c6a9e404c4dca809b7061007bf35f991.ppt

- Количество слайдов: 24

Chapter 9 Pricing and Revenue Management Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Chapter 9 Pricing and Revenue Management Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

What Makes Service Pricing Strategy Different (and Difficult)? § No ownership of services--hard for firms to calculate financial costs of creating an intangible performance § Variability of inputs and outputs--how can firms define a “unit of service” and establish basis for pricing? § Many services hard for customers to evaluate--what are they getting in return for their money? § Importance of time factor--same service may have more value to customers when delivered faster § Delivery through physical or electronic channels--may create differences in perceived value Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

What Makes Service Pricing Strategy Different (and Difficult)? § No ownership of services--hard for firms to calculate financial costs of creating an intangible performance § Variability of inputs and outputs--how can firms define a “unit of service” and establish basis for pricing? § Many services hard for customers to evaluate--what are they getting in return for their money? § Importance of time factor--same service may have more value to customers when delivered faster § Delivery through physical or electronic channels--may create differences in perceived value Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Objectives of Pricing Strategies § Revenue and profit objectives Ø Seek profit Ø Cover costs § Patronage and user base-related objectives Ø Build demand Ø Build a user base Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Objectives of Pricing Strategies § Revenue and profit objectives Ø Seek profit Ø Cover costs § Patronage and user base-related objectives Ø Build demand Ø Build a user base Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

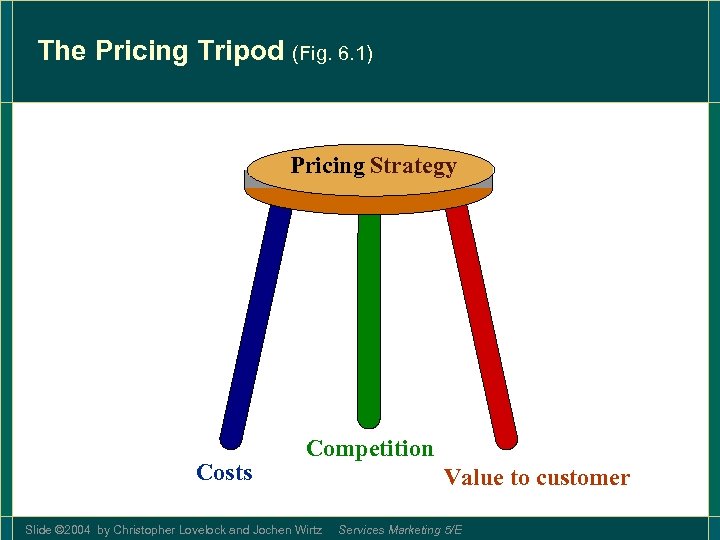

The Pricing Tripod (Fig. 6. 1) Pricing Strategy Costs Competition Slide © 2004 by Christopher Lovelock and Jochen Wirtz Value to customer Services Marketing 5/E

The Pricing Tripod (Fig. 6. 1) Pricing Strategy Costs Competition Slide © 2004 by Christopher Lovelock and Jochen Wirtz Value to customer Services Marketing 5/E

Three Main Approaches to Pricing § Cost-Based Pricing Ø Set prices relative to financial costs (problem: defining costs) § Competition-Based Pricing Ø Monitor competitors’ pricing strategy (especially if service lacks differentiation) Ø Who is the price leader? (one firm sets the pace) § Value-Based Ø Relate price to value perceived by customer Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Three Main Approaches to Pricing § Cost-Based Pricing Ø Set prices relative to financial costs (problem: defining costs) § Competition-Based Pricing Ø Monitor competitors’ pricing strategy (especially if service lacks differentiation) Ø Who is the price leader? (one firm sets the pace) § Value-Based Ø Relate price to value perceived by customer Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Activity-Based Costing: Relating Activities to the Resources They Consume § Managers need to see costs as an integral part of a firm’s effort to create value for customers § When looking at prices, customers care about value to themselves, not what production costs the firm § Traditional cost accounting emphasizes expense categories, with arbitrary allocation of overheads § ABC management systems examine activities needed to create and deliver service (do they add value? ) § Must link resource expenses to: Ø variety of products produced Ø complexity of products Ø demands made by individual customers Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Activity-Based Costing: Relating Activities to the Resources They Consume § Managers need to see costs as an integral part of a firm’s effort to create value for customers § When looking at prices, customers care about value to themselves, not what production costs the firm § Traditional cost accounting emphasizes expense categories, with arbitrary allocation of overheads § ABC management systems examine activities needed to create and deliver service (do they add value? ) § Must link resource expenses to: Ø variety of products produced Ø complexity of products Ø demands made by individual customers Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

