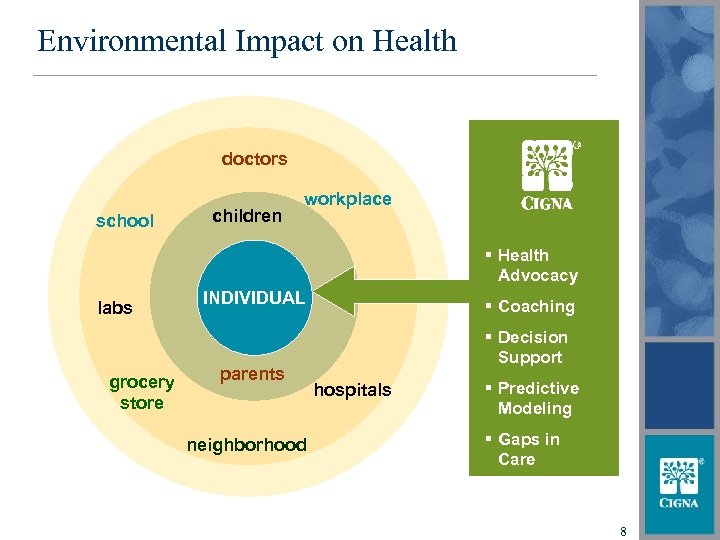

Environmental Impact on Health doctors school children workplace § Health Advocacy labs grocery store INDIVIDUAL parents neighborhood § Coaching § Decision Support hospitals § Predictive Modeling § Gaps in Care 8

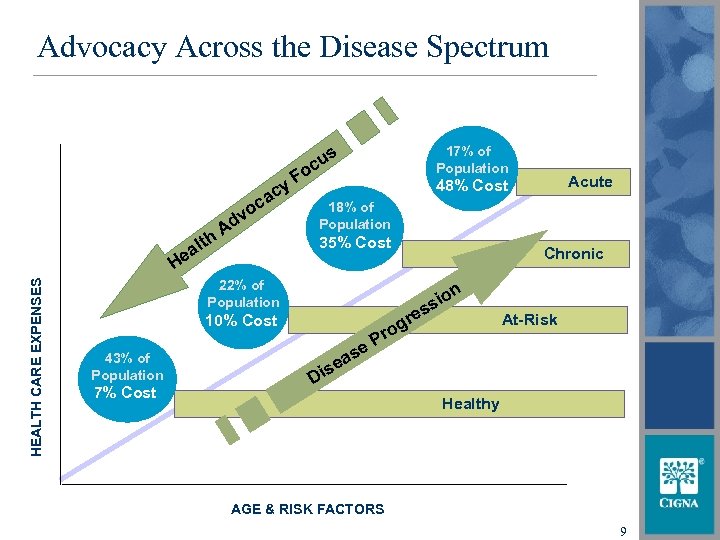

Advocacy Across the Disease Spectrum y ac c HEALTH CARE EXPENSES He h alt o dv A 17% of Population s cu Fo 18% of Population 35% Cost Chronic 22% of Population n 7% Cost io ss e r 10% Cost 43% of Population Acute 48% Cost e as ise g ro At-Risk P D Healthy AGE & RISK FACTORS 9

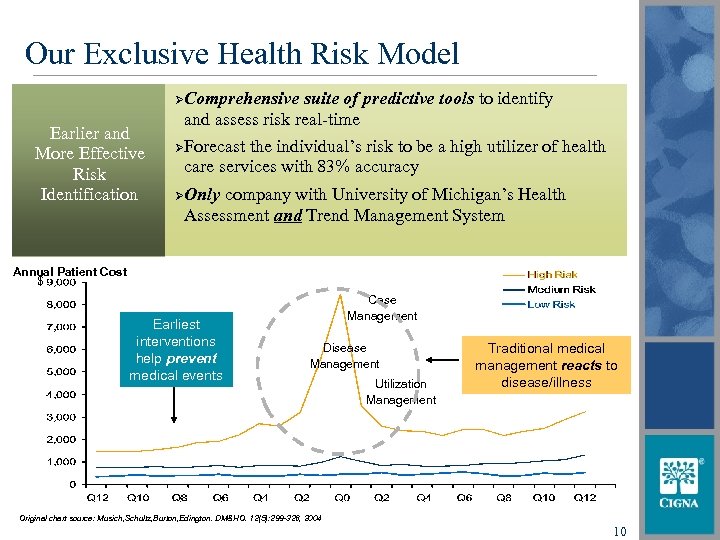

Our Exclusive Health Risk Model ØComprehensive Earlier and More Effective Risk Identification suite of predictive tools to identify and assess risk real-time ØForecast the individual’s risk to be a high utilizer of health care services with 83% accuracy ØOnly company with University of Michigan’s Health Assessment and Trend Management System Annual Patient Cost $ Earliest interventions help prevent medical events Case Management Disease Management Utilization Management Traditional medical management reacts to disease/illness Original chart source: Musich, Schultz, Burton, Edington. DM&HO. 12(5): 299 -326, 2004 10

