036795d4695ba214585c54d7f9f37388.ppt

- Количество слайдов: 36

Chongqing, 2017 October 2017 Cross Border E-Commerce & IPR protection in CHINESE CUSTOMS Eddy De Cuyper Customs Counsellor

Belgian Customs in China Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China

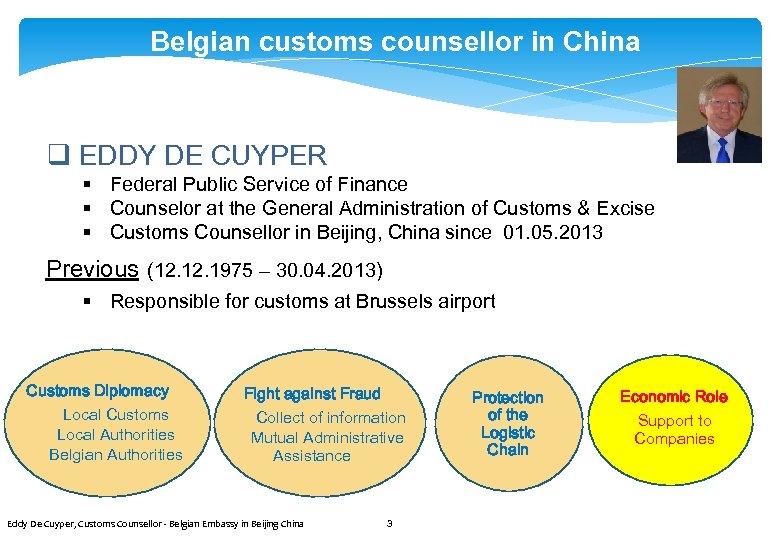

Belgian customs counsellor in China q EDDY DE CUYPER § Federal Public Service of Finance § Counselor at the General Administration of Customs & Excise § Customs Counsellor in Beijing, China since 01. 05. 2013 Previous (12. 1975 – 30. 04. 2013) § Responsible for customs at Brussels airport Customs Diplomacy Local Customs Local Authorities Belgian Authorities Fight against Fraud Collect of information Mutual Administrative Assistance Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 3 Protection of the Logistic Chain Economic Role Support to Companies

MISSION: CUSTOMS DIPLOMACY The customs counsellor represents the Belgian Customs to diplomatic services, public administrations, and other organizations in China. ü The Belgian Embassy (as member of the diplomatic corps); ü The customs authorities of the China; ü The customs attachés of other countries (working in China); ü Supranational organizations of cooperations • World Customs Organization (WCO) • European Union (EU) • ASEM 14 ü Representatives of the Belgian federal/regional administrations (FIT, AWEX, BIE, …) Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China

MISSION: COMBATTING FRAUD Fight against economic and commercial fraud Collect information and support investigation services Anti-fraud projects and cooperation Ø Drugs Ø CITES Ø IPR Ø Smuggling Ø Fiscal fraud Valuation 15 Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China

MISSION: PROTECTION OF LOGISTIC CHAIN Activities/ cooperation security and facilitation of the logistic chain Security: in logistic chain (f. e. stop suspicious goods when necessary), Facilitation: Provide benefits to economic operators that meet supply chain security criteria Worldwide projects ü Mutual recognition and standardization of customs controls; ü Standardization of data exchange; ü “secure trade lanes”. 24 Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China

MISSION: PROTECTION OF LOGISTIC CHAIN Belgium/EU cooperation with China Agreement on Cooperation and Mutual Administrative Assistance in Customs Matters (signed 2004 – entry into force 1/4/2005) • • Mutual Administrative Assistance (MAA) EU-China IPR Action Plan EU-China Drugs Precursors Agreement AEO (Authorized Economic Operator)/ Certification (ACE/GCE/…) IMECM (Interim Measures for the Enterprise Credit Management) ü Mutual recognition of AEO (China / EU) in 2014. In force 11/2015. • Green lane projects: SSTL Smart and Secure Trade Lanes Green Train Lane 25 Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China

SSTL – Seaports, Airports and Railway stations Participating seaports China : Chongqing, Dalian, Shanghai, Shenzhen, Tianjin, Qingdao HK China : Hong Kong port France : Le Havre Germany : Hamburg Belgium : Antwerpen, Zeebrugge Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China • • • Italy : Genoa NL : Rotterdam Poland : Gdansk Spain : Barcelona, Valencia UK : Felixstowe

SSTL – Seaports, Airports and Railway stations Participating airports China : Guangzhou, Bejing, Shanghai HK China : Hong Kong airport NL : Amsterdam (Schiphol) UK : London (Heathrow) Participating railway stations China : Alashankou, Xiajiang, Chongqing Poland : Malaszewicze 39 Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China

