7462e9cf243d782fd507b3616d378c56.ppt

- Количество слайдов: 36

China’s Consumer Markets

China’s Consumer Markets

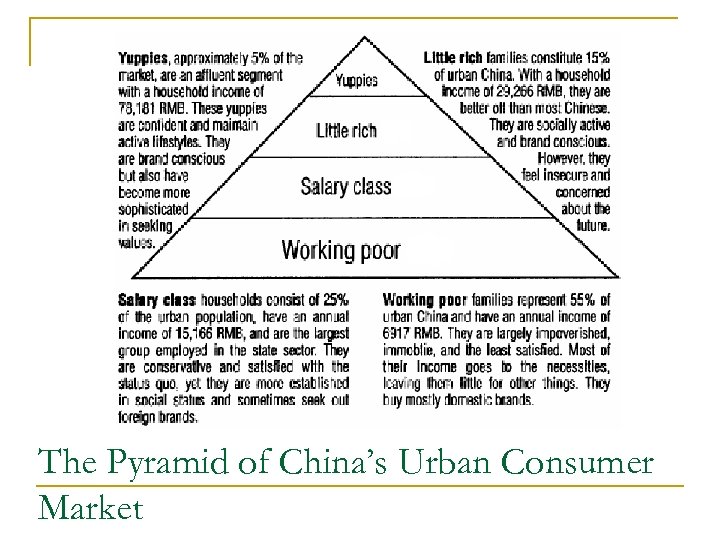

The Pyramid of China’s Urban Consumer Market

The Pyramid of China’s Urban Consumer Market

Changes in Consumer Market n n Rapid economic growth of 9% per year ↑Income/disposable income ↑Purchasing Power (From 1997 to 2003, per capita disposable income of urban Chinese increased 64. 2%) n n n ↑Population Larger market ↓Collectivism ↑Self-satisfaction ↑Education ↑Consumption Change in consumer preference Change in life style and consumption pattern

Changes in Consumer Market n n Rapid economic growth of 9% per year ↑Income/disposable income ↑Purchasing Power (From 1997 to 2003, per capita disposable income of urban Chinese increased 64. 2%) n n n ↑Population Larger market ↓Collectivism ↑Self-satisfaction ↑Education ↑Consumption Change in consumer preference Change in life style and consumption pattern

Where are the opportunities in China’s consumer market?

Where are the opportunities in China’s consumer market?

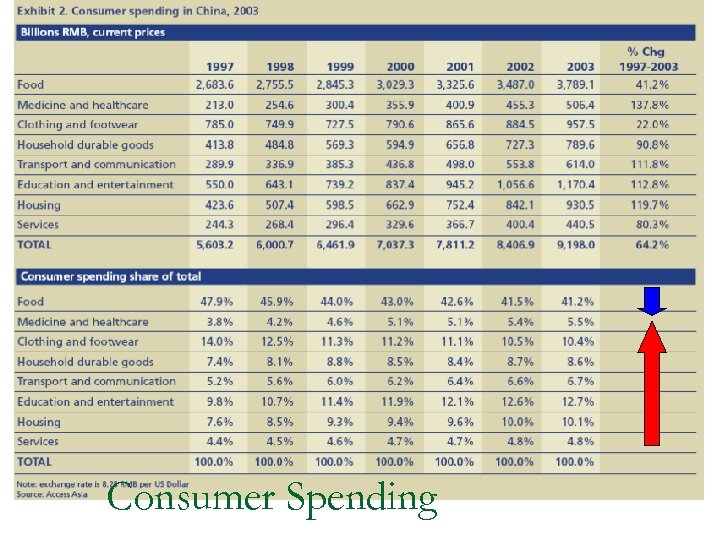

Consumer Spending

Consumer Spending

Savings and Housing n n n Per capita household savings is increased, it rose 123. 9% from 4. 6 trillion RMB to 10. 4 trillion RMB To maintain a stable living standard when they are old Spending on healthcare and for big ticket items such as housing Under the rule of WTO, foreign banks has the opportunity to take the Chinese deposit starting in 2007 These foreign financial institutions will fully participate in the Chinese financial system

