5d38c603623b389d2de632e98d471b1e.ppt

- Количество слайдов: 50

Chapter Outline 6. 1 Insurance Costs and Fair Premiums 6. 2 Expected Claim Costs Homogeneous buyers Heterogeneous buyers Competition, Risk Classification, and Societal Welfare Redistributive Effects of Classification Behavioral Effects of Classification Costs Risk Classification Practices 6. 3 Investment Income and the Timing of Claim Payments 6. 4 Administrative costs 6. 5 Profit Loading Summary H&N, Ch. 6 T 6. 1

Chapter Outline 6. 1 Insurance Costs and Fair Premiums 6. 2 Expected Claim Costs Homogeneous buyers Heterogeneous buyers Competition, Risk Classification, and Societal Welfare Redistributive Effects of Classification Behavioral Effects of Classification Costs Risk Classification Practices 6. 3 Investment Income and the Timing of Claim Payments 6. 4 Administrative costs 6. 5 Profit Loading Summary H&N, Ch. 6 T 6. 1

Chapter Outline 6. 6 Capital Shocks and Underwriting Cycles Fair Premiums are Forward Looking Large Losses And Capital Shocks The Underwriting Cycle 6. 7 Price Regulation Of Rate Changes Why Regulate Rate Changes? Effects of Regulating Rate Changes Regulation of Rating Factors Incentives for Risk Control Fairness, Imperfect Classification, and Control/Causality Issues Excessive Classification and Use of Subjective Assessments Ensuring Availability When Regulation Depresses Rates 6. 8 Summary H&N, Ch. 6 T 6. 2

Chapter Outline 6. 6 Capital Shocks and Underwriting Cycles Fair Premiums are Forward Looking Large Losses And Capital Shocks The Underwriting Cycle 6. 7 Price Regulation Of Rate Changes Why Regulate Rate Changes? Effects of Regulating Rate Changes Regulation of Rating Factors Incentives for Risk Control Fairness, Imperfect Classification, and Control/Causality Issues Excessive Classification and Use of Subjective Assessments Ensuring Availability When Regulation Depresses Rates 6. 8 Summary H&N, Ch. 6 T 6. 2

Insurance Pricing l Objective: • Find the premium that equals expected costs, including a fair return to capital • known as the Fair Premium • It would prevail in a competitive market H&N, Ch. 6 T 6. 3

Insurance Pricing l Objective: • Find the premium that equals expected costs, including a fair return to capital • known as the Fair Premium • It would prevail in a competitive market H&N, Ch. 6 T 6. 3

Determinants of Fair Premiums • 4 Determinants • • Expected Claim Costs Administrative Costs Investment Income Fair Profit Loading • Examine each factor separately H&N, Ch. 6 T 6. 4

Determinants of Fair Premiums • 4 Determinants • • Expected Claim Costs Administrative Costs Investment Income Fair Profit Loading • Examine each factor separately H&N, Ch. 6 T 6. 4

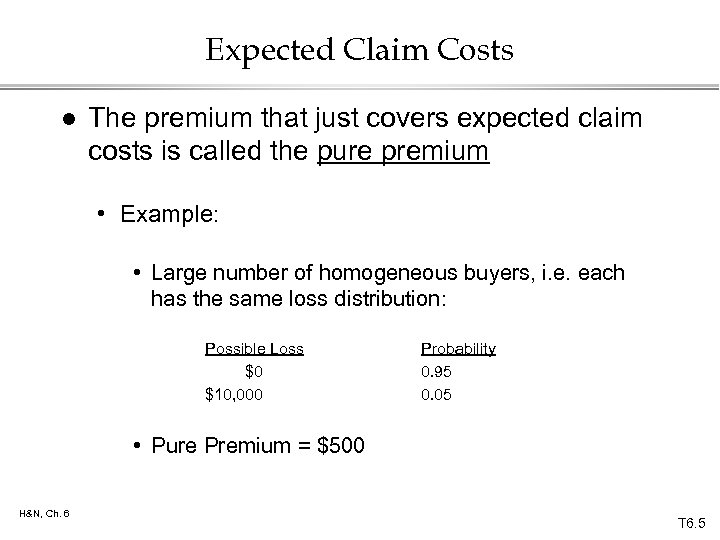

Expected Claim Costs l The premium that just covers expected claim costs is called the pure premium • Example: • Large number of homogeneous buyers, i. e. each has the same loss distribution: Possible Loss $0 $10, 000 Probability 0. 95 0. 05 • Pure Premium = $500 H&N, Ch. 6 T 6. 5

Expected Claim Costs l The premium that just covers expected claim costs is called the pure premium • Example: • Large number of homogeneous buyers, i. e. each has the same loss distribution: Possible Loss $0 $10, 000 Probability 0. 95 0. 05 • Pure Premium = $500 H&N, Ch. 6 T 6. 5

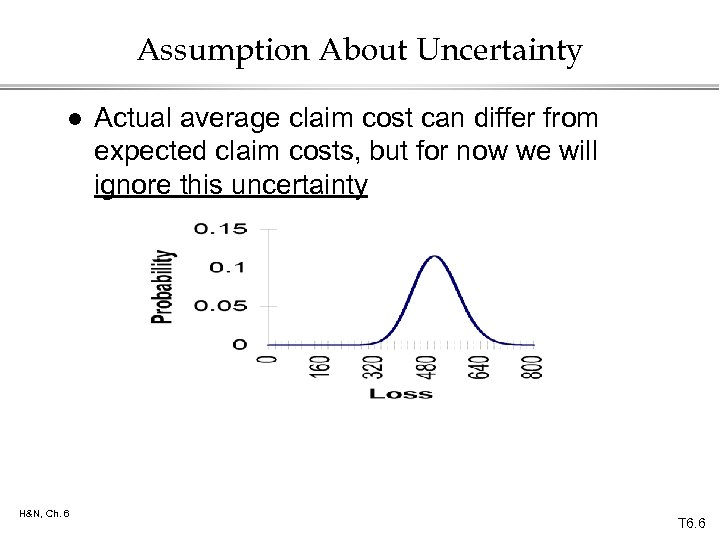

Assumption About Uncertainty l H&N, Ch. 6 Actual average claim cost can differ from expected claim costs, but for now we will ignore this uncertainty T 6. 6

