824a47bb58b313771abe123c3443f055.ppt

- Количество слайдов: 30

Choosing the Correct Entities for Your Farming Operation Presented by Miller Legal Strategic Planning Centers, P. A.

Choosing the Correct Entities for Your Farming Operation Presented by Miller Legal Strategic Planning Centers, P. A.

Choosing the Right Farm Entity to Achieve Your Family’s Goal

Choosing the Right Farm Entity to Achieve Your Family’s Goal

Farming Entities ● ● ● Sole Proprietorship General Partnership Limited Partnership C-Corporation Limited Liability Company

Farming Entities ● ● ● Sole Proprietorship General Partnership Limited Partnership C-Corporation Limited Liability Company

Sole Proprietorship Advantages 1. Simplicity 2. Total Control 3. No Extra Tax Returns

Sole Proprietorship Advantages 1. Simplicity 2. Total Control 3. No Extra Tax Returns

Sole Proprietorship Disadvantages 1. Can’t add Next Generation or Partners 2. Does not Take Advantage of Passive Rental Income 3. Difficult to Use Within Estate Plan 4. No Discounting is Allowed 5. Difficult to Transfer Ownership 6. No Asset Protection

Sole Proprietorship Disadvantages 1. Can’t add Next Generation or Partners 2. Does not Take Advantage of Passive Rental Income 3. Difficult to Use Within Estate Plan 4. No Discounting is Allowed 5. Difficult to Transfer Ownership 6. No Asset Protection

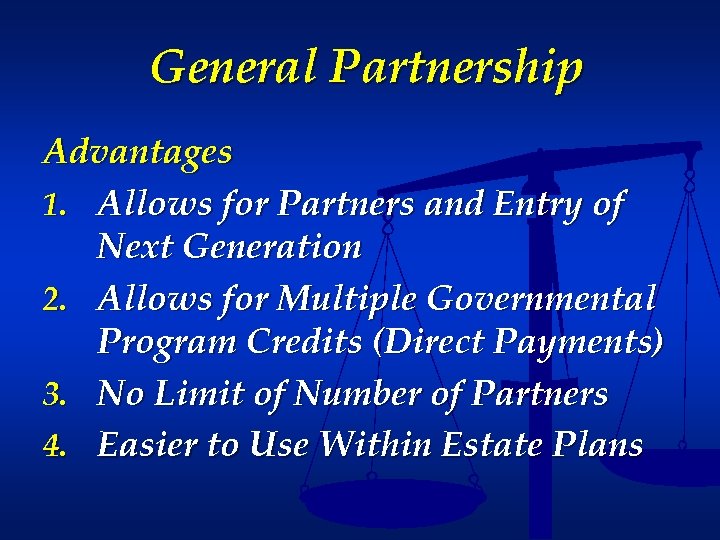

General Partnership Advantages 1. Allows for Partners and Entry of Next Generation 2. Allows for Multiple Governmental Program Credits (Direct Payments) 3. No Limit of Number of Partners 4. Easier to Use Within Estate Plans

General Partnership Advantages 1. Allows for Partners and Entry of Next Generation 2. Allows for Multiple Governmental Program Credits (Direct Payments) 3. No Limit of Number of Partners 4. Easier to Use Within Estate Plans

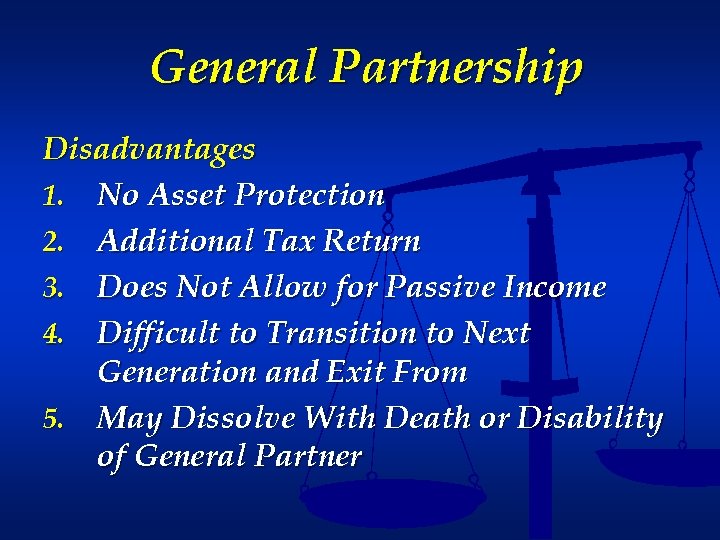

General Partnership Disadvantages 1. No Asset Protection 2. Additional Tax Return 3. Does Not Allow for Passive Income 4. Difficult to Transition to Next Generation and Exit From 5. May Dissolve With Death or Disability of General Partner

