fffbc2de9a78c42e1a8fded01bed1897.ppt

- Количество слайдов: 62

Chapter Thirty-Four Information Technology

Chapter Thirty-Four Information Technology

Information Technologies u Computers, answering machines, FAXes, pagers, cellular phones, … u Many provide strong complementarities. u E. g. email is useful only if lots of people use it -- a network externality. u And computers are more useful if many people use the same software.

Information Technologies u Computers, answering machines, FAXes, pagers, cellular phones, … u Many provide strong complementarities. u E. g. email is useful only if lots of people use it -- a network externality. u And computers are more useful if many people use the same software.

Information Technologies u But then switching technologies becomes very costly -- lock-in. u E. g. Microsoft Windows. u How do markets operate when there are switching costs or network externalities?

Information Technologies u But then switching technologies becomes very costly -- lock-in. u E. g. Microsoft Windows. u How do markets operate when there are switching costs or network externalities?

Competition & Switching Costs u Producer’s cost per month of providing a network service is c per customer. u Customer’s switching cost is s. u Producer offers a one month discount, d. u Rate of interest is r.

Competition & Switching Costs u Producer’s cost per month of providing a network service is c per customer. u Customer’s switching cost is s. u Producer offers a one month discount, d. u Rate of interest is r.

Competition & Switching Costs u All producers set the same nondiscounted price of p per month. u When is switching producers rational for a customer?

Competition & Switching Costs u All producers set the same nondiscounted price of p per month. u When is switching producers rational for a customer?

Competition & Switching Costs u Cost of not switching is

Competition & Switching Costs u Cost of not switching is

Competition & Switching Costs u Cost of not switching is u Cost from switching is

Competition & Switching Costs u Cost of not switching is u Cost from switching is

Competition & Switching Costs u Cost of not switching is u Cost from switching is u Switch if

Competition & Switching Costs u Cost of not switching is u Cost from switching is u Switch if

Competition & Switching Costs u Cost of not switching is u Cost from switching is u Switch u I. e. if if

Competition & Switching Costs u Cost of not switching is u Cost from switching is u Switch u I. e. if if

Competition & Switching Costs u Switch u I. e. if if u Producer competition will ensure at a market equilibrium that customers are indifferent between switching or not

Competition & Switching Costs u Switch u I. e. if if u Producer competition will ensure at a market equilibrium that customers are indifferent between switching or not

Competition & Switching Costs u At equilibrium, producer economic profits are zero. u I. e.

Competition & Switching Costs u At equilibrium, producer economic profits are zero. u I. e.

Competition & Switching Costs u At equilibrium, producer economic profits are zero. u I. e. u Since , at equilibrium

Competition & Switching Costs u At equilibrium, producer economic profits are zero. u I. e. u Since , at equilibrium

Competition & Switching Costs u At equilibrium, producer economic profits are zero. u I. e. u Since u I. e. , at equilibrium present-valued producer profit = consumer switching cost.

Competition & Switching Costs u At equilibrium, producer economic profits are zero. u I. e. u Since u I. e. , at equilibrium present-valued producer profit = consumer switching cost.

Competition & Network Externalities u Individuals 1, …, 1000. u Each can buy one unit of a good providing a network externality. u Person v values a unit of the good at nv, where n is the number of persons who buy the good.

Competition & Network Externalities u Individuals 1, …, 1000. u Each can buy one unit of a good providing a network externality. u Person v values a unit of the good at nv, where n is the number of persons who buy the good.

Competition & Network Externalities u Individuals 1, …, 1000. u Each can buy one unit of a good providing a network externality. u Person v values a unit of the good at nv, where n is the number of persons who buy the good. u At a price p, what is the quantity demanded of the good?

Competition & Network Externalities u Individuals 1, …, 1000. u Each can buy one unit of a good providing a network externality. u Person v values a unit of the good at nv, where n is the number of persons who buy the good. u At a price p, what is the quantity demanded of the good?

