4b99a1425f1547a3b6ba9db5a45d84a2.ppt

- Количество слайдов: 25

Chapter Fifteen The Federal Reserve System

Chapter Fifteen The Federal Reserve System

The Federal Reserve System • What is the Federal Reserve? – The “Fed” is the central bank of the United States…It oversees many financial institutions and ensures the continued efficient functioning of the payments system – Comprised of three main parts • The Federal Reserve banks • The Board of Governors • The Federal Open Market Committee (FOMC) Copyright © Houghton Mifflin Company. All rights reserved. 15 | 2

The Federal Reserve System • What is the Federal Reserve? – The “Fed” is the central bank of the United States…It oversees many financial institutions and ensures the continued efficient functioning of the payments system – Comprised of three main parts • The Federal Reserve banks • The Board of Governors • The Federal Open Market Committee (FOMC) Copyright © Houghton Mifflin Company. All rights reserved. 15 | 2

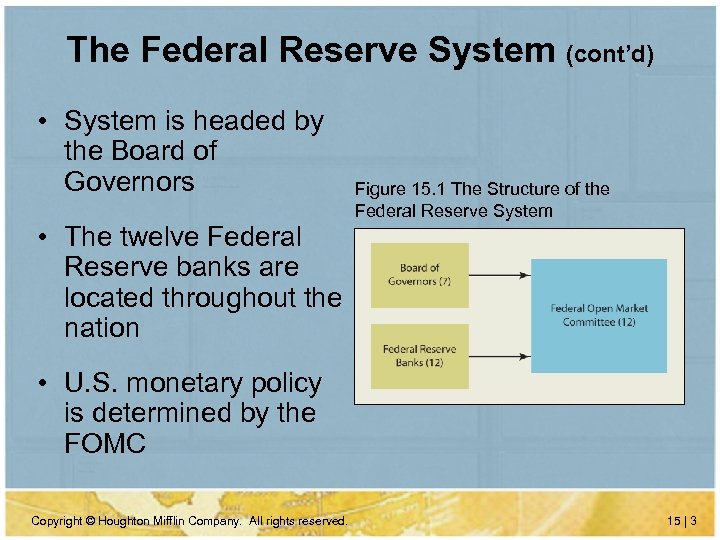

The Federal Reserve System (cont’d) • System is headed by the Board of Governors • The twelve Federal Reserve banks are located throughout the nation Figure 15. 1 The Structure of the Federal Reserve System • U. S. monetary policy is determined by the FOMC Copyright © Houghton Mifflin Company. All rights reserved. 15 | 3

The Federal Reserve System (cont’d) • System is headed by the Board of Governors • The twelve Federal Reserve banks are located throughout the nation Figure 15. 1 The Structure of the Federal Reserve System • U. S. monetary policy is determined by the FOMC Copyright © Houghton Mifflin Company. All rights reserved. 15 | 3

Federal Reserve Banks provide many services • Check clearing services • Supervision and examination of member banks • Track banking statistics and monetary aggregates • Supply currency and coin to member banks • Serve as fiscal agent of the U. S. Treasury • Act as a lender of last resort Copyright © Houghton Mifflin Company. All rights reserved. 15 | 4

Federal Reserve Banks provide many services • Check clearing services • Supervision and examination of member banks • Track banking statistics and monetary aggregates • Supply currency and coin to member banks • Serve as fiscal agent of the U. S. Treasury • Act as a lender of last resort Copyright © Houghton Mifflin Company. All rights reserved. 15 | 4

