e588d50ec76de0234db4bfa509f00604.ppt

- Количество слайдов: 36

China’s Path to Innovation Xiaolan Fu Oxford University DFID-ESRC Growth Research Programme Meeting Overseas Development Institute, London, July 17 th, 2015

China’s Path to Innovation Xiaolan Fu Oxford University DFID-ESRC Growth Research Programme Meeting Overseas Development Institute, London, July 17 th, 2015

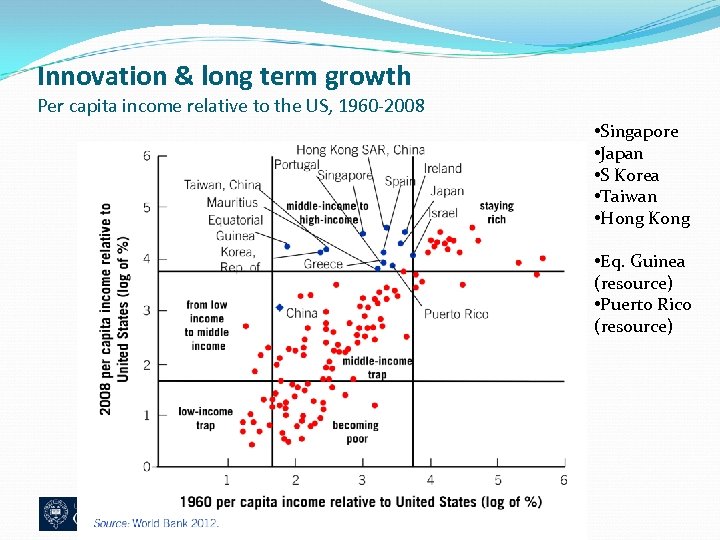

Innovation & long term growth Per capita income relative to the US, 1960 -2008 • Singapore • Japan • S Korea • Taiwan • Hong Kong • Eq. Guinea (resource) • Puerto Rico (resource)

Innovation & long term growth Per capita income relative to the US, 1960 -2008 • Singapore • Japan • S Korea • Taiwan • Hong Kong • Eq. Guinea (resource) • Puerto Rico (resource)

China’s Path to innovation (‘How’ ) The evolution of China’s path to innovation: foreign vs indigenous innovation System building: Open national innovation system Achieving: Capabilities, incentives, institutions Conclusions: ONIS & Innovation diagnosis Policy implications for other countries

China’s Path to innovation (‘How’ ) The evolution of China’s path to innovation: foreign vs indigenous innovation System building: Open national innovation system Achieving: Capabilities, incentives, institutions Conclusions: ONIS & Innovation diagnosis Policy implications for other countries

The Evolution of China’s Path to Innovation

The Evolution of China’s Path to Innovation

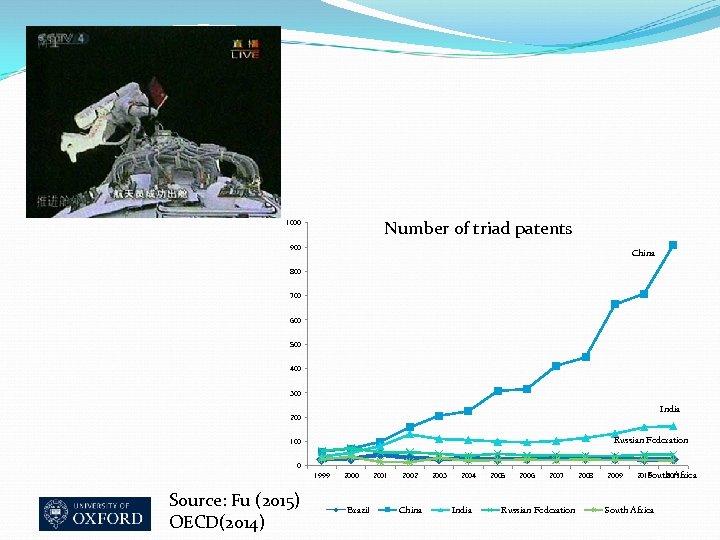

Number of triad patents 1000 900 China 800 700 600 500 400 300 India 200 Russian Federation 100 0 1999 Source: Fu (2015) OECD(2014) 2000 Brazil 2001 2002 China 2003 2004 India 2005 2006 2007 Russian Federation 2008 2009 South Africa 2010 2011 South Africa

Number of triad patents 1000 900 China 800 700 600 500 400 300 India 200 Russian Federation 100 0 1999 Source: Fu (2015) OECD(2014) 2000 Brazil 2001 2002 China 2003 2004 India 2005 2006 2007 Russian Federation 2008 2009 South Africa 2010 2011 South Africa