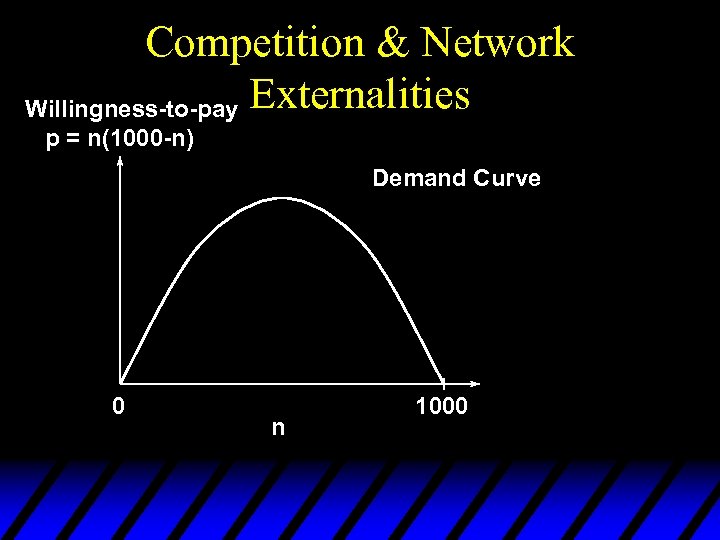

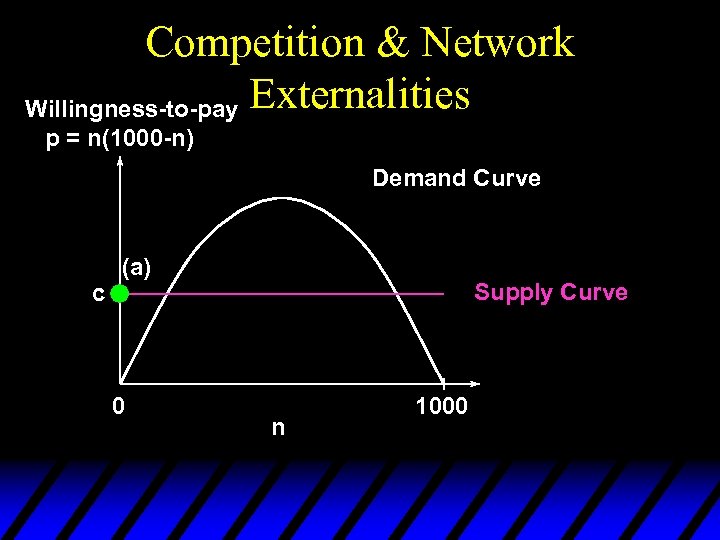

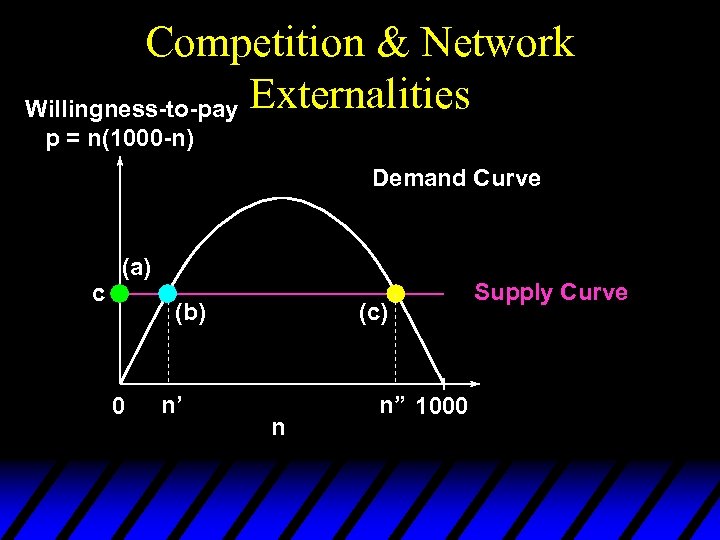

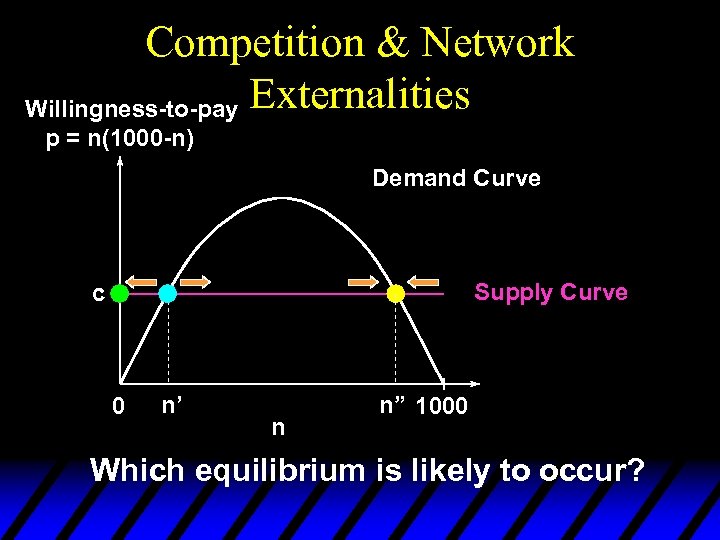

Competition & Network Externalities u If v is the marginal buyer, valuing the good at nv = p, then all buyers v’ > v value the good more, and so buy it. u Quantity demanded is n = 1000 - v. u So inverse demand is p = n(1000 -n).