General Partnership Disadvantages 1. No Asset Protection 2. Additional Tax Return 3. Does Not Allow for Passive Income 4. Difficult to Transition to Next Generation and Exit From 5. May Dissolve With Death or Disability of General Partner

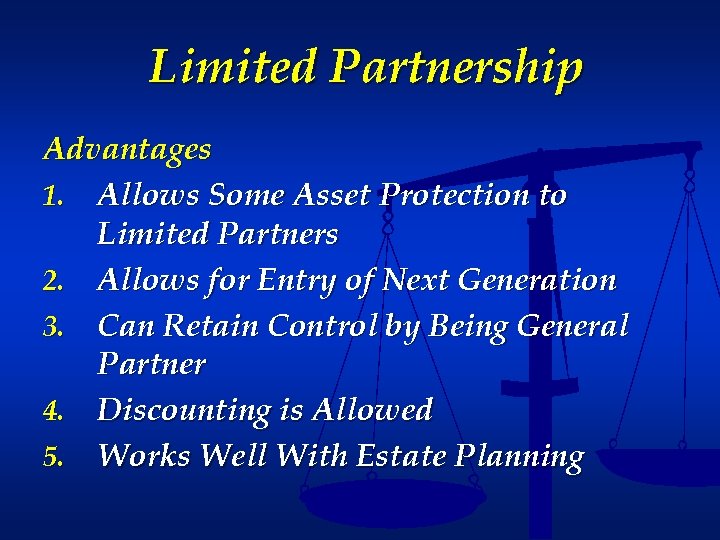

Limited Partnership Advantages 1. Allows Some Asset Protection to Limited Partners 2. Allows for Entry of Next Generation 3. Can Retain Control by Being General Partner 4. Discounting is Allowed 5. Works Well With Estate Planning

Limited Partnership Advantages 1. Allows Some Asset Protection to Limited Partners 2. Allows for Entry of Next Generation 3. Can Retain Control by Being General Partner 4. Discounting is Allowed 5. Works Well With Estate Planning

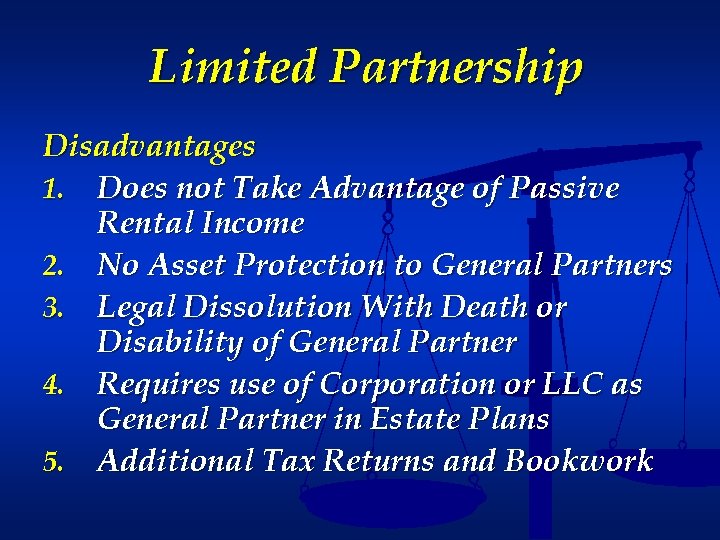

Limited Partnership Disadvantages 1. Does not Take Advantage of Passive Rental Income 2. No Asset Protection to General Partners 3. Legal Dissolution With Death or Disability of General Partner 4. Requires use of Corporation or LLC as General Partner in Estate Plans 5. Additional Tax Returns and Bookwork

Limited Partnership Disadvantages 1. Does not Take Advantage of Passive Rental Income 2. No Asset Protection to General Partners 3. Legal Dissolution With Death or Disability of General Partner 4. Requires use of Corporation or LLC as General Partner in Estate Plans 5. Additional Tax Returns and Bookwork

