b6e3447f6c5ce83b856153303452b1c7.ppt

- Количество слайдов: 33

Chapter Three Labour Supply and Public Policy: Work Incentive Effects of Alternative Income Maintenance Schemes Created by: Erica Morrill, M. Ed Fanshawe College © 2002 Mc. Graw-Hill Ryerson Ltd. 1

Chapter Focus ® Labour Supply Factors ® Government transfer programs ® Welfare programs ® Workers compensation ® Child-care subsidies © 2002 Mc. Graw-Hill Ryerson Ltd. 2

Income Maintenance Schemes ® Designed to supplement low incomes ® No single program can address the multiple reasons for low income ® Difficult for policy makers to design the ideal program © 2002 Mc. Graw-Hill Ryerson Ltd. 3

Universal Programs ® Administratively simple ® Everyone receives the same transfer regardless of income ® Results in raising income and eliminating poverty ® Expensive ® Benefits non-poor © 2002 Mc. Graw-Hill Ryerson Ltd. 4

Perfect Targeting ® Cheaper method ® Individuals are given exactly enough of a transfer to reach the poverty line ® Only those below poverty line would receive transfer ® Individuals below poverty line are guaranteed to be topped up ® May cause individuals to reduce work effort ® Creates a disincentive to earn income © 2002 Mc. Graw-Hill Ryerson Ltd. 5

Permanent or Transitory ® Design features ® to compensate for low wages or lack of hours ® Distinction between permanent and transitory are difficult to isolate © 2002 Mc. Graw-Hill Ryerson Ltd. 6

Characteristics of a Demogrant ® Lump sum transfer ® Income grant ® Specific to a demographic group ® Old Age Security (OAS) ® Universal © 2002 Mc. Graw-Hill Ryerson Ltd. 7

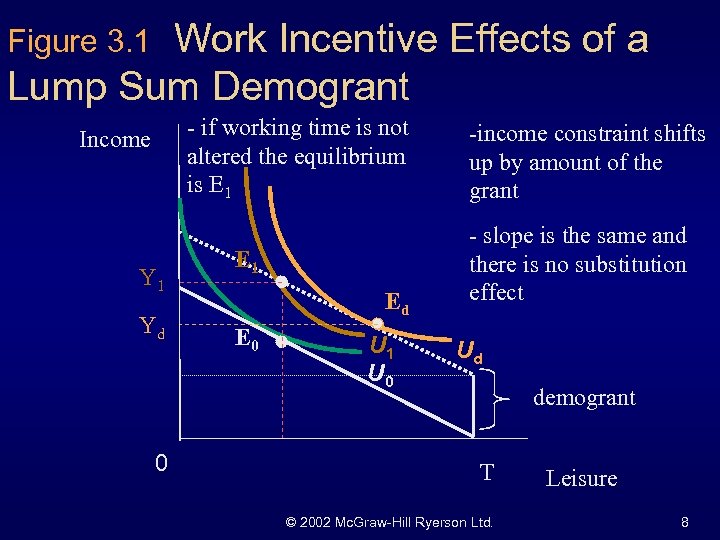

Work Incentive Effects of a Lump Sum Demogrant Figure 3. 1 - if working time is not altered the equilibrium is E 1 Income Y 1 Yd 0 E 1 Ed E 0 U 1 U 0 -income constraint shifts up by amount of the grant - slope is the same and there is no substitution effect Ud demogrant T © 2002 Mc. Graw-Hill Ryerson Ltd. Leisure 8

Work Incentive Effects of a Lump Sum Demogrant ® No substitution effect ® Work incentives are reduced ® Pure leisure - inducing income effect ® Increase in income is less than the demogrant (used to buy leisure) © 2002 Mc. Graw-Hill Ryerson Ltd. 9

Welfare ® Administered by the provinces ® Financed partly by the federal government ® Benefits depend on ® needs of the family, ® assets ® other sources of income © 2002 Mc. Graw-Hill Ryerson Ltd. 10

