2ef476733bae87fc1cd60143d557362b.ppt

- Количество слайдов: 38

Chapter 9 Stocks and Their Valuation

Chapter 9 Stocks and Their Valuation

2 Topics Covered • Common and Preferred Stock Properties • Valuing Preferred Stocks • Valuing Common Stocks - the Dividend Growth Model ▫ No growth ▫ Constant growth ▫ Non-constant or supernormal growth • Valuing the Entire Corporation – Free Cash Flow Approach • Stock Market Equilibrium

2 Topics Covered • Common and Preferred Stock Properties • Valuing Preferred Stocks • Valuing Common Stocks - the Dividend Growth Model ▫ No growth ▫ Constant growth ▫ Non-constant or supernormal growth • Valuing the Entire Corporation – Free Cash Flow Approach • Stock Market Equilibrium

3 Facts about common stock • • • Represents ownership Ownership implies control Stockholders elect directors Directors elect management Management’s goal: Maximize the stock price

3 Facts about common stock • • • Represents ownership Ownership implies control Stockholders elect directors Directors elect management Management’s goal: Maximize the stock price

4 Preferred Stock Characteristics • Unlike common stock, no ownership interest • Second to debt holders on claim on company’s assets in the event of bankruptcy. • Annual dividend yield as a percentage of par value • Preferred dividends must be paid before common dividends • If cumulative preferred, all missed past dividends must be paid before common dividends can be paid.

4 Preferred Stock Characteristics • Unlike common stock, no ownership interest • Second to debt holders on claim on company’s assets in the event of bankruptcy. • Annual dividend yield as a percentage of par value • Preferred dividends must be paid before common dividends • If cumulative preferred, all missed past dividends must be paid before common dividends can be paid.

5 Intrinsic Value and Stock Price • Outside investors, corporate insiders, and analysts use a variety of approaches to estimate a stock’s intrinsic value (P 0). • In equilibrium we assume that a stock’s price equals its intrinsic value. ▫ Outsiders estimate intrinsic value to help determine which stocks are attractive to buy and/or sell. ▫ Stocks with a price below (above) its intrinsic value are undervalued (overvalued).

5 Intrinsic Value and Stock Price • Outside investors, corporate insiders, and analysts use a variety of approaches to estimate a stock’s intrinsic value (P 0). • In equilibrium we assume that a stock’s price equals its intrinsic value. ▫ Outsiders estimate intrinsic value to help determine which stocks are attractive to buy and/or sell. ▫ Stocks with a price below (above) its intrinsic value are undervalued (overvalued).

6 Preferred Stock Valuation • Promises to pay the same dividend year after year forever, never matures. • A perpetuity. • VP = DP/r. P • Expected Return: r. P = DP/P 0 • Example: GM preferred stock has a $25 par value with a 8% dividend yield. What price would you pay if your required return is 7%?

6 Preferred Stock Valuation • Promises to pay the same dividend year after year forever, never matures. • A perpetuity. • VP = DP/r. P • Expected Return: r. P = DP/P 0 • Example: GM preferred stock has a $25 par value with a 8% dividend yield. What price would you pay if your required return is 7%?

7 What do investors in common stock want? • Periodic cash flows: dividends, and… • To sell the stock in the future at a higher price • Management to maximize their wealth

7 What do investors in common stock want? • Periodic cash flows: dividends, and… • To sell the stock in the future at a higher price • Management to maximize their wealth

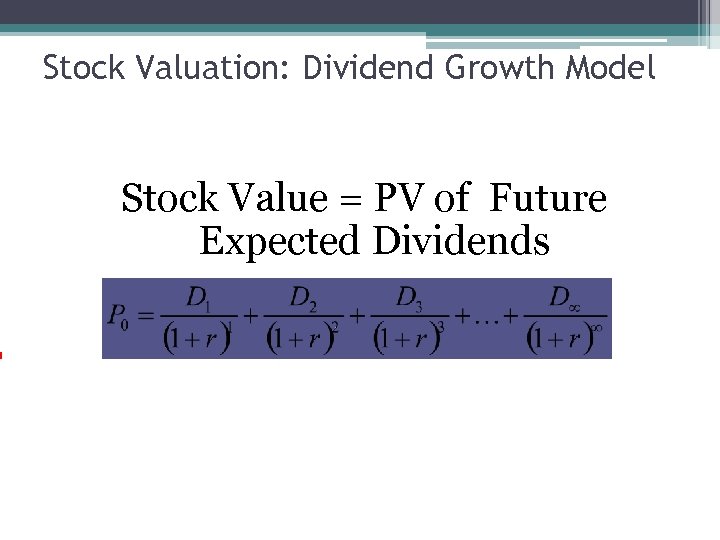

Stock Valuation: Dividend Growth Model Stock Value = PV of Future Expected Dividends 8

