93d5be7f659ec247998172b985f4549d.ppt

- Количество слайдов: 44

CHAPTER CHECKLIST When you have completed your study of this chapter, you will be able to 1 2 3 Define and explain the relationships among capital, investment, wealth, and saving. Explain how investment and saving decisions are made and how these decisions interact in financial markets to determine the real interest rate. Explain how government influences the real interest rate, investment, and saving.

CHAPTER CHECKLIST When you have completed your study of this chapter, you will be able to 1 2 3 Define and explain the relationships among capital, investment, wealth, and saving. Explain how investment and saving decisions are made and how these decisions interact in financial markets to determine the real interest rate. Explain how government influences the real interest rate, investment, and saving.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Physical capital The tools, instruments, machines, buildings, and other constructions that have been produced in the past and that are used to produce goods and services. Financial capital The funds that firms use to buy and operate physical capital.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Physical capital The tools, instruments, machines, buildings, and other constructions that have been produced in the past and that are used to produce goods and services. Financial capital The funds that firms use to buy and operate physical capital.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING

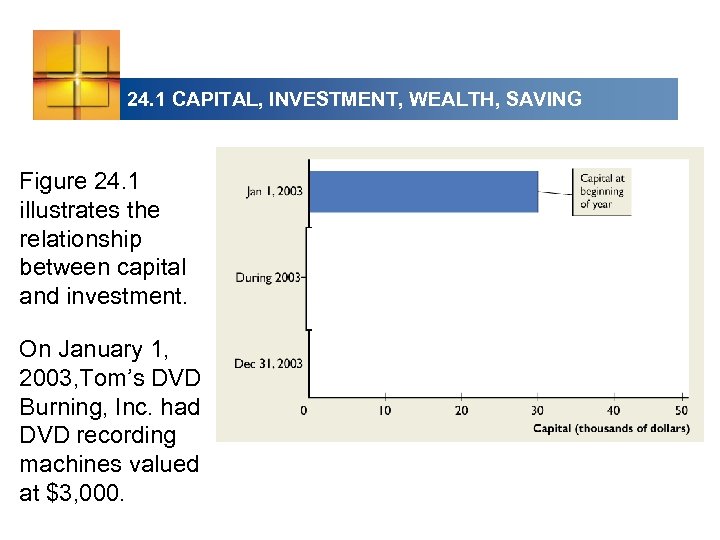

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Figure 24. 1 illustrates the relationship between capital and investment. On January 1, 2003, Tom’s DVD Burning, Inc. had DVD recording machines valued at $3, 000.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Figure 24. 1 illustrates the relationship between capital and investment. On January 1, 2003, Tom’s DVD Burning, Inc. had DVD recording machines valued at $3, 000.

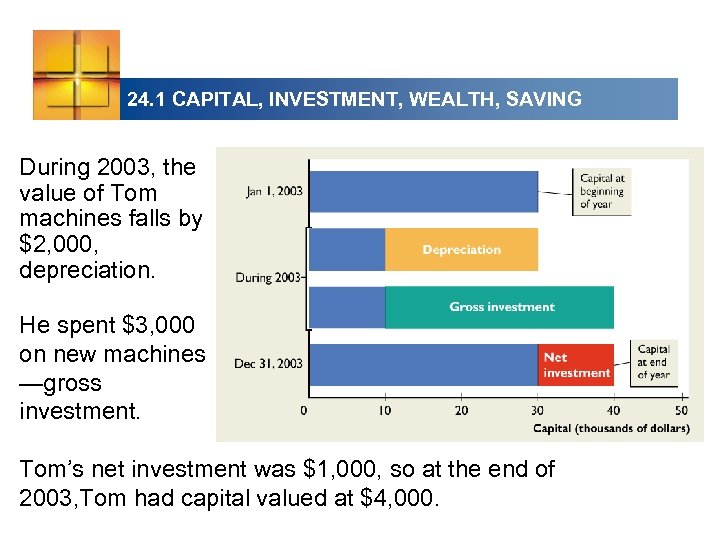

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING During 2003, the value of Tom machines falls by $2, 000, depreciation. He spent $3, 000 on new machines —gross investment. Tom’s net investment was $1, 000, so at the end of 2003, Tom had capital valued at $4, 000.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING During 2003, the value of Tom machines falls by $2, 000, depreciation. He spent $3, 000 on new machines —gross investment. Tom’s net investment was $1, 000, so at the end of 2003, Tom had capital valued at $4, 000.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Financial markets are organized in four groups: • Stock markets • Bond markets • Short-term securities markets • Loans markets

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Financial markets are organized in four groups: • Stock markets • Bond markets • Short-term securities markets • Loans markets

