89775d34ab23cc95acccb23a379e73ae.ppt

- Количество слайдов: 19

China Foods Limited (00506. HK) 2009 Interim Results Announcement 11 September 2009 1

China Foods Limited (00506. HK) 2009 Interim Results Announcement 11 September 2009 1

Disclaimer The slides herein are prepared by China Foods Limited (the "Company") solely to be used as a support for oral discussions of its interim results for the year 2009. They may not be distributed, reproduced or redistributed or passed on, directly or indirectly, to any person, in whole or in part, for any purpose. By participating in this presentation, you agree to be bound by the forgoing restrictions. Any failure to comply with these restrictions may constitute a violation of applicable laws and regulations. The information contained in this presentation does not constitute or form part of any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities nor shall it or any part of it form the basis for or be relied on in connection with any contract or commitment whatsoever. This presentation may contain forward-looking statements. Prospective investors are cautioned that actual results may differ materially from those set forth in any forward-looking statements herein. The information contained in these slides herein has not been independently verified. No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of any information or opinion contained herein. The information contained in these slides should be considered in the context of the circumstances prevailing at the time and has not been, and will not be, updated to reflect material developments which may occur after the date of the presentation. None of the Company, or any of their respective directors, officers, employees, agents or advisers shall be in any way responsible for the contents hereof, or shall be liable for any loss arising from use of the information contained in these slides herein or otherwise arising in connection therewith. 2

Disclaimer The slides herein are prepared by China Foods Limited (the "Company") solely to be used as a support for oral discussions of its interim results for the year 2009. They may not be distributed, reproduced or redistributed or passed on, directly or indirectly, to any person, in whole or in part, for any purpose. By participating in this presentation, you agree to be bound by the forgoing restrictions. Any failure to comply with these restrictions may constitute a violation of applicable laws and regulations. The information contained in this presentation does not constitute or form part of any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities nor shall it or any part of it form the basis for or be relied on in connection with any contract or commitment whatsoever. This presentation may contain forward-looking statements. Prospective investors are cautioned that actual results may differ materially from those set forth in any forward-looking statements herein. The information contained in these slides herein has not been independently verified. No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of any information or opinion contained herein. The information contained in these slides should be considered in the context of the circumstances prevailing at the time and has not been, and will not be, updated to reflect material developments which may occur after the date of the presentation. None of the Company, or any of their respective directors, officers, employees, agents or advisers shall be in any way responsible for the contents hereof, or shall be liable for any loss arising from use of the information contained in these slides herein or otherwise arising in connection therewith. 2

Contents l 2009 Interim Financial Performance l 2009 Interim Business Review and Analysis 3

Contents l 2009 Interim Financial Performance l 2009 Interim Business Review and Analysis 3

China Foods Limited (00506. HK) 2009 Interim Financial Performance 4

China Foods Limited (00506. HK) 2009 Interim Financial Performance 4

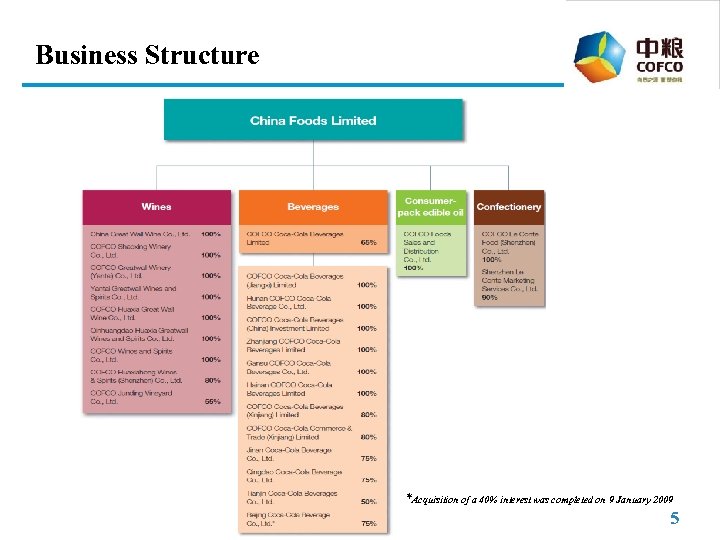

Business Structure *Acquisition of a 40% interest was completed on 9 January 2009 5

Business Structure *Acquisition of a 40% interest was completed on 9 January 2009 5

