bbaa72530f318ac5a3dc8937583748f6.ppt

- Количество слайдов: 51

CHAPTER M 6 Making Decisions Using Relevant Information © 2007 Pearson Custom Publishing 1

CHAPTER M 6 Making Decisions Using Relevant Information © 2007 Pearson Custom Publishing 1

Learning Objective 1: Identify the characteristics of a relevant cost. © 2007 Pearson Custom Publishing 2

Learning Objective 1: Identify the characteristics of a relevant cost. © 2007 Pearson Custom Publishing 2

Relevant Costing n Internal decision makers are faced with tough decisions on a regular basis. When faced with a financial decision, managers are often overwhelmed by a mountain of information. n Relevant costing is the process of determining which pieces of information are relevant to the decision at hand. © 2007 Pearson Custom Publishing 3

Relevant Costing n Internal decision makers are faced with tough decisions on a regular basis. When faced with a financial decision, managers are often overwhelmed by a mountain of information. n Relevant costing is the process of determining which pieces of information are relevant to the decision at hand. © 2007 Pearson Custom Publishing 3

Relevant Costs n Costs can be accumulated for any imaginable reason. Relevant costs are those costs (and revenues) that need to be considered because they have an impact on a particular decision. n A factor that is relevant to one manager may not be relevant to the next. A factor that is relevant to one decision may not be relevant to the next. © 2007 Pearson Custom Publishing 4

Relevant Costs n Costs can be accumulated for any imaginable reason. Relevant costs are those costs (and revenues) that need to be considered because they have an impact on a particular decision. n A factor that is relevant to one manager may not be relevant to the next. A factor that is relevant to one decision may not be relevant to the next. © 2007 Pearson Custom Publishing 4

Determining Relevant Costs n To be relevant to a management decision, information must possess BOTH of these characteristics: n it must be a future cost or revenue, and n it must differ between decision alternatives. n Reasoned decision makers use only relevant information when making an economic decision. © 2007 Pearson Custom Publishing 5

Determining Relevant Costs n To be relevant to a management decision, information must possess BOTH of these characteristics: n it must be a future cost or revenue, and n it must differ between decision alternatives. n Reasoned decision makers use only relevant information when making an economic decision. © 2007 Pearson Custom Publishing 5

Learning Objective 2: Explain why sunk costs and costs that do not differ between alternatives are irrelevant costs. © 2007 Pearson Custom Publishing 6

Learning Objective 2: Explain why sunk costs and costs that do not differ between alternatives are irrelevant costs. © 2007 Pearson Custom Publishing 6

Sunk Cost n A sunk cost is a past cost that cannot be changed by current or future actions. n Examples of sunk costs: n Equipment, land, or buildings purchased in the past n Equipment leased on a long-term lease n New vehicle purchased and used n One-year old computer equipment © 2007 Pearson Custom Publishing 7

Sunk Cost n A sunk cost is a past cost that cannot be changed by current or future actions. n Examples of sunk costs: n Equipment, land, or buildings purchased in the past n Equipment leased on a long-term lease n New vehicle purchased and used n One-year old computer equipment © 2007 Pearson Custom Publishing 7

Irrelevant Information n We should identify irrelevant information and NOT use it in our analysis. Irrelevant information possesses either of the following characteristics: n it is a sunk cost or revenue, or n it does not differ between alternatives. n A manager should filter out all irrelevant information before making a decision. © 2007 Pearson Custom Publishing 8

Irrelevant Information n We should identify irrelevant information and NOT use it in our analysis. Irrelevant information possesses either of the following characteristics: n it is a sunk cost or revenue, or n it does not differ between alternatives. n A manager should filter out all irrelevant information before making a decision. © 2007 Pearson Custom Publishing 8

Learning Objective 3: Describe the qualitative factors that should be considered when making a business decision. © 2007 Pearson Custom Publishing 9

Learning Objective 3: Describe the qualitative factors that should be considered when making a business decision. © 2007 Pearson Custom Publishing 9

Quantitative or Qualitative Factors? n Quantitative factors can be expressed as a number. Qualitative factors cannot be expressed numerically and must be described in words. n Most management decisions require the consideration of both quantitative and qualitative factors. © 2007 Pearson Custom Publishing 10

Quantitative or Qualitative Factors? n Quantitative factors can be expressed as a number. Qualitative factors cannot be expressed numerically and must be described in words. n Most management decisions require the consideration of both quantitative and qualitative factors. © 2007 Pearson Custom Publishing 10

Quantitative or Qualitative Factors? n Consider that management wants to purchase a new copier. n Quantitative factors include: n Cost of the machine n Cost of machine maintenance n Cost per copy of supplies n Qualitative factors include: n Ease of operation n Quality of copies made n Change in environment for users (noise, heat, etc. ) © 2007 Pearson Custom Publishing 11

Quantitative or Qualitative Factors? n Consider that management wants to purchase a new copier. n Quantitative factors include: n Cost of the machine n Cost of machine maintenance n Cost per copy of supplies n Qualitative factors include: n Ease of operation n Quality of copies made n Change in environment for users (noise, heat, etc. ) © 2007 Pearson Custom Publishing 11

Learning Objective 4: Use accounting information and determine the relevant cost of various decisions. © 2007 Pearson Custom Publishing 12