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Stock Markets Stock A certificate of ownership and claim to the profits that a firm makes. Stock market A financial market in which shares of companies’ stocks are traded.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Stock Markets Stock A certificate of ownership and claim to the profits that a firm makes. Stock market A financial market in which shares of companies’ stocks are traded.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Bond Markets Bond A promise to pay specified sums of money on specified dates; it is a debt for the issuer. Bond market A financial market in which bonds issued by firms and governments are traded.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Bond Markets Bond A promise to pay specified sums of money on specified dates; it is a debt for the issuer. Bond market A financial market in which bonds issued by firms and governments are traded.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Short-Term Securities Markets Short-term securities are commercial bills and Treasury bills—promises by large firms and government to pay an agreed sum 90 days in the future. Loans Markets Banks and other financial institutions lower the cost of financing firms’ capital expenditures by accepting shortterm deposits and making longer-term loans.

24. 1 CAPITAL, INVESTMENT, WEALTH, SAVING Short-Term Securities Markets Short-term securities are commercial bills and Treasury bills—promises by large firms and government to pay an agreed sum 90 days in the future. Loans Markets Banks and other financial institutions lower the cost of financing firms’ capital expenditures by accepting shortterm deposits and making longer-term loans.

24. 2 INVESTMENT, SAVING, AND INTEREST

24. 2 INVESTMENT, SAVING, AND INTEREST

24. 2 INVESTMENT, SAVING, AND INTEREST The real interest rate is the opportunity cost of the funds used to finance the purchase of capital, and firms compare the real rate of interest with the rate of profit they expect to earn on their new capital. Firms invest only when they expect to earn a rate of profit that exceeds the real interest rate. The higher the real interest rate, the fewer projects that are profitable, so the smaller is the amount of investment demanded.

24. 2 INVESTMENT, SAVING, AND INTEREST The real interest rate is the opportunity cost of the funds used to finance the purchase of capital, and firms compare the real rate of interest with the rate of profit they expect to earn on their new capital. Firms invest only when they expect to earn a rate of profit that exceeds the real interest rate. The higher the real interest rate, the fewer projects that are profitable, so the smaller is the amount of investment demanded.

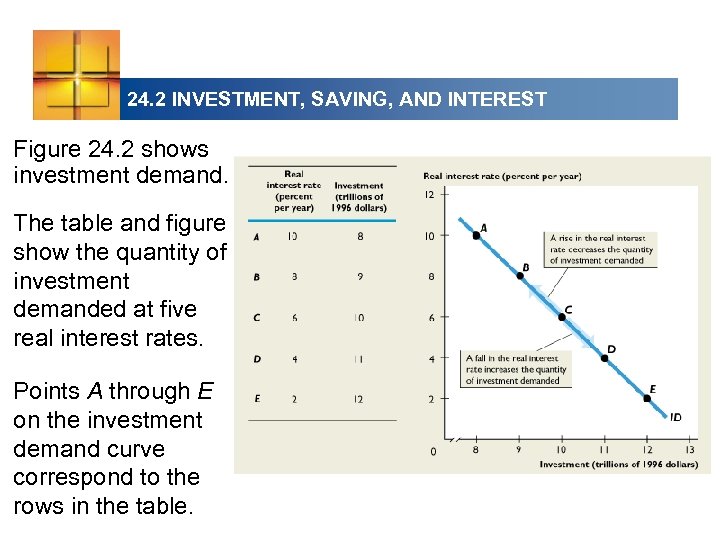

24. 2 INVESTMENT, SAVING, AND INTEREST Investment Demand Curve Investment demand The relationship between the quantity of investment demanded and the real interest rate, other things remaining the same. Investment demand is shown by an investment demand schedule or and investment demand curve.

24. 2 INVESTMENT, SAVING, AND INTEREST Investment Demand Curve Investment demand The relationship between the quantity of investment demanded and the real interest rate, other things remaining the same. Investment demand is shown by an investment demand schedule or and investment demand curve.

24. 2 INVESTMENT, SAVING, AND INTEREST Figure 24. 2 shows investment demand. The table and figure show the quantity of investment demanded at five real interest rates. Points A through E on the investment demand curve correspond to the rows in the table.

24. 2 INVESTMENT, SAVING, AND INTEREST Figure 24. 2 shows investment demand. The table and figure show the quantity of investment demanded at five real interest rates. Points A through E on the investment demand curve correspond to the rows in the table.

24. 2 INVESTMENT, SAVING, AND INTEREST Changes in Investment Demand When the expected rate of profit changes, investment demand changes. Other things remaining the same, the greater the expected profit from new capital, the greater is the amount of investment.

24. 2 INVESTMENT, SAVING, AND INTEREST Changes in Investment Demand When the expected rate of profit changes, investment demand changes. Other things remaining the same, the greater the expected profit from new capital, the greater is the amount of investment.