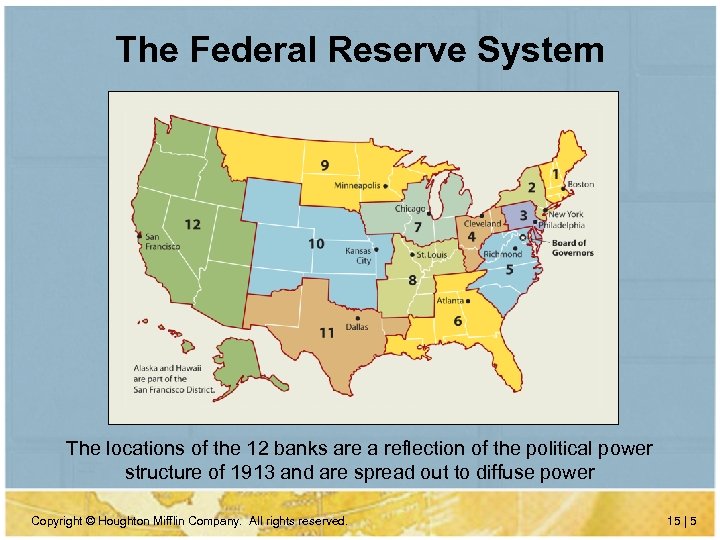

The Federal Reserve System The locations of the 12 banks are a reflection of the political power structure of 1913 and are spread out to diffuse power Copyright © Houghton Mifflin Company. All rights reserved. 15 | 5

The Federal Reserve System The locations of the 12 banks are a reflection of the political power structure of 1913 and are spread out to diffuse power Copyright © Houghton Mifflin Company. All rights reserved. 15 | 5

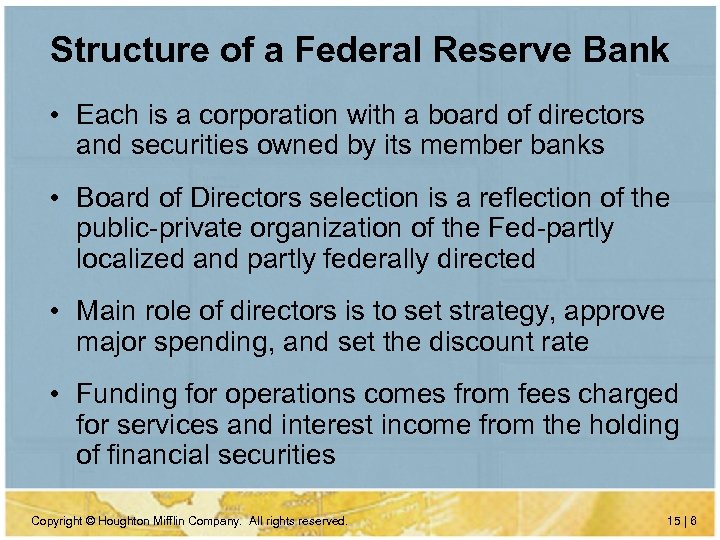

Structure of a Federal Reserve Bank • Each is a corporation with a board of directors and securities owned by its member banks • Board of Directors selection is a reflection of the public-private organization of the Fed-partly localized and partly federally directed • Main role of directors is to set strategy, approve major spending, and set the discount rate • Funding for operations comes from fees charged for services and interest income from the holding of financial securities Copyright © Houghton Mifflin Company. All rights reserved. 15 | 6

Structure of a Federal Reserve Bank • Each is a corporation with a board of directors and securities owned by its member banks • Board of Directors selection is a reflection of the public-private organization of the Fed-partly localized and partly federally directed • Main role of directors is to set strategy, approve major spending, and set the discount rate • Funding for operations comes from fees charged for services and interest income from the holding of financial securities Copyright © Houghton Mifflin Company. All rights reserved. 15 | 6

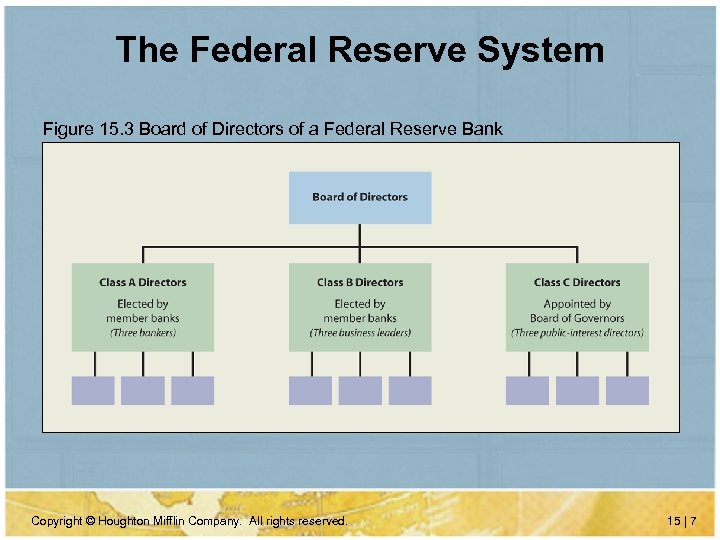

The Federal Reserve System Figure 15. 3 Board of Directors of a Federal Reserve Bank Copyright © Houghton Mifflin Company. All rights reserved. 15 | 7

