36f4cddce82fd3b84bc90fd58fe7face.ppt

- Количество слайдов: 19

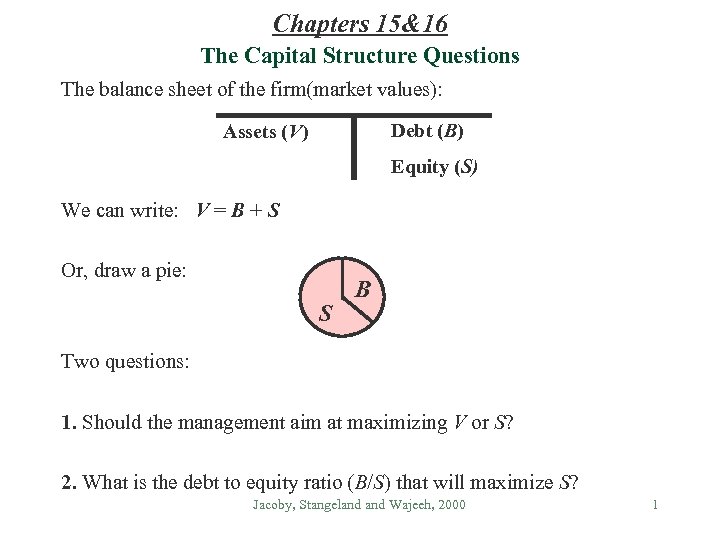

Chapters 15&16 The Capital Structure Questions The balance sheet of the firm(market values): Debt (B) Assets (V) Equity (S) We can write: V = B + S Or, draw a pie: S B Two questions: 1. Should the management aim at maximizing V or S? 2. What is the debt to equity ratio (B/S) that will maximize S? Jacoby, Stangeland Wajeeh, 2000 1

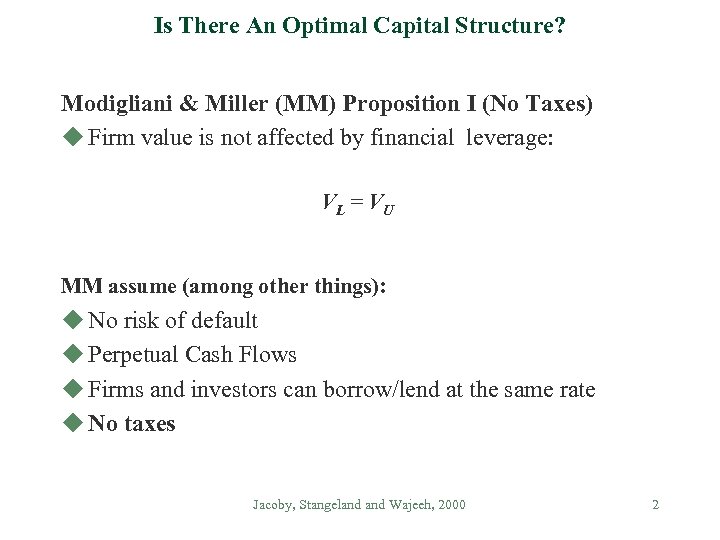

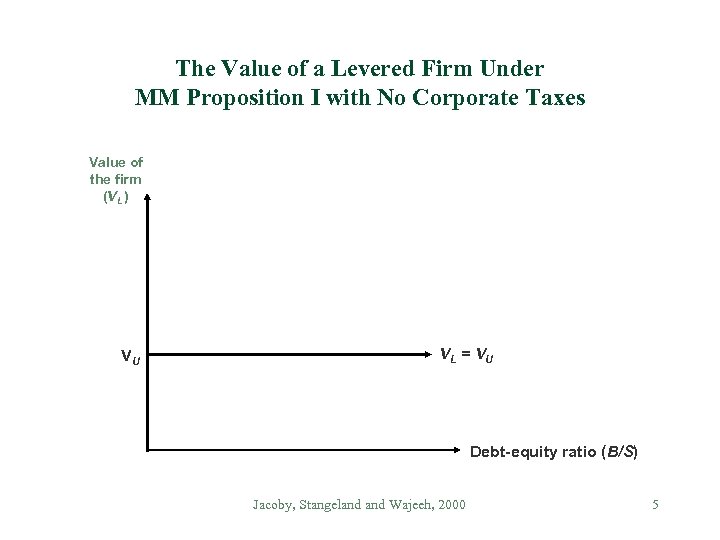

Is There An Optimal Capital Structure? Modigliani & Miller (MM) Proposition I (No Taxes) u Firm value is not affected by financial leverage: VL = V U MM assume (among other things): u No risk of default u Perpetual Cash Flows u Firms and investors can borrow/lend at the same rate u No taxes Jacoby, Stangeland Wajeeh, 2000 2

