PPT CIE ENGLISH.PPTX

- Количество слайдов: 19

Chile: business environment and investment opportunities Matías Mori Arellano Executive Vice-president Foreign Investment Committee

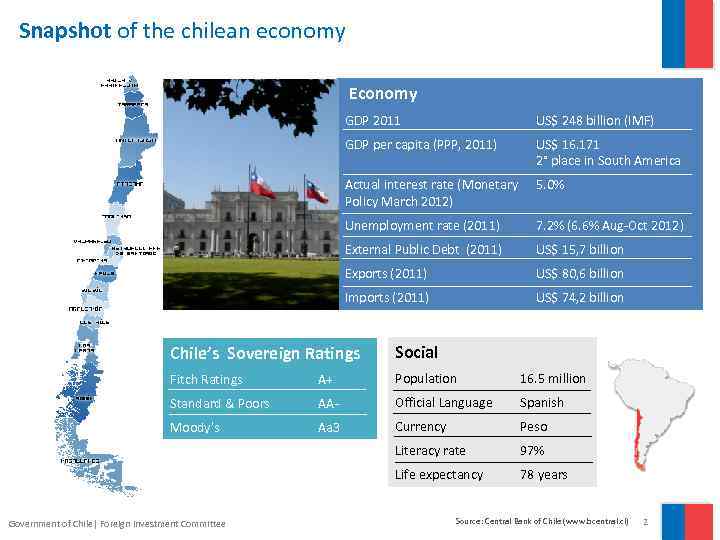

Snapshot of the chilean economy Economy GDP 2011 US$ 248 billion (IMF) GDP per capita (PPP, 2011) US$ 16. 171 2° place in South America Actual interest rate (Monetary Policy March 2012) 5. 0% Unemployment rate (2011) 7. 2% (6. 6% Aug-Oct 2012) External Public Debt (2011) US$ 15, 7 billion Exports (2011) US$ 80, 6 billion Imports (2011) US$ 74, 2 billion Chile’s Sovereign Ratings Social Fitch Ratings A+ Population 16. 5 million Standard & Poors AA- Official Language Spanish Moody’s Aa 3 Currency Peso Literacy rate 97% Life expectancy 78 years Government of Chile| Foreign Investment Committee Source: Central Bank of Chile (www. bcentral. cl) 2

§ The best place to invest

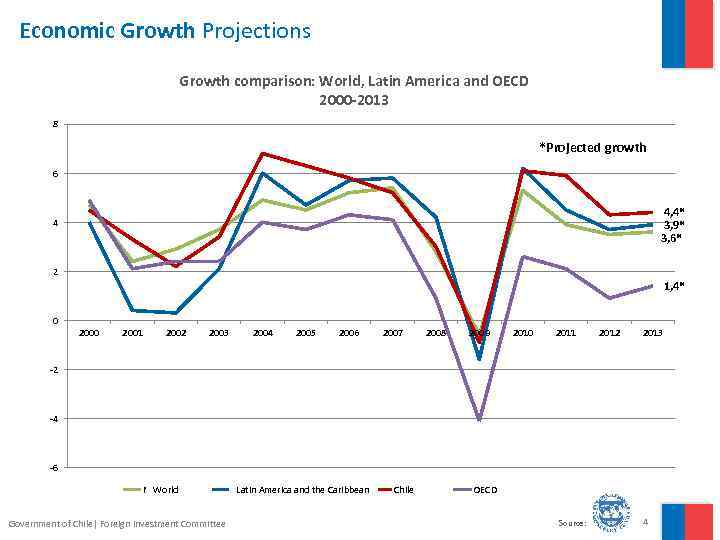

Economic Growth Projections Growth comparison: World, Latin America and OECD 2000 -2013 8 *Projected growth 6 4, 4* 3, 9* 3, 6* 4 2 1, 4* 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 -2 -4 -6 World Mundo Government of Chile| Foreign Investment Committee Latin America and the Caribbean Latinoamérica y el Caribe Chile OECD Source: 4