Savings and Housing n n n Per capita household savings is increased, it rose 123. 9% from 4. 6 trillion RMB to 10. 4 trillion RMB To maintain a stable living standard when they are old Spending on healthcare and for big ticket items such as housing Under the rule of WTO, foreign banks has the opportunity to take the Chinese deposit starting in 2007 These foreign financial institutions will fully participate in the Chinese financial system

n n The government encourages home ownership Smaller initial payments for obtaining a home mortgage is required Mortgage interest payments is tax deductible Save less, buy more

n n The government encourages home ownership Smaller initial payments for obtaining a home mortgage is required Mortgage interest payments is tax deductible Save less, buy more

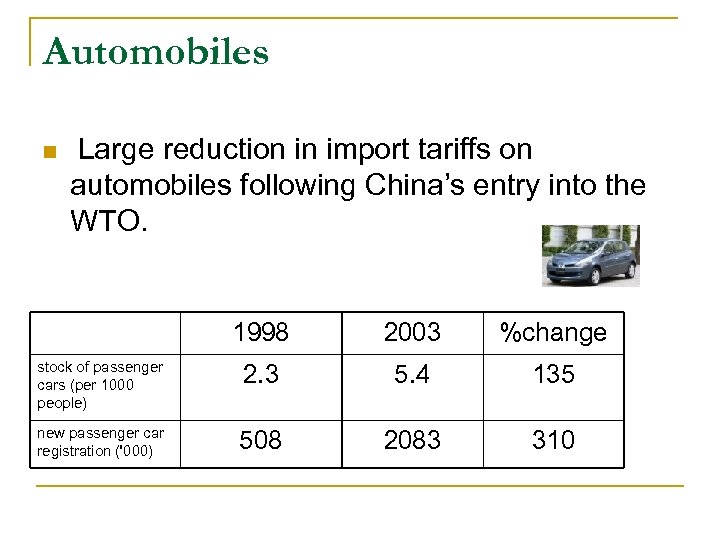

Automobiles n Large reduction in import tariffs on automobiles following China’s entry into the WTO. 1998 2003 %change stock of passenger cars (per 1000 people) 2. 3 5. 4 135 new passenger car registration ('000) 508 2083 310

Automobiles n Large reduction in import tariffs on automobiles following China’s entry into the WTO. 1998 2003 %change stock of passenger cars (per 1000 people) 2. 3 5. 4 135 new passenger car registration ('000) 508 2083 310

n Under the WTO, the automotive financing will be further opened to foreign participation q q q Increase the competition for domestic financing institutions Reduce down-payment requirements Expand the market

n Under the WTO, the automotive financing will be further opened to foreign participation q q q Increase the competition for domestic financing institutions Reduce down-payment requirements Expand the market

Apparel and Fashion n In 2003 Chinese spent roughly US$56 billion on clothing Many global brands are undertaking a multichannel approach to the Chinese market (licensed , franchising ) E. g Gap (US), H&M (Sweden), and Zara (Spain)

Apparel and Fashion n In 2003 Chinese spent roughly US$56 billion on clothing Many global brands are undertaking a multichannel approach to the Chinese market (licensed , franchising ) E. g Gap (US), H&M (Sweden), and Zara (Spain)