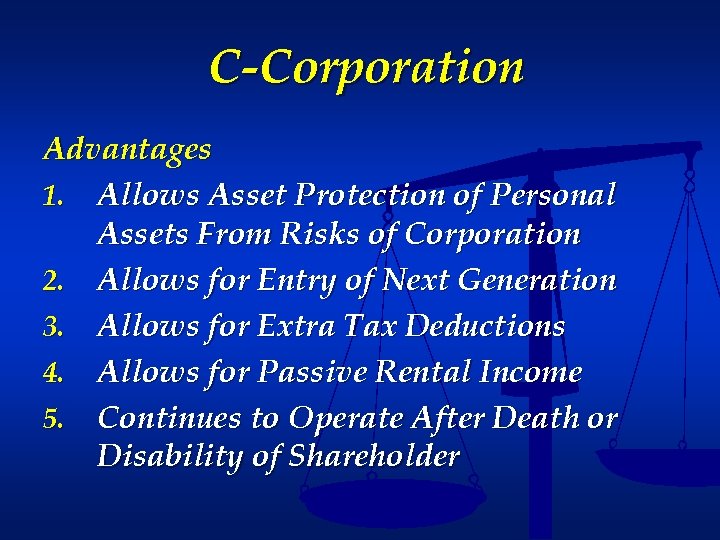

C-Corporation Advantages 1. Allows Asset Protection of Personal Assets From Risks of Corporation 2. Allows for Entry of Next Generation 3. Allows for Extra Tax Deductions 4. Allows for Passive Rental Income 5. Continues to Operate After Death or Disability of Shareholder

C-Corporation Advantages 1. Allows Asset Protection of Personal Assets From Risks of Corporation 2. Allows for Entry of Next Generation 3. Allows for Extra Tax Deductions 4. Allows for Passive Rental Income 5. Continues to Operate After Death or Disability of Shareholder

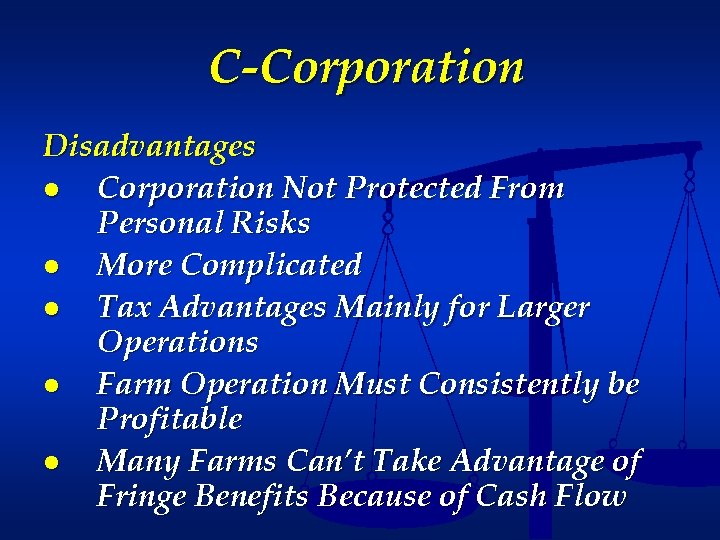

C-Corporation Disadvantages ● Corporation Not Protected From Personal Risks ● More Complicated ● Tax Advantages Mainly for Larger Operations ● Farm Operation Must Consistently be Profitable ● Many Farms Can’t Take Advantage of Fringe Benefits Because of Cash Flow

C-Corporation Disadvantages ● Corporation Not Protected From Personal Risks ● More Complicated ● Tax Advantages Mainly for Larger Operations ● Farm Operation Must Consistently be Profitable ● Many Farms Can’t Take Advantage of Fringe Benefits Because of Cash Flow

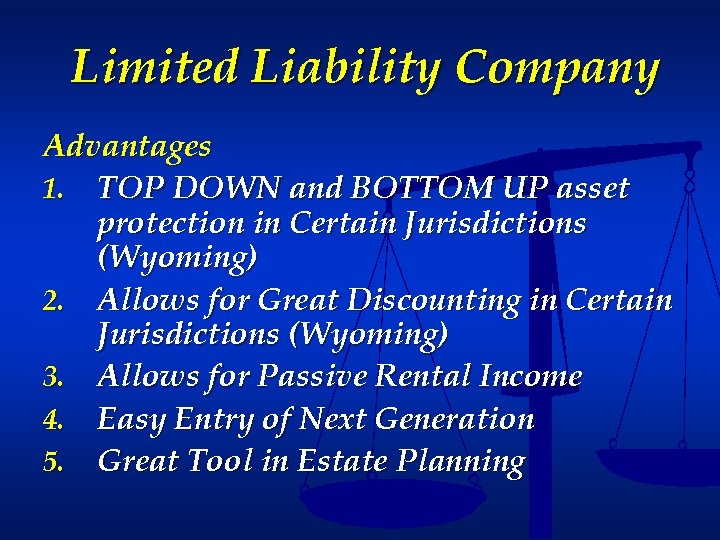

Limited Liability Company Advantages 1. TOP DOWN and BOTTOM UP asset protection in Certain Jurisdictions (Wyoming) 2. Allows for Great Discounting in Certain Jurisdictions (Wyoming) 3. Allows for Passive Rental Income 4. Easy Entry of Next Generation 5. Great Tool in Estate Planning

