4a7c7cbb32b7854924d6ad1604301782.ppt

- Количество слайдов: 103

CHICAGO BOARD OPTIONS EXCHANGE TRADING INDEX OPTIONS Tactics and Strategies Presented by: The CBOE’s Options Institute Options_Institute@cboe. com www. cboe. com

Disclaimer In order to simplify the computations, commissions have not been included in the examples used in these materials. Commission costs will impact the outcome of all stock and options transactions and must be considered prior to entering into any transactions. Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and educational purposes only and are not to be construed as an endorsement, recommendation, or solicitation to buy or sell securities. Options involve risks and are not suitable for everyone. Prior to buying or selling an option, an investor must receive a copy of Characteristics and Risks of Standardized Options. Copies may be obtained from your broker or from The Chicago Board Options Exchange, 400 S. La. Salle, Chicago, IL 60605. Investors considering options should consult their tax advisor as to how taxes may affect the outcome of contemplated options transactions. CBOE 2

Presentation Outline Ø Motivation for Trading Index Options Ø Brief Review of Basics Ø Price Behavior of Index Options Ø Covered Writing “The Market” Ø Protecting a Portfolio Ø Volatility and Advanced Strategies CBOE 3

Motivation for Trading Index Options? An individual stock has: Company Risk Sector Risk Market Risk How can these risk factors be reduced? CBOE 4

Motivation for Trading Index Options? Ø Index options allow investors to enter “the market” rather than individual stocks. Ø View on the Market Ø View on an individual Sector Ø Protect your portfolio Ø Increase Income to the Portfolio CBOE 5

Features of Index Options 1. Index Options vs ETFs 2. Cash Settlement vs. Delivery 3. $100 Multiplier vs. 100 Shares 4. Exercise Style (American vs European) 5. Settlement Method (PM vs. AM) 6. Expiration Dates 7. Broad-Based vs. Narrow-Based 8. Calculation of Index Value CBOE 6

Index Options vs. ETFs 1 Index Options – cash settled options. – OEX (S&P 100® Index) – SPX (S&P 500® Index) – NDX (Nasdaq-100® Index Options) – DJX (Dow Jones Industrial Average) CBOE 7

Index Options vs. ETFs 2 Exchange Traded Funds (ETFs) - index-based investment products that allow investors to buy or sell shares of entire portfolios of stock in a single security. – OEF (i. Shares. SM S&P 100® Index Fund ) – SPY (SPDRs® - Standard & Poor's® Depositary Receipts) – QQQ (Nasdaq-100 ® Index Tracking Stock) – DIAMONDS® (DIA) CBOE 8

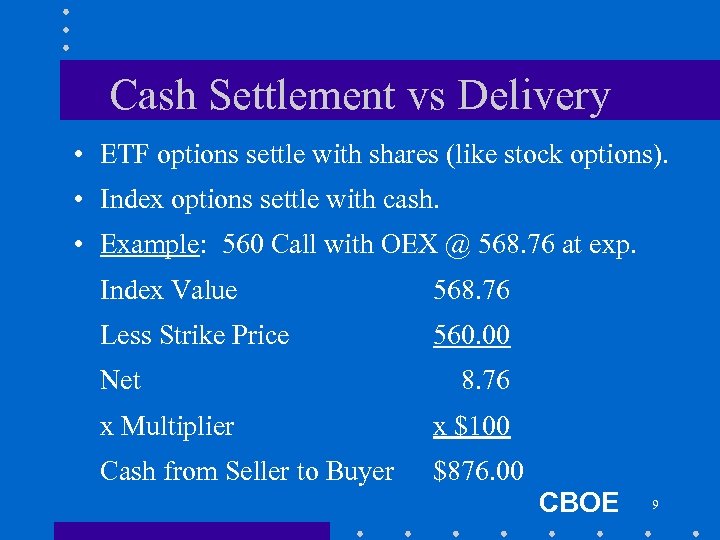

Cash Settlement vs Delivery • ETF options settle with shares (like stock options). • Index options settle with cash. • Example: 560 Call with OEX @ 568. 76 at exp. Index Value 568. 76 Less Strike Price 560. 00 Net 8. 76 x Multiplier x $100 Cash from Seller to Buyer $876. 00 CBOE 9

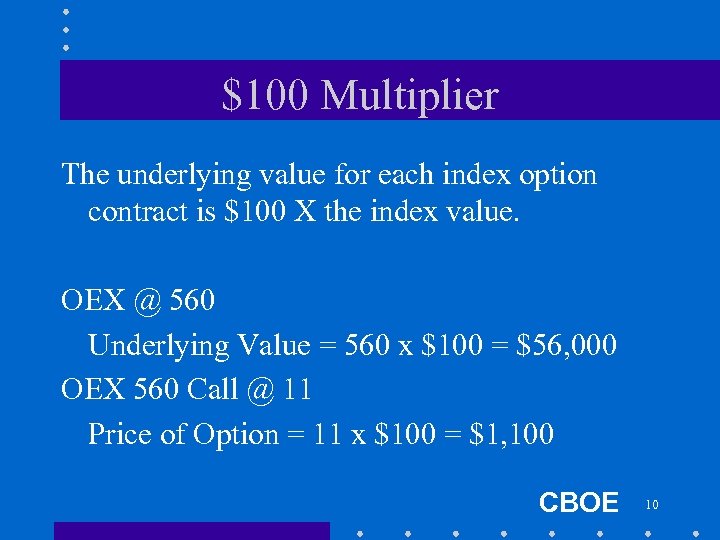

$100 Multiplier The underlying value for each index option contract is $100 X the index value. OEX @ 560 Underlying Value = 560 x $100 = $56, 000 OEX 560 Call @ 11 Price of Option = 11 x $100 = $1, 100 CBOE 10

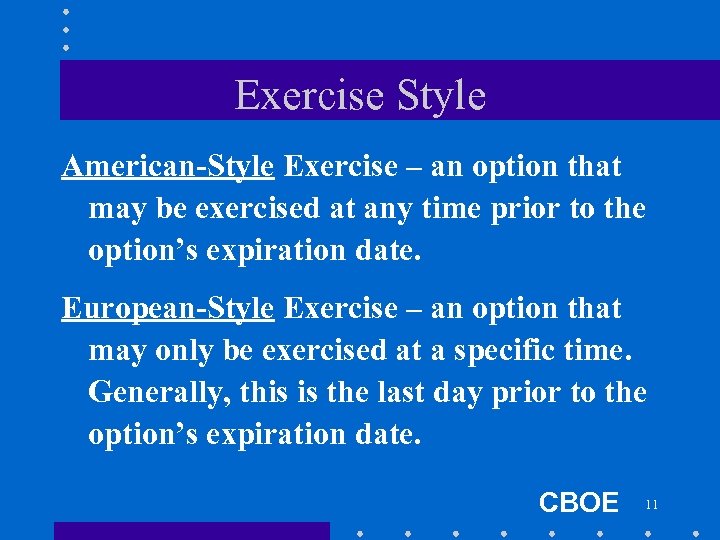

Exercise Style American-Style Exercise – an option that may be exercised at any time prior to the option’s expiration date. European-Style Exercise – an option that may only be exercised at a specific time. Generally, this is the last day prior to the option’s expiration date. CBOE 11

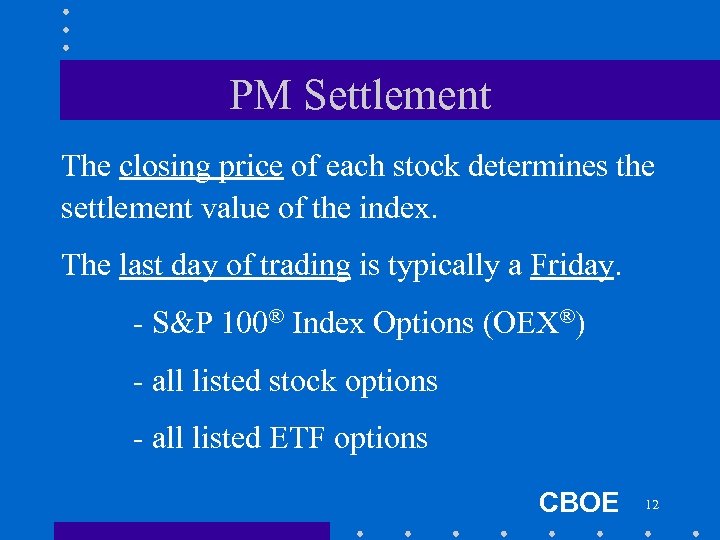

PM Settlement The closing price of each stock determines the settlement value of the index. The last day of trading is typically a Friday. - S&P 100® Index Options (OEX®) - all listed stock options - all listed ETF options CBOE 12

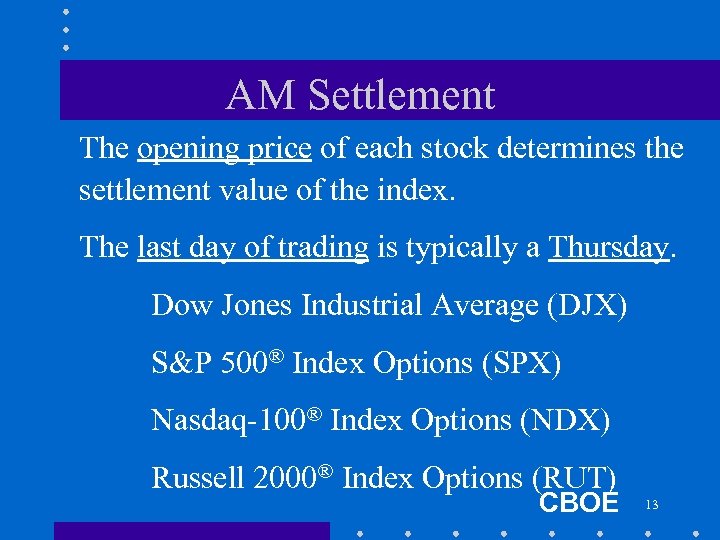

AM Settlement The opening price of each stock determines the settlement value of the index. The last day of trading is typically a Thursday. Dow Jones Industrial Average (DJX) S&P 500® Index Options (SPX) Nasdaq-100® Index Options (NDX) Russell 2000® Index Options (RUT) CBOE 13

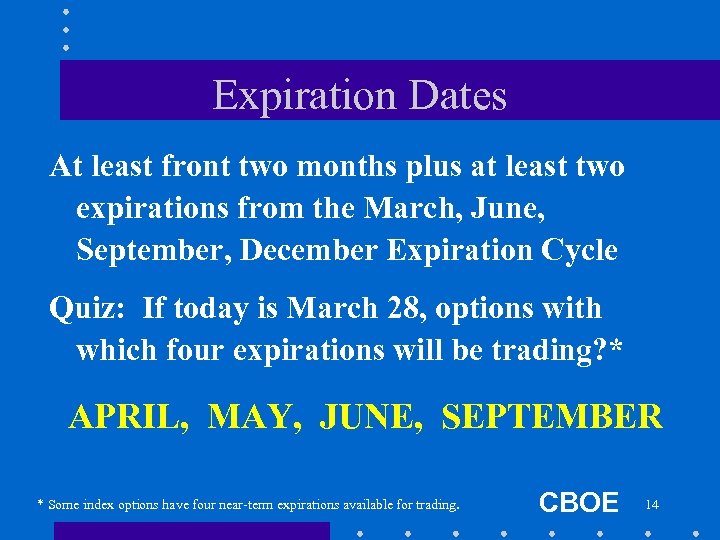

Expiration Dates At least front two months plus at least two expirations from the March, June, September, December Expiration Cycle Quiz: If today is March 28, options with which four expirations will be trading? * APRIL, MAY, JUNE, SEPTEMBER * Some index options have four near-term expirations available for trading. CBOE 14

Many Index Options Available! • Broad-Based Indexes – follow a wide range of stocks across many industries. • Narrow-Based Indexes – follow a specific sector or group of stocks within one industry. CBOE 15

