2e5ef6355baa7dbfc186fcb7265ec8f0.ppt

- Количество слайдов: 36

China Zenix Auto International Limited (NYSE: ZX)

China Zenix Auto International Limited (NYSE: ZX)

Disclaimer This presentation contains forward-looking statements, including statements about China Zenix Auto International Limited (the “Company”)’s business outlook, strategy and market opportunity, and statements that may suggest trends for its business. These statements are individually and collectively forwardlooking statements within the meaning of Section 27 A of the U. S. Securities Act of 1933, as amended, and Section 21 E of the U. S. Securities Exchange Act of 1934, as amended, and as defined in the U. S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are made only as of the date of this presentation and are based on estimates and information available to the Company at the time of this presentation. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict and may be beyond the Company’s control. Therefore, you are cautioned that actual results may differ materially from those set forth in any forward-looking statements herein. You are urged to review the risk factors included in the Company’s filings with the U. S. Securities and Exchange Commission, including its Registration Statement on Form F -1 related to the Company’s initial public offering. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements made during this presentation will in fact be realized. Any forward-looking statements and projections made by others in this presentation are not adopted by the Company and the Company is not responsible for the forward-looking statements and projections of others. Except as otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update or revise forward-looking statements, whether as a result of new information, future events or otherwise. 1

Disclaimer This presentation contains forward-looking statements, including statements about China Zenix Auto International Limited (the “Company”)’s business outlook, strategy and market opportunity, and statements that may suggest trends for its business. These statements are individually and collectively forwardlooking statements within the meaning of Section 27 A of the U. S. Securities Act of 1933, as amended, and Section 21 E of the U. S. Securities Exchange Act of 1934, as amended, and as defined in the U. S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are made only as of the date of this presentation and are based on estimates and information available to the Company at the time of this presentation. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict and may be beyond the Company’s control. Therefore, you are cautioned that actual results may differ materially from those set forth in any forward-looking statements herein. You are urged to review the risk factors included in the Company’s filings with the U. S. Securities and Exchange Commission, including its Registration Statement on Form F -1 related to the Company’s initial public offering. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements made during this presentation will in fact be realized. Any forward-looking statements and projections made by others in this presentation are not adopted by the Company and the Company is not responsible for the forward-looking statements and projections of others. Except as otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update or revise forward-looking statements, whether as a result of new information, future events or otherwise. 1

Overview of China Zenix

Overview of China Zenix

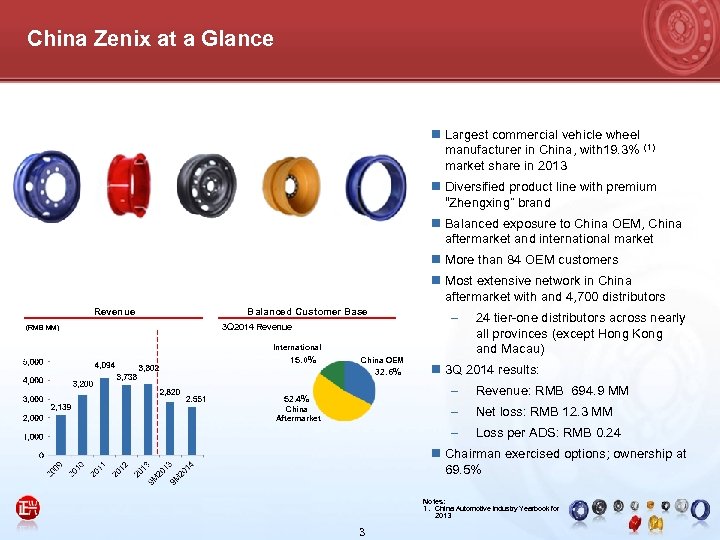

China Zenix at a Glance n Largest commercial vehicle wheel manufacturer in China, with 19. 3% (1) market share in 2013 n Diversified product line with premium “Zhengxing” brand n Balanced exposure to China OEM, China aftermarket and international market n More than 84 OEM customers n Most extensive network in China aftermarket with and 4, 700 distributors Revenue (RMB MM) Balanced Customer Base – 3 Q 2014 Revenue International 15. 0% China OEM 32. 6% 24 tier-one distributors across nearly all provinces (except Hong Kong and Macau) n 3 Q 2014 results: – Net loss: RMB 12. 3 MM – China Aftermarket Revenue: RMB 694. 9 MM – 52. 4% Loss per ADS: RMB 0. 24 n Chairman exercised options; ownership at 69. 5% Notes: 1. China Automotive Industry Yearbook for 2013 3

China Zenix at a Glance n Largest commercial vehicle wheel manufacturer in China, with 19. 3% (1) market share in 2013 n Diversified product line with premium “Zhengxing” brand n Balanced exposure to China OEM, China aftermarket and international market n More than 84 OEM customers n Most extensive network in China aftermarket with and 4, 700 distributors Revenue (RMB MM) Balanced Customer Base – 3 Q 2014 Revenue International 15. 0% China OEM 32. 6% 24 tier-one distributors across nearly all provinces (except Hong Kong and Macau) n 3 Q 2014 results: – Net loss: RMB 12. 3 MM – China Aftermarket Revenue: RMB 694. 9 MM – 52. 4% Loss per ADS: RMB 0. 24 n Chairman exercised options; ownership at 69. 5% Notes: 1. China Automotive Industry Yearbook for 2013 3

Financial Highlights l NYSE ADS Symbol: ZX l ADS Price (Feb. 2, 2015) $1. 22 l 52 -Week Hi/Low: $3. 15 -$1. 01 l Cash and bank balances per ADS (9/30/2014): $3. 46 l. Shareholders’ Equity per ADS (9/30/2014): $8. 22 l Cash flow from operating activities (9 M 2014) $47. 9 mil l Cash/Total liabilities (9/30/2014): 68. 0% l Long-term Debt (9/30/2014): nil 4

Financial Highlights l NYSE ADS Symbol: ZX l ADS Price (Feb. 2, 2015) $1. 22 l 52 -Week Hi/Low: $3. 15 -$1. 01 l Cash and bank balances per ADS (9/30/2014): $3. 46 l. Shareholders’ Equity per ADS (9/30/2014): $8. 22 l Cash flow from operating activities (9 M 2014) $47. 9 mil l Cash/Total liabilities (9/30/2014): 68. 0% l Long-term Debt (9/30/2014): nil 4

