021dd2e76f72e3774204d7681f87b62b.ppt

- Количество слайдов: 62

Chapter Two MARKETS AND INSTRUMENTS The presentation has been amended/updated by Dr. Mounira Ben Arab

Chapter Two MARKETS AND INSTRUMENTS The presentation has been amended/updated by Dr. Mounira Ben Arab

2. 1 THE MONEY MARKET • • • Treasury bills (T-bills) Federal funds (fed funds) Repurchase agreements (repos or RP) Commercial paper (CP) Negotiable certificates of deposit (CD) Banker acceptances (BA) 1 -2

2. 1 THE MONEY MARKET • • • Treasury bills (T-bills) Federal funds (fed funds) Repurchase agreements (repos or RP) Commercial paper (CP) Negotiable certificates of deposit (CD) Banker acceptances (BA) 1 -2

• T- bills: represent the simplest form of borrowing: The government raises money by selling bills to the public. – The Federal Reserve buys and sells T-bills to implement monetary policy – Are virtually default risk free, highly liquid, and have little interest rate risk. – T-bills sell in minimum denominations of only $10, 000. – The income earned on T-bills is exempt from all state and local taxes, as a consequence there is a strong international demand for T-bills as safe haven investment. 1 -3

• T- bills: represent the simplest form of borrowing: The government raises money by selling bills to the public. – The Federal Reserve buys and sells T-bills to implement monetary policy – Are virtually default risk free, highly liquid, and have little interest rate risk. – T-bills sell in minimum denominations of only $10, 000. – The income earned on T-bills is exempt from all state and local taxes, as a consequence there is a strong international demand for T-bills as safe haven investment. 1 -3

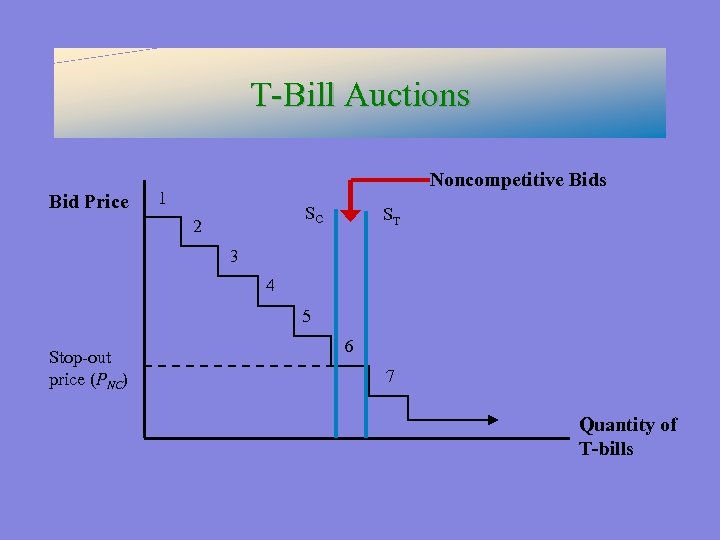

– T-bills with initial maturities of 91 days or 182 days are issued weekly. Offerings of 52 -week bills are made monthly. Sales are conducted via auction, at which investors can submit competitive or noncompetitive bids. – A competitive bid is an order for a given quantity of bills at a specific offered price. The order is filled only if the bid is high enough relative to other bids to be accepted. – A noncompetitive bid is an unconditional offer to purchase bills at the average price of the successful competitive bids.

– T-bills with initial maturities of 91 days or 182 days are issued weekly. Offerings of 52 -week bills are made monthly. Sales are conducted via auction, at which investors can submit competitive or noncompetitive bids. – A competitive bid is an order for a given quantity of bills at a specific offered price. The order is filled only if the bid is high enough relative to other bids to be accepted. – A noncompetitive bid is an unconditional offer to purchase bills at the average price of the successful competitive bids.

T-Bill Auctions Bid Price Noncompetitive Bids 1 SC 2 ST 3 4 5 Stop-out price (PNC) 6 7 Quantity of T-bills

T-Bill Auctions Bid Price Noncompetitive Bids 1 SC 2 ST 3 4 5 Stop-out price (PNC) 6 7 Quantity of T-bills

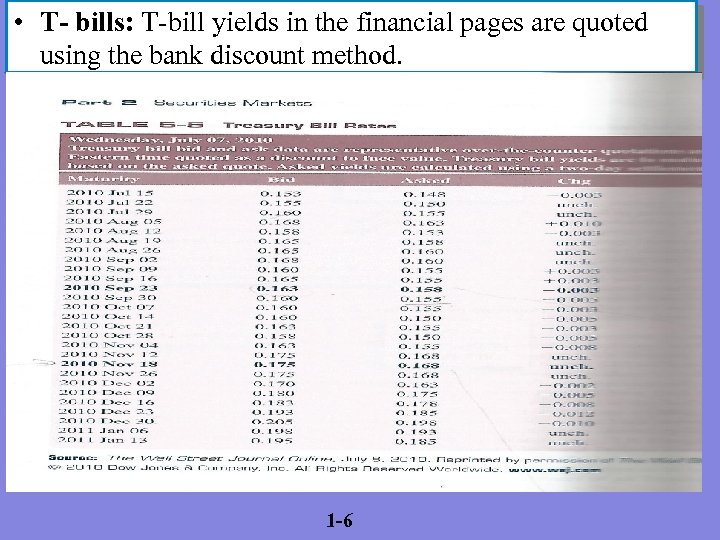

• T- bills: T-bill yields in the financial pages are quoted using the bank discount method. 1 -6

• T- bills: T-bill yields in the financial pages are quoted using the bank discount method. 1 -6

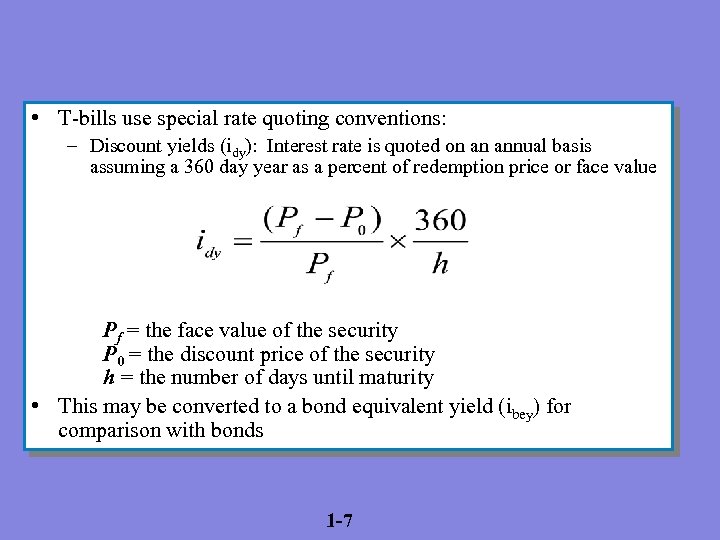

• T-bills use special rate quoting conventions: – Discount yields (idy): Interest rate is quoted on an annual basis assuming a 360 day year as a percent of redemption price or face value Pf = the face value of the security P 0 = the discount price of the security h = the number of days until maturity • This may be converted to a bond equivalent yield (ibey) for comparison with bonds 1 -7

• T-bills use special rate quoting conventions: – Discount yields (idy): Interest rate is quoted on an annual basis assuming a 360 day year as a percent of redemption price or face value Pf = the face value of the security P 0 = the discount price of the security h = the number of days until maturity • This may be converted to a bond equivalent yield (ibey) for comparison with bonds 1 -7

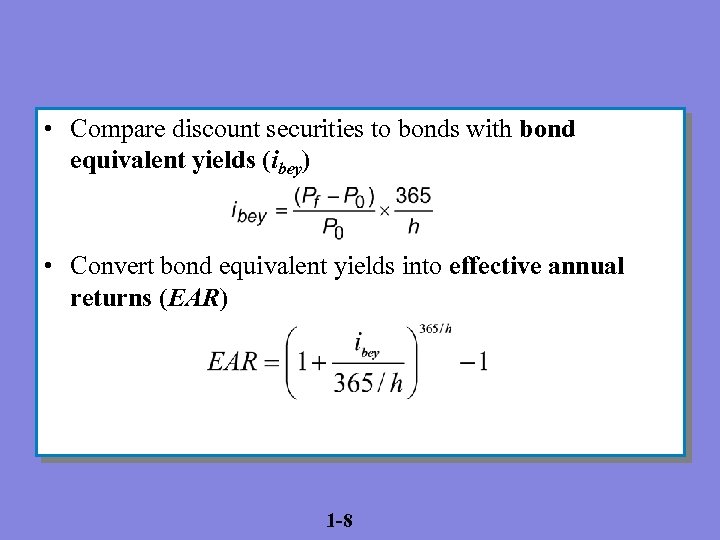

• Compare discount securities to bonds with bond equivalent yields (ibey) • Convert bond equivalent yields into effective annual returns (EAR) 1 -8

• Compare discount securities to bonds with bond equivalent yields (ibey) • Convert bond equivalent yields into effective annual returns (EAR) 1 -8