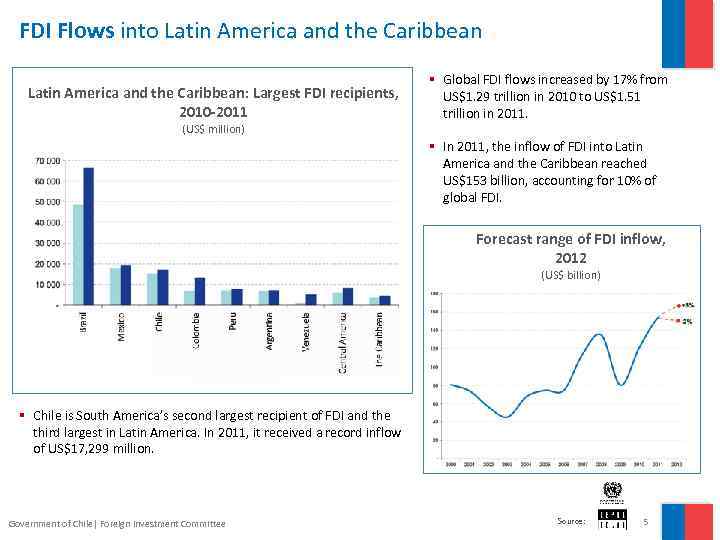

FDI Flows into Latin America and the Caribbean: Largest FDI recipients, 2010 -2011 (US$ million) § Global FDI flows increased by 17% from US$1. 29 trillion in 2010 to US$1. 51 trillion in 2011. § In 2011, the inflow of FDI into Latin America and the Caribbean reached US$153 billion, accounting for 10% of global FDI. Forecast range of FDI inflow, 2012 (US$ billion) § Chile is South America’s second largest recipient of FDI and the third largest in Latin America. In 2011, it received a record inflow of US$17, 299 million. Government of Chile| Foreign Investment Committee Source: 5

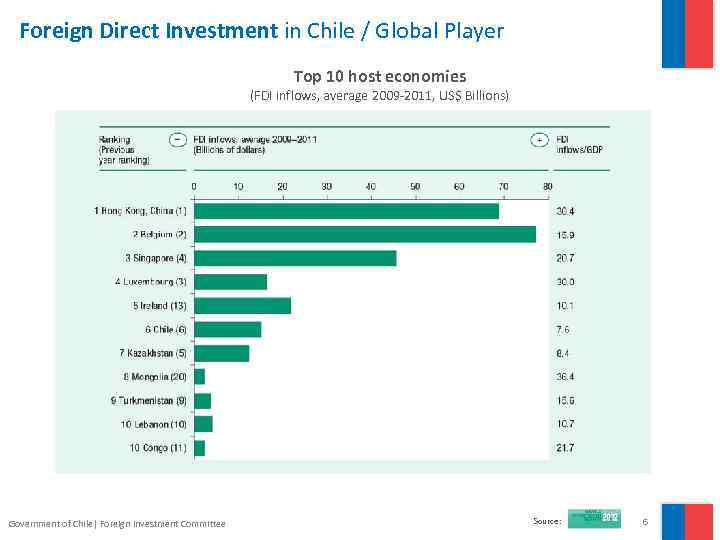

Foreign Direct Investment in Chile / Global Player Top 10 host economies (FDI inflows, average 2009 -2011, US$ Billions) Government of Chile| Foreign Investment Committee Source: 6

