3b4192aa7605a2e79e2c26ffcec7c3c6.ppt

- Количество слайдов: 32

CHINA’S BOND MARKET —THE VIEW 4 -May-2010 1

Contents n Insight into Chinese Bond Market n Size and composition of Chinese Bond Market n China’s Bond Market Outlook 2

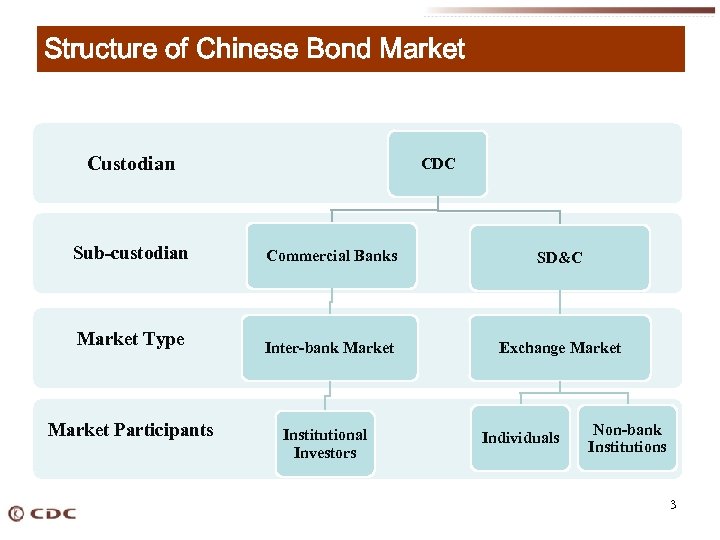

Structure of Chinese Bond Market Custodian CDC Sub-custodian Commercial Banks SD&C Market Type Inter-bank Market Exchange Market Participants Institutional Investors Individuals Non-bank Institutions 3

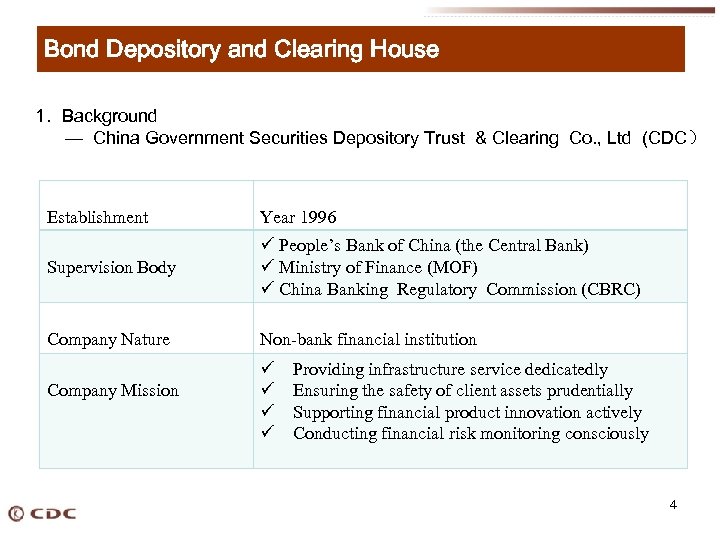

Bond Depository and Clearing House 1. Background — China Government Securities Depository Trust & Clearing Co. , Ltd (CDC) Establishment Year 1996 Supervision Body ü People’s Bank of China (the Central Bank) ü Ministry of Finance (MOF) ü China Banking Regulatory Commission (CBRC) Company Nature Non-bank financial institution Company Mission ü ü Providing infrastructure service dedicatedly Ensuring the safety of client assets prudentially Supporting financial product innovation actively Conducting financial risk monitoring consciously 4

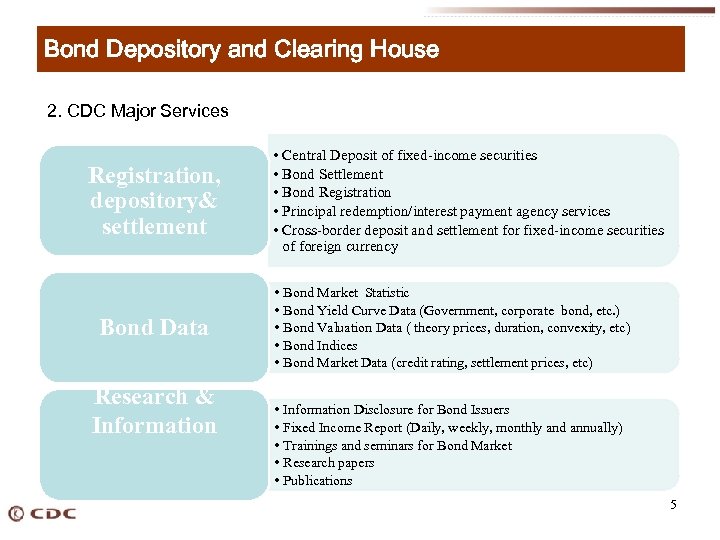

Bond Depository and Clearing House 2. CDC Major Services Registration, depository& settlement Bond Data Research & Information • Central Deposit of fixed-income securities • Bond Settlement • Bond Registration • Principal redemption/interest payment agency services • Cross-border deposit and settlement for fixed-income securities of foreign currency • Bond Market Statistic • Bond Yield Curve Data (Government, corporate bond, etc. ) • Bond Valuation Data ( theory prices, duration, convexity, etc) • Bond Indices • Bond Market Data (credit rating, settlement prices, etc) • Information Disclosure for Bond Issuers • Fixed Income Report (Daily, weekly, monthly and annually) • Trainings and seminars for Bond Market • Research papers • Publications 5