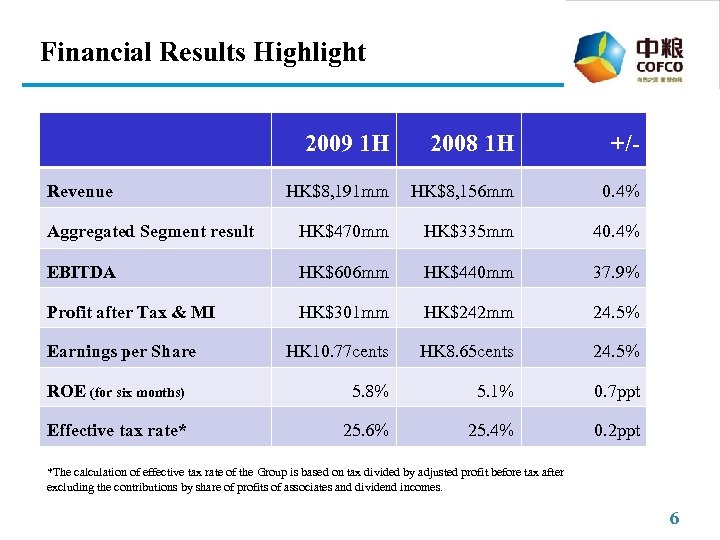

Financial Results Highlight 2009 1 H 2008 1 H +/- HK$8, 191 mm HK$8, 156 mm 0. 4% Aggregated Segment result HK$470 mm HK$335 mm 40. 4% EBITDA HK$606 mm HK$440 mm 37. 9% Profit after Tax & MI HK$301 mm HK$242 mm 24. 5% HK 10. 77 cents HK 8. 65 cents 24. 5% ROE (for six months) 5. 8% 5. 1% 0. 7 ppt Effective tax rate* 25. 6% 25. 4% 0. 2 ppt Revenue Earnings per Share *The calculation of effective tax rate of the Group is based on tax divided by adjusted profit before tax after excluding the contributions by share of profits of associates and dividend incomes. 6

Financial Results Highlight 2009 1 H 2008 1 H +/- HK$8, 191 mm HK$8, 156 mm 0. 4% Aggregated Segment result HK$470 mm HK$335 mm 40. 4% EBITDA HK$606 mm HK$440 mm 37. 9% Profit after Tax & MI HK$301 mm HK$242 mm 24. 5% HK 10. 77 cents HK 8. 65 cents 24. 5% ROE (for six months) 5. 8% 5. 1% 0. 7 ppt Effective tax rate* 25. 6% 25. 4% 0. 2 ppt Revenue Earnings per Share *The calculation of effective tax rate of the Group is based on tax divided by adjusted profit before tax after excluding the contributions by share of profits of associates and dividend incomes. 6

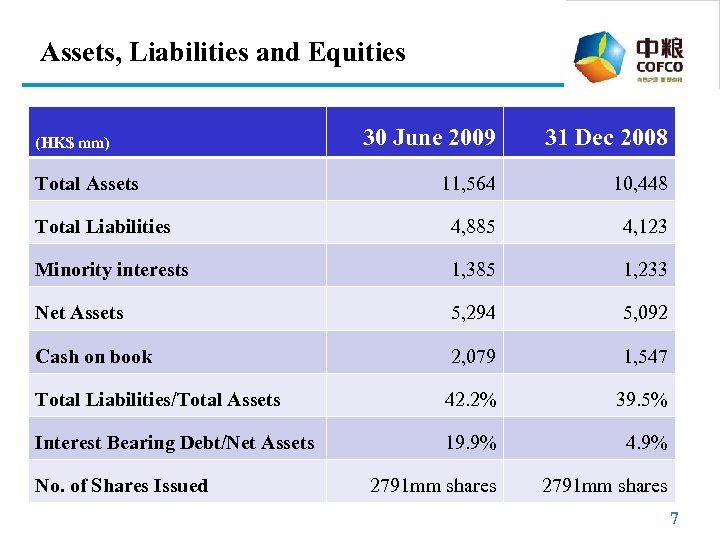

Assets, Liabilities and Equities 30 June 2009 31 Dec 2008 11, 564 10, 448 Total Liabilities 4, 885 4, 123 Minority interests 1, 385 1, 233 Net Assets 5, 294 5, 092 Cash on book 2, 079 1, 547 Total Liabilities/Total Assets 42. 2% 39. 5% Interest Bearing Debt/Net Assets 19. 9% 4. 9% 2791 mm shares (HK$ mm) Total Assets No. of Shares Issued 7