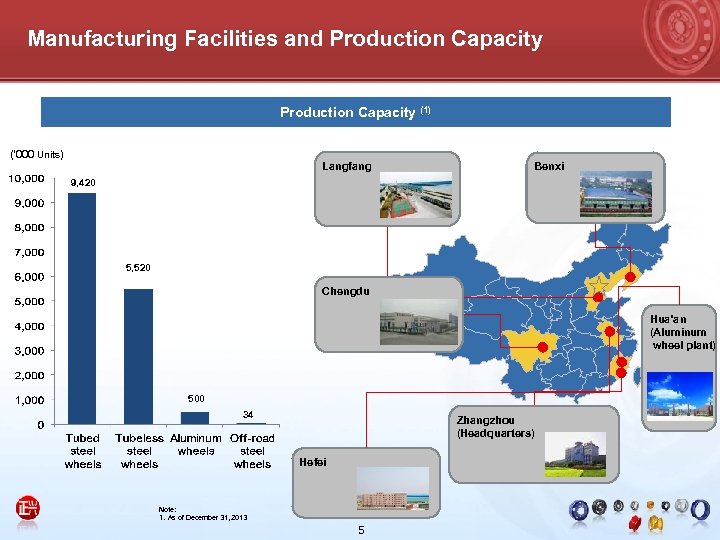

Manufacturing Facilities and Production Capacity (1) (‘ 000 Units) Langfang Benxi 9, 420 5, 520 Chengdu Hua’an (Aluminum wheel plant) 500 34 Zhangzhou (Headquarters) Hefei Note: 1. As of December 31, 2013 5

Manufacturing Facilities and Production Capacity (1) (‘ 000 Units) Langfang Benxi 9, 420 5, 520 Chengdu Hua’an (Aluminum wheel plant) 500 34 Zhangzhou (Headquarters) Hefei Note: 1. As of December 31, 2013 5

Industry Overview

Industry Overview

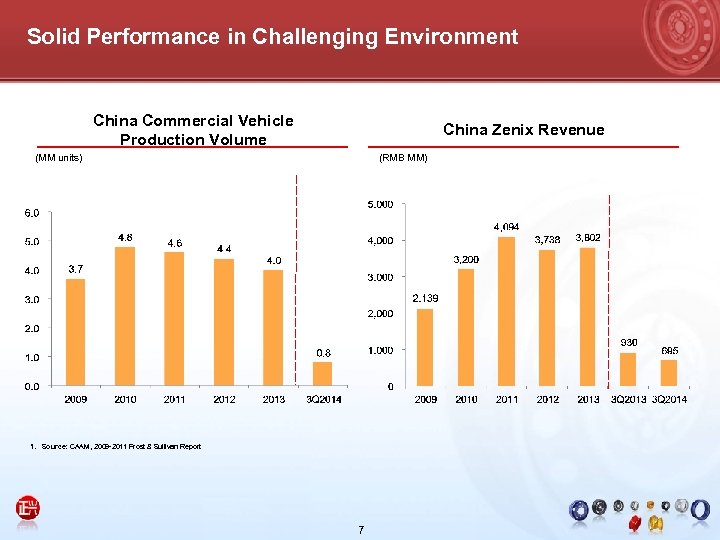

Solid Performance in Challenging Environment China Commercial Vehicle Production Volume China Zenix Revenue (MM units) (RMB MM) 1. Source: CAAM, 2009 -2011 Frost & Sullivan Report 7

Solid Performance in Challenging Environment China Commercial Vehicle Production Volume China Zenix Revenue (MM units) (RMB MM) 1. Source: CAAM, 2009 -2011 Frost & Sullivan Report 7

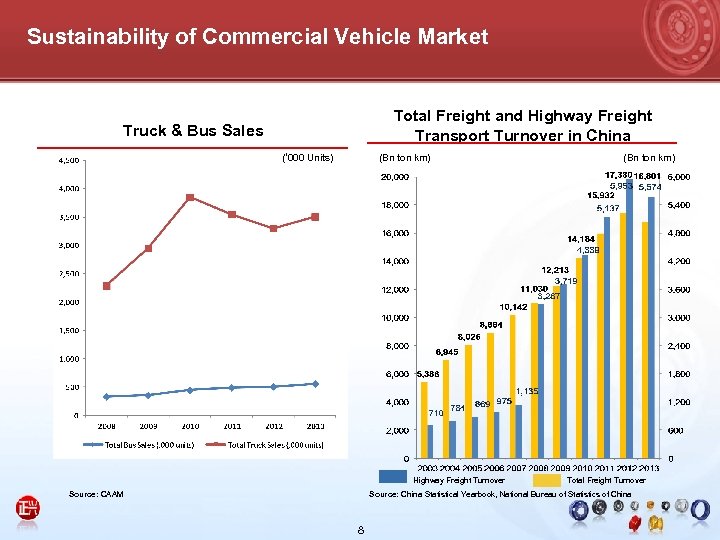

Sustainability of Commercial Vehicle Market Total Freight and Highway Freight Transport Turnover in China Truck & Bus Sales (‘ 000 Units) (Bn ton km) Highway Freight Turnover Source: CAAM (Bn ton km) Total Freight Turnover Source: China Statistical Yearbook, National Bureau of Statistics of China 8

Sustainability of Commercial Vehicle Market Total Freight and Highway Freight Transport Turnover in China Truck & Bus Sales (‘ 000 Units) (Bn ton km) Highway Freight Turnover Source: CAAM (Bn ton km) Total Freight Turnover Source: China Statistical Yearbook, National Bureau of Statistics of China 8

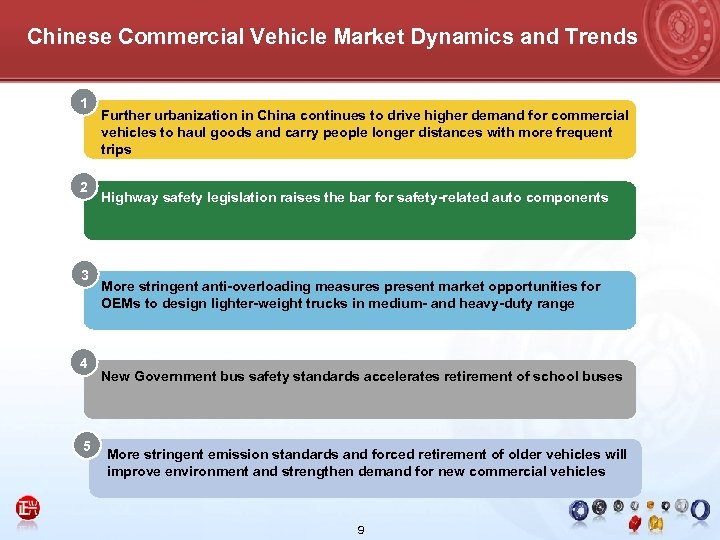

Chinese Commercial Vehicle Market Dynamics and Trends 1 2 3 4 5 Further urbanization in China continues to drive higher demand for commercial vehicles to haul goods and carry people longer distances with more frequent trips Highway safety legislation raises the bar for safety-related auto components More stringent anti-overloading measures present market opportunities for OEMs to design lighter-weight trucks in medium- and heavy-duty range New Government bus safety standards accelerates retirement of school buses More stringent emission standards and forced retirement of older vehicles will improve environment and strengthen demand for new commercial vehicles 9

Chinese Commercial Vehicle Market Dynamics and Trends 1 2 3 4 5 Further urbanization in China continues to drive higher demand for commercial vehicles to haul goods and carry people longer distances with more frequent trips Highway safety legislation raises the bar for safety-related auto components More stringent anti-overloading measures present market opportunities for OEMs to design lighter-weight trucks in medium- and heavy-duty range New Government bus safety standards accelerates retirement of school buses More stringent emission standards and forced retirement of older vehicles will improve environment and strengthen demand for new commercial vehicles 9