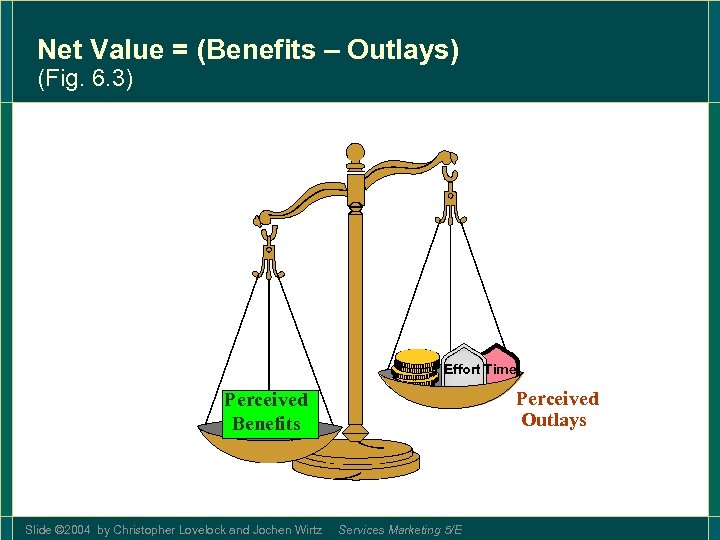

Net Value = (Benefits – Outlays) (Fig. 6. 3) Effort Time e Perceived Outlays Perceived Benefits Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Net Value = (Benefits – Outlays) (Fig. 6. 3) Effort Time e Perceived Outlays Perceived Benefits Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Enhancing Gross Value § Pricing Strategies to Reduce Uncertainty Ø service guarantees Ø benefit-driven (pricing that aspect of service that creates value) Ø flat rate (quoting a fixed price in advance) § Relationship Pricing Ø non-price incentives Ø discounts for volume purchases Ø discounts for purchasing multiple services § Low-cost Leadership Ø Convince customers not to equate price with quality Ø Must keep economic costs low to ensure profitability at low price Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Enhancing Gross Value § Pricing Strategies to Reduce Uncertainty Ø service guarantees Ø benefit-driven (pricing that aspect of service that creates value) Ø flat rate (quoting a fixed price in advance) § Relationship Pricing Ø non-price incentives Ø discounts for volume purchases Ø discounts for purchasing multiple services § Low-cost Leadership Ø Convince customers not to equate price with quality Ø Must keep economic costs low to ensure profitability at low price Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

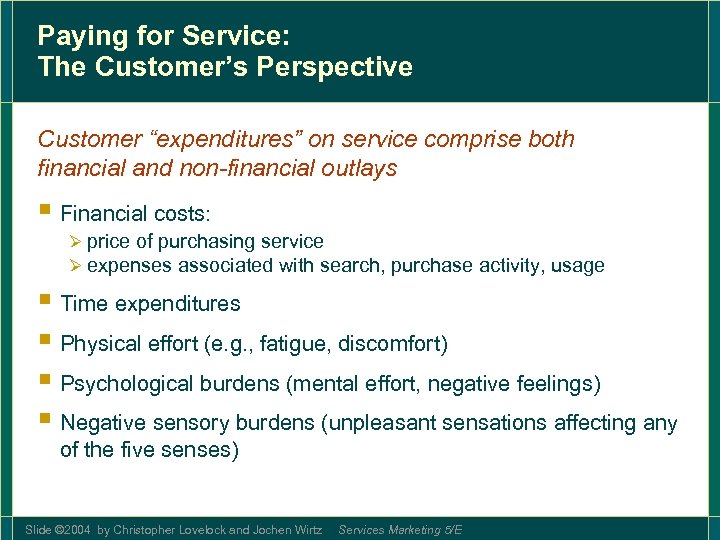

Paying for Service: The Customer’s Perspective Customer “expenditures” on service comprise both financial and non-financial outlays § Financial costs: Ø price of purchasing service Ø expenses associated with search, purchase activity, usage § Time expenditures § Physical effort (e. g. , fatigue, discomfort) § Psychological burdens (mental effort, negative feelings) § Negative sensory burdens (unpleasant sensations affecting any of the five senses) Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Paying for Service: The Customer’s Perspective Customer “expenditures” on service comprise both financial and non-financial outlays § Financial costs: Ø price of purchasing service Ø expenses associated with search, purchase activity, usage § Time expenditures § Physical effort (e. g. , fatigue, discomfort) § Psychological burdens (mental effort, negative feelings) § Negative sensory burdens (unpleasant sensations affecting any of the five senses) Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