Assets, Liabilities and Equities 30 June 2009 31 Dec 2008 11, 564 10, 448 Total Liabilities 4, 885 4, 123 Minority interests 1, 385 1, 233 Net Assets 5, 294 5, 092 Cash on book 2, 079 1, 547 Total Liabilities/Total Assets 42. 2% 39. 5% Interest Bearing Debt/Net Assets 19. 9% 4. 9% 2791 mm shares (HK$ mm) Total Assets No. of Shares Issued 7

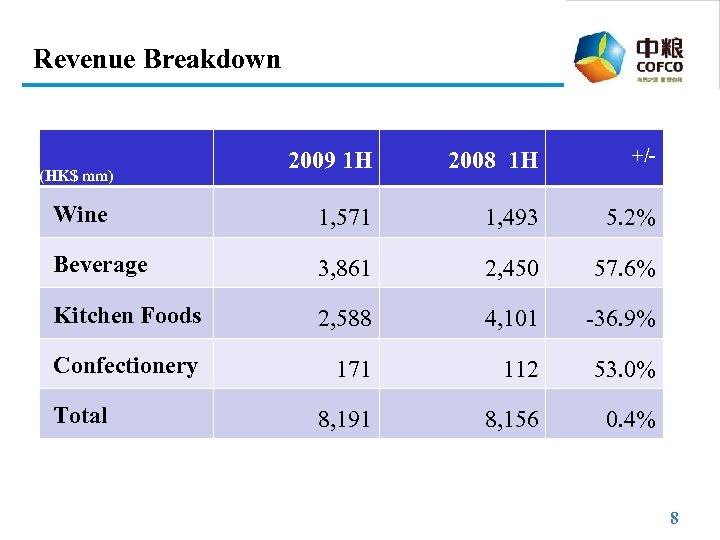

Revenue Breakdown (HK$ mm) 2008 2009 1 H +/-%2008 1 H 2007 +/- Wine 1, 571 1, 493 5. 2% Beverage 3, 861 2, 450 57. 6% Kitchen Foods 2, 588 4, 101 -36. 9% Confectionery 171 112 53. 0% 8, 191 8, 156 0. 4% Total 8

Revenue Breakdown (HK$ mm) 2008 2009 1 H +/-%2008 1 H 2007 +/- Wine 1, 571 1, 493 5. 2% Beverage 3, 861 2, 450 57. 6% Kitchen Foods 2, 588 4, 101 -36. 9% Confectionery 171 112 53. 0% 8, 191 8, 156 0. 4% Total 8

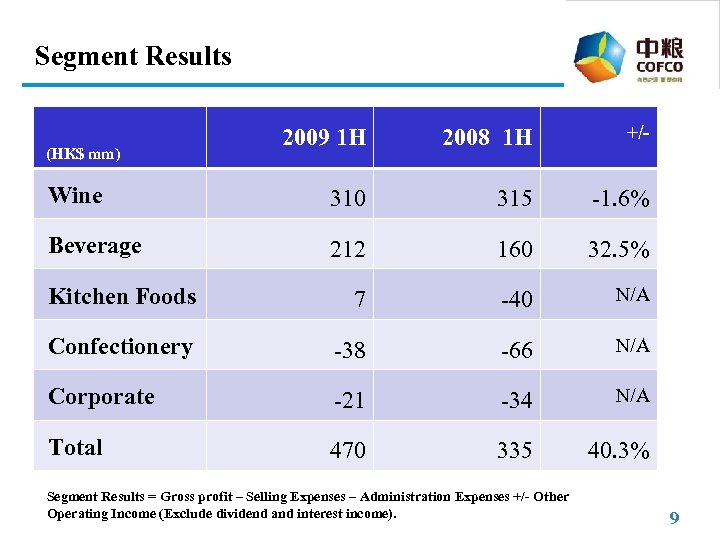

Segment Results 2009 1 H 2008 1 H +/- Wine 310 315 -1. 6% Beverage 212 160 32. 5% Kitchen Foods 7 -40 N/A Confectionery -38 -66 N/A Corporate -21 -34 N/A Total 470 335 40. 3% (HK$ mm) Segment Results = Gross profit – Selling Expenses – Administration Expenses +/- Other Operating Income (Exclude dividend and interest income). 9