24. 2 INVESTMENT, SAVING, AND INTEREST The many influences on expected profit can be placed in three groups: • Objective influences such as the phase of the business cycle, technological change, and population growth • Subjective influences summarized in the phrase “animal spirits” • Contagion effects summarized in the phrase “irrational exuberance”

24. 2 INVESTMENT, SAVING, AND INTEREST The many influences on expected profit can be placed in three groups: • Objective influences such as the phase of the business cycle, technological change, and population growth • Subjective influences summarized in the phrase “animal spirits” • Contagion effects summarized in the phrase “irrational exuberance”

24. 2 INVESTMENT, SAVING, AND INTEREST Shifts of the Investment Demand Curve When investment demand changes, the investment demand curve shifts.

24. 2 INVESTMENT, SAVING, AND INTEREST Shifts of the Investment Demand Curve When investment demand changes, the investment demand curve shifts.

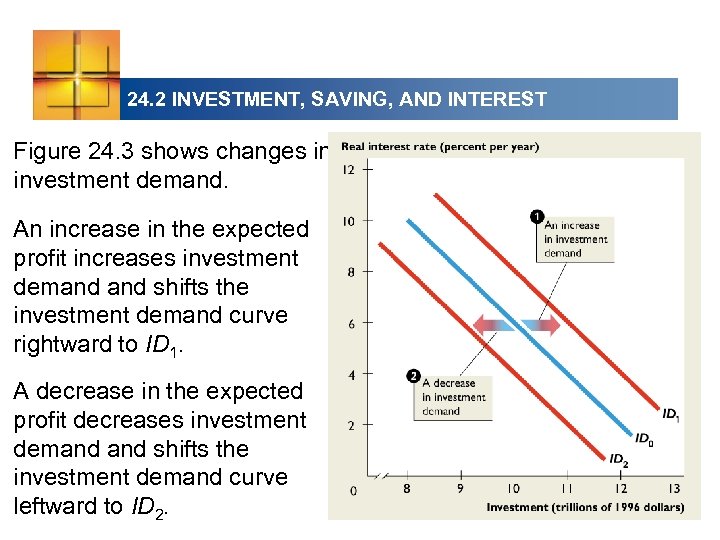

24. 2 INVESTMENT, SAVING, AND INTEREST Figure 24. 3 shows changes in investment demand. An increase in the expected profit increases investment demand shifts the investment demand curve rightward to ID 1. A decrease in the expected profit decreases investment demand shifts the investment demand curve leftward to ID 2.

24. 2 INVESTMENT, SAVING, AND INTEREST Figure 24. 3 shows changes in investment demand. An increase in the expected profit increases investment demand shifts the investment demand curve rightward to ID 1. A decrease in the expected profit decreases investment demand shifts the investment demand curve leftward to ID 2.

24. 2 INVESTMENT, SAVING, AND INTEREST

24. 2 INVESTMENT, SAVING, AND INTEREST

24. 2 INVESTMENT, SAVING, AND INTEREST The real interest rate is the opportunity cost of consumption expenditure. A dollar spent is a dollar not saved, so the interest that could have been earned on that saving is forgone.

24. 2 INVESTMENT, SAVING, AND INTEREST The real interest rate is the opportunity cost of consumption expenditure. A dollar spent is a dollar not saved, so the interest that could have been earned on that saving is forgone.

24. 2 INVESTMENT, SAVING, AND INTEREST Saving Supply Curve Saving supply The relationship between the quantity of saving supplied and the real interest rate, other things remaining the same. Saving supply is illustrated by a saving supply schedule or a saving supply curve.

24. 2 INVESTMENT, SAVING, AND INTEREST Saving Supply Curve Saving supply The relationship between the quantity of saving supplied and the real interest rate, other things remaining the same. Saving supply is illustrated by a saving supply schedule or a saving supply curve.

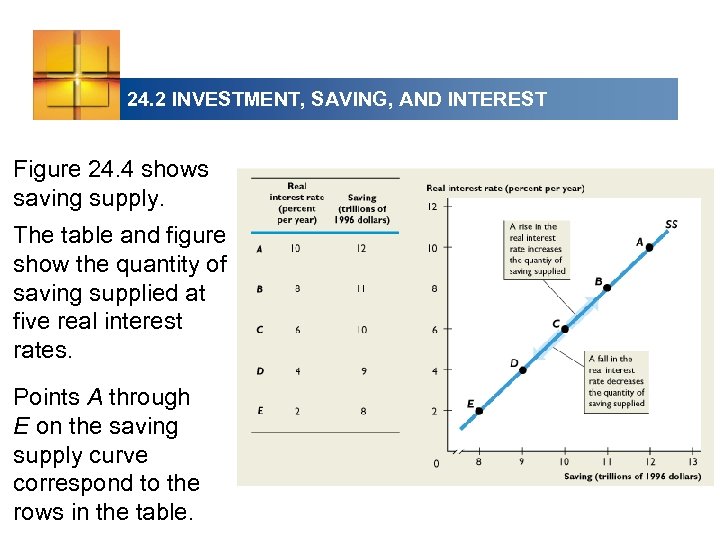

24. 2 INVESTMENT, SAVING, AND INTEREST Figure 24. 4 shows saving supply. The table and figure show the quantity of saving supplied at five real interest rates. Points A through E on the saving supply curve correspond to the rows in the table.

