4690379fc26b666f9359146f5a6477f1.ppt

- Количество слайдов: 64

Chapter One Asset, Liability, Owner’s Equity, Revenue, and Expense Accounts

Performance Objectives 1. Define and identify asset, liability, and owner’s equity accounts 2. Record a group of business transactions, in column form, involving changes in assets, liabilities, and owner’s equity 2

Performance Objectives 3. Define and identify revenue and expense accounts 4. Record a group of business transactions, in column form, involving all five elements of the fundamental accounting equation 3

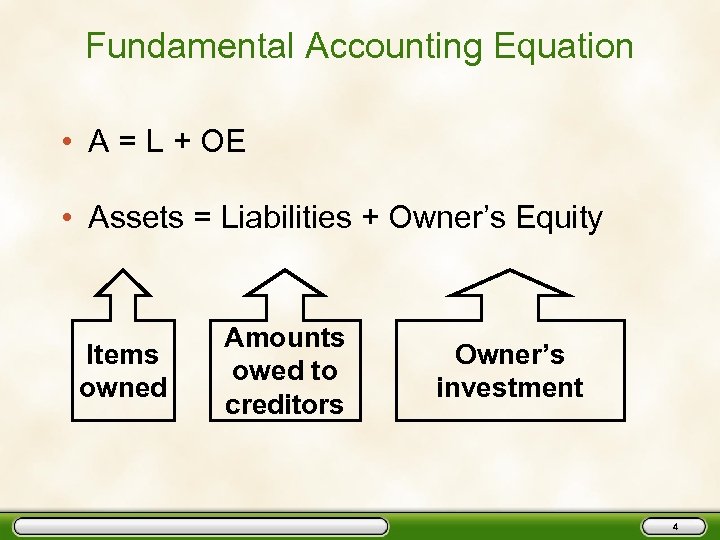

Fundamental Accounting Equation • A = L + OE • Assets = Liabilities + Owner’s Equity Items owned Amounts owed to creditors Owner’s investment 4

Performance Objective 1 Define and identify asset, liability, and owner’s equity accounts Accounting Is Fun! 5

Define Asset • Asset – Cash, properties, and other things of value owned by an economic unit or business entity – Provides (probable) future economic benefits Accounting Is Fun! 6

Identify Assets • Examples of assets: – – – Cash Trucks Buildings Shoes in a shoe store Kites in a kite store Accounts Receivable • The amount owed to you or the business • Assets that seem like Expenses – Prepaid Insurance for one year Accounting Is Fun! 7

Define Accounts Receivable • Accounts Receivable – An account used to record the amounts owed by charge customers • The business has legal claims against charge customers • Look for the words: – “Sold on account” • A/R = Holding Tank for future receipt of cash Accounting Is Fun! 8

Define Liability • Liability – Debts or amounts owed to creditors – (Probable) sacrifice of future economic benefits • In one word: – Debt Accounting Is Fun! 9

Identify Liabilities • Examples of Debts/Liabilities – Loans (borrowing money) – Accounts Payable account • Buy goods/services on credit • Receive a bill, but don’t pay until later • Buy supplies from a store, but pay for them later Accounting Is Fun! 10

Define Accounts Payable • Accounts Payable – A liability account used for short-term liabilities or charge accounts, usually due within thirty days • Look for the words: – “Bought/purchased on account” – “Bought/purchase on credit • A/P = Holding Tank for cash the business will pay out later Accounting Is Fun! 11

Define Owner’s Equity • The owner’s right to or investment in the business • Assets – Liabilities = Owners’ Equity • A – L = OE Accounting Is Fun! 12

Identify Owner’s Equity • What is left over for the owner after all the debts have been paid – Remember: Creditors must be paid before the owner’s are paid • In this text book we will use the account: – Capital Accounting Is Fun! 13

Fundamental Accounting Equation • A = L + OE • Assets = Liabilities + Owner’s Equity – The equals sign means that one side must always equal the other side – We’ll use this equation later to determine whether we have recorded our business transactions correctly Accounting Is Fun! 14

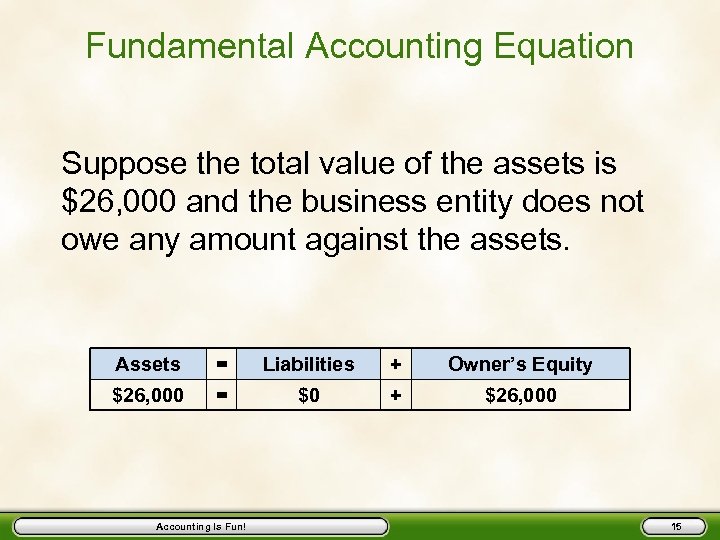

Fundamental Accounting Equation Suppose the total value of the assets is $26, 000 and the business entity does not owe any amount against the assets. Assets = Liabilities + Owner’s Equity $26, 000 = $0 + $26, 000 Accounting Is Fun! 15

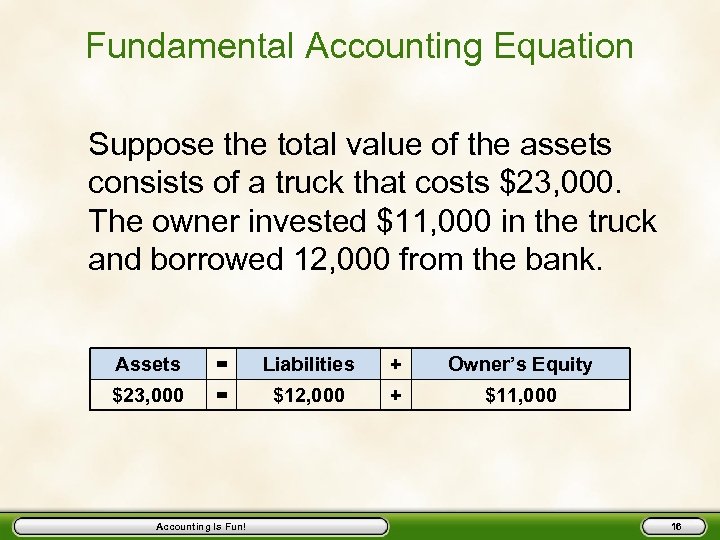

Fundamental Accounting Equation Suppose the total value of the assets consists of a truck that costs $23, 000. The owner invested $11, 000 in the truck and borrowed 12, 000 from the bank. Assets = Liabilities + Owner’s Equity $23, 000 = $12, 000 + $11, 000 Accounting Is Fun! 16

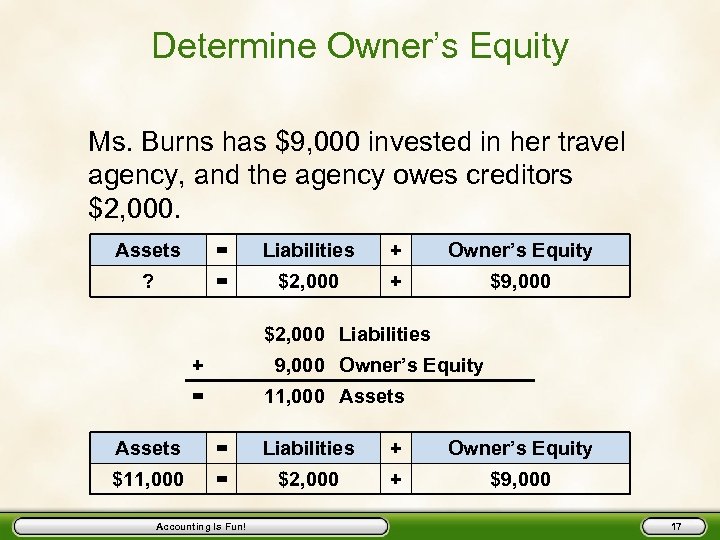

Determine Owner’s Equity Ms. Burns has $9, 000 invested in her travel agency, and the agency owes creditors $2, 000. Assets = Liabilities + Owner’s Equity ? = $2, 000 + $9, 000 $2, 000 Liabilities + 9, 000 Owner’s Equity = 11, 000 Assets = Liabilities + Owner’s Equity $11, 000 = $2, 000 + $9, 000 Accounting Is Fun! 17

