7b46a8024b307e36bebd3d108d105fd3.ppt

- Количество слайдов: 61

Chapter Six Bond Markets Mc. Graw-Hill/Irwin 6 -1 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Overview of the Bond Markets • A bond is a promise to make periodic coupon payments and to repay principal at maturity; breech of this promise is an event of default • Bonds carry original maturities greater than one year so bonds are instruments of the capital markets • Issuers are corporations and government units Mc. Graw-Hill/Irwin 6 -2 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

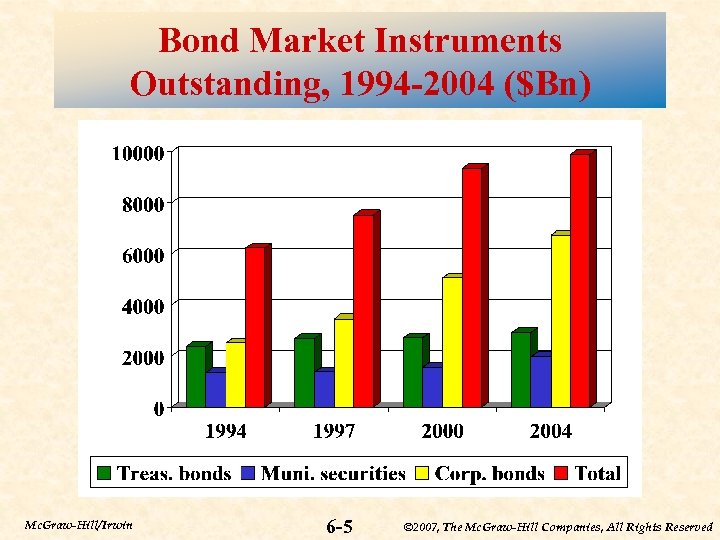

• Bonds are capital market instruments with original issue maturities greater than one year. • Bonds are typically fixed income securities that represent nonamortized loans made to corporate or government borrowers to fund their long term capital needs. Principal is paid at maturity, and interest is typically paid semiannually at one half the ‘coupon’ rate times the face value of the bond. The major types of bonds include Treasury bonds and notes, corporate bonds and municipal bonds. 6 -3 Mc. Graw-Hill/Irwin © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• Principal is paid at maturity, and interest is typically paid semiannually at one half the ‘coupon’ rate times the face value of the bond. The major types of bonds include Treasury bonds and notes, corporate bonds and municipal bonds. Mc. Graw-Hill/Irwin 6 -4 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Bond Market Instruments Outstanding, 1994 -2004 ($Bn) Mc. Graw-Hill/Irwin 6 -5 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Treasury Notes and Bonds • T-notes and T-bonds issued by the U. S. Treasury to finance the national debt and other federal government expenditures • Backed by the full faith and credit of the U. S. government and are default risk free • Pay relatively low rates of interest (yields to maturity) • Given their longer maturity, not entirely risk free due to interest rate fluctuations • Pay coupon interest (semiannually): notes have maturities from 1 -10 years; bonds 10 -30 years • The minimum par or 6 -6 value is $1, 000. face Mc. Graw-Hill/Irwin © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