Segment Results 2009 1 H 2008 1 H +/- Wine 310 315 -1. 6% Beverage 212 160 32. 5% Kitchen Foods 7 -40 N/A Confectionery -38 -66 N/A Corporate -21 -34 N/A Total 470 335 40. 3% (HK$ mm) Segment Results = Gross profit – Selling Expenses – Administration Expenses +/- Other Operating Income (Exclude dividend and interest income). 9

China Foods Limited (00506. HK) 2009 Interim Business Review and Analysis 10

China Foods Limited (00506. HK) 2009 Interim Business Review and Analysis 10

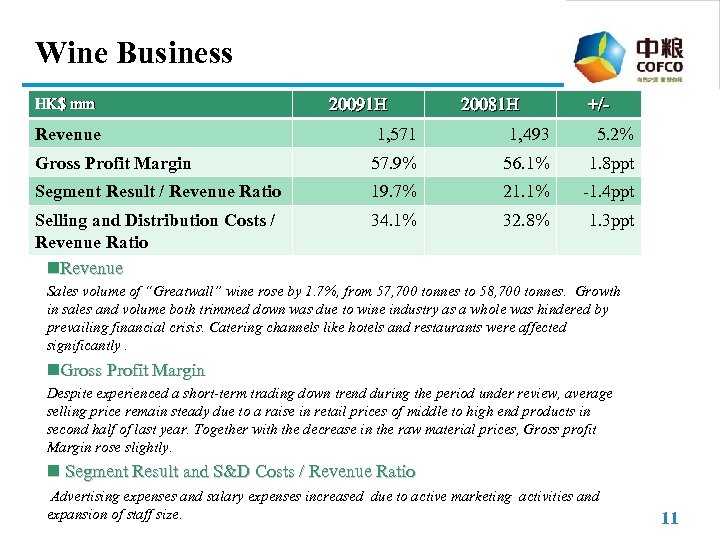

Wine Business HK$ mm Revenue 20091 H 20081 H +/- 1, 571 1, 493 5. 2% Gross Profit Margin 57. 9% 56. 1% 1. 8 ppt Segment Result / Revenue Ratio 19. 7% 21. 1% -1. 4 ppt Selling and Distribution Costs / Revenue Ratio n. Revenue 34. 1% 32. 8% 1. 3 ppt Sales volume of “Greatwall” wine rose by 1. 7%, from 57, 700 tonnes to 58, 700 tonnes. Growth in sales and volume both trimmed down was due to wine industry as a whole was hindered by prevailing financial crisis. Catering channels like hotels and restaurants were affected significantly. n. Gross Profit Margin Despite experienced a short-term trading down trend during the period under review, average selling price remain steady due to a raise in retail prices of middle to high end products in second half of last year. Together with the decrease in the raw material prices, Gross profit Margin rose slightly. n Segment Result and S&D Costs / Revenue Ratio Advertising expenses and salary expenses increased due to active marketing activities and expansion of staff size. 11

Wine Business HK$ mm Revenue 20091 H 20081 H +/- 1, 571 1, 493 5. 2% Gross Profit Margin 57. 9% 56. 1% 1. 8 ppt Segment Result / Revenue Ratio 19. 7% 21. 1% -1. 4 ppt Selling and Distribution Costs / Revenue Ratio n. Revenue 34. 1% 32. 8% 1. 3 ppt Sales volume of “Greatwall” wine rose by 1. 7%, from 57, 700 tonnes to 58, 700 tonnes. Growth in sales and volume both trimmed down was due to wine industry as a whole was hindered by prevailing financial crisis. Catering channels like hotels and restaurants were affected significantly. n. Gross Profit Margin Despite experienced a short-term trading down trend during the period under review, average selling price remain steady due to a raise in retail prices of middle to high end products in second half of last year. Together with the decrease in the raw material prices, Gross profit Margin rose slightly. n Segment Result and S&D Costs / Revenue Ratio Advertising expenses and salary expenses increased due to active marketing activities and expansion of staff size. 11