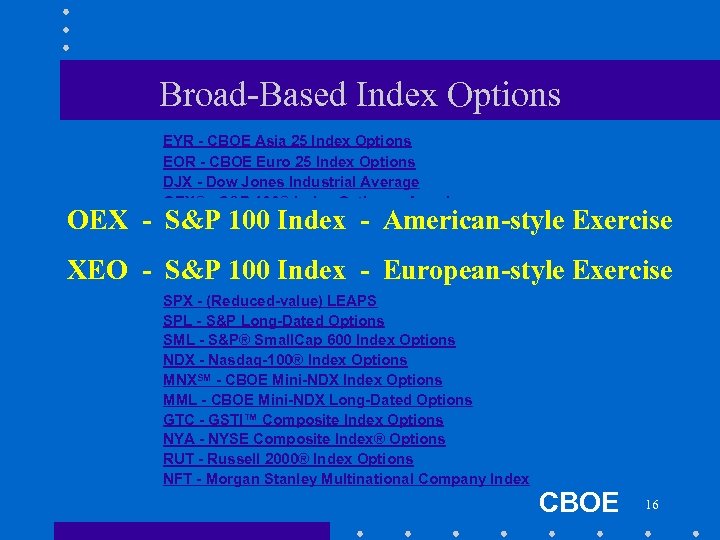

Broad-Based Index Options EYR - CBOE Asia 25 Index Options EOR - CBOE Euro 25 Index Options DJX - Dow Jones Industrial Average OEX® - S&P 100® Index Options - American OEX® - S&P 100® Index LEAPS - American XEO® - European-style S&P 100® Index Options XEO® - European-style S&P 100® LEAPS SPX - S&P 500® Index Options SPX - (Reduced-value) LEAPS SPL - S&P Long-Dated Options SML - S&P® Small. Cap 600 Index Options NDX - Nasdaq-100® Index Options MNXSM - CBOE Mini-NDX Index Options MML - CBOE Mini-NDX Long-Dated Options GTC - GSTI™ Composite Index Options NYA - NYSE Composite Index® Options RUT - Russell 2000® Index Options NFT - Morgan Stanley Multinational Company Index OEX - S&P 100 Index - American-style Exercise XEO - S&P 100 Index - European-style Exercise CBOE 16

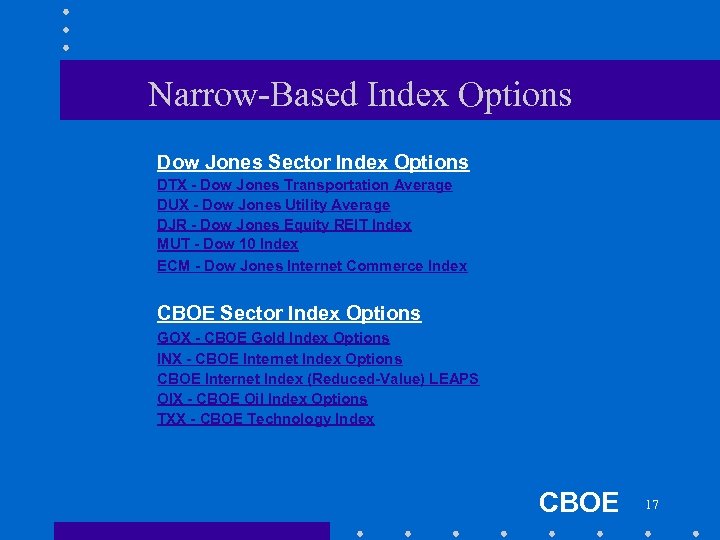

Narrow-Based Index Options Dow Jones Sector Index Options DTX - Dow Jones Transportation Average DUX - Dow Jones Utility Average DJR - Dow Jones Equity REIT Index MUT - Dow 10 Index ECM - Dow Jones Internet Commerce Index CBOE Sector Index Options GOX - CBOE Gold Index Options INX - CBOE Internet Index Options CBOE Internet Index (Reduced-Value) LEAPS OIX - CBOE Oil Index Options TXX - CBOE Technology Index CBOE 17

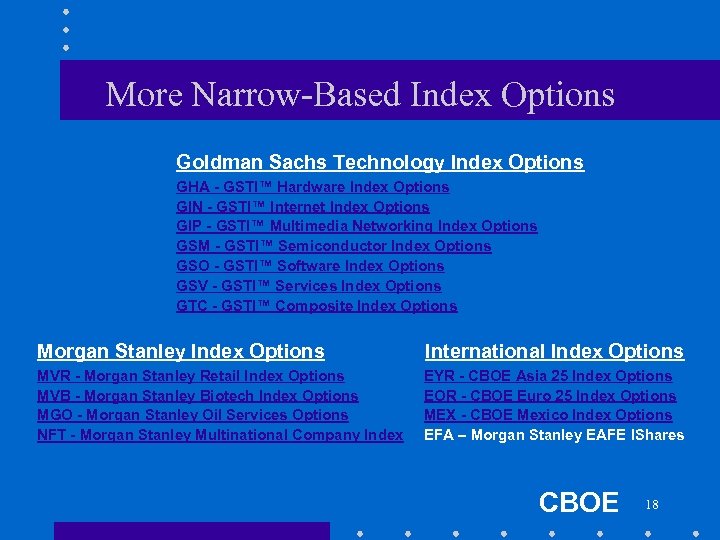

More Narrow-Based Index Options Goldman Sachs Technology Index Options GHA - GSTI™ Hardware Index Options GIN - GSTI™ Internet Index Options GIP - GSTI™ Multimedia Networking Index Options GSM - GSTI™ Semiconductor Index Options GSO - GSTI™ Software Index Options GSV - GSTI™ Services Index Options GTC - GSTI™ Composite Index Options Morgan Stanley Index Options International Index Options MVR - Morgan Stanley Retail Index Options MVB - Morgan Stanley Biotech Index Options MGO - Morgan Stanley Oil Services Options NFT - Morgan Stanley Multinational Company Index EYR - CBOE Asia 25 Index Options EOR - CBOE Euro 25 Index Options MEX - CBOE Mexico Index Options EFA – Morgan Stanley EAFE IShares CBOE 18

CHICAGO BOARD OPTIONS EXCHANGE Price Behavior of Index Options

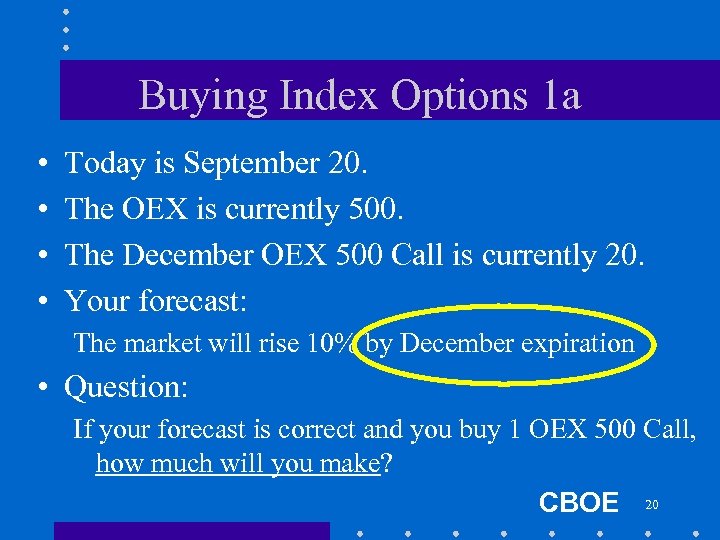

Buying Index Options 1 a • • Today is September 20. The OEX is currently 500. The December OEX 500 Call is currently 20. Your forecast: The market will rise 10% by December expiration • Question: If your forecast is correct and you buy 1 OEX 500 Call, how much will you make? CBOE 20

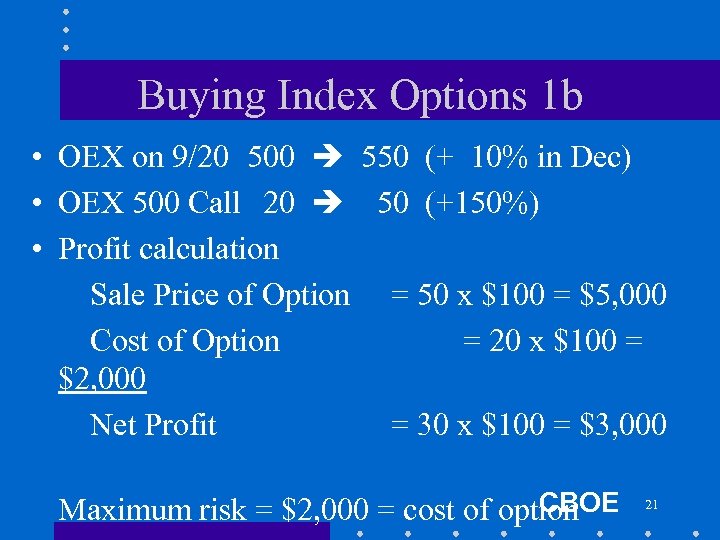

Buying Index Options 1 b • OEX on 9/20 500 550 (+ 10% in Dec) • OEX 500 Call 20 50 (+150%) • Profit calculation Sale Price of Option = 50 x $100 = $5, 000 Cost of Option = 20 x $100 = $2, 000 Net Profit = 30 x $100 = $3, 000 CBOE Maximum risk = $2, 000 = cost of option 21

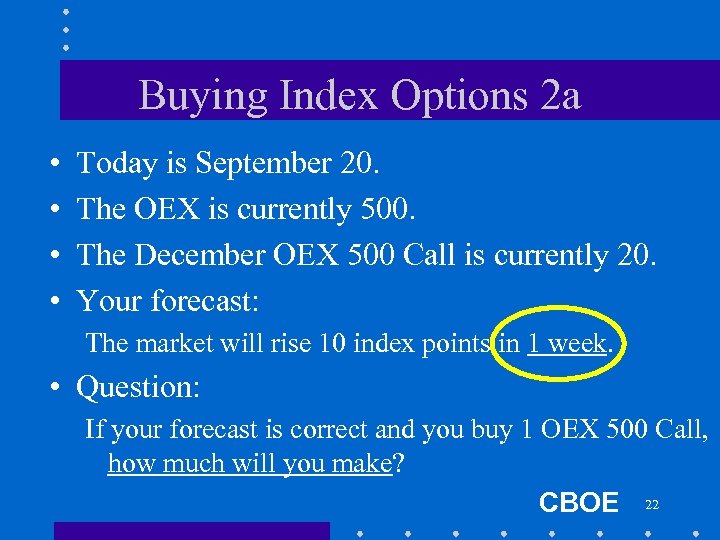

Buying Index Options 2 a • • Today is September 20. The OEX is currently 500. The December OEX 500 Call is currently 20. Your forecast: The market will rise 10 index points in 1 week. • Question: If your forecast is correct and you buy 1 OEX 500 Call, how much will you make? CBOE 22

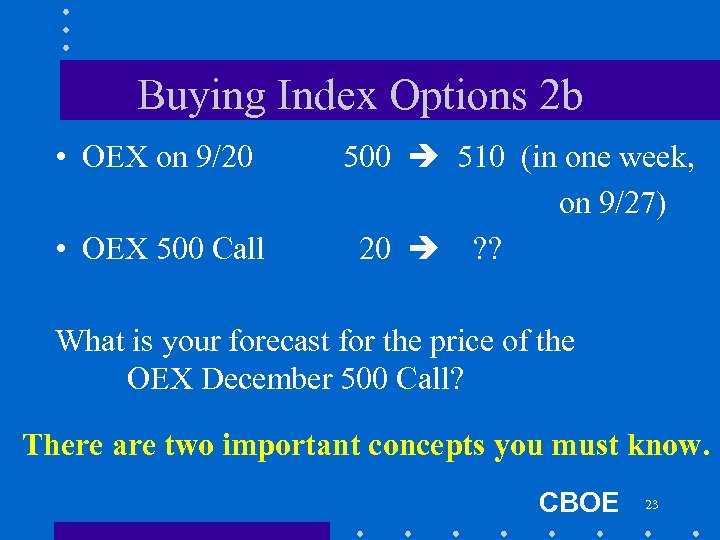

Buying Index Options 2 b • OEX on 9/20 • OEX 500 Call 500 510 (in one week, on 9/27) 20 ? ? What is your forecast for the price of the OEX December 500 Call? There are two important concepts you must know. CBOE 23