Competition & Network Externalities u If v is the marginal buyer, valuing the good at nv = p, then all buyers v’ > v value the good more, and so buy it. u Quantity demanded is n = 1000 - v. u So inverse demand is p = n(1000 -n).

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve 0 n 1000

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve 0 n 1000

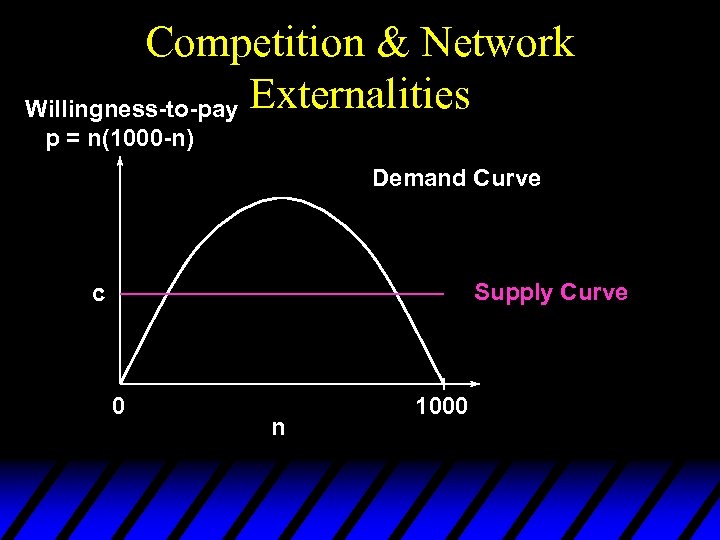

Competition & Network Externalities u Suppose all suppliers have the same marginal production cost, c.

Competition & Network Externalities u Suppose all suppliers have the same marginal production cost, c.

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Supply Curve c 0 n 1000

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Supply Curve c 0 n 1000

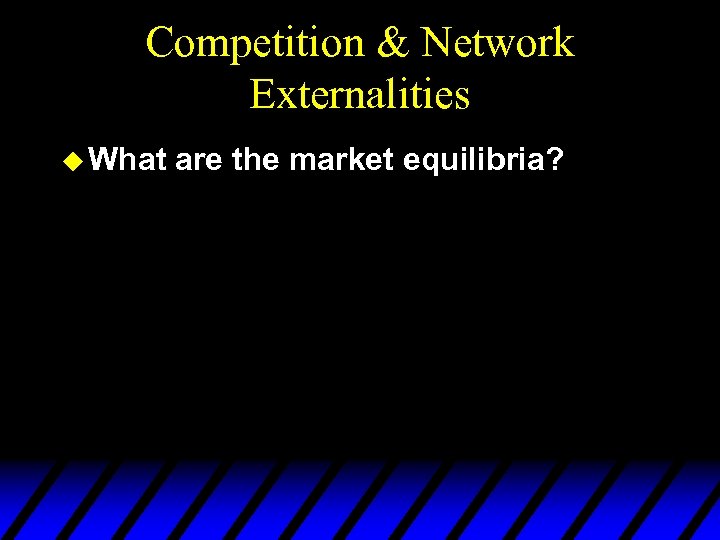

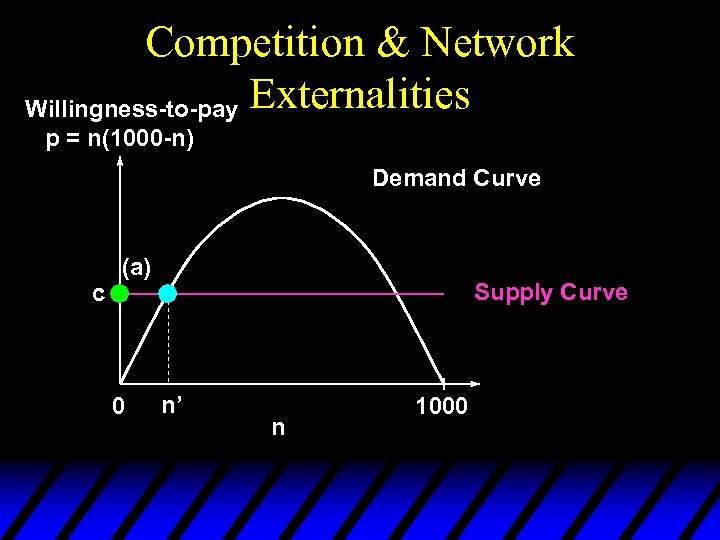

Competition & Network Externalities u What are the market equilibria?