The Federal Reserve System Figure 15. 3 Board of Directors of a Federal Reserve Bank Copyright © Houghton Mifflin Company. All rights reserved. 15 | 7

Central Bank Functions • Economic Research – Keep bank president informed about the regional economy, national economy, financial markets, foreign economies, forecasts, and new research on economics – Produce Beigebook report on local economic conditions for FOMC – Economic education, articles in “Economic Review” • Supervision & Regulation – examine banks – provide discount loans Copyright © Houghton Mifflin Company. All rights reserved. 15 | 8

Central Bank Functions • Economic Research – Keep bank president informed about the regional economy, national economy, financial markets, foreign economies, forecasts, and new research on economics – Produce Beigebook report on local economic conditions for FOMC – Economic education, articles in “Economic Review” • Supervision & Regulation – examine banks – provide discount loans Copyright © Houghton Mifflin Company. All rights reserved. 15 | 8

Central Bank Functions (cont’d) • Statistics Department – Compile banking statistics for money supply data • Community & Consumer Affairs – Help implement laws such as CRA and Truth in Lending Copyright © Houghton Mifflin Company. All rights reserved. 15 | 9

Central Bank Functions (cont’d) • Statistics Department – Compile banking statistics for money supply data • Community & Consumer Affairs – Help implement laws such as CRA and Truth in Lending Copyright © Houghton Mifflin Company. All rights reserved. 15 | 9

The Board of Governors • The Board is more like a government agency than the banks, and subject to more scrutiny • Each member is appointed by the President to a 14 year term which is not renewable – 7 governors serve – One member’s term expires every 2 years – Can stay more than 14 years if appointed to less-thanfull term initially • Chairman of the Board of Governors is second most-powerful position in U. S. after President Copyright © Houghton Mifflin Company. All rights reserved. 15 | 10

The Board of Governors • The Board is more like a government agency than the banks, and subject to more scrutiny • Each member is appointed by the President to a 14 year term which is not renewable – 7 governors serve – One member’s term expires every 2 years – Can stay more than 14 years if appointed to less-thanfull term initially • Chairman of the Board of Governors is second most-powerful position in U. S. after President Copyright © Houghton Mifflin Company. All rights reserved. 15 | 10

Name Members of the Federal Reserve Board of Governors Term Began Term Ends Alan Greenspan 1987 2006 Roger Ferguson 1997 2014 vacant 2004 2018 vacant 1994 2008 Mark Olson 2001 2010 Susan Bies 2001 2012 Don Kohn 2002 2016 Copyright © Houghton Mifflin Company. All rights reserved. 15 | 11

Name Members of the Federal Reserve Board of Governors Term Began Term Ends Alan Greenspan 1987 2006 Roger Ferguson 1997 2014 vacant 2004 2018 vacant 1994 2008 Mark Olson 2001 2010 Susan Bies 2001 2012 Don Kohn 2002 2016 Copyright © Houghton Mifflin Company. All rights reserved. 15 | 11

The Board of Governors (cont’d) • Chairman & Vice-Chairman are appointed by the President to renewable 4 -year terms • Chairman wields tremendous power – Measure Chairman’s success by the inflation rate, the only economic variable the Fed can control in the long run – Effects of monetary policy are short-lived Copyright © Houghton Mifflin Company. All rights reserved. 15 | 12

The Board of Governors (cont’d) • Chairman & Vice-Chairman are appointed by the President to renewable 4 -year terms • Chairman wields tremendous power – Measure Chairman’s success by the inflation rate, the only economic variable the Fed can control in the long run – Effects of monetary policy are short-lived Copyright © Houghton Mifflin Company. All rights reserved. 15 | 12