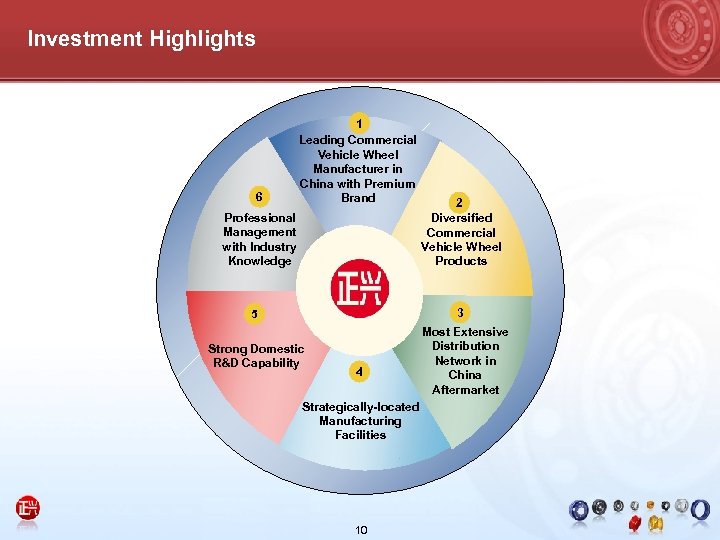

Investment Highlights 6 1 Leading Commercial Vehicle Wheel Manufacturer in China with Premium Brand Professional Management with Industry Knowledge 2 Diversified Commercial Vehicle Wheel Products 3 5 Most Extensive Distribution Strong Domestic Network in R&D Capability 4 China Aftermarket Strategically-located Manufacturing Facilities 10

Investment Highlights 6 1 Leading Commercial Vehicle Wheel Manufacturer in China with Premium Brand Professional Management with Industry Knowledge 2 Diversified Commercial Vehicle Wheel Products 3 5 Most Extensive Distribution Strong Domestic Network in R&D Capability 4 China Aftermarket Strategically-located Manufacturing Facilities 10

1 Zenix is the Leading Commercial Vehicle Wheel Manufacturer in China • Largest Wheel manufacturer by sales with 19. 3% market share • Broadest product line – 644 wheel models • Tubed, tubeless and off-road wheels • Over 84 OEM customers • More than 4, 700 aftermarket sales distributors • Exports steel wheels to more than 30 countries • Developed China’s first domestic aluminum wheels 11

1 Zenix is the Leading Commercial Vehicle Wheel Manufacturer in China • Largest Wheel manufacturer by sales with 19. 3% market share • Broadest product line – 644 wheel models • Tubed, tubeless and off-road wheels • Over 84 OEM customers • More than 4, 700 aftermarket sales distributors • Exports steel wheels to more than 30 countries • Developed China’s first domestic aluminum wheels 11

1 with Premium “Zhengxing” Brand… Premium Brand with High Customer Recognition Brand Awareness: § Zhengxing is the best known commercial vehicle wheel brand by end-users. In a survey, 92% of responded end-users ranked the brand “very familiar”, and additional 4% ranked “familiar” (1) Brand Reputation: § Zhengxing is regarded as the best commercial vehicle wheel brand in China by 70% of responded end-users (1) Note: 1. Source: Frost & Sullivan 2011 Report 12

1 with Premium “Zhengxing” Brand… Premium Brand with High Customer Recognition Brand Awareness: § Zhengxing is the best known commercial vehicle wheel brand by end-users. In a survey, 92% of responded end-users ranked the brand “very familiar”, and additional 4% ranked “familiar” (1) Brand Reputation: § Zhengxing is regarded as the best commercial vehicle wheel brand in China by 70% of responded end-users (1) Note: 1. Source: Frost & Sullivan 2011 Report 12

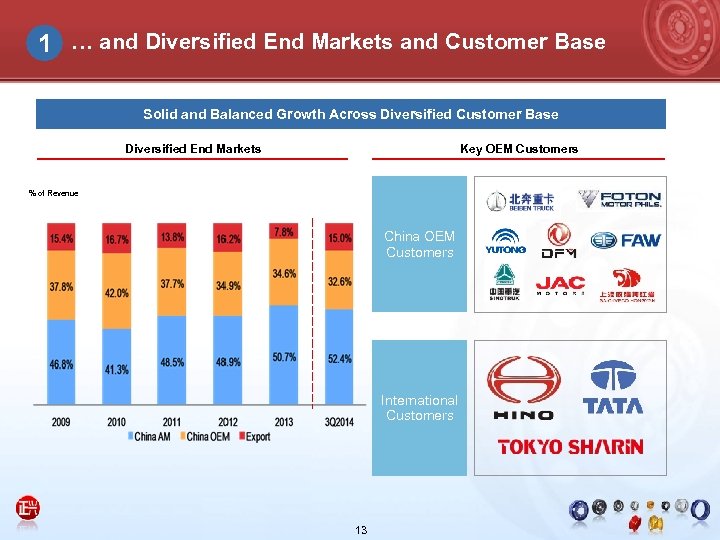

1 … and Diversified End Markets and Customer Base Solid and Balanced Growth Across Diversified Customer Base Diversified End Markets Key OEM Customers % of Revenue China OEM Customers International Customers 13

1 … and Diversified End Markets and Customer Base Solid and Balanced Growth Across Diversified Customer Base Diversified End Markets Key OEM Customers % of Revenue China OEM Customers International Customers 13

1 Awards & Recognitions from Customers “ 2012 Excellent Supplier Award” “ 2014 Quality Award” “ 2013 Quality Excellence Award” “ 2012 Win-win Partner Award” “ 2013 Class B Supplier Award” “Ten-year Excellent Supplier Award” Premium Quality Won High Customer Recognition 14

1 Awards & Recognitions from Customers “ 2012 Excellent Supplier Award” “ 2014 Quality Award” “ 2013 Quality Excellence Award” “ 2012 Win-win Partner Award” “ 2013 Class B Supplier Award” “Ten-year Excellent Supplier Award” Premium Quality Won High Customer Recognition 14

Wide Range of Product Offerings to Meet Customers 2 Demand Well Serve Aftermarket Product Types – 644 + models Tubed Steel Wheels Applications 351 Series Medium-duty & Heavy-duty Trucks Tubeless Steel Wheels Buses 263 Series Light-duty Trucks Off-road Steel Wheels Mini Trucks 28 Series Forklifts Aluminum Wheels Loaders 2 series 15 Buses

Wide Range of Product Offerings to Meet Customers 2 Demand Well Serve Aftermarket Product Types – 644 + models Tubed Steel Wheels Applications 351 Series Medium-duty & Heavy-duty Trucks Tubeless Steel Wheels Buses 263 Series Light-duty Trucks Off-road Steel Wheels Mini Trucks 28 Series Forklifts Aluminum Wheels Loaders 2 series 15 Buses