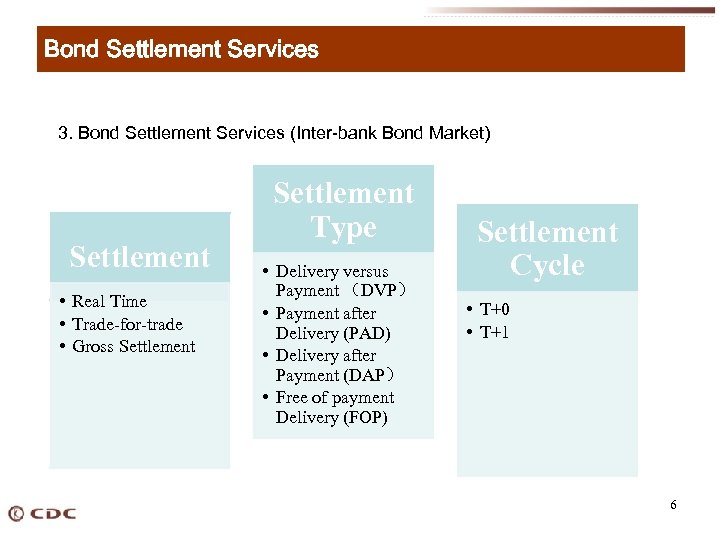

Bond Settlement Services 3. Bond Settlement Services (Inter-bank Bond Market) Settlement • Real Time • Trade-for-trade • Gross Settlement Type • Delivery versus Payment (DVP) • Payment after Delivery (PAD) • Delivery after Payment (DAP) • Free of payment Delivery (FOP) Settlement Cycle • T+0 • T+1 6

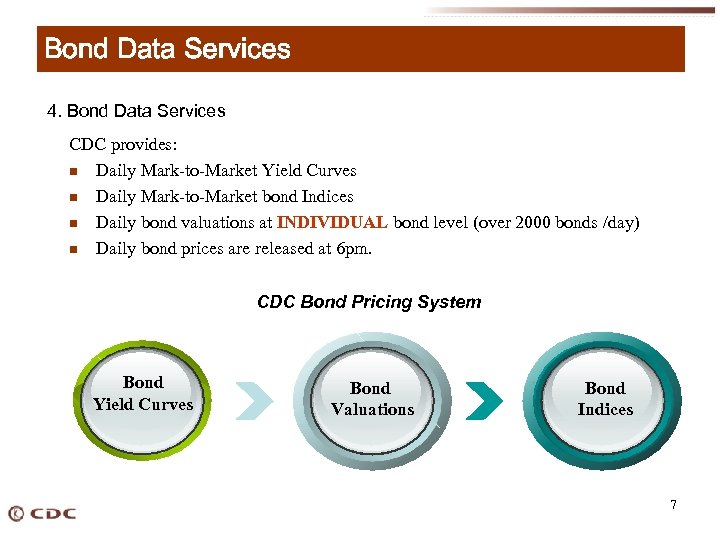

Bond Data Services 4. Bond Data Services CDC provides: n Daily Mark-to-Market Yield Curves n Daily Mark-to-Market bond Indices n Daily bond valuations at INDIVIDUAL bond level (over 2000 bonds /day) n Daily bond prices are released at 6 pm. CDC Bond Pricing System Bond Yield Curves Bond Valuations Bond Indices 7

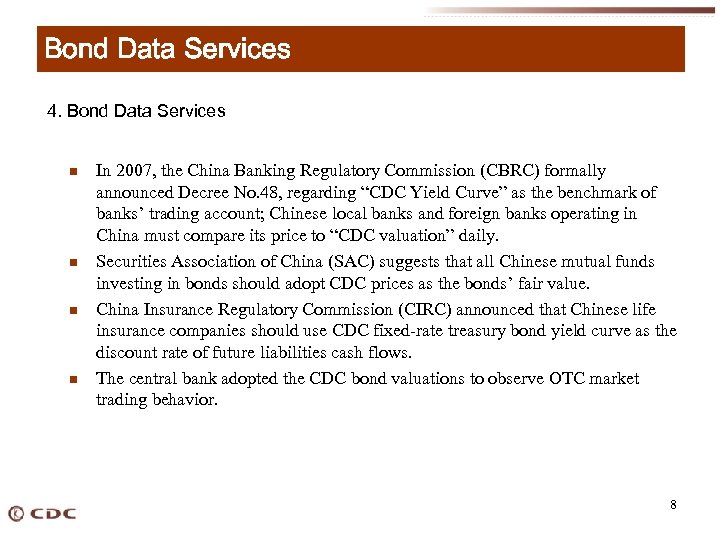

Bond Data Services 4. Bond Data Services n n In 2007, the China Banking Regulatory Commission (CBRC) formally announced Decree No. 48, regarding “CDC Yield Curve” as the benchmark of banks’ trading account; Chinese local banks and foreign banks operating in China must compare its price to “CDC valuation” daily. Securities Association of China (SAC) suggests that all Chinese mutual funds investing in bonds should adopt CDC prices as the bonds’ fair value. China Insurance Regulatory Commission (CIRC) announced that Chinese life insurance companies should use CDC fixed-rate treasury bond yield curve as the discount rate of future liabilities cash flows. The central bank adopted the CDC bond valuations to observe OTC market trading behavior. 8