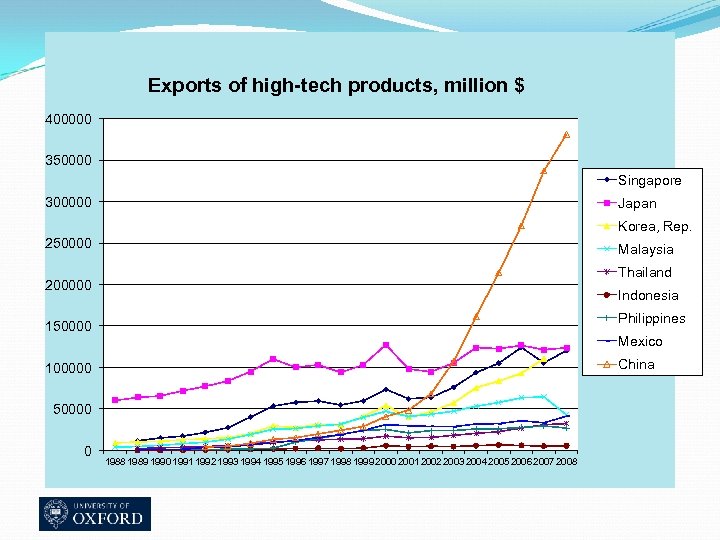

Exports of high-tech products, million $ 400000 350000 Singapore 300000 Japan Korea, Rep. 250000 Malaysia Thailand 200000 Indonesia Philippines 150000 Mexico China 100000 50000 0 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Exports of high-tech products, million $ 400000 350000 Singapore 300000 Japan Korea, Rep. 250000 Malaysia Thailand 200000 Indonesia Philippines 150000 Mexico China 100000 50000 0 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

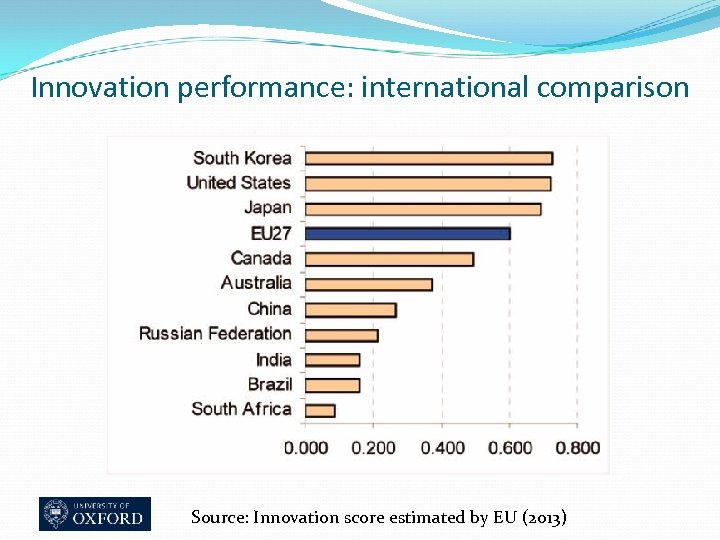

Innovation performance: international comparison Source: Innovation score estimated by EU (2013)

Innovation performance: international comparison Source: Innovation score estimated by EU (2013)

From S&T to innovation policy Lessons from China 1978: S&T are productive forces 1985: S&T system reforms -Marketisation of the S&T system (planning--market) -Focus on serving economic development (defence –eco) -Acquisition of foreign technology (Imports: aid, debt; FDI: market for tech. strategy) 1995: Acceleration of S&T development -Priority of resource allocation to high-tech industries 2006: Strengthen indigenous innovation

From S&T to innovation policy Lessons from China 1978: S&T are productive forces 1985: S&T system reforms -Marketisation of the S&T system (planning--market) -Focus on serving economic development (defence –eco) -Acquisition of foreign technology (Imports: aid, debt; FDI: market for tech. strategy) 1995: Acceleration of S&T development -Priority of resource allocation to high-tech industries 2006: Strengthen indigenous innovation

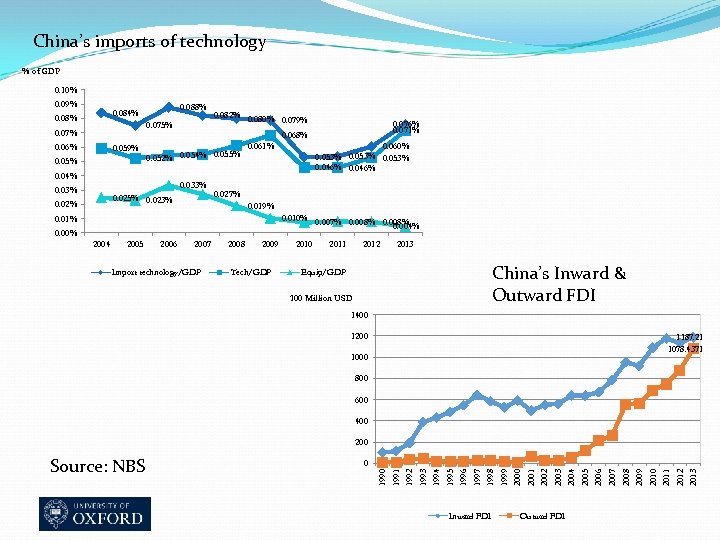

China’s imports of technology % of GDP 0. 10% 0. 09% 0. 088% 0. 084% 0. 08% 0. 075% 0. 07% 0. 06% 0. 059% 0. 05% 0. 033% 0. 025% 0. 023% 0. 02% 0. 076% 0. 071% 0. 068% 0. 052% 0. 054% 0. 055% 0. 04% 0. 03% 0. 082% 0. 080% 0. 079% 0. 061% 0. 060% 0. 053% 0. 046% 0. 027% 0. 019% 0. 010% 0. 007% 0. 008% 0. 004% 0. 01% 0. 00% 2004 2005 2006 2007 Import technology/GDP 2008 2009 Tech/GDP 2010 2011 2012 2013 China’s Inward & Outward FDI Equip/GDP 100 Million USD 1400 1200 1187. 21 1078. 4371 1000 800 600 400 200 Inward FDI Outwrd FDI 2013 2012 2011 2010 2008 2009 2007 2006 2005 2004 2003 2001 2002 2000 1999 1998 1997 1996 1995 1994 1992 1993 1991 0 1990 Source: NBS