2 Advanced Production Technologies to Ensure Quality § Wheel Steel with our Special Specifications § Advanced Spinning and Pressing Technology § Rim-shaped Steel Production Technology § Comprehensive Quality Management System 16

2 Advanced Production Technologies to Ensure Quality § Wheel Steel with our Special Specifications § Advanced Spinning and Pressing Technology § Rim-shaped Steel Production Technology § Comprehensive Quality Management System 16

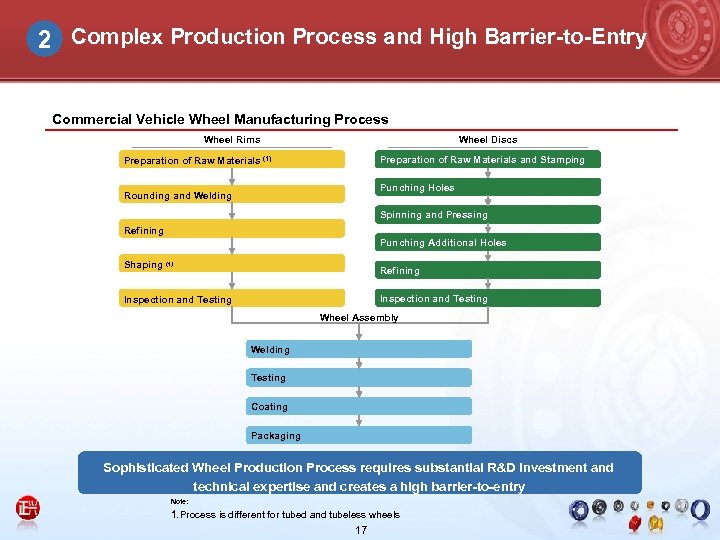

2 Complex Production Process and High Barrier-to-Entry Commercial Vehicle Wheel Manufacturing Process Wheel Rims Wheel Discs Preparation of Raw Materials and Stamping Preparation of Raw Materials (1) Punching Holes Rounding and Welding Spinning and Pressing Refining Punching Additional Holes Shaping (1) Refining Inspection and Testing Wheel Assembly Welding Testing Coating Packaging Sophisticated Wheel Production Process requires substantial R&D investment and technical expertise and creates a high barrier-to-entry Note: 1. Process is different for tubed and tubeless wheels 17

2 Complex Production Process and High Barrier-to-Entry Commercial Vehicle Wheel Manufacturing Process Wheel Rims Wheel Discs Preparation of Raw Materials and Stamping Preparation of Raw Materials (1) Punching Holes Rounding and Welding Spinning and Pressing Refining Punching Additional Holes Shaping (1) Refining Inspection and Testing Wheel Assembly Welding Testing Coating Packaging Sophisticated Wheel Production Process requires substantial R&D investment and technical expertise and creates a high barrier-to-entry Note: 1. Process is different for tubed and tubeless wheels 17

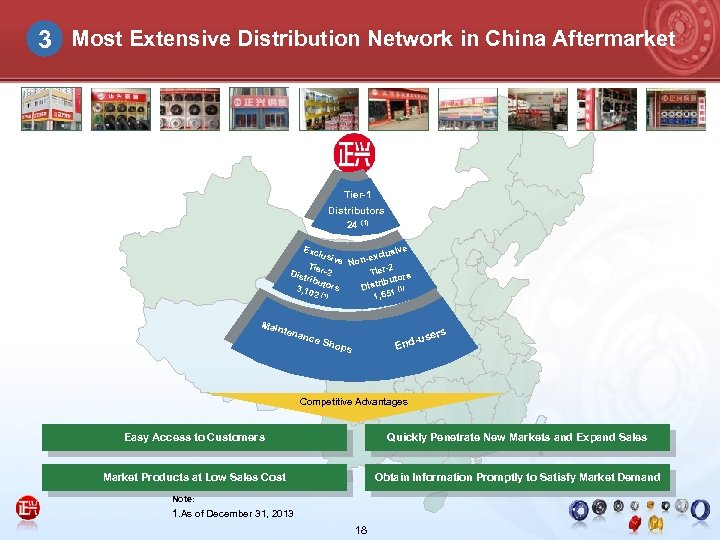

3 Most Extensive Distribution Network in China Aftermarket Tier-1 Distributors 24 (1) Exc e usiv lusi ve on-excl N Tier 2 -2 Tier. Dist rs ribu ibuto) t Distr 3, 10 ors (1 1 2 (1) 1, 65 Main tena nce Sho rs -use End ps Competitive Advantages Easy Access to Customers Quickly Penetrate New Markets and Expand Sales Market Products at Low Sales Cost Obtain Information Promptly to Satisfy Market Demand Note: 1. As of December 31, 2013 18

3 Most Extensive Distribution Network in China Aftermarket Tier-1 Distributors 24 (1) Exc e usiv lusi ve on-excl N Tier 2 -2 Tier. Dist rs ribu ibuto) t Distr 3, 10 ors (1 1 2 (1) 1, 65 Main tena nce Sho rs -use End ps Competitive Advantages Easy Access to Customers Quickly Penetrate New Markets and Expand Sales Market Products at Low Sales Cost Obtain Information Promptly to Satisfy Market Demand Note: 1. As of December 31, 2013 18

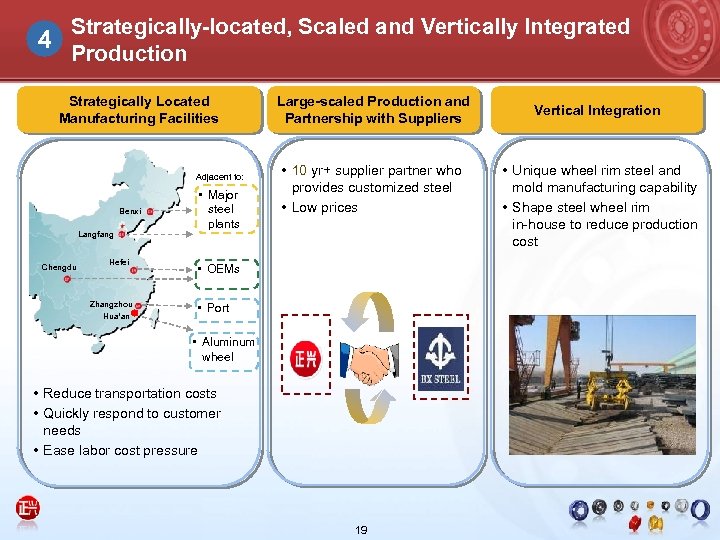

4 Strategically-located, Scaled and Vertically Integrated Production Strategically Located Manufacturing Facilities Adjacent to: Benxi Langfang Chengdu Hefei Zhangzhou Hua’an • Major steel plants Large-scaled Production and Partnership with Suppliers • 10 yr+ supplier partner who provides customized steel • Low prices • OEMs • Port • Aluminum wheel • Reduce transportation costs • Quickly respond to customer needs • Ease labor cost pressure 19 Vertical Integration • Unique wheel rim steel and mold manufacturing capability • Shape steel wheel rim in-house to reduce production cost