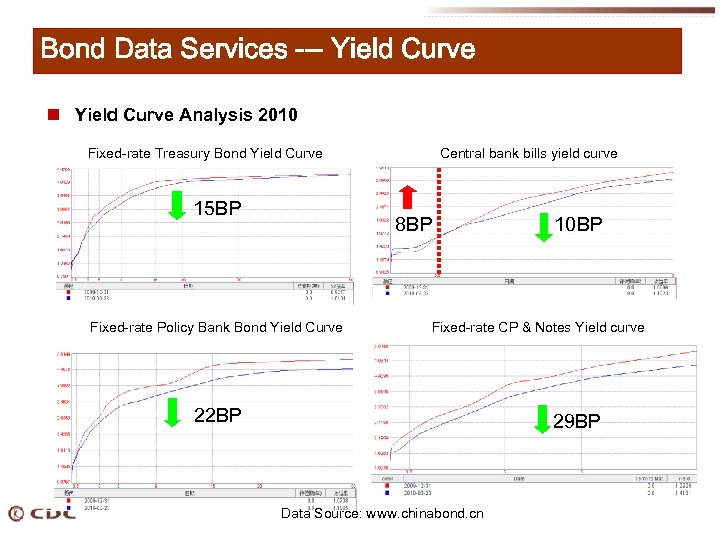

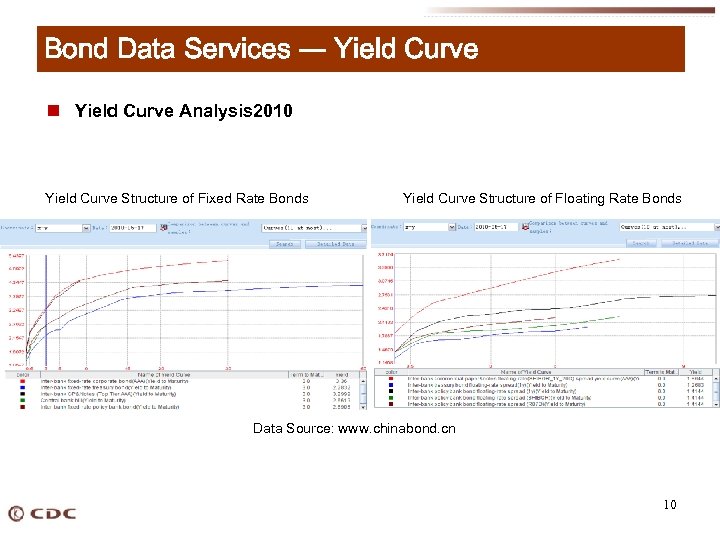

Bond Data Services --- Yield Curve n Yield Curve Analysis 2010 Fixed-rate Treasury Bond Yield Curve 15 BP Central bank bills yield curve 8 BP Fixed-rate Policy Bank Bond Yield Curve 10 BP Fixed-rate CP & Notes Yield curve 22 BP 29 BP Data Source: www. chinabond. cn

Bond Data Services --- Yield Curve n Yield Curve Analysis 2010 Yield Curve Structure of Fixed Rate Bonds Yield Curve Structure of Floating Rate Bonds Data Source: www. chinabond. cn 10

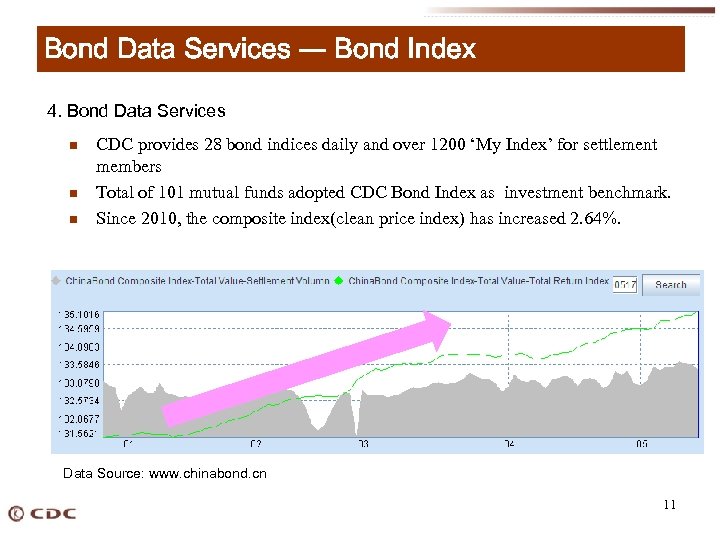

Bond Data Services --- Bond Index 4. Bond Data Services n n n CDC provides 28 bond indices daily and over 1200 ‘My Index’ for settlement members Total of 101 mutual funds adopted CDC Bond Index as investment benchmark. Since 2010, the composite index(clean price index) has increased 2. 64%. Data Source: www. chinabond. cn 11