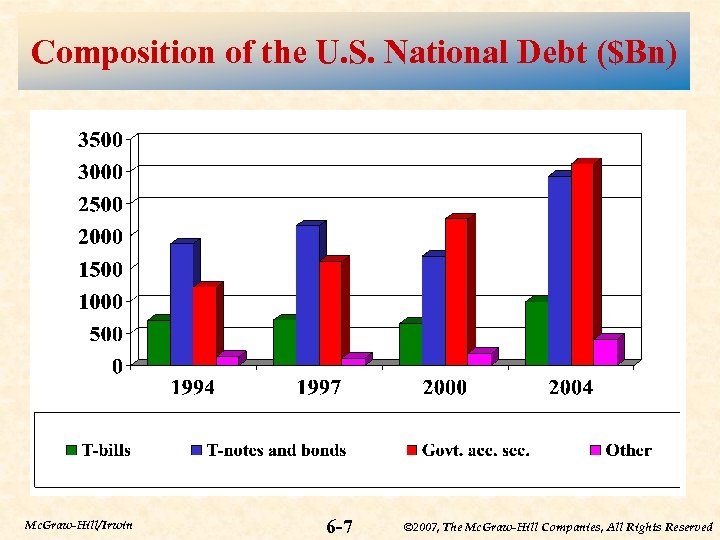

Composition of the U. S. National Debt ($Bn) Mc. Graw-Hill/Irwin 6 -7 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Treasury Strips • A treasury security in which the individual interest payments are separated from the principal payment • Effectively creates sets of securities--one for each semiannual interest payment and one for the final principal payment • Often referred to as “Treasury zero-coupon bonds” • Created by U. S. Treasury in response to separate trading of treasury security principal and interest developed by securities firms; only available through FIs and government securities brokers Mc. Graw-Hill/Irwin 6 -8 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Separate Trading of Registered Interest and Principle Securities (STRIP) • STRIPs are registered securities; a private dealer requests that the Treasury ‘strip’ the individual payments and keep a record of them on the Treasury’s computer system. • Each payment will be given its own CUSIP (identification) number. • Only certain securities are eligible for stripping. Mc. Graw-Hill/Irwin 6 -9 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• The minimum face value of a stripped payment (such as a single coupon payment) is $1, 000. • Thus the par amount must be large enough to yield a semi-annual payment amount of $1, 000 (or multiples of $1, 000). • These stripped payments are then zero coupon bonds that trade at a discount. Prices and yields on quotes follow similar conventions as T-notes and T-bonds. Mc. Graw-Hill/Irwin 6 -10 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• The sum of the sale price of the components of STRIPs is often greater than the fair present value of the original Treasury security. • This provides the motivation for dealers to petition the Treasury to create STRIPs. • Investors are willing to pay a small premium because the individual payments can be used in duration matching strategies or cash matching strategies that limit the investor’s risk. Mc. Graw-Hill/Irwin 6 -11 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Accrued interest • Accrued interest must be paid by the buyer of a bond to the seller of a bond if the bond is purchased between interest payment dates. • The price of the bond with accrued interest is called the full price or the dirty price, the price without accounting for accrued interest is the clean price. Mc. Graw-Hill/Irwin 6 -12 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Treasury Inflation Protection Securities (TIPS) • The Treasury began issuing TIPS in January 1997. • TIPS pay a fixed coupon rate (presumably equal to the real rate of interest required by investors at the time of issue assuming the bond is issued at par) for the life of the security. • The principle amount of the bond is indexed to inflation however. Mc. Graw-Hill/Irwin 6 -13 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• The principal is adjusted every six months based on changes in the Consumer Price Index (CPI). • Because of the principal adjustment, investors are protected from unexpected increases in inflation. Investor rates of return will be reduced by unexpected decreases in inflation Mc. Graw-Hill/Irwin 6 -14 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