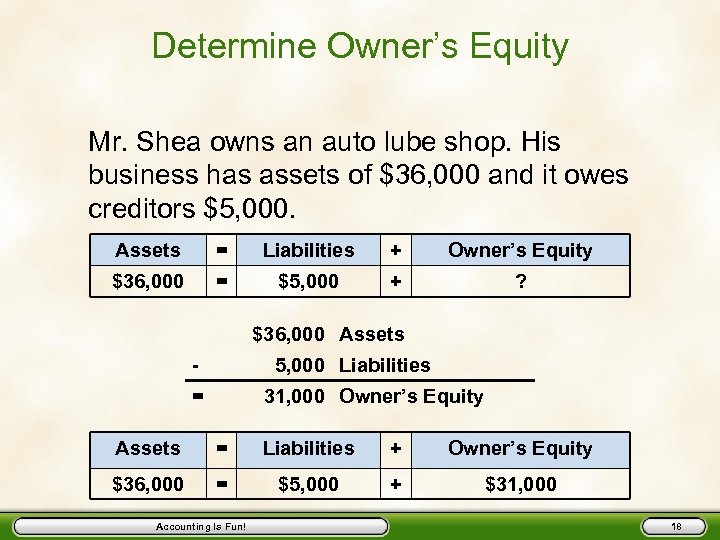

Determine Owner’s Equity Mr. Shea owns an auto lube shop. His business has assets of $36, 000 and it owes creditors $5, 000. Assets = Liabilities + Owner’s Equity $36, 000 = $5, 000 + ? $36, 000 Assets - 5, 000 Liabilities = 31, 000 Owner’s Equity Assets = Liabilities + Owner’s Equity $36, 000 = $5, 000 + $31, 000 Accounting Is Fun! 18

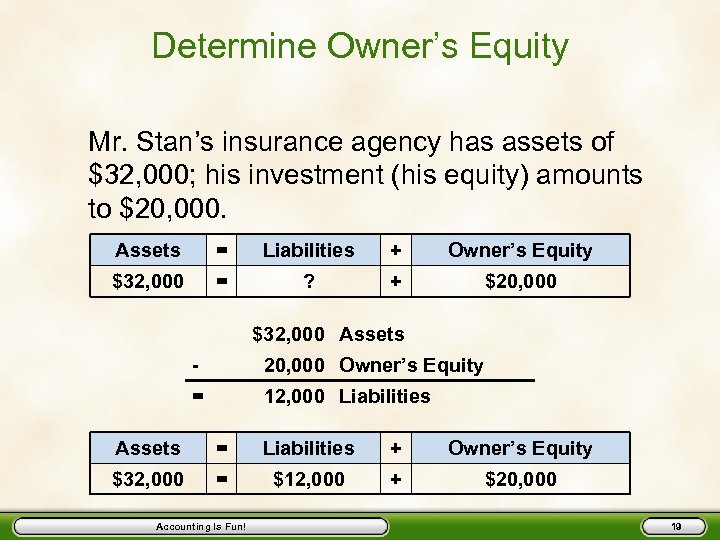

Determine Owner’s Equity Mr. Stan’s insurance agency has assets of $32, 000; his investment (his equity) amounts to $20, 000. Assets = Liabilities + Owner’s Equity $32, 000 = ? + $20, 000 $32, 000 Assets - 20, 000 Owner’s Equity = 12, 000 Liabilities Assets = Liabilities + Owner’s Equity $32, 000 = $12, 000 + $20, 000 Accounting Is Fun! 19

Performance Objective 2 Record a group of business transactions, in column form, involving changes in assets, liabilities, and owner’s equity Accounting Is Fun! 20

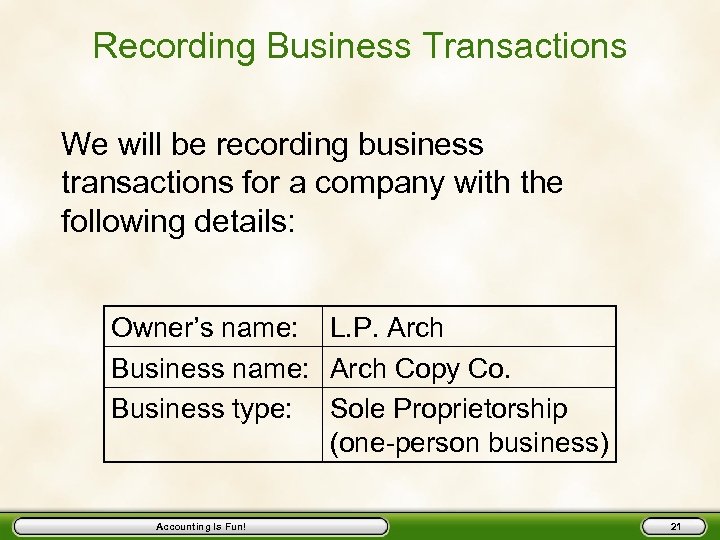

Recording Business Transactions We will be recording business transactions for a company with the following details: Owner’s name: L. P. Arch Business name: Arch Copy Co. Business type: Sole Proprietorship (one-person business) Accounting Is Fun! 21

Some Definitions • Sole proprietorship – A one-owner business • Separate entity concept – The concept by which a business is treated as a separate economic or accounting entity – The business stands by itself, separate from its owners, creditors, and customers Accounting Is Fun! 22

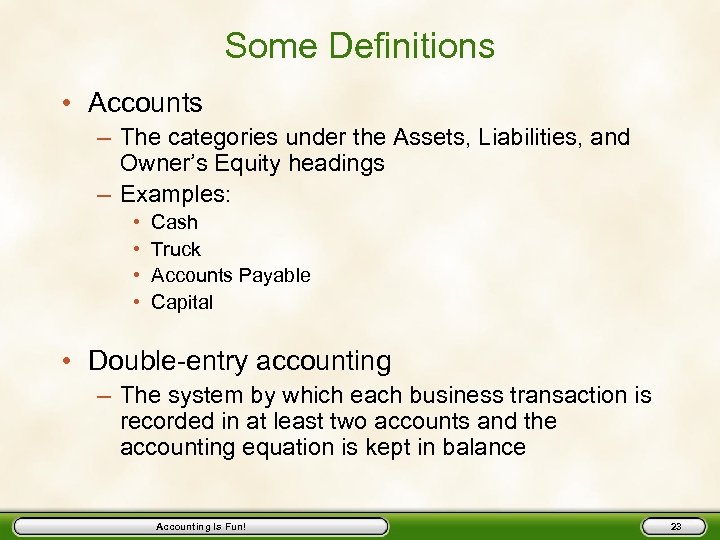

Some Definitions • Accounts – The categories under the Assets, Liabilities, and Owner’s Equity headings – Examples: • • Cash Truck Accounts Payable Capital • Double-entry accounting – The system by which each business transaction is recorded in at least two accounts and the accounting equation is kept in balance Accounting Is Fun! 23