4 Strategically-located, Scaled and Vertically Integrated Production Strategically Located Manufacturing Facilities Adjacent to: Benxi Langfang Chengdu Hefei Zhangzhou Hua’an • Major steel plants Large-scaled Production and Partnership with Suppliers • 10 yr+ supplier partner who provides customized steel • Low prices • OEMs • Port • Aluminum wheel • Reduce transportation costs • Quickly respond to customer needs • Ease labor cost pressure 19 Vertical Integration • Unique wheel rim steel and mold manufacturing capability • Shape steel wheel rim in-house to reduce production cost

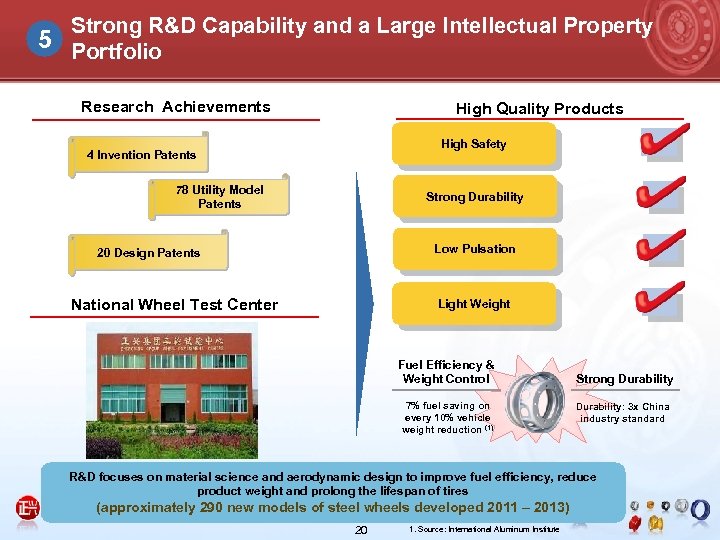

Strong R&D Capability and a Large Intellectual Property 5 Portfolio Research Achievements High Quality Products High Safety 4 Invention Patents 78 Utility Model Patents Strong Durability Low Pulsation 20 Design Patents National Wheel Test Center Light Weight Fuel Efficiency & Weight Control 7% fuel saving on every 10% vehicle weight reduction (1) Strong Durability: 3 x China industry standard R&D focuses on material science and aerodynamic design to improve fuel efficiency, reduce product weight and prolong the lifespan of tires (approximately 290 new models of steel wheels developed 2011 – 2013) 20 1. Source: International Aluminum Institute

Strong R&D Capability and a Large Intellectual Property 5 Portfolio Research Achievements High Quality Products High Safety 4 Invention Patents 78 Utility Model Patents Strong Durability Low Pulsation 20 Design Patents National Wheel Test Center Light Weight Fuel Efficiency & Weight Control 7% fuel saving on every 10% vehicle weight reduction (1) Strong Durability: 3 x China industry standard R&D focuses on material science and aerodynamic design to improve fuel efficiency, reduce product weight and prolong the lifespan of tires (approximately 290 new models of steel wheels developed 2011 – 2013) 20 1. Source: International Aluminum Institute

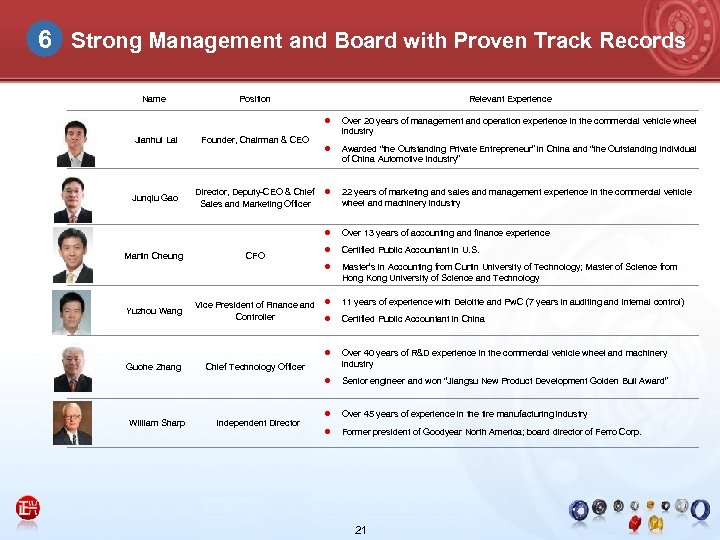

6 Strong Management and Board with Proven Track Records Name Position Relevant Experience l Jianhui Lai Junqiu Gao Founder, Chairman & CEO Over 20 years of management and operation experience in the commercial vehicle wheel industry l Awarded “the Outstanding Private Entrepreneur” in China and “the Outstanding Individual of China Automotive Industry” Director, Deputy-CEO & Chief l Sales and Marketing Officer 22 years of marketing and sales and management experience in the commercial vehicle wheel and machinery industry l Yuzhou Wang CFO l Certified Public Accountant in U. S. l Martin Cheung Over 13 years of accounting and finance experience Master’s in Accounting from Curtin University of Technology; Master of Science from Hong Kong University of Science and Technology Vice President of Finance and l Controller l 11 years of experience with Deloitte and Pw. C (7 years in auditing and internal control) Certified Public Accountant in China l William Sharp Over 40 years of R&D experience in the commercial vehicle wheel and machinery industry l Guohe Zhang Senior engineer and won “Jiangsu New Product Development Golden Bull Award” l Over 45 years of experience in the tire manufacturing industry l Former president of Goodyear North America; board director of Ferro Corp. Chief Technology Officer Independent Director 21

6 Strong Management and Board with Proven Track Records Name Position Relevant Experience l Jianhui Lai Junqiu Gao Founder, Chairman & CEO Over 20 years of management and operation experience in the commercial vehicle wheel industry l Awarded “the Outstanding Private Entrepreneur” in China and “the Outstanding Individual of China Automotive Industry” Director, Deputy-CEO & Chief l Sales and Marketing Officer 22 years of marketing and sales and management experience in the commercial vehicle wheel and machinery industry l Yuzhou Wang CFO l Certified Public Accountant in U. S. l Martin Cheung Over 13 years of accounting and finance experience Master’s in Accounting from Curtin University of Technology; Master of Science from Hong Kong University of Science and Technology Vice President of Finance and l Controller l 11 years of experience with Deloitte and Pw. C (7 years in auditing and internal control) Certified Public Accountant in China l William Sharp Over 40 years of R&D experience in the commercial vehicle wheel and machinery industry l Guohe Zhang Senior engineer and won “Jiangsu New Product Development Golden Bull Award” l Over 45 years of experience in the tire manufacturing industry l Former president of Goodyear North America; board director of Ferro Corp. Chief Technology Officer Independent Director 21

