ce9f131a2b7f0d0b96c04abfe56d95ee.ppt

- Количество слайдов: 84

Chapter 9 Skyline College 1

Chapter 9 Skyline College 1

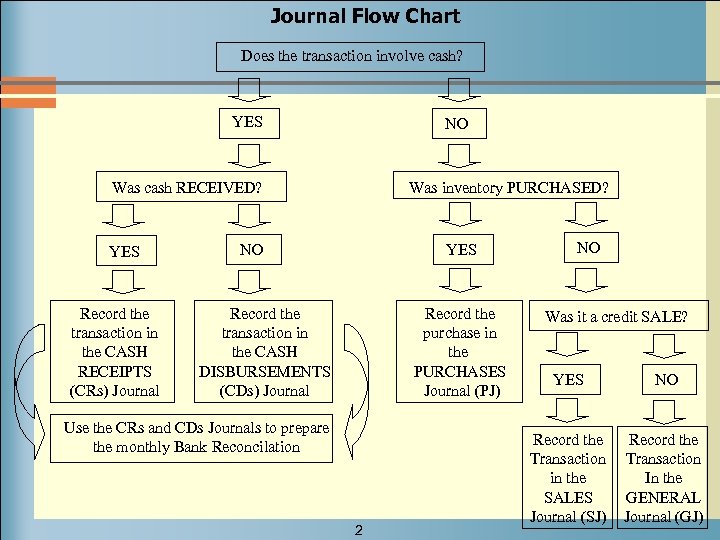

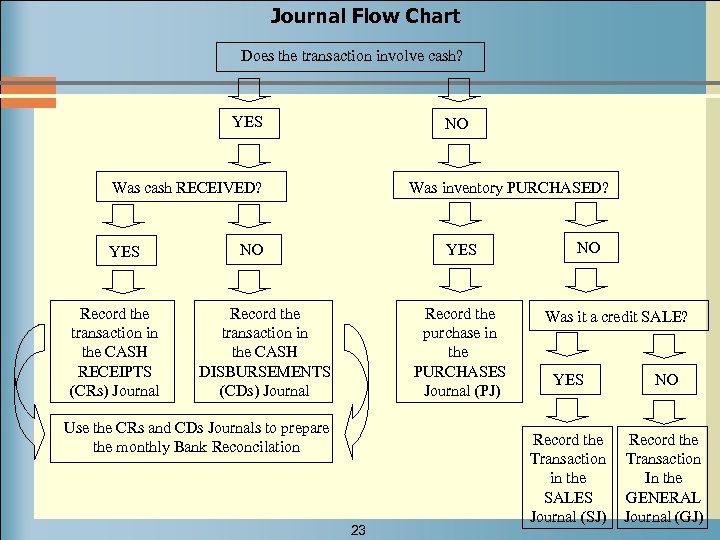

Journal Flow Chart Does the transaction involve cash? YES NO Was cash RECEIVED? YES Record the transaction in the CASH RECEIPTS (CRs) Journal Was inventory PURCHASED? NO YES Record the transaction in the CASH DISBURSEMENTS (CDs) Journal Record the purchase in the PURCHASES Journal (PJ) Use the CRs and CDs Journals to prepare the monthly Bank Reconcilation 2 NO Was it a credit SALE? YES NO Record the Transaction in the SALES Journal (SJ) Record the Transaction In the GENERAL Journal (GJ)

Journal Flow Chart Does the transaction involve cash? YES NO Was cash RECEIVED? YES Record the transaction in the CASH RECEIPTS (CRs) Journal Was inventory PURCHASED? NO YES Record the transaction in the CASH DISBURSEMENTS (CDs) Journal Record the purchase in the PURCHASES Journal (PJ) Use the CRs and CDs Journals to prepare the monthly Bank Reconcilation 2 NO Was it a credit SALE? YES NO Record the Transaction in the SALES Journal (SJ) Record the Transaction In the GENERAL Journal (GJ)

The Cash Receipts Journal A cash receipts journal is a special journal used to record and post transactions involving the receipt of cash. 3

The Cash Receipts Journal A cash receipts journal is a special journal used to record and post transactions involving the receipt of cash. 3

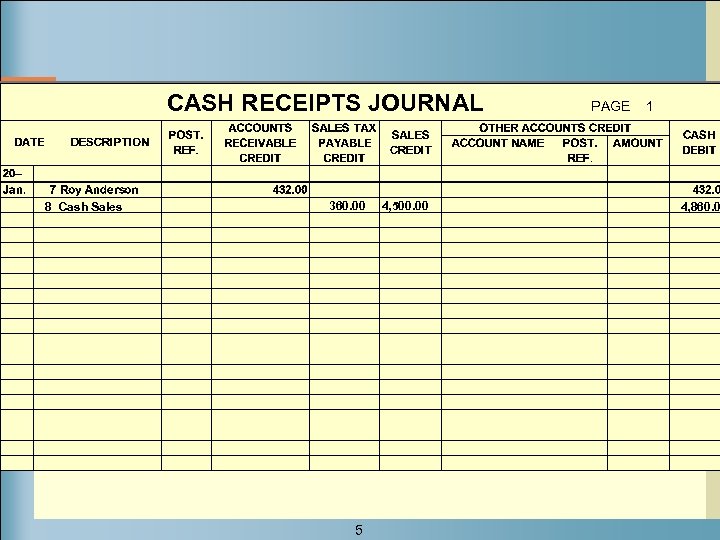

Cash Sales and Sales Taxes Consider the cash sales entries for January 8 in the cash receipts journal for The Style Shop. 4

Cash Sales and Sales Taxes Consider the cash sales entries for January 8 in the cash receipts journal for The Style Shop. 4

CASH RECEIPTS JOURNAL 8 Cash Sales 360. 00 5 4, 500. 00 PAGE 1 4, 860. 0

CASH RECEIPTS JOURNAL 8 Cash Sales 360. 00 5 4, 500. 00 PAGE 1 4, 860. 0

Cash Short Over Occasionally errors occur when making change. When errors happen, the cash in the cash register is either more or less than the cash listed on the audit tape. l l When cash in the register is more than the audit tape, cash is over. When the cash in the register is less than the audit tape, cash is short. 6

Cash Short Over Occasionally errors occur when making change. When errors happen, the cash in the cash register is either more or less than the cash listed on the audit tape. l l When cash in the register is more than the audit tape, cash is over. When the cash in the register is less than the audit tape, cash is short. 6

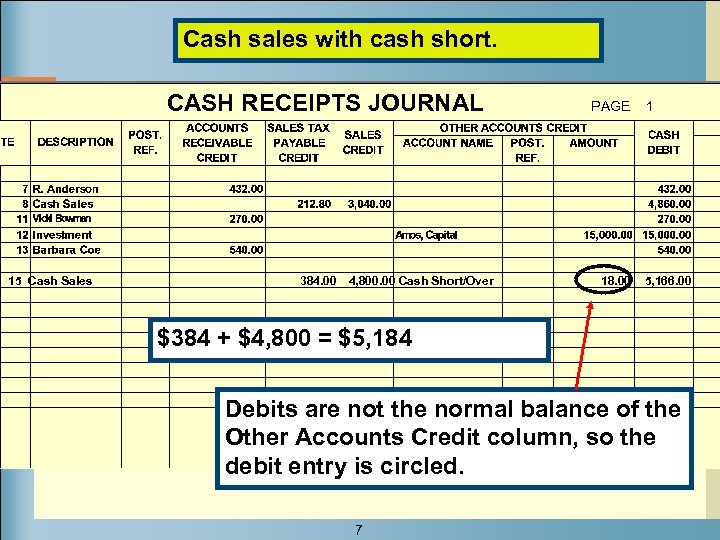

Cash sales with cash short. CASH RECEIPTS JOURNAL 15 Cash Sales 384. 00 4, 800. 00 Cash Short/Over PAGE 18. 00 1 5, 166. 00 $384 + $4, 800 = $5, 184 Debits are not the normal balance of the Other Accounts Credit column, so the debit entry is circled. 7

Cash sales with cash short. CASH RECEIPTS JOURNAL 15 Cash Sales 384. 00 4, 800. 00 Cash Short/Over PAGE 18. 00 1 5, 166. 00 $384 + $4, 800 = $5, 184 Debits are not the normal balance of the Other Accounts Credit column, so the debit entry is circled. 7

Cash Discounts on Sales l The Style Shop does not offer cash discounts. l However, many wholesale businesses offer cash discounts to customers who pay within a certain time period. These are sales discounts. l Businesses with many sales discounts add a Sales Discounts Debit column to the cash receipts journal. 8

Cash Discounts on Sales l The Style Shop does not offer cash discounts. l However, many wholesale businesses offer cash discounts to customers who pay within a certain time period. These are sales discounts. l Businesses with many sales discounts add a Sales Discounts Debit column to the cash receipts journal. 8

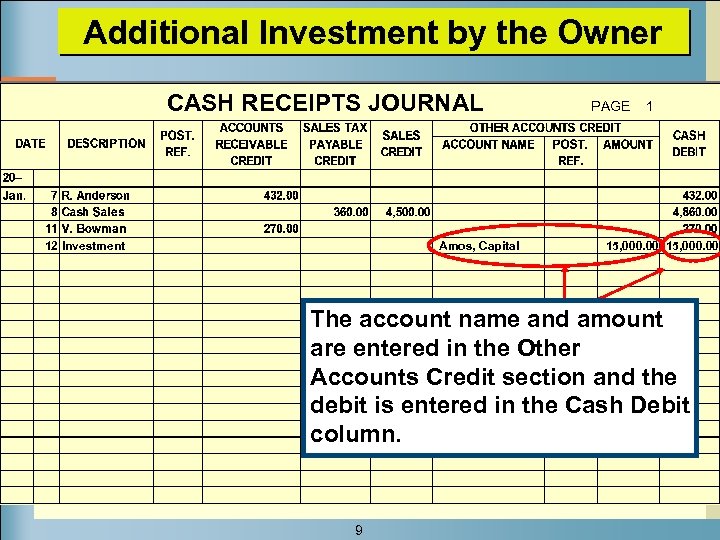

Additional Investment by the Owner CASH RECEIPTS JOURNAL 12 Investment Amos, Capital PAGE 1 15, 000. 00 The account name and amount are entered in the Other Accounts Credit section and the debit is entered in the Cash Debit column. 9

Additional Investment by the Owner CASH RECEIPTS JOURNAL 12 Investment Amos, Capital PAGE 1 15, 000. 00 The account name and amount are entered in the Other Accounts Credit section and the debit is entered in the Cash Debit column. 9

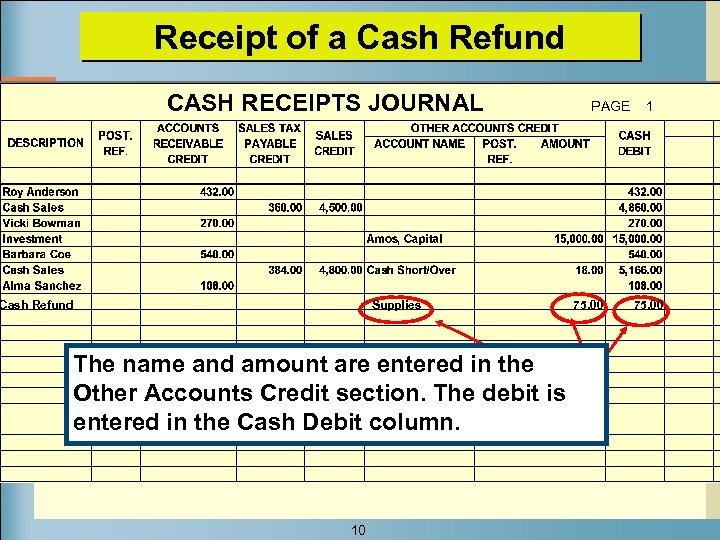

Receipt of a Cash Refund CASH RECEIPTS JOURNAL Cash Refund Supplies The name and amount are entered in the Other Accounts Credit section. The debit is entered in the Cash Debit column. 10 PAGE 75. 00 1 75. 00

Receipt of a Cash Refund CASH RECEIPTS JOURNAL Cash Refund Supplies The name and amount are entered in the Other Accounts Credit section. The debit is entered in the Cash Debit column. 10 PAGE 75. 00 1 75. 00

Promissory Note A promissory note is a written promise to pay a specified amount of money on a certain date. Sometimes promissory notes are used to replace an accounts receivable balance when the account is overdue. 11

Promissory Note A promissory note is a written promise to pay a specified amount of money on a certain date. Sometimes promissory notes are used to replace an accounts receivable balance when the account is overdue. 11

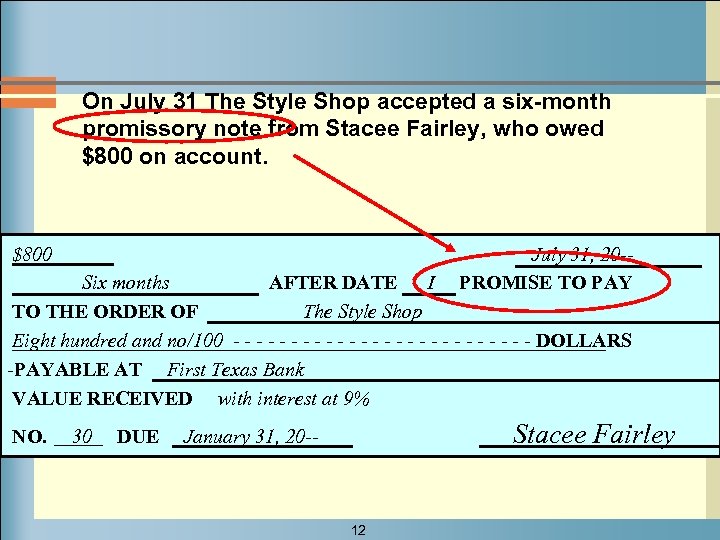

On July 31 The Style Shop accepted a six-month promissory note from Stacee Fairley, who owed $800 on account. $800 July 31, 20 -PROMISE TO PAY Six months AFTER DATE I TO THE ORDER OF The Style Shop Eight hundred and no/100 - - - - - - - DOLLARS -PAYABLE AT First Texas Bank VALUE RECEIVED with interest at 9% NO. 30 DUE Stacee Fairley January 31, 20 -- 12

On July 31 The Style Shop accepted a six-month promissory note from Stacee Fairley, who owed $800 on account. $800 July 31, 20 -PROMISE TO PAY Six months AFTER DATE I TO THE ORDER OF The Style Shop Eight hundred and no/100 - - - - - - - DOLLARS -PAYABLE AT First Texas Bank VALUE RECEIVED with interest at 9% NO. 30 DUE Stacee Fairley January 31, 20 -- 12