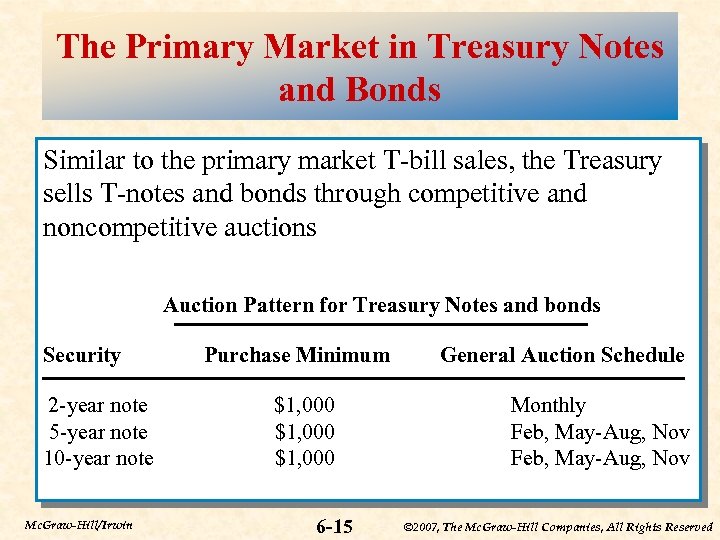

The Primary Market in Treasury Notes and Bonds Similar to the primary market T-bill sales, the Treasury sells T-notes and bonds through competitive and noncompetitive auctions Auction Pattern for Treasury Notes and bonds Security 2 -year note 5 -year note 10 -year note Mc. Graw-Hill/Irwin Purchase Minimum $1, 000 6 -15 General Auction Schedule Monthly Feb, May-Aug, Nov © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Secondary Market in Treasury Notes and Bonds • Most secondary market trading occurs directly through brokers and dealers • Wall Street Journal shows full list of Treasury securities that trade daily Mc. Graw-Hill/Irwin 6 -16 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• Secondary market activity is large compared to other types of bonds. • In 2004 daily trading activity was over $550 billion on average. • Although the Treasury market is the most liquid bond market in the U. S. “off the run” (existing) securities may have less liquidity than “on the run” (newly issued) securities. Mc. Graw-Hill/Irwin 6 -17 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Municipal bonds • Municipal bonds are bonds issued by state or local governments. • The typical par value on a municipal bond is $5, 000. • Munis comprise about 17% of total bonds outstanding. • Interest income on munis is not taxed at the federal level and is usually exempt from state and local taxes if the investor lives in the state in which the muni is issued. Capital gains are taxable. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Municipal Bonds (Munis) • The tax exemption allows municipal governments to obtain lower cost financing. • With the tax exemption, investors require lower yields on munis than on equivalent risk taxable bonds. • Tax receipts or revenues generated are the source of repayment • Attractive to household investors because interest (but not capital gains) are tax exempt Mc. Graw-Hill/Irwin 6 -19 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

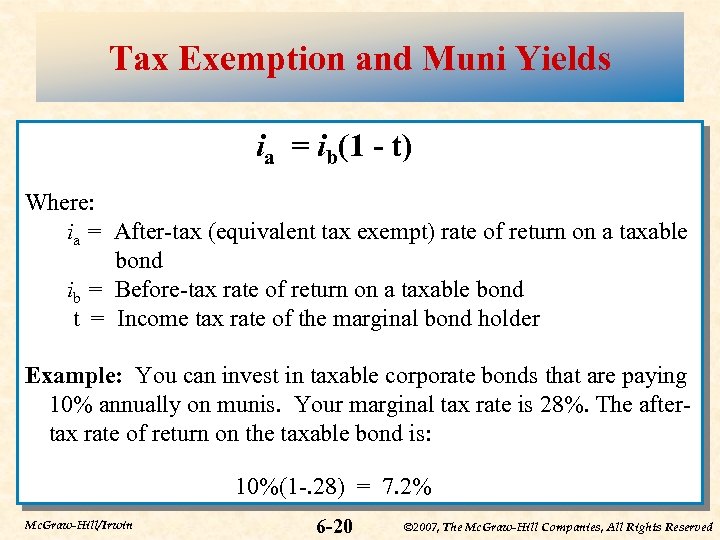

Tax Exemption and Muni Yields ia = ib(1 - t) Where: ia = After-tax (equivalent tax exempt) rate of return on a taxable bond ib = Before-tax rate of return on a taxable bond t = Income tax rate of the marginal bond holder Example: You can invest in taxable corporate bonds that are paying 10% annually on munis. Your marginal tax rate is 28%. The aftertax rate of return on the taxable bond is: 10%(1 -. 28) = 7. 2% Mc. Graw-Hill/Irwin 6 -20 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Types of Municipal Bonds • General Obligation Bonds – bonds backed by the full faith and credit of the issuer • Revenue Bonds – bonds sold to finance a specific revenue generating project and are backed by cash flows from that project Mc. Graw-Hill/Irwin 6 -21 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Primary Market Placement Choices for Munis • General Public Offering – underwriter is selected either by negotiation or by competitive bidding – the underwriter offers the bonds to the general public • Rule 144 A Placement – bonds are sold on a semi-private basis to qualified investors (generally FIs) Mc. Graw-Hill/Irwin 6 -22 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