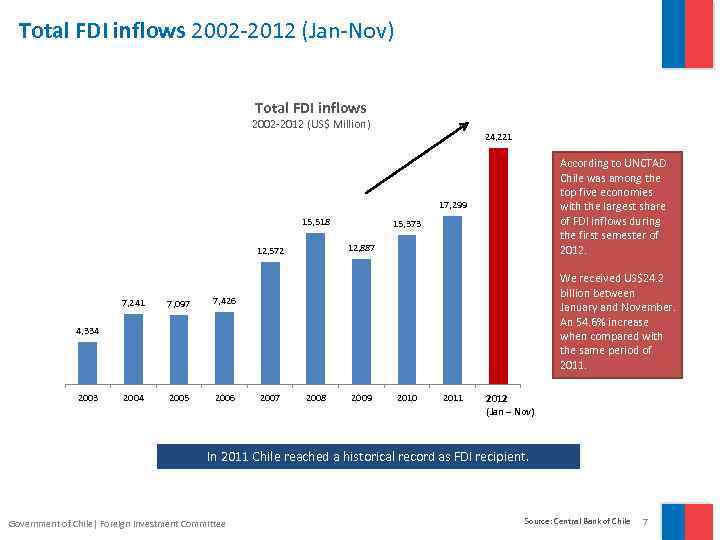

Total FDI inflows 2002 -2012 (Jan-Nov) Total FDI inflows 2002 -2012 (US$ Million) 24, 221 According to UNCTAD Chile was among the top five economies with the largest share of FDI inflows during the first semester of 2012. 17, 299 15, 518 12, 887 12, 572 7, 241 7, 097 2005 2006 We received US$24. 2 billion between January and November. An 54. 6% increase when compared with the same period of 2011. 7, 426 2004 15, 373 4, 334 2003 2007 2008 2009 2010 2011 2012* 2012 (Jan – Nov) In 2011 Chile reached a historical record as FDI recipient. Government of Chile| Foreign Investment Committee Source: Central Bank of Chile 7

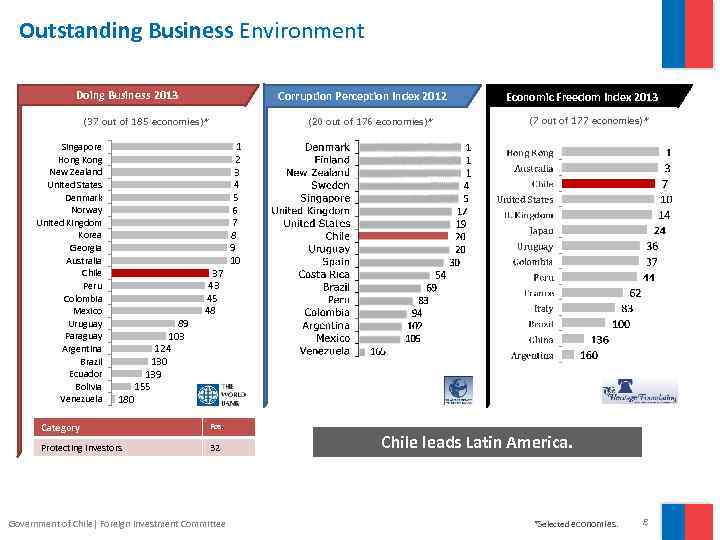

Outstanding Business Environment Doing Business 2013 Corruption Perception Index 2012 (37 out of 185 economies)* Singapore Hong Kong New Zealand United States Denmark Norway United Kingdom Korea Georgia Australia Chile Peru Colombia Mexico Uruguay Paraguay Argentina Brazil Ecuador Bolivia Venezuela 89 103 124 130 139 155 180 (20 out of 176 economies)* 37 43 45 48 Category Pos. Protecting investors 32 Government of Chile| Foreign Investment Committee Economic Freedom Index 2013 (7 out of 177 economies)* 1 2 3 4 5 6 7 8 9 10 Chile leads Latin America. *Selected economies. 8