Learning Objective 4: Use accounting information and determine the relevant cost of various decisions. © 2007 Pearson Custom Publishing 12

Relevant Cost Decision Making n When making a relevant cost decision, follow these steps in the process: Gather all costs associated with the decision. n Determine the relevant cost of each alternative. n Compare relevant costs and select an alternative. n © 2007 Pearson Custom Publishing 13

Relevant Cost Decision Making n When making a relevant cost decision, follow these steps in the process: Gather all costs associated with the decision. n Determine the relevant cost of each alternative. n Compare relevant costs and select an alternative. n © 2007 Pearson Custom Publishing 13

Equipment Replacement n Managers are often faced with the decision to replace equipment or other long-term assets. This is actually a complicated decision with many uncontrollable factors, such as the rate of technological change. n We will look at the basics of the replacement decision from a relevant cost perspective. © 2007 Pearson Custom Publishing 14

Equipment Replacement n Managers are often faced with the decision to replace equipment or other long-term assets. This is actually a complicated decision with many uncontrollable factors, such as the rate of technological change. n We will look at the basics of the replacement decision from a relevant cost perspective. © 2007 Pearson Custom Publishing 14

Associated Costs n We need to gather all relevant costs related to the equipment replacement decision. Any differential costs to be incurred in the future would be relevant. Possible examples include start-up costs, operating costs, and shutdown costs. n Irrelevant costs will include the original and current book values of the old equipment, and all depreciation charges. © 2007 Pearson Custom Publishing 15

Associated Costs n We need to gather all relevant costs related to the equipment replacement decision. Any differential costs to be incurred in the future would be relevant. Possible examples include start-up costs, operating costs, and shutdown costs. n Irrelevant costs will include the original and current book values of the old equipment, and all depreciation charges. © 2007 Pearson Custom Publishing 15

Replacement Example n Company AYZ is considering the replacement of an old computer system with a new one. One qualitative factor to consider is the fact that the new computer will allow them to do various new computing tasks not possible with the old computer. n Let’s review the quantitative information. © 2007 Pearson Custom Publishing 16

Replacement Example n Company AYZ is considering the replacement of an old computer system with a new one. One qualitative factor to consider is the fact that the new computer will allow them to do various new computing tasks not possible with the old computer. n Let’s review the quantitative information. © 2007 Pearson Custom Publishing 16

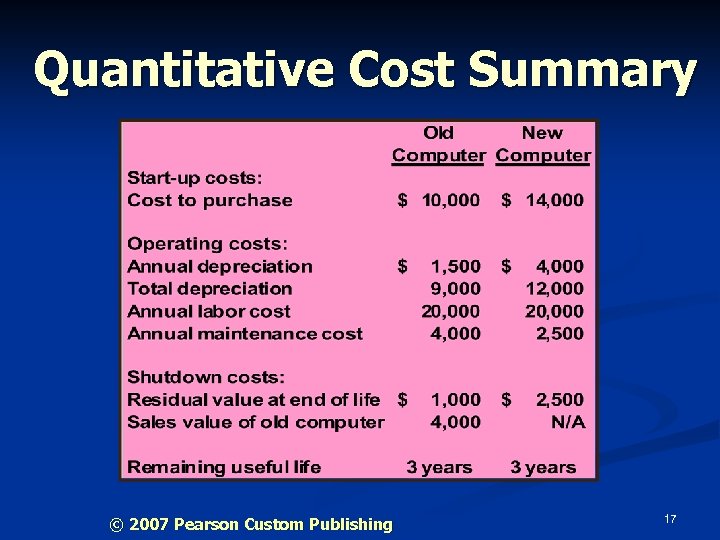

Quantitative Cost Summary © 2007 Pearson Custom Publishing 17

Quantitative Cost Summary © 2007 Pearson Custom Publishing 17

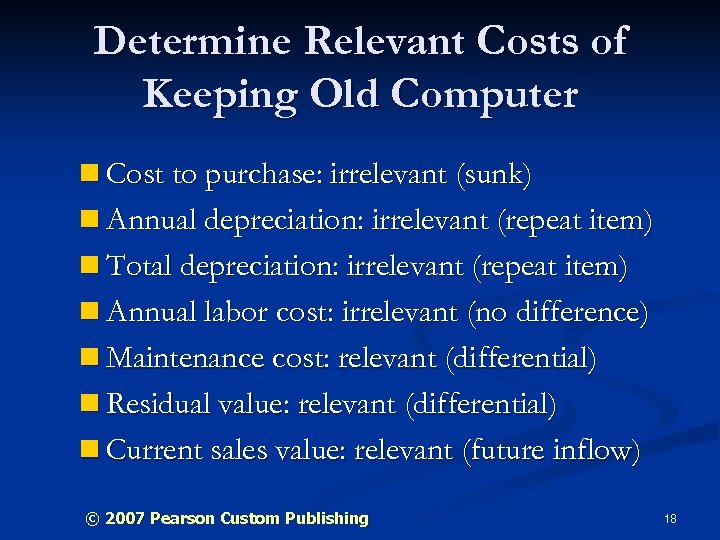

Determine Relevant Costs of Keeping Old Computer n Cost to purchase: irrelevant (sunk) n Annual depreciation: irrelevant (repeat item) n Total depreciation: irrelevant (repeat item) n Annual labor cost: irrelevant (no difference) n Maintenance cost: relevant (differential) n Residual value: relevant (differential) n Current sales value: relevant (future inflow) © 2007 Pearson Custom Publishing 18