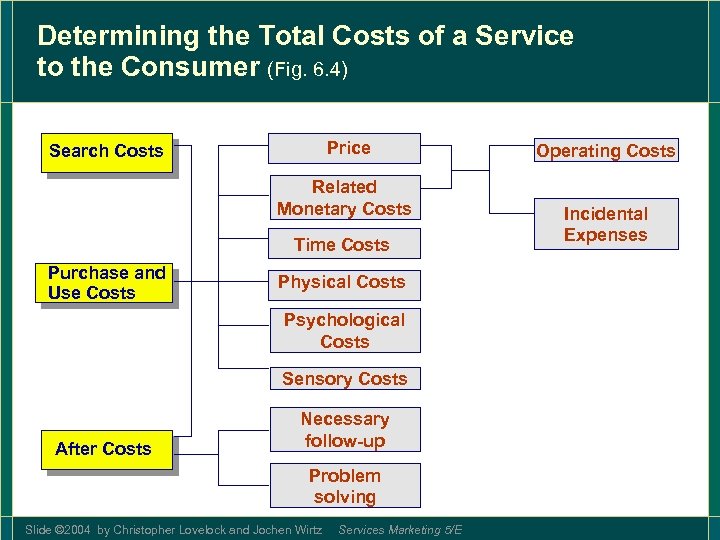

Determining the Total Costs of a Service to the Consumer (Fig. 6. 4) Price Search Costs Related Monetary Costs Time Costs Purchase and Use Costs Physical Costs Psychological Costs Sensory Costs After Costs Necessary follow-up Problem solving Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E Operating Costs Incidental Expenses

Determining the Total Costs of a Service to the Consumer (Fig. 6. 4) Price Search Costs Related Monetary Costs Time Costs Purchase and Use Costs Physical Costs Psychological Costs Sensory Costs After Costs Necessary follow-up Problem solving Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E Operating Costs Incidental Expenses

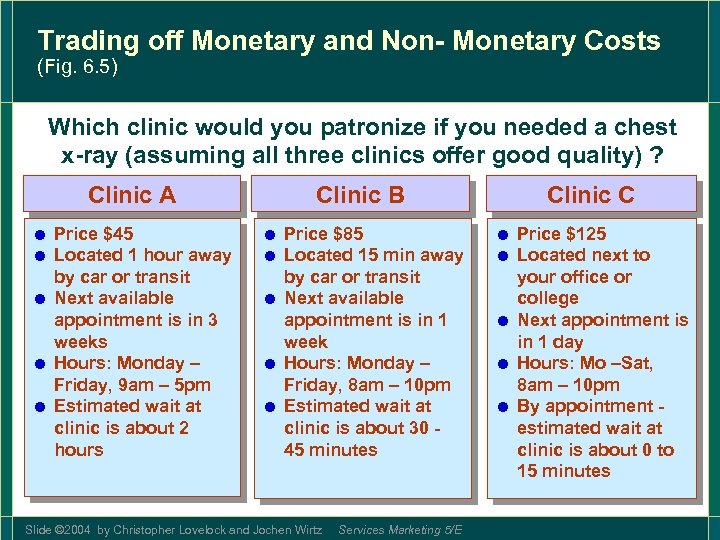

Trading off Monetary and Non- Monetary Costs (Fig. 6. 5) Which clinic would you patronize if you needed a chest x-ray (assuming all three clinics offer good quality) ? Clinic A Clinic B Clinic C = Price $45 = Located 1 hour away by car or transit = Next available appointment is in 3 weeks = Hours: Monday – Friday, 9 am – 5 pm = Estimated wait at clinic is about 2 hours = Price $85 = Located 15 min away by car or transit = Next available appointment is in 1 week = Hours: Monday – Friday, 8 am – 10 pm = Estimated wait at clinic is about 30 45 minutes = Price $125 = Located next to your office or college = Next appointment is in 1 day = Hours: Mo –Sat, 8 am – 10 pm = By appointment estimated wait at clinic is about 0 to 15 minutes Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Trading off Monetary and Non- Monetary Costs (Fig. 6. 5) Which clinic would you patronize if you needed a chest x-ray (assuming all three clinics offer good quality) ? Clinic A Clinic B Clinic C = Price $45 = Located 1 hour away by car or transit = Next available appointment is in 3 weeks = Hours: Monday – Friday, 9 am – 5 pm = Estimated wait at clinic is about 2 hours = Price $85 = Located 15 min away by car or transit = Next available appointment is in 1 week = Hours: Monday – Friday, 8 am – 10 pm = Estimated wait at clinic is about 30 45 minutes = Price $125 = Located next to your office or college = Next appointment is in 1 day = Hours: Mo –Sat, 8 am – 10 pm = By appointment estimated wait at clinic is about 0 to 15 minutes Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Increasing Net Value by Reducing Non-financial Costs of Service § Reduce time costs of service at each stage § Minimize unwanted psychological costs of service § Eliminate unwanted physical costs of service § Decrease unpleasant sensory costs of service Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Increasing Net Value by Reducing Non-financial Costs of Service § Reduce time costs of service at each stage § Minimize unwanted psychological costs of service § Eliminate unwanted physical costs of service § Decrease unpleasant sensory costs of service Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