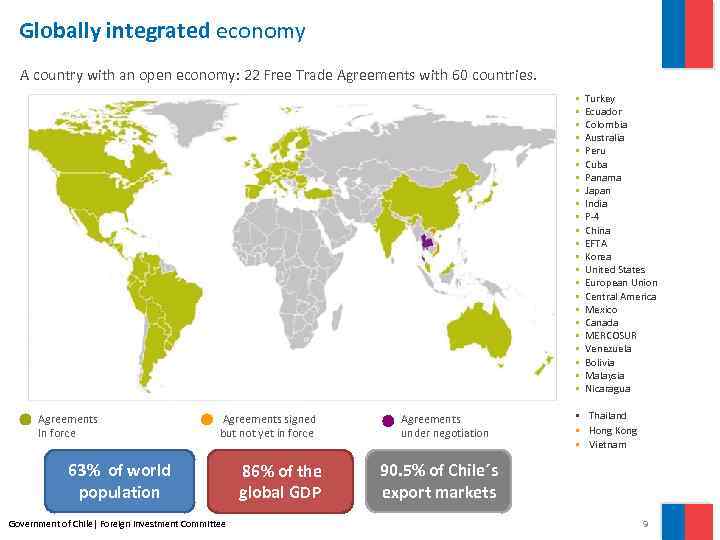

Chile, un país abierto al mundo Globally integrated economy A country with an open economy: 22 Free Trade Agreements with 60 countries. § Turkey § Ecuador § Colombia § Australia § Peru § Cuba § Panama § Japan § India § P-4 § China § EFTA § Korea § United States § European Union § Central America § Mexico § Canada § MERCOSUR § Venezuela § Bolivia § Malaysia § Nicaragua Agreements In force Agreements signed but not yet in force 63% of world population Government of Chile| Foreign Investment Committee 86% of the global GDP Agreements under negotiation § Thailand § Hong Kong § Vietnam 90. 5% of Chile´s export markets 9

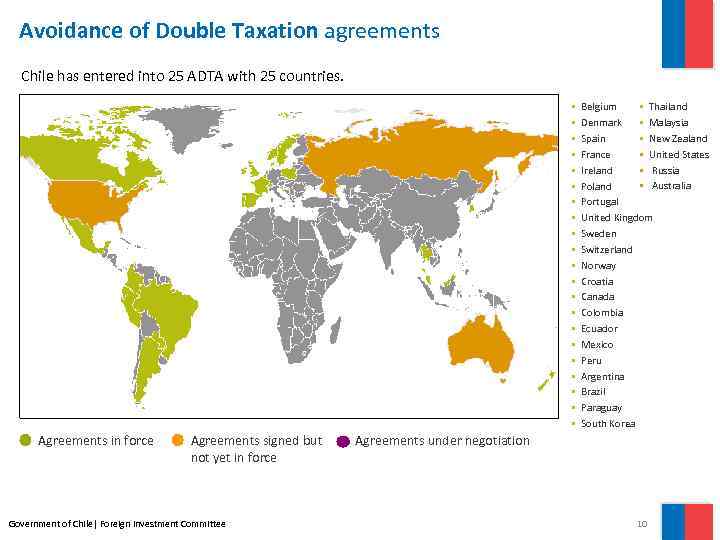

Avoidance of Double Taxation agreements Chile has entered into 25 ADTA with 25 countries. § Belgium § Thailand § Denmark § Malaysia § Spain § New Zealand § France § United States § Ireland § Russia § Poland § Australia § Portugal § United Kingdom § Sweden § Switzerland § Norway § Croatia § Canada § Colombia § Ecuador § Mexico § Peru § Argentina § Brazil § Paraguay § South Korea Agreements in force Agreements signed but not yet in force Government of Chile| Foreign Investment Committee Agreements under negotiation 10

§ Investment opportunities

§ Chile has 27. 5% of world copper reserves (USGS). § World´s largest producer: copper (34%), natural nitrates (100%), iodine (58%), Rhenium (52%), Lithium (45%) and 5 th largest silver producer § Mining companies plan to invest US$104 billion during the next eight years. § Chile in 5 th place in Current Mineral Potential Index (Fraser Institute) § Expenditure by mining companies is over US 21 billion per year. § There around 4000 supplier companies. Mining Opportunities § § § Government of Chile| Foreign Investment Committee Equipment and supplies. Engineering and consulting. Construction. Production support services. Mining suppliers to create regional headquarters, export and diversify area of activitiy. 12