24. 2 INVESTMENT, SAVING, AND INTEREST Figure 24. 4 shows saving supply. The table and figure show the quantity of saving supplied at five real interest rates. Points A through E on the saving supply curve correspond to the rows in the table.

24. 2 INVESTMENT, SAVING, AND INTEREST Changes in Saving Supply The three main factors that influence saving supply are: • Disposable income • Buying power of net assets • Expected future disposable income

24. 2 INVESTMENT, SAVING, AND INTEREST Changes in Saving Supply The three main factors that influence saving supply are: • Disposable income • Buying power of net assets • Expected future disposable income

24. 2 INVESTMENT, SAVING, AND INTEREST Disposable income Income earned minus net taxes. The greater a household’s disposable income, other things remaining the same, the greater is its saving. The greater the buying power of the net assets a household has accumulated, other things remaining the same, the less it will save. The higher a household’s expected future disposable income, other things remaining the same, the smaller is its saving.

24. 2 INVESTMENT, SAVING, AND INTEREST Disposable income Income earned minus net taxes. The greater a household’s disposable income, other things remaining the same, the greater is its saving. The greater the buying power of the net assets a household has accumulated, other things remaining the same, the less it will save. The higher a household’s expected future disposable income, other things remaining the same, the smaller is its saving.

24. 2 INVESTMENT, SAVING, AND INTEREST Shifts of the Saving Supply Curve • Along the saving supply curve, all the influences on saving other than the real interest rate remain the same. • A change in any of these influences on saving changes saving supply and shifts the saving supply curve.

24. 2 INVESTMENT, SAVING, AND INTEREST Shifts of the Saving Supply Curve • Along the saving supply curve, all the influences on saving other than the real interest rate remain the same. • A change in any of these influences on saving changes saving supply and shifts the saving supply curve.

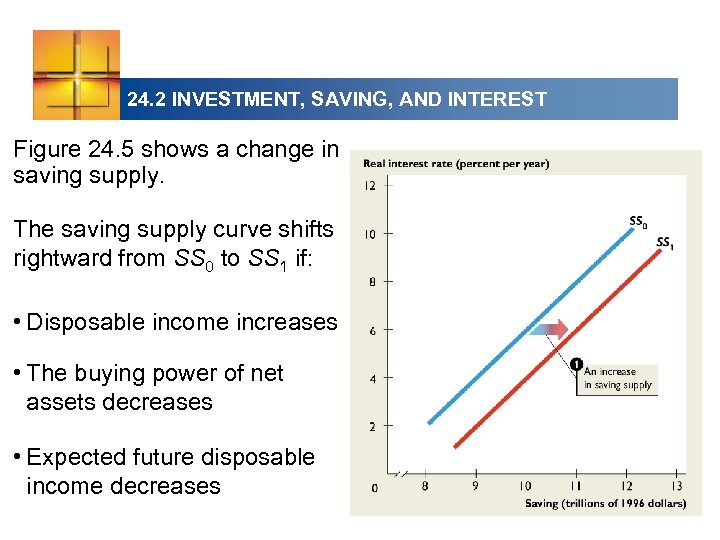

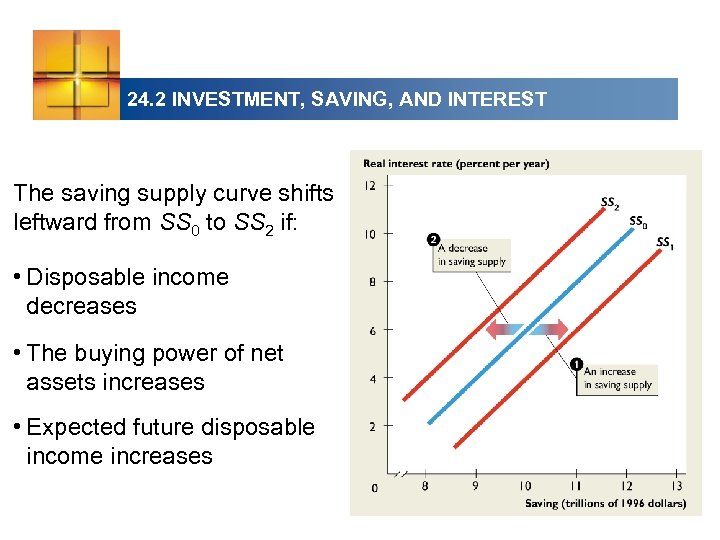

24. 2 INVESTMENT, SAVING, AND INTEREST Figure 24. 5 shows a change in saving supply. The saving supply curve shifts rightward from SS 0 to SS 1 if: • Disposable income increases • The buying power of net assets decreases • Expected future disposable income decreases