Determine Relevant Costs of Keeping Old Computer n Cost to purchase: irrelevant (sunk) n Annual depreciation: irrelevant (repeat item) n Total depreciation: irrelevant (repeat item) n Annual labor cost: irrelevant (no difference) n Maintenance cost: relevant (differential) n Residual value: relevant (differential) n Current sales value: relevant (future inflow) © 2007 Pearson Custom Publishing 18

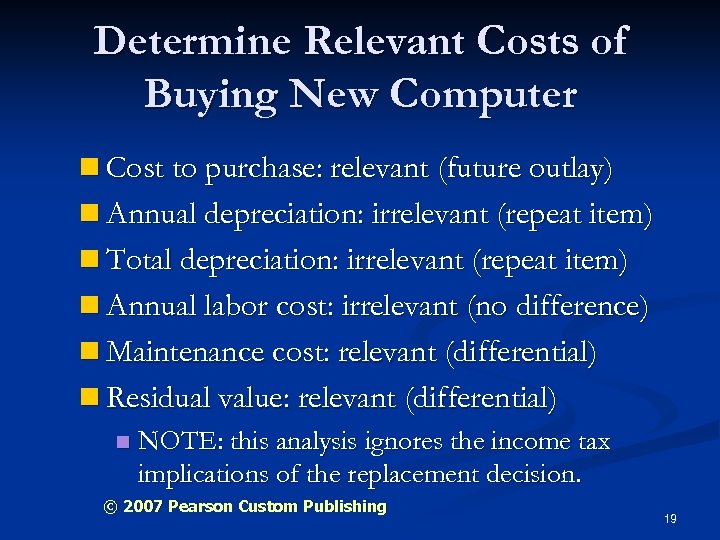

Determine Relevant Costs of Buying New Computer n Cost to purchase: relevant (future outlay) n Annual depreciation: irrelevant (repeat item) n Total depreciation: irrelevant (repeat item) n Annual labor cost: irrelevant (no difference) n Maintenance cost: relevant (differential) n Residual value: relevant (differential) n NOTE: this analysis ignores the income tax implications of the replacement decision. © 2007 Pearson Custom Publishing 19

Determine Relevant Costs of Buying New Computer n Cost to purchase: relevant (future outlay) n Annual depreciation: irrelevant (repeat item) n Total depreciation: irrelevant (repeat item) n Annual labor cost: irrelevant (no difference) n Maintenance cost: relevant (differential) n Residual value: relevant (differential) n NOTE: this analysis ignores the income tax implications of the replacement decision. © 2007 Pearson Custom Publishing 19

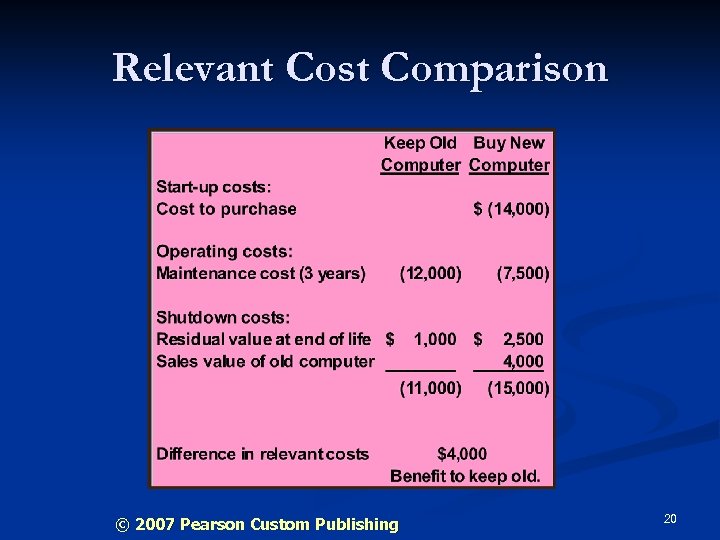

Relevant Cost Comparison © 2007 Pearson Custom Publishing 20

Relevant Cost Comparison © 2007 Pearson Custom Publishing 20

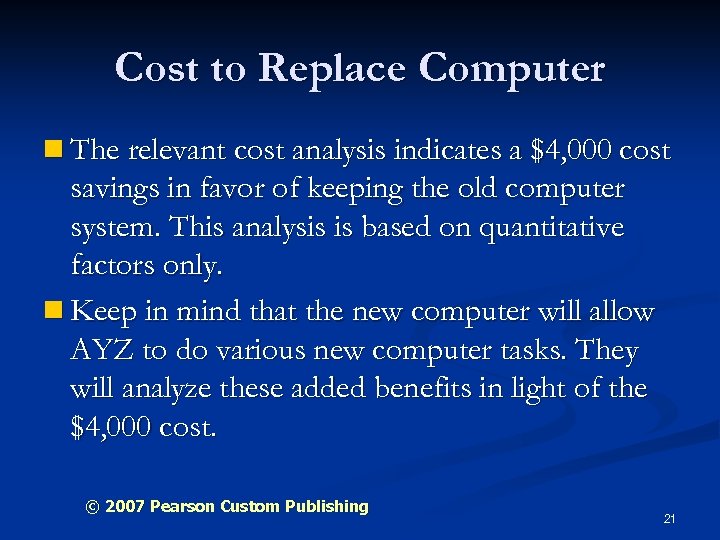

Cost to Replace Computer n The relevant cost analysis indicates a $4, 000 cost savings in favor of keeping the old computer system. This analysis is based on quantitative factors only. n Keep in mind that the new computer will allow AYZ to do various new computer tasks. They will analyze these added benefits in light of the $4, 000 cost. © 2007 Pearson Custom Publishing 21