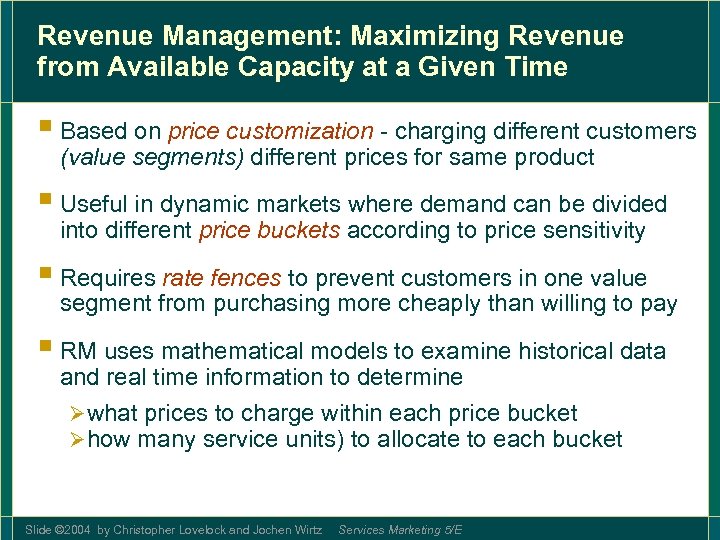

Revenue Management: Maximizing Revenue from Available Capacity at a Given Time § Based on price customization - charging different customers (value segments) different prices for same product § Useful in dynamic markets where demand can be divided into different price buckets according to price sensitivity § Requires rate fences to prevent customers in one value segment from purchasing more cheaply than willing to pay § RM uses mathematical models to examine historical data and real time information to determine Ø what prices to charge within each price bucket Ø how many service units) to allocate to each bucket Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Revenue Management: Maximizing Revenue from Available Capacity at a Given Time § Based on price customization - charging different customers (value segments) different prices for same product § Useful in dynamic markets where demand can be divided into different price buckets according to price sensitivity § Requires rate fences to prevent customers in one value segment from purchasing more cheaply than willing to pay § RM uses mathematical models to examine historical data and real time information to determine Ø what prices to charge within each price bucket Ø how many service units) to allocate to each bucket Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

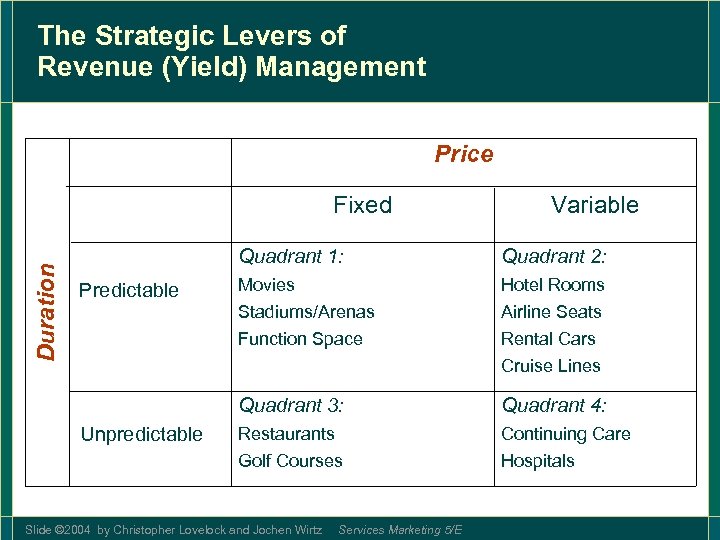

The Strategic Levers of Revenue (Yield) Management Price Fixed Variable Predictable Unpredictable Quadrant 2: Movies Stadiums/Arenas Function Space Hotel Rooms Airline Seats Rental Cars Cruise Lines Quadrant 3: Duration Quadrant 1: Quadrant 4: Restaurants Golf Courses Continuing Care Hospitals Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

The Strategic Levers of Revenue (Yield) Management Price Fixed Variable Predictable Unpredictable Quadrant 2: Movies Stadiums/Arenas Function Space Hotel Rooms Airline Seats Rental Cars Cruise Lines Quadrant 3: Duration Quadrant 1: Quadrant 4: Restaurants Golf Courses Continuing Care Hospitals Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