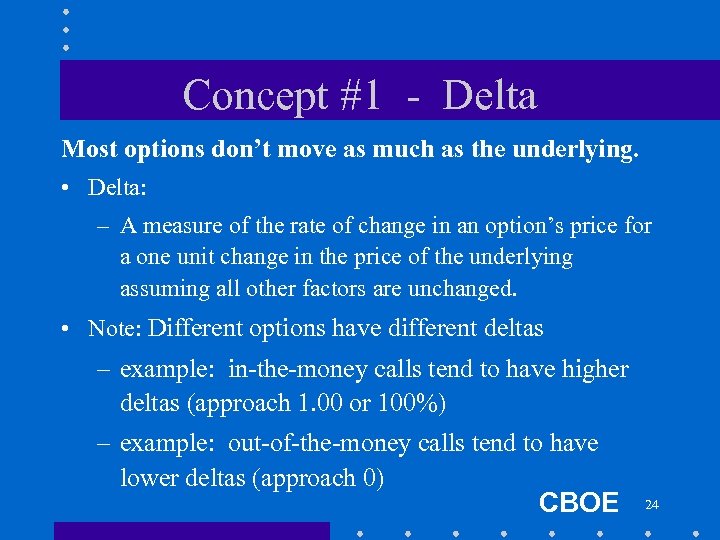

Concept #1 - Delta Most options don’t move as much as the underlying. • Delta: – A measure of the rate of change in an option’s price for a one unit change in the price of the underlying assuming all other factors are unchanged. • Note: Different options have different deltas – example: in-the-money calls tend to have higher deltas (approach 1. 00 or 100%) – example: out-of-the-money calls tend to have lower deltas (approach 0) CBOE 24

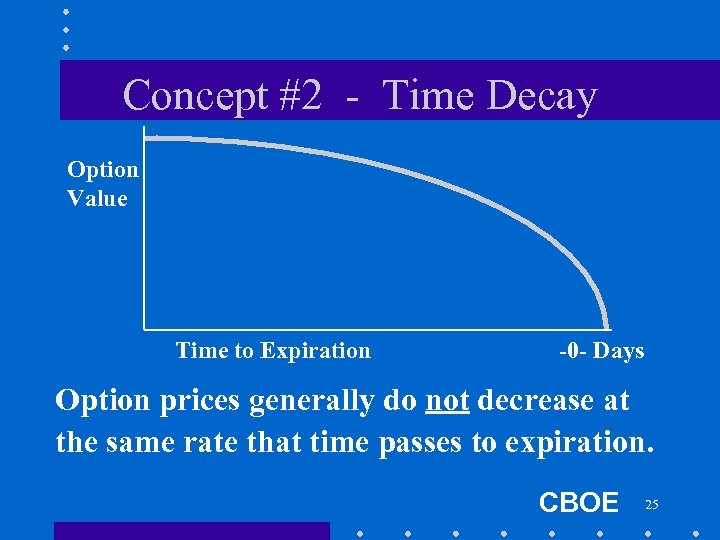

Concept #2 - Time Decay Option Value Time to Expiration -0 - Days Option prices generally do not decrease at the same rate that time passes to expiration. CBOE 25

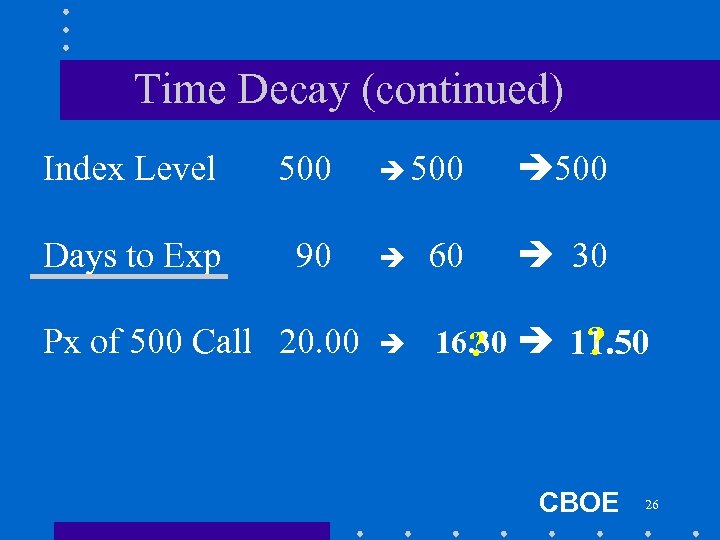

Time Decay (continued) Index Level 500 Days to Exp 90 Px of 500 Call 20. 00 500 60 30 16. 30 11. 50 ? ? CBOE 26

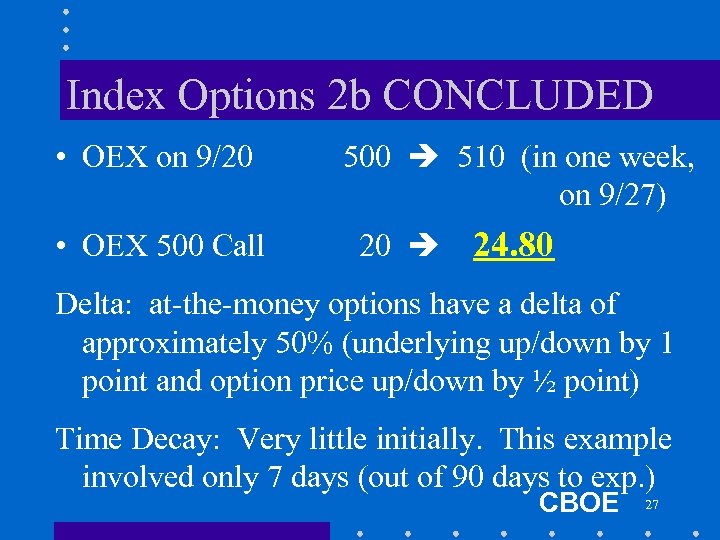

Index Options 2 b CONCLUDED • OEX on 9/20 • OEX 500 Call 500 510 (in one week, on 9/27) 20 24. 80 Delta: at-the-money options have a delta of approximately 50% (underlying up/down by 1 point and option price up/down by ½ point) Time Decay: Very little initially. This example involved only 7 days (out of 90 days to exp. ) CBOE 27

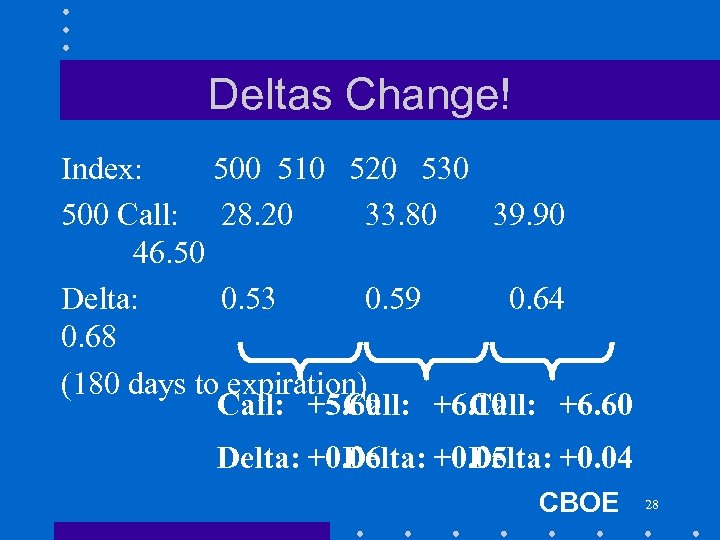

Deltas Change! Index: 500 510 520 530 500 Call: 28. 20 33. 80 39. 90 46. 50 Delta: 0. 53 0. 59 0. 64 0. 68 (180 days to expiration) Call: +5. 60 Call: +6. 10 Call: +6. 60 Delta: +0. 06 Delta: +0. 05 Delta: +0. 04 CBOE 28

CHICAGO BOARD OPTIONS EXCHANGE Planning a Long-Term Investment

Planning for the Long Term • You plan to invest $10, 000 per year over the next 3 years in a DJIA Index fund. • You want approximately $30, 000 of market exposure today. • You can use DIA LEAPS® options to target this objective. CBOE 30

Planning Ahead • The DJIA ETF (DIA) is currently trading at $92 per share • The DIA January 2005 LEAPS 92 Call is trading at $8. • Step 1? • Step 2? • Step 3? CBOE 31

Planning Step 1 - Today - Deposit $10, 000 in your account - Buy 3 DIA January 2005 92 -strike LEAPS® Calls at $8 each (Total Cost $2, 400 + comm. ) - Account balance = $7, 600 CBOE 32

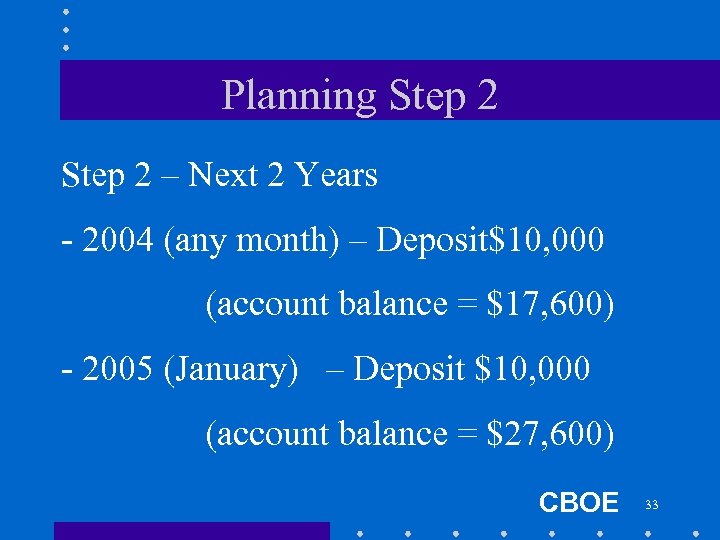

Planning Step 2 – Next 2 Years - 2004 (any month) – Deposit$10, 000 (account balance = $17, 600) - 2005 (January) – Deposit $10, 000 (account balance = $27, 600) CBOE 33

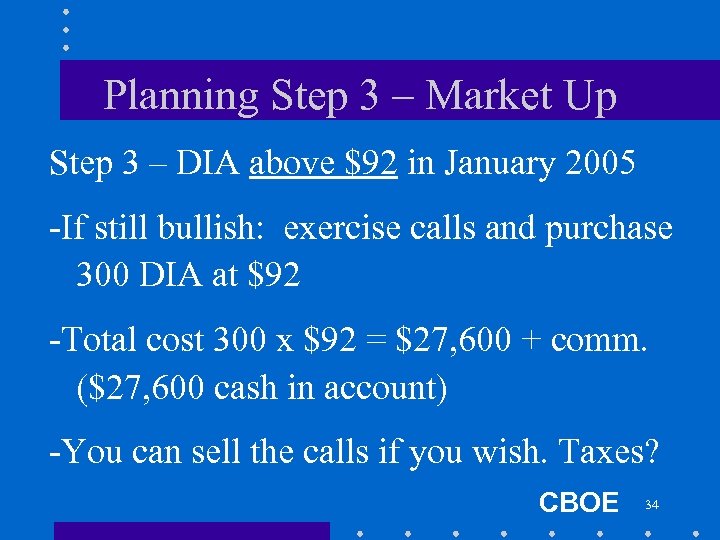

Planning Step 3 – Market Up Step 3 – DIA above $92 in January 2005 -If still bullish: exercise calls and purchase 300 DIA at $92 -Total cost 300 x $92 = $27, 600 + comm. ($27, 600 cash in account) -You can sell the calls if you wish. Taxes? CBOE 34

