f5af5ba76fadb675737d7eb7a174608a.ppt

- Количество слайдов: 42

Chapter 9 Housing

Chapter 9 Housing

I. Homeownership

I. Homeownership

A. Homeownership Statistics p In 1940, after the Great Depression, 43. 6% of American households owned their own homes p Today, homeownership in the U. S. is close to 67% of all households p Homeownership rates vary by community n n Midwest – 71. 7% West – 63%

A. Homeownership Statistics p In 1940, after the Great Depression, 43. 6% of American households owned their own homes p Today, homeownership in the U. S. is close to 67% of all households p Homeownership rates vary by community n n Midwest – 71. 7% West – 63%

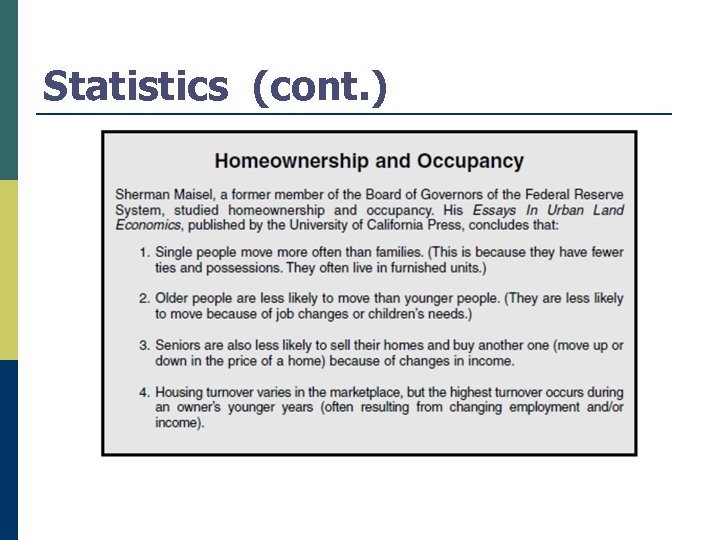

Statistics (cont. )

Statistics (cont. )

Statistics (cont. ) p In 2008, ownership broke down as follows: n n n n Married couples : 83. 8% Single male head of household: 50. 1% Single female head of household : 54. 1% One person household (male) : 55. 2% African American households : 47. 1% Hispanic households : 48. 9% Non-Hispanic, White households : 75% Asians / others ; 58. 6% p Age bears a direct relationship to homeownership p Single person households are on the rise and are expected to grow faster than all other households

Statistics (cont. ) p In 2008, ownership broke down as follows: n n n n Married couples : 83. 8% Single male head of household: 50. 1% Single female head of household : 54. 1% One person household (male) : 55. 2% African American households : 47. 1% Hispanic households : 48. 9% Non-Hispanic, White households : 75% Asians / others ; 58. 6% p Age bears a direct relationship to homeownership p Single person households are on the rise and are expected to grow faster than all other households

Statistics (cont. ) p Homeownership rates are likely to fall to 64% by 2015 from a high of 69% at its peak in 2004 p Higher income people are more likely to change their housing than lower income people p HOUSING TURNOVER is the number of times the inventory of housing is sold within a year

Statistics (cont. ) p Homeownership rates are likely to fall to 64% by 2015 from a high of 69% at its peak in 2004 p Higher income people are more likely to change their housing than lower income people p HOUSING TURNOVER is the number of times the inventory of housing is sold within a year

B. Benefits of Homeownership p Confidence p Stability p Wealth p Children

B. Benefits of Homeownership p Confidence p Stability p Wealth p Children

II. The Housing Marketplace

II. The Housing Marketplace

Housing Marketplace p The sale of a house in NOT usually an isolated event, it is normally part of a chain of real estate transactions p Housing prices vary greatly across the country

Housing Marketplace p The sale of a house in NOT usually an isolated event, it is normally part of a chain of real estate transactions p Housing prices vary greatly across the country