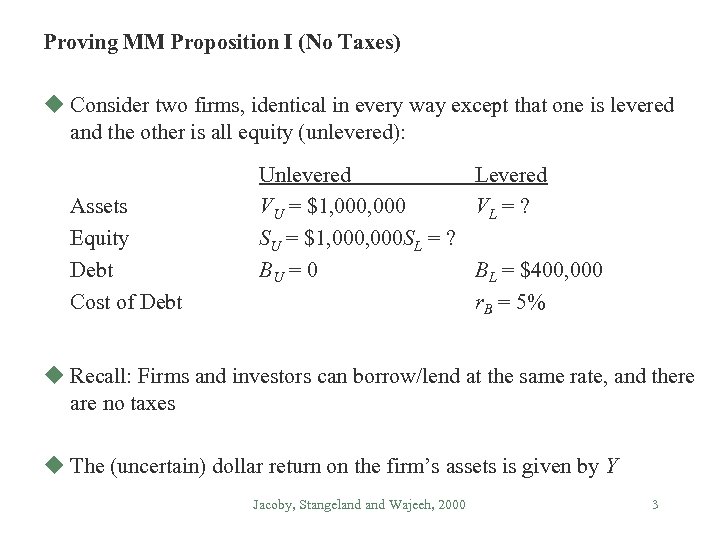

Proving MM Proposition I (No Taxes) u Consider two firms, identical in every way except that one is levered and the other is all equity (unlevered): Assets Equity Debt Cost of Debt Unlevered Levered VU = $1, 000 VL = ? SU = $1, 000 SL = ? BU = 0 BL = $400, 000 r. B = 5% u Recall: Firms and investors can borrow/lend at the same rate, and there are no taxes u The (uncertain) dollar return on the firm’s assets is given by Y Jacoby, Stangeland Wajeeh, 2000 3

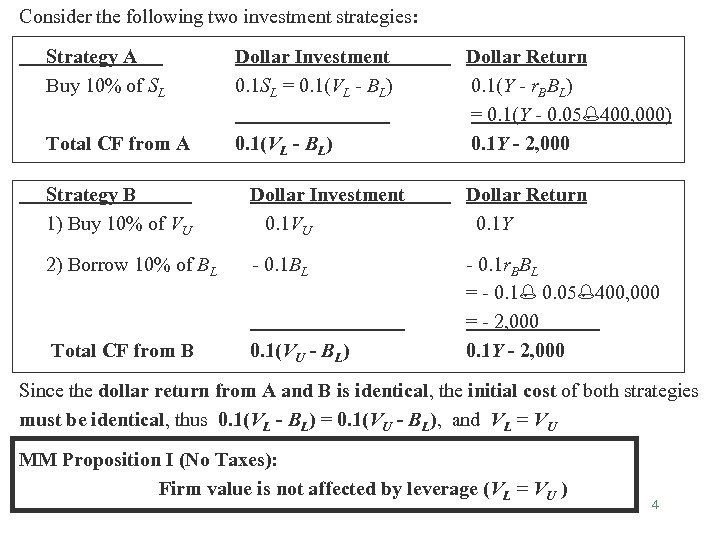

Consider the following two investment strategies: Strategy A Buy 10% of SL Dollar Investment 0. 1 SL = 0. 1(VL - BL) Total CF from A 0. 1(VL - BL) Dollar Return 0. 1(Y - r. BBL) = 0. 1(Y - 0. 05%400, 000) 0. 1 Y - 2, 000 Strategy B 1) Buy 10% of VU Dollar Investment 0. 1 VU Dollar Return 0. 1 Y 2) Borrow 10% of BL - 0. 1 BL Total CF from B 0. 1(VU - BL) - 0. 1 r. BBL = - 0. 1% 0. 05%400, 000 = - 2, 000 0. 1 Y - 2, 000 Since the dollar return from A and B is identical, the initial cost of both strategies must be identical, thus 0. 1(VL - BL) = 0. 1(VU - BL), and VL = VU MM Proposition I (No Taxes): Firm value is not affected by leverage (VL = VU ) 4