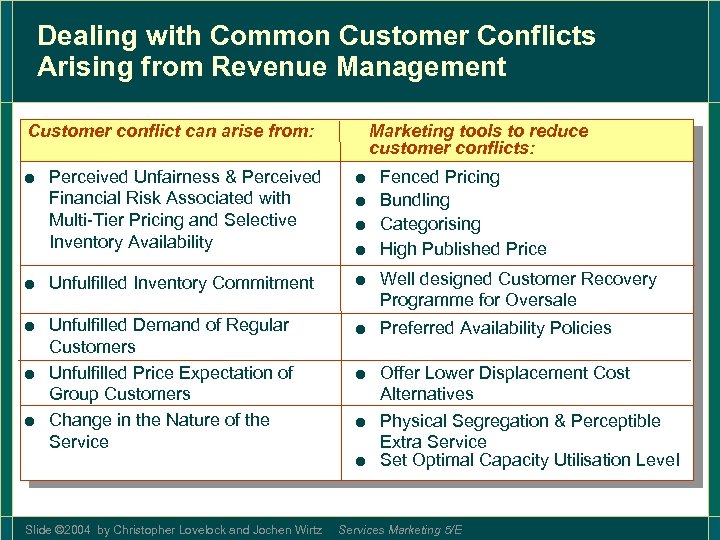

Dealing with Common Customer Conflicts Arising from Revenue Management Customer conflict can arise from: = Perceived Unfairness & Perceived Financial Risk Associated with Multi-Tier Pricing and Selective Inventory Availability Marketing tools to reduce customer conflicts: = = Fenced Pricing Bundling Categorising High Published Price = Unfulfilled Inventory Commitment = Well designed Customer Recovery = Unfulfilled Demand of Regular = Preferred Availability Policies Customers = Unfulfilled Price Expectation of Group Customers = Change in the Nature of the Service Slide © 2004 by Christopher Lovelock and Jochen Wirtz Programme for Oversale = Offer Lower Displacement Cost Alternatives = Physical Segregation & Perceptible Extra Service = Set Optimal Capacity Utilisation Level Services Marketing 5/E

Dealing with Common Customer Conflicts Arising from Revenue Management Customer conflict can arise from: = Perceived Unfairness & Perceived Financial Risk Associated with Multi-Tier Pricing and Selective Inventory Availability Marketing tools to reduce customer conflicts: = = Fenced Pricing Bundling Categorising High Published Price = Unfulfilled Inventory Commitment = Well designed Customer Recovery = Unfulfilled Demand of Regular = Preferred Availability Policies Customers = Unfulfilled Price Expectation of Group Customers = Change in the Nature of the Service Slide © 2004 by Christopher Lovelock and Jochen Wirtz Programme for Oversale = Offer Lower Displacement Cost Alternatives = Physical Segregation & Perceptible Extra Service = Set Optimal Capacity Utilisation Level Services Marketing 5/E

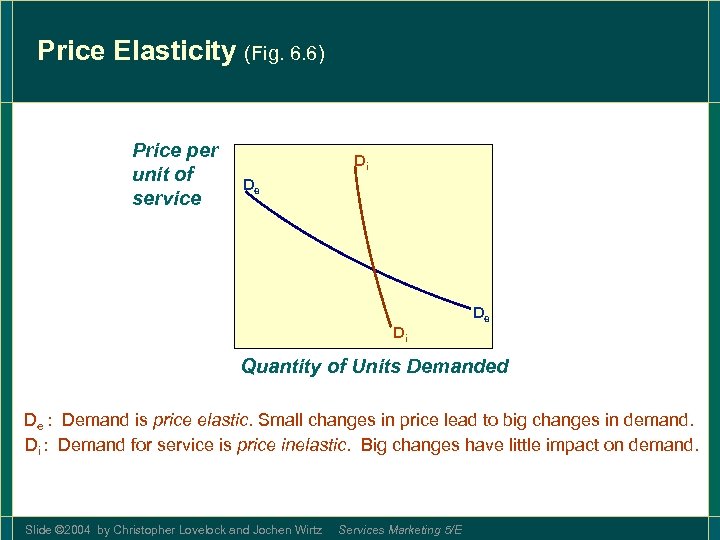

Price Elasticity (Fig. 6. 6) Price per unit of service Di De Quantity of Units Demanded De : Demand is price elastic. Small changes in price lead to big changes in demand. Di : Demand for service is price inelastic. Big changes have little impact on demand. Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Price Elasticity (Fig. 6. 6) Price per unit of service Di De Quantity of Units Demanded De : Demand is price elastic. Small changes in price lead to big changes in demand. Di : Demand for service is price inelastic. Big changes have little impact on demand. Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