Stock Valuation: Dividend Growth Model Stock Value = PV of Future Expected Dividends 8

9 Stock Valuation: Dividend Patterns • For Valuation: we will assume stocks fall into one of the following dividend growth patterns. ▫ Constant growth rate in dividends ▫ Zero growth rate in dividends, like preferred stock ▫ Variable (non-constant) growth rate in dividends

9 Stock Valuation: Dividend Patterns • For Valuation: we will assume stocks fall into one of the following dividend growth patterns. ▫ Constant growth rate in dividends ▫ Zero growth rate in dividends, like preferred stock ▫ Variable (non-constant) growth rate in dividends

10 Stock Valuation Case Study: Doh! Doughnuts • We have found the following information for Doh! Doughnuts: • current dividend = $2. 00 = Div 0 • The current T-bill rate is 5% and investors demand an 9% market risk premium. • Doh!’s beta = 1. 2.

10 Stock Valuation Case Study: Doh! Doughnuts • We have found the following information for Doh! Doughnuts: • current dividend = $2. 00 = Div 0 • The current T-bill rate is 5% and investors demand an 9% market risk premium. • Doh!’s beta = 1. 2.

11 Analysts Estimates for Doh! Doughnuts • NEDFlanders predicts a constant annual growth rate in dividends and earnings of zero percent (0%) • Barton Kruston Simpson predicts a constant annual growth rate in dividends and earnings of 10 percent (9%). • Homer Co. expects a dramatic growth phase of 30% annually for each of the next 3 years followed by a constant 10% growth rate in year 4 and beyond.

11 Analysts Estimates for Doh! Doughnuts • NEDFlanders predicts a constant annual growth rate in dividends and earnings of zero percent (0%) • Barton Kruston Simpson predicts a constant annual growth rate in dividends and earnings of 10 percent (9%). • Homer Co. expects a dramatic growth phase of 30% annually for each of the next 3 years followed by a constant 10% growth rate in year 4 and beyond.

12 Our Task: Valuation Estimates • What should be each analyst’s estimated value of Doh! Doughnuts?

12 Our Task: Valuation Estimates • What should be each analyst’s estimated value of Doh! Doughnuts?

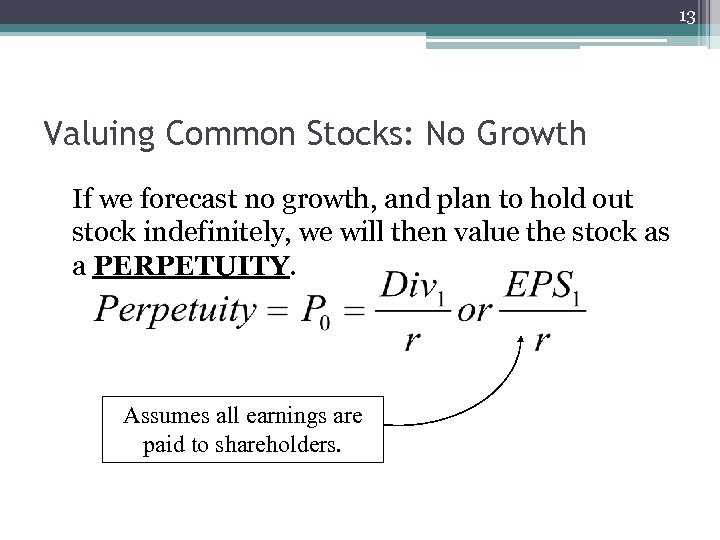

13 Valuing Common Stocks: No Growth If we forecast no growth, and plan to hold out stock indefinitely, we will then value the stock as a PERPETUITY. Assumes all earnings are paid to shareholders.

13 Valuing Common Stocks: No Growth If we forecast no growth, and plan to hold out stock indefinitely, we will then value the stock as a PERPETUITY. Assumes all earnings are paid to shareholders.