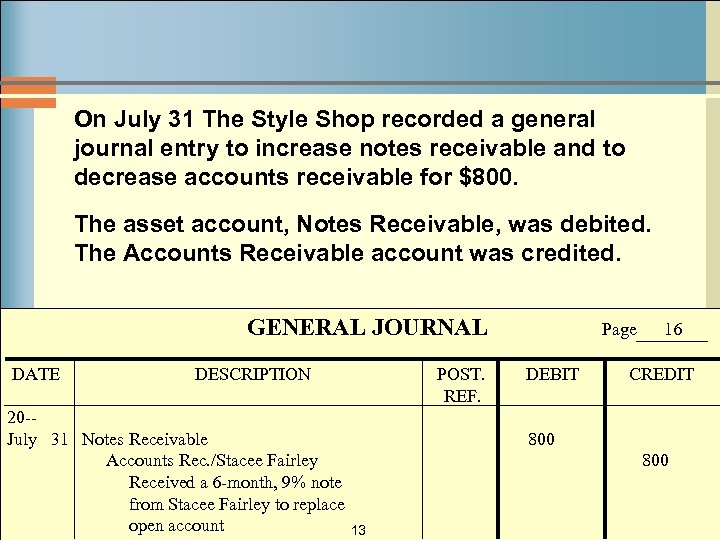

On July 31 The Style Shop recorded a general journal entry to increase notes receivable and to decrease accounts receivable for $800. The asset account, Notes Receivable, was debited. The Accounts Receivable account was credited. GENERAL JOURNAL DATE DESCRIPTION 20 -July 31 Notes Receivable Accounts Rec. /Stacee Fairley Received a 6 -month, 9% note from Stacee Fairley to replace open account POST. REF. Page DEBIT 16 CREDIT 800 13

On July 31 The Style Shop recorded a general journal entry to increase notes receivable and to decrease accounts receivable for $800. The asset account, Notes Receivable, was debited. The Accounts Receivable account was credited. GENERAL JOURNAL DATE DESCRIPTION 20 -July 31 Notes Receivable Accounts Rec. /Stacee Fairley Received a 6 -month, 9% note from Stacee Fairley to replace open account POST. REF. Page DEBIT 16 CREDIT 800 13

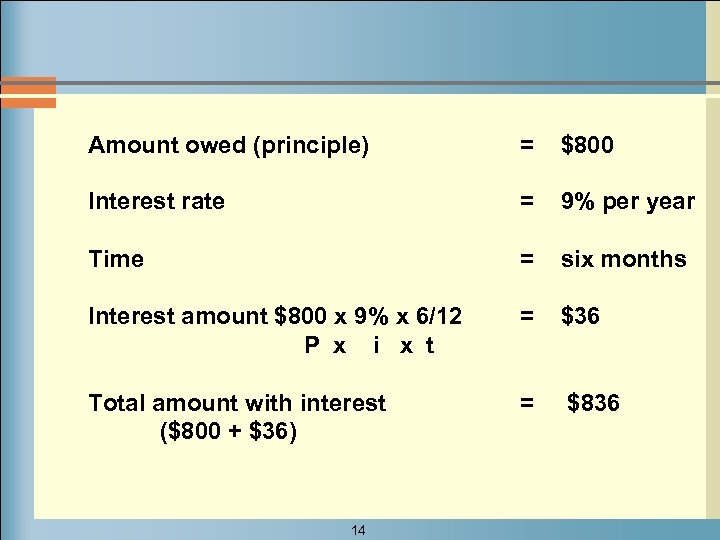

Amount owed (principle) = $800 Interest rate = 9% per year Time = six months Interest amount $800 x 9% x 6/12 P x i x t = $36 Total amount with interest ($800 + $36) = $836 14

Amount owed (principle) = $800 Interest rate = 9% per year Time = six months Interest amount $800 x 9% x 6/12 P x i x t = $36 Total amount with interest ($800 + $36) = $836 14

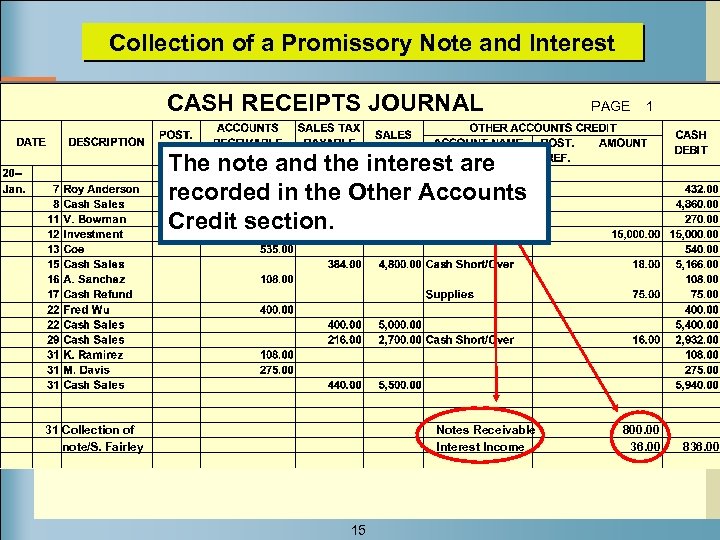

Collection of a Promissory Note and Interest CASH RECEIPTS JOURNAL PAGE 1 The note and the interest are recorded in the Other Accounts Credit section. 31 Collection of note/S. Fairley Notes Receivable Interest Income 15 800. 00 36. 00 836. 00

Collection of a Promissory Note and Interest CASH RECEIPTS JOURNAL PAGE 1 The note and the interest are recorded in the Other Accounts Credit section. 31 Collection of note/S. Fairley Notes Receivable Interest Income 15 800. 00 36. 00 836. 00

Posting the Cash Receipts Journal Posting the Column Totals At the end of the month, the cash receipts journal is totaled and the equality of debits and credits is proved. 16

Posting the Cash Receipts Journal Posting the Column Totals At the end of the month, the cash receipts journal is totaled and the equality of debits and credits is proved. 16

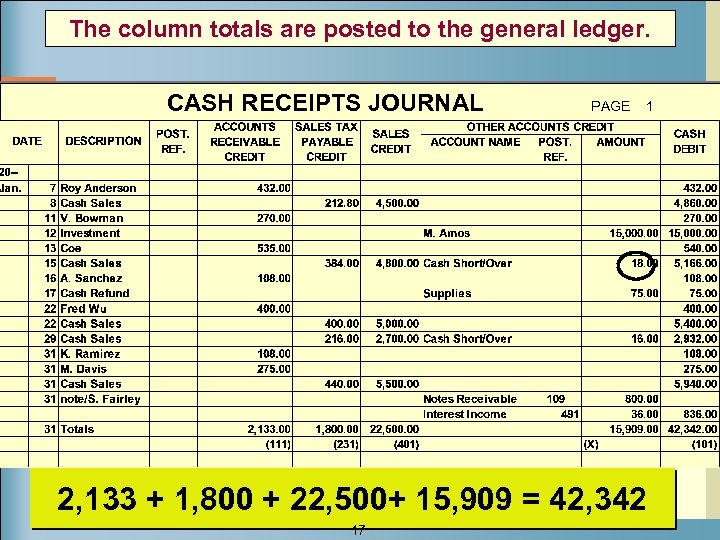

The column totals are posted to the general ledger. CASH RECEIPTS JOURNAL PAGE 1 2, 133 + 1, 800 + 22, 500+ 15, 909 = 42, 342 17

The column totals are posted to the general ledger. CASH RECEIPTS JOURNAL PAGE 1 2, 133 + 1, 800 + 22, 500+ 15, 909 = 42, 342 17

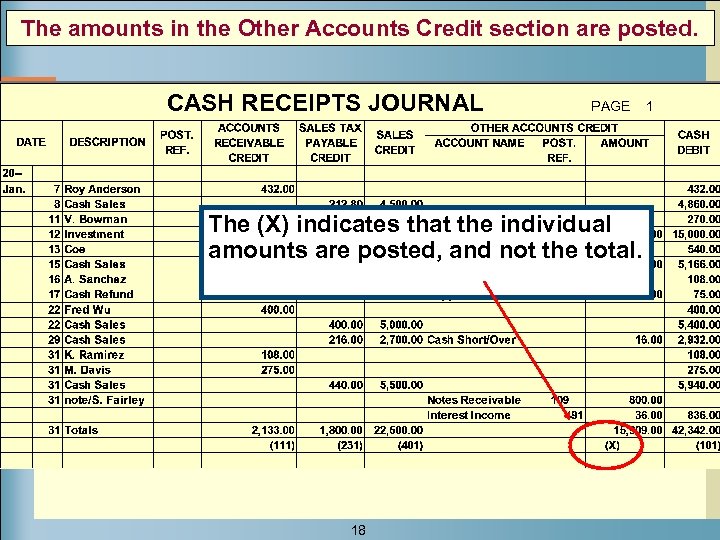

The amounts in the Other Accounts Credit section are posted. CASH RECEIPTS JOURNAL PAGE The (X) indicates that the individual amounts are posted, and not the total. 18 1

The amounts in the Other Accounts Credit section are posted. CASH RECEIPTS JOURNAL PAGE The (X) indicates that the individual amounts are posted, and not the total. 18 1

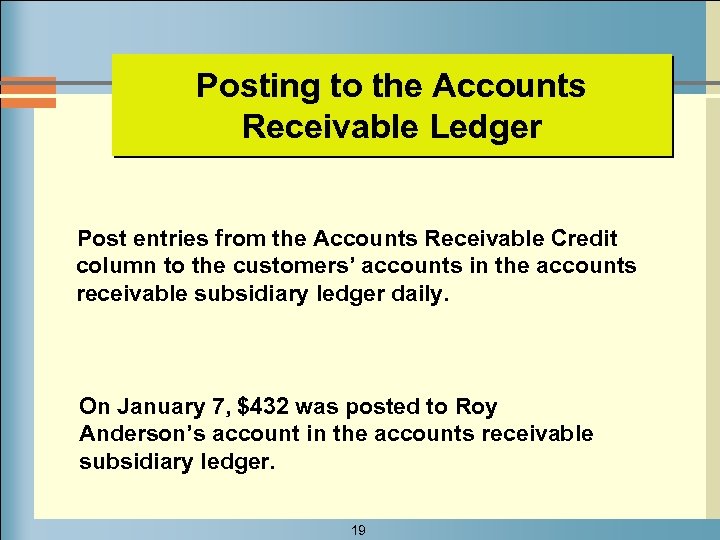

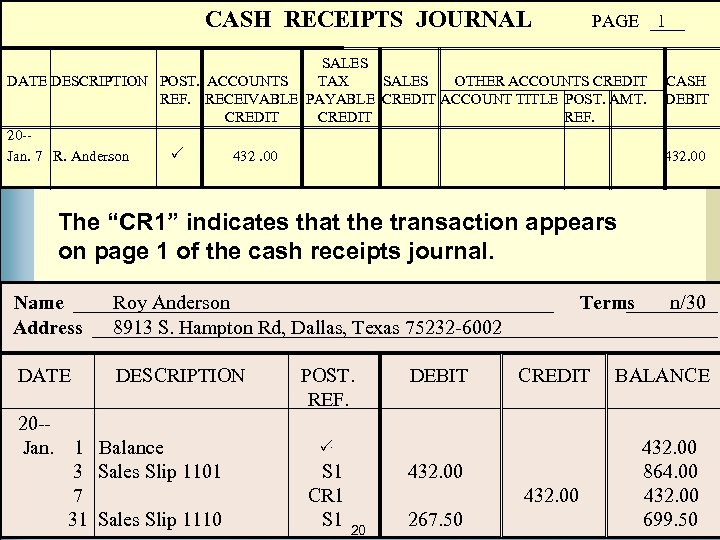

Posting to the Accounts Receivable Ledger Post entries from the Accounts Receivable Credit column to the customers’ accounts in the accounts receivable subsidiary ledger daily. On January 7, $432 was posted to Roy Anderson’s account in the accounts receivable subsidiary ledger. 19

Posting to the Accounts Receivable Ledger Post entries from the Accounts Receivable Credit column to the customers’ accounts in the accounts receivable subsidiary ledger daily. On January 7, $432 was posted to Roy Anderson’s account in the accounts receivable subsidiary ledger. 19

CASH RECEIPTS JOURNAL PAGE 1 SALES DATE DESCRIPTION POST. ACCOUNTS TAX SALES OTHER ACCOUNTS CREDIT REF. RECEIVABLE PAYABLE CREDIT ACCOUNT TITLE POST. AMT. CREDIT REF. 20 -Jan. 7 R. Anderson 432. 00 CASH DEBIT 432. 00 The “CR 1” indicates that the transaction appears on page 1 of the cash receipts journal. Name Address Roy Anderson 8913 S. Hampton Rd, Dallas, Texas 75232 -6002 DATE DESCRIPTION 20 -Jan. 1 Balance 3 Sales Slip 1101 7 31 Sales Slip 1110 POST. REF. DEBIT Terms CREDIT S 1 CR 1 S 1 432. 00 20 267. 50 n/30 BALANCE 432. 00 864. 00 432. 00 699. 50

CASH RECEIPTS JOURNAL PAGE 1 SALES DATE DESCRIPTION POST. ACCOUNTS TAX SALES OTHER ACCOUNTS CREDIT REF. RECEIVABLE PAYABLE CREDIT ACCOUNT TITLE POST. AMT. CREDIT REF. 20 -Jan. 7 R. Anderson 432. 00 CASH DEBIT 432. 00 The “CR 1” indicates that the transaction appears on page 1 of the cash receipts journal. Name Address Roy Anderson 8913 S. Hampton Rd, Dallas, Texas 75232 -6002 DATE DESCRIPTION 20 -Jan. 1 Balance 3 Sales Slip 1101 7 31 Sales Slip 1110 POST. REF. DEBIT Terms CREDIT S 1 CR 1 S 1 432. 00 20 267. 50 n/30 BALANCE 432. 00 864. 00 432. 00 699. 50

Advantages of the Cash Receipts Journal The cash receipts journal: l Saves time and effort when recording and posting cash receipts l Allows for the division of work among the accounting staff l Strengthens the audit trail by recording all cash receipts transactions in one place 21

Advantages of the Cash Receipts Journal The cash receipts journal: l Saves time and effort when recording and posting cash receipts l Allows for the division of work among the accounting staff l Strengthens the audit trail by recording all cash receipts transactions in one place 21

The Cash Payments Journal A cash payments journal is a special journal used to record transactions involving the payment of cash. 22

The Cash Payments Journal A cash payments journal is a special journal used to record transactions involving the payment of cash. 22

