a7e1be01ec66728dfe539894f0aed754.ppt

- Количество слайдов: 36

Chapters 5 and 13 -The Open Economy 5 and 13 -1

Chapters 5 and 13 -The Open Economy 5 and 13 -1

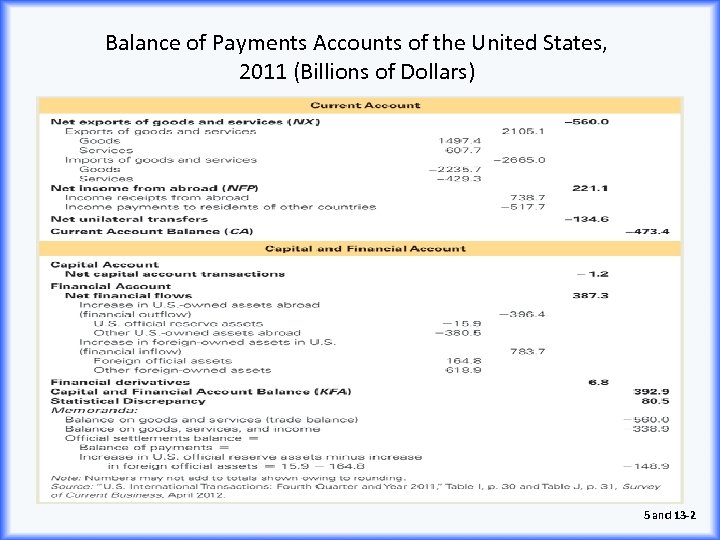

Balance of Payments Accounts of the United States, 2011 (Billions of Dollars) 5 and 13 -2

Balance of Payments Accounts of the United States, 2011 (Billions of Dollars) 5 and 13 -2

Balance of Payments Accounting • Basic Principles – Credit item (+) • Funds flow into the country • Example: exports of goods – Debit item (–) • Funds flow out of the country • Example: imports of goods 5 and 13 -3

Balance of Payments Accounting • Basic Principles – Credit item (+) • Funds flow into the country • Example: exports of goods – Debit item (–) • Funds flow out of the country • Example: imports of goods 5 and 13 -3

Balance of Payments Accounting • The current account – Net exports of goods and services (NX) – Net income from abroad (NFP) – Net unilateral transfers (NUT) q Net income from abroad (NFP) § Income received from abroad is a credit item, since it causes funds to flow into the United States § Payment of income to foreigners is a debit item q Net income from abroad is part of the current account, and is about equal to NFP, net factor payments q Net unilateral transfers (NUT) § Payments made from one country to another § Negative net unilateral transfers for United States, since United States is a net donor to other countries 5 and 13 -4

Balance of Payments Accounting • The current account – Net exports of goods and services (NX) – Net income from abroad (NFP) – Net unilateral transfers (NUT) q Net income from abroad (NFP) § Income received from abroad is a credit item, since it causes funds to flow into the United States § Payment of income to foreigners is a debit item q Net income from abroad is part of the current account, and is about equal to NFP, net factor payments q Net unilateral transfers (NUT) § Payments made from one country to another § Negative net unilateral transfers for United States, since United States is a net donor to other countries 5 and 13 -4

Balance of Payments Accounting • Sum of net exports of goods and services, net income from abroad, and net unilateral transfers is the current account balance • CA = NX + NFP + NUT – Positive current account balance implies current account surplus – Negative current account balance implies current account deficit 5 and 13 -5

Balance of Payments Accounting • Sum of net exports of goods and services, net income from abroad, and net unilateral transfers is the current account balance • CA = NX + NFP + NUT – Positive current account balance implies current account surplus – Negative current account balance implies current account deficit 5 and 13 -5

Balance of Payments Accounting • The capital and financial account – The capital and financial account records trades in existing assets, either real (for example, houses) or financial (for example, stocks and bonds) – The capital account records the net flow of unilateral transfers of assets into the country 5 and 13 -6

Balance of Payments Accounting • The capital and financial account – The capital and financial account records trades in existing assets, either real (for example, houses) or financial (for example, stocks and bonds) – The capital account records the net flow of unilateral transfers of assets into the country 5 and 13 -6

Balance of Payments Accounting • The capital and financial account – Most transactions appear in the financial account part of the capital and financial account • When home country sells assets to a foreign country, that is a capital inflow for the home country and a credit (+) item in the capital and financial account • When assets are purchased from a foreign country, there is a capital outflow from the home country and a debit (–) item in the capital and financial account q Financial Account • Financial Inflow – Credit item (+) – Sale of U. S. assets to foreigners • Financial Outflow – Debit item (–) – Purchase of foreign assets by U. S. residents • KFA = capital and financial account balance 5 and 13 -7

