0fd93b3f4f1ecd5c9b04e8d0e0b20859.ppt

- Количество слайдов: 8

CHAPTER Policy Implementation Copyright © 2003 by South-Western/Thomson Learning. All rights reserved. 27

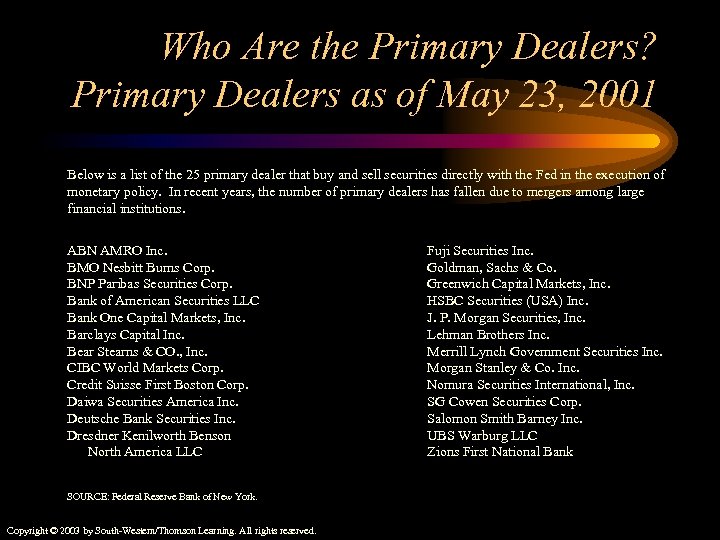

Who Are the Primary Dealers? Primary Dealers as of May 23, 2001 Below is a list of the 25 primary dealer that buy and sell securities directly with the Fed in the execution of monetary policy. In recent years, the number of primary dealers has fallen due to mergers among large financial institutions. ABN AMRO Inc. BMO Nesbitt Burns Corp. BNP Paribas Securities Corp. Bank of American Securities LLC Bank One Capital Markets, Inc. Barclays Capital Inc. Bear Stearns & CO. , Inc. CIBC World Markets Corp. Credit Suisse First Boston Corp. Daiwa Securities America Inc. Deutsche Bank Securities Inc. Dresdner Kenilworth Benson North America LLC SOURCE: Federal Reserve Bank of New York. Copyright © 2003 by South-Western/Thomson Learning. All rights reserved. Fuji Securities Inc. Goldman, Sachs & Co. Greenwich Capital Markets, Inc. HSBC Securities (USA) Inc. J. P. Morgan Securities, Inc. Lehman Brothers Inc. Merrill Lynch Government Securities Inc. Morgan Stanley & Co. Inc. Nomura Securities International, Inc. SG Cowen Securities Corp. Salomon Smith Barney Inc. UBS Warburg LLC Zions First National Bank

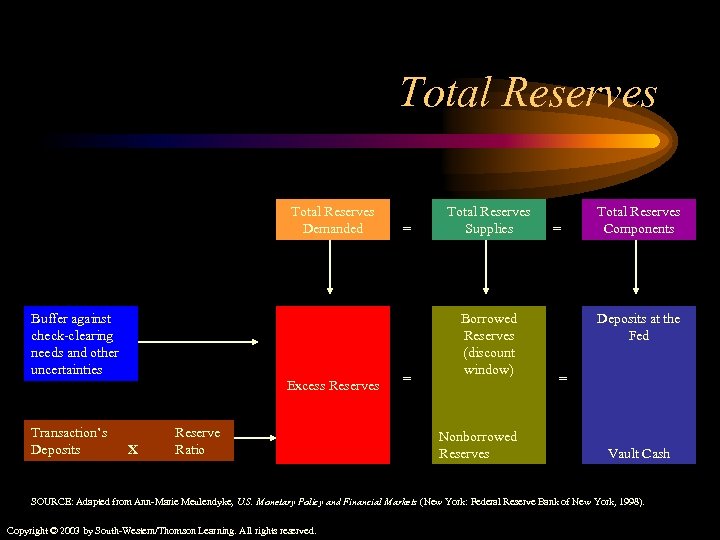

Total Reserves Demanded Buffer against check-clearing needs and other uncertainties Excess Reserves Transaction’s Deposits X Reserve Ratio = = Total Reserves Supplies Borrowed Reserves (discount window) Nonborrowed Reserves = Total Reserves Components Deposits at the Fed = Vault Cash SOURCE: Adapted from Ann-Marie Meulendyke, U. S. Monetary Policy and Financial Markets (New York: Federal Reserve Bank of New York, 1998). Copyright © 2003 by South-Western/Thomson Learning. All rights reserved.