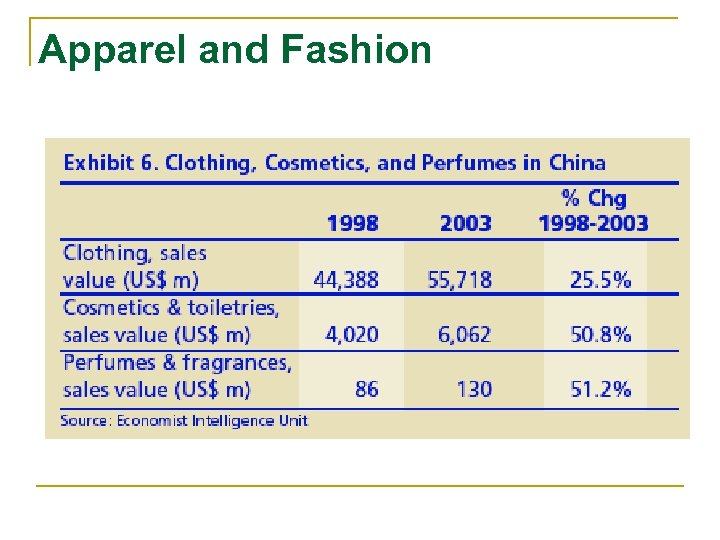

Apparel and Fashion

Apparel and Fashion

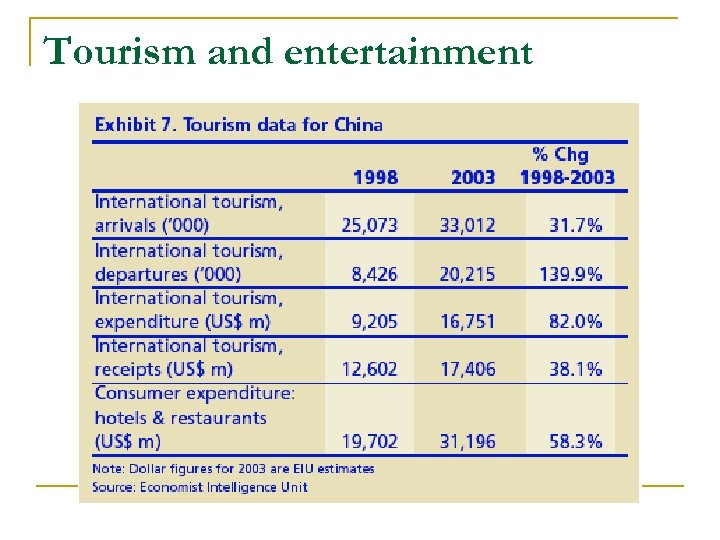

Tourism and entertainment

Tourism and entertainment

Foreign brand n n Highly brand-conscious Quality is perceived as highly important Preferences for domestics goods has dropped from 78% to 67% Preferences foreign goods has increased from 19% to 22%

Foreign brand n n Highly brand-conscious Quality is perceived as highly important Preferences for domestics goods has dropped from 78% to 67% Preferences foreign goods has increased from 19% to 22%

Foreign brand n n Small stores: purchasing apparel such as footwear, jewelry, or cosmetics E. g Louis Vuitton, Bally, Gucci and Ferragamo. Large stores : electronics, furniture, and other home related goods E. g Carrefour, Metro, Wal-Mart, Auchan, Ikea, and B&Q

Foreign brand n n Small stores: purchasing apparel such as footwear, jewelry, or cosmetics E. g Louis Vuitton, Bally, Gucci and Ferragamo. Large stores : electronics, furniture, and other home related goods E. g Carrefour, Metro, Wal-Mart, Auchan, Ikea, and B&Q

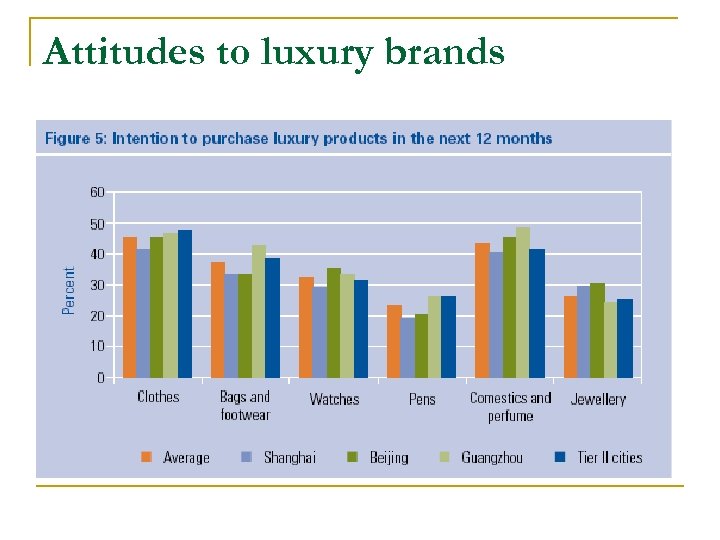

Attitudes to luxury brands n The majority of them regard owners of luxury brands as being successful and having good taste n Over half of them said they longed to buy luxury goods, even if they could not afford them at present

Attitudes to luxury brands n The majority of them regard owners of luxury brands as being successful and having good taste n Over half of them said they longed to buy luxury goods, even if they could not afford them at present

Attitudes to luxury brands

Attitudes to luxury brands

Attitudes to luxury brands

Attitudes to luxury brands

2. How do Chinese consumers differ in their lifestyles and consumption patterns?

2. How do Chinese consumers differ in their lifestyles and consumption patterns?

Lifestyles of Chinese consumers n Demand for trendy and innovative products q n Demand for quality of life q n curious to fashion and fresh products enjoy good quality and luxury goods Less inclined to save and a strong propensity to spend q confidence in their long-term earning potential, higher qualifications, growing purchasing power