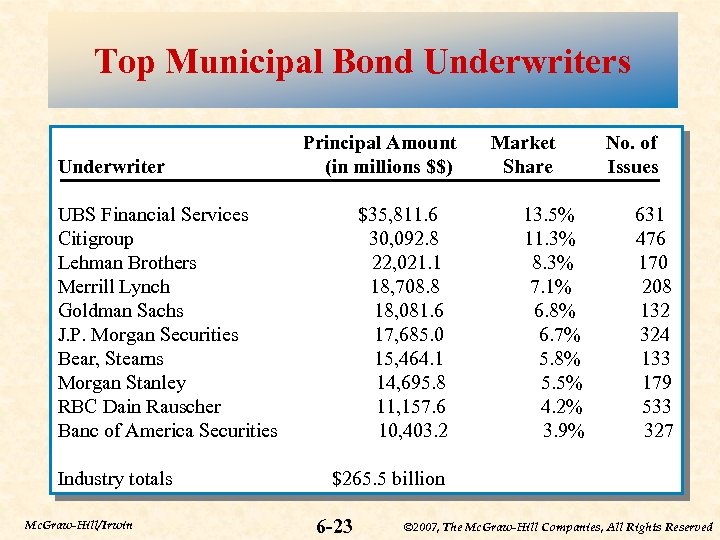

Top Municipal Bond Underwriters Underwriter Principal Amount (in millions $$) UBS Financial Services Citigroup Lehman Brothers Merrill Lynch Goldman Sachs J. P. Morgan Securities Bear, Stearns Morgan Stanley RBC Dain Rauscher Banc of America Securities Industry totals Mc. Graw-Hill/Irwin $35, 811. 6 30, 092. 8 22, 021. 1 18, 708. 8 18, 081. 6 17, 685. 0 15, 464. 1 14, 695. 8 11, 157. 6 10, 403. 2 Market Share 13. 5% 11. 3% 8. 3% 7. 1% 6. 8% 6. 7% 5. 8% 5. 5% 4. 2% 3. 9% No. of Issues 631 476 170 208 132 324 133 179 533 327 $265. 5 billion 6 -23 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Contracting Choices with the Underwriter • Firm commitment underwriting • Best efforts underwriting Mc. Graw-Hill/Irwin 6 -24 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Secondary Market for Munis • Secondary market is thin (i. e. trades are relatively infrequent) due to a lack of information on bond issuers, who are generally much smaller than corporate bond issuers Mc. Graw-Hill/Irwin 6 -25 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Corporate Bonds • All long-term bonds issued by corporations • Minimum denominations publicly traded corporate bonds is $1, 000 • Generally pay interest semiannually • Bond indenture: The rights of the bondholders are protected by the bond indenture (contract). Mc. Graw-Hill/Irwin 6 -26 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Types of Corporate Bonds • • Bearer bonds Registered bonds Term bonds Serial bonds Mortgage bonds Equipment Trust Certificates Debentures Mc. Graw-Hill/Irwin 6 -27 (continued) © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Types of Corporate Bonds • • • Subordinated debentures Convertible bonds Stock Warrant Callable bonds Sinking Fund bonds Mc. Graw-Hill/Irwin 6 -28 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Bearer bonds versus registered bonds • Bearer bonds versus registered bonds: Payments are made automatically to the owner of record of a registered bond. Bearer bond payments are made at the request of the bearer, usually the investor clips a coupon and mails it to the borrower. In the U. S. borrowers may no longer issue bearer bonds © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Term vs serial bonds • Term bonds mature all at once at maturity. Serial bonds mature sequentially. • For instance with a ten year overall maturity, some serial bonds would mature in five years, some in six years, etc, so that a portion of the outstanding debt is paid off each year. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Mortgage bonds: • With a mortgage bond specific collateral has been pledged as security for the bondholders. • In the event of non-payment of interest or principle, the trustee can seize the collateral on behalf of the bondholders and sell it to recover their money. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Debentures and subordinated (junior) debentures • Debentures have no specific asset pledged as collateral. • They are riskier than mortgage bonds and carry higher yields. Subordinated debentures are riskier yet as they are not paid off until debenture holders are paid off. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Convertible bonds • Bonds convertible at the option of the bondholder into either preferred or common stock as the contract states. • The conversion option allows the issuer to issue the bond at a lower required yield, ceteris paribus. Usually the stock price must increase 15% to 25% before the conversion option becomes profitable to the bondholder. • If the stock price increases the convertible bond’s price will begin to act like the stock price. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Tip • Is it a good deal? believe that convertible bonds are good deals because they combine the protection of a bond’s fixed income with the stock’s upside potential? • Virtually all convertible bonds are callable. The issuer often uses the call feature to force conversion and eliminate the fixed interest payments. • In an efficient market however, the embedded option in the bond is priced according to the prospects of the firm’s stock. There is little reason to think that the investor is getting a particularly good deal. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• For instance, agency theory tells us that convertible bonds will normally be a preferred financing instrument when the bondholders are worried that management will favor stockholders over the bondholders. • In the event of a takeover that benefited shareholders and hurt bondholders the conversion option may be a valuable feature but the conversion option doesn’t necessarily mean the convertible is a better deal than straight bonds. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Callable bonds • Bonds that may be redeemed at the option of the issuer at a predetermined price above par (call premium), or according to a predetermined price schedule (the call price often drops as maturity approaches). • Issuers typically call the bonds after interest rates have fallen, which can leave the investor with an overall lower realized yield over a given investment horizon. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Example • You have a five year investment horizon. • You buy a callable 7% coupon five year bond at par. • Rates drop to 5%, the bond is called at a call price of $1, 075. • You reinvest your funds in 5% coupon bonds for the five years. • A 7% annual compound rate of return on a $1, 000 initial investment over five years should yield: $1, 000 (1. 07)^5 = $1, 402. 55. • You actually earned $1, 075 (1. 05)^5 = $1, 372 or you earned a 6. 53% rate of return from your original $1, 000 investment © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Sinking fund • A sinking fund requires the bond issuer to ensure that enough money will be available to retire the debt at maturity. This can be done by having the borrower deposit funds with the trustee each year so that at maturity enough money is available to pay off the principle. This is an added safety feature to the bond that allows the bond issuer to offer a lower required rate of return. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• Sometimes sinking funds allow the bond issuer to randomly select and redeem a given percentage of the bonds each year. • Issuers prefer this method because it terminates the interest owed on the retired bonds. • This type of sinking fund however may leave the bondholder whose bond is selected for redemption worse off if interest rates have fallen since the bond was issued. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Stock warrants • Warrants are call options attached to the bond that can be detached and exercised or sold separately, unlike the convertible bond which requires the bondholder to give up the bond to acquire the stock. Warrants are often used as ‘sweeteners’ to bond deals to obtain a lower interest rate on the bond. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Primary and Secondary Markets for Corp Bonds • Primary sales of corp bonds occur through either a public sale (issue) or a private placement similar to municipal bonds • Two secondary markets – the exchange market (e. g. , the NYSE) – the over-the-counter (OTC) market • OTC electronic market dominates trading in corp bonds Mc. Graw-Hill/Irwin 6 -41 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

primary and secondary market for corporate bonds • The primary market for corporate bonds operates similarly to the primary market for municipal securities. • Both corporate and municipal bonds have lower secondary market activity than Treasuries. • There are two secondary markets for corporate bonds, the NYSE Fixed Income Market and the over the counter (OTC) market. • Less than 1% of corporate bonds are exchange traded (primarily on the bond division of the NYSE). © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• Trading on the NYSE bond market is mostly automated and occurs through the Automated Bond System (ABS). • On the ABS order execution is fully automated. • The OTC market consists of large bank dealers and contains most of the actual trading done in bonds. • Hence exchange bond price quotes are often behind or inaccurate for large deals. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