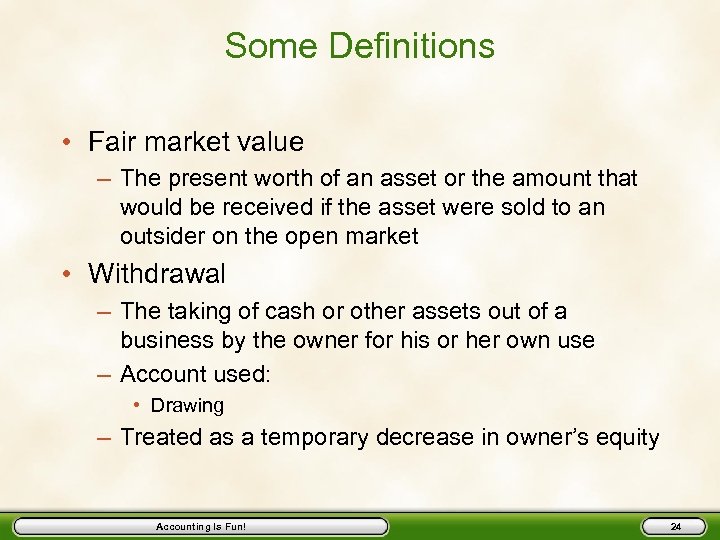

Some Definitions • Fair market value – The present worth of an asset or the amount that would be received if the asset were sold to an outsider on the open market • Withdrawal – The taking of cash or other assets out of a business by the owner for his or her own use – Account used: • Drawing – Treated as a temporary decrease in owner’s equity Accounting Is Fun! 24

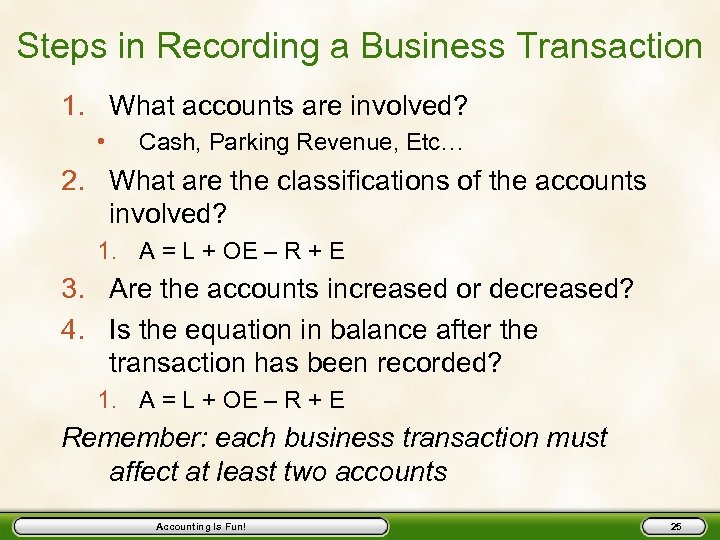

Steps in Recording a Business Transaction 1. What accounts are involved? • Cash, Parking Revenue, Etc… 2. What are the classifications of the accounts involved? 1. A = L + OE – R + E 3. Are the accounts increased or decreased? 4. Is the equation in balance after the transaction has been recorded? 1. A = L + OE – R + E Remember: each business transaction must affect at least two accounts Accounting Is Fun! 25

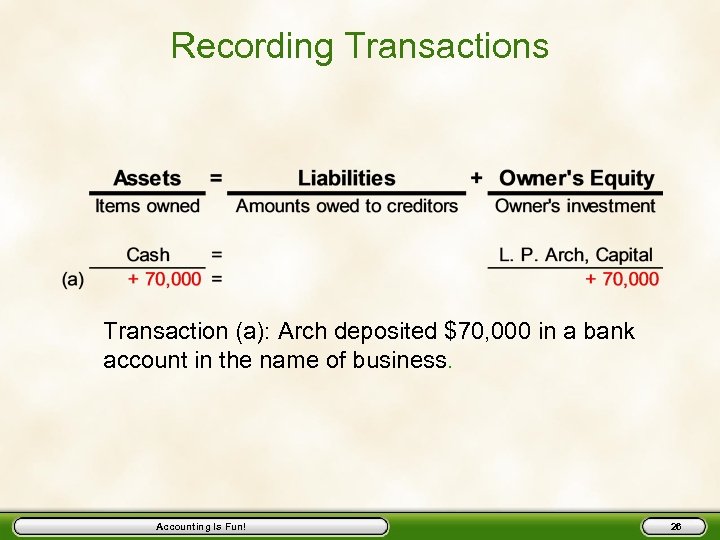

Recording Transactions Transaction (a): Arch deposited $70, 000 in a bank account in the name of business. Accounting Is Fun! 26

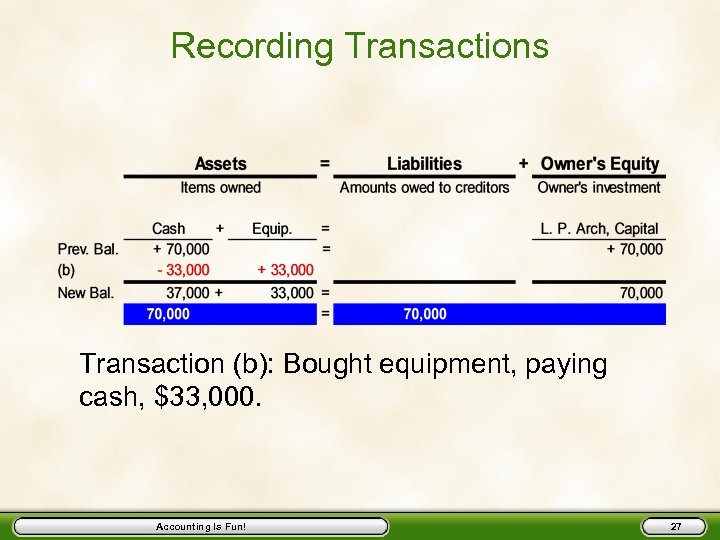

Recording Transactions Transaction (b): Bought equipment, paying cash, $33, 000. Accounting Is Fun! 27

Recording Transactions Assets = Cash + Equip. = Prev. Bal. 37, 000 + 33, 000 = (c) + 7, 000 New Bal. 37, 000 + 40, 000 = = 77, 000 Liabilities + Accounts Payable Owner's Equity + L. P. Arch, Capital + 70, 000 + 7, 000 + 77, 000 70, 000 Transaction (c): Bought equipment on account from Melton Office Supply, $7, 000. Accounting Is Fun! 28

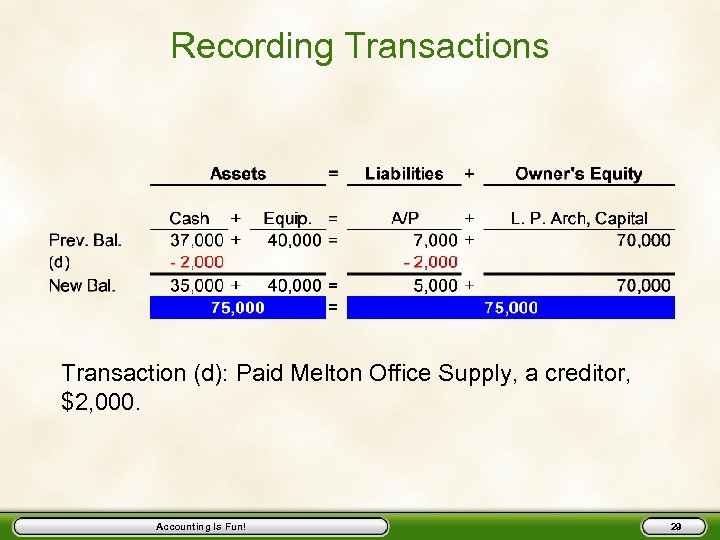

Recording Transactions Transaction (d): Paid Melton Office Supply, a creditor, $2, 000. Accounting Is Fun! 29

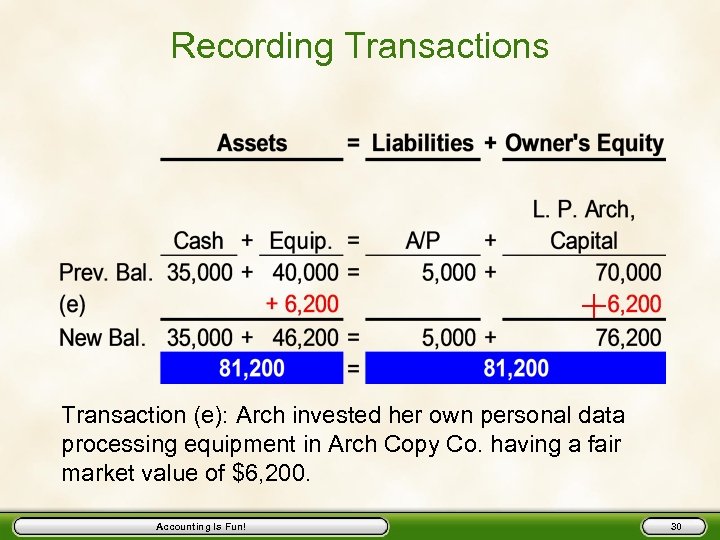

Recording Transactions Transaction (e): Arch invested her own personal data processing equipment in Arch Copy Co. having a fair market value of $6, 200. Accounting Is Fun! 30