Wine Business (Cont’) n. Sales of non-traditional regions outperforming Industry output ever reported a negative growth in the first four months of 2009. However, given that “Greatwall” has a National distribution sales network, the drop in sales along the coastal areas was off set by the promising growth in certain non-traditional regions like the Central, Southwestern and Northern China. n. Demand likely bottomed out Latest industry statistics suggested that the ultimate consumption demand of wine appears to have bottomed out. Sales volume of “Greatwall” wine is expected to pick up and grow vigorously again in the second half of the year. nplanning to built new facilities in Ningxia the company is planning to build vineyard and winery in Ningxia Hui Autonomous Region. n. Focus on high-end wine promotion to enhance brand image In view of further promoting the brand awareness and customers loyalty, We began to advertise Chateau Sungod on CCTV in July. Our Chateau Junding range will also be promoted as a high quality, prestige brand targeting consumers with high disposable income through an exclusive club membership initiative. n. Shaoxing wine business perform well Company stood out from its peers by recording a 46% turnover growth over the same period of 12 previous year.

Wine Business (Cont’) n. Sales of non-traditional regions outperforming Industry output ever reported a negative growth in the first four months of 2009. However, given that “Greatwall” has a National distribution sales network, the drop in sales along the coastal areas was off set by the promising growth in certain non-traditional regions like the Central, Southwestern and Northern China. n. Demand likely bottomed out Latest industry statistics suggested that the ultimate consumption demand of wine appears to have bottomed out. Sales volume of “Greatwall” wine is expected to pick up and grow vigorously again in the second half of the year. nplanning to built new facilities in Ningxia the company is planning to build vineyard and winery in Ningxia Hui Autonomous Region. n. Focus on high-end wine promotion to enhance brand image In view of further promoting the brand awareness and customers loyalty, We began to advertise Chateau Sungod on CCTV in July. Our Chateau Junding range will also be promoted as a high quality, prestige brand targeting consumers with high disposable income through an exclusive club membership initiative. n. Shaoxing wine business perform well Company stood out from its peers by recording a 46% turnover growth over the same period of 12 previous year.

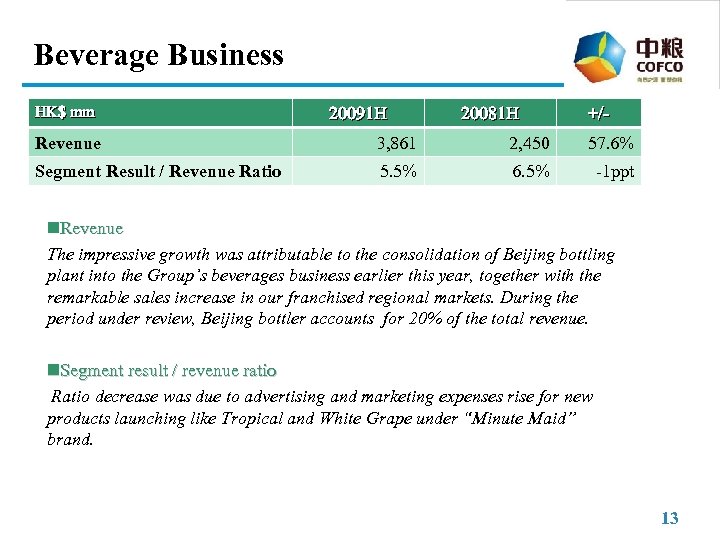

Beverage Business HK$ mm 20091 H 20081 H +/- Revenue 3, 861 2, 450 57. 6% Segment Result / Revenue Ratio 5. 5% 6. 5% -1 ppt n. Revenue The impressive growth was attributable to the consolidation of Beijing bottling plant into the Group’s beverages business earlier this year, together with the remarkable sales increase in our franchised regional markets. During the period under review, Beijing bottler accounts for 20% of the total revenue. n. Segment result / revenue ratio Ratio decrease was due to advertising and marketing expenses rise for new products launching like Tropical and White Grape under “Minute Maid” brand. 13

Beverage Business HK$ mm 20091 H 20081 H +/- Revenue 3, 861 2, 450 57. 6% Segment Result / Revenue Ratio 5. 5% 6. 5% -1 ppt n. Revenue The impressive growth was attributable to the consolidation of Beijing bottling plant into the Group’s beverages business earlier this year, together with the remarkable sales increase in our franchised regional markets. During the period under review, Beijing bottler accounts for 20% of the total revenue. n. Segment result / revenue ratio Ratio decrease was due to advertising and marketing expenses rise for new products launching like Tropical and White Grape under “Minute Maid” brand. 13