Limited Liability Company Advantages 1. TOP DOWN and BOTTOM UP asset protection in Certain Jurisdictions (Wyoming) 2. Allows for Great Discounting in Certain Jurisdictions (Wyoming) 3. Allows for Passive Rental Income 4. Easy Entry of Next Generation 5. Great Tool in Estate Planning

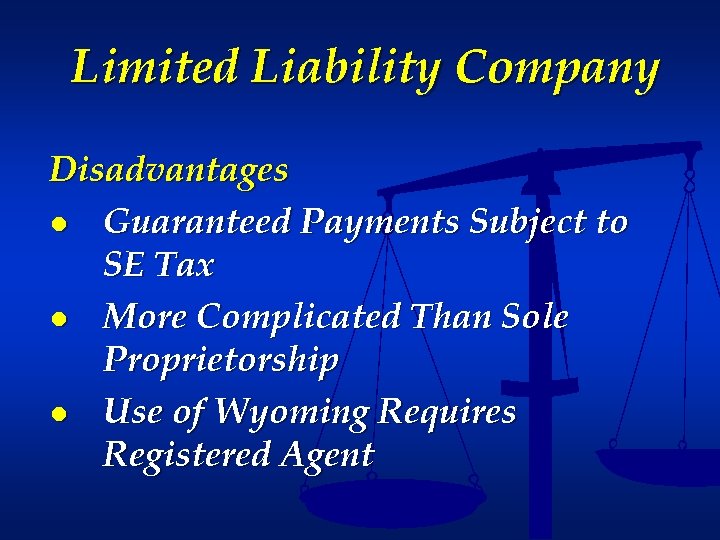

Limited Liability Company Disadvantages ● Guaranteed Payments Subject to SE Tax ● More Complicated Than Sole Proprietorship ● Use of Wyoming Requires Registered Agent

Limited Liability Company Disadvantages ● Guaranteed Payments Subject to SE Tax ● More Complicated Than Sole Proprietorship ● Use of Wyoming Requires Registered Agent

The Farm

The Farm

Advanced Collaborative Planning LTC Insurance Limited Partnership RLT ILIT Incorporation Charitable Trusts LLC FLP

Advanced Collaborative Planning LTC Insurance Limited Partnership RLT ILIT Incorporation Charitable Trusts LLC FLP

Planning Using Advanced Collaborative Planning ● ● ● Plans Customized to Meet Clients Hopes, Dreams, Goals and Aspirations Multiple Disciplines Used to Create the Best Possible Plan for the Client Farm Succession and Operation is Completed in a Manner That Works for the Whole Family

Planning Using Advanced Collaborative Planning ● ● ● Plans Customized to Meet Clients Hopes, Dreams, Goals and Aspirations Multiple Disciplines Used to Create the Best Possible Plan for the Client Farm Succession and Operation is Completed in a Manner That Works for the Whole Family

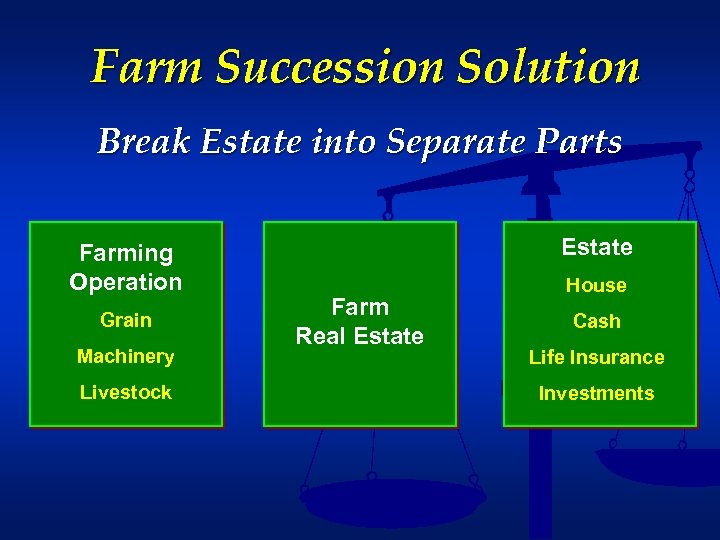

Farm Succession Solution Break Estate into Separate Parts Farming Operation Grain Machinery Livestock Estate Farm Real Estate House Cash Life Insurance Investments