Balance of Payments Accounting • The capital and financial account – Most transactions appear in the financial account part of the capital and financial account • When home country sells assets to a foreign country, that is a capital inflow for the home country and a credit (+) item in the capital and financial account • When assets are purchased from a foreign country, there is a capital outflow from the home country and a debit (–) item in the capital and financial account q Financial Account • Financial Inflow – Credit item (+) – Sale of U. S. assets to foreigners • Financial Outflow – Debit item (–) – Purchase of foreign assets by U. S. residents • KFA = capital and financial account balance 5 and 13 -7

Balance of Payments Accounting • The official settlements balance – Transactions in official reserve assets are conducted by central banks of countries – Official reserve assets are assets (foreign government securities, bank deposits, and SDRs of the IMF, gold) used in making international payments – Central banks buy (or sell) official reserve assets with (or to obtain) their own currencies – Also called the balance of payments, it equals the net increase in a country’s official reserve assets – For the United States, the net increase in official reserve assets is the rise in U. S. government reserve assets minus foreign central bank holdings of U. S. dollar assets – Having a balance of payments surplus means a country is increasing its official reserve assets; a balance of payments deficit is a reduction in official reserve assets 5 and 13 -8

Balance of Payments Accounting • The official settlements balance – Transactions in official reserve assets are conducted by central banks of countries – Official reserve assets are assets (foreign government securities, bank deposits, and SDRs of the IMF, gold) used in making international payments – Central banks buy (or sell) official reserve assets with (or to obtain) their own currencies – Also called the balance of payments, it equals the net increase in a country’s official reserve assets – For the United States, the net increase in official reserve assets is the rise in U. S. government reserve assets minus foreign central bank holdings of U. S. dollar assets – Having a balance of payments surplus means a country is increasing its official reserve assets; a balance of payments deficit is a reduction in official reserve assets 5 and 13 -8

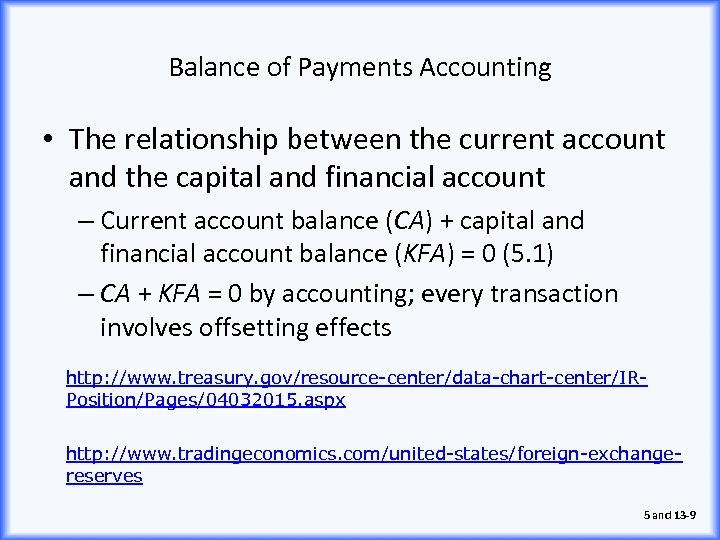

Balance of Payments Accounting • The relationship between the current account and the capital and financial account – Current account balance (CA) + capital and financial account balance (KFA) = 0 (5. 1) – CA + KFA = 0 by accounting; every transaction involves offsetting effects http: //www. treasury. gov/resource-center/data-chart-center/IRPosition/Pages/04032015. aspx http: //www. tradingeconomics. com/united-states/foreign-exchangereserves 5 and 13 -9

Balance of Payments Accounting • The relationship between the current account and the capital and financial account – Current account balance (CA) + capital and financial account balance (KFA) = 0 (5. 1) – CA + KFA = 0 by accounting; every transaction involves offsetting effects http: //www. treasury. gov/resource-center/data-chart-center/IRPosition/Pages/04032015. aspx http: //www. tradingeconomics. com/united-states/foreign-exchangereserves 5 and 13 -9