China’s imports of technology % of GDP 0. 10% 0. 09% 0. 088% 0. 084% 0. 08% 0. 075% 0. 07% 0. 06% 0. 059% 0. 05% 0. 033% 0. 025% 0. 023% 0. 02% 0. 076% 0. 071% 0. 068% 0. 052% 0. 054% 0. 055% 0. 04% 0. 03% 0. 082% 0. 080% 0. 079% 0. 061% 0. 060% 0. 053% 0. 046% 0. 027% 0. 019% 0. 010% 0. 007% 0. 008% 0. 004% 0. 01% 0. 00% 2004 2005 2006 2007 Import technology/GDP 2008 2009 Tech/GDP 2010 2011 2012 2013 China’s Inward & Outward FDI Equip/GDP 100 Million USD 1400 1200 1187. 21 1078. 4371 1000 800 600 400 200 Inward FDI Outwrd FDI 2013 2012 2011 2010 2008 2009 2007 2006 2005 2004 2003 2001 2002 2000 1999 1998 1997 1996 1995 1994 1992 1993 1991 0 1990 Source: NBS

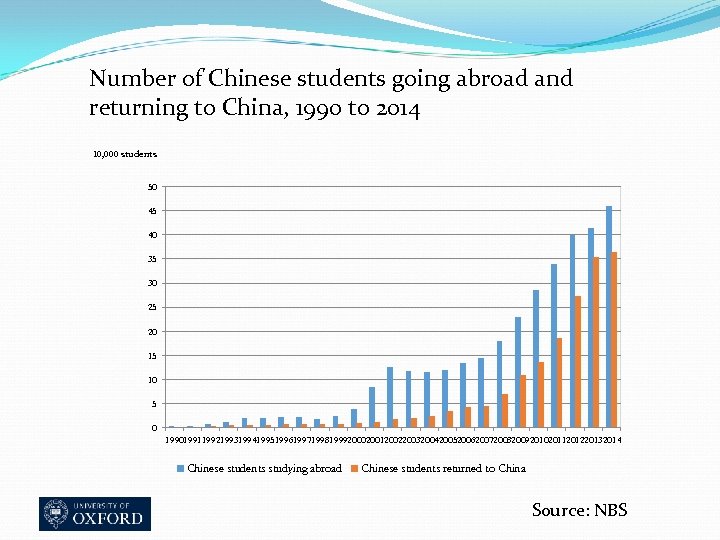

Number of Chinese students going abroad and returning to China, 1990 to 2014 10, 000 students 50 45 40 35 30 25 20 15 10 5 0 1990199119921993199419951996199719981999200020012002200320042005200620072008200920102011201220132014 Chinese students studying abroad Chinese students returned to China Source: NBS

Number of Chinese students going abroad and returning to China, 1990 to 2014 10, 000 students 50 45 40 35 30 25 20 15 10 5 0 1990199119921993199419951996199719981999200020012002200320042005200620072008200920102011201220132014 Chinese students studying abroad Chinese students returned to China Source: NBS

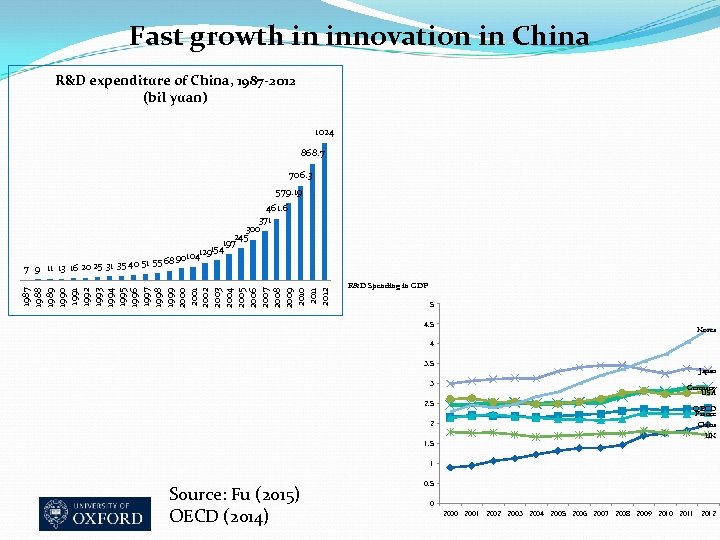

Fast growth in innovation in China R&D expenditure of China, 1987 -2012 (bil yuan) 1024 868. 7 706. 3 579. 19 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 51 7 9 11 13 16 20 25 31 35 40 461. 6 371 300 245 197 154 104129 55 68 90 R&D Spending in GDP 5 4. 5 Korea 4 3. 5 3 2. 5 2 1. 5 Japan Germany USA OECD France China UK 1 Source: Fu (2015) OECD (2014) 0. 5 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Fast growth in innovation in China R&D expenditure of China, 1987 -2012 (bil yuan) 1024 868. 7 706. 3 579. 19 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 51 7 9 11 13 16 20 25 31 35 40 461. 6 371 300 245 197 154 104129 55 68 90 R&D Spending in GDP 5 4. 5 Korea 4 3. 5 3 2. 5 2 1. 5 Japan Germany USA OECD France China UK 1 Source: Fu (2015) OECD (2014) 0. 5 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