Cost to Replace Computer n The relevant cost analysis indicates a $4, 000 cost savings in favor of keeping the old computer system. This analysis is based on quantitative factors only. n Keep in mind that the new computer will allow AYZ to do various new computer tasks. They will analyze these added benefits in light of the $4, 000 cost. © 2007 Pearson Custom Publishing 21

Discussion Questions n Consider a slightly different computer replacement decision. Would your analysis change if you had purchased the old computer one year ago instead of six years ago? n Would your analysis change if you bought the old computer one month ago? What about one week ago? © 2007 Pearson Custom Publishing 22

Discussion Questions n Consider a slightly different computer replacement decision. Would your analysis change if you had purchased the old computer one year ago instead of six years ago? n Would your analysis change if you bought the old computer one month ago? What about one week ago? © 2007 Pearson Custom Publishing 22

Time Value of Money n Whenever long-term cash flows are being considered, the time value of money be should factored into the analysis. We will consider this factor in the next chapter. n The time value of money recognizes that a dollar received or spent in the future is not equal to a dollar received or spent today. © 2007 Pearson Custom Publishing 23

Time Value of Money n Whenever long-term cash flows are being considered, the time value of money be should factored into the analysis. We will consider this factor in the next chapter. n The time value of money recognizes that a dollar received or spent in the future is not equal to a dollar received or spent today. © 2007 Pearson Custom Publishing 23

Special Order Decisions n A manufacturing company is sometimes presented with a special order. an order Such usually includes a discounted price for the items being ordered. n The manufacturer must decide whether to accept or reject the special order. © 2007 Pearson Custom Publishing 24

Special Order Decisions n A manufacturing company is sometimes presented with a special order. an order Such usually includes a discounted price for the items being ordered. n The manufacturer must decide whether to accept or reject the special order. © 2007 Pearson Custom Publishing 24

Special Order Factors to Consider n Quantitative factors to consider include: n relevant manufacturing costs of the items, n relevant selling/distribution costs of the items, n selling price to be paid by the customer, and n impact (if any) on regular sales volume. n Qualitative factors may include the effect on the workforce (avoid layoffs? ), competitive considerations, and prospects of future deals. © 2007 Pearson Custom Publishing 25

Special Order Factors to Consider n Quantitative factors to consider include: n relevant manufacturing costs of the items, n relevant selling/distribution costs of the items, n selling price to be paid by the customer, and n impact (if any) on regular sales volume. n Qualitative factors may include the effect on the workforce (avoid layoffs? ), competitive considerations, and prospects of future deals. © 2007 Pearson Custom Publishing 25