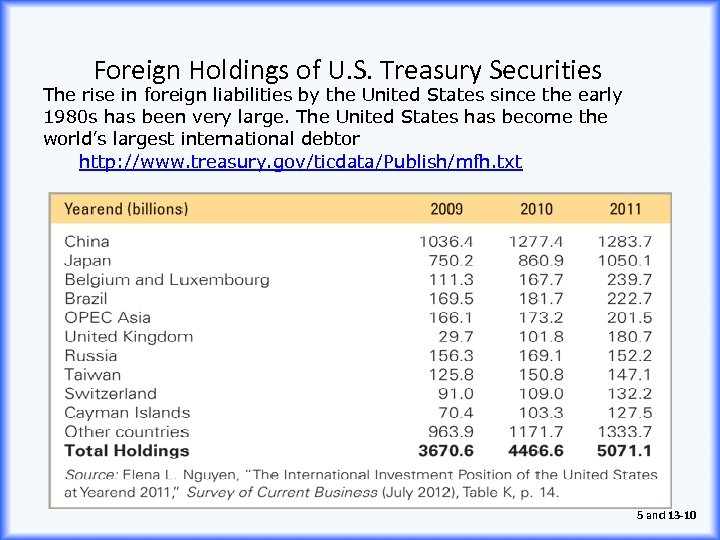

Foreign Holdings of U. S. Treasury Securities The rise in foreign liabilities by the United States since the early 1980 s has been very large. The United States has become the world’s largest international debtor http: //www. treasury. gov/ticdata/Publish/mfh. txt 5 and 13 -10

Foreign Holdings of U. S. Treasury Securities The rise in foreign liabilities by the United States since the early 1980 s has been very large. The United States has become the world’s largest international debtor http: //www. treasury. gov/ticdata/Publish/mfh. txt 5 and 13 -10

Globalization • The Impact of Globalization on the U. S. Economy • World’s economies are increasingly interdependent—more international trade and investment • Should the U. S. reign in globalization? 5 and 13 -11

Globalization • The Impact of Globalization on the U. S. Economy • World’s economies are increasingly interdependent—more international trade and investment • Should the U. S. reign in globalization? 5 and 13 -11

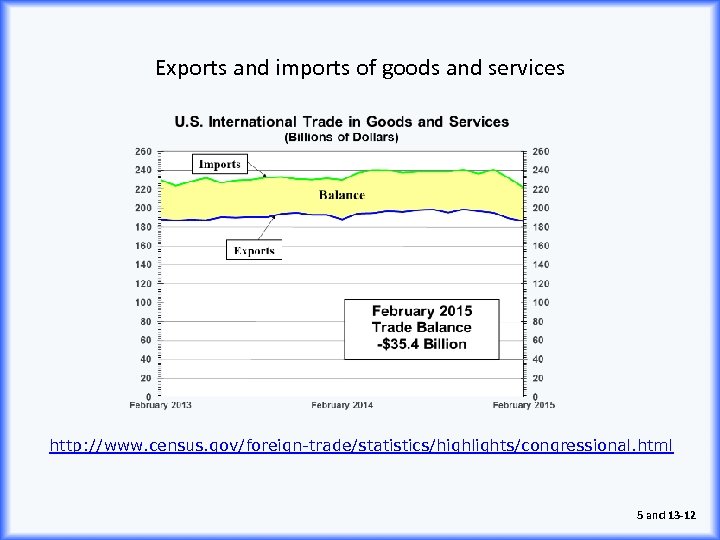

Exports and imports of goods and services http: //www. census. gov/foreign-trade/statistics/highlights/congressional. html 5 and 13 -12

Exports and imports of goods and services http: //www. census. gov/foreign-trade/statistics/highlights/congressional. html 5 and 13 -12

Globalization • Costs of globalization: U. S. jobs lost in particular sectors • Benefits of globalization: U. S. jobs gained in particular sectors – U. S. exports increase – Cheaper imported goods means more goods & services at lower prices—gains from trade • But loss for jobs from foreign trade is a small fraction of total job loss in U. S. 5 and 13 -13

Globalization • Costs of globalization: U. S. jobs lost in particular sectors • Benefits of globalization: U. S. jobs gained in particular sectors – U. S. exports increase – Cheaper imported goods means more goods & services at lower prices—gains from trade • But loss for jobs from foreign trade is a small fraction of total job loss in U. S. 5 and 13 -13

Globalization • Recent years: big changes in business services industry—call centers, etc. • Critics: moving jobs abroad • Reality: U. S. is world leader in exporting business services—far more is done in U. S. and sold abroad than vice versa • So U. S. benefits from such activity far more than it “loses” 5 and 13 -14

Globalization • Recent years: big changes in business services industry—call centers, etc. • Critics: moving jobs abroad • Reality: U. S. is world leader in exporting business services—far more is done in U. S. and sold abroad than vice versa • So U. S. benefits from such activity far more than it “loses” 5 and 13 -14