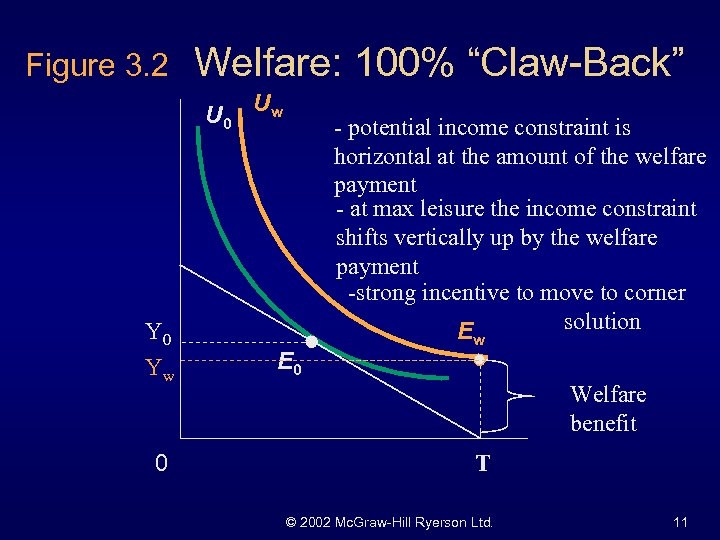

Figure 3. 2 Welfare: 100% “Claw-Back” U 0 Uw Y 0 Yw 0 - potential income constraint is horizontal at the amount of the welfare payment - at max leisure the income constraint shifts vertically up by the welfare payment -strong incentive to move to corner solution E E 0 w Welfare benefit T © 2002 Mc. Graw-Hill Ryerson Ltd. 11

Welfare: 100% “Claw Back” ® Adverse effect on work incentives ® Work is not chosen because of the 100% tax on earned income ® Negative impact on work incentives ® Not an acceptable policy © 2002 Mc. Graw-Hill Ryerson Ltd. 12

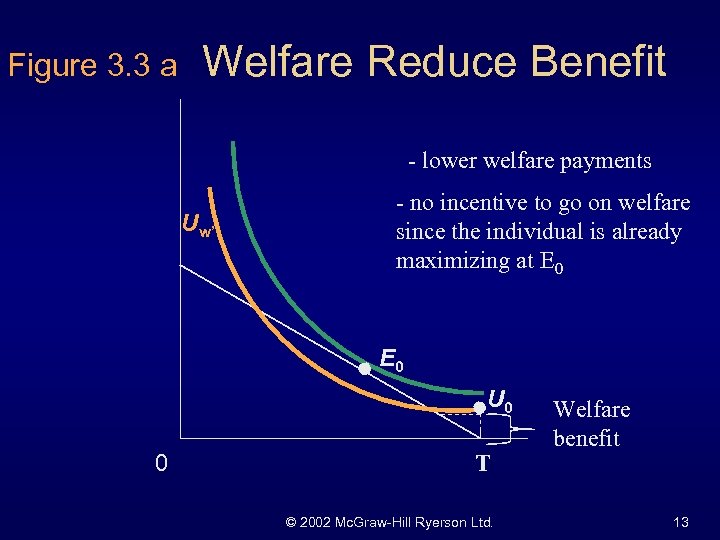

Figure 3. 3 a Welfare Reduce Benefit - lower welfare payments Uw’ - no incentive to go on welfare since the individual is already maximizing at E 0 U 0 0 T © 2002 Mc. Graw-Hill Ryerson Ltd. Welfare benefit 13

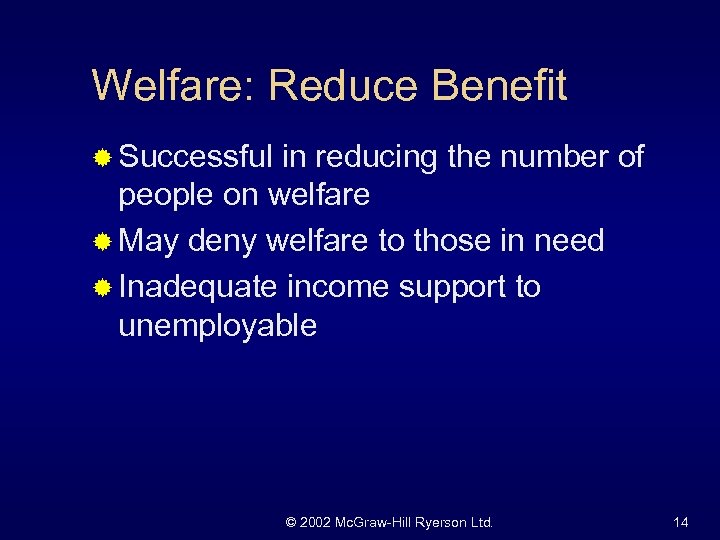

Welfare: Reduce Benefit ® Successful in reducing the number of people on welfare ® May deny welfare to those in need ® Inadequate income support to unemployable © 2002 Mc. Graw-Hill Ryerson Ltd. 14