Assumption About Uncertainty l H&N, Ch. 6 Actual average claim cost can differ from expected claim costs, but for now we will ignore this uncertainty T 6. 6

Premium Must Cover Expected Claim Costs • To cover claim costs, on average, premiums must equal $500. • if premium = $480, the insurer will lose money, on average • if premium = $640, the insurer will make profits, on average (competition would prevent this) • Conclusion: • Fair Premium must cover expected claim costs H&N, Ch. 6 T 6. 7

Premium Must Cover Expected Claim Costs • To cover claim costs, on average, premiums must equal $500. • if premium = $480, the insurer will lose money, on average • if premium = $640, the insurer will make profits, on average (competition would prevent this) • Conclusion: • Fair Premium must cover expected claim costs H&N, Ch. 6 T 6. 7

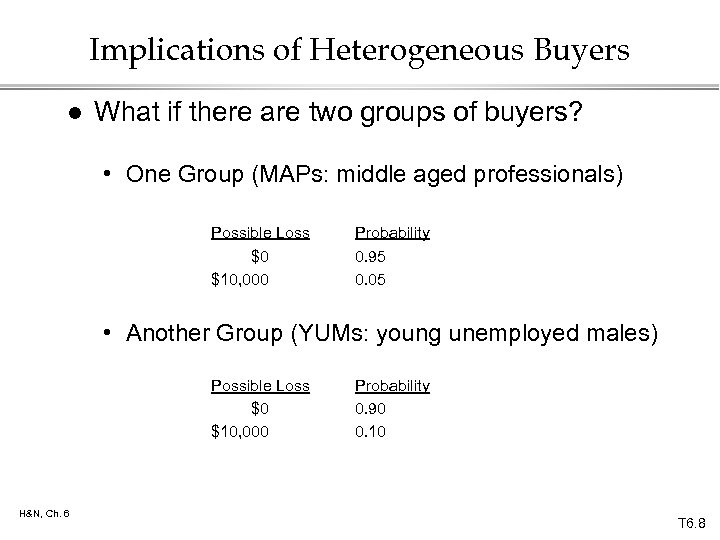

Implications of Heterogeneous Buyers l What if there are two groups of buyers? • One Group (MAPs: middle aged professionals) Possible Loss $0 $10, 000 Probability 0. 95 0. 05 • Another Group (YUMs: young unemployed males) Possible Loss $0 $10, 000 H&N, Ch. 6 Probability 0. 90 0. 10 T 6. 8

Implications of Heterogeneous Buyers l What if there are two groups of buyers? • One Group (MAPs: middle aged professionals) Possible Loss $0 $10, 000 Probability 0. 95 0. 05 • Another Group (YUMs: young unemployed males) Possible Loss $0 $10, 000 H&N, Ch. 6 Probability 0. 90 0. 10 T 6. 8

Implications of Heterogeneous Buyers l Assume initially that • Equal number of each type • Losses are Independent • Full Insurance is mandatory • Costless to distinguish MAPs from YUMs H&N, Ch. 6 T 6. 9

Implications of Heterogeneous Buyers l Assume initially that • Equal number of each type • Losses are Independent • Full Insurance is mandatory • Costless to distinguish MAPs from YUMs H&N, Ch. 6 T 6. 9

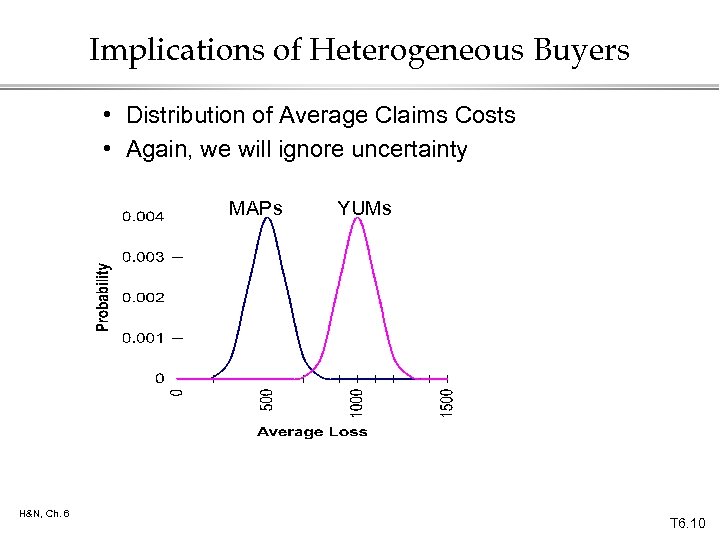

Implications of Heterogeneous Buyers • Distribution of Average Claims Costs • Again, we will ignore uncertainty MAPs H&N, Ch. 6 YUMs T 6. 10

Implications of Heterogeneous Buyers • Distribution of Average Claims Costs • Again, we will ignore uncertainty MAPs H&N, Ch. 6 YUMs T 6. 10

Implications of Heterogeneous Buyers l Initial Scenario: • Equal Treatment Insurance Company is only insurer • Premium for everyone = $750 • Does Equal Treatment cover its costs? • Yes, the YUMs pay less than their expected cost, but the MAPs pay more H&N, Ch. 6 T 6. 11

Implications of Heterogeneous Buyers l Initial Scenario: • Equal Treatment Insurance Company is only insurer • Premium for everyone = $750 • Does Equal Treatment cover its costs? • Yes, the YUMs pay less than their expected cost, but the MAPs pay more H&N, Ch. 6 T 6. 11

Implications of Heterogeneous Buyers l New Scenario: allow competition • Competition from Selective Insurance Company • If Selective assumes Equal Treatment will continue to charge $750, how does Selective set price to maximize profits, • Premium to MAPs = • Premium to YUMs = • Profit per policyholder = H&N, Ch. 6 T 6. 12

Implications of Heterogeneous Buyers l New Scenario: allow competition • Competition from Selective Insurance Company • If Selective assumes Equal Treatment will continue to charge $750, how does Selective set price to maximize profits, • Premium to MAPs = • Premium to YUMs = • Profit per policyholder = H&N, Ch. 6 T 6. 12

Implications of Heterogeneous Buyers • What happens to Equal Treatment? • It would experience adverse selection • I. e. , it would obtain an adverse selection of policyholders -- only the YUMs will purchase from Equal Treatment • Thus, Equal Treatment will have to classify or lose money H&N, Ch. 6 T 6. 13