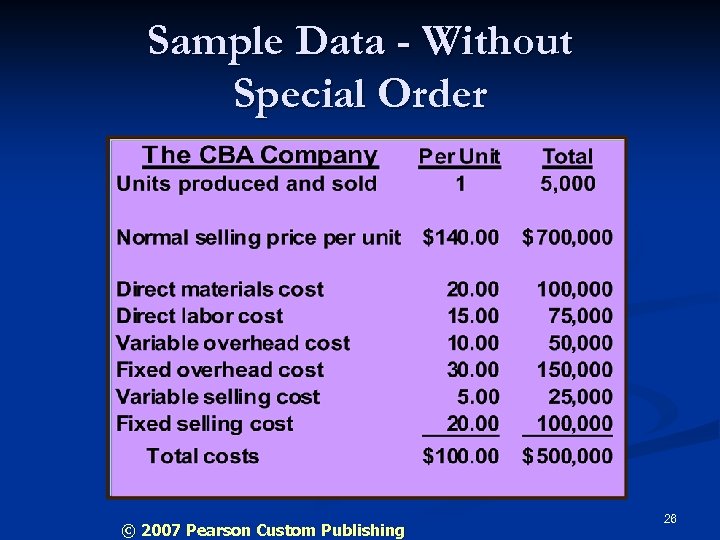

Sample Data - Without Special Order © 2007 Pearson Custom Publishing 26

Sample Data - Without Special Order © 2007 Pearson Custom Publishing 26

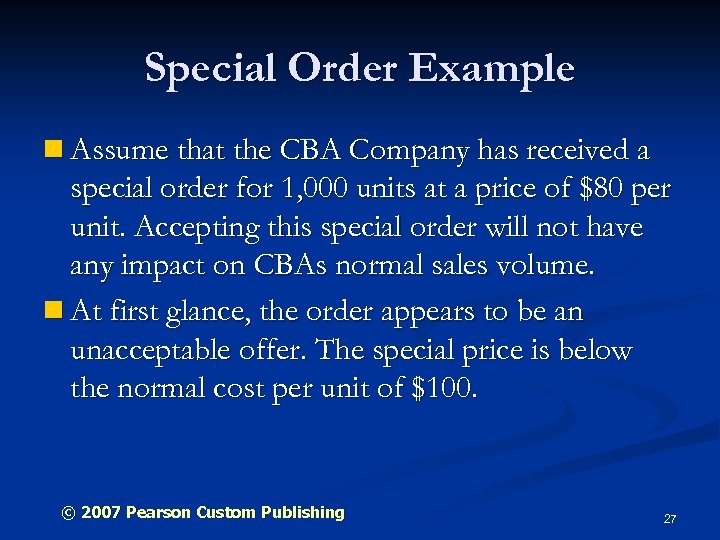

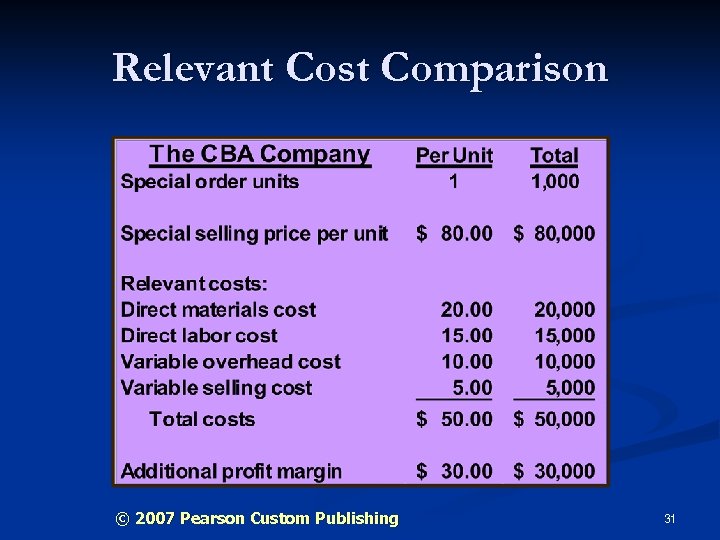

Special Order Example n Assume that the CBA Company has received a special order for 1, 000 units at a price of $80 per unit. Accepting this special order will not have any impact on CBAs normal sales volume. n At first glance, the order appears to be an unacceptable offer. The special price is below the normal cost per unit of $100. © 2007 Pearson Custom Publishing 27

Special Order Example n Assume that the CBA Company has received a special order for 1, 000 units at a price of $80 per unit. Accepting this special order will not have any impact on CBAs normal sales volume. n At first glance, the order appears to be an unacceptable offer. The special price is below the normal cost per unit of $100. © 2007 Pearson Custom Publishing 27

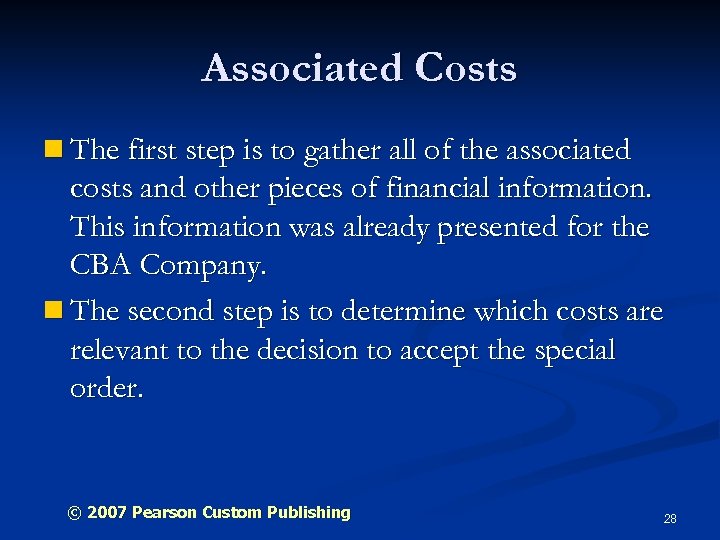

Associated Costs n The first step is to gather all of the associated costs and other pieces of financial information. This information was already presented for the CBA Company. n The second step is to determine which costs are relevant to the decision to accept the special order. © 2007 Pearson Custom Publishing 28

Associated Costs n The first step is to gather all of the associated costs and other pieces of financial information. This information was already presented for the CBA Company. n The second step is to determine which costs are relevant to the decision to accept the special order. © 2007 Pearson Custom Publishing 28

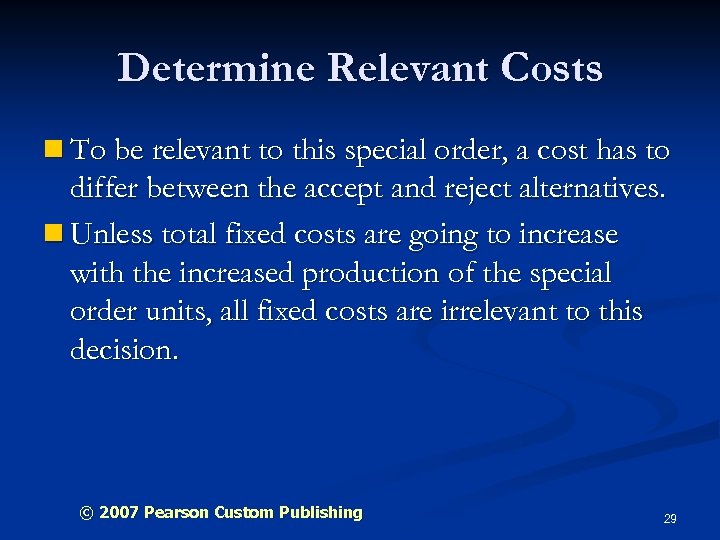

Determine Relevant Costs n To be relevant to this special order, a cost has to differ between the accept and reject alternatives. n Unless total fixed costs are going to increase with the increased production of the special order units, all fixed costs are irrelevant to this decision. © 2007 Pearson Custom Publishing 29