Competition & Network Externalities u What are the market equilibria?

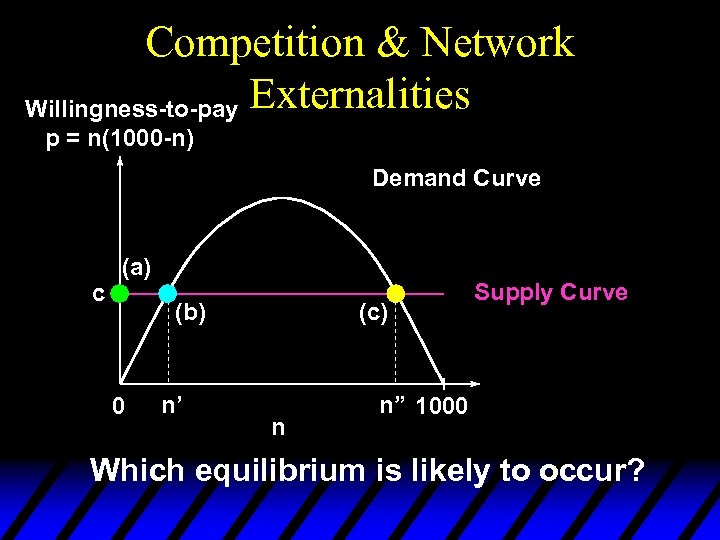

Competition & Network Externalities u What are the market equilibria? u (a) No buyer buys, no seller supplies. – If n = 0, then value nv = 0 for all buyers v, so no buyer buys. – If no buyer buys, then no seller supplies.

Competition & Network Externalities u What are the market equilibria? u (a) No buyer buys, no seller supplies. – If n = 0, then value nv = 0 for all buyers v, so no buyer buys. – If no buyer buys, then no seller supplies.

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve c (a) 0 Supply Curve n 1000

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve c (a) 0 Supply Curve n 1000

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve c (a) 0 Supply Curve n’ n 1000

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve c (a) 0 Supply Curve n’ n 1000

Competition & Network Externalities u What are the market equilibria? u (b) A small number, n’, of buyers buy. – small n’ small network externality value n’v – good is bought only by buyers with n’v c; i. e. only large v v’ = c/n’.

Competition & Network Externalities u What are the market equilibria? u (b) A small number, n’, of buyers buy. – small n’ small network externality value n’v – good is bought only by buyers with n’v c; i. e. only large v v’ = c/n’.

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve c (a) (b) 0 n’ (c) n n” 1000 Supply Curve

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve c (a) (b) 0 n’ (c) n n” 1000 Supply Curve

Competition & Network Externalities u What are the market equilibria? u (c) A large number, n”, of buyers buy. – Large n” large network externality value n”v – good is bought only by buyers with n’v c; i. e. up to small v v” = c/n”.

Competition & Network Externalities u What are the market equilibria? u (c) A large number, n”, of buyers buy. – Large n” large network externality value n”v – good is bought only by buyers with n’v c; i. e. up to small v v” = c/n”.

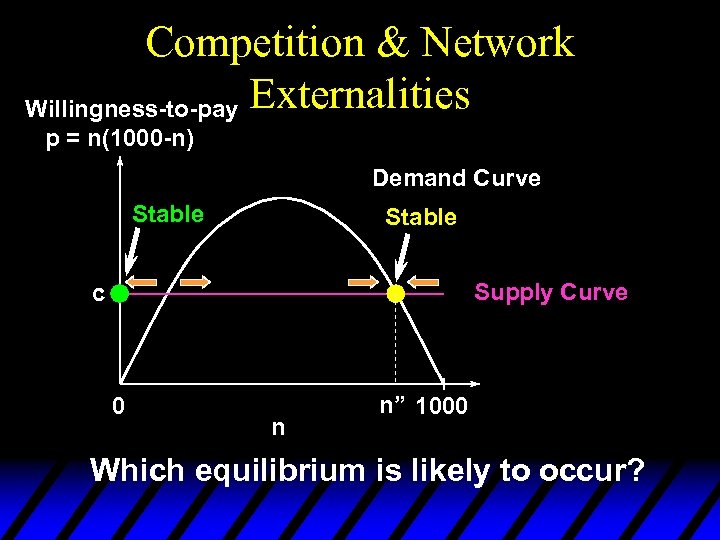

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve c (a) (b) 0 n’ (c) n Supply Curve n” 1000 Which equilibrium is likely to occur?