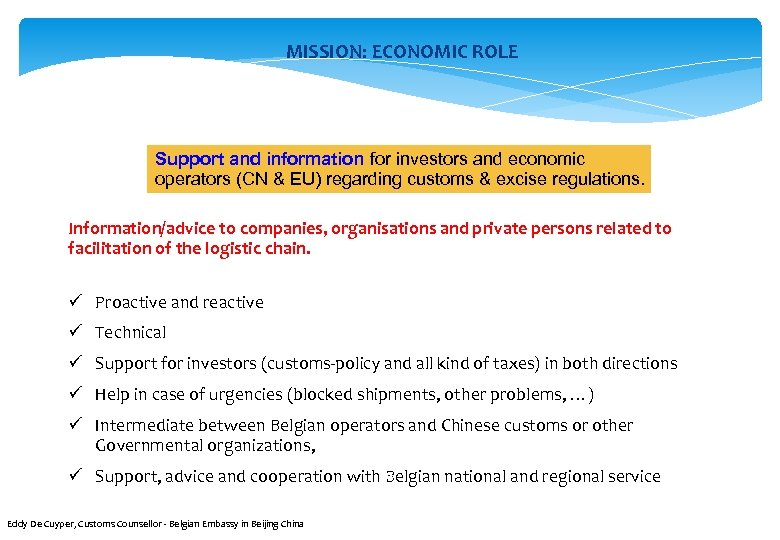

MISSION: ECONOMIC ROLE Support and information for investors and economic operators (CN & EU) regarding customs & excise regulations. Information/advice to companies, organisations and private persons related to facilitation of the logistic chain. ü Proactive and reactive ü Technical ü Support for investors (customs-policy and all kind of taxes) in both directions ü Help in case of urgencies (blocked shipments, other problems, …) ü Intermediate between Belgian operators and Chinese customs or other Governmental organizations, 16 ü Support, advice and cooperation with Belgian national and regional service Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China

MISSION: ECONOMIC ROLE Advices • Preparation. It is not an adventure. Ask and search information where available before you encounter problems. Ø Commercial and open sources (internet) Ø Regional representatives (FIT, AWEX, BIE, …) Ø Belgian Embassy in China (or Chinese in Belgium) Ø The customs attaché I am there to help and advice and support you, Take your advantage of my FREE service! • Find reliable partner in China (trader, customs broker, . . . ) 19 Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China

Cross-Border E-Commerce in China 12

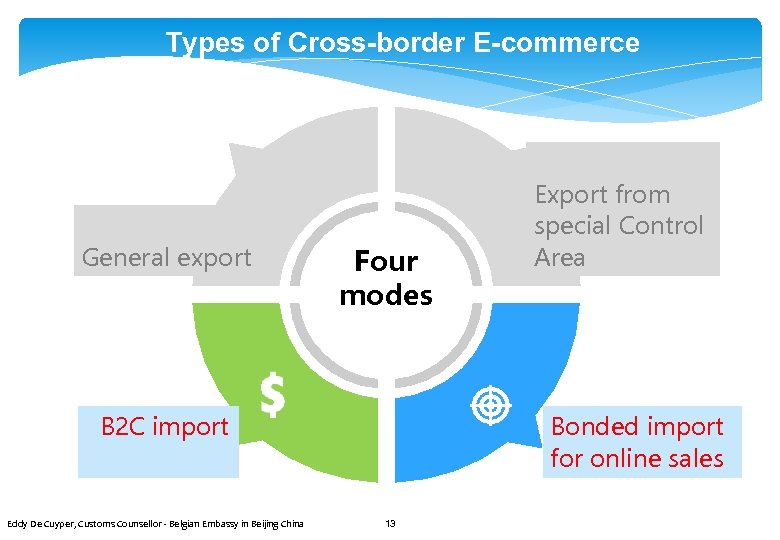

Types of Cross-border E-commerce General export Four modes B 2 C import Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China Export from special Control Area Bonded import for online sales 13

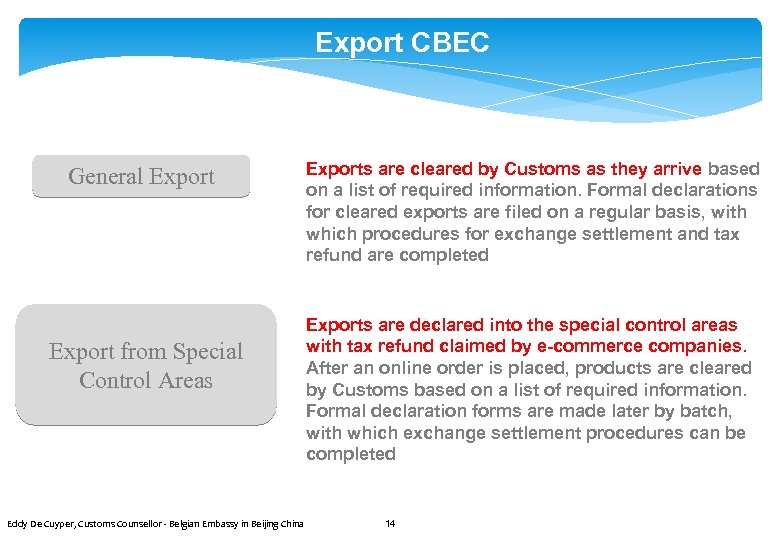

Export CBEC General Export from Special Control Areas Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China Exports are cleared by Customs as they arrive based on a list of required information. Formal declarations for cleared exports are filed on a regular basis, with which procedures for exchange settlement and tax refund are completed Exports are declared into the special control areas with tax refund claimed by e-commerce companies. After an online order is placed, products are cleared by Customs based on a list of required information. Formal declaration forms are made later by batch, with which exchange settlement procedures can be completed 14