Implications of Heterogeneous Buyers • What happens to Equal Treatment? • It would experience adverse selection • I. e. , it would obtain an adverse selection of policyholders -- only the YUMs will purchase from Equal Treatment • Thus, Equal Treatment will have to classify or lose money H&N, Ch. 6 T 6. 13

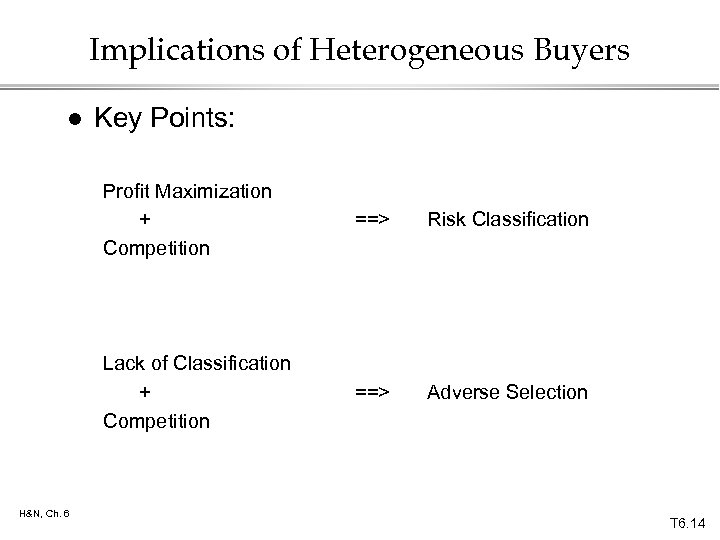

Implications of Heterogeneous Buyers l Key Points: Profit Maximization + Competition Risk Classification Lack of Classification + Competition H&N, Ch. 6 ==> Adverse Selection T 6. 14

Implications of Heterogeneous Buyers l Key Points: Profit Maximization + Competition Risk Classification Lack of Classification + Competition H&N, Ch. 6 ==> Adverse Selection T 6. 14

Implications of Heterogeneous Buyers l What if full insurance is not mandatory? • Recall, Initial Scenario: • Equal Treatment is only insurer • Equal Treatment charges $750 to everyone • What do MAPs do? • MAPs may not purchase insurance • If not, only YUMs buy from Equal Treatment • Equal Treatment experiences adverse selection H&N, Ch. 6 T 6. 15

Implications of Heterogeneous Buyers l What if full insurance is not mandatory? • Recall, Initial Scenario: • Equal Treatment is only insurer • Equal Treatment charges $750 to everyone • What do MAPs do? • MAPs may not purchase insurance • If not, only YUMs buy from Equal Treatment • Equal Treatment experiences adverse selection H&N, Ch. 6 T 6. 15

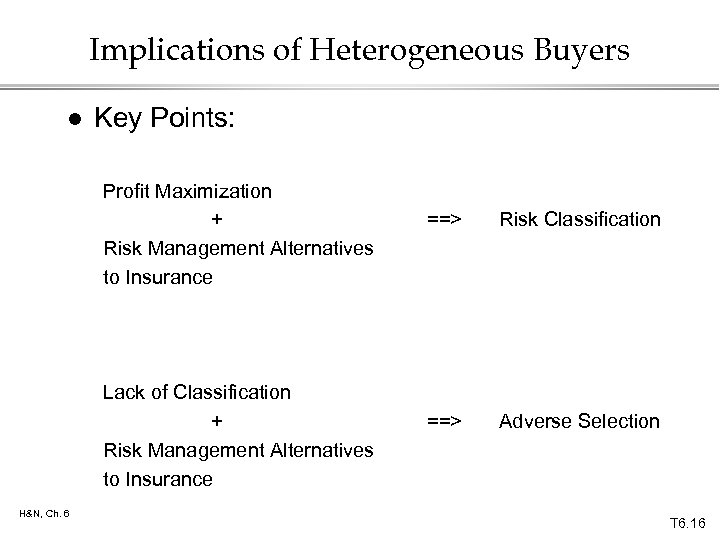

Implications of Heterogeneous Buyers l Key Points: Profit Maximization + Risk Management Alternatives to Insurance Lack of Classification + Risk Management Alternatives to Insurance H&N, Ch. 6 ==> Risk Classification ==> Adverse Selection T 6. 16

Implications of Heterogeneous Buyers l Key Points: Profit Maximization + Risk Management Alternatives to Insurance Lack of Classification + Risk Management Alternatives to Insurance H&N, Ch. 6 ==> Risk Classification ==> Adverse Selection T 6. 16

Implications of Heterogeneous Buyers l What if it is costly to identify MAPs? • Go back to initial situation, but suppose that it costs $100 for each MAP identified • Assuming Equal Treatment continues to charge $750, what does Selective charge? • What if the cost per MAP identified = $300? H&N, Ch. 6 T 6. 17

Implications of Heterogeneous Buyers l What if it is costly to identify MAPs? • Go back to initial situation, but suppose that it costs $100 for each MAP identified • Assuming Equal Treatment continues to charge $750, what does Selective charge? • What if the cost per MAP identified = $300? H&N, Ch. 6 T 6. 17

Implications of Heterogeneous Buyers l Key Point: Profit Maximization + Competition H&N, Ch. 6 ==> Risk Classification if it is Cost Effective T 6. 18

Implications of Heterogeneous Buyers l Key Point: Profit Maximization + Competition H&N, Ch. 6 ==> Risk Classification if it is Cost Effective T 6. 18

Is Classification Good for Society? • Public Policy Issue: • From a societal perspective, is risk classification desirable? • Some argue that risk classification should be restricted when • insurance is mandatory (e. g. , auto liability) • classification is based on inherited traits (e. g. , gender, genes) • classification is based on location of residence (e. g. , auto, property) • classification is based on subjective criteria (e. g. , “poor moral risks”) H&N, Ch. 6 T 6. 19

Is Classification Good for Society? • Public Policy Issue: • From a societal perspective, is risk classification desirable? • Some argue that risk classification should be restricted when • insurance is mandatory (e. g. , auto liability) • classification is based on inherited traits (e. g. , gender, genes) • classification is based on location of residence (e. g. , auto, property) • classification is based on subjective criteria (e. g. , “poor moral risks”) H&N, Ch. 6 T 6. 19