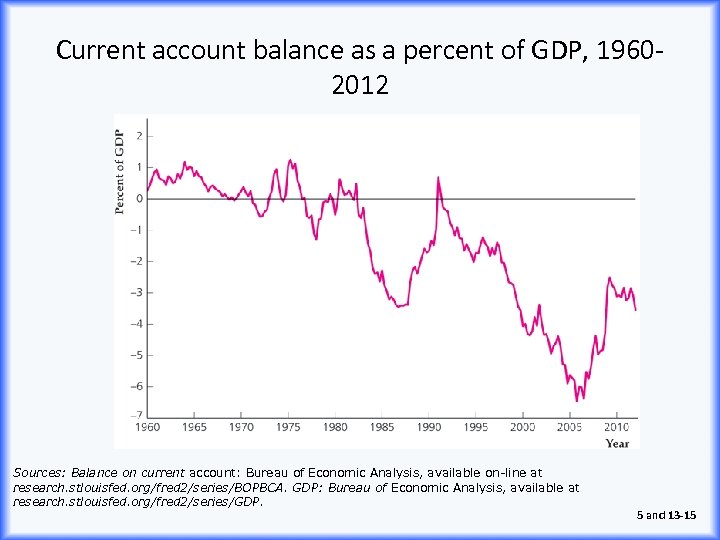

Current account balance as a percent of GDP, 19602012 Sources: Balance on current account: Bureau of Economic Analysis, available on-line at research. stlouisfed. org/fred 2/series/BOPBCA. GDP: Bureau of Economic Analysis, available at research. stlouisfed. org/fred 2/series/GDP. 5 and 13 -15

Current account balance as a percent of GDP, 19602012 Sources: Balance on current account: Bureau of Economic Analysis, available on-line at research. stlouisfed. org/fred 2/series/BOPBCA. GDP: Bureau of Economic Analysis, available at research. stlouisfed. org/fred 2/series/GDP. 5 and 13 -15

Exchange Rates • Nominal exchange rates – The nominal exchange rate tells you how much foreign currency you can obtain with one unit of the domestic currency • For example, if the nominal exchange rate is 90 yen per dollar, one dollar can be exchanged for 90 yen • Transactions between currencies take place in the foreign exchange market • Denote the nominal exchange rate (or simply, exchange rate) as enom in units of the foreign currency per unit of domestic currency 5 and 13 -16

Exchange Rates • Nominal exchange rates – The nominal exchange rate tells you how much foreign currency you can obtain with one unit of the domestic currency • For example, if the nominal exchange rate is 90 yen per dollar, one dollar can be exchanged for 90 yen • Transactions between currencies take place in the foreign exchange market • Denote the nominal exchange rate (or simply, exchange rate) as enom in units of the foreign currency per unit of domestic currency 5 and 13 -16

Exchange Rates • Nominal exchange rates – Under a flexible-exchange-rate system or floatingexchange-rate system, exchange rates are determined by supply and demand may change every day; this is the current system for major currencies 5 and 13 -17

Exchange Rates • Nominal exchange rates – Under a flexible-exchange-rate system or floatingexchange-rate system, exchange rates are determined by supply and demand may change every day; this is the current system for major currencies 5 and 13 -17

Exchange Rates • Nominal exchange rates – In the past, many currencies operated under a fixed-exchange-rate system, in which exchange rates were determined by governments • The exchange rates were fixed because the central banks in those countries offered to buy or sell the currencies at the fixed exchange rate • Examples include the gold standard, which operated in the late 1800 s and early 1900 s, and the Bretton Woods system, which was in place from 1944 until the early 1970 s • Even today, though major currencies are in a flexibleexchange-rate system, some smaller countries fix their exchange rates 5 and 13 -18

Exchange Rates • Nominal exchange rates – In the past, many currencies operated under a fixed-exchange-rate system, in which exchange rates were determined by governments • The exchange rates were fixed because the central banks in those countries offered to buy or sell the currencies at the fixed exchange rate • Examples include the gold standard, which operated in the late 1800 s and early 1900 s, and the Bretton Woods system, which was in place from 1944 until the early 1970 s • Even today, though major currencies are in a flexibleexchange-rate system, some smaller countries fix their exchange rates 5 and 13 -18