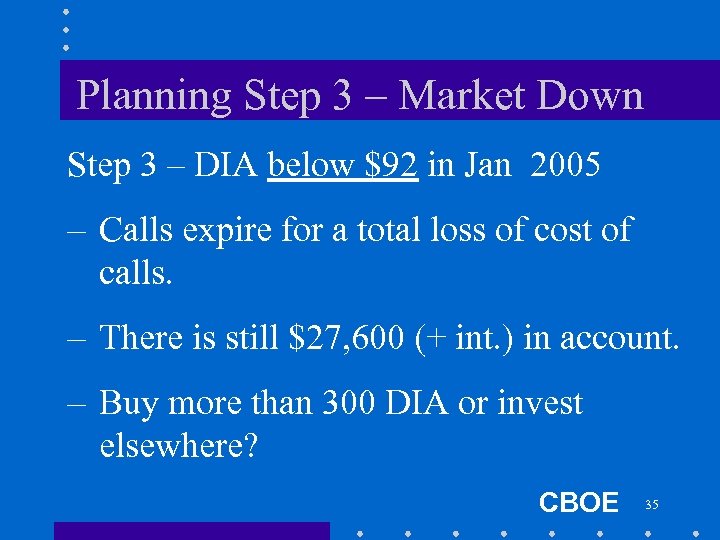

Planning Step 3 – Market Down Step 3 – DIA below $92 in Jan 2005 – Calls expire for a total loss of cost of calls. – There is still $27, 600 (+ int. ) in account. – Buy more than 300 DIA or invest elsewhere? CBOE 35

CHICAGO BOARD OPTIONS EXCHANGE Covered Writing on The Market

Covered Writing - A Definition The Covered Call Strategy consists of selling calls on a share-for-share basis against stock that is owned. (Simultaneously buying stock and selling calls is known as a “buy-write. ”) CBOE 37

Covered Writing on “The Market” Buy an ETF and sell calls - Dow Jones Industrial Average Buy DIA and sell DIA calls - S&P 100 Stock Index Buy OEF and sell OEF calls - NASDAQ 100 Stock Index Buy QQQ and sell QQQ calls CBOE 38

Why Sell Covered Calls? • Forecast: neutral to moderately bullish on the stock • Goals: increase returns in stable markets and reduce stock price risk CBOE 39

What You Should Know The seller of a covered call: • has the obligation to sell stock at the strike price (at any time, if assigned). • until the expiration date. • In exchange for accepting the obligation, the call seller receives a premium. CBOE 40

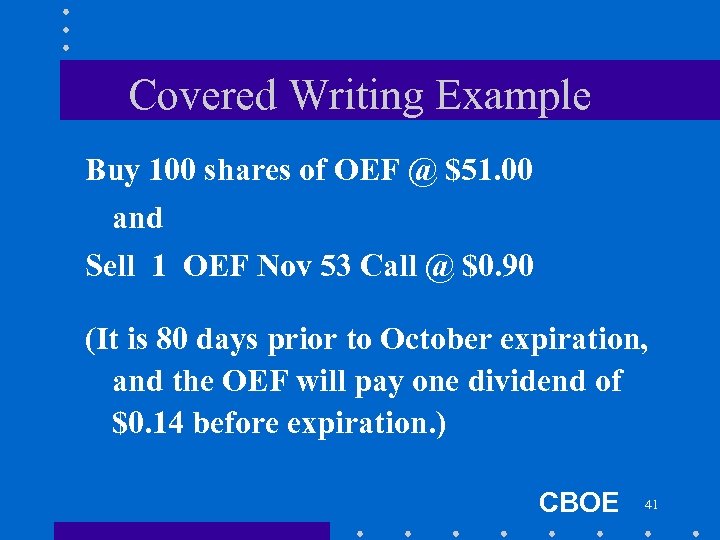

Covered Writing Example Buy 100 shares of OEF @ $51. 00 and Sell 1 OEF Nov 53 Call @ $0. 90 (It is 80 days prior to October expiration, and the OEF will pay one dividend of $0. 14 before expiration. ) CBOE 41

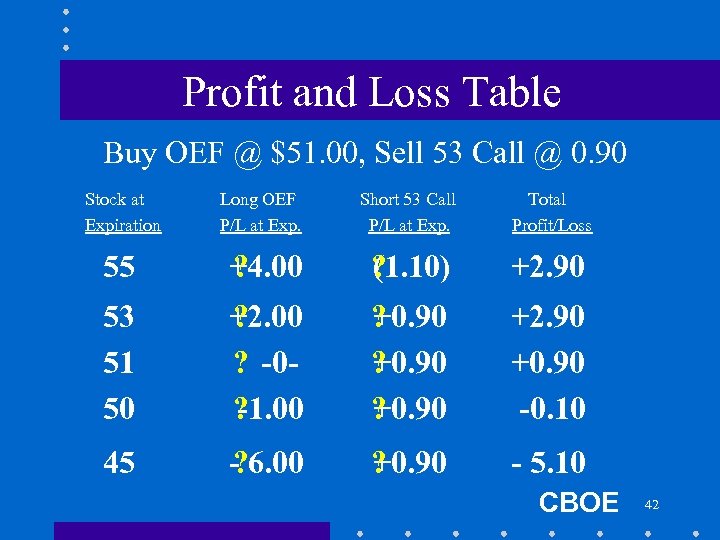

Profit and Loss Table Buy OEF @ $51. 00, Sell 53 Call @ 0. 90 Stock at Expiration Long OEF P/L at Exp. Short 53 Call P/L at Exp. Total Profit/Loss 55 +4. 00 ? ? (1. 10) +2. 90 53 51 50 +2. 00 ? ? -0? -1. 00 ? +0. 90 +2. 90 +0. 90 -0. 10 45 - 6. 00 ? ? +0. 90 - 5. 10 CBOE 42

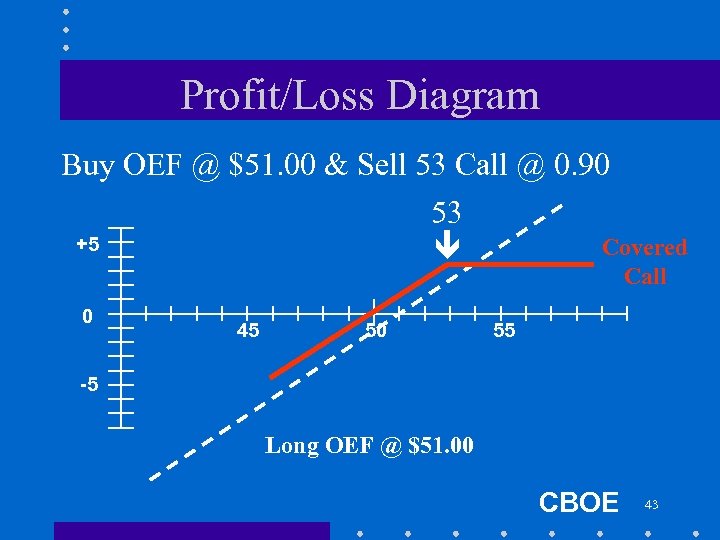

Profit/Loss Diagram Buy OEF @ $51. 00 & Sell 53 Call @ 0. 90 53 +5 Covered Call 0 45 50 55 -5 Long OEF @ $51. 00 CBOE 43

Calculating the Static Return • The static return assumes that the price of the underlying is unchanged at expiration and the call expires worthless. • Note: Return calculations assume that the same per-period profit can be earned repeatedly throughout the year, and this may not be possible. CBOE 44

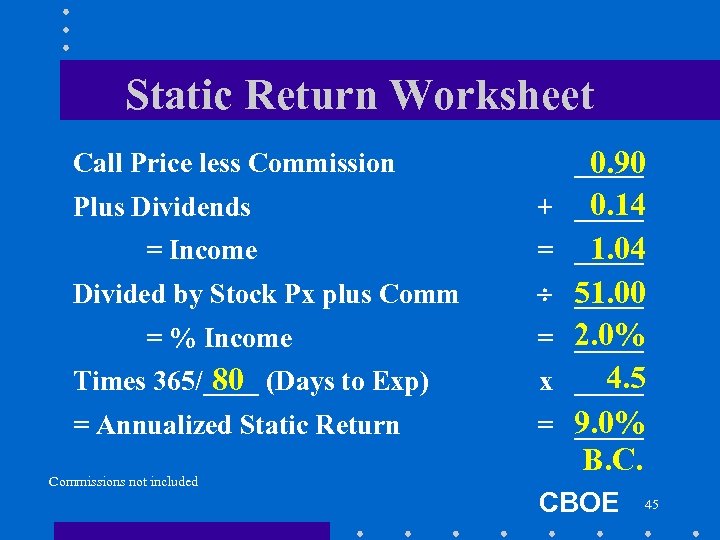

Static Return Worksheet Call Price less Commission _____ 0. 90 Plus Dividends 0. 14 + _____ = Income 1. 04 = _____ Divided by Stock Px plus Comm = % Income _____ 51. 00 2. 0% = _____ 80 Times 365/____ (Days to Exp) 4. 5 x _____ = Annualized Static Return 9. 0% = _____ Commissions not included B. C. CBOE 45

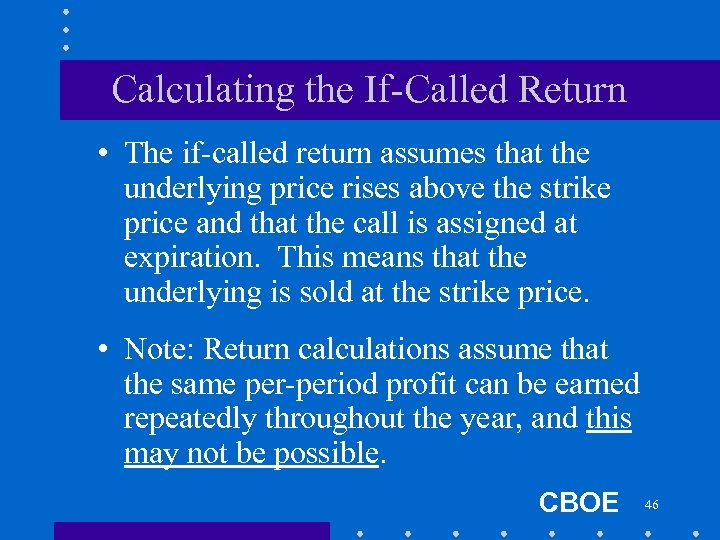

Calculating the If-Called Return • The if-called return assumes that the underlying price rises above the strike price and that the call is assigned at expiration. This means that the underlying is sold at the strike price. • Note: Return calculations assume that the same per-period profit can be earned repeatedly throughout the year, and this may not be possible. CBOE 46

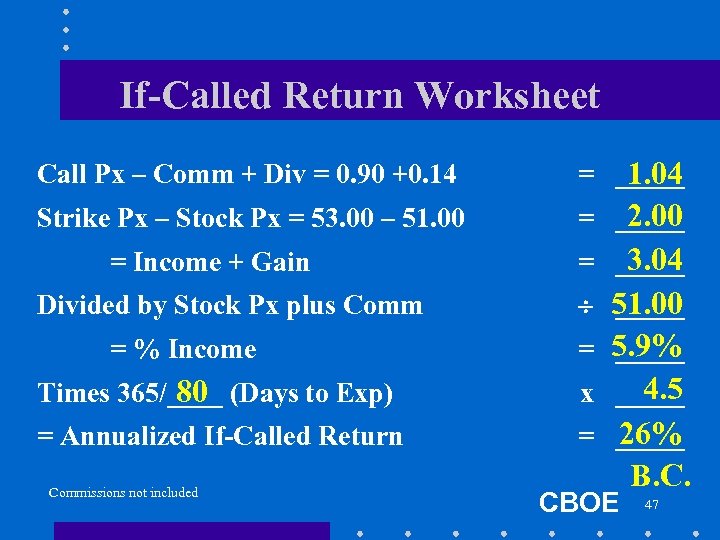

If-Called Return Worksheet Call Px – Comm + Div = 0. 90 +0. 14 = _____ 1. 04 Strike Px – Stock Px = 53. 00 – 51. 00 2. 00 = _____ = Income + Gain Divided by Stock Px plus Comm = % Income 3. 04 = _____ 51. 00 _____ = 5. 9% _____ 80 Times 365/____ (Days to Exp) 4. 5 x _____ = Annualized If-Called Return 26% = _____ Commissions not included CBOE B. C. 47

After the Break • Protecting a Portfolio • Trading Spreads • Advanced Strategies CBOE 48

CHICAGO BOARD OPTIONS EXCHANGE INTERMISSION

Protecting a Portfolio Protective Put defined: Purchasing a put in conjunction with a long stock position or an owned portfolio. CBOE 50

Protective Put Example Own a $200, 000 Portfolio that matches the S&P 500 Index. The Index is currently at 1, 000. Action: Buy 2 6 -month SPX 975 Puts CBOE 51