Is Classification Good for Society? l Framework for evaluating public policy issue: • Four effects of restricting classification 1. Redistributes income • From low risk to high risk • Examples: • Is this fair? H&N, Ch. 6 T 6. 20

Is Classification Good for Society? l Framework for evaluating public policy issue: • Four effects of restricting classification 1. Redistributes income • From low risk to high risk • Examples: • Is this fair? H&N, Ch. 6 T 6. 20

Is Classification Good for Society? 2. Classification will alter insurance prices to certain groups and therefore change behavior • Types of behavior: • amount of insurance purchased • loss control activities • Some changes in behavior may be desirable and some undesirable • Examples: • amount of liability insurance purchased by poor people • smoking • amount of life insurance purchased by people with HIV H&N, Ch. 6 T 6. 21

Is Classification Good for Society? 2. Classification will alter insurance prices to certain groups and therefore change behavior • Types of behavior: • amount of insurance purchased • loss control activities • Some changes in behavior may be desirable and some undesirable • Examples: • amount of liability insurance purchased by poor people • smoking • amount of life insurance purchased by people with HIV H&N, Ch. 6 T 6. 21

Is Classification Good for Society? 3. May decrease classification costs • Ignoring fairness issues (point #1), if there are no behavioral effects of classification (point #2), then costly classification is a waste; • I. e. , classification simply redistributes income • Controversial issues: (gender, age, location) have low classification costs H&N, Ch. 6 T 6. 22

Is Classification Good for Society? 3. May decrease classification costs • Ignoring fairness issues (point #1), if there are no behavioral effects of classification (point #2), then costly classification is a waste; • I. e. , classification simply redistributes income • Controversial issues: (gender, age, location) have low classification costs H&N, Ch. 6 T 6. 22

Is Classification Good for Society? 4. Limiting classification may increase regulatory costs • Monitoring of insurers to enforce restrictions • Need to impose other costly restrictions on insurers • marketing activities • underwriting activities • Restrictions lead insurers to not offer coverage • Leads to residual market (involuntary market) mechanisms • Leads to additional costs H&N, Ch. 6 T 6. 23

Is Classification Good for Society? 4. Limiting classification may increase regulatory costs • Monitoring of insurers to enforce restrictions • Need to impose other costly restrictions on insurers • marketing activities • underwriting activities • Restrictions lead insurers to not offer coverage • Leads to residual market (involuntary market) mechanisms • Leads to additional costs H&N, Ch. 6 T 6. 23

Risk Classification Practices • Consumers are classified by various criteria • Class Rate is applies to all consumers in a given classification • Underwriter decides whether a particular consumer will be offered coverage at the class rate • Schedule rating: modification of the rate by the underwriter based on specific characteristics of the consumer (applies mostly to commercial insurance) • Experience rating refers to practice of basing rates on past experience H&N, Ch. 6 T 6. 24

Risk Classification Practices • Consumers are classified by various criteria • Class Rate is applies to all consumers in a given classification • Underwriter decides whether a particular consumer will be offered coverage at the class rate • Schedule rating: modification of the rate by the underwriter based on specific characteristics of the consumer (applies mostly to commercial insurance) • Experience rating refers to practice of basing rates on past experience H&N, Ch. 6 T 6. 24

Recouping versus Updating • Basing rates on past experience is often controversial • Are insurers • recouping past losses or • updating expected losses on future business? • Competition and low switching costs limit the ability of insurers to recoup H&N, Ch. 6 T 6. 25

Recouping versus Updating • Basing rates on past experience is often controversial • Are insurers • recouping past losses or • updating expected losses on future business? • Competition and low switching costs limit the ability of insurers to recoup H&N, Ch. 6 T 6. 25

Return to Determinants of Fair Premiums l Summary: Ignoring • administrative costs • investment income • profits Fair Premium = Expected Claim Costs || Pure Premium H&N, Ch. 6 T 6. 26

Return to Determinants of Fair Premiums l Summary: Ignoring • administrative costs • investment income • profits Fair Premium = Expected Claim Costs || Pure Premium H&N, Ch. 6 T 6. 26

Investment Income l Key Point: • Fair premium is reduced to reflect investment income on premiums • Equivalently, • Fair Premium = Present Value of Expected Costs H&N, Ch. 6 T 6. 27

Investment Income l Key Point: • Fair premium is reduced to reflect investment income on premiums • Equivalently, • Fair Premium = Present Value of Expected Costs H&N, Ch. 6 T 6. 27

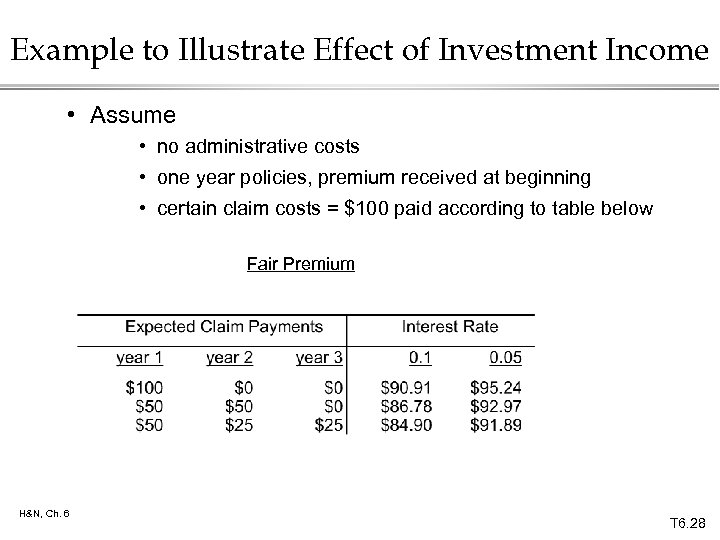

Example to Illustrate Effect of Investment Income • Assume • no administrative costs • one year policies, premium received at beginning • certain claim costs = $100 paid according to table below Fair Premium H&N, Ch. 6 T 6. 28

Example to Illustrate Effect of Investment Income • Assume • no administrative costs • one year policies, premium received at beginning • certain claim costs = $100 paid according to table below Fair Premium H&N, Ch. 6 T 6. 28