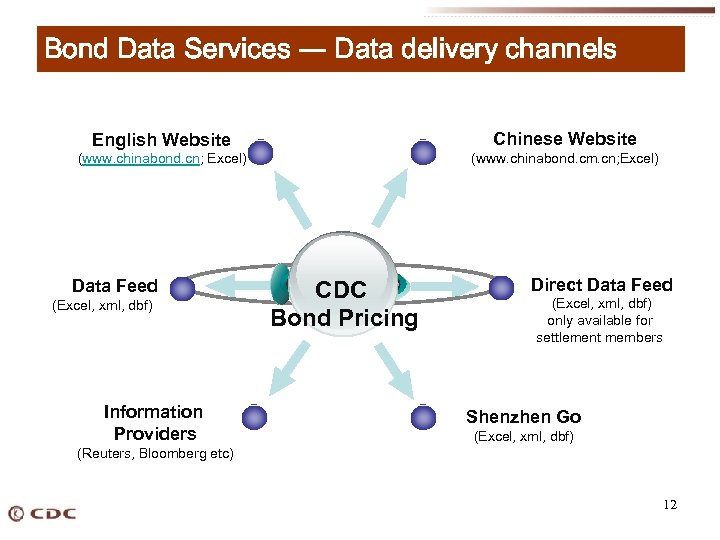

Bond Data Services --- Data delivery channels English Website Chinese Website (www. chinabond. cn; Excel) (www. chinabond. cm. cn; Excel) Data Feed (Excel, xml, dbf) Information Providers CDC Bond Pricing Direct Data Feed (Excel, xml, dbf) only available for settlement members Shenzhen Go (Excel, xml, dbf) (Reuters, Bloomberg etc) 12

Contents n Insight into Chinese Bond Market n Size and composition of Chinese Bond Market ü ü n China’s OTC Market at a Glance The RMB bond issuance and key characters The RMB bond deposit and key characters The RMB bond settlement and key characters China’s Bond Market Outlook 13

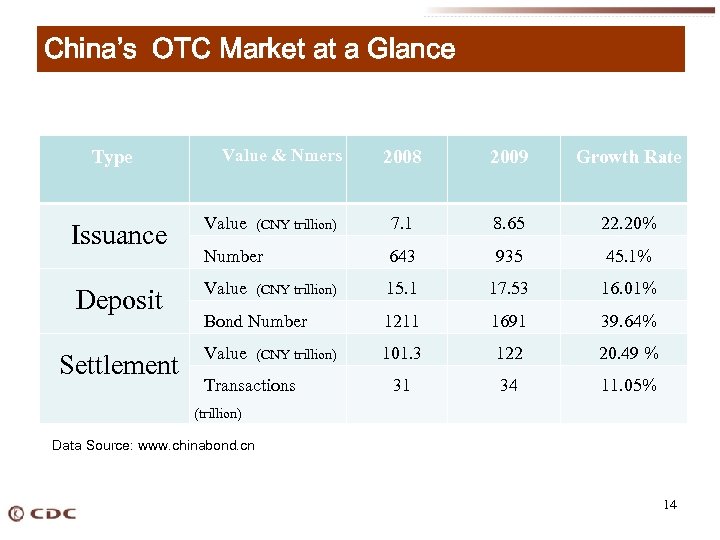

China’s OTC Market at a Glance Type Value & Nmers 2008 2009 Growth Rate 7. 1 8. 65 22. 20% Issuance Value Number 643 935 45. 1% Deposit Value 15. 1 17. 53 16. 01% Bond Number 1211 1691 39. 64% Settlement Value 101. 3 122 20. 49 % 31 34 11. 05% (CNY trillion) Transactions (trillion) Data Source: www. chinabond. cn 14

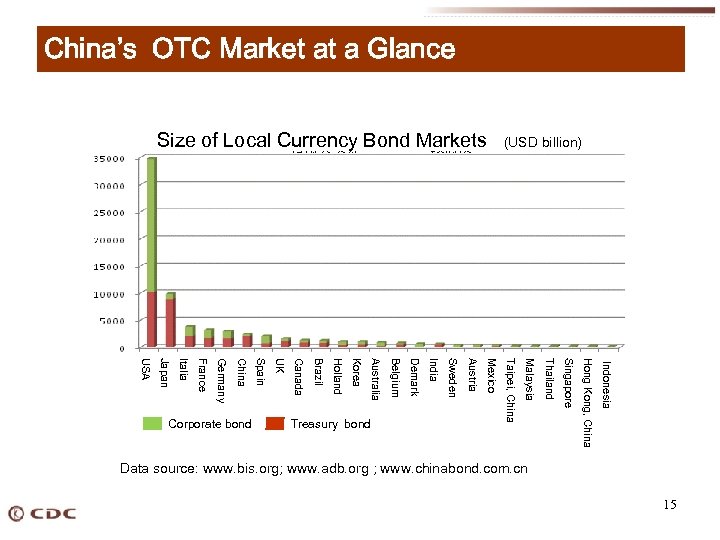

China’s OTC Market at a Glance Size of Local Currency Bond Markets (USD billion) Indonesia Hong Kong, China Singapore Thailand Malaysia Taipei, China Mexico Austria Sweden India Demark Treasury bond Belgium Australia Korea Holland Brazil Canada UK Spain China Germany France Italia Japan USA Corporate bond Data source: www. bis. org; www. adb. org ; www. chinabond. com. cn 15