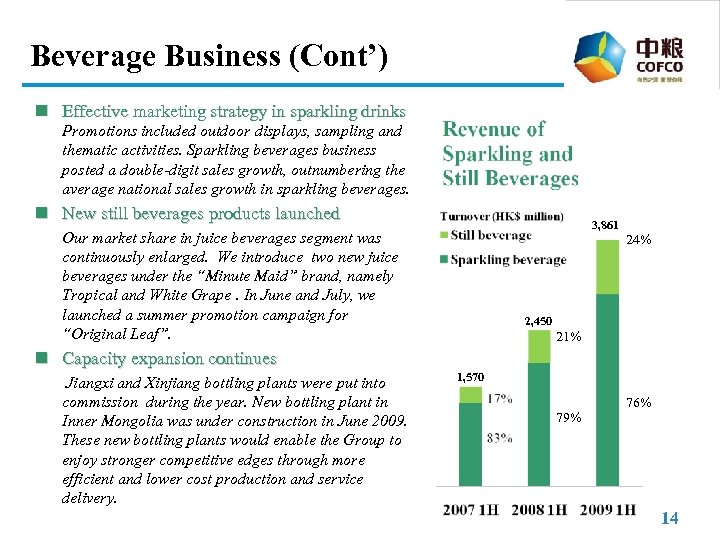

Beverage Business (Cont’) n Effective marketing strategy in sparkling drinks Promotions included outdoor displays, sampling and thematic activities. Sparkling beverages business posted a double-digit sales growth, outnumbering the average national sales growth in sparkling beverages. n New still beverages products launched 3, 861 Our market share in juice beverages segment was continuously enlarged. We introduce two new juice beverages under the “Minute Maid” brand, namely Tropical and White Grape. In June and July, we launched a summer promotion campaign for “Original Leaf”. 24% 2, 450 21% n Capacity expansion continues Jiangxi and Xinjiang bottling plants were put into commission during the year. New bottling plant in Inner Mongolia was under construction in June 2009. These new bottling plants would enable the Group to enjoy stronger competitive edges through more efficient and lower cost production and service delivery. 1, 570 79% 76% 14

Beverage Business (Cont’) n Effective marketing strategy in sparkling drinks Promotions included outdoor displays, sampling and thematic activities. Sparkling beverages business posted a double-digit sales growth, outnumbering the average national sales growth in sparkling beverages. n New still beverages products launched 3, 861 Our market share in juice beverages segment was continuously enlarged. We introduce two new juice beverages under the “Minute Maid” brand, namely Tropical and White Grape. In June and July, we launched a summer promotion campaign for “Original Leaf”. 24% 2, 450 21% n Capacity expansion continues Jiangxi and Xinjiang bottling plants were put into commission during the year. New bottling plant in Inner Mongolia was under construction in June 2009. These new bottling plants would enable the Group to enjoy stronger competitive edges through more efficient and lower cost production and service delivery. 1, 570 79% 76% 14