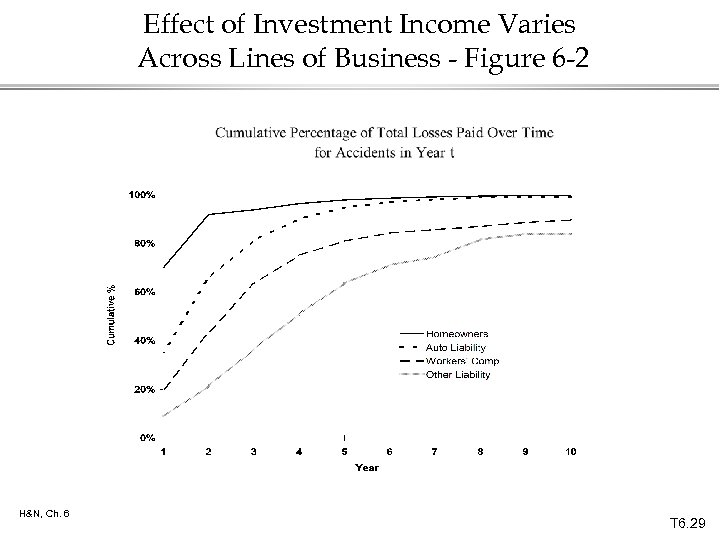

Effect of Investment Income Varies Across Lines of Business - Figure 6 -2 H&N, Ch. 6 T 6. 29

Effect of Investment Income Varies Across Lines of Business - Figure 6 -2 H&N, Ch. 6 T 6. 29

Administrative Expenses l Fair Premium must cover administrative costs, such as • • • H&N, Ch. 6 marketing underwriting loss adjustment premium taxes underwriting income taxes etc. T 6. 30

Administrative Expenses l Fair Premium must cover administrative costs, such as • • • H&N, Ch. 6 marketing underwriting loss adjustment premium taxes underwriting income taxes etc. T 6. 30

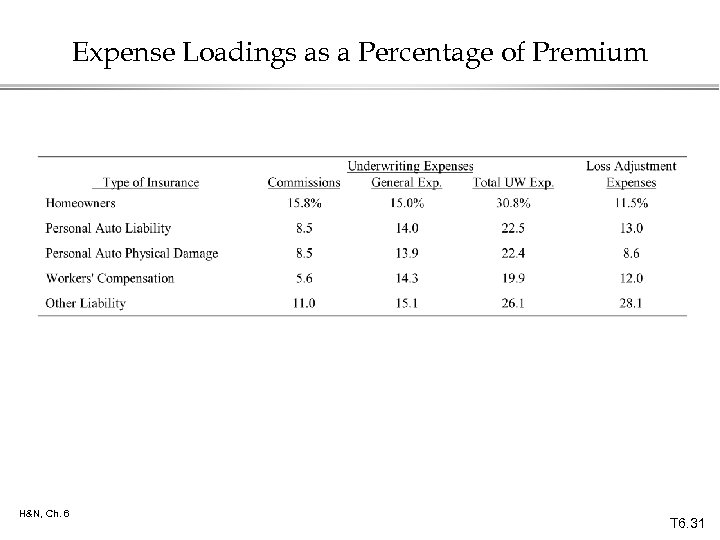

Expense Loadings as a Percentage of Premium H&N, Ch. 6 T 6. 31

Expense Loadings as a Percentage of Premium H&N, Ch. 6 T 6. 31

Summary of Determinants of Fair Premiums • Ignoring profit loading • Fair Premium = PV of Expected Costs • Fair Premium = PV of Pure Premium + PV of Expenses • Note: Analysis to this point has been based on expected values • Now take into consideration the uncertainty associated with operations H&N, Ch. 6 T 6. 32

Summary of Determinants of Fair Premiums • Ignoring profit loading • Fair Premium = PV of Expected Costs • Fair Premium = PV of Pure Premium + PV of Expenses • Note: Analysis to this point has been based on expected values • Now take into consideration the uncertainty associated with operations H&N, Ch. 6 T 6. 32

Effect of Uncertainty: Profit Loading • Uncertainty ==> claim costs could exceed premiums • That is, insolvency is possible • Insurers hold capital to reduce the likelihood of insolvency • Thus, capital providers bear the risk associated with insurance operations • The insurer’s profit is the owners’ compensation for bearing this risk H&N, Ch. 6 T 6. 33

Effect of Uncertainty: Profit Loading • Uncertainty ==> claim costs could exceed premiums • That is, insolvency is possible • Insurers hold capital to reduce the likelihood of insolvency • Thus, capital providers bear the risk associated with insurance operations • The insurer’s profit is the owners’ compensation for bearing this risk H&N, Ch. 6 T 6. 33

Summary of Fair Premium Model l Fair Premium = PV of Expected Costs + Profit loading • Other terms for profit loading: • risk load • capital costs H&N, Ch. 6 T 6. 34

Summary of Fair Premium Model l Fair Premium = PV of Expected Costs + Profit loading • Other terms for profit loading: • risk load • capital costs H&N, Ch. 6 T 6. 34

Determinants of Profit Loadings • Actuarial Models: • Variance of distribution of claim costs for that line of business determines risk load • Risk load increases with the unpredictability of claim costs H&N, Ch. 6 T 6. 35

Determinants of Profit Loadings • Actuarial Models: • Variance of distribution of claim costs for that line of business determines risk load • Risk load increases with the unpredictability of claim costs H&N, Ch. 6 T 6. 35

Determinants of Profit Loadings • Financial Models: • Optimal level of capital given its costs and benefits • Benefits of capital depend on • variance of claim costs • covariance of claim costs across lines and with assets • Cost of holding capital: • tax costs • agency costs H&N, Ch. 6 T 6. 36

Determinants of Profit Loadings • Financial Models: • Optimal level of capital given its costs and benefits • Benefits of capital depend on • variance of claim costs • covariance of claim costs across lines and with assets • Cost of holding capital: • tax costs • agency costs H&N, Ch. 6 T 6. 36