Journal Flow Chart Does the transaction involve cash? YES NO Was cash RECEIVED? YES Record the transaction in the CASH RECEIPTS (CRs) Journal Was inventory PURCHASED? NO YES Record the transaction in the CASH DISBURSEMENTS (CDs) Journal Record the purchase in the PURCHASES Journal (PJ) Use the CRs and CDs Journals to prepare the monthly Bank Reconcilation 23 NO Was it a credit SALE? YES NO Record the Transaction in the SALES Journal (SJ) Record the Transaction In the GENERAL Journal (GJ)

Journal Flow Chart Does the transaction involve cash? YES NO Was cash RECEIVED? YES Record the transaction in the CASH RECEIPTS (CRs) Journal Was inventory PURCHASED? NO YES Record the transaction in the CASH DISBURSEMENTS (CDs) Journal Record the purchase in the PURCHASES Journal (PJ) Use the CRs and CDs Journals to prepare the monthly Bank Reconcilation 23 NO Was it a credit SALE? YES NO Record the Transaction in the SALES Journal (SJ) Record the Transaction In the GENERAL Journal (GJ)

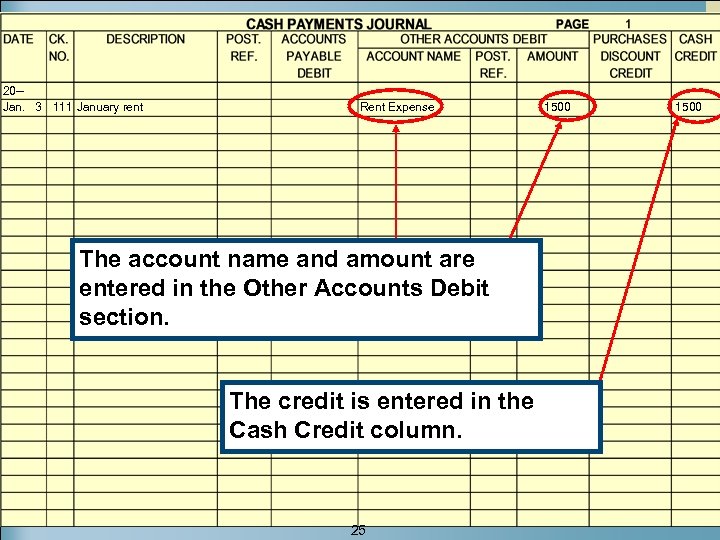

Payments for Expenses Businesses write checks for a variety of expenses each month. In January The Style Shop issued checks for rent, electricity, telephone service, advertising, and salaries. Consider the January 3 entry for rent expense. 24

Payments for Expenses Businesses write checks for a variety of expenses each month. In January The Style Shop issued checks for rent, electricity, telephone service, advertising, and salaries. Consider the January 3 entry for rent expense. 24

20 -Jan. 3 111 January rent Rent Expense The account name and amount are entered in the Other Accounts Debit section. The credit is entered in the Cash Credit column. 25 1500

20 -Jan. 3 111 January rent Rent Expense The account name and amount are entered in the Other Accounts Debit section. The credit is entered in the Cash Credit column. 25 1500

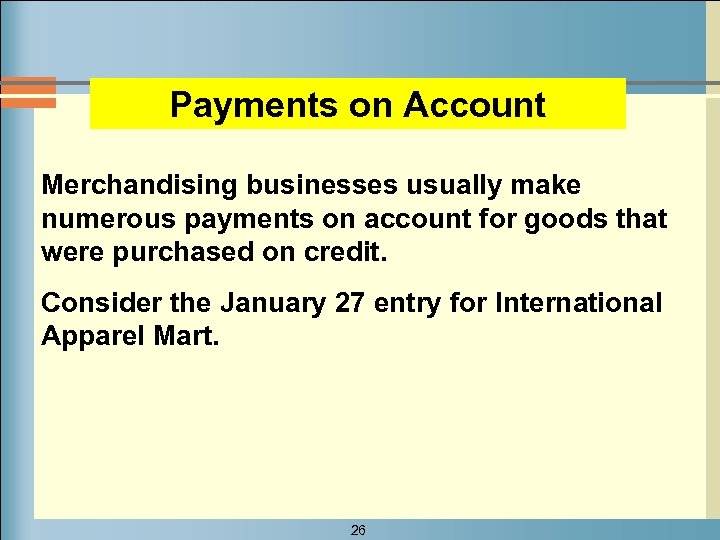

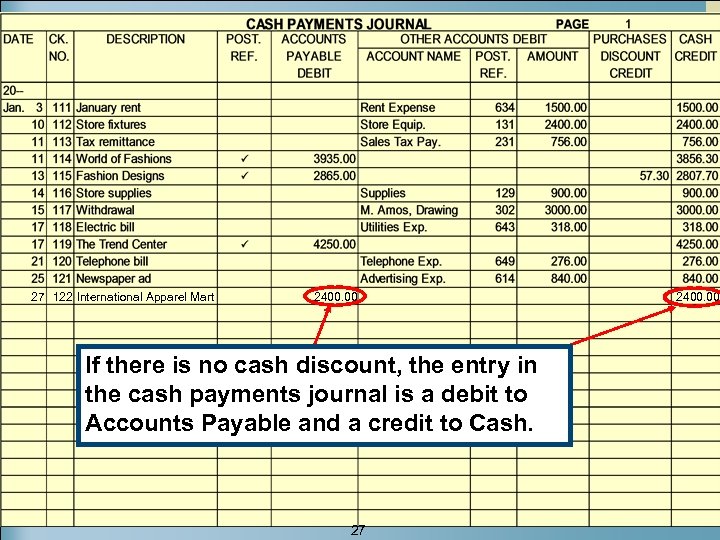

Payments on Account Merchandising businesses usually make numerous payments on account for goods that were purchased on credit. Consider the January 27 entry for International Apparel Mart. 26

Payments on Account Merchandising businesses usually make numerous payments on account for goods that were purchased on credit. Consider the January 27 entry for International Apparel Mart. 26

27 122 International Apparel Mart 2400. 00 If there is no cash discount, the entry in the cash payments journal is a debit to Accounts Payable and a credit to Cash. 27 2400. 00

27 122 International Apparel Mart 2400. 00 If there is no cash discount, the entry in the cash payments journal is a debit to Accounts Payable and a credit to Cash. 27 2400. 00

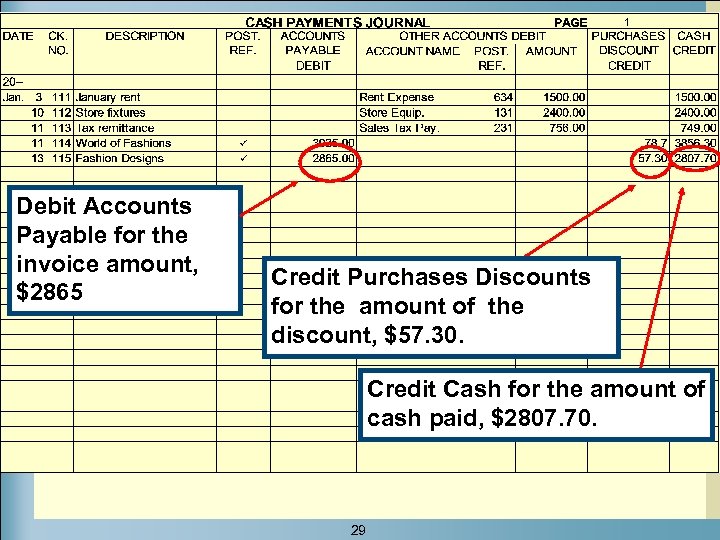

Purchases Discounts is a contra cost of goods sold account. For an example of a payment with a discount, refer to the January 13 entry for Fashion Designs. 28

Purchases Discounts is a contra cost of goods sold account. For an example of a payment with a discount, refer to the January 13 entry for Fashion Designs. 28

Debit Accounts Payable for the invoice amount, $2865 Credit Purchases Discounts for the amount of the discount, $57. 30. Credit Cash for the amount of cash paid, $2807. 70. 29

Debit Accounts Payable for the invoice amount, $2865 Credit Purchases Discounts for the amount of the discount, $57. 30. Credit Cash for the amount of cash paid, $2807. 70. 29

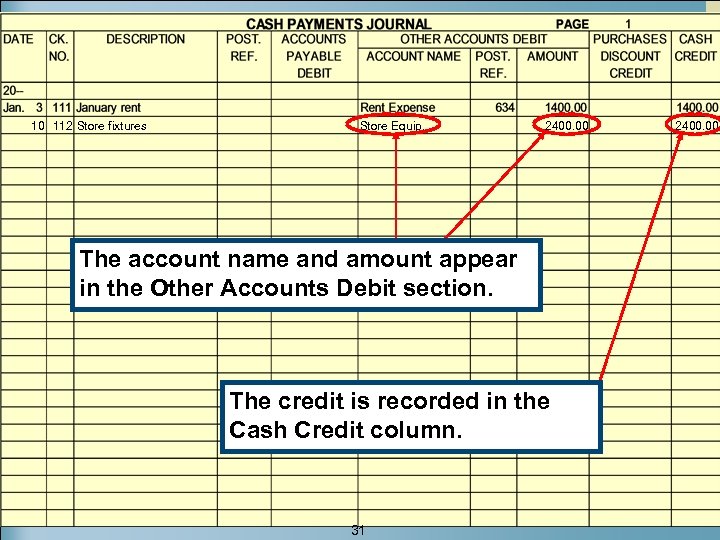

Cash Purchases of Equipment and Supplies Businesses use cash to purchase equipment and other assets. On January 10 The Style Shop issued a check for store fixtures. 30

Cash Purchases of Equipment and Supplies Businesses use cash to purchase equipment and other assets. On January 10 The Style Shop issued a check for store fixtures. 30

10 112 Store fixtures Store Equip. 2400. 00 The account name and amount appear in the Other Accounts Debit section. The credit is recorded in the Cash Credit column. 31 2400. 00

10 112 Store fixtures Store Equip. 2400. 00 The account name and amount appear in the Other Accounts Debit section. The credit is recorded in the Cash Credit column. 31 2400. 00

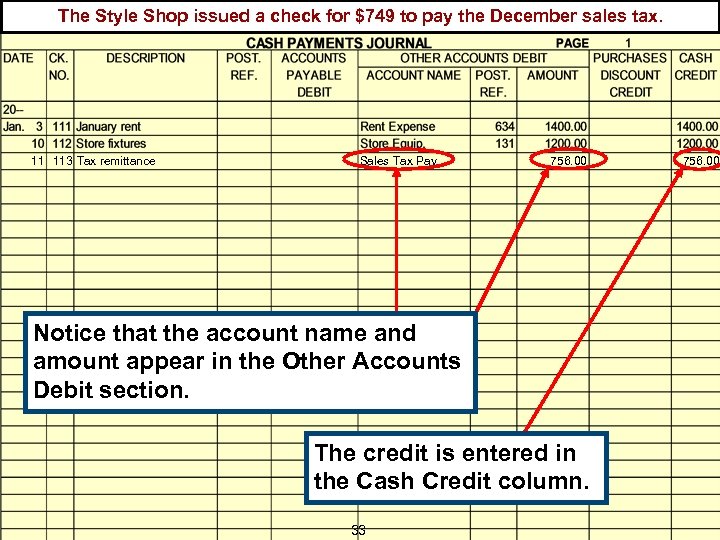

Payment of Taxes Retail businesses collect sales tax from their customers. Periodically the sales tax is remitted to the taxing authority. Consider the entry on January 11. 32

Payment of Taxes Retail businesses collect sales tax from their customers. Periodically the sales tax is remitted to the taxing authority. Consider the entry on January 11. 32

The Style Shop issued a check for $749 to pay the December sales tax. 11 113 Tax remittance Sales Tax Pay. 756. 00 Notice that the account name and amount appear in the Other Accounts Debit section. The credit is entered in the Cash Credit column. 33 756. 00

The Style Shop issued a check for $749 to pay the December sales tax. 11 113 Tax remittance Sales Tax Pay. 756. 00 Notice that the account name and amount appear in the Other Accounts Debit section. The credit is entered in the Cash Credit column. 33 756. 00

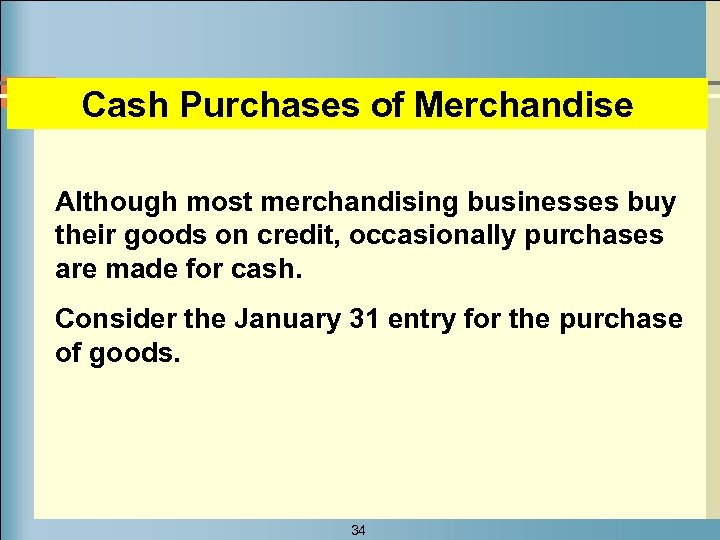

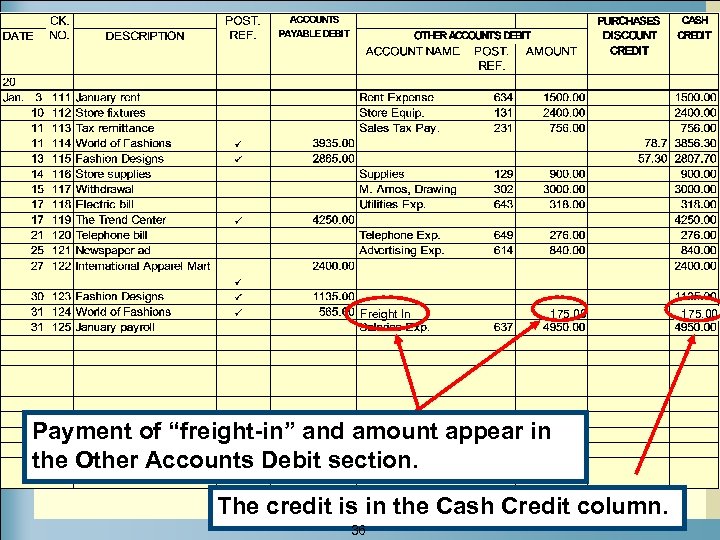

Cash Purchases of Merchandise Although most merchandising businesses buy their goods on credit, occasionally purchases are made for cash. Consider the January 31 entry for the purchase of goods. 34