Lifestyles of Chinese consumers n Demand for trendy and innovative products q n Demand for quality of life q n curious to fashion and fresh products enjoy good quality and luxury goods Less inclined to save and a strong propensity to spend q confidence in their long-term earning potential, higher qualifications, growing purchasing power

Lifestyles of Chinese consumers n Like to show off individuality q n Spending according to own interests q n build up own image by different brand name goods freedom and independence to spend Buying products through the internet q convenient and popular channel

Lifestyles of Chinese consumers n Like to show off individuality q n Spending according to own interests q n build up own image by different brand name goods freedom and independence to spend Buying products through the internet q convenient and popular channel

Consumption Patterns (Products) n The need of durables are mostly satisfied in urban cities q n Desire for life enjoying goods q n Color television, washing machine and refrigerator Traveling (48%↑), houses (38. 5%↑), mobile phones (35. 9%↑), luxury goods (20%↑), automobiles (15%↑), cosmetics (8%) and laptop computers Emphasize fashion over function q q MP 3 players → i. Pod TV games → PS 2

Consumption Patterns (Products) n The need of durables are mostly satisfied in urban cities q n Desire for life enjoying goods q n Color television, washing machine and refrigerator Traveling (48%↑), houses (38. 5%↑), mobile phones (35. 9%↑), luxury goods (20%↑), automobiles (15%↑), cosmetics (8%) and laptop computers Emphasize fashion over function q q MP 3 players → i. Pod TV games → PS 2

Consumption Patterns (Distribution Channels) n n Department stores became less popular New purchasing channel: q q q Internet Convenience stores Hypermarkets, shopping centers and warehousestyle supermarkets

Consumption Patterns (Distribution Channels) n n Department stores became less popular New purchasing channel: q q q Internet Convenience stores Hypermarkets, shopping centers and warehousestyle supermarkets

Different approaches of Segmentation 1 st Geographic Coastal (urban &richer) vs. interior region (rural &poorer) e. g. Shanghai— 1 st in「China Development Index」 , highest GDP per capita in 2006 Gansu—the lowest level in 「 China Development Index 」, poorest in China → urban vs. rural: 3 times higher in consumption expenditure - sub-segments emerge e. g. Xi’an, Wuhan, Nanjing -

Different approaches of Segmentation 1 st Geographic Coastal (urban &richer) vs. interior region (rural &poorer) e. g. Shanghai— 1 st in「China Development Index」 , highest GDP per capita in 2006 Gansu—the lowest level in 「 China Development Index 」, poorest in China → urban vs. rural: 3 times higher in consumption expenditure - sub-segments emerge e. g. Xi’an, Wuhan, Nanjing -

Different approaches of Segmentation 2 nd Demographic : size, density, age, gender, race, occupation, education etc China: - changing age and sexual structure of Chinese population e. g. elderly ↑, 7. 7% of the people reached 65 in 2005 & around 12% in 2010 -↑educational level -- > 50% post 80 s have secondary level -↑female labours -- > Women purchasing power

Different approaches of Segmentation 2 nd Demographic : size, density, age, gender, race, occupation, education etc China: - changing age and sexual structure of Chinese population e. g. elderly ↑, 7. 7% of the people reached 65 in 2005 & around 12% in 2010 -↑educational level -- > 50% post 80 s have secondary level -↑female labours -- > Women purchasing power