24. 2 INVESTMENT, SAVING, AND INTEREST Figure 24. 5 shows a change in saving supply. The saving supply curve shifts rightward from SS 0 to SS 1 if: • Disposable income increases • The buying power of net assets decreases • Expected future disposable income decreases

24. 2 INVESTMENT, SAVING, AND INTEREST The saving supply curve shifts leftward from SS 0 to SS 2 if: • Disposable income decreases • The buying power of net assets increases • Expected future disposable income increases

24. 2 INVESTMENT, SAVING, AND INTEREST The saving supply curve shifts leftward from SS 0 to SS 2 if: • Disposable income decreases • The buying power of net assets increases • Expected future disposable income increases

24. 2 INVESTMENT, SAVING, AND INTEREST

24. 2 INVESTMENT, SAVING, AND INTEREST

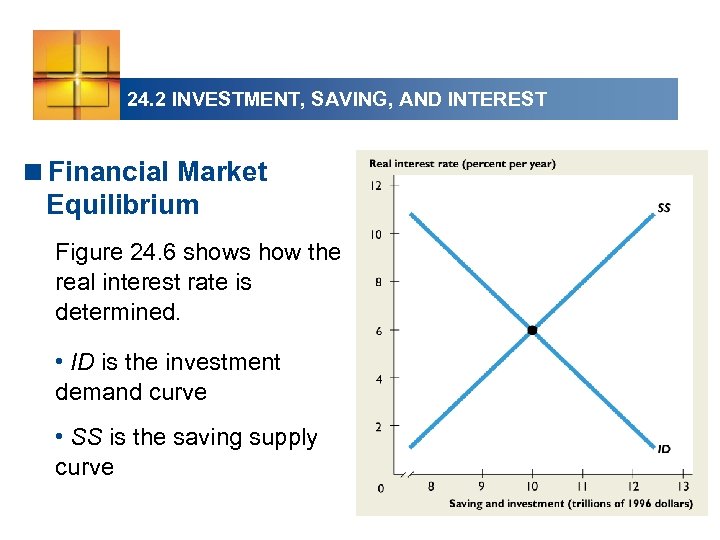

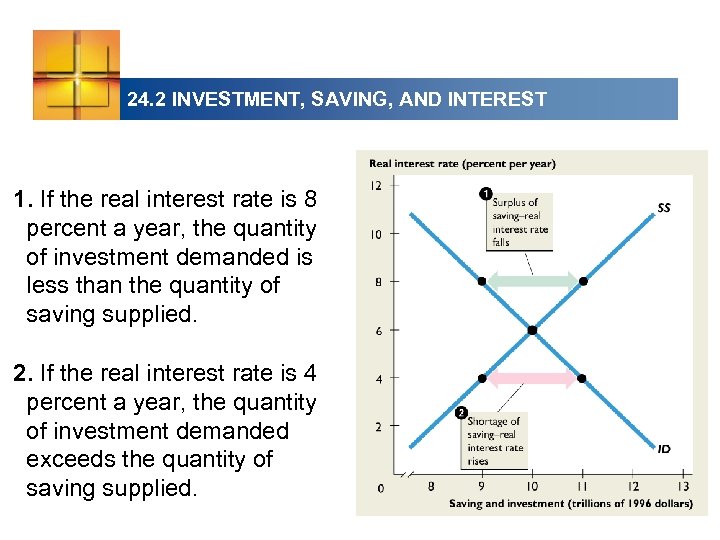

24. 2 INVESTMENT, SAVING, AND INTEREST 1. If the real interest rate is 8 percent a year, the quantity of investment demanded is less than the quantity of saving supplied. 2. If the real interest rate is 4 percent a year, the quantity of investment demanded exceeds the quantity of saving supplied.

24. 2 INVESTMENT, SAVING, AND INTEREST 1. If the real interest rate is 8 percent a year, the quantity of investment demanded is less than the quantity of saving supplied. 2. If the real interest rate is 4 percent a year, the quantity of investment demanded exceeds the quantity of saving supplied.