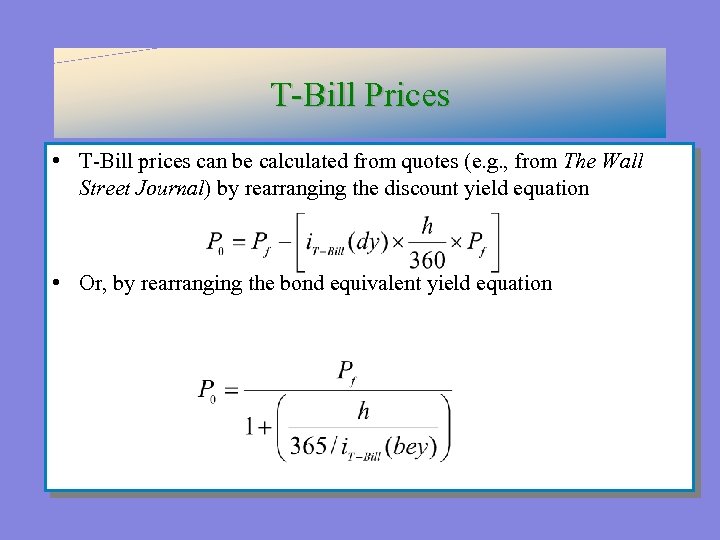

T-Bill Prices • T-Bill prices can be calculated from quotes (e. g. , from The Wall Street Journal) by rearranging the discount yield equation • Or, by rearranging the bond equivalent yield equation

T-Bill Prices • T-Bill prices can be calculated from quotes (e. g. , from The Wall Street Journal) by rearranging the discount yield equation • Or, by rearranging the bond equivalent yield equation

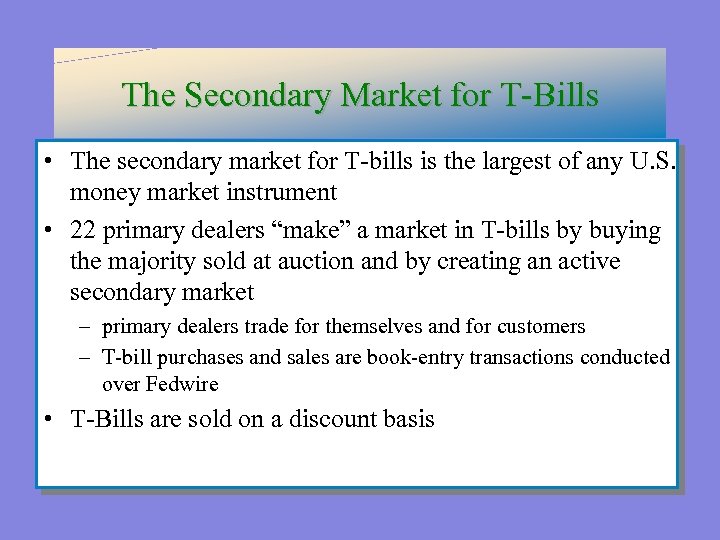

The Secondary Market for T-Bills • The secondary market for T-bills is the largest of any U. S. money market instrument • 22 primary dealers “make” a market in T-bills by buying the majority sold at auction and by creating an active secondary market – primary dealers trade for themselves and for customers – T-bill purchases and sales are book-entry transactions conducted over Fedwire • T-Bills are sold on a discount basis

The Secondary Market for T-Bills • The secondary market for T-bills is the largest of any U. S. money market instrument • 22 primary dealers “make” a market in T-bills by buying the majority sold at auction and by creating an active secondary market – primary dealers trade for themselves and for customers – T-bill purchases and sales are book-entry transactions conducted over Fedwire • T-Bills are sold on a discount basis

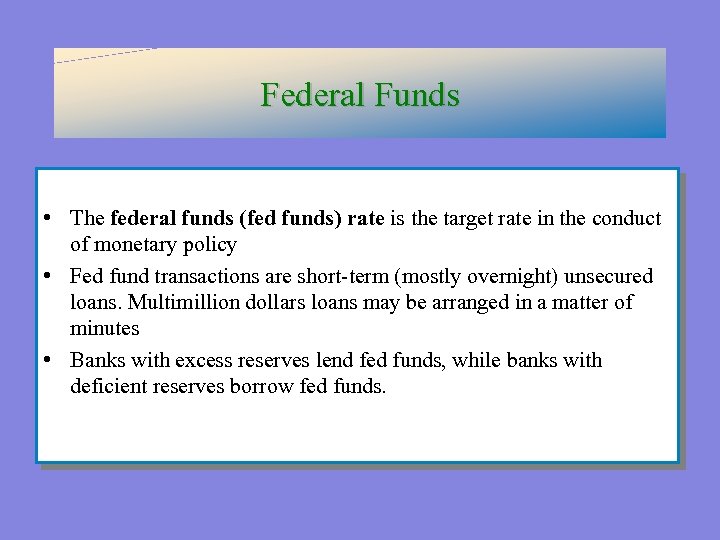

Federal Funds • The federal funds (fed funds) rate is the target rate in the conduct of monetary policy • Fed fund transactions are short-term (mostly overnight) unsecured loans. Multimillion dollars loans may be arranged in a matter of minutes • Banks with excess reserves lend fed funds, while banks with deficient reserves borrow fed funds.

Federal Funds • The federal funds (fed funds) rate is the target rate in the conduct of monetary policy • Fed fund transactions are short-term (mostly overnight) unsecured loans. Multimillion dollars loans may be arranged in a matter of minutes • Banks with excess reserves lend fed funds, while banks with deficient reserves borrow fed funds.

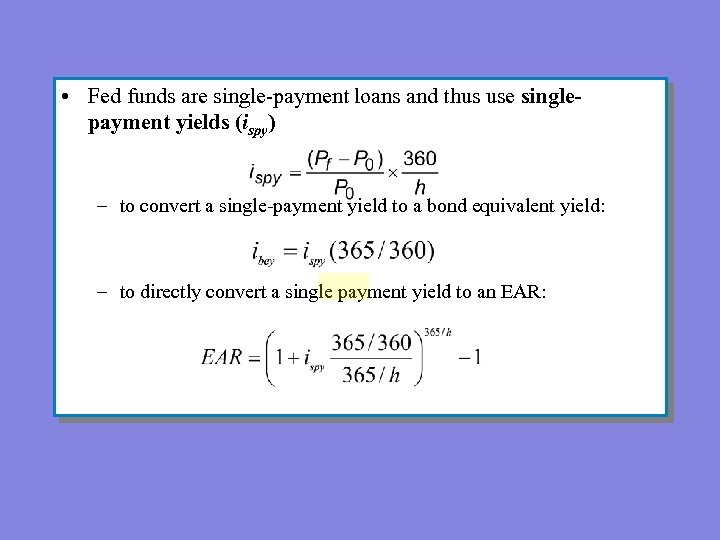

• Fed funds are single-payment loans and thus use singlepayment yields (ispy) – to convert a single-payment yield to a bond equivalent yield: – to directly convert a single payment yield to an EAR:

• Fed funds are single-payment loans and thus use singlepayment yields (ispy) – to convert a single-payment yield to a bond equivalent yield: – to directly convert a single payment yield to an EAR:

Repurchase Agreement • A repurchase agreement (repo or RP) is the sale of a security with an agreement to buy the security back at a set price in the future • Repos are short-term collateralized loans (typical collateral is U. S. Treasury securities) – Similar to a fed fund loan, but collateralized – Funds may be transferred over Fed. Wire system – If collateralized by risky assets, the repo may involve a ‘haircut’

Repurchase Agreement • A repurchase agreement (repo or RP) is the sale of a security with an agreement to buy the security back at a set price in the future • Repos are short-term collateralized loans (typical collateral is U. S. Treasury securities) – Similar to a fed fund loan, but collateralized – Funds may be transferred over Fed. Wire system – If collateralized by risky assets, the repo may involve a ‘haircut’

Repurchase Agreement • Typical denominations on repos of one week or less are $25 million and longer term repos usually have $10 million denominations • A reverse repurchase agreement is the purchase of a security with an agreement to sell it back in the future

Repurchase Agreement • Typical denominations on repos of one week or less are $25 million and longer term repos usually have $10 million denominations • A reverse repurchase agreement is the purchase of a security with an agreement to sell it back in the future

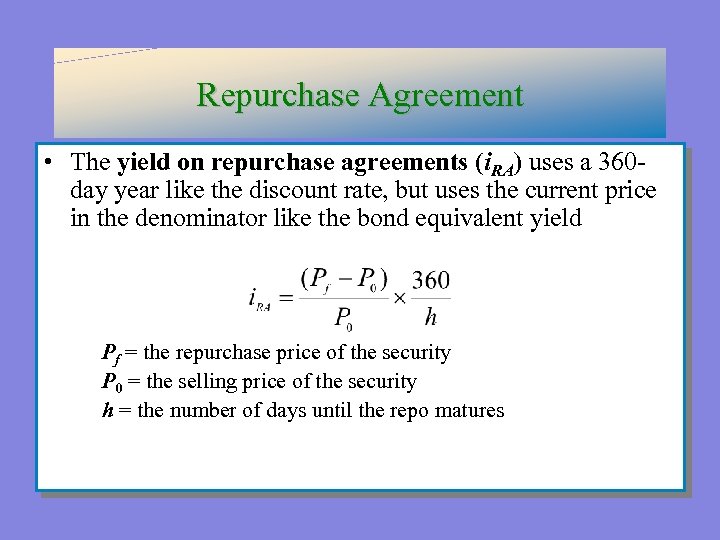

Repurchase Agreement • The yield on repurchase agreements (i. RA) uses a 360 day year like the discount rate, but uses the current price in the denominator like the bond equivalent yield Pf = the repurchase price of the security P 0 = the selling price of the security h = the number of days until the repo matures

Repurchase Agreement • The yield on repurchase agreements (i. RA) uses a 360 day year like the discount rate, but uses the current price in the denominator like the bond equivalent yield Pf = the repurchase price of the security P 0 = the selling price of the security h = the number of days until the repo matures