Import CBEC B 2 C Imports Notice No. 18 by China’s Ministry of Finance, GACC and State Administration of Taxation In order to create a fair market environment and promote growth of cross-border e- commerce, it is approved by the State Council that starting from April 8 2016, tariff policies for B 2 C imports of cross-border ecommerce will be adopted. Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 15

Import CBEC B 2 C Imports Applied to: • B 2 C imported products via CBEC platform with data exchange linked to Chinese customs (information of transaction, payment and logistics) • B 2 C imported products via CBEC platform with NO data exchange linked to Chinese customs. The express delivery company has to provide the information (transaction, payment and logistics) and is responsible. Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 16

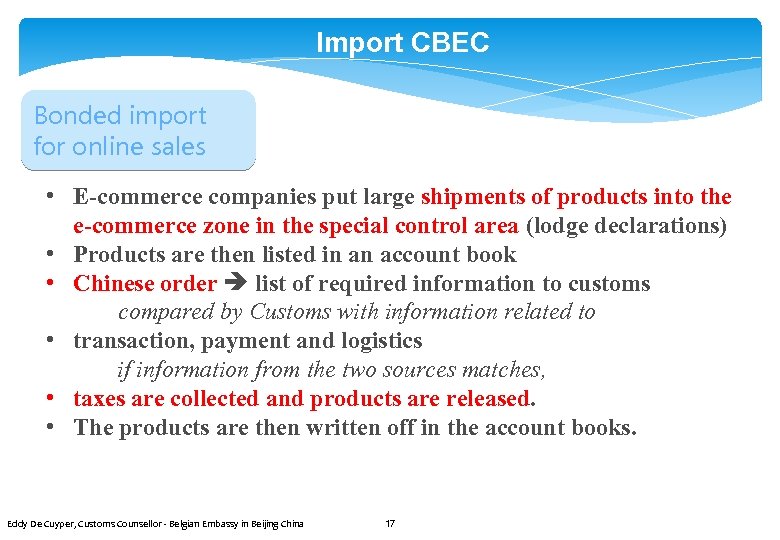

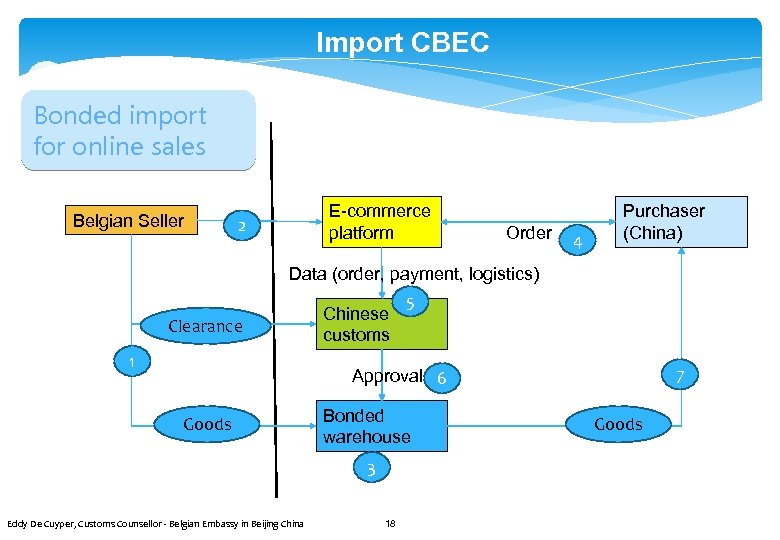

Import CBEC Bonded import for online sales • E-commerce companies put large shipments of products into the e-commerce zone in the special control area (lodge declarations) • Products are then listed in an account book • Chinese order list of required information to customs compared by Customs with information related to • transaction, payment and logistics if information from the two sources matches, • taxes are collected and products are released. • The products are then written off in the account books. Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 17

Import CBEC Bonded import for online sales Belgian Seller E-commerce platform 2 Order 4 Purchaser (China) Data (order, payment, logistics) Clearance 1 Chinese customs 5 7 Approval 6 Goods Bonded warehouse 3 Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 18 Goods