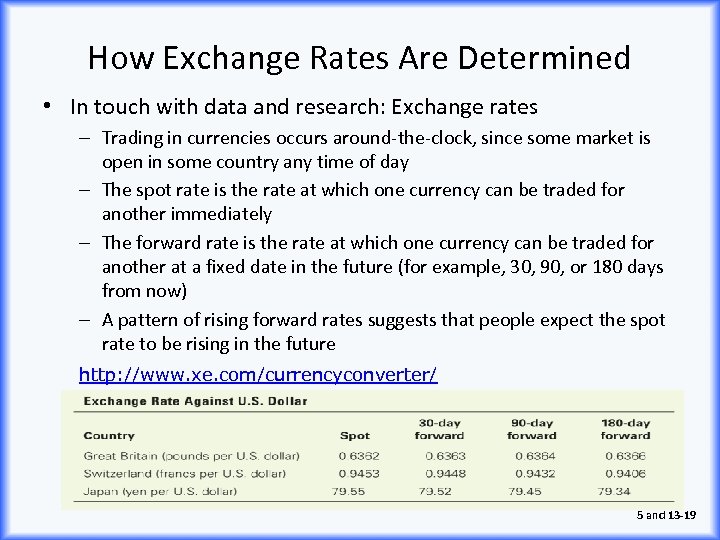

How Exchange Rates Are Determined • In touch with data and research: Exchange rates – Trading in currencies occurs around-the-clock, since some market is open in some country any time of day – The spot rate is the rate at which one currency can be traded for another immediately – The forward rate is the rate at which one currency can be traded for another at a fixed date in the future (for example, 30, 90, or 180 days from now) – A pattern of rising forward rates suggests that people expect the spot rate to be rising in the future http: //www. xe. com/currencyconverter/ 5 and 13 -19

How Exchange Rates Are Determined • In touch with data and research: Exchange rates – Trading in currencies occurs around-the-clock, since some market is open in some country any time of day – The spot rate is the rate at which one currency can be traded for another immediately – The forward rate is the rate at which one currency can be traded for another at a fixed date in the future (for example, 30, 90, or 180 days from now) – A pattern of rising forward rates suggests that people expect the spot rate to be rising in the future http: //www. xe. com/currencyconverter/ 5 and 13 -19

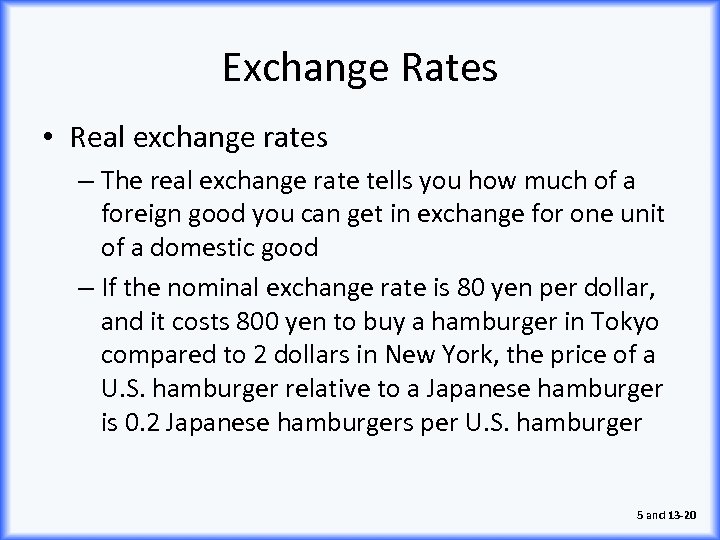

Exchange Rates • Real exchange rates – The real exchange rate tells you how much of a foreign good you can get in exchange for one unit of a domestic good – If the nominal exchange rate is 80 yen per dollar, and it costs 800 yen to buy a hamburger in Tokyo compared to 2 dollars in New York, the price of a U. S. hamburger relative to a Japanese hamburger is 0. 2 Japanese hamburgers per U. S. hamburger 5 and 13 -20

Exchange Rates • Real exchange rates – The real exchange rate tells you how much of a foreign good you can get in exchange for one unit of a domestic good – If the nominal exchange rate is 80 yen per dollar, and it costs 800 yen to buy a hamburger in Tokyo compared to 2 dollars in New York, the price of a U. S. hamburger relative to a Japanese hamburger is 0. 2 Japanese hamburgers per U. S. hamburger 5 and 13 -20

Exchange Rates • Real exchange rates – The real exchange rate is the price of domestic goods relative to foreign goods, or e = enom P/PFor To simplify matters, we’ll assume that each country produces a unique good – In reality, countries produce many goods, so we must use price indexes to get P and PFor – If a country’s real exchange rate is rising, its goods are becoming more expensive relative to the goods of the other country 5 and 13 -21

Exchange Rates • Real exchange rates – The real exchange rate is the price of domestic goods relative to foreign goods, or e = enom P/PFor To simplify matters, we’ll assume that each country produces a unique good – In reality, countries produce many goods, so we must use price indexes to get P and PFor – If a country’s real exchange rate is rising, its goods are becoming more expensive relative to the goods of the other country 5 and 13 -21