Cash Purchases of Merchandise Although most merchandising businesses buy their goods on credit, occasionally purchases are made for cash. Consider the January 31 entry for the purchase of goods. 34

31 126 Purchase of goods Purchases Cash purchases are recorded in the cash payments journal. 35 3200. 00

31 126 Purchase of goods Purchases Cash purchases are recorded in the cash payments journal. 35 3200. 00

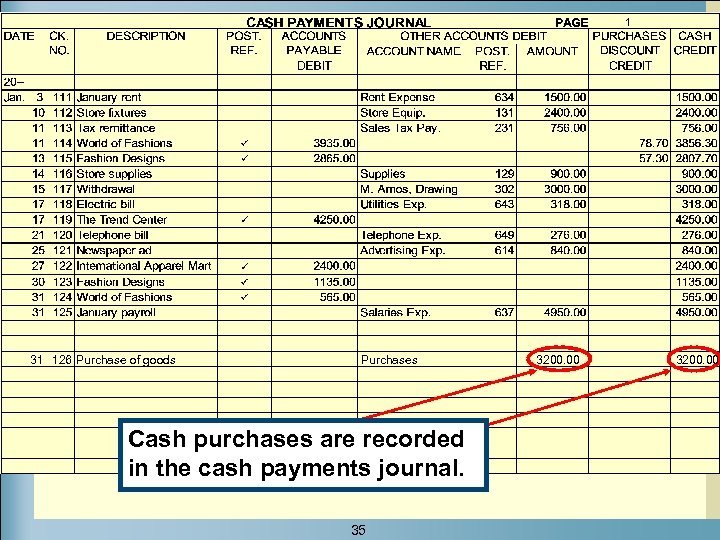

Freight In 175. 00 Payment of “freight-in” and amount appear in the Other Accounts Debit section. The credit is in the Cash Credit column. 36 175. 00

Freight In 175. 00 Payment of “freight-in” and amount appear in the Other Accounts Debit section. The credit is in the Cash Credit column. 36 175. 00

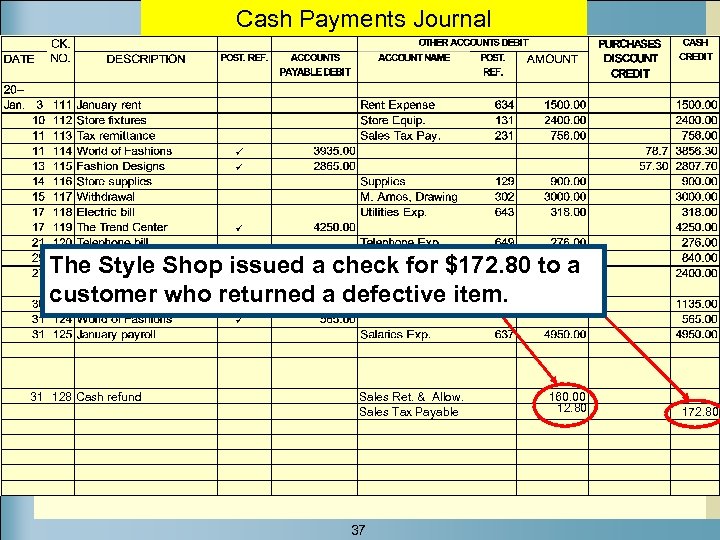

Cash Payments Journal The Style Shop issued a check for $172. 80 to a customer who returned a defective item. 31 128 Cash refund Sales Ret. & Allow. Sales Tax Payable 37 160. 00 12. 80 172. 80

Cash Payments Journal The Style Shop issued a check for $172. 80 to a customer who returned a defective item. 31 128 Cash refund Sales Ret. & Allow. Sales Tax Payable 37 160. 00 12. 80 172. 80

Payment of a Promissory Note and Interest A promissory note can be issued to settle an overdue account or to obtain goods, equipment, or other property. 38

Payment of a Promissory Note and Interest A promissory note can be issued to settle an overdue account or to obtain goods, equipment, or other property. 38

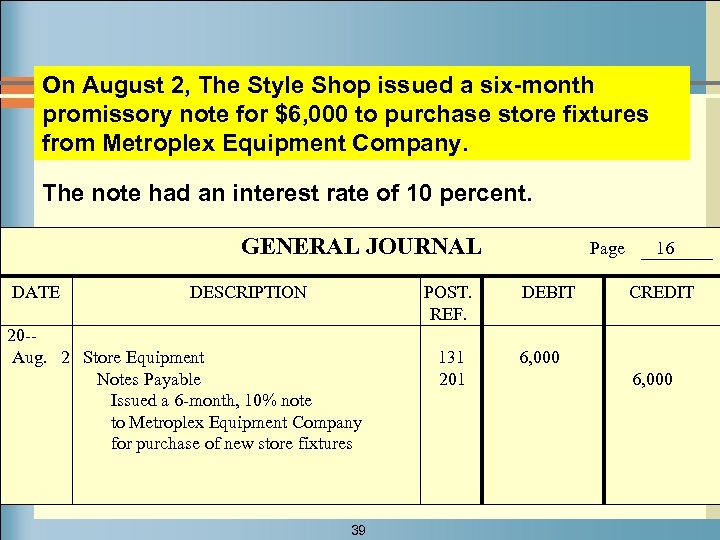

On August 2, The Style Shop issued a six-month promissory note for $6, 000 to purchase store fixtures from Metroplex Equipment Company. The note had an interest rate of 10 percent. GENERAL JOURNAL DATE DESCRIPTION POST. REF. 20 -Aug. 2 Store Equipment Notes Payable Issued a 6 -month, 10% note to Metroplex Equipment Company for purchase of new store fixtures 39 131 201 Page DEBIT 16 CREDIT 6, 000

On August 2, The Style Shop issued a six-month promissory note for $6, 000 to purchase store fixtures from Metroplex Equipment Company. The note had an interest rate of 10 percent. GENERAL JOURNAL DATE DESCRIPTION POST. REF. 20 -Aug. 2 Store Equipment Notes Payable Issued a 6 -month, 10% note to Metroplex Equipment Company for purchase of new store fixtures 39 131 201 Page DEBIT 16 CREDIT 6, 000

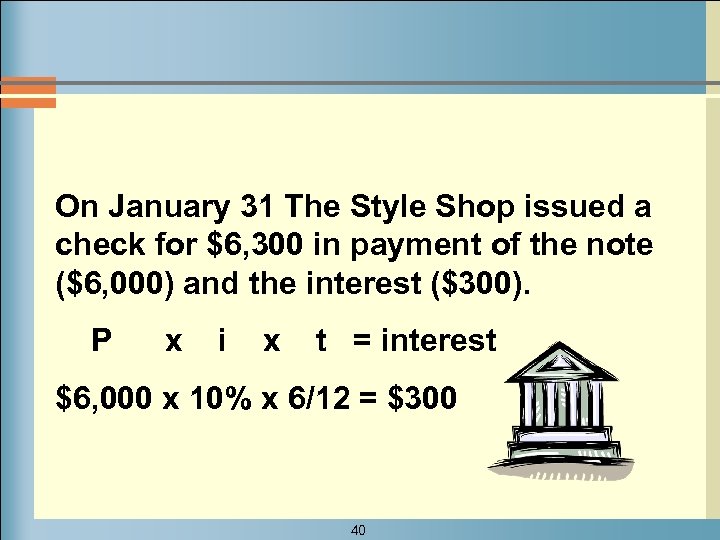

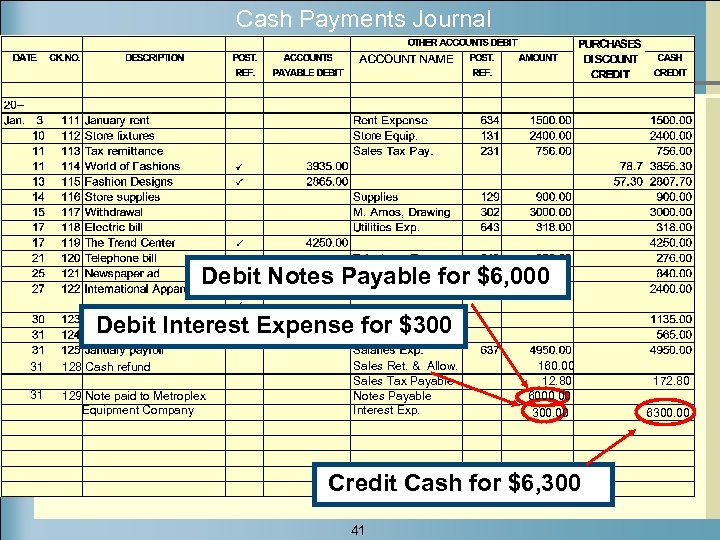

On January 31 The Style Shop issued a check for $6, 300 in payment of the note ($6, 000) and the interest ($300). P x i x t = interest $6, 000 x 10% x 6/12 = $300 40

On January 31 The Style Shop issued a check for $6, 300 in payment of the note ($6, 000) and the interest ($300). P x i x t = interest $6, 000 x 10% x 6/12 = $300 40

Cash Payments Journal Debit Notes Payable for $6, 000 Debit Interest Expense for $300 31 128 Cash refund 31 129 Note paid to Metroplex Equipment Company Sales Ret. & Allow. Sales Tax Payable Notes Payable Interest Exp. 160. 00 12. 80 6000. 00 300. 00 Credit Cash for $6, 300 41 172. 80 6300. 00

Cash Payments Journal Debit Notes Payable for $6, 000 Debit Interest Expense for $300 31 128 Cash refund 31 129 Note paid to Metroplex Equipment Company Sales Ret. & Allow. Sales Tax Payable Notes Payable Interest Exp. 160. 00 12. 80 6000. 00 300. 00 Credit Cash for $6, 300 41 172. 80 6300. 00

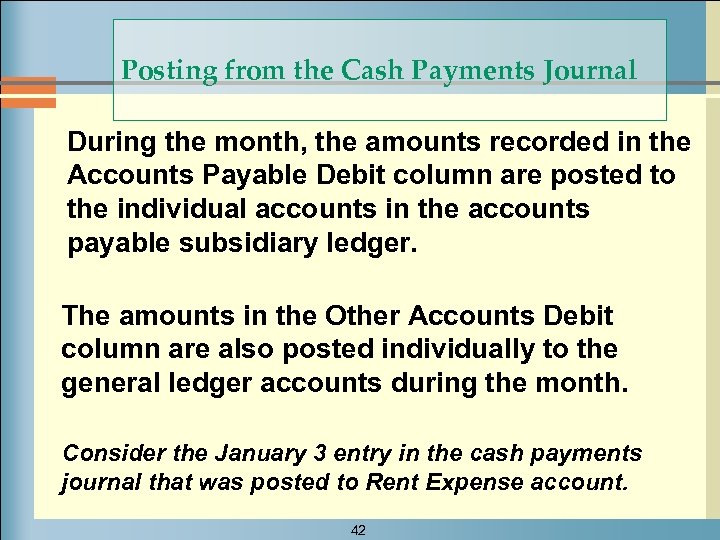

Posting from the Cash Payments Journal During the month, the amounts recorded in the Accounts Payable Debit column are posted to the individual accounts in the accounts payable subsidiary ledger. The amounts in the Other Accounts Debit column are also posted individually to the general ledger accounts during the month. Consider the January 3 entry in the cash payments journal that was posted to Rent Expense account. 42

Posting from the Cash Payments Journal During the month, the amounts recorded in the Accounts Payable Debit column are posted to the individual accounts in the accounts payable subsidiary ledger. The amounts in the Other Accounts Debit column are also posted individually to the general ledger accounts during the month. Consider the January 3 entry in the cash payments journal that was posted to Rent Expense account. 42

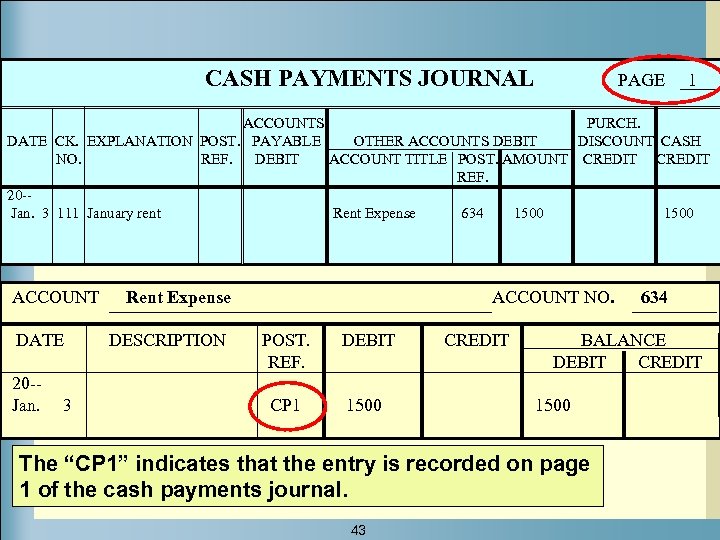

CASH PAYMENTS JOURNAL PAGE 1 ACCOUNTS PURCH. DATE CK. EXPLANATION POST. PAYABLE OTHER ACCOUNTS DEBIT DISCOUNT CASH NO. REF. DEBIT ACCOUNT TITLE POST. AMOUNT CREDIT REF. 20 -Jan. 3 111 January rent Rent Expense 634 1500 ACCOUNT DATE 20 -Jan. 3 Rent Expense DESCRIPTION ACCOUNT NO. POST. REF. DEBIT CP 1 1500 CREDIT BALANCE DEBIT CREDIT 1500 The “CP 1” indicates that the entry is recorded on page 1 of the cash payments journal. 43 634

CASH PAYMENTS JOURNAL PAGE 1 ACCOUNTS PURCH. DATE CK. EXPLANATION POST. PAYABLE OTHER ACCOUNTS DEBIT DISCOUNT CASH NO. REF. DEBIT ACCOUNT TITLE POST. AMOUNT CREDIT REF. 20 -Jan. 3 111 January rent Rent Expense 634 1500 ACCOUNT DATE 20 -Jan. 3 Rent Expense DESCRIPTION ACCOUNT NO. POST. REF. DEBIT CP 1 1500 CREDIT BALANCE DEBIT CREDIT 1500 The “CP 1” indicates that the entry is recorded on page 1 of the cash payments journal. 43 634