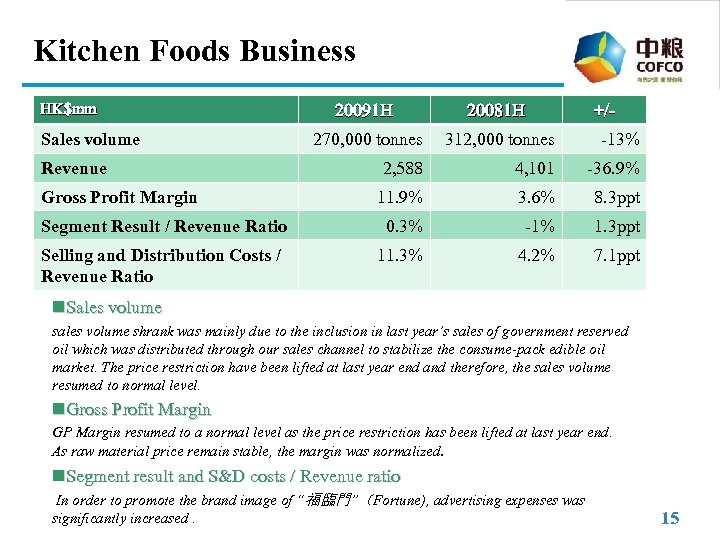

Kitchen Foods Business HK$mm 20091 H 20081 H 270, 000 tonnes 312, 000 tonnes -13% 2, 588 4, 101 -36. 9% 11. 9% 3. 6% 8. 3 ppt Segment Result / Revenue Ratio 0. 3% -1% 1. 3 ppt Selling and Distribution Costs / Revenue Ratio 11. 3% 4. 2% 7. 1 ppt Sales volume Revenue Gross Profit Margin +/- n. Sales volume shrank was mainly due to the inclusion in last year’s sales of government reserved oil which was distributed through our sales channel to stabilize the consume-pack edible oil market. The price restriction have been lifted at last year end and therefore, the sales volume resumed to normal level. n. Gross Profit Margin GP Margin resumed to a normal level as the price restriction has been lifted at last year end. As raw material price remain stable, the margin was normalized. n. Segment result and S&D costs / Revenue ratio In order to promote the brand image of “福臨門”(Fortune), advertising expenses was significantly increased. 15

Kitchen Foods Business HK$mm 20091 H 20081 H 270, 000 tonnes 312, 000 tonnes -13% 2, 588 4, 101 -36. 9% 11. 9% 3. 6% 8. 3 ppt Segment Result / Revenue Ratio 0. 3% -1% 1. 3 ppt Selling and Distribution Costs / Revenue Ratio 11. 3% 4. 2% 7. 1 ppt Sales volume Revenue Gross Profit Margin +/- n. Sales volume shrank was mainly due to the inclusion in last year’s sales of government reserved oil which was distributed through our sales channel to stabilize the consume-pack edible oil market. The price restriction have been lifted at last year end and therefore, the sales volume resumed to normal level. n. Gross Profit Margin GP Margin resumed to a normal level as the price restriction has been lifted at last year end. As raw material price remain stable, the margin was normalized. n. Segment result and S&D costs / Revenue ratio In order to promote the brand image of “福臨門”(Fortune), advertising expenses was significantly increased. 15

Kitchen Foods Business (Cont’) n. Premium range products sales grew faster Premium range products with 20% average gross margin such as peanut oil, corn oil and sunflower oil grew at a faster pace. The percentage of premium range products of the total sales turnover was 42. 2%. n. Seasoning sauces sales experienced a vigorous growth Sales volume of seasoning sauces reached 922 tonnes. The sales turnover HK$19. 73 million was more than triple that of last year’s corresponding figure. In the later half of the year, we are continuing to explore new sales channel to improve our market penetration. l. Well positioned to expand our presence in Northern regions The composite production base in Tianjin (中糧集團天津糧油綜合生產基地), developed and owned by COFCO, our parent company, is expected to be completed by the end of 2010. It will be equipped with a processing capability of 1. 6 million tonnes of edible oil. The group is thus in a better positioned to expand our presence into the markets of Northeastern and Northern China. l. New products development and promotion A new type corn oil which is helpful to reduce the cholesterol has been developed in the first half of the year and was launched to the market at July. we target to be the industry standard and market leader in corn oil segment. 16

Kitchen Foods Business (Cont’) n. Premium range products sales grew faster Premium range products with 20% average gross margin such as peanut oil, corn oil and sunflower oil grew at a faster pace. The percentage of premium range products of the total sales turnover was 42. 2%. n. Seasoning sauces sales experienced a vigorous growth Sales volume of seasoning sauces reached 922 tonnes. The sales turnover HK$19. 73 million was more than triple that of last year’s corresponding figure. In the later half of the year, we are continuing to explore new sales channel to improve our market penetration. l. Well positioned to expand our presence in Northern regions The composite production base in Tianjin (中糧集團天津糧油綜合生產基地), developed and owned by COFCO, our parent company, is expected to be completed by the end of 2010. It will be equipped with a processing capability of 1. 6 million tonnes of edible oil. The group is thus in a better positioned to expand our presence into the markets of Northeastern and Northern China. l. New products development and promotion A new type corn oil which is helpful to reduce the cholesterol has been developed in the first half of the year and was launched to the market at July. we target to be the industry standard and market leader in corn oil segment. 16