Commercial Paper • Commercial Paper (CP) is unsecured short-term corporate debt issued to raise short-term funds (e. g. , for working capital) • Generally sold in large denominations (e. g. , $100, 000 to $1 million) with maturities between 1 and 270 days. • CP is usually sold to investors indirectly through brokers and dealers (approximately 85% of the time) • CP is usually held by investors until maturity and has no active secondary market • CP like Treasury bills are quoted on a discount basis

Commercial Paper • Commercial Paper (CP) is unsecured short-term corporate debt issued to raise short-term funds (e. g. , for working capital) • Generally sold in large denominations (e. g. , $100, 000 to $1 million) with maturities between 1 and 270 days. • CP is usually sold to investors indirectly through brokers and dealers (approximately 85% of the time) • CP is usually held by investors until maturity and has no active secondary market • CP like Treasury bills are quoted on a discount basis

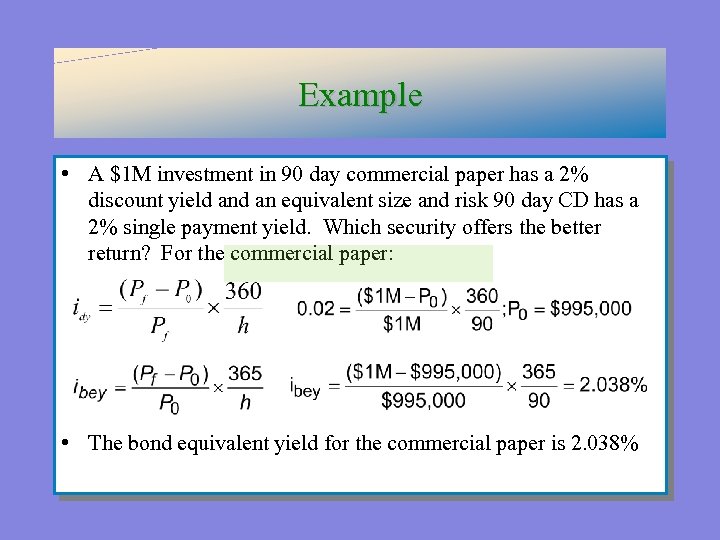

Example • A $1 M investment in 90 day commercial paper has a 2% discount yield an equivalent size and risk 90 day CD has a 2% single payment yield. Which security offers the better return? For the commercial paper: • The bond equivalent yield for the commercial paper is 2. 038%

Example • A $1 M investment in 90 day commercial paper has a 2% discount yield an equivalent size and risk 90 day CD has a 2% single payment yield. Which security offers the better return? For the commercial paper: • The bond equivalent yield for the commercial paper is 2. 038%

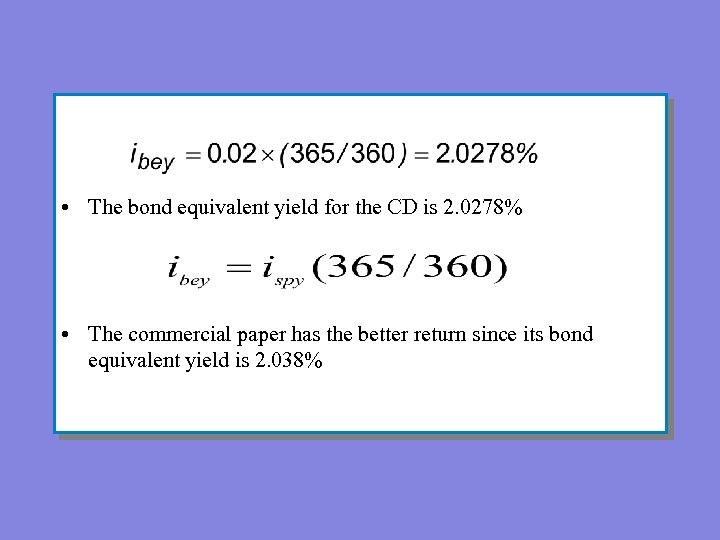

• The bond equivalent yield for the CD is 2. 0278% • The commercial paper has the better return since its bond equivalent yield is 2. 038%

• The bond equivalent yield for the CD is 2. 0278% • The commercial paper has the better return since its bond equivalent yield is 2. 038%

Asset-Backed Commercial Paper • A type of commercial paper that is backed by assets of the issuing firm • Grew very rapidly prior to the financial crisis peaking at $2. 16 trillion. Much of it was backed by mortgage investments • The market collapsed during the financial crisis

Asset-Backed Commercial Paper • A type of commercial paper that is backed by assets of the issuing firm • Grew very rapidly prior to the financial crisis peaking at $2. 16 trillion. Much of it was backed by mortgage investments • The market collapsed during the financial crisis

Negotiable Certificate of Deposit • A negotiable certificate of deposit (CD) is a bank-issued time deposit that specifies the interest rate and the maturity date • CDs are bearer instruments and thus are salable in the secondary market • Denominations range from $100, 000 to $10 million; $1 million being the most common • Often purchased by money market mutual funds with pools of funds from individual investors • Negotiable (or jumbo) CDs like fed funds are money market securities that pay interest only at maturity. These use single-payment yields (ispy)

Negotiable Certificate of Deposit • A negotiable certificate of deposit (CD) is a bank-issued time deposit that specifies the interest rate and the maturity date • CDs are bearer instruments and thus are salable in the secondary market • Denominations range from $100, 000 to $10 million; $1 million being the most common • Often purchased by money market mutual funds with pools of funds from individual investors • Negotiable (or jumbo) CDs like fed funds are money market securities that pay interest only at maturity. These use single-payment yields (ispy)

Banker’s Acceptance • A Banker’s Acceptance (BA) is a time draft payable to a seller of goods with payment guaranteed by a bank • Used in international trade transactions to finance trade in goods that have yet to be shipped from a foreign exporter (seller) to a domestic importer (buyer) • Foreign exporters prefer that banks act as payment guarantors before sending goods to importers • Banker’s acceptances are bearer instruments and thus are salable in secondary markets

Banker’s Acceptance • A Banker’s Acceptance (BA) is a time draft payable to a seller of goods with payment guaranteed by a bank • Used in international trade transactions to finance trade in goods that have yet to be shipped from a foreign exporter (seller) to a domestic importer (buyer) • Foreign exporters prefer that banks act as payment guarantors before sending goods to importers • Banker’s acceptances are bearer instruments and thus are salable in secondary markets

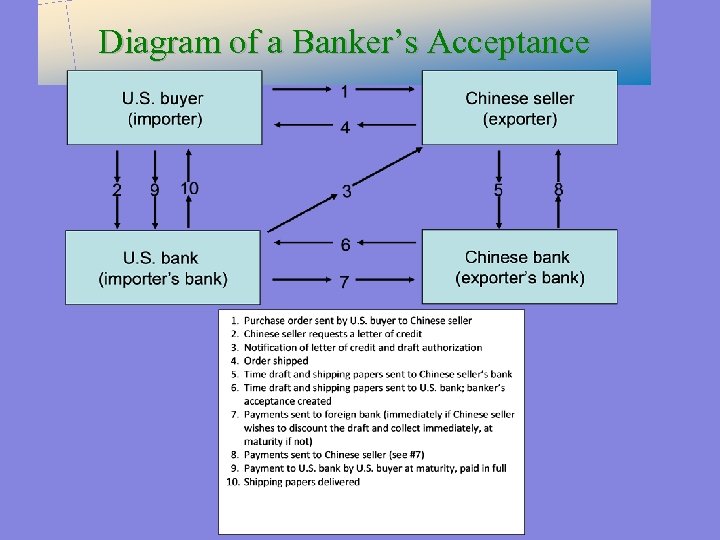

Diagram of a Banker’s Acceptance

Diagram of a Banker’s Acceptance

International Money Markets • U. S. dollars held outside the U. S. are tracked among multinational banks in the Eurodollar market • The rate offered for sale on Eurodollar funds is the London Interbank Offered Rate (LIBOR) • Eurodollar Certificates of Deposit are U. S. dollar-denominated CDs held in foreign banks • Eurocommercial paper (Euro-CP) is issued in Europe and can be in local currencies or U. S. dollars

International Money Markets • U. S. dollars held outside the U. S. are tracked among multinational banks in the Eurodollar market • The rate offered for sale on Eurodollar funds is the London Interbank Offered Rate (LIBOR) • Eurodollar Certificates of Deposit are U. S. dollar-denominated CDs held in foreign banks • Eurocommercial paper (Euro-CP) is issued in Europe and can be in local currencies or U. S. dollars

Bond and Bond Markets • Capital markets involve equity and debt instruments with maturities of more than one year • Bonds are long-term debt obligations issued by corporations and government units • Bond markets are markets in which bonds are issued and traded – Treasury notes (T-notes) and bonds (T-bonds) – Municipal bonds (Munis) – Corporate bonds

Bond and Bond Markets • Capital markets involve equity and debt instruments with maturities of more than one year • Bonds are long-term debt obligations issued by corporations and government units • Bond markets are markets in which bonds are issued and traded – Treasury notes (T-notes) and bonds (T-bonds) – Municipal bonds (Munis) – Corporate bonds