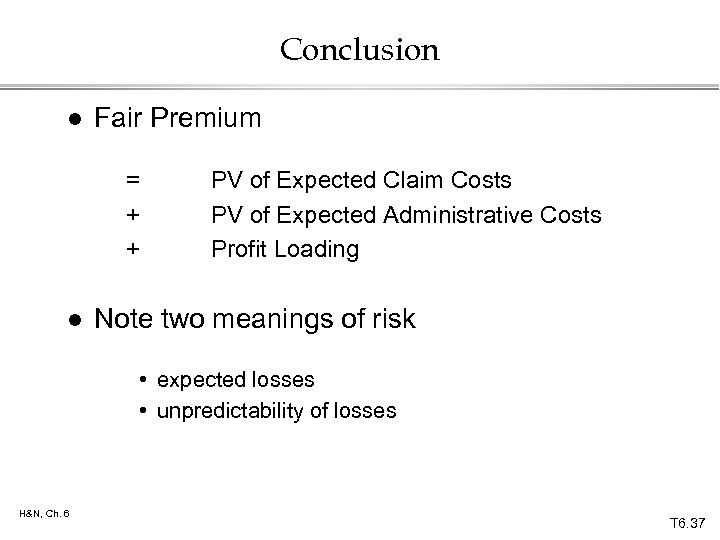

Conclusion l Fair Premium = + + l PV of Expected Claim Costs PV of Expected Administrative Costs Profit Loading Note two meanings of risk • expected losses • unpredictability of losses H&N, Ch. 6 T 6. 37

Conclusion l Fair Premium = + + l PV of Expected Claim Costs PV of Expected Administrative Costs Profit Loading Note two meanings of risk • expected losses • unpredictability of losses H&N, Ch. 6 T 6. 37

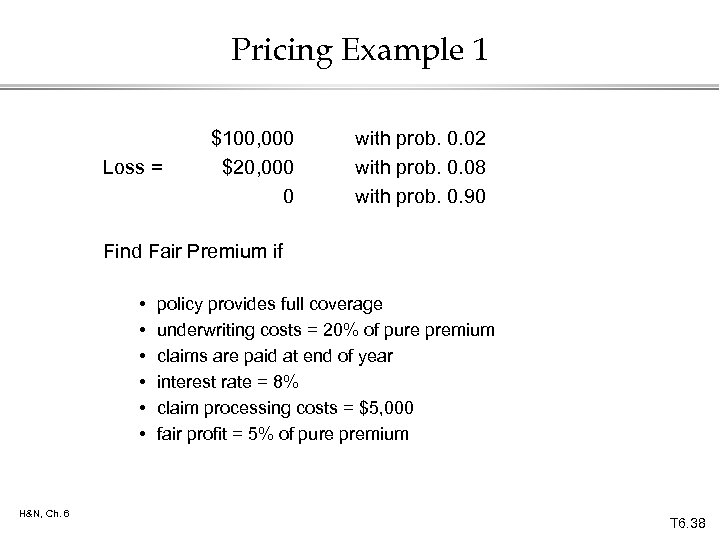

Pricing Example 1 Loss = $100, 000 $20, 000 0 with prob. 0. 02 with prob. 0. 08 with prob. 0. 90 Find Fair Premium if • • • H&N, Ch. 6 policy provides full coverage underwriting costs = 20% of pure premium claims are paid at end of year interest rate = 8% claim processing costs = $5, 000 fair profit = 5% of pure premium T 6. 38

Pricing Example 1 Loss = $100, 000 $20, 000 0 with prob. 0. 02 with prob. 0. 08 with prob. 0. 90 Find Fair Premium if • • • H&N, Ch. 6 policy provides full coverage underwriting costs = 20% of pure premium claims are paid at end of year interest rate = 8% claim processing costs = $5, 000 fair profit = 5% of pure premium T 6. 38

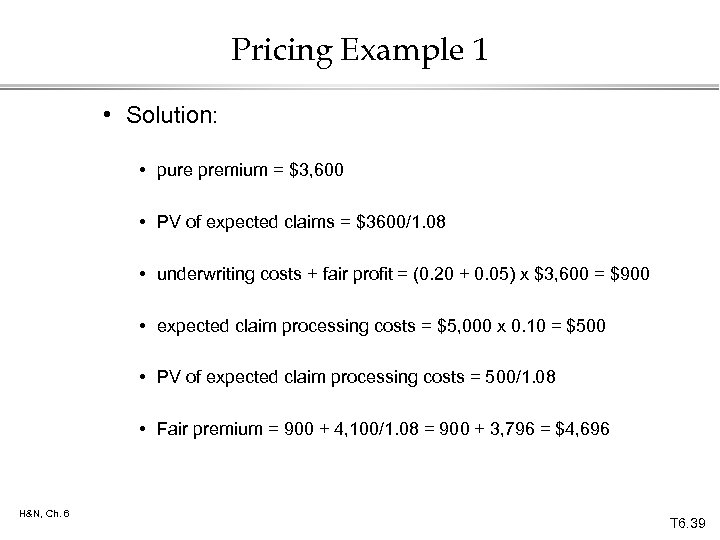

Pricing Example 1 • Solution: • pure premium = $3, 600 • PV of expected claims = $3600/1. 08 • underwriting costs + fair profit = (0. 20 + 0. 05) x $3, 600 = $900 • expected claim processing costs = $5, 000 x 0. 10 = $500 • PV of expected claim processing costs = 500/1. 08 • Fair premium = 900 + 4, 100/1. 08 = 900 + 3, 796 = $4, 696 H&N, Ch. 6 T 6. 39

Pricing Example 1 • Solution: • pure premium = $3, 600 • PV of expected claims = $3600/1. 08 • underwriting costs + fair profit = (0. 20 + 0. 05) x $3, 600 = $900 • expected claim processing costs = $5, 000 x 0. 10 = $500 • PV of expected claim processing costs = 500/1. 08 • Fair premium = 900 + 4, 100/1. 08 = 900 + 3, 796 = $4, 696 H&N, Ch. 6 T 6. 39