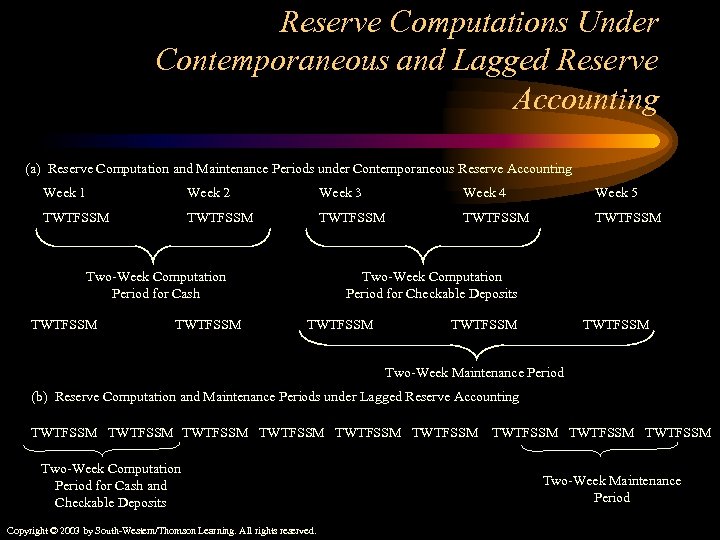

Reserve Computations Under Contemporaneous and Lagged Reserve Accounting (a) Reserve Computation and Maintenance Periods under Contemporaneous Reserve Accounting Week 1 Week 2 Week 3 Week 4 Week 5 TWTFSSM TWTFSSM Two-Week Computation Period for Cash TWTFSSM Two-Week Computation Period for Checkable Deposits TWTFSSM Two-Week Maintenance Period (b) Reserve Computation and Maintenance Periods under Lagged Reserve Accounting TWTFSSM TWTFSSM Two-Week Computation Period for Cash and Checkable Deposits Copyright © 2003 by South-Western/Thomson Learning. All rights reserved. TWTFSSM Two-Week Maintenance Period