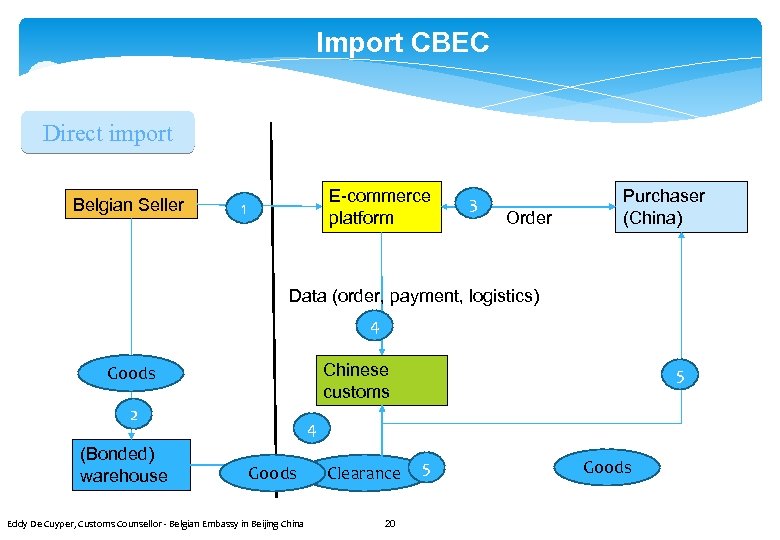

Import CBEC Direct import • Chinese order on internet platform • Goods shipped from Belgium to China • Declaration of goods and clearance document to Chinese customs compared by Customs with information related to • transaction, payment and logistics if information from the two sources matches, • taxes are collected and products are released. Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 19

Import CBEC Direct import Belgian Seller E-commerce platform 1 3 Order Purchaser (China) Data (order, payment, logistics) 4 Chinese customs Goods 2 (Bonded) warehouse 5 4 Goods Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China Clearance 20 5 Goods

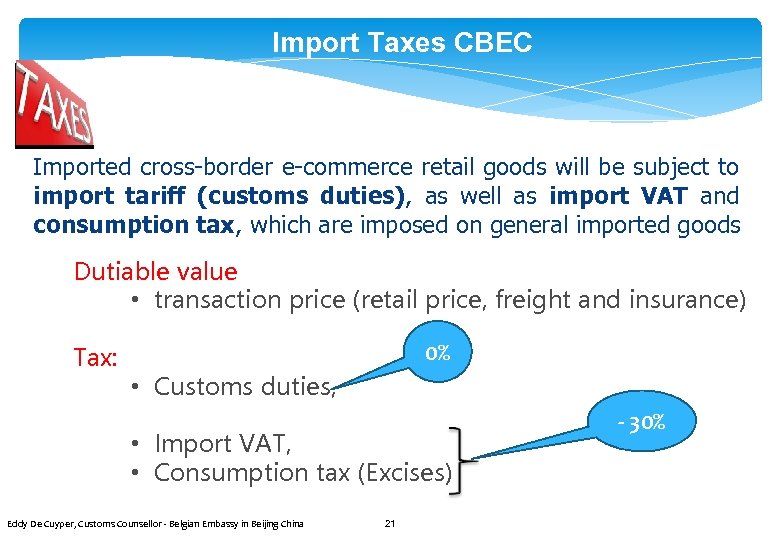

Import Taxes CBEC Imported cross-border e-commerce retail goods will be subject to import tariff (customs duties), as well as import VAT and consumption tax, which are imposed on general imported goods Dutiable value • transaction price (retail price, freight and insurance) Tax: 0% • Customs duties, • Import VAT, • Consumption tax (Excises) Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 21 - 30%

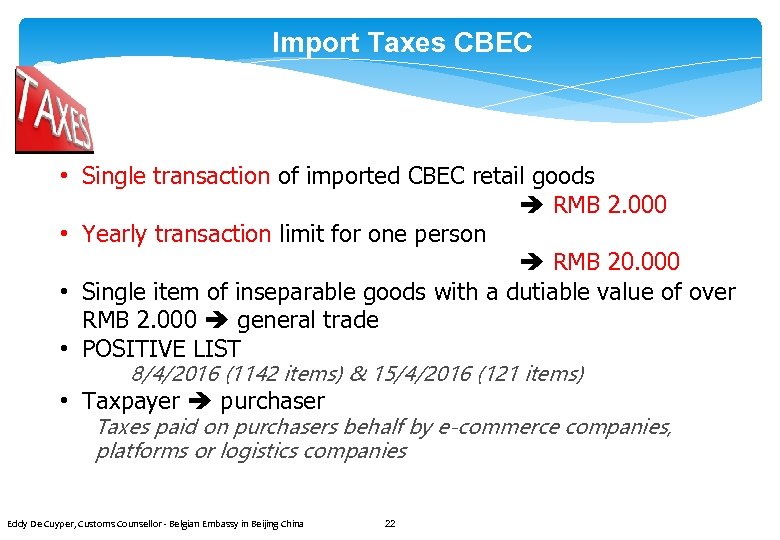

Import Taxes CBEC • Single transaction of imported CBEC retail goods RMB 2. 000 • Yearly transaction limit for one person RMB 20. 000 • Single item of inseparable goods with a dutiable value of over RMB 2. 000 general trade • POSITIVE LIST 8/4/2016 (1142 items) & 15/4/2016 (121 items) • Taxpayer purchaser Taxes paid on purchasers behalf by e-commerce companies, platforms or logistics companies Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 22