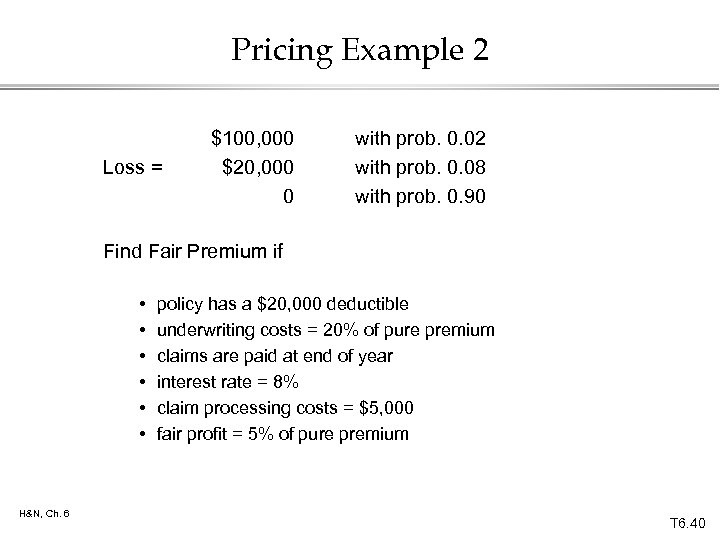

Pricing Example 2 Loss = $100, 000 $20, 000 0 with prob. 0. 02 with prob. 0. 08 with prob. 0. 90 Find Fair Premium if • • • H&N, Ch. 6 policy has a $20, 000 deductible underwriting costs = 20% of pure premium claims are paid at end of year interest rate = 8% claim processing costs = $5, 000 fair profit = 5% of pure premium T 6. 40

Pricing Example 2 Loss = $100, 000 $20, 000 0 with prob. 0. 02 with prob. 0. 08 with prob. 0. 90 Find Fair Premium if • • • H&N, Ch. 6 policy has a $20, 000 deductible underwriting costs = 20% of pure premium claims are paid at end of year interest rate = 8% claim processing costs = $5, 000 fair profit = 5% of pure premium T 6. 40

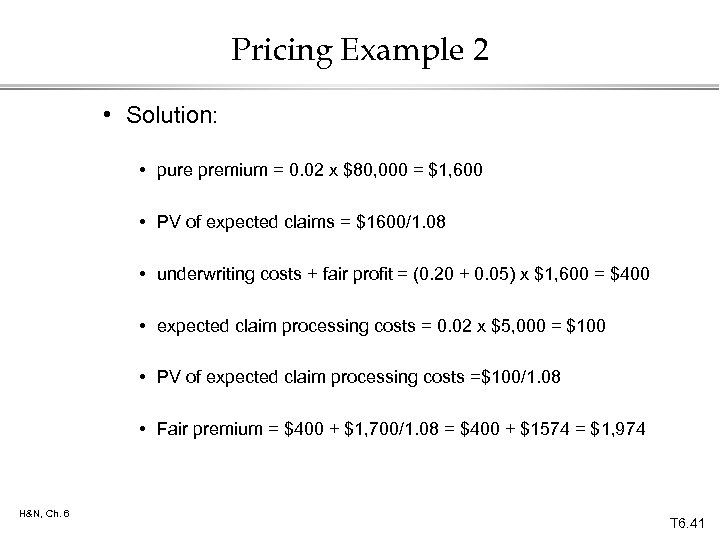

Pricing Example 2 • Solution: • pure premium = 0. 02 x $80, 000 = $1, 600 • PV of expected claims = $1600/1. 08 • underwriting costs + fair profit = (0. 20 + 0. 05) x $1, 600 = $400 • expected claim processing costs = 0. 02 x $5, 000 = $100 • PV of expected claim processing costs =$100/1. 08 • Fair premium = $400 + $1, 700/1. 08 = $400 + $1574 = $1, 974 H&N, Ch. 6 T 6. 41

Pricing Example 2 • Solution: • pure premium = 0. 02 x $80, 000 = $1, 600 • PV of expected claims = $1600/1. 08 • underwriting costs + fair profit = (0. 20 + 0. 05) x $1, 600 = $400 • expected claim processing costs = 0. 02 x $5, 000 = $100 • PV of expected claim processing costs =$100/1. 08 • Fair premium = $400 + $1, 700/1. 08 = $400 + $1574 = $1, 974 H&N, Ch. 6 T 6. 41

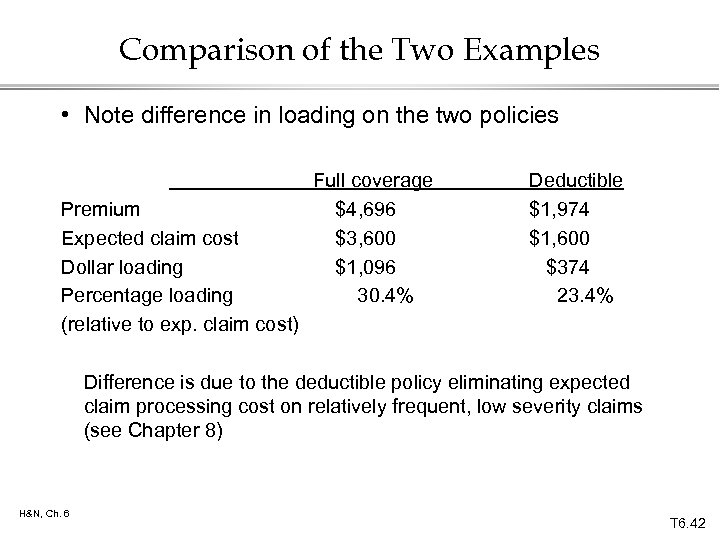

Comparison of the Two Examples • Note difference in loading on the two policies Premium Expected claim cost Dollar loading Percentage loading (relative to exp. claim cost) Full coverage $4, 696 $3, 600 $1, 096 30. 4% Deductible $1, 974 $1, 600 $374 23. 4% Difference is due to the deductible policy eliminating expected claim processing cost on relatively frequent, low severity claims (see Chapter 8) H&N, Ch. 6 T 6. 42

Comparison of the Two Examples • Note difference in loading on the two policies Premium Expected claim cost Dollar loading Percentage loading (relative to exp. claim cost) Full coverage $4, 696 $3, 600 $1, 096 30. 4% Deductible $1, 974 $1, 600 $374 23. 4% Difference is due to the deductible policy eliminating expected claim processing cost on relatively frequent, low severity claims (see Chapter 8) H&N, Ch. 6 T 6. 42