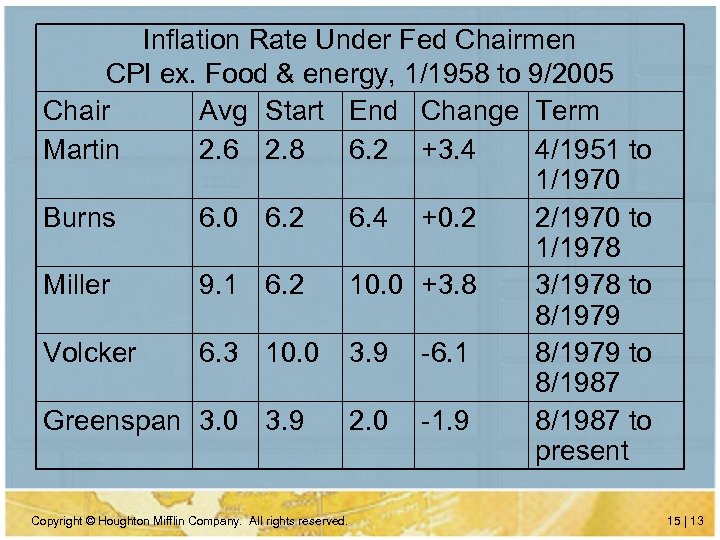

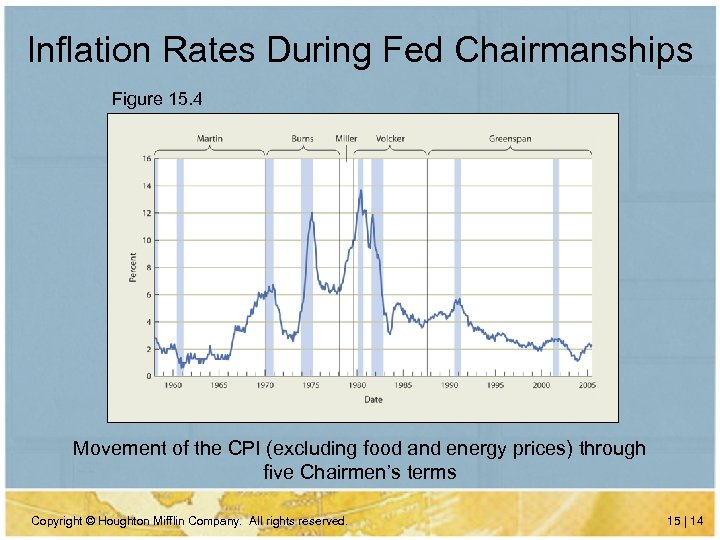

Inflation Rate Under Fed Chairmen CPI ex. Food & energy, 1/1958 to 9/2005 Chair Avg Start End Change Term Martin 2. 6 2. 8 6. 2 +3. 4 4/1951 to 1/1970 Burns 6. 0 6. 2 6. 4 +0. 2 2/1970 to 1/1978 Miller 9. 1 6. 2 10. 0 +3. 8 3/1978 to 8/1979 Volcker 6. 3 10. 0 3. 9 -6. 1 8/1979 to 8/1987 Greenspan 3. 0 3. 9 2. 0 -1. 9 8/1987 to present Copyright © Houghton Mifflin Company. All rights reserved. 15 | 13

Inflation Rate Under Fed Chairmen CPI ex. Food & energy, 1/1958 to 9/2005 Chair Avg Start End Change Term Martin 2. 6 2. 8 6. 2 +3. 4 4/1951 to 1/1970 Burns 6. 0 6. 2 6. 4 +0. 2 2/1970 to 1/1978 Miller 9. 1 6. 2 10. 0 +3. 8 3/1978 to 8/1979 Volcker 6. 3 10. 0 3. 9 -6. 1 8/1979 to 8/1987 Greenspan 3. 0 3. 9 2. 0 -1. 9 8/1987 to present Copyright © Houghton Mifflin Company. All rights reserved. 15 | 13

Inflation Rates During Fed Chairmanships Figure 15. 4 Movement of the CPI (excluding food and energy prices) through five Chairmen’s terms Copyright © Houghton Mifflin Company. All rights reserved. 15 | 14

Inflation Rates During Fed Chairmanships Figure 15. 4 Movement of the CPI (excluding food and energy prices) through five Chairmen’s terms Copyright © Houghton Mifflin Company. All rights reserved. 15 | 14