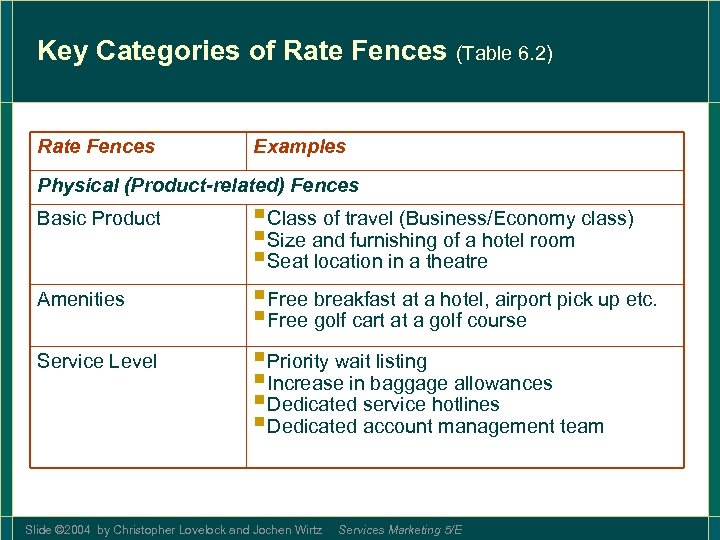

Key Categories of Rate Fences (Table 6. 2) Rate Fences Examples Physical (Product-related) Fences Basic Product Amenities Service Level §Class of travel (Business/Economy class) §Size and furnishing of a hotel room §Seat location in a theatre §Free breakfast at a hotel, airport pick up etc. §Free golf cart at a golf course §Priority wait listing §Increase in baggage allowances §Dedicated service hotlines §Dedicated account management team Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Key Categories of Rate Fences (Table 6. 2) Rate Fences Examples Physical (Product-related) Fences Basic Product Amenities Service Level §Class of travel (Business/Economy class) §Size and furnishing of a hotel room §Seat location in a theatre §Free breakfast at a hotel, airport pick up etc. §Free golf cart at a golf course §Priority wait listing §Increase in baggage allowances §Dedicated service hotlines §Dedicated account management team Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

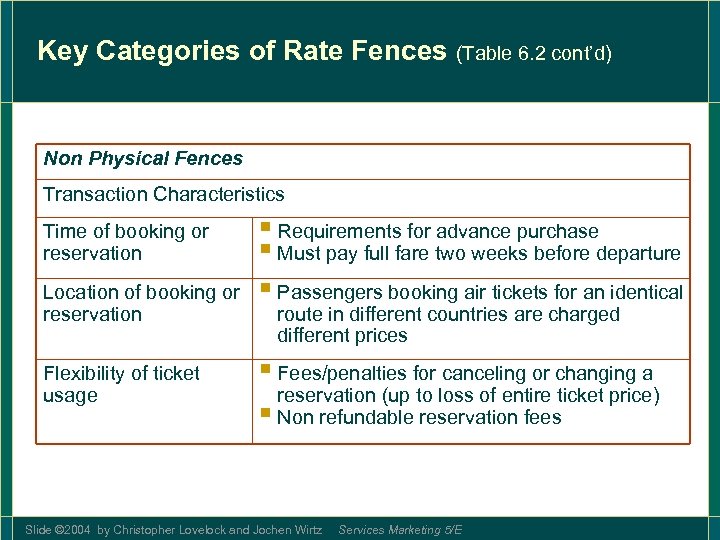

Key Categories of Rate Fences (Table 6. 2 cont’d) Non Physical Fences Transaction Characteristics Time of booking or reservation Location of booking or reservation Flexibility of ticket usage § Requirements for advance purchase § Must pay full fare two weeks before departure § Passengers booking air tickets for an identical route in different countries are charged different prices § Fees/penalties for canceling or changing a reservation (up to loss of entire ticket price) § Non refundable reservation fees Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Key Categories of Rate Fences (Table 6. 2 cont’d) Non Physical Fences Transaction Characteristics Time of booking or reservation Location of booking or reservation Flexibility of ticket usage § Requirements for advance purchase § Must pay full fare two weeks before departure § Passengers booking air tickets for an identical route in different countries are charged different prices § Fees/penalties for canceling or changing a reservation (up to loss of entire ticket price) § Non refundable reservation fees Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