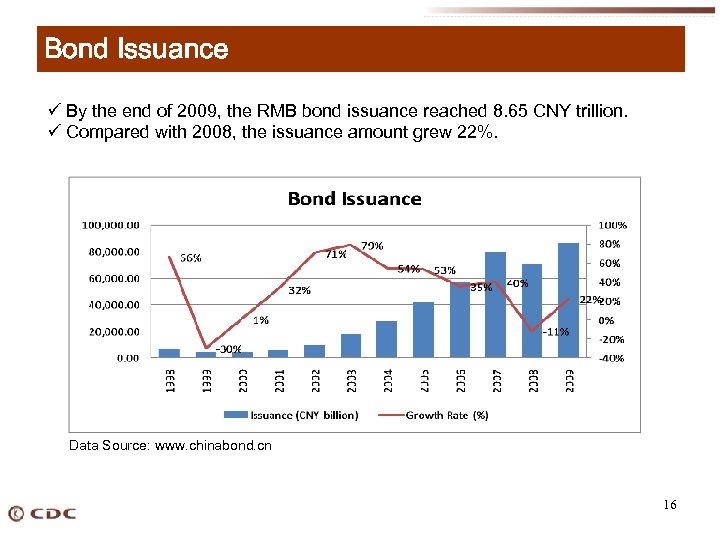

Bond Issuance ü By the end of 2009, the RMB bond issuance reached 8. 65 CNY trillion. ü Compared with 2008, the issuance amount grew 22%. Data Source: www. chinabond. cn 16

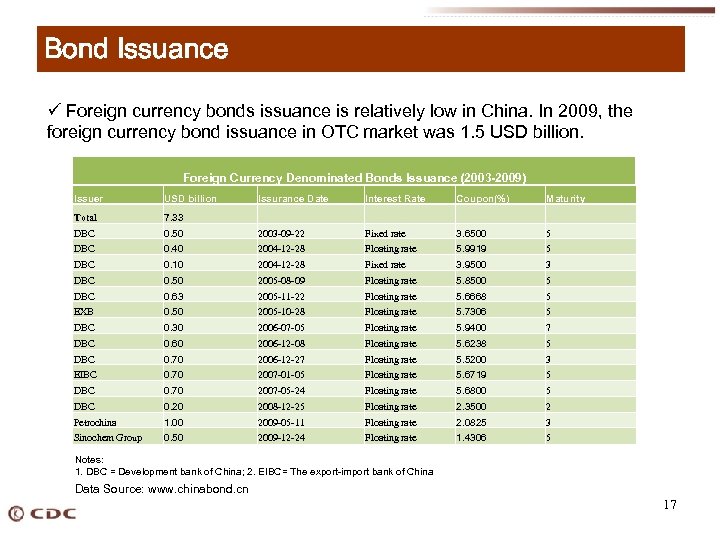

Bond Issuance ü Foreign currency bonds issuance is relatively low in China. In 2009, the foreign currency bond issuance in OTC market was 1. 5 USD billion. Foreign Currency Denominated Bonds Issuance (2003 -2009) Issuer USD billion Issurance Date Interest Rate Coupon(%) Maturity Total 7. 33 DBC 0. 50 2003 -09 -22 Fixed rate 3. 6500 5 DBC 0. 40 2004 -12 -28 Floating rate 5. 9919 5 DBC 0. 10 2004 -12 -28 Fixed rate 3. 9500 3 DBC 0. 50 2005 -08 -09 Floating rate 5. 8500 5 DBC 0. 63 2005 -11 -22 Floating rate 5. 6668 5 EXB 0. 50 2005 -10 -28 Floating rate 5. 7306 5 DBC 0. 30 2006 -07 -05 Floating rate 5. 9400 7 DBC 0. 60 2006 -12 -08 Floating rate 5. 6238 5 DBC 0. 70 2006 -12 -27 Floating rate 5. 5200 3 EIBC 0. 70 2007 -01 -05 Floating rate 5. 6719 5 DBC 0. 70 2007 -05 -24 Floating rate 5. 6800 5 DBC 0. 20 2008 -12 -25 Floating rate 2. 3500 2 Petrochina 1. 00 2009 -05 -11 Floating rate 2. 0825 3 Sinochem Group 0. 50 2009 -12 -24 Floating rate 1. 4306 5 Notes: 1. DBC = Development bank of China; 2. EIBC= The export-import bank of China Data Source: www. chinabond. cn 17

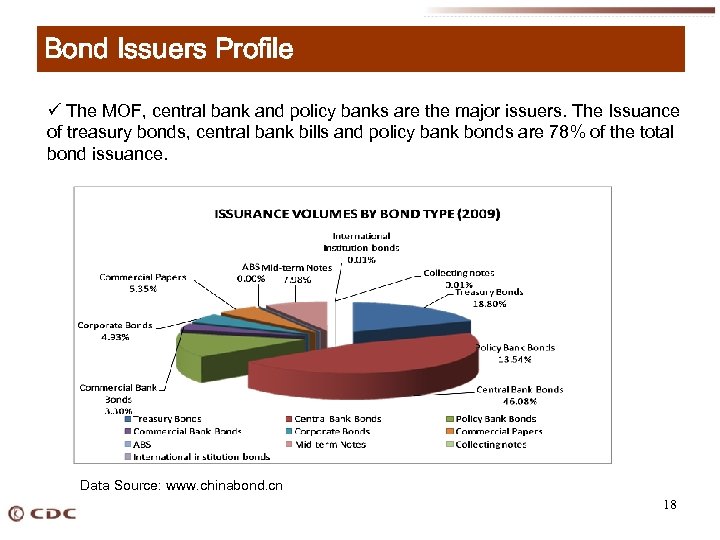

Bond Issuers Profile ü The MOF, central bank and policy banks are the major issuers. The Issuance of treasury bonds, central bank bills and policy bank bonds are 78% of the total bond issuance. Data Source: www. chinabond. cn 18