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve c (a) (b) 0 n’ (c) n Supply Curve n” 1000 Which equilibrium is likely to occur?

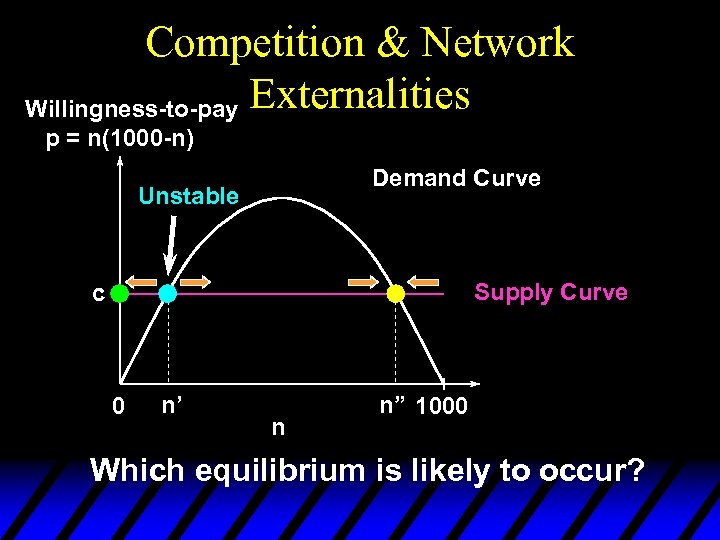

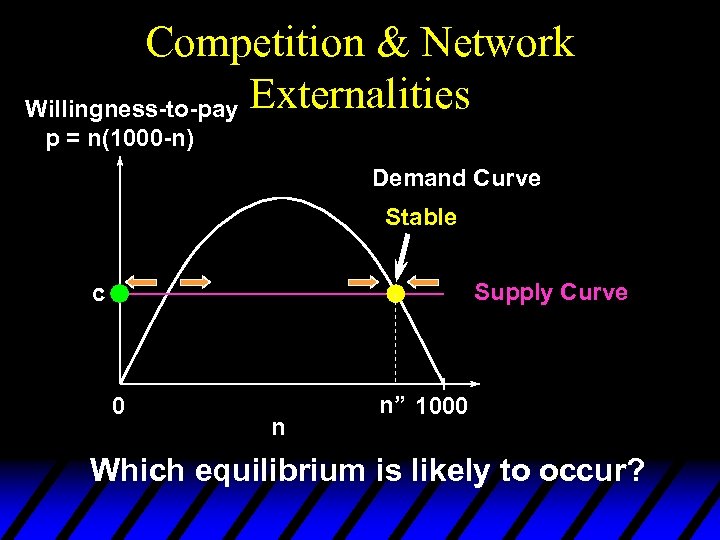

Competition & Network Externalities u Suppose the market expands whenever willingness-to-pay exceeds marginal production cost, c.

Competition & Network Externalities u Suppose the market expands whenever willingness-to-pay exceeds marginal production cost, c.

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Supply Curve c 0 n’ n n” 1000 Which equilibrium is likely to occur?

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Supply Curve c 0 n’ n n” 1000 Which equilibrium is likely to occur?

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Unstable Supply Curve c 0 n’ n n” 1000 Which equilibrium is likely to occur?

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Unstable Supply Curve c 0 n’ n n” 1000 Which equilibrium is likely to occur?

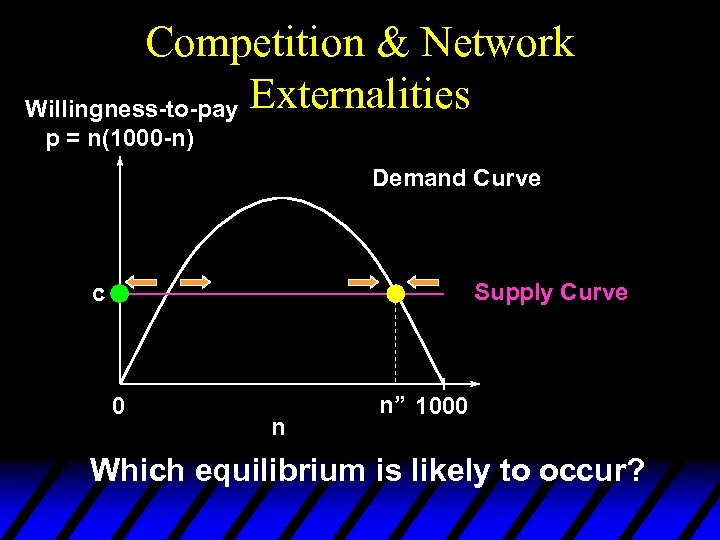

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Supply Curve c 0 n n” 1000 Which equilibrium is likely to occur?