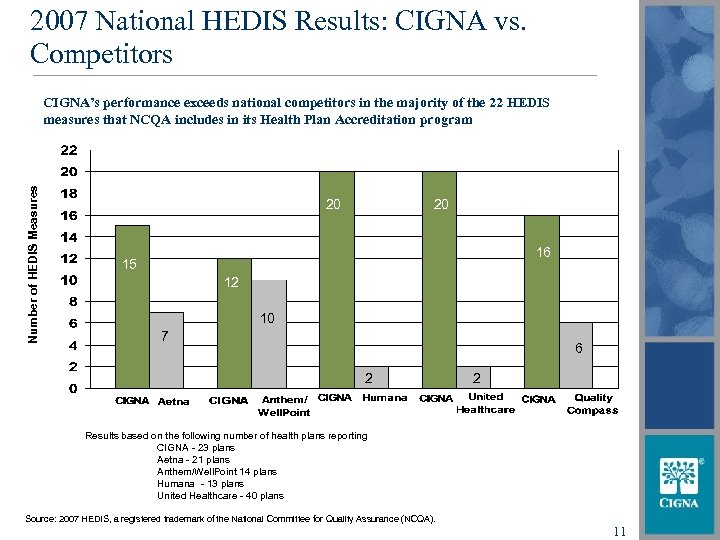

2007 National HEDIS Results: CIGNA vs. Competitors Number of HEDIS Measures CIGNA’s performance exceeds national competitors in the majority of the 22 HEDIS measures that NCQA includes in its Health Plan Accreditation program 20 20 16 15 12 10 7 6 2 2 Results based on the following number of health plans reporting CIGNA - 23 plans Aetna - 21 plans Anthem/Well. Point 14 plans Humana - 13 plans United Healthcare - 40 plans Source: 2007 HEDIS, a registered trademark of the National Committee for Quality Assurance (NCQA). 11

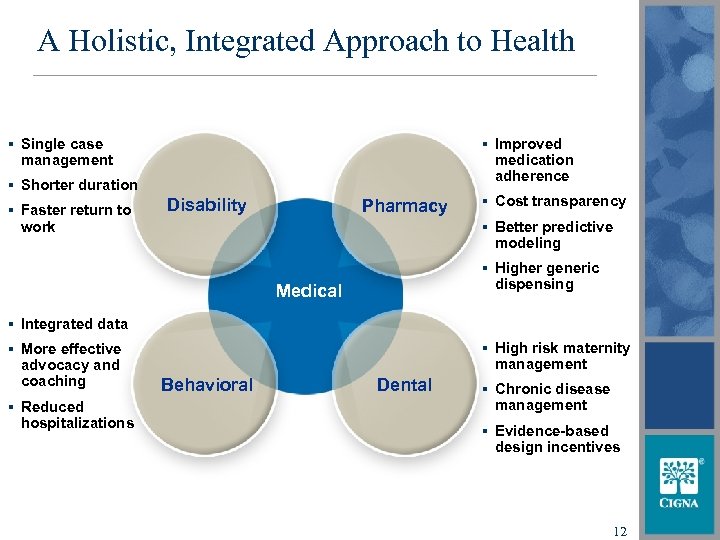

A Holistic, Integrated Approach to Health § Single case management § Improved medication adherence § Shorter duration § Faster return to work Disability Pharmacy § Cost transparency § Better predictive modeling § Higher generic dispensing Medical § Integrated data § More effective advocacy and coaching § Reduced hospitalizations § High risk maternity management Behavioral Dental § Chronic disease management § Evidence-based design incentives 12