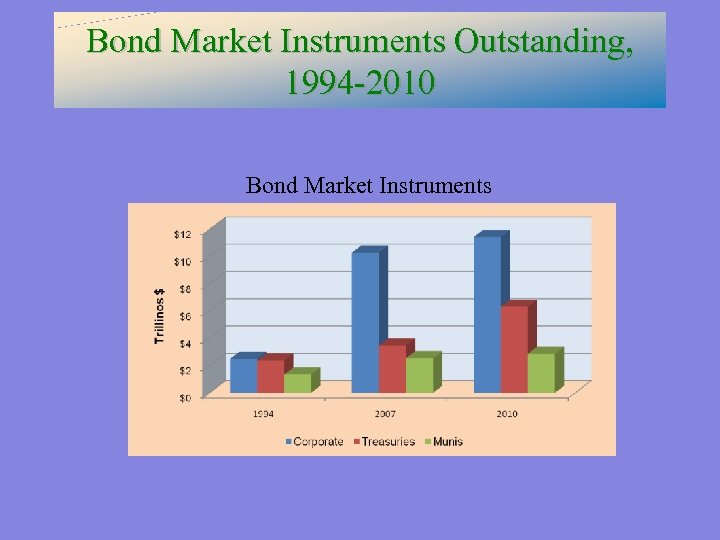

Bond Market Instruments Outstanding, 1994 -2010 Bond Market Instruments

Bond Market Instruments Outstanding, 1994 -2010 Bond Market Instruments

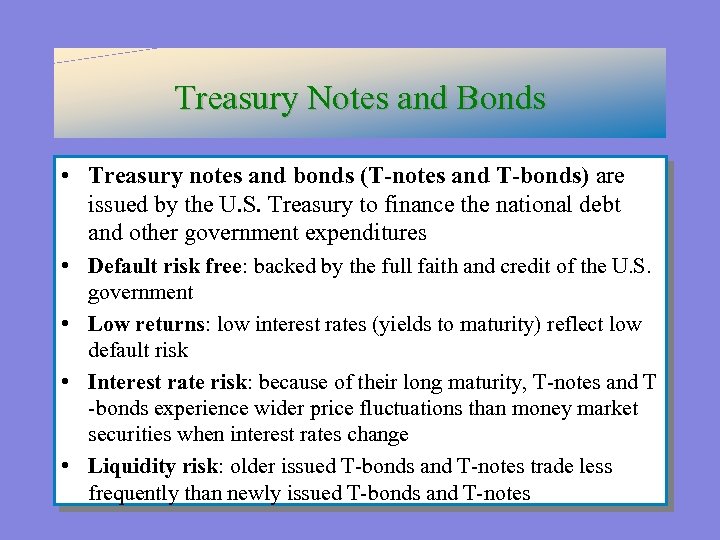

Treasury Notes and Bonds • Treasury notes and bonds (T-notes and T-bonds) are issued by the U. S. Treasury to finance the national debt and other government expenditures • Default risk free: backed by the full faith and credit of the U. S. government • Low returns: low interest rates (yields to maturity) reflect low default risk • Interest rate risk: because of their long maturity, T-notes and T -bonds experience wider price fluctuations than money market securities when interest rates change • Liquidity risk: older issued T-bonds and T-notes trade less frequently than newly issued T-bonds and T-notes

Treasury Notes and Bonds • Treasury notes and bonds (T-notes and T-bonds) are issued by the U. S. Treasury to finance the national debt and other government expenditures • Default risk free: backed by the full faith and credit of the U. S. government • Low returns: low interest rates (yields to maturity) reflect low default risk • Interest rate risk: because of their long maturity, T-notes and T -bonds experience wider price fluctuations than money market securities when interest rates change • Liquidity risk: older issued T-bonds and T-notes trade less frequently than newly issued T-bonds and T-notes

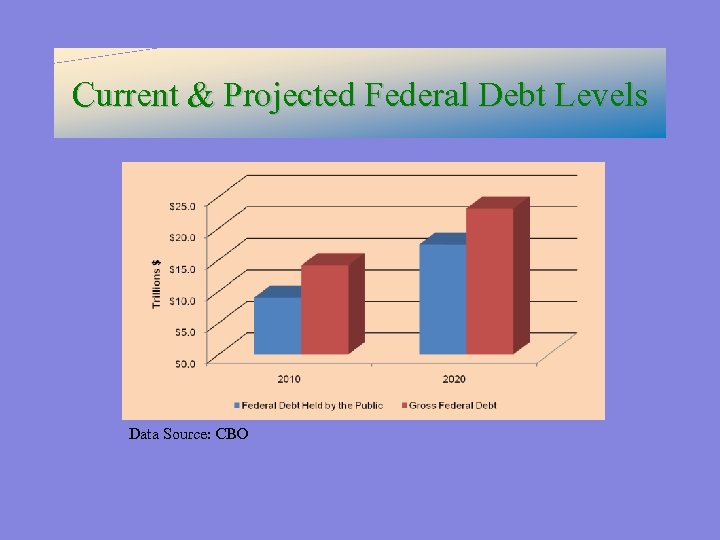

Current & Projected Federal Debt Levels Data Source: CBO

Current & Projected Federal Debt Levels Data Source: CBO

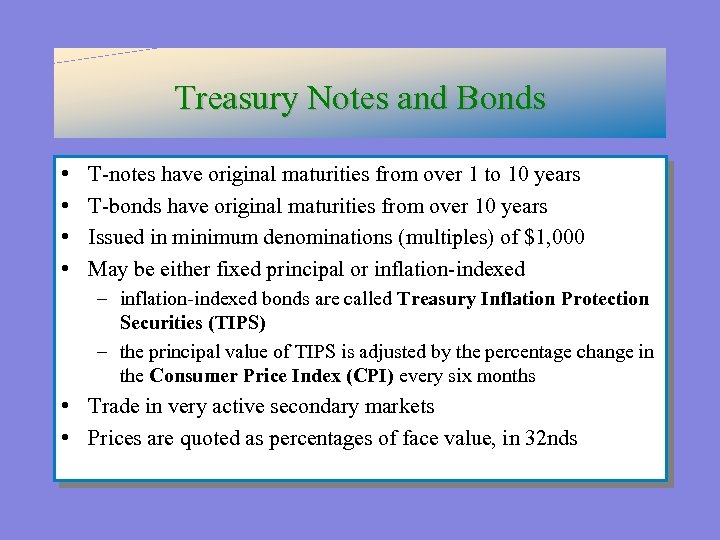

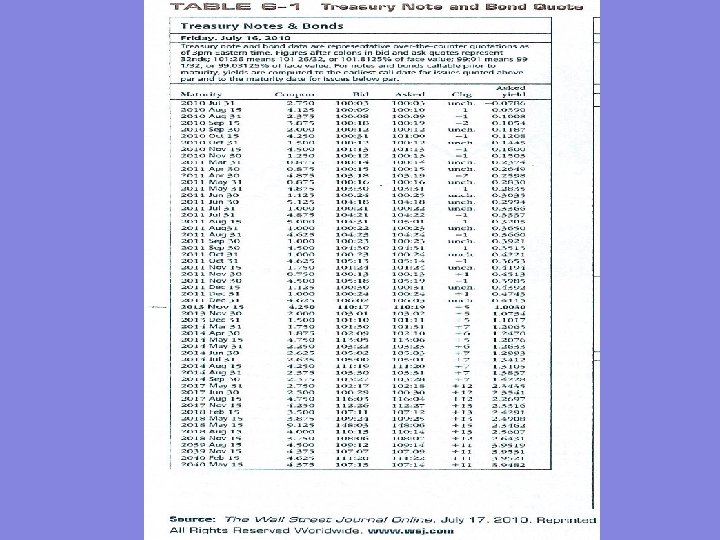

Treasury Notes and Bonds • • T-notes have original maturities from over 1 to 10 years T-bonds have original maturities from over 10 years Issued in minimum denominations (multiples) of $1, 000 May be either fixed principal or inflation-indexed – inflation-indexed bonds are called Treasury Inflation Protection Securities (TIPS) – the principal value of TIPS is adjusted by the percentage change in the Consumer Price Index (CPI) every six months • Trade in very active secondary markets • Prices are quoted as percentages of face value, in 32 nds

Treasury Notes and Bonds • • T-notes have original maturities from over 1 to 10 years T-bonds have original maturities from over 10 years Issued in minimum denominations (multiples) of $1, 000 May be either fixed principal or inflation-indexed – inflation-indexed bonds are called Treasury Inflation Protection Securities (TIPS) – the principal value of TIPS is adjusted by the percentage change in the Consumer Price Index (CPI) every six months • Trade in very active secondary markets • Prices are quoted as percentages of face value, in 32 nds

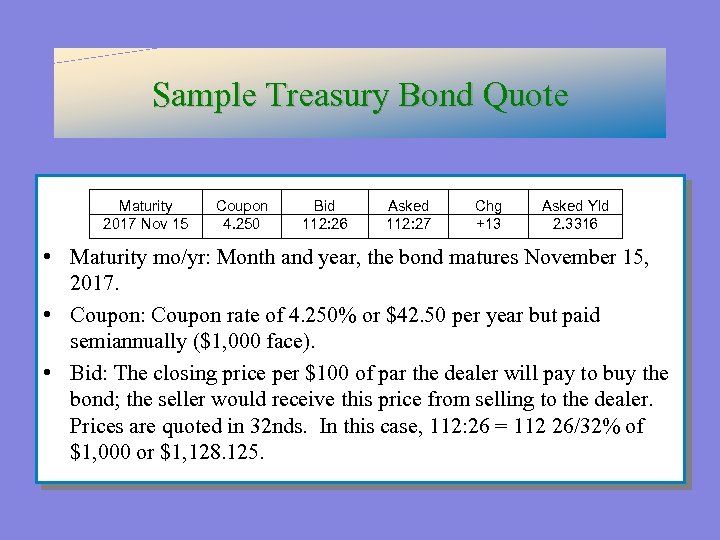

Sample Treasury Bond Quote Maturity 2017 Nov 15 Coupon 4. 250 Bid 112: 26 Asked 112: 27 Chg +13 Asked Yld 2. 3316 • Maturity mo/yr: Month and year, the bond matures November 15, 2017. • Coupon: Coupon rate of 4. 250% or $42. 50 per year but paid semiannually ($1, 000 face). • Bid: The closing price per $100 of par the dealer will pay to buy the bond; the seller would receive this price from selling to the dealer. Prices are quoted in 32 nds. In this case, 112: 26 = 112 26/32% of $1, 000 or $1, 128. 125.