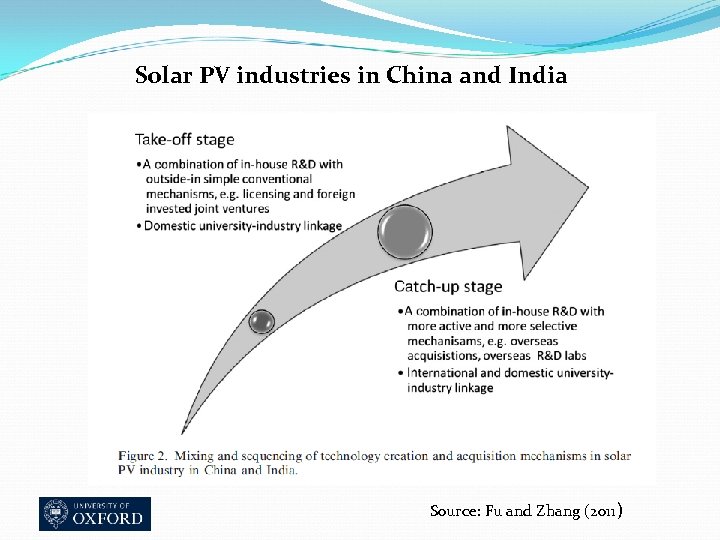

Solar PV industries in China and India Source: Fu and Zhang (2011)

Solar PV industries in China and India Source: Fu and Zhang (2011)

Foreign vs indigenous innovation Evidence from large firm level data Different roles of foreign vs indigenous innovation in different industries The dual role of Chinese universities: knowledge creation and assist diffusion and absorption The role of foreign universities & international collaboration for radical innovation Open Innovation a response to risks and constraints (differ by firms of different ownership)

Foreign vs indigenous innovation Evidence from large firm level data Different roles of foreign vs indigenous innovation in different industries The dual role of Chinese universities: knowledge creation and assist diffusion and absorption The role of foreign universities & international collaboration for radical innovation Open Innovation a response to risks and constraints (differ by firms of different ownership)

System Building The open national innovation system (ONIS) in the age of globalisation: Openness at both national and firm level

System Building The open national innovation system (ONIS) in the age of globalisation: Openness at both national and firm level

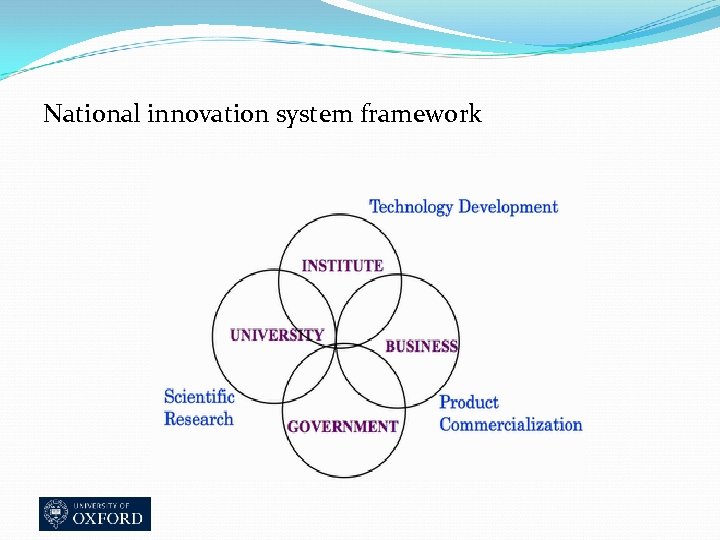

National innovation system framework

National innovation system framework

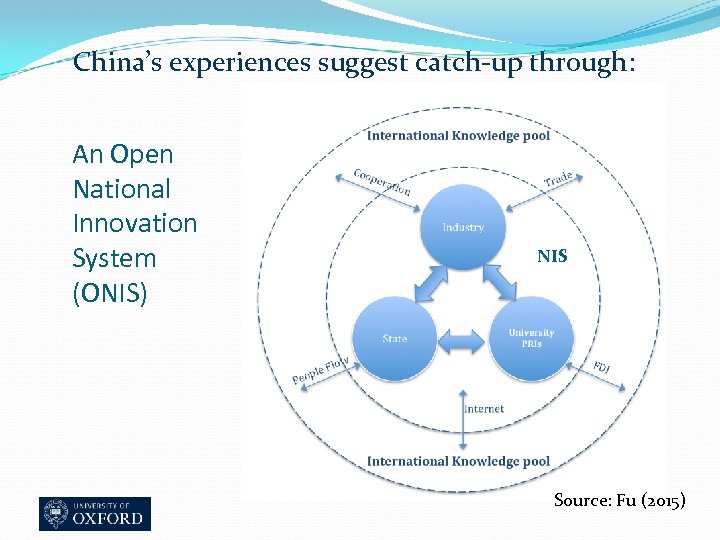

China’s experiences suggest catch-up through: An Open National Innovation System (ONIS) NIS Source: Fu (2015)