Farm Succession Solution Break Estate into Separate Parts Farming Operation Grain Machinery Livestock Estate Farm Real Estate House Cash Life Insurance Investments

Farm Succession Plan Developed ● ● Plan is Designed to allow for Possible Entry of Farming Child Into Current Business Plan is Designed to Allow for Transfer of Farm Operation Either During Life of Parents or Upon Their Death Thru Inheritance

Farm Succession Plan Developed ● ● Plan is Designed to allow for Possible Entry of Farming Child Into Current Business Plan is Designed to Allow for Transfer of Farm Operation Either During Life of Parents or Upon Their Death Thru Inheritance

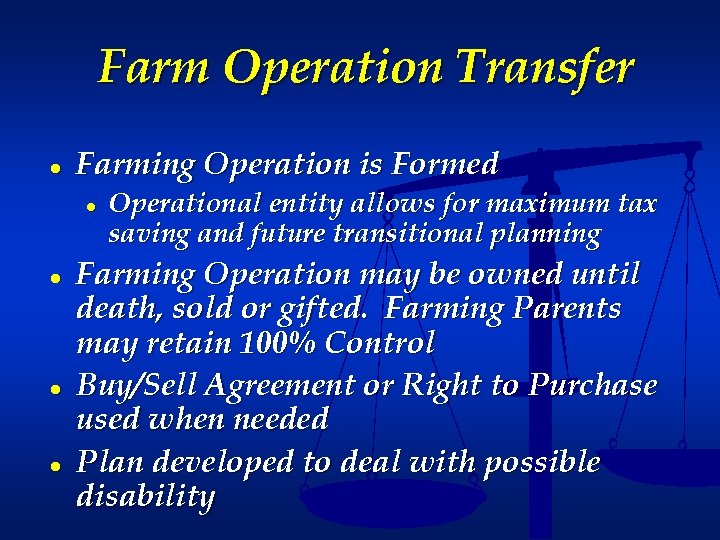

Farm Operation Transfer ● Farming Operation is Formed ● ● Operational entity allows for maximum tax saving and future transitional planning Farming Operation may be owned until death, sold or gifted. Farming Parents may retain 100% Control Buy/Sell Agreement or Right to Purchase used when needed Plan developed to deal with possible disability

Farm Operation Transfer ● Farming Operation is Formed ● ● Operational entity allows for maximum tax saving and future transitional planning Farming Operation may be owned until death, sold or gifted. Farming Parents may retain 100% Control Buy/Sell Agreement or Right to Purchase used when needed Plan developed to deal with possible disability

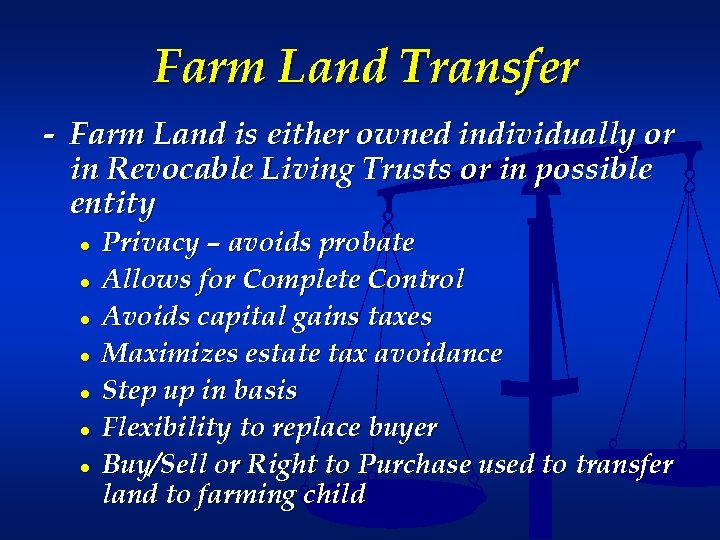

Farm Land Transfer - Farm Land is either owned individually or in Revocable Living Trusts or in possible entity ● ● ● ● Privacy – avoids probate Allows for Complete Control Avoids capital gains taxes Maximizes estate tax avoidance Step up in basis Flexibility to replace buyer Buy/Sell or Right to Purchase used to transfer land to farming child