Protective Put Case Study Your portfolio is worth $200, 000. You cannot afford to let the value fall below $180, 000. You want to protect yourself and stay in the market at the same time. CBOE 52

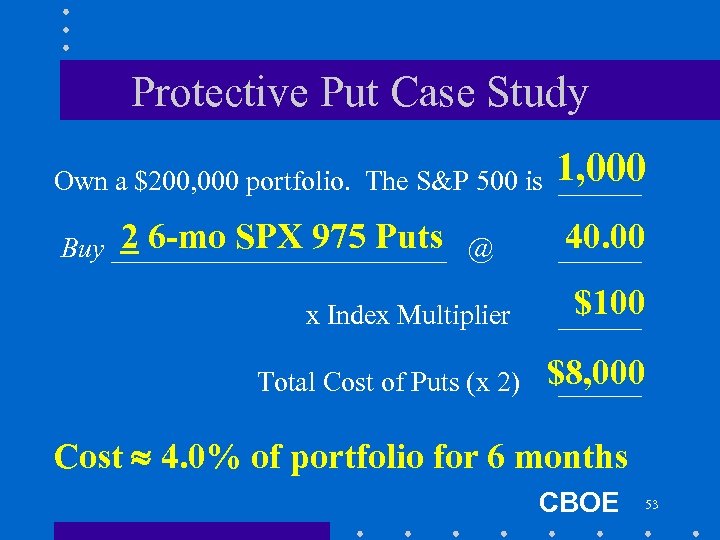

Protective Put Case Study Own a $200, 000 portfolio. The S&P 500 is 1, 000 ______ 2 6 -mo SPX 975 Puts Buy ____________ @ x Index Multiplier Total Cost of Puts (x 2) 40. 00 ______ $100 ______ $8, 000 ______ Cost 4. 0% of portfolio for 6 months CBOE 53

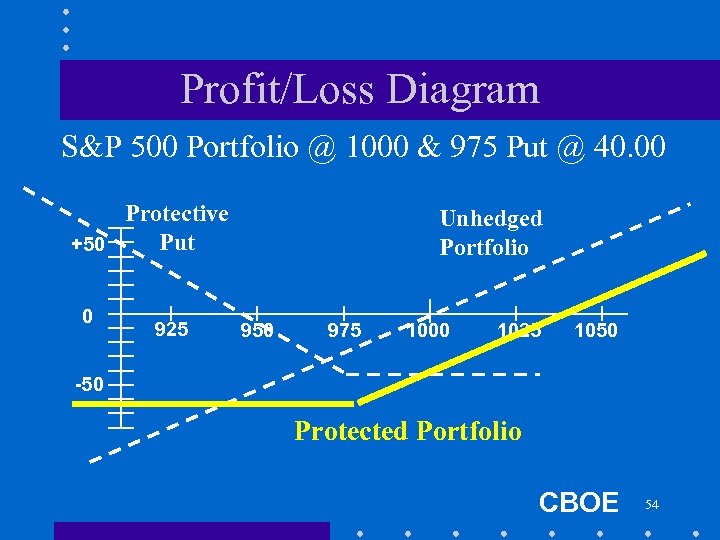

Profit/Loss Diagram S&P 500 Portfolio @ 1000 & 975 Put @ 40. 00 Protective Put +50 0 925 Unhedged Portfolio 950 975 1000 1025 1050 -50 Protected Portfolio CBOE 54

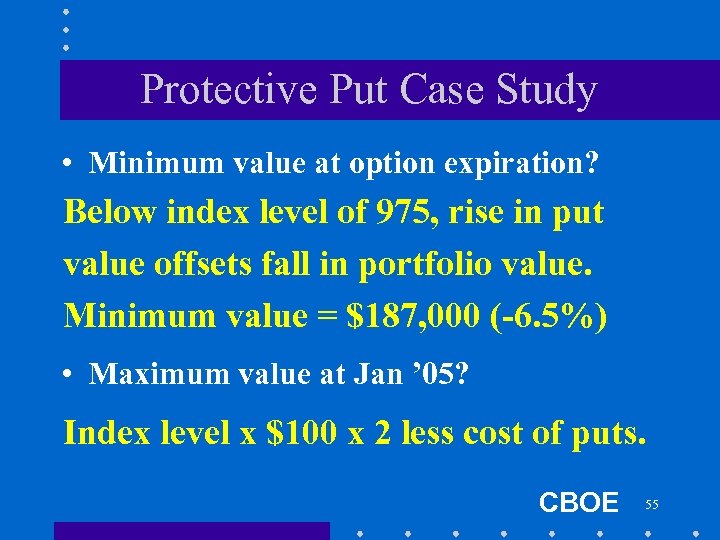

Protective Put Case Study • Minimum value at option expiration? Below index level of 975, rise in put value offsets fall in portfolio value. Minimum value = $187, 000 (-6. 5%) • Maximum value at Jan ’ 05? Index level x $100 x 2 less cost of puts. CBOE 55

“Low-Cost” Protection • You are bearish on the market short-term. • You think that index puts are “too expensive. ” • How can you bring in cash to pay for (or reduce the cost of) the index puts? Sell covered calls on some of the individual stocks in your portfolio. Use the cash to pay for the index puts. CBOE 56

Protective Puts - Pros & Cons Pros: • Protection below a known index level • Unlimited upside Cons: • Protection has a cost • Limited time period CBOE 57

CHICAGO BOARD OPTIONS EXCHANGE Advanced Strategies 1 Vertical Spreads

Vertical Spreads Defined The purchase of one option and simultaneous sale of another option with the same underlying, the same expiration date, but with a different strike price. Vertical spreads are usually established in a margin account. CBOE 59

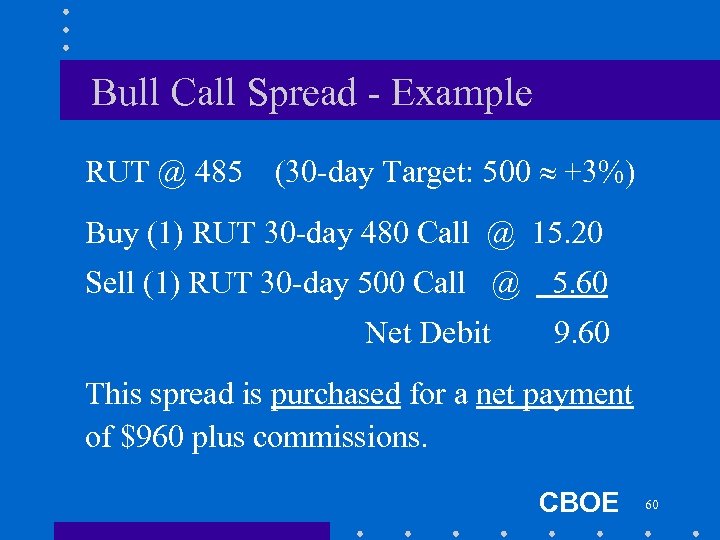

Bull Call Spread - Example RUT @ 485 (30 -day Target: 500 +3%) Buy (1) RUT 30 -day 480 Call @ 15. 20 Sell (1) RUT 30 -day 500 Call @ Net Debit 5. 60 9. 60 This spread is purchased for a net payment of $960 plus commissions. CBOE 60

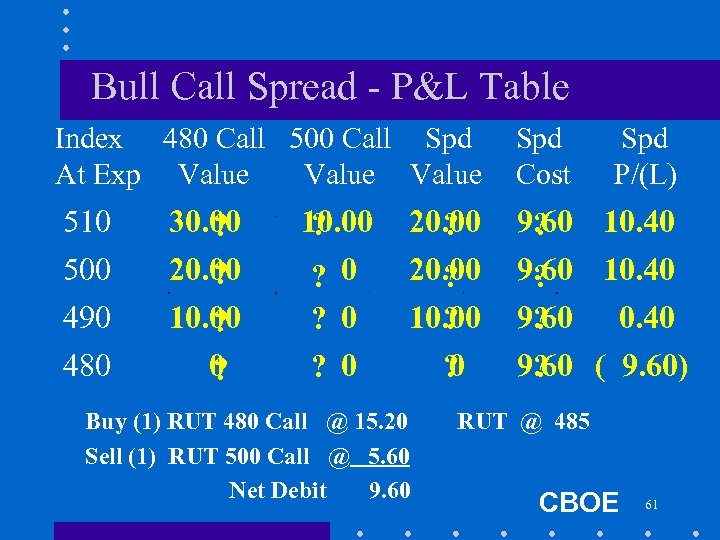

Bull Call Spread - P&L Table Index 480 Call 500 Call Spd At Exp Value Spd Cost 510 500 490 480 30. 00 ? 20. 00 ? 10. 00 ? Spd P/(L) 10. 00 ? ? 0 20. 00 ? 10. 00 ? 9. 60 10. 40 ? 9. 60 0. 40 ? ? 0 0 ? 9. 60 ( 9. 60) ? Buy (1) RUT 480 Call @ 15. 20 Sell (1) RUT 500 Call @ 5. 60 Net Debit 9. 60 RUT @ 485 CBOE 61

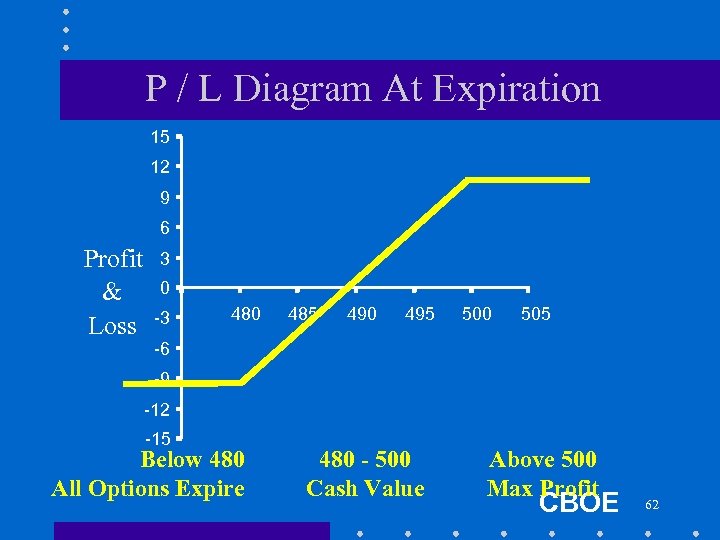

P / L Diagram At Expiration 15 12 9 6 Profit & Loss 3 0 -3 480 485 490 495 500 505 -6 -9 -12 -15 Below 480 All Options Expire 480 - 500 Cash Value Above 500 Max Profit CBOE 62

Trading Vertical Call Spreads A Shorter Term Perspective Do I Have to Hold Until Expiration? No. Spreads can be closed at any time, during trading hours, just like individual options. CBOE 63

Price Behavior How will a bull call spread change in price prior to expiration? CBOE 64

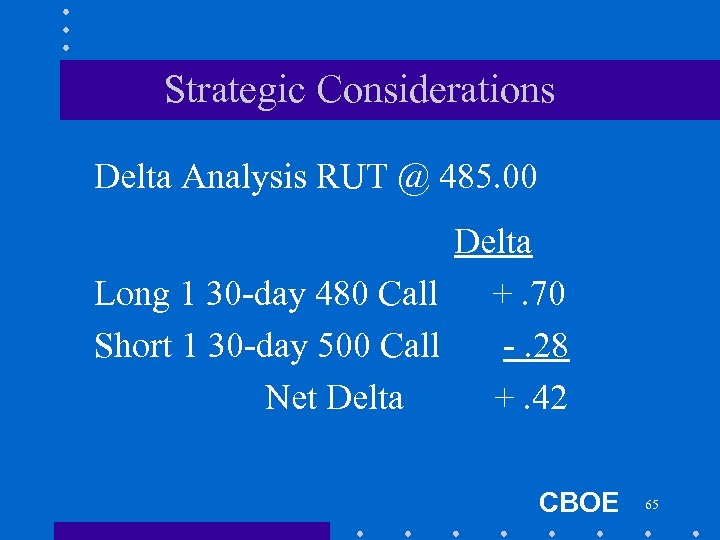

Strategic Considerations Delta Analysis RUT @ 485. 00 Delta Long 1 30 -day 480 Call +. 70 Short 1 30 -day 500 Call -. 28 Net Delta +. 42 CBOE 65