14 Ned Flanders’ Valuation • D 0 = $2. 00, r. S = 15. 8% or 0. 158, g = 0%

14 Ned Flanders’ Valuation • D 0 = $2. 00, r. S = 15. 8% or 0. 158, g = 0%

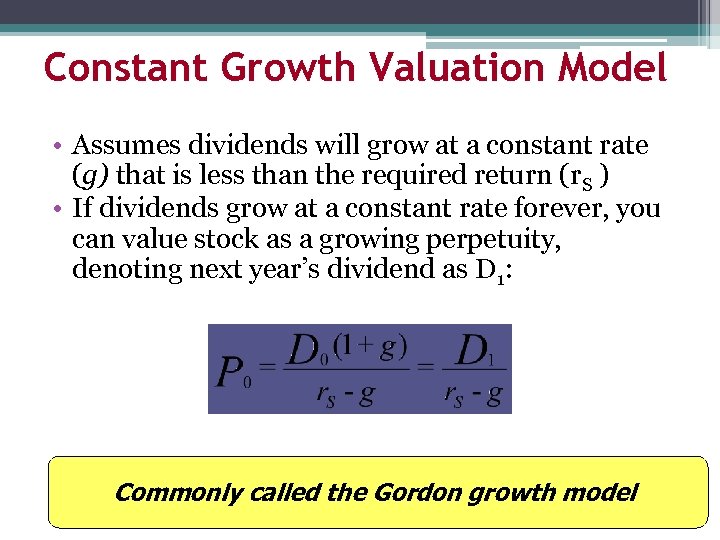

Constant Growth Valuation Model • Assumes dividends will grow at a constant rate (g) that is less than the required return (r. S ) • If dividends grow at a constant rate forever, you can value stock as a growing perpetuity, denoting next year’s dividend as D 1: Commonly called the Gordon growth model 15

Constant Growth Valuation Model • Assumes dividends will grow at a constant rate (g) that is less than the required return (r. S ) • If dividends grow at a constant rate forever, you can value stock as a growing perpetuity, denoting next year’s dividend as D 1: Commonly called the Gordon growth model 15

16 Barton Kruston Simpson’s Valuation • D 0 = $2. 00, g = 9%, r. S = 15. 8%

16 Barton Kruston Simpson’s Valuation • D 0 = $2. 00, g = 9%, r. S = 15. 8%

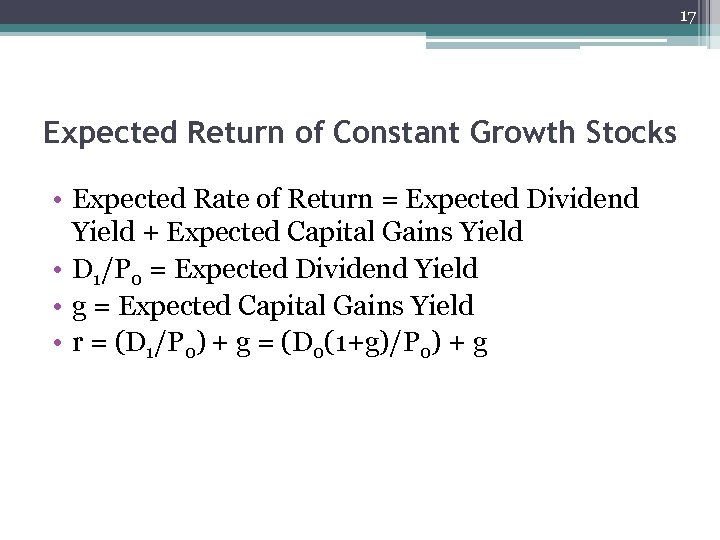

17 Expected Return of Constant Growth Stocks • Expected Rate of Return = Expected Dividend Yield + Expected Capital Gains Yield • D 1/P 0 = Expected Dividend Yield • g = Expected Capital Gains Yield • r = (D 1/P 0) + g = (D 0(1+g)/P 0) + g

17 Expected Return of Constant Growth Stocks • Expected Rate of Return = Expected Dividend Yield + Expected Capital Gains Yield • D 1/P 0 = Expected Dividend Yield • g = Expected Capital Gains Yield • r = (D 1/P 0) + g = (D 0(1+g)/P 0) + g