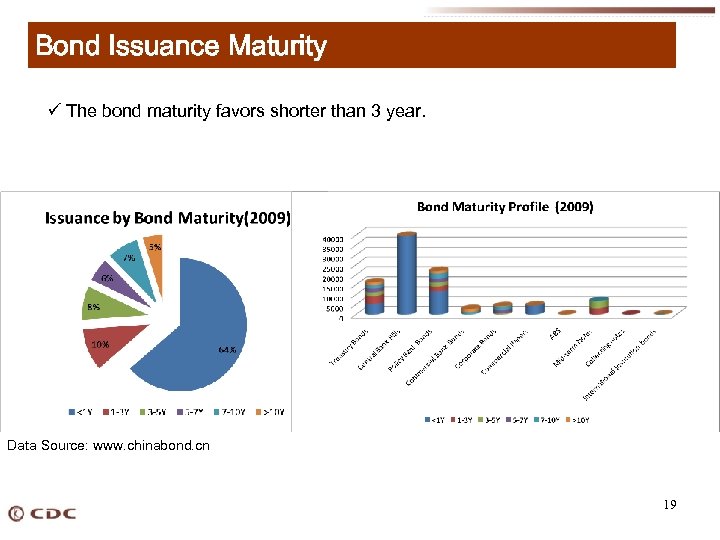

Bond Issuance Maturity ü The bond maturity favors shorter than 3 year. Data Source: www. chinabond. cn 19

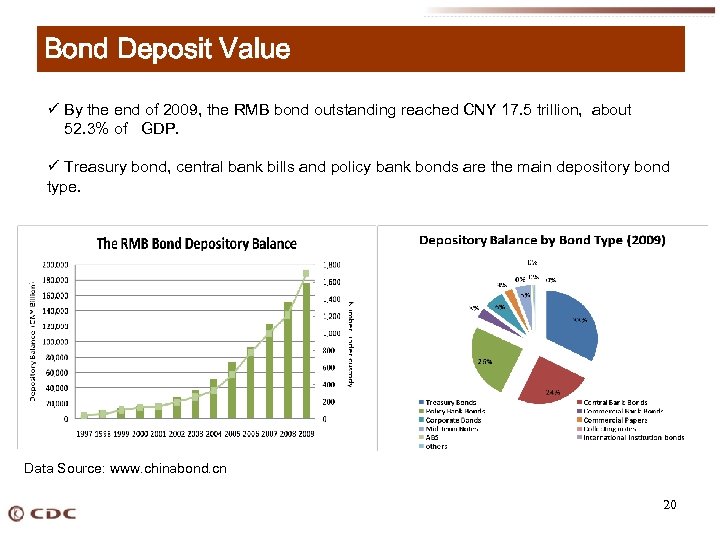

Bond Deposit Value ü By the end of 2009, the RMB bond outstanding reached CNY 17. 5 trillion, about 52. 3% of GDP. ü Treasury bond, central bank bills and policy bank bonds are the main depository bond type. Data Source: www. chinabond. cn 20

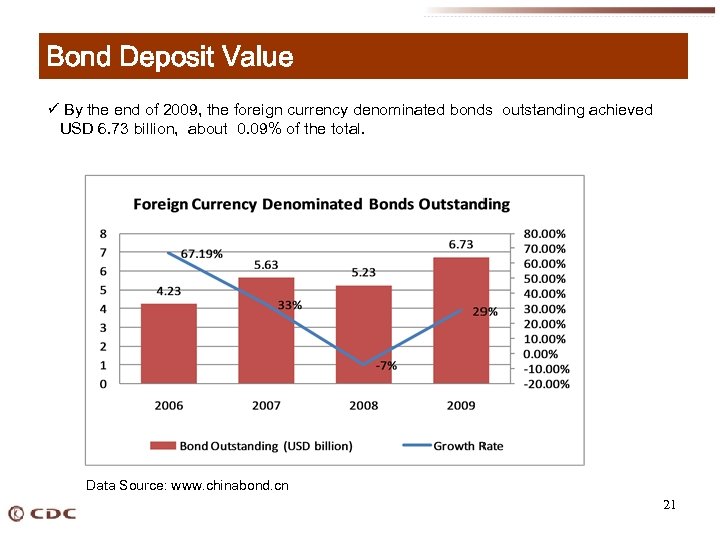

Bond Deposit Value ü By the end of 2009, the foreign currency denominated bonds outstanding achieved USD 6. 73 billion, about 0. 09% of the total. Data Source: www. chinabond. cn 21

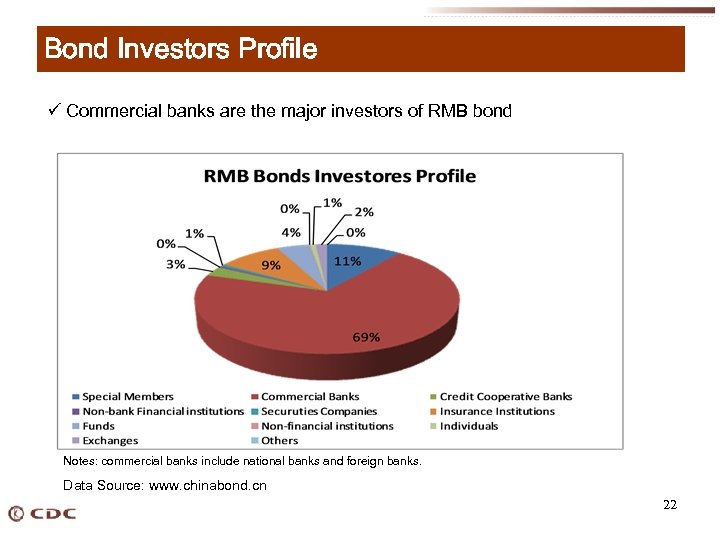

Bond Investors Profile ü Commercial banks are the major investors of RMB bond Notes: commercial banks include national banks and foreign banks. Data Source: www. chinabond. cn 22

