6d44410c1d28b6d7d3f522143f139791.ppt

- Количество слайдов: 25

CHAPTER FIFTEEN THE ROLE OF DERIVATIVE ASSETS © 2001 South-Western College Publishing

CHAPTER FIFTEEN THE ROLE OF DERIVATIVE ASSETS © 2001 South-Western College Publishing

Outline u Background u u u The Rationale for Derivative Assets Uses of Derivatives The Options Market u u u Options Terminology The Financial Page Listing The Origin of an Option The Role of the Options Clearing Corporation Standardized Option Characteristics 2

Outline u Background u u u The Rationale for Derivative Assets Uses of Derivatives The Options Market u u u Options Terminology The Financial Page Listing The Origin of an Option The Role of the Options Clearing Corporation Standardized Option Characteristics 2

Outline u The Futures Market u u u Futures vs. Options Market Participants Keeping the Promise Categories of Futures Contracts Financial Futures u u u Stock Index Futures Interest Rate Futures Foreign Currency Futures 3

Outline u The Futures Market u u u Futures vs. Options Market Participants Keeping the Promise Categories of Futures Contracts Financial Futures u u u Stock Index Futures Interest Rate Futures Foreign Currency Futures 3

Outline u Derivative Assets and the News u u u Current Events Risk of Derivative Assets Listed vs. Over-the-Counter Derivatives 4

Outline u Derivative Assets and the News u u u Current Events Risk of Derivative Assets Listed vs. Over-the-Counter Derivatives 4

Background : The Rationale for Derivative Assets u The first organized derivatives exchange in the United States was developed in order to bring stability to agricultural prices, by enabling farmers to eliminate or reduce their price risk. 5

Background : The Rationale for Derivative Assets u The first organized derivatives exchange in the United States was developed in order to bring stability to agricultural prices, by enabling farmers to eliminate or reduce their price risk. 5

Background : Uses of Derivatives u Risk management : The equity manager’s market risk or the bond manager’s interest rate risk is analogous to the farmer’s price risk. u Risk transfer : Derivatives provide a means for risk to be transferred from one person to some other market participant who, for a price, is willing to bear it. u Derivatives may provide financial leverage. 6

Background : Uses of Derivatives u Risk management : The equity manager’s market risk or the bond manager’s interest rate risk is analogous to the farmer’s price risk. u Risk transfer : Derivatives provide a means for risk to be transferred from one person to some other market participant who, for a price, is willing to bear it. u Derivatives may provide financial leverage. 6

Background : Uses of Derivatives u Income generation : Some people use derivatives as a means of generating additional income from their investment portfolio. u Financial engineering : Derivatives can be stable or volatile depending on how they are combined with other assets. u What’s next? 7

Background : Uses of Derivatives u Income generation : Some people use derivatives as a means of generating additional income from their investment portfolio. u Financial engineering : Derivatives can be stable or volatile depending on how they are combined with other assets. u What’s next? 7

Options Terminology u A call option gives its owner the right to buy a specified quantity of the underlying asset at a set price within a set time period. u A put option gives its owner the right to sell a specified quantity of the underlying asset at a set price within a set time period. u The set price is called the striking price or exercise price, and the last day the option is valid is called the expiration date. u The price of the option is the premium. 8

Options Terminology u A call option gives its owner the right to buy a specified quantity of the underlying asset at a set price within a set time period. u A put option gives its owner the right to sell a specified quantity of the underlying asset at a set price within a set time period. u The set price is called the striking price or exercise price, and the last day the option is valid is called the expiration date. u The price of the option is the premium. 8

Options Terminology u Options trade in units called contracts, each of which normally covers 100 shares. u An option’s volume indicates how many option contracts changed hands over some period of time. It measures trading activity. u An option’s open interest indicates how many option contracts exist. u Open interest goes up when someone creates an option and does down when two people trade and each close out an options position. 9

Options Terminology u Options trade in units called contracts, each of which normally covers 100 shares. u An option’s volume indicates how many option contracts changed hands over some period of time. It measures trading activity. u An option’s open interest indicates how many option contracts exist. u Open interest goes up when someone creates an option and does down when two people trade and each close out an options position. 9