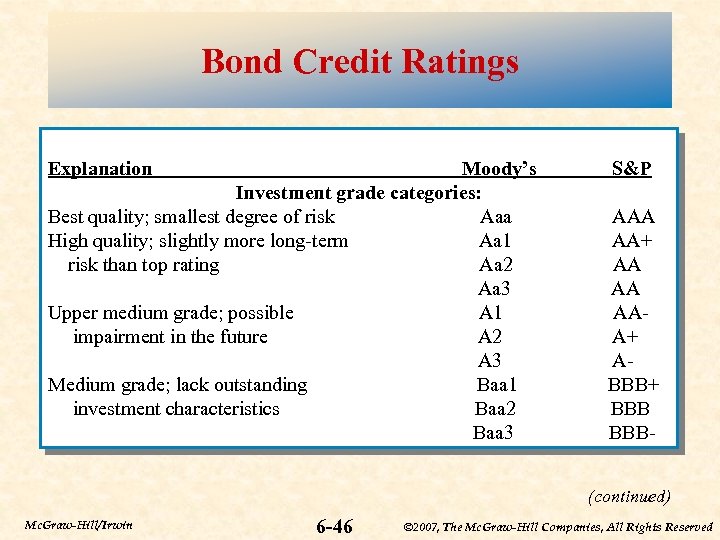

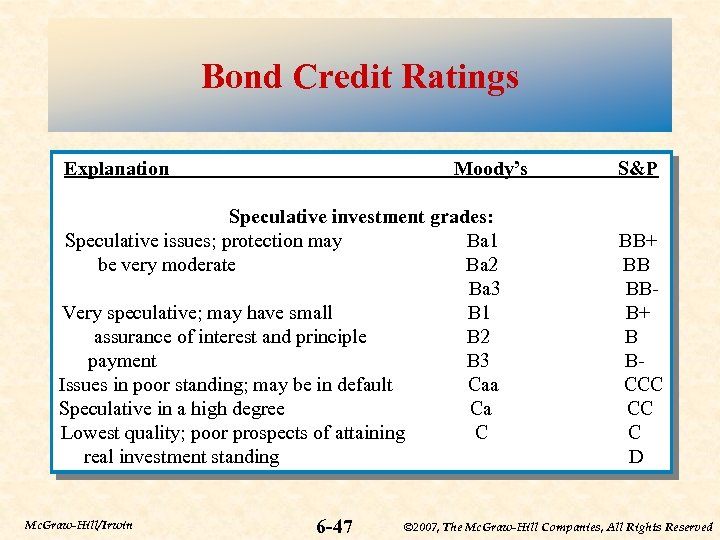

Bond Ratings • Bonds are rated by the issuer’s default risk • Large bond investors, traders and managers evaluate default risk by analyzing the issuer’s financial ratios and security prices • Two major bond rating agencies are Moody’s and Standard & Poor’s (S&P) • Bonds assigned a letter grade based on perceived probability of issuer default Mc. Graw-Hill/Irwin 6 -44 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