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Supply Curve c 0 n n” 1000 Which equilibrium is likely to occur?

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Stable Supply Curve c 0 n n” 1000 Which equilibrium is likely to occur?

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Stable Supply Curve c 0 n n” 1000 Which equilibrium is likely to occur?

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Stable Supply Curve c 0 n n” 1000 Which equilibrium is likely to occur?

Competition & Network Willingness-to-pay Externalities p = n(1000 -n) Demand Curve Stable Supply Curve c 0 n n” 1000 Which equilibrium is likely to occur?

Rights Management u Should a good be vsold outright, vlicensed for production by others, or vrented? u How is the ownership right of the good to be managed?

Rights Management u Should a good be vsold outright, vlicensed for production by others, or vrented? u How is the ownership right of the good to be managed?

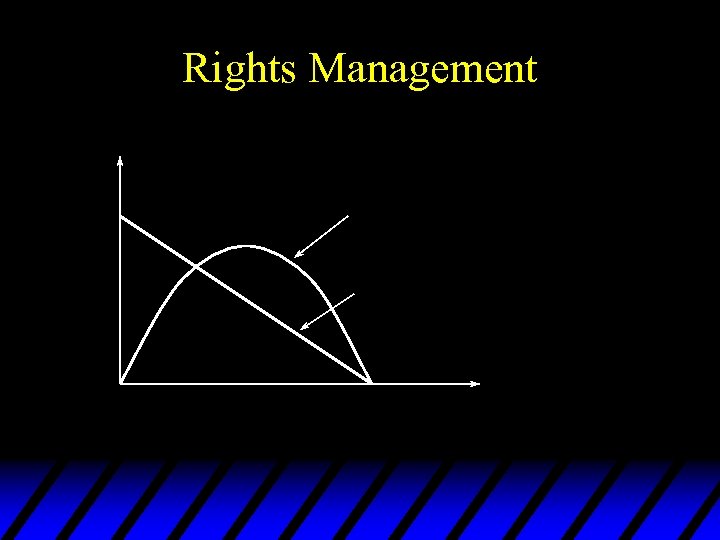

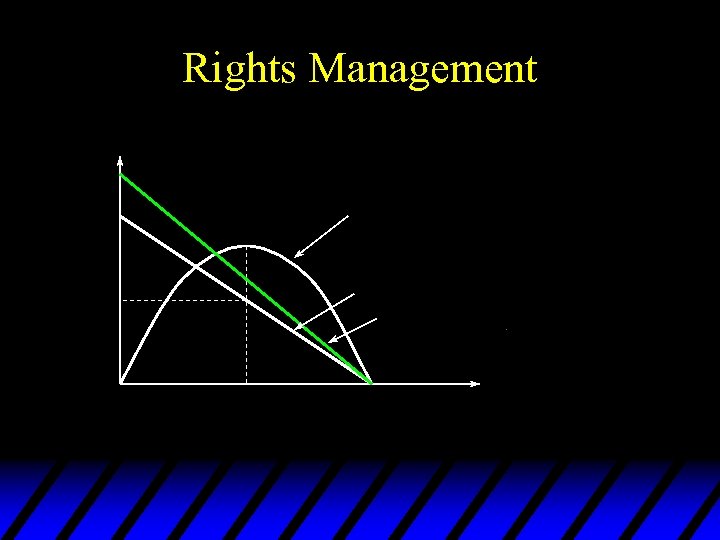

Rights Management u Suppose production costs are negligible. u Market demand is p(y). u The firm wishes to

Rights Management u Suppose production costs are negligible. u Market demand is p(y). u The firm wishes to