Determine Relevant Costs n To be relevant to this special order, a cost has to differ between the accept and reject alternatives. n Unless total fixed costs are going to increase with the increased production of the special order units, all fixed costs are irrelevant to this decision. © 2007 Pearson Custom Publishing 29

Determine Relevant Costs n Unless stated otherwise, all variable costs will be relevant to accepting the order. n By definition, total variable costs increase as volume increases. Thus, there will be 1, 000 additional units manufactured and sold during this period, with a proportionate increase in the amount of variable costs incurred. © 2007 Pearson Custom Publishing 30

Determine Relevant Costs n Unless stated otherwise, all variable costs will be relevant to accepting the order. n By definition, total variable costs increase as volume increases. Thus, there will be 1, 000 additional units manufactured and sold during this period, with a proportionate increase in the amount of variable costs incurred. © 2007 Pearson Custom Publishing 30

Relevant Cost Comparison © 2007 Pearson Custom Publishing 31

Relevant Cost Comparison © 2007 Pearson Custom Publishing 31

Special Order Final Analysis n Although the special order price is below the normal full cost per unit, the CBA Company can experience a $30, 000 increase in operating profit this period by accepting the special order. n In some special order situations, the variable selling costs might not be relevant if they will be avoided on the extra units. © 2007 Pearson Custom Publishing 32

Special Order Final Analysis n Although the special order price is below the normal full cost per unit, the CBA Company can experience a $30, 000 increase in operating profit this period by accepting the special order. n In some special order situations, the variable selling costs might not be relevant if they will be avoided on the extra units. © 2007 Pearson Custom Publishing 32

Discussion Questions n Can you give an example of a situation where accepting a special order could have a negative impact on your regular sales volume? n Can you give an example of a situation where the variable selling costs would not be relevant to a special order decision? © 2007 Pearson Custom Publishing 33

Discussion Questions n Can you give an example of a situation where accepting a special order could have a negative impact on your regular sales volume? n Can you give an example of a situation where the variable selling costs would not be relevant to a special order decision? © 2007 Pearson Custom Publishing 33

Make or Buy Decision n Some companies purchase certain products or parts instead of manufacturing them. Each product or part represents a separate make or buy decision. n When a company chooses to purchase a service, product, or part from an outside vendor, it is called outsourcing. © 2007 Pearson Custom Publishing 34

Make or Buy Decision n Some companies purchase certain products or parts instead of manufacturing them. Each product or part represents a separate make or buy decision. n When a company chooses to purchase a service, product, or part from an outside vendor, it is called outsourcing. © 2007 Pearson Custom Publishing 34

Associated Costs n We first need to gather information about all related costs. This includes all costs to manufacture the item as well as the cost to purchase the item. n Other obvious considerations include control over the quality of the product, and availability of the item in the quantities needed on a timely basis. © 2007 Pearson Custom Publishing 35

Associated Costs n We first need to gather information about all related costs. This includes all costs to manufacture the item as well as the cost to purchase the item. n Other obvious considerations include control over the quality of the product, and availability of the item in the quantities needed on a timely basis. © 2007 Pearson Custom Publishing 35