A. Local Economic Conditions Affect Demand p The housing market is a segmented market p The market can be strong in one price range and weak in another p The time it takes to sell property is related directly to the relationship between the list price and the market value p The economy drives the market p High area housing costs cause business and schools to offer incentives to lure employees and teachers who can’t afford to normally live there

A. Local Economic Conditions Affect Demand p The housing market is a segmented market p The market can be strong in one price range and weak in another p The time it takes to sell property is related directly to the relationship between the list price and the market value p The economy drives the market p High area housing costs cause business and schools to offer incentives to lure employees and teachers who can’t afford to normally live there

B. Filtering Down in Action p The housing FILTERING DOWN process is much like hand-me-down clothing, which passes to younger family members

B. Filtering Down in Action p The housing FILTERING DOWN process is much like hand-me-down clothing, which passes to younger family members

C. Housing Demolitions p Income housing has fixed costs, such as taxes, and variable costs of operation, which include utilities, maintenance, etc p If a property’s income cannot at least cover the Average Variable Costs, the property should be left not rented p When the rent exceeds the Average Variable Costs, the building is better off rented than vacant p If the Average Fixed Costs can be reduced by demolition, then the building should be demolished p More buildings are torn down than wear out

C. Housing Demolitions p Income housing has fixed costs, such as taxes, and variable costs of operation, which include utilities, maintenance, etc p If a property’s income cannot at least cover the Average Variable Costs, the property should be left not rented p When the rent exceeds the Average Variable Costs, the building is better off rented than vacant p If the Average Fixed Costs can be reduced by demolition, then the building should be demolished p More buildings are torn down than wear out

III. The Rental Marketplace

III. The Rental Marketplace

Rental Marketplace Renters are generally more informed about the current market than home buyers The rental market is only concerned with vacant units When single-family homes are rented, it is generally because the owner could NOT find a buyer

Rental Marketplace Renters are generally more informed about the current market than home buyers The rental market is only concerned with vacant units When single-family homes are rented, it is generally because the owner could NOT find a buyer

A. Rental Needs The CRITICAL RENT LEVEL is that level at which no new rental housing will be built When interest rates drop, the critical rent level drops and construction of new units picks up In some areas, conversion to cooperatives and condominiums has significant reduced the rental supply, resulting in higher rents

A. Rental Needs The CRITICAL RENT LEVEL is that level at which no new rental housing will be built When interest rates drop, the critical rent level drops and construction of new units picks up In some areas, conversion to cooperatives and condominiums has significant reduced the rental supply, resulting in higher rents

B. Competition in the Rental Market Landlords compete by offering tenants more amenities Renters are demanding more and more amenities, for example, being wired for high speed internet

B. Competition in the Rental Market Landlords compete by offering tenants more amenities Renters are demanding more and more amenities, for example, being wired for high speed internet

C. What Vacancy Rates Mean p Many vacancies are NOT really available for rental p The Department of Housing and Urban Development (HUD) believes that a city vacancy rate of 5% or less indicates a housing crisis in that city p Vacancy rates are customarily obtained from postal authorities and utility companies p When there is a low vacancy rate for an area, conversion of apartments to condominiums generally means a substantial number of the units will be sold to current tenants

C. What Vacancy Rates Mean p Many vacancies are NOT really available for rental p The Department of Housing and Urban Development (HUD) believes that a city vacancy rate of 5% or less indicates a housing crisis in that city p Vacancy rates are customarily obtained from postal authorities and utility companies p When there is a low vacancy rate for an area, conversion of apartments to condominiums generally means a substantial number of the units will be sold to current tenants

D. Family Rentals p Despite court decisions prohibiting rental discrimination against children, discrimination still exists p Families with children are the most discriminated against according to the California Association of Tenants p The effect of rental discrimination against children is to encourage families to purchase instead of rent

D. Family Rentals p Despite court decisions prohibiting rental discrimination against children, discrimination still exists p Families with children are the most discriminated against according to the California Association of Tenants p The effect of rental discrimination against children is to encourage families to purchase instead of rent