Farm Land Transfer - Farm Land is either owned individually or in Revocable Living Trusts or in possible entity ● ● ● ● Privacy – avoids probate Allows for Complete Control Avoids capital gains taxes Maximizes estate tax avoidance Step up in basis Flexibility to replace buyer Buy/Sell or Right to Purchase used to transfer land to farming child

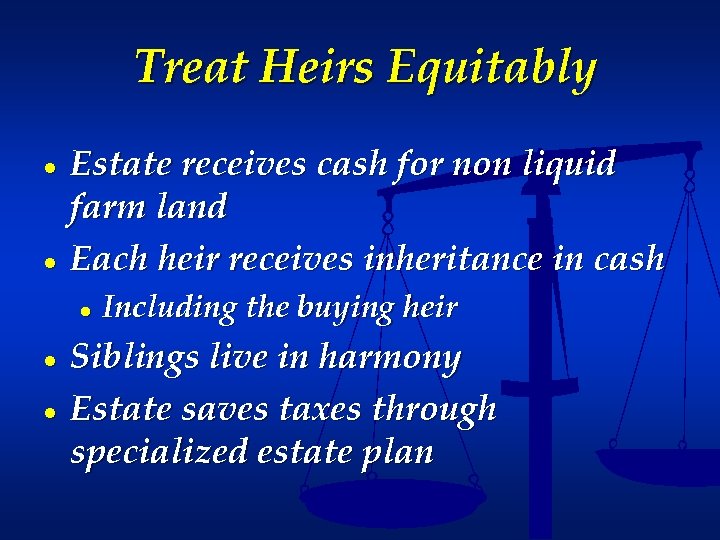

Treat Heirs Equitably ● ● Estate receives cash for non liquid farm land Each heir receives inheritance in cash ● ● ● Including the buying heir Siblings live in harmony Estate saves taxes through specialized estate plan

Treat Heirs Equitably ● ● Estate receives cash for non liquid farm land Each heir receives inheritance in cash ● ● ● Including the buying heir Siblings live in harmony Estate saves taxes through specialized estate plan

Farm Succession Planning ● ● ● Mom & Dad retire comfortably Clients’ goals are met with customized estate plan Farm transferred to active farmer ● ● All heirs treated equitably ● ● Flexibility to change buyers Cash available at time of inheritance Tax savings stays with family or possibly goes to the community

Farm Succession Planning ● ● ● Mom & Dad retire comfortably Clients’ goals are met with customized estate plan Farm transferred to active farmer ● ● All heirs treated equitably ● ● Flexibility to change buyers Cash available at time of inheritance Tax savings stays with family or possibly goes to the community

The Successful Transfer Ability to Treat Heirs Equitably Active Heir Non-Active Heirs

The Successful Transfer Ability to Treat Heirs Equitably Active Heir Non-Active Heirs