The Value of a Levered Firm Under MM Proposition I with No Corporate Taxes Value of the firm (VL ) VU VL = VU Debt-equity ratio (B/S) Jacoby, Stangeland Wajeeh, 2000 5

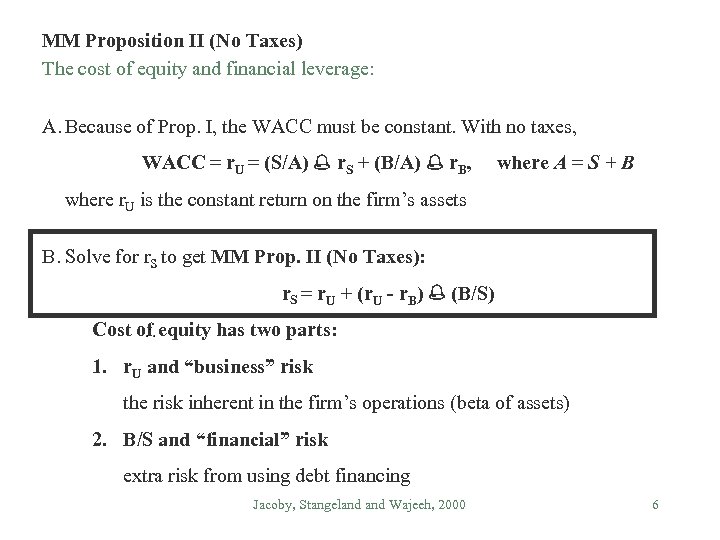

MM Proposition II (No Taxes) The cost of equity and financial leverage: A. Because of Prop. I, the WACC must be constant. With no taxes, WACC = r. U = (S/A) % r. S + (B/A) % r. B, where A = S + B where r. U is the constant return on the firm’s assets B. Solve for r. S to get MM Prop. II (No Taxes): r. S = r. U + (r. U - r. B) % (B/S) Cost of equity has two parts: 1. r. U and “business” risk the risk inherent in the firm’s operations (beta of assets) 2. B/S and “financial” risk extra risk from using debt financing Jacoby, Stangeland Wajeeh, 2000 6

The Cost of Equity, the Cost of Debt, and the Weighted Average Cost of Capital: MM Proposition II with No Corporate Taxes Cost of capital r. S = r. U + (r. U – r. B) x (B/S) WACC = r. U r. B Debt-equity ratio (B/S) Jacoby, Stangeland Wajeeh, 2000 7

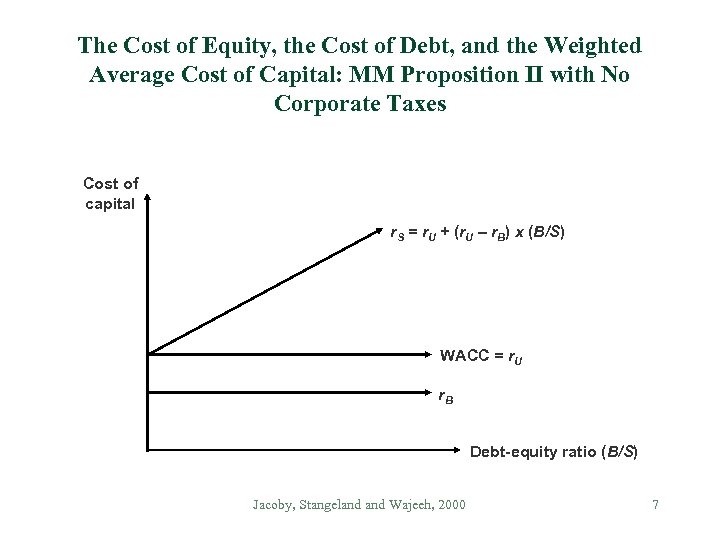

Debt, Taxes, and Firm Value u The interest tax shield and firm value For simplicity: (1) perpetual cash flows (2) no depreciation (3) no fixed asset or NWC spending A firm is considering going from zero debt to $400 at 10%: Firm U Firm L (unlevered) EBIT $200 Interest 0 Tax (40%) $80 Net income $120 Cash flow from assets (EBIT-Taxes) $120 (levered) $40 $64 $96 +$16 $136 Tax saving = $16 = 0. 4 % $40 = TC % r. B % B Jacoby, Stangeland Wajeeh, 2000 8