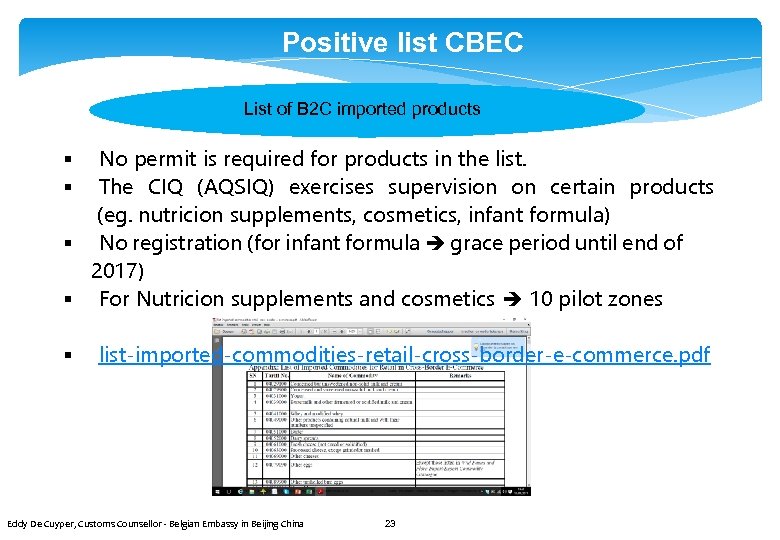

Positive list CBEC List of B 2 C imported products No permit is required for products in the list. The CIQ (AQSIQ) exercises supervision on certain products (eg. nutricion supplements, cosmetics, infant formula) § No registration (for infant formula grace period until end of 2017) § For Nutricion supplements and cosmetics 10 pilot zones § § § list-imported-commodities-retail-cross-border-e-commerce. pdf Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 23

Import (Postal & passengers) B 2 C Imports Notice No. 18 by China’s Ministry of Finance, GACC and State Administration of Taxation In addition to the cross-border e-commerce channel for retail imports, there exist other channels for importing personal articles in China. Therefore, in order to improve the policy of import tax on imported articles, the Customs Tariff Commission of the State Council on Issues Pertaining to the Adjustment of Import Tax for Imported Articles (Notice No. 2) on 16 March 2016 to revise the classification of imported articles and adjust corresponding import tax rates of imported articles. Effective from 8 April 2016. Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 24

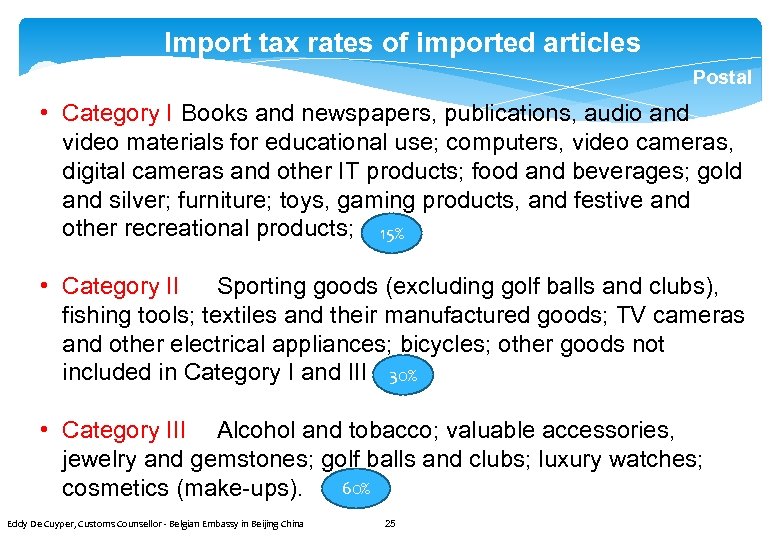

Import tax rates of imported articles Postal • Category I Books and newspapers, publications, audio and video materials for educational use; computers, video cameras, digital cameras and other IT products; food and beverages; gold and silver; furniture; toys, gaming products, and festive and other recreational products; 15% • Category II Sporting goods (excluding golf balls and clubs), fishing tools; textiles and their manufactured goods; TV cameras and other electrical appliances; bicycles; other goods not included in Category I and III 30% • Category III Alcohol and tobacco; valuable accessories, jewelry and gemstones; golf balls and clubs; luxury watches; 60% cosmetics (make-ups). Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 25

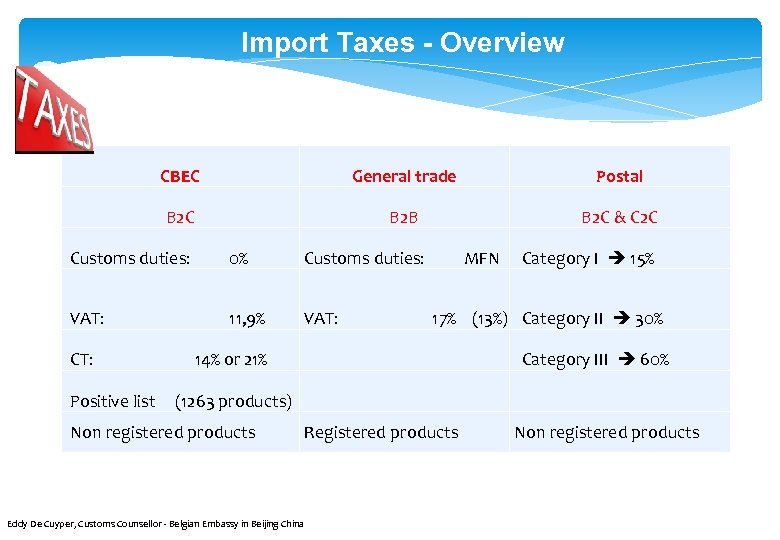

Import Taxes - Overview CBEC General trade Postal B 2 C B 2 B B 2 C & C 2 C Customs duties: 0% Customs duties: MFN Category I 15% VAT: 11, 9% VAT: 17% (13%) Category II 30% CT: 14% or 21% Category III 60% Positive list (1263 products) Non registered products Registered products Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China