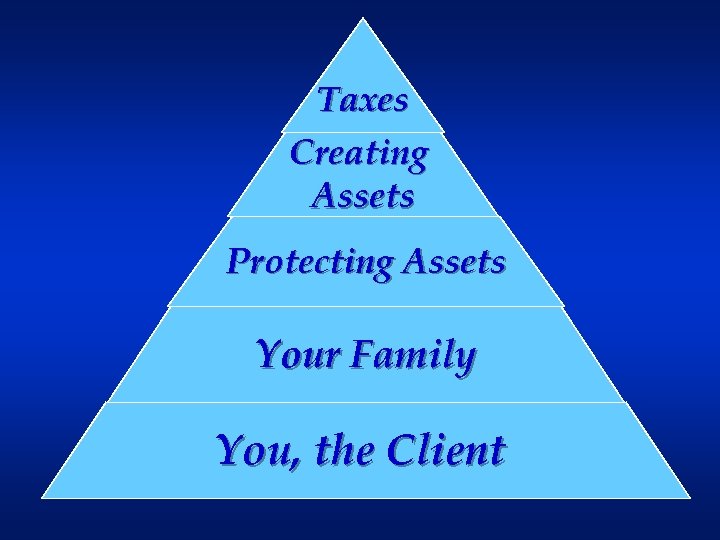

Taxes Creating Assets Protecting Assets Your Family You, the Client

Taxes Creating Assets Protecting Assets Your Family You, the Client

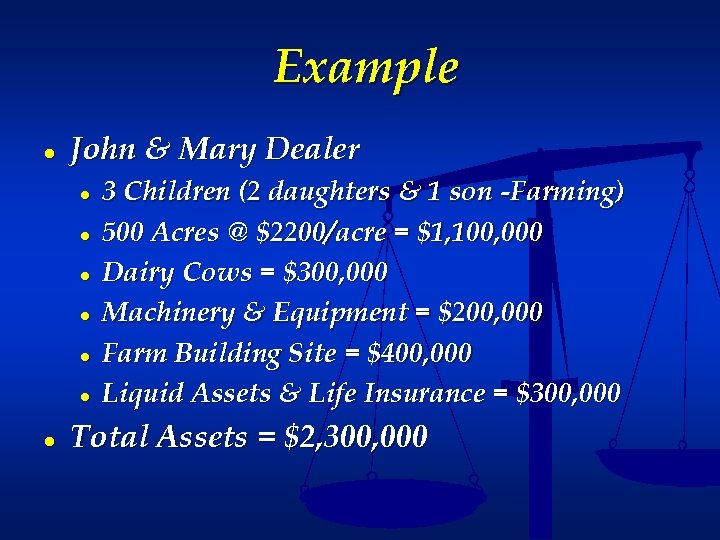

Example ● John & Mary Dealer ● ● ● ● 3 Children (2 daughters & 1 son -Farming) 500 Acres @ $2200/acre = $1, 100, 000 Dairy Cows = $300, 000 Machinery & Equipment = $200, 000 Farm Building Site = $400, 000 Liquid Assets & Life Insurance = $300, 000 Total Assets = $2, 300, 000

Example ● John & Mary Dealer ● ● ● ● 3 Children (2 daughters & 1 son -Farming) 500 Acres @ $2200/acre = $1, 100, 000 Dairy Cows = $300, 000 Machinery & Equipment = $200, 000 Farm Building Site = $400, 000 Liquid Assets & Life Insurance = $300, 000 Total Assets = $2, 300, 000

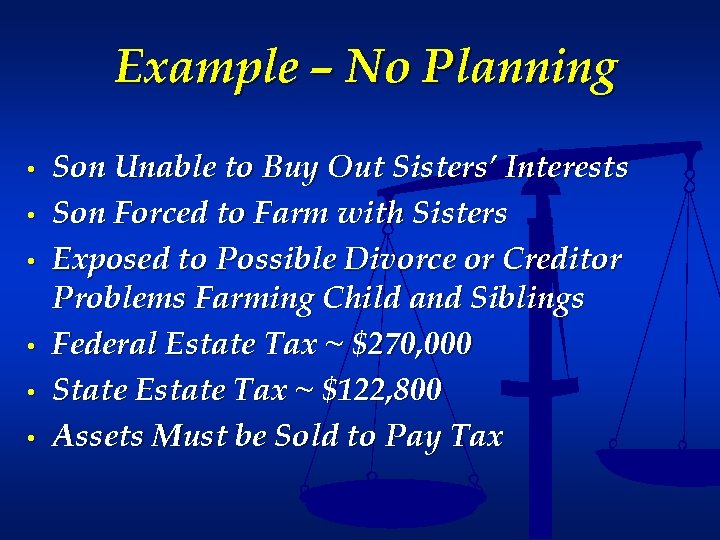

Example – No Planning • • • Son Unable to Buy Out Sisters’ Interests Son Forced to Farm with Sisters Exposed to Possible Divorce or Creditor Problems Farming Child and Siblings Federal Estate Tax ~ $270, 000 State Estate Tax ~ $122, 800 Assets Must be Sold to Pay Tax

Example – No Planning • • • Son Unable to Buy Out Sisters’ Interests Son Forced to Farm with Sisters Exposed to Possible Divorce or Creditor Problems Farming Child and Siblings Federal Estate Tax ~ $270, 000 State Estate Tax ~ $122, 800 Assets Must be Sold to Pay Tax