The Board of Governors (cont’d) • Governors’ (other than Chairman) also play an important role in the system – Serve on FOMC – Oversee operations of Federal Reserve System – Regulate banks – Supervise Reserve Banks – Public speaking – Possibility always exists to outvote Chairman Copyright © Houghton Mifflin Company. All rights reserved. 15 | 15

The Board of Governors (cont’d) • Governors’ (other than Chairman) also play an important role in the system – Serve on FOMC – Oversee operations of Federal Reserve System – Regulate banks – Supervise Reserve Banks – Public speaking – Possibility always exists to outvote Chairman Copyright © Houghton Mifflin Company. All rights reserved. 15 | 15

The FOMC • FOMC influences the money supply through open-market operations • 12 voting members on the Committee – 7 governors – President of New York FRB – 4 other presidents on rotating basis • 7 non-voting members are the other FRB presidents (rotating) – Right to vote may not be as significant as suggested by the press Copyright © Houghton Mifflin Company. All rights reserved. 15 | 16

The FOMC • FOMC influences the money supply through open-market operations • 12 voting members on the Committee – 7 governors – President of New York FRB – 4 other presidents on rotating basis • 7 non-voting members are the other FRB presidents (rotating) – Right to vote may not be as significant as suggested by the press Copyright © Houghton Mifflin Company. All rights reserved. 15 | 16

Open-Market Operations • Open-market operations is the buying and selling of government securities in the secondary market; a tool to adjust the money supply • Fed buys securities more reserves M ↑ fed funds rate ↓ • Fed sells securities less reserves M ↓ fed funds rate ↑ • Carried out at Open Market Desk of Federal Reserve Bank of New York • Buy or sell from primary government securities dealers Copyright © Houghton Mifflin Company. All rights reserved. 15 | 17

Open-Market Operations • Open-market operations is the buying and selling of government securities in the secondary market; a tool to adjust the money supply • Fed buys securities more reserves M ↑ fed funds rate ↓ • Fed sells securities less reserves M ↓ fed funds rate ↑ • Carried out at Open Market Desk of Federal Reserve Bank of New York • Buy or sell from primary government securities dealers Copyright © Houghton Mifflin Company. All rights reserved. 15 | 17

FOMC Directive • FOMC operates by giving a directive to the Desk one statement of FOMC goals, and one operative sentence • FOMC votes on the directive to (possibly) change the target for the federal funds rate (ffr) • Three main options to choose from – Option A: cut ffr target 50 basis points – Option B: keep ffr target unchanged – Option C: raise ffr target 50 basis points • 1 basis point = 1/100 percentage point • When economy is very weak, Option C is not considered. Option A not considered when economy is very strong Copyright © Houghton Mifflin Company. All rights reserved. 15 | 18

FOMC Directive • FOMC operates by giving a directive to the Desk one statement of FOMC goals, and one operative sentence • FOMC votes on the directive to (possibly) change the target for the federal funds rate (ffr) • Three main options to choose from – Option A: cut ffr target 50 basis points – Option B: keep ffr target unchanged – Option C: raise ffr target 50 basis points • 1 basis point = 1/100 percentage point • When economy is very weak, Option C is not considered. Option A not considered when economy is very strong Copyright © Houghton Mifflin Company. All rights reserved. 15 | 18

FOMC Meetings • Typical meeting – Report by International Desk on foreign-exchange intervention – Report by Open Market Desk on open-market operations – Discussion of Greenbook forecasts by Director of Research and Statistics Division – Go-around on the economy (all 19 participants) – Discussion of Bluebook policy options by Director of Monetary Affairs Division – Go-around on policy (all 19) – Vote (12 voting members) – Discuss statement, especially statement on risks Copyright © Houghton Mifflin Company. All rights reserved. 15 | 19

FOMC Meetings • Typical meeting – Report by International Desk on foreign-exchange intervention – Report by Open Market Desk on open-market operations – Discussion of Greenbook forecasts by Director of Research and Statistics Division – Go-around on the economy (all 19 participants) – Discussion of Bluebook policy options by Director of Monetary Affairs Division – Go-around on policy (all 19) – Vote (12 voting members) – Discuss statement, especially statement on risks Copyright © Houghton Mifflin Company. All rights reserved. 15 | 19