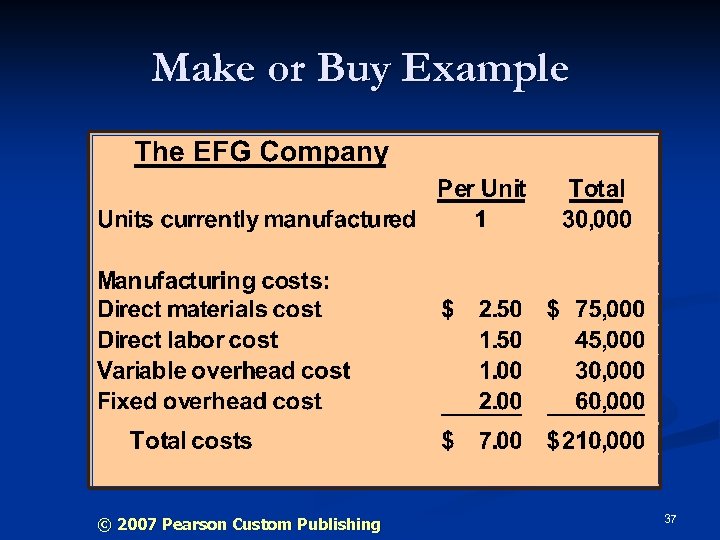

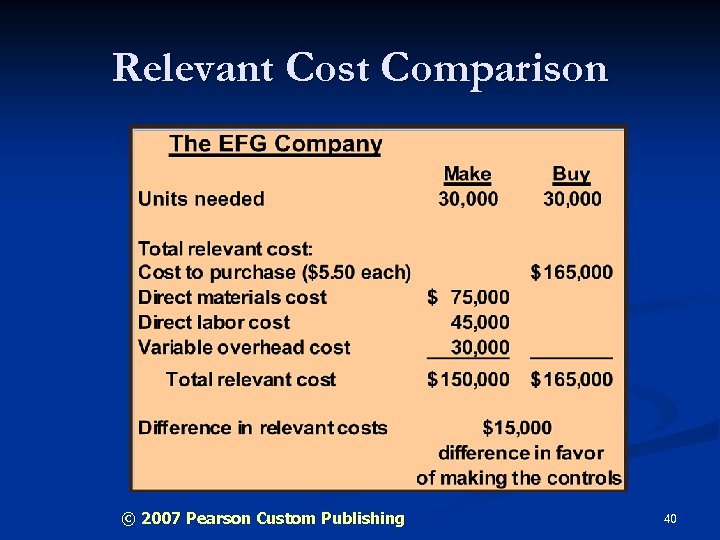

Make or Buy Example n The EFG Company currently manufactures all of the parts used in the production of remote control toy cars. n They have been approached by another company that has offered to supply the remote control device at a cost of $5. 50 per unit. Quality and availability of the controls is not an issue. © 2007 Pearson Custom Publishing 36

Make or Buy Example n The EFG Company currently manufactures all of the parts used in the production of remote control toy cars. n They have been approached by another company that has offered to supply the remote control device at a cost of $5. 50 per unit. Quality and availability of the controls is not an issue. © 2007 Pearson Custom Publishing 36

Make or Buy Example © 2007 Pearson Custom Publishing 37

Make or Buy Example © 2007 Pearson Custom Publishing 37

Determine Relevant Costs n Relevant costs for the “make” alternative include only those future, differential production costs. By definition, all future variable production costs will be relevant. n Fixed production costs stay constant in total regardless of the amount of production activity. Therefore, the fixed overhead cost allocated to this unit is irrelevant. © 2007 Pearson Custom Publishing 38

Determine Relevant Costs n Relevant costs for the “make” alternative include only those future, differential production costs. By definition, all future variable production costs will be relevant. n Fixed production costs stay constant in total regardless of the amount of production activity. Therefore, the fixed overhead cost allocated to this unit is irrelevant. © 2007 Pearson Custom Publishing 38

Determine Relevant Costs n The relevant costs of the “buy” alternative are easy to determine. If the supplier charges $5. 50 per unit, and if there are no “hidden” or additional charges, then that amount represents the only relevant cost to buy the controls. © 2007 Pearson Custom Publishing 39

Determine Relevant Costs n The relevant costs of the “buy” alternative are easy to determine. If the supplier charges $5. 50 per unit, and if there are no “hidden” or additional charges, then that amount represents the only relevant cost to buy the controls. © 2007 Pearson Custom Publishing 39

Relevant Cost Comparison © 2007 Pearson Custom Publishing 40

Relevant Cost Comparison © 2007 Pearson Custom Publishing 40

Changes in Fixed Costs n In some situations, there may be some fixed manufacturing costs that are relevant. n It is possible that there could be an increase in the total fixed overhead costs if a special order was accepted. n It is also possible that total fixed costs could decrease if we purchased rather than manufactured a particular item. © 2007 Pearson Custom Publishing 41

Changes in Fixed Costs n In some situations, there may be some fixed manufacturing costs that are relevant. n It is possible that there could be an increase in the total fixed overhead costs if a special order was accepted. n It is also possible that total fixed costs could decrease if we purchased rather than manufactured a particular item. © 2007 Pearson Custom Publishing 41

Changes in Fixed Costs n Let’s continue with the make or buy example and add one more fact. Assume that the EFG Company would experience a $20, 000 reduction in their fixed overhead costs if they started to buy the remote controls from the outside vendor. n This amount of fixed cost is now relevant since it is a future differential cost. © 2007 Pearson Custom Publishing 42

Changes in Fixed Costs n Let’s continue with the make or buy example and add one more fact. Assume that the EFG Company would experience a $20, 000 reduction in their fixed overhead costs if they started to buy the remote controls from the outside vendor. n This amount of fixed cost is now relevant since it is a future differential cost. © 2007 Pearson Custom Publishing 42

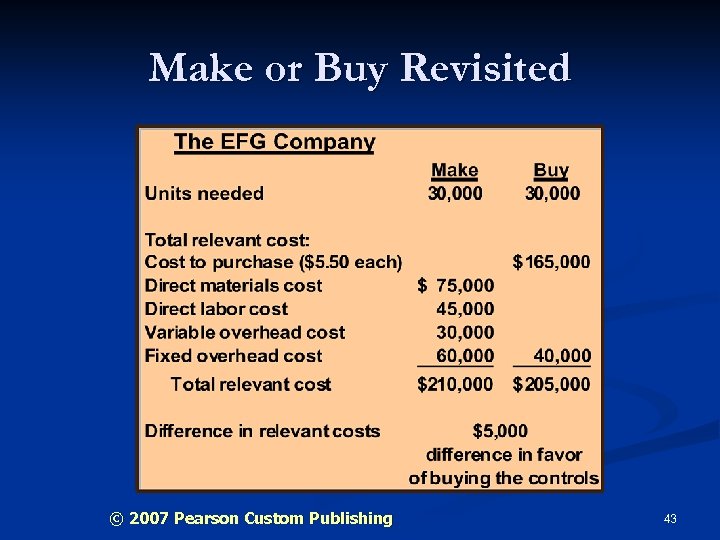

Make or Buy Revisited © 2007 Pearson Custom Publishing 43

Make or Buy Revisited © 2007 Pearson Custom Publishing 43

Learning Objective 5: Explain the effects of fixed costs and opportunity costs on outsourcing decisions. © 2007 Pearson Custom Publishing 44