Sample Treasury Bond Quote Maturity 2017 Nov 15 Coupon 4. 250 Bid 112: 26 Asked 112: 27 Chg +13 Asked Yld 2. 3316 • Maturity mo/yr: Month and year, the bond matures November 15, 2017. • Coupon: Coupon rate of 4. 250% or $42. 50 per year but paid semiannually ($1, 000 face). • Bid: The closing price per $100 of par the dealer will pay to buy the bond; the seller would receive this price from selling to the dealer. Prices are quoted in 32 nds. In this case, 112: 26 = 112 26/32% of $1, 000 or $1, 128. 125.

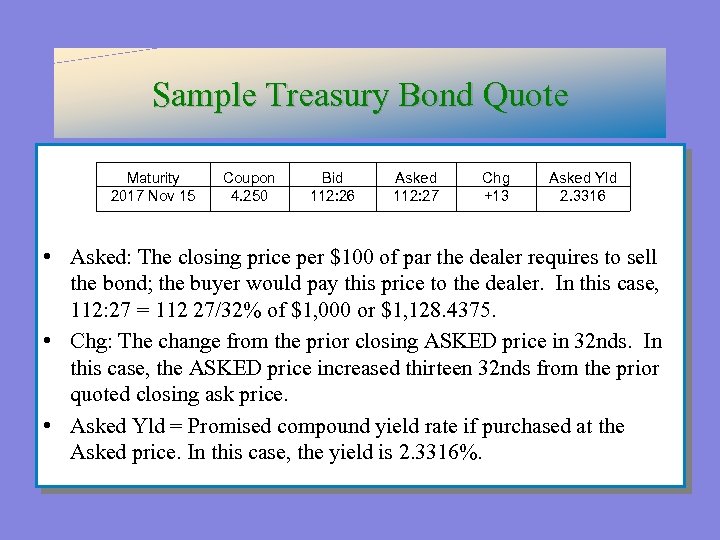

Sample Treasury Bond Quote Maturity 2017 Nov 15 Coupon 4. 250 Bid 112: 26 Asked 112: 27 Chg +13 Asked Yld 2. 3316 • Asked: The closing price per $100 of par the dealer requires to sell the bond; the buyer would pay this price to the dealer. In this case, 112: 27 = 112 27/32% of $1, 000 or $1, 128. 4375. • Chg: The change from the prior closing ASKED price in 32 nds. In this case, the ASKED price increased thirteen 32 nds from the prior quoted closing ask price. • Asked Yld = Promised compound yield rate if purchased at the Asked price. In this case, the yield is 2. 3316%.

Sample Treasury Bond Quote Maturity 2017 Nov 15 Coupon 4. 250 Bid 112: 26 Asked 112: 27 Chg +13 Asked Yld 2. 3316 • Asked: The closing price per $100 of par the dealer requires to sell the bond; the buyer would pay this price to the dealer. In this case, 112: 27 = 112 27/32% of $1, 000 or $1, 128. 4375. • Chg: The change from the prior closing ASKED price in 32 nds. In this case, the ASKED price increased thirteen 32 nds from the prior quoted closing ask price. • Asked Yld = Promised compound yield rate if purchased at the Asked price. In this case, the yield is 2. 3316%.

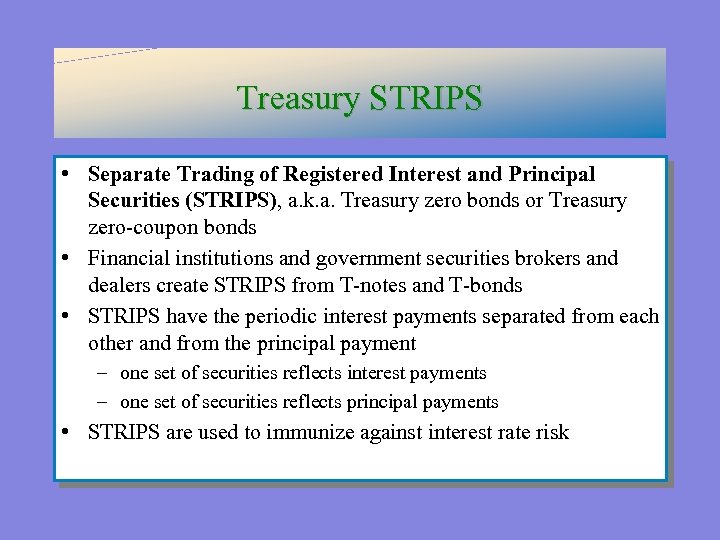

Treasury STRIPS • Separate Trading of Registered Interest and Principal Securities (STRIPS), a. k. a. Treasury zero bonds or Treasury zero-coupon bonds • Financial institutions and government securities brokers and dealers create STRIPS from T-notes and T-bonds • STRIPS have the periodic interest payments separated from each other and from the principal payment – one set of securities reflects interest payments – one set of securities reflects principal payments • STRIPS are used to immunize against interest rate risk

Treasury STRIPS • Separate Trading of Registered Interest and Principal Securities (STRIPS), a. k. a. Treasury zero bonds or Treasury zero-coupon bonds • Financial institutions and government securities brokers and dealers create STRIPS from T-notes and T-bonds • STRIPS have the periodic interest payments separated from each other and from the principal payment – one set of securities reflects interest payments – one set of securities reflects principal payments • STRIPS are used to immunize against interest rate risk

Accrued Interest and Prices • Accrued interest must be paid by the buyer of a bond to the seller of a bond if the bond is purchased between interest payment dates. • The price of the bond with accrued interest is called the full price or the dirty price, the price without accounting for accrued interest is the clean price.

Accrued Interest and Prices • Accrued interest must be paid by the buyer of a bond to the seller of a bond if the bond is purchased between interest payment dates. • The price of the bond with accrued interest is called the full price or the dirty price, the price without accounting for accrued interest is the clean price.

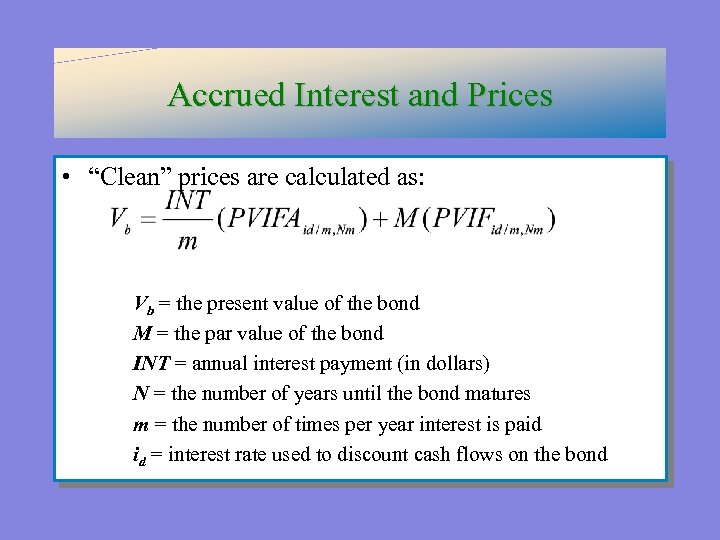

Accrued Interest and Prices • “Clean” prices are calculated as: Vb = the present value of the bond M = the par value of the bond INT = annual interest payment (in dollars) N = the number of years until the bond matures m = the number of times per year interest is paid id = interest rate used to discount cash flows on the bond

Accrued Interest and Prices • “Clean” prices are calculated as: Vb = the present value of the bond M = the par value of the bond INT = annual interest payment (in dollars) N = the number of years until the bond matures m = the number of times per year interest is paid id = interest rate used to discount cash flows on the bond

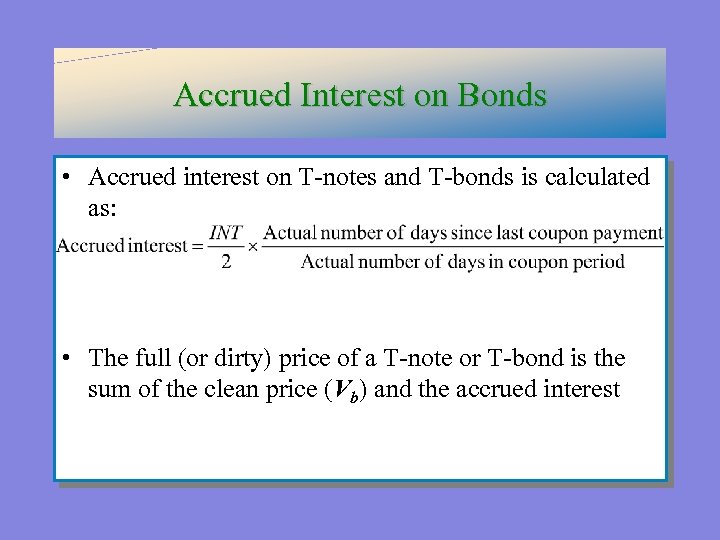

Accrued Interest on Bonds • Accrued interest on T-notes and T-bonds is calculated as: • The full (or dirty) price of a T-note or T-bond is the sum of the clean price (Vb) and the accrued interest