Performance Objective 3 Define and identify revenue and expense accounts Accounting Is Fun! 31

Define Revenues • The amounts a business earns • Examples – Fees earned for performing services – Sales of merchandise – Rent income, and interest income • May take the form of cash, credit card receipts, or accounts receivable (charge accounts) Accounting Is Fun! 32

Identify Revenue Accounts • • • Fees Earned for performing services Sales Income from selling merchandise Rent Income for the use of property Interest Income for lending money Credit Sales where cash will be received at a later time – Example: Home Depot sells lumber to a customer and lets the customer pay later Accounting Is Fun! 33

Define Expenses • The costs that relate to earning revenue (the costs of doing business) • Examples – Wages – Rent – Interest – Advertising • May be paid in cash, immediately or at a future time (accounts payable) Accounting Is Fun! 34

Identify Expense Accounts • • • Wages Expense for labor performed Rent Expense for the use of property Interest Expense for the use of money Advertising Expense incurred but not paid: – Example: Received a bill for a newspaper ad you took out last week – Cash will be paid at a later time Accounting Is Fun! 35

Owner’s Equity • Revenues and expenses are under the umbrella of owner’s equity • Revenue Add to Capital account • Expenses Subtract from Capital account Accounting Is Fun! 36

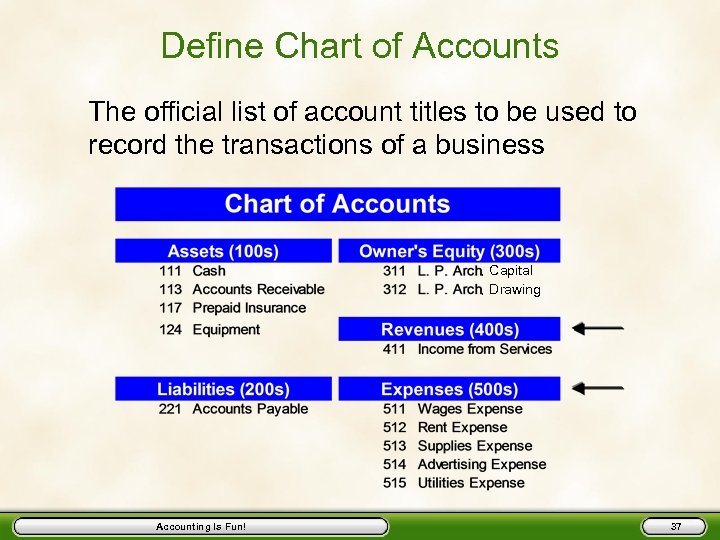

Define Chart of Accounts The official list of account titles to be used to record the transactions of a business , , Accounting Is Fun! Capital Drawing 37

Performance Objective 4 Record a group of business transactions, in column form, involving all five elements of the fundamental accounting equation Accounting Is Fun! 38

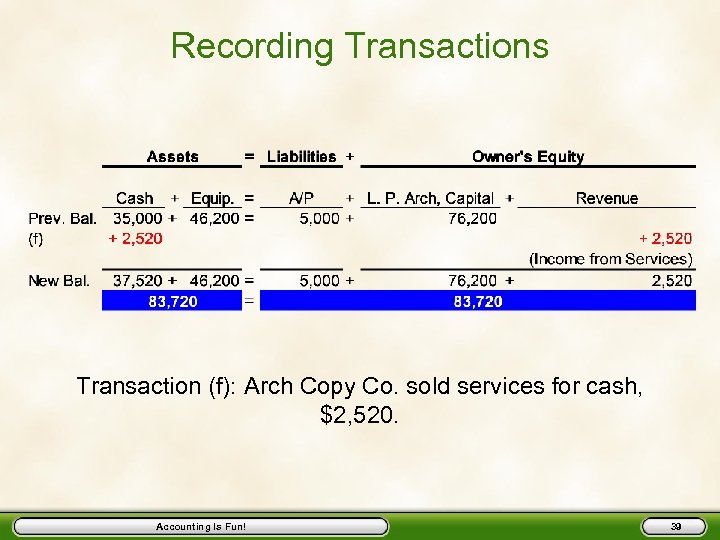

Recording Transactions Transaction (f): Arch Copy Co. sold services for cash, $2, 520. Accounting Is Fun! 39

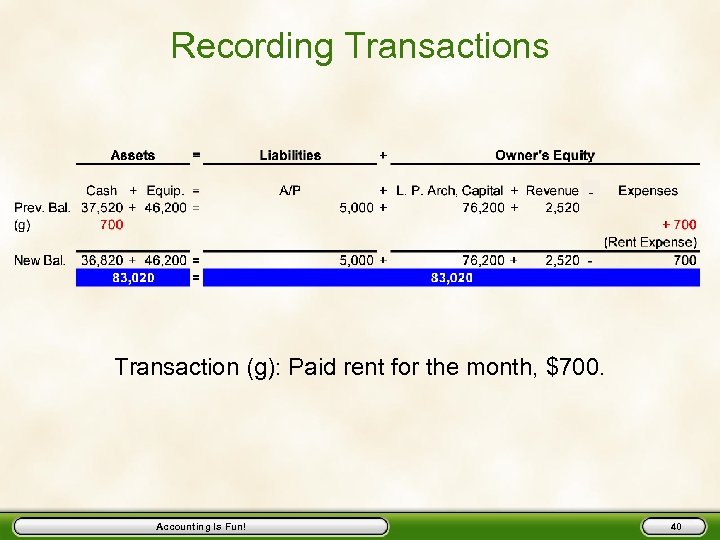

Recording Transactions - Transaction (g): Paid rent for the month, $700. Accounting Is Fun! 40

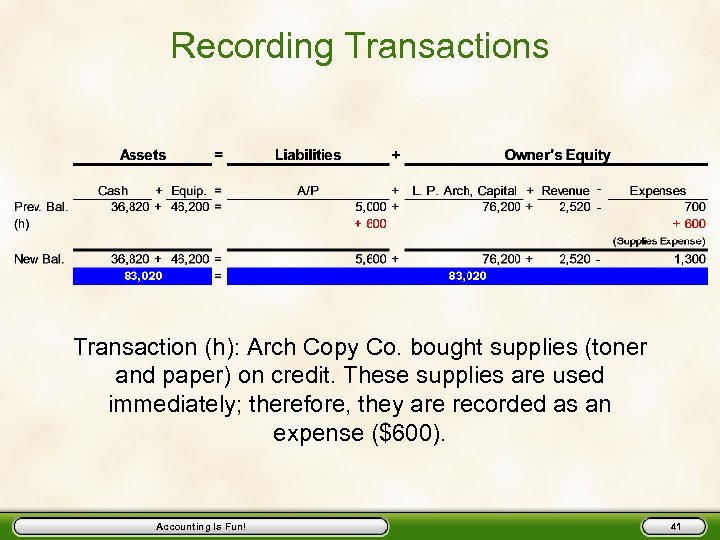

Recording Transactions - Transaction (h): Arch Copy Co. bought supplies (toner and paper) on credit. These supplies are used immediately; therefore, they are recorded as an expense ($600). Accounting Is Fun! 41