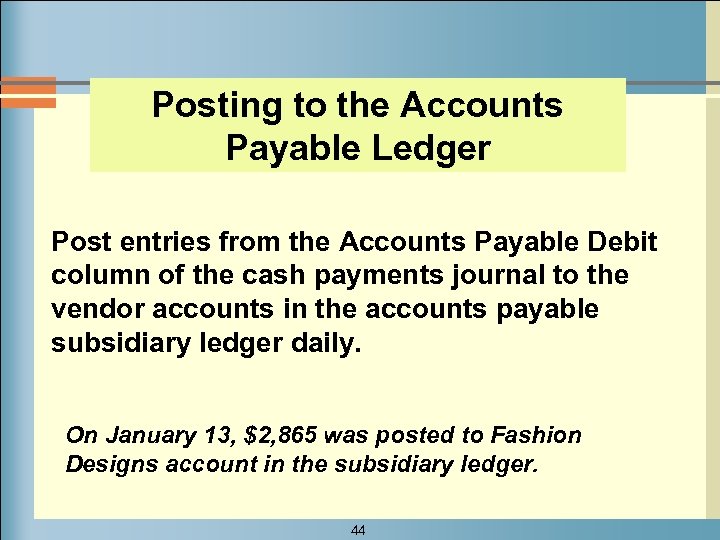

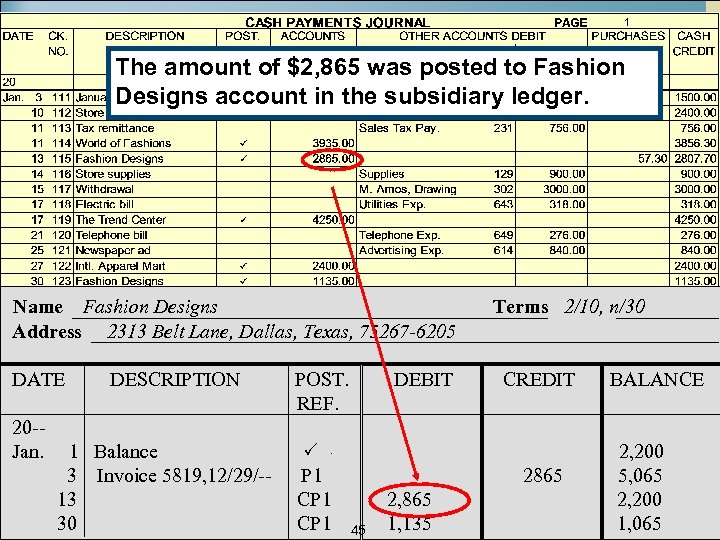

Posting to the Accounts Payable Ledger Post entries from the Accounts Payable Debit column of the cash payments journal to the vendor accounts in the accounts payable subsidiary ledger daily. On January 13, $2, 865 was posted to Fashion Designs account in the subsidiary ledger. 44

Posting to the Accounts Payable Ledger Post entries from the Accounts Payable Debit column of the cash payments journal to the vendor accounts in the accounts payable subsidiary ledger daily. On January 13, $2, 865 was posted to Fashion Designs account in the subsidiary ledger. 44

The amount of $2, 865 was posted to Fashion Designs account in the subsidiary ledger. Name Fashion Designs Address 2313 Belt Lane, Dallas, Texas, 75267 -6205 DATE 20 -Jan. DESCRIPTION 1 Balance 3 Invoice 5819, 12/29/-13 30 POST. REF. P 1 CP 1 DEBIT Terms 2/10, n/30 CREDIT 2865 45 2, 865 1, 135 BALANCE 2, 200 5, 065 Page 2, 200 1, 065 303

The amount of $2, 865 was posted to Fashion Designs account in the subsidiary ledger. Name Fashion Designs Address 2313 Belt Lane, Dallas, Texas, 75267 -6205 DATE 20 -Jan. DESCRIPTION 1 Balance 3 Invoice 5819, 12/29/-13 30 POST. REF. P 1 CP 1 DEBIT Terms 2/10, n/30 CREDIT 2865 45 2, 865 1, 135 BALANCE 2, 200 5, 065 Page 2, 200 1, 065 303

Advantages of the Cash Payments Journal The cash payments journal: l Saves time and effort when recording and posting cash payments l Allows for a division of labor among the accounting staff l Improves the audit trail because all cash payments are recorded in one place and listed by check number 46

Advantages of the Cash Payments Journal The cash payments journal: l Saves time and effort when recording and posting cash payments l Allows for a division of labor among the accounting staff l Improves the audit trail because all cash payments are recorded in one place and listed by check number 46

The Petty Cash Fund Most businesses use a petty cash fund to pay for small expenditures The amount of the petty cash fund depends on the needs of the business. Usually the office manager, cashier, or assistant is in charge of the petty cash fund. 47

The Petty Cash Fund Most businesses use a petty cash fund to pay for small expenditures The amount of the petty cash fund depends on the needs of the business. Usually the office manager, cashier, or assistant is in charge of the petty cash fund. 47

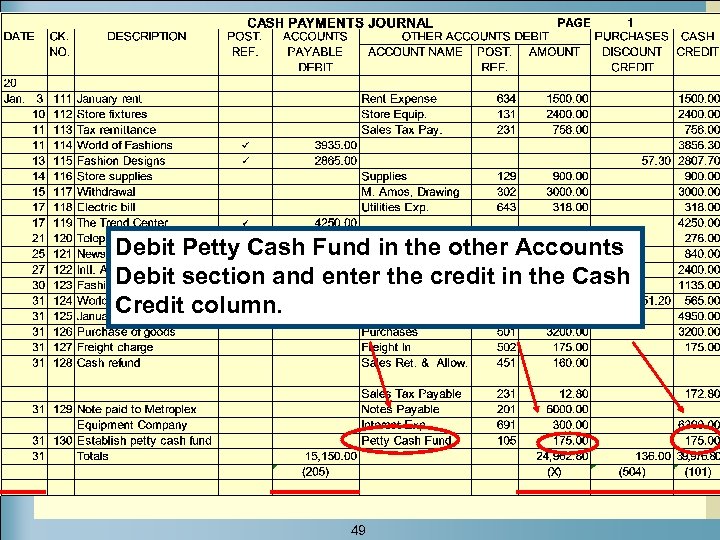

Establishing the Fund The Style Shop’s cashier is responsible for petty cash. The Style Shop wrote a $175 check to the cashier, who cashed the check and put the currency in a locked cash box. 48

Establishing the Fund The Style Shop’s cashier is responsible for petty cash. The Style Shop wrote a $175 check to the cashier, who cashed the check and put the currency in a locked cash box. 48

Debit Petty Cash Fund in the other Accounts Debit section and enter the credit in the Cash Credit column. 49

Debit Petty Cash Fund in the other Accounts Debit section and enter the credit in the Cash Credit column. 49

Petty Cash Voucher A petty cash voucher is a form used to record the payments made from a petty cash fund. The person receiving the funds signs the voucher. The person who controls the petty cash fund initials the voucher. 50

Petty Cash Voucher A petty cash voucher is a form used to record the payments made from a petty cash fund. The person receiving the funds signs the voucher. The person who controls the petty cash fund initials the voucher. 50

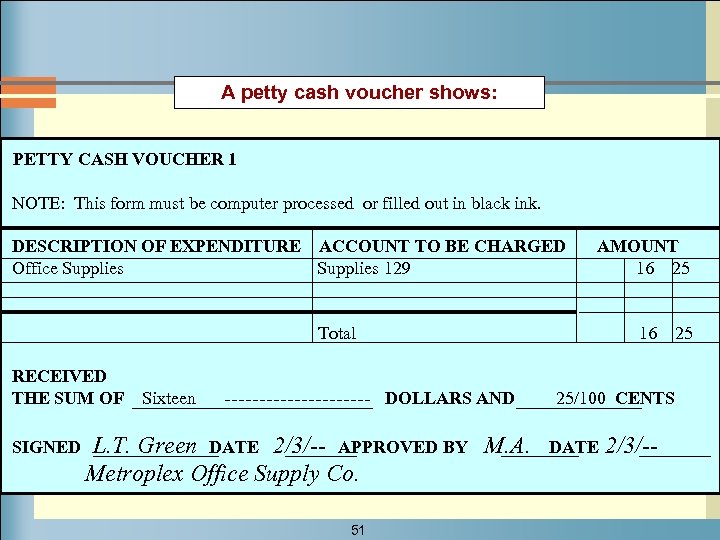

A petty cash voucher shows: PETTY CASH VOUCHER 1 NOTE: This form must be computer processed or filled out in black ink. DESCRIPTION OF EXPENDITURE ACCOUNT TO BE CHARGED Office Supplies 129 AMOUNT 16 25 Total RECEIVED THE SUM OF SIGNED Sixteen 16 DOLLARS AND L. T. Green DATE 2/3/-- APPROVED BY M. A. Metroplex Office Supply Co. 51 25/100 CENTS DATE 2/3/-- 25

A petty cash voucher shows: PETTY CASH VOUCHER 1 NOTE: This form must be computer processed or filled out in black ink. DESCRIPTION OF EXPENDITURE ACCOUNT TO BE CHARGED Office Supplies 129 AMOUNT 16 25 Total RECEIVED THE SUM OF SIGNED Sixteen 16 DOLLARS AND L. T. Green DATE 2/3/-- APPROVED BY M. A. Metroplex Office Supply Co. 51 25/100 CENTS DATE 2/3/-- 25

Replenishing the Fund The total vouchers plus the cash on hand should always equal the amount of the fund– $175 for The Style Shop. Replenish the petty cash fund at the end of each month or sooner if the fund is low. The fund MUST be replenished at the end of the period. 52

Replenishing the Fund The total vouchers plus the cash on hand should always equal the amount of the fund– $175 for The Style Shop. Replenish the petty cash fund at the end of each month or sooner if the fund is low. The fund MUST be replenished at the end of the period. 52

The following internal control procedures apply to petty cash: 1. Use the petty cash fund only for small payments that cannot conveniently be made by check. 2. Limit the amount set aside for petty cash to the approximate amount needed to cover one month's payments from the fund. 3. Write petty cash fund checks to the person in charge of the fund, not to the order of "Cash. " 53

The following internal control procedures apply to petty cash: 1. Use the petty cash fund only for small payments that cannot conveniently be made by check. 2. Limit the amount set aside for petty cash to the approximate amount needed to cover one month's payments from the fund. 3. Write petty cash fund checks to the person in charge of the fund, not to the order of "Cash. " 53

The following internal control procedures apply to petty cash: 4. Assign one person to control the petty cash fund. This person has sole control of the money and is the only one authorized to make payments from the fund. 5. Keep petty cash in a safe, a locked cash box, or a locked drawer. 6. Obtain a petty cash voucher for each payment. The voucher should be signed by the person who receives the money and should show the payment details. This provides an audit trail for the fund. 54

The following internal control procedures apply to petty cash: 4. Assign one person to control the petty cash fund. This person has sole control of the money and is the only one authorized to make payments from the fund. 5. Keep petty cash in a safe, a locked cash box, or a locked drawer. 6. Obtain a petty cash voucher for each payment. The voucher should be signed by the person who receives the money and should show the payment details. This provides an audit trail for the fund. 54

Internal Control over Cash The internal control over cash should be tailored to the needs of a business. Accountants play a vital role in designing, establishing, and monitoring the cash control system. 55

Internal Control over Cash The internal control over cash should be tailored to the needs of a business. Accountants play a vital role in designing, establishing, and monitoring the cash control system. 55

Essential Cash Receipt Controls 1. Have only designated employees receive and handle cash. In some businesses employees handling cash are bonded. Bonding is the process by which will insure the business against losses through employee theft or mishandling of funds. 56

Essential Cash Receipt Controls 1. Have only designated employees receive and handle cash. In some businesses employees handling cash are bonded. Bonding is the process by which will insure the business against losses through employee theft or mishandling of funds. 56

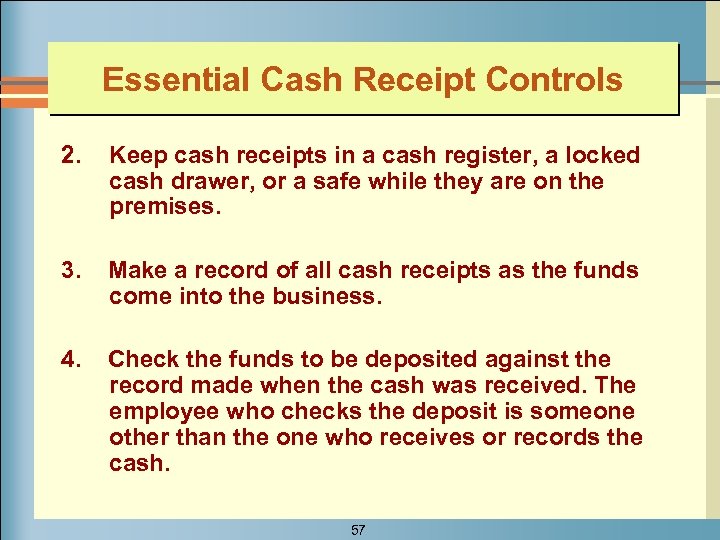

Essential Cash Receipt Controls 2. Keep cash receipts in a cash register, a locked cash drawer, or a safe while they are on the premises. 3. Make a record of all cash receipts as the funds come into the business. 4. Check the funds to be deposited against the record made when the cash was received. The employee who checks the deposit is someone other than the one who receives or records the cash. 57

Essential Cash Receipt Controls 2. Keep cash receipts in a cash register, a locked cash drawer, or a safe while they are on the premises. 3. Make a record of all cash receipts as the funds come into the business. 4. Check the funds to be deposited against the record made when the cash was received. The employee who checks the deposit is someone other than the one who receives or records the cash. 57

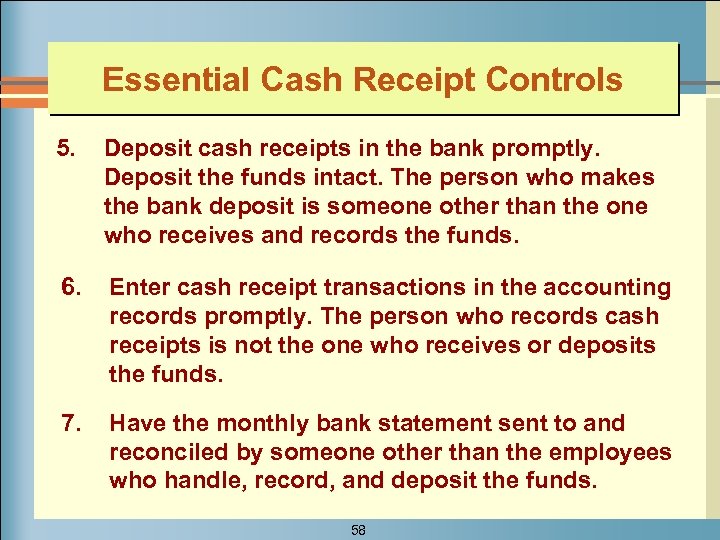

Essential Cash Receipt Controls 5. Deposit cash receipts in the bank promptly. Deposit the funds intact. The person who makes the bank deposit is someone other than the one who receives and records the funds. 6. Enter cash receipt transactions in the accounting records promptly. The person who records cash receipts is not the one who receives or deposits the funds. 7. Have the monthly bank statement sent to and reconciled by someone other than the employees who handle, record, and deposit the funds. 58