FOMC Meeting • Deliberations of the committee are secret, but a statement is issued shortly after each meeting ends • FOMC wants to communicate its policy views so investors know what the Fed thinks of the economy and what its long-term plans are • Brief minutes are released 2 days after next meeting; transcripts are released after 5 years Copyright © Houghton Mifflin Company. All rights reserved. 15 | 20

FOMC Meeting • Deliberations of the committee are secret, but a statement is issued shortly after each meeting ends • FOMC wants to communicate its policy views so investors know what the Fed thinks of the economy and what its long-term plans are • Brief minutes are released 2 days after next meeting; transcripts are released after 5 years Copyright © Houghton Mifflin Company. All rights reserved. 15 | 20

Fed Independence Attributes contributing to independence • Governors have 14 -year terms (avoids political pressure) • Governors’ terms end every two years, so any U. S. President needs a long time to appoint a majority • Fed’s incomes from seignorage…an independent budget (expenses ~$2. 5 billion, income ~$24 billion) Copyright © Houghton Mifflin Company. All rights reserved. 15 | 21

Fed Independence Attributes contributing to independence • Governors have 14 -year terms (avoids political pressure) • Governors’ terms end every two years, so any U. S. President needs a long time to appoint a majority • Fed’s incomes from seignorage…an independent budget (expenses ~$2. 5 billion, income ~$24 billion) Copyright © Houghton Mifflin Company. All rights reserved. 15 | 21

Fed Independence (cont’d) • Power of the Fed makes it susceptible to political pressure • Economy’s strength closely related to odds of reelection of President – “It’s the economy, stupid” – George Bush Sr. blamed Greenspan for losing reelection in 1992 Copyright © Houghton Mifflin Company. All rights reserved. 15 | 22

Fed Independence (cont’d) • Power of the Fed makes it susceptible to political pressure • Economy’s strength closely related to odds of reelection of President – “It’s the economy, stupid” – George Bush Sr. blamed Greenspan for losing reelection in 1992 Copyright © Houghton Mifflin Company. All rights reserved. 15 | 22

Fed Independence (cont’d) • But Fed’s independence could be changed – Fed is established by law, not by Constitution – Many attempts over the years to put the Fed under the influence of politicians • Does independence lead the Fed to become inefficiently large (empire building)? • Does the Fed do the wrong thing because it isn’t accountable? Copyright © Houghton Mifflin Company. All rights reserved. 15 | 23

Fed Independence (cont’d) • But Fed’s independence could be changed – Fed is established by law, not by Constitution – Many attempts over the years to put the Fed under the influence of politicians • Does independence lead the Fed to become inefficiently large (empire building)? • Does the Fed do the wrong thing because it isn’t accountable? Copyright © Houghton Mifflin Company. All rights reserved. 15 | 23

Fed Independence (cont’d) • Is there evidence that the Fed does the right thing, even though lacking in accountability? – Fed officials could make much higher salaries in the private sector – Ethics rules prevent officials from trading for private gain – Transcripts: Fed officials concerned with public interest (Al Broaddus example) Copyright © Houghton Mifflin Company. All rights reserved. 15 | 24

Fed Independence (cont’d) • Is there evidence that the Fed does the right thing, even though lacking in accountability? – Fed officials could make much higher salaries in the private sector – Ethics rules prevent officials from trading for private gain – Transcripts: Fed officials concerned with public interest (Al Broaddus example) Copyright © Houghton Mifflin Company. All rights reserved. 15 | 24

Fed Independence (cont’d) • Lack of accountability? – It’s hard to hold the Fed accountable in the short run; can’t blame it for shocks that move the economy in short run, but does it ease & tighten appropriately (esp. 1990 -91 period)? – Main goal is long run inflation rate, which can help to hold the Fed accountable in long run Copyright © Houghton Mifflin Company. All rights reserved. 15 | 25

Fed Independence (cont’d) • Lack of accountability? – It’s hard to hold the Fed accountable in the short run; can’t blame it for shocks that move the economy in short run, but does it ease & tighten appropriately (esp. 1990 -91 period)? – Main goal is long run inflation rate, which can help to hold the Fed accountable in long run Copyright © Houghton Mifflin Company. All rights reserved. 15 | 25