Financial Overview

Financial Overview

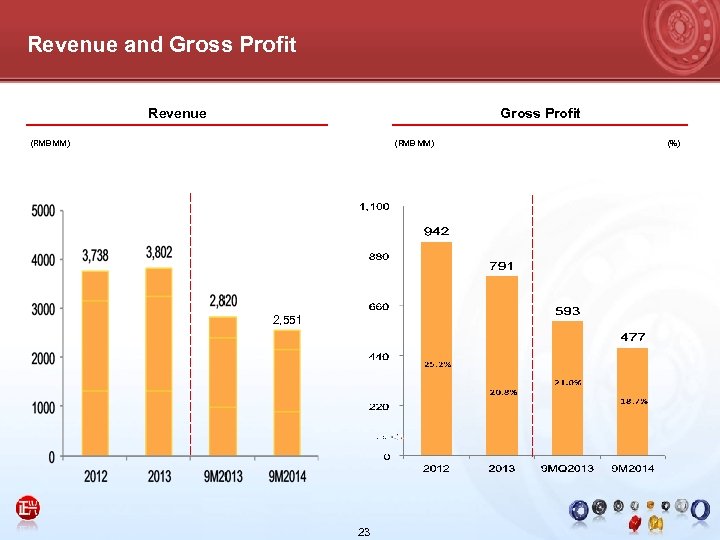

Revenue and Gross Profit Revenue Gross Profit (RMB MM) 2, 551 23 (%)

Revenue and Gross Profit Revenue Gross Profit (RMB MM) 2, 551 23 (%)

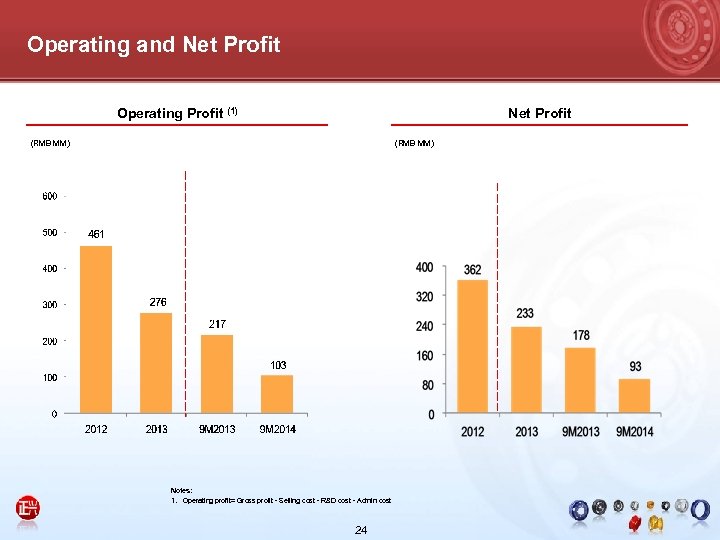

Operating and Net Profit Operating Profit (1) Net Profit (RMB MM) Notes: 1. Operating profit= Gross profit - Selling cost - R&D cost - Admin cost 24

Operating and Net Profit Operating Profit (1) Net Profit (RMB MM) Notes: 1. Operating profit= Gross profit - Selling cost - R&D cost - Admin cost 24

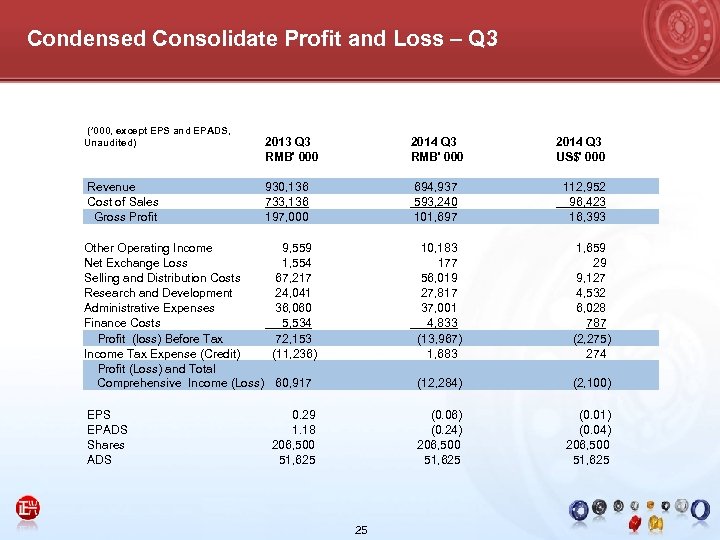

Condensed Consolidate Profit and Loss – Q 3 (’ 000, except EPS and EPADS, Unaudited) 2013 Q 3 RMB' 000 930, 136 733, 136 197, 000 9, 559 1, 554 67, 217 24, 041 36, 060 5, 534 72, 153 (11, 236) 2014 Q 3 RMB' 000 694, 937 593, 240 101, 697 10, 183 177 56, 019 27, 817 37, 001 4, 833 (13, 967) 1, 683 25 112, 952 96, 423 16, 393 1, 659 29 9, 127 4, 532 6, 028 787 (2, 275) 274 (12, 284) (0. 06) (0. 24) 206, 500 51, 625 Revenue Cost of Sales Gross Profit Other Operating Income Net Exchange Loss Selling and Distribution Costs Research and Development Administrative Expenses Finance Costs Profit (loss) Before Tax Income Tax Expense (Credit) Profit (Loss) and Total Comprehensive Income (Loss) 60, 917 EPS 0. 29 EPADS 1. 18 Shares 206, 500 ADS 51, 625 2014 Q 3 US$' 000 (2, 100) (0. 01) (0. 04) 206, 500 51, 625

Condensed Consolidate Profit and Loss – Q 3 (’ 000, except EPS and EPADS, Unaudited) 2013 Q 3 RMB' 000 930, 136 733, 136 197, 000 9, 559 1, 554 67, 217 24, 041 36, 060 5, 534 72, 153 (11, 236) 2014 Q 3 RMB' 000 694, 937 593, 240 101, 697 10, 183 177 56, 019 27, 817 37, 001 4, 833 (13, 967) 1, 683 25 112, 952 96, 423 16, 393 1, 659 29 9, 127 4, 532 6, 028 787 (2, 275) 274 (12, 284) (0. 06) (0. 24) 206, 500 51, 625 Revenue Cost of Sales Gross Profit Other Operating Income Net Exchange Loss Selling and Distribution Costs Research and Development Administrative Expenses Finance Costs Profit (loss) Before Tax Income Tax Expense (Credit) Profit (Loss) and Total Comprehensive Income (Loss) 60, 917 EPS 0. 29 EPADS 1. 18 Shares 206, 500 ADS 51, 625 2014 Q 3 US$' 000 (2, 100) (0. 01) (0. 04) 206, 500 51, 625