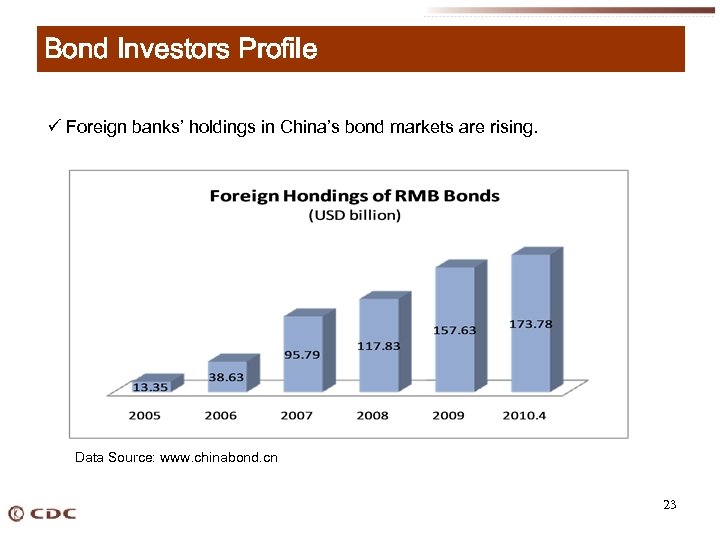

Bond Investors Profile ü Foreign banks’ holdings in China’s bond markets are rising. Data Source: www. chinabond. cn 23

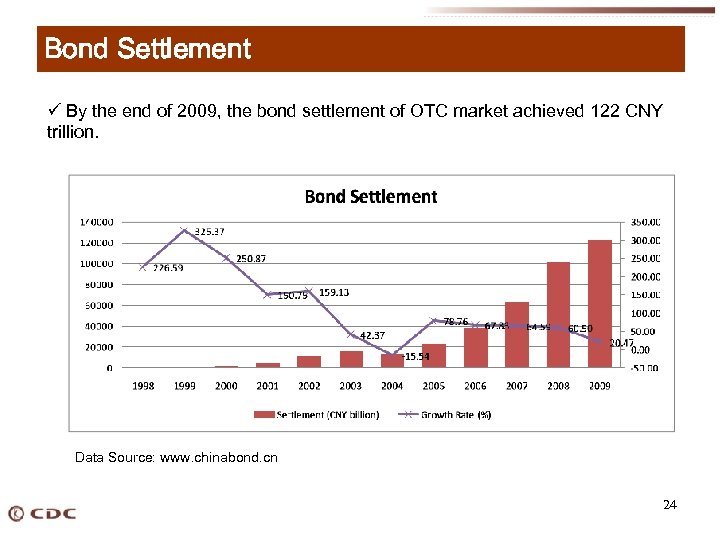

Bond Settlement ü By the end of 2009, the bond settlement of OTC market achieved 122 CNY trillion. Data Source: www. chinabond. cn 24

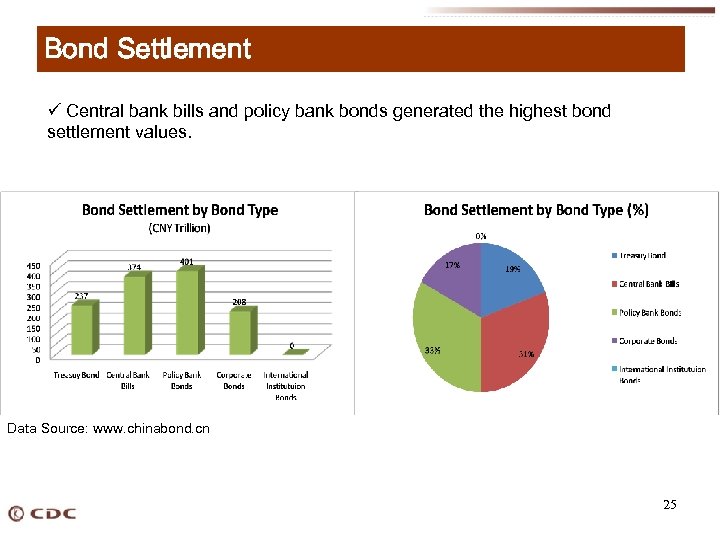

Bond Settlement ü Central bank bills and policy bank bonds generated the highest bond settlement values. Data Source: www. chinabond. cn 25

Contents n Insight into Chinese Bond Market n Size and composition of Chinese Bond Market n China’s Bond Market Outlook 26