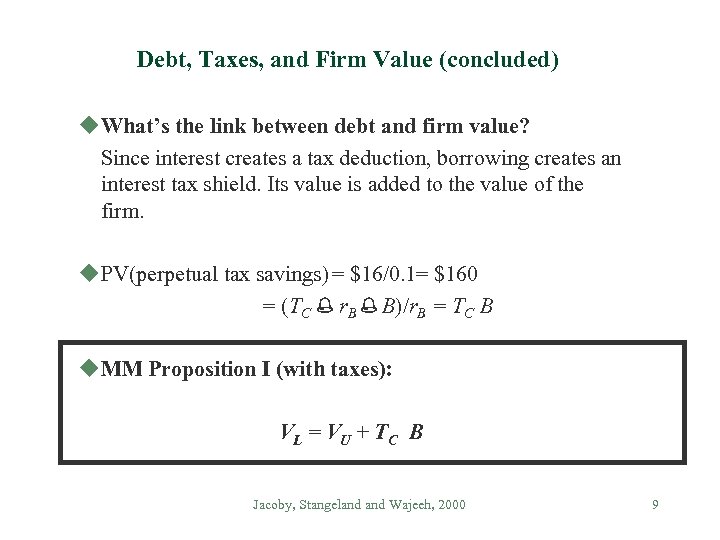

Debt, Taxes, and Firm Value (concluded) u. What’s the link between debt and firm value? Since interest creates a tax deduction, borrowing creates an interest tax shield. Its value is added to the value of the firm. u. PV(perpetual tax savings) = $16/0. 1= $160 = (TC % r. B % B)/r. B = TC B u. MM Proposition I (with taxes): VL = V U + T C B Jacoby, Stangeland Wajeeh, 2000 9

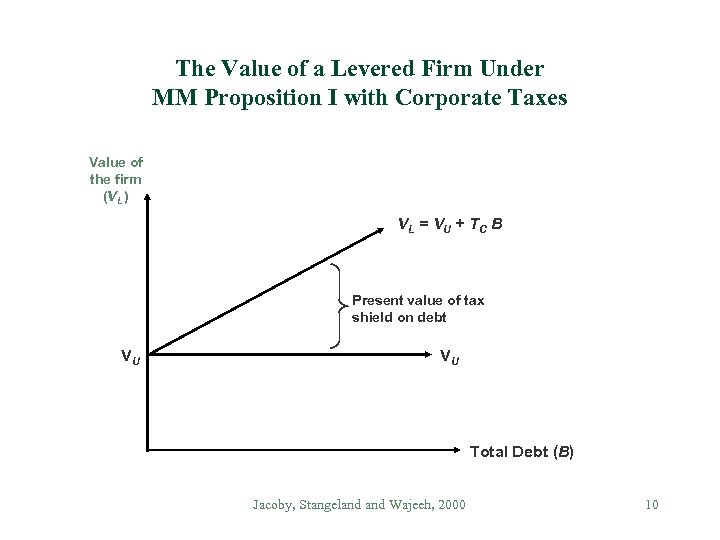

The Value of a Levered Firm Under MM Proposition I with Corporate Taxes Value of the firm (VL ) VL = VU + TC B Present value of tax shield on debt VU VU Total Debt (B) Jacoby, Stangeland Wajeeh, 2000 10

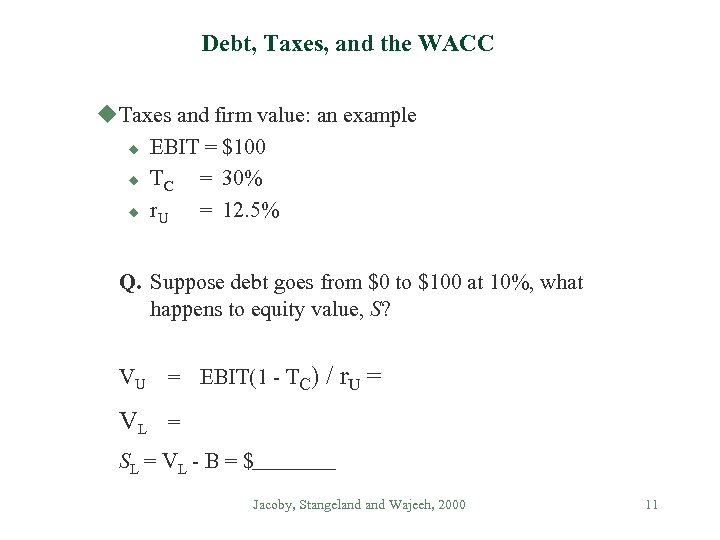

Debt, Taxes, and the WACC u. Taxes and firm value: an example u EBIT = $100 u TC = 30% u r. U = 12. 5% Q. Suppose debt goes from $0 to $100 at 10%, what happens to equity value, S? VU = EBIT(1 - TC) / r. U = VL = SL = VL - B = $ Jacoby, Stangeland Wajeeh, 2000 11