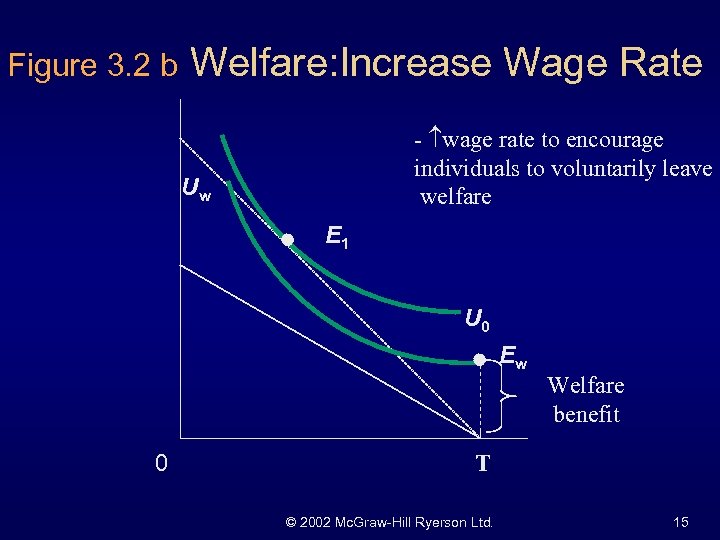

Figure 3. 2 b Welfare: Increase Wage Rate - wage rate to encourage individuals to voluntarily leave welfare Uw E 1 U 0 Ew 0 Welfare benefit T © 2002 Mc. Graw-Hill Ryerson Ltd. 15

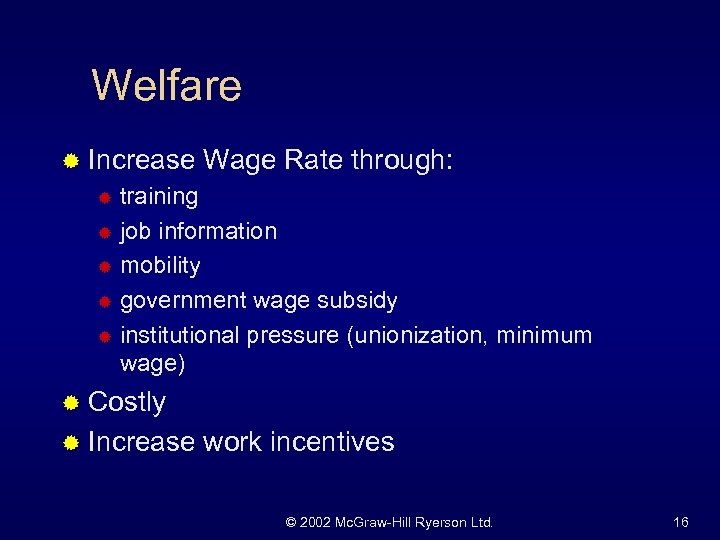

Welfare ® Increase Wage Rate through: training ® job information ® mobility ® government wage subsidy ® institutional pressure (unionization, minimum wage) ® ® Costly ® Increase work incentives © 2002 Mc. Graw-Hill Ryerson Ltd. 16

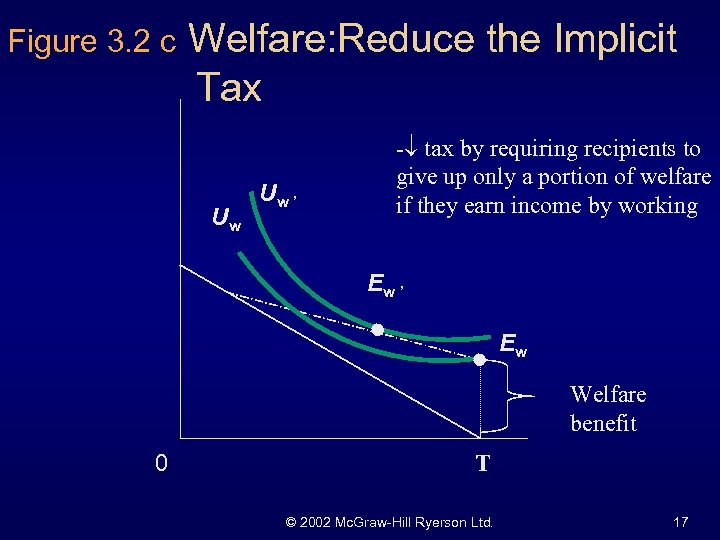

Figure 3. 2 c Welfare: Reduce the Implicit Tax Uw Uw ’ - tax by requiring recipients to give up only a portion of welfare if they earn income by working Ew ’ Ew Welfare benefit 0 T © 2002 Mc. Graw-Hill Ryerson Ltd. 17