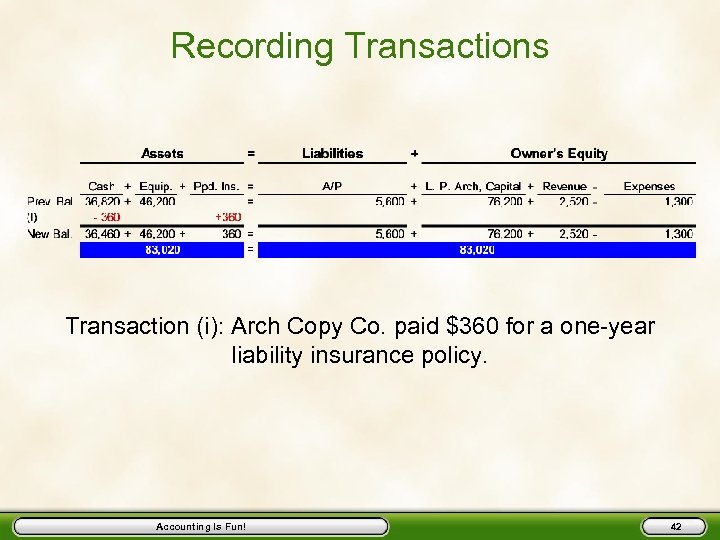

Recording Transactions Transaction (i): Arch Copy Co. paid $360 for a one-year liability insurance policy. Accounting Is Fun! 42

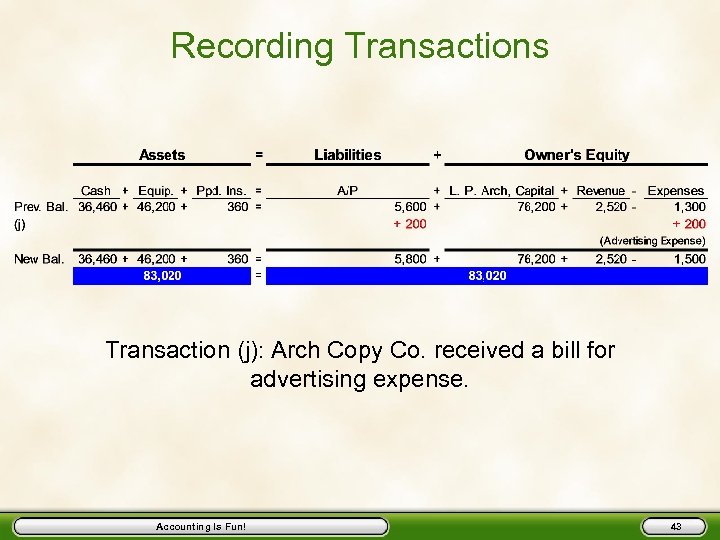

Recording Transactions Transaction (j): Arch Copy Co. received a bill for advertising expense. Accounting Is Fun! 43

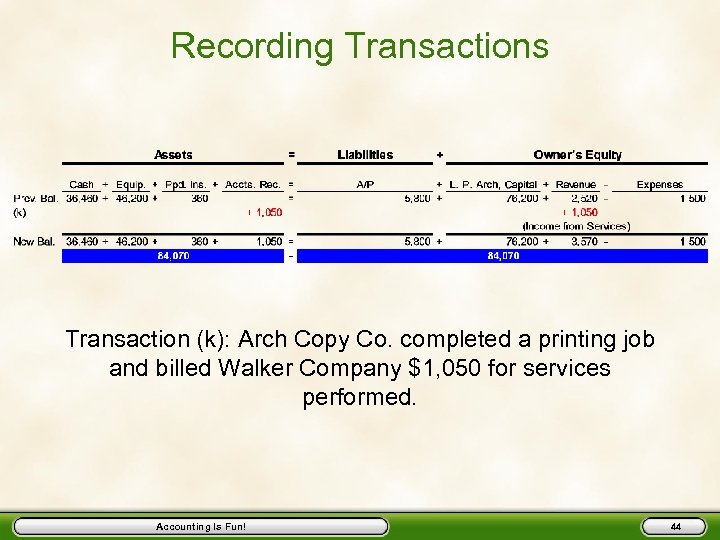

Recording Transactions Transaction (k): Arch Copy Co. completed a printing job and billed Walker Company $1, 050 for services performed. Accounting Is Fun! 44

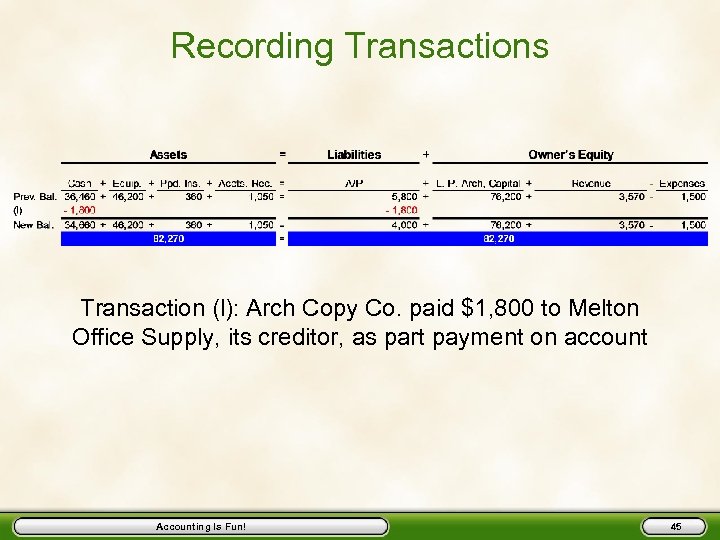

Recording Transactions Transaction (l): Arch Copy Co. paid $1, 800 to Melton Office Supply, its creditor, as part payment on account Accounting Is Fun! 45

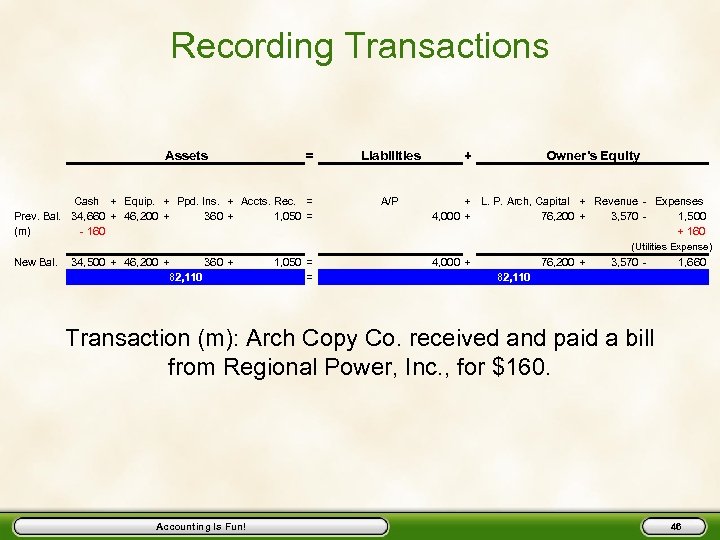

Recording Transactions Assets = Cash + Equip. + Ppd. Ins. + Accts. Rec. = Prev. Bal. 34, 660 + 46, 200 + 360 + 1, 050 = (m) - 160 Liabilities A/P + Owner's Equity + L. P. Arch, Capital + Revenue - Expenses 4, 000 + 76, 200 + 3, 570 1, 500 + 160 (Utilities Expense) New Bal. 34, 500 + 46, 200 + 360 + 82, 110 1, 050 = = 4, 000 + 76, 200 + 3, 570 - 1, 660 82, 110 Transaction (m): Arch Copy Co. received and paid a bill from Regional Power, Inc. , for $160. Accounting Is Fun! 46

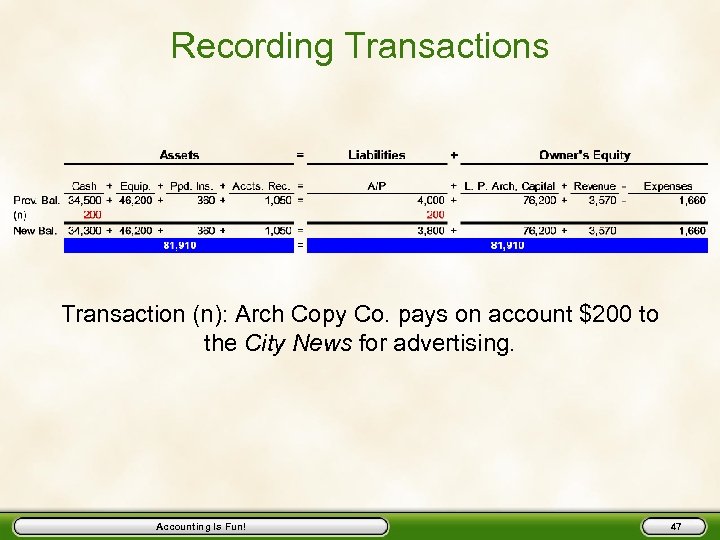

Recording Transactions Transaction (n): Arch Copy Co. pays on account $200 to the City News for advertising. Accounting Is Fun! 47