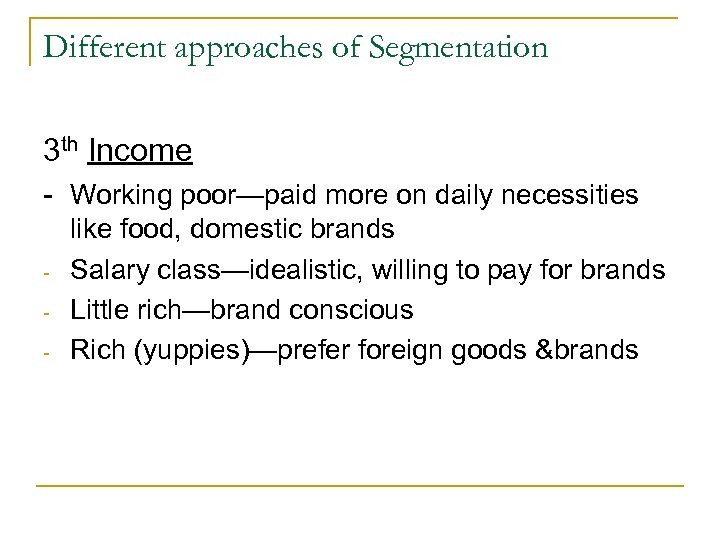

Different approaches of Segmentation 3 th Income - Working poor—paid more on daily necessities - like food, domestic brands Salary class—idealistic, willing to pay for brands Little rich—brand conscious Rich (yuppies)—prefer foreign goods &brands

Different approaches of Segmentation 3 th Income - Working poor—paid more on daily necessities - like food, domestic brands Salary class—idealistic, willing to pay for brands Little rich—brand conscious Rich (yuppies)—prefer foreign goods &brands

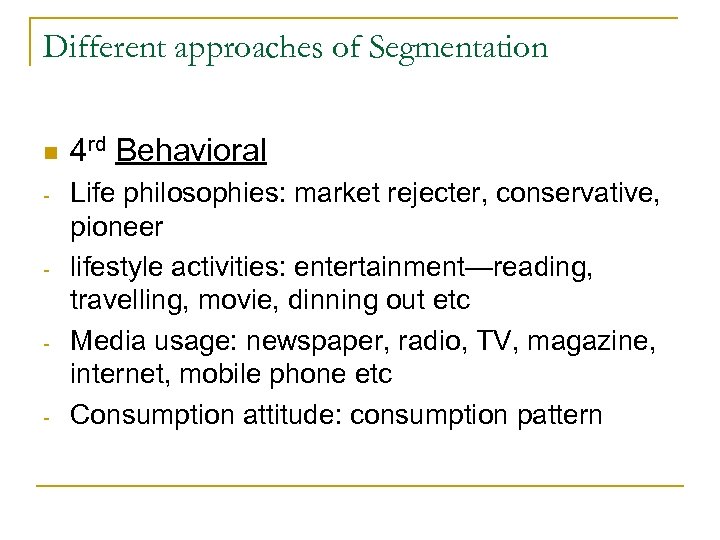

Different approaches of Segmentation n - - 4 rd Behavioral Life philosophies: market rejecter, conservative, pioneer lifestyle activities: entertainment—reading, travelling, movie, dinning out etc Media usage: newspaper, radio, TV, magazine, internet, mobile phone etc Consumption attitude: consumption pattern

Different approaches of Segmentation n - - 4 rd Behavioral Life philosophies: market rejecter, conservative, pioneer lifestyle activities: entertainment—reading, travelling, movie, dinning out etc Media usage: newspaper, radio, TV, magazine, internet, mobile phone etc Consumption attitude: consumption pattern

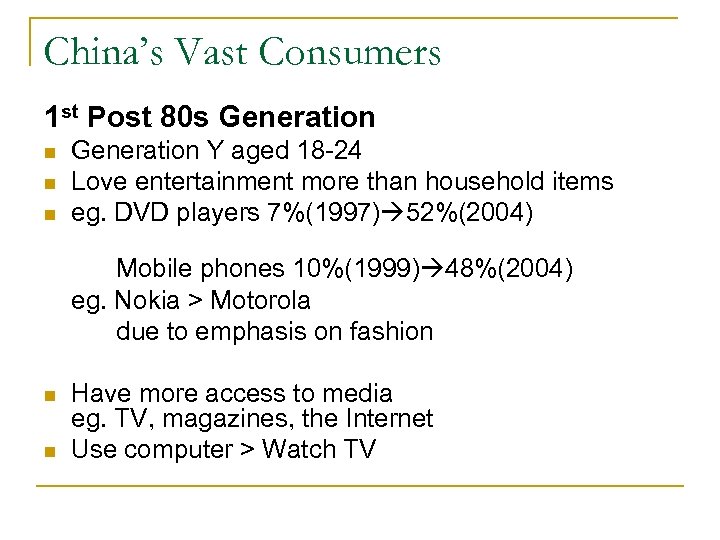

China’s Vast Consumers 1 st Post 80 s Generation n Generation Y aged 18 -24 Love entertainment more than household items eg. DVD players 7%(1997) 52%(2004) Mobile phones 10%(1999) 48%(2004) eg. Nokia > Motorola due to emphasis on fashion n n Have more access to media eg. TV, magazines, the Internet Use computer > Watch TV