Vertical Spreads - Summary Lower susceptibility to time decay than at-the-money options. Understanding the mechanics is important. Extra commissions are likely. The strategy of choice when the forecast is for a gradual price rise in the underlying stock. CBOE 66

CHICAGO BOARD OPTIONS EXCHANGE Advanced Strategies 2 Credit Spreads

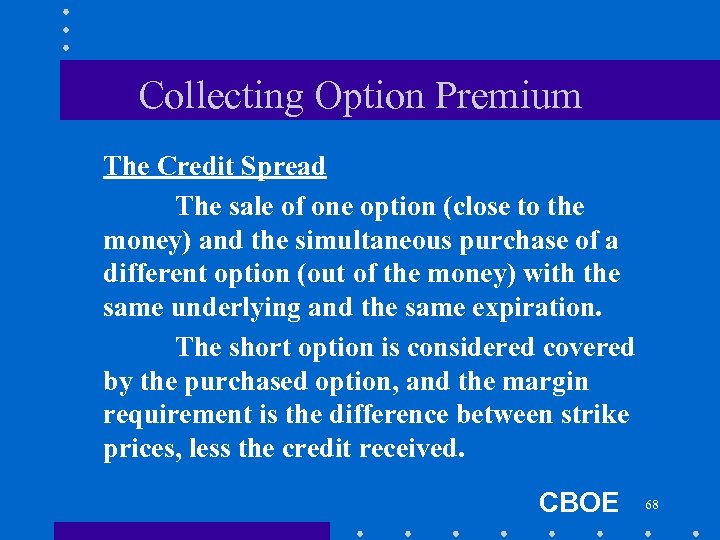

Collecting Option Premium The Credit Spread The sale of one option (close to the money) and the simultaneous purchase of a different option (out of the money) with the same underlying and the same expiration. The short option is considered covered by the purchased option, and the margin requirement is the difference between strike prices, less the credit received. CBOE 68

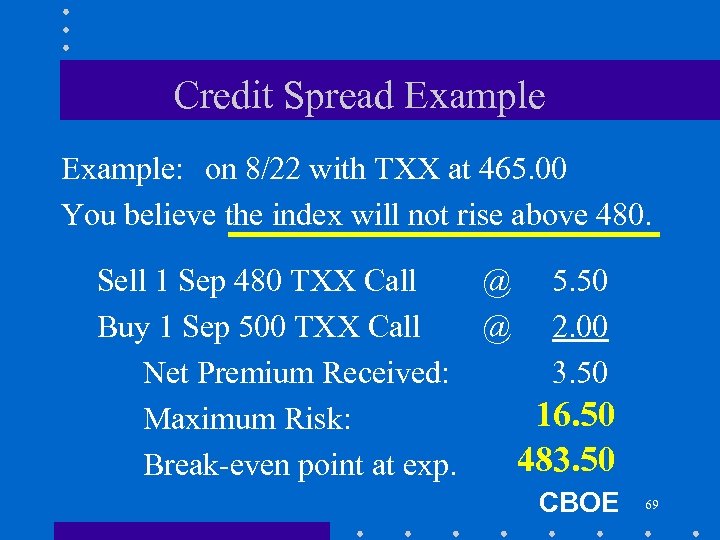

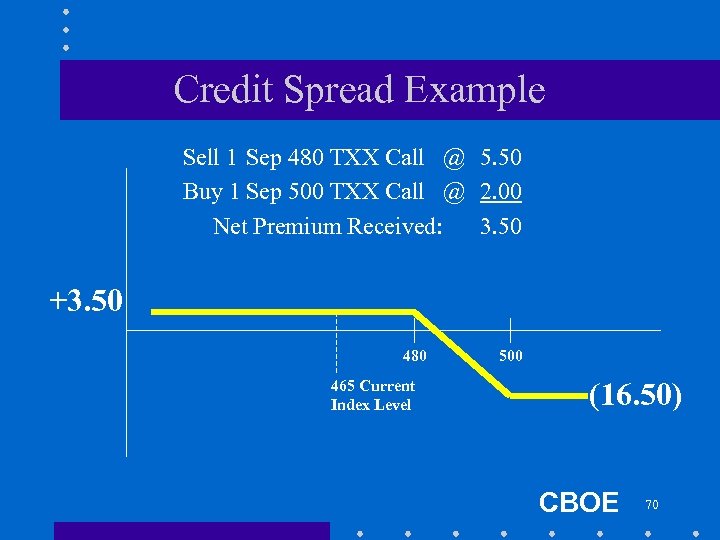

Credit Spread Example: on 8/22 with TXX at 465. 00 You believe the index will not rise above 480. Sell 1 Sep 480 TXX Call @ 5. 50 Buy 1 Sep 500 TXX Call @ 2. 00 Net Premium Received: 3. 50 16. 50 Maximum Risk: 483. 50 Break-even point at exp. CBOE 69

Credit Spread Example Sell 1 Sep 480 TXX Call @ 5. 50 Buy 1 Sep 500 TXX Call @ 2. 00 Net Premium Received: 3. 50 +3. 50 480 465 Current Index Level 500 (16. 50) CBOE 70

CHICAGO BOARD OPTIONS EXCHANGE Advanced Concepts 1 Volatility

Forecasting Index Price Strike Price Days to Exp. Index Price Strike Price Int Rates & Div Days to Exp. Int. Rates & Div Implied Volatility = Mkt Px of Option WHICH COMPONENTS CHANGE? CBOE 72

Volatility VOLATILITY IS A MEASURE OF RISK Mathematical definition Intuitive understanding CBOE 73

Types of Volatility • Historical actual volatility during a specified time period • Future actual volatility from present to option expiration • Implied volatility that justifies an option’s current market price • Forecasted estimate of future volatility used in computer models to calculate theoretical values CBOE 74

Implied Volatility The volatility percentage used in an option pricing formula that returns the market price of an option as theoretical value. CBOE 75

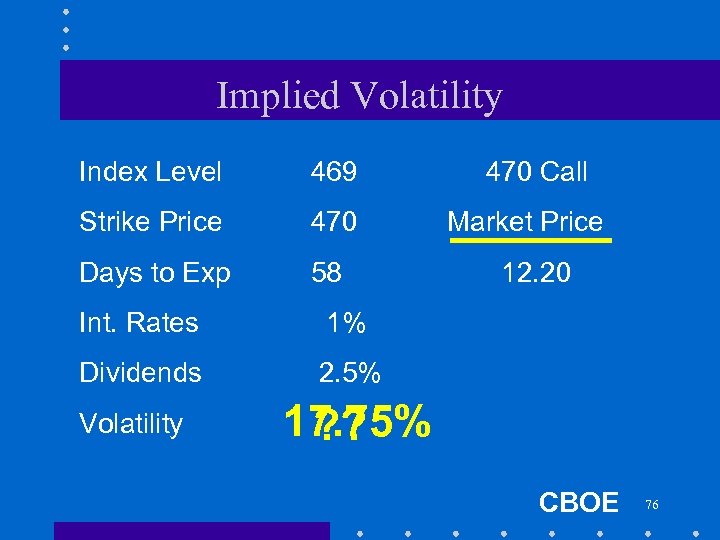

Implied Volatility Index Level 469 Strike Price 470 Days to Exp 58 Int. Rates Market Price 12. 20 1% Dividends 470 Call 2. 5% Volatility 17. 75% ? ? CBOE 76

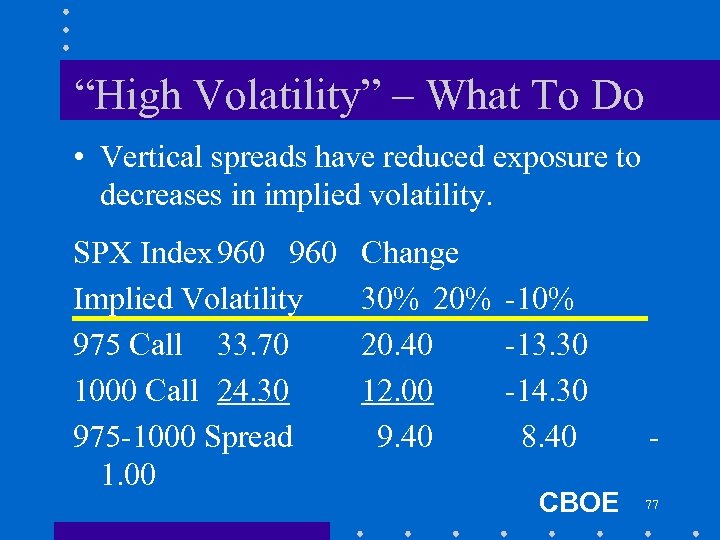

“High Volatility” – What To Do • Vertical spreads have reduced exposure to decreases in implied volatility. SPX Index 960 Implied Volatility 975 Call 33. 70 1000 Call 24. 30 975 -1000 Spread 1. 00 Change 30% 20. 40 12. 00 9. 40 -10% -13. 30 -14. 30 8. 40 CBOE 77

Volatility Skew • “Volatility skew” defined: A market condition in which options on the same underlying trade at different levels of implied volatility. • It is normal for a volatility skew to exist among index options. CBOE 78

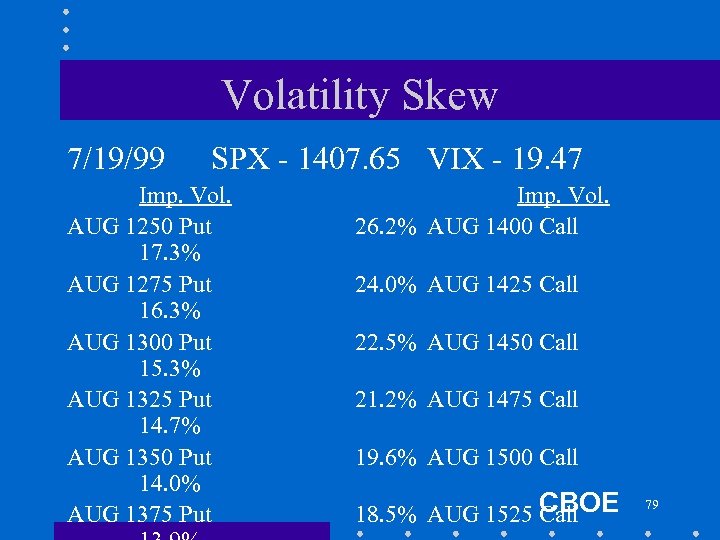

Volatility Skew 7/19/99 SPX - 1407. 65 VIX - 19. 47 Imp. Vol. AUG 1250 Put 17. 3% AUG 1275 Put 16. 3% AUG 1300 Put 15. 3% AUG 1325 Put 14. 7% AUG 1350 Put 14. 0% AUG 1375 Put Imp. Vol. 26. 2% AUG 1400 Call 24. 0% AUG 1425 Call 22. 5% AUG 1450 Call 21. 2% AUG 1475 Call 19. 6% AUG 1500 Call 18. 5% AUG 1525 CBOE Call 79

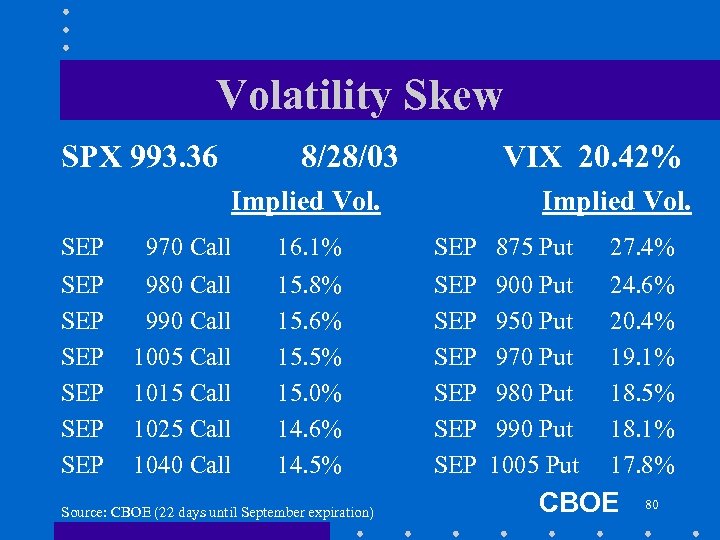

Volatility Skew SPX 993. 36 8/28/03 VIX 20. 42% Implied Vol. SEP 970 Call 16. 1% SEP 875 Put 27. 4% SEP SEP SEP 980 Call 990 Call 1005 Call 1015 Call 1025 Call 1040 Call 15. 8% 15. 6% 15. 5% 15. 0% 14. 6% 14. 5% SEP SEP SEP 24. 6% 20. 4% 19. 1% 18. 5% 18. 1% 17. 8% Source: CBOE (22 days until September expiration) 900 Put 950 Put 970 Put 980 Put 990 Put 1005 Put CBOE 80