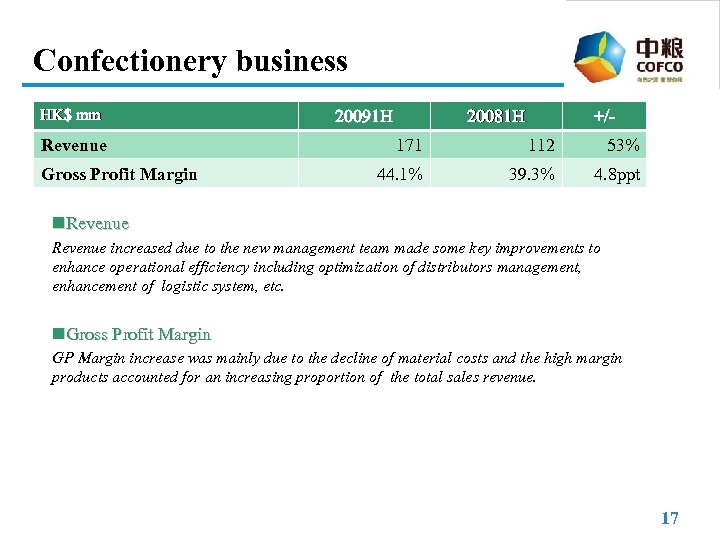

Confectionery business HK$ mm Revenue Gross Profit Margin 20091 H 20081 H +/- 171 112 53% 44. 1% 39. 3% 4. 8 ppt n. Revenue increased due to the new management team made some key improvements to enhance operational efficiency including optimization of distributors management, enhancement of logistic system, etc. n. Gross Profit Margin GP Margin increase was mainly due to the decline of material costs and the high margin products accounted for an increasing proportion of the total sales revenue. 17

Confectionery business HK$ mm Revenue Gross Profit Margin 20091 H 20081 H +/- 171 112 53% 44. 1% 39. 3% 4. 8 ppt n. Revenue increased due to the new management team made some key improvements to enhance operational efficiency including optimization of distributors management, enhancement of logistic system, etc. n. Gross Profit Margin GP Margin increase was mainly due to the decline of material costs and the high margin products accounted for an increasing proportion of the total sales revenue. 17

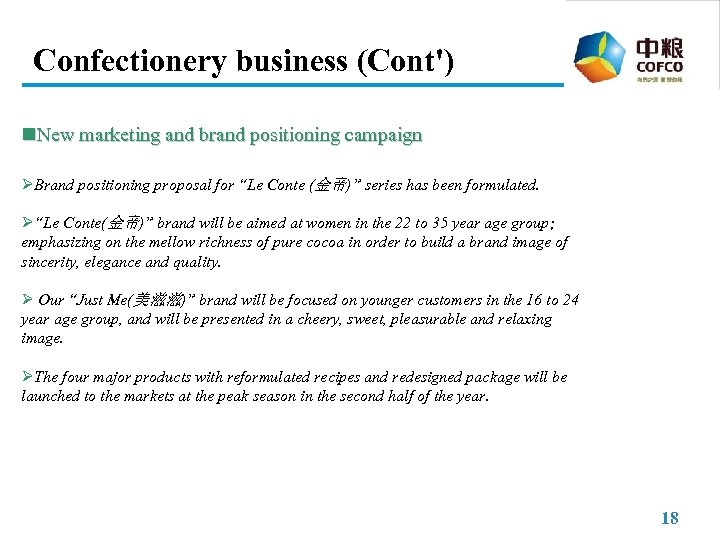

Confectionery business (Cont') n. New marketing and brand positioning campaign ØBrand positioning proposal for “Le Conte (金帝)” series has been formulated. Ø“Le Conte(金帝)” brand will be aimed at women in the 22 to 35 year age group; emphasizing on the mellow richness of pure cocoa in order to build a brand image of sincerity, elegance and quality. Ø Our “Just Me(美滋滋)” brand will be focused on younger customers in the 16 to 24 year age group, and will be presented in a cheery, sweet, pleasurable and relaxing image. ØThe four major products with reformulated recipes and redesigned package will be launched to the markets at the peak season in the second half of the year. 18

Confectionery business (Cont') n. New marketing and brand positioning campaign ØBrand positioning proposal for “Le Conte (金帝)” series has been formulated. Ø“Le Conte(金帝)” brand will be aimed at women in the 22 to 35 year age group; emphasizing on the mellow richness of pure cocoa in order to build a brand image of sincerity, elegance and quality. Ø Our “Just Me(美滋滋)” brand will be focused on younger customers in the 16 to 24 year age group, and will be presented in a cheery, sweet, pleasurable and relaxing image. ØThe four major products with reformulated recipes and redesigned package will be launched to the markets at the peak season in the second half of the year. 18

Thank you! 19

Thank you! 19