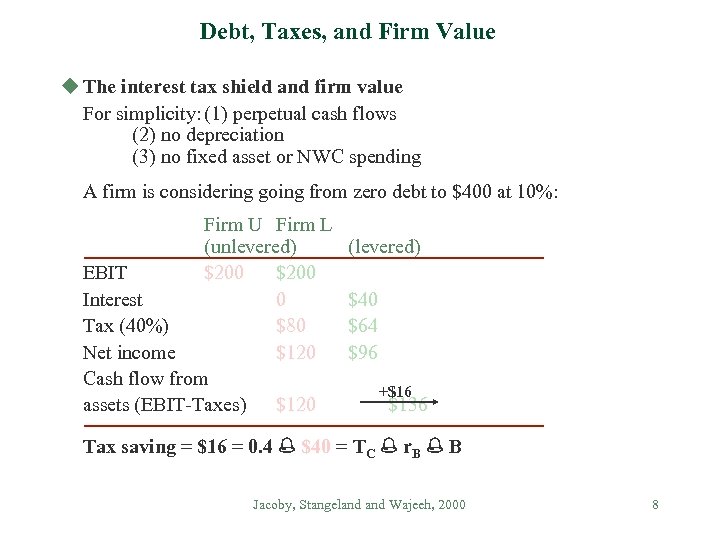

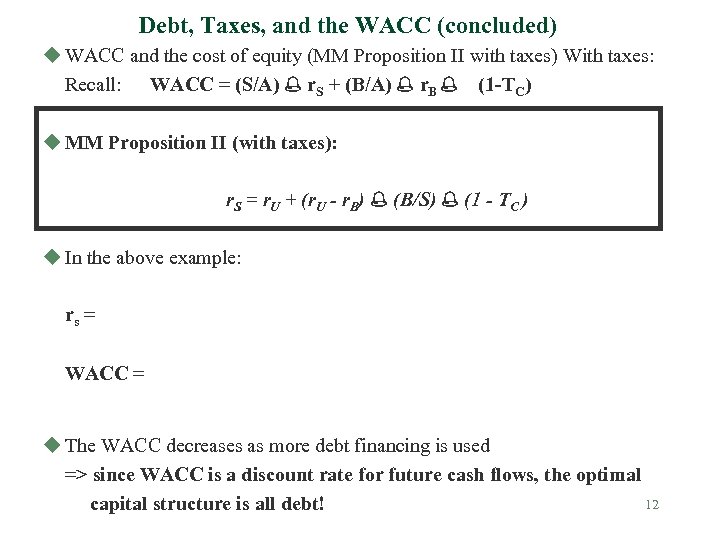

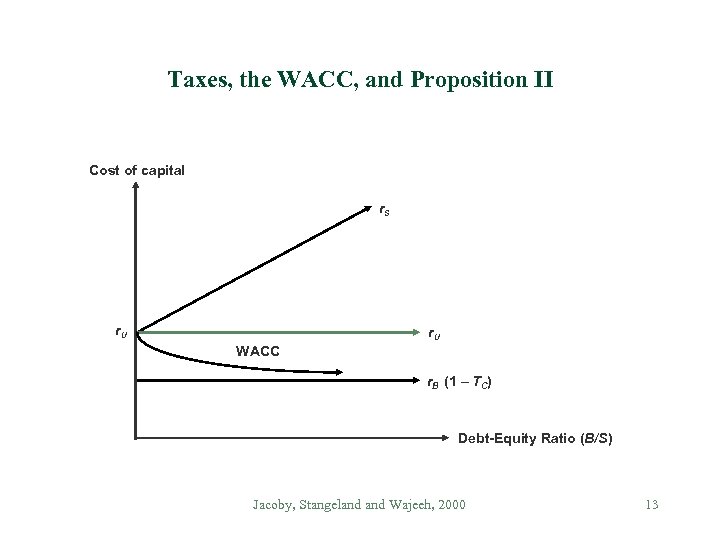

Debt, Taxes, and the WACC (concluded) u WACC and the cost of equity (MM Proposition II with taxes) With taxes: Recall: WACC = (S/A) % r. S + (B/A) % r. B % (1 -TC) u MM Proposition II (with taxes): r. S = r. U + (r. U - r. B) % (B/S) % (1 - TC ) u In the above example: rs = WACC = u The WACC decreases as more debt financing is used => since WACC is a discount rate for future cash flows, the optimal 12 capital structure is all debt!