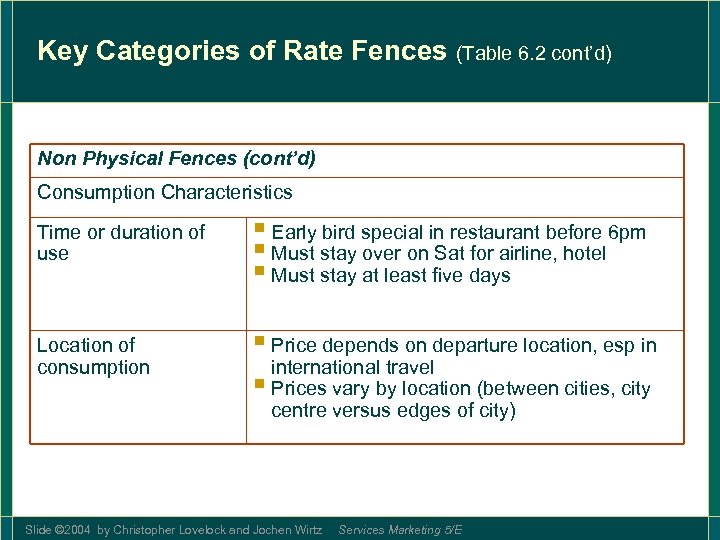

Key Categories of Rate Fences (Table 6. 2 cont’d) Non Physical Fences (cont’d) Consumption Characteristics Time or duration of use § Early bird special in restaurant before 6 pm § Must stay over on Sat for airline, hotel § Must stay at least five days Location of consumption § Price depends on departure location, esp in international travel § Prices vary by location (between cities, city centre versus edges of city) Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Key Categories of Rate Fences (Table 6. 2 cont’d) Non Physical Fences (cont’d) Consumption Characteristics Time or duration of use § Early bird special in restaurant before 6 pm § Must stay over on Sat for airline, hotel § Must stay at least five days Location of consumption § Price depends on departure location, esp in international travel § Prices vary by location (between cities, city centre versus edges of city) Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

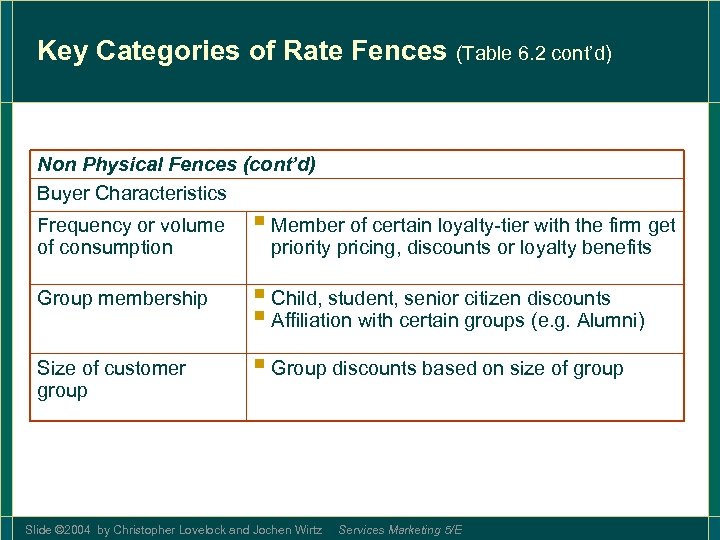

Key Categories of Rate Fences (Table 6. 2 cont’d) Non Physical Fences (cont’d) Buyer Characteristics Frequency or volume of consumption § Member of certain loyalty-tier with the firm get Group membership § Child, student, senior citizen discounts § Affiliation with certain groups (e. g. Alumni) Size of customer group § Group discounts based on size of group priority pricing, discounts or loyalty benefits Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Key Categories of Rate Fences (Table 6. 2 cont’d) Non Physical Fences (cont’d) Buyer Characteristics Frequency or volume of consumption § Member of certain loyalty-tier with the firm get Group membership § Child, student, senior citizen discounts § Affiliation with certain groups (e. g. Alumni) Size of customer group § Group discounts based on size of group priority pricing, discounts or loyalty benefits Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