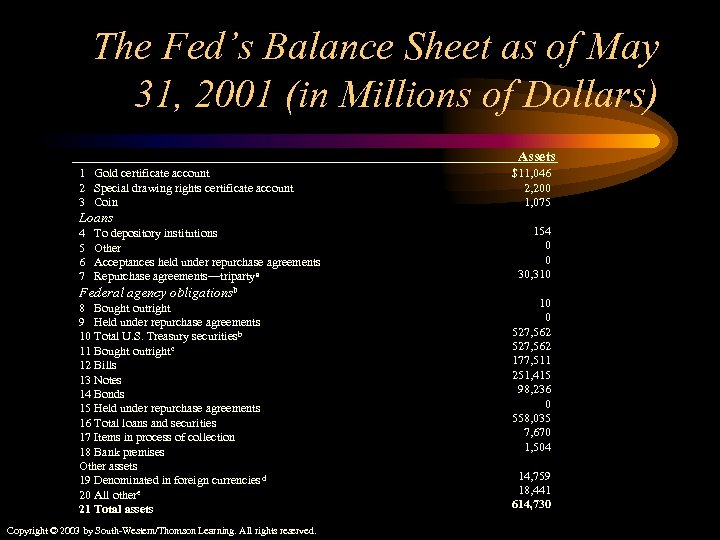

The Fed’s Balance Sheet as of May 31, 2001 (in Millions of Dollars) Assets 1 Gold certificate account 2 Special drawing rights certificate account 3 Coin Loans 4 5 6 7 To depository institutions Other Acceptances held under repurchase agreements Repurchase agreements—tripartya Federal agency obligationsb 8 Bought outright 9 Held under repurchase agreements 10 Total U. S. Treasury securities b 11 Bought outrightc 12 Bills 13 Notes 14 Bonds 15 Held under repurchase agreements 16 Total loans and securities 17 Items in process of collection 18 Bank premises Other assets 19 Denominated in foreign currencies d 20 All othere 21 Total assets Copyright © 2003 by South-Western/Thomson Learning. All rights reserved. $11, 046 2, 200 1, 075 154 0 0 30, 310 10 0 527, 562 177, 511 251, 415 98, 236 0 558, 035 7, 670 1, 504 14, 759 18, 441 614, 730

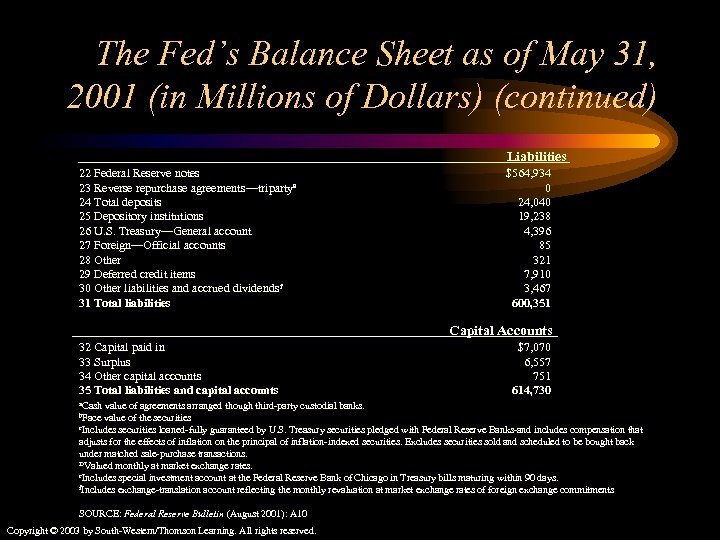

The Fed’s Balance Sheet as of May 31, 2001 (in Millions of Dollars) (continued) Liabilities 22 Federal Reserve notes 23 Reverse repurchase agreements—tripartya 24 Total deposits 25 Depository institutions 26 U. S. Treasury—General account 27 Foreign—Official accounts 28 Other 29 Deferred credit items 30 Other liabilities and accrued dividends f 31 Total liabilities $564, 934 0 24, 040 19, 238 4, 396 85 321 7, 910 3, 467 600, 351 Capital Accounts 32 Capital paid in 33 Surplus 34 Other capital accounts 35 Total liabilities and capital accounts a. Cash $7, 070 6, 557 751 614, 730 value of agreements arranged though third-party custodial banks. value of the securities c. Includes securities loaned-fully guaranteed by U. S. Treasury securities pledged with Federal Reserve Banks-and includes compensation that adjusts for the effects of inflation on the principal of inflation-indexed securities. Excludes securities sold and scheduled to be bought back under matched sale-purchase transactions. DValued monthly at market exchange rates. e. Includes special investment account at the Federal Reserve Bank of Chicago in Treasury bills maturing within 90 days. f. Includes exchange-translation account reflecting the monthly revaluation at market exchange rates of foreign exchange commitments b. Face SOURCE: Federal Reserve Bulletin (August 2001): A 10 Copyright © 2003 by South-Western/Thomson Learning. All rights reserved.