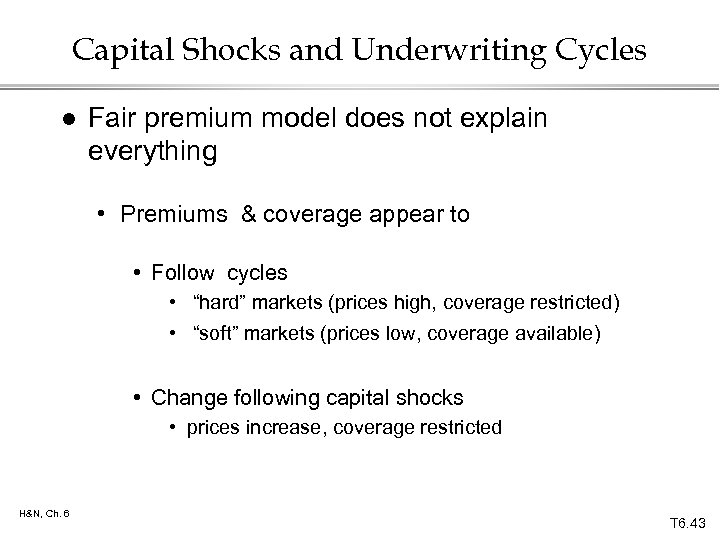

Capital Shocks and Underwriting Cycles l Fair premium model does not explain everything • Premiums & coverage appear to • Follow cycles • “hard” markets (prices high, coverage restricted) • “soft” markets (prices low, coverage available) • Change following capital shocks • prices increase, coverage restricted H&N, Ch. 6 T 6. 43

Capital Shocks and Underwriting Cycles l Fair premium model does not explain everything • Premiums & coverage appear to • Follow cycles • “hard” markets (prices high, coverage restricted) • “soft” markets (prices low, coverage available) • Change following capital shocks • prices increase, coverage restricted H&N, Ch. 6 T 6. 43

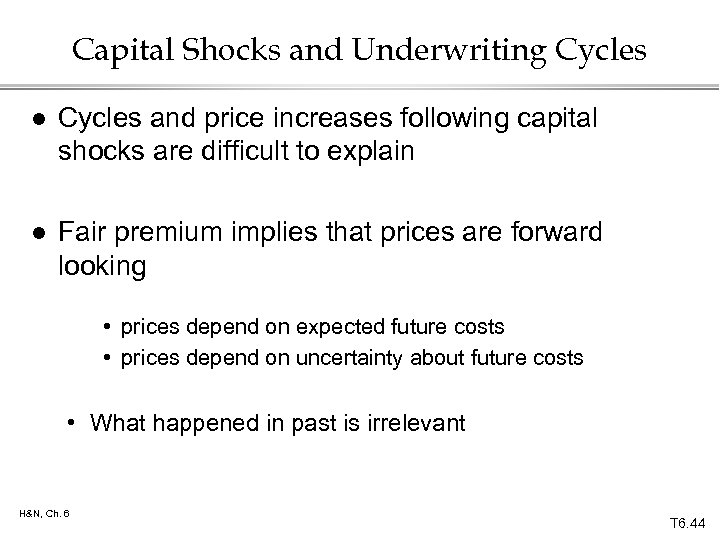

Capital Shocks and Underwriting Cycles l Cycles and price increases following capital shocks are difficult to explain l Fair premium implies that prices are forward looking • prices depend on expected future costs • prices depend on uncertainty about future costs • What happened in past is irrelevant H&N, Ch. 6 T 6. 44

Capital Shocks and Underwriting Cycles l Cycles and price increases following capital shocks are difficult to explain l Fair premium implies that prices are forward looking • prices depend on expected future costs • prices depend on uncertainty about future costs • What happened in past is irrelevant H&N, Ch. 6 T 6. 44

Premium Increases Following Capital Shocks l One explanation: • Capital shock depletes insurer capital • Costly to raise new capital • Capital becomes scarce ==> its required return increases • That is, the risk load increases H&N, Ch. 6 T 6. 45

Premium Increases Following Capital Shocks l One explanation: • Capital shock depletes insurer capital • Costly to raise new capital • Capital becomes scarce ==> its required return increases • That is, the risk load increases H&N, Ch. 6 T 6. 45

Underwriting Cycles • Possible explanations • Insurers naively extrapolate from recent past • high (low) losses in the past cause insurers to predict that future losses will be high (low) • Capital shocks, followed by excessive competition • capital shock lowers capital • premiums increase, which replenishes capital • excess capital develops • premiums decrease H&N, Ch. 6 T 6. 46

Underwriting Cycles • Possible explanations • Insurers naively extrapolate from recent past • high (low) losses in the past cause insurers to predict that future losses will be high (low) • Capital shocks, followed by excessive competition • capital shock lowers capital • premiums increase, which replenishes capital • excess capital develops • premiums decrease H&N, Ch. 6 T 6. 46

Price Regulation l Types • Restrict level or change in rates • prior approval • file and use • competitive • Restrict underwriting criteria H&N, Ch. 6 T 6. 47

Price Regulation l Types • Restrict level or change in rates • prior approval • file and use • competitive • Restrict underwriting criteria H&N, Ch. 6 T 6. 47

Why Regulate Rates? l Public Interest Perspective: • Correct problems in market place • collusion among insurers • lack of consumer information H&N, Ch. 6 T 6. 48

Why Regulate Rates? l Public Interest Perspective: • Correct problems in market place • collusion among insurers • lack of consumer information H&N, Ch. 6 T 6. 48

Why Regulate Rates? l Economic Theory of Regulation Perspective • Regulation benefits politically influential groups • Possible beneficiaries of price regulation: • Insurers as a group • Inefficient insurers • High risk consumers H&N, Ch. 6 T 6. 49

Why Regulate Rates? l Economic Theory of Regulation Perspective • Regulation benefits politically influential groups • Possible beneficiaries of price regulation: • Insurers as a group • Inefficient insurers • High risk consumers H&N, Ch. 6 T 6. 49

Effects of Rate Suppression and Compression l Rate suppression - lower rates below costs l Rate compression - restrict differences in rates across classifications • Suppression and/or compression lead insurers to not voluntarily offer coverage to some groups • which leads to creation of residual market mechanisms (e. g. , joint underwriting associations) (JUAs) H&N, Ch. 6 T 6. 50

Effects of Rate Suppression and Compression l Rate suppression - lower rates below costs l Rate compression - restrict differences in rates across classifications • Suppression and/or compression lead insurers to not voluntarily offer coverage to some groups • which leads to creation of residual market mechanisms (e. g. , joint underwriting associations) (JUAs) H&N, Ch. 6 T 6. 50