Taxes, the WACC, and Proposition II Cost of capital r. S r. U WACC r. B (1 – TC) Debt-Equity Ratio (B/S) Jacoby, Stangeland Wajeeh, 2000 13

Financial Distress u MM with taxes VL = V U + TC B debt provides tax benefits to the firm => the firm should borrow an infinite amount u In reality u the firm has to pay interest and principal to bondholders regardless of profitability u if the firm defaults on a payment to its bondholders, it will enter a phase of financial distress (e. g. Eaton’s), or u ultimately, if financial distress persists, the firm will declare bankruptcy u there are costs involved in both financial distress and bankruptcy Jacoby, Stangeland Wajeeh, 2000 14

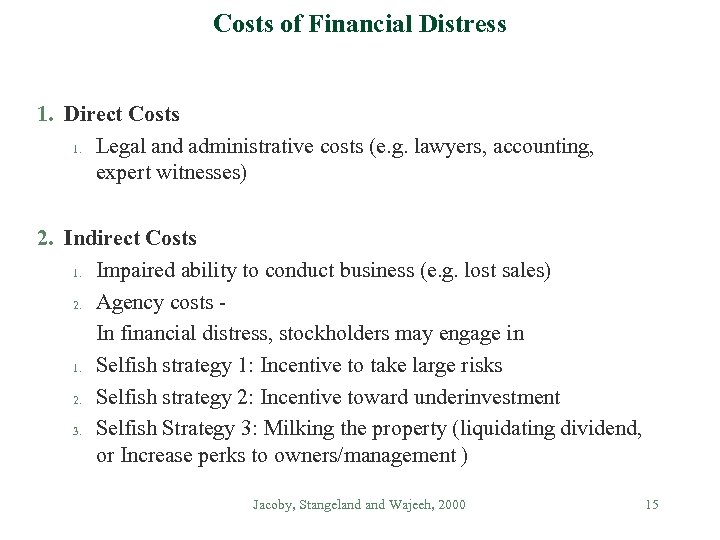

Costs of Financial Distress 1. Direct Costs 1. Legal and administrative costs (e. g. lawyers, accounting, expert witnesses) 2. Indirect Costs 1. Impaired ability to conduct business (e. g. lost sales) 2. Agency costs In financial distress, stockholders may engage in 1. Selfish strategy 1: Incentive to take large risks 2. Selfish strategy 2: Incentive toward underinvestment 3. Selfish Strategy 3: Milking the property (liquidating dividend, or Increase perks to owners/management ) Jacoby, Stangeland Wajeeh, 2000 15

Selfish Strategy 3: Milking the Property u Liquidating dividends u Such tactics are often illegal u Increase perks to owners/management Jacoby, Stangeland Wajeeh, 2000 16