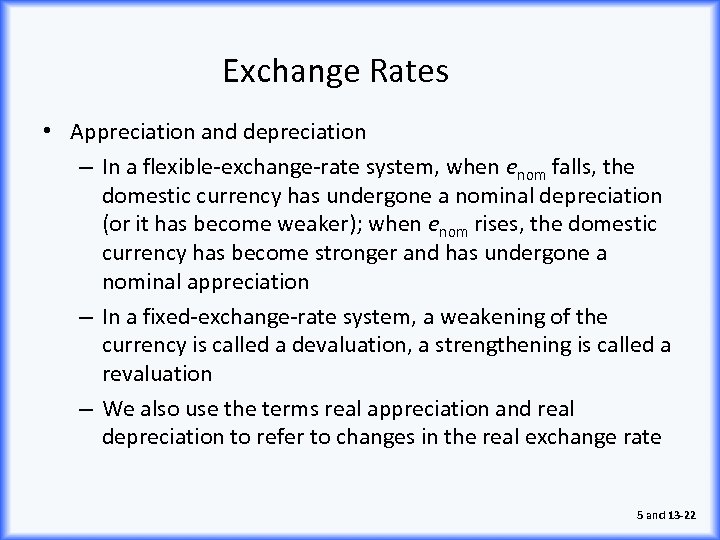

Exchange Rates • Appreciation and depreciation – In a flexible-exchange-rate system, when enom falls, the domestic currency has undergone a nominal depreciation (or it has become weaker); when enom rises, the domestic currency has become stronger and has undergone a nominal appreciation – In a fixed-exchange-rate system, a weakening of the currency is called a devaluation, a strengthening is called a revaluation – We also use the terms real appreciation and real depreciation to refer to changes in the real exchange rate 5 and 13 -22

Exchange Rates • Appreciation and depreciation – In a flexible-exchange-rate system, when enom falls, the domestic currency has undergone a nominal depreciation (or it has become weaker); when enom rises, the domestic currency has become stronger and has undergone a nominal appreciation – In a fixed-exchange-rate system, a weakening of the currency is called a devaluation, a strengthening is called a revaluation – We also use the terms real appreciation and real depreciation to refer to changes in the real exchange rate 5 and 13 -22

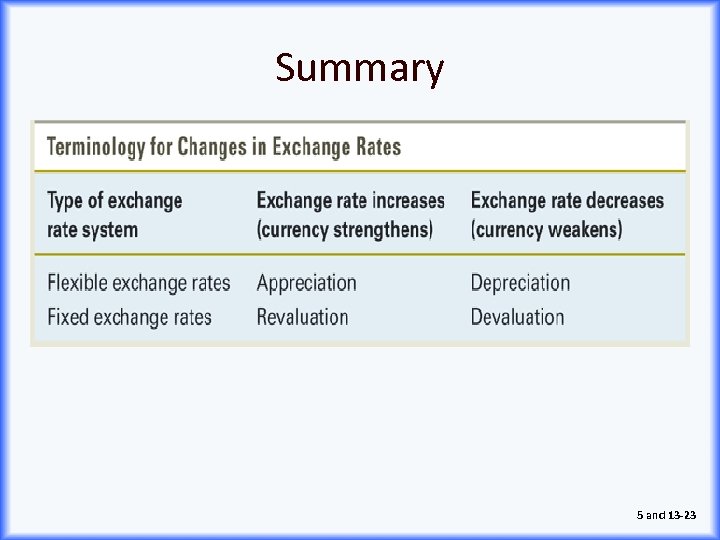

Summary 5 and 13 -23

Summary 5 and 13 -23

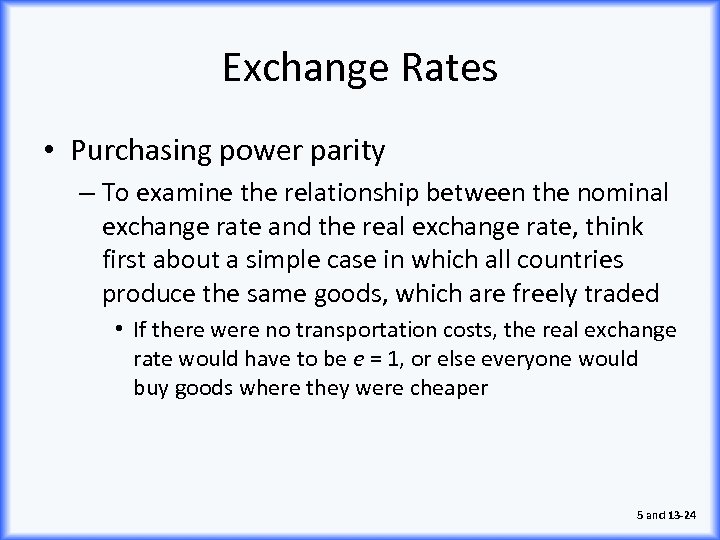

Exchange Rates • Purchasing power parity – To examine the relationship between the nominal exchange rate and the real exchange rate, think first about a simple case in which all countries produce the same goods, which are freely traded • If there were no transportation costs, the real exchange rate would have to be e = 1, or else everyone would buy goods where they were cheaper 5 and 13 -24