Learning Objective 5: Explain the effects of fixed costs and opportunity costs on outsourcing decisions. © 2007 Pearson Custom Publishing 44

Opportunity Costs n An opportunity cost is something of value that is given up when one alternative is chosen over another. n There is usually an opportunity cost involved when faced with a make or buy decision. If we choose not to make an item, those productive resources can usually be put to a profitable alternative use. © 2007 Pearson Custom Publishing 45

Opportunity Costs n An opportunity cost is something of value that is given up when one alternative is chosen over another. n There is usually an opportunity cost involved when faced with a make or buy decision. If we choose not to make an item, those productive resources can usually be put to a profitable alternative use. © 2007 Pearson Custom Publishing 45

Opportunity Cost Example n Assume that if the EFG Company purchases the remote controls from the outside vendor, they could use the released production capacity to make remote control boats. n The boats would use the same remote control (which the vendor would supply), and should not cause a reduction in the sales of the remote control cars. © 2007 Pearson Custom Publishing 46

Opportunity Cost Example n Assume that if the EFG Company purchases the remote controls from the outside vendor, they could use the released production capacity to make remote control boats. n The boats would use the same remote control (which the vendor would supply), and should not cause a reduction in the sales of the remote control cars. © 2007 Pearson Custom Publishing 46

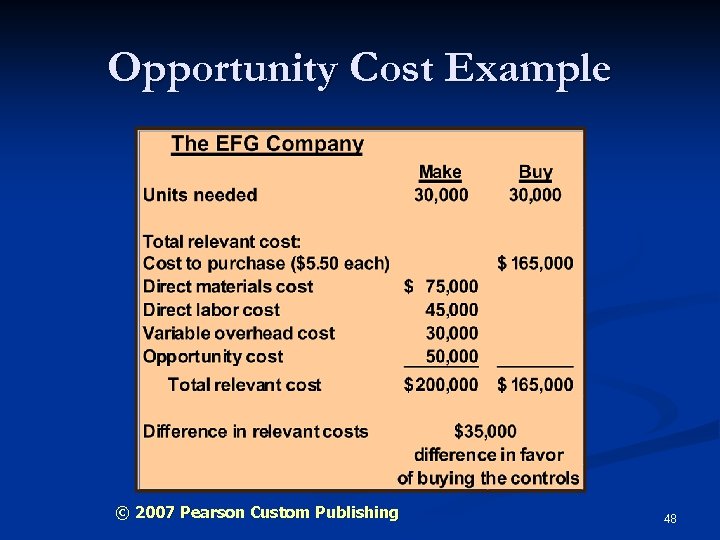

Opportunity Cost Example n Let’s return to the original make or buy decision, where there was no change in the fixed overhead costs. n Assume that the sales of the remote control boats would result in a contribution margin of $10 per boat. Estimated sales of remote control boats are 5, 000 units period. © 2007 Pearson Custom Publishing 47

Opportunity Cost Example n Let’s return to the original make or buy decision, where there was no change in the fixed overhead costs. n Assume that the sales of the remote control boats would result in a contribution margin of $10 per boat. Estimated sales of remote control boats are 5, 000 units period. © 2007 Pearson Custom Publishing 47

Opportunity Cost Example © 2007 Pearson Custom Publishing 48

Opportunity Cost Example © 2007 Pearson Custom Publishing 48

Opportunity Cost Analysis n The $50, 000 opportunity cost is added to the relevant cost of the make decision. n If they make the controls, they are unable to make the boats and unable to realize the increased profits from the boat sales. n Without the opportunity cost, the choice is to make the units. With the opportunity cost, the choice is to buy the units. © 2007 Pearson Custom Publishing 49

Opportunity Cost Analysis n The $50, 000 opportunity cost is added to the relevant cost of the make decision. n If they make the controls, they are unable to make the boats and unable to realize the increased profits from the boat sales. n Without the opportunity cost, the choice is to make the units. With the opportunity cost, the choice is to buy the units. © 2007 Pearson Custom Publishing 49

Discussion Questions n Analyze your dinner plans for tonight as a make or buy decision. What are the relevant costs of making a hamburger meal at home versus the cost of buying a hamburger meal at a restaurant? n What are some of the qualitative factors that you would consider in this decision? © 2007 Pearson Custom Publishing 50

Discussion Questions n Analyze your dinner plans for tonight as a make or buy decision. What are the relevant costs of making a hamburger meal at home versus the cost of buying a hamburger meal at a restaurant? n What are some of the qualitative factors that you would consider in this decision? © 2007 Pearson Custom Publishing 50

The End of Chapter M 6 © 2007 Pearson Custom Publishing 51

The End of Chapter M 6 © 2007 Pearson Custom Publishing 51