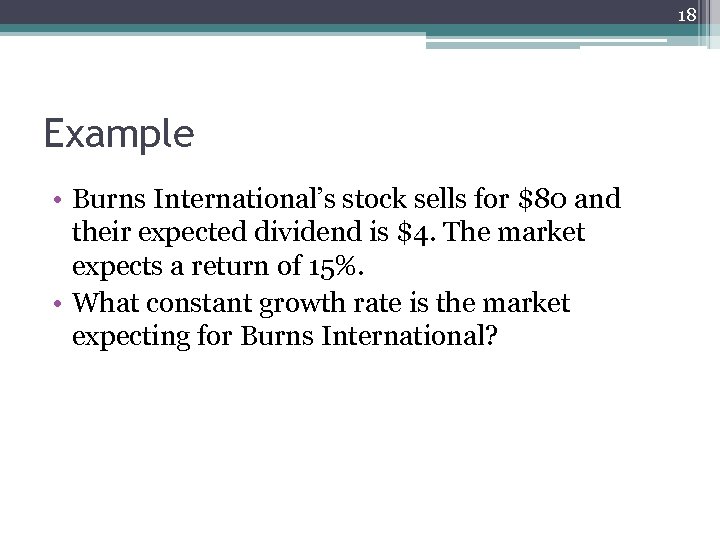

18 Example • Burns International’s stock sells for $80 and their expected dividend is $4. The market expects a return of 15%. • What constant growth rate is the market expecting for Burns International?

18 Example • Burns International’s stock sells for $80 and their expected dividend is $4. The market expects a return of 15%. • What constant growth rate is the market expecting for Burns International?

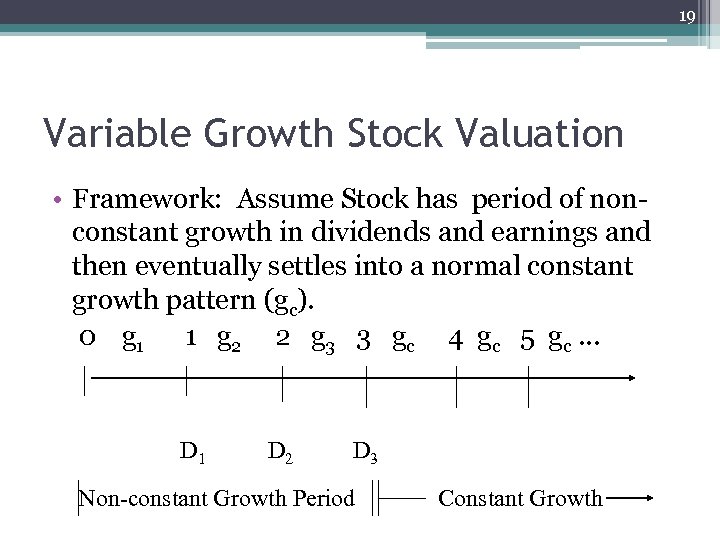

19 Variable Growth Stock Valuation • Framework: Assume Stock has period of nonconstant growth in dividends and earnings and then eventually settles into a normal constant growth pattern (gc). 0 g 1 1 g 2 2 g 3 3 gc 4 gc 5 gc. . . D 1 D 2 D 3 Non-constant Growth Period Constant Growth

19 Variable Growth Stock Valuation • Framework: Assume Stock has period of nonconstant growth in dividends and earnings and then eventually settles into a normal constant growth pattern (gc). 0 g 1 1 g 2 2 g 3 3 gc 4 gc 5 gc. . . D 1 D 2 D 3 Non-constant Growth Period Constant Growth

20 Today’s agenda • Supernormal (non-constant) dividend growth valuation • Corporate value approach to stock valuation • Stock Market Equilibrium

20 Today’s agenda • Supernormal (non-constant) dividend growth valuation • Corporate value approach to stock valuation • Stock Market Equilibrium

21 Homer Co. Valuation • Variable (non-constant) growth • Years 1 -3 expect 30% growth • After year 3: constant growth of 10%

21 Homer Co. Valuation • Variable (non-constant) growth • Years 1 -3 expect 30% growth • After year 3: constant growth of 10%

22 Variable Growth Valuation Process 3 Step Process • Estimate Dividends during non-constant growth period. • Estimate Price, which is the PV of the constant growth dividends, at the end of non-constant growth period which is also the beginning of the constant growth period. This is called the horizon or terminal value. • Find the PV of non-constant dividends and horizon value. The total of these PVs = Today’s estimated stock value.