E. Present Rental Market When interest rates are low and down payments are low, more renters will consider buying a home The EFFECTIVE RENT is the rent actually collected Most landlords keep their properties well maintained, except where rent-control is in effect and where units are to be demolished

E. Present Rental Market When interest rates are low and down payments are low, more renters will consider buying a home The EFFECTIVE RENT is the rent actually collected Most landlords keep their properties well maintained, except where rent-control is in effect and where units are to be demolished

IV. Special Housing Markets

IV. Special Housing Markets

A. Central City Market p GENTRIFICATION is the process where inner-city and working class neighborhoods are converted to housing for upwardly mobile young people who want the social benefits of living in the central city

A. Central City Market p GENTRIFICATION is the process where inner-city and working class neighborhoods are converted to housing for upwardly mobile young people who want the social benefits of living in the central city

B. Unique Real Estate Marketplace p Communities with unique real estate marketplaces, like Las Vegas, are becoming popular p When a community has special benefits, e. g. no income tax, it will attract more permanent residents

B. Unique Real Estate Marketplace p Communities with unique real estate marketplaces, like Las Vegas, are becoming popular p When a community has special benefits, e. g. no income tax, it will attract more permanent residents

C. For Sale by Owner Market p According to the National Association of Realtors® 14% of sellers sell without an agent p The median selling price of homes sold without an agent was reported to be 15. 4% less than the median price with a agent

C. For Sale by Owner Market p According to the National Association of Realtors® 14% of sellers sell without an agent p The median selling price of homes sold without an agent was reported to be 15. 4% less than the median price with a agent

D. Illegal Alien Housing Market Illegal aliens are believed to constitute over five percent of California’s population Many property owners take advantage of illegal aliens, providing minimum maintenance and repairs and charging high rents Many developers and real estate agents actively seek illegal aliens as buyers Competition for home loans has encouraged banks to make loans to illegal aliens

D. Illegal Alien Housing Market Illegal aliens are believed to constitute over five percent of California’s population Many property owners take advantage of illegal aliens, providing minimum maintenance and repairs and charging high rents Many developers and real estate agents actively seek illegal aliens as buyers Competition for home loans has encouraged banks to make loans to illegal aliens

E. The Auction Marketplace Real estate auctions have been common marketing tools for many years in England, Ireland, and Australia and are now becoming popular in the United States Foreclosures are frequently auctioned off

E. The Auction Marketplace Real estate auctions have been common marketing tools for many years in England, Ireland, and Australia and are now becoming popular in the United States Foreclosures are frequently auctioned off

F. Minorities in the Marketplace Today, the reason for separate markets is due more to economic reasons than racial prejudice There is still some racial prejudice, despite legislation making it illegal Discrimination in renting tends to be more common than sale’s discrimination

F. Minorities in the Marketplace Today, the reason for separate markets is due more to economic reasons than racial prejudice There is still some racial prejudice, despite legislation making it illegal Discrimination in renting tends to be more common than sale’s discrimination

G. Foreign Buyers in the Marketplace We have seen foreign buying tours of the U. S. since the 1970’s American is considered the safest have for investment The percent of sales to other nations is as follows: Canada U. K. Mexico India China 17. 6% 10. 5% 9. 8% 8. 5% 5. 4%

G. Foreign Buyers in the Marketplace We have seen foreign buying tours of the U. S. since the 1970’s American is considered the safest have for investment The percent of sales to other nations is as follows: Canada U. K. Mexico India China 17. 6% 10. 5% 9. 8% 8. 5% 5. 4%

H. Residential Lot Market Builders accumulate lots in periods of building activity and when they believe there will be a significant activity in the near future Private homeowners may buy a lot to build their home on long before they intend to build Some lenders are reluctant to fund lot purchases, so many sellers will carry the loans

H. Residential Lot Market Builders accumulate lots in periods of building activity and when they believe there will be a significant activity in the near future Private homeowners may buy a lot to build their home on long before they intend to build Some lenders are reluctant to fund lot purchases, so many sellers will carry the loans