China’s experiences suggest catch-up through: An Open National Innovation System (ONIS) NIS Source: Fu (2015)

ONIS Embedding NIS into the global innovation system Creating linkages: - Trade - FDI - Human mobility - University – industry linkage - Public-private partnership & the role of the state Firms can map out their innovation ecosystem by focusing on industry and including vertical and horizontal linkages

ONIS Embedding NIS into the global innovation system Creating linkages: - Trade - FDI - Human mobility - University – industry linkage - Public-private partnership & the role of the state Firms can map out their innovation ecosystem by focusing on industry and including vertical and horizontal linkages

Open National Innovation System Foster indigenous innovation while opening up to external knowledge, resources and markets. Dual knowledge sources and uses a dynamic combination that evolves over time. Multiple driving forces: the state, the private sector and the MNEs. Uses a combination of market and state for different functions and at different stages of innovation. Multiple knowledge diffusion channels. Uses a combination of knowledge sourcing channels, which is again dynamic.

Open National Innovation System Foster indigenous innovation while opening up to external knowledge, resources and markets. Dual knowledge sources and uses a dynamic combination that evolves over time. Multiple driving forces: the state, the private sector and the MNEs. Uses a combination of market and state for different functions and at different stages of innovation. Multiple knowledge diffusion channels. Uses a combination of knowledge sourcing channels, which is again dynamic.

The relevance of ONIS for the rise of NIEs Japan (MNEs) South Korea (Foreign technical assistance and returnees) Taiwan (Foreign technical assistance and returnees)

The relevance of ONIS for the rise of NIEs Japan (MNEs) South Korea (Foreign technical assistance and returnees) Taiwan (Foreign technical assistance and returnees)

Achieving high performance: Capabilities, incentives and institutions

Achieving high performance: Capabilities, incentives and institutions

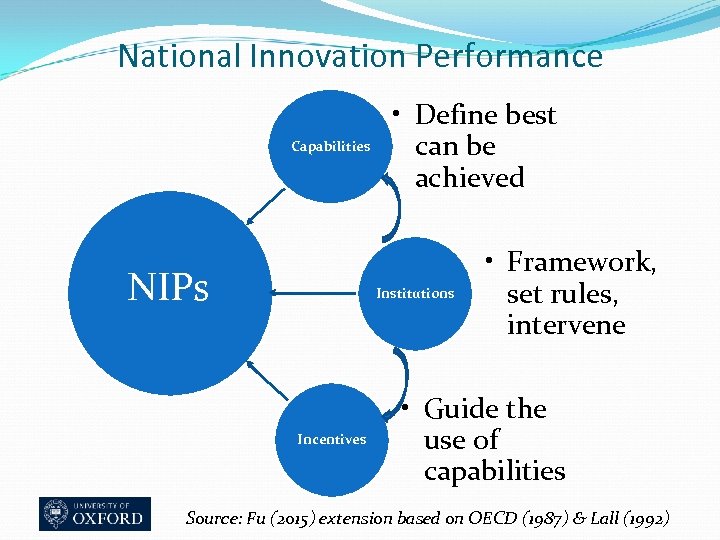

National Innovation Performance Capabilities NIPs • Define best can be achieved Institutions Incentives • Framework, set rules, intervene • Guide the use of capabilities Source: Fu (2015) extension based on OECD (1987) & Lall (1992)

National Innovation Performance Capabilities NIPs • Define best can be achieved Institutions Incentives • Framework, set rules, intervene • Guide the use of capabilities Source: Fu (2015) extension based on OECD (1987) & Lall (1992)

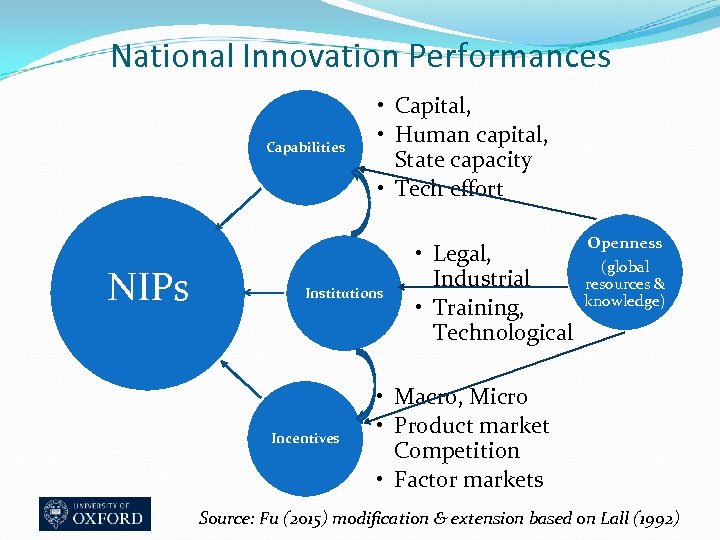

National Innovation Performances Capabilities NIPs • Capital, • Human capital, State capacity • Tech effort Institutions Incentives • Legal, Industrial • Training, Technological Openness (global resources & knowledge) • Macro, Micro • Product market Competition • Factor markets Source: Fu (2015) modification & extension based on Lall (1992)