Rights Management

Rights Management

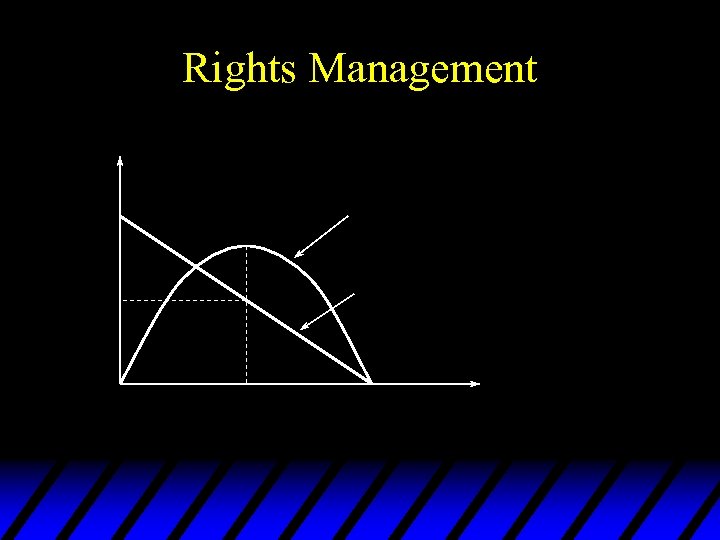

Rights Management

Rights Management

Rights Management

Rights Management

Rights Management u The rights owner now allows a free trial period. This causes – an increase in consumption

Rights Management u The rights owner now allows a free trial period. This causes – an increase in consumption

Rights Management u The rights owner now allows a free trial period. This causes – an increase in consumption and a decrease in sales per unit of consumption

Rights Management u The rights owner now allows a free trial period. This causes – an increase in consumption and a decrease in sales per unit of consumption

Rights Management u The rights owner now allows a free trial period. This causes – increase in value to all users increase in willingness-to-pay;

Rights Management u The rights owner now allows a free trial period. This causes – increase in value to all users increase in willingness-to-pay;

Rights Management

Rights Management

Rights Management u The firm’s problem is now to

Rights Management u The firm’s problem is now to

Rights Management u The u This firm’s problem is now to problem must have the same solution as

Rights Management u The u This firm’s problem is now to problem must have the same solution as

Rights Management u The u This firm’s problem is now to problem must have the same solution as u So

Rights Management u The u This firm’s problem is now to problem must have the same solution as u So

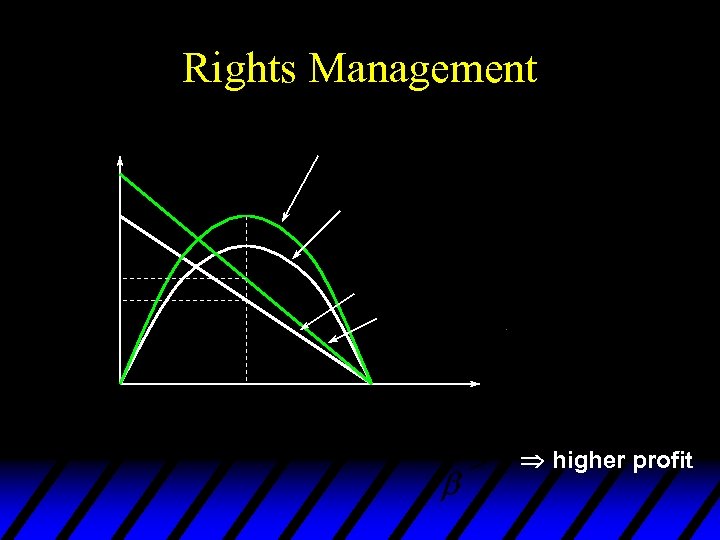

Rights Management

Rights Management

Rights Management higher profit

Rights Management higher profit

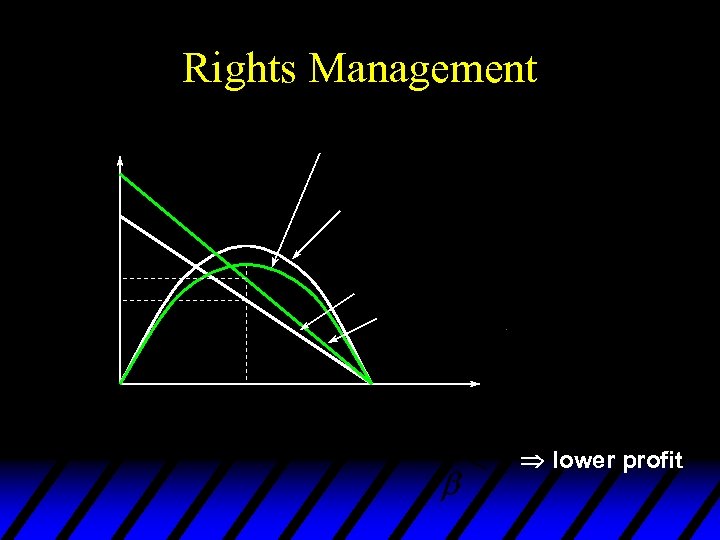

Rights Management lower profit

Rights Management lower profit

Sharing Intellectual Property u Produce a lot for direct sales, or only a little for multiple rentals? u Lending books, software. u Renting tools, videos etc. u Sell movies directly, or only sell to video rental stores, or pay-per-view? u When is selling for rental more profitable than selling for personal use only?