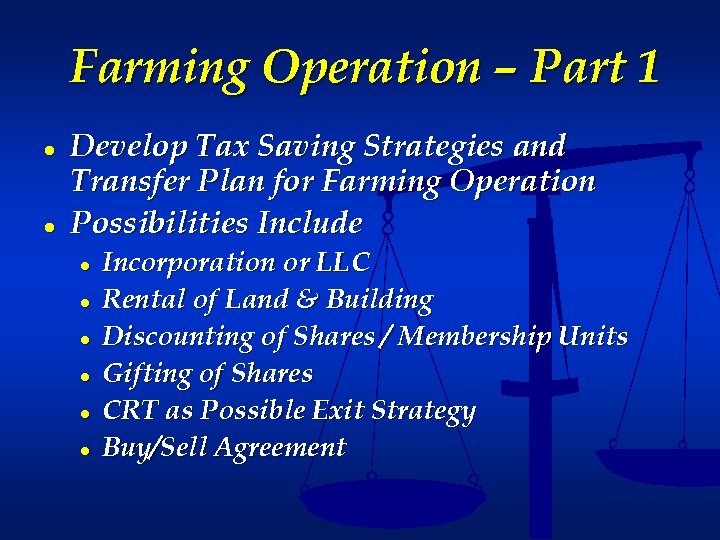

Farming Operation – Part 1 ● ● Develop Tax Saving Strategies and Transfer Plan for Farming Operation Possibilities Include ● ● ● Incorporation or LLC Rental of Land & Building Discounting of Shares / Membership Units Gifting of Shares CRT as Possible Exit Strategy Buy/Sell Agreement

Farming Operation – Part 1 ● ● Develop Tax Saving Strategies and Transfer Plan for Farming Operation Possibilities Include ● ● ● Incorporation or LLC Rental of Land & Building Discounting of Shares / Membership Units Gifting of Shares CRT as Possible Exit Strategy Buy/Sell Agreement

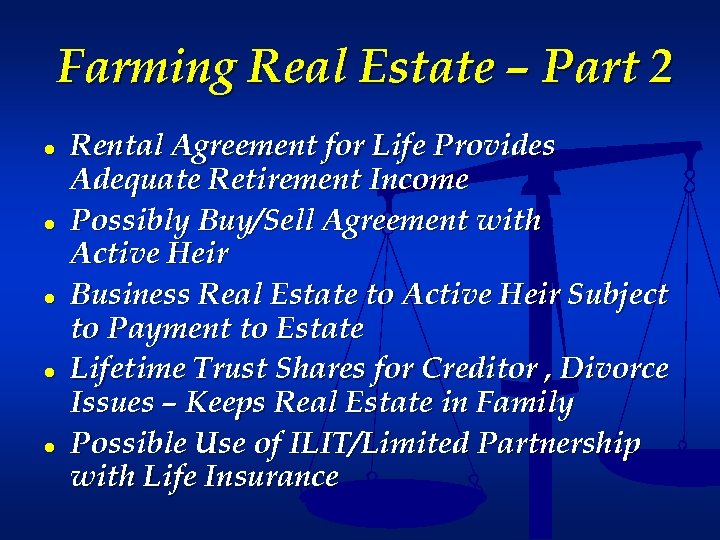

Farming Real Estate – Part 2 ● ● ● Rental Agreement for Life Provides Adequate Retirement Income Possibly Buy/Sell Agreement with Active Heir Business Real Estate to Active Heir Subject to Payment to Estate Lifetime Trust Shares for Creditor , Divorce Issues – Keeps Real Estate in Family Possible Use of ILIT/Limited Partnership with Life Insurance

Farming Real Estate – Part 2 ● ● ● Rental Agreement for Life Provides Adequate Retirement Income Possibly Buy/Sell Agreement with Active Heir Business Real Estate to Active Heir Subject to Payment to Estate Lifetime Trust Shares for Creditor , Divorce Issues – Keeps Real Estate in Family Possible Use of ILIT/Limited Partnership with Life Insurance

Results ● ● ● ● Farming Real Estate & Operation to Active Heir Cash Divided Equitably to Other Heirs Protective Trust Shares Zero Federal Estate Tax Due State Estate Tax Reduced or Eliminated Step Up in Basis Annual Income Tax Savings Adequate Retirement Income

Results ● ● ● ● Farming Real Estate & Operation to Active Heir Cash Divided Equitably to Other Heirs Protective Trust Shares Zero Federal Estate Tax Due State Estate Tax Reduced or Eliminated Step Up in Basis Annual Income Tax Savings Adequate Retirement Income

Questions? Miller Legal Strategic Planning Centers, P. A. 191 North Tyler Street PO Box 738 Tyler, MN 56178 -0738 507 -247 -4700 507 -247 -5333 fax www. millerlegal. com

Questions? Miller Legal Strategic Planning Centers, P. A. 191 North Tyler Street PO Box 738 Tyler, MN 56178 -0738 507 -247 -4700 507 -247 -5333 fax www. millerlegal. com