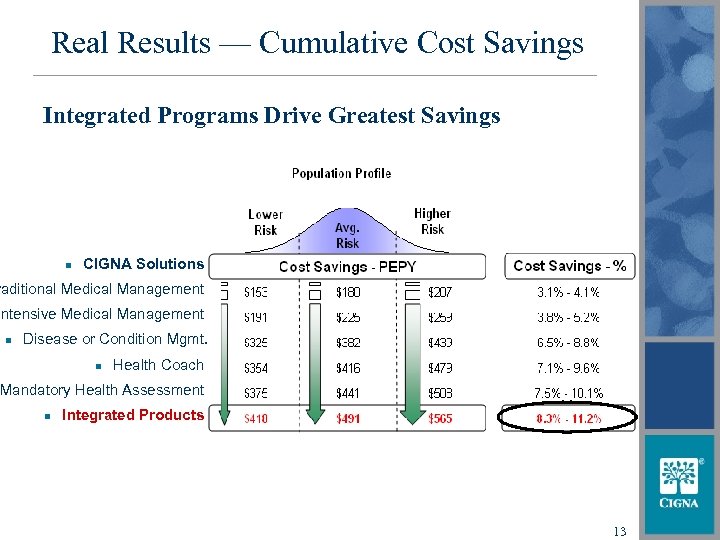

Real Results — Cumulative Cost Savings Integrated Programs Drive Greatest Savings n CIGNA Solutions raditional Medical Management Intensive Medical Management n Disease or Condition Mgmt. n Health Coach Mandatory Health Assessment n Integrated Products 13

Multi-year Health. Care Growth Strategy Ø Grow existing commercial employer membership q Ø Take share from first and second tier competitors Segment expansion q Voluntary q Individual q Small group (<200) q Seniors (both 50 to 64 and Medicare eligible 65+) Ø Continued productivity improvements Ø Specialty penetration 14

2008 Outlook Ø Grow full-year Healthcare membership by 2% to 5% q Increased membership by ~ 2% as of January 1, 2008 Ø Continue to deliver competitively superior results in Group Insurance and International businesses Ø Earnings Outlook q Full year consolidated income²: $1. 165 B – 1. 225 B q EPS²: $4. 05 - $4. 25 q Health Care income²: $740 M - $780 M ² Based on adjusted income from operations, which is income from continuing operations excluding realized investment, Guaranteed Minimum Business Income Benefit business results and special items. 15

Great-West Health. Care Acquisition - Overview Ø Acquiring 2. 2 million covered lives q Increases medical membership by ~1. 5 million Ø Accelerates growth in small group segment Ø Differentiated product capability Ø Accretive in 2009 and significantly accretive in 2010+ q Improve medical costs near term and realize expense synergies over time 16

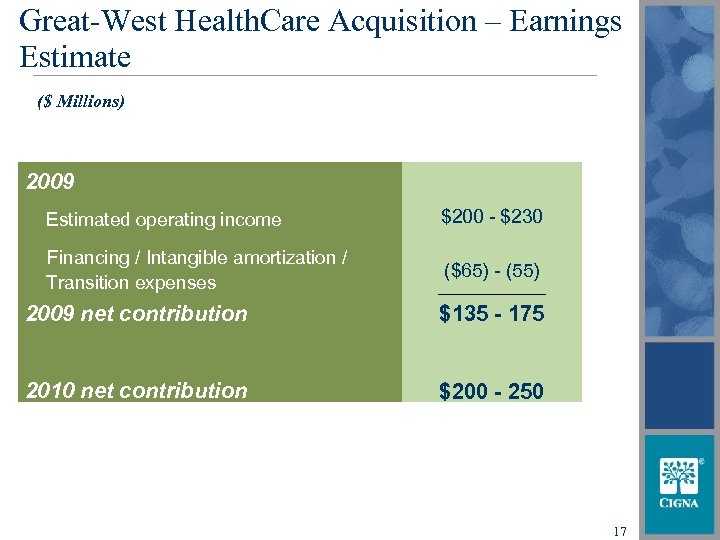

Great-West Health. Care Acquisition – Earnings Estimate ($ Millions) 2009 Estimated operating income $200 - $230 Financing / Intangible amortization / Transition expenses ($65) - (55) 2009 net contribution $135 - 175 2010 net contribution $200 - 250 17

Longer-Term Expectations³ Ø Target annual operating income growth in ongoing businesses – 9% to 10% Ø Capital management contribution – 3% to 5% Ø Target compound annual EPS growth – 12% to 15% ³ 3 to 5 year outlook 18

Investor Considerations Ø Health. Care growth outlook q Anticipated additional share gains q Specialty penetration q Profit margin expansion Ø Significant concentration in fee-based products Ø Diversified earnings stream q Ø Health. Care, Group Insurance, International Strong cash flow generation 19

20

2c933e444018b53f16f72554c6daa317.ppt