Accrued Interest on Bonds • Accrued interest on T-notes and T-bonds is calculated as: • The full (or dirty) price of a T-note or T-bond is the sum of the clean price (Vb) and the accrued interest

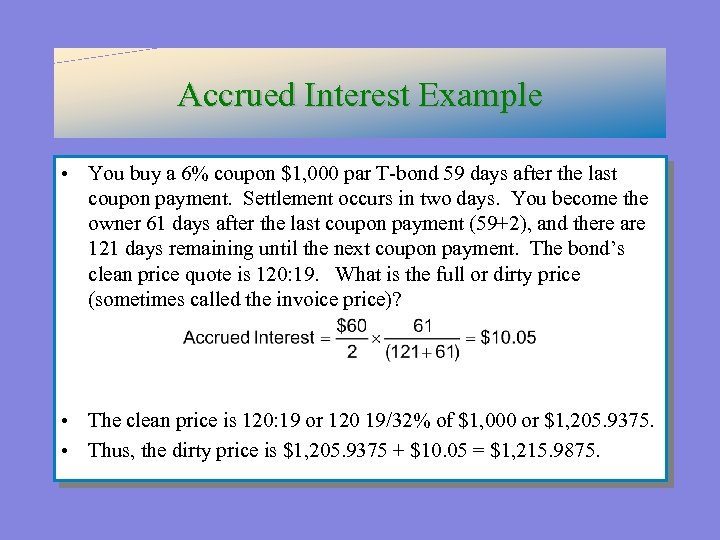

Accrued Interest Example • You buy a 6% coupon $1, 000 par T-bond 59 days after the last coupon payment. Settlement occurs in two days. You become the owner 61 days after the last coupon payment (59+2), and there are 121 days remaining until the next coupon payment. The bond’s clean price quote is 120: 19. What is the full or dirty price (sometimes called the invoice price)? • The clean price is 120: 19 or 120 19/32% of $1, 000 or $1, 205. 9375. • Thus, the dirty price is $1, 205. 9375 + $10. 05 = $1, 215. 9875.

Accrued Interest Example • You buy a 6% coupon $1, 000 par T-bond 59 days after the last coupon payment. Settlement occurs in two days. You become the owner 61 days after the last coupon payment (59+2), and there are 121 days remaining until the next coupon payment. The bond’s clean price quote is 120: 19. What is the full or dirty price (sometimes called the invoice price)? • The clean price is 120: 19 or 120 19/32% of $1, 000 or $1, 205. 9375. • Thus, the dirty price is $1, 205. 9375 + $10. 05 = $1, 215. 9875.

Notes and Bonds Markets • The primary market of T-notes and T-bonds is similar to that of T-bills; the U. S. Treasury sells T-notes and T -bonds through competitive and noncompetitive single -bid auctions – 2 -year notes are auctioned monthly – 3 -, 5 -, and 10 -year notes are auctioned quarterly (Feb, May, Aug, and Nov) – 30 -year bonds are auctioned semi-annually (Feb and Aug) • Most secondary trading occurs directly through brokers and dealers

Notes and Bonds Markets • The primary market of T-notes and T-bonds is similar to that of T-bills; the U. S. Treasury sells T-notes and T -bonds through competitive and noncompetitive single -bid auctions – 2 -year notes are auctioned monthly – 3 -, 5 -, and 10 -year notes are auctioned quarterly (Feb, May, Aug, and Nov) – 30 -year bonds are auctioned semi-annually (Feb and Aug) • Most secondary trading occurs directly through brokers and dealers

Municipal Bonds • Municipal bonds (Munis) are securities issued by state and local governments – to fund imbalances between expenditures and receipts – to finance long-term capital outlays • Attractive to household investors because interest is exempt from federal and most local income taxes • General obligation (GO) bonds are backed by the full faith and credit of the issuing municipality • Revenue bonds are sold to finance specific revenue generating projects

Municipal Bonds • Municipal bonds (Munis) are securities issued by state and local governments – to fund imbalances between expenditures and receipts – to finance long-term capital outlays • Attractive to household investors because interest is exempt from federal and most local income taxes • General obligation (GO) bonds are backed by the full faith and credit of the issuing municipality • Revenue bonds are sold to finance specific revenue generating projects

Municipal Bonds • Compare Muni returns with fully taxable corporate bonds by finding the after tax return for corporate bonds: ia = ib(1 – t) ia = after-tax rate of return on a taxable corporate bond ib = before-tax rate of return on a taxable bond t = marginal total income tax rate of the bond holder • Alternately, convert Muni interest rates to tax equivalent rates of return: ib = ia/(1 – t)

Municipal Bonds • Compare Muni returns with fully taxable corporate bonds by finding the after tax return for corporate bonds: ia = ib(1 – t) ia = after-tax rate of return on a taxable corporate bond ib = before-tax rate of return on a taxable bond t = marginal total income tax rate of the bond holder • Alternately, convert Muni interest rates to tax equivalent rates of return: ib = ia/(1 – t)

Municipal Bond Rates & Taxes • For a 28% tax bracket, what is the equivalent after tax rate of a 6% corporate yield? – ia = 6%(1 - 0. 28) = 4. 32% • For a 28% tax bracket, what corporate taxable yield is equivalent to a 4. 5% muni bond rate? – ib = 4. 5% / (1 -0. 28) = 6. 25%

Municipal Bond Rates & Taxes • For a 28% tax bracket, what is the equivalent after tax rate of a 6% corporate yield? – ia = 6%(1 - 0. 28) = 4. 32% • For a 28% tax bracket, what corporate taxable yield is equivalent to a 4. 5% muni bond rate? – ib = 4. 5% / (1 -0. 28) = 6. 25%

Municipal Bonds • Primary markets – firm commitment underwriting: a public offering of Munis made through an investment bank, where the investment bank guarantees a price for the newly issued bonds by buying the entire issue and then reselling it to the public – best efforts offering: a public offering in which the investment bank does not guarantee a firm price – private placement: bonds are sold on a semi-private basis to qualified investors (generally FIs) • Secondary markets: Munis trade infrequently due mainly to a lack of information on bond issuers

Municipal Bonds • Primary markets – firm commitment underwriting: a public offering of Munis made through an investment bank, where the investment bank guarantees a price for the newly issued bonds by buying the entire issue and then reselling it to the public – best efforts offering: a public offering in which the investment bank does not guarantee a firm price – private placement: bonds are sold on a semi-private basis to qualified investors (generally FIs) • Secondary markets: Munis trade infrequently due mainly to a lack of information on bond issuers

Corporate Bonds • Corporate bonds are long-term bonds issued by corporations • A bond indenture is the legal contract that specifies the rights and obligations of the issuer and the holders • Bearer versus registered bonds • Term versus serial bonds • Mortgage bonds are secured debt issues

Corporate Bonds • Corporate bonds are long-term bonds issued by corporations • A bond indenture is the legal contract that specifies the rights and obligations of the issuer and the holders • Bearer versus registered bonds • Term versus serial bonds • Mortgage bonds are secured debt issues

Corporate Bonds • Debentures and subordinated debentures • Convertible bonds versus non-convertible bonds icvb = rate of return on a convertible bond incvb = rate of return on a nonconvertible bond opcvb = value of the conversion option • Stock warrants give bondholders the opportunity to purchase common stock at a prespecified price

Corporate Bonds • Debentures and subordinated debentures • Convertible bonds versus non-convertible bonds icvb = rate of return on a convertible bond incvb = rate of return on a nonconvertible bond opcvb = value of the conversion option • Stock warrants give bondholders the opportunity to purchase common stock at a prespecified price

Corporate Bonds • Callable bonds versus non-callable bonds incb = rate of return on a noncallable bond icb = rate of return on a callable bond opcb = value of the call option • A sinking fund provision is a requirement that the issuer retire a certain amount of the bond issue early as the bonds approach maturity

Corporate Bonds • Callable bonds versus non-callable bonds incb = rate of return on a noncallable bond icb = rate of return on a callable bond opcb = value of the call option • A sinking fund provision is a requirement that the issuer retire a certain amount of the bond issue early as the bonds approach maturity

Corporate Bonds • Primary markets are identical to that of Munis • Secondary markets – the exchange market (e. g. , bond division of the NYSE) – the over-the-counter (OTC) market • Bond ratings – the three major bond rating agencies are Moody’s, Standard & Poor’s (S&P), and Fitch – bonds are rated by perceived default risk – bonds may be either investment or speculative (i. e. , junk) grade

Corporate Bonds • Primary markets are identical to that of Munis • Secondary markets – the exchange market (e. g. , bond division of the NYSE) – the over-the-counter (OTC) market • Bond ratings – the three major bond rating agencies are Moody’s, Standard & Poor’s (S&P), and Fitch – bonds are rated by perceived default risk – bonds may be either investment or speculative (i. e. , junk) grade