22 Variable Growth Valuation Process 3 Step Process • Estimate Dividends during non-constant growth period. • Estimate Price, which is the PV of the constant growth dividends, at the end of non-constant growth period which is also the beginning of the constant growth period. This is called the horizon or terminal value. • Find the PV of non-constant dividends and horizon value. The total of these PVs = Today’s estimated stock value.

23 Back to Homer Co’s Valuation: Step 1 • D 0 = $2. 00, g = 30% or 0. 3 for next 3 years

23 Back to Homer Co’s Valuation: Step 1 • D 0 = $2. 00, g = 30% or 0. 3 for next 3 years

24 Homer Co’s Valuation: Step 2 • Find Horizon Value which is the constant growth stock value at the end of year 3.

24 Homer Co’s Valuation: Step 2 • Find Horizon Value which is the constant growth stock value at the end of year 3.

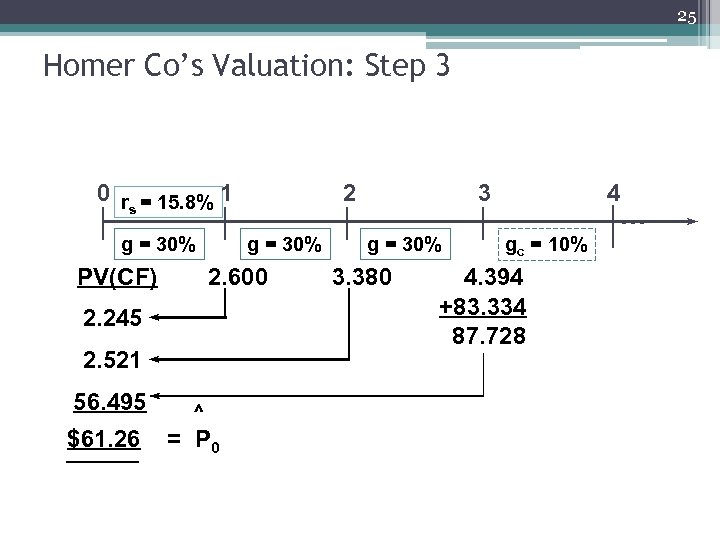

25 Homer Co’s Valuation: Step 3 0 r = 15. 8% 1 s g = 30% PV(CF) g = 30% 2. 600 2. 245 2. 521 56. 495 $61. 26 2 ^ = P 0 3 g = 30% 3. 380 4 . . . gc = 10% 4. 394 +83. 334 87. 728

25 Homer Co’s Valuation: Step 3 0 r = 15. 8% 1 s g = 30% PV(CF) g = 30% 2. 600 2. 245 2. 521 56. 495 $61. 26 2 ^ = P 0 3 g = 30% 3. 380 4 . . . gc = 10% 4. 394 +83. 334 87. 728

26 Corporate value model • Also called the free cash flow method. Suggests the value of the entire firm equals the present value of the firm’s free cash flows. • Remember, free cash flow is the firm’s after-tax operating income less the net capital investment ▫ FCF = NOPAT – Net capital investment

26 Corporate value model • Also called the free cash flow method. Suggests the value of the entire firm equals the present value of the firm’s free cash flows. • Remember, free cash flow is the firm’s after-tax operating income less the net capital investment ▫ FCF = NOPAT – Net capital investment

27 Applying the corporate value model • Find the market value (MV) of the firm, by finding the PV of the firm’s future FCFs at the company’s weighted average cost of capital, WACC. • Subtract MV of firm’s debt and preferred stock to get MV of common stock. • Divide MV of common stock by the number of shares outstanding to get intrinsic stock price (value).

27 Applying the corporate value model • Find the market value (MV) of the firm, by finding the PV of the firm’s future FCFs at the company’s weighted average cost of capital, WACC. • Subtract MV of firm’s debt and preferred stock to get MV of common stock. • Divide MV of common stock by the number of shares outstanding to get intrinsic stock price (value).

28 Issues regarding the corporate value model • Often preferred to the dividend growth model, especially when considering number of firms that don’t pay dividends or when dividends are hard to forecast. • Similar to dividend growth model, assumes at some point free cash flow will grow at a constant rate. • Terminal value (TVN) represents value of firm at the point that growth becomes constant.

28 Issues regarding the corporate value model • Often preferred to the dividend growth model, especially when considering number of firms that don’t pay dividends or when dividends are hard to forecast. • Similar to dividend growth model, assumes at some point free cash flow will grow at a constant rate. • Terminal value (TVN) represents value of firm at the point that growth becomes constant.