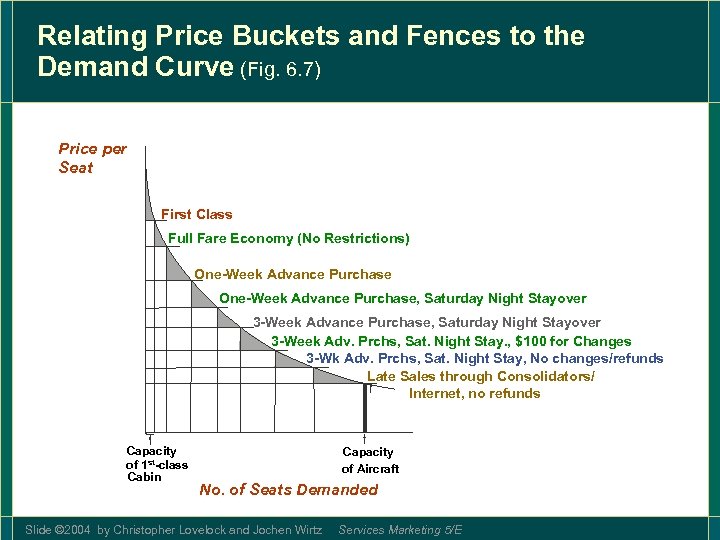

Relating Price Buckets and Fences to the Demand Curve (Fig. 6. 7) Price per Seat First Class Full Fare Economy (No Restrictions) One-Week Advance Purchase, Saturday Night Stayover 3 -Week Adv. Prchs, Sat. Night Stay. , $100 for Changes 3 -Wk Adv. Prchs, Sat. Night Stay, No changes/refunds Late Sales through Consolidators/ Internet, no refunds Capacity of 1 st-class Cabin Capacity of Aircraft No. of Seats Demanded Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Relating Price Buckets and Fences to the Demand Curve (Fig. 6. 7) Price per Seat First Class Full Fare Economy (No Restrictions) One-Week Advance Purchase, Saturday Night Stayover 3 -Week Adv. Prchs, Sat. Night Stay. , $100 for Changes 3 -Wk Adv. Prchs, Sat. Night Stay, No changes/refunds Late Sales through Consolidators/ Internet, no refunds Capacity of 1 st-class Cabin Capacity of Aircraft No. of Seats Demanded Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Ethical Concerns in Pricing § Customers are vulnerable when service is hard to evaluate or they don’t observe work § Many services have complex pricing schedules Ø hard to understand Ø difficult to calculate full costs in advance of service § Unfairness and misrepresentation in price promotions Ø misleading advertising Ø hidden charges § Too many rules and regulations Ø customers feel constrained, exploited Ø customers unfairly penalized when plans change Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Ethical Concerns in Pricing § Customers are vulnerable when service is hard to evaluate or they don’t observe work § Many services have complex pricing schedules Ø hard to understand Ø difficult to calculate full costs in advance of service § Unfairness and misrepresentation in price promotions Ø misleading advertising Ø hidden charges § Too many rules and regulations Ø customers feel constrained, exploited Ø customers unfairly penalized when plans change Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Pricing Issues: Putting Strategy into Practice (Table 6. 3) v How much to charge? v What basis for pricing? v Who should collect payment? v Where should payment be made? v When should payment be made? v How to communicate prices? Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Pricing Issues: Putting Strategy into Practice (Table 6. 3) v How much to charge? v What basis for pricing? v Who should collect payment? v Where should payment be made? v When should payment be made? v How to communicate prices? Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

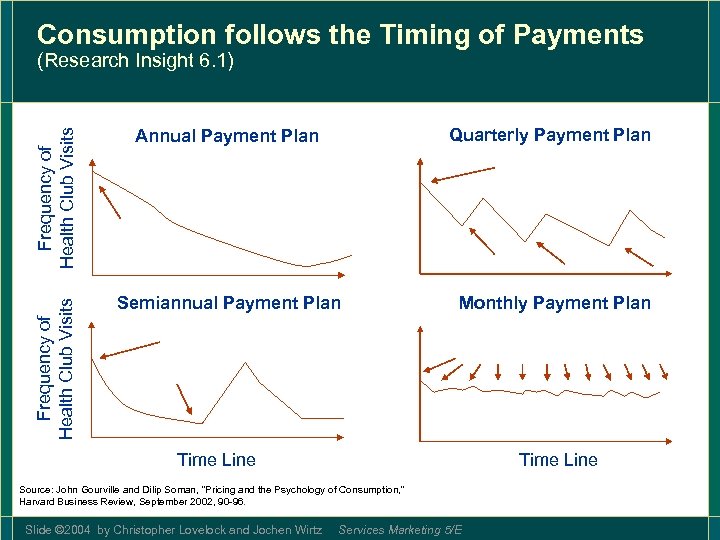

Consumption follows the Timing of Payments Frequency of Health Club Visits Annual Payment Plan Quarterly Payment Plan Frequency of Health Club Visits (Research Insight 6. 1) Semiannual Payment Plan Monthly Payment Plan Time Line Source: John Gourville and Dilip Soman, “Pricing and the Psychology of Consumption, ” Harvard Business Review, September 2002, 90 -96. Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E

Consumption follows the Timing of Payments Frequency of Health Club Visits Annual Payment Plan Quarterly Payment Plan Frequency of Health Club Visits (Research Insight 6. 1) Semiannual Payment Plan Monthly Payment Plan Time Line Source: John Gourville and Dilip Soman, “Pricing and the Psychology of Consumption, ” Harvard Business Review, September 2002, 90 -96. Slide © 2004 by Christopher Lovelock and Jochen Wirtz Services Marketing 5/E