Essential Cash Receipt Controls 5. Deposit cash receipts in the bank promptly. Deposit the funds intact. The person who makes the bank deposit is someone other than the one who receives and records the funds. 6. Enter cash receipt transactions in the accounting records promptly. The person who records cash receipts is not the one who receives or deposits the funds. 7. Have the monthly bank statement sent to and reconciled by someone other than the employees who handle, record, and deposit the funds. 58

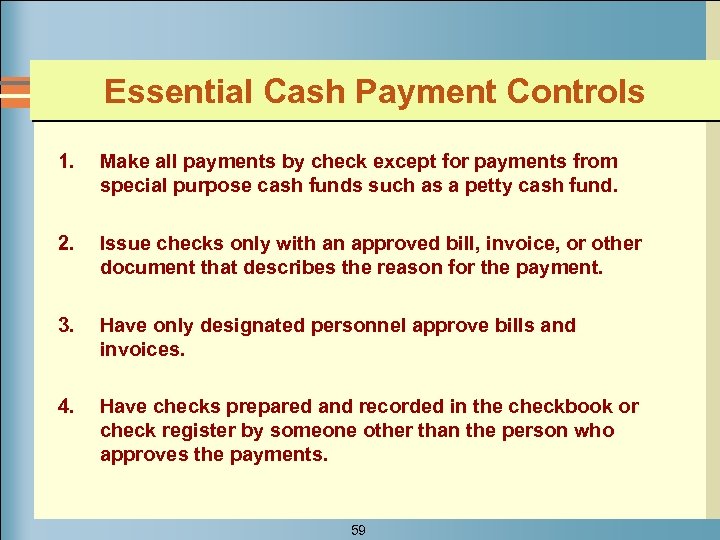

Essential Cash Payment Controls 1. Make all payments by check except for payments from special purpose cash funds such as a petty cash fund. 2. Issue checks only with an approved bill, invoice, or other document that describes the reason for the payment. 3. Have only designated personnel approve bills and invoices. 4. Have checks prepared and recorded in the checkbook or check register by someone other than the person who approves the payments. 59

Essential Cash Payment Controls 1. Make all payments by check except for payments from special purpose cash funds such as a petty cash fund. 2. Issue checks only with an approved bill, invoice, or other document that describes the reason for the payment. 3. Have only designated personnel approve bills and invoices. 4. Have checks prepared and recorded in the checkbook or check register by someone other than the person who approves the payments. 59

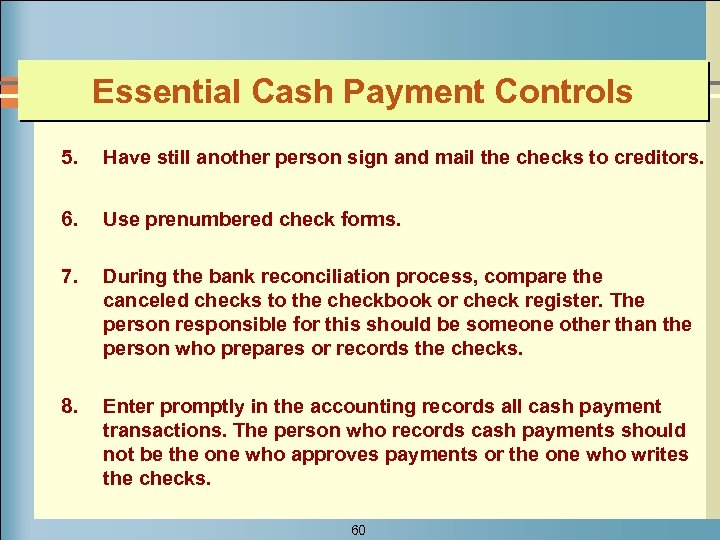

Essential Cash Payment Controls 5. Have still another person sign and mail the checks to creditors. 6. Use prenumbered check forms. 7. During the bank reconciliation process, compare the canceled checks to the checkbook or check register. The person responsible for this should be someone other than the person who prepares or records the checks. 8. Enter promptly in the accounting records all cash payment transactions. The person who records cash payments should not be the one who approves payments or the one who writes the checks. 60

Essential Cash Payment Controls 5. Have still another person sign and mail the checks to creditors. 6. Use prenumbered check forms. 7. During the bank reconciliation process, compare the canceled checks to the checkbook or check register. The person responsible for this should be someone other than the person who prepares or records the checks. 8. Enter promptly in the accounting records all cash payment transactions. The person who records cash payments should not be the one who approves payments or the one who writes the checks. 60

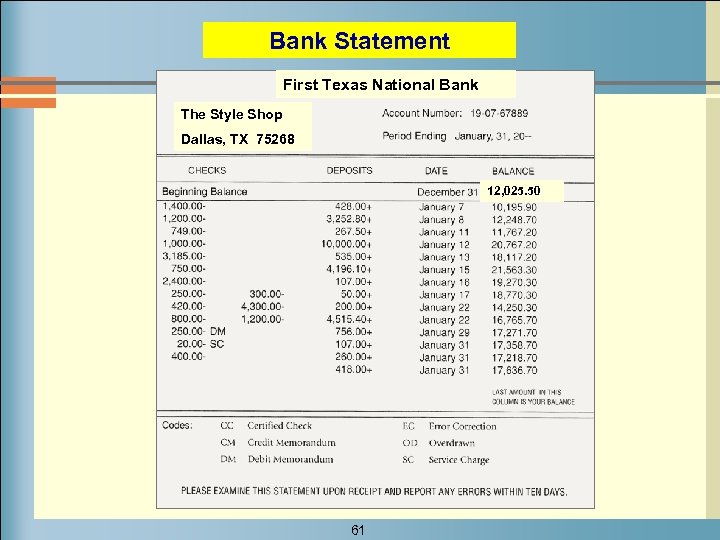

Bank Statement First Texas National Bank The Style Shop Dallas, TX 75268 12, 025. 50 61

Bank Statement First Texas National Bank The Style Shop Dallas, TX 75268 12, 025. 50 61

Bank Reconciliation Statement A bank reconciliation statement is a statement that accounts for all differences between the balance on the bank statement and the book balance of cash. 62

Bank Reconciliation Statement A bank reconciliation statement is a statement that accounts for all differences between the balance on the bank statement and the book balance of cash. 62

A credit memorandum is a form that explains any addition, other than a deposit, to a checking account. A debit memorandum is a form that explains any deduction, other than a check, from a checking account. 63

A credit memorandum is a form that explains any addition, other than a deposit, to a checking account. A debit memorandum is a form that explains any deduction, other than a check, from a checking account. 63

A dishonored check is a check returned to the depositor unpaid because of insufficient funds in the drawer’s account. It is also called an NSF check. A service charge is a fee charged by a bank to cover the costs of maintaining accounts and providing services. 64

A dishonored check is a check returned to the depositor unpaid because of insufficient funds in the drawer’s account. It is also called an NSF check. A service charge is a fee charged by a bank to cover the costs of maintaining accounts and providing services. 64

The Bank Reconciliation Process: An Illustration When the bank statement is received, it is reconciled with the financial records of the business. The ending bank balance on January 31 was $21, 838. 50. On January 31 the Cash account, called the book balance of cash, is $14, 390. 70. 65

The Bank Reconciliation Process: An Illustration When the bank statement is received, it is reconciled with the financial records of the business. The ending bank balance on January 31 was $21, 838. 50. On January 31 the Cash account, called the book balance of cash, is $14, 390. 70. 65

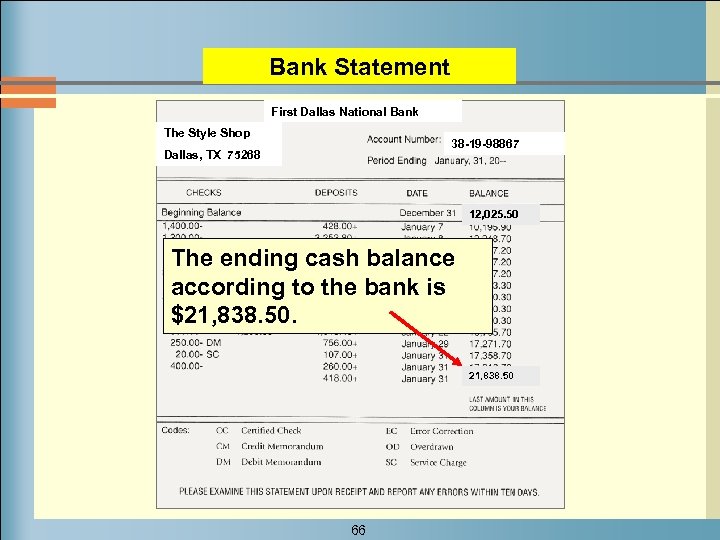

Bank Statement First Dallas National Bank The Style Shop 38 -19 -98867 Dallas, TX 75268 12, 025. 50 The ending cash balance according to the bank is $21, 838. 50 66

Bank Statement First Dallas National Bank The Style Shop 38 -19 -98867 Dallas, TX 75268 12, 025. 50 The ending cash balance according to the bank is $21, 838. 50 66

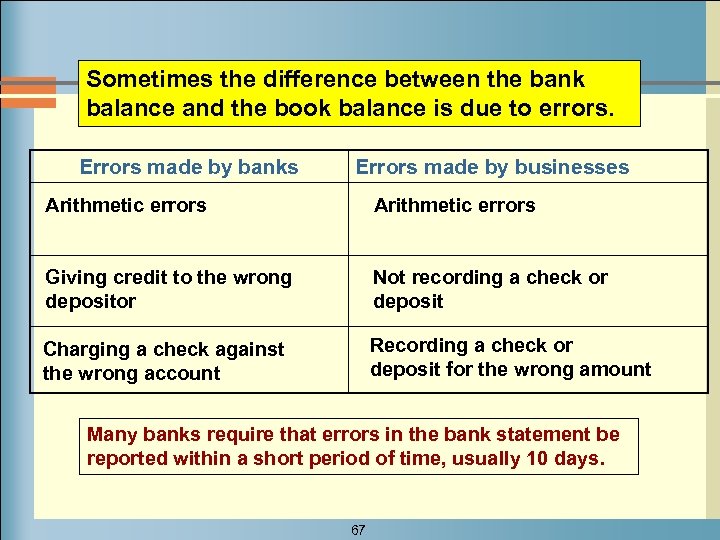

Sometimes the difference between the bank balance and the book balance is due to errors. Errors made by banks Errors made by businesses Arithmetic errors Giving credit to the wrong depositor Not recording a check or deposit Charging a check against the wrong account Recording a check or deposit for the wrong amount Many banks require that errors in the bank statement be reported within a short period of time, usually 10 days. 67

Sometimes the difference between the bank balance and the book balance is due to errors. Errors made by banks Errors made by businesses Arithmetic errors Giving credit to the wrong depositor Not recording a check or deposit Charging a check against the wrong account Recording a check or deposit for the wrong amount Many banks require that errors in the bank statement be reported within a short period of time, usually 10 days. 67

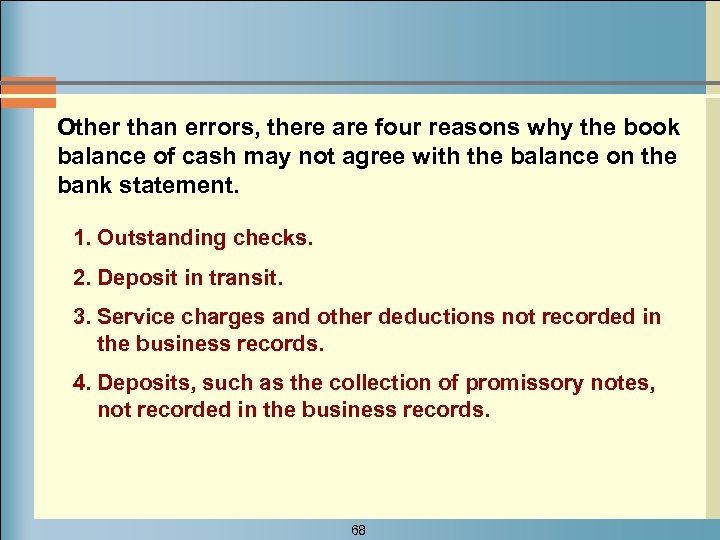

Other than errors, there are four reasons why the book balance of cash may not agree with the balance on the bank statement. 1. Outstanding checks. 2. Deposit in transit. 3. Service charges and other deductions not recorded in the business records. 4. Deposits, such as the collection of promissory notes, not recorded in the business records. 68

Other than errors, there are four reasons why the book balance of cash may not agree with the balance on the bank statement. 1. Outstanding checks. 2. Deposit in transit. 3. Service charges and other deductions not recorded in the business records. 4. Deposits, such as the collection of promissory notes, not recorded in the business records. 68

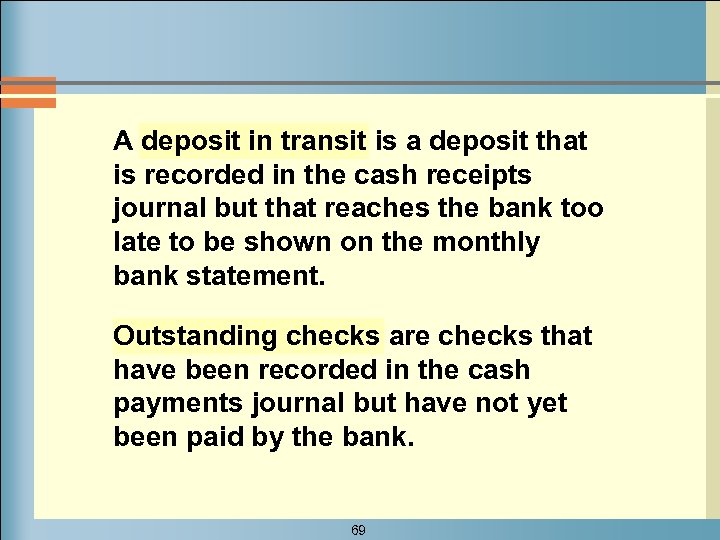

A deposit in transit is a deposit that is recorded in the cash receipts journal but that reaches the bank too late to be shown on the monthly bank statement. Outstanding checks are checks that have been recorded in the cash payments journal but have not yet been paid by the bank. 69