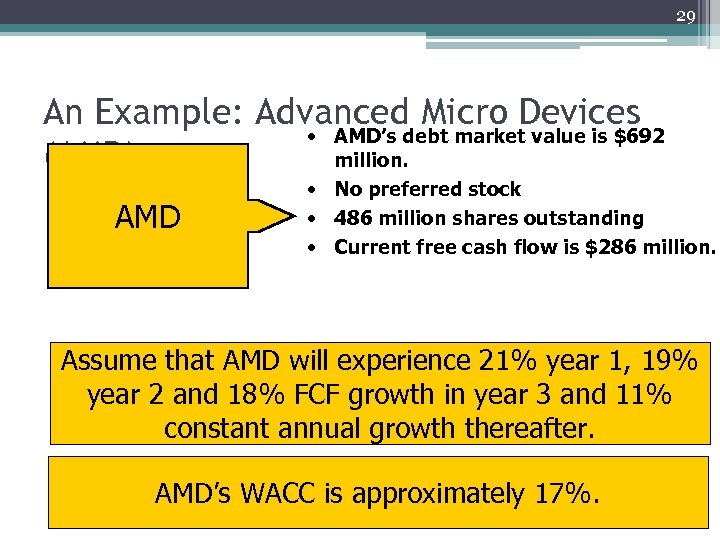

29 An Example: Advanced Micro Devices • AMD’s debt market value is $692 (AMD) million. AMD • No preferred stock • 486 million shares outstanding • Current free cash flow is $286 million. Assume that AMD will experience 21% year 1, 19% year 2 and 18% FCF growth in year 3 and 11% constant annual growth thereafter. AMD’s WACC is approximately 17%.

29 An Example: Advanced Micro Devices • AMD’s debt market value is $692 (AMD) million. AMD • No preferred stock • 486 million shares outstanding • Current free cash flow is $286 million. Assume that AMD will experience 21% year 1, 19% year 2 and 18% FCF growth in year 3 and 11% constant annual growth thereafter. AMD’s WACC is approximately 17%.

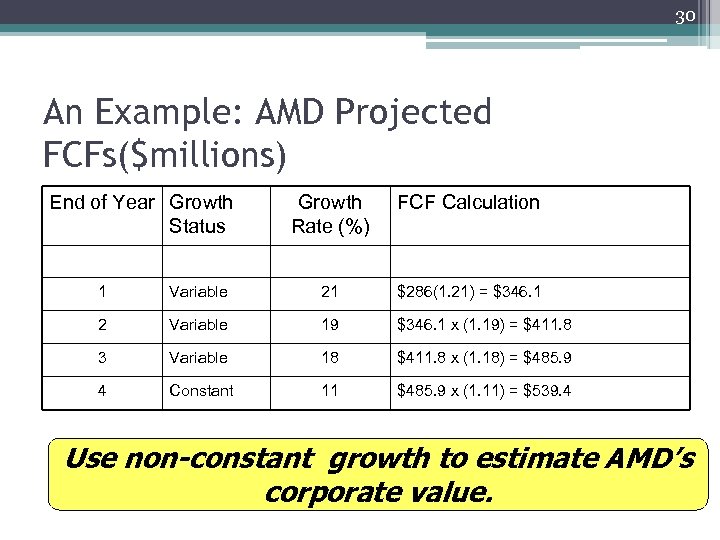

30 An Example: AMD Projected FCFs($millions) End of Year Growth Status Growth Rate (%) FCF Calculation 1 Variable 21 $286(1. 21) = $346. 1 2 Variable 19 $346. 1 x (1. 19) = $411. 8 3 Variable 18 $411. 8 x (1. 18) = $485. 9 4 Constant 11 $485. 9 x (1. 11) = $539. 4 Use non-constant growth to estimate AMD’s corporate value.

30 An Example: AMD Projected FCFs($millions) End of Year Growth Status Growth Rate (%) FCF Calculation 1 Variable 21 $286(1. 21) = $346. 1 2 Variable 19 $346. 1 x (1. 19) = $411. 8 3 Variable 18 $411. 8 x (1. 18) = $485. 9 4 Constant 11 $485. 9 x (1. 11) = $539. 4 Use non-constant growth to estimate AMD’s corporate value.