China’s Vast Consumers 1 st Post 80 s Generation n Generation Y aged 18 -24 Love entertainment more than household items eg. DVD players 7%(1997) 52%(2004) Mobile phones 10%(1999) 48%(2004) eg. Nokia > Motorola due to emphasis on fashion n n Have more access to media eg. TV, magazines, the Internet Use computer > Watch TV

China’s Vast Consumers 2 nd Affluent Group n n n Coastal Urban regions High desire for buying with high purchasing power Love high technological products, especially mobile phones, pc etc. Willing to pay higher price for higher quality Emphasis on Brand name products

China’s Vast Consumers 2 nd Affluent Group n n n Coastal Urban regions High desire for buying with high purchasing power Love high technological products, especially mobile phones, pc etc. Willing to pay higher price for higher quality Emphasis on Brand name products

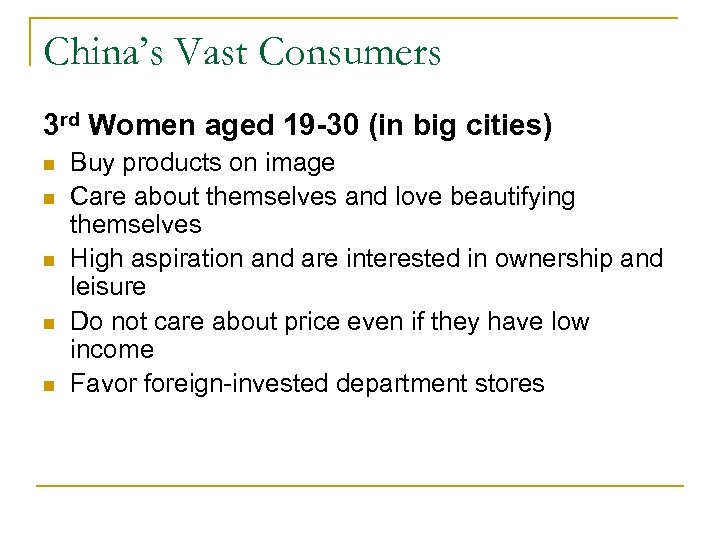

China’s Vast Consumers 3 rd Women aged 19 -30 (in big cities) n n n Buy products on image Care about themselves and love beautifying themselves High aspiration and are interested in ownership and leisure Do not care about price even if they have low income Favor foreign-invested department stores

China’s Vast Consumers 3 rd Women aged 19 -30 (in big cities) n n n Buy products on image Care about themselves and love beautifying themselves High aspiration and are interested in ownership and leisure Do not care about price even if they have low income Favor foreign-invested department stores

3/ How to target the different segments of the market, i. e. the implications of the marketing strategies?

3/ How to target the different segments of the market, i. e. the implications of the marketing strategies?

Marketing strategies 1 st Undifferentiated marketing n Base on largest numbers of buyer n Ignore market segment differences n Target the whole market with one offer 2 nd Differentiated marketing n Target several market segments and design separate offers for each n e. g. Gap (clothing) n 3 different retail stores format n Gap, Gap Banana Republic, Old Navy

Marketing strategies 1 st Undifferentiated marketing n Base on largest numbers of buyer n Ignore market segment differences n Target the whole market with one offer 2 nd Differentiated marketing n Target several market segments and design separate offers for each n e. g. Gap (clothing) n 3 different retail stores format n Gap, Gap Banana Republic, Old Navy

Marketing strategies 3 rd Concentrated / Niche Marketing n n n Focus on a large share of one or a few segments or niches Used by companies with limited resources – capture more market share e. g. Tetra ( fish supplier 80% of the world’s tropical fish food) 4 th Micro marketing n n 1/ local marketing e. g. Citi. Bank different services in different branches 2/ individual e. g. Dell Focus on product tailoring Satisfy the needs and wants of specific individual and local customer group

Marketing strategies 3 rd Concentrated / Niche Marketing n n n Focus on a large share of one or a few segments or niches Used by companies with limited resources – capture more market share e. g. Tetra ( fish supplier 80% of the world’s tropical fish food) 4 th Micro marketing n n 1/ local marketing e. g. Citi. Bank different services in different branches 2/ individual e. g. Dell Focus on product tailoring Satisfy the needs and wants of specific individual and local customer group