VIX – CBOE’s Market Volatility Index • CBOE introduced VIX in 1993, and it has since become the most widely followed benchmark for stock market volatility. • VIX measures market expectations of near term volatility conveyed by stock index option prices. • Since volatility often signifies financial turmoil, VIX is called the “investor fear gauge”. CBOE 81

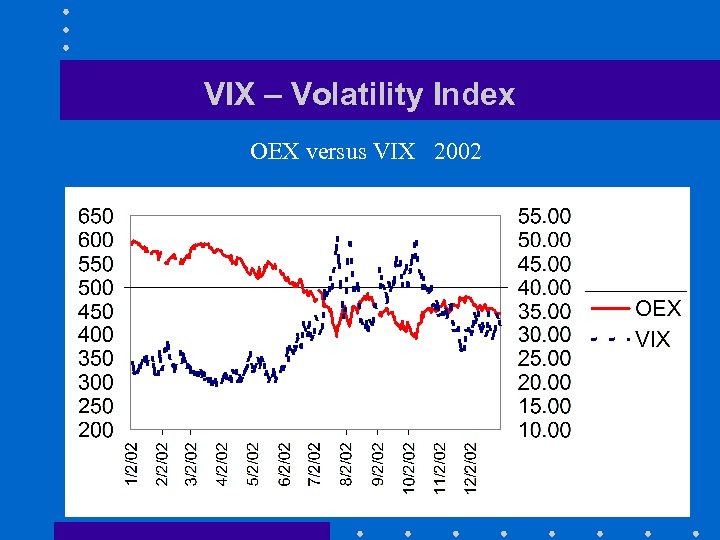

VIX – Volatility Index OEX versus VIX 2002 CBOE 82

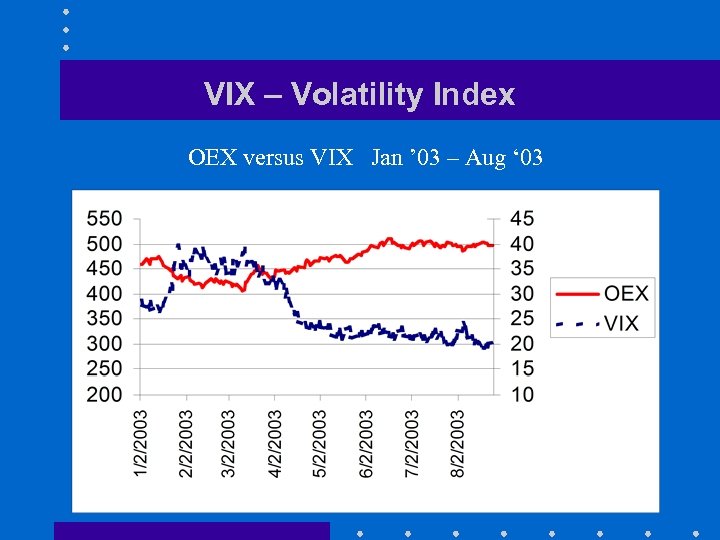

VIX – Volatility Index OEX versus VIX Jan ’ 03 – Aug ‘ 03 CBOE 83

VIX is Changing! • “New VIX” (VIX) effective 9/22/03, there will be a new VIX calculation based on the implied volatility of S&P 500 Index options (SPX). • “Old VIX” (VXO) is based on the implied volatility of S&P 100 Index options (OEX). VXO will continue to be calculated and available from most quote vendors. CBOE 84

CHICAGO BOARD OPTIONS EXCHANGE Advanced Concepts 2 How Much the Market Moves

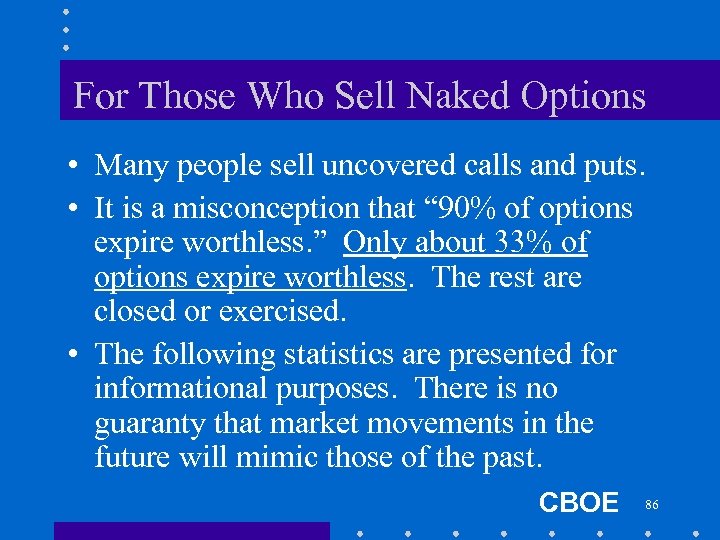

For Those Who Sell Naked Options • Many people sell uncovered calls and puts. • It is a misconception that “ 90% of options expire worthless. ” Only about 33% of options expire worthless. The rest are closed or exercised. • The following statistics are presented for informational purposes. There is no guaranty that market movements in the future will mimic those of the past. CBOE 86

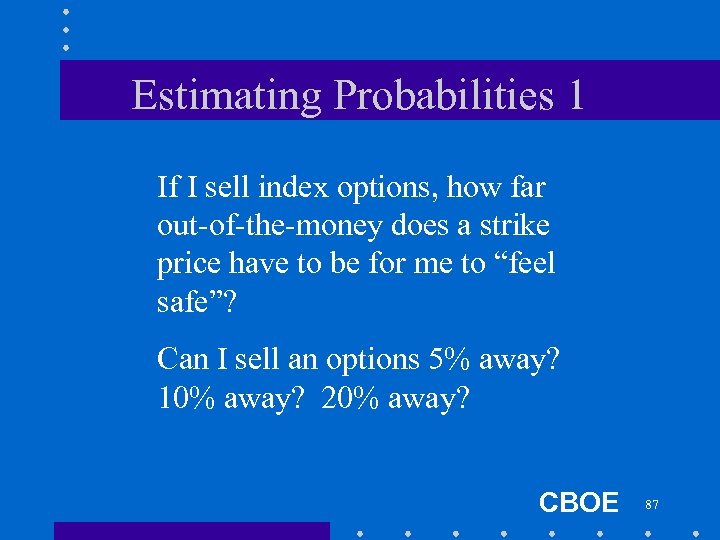

Estimating Probabilities 1 If I sell index options, how far out-of-the-money does a strike price have to be for me to “feel safe”? Can I sell an options 5% away? 10% away? 20% away? CBOE 87

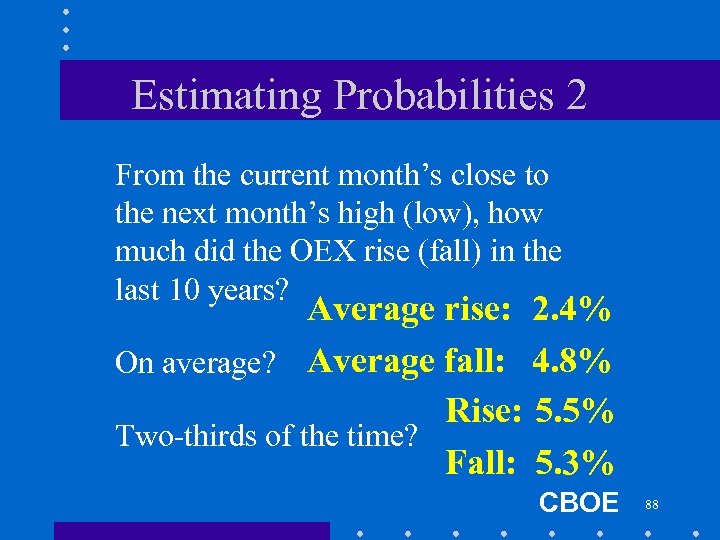

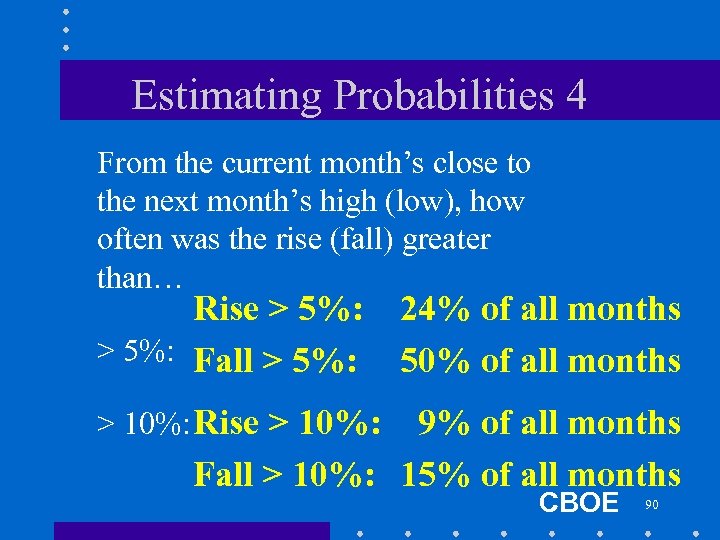

Estimating Probabilities 2 From the current month’s close to the next month’s high (low), how much did the OEX rise (fall) in the last 10 years? Average rise: 2. 4% On average? Average fall: 4. 8% Rise: 5. 5% Two-thirds of the time? Fall: 5. 3% CBOE 88

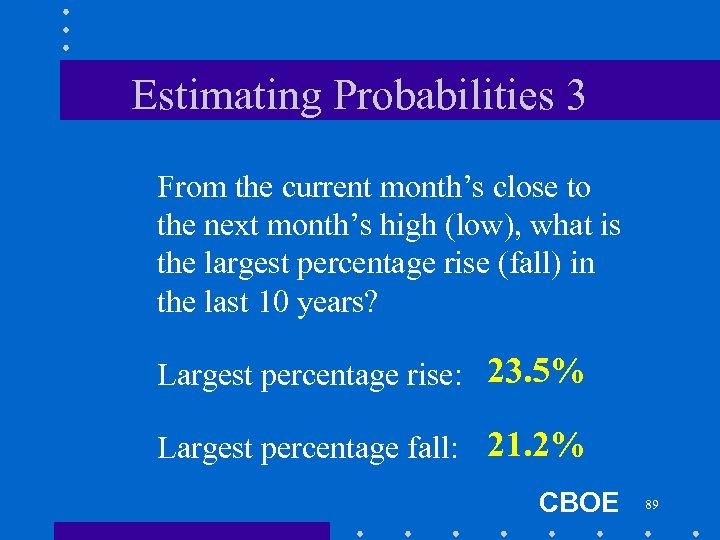

Estimating Probabilities 3 From the current month’s close to the next month’s high (low), what is the largest percentage rise (fall) in the last 10 years? Largest percentage rise: 23. 5% Largest percentage fall: 21. 2% CBOE 89

Estimating Probabilities 4 From the current month’s close to the next month’s high (low), how often was the rise (fall) greater than… Rise > 5%: Fall > 5%: 24% of all months 50% of all months > 10%: Rise > 10%: 9% of all months Fall > 10%: 15% of all months CBOE 90

What Do Probabilities Tell Us? The market moves more on a short-term basis than many people realize. Blindly following “trading systems” is very risky. Judgment is essential at every step. Manage capital so as to stay in business. Close trades and take profits and losses. CBOE 91