National Innovation Performances Capabilities NIPs • Capital, • Human capital, State capacity • Tech effort Institutions Incentives • Legal, Industrial • Training, Technological Openness (global resources & knowledge) • Macro, Micro • Product market Competition • Factor markets Source: Fu (2015) modification & extension based on Lall (1992)

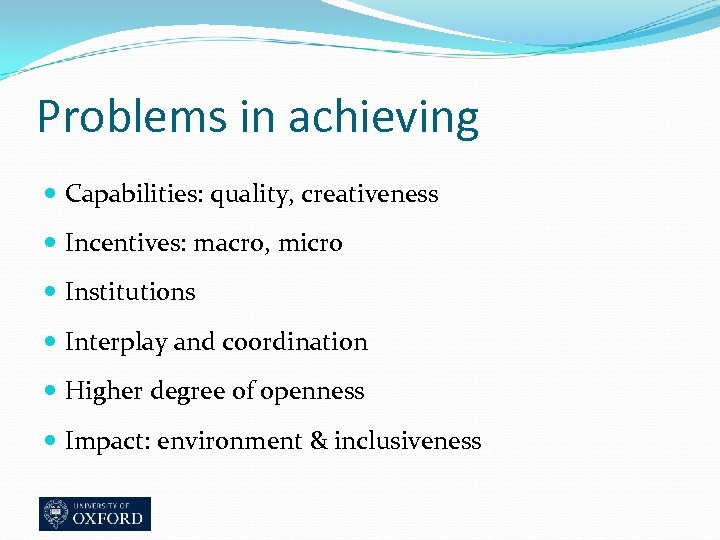

Problems in achieving Capabilities: quality, creativeness Incentives: macro, micro Institutions Interplay and coordination Higher degree of openness Impact: environment & inclusiveness

Problems in achieving Capabilities: quality, creativeness Incentives: macro, micro Institutions Interplay and coordination Higher degree of openness Impact: environment & inclusiveness

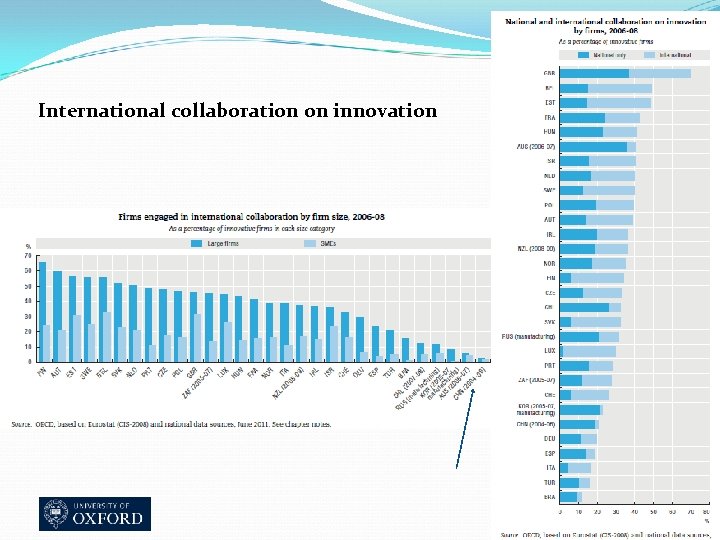

International collaboration on innovation

International collaboration on innovation

Conclusions

Conclusions

Conclusions & implications China’s experiences suggest upgrading using an ONIS Uses indigenous innovation and foreign technology transfer at all stages of development, though with different emphasis For middle income countries’, more targeted, proactive international knowledge sourcing : OFDI, highly skilled migrants, international collaboration, foreign universities Different roles of the state and market at different parts of the innovation chain

Conclusions & implications China’s experiences suggest upgrading using an ONIS Uses indigenous innovation and foreign technology transfer at all stages of development, though with different emphasis For middle income countries’, more targeted, proactive international knowledge sourcing : OFDI, highly skilled migrants, international collaboration, foreign universities Different roles of the state and market at different parts of the innovation chain

The path to an innovative nation China’s experiences also suggest that in addition to investment & openness, incentives & Institutions are also very important. Hence suggesting Innovation diagnosis as a policy tool

The path to an innovative nation China’s experiences also suggest that in addition to investment & openness, incentives & Institutions are also very important. Hence suggesting Innovation diagnosis as a policy tool