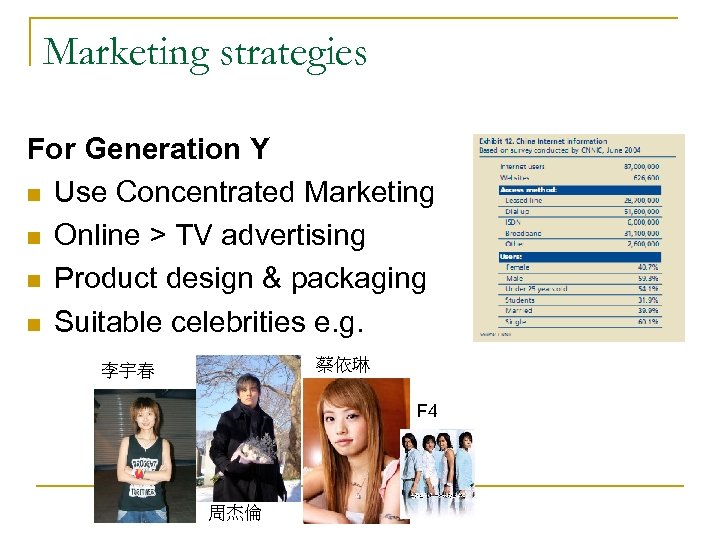

Marketing strategies For Generation Y n Use Concentrated Marketing n Online > TV advertising n Product design & packaging n Suitable celebrities e. g. 蔡依琳 李宇春 F 4 周杰倫

Marketing strategies For Generation Y n Use Concentrated Marketing n Online > TV advertising n Product design & packaging n Suitable celebrities e. g. 蔡依琳 李宇春 F 4 周杰倫

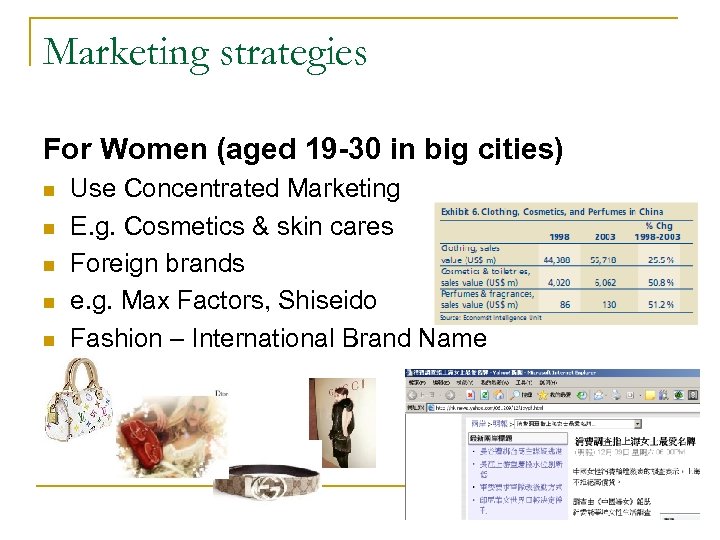

Marketing strategies For Women (aged 19 -30 in big cities) n n n Use Concentrated Marketing E. g. Cosmetics & skin cares Foreign brands e. g. Max Factors, Shiseido Fashion – International Brand Name

Marketing strategies For Women (aged 19 -30 in big cities) n n n Use Concentrated Marketing E. g. Cosmetics & skin cares Foreign brands e. g. Max Factors, Shiseido Fashion – International Brand Name

Marketing strategies For Affluent Group n Use Individual Marketing n High class brand name n Provide direct experiences n E. g. Rolls Royce - Personal selling satisfy specific needs of customers

Marketing strategies For Affluent Group n Use Individual Marketing n High class brand name n Provide direct experiences n E. g. Rolls Royce - Personal selling satisfy specific needs of customers

Conclusion n Nowadays, the disposable income lifestyle and consumption pattern changed purchasing power Business opportunity If we want to start a business in China Concentrated on specific segments We need to realize what China’s Vast Consumer specific needs and wants

Conclusion n Nowadays, the disposable income lifestyle and consumption pattern changed purchasing power Business opportunity If we want to start a business in China Concentrated on specific segments We need to realize what China’s Vast Consumer specific needs and wants