CHICAGO BOARD OPTIONS EXCHANGE Advanced Strategies 3 Time Spreads

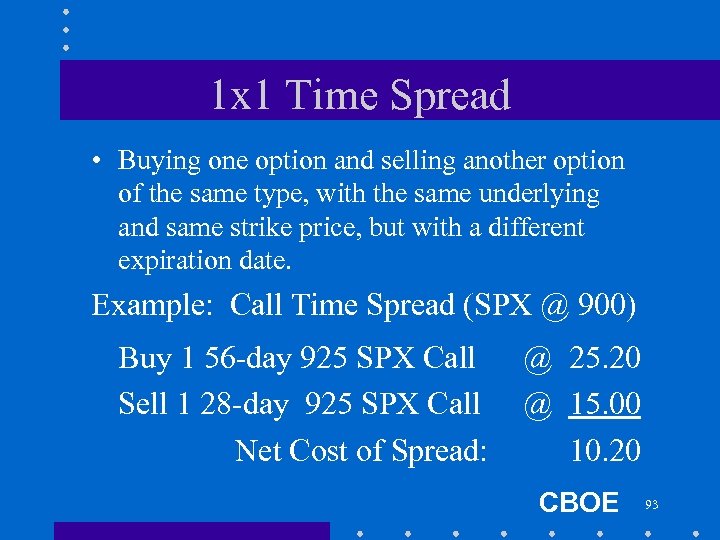

1 x 1 Time Spread • Buying one option and selling another option of the same type, with the same underlying and same strike price, but with a different expiration date. Example: Call Time Spread (SPX @ 900) Buy 1 56 -day 925 SPX Call Sell 1 28 -day 925 SPX Call Net Cost of Spread: @ 25. 20 @ 15. 00 10. 20 CBOE 93

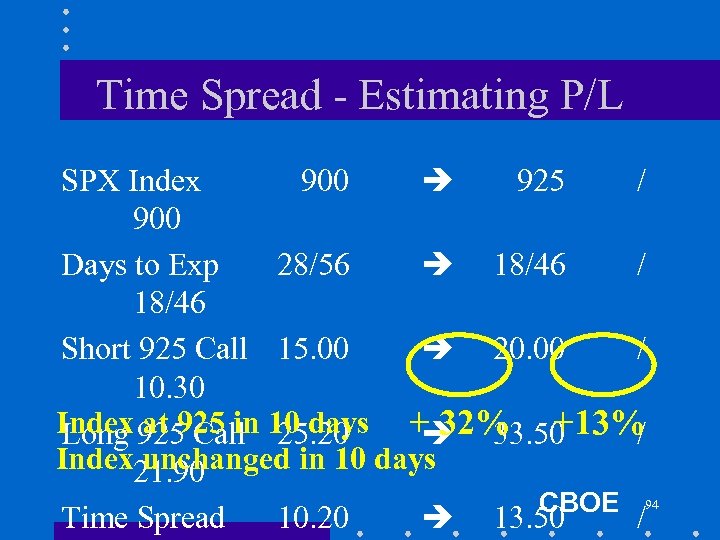

Time Spread - Estimating P/L SPX Index 900 925 / 900 Days to Exp 28/56 18/46 / 18/46 Short 925 Call 15. 00 20. 00 / 10. 30 Index 925 Call 10 days + 32% +13% Long at 925 in 25. 20 33. 50 / Index 21. 90 unchanged in 10 days CBOE 94 Time Spread 10. 20 13. 50 /

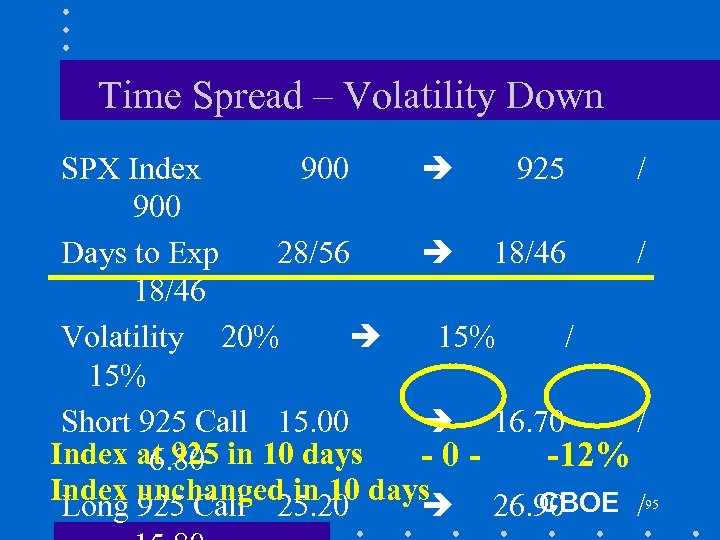

Time Spread – Volatility Down SPX Index 900 925 / 900 Days to Exp 28/56 18/46 / 18/46 Volatility 20% 15% / 15% Short 925 Call 15. 00 16. 70 / Index at 925 in 10 days -0 -12% 6. 80 Index unchanged in 10 days CBOE /95 Long 925 Call 25. 20 26. 90

Time Spread - Conclusions • Neutral market strategy – Near zero delta – Profitable for “small” rise or fall in the underlying (with implied volatility unchanged) • Time decay is major benefit • High exposure to changes in implied volatility – Time spreads are a “low-volatility” strategy CBOE 96

CHICAGO BOARD OPTIONS EXCHANGE Advanced Strategies 4 Diagonal Spreads

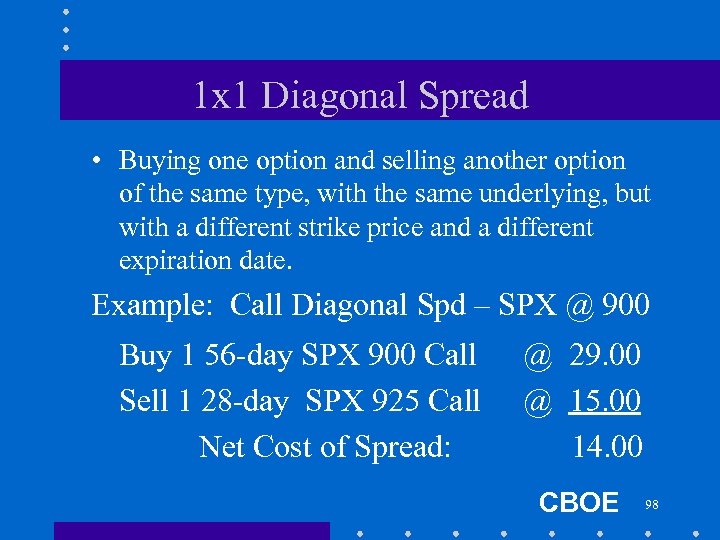

1 x 1 Diagonal Spread • Buying one option and selling another option of the same type, with the same underlying, but with a different strike price and a different expiration date. Example: Call Diagonal Spd – SPX @ 900 Buy 1 56 -day SPX 900 Call Sell 1 28 -day SPX 925 Call Net Cost of Spread: @ 29. 00 @ 15. 00 14. 00 CBOE 98

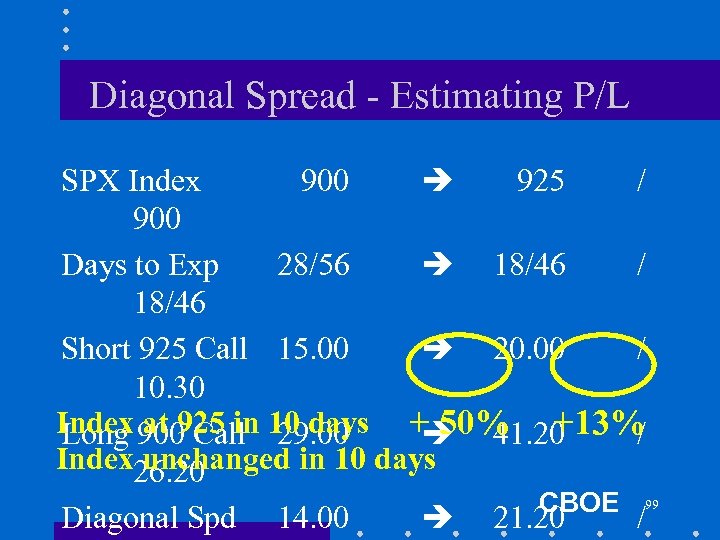

Diagonal Spread - Estimating P/L SPX Index 900 925 / 900 Days to Exp 28/56 18/46 / 18/46 Short 925 Call 15. 00 20. 00 / 10. 30 Index 900 Call 10 days + 50% +13% Long at 925 in 29. 00 41. 20 / Index 26. 20 unchanged in 10 days CBOE 99 Diagonal Spd 14. 00 21. 20 /

Diagonal Spread – Volatility Down SPX Index 900 925 / 900 Days to Exp 28/56 18/46 / 18/46 Volatility 20% 15% / 15% Short 925 Call 15. 00 16. 70 / Index at 925 in 10 days + 33% - 8% 6. 80 CBOE 100 Index unchanged in 10 days Long 900 Call 29. 00 35. 40 /

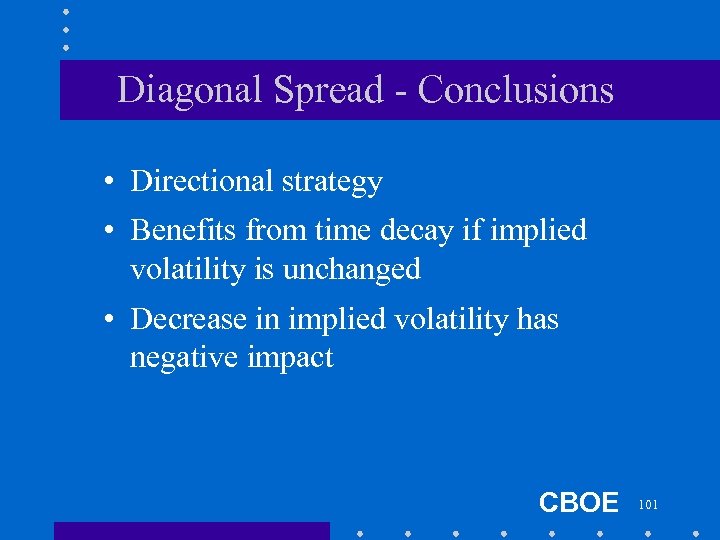

Diagonal Spread - Conclusions • Directional strategy • Benefits from time decay if implied volatility is unchanged • Decrease in implied volatility has negative impact CBOE 101

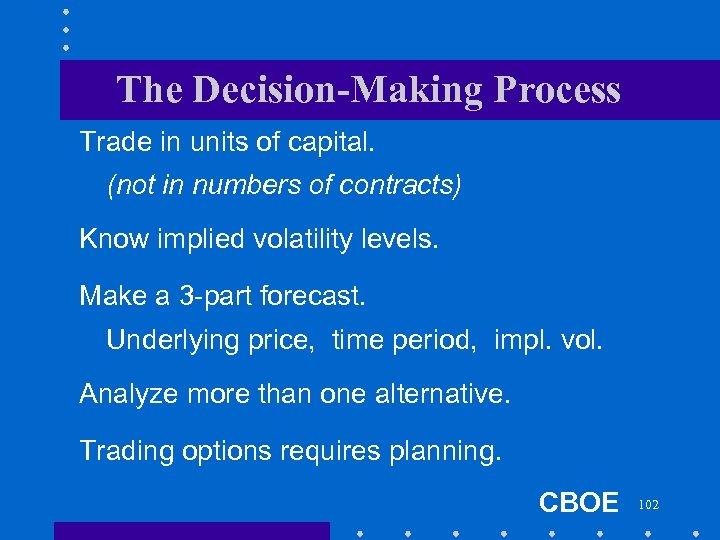

The Decision-Making Process Trade in units of capital. (not in numbers of contracts) Know implied volatility levels. Make a 3 -part forecast. Underlying price, time period, impl. vol. Analyze more than one alternative. Trading options requires planning. CBOE 102

Thank You for Attending • Contact us at: www. cboe. com • The Options Institute – 1 -877 -THE-CBOE then press 4, 3 • Questions: options_institute@cboe. com • Courses: http: //www. cboe. com/Learn. Center/Seminars. asp CHICAGO BOARD OPTIONS EXCHANGE CBOE 103

4a7c7cbb32b7854924d6ad1604301782.ppt