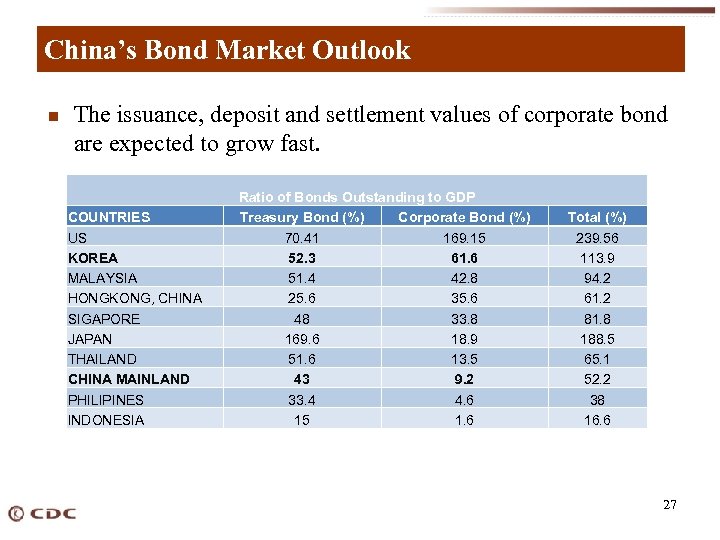

China’s Bond Market Outlook n The issuance, deposit and settlement values of corporate bond are expected to grow fast. COUNTRIES US KOREA MALAYSIA HONGKONG, CHINA SIGAPORE JAPAN THAILAND CHINA MAINLAND PHILIPINES INDONESIA Ratio of Bonds Outstanding to GDP Treasury Bond (%) Corporate Bond (%) 70. 41 169. 15 52. 3 61. 6 51. 4 42. 8 25. 6 35. 6 48 33. 8 169. 6 18. 9 51. 6 13. 5 43 9. 2 33. 4 4. 6 15 1. 6 Total (%) 239. 56 113. 9 94. 2 61. 2 81. 8 188. 5 65. 1 52. 2 38 16. 6 27

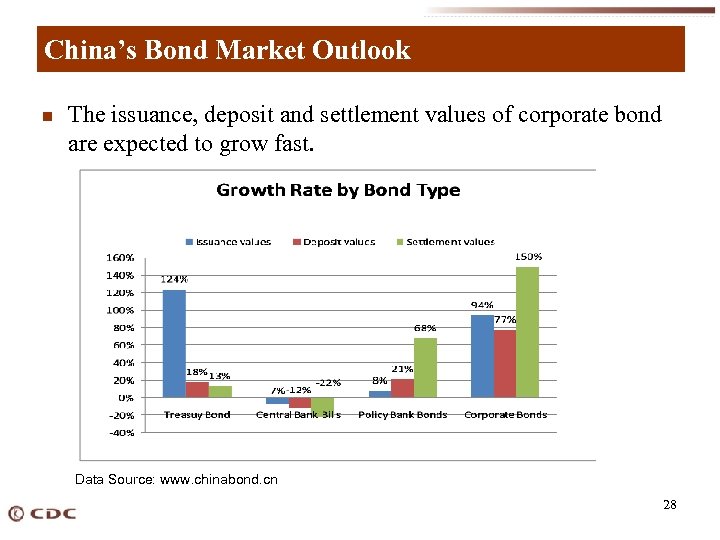

China’s Bond Market Outlook n The issuance, deposit and settlement values of corporate bond are expected to grow fast. Data Source: www. chinabond. cn 28

China’s Bond Market Outlook n The number of non-legal representative investors are expected to increase. ü Since 2007, the central bank has permitted supplementary pension, insurance products, trust units and asset management plans to open account in the OTC market. ü In 2009, the OTC market increased 941 investors, and the number of increased non-legal representative investors are 525(55. 8%). 29

China’s Bond Market Outlook n To allow qualified foreign investors to invest in the Chinese inter-bank bond market. n To allow qualified foreign institutions to issue RMB bonds in China, such as the South Korean Government. n To regulate the credit rating system, allowing investors to choose bond credit rating agencies by voting on www. chinabond. com. cn. 30

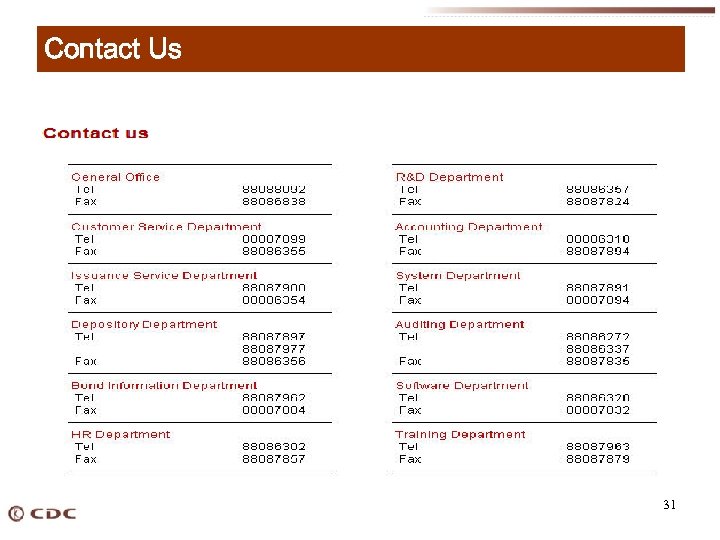

Contact Us 31

Thank You! Ling Zhao China Government Securities Depository Trust& Clearing Co. , Ltd Bond Information Department Tel: 0086 -10 -88086344 Fax: 0086 -10 -88087884 Add:Floor 5 Building B, Tongtai Mansion, No. 33 Financial Street, Beijing MSN: zhaoling 20@hotmail. com Email: zhaoling@chindbond. com. cn 32

3b4192aa7605a2e79e2c26ffcec7c3c6.ppt