IPR Customs Protection Decree No. 183 of GACC, March 3 rd 2009 Implementing the Regulations of the PRC on Customs protection of Intellectual Property Rights deliberated and adopted in GACC on February 17, 2009 and coming into force on July 1 st 2009. Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 27

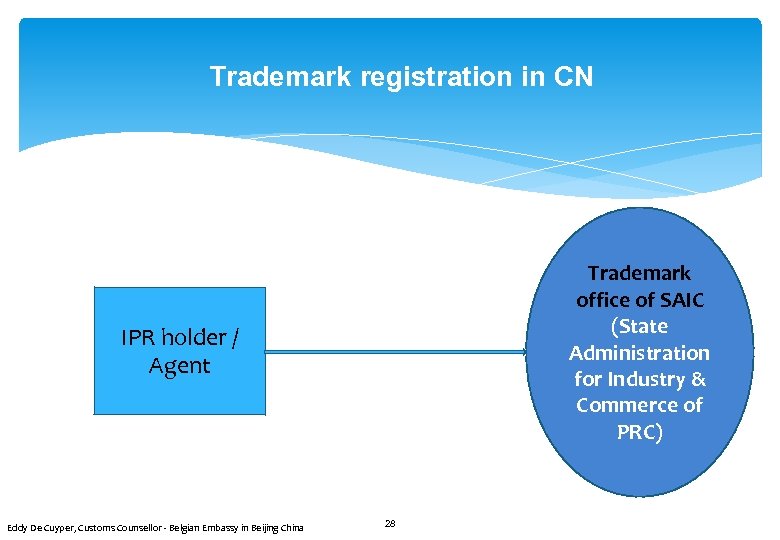

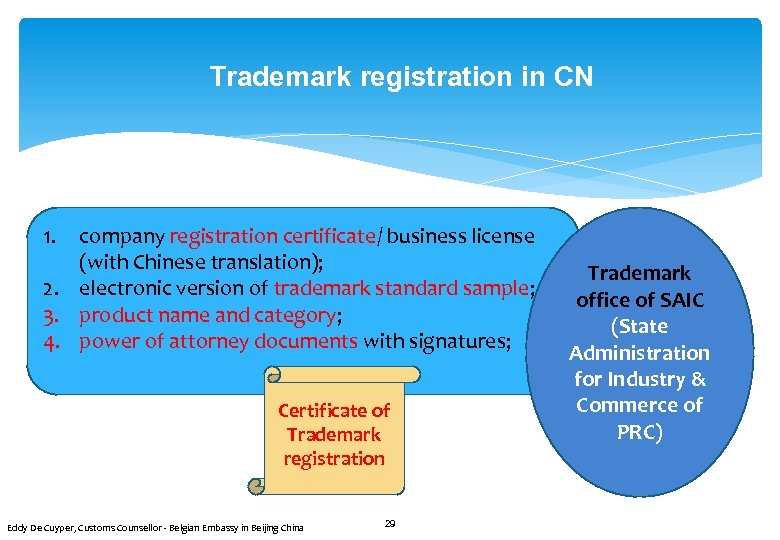

Trademark registration in CN Trademark office of SAIC (State Administration for Industry & Commerce of PRC) IPR holder / Agent Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 28

Trademark registration in CN 1. company registration certificate/ business license (with Chinese translation); 2. electronic version of trademark standard sample; 3. product name and category; 4. power of attorney documents with signatures; Certificate of Trademark registration Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 29 Trademark office of SAIC (State Administration for Industry & Commerce of PRC)