Exchange Rates • Purchasing power parity – To examine the relationship between the nominal exchange rate and the real exchange rate, think first about a simple case in which all countries produce the same goods, which are freely traded • If there were no transportation costs, the real exchange rate would have to be e = 1, or else everyone would buy goods where they were cheaper 5 and 13 -24

Exchange Rates • Purchasing power parity – Setting e = 1 in Eq. (13. 1) gives P = PFor/enom (13. 2) – This means that similar goods have the same price in terms of the same currency, a concept known as purchasing power parity, or PPP 5 and 13 -25

Exchange Rates • Purchasing power parity – Setting e = 1 in Eq. (13. 1) gives P = PFor/enom (13. 2) – This means that similar goods have the same price in terms of the same currency, a concept known as purchasing power parity, or PPP 5 and 13 -25

Exchange Rates • Purchasing power parity – Empirical evidence PPP holds in the long run but not in the short run Countries produce different goods Some goods aren’t traded Transportation costs Legal barriers to trade 5 and 13 -26

Exchange Rates • Purchasing power parity – Empirical evidence PPP holds in the long run but not in the short run Countries produce different goods Some goods aren’t traded Transportation costs Legal barriers to trade 5 and 13 -26

Exchange Rates • The real exchange rate and net exports – The real exchange rate (also called the terms of trade) is important because it represents the rate at which domestic goods and services can be traded for those produced abroad • An increase in the real exchange rate means people in a country can get more foreign goods for a given amount of domestic goods 5 and 13 -27

Exchange Rates • The real exchange rate and net exports – The real exchange rate (also called the terms of trade) is important because it represents the rate at which domestic goods and services can be traded for those produced abroad • An increase in the real exchange rate means people in a country can get more foreign goods for a given amount of domestic goods 5 and 13 -27

Exchange Rates • The real exchange rate and net exports – The real exchange rate also affects a country’s net exports (exports minus imports) • Changes in net exports have a direct impact on export and import industries in the country • Changes in net exports affect overall economic activity and are a primary channel through which business cycles and macroeconomic policy changes are transmitted internationally 5 and 13 -28

Exchange Rates • The real exchange rate and net exports – The real exchange rate also affects a country’s net exports (exports minus imports) • Changes in net exports have a direct impact on export and import industries in the country • Changes in net exports affect overall economic activity and are a primary channel through which business cycles and macroeconomic policy changes are transmitted internationally 5 and 13 -28

Exchange Rates • The real exchange rate and net exports – The real exchange rate affects net exports through its effect on the demand for goods • A high real exchange rate makes foreign goods cheap relative to domestic goods, so there’s a high demand foreign goods (in both countries) • With demand foreign goods high, net exports decline • Thus the higher the real exchange rate, the lower a country’s net exports 5 and 13 -29

Exchange Rates • The real exchange rate and net exports – The real exchange rate affects net exports through its effect on the demand for goods • A high real exchange rate makes foreign goods cheap relative to domestic goods, so there’s a high demand foreign goods (in both countries) • With demand foreign goods high, net exports decline • Thus the higher the real exchange rate, the lower a country’s net exports 5 and 13 -29

Exchange Rates • The real exchange rate and net exports – The J curve • The effect of a change in the real exchange rate may be weak in the short run and can even go the “wrong” way • Although a rise in the real exchange rate will reduce net exports in the long run, in the short run it may be difficult to quickly change imports and exports • As a result, a country will import and export the same amount of goods for a time, with lower relative prices on the foreign goods, thus increasing net exports 5 and 13 -30

Exchange Rates • The real exchange rate and net exports – The J curve • The effect of a change in the real exchange rate may be weak in the short run and can even go the “wrong” way • Although a rise in the real exchange rate will reduce net exports in the long run, in the short run it may be difficult to quickly change imports and exports • As a result, a country will import and export the same amount of goods for a time, with lower relative prices on the foreign goods, thus increasing net exports 5 and 13 -30