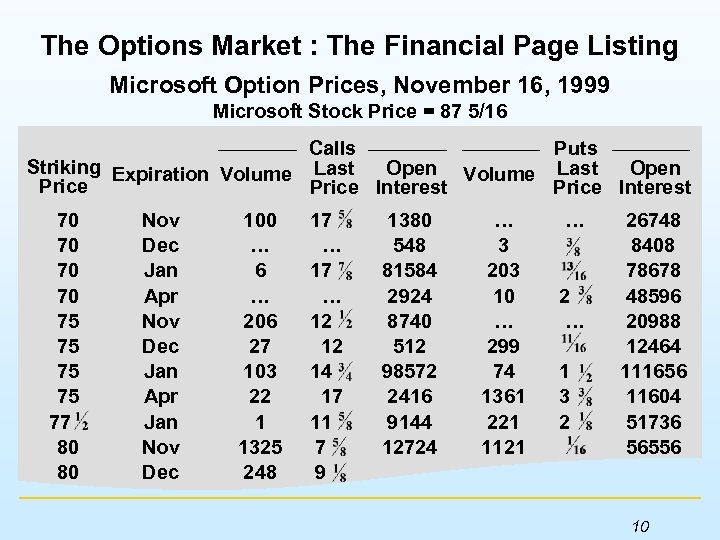

The Options Market : The Financial Page Listing Microsoft Option Prices, November 16, 1999 Microsoft Stock Price = 87 5/16 Calls Puts Striking Expiration Volume Last Open Price Interest 70 70 75 75 77 80 80 Nov Dec Jan Apr Jan Nov Dec 100 … 6 … 206 27 103 22 1 1325 248 17 … 12 12 14 17 11 7 9 1380 548 81584 2924 8740 512 98572 2416 9144 12724 … 3 203 10 … 299 74 1361 221 1121 … 2 … 1 3 2 26748 8408 78678 48596 20988 12464 111656 11604 51736 56556 10

The Options Market : The Financial Page Listing Microsoft Option Prices, November 16, 1999 Microsoft Stock Price = 87 5/16 Calls Puts Striking Expiration Volume Last Open Price Interest 70 70 75 75 77 80 80 Nov Dec Jan Apr Jan Nov Dec 100 … 6 … 206 27 103 22 1 1325 248 17 … 12 12 14 17 11 7 9 1380 548 81584 2924 8740 512 98572 2416 9144 12724 … 3 203 10 … 299 74 1361 221 1121 … 2 … 1 3 2 26748 8408 78678 48596 20988 12464 111656 11604 51736 56556 10

The Origin of an Option u Options can be created, or destroyed. The quantity of options in existence changes everyday. u The first trade someone makes in a particular option is called an opening transaction. If an investor sells an option as an opening transaction, it is called writing the option. u Options are fungible, meaning that, for a given company, all options of the same type with the same expiration and striking price are identical. 11

The Origin of an Option u Options can be created, or destroyed. The quantity of options in existence changes everyday. u The first trade someone makes in a particular option is called an opening transaction. If an investor sells an option as an opening transaction, it is called writing the option. u Options are fungible, meaning that, for a given company, all options of the same type with the same expiration and striking price are identical. 11

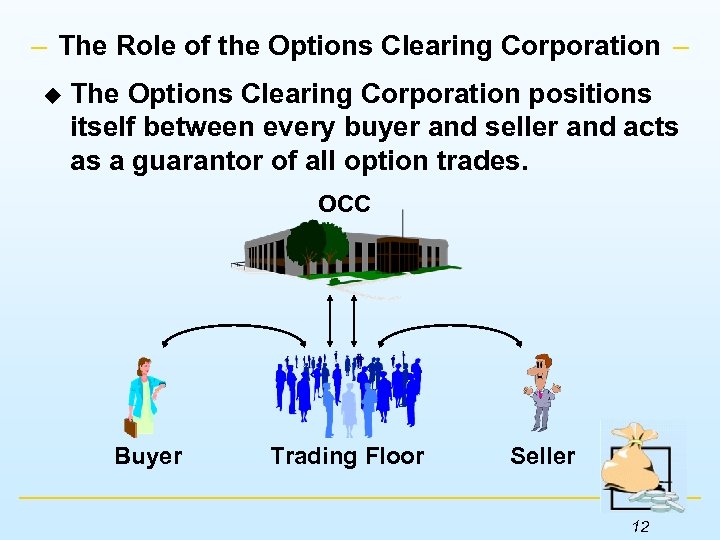

The Role of the Options Clearing Corporation u The Options Clearing Corporation positions itself between every buyer and seller and acts as a guarantor of all option trades. OCC Buyer Trading Floor Seller 12

The Role of the Options Clearing Corporation u The Options Clearing Corporation positions itself between every buyer and seller and acts as a guarantor of all option trades. OCC Buyer Trading Floor Seller 12