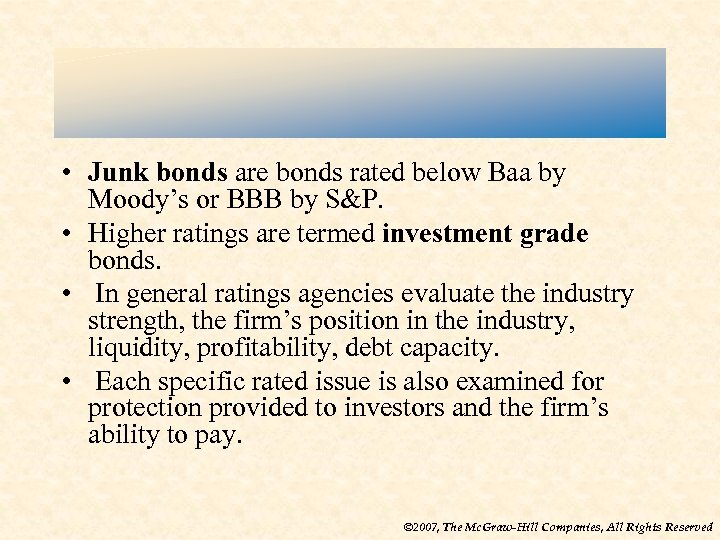

• Junk bonds are bonds rated below Baa by Moody’s or BBB by S&P. • Higher ratings are termed investment grade bonds. • In general ratings agencies evaluate the industry strength, the firm’s position in the industry, liquidity, profitability, debt capacity. • Each specific rated issue is also examined for protection provided to investors and the firm’s ability to pay. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Bond Credit Ratings Explanation Moody’s Investment grade categories: Best quality; smallest degree of risk Aaa High quality; slightly more long-term Aa 1 risk than top rating Aa 2 Aa 3 Upper medium grade; possible A 1 impairment in the future A 2 A 3 Medium grade; lack outstanding Baa 1 investment characteristics Baa 2 Baa 3 S&P AAA AA+ AA AA AAA+ ABBB+ BBB(continued) Mc. Graw-Hill/Irwin 6 -46 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Bond Credit Ratings Explanation Moody’s Speculative investment grades: Speculative issues; protection may Ba 1 be very moderate Ba 2 Ba 3 Very speculative; may have small B 1 assurance of interest and principle B 2 payment B 3 Issues in poor standing; may be in default Caa Speculative in a high degree Ca Lowest quality; poor prospects of attaining C real investment standing Mc. Graw-Hill/Irwin 6 -47 S&P BB+ BB BBB+ B BCCC CC C D © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