A deposit in transit is a deposit that is recorded in the cash receipts journal but that reaches the bank too late to be shown on the monthly bank statement. Outstanding checks are checks that have been recorded in the cash payments journal but have not yet been paid by the bank. 69

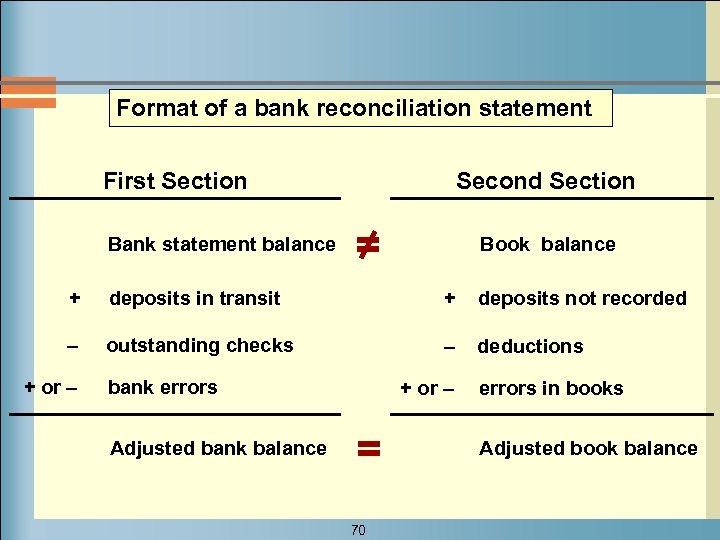

Format of a bank reconciliation statement First Section Bank statement balance Second Section = Book balance + deposits in transit + deposits not recorded – outstanding checks – deductions + or – bank errors Adjusted bank balance + or – = 70 errors in books Adjusted book balance

Format of a bank reconciliation statement First Section Bank statement balance Second Section = Book balance + deposits in transit + deposits not recorded – outstanding checks – deductions + or – bank errors Adjusted bank balance + or – = 70 errors in books Adjusted book balance

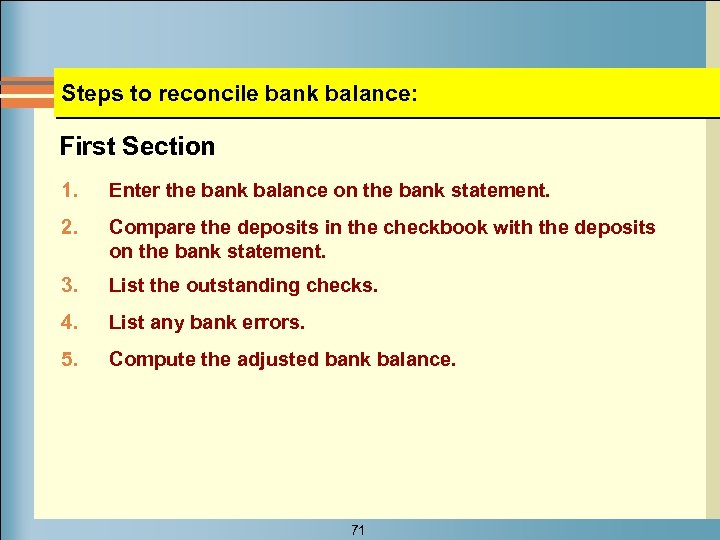

Steps to reconcile bank balance: First Section 1. Enter the bank balance on the bank statement. 2. Compare the deposits in the checkbook with the deposits on the bank statement. 3. List the outstanding checks. 4. List any bank errors. 5. Compute the adjusted bank balance. 71

Steps to reconcile bank balance: First Section 1. Enter the bank balance on the bank statement. 2. Compare the deposits in the checkbook with the deposits on the bank statement. 3. List the outstanding checks. 4. List any bank errors. 5. Compute the adjusted bank balance. 71

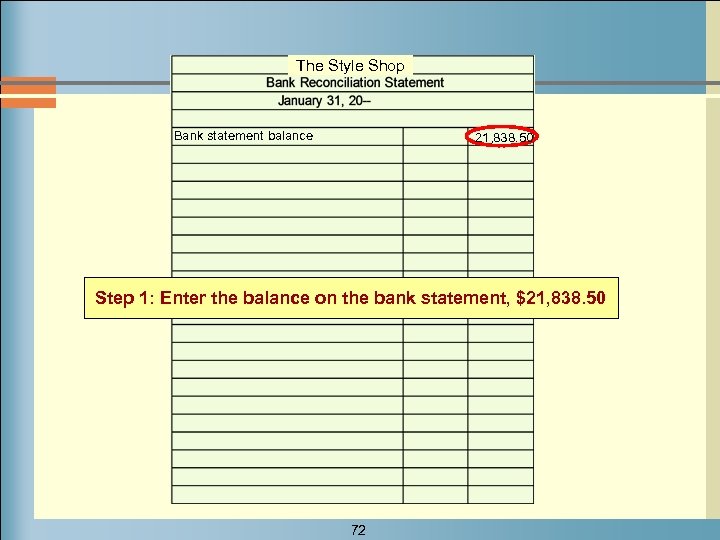

The Style Shop Bank statement balance 21, 838. 50 Step 1: Enter the balance on the bank statement, $21, 838. 50 72

The Style Shop Bank statement balance 21, 838. 50 Step 1: Enter the balance on the bank statement, $21, 838. 50 72

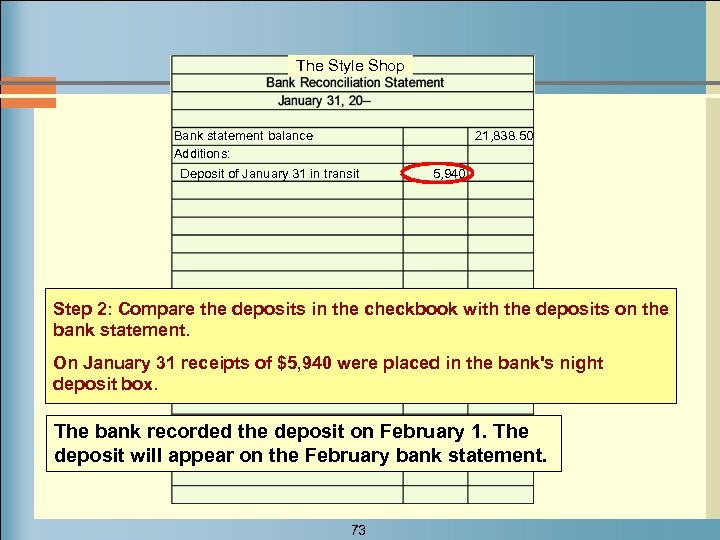

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit 21, 838. 50 5, 940 Step 2: Compare the deposits in the checkbook with the deposits on the bank statement. On January 31 receipts of $5, 940 were placed in the bank's night deposit box. The bank recorded the deposit on February 1. The deposit will appear on the February bank statement. 73

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit 21, 838. 50 5, 940 Step 2: Compare the deposits in the checkbook with the deposits on the bank statement. On January 31 receipts of $5, 940 were placed in the bank's night deposit box. The bank recorded the deposit on February 1. The deposit will appear on the February bank statement. 73

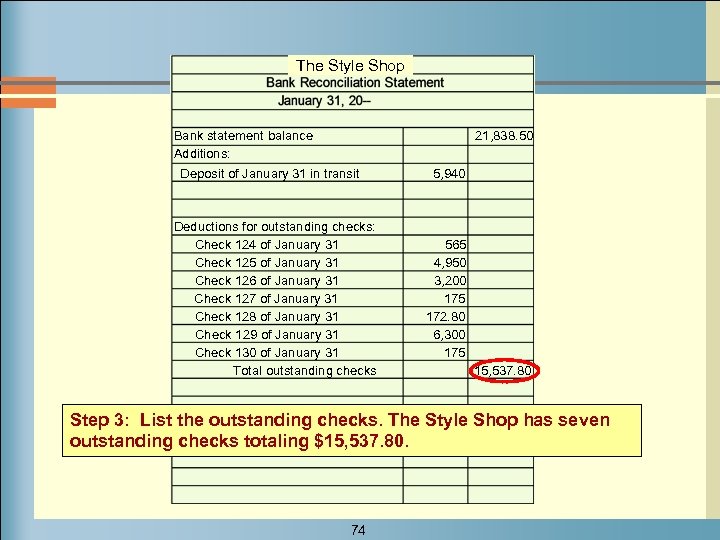

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of January 31 Check 128 of January 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks 21, 838. 50 5, 940 565 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 Step 3: List the outstanding checks. The Style Shop has seven outstanding checks totaling $15, 537. 80. 74

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of January 31 Check 128 of January 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks 21, 838. 50 5, 940 565 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 Step 3: List the outstanding checks. The Style Shop has seven outstanding checks totaling $15, 537. 80. 74

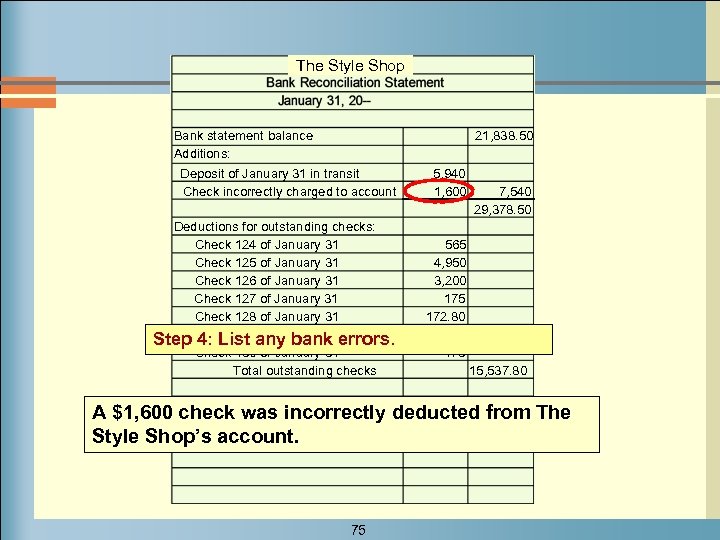

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of January 31 Check 128 of January 31 Step Check 129 any bank errors. 4: List of January 31 Check 130 of January 31 Total outstanding checks 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 A $1, 600 check was incorrectly deducted from The Style Shop’s account. 75

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of January 31 Check 128 of January 31 Step Check 129 any bank errors. 4: List of January 31 Check 130 of January 31 Total outstanding checks 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 A $1, 600 check was incorrectly deducted from The Style Shop’s account. 75

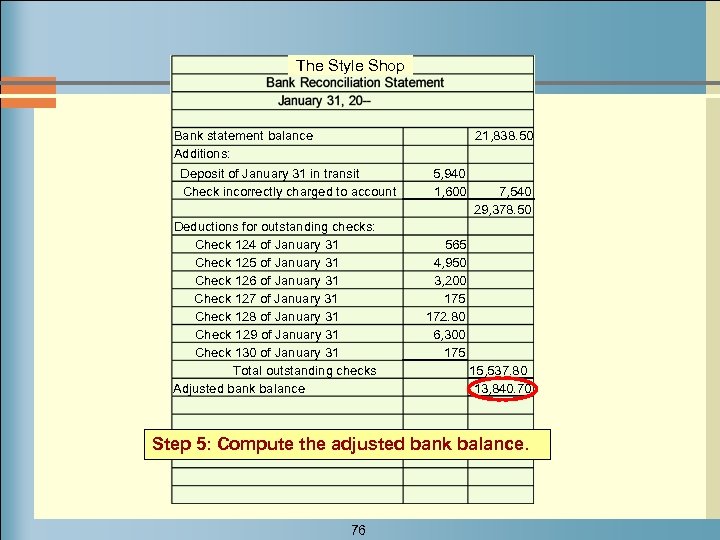

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of January 31 Check 128 of January 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 13, 840. 70 Step 5: Compute the adjusted bank balance. 76

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of January 31 Check 128 of January 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 13, 840. 70 Step 5: Compute the adjusted bank balance. 76

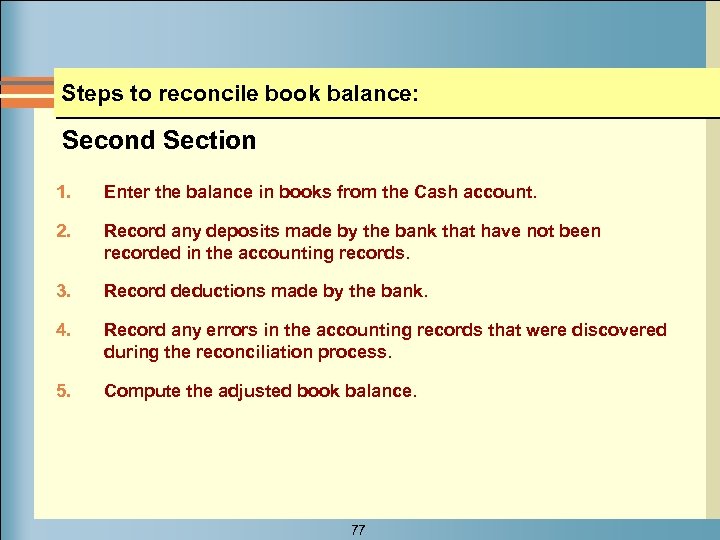

Steps to reconcile book balance: Second Section 1. Enter the balance in books from the Cash account. 2. Record any deposits made by the bank that have not been recorded in the accounting records. 3. Record deductions made by the bank. 4. Record any errors in the accounting records that were discovered during the reconciliation process. 5. Compute the adjusted book balance. 77

Steps to reconcile book balance: Second Section 1. Enter the balance in books from the Cash account. 2. Record any deposits made by the bank that have not been recorded in the accounting records. 3. Record deductions made by the bank. 4. Record any errors in the accounting records that were discovered during the reconciliation process. 5. Compute the adjusted book balance. 77

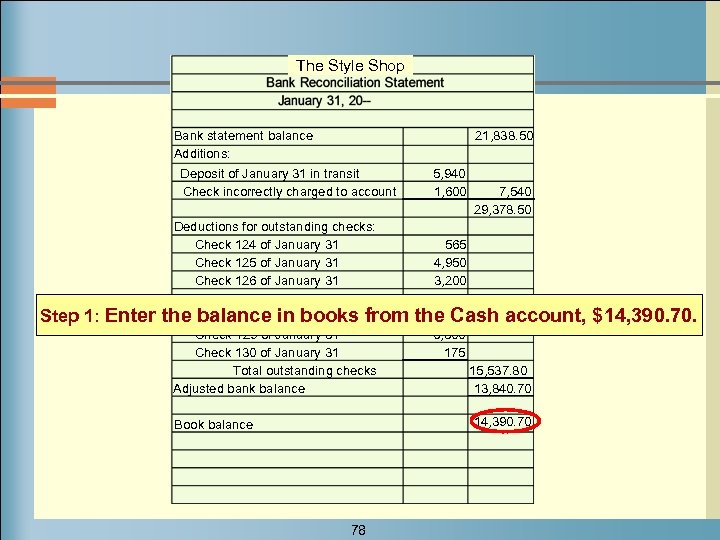

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Step 1: Enter Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of January 31 the Check 128 of January 31 from balance in books Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 4, 950 3, 200 175 172. 80 the Cash account, 6, 300 175 15, 537. 80 13, 840. 70 14, 390. 70 Book balance 78 $14, 390. 70.