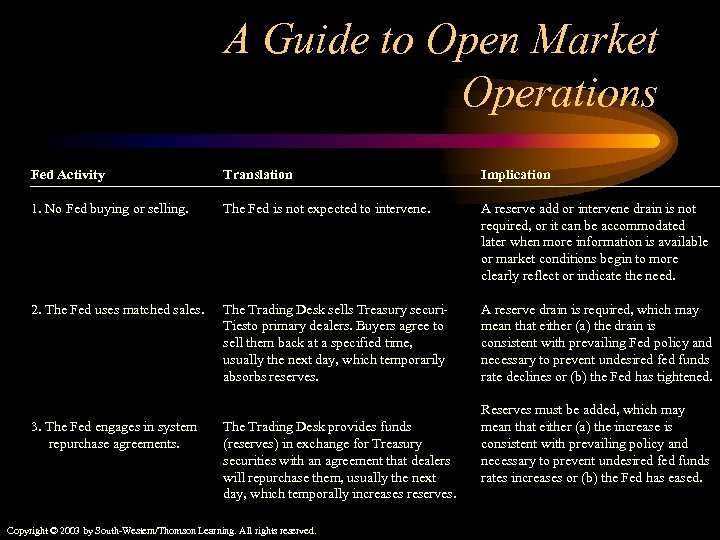

A Guide to Open Market Operations Fed Activity Translation Implication 1. No Fed buying or selling. The Fed is not expected to intervene. A reserve add or intervene drain is not required, or it can be accommodated later when more information is available or market conditions begin to more clearly reflect or indicate the need. 2. The Fed uses matched sales. The Trading Desk sells Treasury securi. Tiesto primary dealers. Buyers agree to sell them back at a specified time, usually the next day, which temporarily absorbs reserves. A reserve drain is required, which may mean that either (a) the drain is consistent with prevailing Fed policy and necessary to prevent undesired funds rate declines or (b) the Fed has tightened. 3. The Fed engages in system repurchase agreements. The Trading Desk provides funds (reserves) in exchange for Treasury securities with an agreement that dealers will repurchase them, usually the next day, which temporally increases reserves. Copyright © 2003 by South-Western/Thomson Learning. All rights reserved. Reserves must be added, which may mean that either (a) the increase is consistent with prevailing policy and necessary to prevent undesired funds rates increases or (b) the Fed has eased.

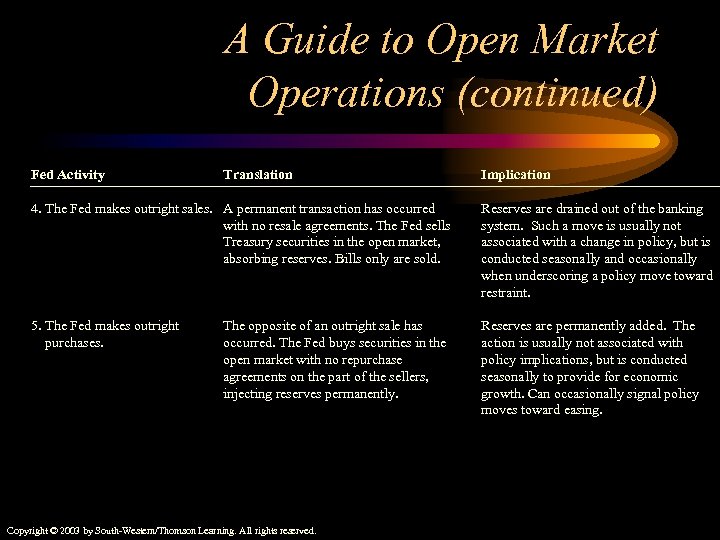

A Guide to Open Market Operations (continued) Fed Activity Translation Implication 4. The Fed makes outright sales. A permanent transaction has occurred with no resale agreements. The Fed sells Treasury securities in the open market, absorbing reserves. Bills only are sold. Reserves are drained out of the banking system. Such a move is usually not associated with a change in policy, but is conducted seasonally and occasionally when underscoring a policy move toward restraint. 5. The Fed makes outright purchases. Reserves are permanently added. The action is usually not associated with policy implications, but is conducted seasonally to provide for economic growth. Can occasionally signal policy moves toward easing. The opposite of an outright sale has occurred. The Fed buys securities in the open market with no repurchase agreements on the part of the sellers, injecting reserves permanently. Copyright © 2003 by South-Western/Thomson Learning. All rights reserved.

0fd93b3f4f1ecd5c9b04e8d0e0b20859.ppt