FRUITS World´s largest exporter of table grapes, plums and blueberries, and top 3 in avocado, kiwi, raspberries and apples. Food industry New opportunities: § Berries. § Cherries. § Walnuts. WINE World´s 5 th largest exporter. New opportunities: § Organic wine. § “Functional” foods based on grape sub-products. § Grape-seed oil. SALMON FARMING World’s second largest producer. Opportunities: § Salmon food. § Cage services. Government of Chile| Foreign Investment Committee 13

§ § Electricity consumption expected to grow 6% to 7% annually. § Need to become independent in terms of energy supplies. § Energy Chile’s total installed capacity is 17, 000 MW. Need to diversify energy supplies. Opportunities § § Natural conditions suitable for Non-Conventional Renewable Energies. § Government of Chile| Foreign Investment Committee Generation: More than 8, 000 MW of new projects required by 2020. Transmission. 14

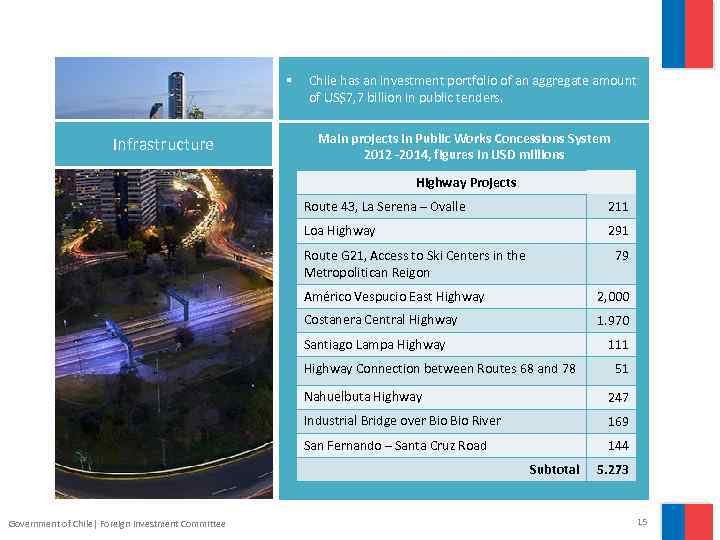

§ Infrastructure Chile has an investment portfolio of an aggregate amount of US$7, 7 billion in public tenders. Main projects in Public Works Concessions System 2012 -2014, figures in USD millions Highway Projects Route 43, La Serena – Ovalle 211 Loa Highway 291 Route G 21, Access to Ski Centers in the Metropolitican Reigon 79 Américo Vespucio East Highway 2, 000 Costanera Central Highway 1. 970 Santiago Lampa Highway 111 Highway Connection between Routes 68 and 78 51 Nahuelbuta Highway 247 Industrial Bridge over Bio River 169 San Fernando – Santa Cruz Road 144 Subtotal Government of Chile| Foreign Investment Committee 5. 273 15