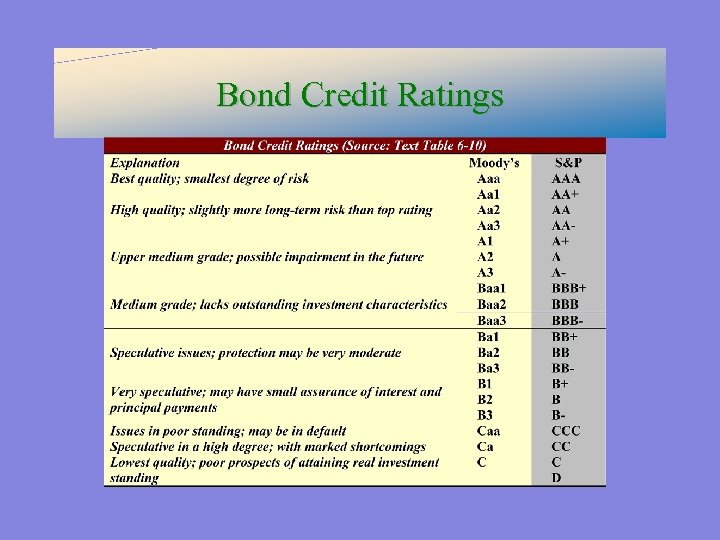

Bond Credit Ratings

Bond Credit Ratings

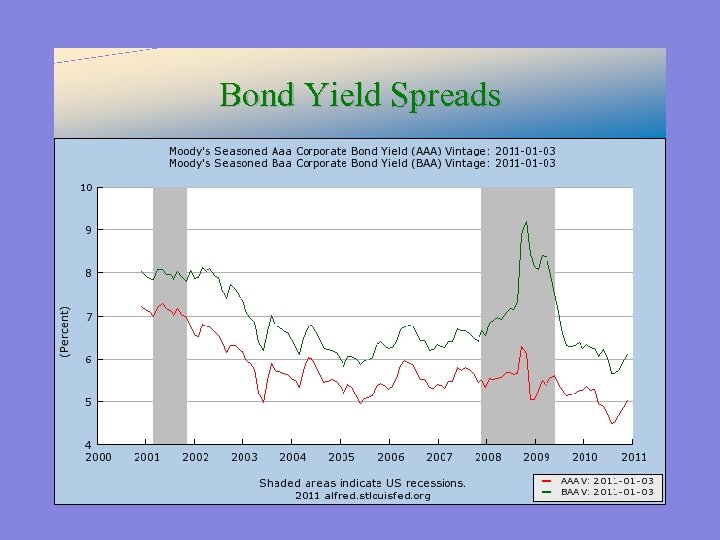

Bond Yield Spreads

Bond Yield Spreads

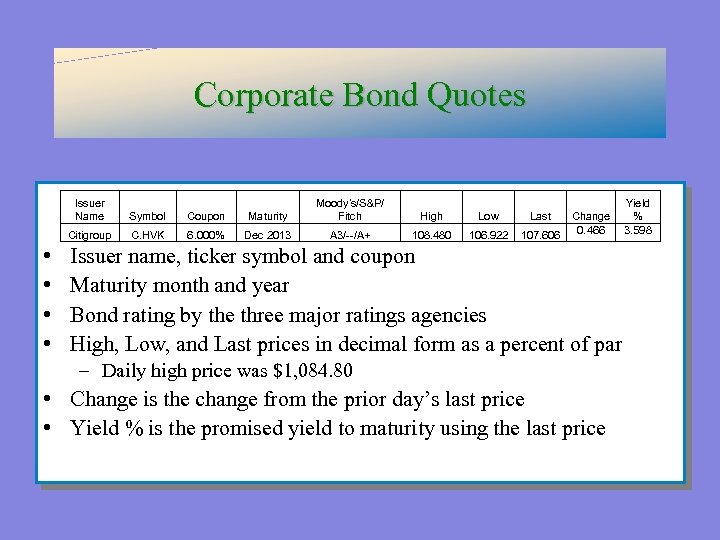

Corporate Bond Quotes Issuer Name Coupon Citigroup • • Symbol C. HVK 6. 000% Maturity Moody’s/S&P/ Fitch High Low Last Dec 2013 A 3/--/A+ 108. 480 106. 922 107. 606 Change 0. 466 Issuer name, ticker symbol and coupon Maturity month and year Bond rating by the three major ratings agencies High, Low, and Last prices in decimal form as a percent of par – Daily high price was $1, 084. 80 • Change is the change from the prior day’s last price • Yield % is the promised yield to maturity using the last price Yield % 3. 598

Corporate Bond Quotes Issuer Name Coupon Citigroup • • Symbol C. HVK 6. 000% Maturity Moody’s/S&P/ Fitch High Low Last Dec 2013 A 3/--/A+ 108. 480 106. 922 107. 606 Change 0. 466 Issuer name, ticker symbol and coupon Maturity month and year Bond rating by the three major ratings agencies High, Low, and Last prices in decimal form as a percent of par – Daily high price was $1, 084. 80 • Change is the change from the prior day’s last price • Yield % is the promised yield to maturity using the last price Yield % 3. 598

Bond Market Indexes • Managed by major investment banks • Reflect both the monthly capital gain and loss on bonds plus any interest (coupon) income earned • Changes in values of bond indexes can be used by bond traders to evaluate changes in the investment attractiveness of bonds of different types and maturities

Bond Market Indexes • Managed by major investment banks • Reflect both the monthly capital gain and loss on bonds plus any interest (coupon) income earned • Changes in values of bond indexes can be used by bond traders to evaluate changes in the investment attractiveness of bonds of different types and maturities

Bond Market Participants • The major issuers of debt market securities are federal, state and local governments, and corporations • The major purchasers of capital market securities are households, businesses, government units, and foreign investors – Businesses and financial firms (e. g. , banks, insurance companies, and mutual funds) are the major suppliers of funds for Munis and corporate bonds – Foreign investors and governments are the major suppliers of funds for T-notes and T-bonds

Bond Market Participants • The major issuers of debt market securities are federal, state and local governments, and corporations • The major purchasers of capital market securities are households, businesses, government units, and foreign investors – Businesses and financial firms (e. g. , banks, insurance companies, and mutual funds) are the major suppliers of funds for Munis and corporate bonds – Foreign investors and governments are the major suppliers of funds for T-notes and T-bonds

International Bonds and Markets • International bond markets involve unregistered bonds that are internationally syndicated, offered simultaneously to investors in several countries, and issued outside of the jurisdiction of any single country • Eurobonds are long-term bonds issued outside the country of the currency in which they are denominated • Foreign Bonds are long-term bonds issued outside of the issuer’s home country • Sovereign Bonds are government issued debt

International Bonds and Markets • International bond markets involve unregistered bonds that are internationally syndicated, offered simultaneously to investors in several countries, and issued outside of the jurisdiction of any single country • Eurobonds are long-term bonds issued outside the country of the currency in which they are denominated • Foreign Bonds are long-term bonds issued outside of the issuer’s home country • Sovereign Bonds are government issued debt

Common Stock-1 • Common stock is the fundamental ownership claim in a public or private corporation • The characteristics of common stock differentiate it from other types of financial securities in 4 dimentions: – 1) Discretionary divident payments (not guaranteed) – 2) Residual claim status (have the lowest priority claim in the event of bankcrupcy after paying creditors, employees, bond holders, goverment and preferred stockholders) – 3) Limited Liability (common stockholders can lose no more than their original investment, not like sole proprietorship or partnership. ) – 4) Voting Rights (common stockholders control the firm’s activities indirectly by exercising their voting rights in the election of the board of directors. ) 8 -52

Common Stock-1 • Common stock is the fundamental ownership claim in a public or private corporation • The characteristics of common stock differentiate it from other types of financial securities in 4 dimentions: – 1) Discretionary divident payments (not guaranteed) – 2) Residual claim status (have the lowest priority claim in the event of bankcrupcy after paying creditors, employees, bond holders, goverment and preferred stockholders) – 3) Limited Liability (common stockholders can lose no more than their original investment, not like sole proprietorship or partnership. ) – 4) Voting Rights (common stockholders control the firm’s activities indirectly by exercising their voting rights in the election of the board of directors. ) 8 -52

Common Stock-2 (note for dividents) • Can be paid or not !!! Once or more • When it is paid dividents are taxed twice (firm level corporate tax and personel level personal income tax). Holding stocks in growth firms can help avoiding this double taxation effect. • In the context of return; (reinvesment of earnings instead of paying divident) the divident component of returns decreases while generally increase the capital gains component. • • If dividents are paid; 50 -50/50 + 2/50 = 4%. Ordinary tax is 30 %. 4% (1 -. 30) = 2. 8 % net return after the tax. If dividents are not paid: 52 -50/50+ 0/50 = 4% (capital gain tax 20%) 4% (1 -. 20) = 3. 2 % net return after the tax. 8 -53

Common Stock-2 (note for dividents) • Can be paid or not !!! Once or more • When it is paid dividents are taxed twice (firm level corporate tax and personel level personal income tax). Holding stocks in growth firms can help avoiding this double taxation effect. • In the context of return; (reinvesment of earnings instead of paying divident) the divident component of returns decreases while generally increase the capital gains component. • • If dividents are paid; 50 -50/50 + 2/50 = 4%. Ordinary tax is 30 %. 4% (1 -. 30) = 2. 8 % net return after the tax. If dividents are not paid: 52 -50/50+ 0/50 = 4% (capital gain tax 20%) 4% (1 -. 20) = 3. 2 % net return after the tax. 8 -53

Common Stock-3 (note for voting) • Common stockholders control the firm’s activities indirectly by exercising their voting rights in the election of the board of directors. Direct control is with the managers hired to act in the best interests of the firm. • Voting rights are arranged usually one vote per share of common stock. Some companies are organized as dual class firms, where two classes of common stock are outstanding with different voting rights. • To offset the reduced voting rights, inferior class shares are often assigned higher divident rights. 8 -54