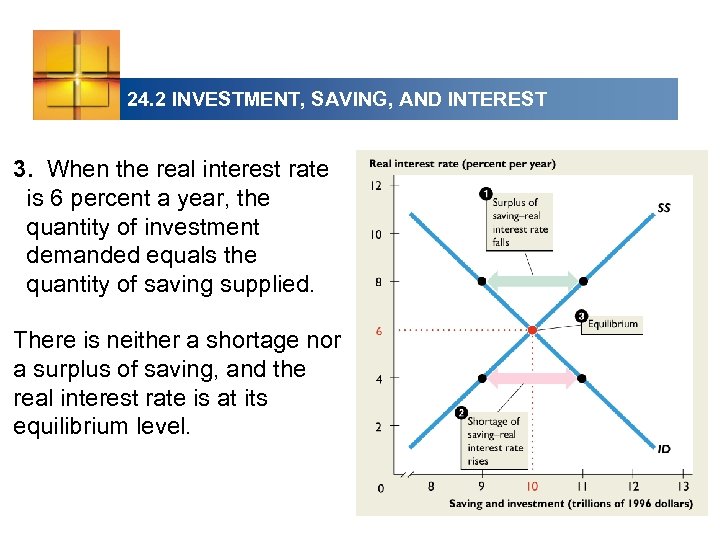

24. 2 INVESTMENT, SAVING, AND INTEREST 3. When the real interest rate is 6 percent a year, the quantity of investment demanded equals the quantity of saving supplied. There is neither a shortage nor a surplus of saving, and the real interest rate is at its equilibrium level.

24. 2 INVESTMENT, SAVING, AND INTEREST 3. When the real interest rate is 6 percent a year, the quantity of investment demanded equals the quantity of saving supplied. There is neither a shortage nor a surplus of saving, and the real interest rate is at its equilibrium level.

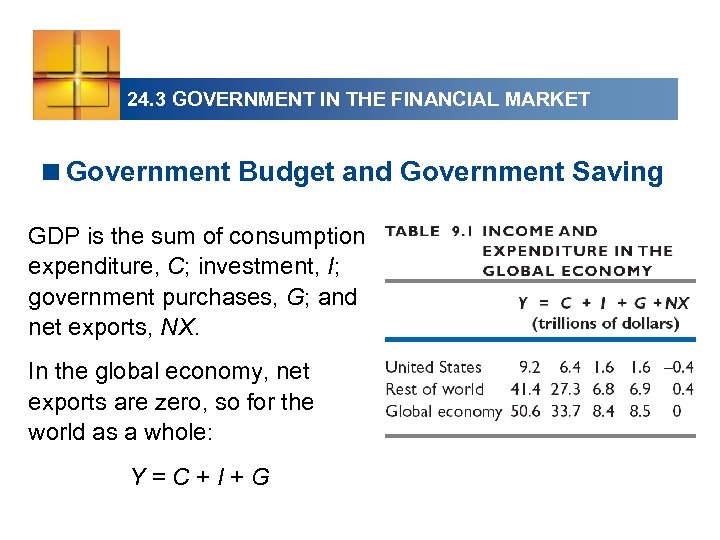

24. 3 GOVERNMENT IN THE FINANCIAL MARKET

24. 3 GOVERNMENT IN THE FINANCIAL MARKET

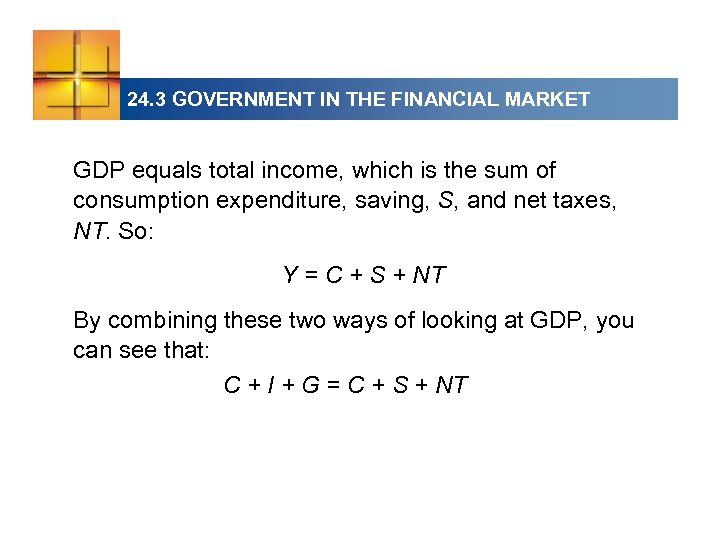

24. 3 GOVERNMENT IN THE FINANCIAL MARKET GDP equals total income, which is the sum of consumption expenditure, saving, S, and net taxes, NT. So: Y = C + S + NT By combining these two ways of looking at GDP, you can see that: C + I + G = C + S + NT

24. 3 GOVERNMENT IN THE FINANCIAL MARKET GDP equals total income, which is the sum of consumption expenditure, saving, S, and net taxes, NT. So: Y = C + S + NT By combining these two ways of looking at GDP, you can see that: C + I + G = C + S + NT

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Because consumption is on both sides of this equation, we can subtract C and simplify the equation to: I + G = S + NT Now subtract government purchases from both sides of this equation to obtain: I = S + (NT – G) This equation tells us that investment is financed by private saving and government saving, NT – G. Government saving, NT – G, is also the government budget surplus.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Because consumption is on both sides of this equation, we can subtract C and simplify the equation to: I + G = S + NT Now subtract government purchases from both sides of this equation to obtain: I = S + (NT – G) This equation tells us that investment is financed by private saving and government saving, NT – G. Government saving, NT – G, is also the government budget surplus.