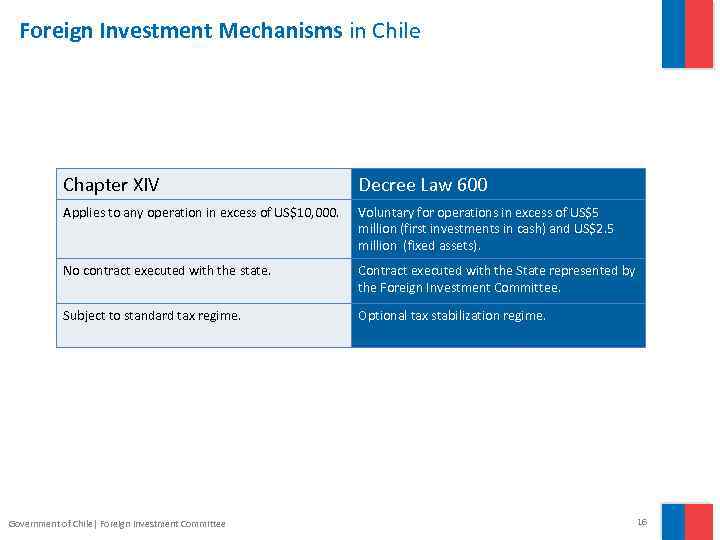

Foreign Investment Mechanisms in Chile Chapter XIV Decree Law 600 Applies to any operation in excess of US$10, 000. Voluntary for operations in excess of US$5 million (first investments in cash) and US$2. 5 million (fixed assets). No contract executed with the state. Contract executed with the State represented by the Foreign Investment Committee. Subject to standard tax regime. Optional tax stabilization regime. Government of Chile| Foreign Investment Committee 16

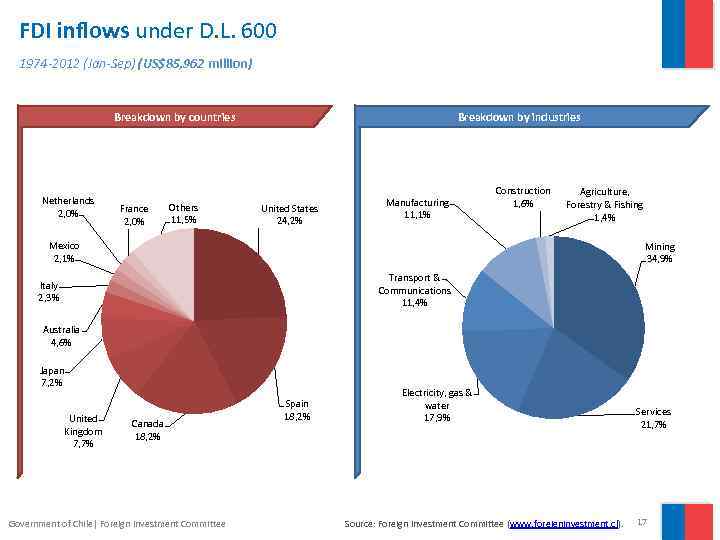

FDI inflows under D. L. 600 1974 -2012 (Jan-Sep) (US$85, 962 million) Breakdown by countries Netherlands 2, 0% France 2, 0% Others 11, 5% Breakdown by industries United States 24, 2% Manufacturing 11, 1% Construction 1, 6% Agriculture, Forestry & Fishing 1, 4% Mexico 2, 1% Mining 34, 9% Transport & Communications 11, 4% Italy 2, 3% Australia 4, 6% Japan 7, 2% United Kingdom 7, 7% Canada 18, 2% Government of Chile| Foreign Investment Committee Spain 18, 2% Electricity, gas & water 17, 9% Source: Foreign Investment Committee (www. foreigninvestment. cl). Services 21, 7% 17

Our activities and tools Information services Information about Chile’s business climate. Portfolio of public and private investment projects. Investment facilitation services Reports and other publications. Legal advice for the signing of a foreign investment contract. Information about DL 600. FDI statistics. Assistance in preparing schedule of meetings. Material in Spanish, English and Chinese. Processing of investors’ queries and applications. Participation in forums. Government of Chile | Foreign Investment Committee Tools Foreign investment contract. 18

Foreign Investment Committee www. foreigninvestment. cl cie@foreigninvestment. cl DISCLAIMER: The information contained in this document is for the purposes of information only and the particular conditions of each specific potential project may vary from those set out here. The contents of this document should in no way be interpreted as a legally binding obligation of the Republic of Chile or any other state agency that participates in any way in the processes of administrative approval or of any other nature corresponding under Chilean law. This information in no way constitutes an authorization to start or exercise the economic activity potentially intended to be developed. The resulting law. This information in no way constitutes an authorization to start or exercise the economic activity intended to be developed. The resulting agreements will be governed and interpreted exclusively according to the laws of the Republic of Chile, their related regulation and the national policies applicable to each particular case.

PPT CIE ENGLISH.PPTX