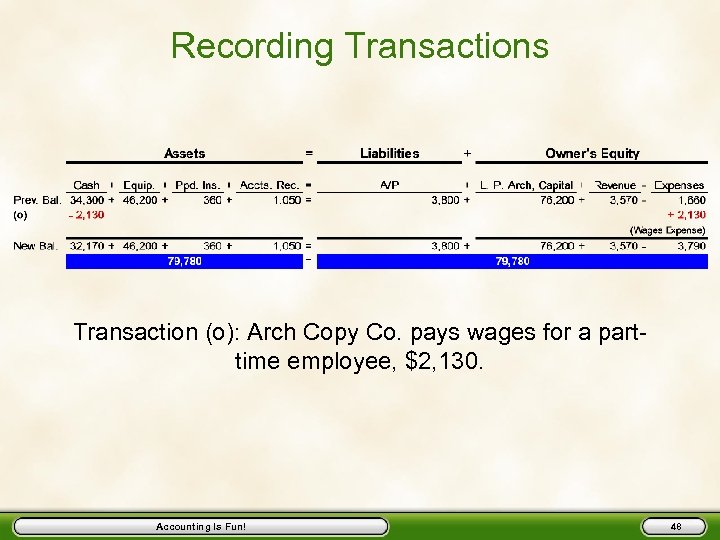

Recording Transactions Transaction (o): Arch Copy Co. pays wages for a parttime employee, $2, 130. Accounting Is Fun! 48

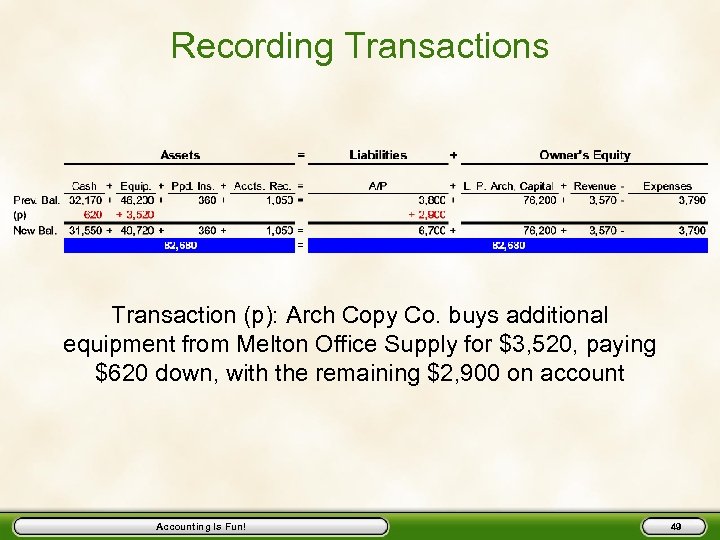

Recording Transactions Transaction (p): Arch Copy Co. buys additional equipment from Melton Office Supply for $3, 520, paying $620 down, with the remaining $2, 900 on account Accounting Is Fun! 49

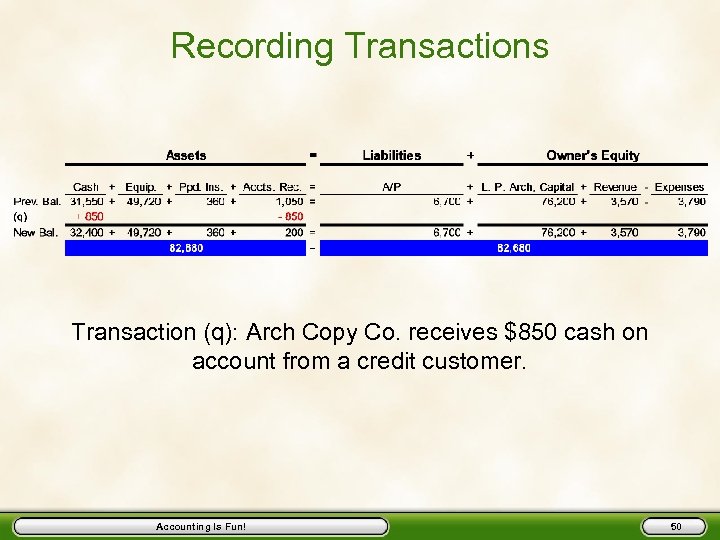

Recording Transactions Transaction (q): Arch Copy Co. receives $850 cash on account from a credit customer. Accounting Is Fun! 50

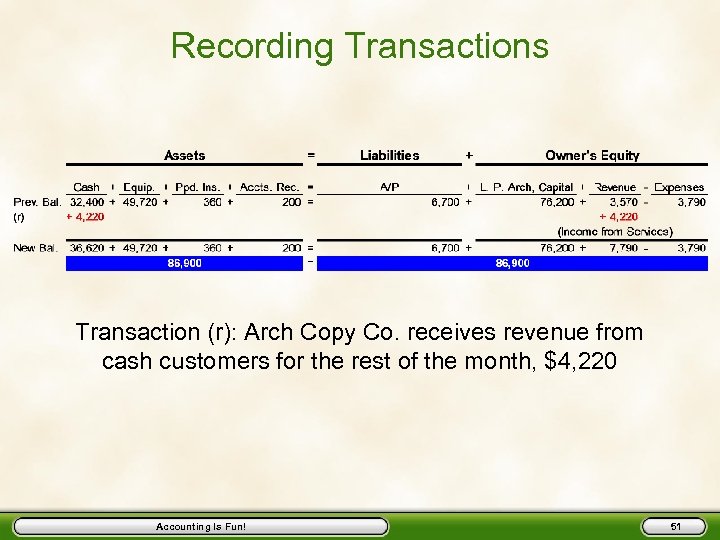

Recording Transactions Transaction (r): Arch Copy Co. receives revenue from cash customers for the rest of the month, $4, 220 Accounting Is Fun! 51

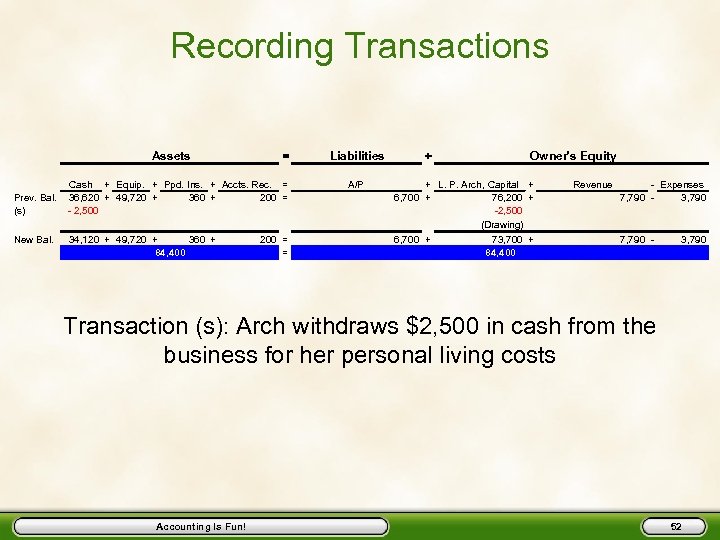

Recording Transactions Assets Prev. Bal. (s) New Bal. = Cash + Equip. + Ppd. Ins. + Accts. Rec. = 36, 620 + 49, 720 + 360 + 200 = - 2, 500 34, 120 + 49, 720 + 360 + 84, 400 200 = = Liabilities A/P + Owner's Equity + L. P. Arch, Capital + 6, 700 + 76, 200 + -2, 500 (Drawing) 6, 700 + 73, 700 + 84, 400 Revenue - Expenses 7, 790 3, 790 7, 790 - 3, 790 Transaction (s): Arch withdraws $2, 500 in cash from the business for her personal living costs Accounting Is Fun! 52