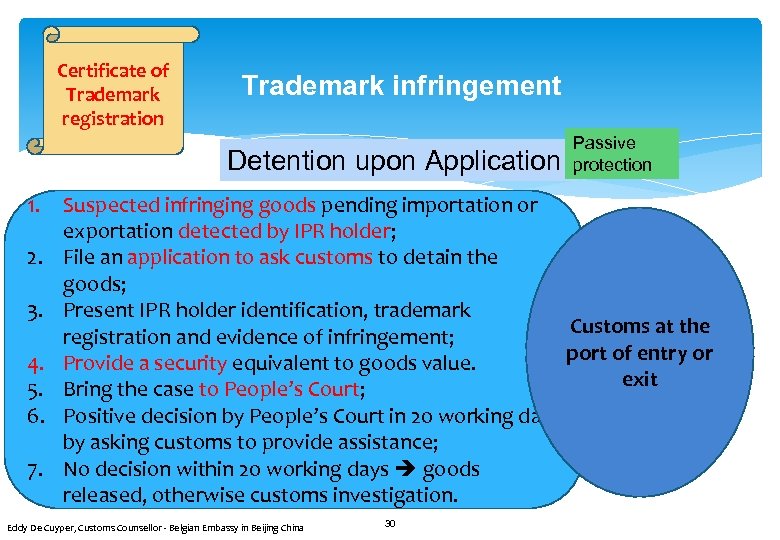

Certificate of Trademark registration Trademark infringement Detention upon Application Passive protection 1. Suspected infringing goods pending importation or exportation detected by IPR holder; 2. File an application to ask customs to detain the goods; 3. Present IPR holder identification, trademark Customs at the registration and evidence of infringement; port of entry or 4. Provide a security equivalent to goods value. exit 5. Bring the case to People’s Court; 6. Positive decision by People’s Court in 20 working days by asking customs to provide assistance; 7. No decision within 20 working days goods released, otherwise customs investigation. Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 30

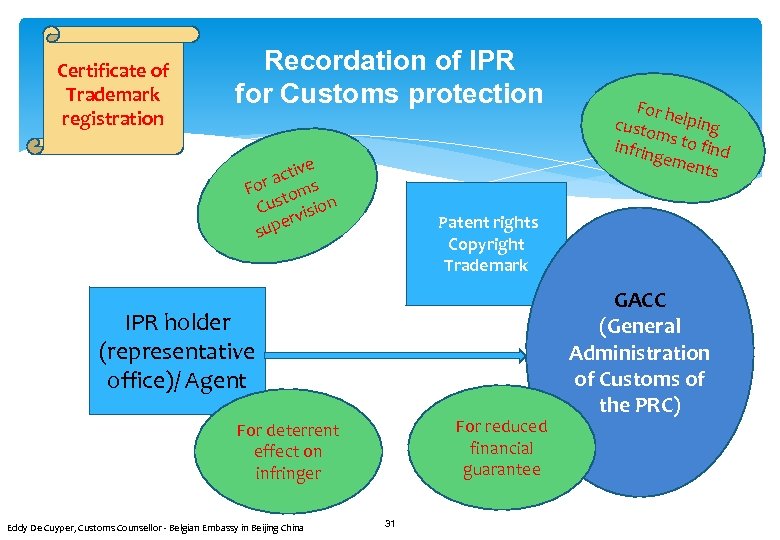

Certificate of Trademark registration Recordation of IPR for Customs protection tive ac For toms Cus vision er sup Patent rights Copyright Trademark IPR holder (representative office)/ Agent For reduced financial guarantee For deterrent effect on infringer Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China For h custo elping m infrin s to find geme nts 31 GACC (General Administration of Customs of the PRC)

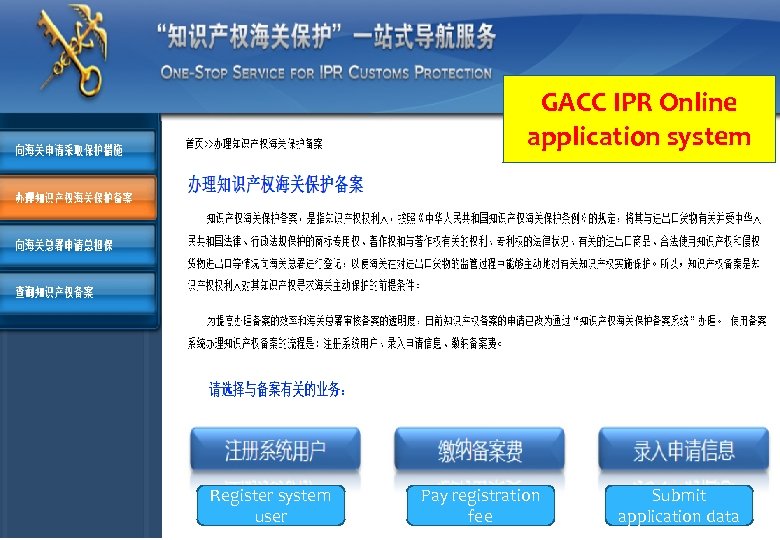

GACC IPR Online application system Register system user Pay registration fee Submit application data