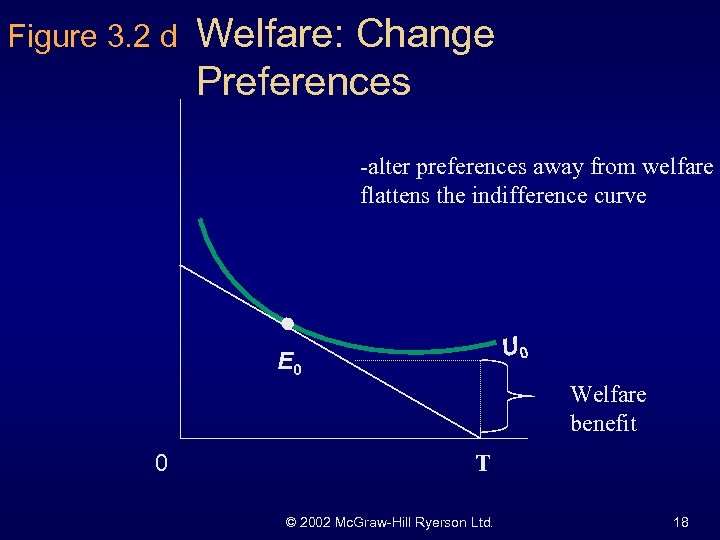

Figure 3. 2 d Welfare: Change Preferences -alter preferences away from welfare flattens the indifference curve U 0 E 0 Welfare benefit 0 T © 2002 Mc. Graw-Hill Ryerson Ltd. 18

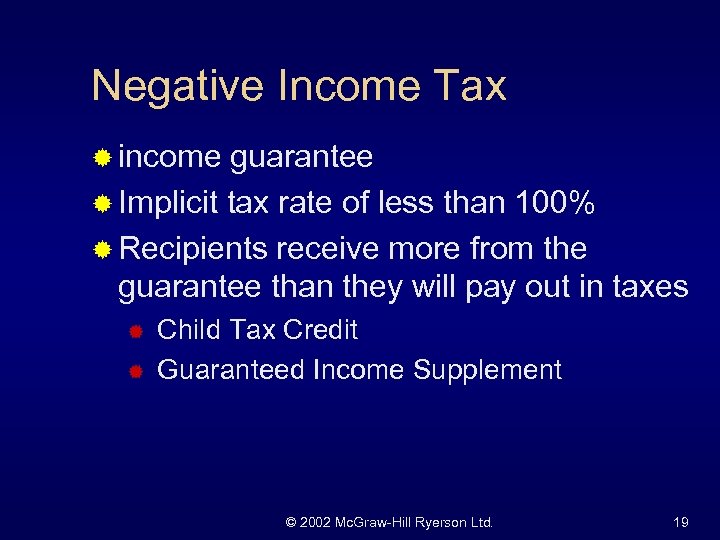

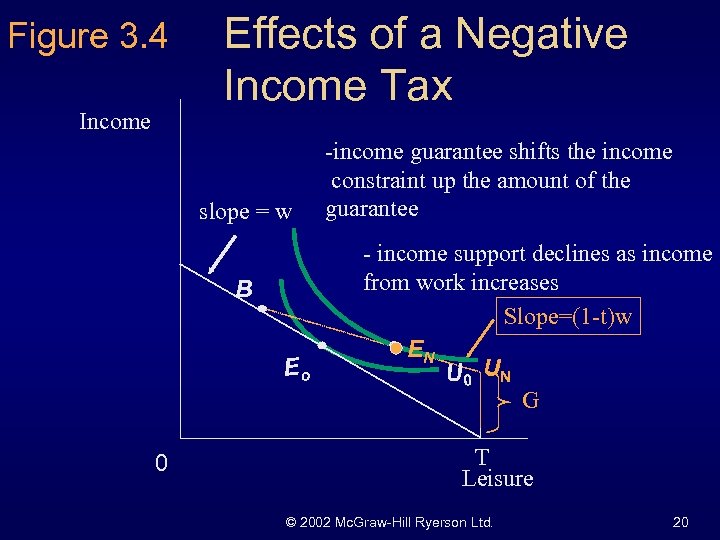

Negative Income Tax ® income guarantee ® Implicit tax rate of less than 100% ® Recipients receive more from the guarantee than they will pay out in taxes ® ® Child Tax Credit Guaranteed Income Supplement © 2002 Mc. Graw-Hill Ryerson Ltd. 19