Sharing Intellectual Property u Produce a lot for direct sales, or only a little for multiple rentals? u Lending books, software. u Renting tools, videos etc. u Sell movies directly, or only sell to video rental stores, or pay-per-view? u When is selling for rental more profitable than selling for personal use only?

Sharing Intellectual Property u. F is the fixed cost of designing the good. u c is the constant marginal cost of copying the good. u p(y) is the market demand. u Direct sales problem is to

Sharing Intellectual Property u. F is the fixed cost of designing the good. u c is the constant marginal cost of copying the good. u p(y) is the market demand. u Direct sales problem is to

Sharing Intellectual Property u. F is the fixed cost of designing the good. u c is the constant marginal cost of copying the good. u p(y) is the market demand. u Direct sales problem is to

Sharing Intellectual Property u. F is the fixed cost of designing the good. u c is the constant marginal cost of copying the good. u p(y) is the market demand. u Direct sales problem is to

Sharing Intellectual Property u Is selling for rental more profitable? u Each rental unit is used by k > 1 consumers. u So y units sold x = ky consumption units.

Sharing Intellectual Property u Is selling for rental more profitable? u Each rental unit is used by k > 1 consumers. u So y units sold x = ky consumption units.

Sharing Intellectual Property u Is selling for rental more profitable? u Each rental unit is used by k > 1 consumers. u So y units sold x = ky consumption units. u Marginal consumer’s willingness-topay is p(x) = p(ky).

Sharing Intellectual Property u Is selling for rental more profitable? u Each rental unit is used by k > 1 consumers. u So y units sold x = ky consumption units. u Marginal consumer’s willingness-topay is p(x) = p(ky).

Sharing Intellectual Property u Is selling for rental more profitable? u Each rental unit used by k > 1 consumers. u So y units sold x = ky consumption units. u Marginal consumer’s willingness-topay is p(x) = p(ky). u Rental transaction cost t reduces willingness-to-pay to p(ky) - t.

Sharing Intellectual Property u Is selling for rental more profitable? u Each rental unit used by k > 1 consumers. u So y units sold x = ky consumption units. u Marginal consumer’s willingness-topay is p(x) = p(ky). u Rental transaction cost t reduces willingness-to-pay to p(ky) - t.

Sharing Intellectual Property u Rental transaction cost t reduces willingness-to-pay to p(ky) - t. u Rental store’s willingness-to-pay is

Sharing Intellectual Property u Rental transaction cost t reduces willingness-to-pay to p(ky) - t. u Rental store’s willingness-to-pay is

Sharing Intellectual Property u Rental transaction cost t reduces willingness-to-pay to p(ky) - t. u Rental store’s willingness-to-pay is u Producer’s sale-for-rental problem is

Sharing Intellectual Property u Rental transaction cost t reduces willingness-to-pay to p(ky) - t. u Rental store’s willingness-to-pay is u Producer’s sale-for-rental problem is

Sharing Intellectual Property u Rental transaction cost t reduces willingness-to-pay to p(ky) - t. u Rental store’s willingness-to-pay is u Producer’s sale-for-rental problem is

Sharing Intellectual Property u Rental transaction cost t reduces willingness-to-pay to p(ky) - t. u Rental store’s willingness-to-pay is u Producer’s sale-for-rental problem is

Sharing Intellectual Property u Rental transaction cost t reduces willingness-to-pay to p(ky) - t. u Rental store’s willingness-to-pay is u Producer’s sale-for-rental problem is

Sharing Intellectual Property u Rental transaction cost t reduces willingness-to-pay to p(ky) - t. u Rental store’s willingness-to-pay is u Producer’s sale-for-rental problem is

Sharing Intellectual Property is the same problem as the direct sale problem except for the marginal costs.

Sharing Intellectual Property is the same problem as the direct sale problem except for the marginal costs.

Sharing Intellectual Property is the same problem as the direct sale problem except for the marginal costs. Direct sale is better for the producer if

Sharing Intellectual Property is the same problem as the direct sale problem except for the marginal costs. Direct sale is better for the producer if

Sharing Intellectual Property u Direct u I. e. if sale is better for the producer if

Sharing Intellectual Property u Direct u I. e. if sale is better for the producer if

Sharing Intellectual Property u Direct sale is better for the producer if sale is better if – replication cost c is low – rental transaction cost t is high – rentals per item, k, is small.

Sharing Intellectual Property u Direct sale is better for the producer if sale is better if – replication cost c is low – rental transaction cost t is high – rentals per item, k, is small.