Standardized Option Characteristics u Options have standardized expiration dates, striking prices, and lot size. u option premium = intrinsic value + time value If an option has no intrinsic value, it is out-ofthe-money. Otherwise, it is either in-themoney or at-the-money. u An American option can be exercised anytime prior to the expiration of the option. A European option, on the other hand, can only be exercised at expiration. 13

Standardized Option Characteristics u Options have standardized expiration dates, striking prices, and lot size. u option premium = intrinsic value + time value If an option has no intrinsic value, it is out-ofthe-money. Otherwise, it is either in-themoney or at-the-money. u An American option can be exercised anytime prior to the expiration of the option. A European option, on the other hand, can only be exercised at expiration. 13

The Futures Market u A futures contract is a promise. The initial seller of the contract promises to deliver a quantity of a standardized commodity to a designated delivery point during a certain delivery month. u The other party to the trade promises to pay a predetermined price for the goods upon delivery. u The person who promises to buy is said to be long, while the person who promises to deliver is said to be short. u 14

The Futures Market u A futures contract is a promise. The initial seller of the contract promises to deliver a quantity of a standardized commodity to a designated delivery point during a certain delivery month. u The other party to the trade promises to pay a predetermined price for the goods upon delivery. u The person who promises to buy is said to be long, while the person who promises to deliver is said to be short. u 14

The Futures Market u Futures vs. options : Futures contracts do not expire unexercised. u Market participants : u Hedgers use futures to reduce price risk. u Speculators assume risk in the hope of making a profit. u Marketmakers provide liquidity for the marketplace. 15

The Futures Market u Futures vs. options : Futures contracts do not expire unexercised. u Market participants : u Hedgers use futures to reduce price risk. u Speculators assume risk in the hope of making a profit. u Marketmakers provide liquidity for the marketplace. 15

The Futures Market u Keeping the promise : Each exchange has a clearing corporation which ensures the integrity of the futures contract when a member is in financial distress. u Categories of futures contracts : u Agricultural e. g. wheat, cotton, cattle, eggs. u Metals and petroleum e. g. platinum, copper, natural gas, crude oil. u Financial e. g. foreign currency, stock index, interest rate. 16

The Futures Market u Keeping the promise : Each exchange has a clearing corporation which ensures the integrity of the futures contract when a member is in financial distress. u Categories of futures contracts : u Agricultural e. g. wheat, cotton, cattle, eggs. u Metals and petroleum e. g. platinum, copper, natural gas, crude oil. u Financial e. g. foreign currency, stock index, interest rate. 16

Financial Futures : Stock Index Futures u A stock index future is a promise to buy or sell the standardized units of a specific index at a fixed price at a predetermined future date. u Unlike most other commodity contracts, there is no actual delivery mechanism when the contract expires. For practicality, all settlements are in cash. 17

Financial Futures : Stock Index Futures u A stock index future is a promise to buy or sell the standardized units of a specific index at a fixed price at a predetermined future date. u Unlike most other commodity contracts, there is no actual delivery mechanism when the contract expires. For practicality, all settlements are in cash. 17

Financial Futures : Interest Rate Futures 1. Interest rate futures contracts are customarily grouped into short-term, intermediate-term, and long-term categories. 2. The two principal short-term contracts are Eurodollars and U. S. Treasury bills. 3. The Treasury bill futures contract calls for the delivery of $1 million par value of 90 -day Tbills on the delivery date of the futures contract. 18

Financial Futures : Interest Rate Futures 1. Interest rate futures contracts are customarily grouped into short-term, intermediate-term, and long-term categories. 2. The two principal short-term contracts are Eurodollars and U. S. Treasury bills. 3. The Treasury bill futures contract calls for the delivery of $1 million par value of 90 -day Tbills on the delivery date of the futures contract. 18

Financial Futures : Interest Rate Futures 1. The contract on U. S. Treasury notes is the only intermediate-term contract, while Treasury bonds are the principal long-term contracts. 2. The Treasury bond futures contract calls for the delivery of $100, 000 face value of U. S. Treasury bonds with a minimum of 15 years until maturity (and, if callable, with a minimum of 15 years of call protection). Bonds that meet these criteria are said to be deliverable. 19

Financial Futures : Interest Rate Futures 1. The contract on U. S. Treasury notes is the only intermediate-term contract, while Treasury bonds are the principal long-term contracts. 2. The Treasury bond futures contract calls for the delivery of $100, 000 face value of U. S. Treasury bonds with a minimum of 15 years until maturity (and, if callable, with a minimum of 15 years of call protection). Bonds that meet these criteria are said to be deliverable. 19