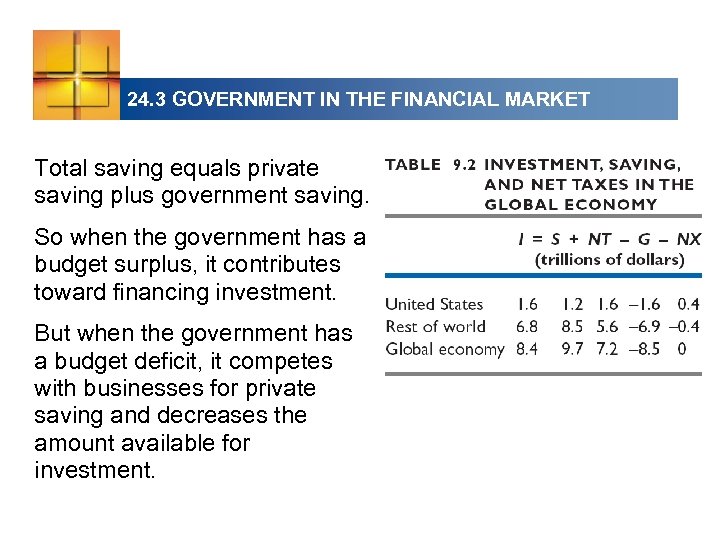

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Total saving equals private saving plus government saving. So when the government has a budget surplus, it contributes toward financing investment. But when the government has a budget deficit, it competes with businesses for private saving and decreases the amount available for investment.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Total saving equals private saving plus government saving. So when the government has a budget surplus, it contributes toward financing investment. But when the government has a budget deficit, it competes with businesses for private saving and decreases the amount available for investment.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET

24. 3 GOVERNMENT IN THE FINANCIAL MARKET

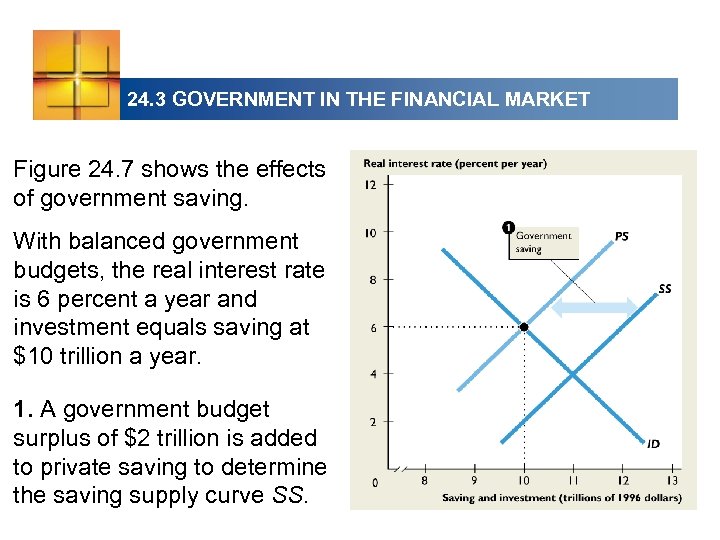

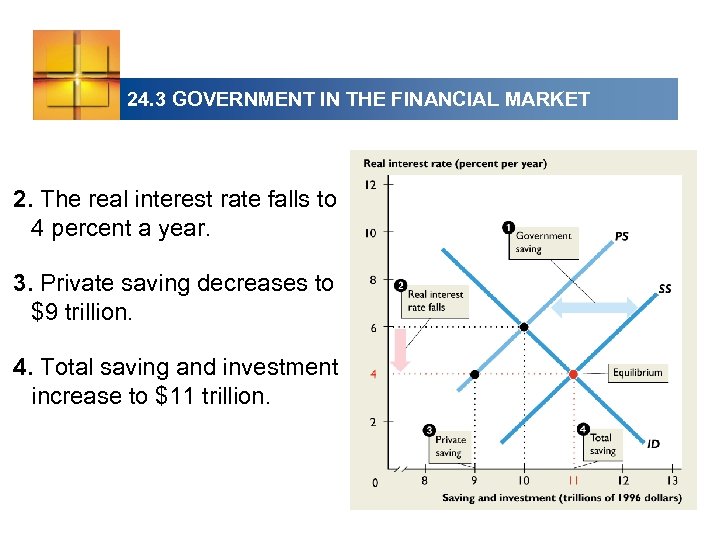

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Figure 24. 7 shows the effects of government saving. With balanced government budgets, the real interest rate is 6 percent a year and investment equals saving at $10 trillion a year. 1. A government budget surplus of $2 trillion is added to private saving to determine the saving supply curve SS.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Figure 24. 7 shows the effects of government saving. With balanced government budgets, the real interest rate is 6 percent a year and investment equals saving at $10 trillion a year. 1. A government budget surplus of $2 trillion is added to private saving to determine the saving supply curve SS.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET 2. The real interest rate falls to 4 percent a year. 3. Private saving decreases to $9 trillion. 4. Total saving and investment increase to $11 trillion.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET 2. The real interest rate falls to 4 percent a year. 3. Private saving decreases to $9 trillion. 4. Total saving and investment increase to $11 trillion.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET

24. 3 GOVERNMENT IN THE FINANCIAL MARKET

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Crowding-out effect The tendency for a government budget deficit to decrease investment.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Crowding-out effect The tendency for a government budget deficit to decrease investment.

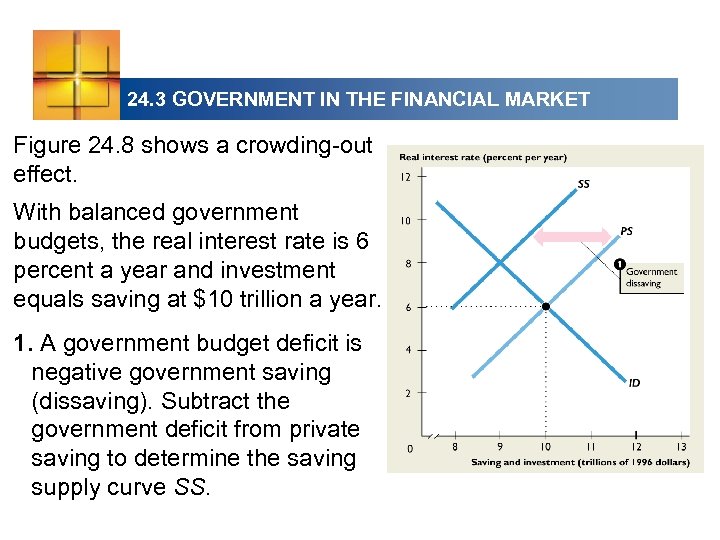

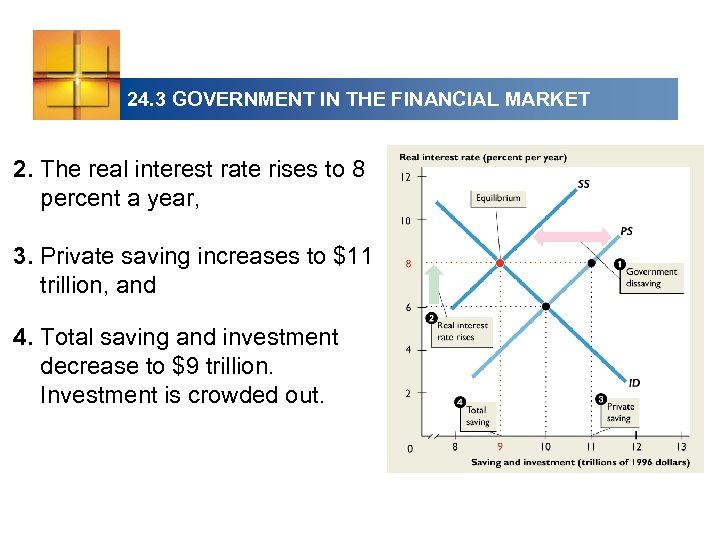

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Figure 24. 8 shows a crowding-out effect. With balanced government budgets, the real interest rate is 6 percent a year and investment equals saving at $10 trillion a year. 1. A government budget deficit is negative government saving (dissaving). Subtract the government deficit from private saving to determine the saving supply curve SS.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET Figure 24. 8 shows a crowding-out effect. With balanced government budgets, the real interest rate is 6 percent a year and investment equals saving at $10 trillion a year. 1. A government budget deficit is negative government saving (dissaving). Subtract the government deficit from private saving to determine the saving supply curve SS.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET 2. The real interest rate rises to 8 percent a year, 3. Private saving increases to $11 trillion, and 4. Total saving and investment decrease to $9 trillion. Investment is crowded out.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET 2. The real interest rate rises to 8 percent a year, 3. Private saving increases to $11 trillion, and 4. Total saving and investment decrease to $9 trillion. Investment is crowded out.

24. 3 GOVERNMENT IN THE FINANCIAL MARKET

24. 3 GOVERNMENT IN THE FINANCIAL MARKET