Figure 3. 4 Income Effects of a Negative Income Tax slope = w B Eo 0 -income guarantee shifts the income constraint up the amount of the guarantee - income support declines as income from work increases Slope=(1 -t)w EN U 0 UN G T Leisure © 2002 Mc. Graw-Hill Ryerson Ltd. 20

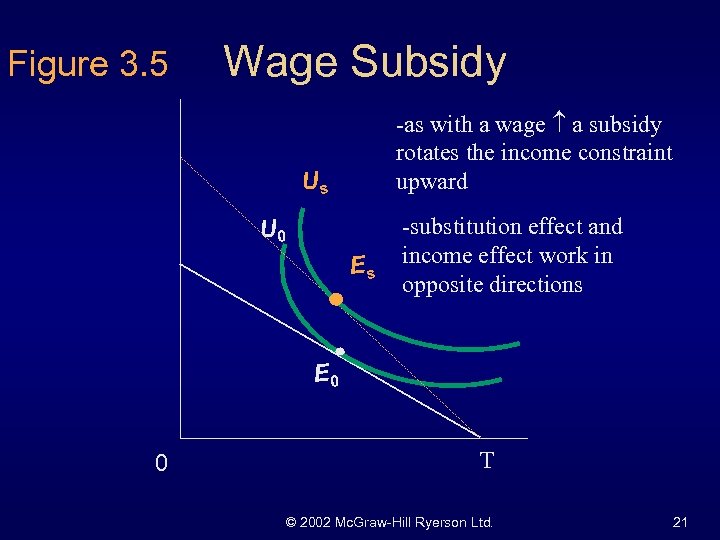

Figure 3. 5 Wage Subsidy -as with a wage a subsidy rotates the income constraint upward Us U 0 Es -substitution effect and income effect work in opposite directions E 0 0 T © 2002 Mc. Graw-Hill Ryerson Ltd. 21

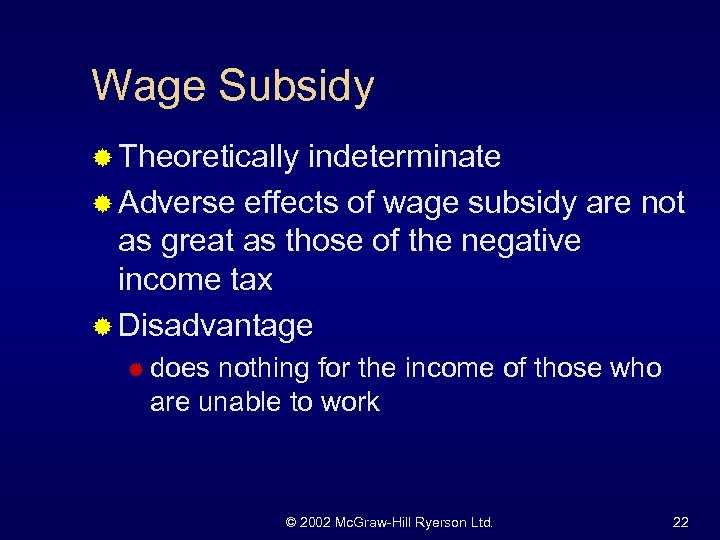

Wage Subsidy ® Theoretically indeterminate ® Adverse effects of wage subsidy are not as great as those of the negative income tax ® Disadvantage ® does nothing for the income of those who are unable to work © 2002 Mc. Graw-Hill Ryerson Ltd. 22