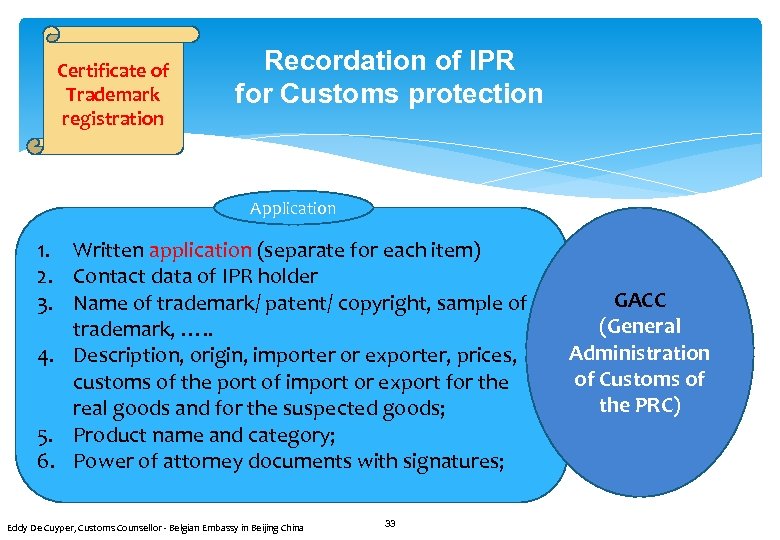

Certificate of Trademark registration Recordation of IPR for Customs protection Application 1. Written application (separate for each item) 2. Contact data of IPR holder 3. Name of trademark/ patent/ copyright, sample of trademark, …. . 4. Description, origin, importer or exporter, prices, customs of the port of import or export for the real goods and for the suspected goods; 5. Product name and category; 6. Power of attorney documents with signatures; Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 33 GACC (General Administration of Customs of the PRC)

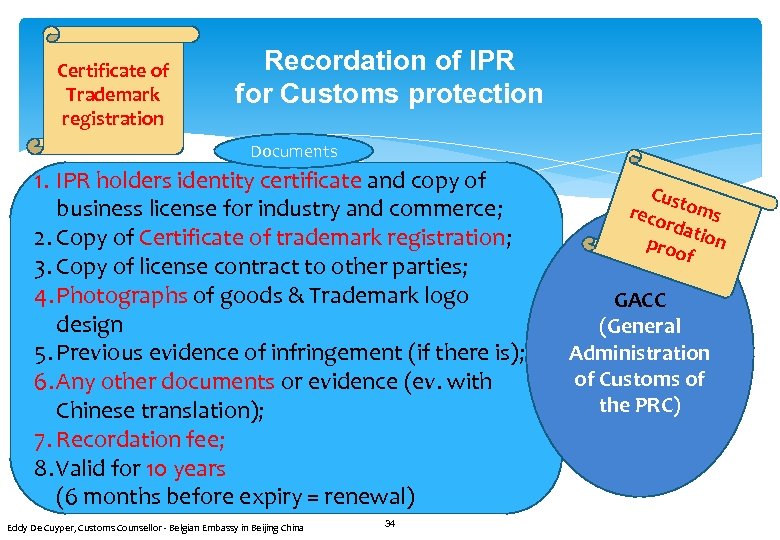

Certificate of Trademark registration Recordation of IPR for Customs protection Documents 1. IPR holders identity certificate and copy of business license for industry and commerce; 2. Copy of Certificate of trademark registration; 3. Copy of license contract to other parties; 4. Photographs of goods & Trademark logo design 5. Previous evidence of infringement (if there is); 6. Any other documents or evidence (ev. with Chinese translation); 7. Recordation fee; 8. Valid for 10 years (6 months before expiry = renewal) Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 34 Cust reco oms rdat proo ion f GACC (General Administration of Customs of the PRC)

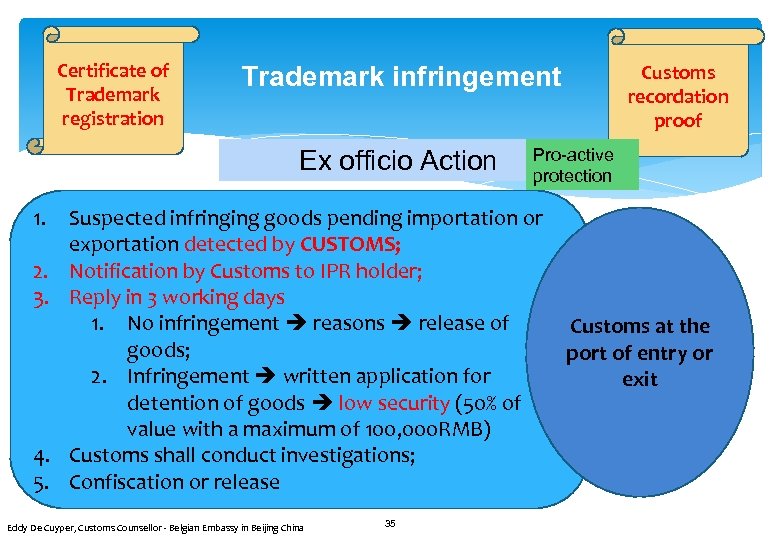

Certificate of Trademark registration Trademark infringement Ex officio Action 1. 2. 3. 4. 5. Customs recordation proof Pro-active protection Suspected infringing goods pending importation or exportation detected by CUSTOMS; Notification by Customs to IPR holder; Reply in 3 working days 1. No infringement reasons release of Customs at the goods; port of entry or 2. Infringement written application for exit detention of goods low security (50% of value with a maximum of 100, 000 RMB) Customs shall conduct investigations; Confiscation or release Eddy De Cuyper, Customs Counsellor - Belgian Embassy in Beijing China 35

Contact Thank you Eddy De Cuyper Counsellor - Customs Attachè Embassy of Belgium in China 6 San Li Tun Lu 100600 Beijing Mobile: + 86 138 1004 8414 E-mail: eddy. decuyper@minfin. fed. be 36

036795d4695ba214585c54d7f9f37388.ppt