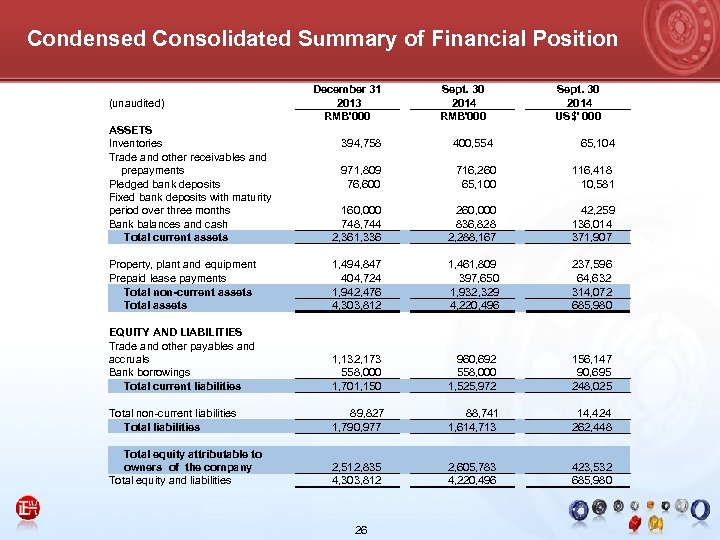

Condensed Consolidated Summary of Financial Position (unaudited) ASSETS Inventories Trade and other receivables and prepayments Pledged bank deposits Fixed bank deposits with maturity period over three months Bank balances and cash Total current assets December 31 2013 RMB'000 Sept. 30 2014 US$' 000 394, 758 400, 554 65, 104 971, 809 76, 600 716, 260 65, 100 116, 418 10, 581 160, 000 748, 744 2, 361, 336 260, 000 836, 828 2, 288, 167 42, 259 136, 014 371, 907 Property, plant and equipment Prepaid lease payments Total non-current assets Total assets 1, 494, 847 404, 724 1, 942, 476 4, 303, 812 1, 461, 809 397, 650 1, 932, 329 4, 220, 496 237, 596 64, 632 314, 072 685, 980 EQUITY AND LIABILITIES Trade and other payables and accruals Bank borrowings Total current liabilities 1, 132, 173 558, 000 1, 701, 150 960, 692 558, 000 1, 525, 972 156, 147 90, 695 248, 025 Total non-current liabilities Total liabilities 89, 827 1, 790, 977 88, 741 1, 614, 713 14, 424 262, 448 Total equity attributable to owners of the company Total equity and liabilities 2, 512, 835 4, 303, 812 2, 605, 783 4, 220, 496 423, 532 685, 980 26

Condensed Consolidated Summary of Financial Position (unaudited) ASSETS Inventories Trade and other receivables and prepayments Pledged bank deposits Fixed bank deposits with maturity period over three months Bank balances and cash Total current assets December 31 2013 RMB'000 Sept. 30 2014 US$' 000 394, 758 400, 554 65, 104 971, 809 76, 600 716, 260 65, 100 116, 418 10, 581 160, 000 748, 744 2, 361, 336 260, 000 836, 828 2, 288, 167 42, 259 136, 014 371, 907 Property, plant and equipment Prepaid lease payments Total non-current assets Total assets 1, 494, 847 404, 724 1, 942, 476 4, 303, 812 1, 461, 809 397, 650 1, 932, 329 4, 220, 496 237, 596 64, 632 314, 072 685, 980 EQUITY AND LIABILITIES Trade and other payables and accruals Bank borrowings Total current liabilities 1, 132, 173 558, 000 1, 701, 150 960, 692 558, 000 1, 525, 972 156, 147 90, 695 248, 025 Total non-current liabilities Total liabilities 89, 827 1, 790, 977 88, 741 1, 614, 713 14, 424 262, 448 Total equity attributable to owners of the company Total equity and liabilities 2, 512, 835 4, 303, 812 2, 605, 783 4, 220, 496 423, 532 685, 980 26

Strategies & Recent Development

Strategies & Recent Development

Development Strategies Strengthen Market Leadership Broaden Product Offerings Develop International Market Enhance Productivity Further Expand China Aftermarket Distribution Enhance R&D Capability 28

Development Strategies Strengthen Market Leadership Broaden Product Offerings Develop International Market Enhance Productivity Further Expand China Aftermarket Distribution Enhance R&D Capability 28

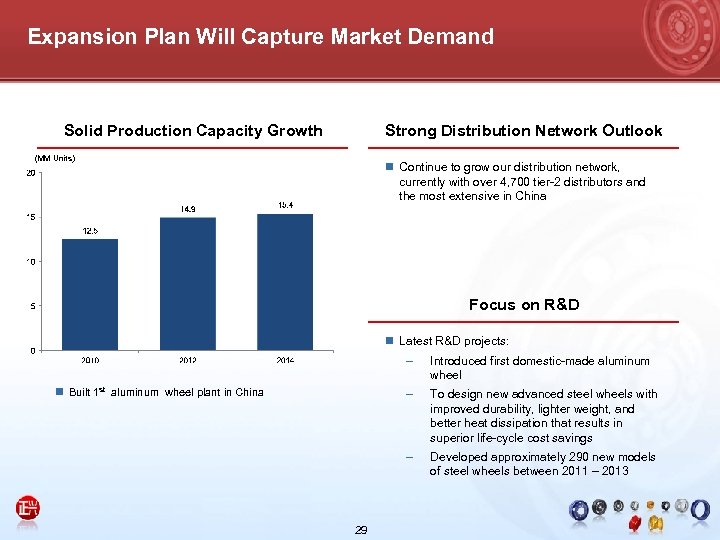

Expansion Plan Will Capture Market Demand Solid Production Capacity Growth Strong Distribution Network Outlook (MM Units) n Continue to grow our distribution network, currently with over 4, 700 tier-2 distributors and the most extensive in China Focus on R&D n Latest R&D projects: – – 29 To design new advanced steel wheels with improved durability, lighter weight, and better heat dissipation that results in superior life-cycle cost savings – n Built 1 st aluminum wheel plant in China Introduced first domestic-made aluminum wheel Developed approximately 290 new models of steel wheels between 2011 – 2013

Expansion Plan Will Capture Market Demand Solid Production Capacity Growth Strong Distribution Network Outlook (MM Units) n Continue to grow our distribution network, currently with over 4, 700 tier-2 distributors and the most extensive in China Focus on R&D n Latest R&D projects: – – 29 To design new advanced steel wheels with improved durability, lighter weight, and better heat dissipation that results in superior life-cycle cost savings – n Built 1 st aluminum wheel plant in China Introduced first domestic-made aluminum wheel Developed approximately 290 new models of steel wheels between 2011 – 2013

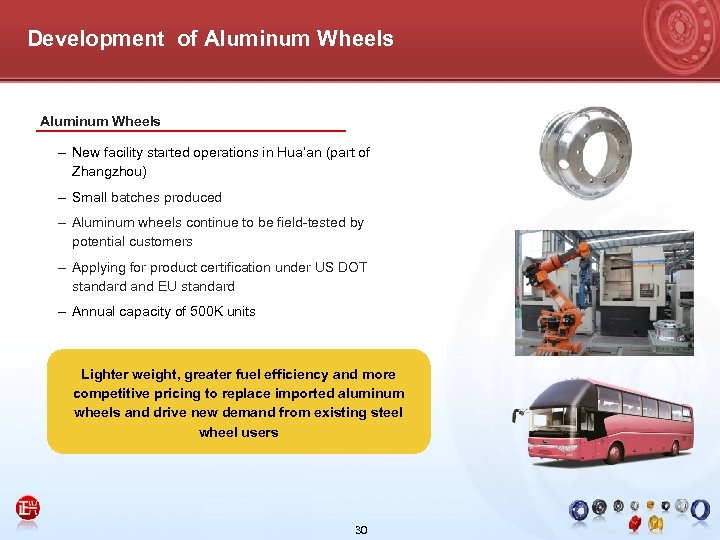

Development of Aluminum Wheels – New facility started operations in Hua’an (part of Zhangzhou) – Small batches produced – Aluminum wheels continue to be field-tested by potential customers – Applying for product certification under US DOT standard and EU standard – Annual capacity of 500 K units Lighter weight, greater fuel efficiency and more competitive pricing to replace imported aluminum wheels and drive new demand from existing steel wheel users 30