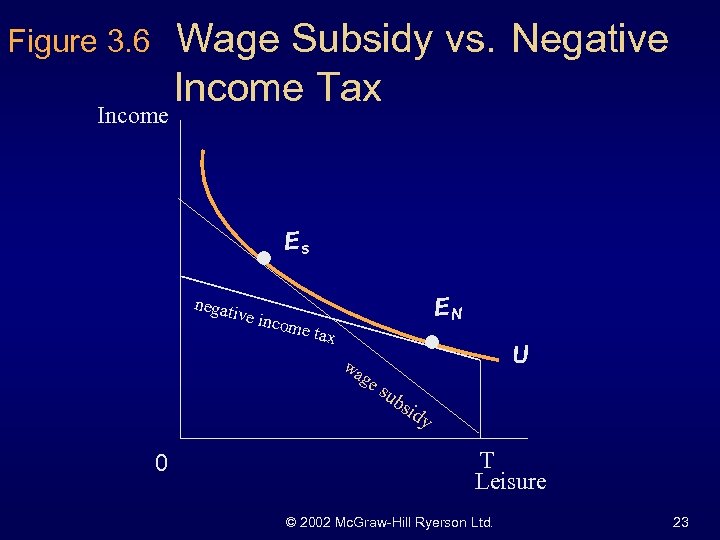

Figure 3. 6 Income Wage Subsidy vs. Negative Income Tax Es negat ive in EN come t ax wa ge 0 U su bs idy T Leisure © 2002 Mc. Graw-Hill Ryerson Ltd. 23

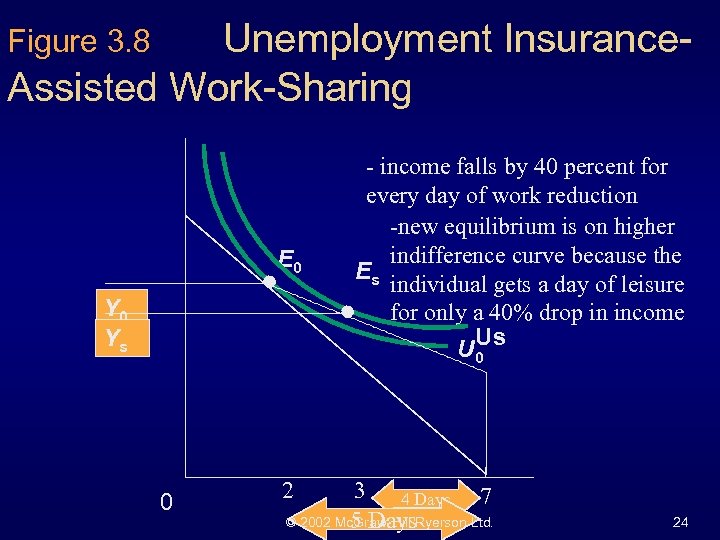

Unemployment Insurance. Assisted Work-Sharing Figure 3. 8 E 0 Ys 0 - income falls by 40 percent for every day of work reduction -new equilibrium is on higher indifference curve because the Es individual gets a day of leisure for only a 40% drop in income Us U 0 2 3 4 Days 7 © 2002 Mc. Graw-Hill Ryerson Ltd. 5 Days 24

Effect of a Disability ® Budget constraint or preference curve could be altered ® Factors to be considered: ® hours able to work ® medical expenses ® reduced ability to earn wages ® disutility of labour market vs. other activities © 2002 Mc. Graw-Hill Ryerson Ltd. 25

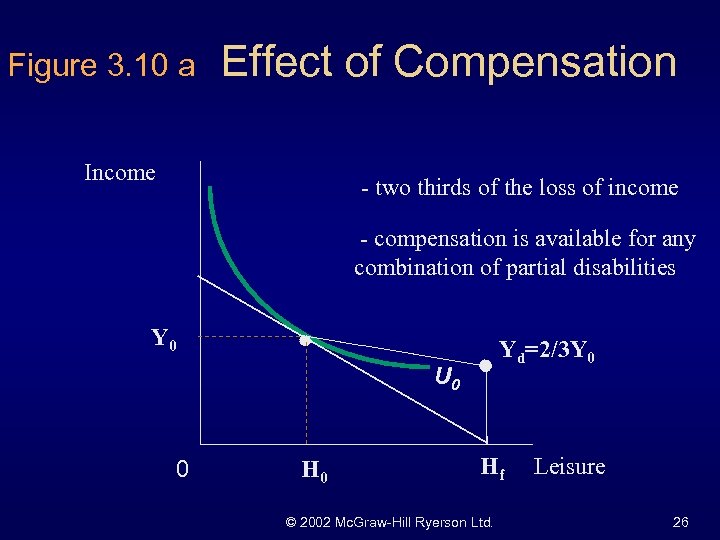

Figure 3. 10 a Effect of Compensation Income - two thirds of the loss of income - compensation is available for any combination of partial disabilities Y 0 Yd=2/3 Y 0 U 0 0 Hf © 2002 Mc. Graw-Hill Ryerson Ltd. Leisure 26