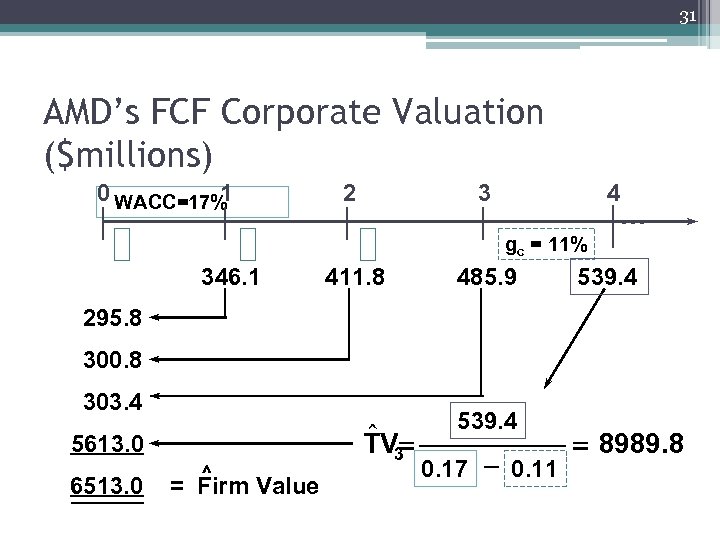

31 AMD’s FCF Corporate Valuation ($millions) 0 WACC=17% 1 2 3 4 . . . gc = 11% 346. 1 411. 8 485. 9 539. 4 295. 8 300. 8 303. 4 5613. 0 6513. 0 ^ = Firm Value $ TV= 3 539. 4 0. 17 - 0. 11 = 8989. 8

31 AMD’s FCF Corporate Valuation ($millions) 0 WACC=17% 1 2 3 4 . . . gc = 11% 346. 1 411. 8 485. 9 539. 4 295. 8 300. 8 303. 4 5613. 0 6513. 0 ^ = Firm Value $ TV= 3 539. 4 0. 17 - 0. 11 = 8989. 8

32 AMD’s Stock Value per share • MV of firm = $6513 million • MV of debt = $692 million • MV of equity (stock) = $6513 - $692 = $5821 million • 486 million shares outstanding • P 0 = MV of equity/shares = $5821/486 = $11. 98 • Recent price = $13. 50

32 AMD’s Stock Value per share • MV of firm = $6513 million • MV of debt = $692 million • MV of equity (stock) = $6513 - $692 = $5821 million • 486 million shares outstanding • P 0 = MV of equity/shares = $5821/486 = $11. 98 • Recent price = $13. 50

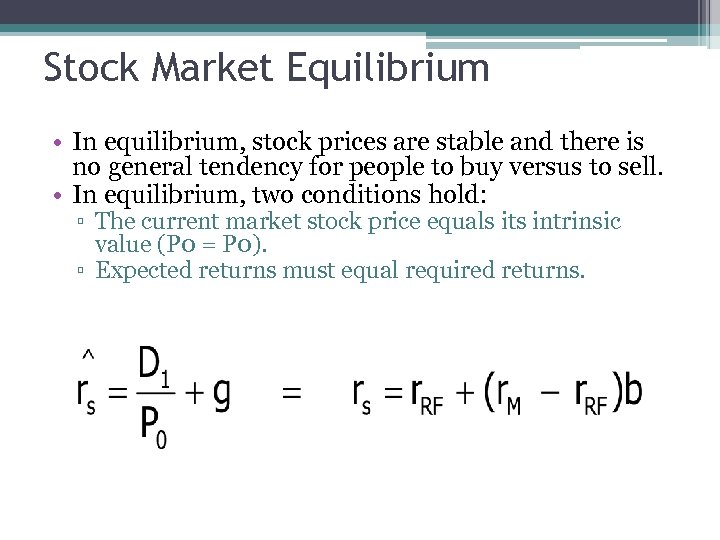

Stock Market Equilibrium • In equilibrium, stock prices are stable and there is no general tendency for people to buy versus to sell. • In equilibrium, two conditions hold: ▫ The current market stock price equals its intrinsic value (P 0 = P 0). ▫ Expected returns must equal required returns. 33

Stock Market Equilibrium • In equilibrium, stock prices are stable and there is no general tendency for people to buy versus to sell. • In equilibrium, two conditions hold: ▫ The current market stock price equals its intrinsic value (P 0 = P 0). ▫ Expected returns must equal required returns. 33

34 How is market equilibrium established? • If price is below intrinsic value … ▫ The current price (P 0) is “too low” and offers a bargain. ▫ Buy orders will be greater than sell orders. ▫ P 0 will be bid up until expected return equals required return.