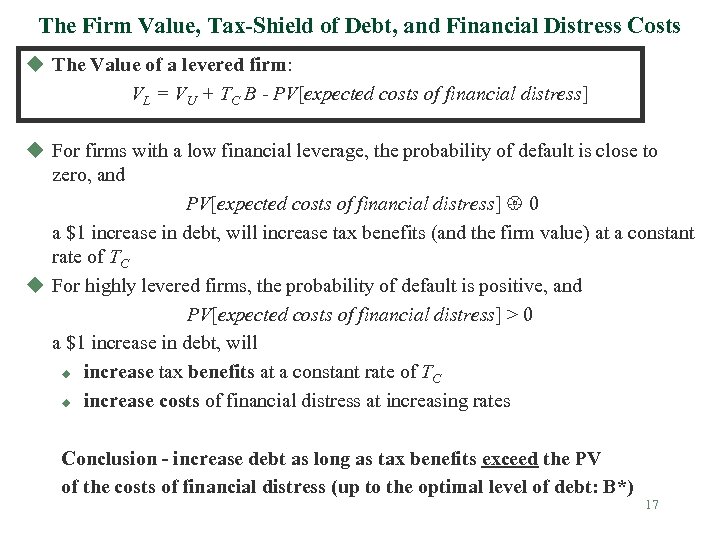

The Firm Value, Tax-Shield of Debt, and Financial Distress Costs u The Value of a levered firm: VL = VU + TC B - PV[expected costs of financial distress] u For firms with a low financial leverage, the probability of default is close to zero, and PV[expected costs of financial distress] { 0 a $1 increase in debt, will increase tax benefits (and the firm value) at a constant rate of TC u For highly levered firms, the probability of default is positive, and PV[expected costs of financial distress] > 0 a $1 increase in debt, will u increase tax benefits at a constant rate of TC u increase costs of financial distress at increasing rates Conclusion - increase debt as long as tax benefits exceed the PV of the costs of financial distress (up to the optimal level of debt: B*) 17

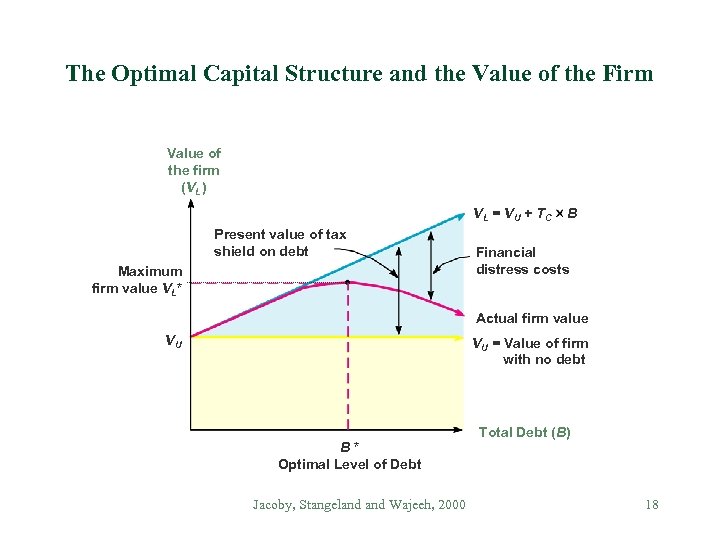

The Optimal Capital Structure and the Value of the Firm Value of the firm (VL ) VL = VU + TC Present value of tax shield on debt Maximum firm value VL* B Financial distress costs Actual firm value VU VU = Value of firm with no debt B* Optimal Level of Debt Jacoby, Stangeland Wajeeh, 2000 Total Debt (B) 18

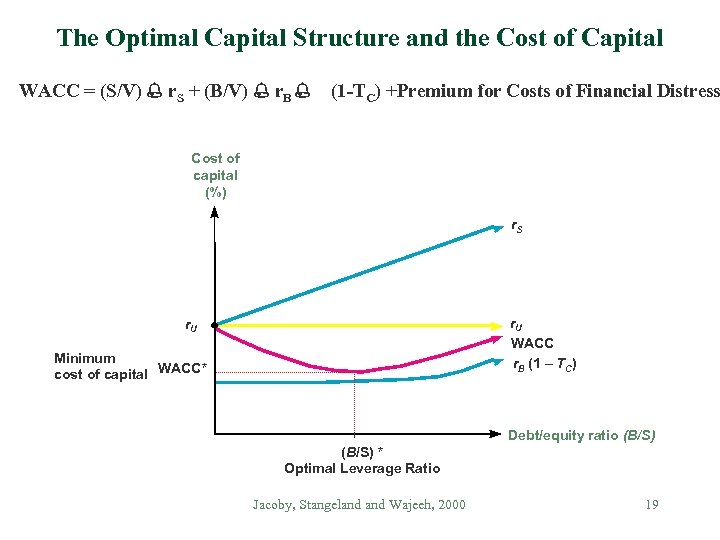

The Optimal Capital Structure and the Cost of Capital WACC = (S/V) % r. S + (B/V) % r. B % (1 -TC) +Premium for Costs of Financial Distress Cost of capital (%) r. S r. U WACC r. B (1 – TC) r. U Minimum cost of capital WACC* Debt/equity ratio (B/S) * Optimal Leverage Ratio Jacoby, Stangeland Wajeeh, 2000 19

36f4cddce82fd3b84bc90fd58fe7face.ppt