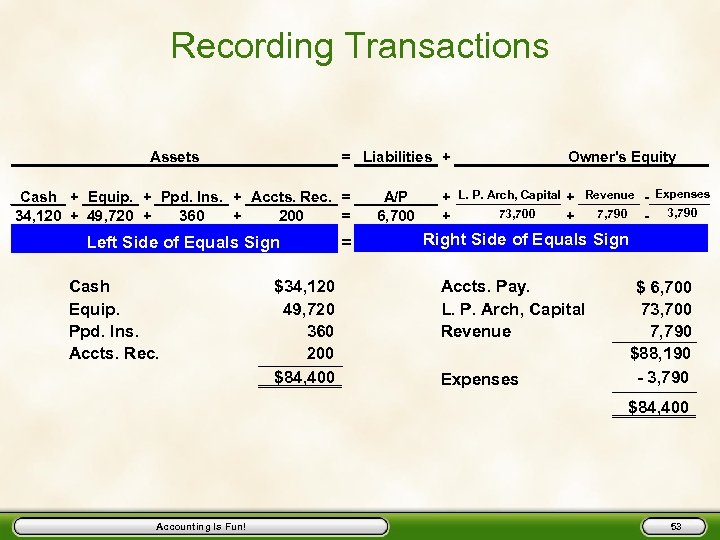

Recording Transactions Assets = Liabilities + Cash + Equip. + Ppd. Ins. + Accts. Rec. = 34, 120 + 49, 720 + 360 + 200 = Left Side of Equals Sign Cash Equip. Ppd. Ins. Accts. Rec. $34, 120 49, 720 360 200 $84, 400 = A/P 6, 700 + + Owner's Equity L. P. Arch, Capital 73, 700 + + Revenue 7, 790 - Expenses 3, 790 Right Side of Equals Sign Accts. Pay. L. P. Arch, Capital Revenue Expenses $ 6, 700 73, 700 7, 790 $88, 190 - 3, 790 $84, 400 Accounting Is Fun! 53

A = L + OE • Does this apply in our own everyday lives? • Buy a car? • Buy a house? Accounting Is Fun! 54

What is the essence of each side? A = L + OE Use of Cash Accounting Is Fun! Source of Cash 55

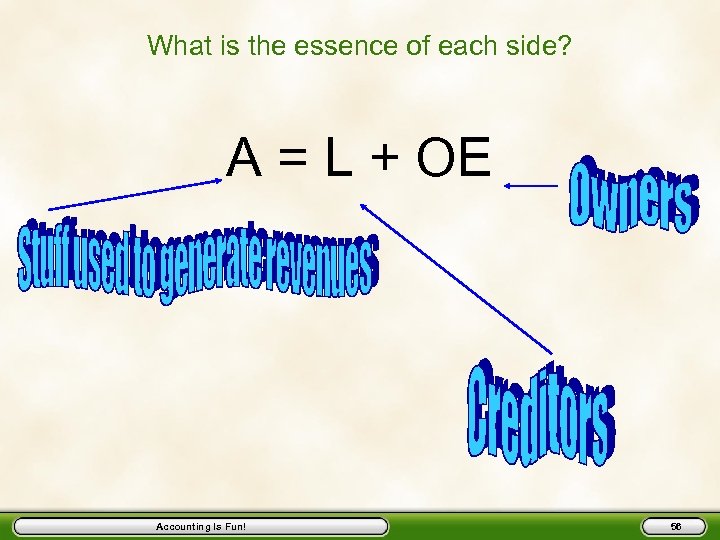

What is the essence of each side? A = L + OE Accounting Is Fun! 56

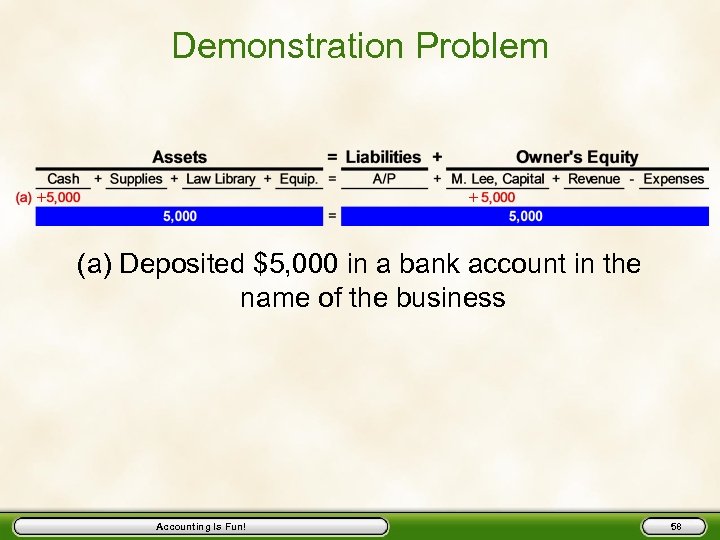

Demonstration Problem • We will be recording business transactions for a company with the following details: Owner name: Mai Lee Business name: Lee Attorneys Business type: Sole proprietorship (one-person business) Accounting Is Fun! 57

Demonstration Problem + + (a) Deposited $5, 000 in a bank account in the name of the business Accounting Is Fun! 58

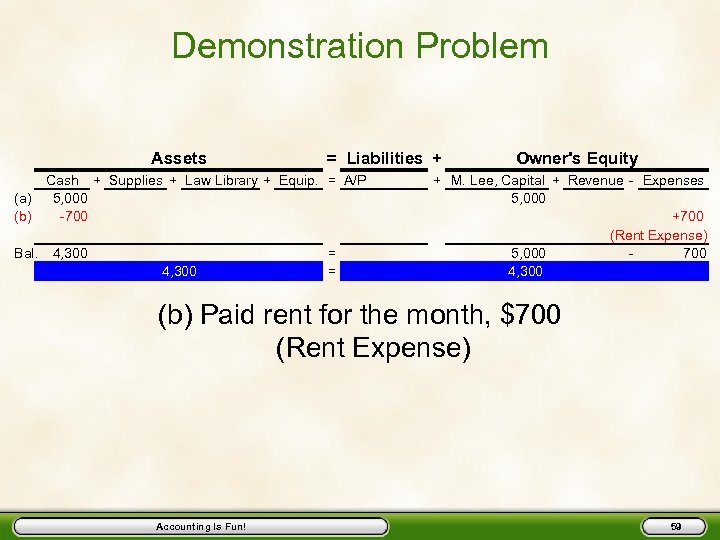

Demonstration Problem Assets (a) (b) Bal. = Liabilities + Cash + Supplies + Law Library + Equip. = A/P 5, 000 -700 4, 300 = = Owner's Equity + M. Lee, Capital + Revenue - Expenses 5, 000 +700 (Rent Expense) 5, 000 700 4, 300 (b) Paid rent for the month, $700 (Rent Expense) Accounting Is Fun! 59

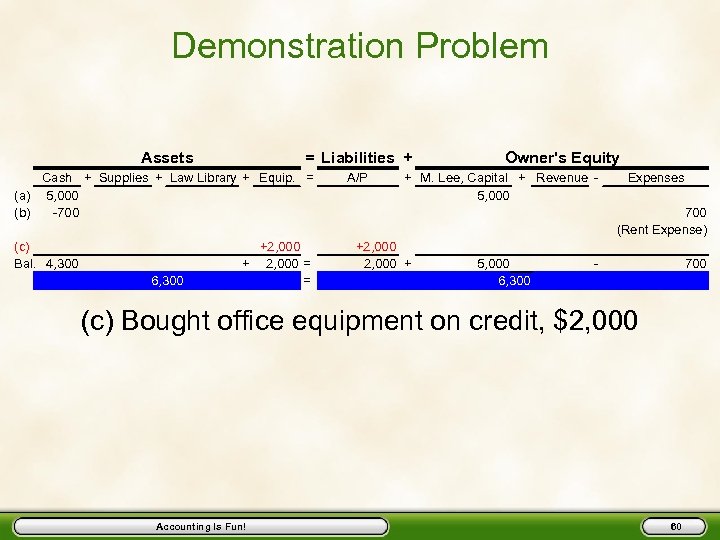

Demonstration Problem Assets = Liabilities + Cash + Supplies + Law Library + Equip. = (a) 5, 000 (b) -700 (c) Bal. 4, 300 6, 300 +2, 000 + 2, 000 = = A/P Owner's Equity + M. Lee, Capital + Revenue 5, 000 Expenses 700 (Rent Expense) +2, 000 + 5, 000 6, 300 - 700 (c) Bought office equipment on credit, $2, 000 Accounting Is Fun! 60