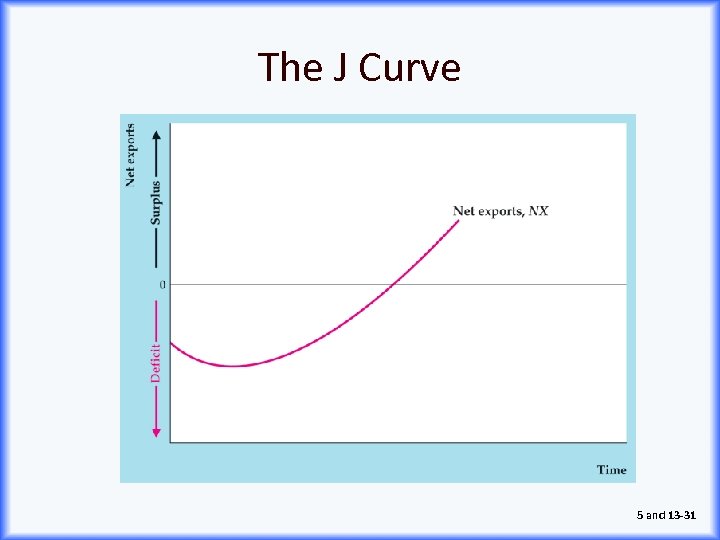

The J Curve 5 and 13 -31

The J Curve 5 and 13 -31

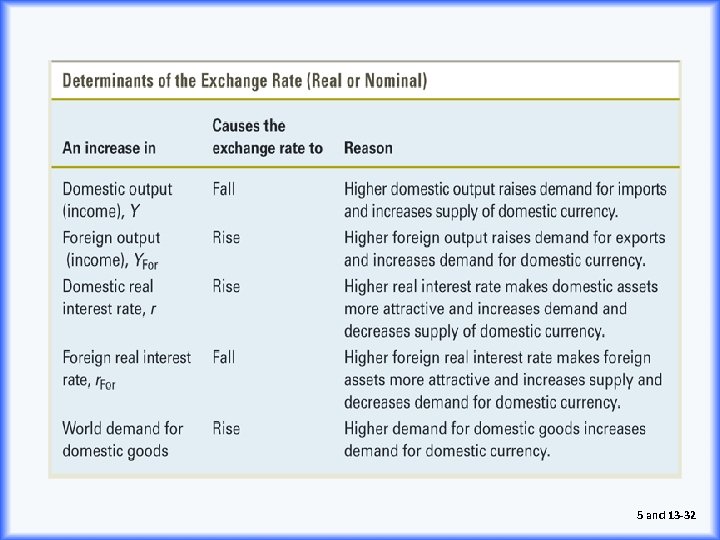

5 and 13 -32

5 and 13 -32

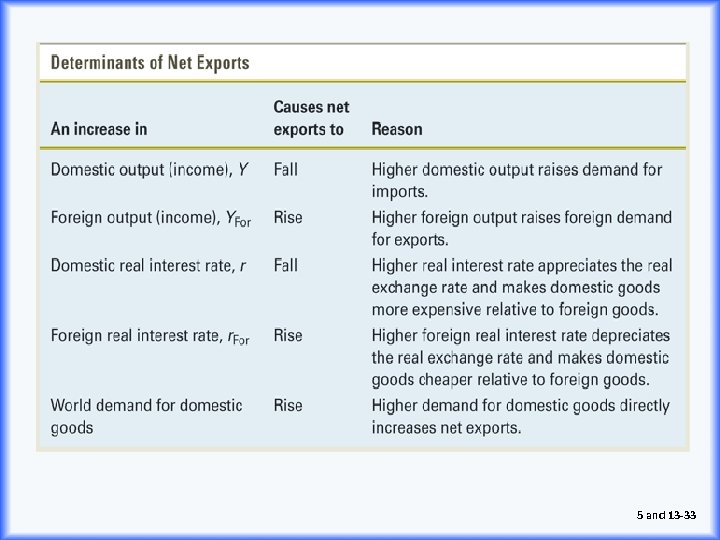

5 and 13 -33

5 and 13 -33

5 and 13 -34

5 and 13 -34

5 and 13 -35

5 and 13 -35

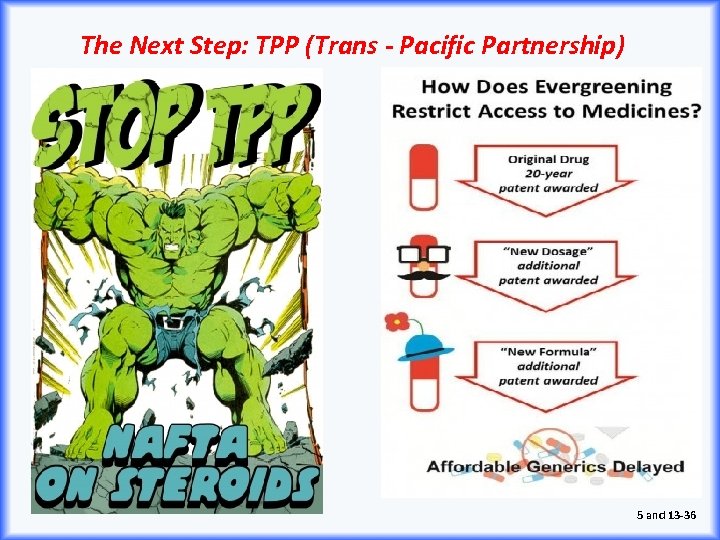

The Next Step: TPP (Trans - Pacific Partnership) 5 and 13 -36

The Next Step: TPP (Trans - Pacific Partnership) 5 and 13 -36