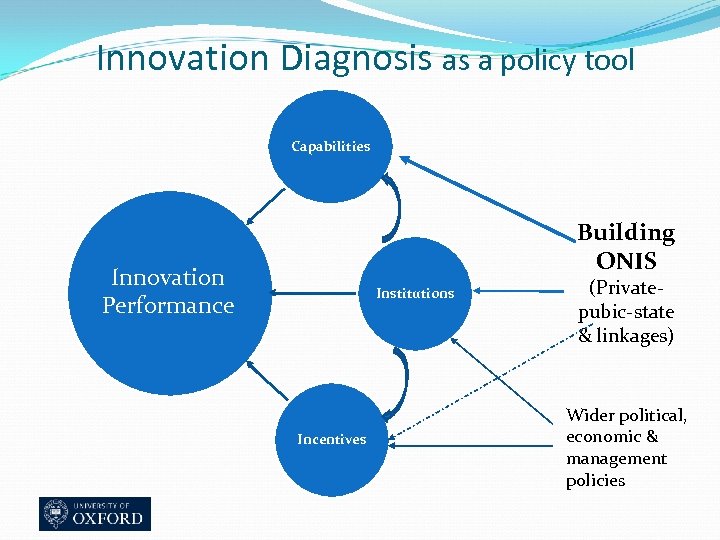

Innovation Diagnosis as a policy tool Capabilities Building ONIS Innovation Performance Institutions Incentives (Privatepubic-state & linkages) Wider political, economic & management policies

Innovation Diagnosis as a policy tool Capabilities Building ONIS Innovation Performance Institutions Incentives (Privatepubic-state & linkages) Wider political, economic & management policies

China: Current status & Way forward Moving towards the right direction; but details are the monsters Future: actions in 3 dimensions System and capabilities building - resources, skills, linkages - Solutions: invest, talents, open innovation, M&A, policy Set incentives right - Financial and non-financial incentives, monitoring Institutions development -IPR, incubators/sci parks, regulations, SMEs /high tech IPOs

China: Current status & Way forward Moving towards the right direction; but details are the monsters Future: actions in 3 dimensions System and capabilities building - resources, skills, linkages - Solutions: invest, talents, open innovation, M&A, policy Set incentives right - Financial and non-financial incentives, monitoring Institutions development -IPR, incubators/sci parks, regulations, SMEs /high tech IPOs

Lessons for other countries South-South technology transfer How to participate global value chains & role of EPZs Orientations to sustainability in technology and upgrading strategy Consequences on inequality and inclusive innovation

Lessons for other countries South-South technology transfer How to participate global value chains & role of EPZs Orientations to sustainability in technology and upgrading strategy Consequences on inequality and inclusive innovation

Thank you!

Thank you!

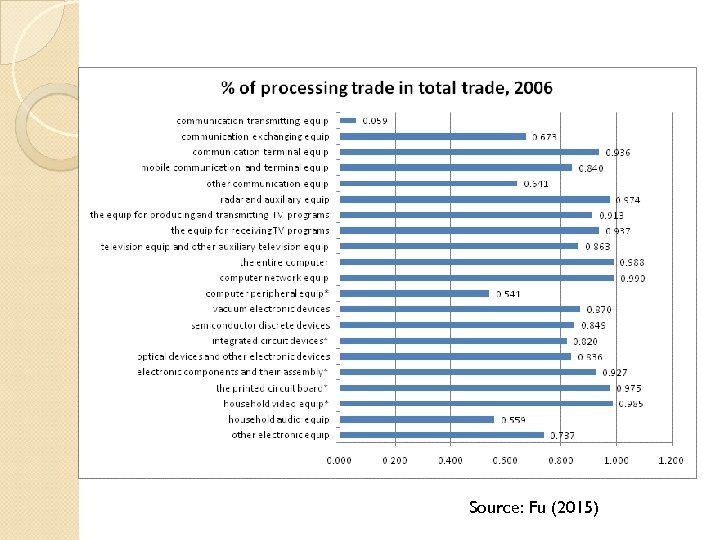

Source: Fu (2015)

Source: Fu (2015)

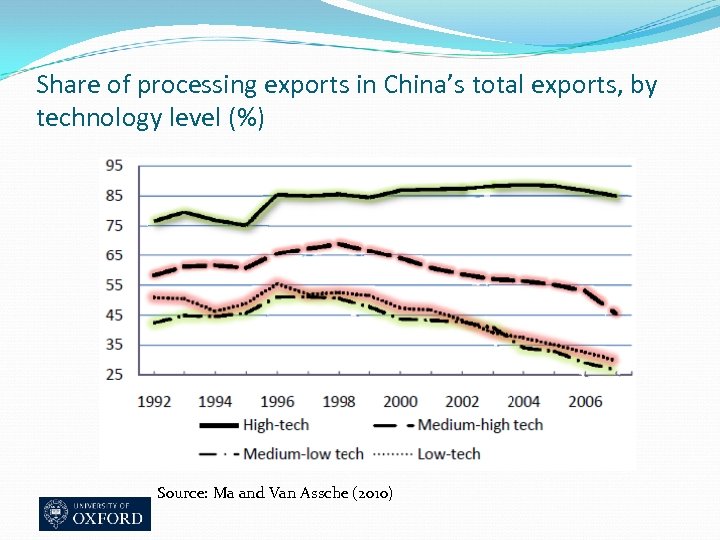

Share of processing exports in China’s total exports, by technology level (%) Source: Ma and Van Assche (2010)

Share of processing exports in China’s total exports, by technology level (%) Source: Ma and Van Assche (2010)

Structural change & industry upgrading Processing trade: 50%+ total trade : 90%+ high-tech exp