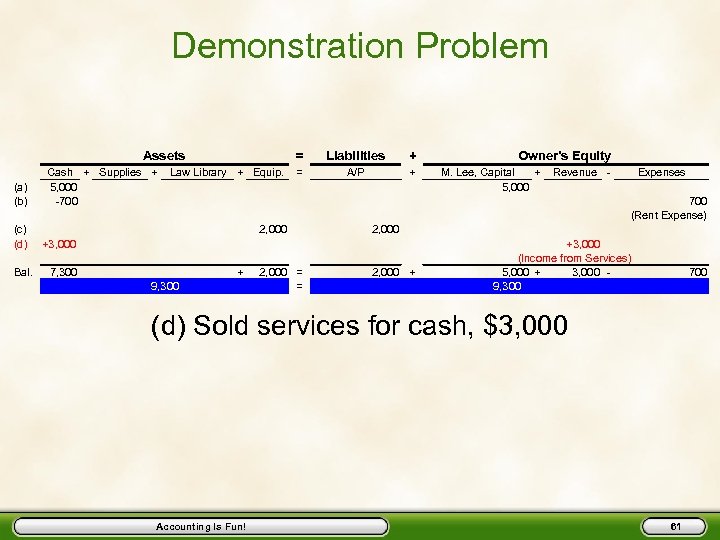

Demonstration Problem Assets (a) (b) (c) (d) Bal. Cash + Supplies + 5, 000 -700 = Law Library + Equip. Liabilities + = A/P + M. Lee, Capital + 5, 000 Revenue - Expenses 700 (Rent Expense) 2, 000 +3, 000 7, 300 Owner's Equity + 9, 300 2, 000 = = 2, 000 + +3, 000 (Income from Services) 5, 000 + 3, 000 9, 300 700 (d) Sold services for cash, $3, 000 Accounting Is Fun! 61

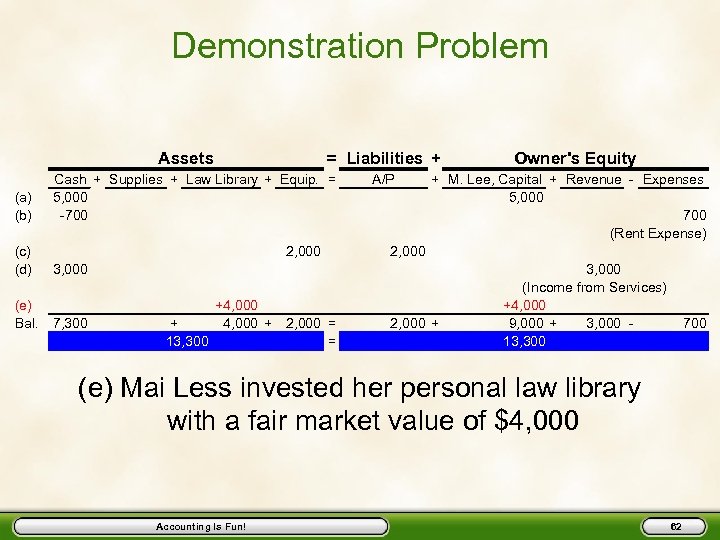

Demonstration Problem Assets (a) (b) (c) (d) (e) Bal. = Liabilities + Cash + Supplies + Law Library + Equip. = 5, 000 -700 2, 000 A/P + M. Lee, Capital + Revenue - Expenses 5, 000 700 (Rent Expense) 2, 000 3, 000 7, 300 + 13, 300 +4, 000 + 2, 000 = = Owner's Equity 2, 000 + 3, 000 (Income from Services) +4, 000 9, 000 + 3, 000 13, 300 700 (e) Mai Less invested her personal law library with a fair market value of $4, 000 Accounting Is Fun! 62

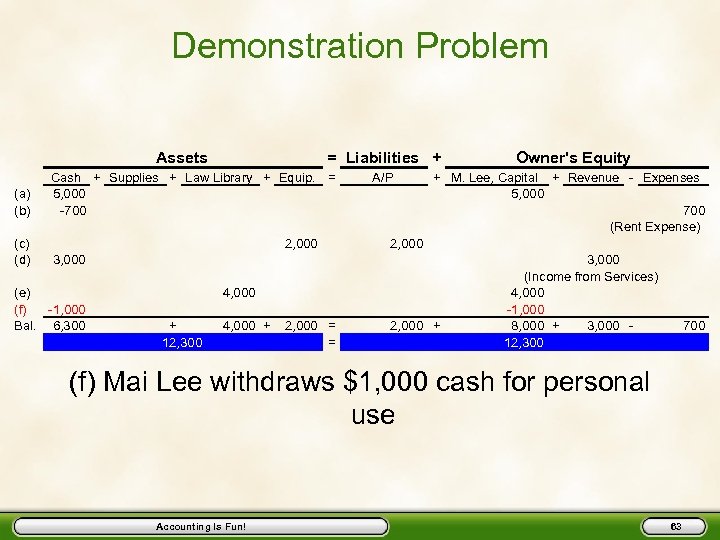

Demonstration Problem Assets (a) (b) (c) (d) = Liabilities + Cash + Supplies + Law Library + Equip. = 5, 000 -700 2, 000 A/P + M. Lee, Capital + Revenue - Expenses 5, 000 700 (Rent Expense) 2, 000 3, 000 (e) (f) -1, 000 Bal. 6, 300 4, 000 + 12, 300 4, 000 + 2, 000 = = Owner's Equity 2, 000 + 3, 000 (Income from Services) 4, 000 -1, 000 8, 000 + 3, 000 12, 300 700 (f) Mai Lee withdraws $1, 000 cash for personal use Accounting Is Fun! 63

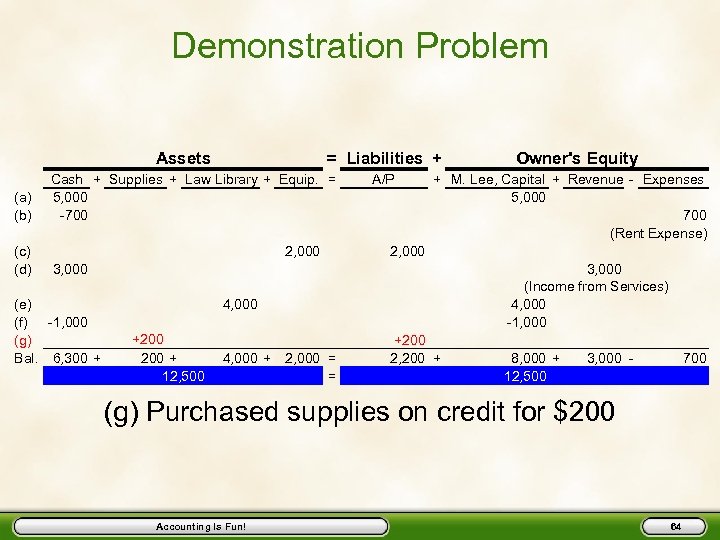

Demonstration Problem Assets (a) (b) (c) (d) = Liabilities + Cash + Supplies + Law Library + Equip. = 5, 000 -700 2, 000 A/P + M. Lee, Capital + Revenue - Expenses 5, 000 700 (Rent Expense) 2, 000 3, 000 (e) (f) -1, 000 (g) Bal. 6, 300 + 3, 000 (Income from Services) 4, 000 -1, 000 4, 000 +200 + 12, 500 4, 000 + Owner's Equity 2, 000 = = +200 2, 200 + 8, 000 + 12, 500 3, 000 - 700 (g) Purchased supplies on credit for $200 Accounting Is Fun! 64

4690379fc26b666f9359146f5a6477f1.ppt