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Step 1: Enter Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of January 31 the Check 128 of January 31 from balance in books Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 4, 950 3, 200 175 172. 80 the Cash account, 6, 300 175 15, 537. 80 13, 840. 70 14, 390. 70 Book balance 78 $14, 390. 70.

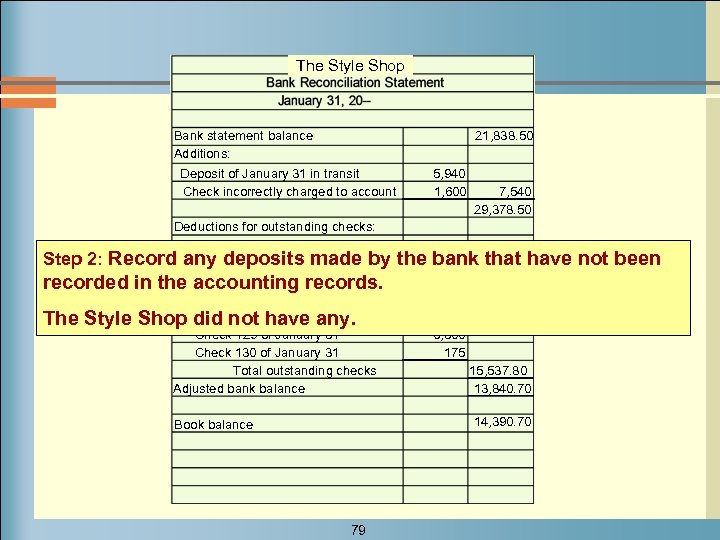

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Deductions for outstanding checks: Check 124 of January 31 Step 2: Record any deposits made by Check 125 of January 31 Check 126 of January 31 recorded in the accounting records. Check 127 of January 31 Check 128 have any. The Style Shop did not of January 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 the bank that have 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 13, 840. 70 14, 390. 70 Book balance 79 not been

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Deductions for outstanding checks: Check 124 of January 31 Step 2: Record any deposits made by Check 125 of January 31 Check 126 of January 31 recorded in the accounting records. Check 127 of January 31 Check 128 have any. The Style Shop did not of January 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 the bank that have 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 13, 840. 70 14, 390. 70 Book balance 79 not been

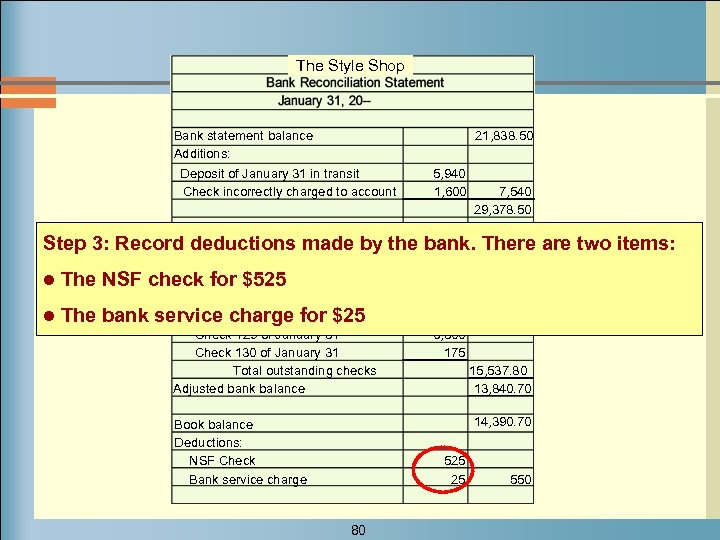

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Deductions for outstanding checks: Check 124 of January 31 Step 3: Record deductions made by Check 125 of January 31 Check $525 l The NSF check for 126 of January 31 Check 127 of January 31 Check 128 of January $25 l The bank service charge for 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 the bank. There are two items: 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 13, 840. 70 14, 390. 70 Book balance Deductions: NSF Check Bank service charge 525 25 80 550

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Deductions for outstanding checks: Check 124 of January 31 Step 3: Record deductions made by Check 125 of January 31 Check $525 l The NSF check for 126 of January 31 Check 127 of January 31 Check 128 of January $25 l The bank service charge for 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 the bank. There are two items: 4, 950 3, 200 175 172. 80 6, 300 175 15, 537. 80 13, 840. 70 14, 390. 70 Book balance Deductions: NSF Check Bank service charge 525 25 80 550

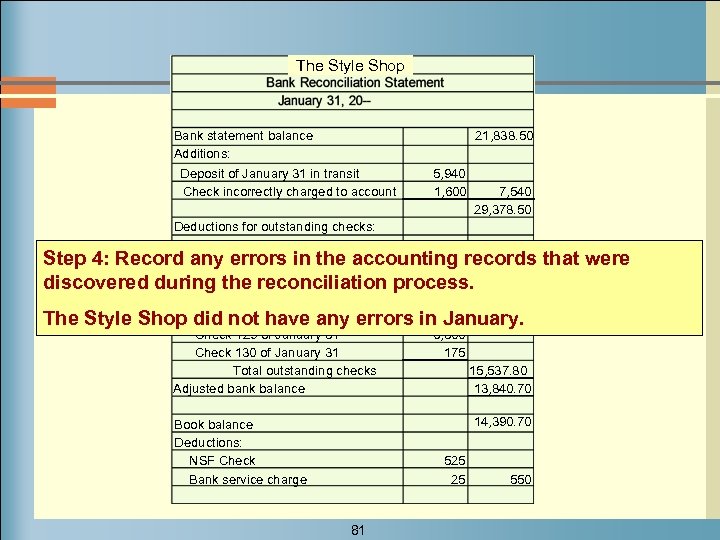

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 Deductions for outstanding checks: Check 124 of January 31 565 Step 4: Record any errors in the accounting records Check 125 of January 31 4, 950 Check 126 of January 31 3, 200 discovered during the reconciliation process. Check 127 of January 31 175 Check 128 have any 172. 80 The Style Shop did not of January 31 errors in January. Check 129 of January 31 6, 300 Check 130 of January 31 175 Total outstanding checks 15, 537. 80 Adjusted bank balance 13, 840. 70 14, 390. 70 Book balance Deductions: NSF Check Bank service charge 525 25 81 550 that were

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 Deductions for outstanding checks: Check 124 of January 31 565 Step 4: Record any errors in the accounting records Check 125 of January 31 4, 950 Check 126 of January 31 3, 200 discovered during the reconciliation process. Check 127 of January 31 175 Check 128 have any 172. 80 The Style Shop did not of January 31 errors in January. Check 129 of January 31 6, 300 Check 130 of January 31 175 Total outstanding checks 15, 537. 80 Adjusted bank balance 13, 840. 70 14, 390. 70 Book balance Deductions: NSF Check Bank service charge 525 25 81 550 that were

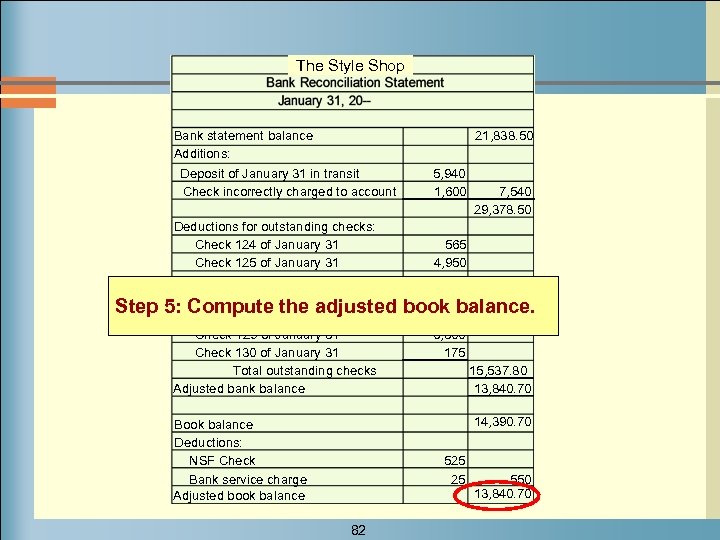

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Step Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of 5: Compute. January 31 the adjusted Check 128 of January 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 4, 950 3, 200 175 book balance. 172. 80 6, 300 175 15, 537. 80 13, 840. 70 14, 390. 70 Book balance Deductions: NSF Check Bank service charge Adjusted book balance 525 25 82 550 13, 840. 70

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account Step Deductions for outstanding checks: Check 124 of January 31 Check 125 of January 31 Check 126 of January 31 Check 127 of 5: Compute. January 31 the adjusted Check 128 of January 31 Check 129 of January 31 Check 130 of January 31 Total outstanding checks Adjusted bank balance 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 565 4, 950 3, 200 175 book balance. 172. 80 6, 300 175 15, 537. 80 13, 840. 70 14, 390. 70 Book balance Deductions: NSF Check Bank service charge Adjusted book balance 525 25 82 550 13, 840. 70

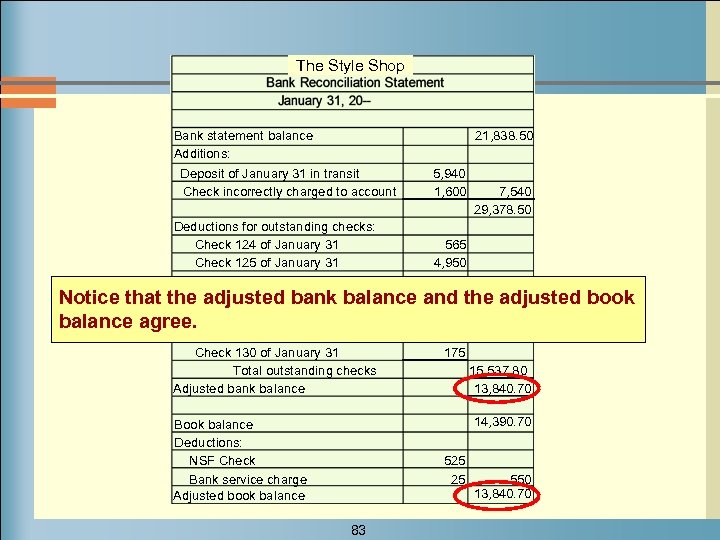

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 Deductions for outstanding checks: Check 124 of January 31 565 Check 125 of January 31 4, 950 Check 126 of January 31 3, 200 175 Notice that the. Check 127 of January 31 balance and the adjusted bank 172. 80 balance agree. Check 128 of January 31 Check 129 of January 31 6, 300 Check 130 of January 31 175 Total outstanding checks 15, 537. 80 Adjusted bank balance 13, 840. 70 14, 390. 70 Book balance Deductions: NSF Check Bank service charge Adjusted book balance 525 25 83 550 13, 840. 70 book

The Style Shop Bank statement balance Additions: Deposit of January 31 in transit Check incorrectly charged to account 21, 838. 50 5, 940 1, 600 7, 540 29, 378. 50 Deductions for outstanding checks: Check 124 of January 31 565 Check 125 of January 31 4, 950 Check 126 of January 31 3, 200 175 Notice that the. Check 127 of January 31 balance and the adjusted bank 172. 80 balance agree. Check 128 of January 31 Check 129 of January 31 6, 300 Check 130 of January 31 175 Total outstanding checks 15, 537. 80 Adjusted bank balance 13, 840. 70 14, 390. 70 Book balance Deductions: NSF Check Bank service charge Adjusted book balance 525 25 83 550 13, 840. 70 book

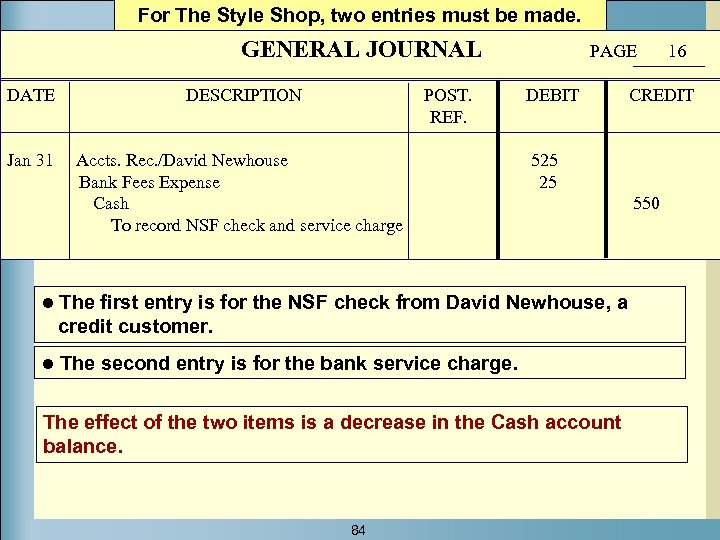

For The Style Shop, two entries must be made. GENERAL JOURNAL DATE DESCRIPTION POST. REF. Jan 31 Accts. Rec. /David Newhouse Bank Fees Expense Cash To record NSF check and service charge PAGE DEBIT The first entry is for the NSF check from David Newhouse, a credit customer. l The second entry is for the bank service charge. The effect of the two items is a decrease in the Cash account balance. 84 CREDIT 525 25 l 16 550

For The Style Shop, two entries must be made. GENERAL JOURNAL DATE DESCRIPTION POST. REF. Jan 31 Accts. Rec. /David Newhouse Bank Fees Expense Cash To record NSF check and service charge PAGE DEBIT The first entry is for the NSF check from David Newhouse, a credit customer. l The second entry is for the bank service charge. The effect of the two items is a decrease in the Cash account balance. 84 CREDIT 525 25 l 16 550