Development of Aluminum Wheels – New facility started operations in Hua’an (part of Zhangzhou) – Small batches produced – Aluminum wheels continue to be field-tested by potential customers – Applying for product certification under US DOT standard and EU standard – Annual capacity of 500 K units Lighter weight, greater fuel efficiency and more competitive pricing to replace imported aluminum wheels and drive new demand from existing steel wheel users 30

Appendix

Appendix

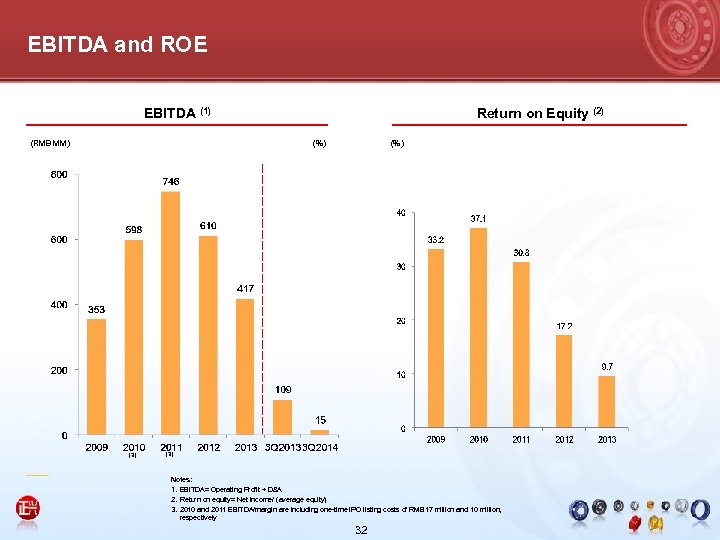

EBITDA and ROE EBITDA (1) (RMB MM) Return on Equity (2) (%) (3) Notes: 1. EBITDA= Operating Profit + D&A 2. Return on equity= Net income/ (average equity) 3. 2010 and 2011 EBITDA/margin are including one-time IPO listing costs of RMB 17 million and 10 million, respectively 32

EBITDA and ROE EBITDA (1) (RMB MM) Return on Equity (2) (%) (3) Notes: 1. EBITDA= Operating Profit + D&A 2. Return on equity= Net income/ (average equity) 3. 2010 and 2011 EBITDA/margin are including one-time IPO listing costs of RMB 17 million and 10 million, respectively 32

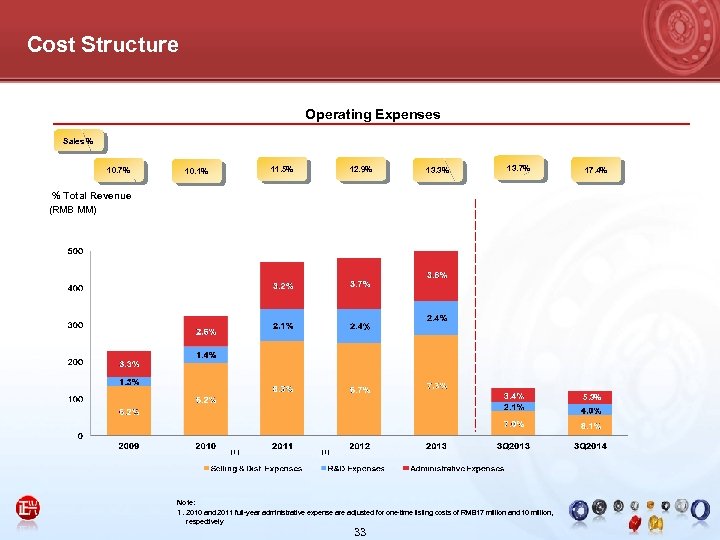

Cost Structure Operating Expenses Sales % 10. 7% 11. 5% 10. 1% 12. 9% 13. 3% 13. 7% 17. 4% % Total Revenue (RMB MM) 5. 3% (1) Note: 1. 2010 and 2011 full-year administrative expense are adjusted for one-time listing costs of RMB 17 million and 10 million, respectively 33

Cost Structure Operating Expenses Sales % 10. 7% 11. 5% 10. 1% 12. 9% 13. 3% 13. 7% 17. 4% % Total Revenue (RMB MM) 5. 3% (1) Note: 1. 2010 and 2011 full-year administrative expense are adjusted for one-time listing costs of RMB 17 million and 10 million, respectively 33

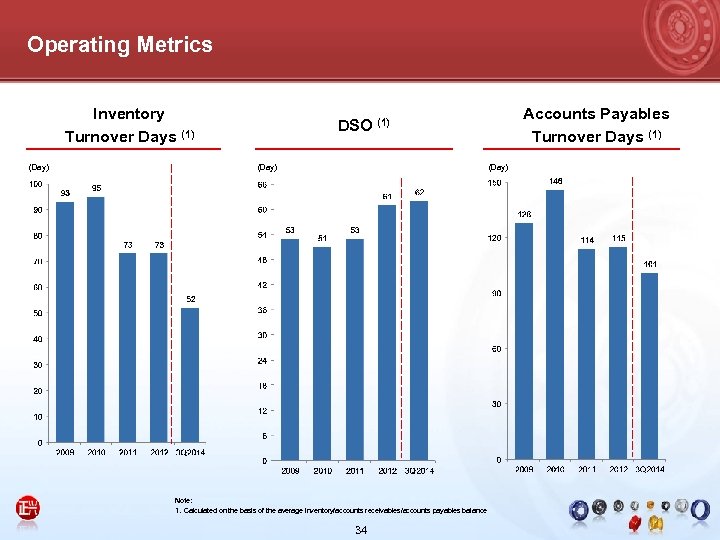

Operating Metrics Inventory Turnover Days (1) (Day) Accounts Payables Turnover Days (1) DSO (1) (Day) Note: 1. Calculated on the basis of the average inventory/accounts receivables/accounts payables balance 34

Operating Metrics Inventory Turnover Days (1) (Day) Accounts Payables Turnover Days (1) DSO (1) (Day) Note: 1. Calculated on the basis of the average inventory/accounts receivables/accounts payables balance 34

China Zenix Auto International Limited www. zenixauto. com/en

China Zenix Auto International Limited www. zenixauto. com/en