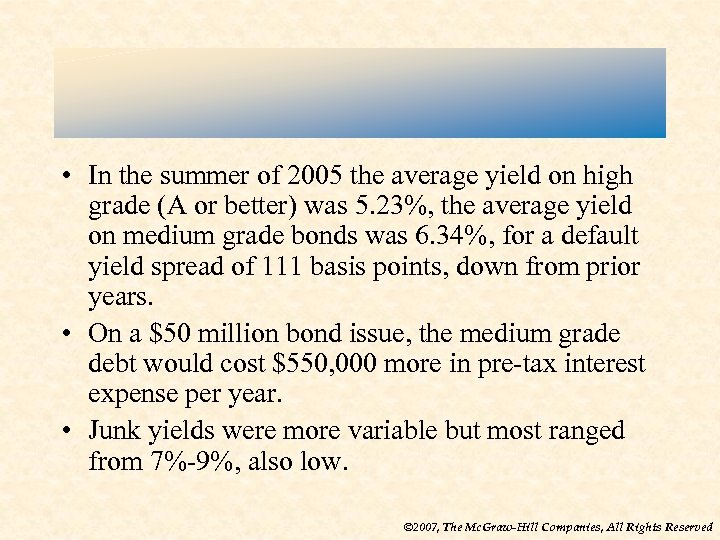

• In the summer of 2005 the average yield on high grade (A or better) was 5. 23%, the average yield on medium grade bonds was 6. 34%, for a default yield spread of 111 basis points, down from prior years. • On a $50 million bond issue, the medium grade debt would cost $550, 000 more in pre-tax interest expense per year. • Junk yields were more variable but most ranged from 7%-9%, also low. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• In May 2005, Standard & Poor’s downgraded almost $300 billion of General Motor’s debt to junk status. • GM stock dropped 4% when the news came out. Nissan has been attempting to improve its bond rating out of the medium grade to better compete with Toyota, which has the highest rating. • In 2005, Toyota had more than twice the cash reserves of Nissan. • Ratings agencies have been criticized for failing to downgrade firms quickly when conditions deteriorate © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Bond Market Indexes • Managed by major investment banks • Reflect both the monthly capital gain and loss on bonds plus any interest (coupon) income earned • Changes in values of the broad market indexes can be used by bond traders to evaluate changes in the investment attractiveness of bonds of different types and maturities • Bond market indexes are published daily in the Wall Street Journal; indexes are available for the major bond sectors Mc. Graw-Hill/Irwin 6 -50 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Bond Market Participants • The major issuers of debt market securities are federal, state and local governments and corporations • The major purchasers of capital market securities are households, businesses, government units and foreign investors • Businesses and financial firms (e. g. , banks, insurance companies, mutual funds) are the major suppliers of funds for all three types of bonds Mc. Graw-Hill/Irwin 6 -51 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• Treasury security investments are roughly equally divided among government investors, foreign investors and business financial investors. Municipal and corporate bonds are predominantly held by business financial institutions. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• From 1995 to 2004 the quantity of international debt securities outstanding grew 431% in total, or at an average annual growth rate of 20. 38%. • In terms of dollar volume, there are now more euro denominated floating rate and fixed rate debt instruments outstanding than dollar denominated instruments • In equity related bonds and notes the U. S. dollar still dominates © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

• International bonds are usually bearer bonds placed in multiple countries or in a country other than the issuer’s home country. • Financial institutions are the largest issuers of international bonds, other than equity related bonds which are dominated by corporate issuers. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

International Aspects of Bond Markets • International bond market – trades bonds that are underwritten by an international syndicate – offer bonds simultaneously to investors in several countries – issue bonds outside the jurisdiction of any single country – offer bonds in unregistered form Mc. Graw-Hill/Irwin 6 -55 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Eurobonds, Foreign Bonds, Brady Bonds and Sovereign Bonds • Eurobonds • Foreign Bonds • Brady Bonds and Sovereign Bonds Mc. Graw-Hill/Irwin 6 -56 © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Eurobonds • Eurobonds are long-term bonds sold outside the country of the currency in which they are denominated. • This need not be in Europe. For instance Eurodollar bonds may be dollar denominated bonds sold in Japan. • They typically have denominations of $5, 000 and $10, 000 and are traded mostly OTC in London and Luxembourg. • Eurobonds are typically placed by an investment banking syndicate, traditionally the issue costs have been higher than for domestic bonds. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Foreign bonds • Foreign bonds are bonds issued outside the home country and are denominated in the host country’s currency. • For example, Samurai bonds are dollar denominated bonds issued by Japanese borrowers in the U. S. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

Brady Bonds and Sovereign Bonds • Brady bonds were created when a bank restructured an existing loan made to a less developed country (LDC) that could not be repaid in full. The loan was eliminated and in exchange the borrower agreed to accept the liability of the Brady bond. The Brady bonds have longer maturities and lower interest rates than the original loans. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

why • The banks were willing to accept the Brady bonds in place of the original loan because • 1) the U. S. government strongly urged them to do so, and in some cases borrowers agreed to back the bonds by holding U. S. Treasury assets • 2) the alternative was to receive no payments from the borrowers and, • 3) the Brady bonds were saleable, so that the banks could cut their losses if they chose. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

sovereign bonds • As some LDC’s credit ratings have improved, countries have removed the backing of U. S. Treasury Bonds, and the bonds then become priced according to the creditworthiness of the respective country. These bonds are called sovereign bonds. © 2007, The Mc. Graw-Hill Companies, All Rights Reserved

7b46a8024b307e36bebd3d108d105fd3.ppt