Structural change & industry upgrading Processing trade: 50%+ total trade : 90%+ high-tech exp

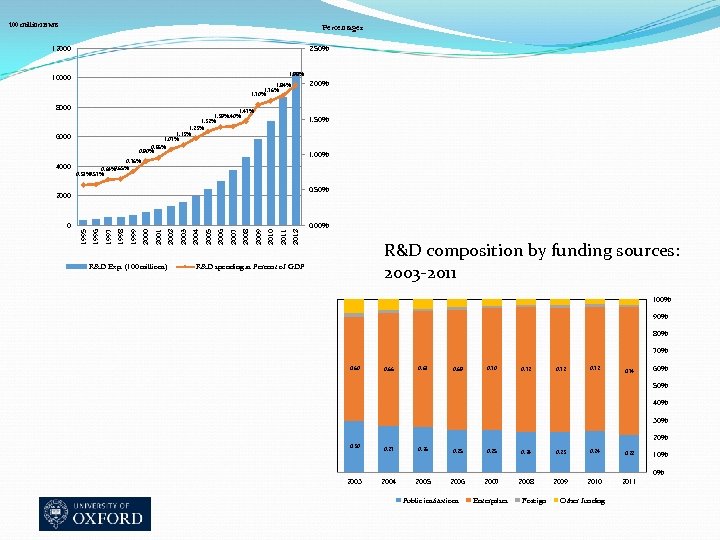

100 million RMB Percentages 12000 2. 50% 1. 98% 10000 8000 1. 47% 1. 40% 1. 39% 1. 32% 1. 23% 1. 13% 1. 07% 0. 95% 0. 90% 6000 4000 2. 00% 1. 84% 1. 76% 1. 70% 1. 50% 1. 00% 0. 76% 0. 65% 0. 64% 0. 57% 0. 50% R&D Exp. (100 millions) 2012 2010 2011 2009 2008 2007 2005 2006 2004 2003 2002 2000 2001 1998 1999 1997 1996 0 1995 2000 0. 00% R&D composition by funding sources: 2003 -2011 R&D spending as Percent of GDP 100% 90% 80% 70% 0. 60 0. 66 0. 67 0. 69 0. 70 0. 72 0. 74 60% 50% 40% 30% 20% 0. 30 0. 27 0. 26 0. 25 0. 24 0. 23 0. 24 0. 22 2004 2005 2006 2007 2008 2009 2010 2011 10% 0% 2003 Public institutions Enterprises Foreign Other funding

100 million RMB Percentages 12000 2. 50% 1. 98% 10000 8000 1. 47% 1. 40% 1. 39% 1. 32% 1. 23% 1. 13% 1. 07% 0. 95% 0. 90% 6000 4000 2. 00% 1. 84% 1. 76% 1. 70% 1. 50% 1. 00% 0. 76% 0. 65% 0. 64% 0. 57% 0. 50% R&D Exp. (100 millions) 2012 2010 2011 2009 2008 2007 2005 2006 2004 2003 2002 2000 2001 1998 1999 1997 1996 0 1995 2000 0. 00% R&D composition by funding sources: 2003 -2011 R&D spending as Percent of GDP 100% 90% 80% 70% 0. 60 0. 66 0. 67 0. 69 0. 70 0. 72 0. 74 60% 50% 40% 30% 20% 0. 30 0. 27 0. 26 0. 25 0. 24 0. 23 0. 24 0. 22 2004 2005 2006 2007 2008 2009 2010 2011 10% 0% 2003 Public institutions Enterprises Foreign Other funding

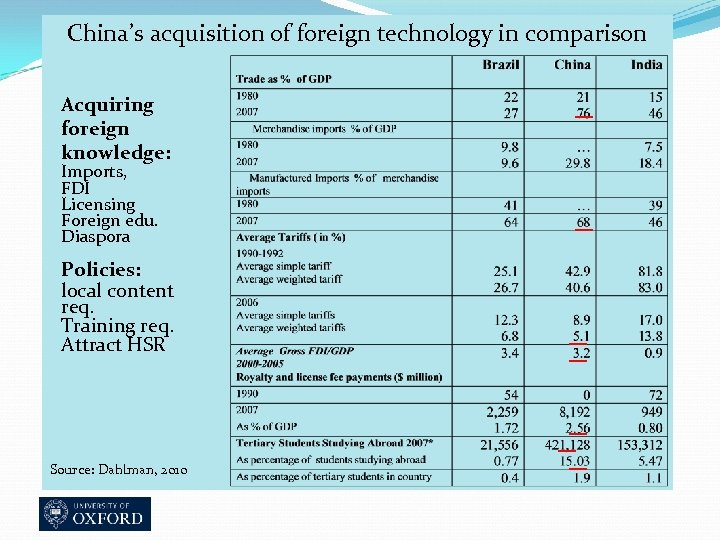

China’s acquisition of foreign technology in comparison Acquiring foreign knowledge: Imports, FDI Licensing Foreign edu. Diaspora Policies: local content req. Training req. Attract HSR Source: Dahlman, 2010

China’s acquisition of foreign technology in comparison Acquiring foreign knowledge: Imports, FDI Licensing Foreign edu. Diaspora Policies: local content req. Training req. Attract HSR Source: Dahlman, 2010