34 How is market equilibrium established? • If price is below intrinsic value … ▫ The current price (P 0) is “too low” and offers a bargain. ▫ Buy orders will be greater than sell orders. ▫ P 0 will be bid up until expected return equals required return.

35 Doh! In equilibrium? • Doh! Doughnuts current stock price is $30. • Required return = 5% + 9%(1. 2) = 15. 8% • Let’s assume the 2 nd analyst is correct and Doh! Has a constant growth rate of 9% and its current dividend is $2. • Is Doh! Doughnuts’ current stock price in equilibrium?

35 Doh! In equilibrium? • Doh! Doughnuts current stock price is $30. • Required return = 5% + 9%(1. 2) = 15. 8% • Let’s assume the 2 nd analyst is correct and Doh! Has a constant growth rate of 9% and its current dividend is $2. • Is Doh! Doughnuts’ current stock price in equilibrium?

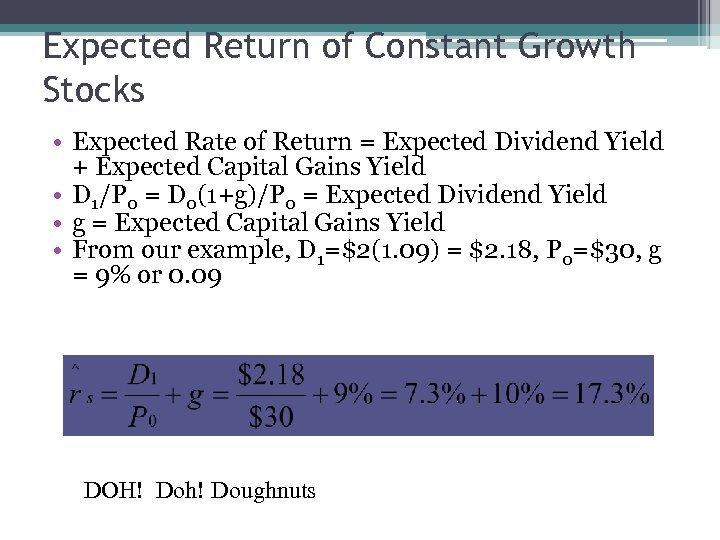

Expected Return of Constant Growth Stocks • Expected Rate of Return = Expected Dividend Yield + Expected Capital Gains Yield • D 1/P 0 = D 0(1+g)/P 0 = Expected Dividend Yield • g = Expected Capital Gains Yield • From our example, D 1=$2(1. 09) = $2. 18, P 0=$30, g = 9% or 0. 09 DOH! Doh! Doughnuts 36

Expected Return of Constant Growth Stocks • Expected Rate of Return = Expected Dividend Yield + Expected Capital Gains Yield • D 1/P 0 = D 0(1+g)/P 0 = Expected Dividend Yield • g = Expected Capital Gains Yield • From our example, D 1=$2(1. 09) = $2. 18, P 0=$30, g = 9% or 0. 09 DOH! Doh! Doughnuts 36

The Effect On the Stock Price • Expected Return needs to fall to the required return of 15. 8%. This means the stock price must rise to the equilibrium price that yields the required return of 15. 8% • New Price = D 1/(rs- g)=$2. 18/(. 158 -. 09)= $32. 06 37

The Effect On the Stock Price • Expected Return needs to fall to the required return of 15. 8%. This means the stock price must rise to the equilibrium price that yields the required return of 15. 8% • New Price = D 1/(rs- g)=$2. 18/(. 158 -. 09)= $32. 06 37

38 Stock Valuation Summary • Looked at Dividend Discount Model: Value = PV of future expected dividends. All else equal: ▫ Higher interest rates (rs) yields lower stock prices (inverse relationship) ▫ Higher growth rate yields higher stock price. • Other Stock Valuation Methods ▫ “Multiples” Method: P/E, P/CF, P/S ▫ For example: Price Estimate = PE Ratio x expected EPS

38 Stock Valuation Summary • Looked at Dividend Discount Model: Value = PV of future expected dividends. All else equal: ▫ Higher interest rates (rs) yields lower stock prices (inverse relationship) ▫ Higher growth rate yields higher stock price. • Other Stock Valuation Methods ▫ “Multiples” Method: P/E, P/CF, P/S ▫ For example: Price Estimate = PE Ratio x expected EPS