Common Stock-3 (note for voting) • Common stockholders control the firm’s activities indirectly by exercising their voting rights in the election of the board of directors. Direct control is with the managers hired to act in the best interests of the firm. • Voting rights are arranged usually one vote per share of common stock. Some companies are organized as dual class firms, where two classes of common stock are outstanding with different voting rights. • To offset the reduced voting rights, inferior class shares are often assigned higher divident rights. 8 -54

Common Stock-4 (note for voting) • Voting can be cumulative or straight. • cumulative voting: the number of votes assigned to each stockholder • • equals the number of shares held multiplied by the number of directors to be elected Share holder may assign all of his or her votes to a singe candidate or may spread them over more. This methods permits minority stockholders to have some real say in the election. – the number of shares needed to elect p directors, Np, is: Np = [(p x # of shares outstanding)/(# of directors to be elected + 1)] +1 • straight voting: One director at a time. Owner of over half the voting • shares can elect the entire board of directors. (example in page 227, 8 -3 or 8 -2) A proxy vote allows stockholders to vote by absentee ballot (e. g. , by mail) 8 -55

Common Stock-4 (note for voting) • Voting can be cumulative or straight. • cumulative voting: the number of votes assigned to each stockholder • • equals the number of shares held multiplied by the number of directors to be elected Share holder may assign all of his or her votes to a singe candidate or may spread them over more. This methods permits minority stockholders to have some real say in the election. – the number of shares needed to elect p directors, Np, is: Np = [(p x # of shares outstanding)/(# of directors to be elected + 1)] +1 • straight voting: One director at a time. Owner of over half the voting • shares can elect the entire board of directors. (example in page 227, 8 -3 or 8 -2) A proxy vote allows stockholders to vote by absentee ballot (e. g. , by mail) 8 -55

Common Stock-5 (note for voting) A firm has 1 million shares of common stocks outstanding and three directors up for election. (and there are 4 candidates) • Cumulative voting: • 1 million shares for 3 directors = 1 million. X 3= 3, 000 votes • What if there are 4 candidates: the highest 3 gets the position. • • • Straight voting: 1 million shares for 3 directors (not 3 million) For each candidate there is an election. You vote for each candidate seperately If you are a big investor than in each election, you will be the strongest. 8 -56

Common Stock-5 (note for voting) A firm has 1 million shares of common stocks outstanding and three directors up for election. (and there are 4 candidates) • Cumulative voting: • 1 million shares for 3 directors = 1 million. X 3= 3, 000 votes • What if there are 4 candidates: the highest 3 gets the position. • • • Straight voting: 1 million shares for 3 directors (not 3 million) For each candidate there is an election. You vote for each candidate seperately If you are a big investor than in each election, you will be the strongest. 8 -56

Preferred Stock • 1. 2. 3. 4. • 1. 2. Preferred stock is a hybrid security that has characteristics of both bonds and common stock: Represents an ownership interest in the issuing firm, like stocks. And it pays a fixed periodic (divident) like a bond. Generally has fixed dividends that are paid quarterly Generally does not have voting rights unless dividend payments are missed If the dividents are not paid, the company can’t be forced to bankrupcy. Drawbacs Not like coupon interest paid on corporate bonds, dividends are paid out of after tax earnings. This raises the cost of preferred stock relative to bonds for the shareholders. If the dividents are not paid, new investors will be reluctant to make investment. Divident should be a good one (costly!) to attract the investors. 8 -57

Preferred Stock • 1. 2. 3. 4. • 1. 2. Preferred stock is a hybrid security that has characteristics of both bonds and common stock: Represents an ownership interest in the issuing firm, like stocks. And it pays a fixed periodic (divident) like a bond. Generally has fixed dividends that are paid quarterly Generally does not have voting rights unless dividend payments are missed If the dividents are not paid, the company can’t be forced to bankrupcy. Drawbacs Not like coupon interest paid on corporate bonds, dividends are paid out of after tax earnings. This raises the cost of preferred stock relative to bonds for the shareholders. If the dividents are not paid, new investors will be reluctant to make investment. Divident should be a good one (costly!) to attract the investors. 8 -57

Preferred Stock & Dividents. . . • • Calculation of Preferred Stock Dividents: Suppose you own a preferred stock that promises to pay an annual divident of 5 prcnt (in quarterly installmens). If the face value of the stock is $100; $100 x. 05= $5 Quarterly divident = 5/4=1. 25 • Typically, preferred stock is nonparticipating and cumulative !!! • • Nonparticipating versus participating (about profit sharing) In Nonparticipating divident is fixed as % or USD and not effected from the increase in the profits. Cumulative versus noncumulative (about the divident payments) Cumulative divident payment means any missed dividents must be made up before any common stock divident is paid. ) If noncumulative, missed divident payments are never paid. 8 -58

Preferred Stock & Dividents. . . • • Calculation of Preferred Stock Dividents: Suppose you own a preferred stock that promises to pay an annual divident of 5 prcnt (in quarterly installmens). If the face value of the stock is $100; $100 x. 05= $5 Quarterly divident = 5/4=1. 25 • Typically, preferred stock is nonparticipating and cumulative !!! • • Nonparticipating versus participating (about profit sharing) In Nonparticipating divident is fixed as % or USD and not effected from the increase in the profits. Cumulative versus noncumulative (about the divident payments) Cumulative divident payment means any missed dividents must be made up before any common stock divident is paid. ) If noncumulative, missed divident payments are never paid. 8 -58

2. 5 DERIVATIVE MARKETS • One of the most significant developments in financial markets in recent years has been the growth of futures, options, and related derivatives markets. • These instruments provide payoffs that depend on the values of other assets such as commodity prices, bond and stock prices, or market index values. • For this reason these instruments sometimes are called derivative assets, or contingent claims. • Their values derive from or are contingent on the values of other assets. 8 -59

2. 5 DERIVATIVE MARKETS • One of the most significant developments in financial markets in recent years has been the growth of futures, options, and related derivatives markets. • These instruments provide payoffs that depend on the values of other assets such as commodity prices, bond and stock prices, or market index values. • For this reason these instruments sometimes are called derivative assets, or contingent claims. • Their values derive from or are contingent on the values of other assets. 8 -59

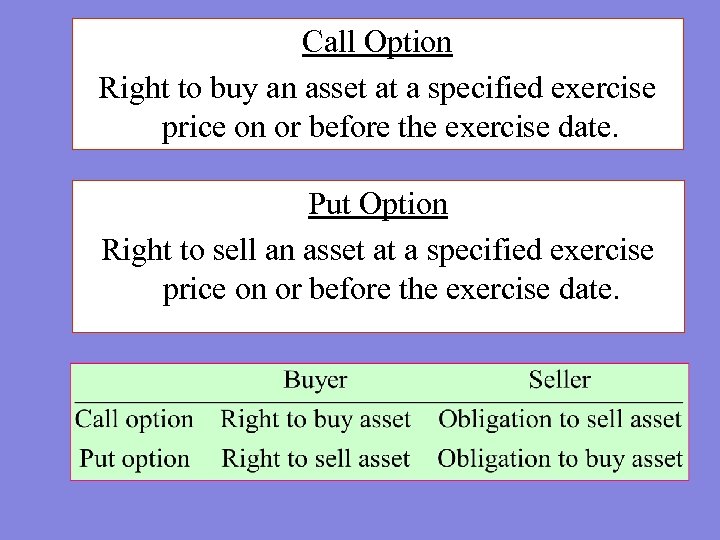

Call Option Right to buy an asset at a specified exercise price on or before the exercise date. Put Option Right to sell an asset at a specified exercise price on or before the exercise date.

Call Option Right to buy an asset at a specified exercise price on or before the exercise date. Put Option Right to sell an asset at a specified exercise price on or before the exercise date.

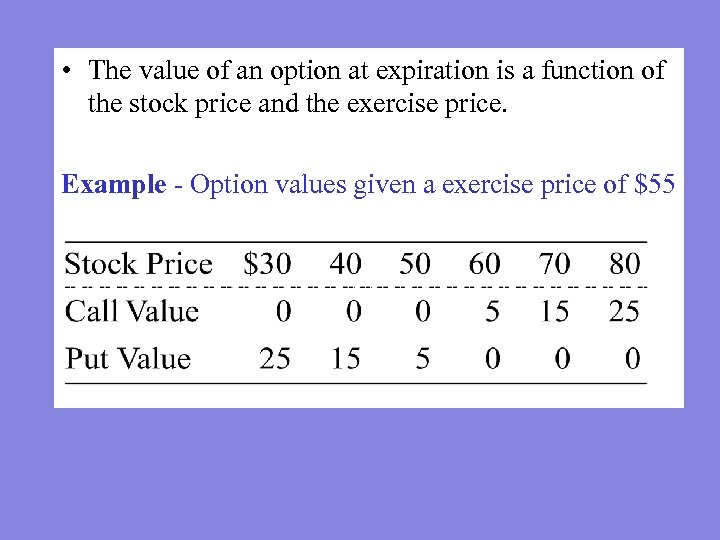

• The value of an option at expiration is a function of the stock price and the exercise price. Example - Option values given a exercise price of $55

• The value of an option at expiration is a function of the stock price and the exercise price. Example - Option values given a exercise price of $55

End of Chapter 2 Thanks 1 -62

End of Chapter 2 Thanks 1 -62