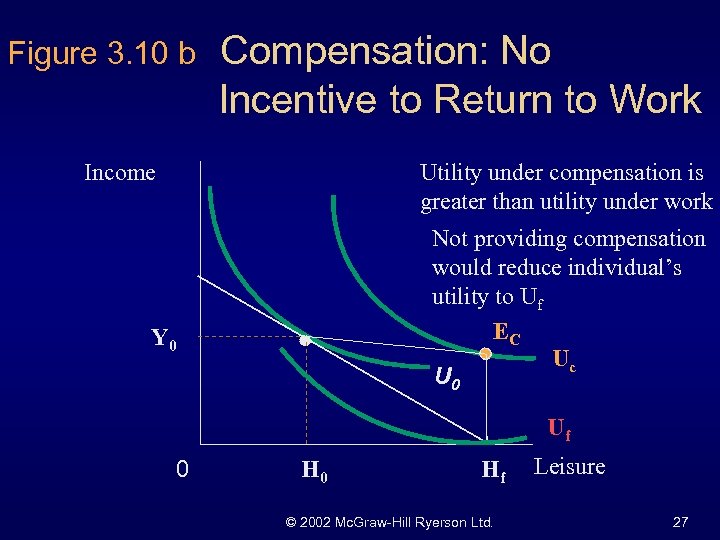

Figure 3. 10 b Compensation: No Incentive to Return to Work Income Utility under compensation is greater than utility under work Not providing compensation would reduce individual’s utility to Uf EC Uc U 0 Y 0 Uf 0 Hf © 2002 Mc. Graw-Hill Ryerson Ltd. Leisure 27

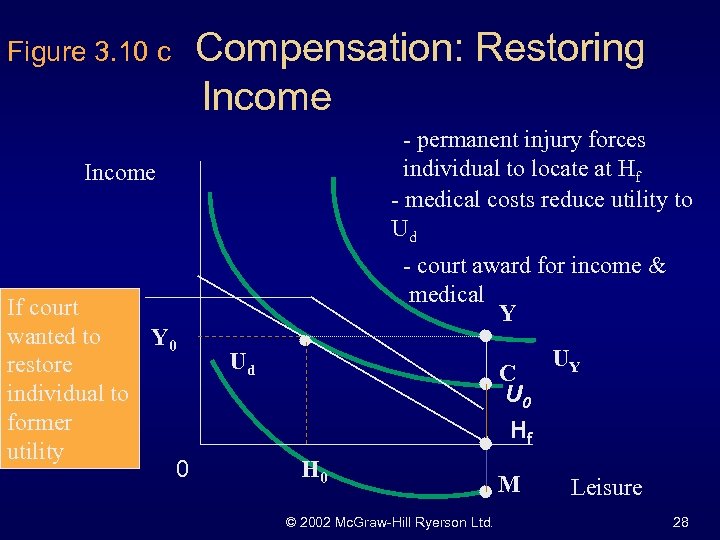

Figure 3. 10 c Compensation: Restoring Income - permanent injury forces individual to locate at Hf - medical costs reduce utility to Ud Income If court wanted to Y 0 restore individual to former utility 0 - court award for income & medical Y Ud C U 0 Hf H 0 © 2002 Mc. Graw-Hill Ryerson Ltd. M UY Leisure 28