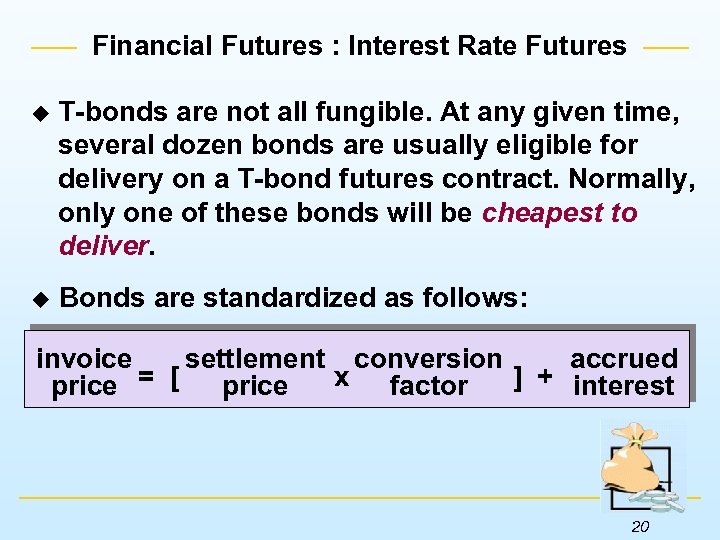

Financial Futures : Interest Rate Futures u T-bonds are not all fungible. At any given time, several dozen bonds are usually eligible for delivery on a T-bond futures contract. Normally, only one of these bonds will be cheapest to deliver. u Bonds are standardized as follows: invoice settlement conversion accrued x factor ] + interest price = [ price 20

Financial Futures : Interest Rate Futures u T-bonds are not all fungible. At any given time, several dozen bonds are usually eligible for delivery on a T-bond futures contract. Normally, only one of these bonds will be cheapest to deliver. u Bonds are standardized as follows: invoice settlement conversion accrued x factor ] + interest price = [ price 20

Financial Futures : Foreign Currency Futures u Foreign currency futures contracts call for delivery of the foreign currency in the country of issuance to a bank of the clearing house’s choosing. u Most major corporations face at least some foreign exchange risk and quickly discovered the convenience of these futures as a hedging vehicle, while speculators saw the contracts as easy to understand use. 21

Financial Futures : Foreign Currency Futures u Foreign currency futures contracts call for delivery of the foreign currency in the country of issuance to a bank of the clearing house’s choosing. u Most major corporations face at least some foreign exchange risk and quickly discovered the convenience of these futures as a hedging vehicle, while speculators saw the contracts as easy to understand use. 21

Derivative Assets and the News u Newspapers in recent months have been full of reports on various businesses that have lost billions “investing in derivatives. ” u Derivatives are neutral products. Their risk depends on what an investor does with them. u Exchange-traded derivative assets and overthe-counter derivatives are markedly different. 22

Derivative Assets and the News u Newspapers in recent months have been full of reports on various businesses that have lost billions “investing in derivatives. ” u Derivatives are neutral products. Their risk depends on what an investor does with them. u Exchange-traded derivative assets and overthe-counter derivatives are markedly different. 22

Review u Background The Rationale for Derivative Assets u Uses of Derivatives u u The Options Market Options Terminology u The Financial Page Listing u The Origin of an Option u The Role of the Options Clearing Corporation u Standardized Option Characteristics u 23

Review u Background The Rationale for Derivative Assets u Uses of Derivatives u u The Options Market Options Terminology u The Financial Page Listing u The Origin of an Option u The Role of the Options Clearing Corporation u Standardized Option Characteristics u 23

Review u The Futures Market Futures vs. Options u Market Participants u Keeping the Promise u Categories of Futures Contracts u u Financial Futures Stock Index Futures u Interest Rate Futures u Foreign Currency Futures u 24

Review u The Futures Market Futures vs. Options u Market Participants u Keeping the Promise u Categories of Futures Contracts u u Financial Futures Stock Index Futures u Interest Rate Futures u Foreign Currency Futures u 24

Review u Derivative Assets and the News Current Events u Risk of Derivative Assets u Listed vs. Over-the-Counter Derivatives u 25

Review u Derivative Assets and the News Current Events u Risk of Derivative Assets u Listed vs. Over-the-Counter Derivatives u 25