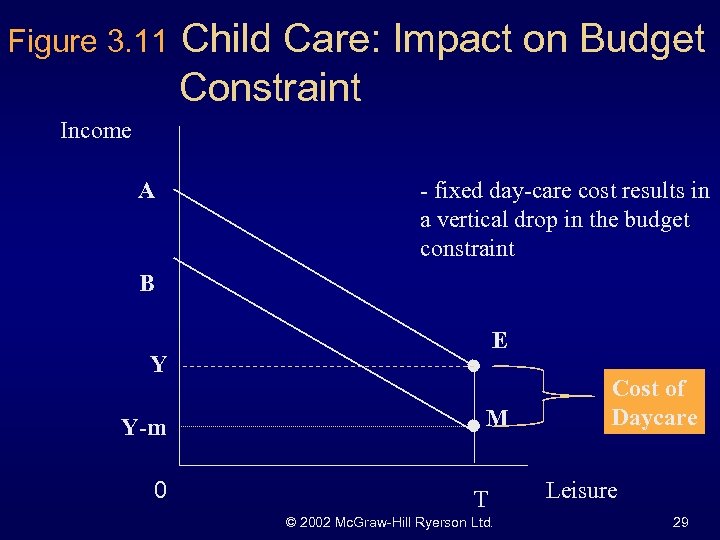

Figure 3. 11 Child Care: Impact on Budget Constraint Income A - fixed day-care cost results in a vertical drop in the budget constraint B E Y Y-m 0 M T © 2002 Mc. Graw-Hill Ryerson Ltd. Cost of Daycare Leisure 29

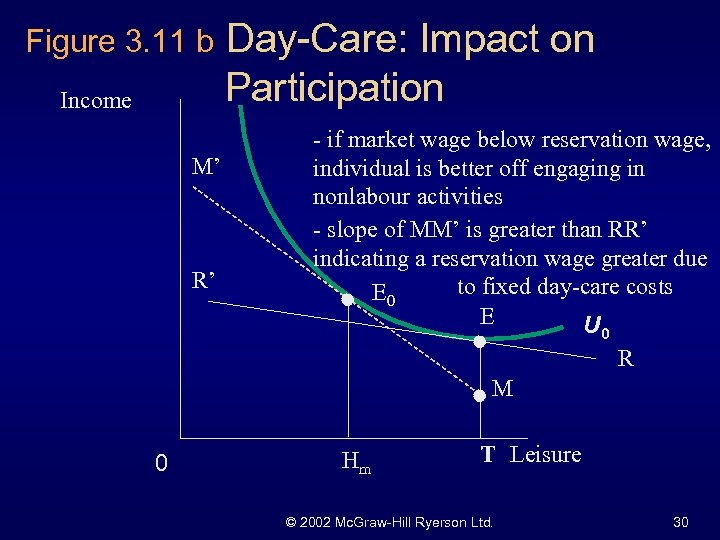

Figure 3. 11 b Income M’ R’ 0 Day-Care: Impact on Participation - if market wage below reservation wage, individual is better off engaging in nonlabour activities - slope of MM’ is greater than RR’ indicating a reservation wage greater due to fixed day-care costs E 0 E U 0 R M Hm T Leisure © 2002 Mc. Graw-Hill Ryerson Ltd. 30

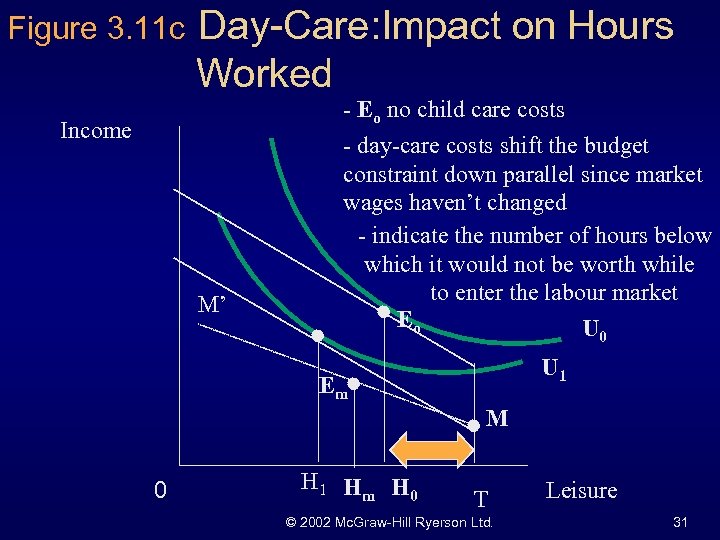

Figure 3. 11 c Day-Care: Impact on Hours Worked - Eo no child care costs Income M’ - day-care costs shift the budget constraint down parallel since market wages haven’t changed - indicate the number of hours below which it would not be worth while to enter the labour market Eo U 0 U 1 Em M 0 H 1 H m H 0 T © 2002 Mc. Graw-Hill Ryerson Ltd. Leisure 31

Day-care Subsidy ® Encourages labour force participation and part-time work ® Reduces the hours of work for those already participating © 2002 Mc. Graw-Hill Ryerson Ltd. 32

End of Chapter Three © 2002 Mc. Graw-Hill Ryerson Ltd. 33

b6e3447f6c5ce83b856153303452b1c7.ppt