I. Fixer-Upper Marketplace Generally, homebuyers want a home ready to be lived in FIXER-UPPERS are homes or condos in rundown condition or with physical problems than can be purchased at a reduced price SWEAT EQUITY is the actual, physical work owners do to their house in order to increase its value

I. Fixer-Upper Marketplace Generally, homebuyers want a home ready to be lived in FIXER-UPPERS are homes or condos in rundown condition or with physical problems than can be purchased at a reduced price SWEAT EQUITY is the actual, physical work owners do to their house in order to increase its value

J. Condominium Marketplace CONDOMINIUMS are vertical subdivisions in which the interior space of units is individually owned and the land other common areas are owned in common with other dwellers Higher prices for single family homes leads many to consider condominium ownership a bargain During the late 1970’s, many apartments were converted to condominiums because they sold for more than the multi-unit rental properties

J. Condominium Marketplace CONDOMINIUMS are vertical subdivisions in which the interior space of units is individually owned and the land other common areas are owned in common with other dwellers Higher prices for single family homes leads many to consider condominium ownership a bargain During the late 1970’s, many apartments were converted to condominiums because they sold for more than the multi-unit rental properties

V. Facts About Home Buying

V. Facts About Home Buying

A. Two-Income Families Two-income families have become the norm Many families have opted to spend a large portion of a second income toward better housing Two jobs provide greater protection against job loss and income loss

A. Two-Income Families Two-income families have become the norm Many families have opted to spend a large portion of a second income toward better housing Two jobs provide greater protection against job loss and income loss

B. First-Time Homebuyers Low prices plus a tax credit and low interest equals opportunity for first-time homebuyers First-time buyers are more likely to purchase housing units with two or fewer bedrooms than are repeat buyers

B. First-Time Homebuyers Low prices plus a tax credit and low interest equals opportunity for first-time homebuyers First-time buyers are more likely to purchase housing units with two or fewer bedrooms than are repeat buyers

C. Low Down Home Purchases Lenders were once using all kinds of creative financing such as: ◦ ◦ ◦ 40 -Year Loan 80 -20 Loans Adjustable Rate Loans 5 -25 Loans Interest Only Loans Option-Adjustable Rate Mortgage After the latest recession and foreclosure debacle, lenders are now avoiding all of the above except the extended term loan

C. Low Down Home Purchases Lenders were once using all kinds of creative financing such as: ◦ ◦ ◦ 40 -Year Loan 80 -20 Loans Adjustable Rate Loans 5 -25 Loans Interest Only Loans Option-Adjustable Rate Mortgage After the latest recession and foreclosure debacle, lenders are now avoiding all of the above except the extended term loan

D. Housing Costs vs. Income An old rule of thumb is a person should NOT pay more than 2 ½ times his or her annual income for a home Another rule is housing costs should NOT exceed 30% of gross income In recent times, many families were paying as much as 50% or more of their income to live in desirable areas

D. Housing Costs vs. Income An old rule of thumb is a person should NOT pay more than 2 ½ times his or her annual income for a home Another rule is housing costs should NOT exceed 30% of gross income In recent times, many families were paying as much as 50% or more of their income to live in desirable areas

D. Housing Costs vs. Income (cont. ) p In general, white-collar workers have higher housing priorities than blue-collar workers of similar homes p SCHWABE’S LAW states that lower income people pay a higher percentage of their income for housing than higher income people p AFFORDABILITY INDEX is based on the median price of homes in a area as well as the median income

D. Housing Costs vs. Income (cont. ) p In general, white-collar workers have higher housing priorities than blue-collar workers of similar homes p SCHWABE’S LAW states that lower income people pay a higher percentage of their income for housing than higher income people p AFFORDABILITY INDEX is based on the median price of homes in a area as well as the median income

E. Down Payment Requirements In a period of rapid real estate inflation, lenders feel safe in making high loan-to-value (LTV) ratio home loans When real estate prices fall, subdivisions where buyers had low down payments will suffer abandonments and foreclosures Larger down payment requirements particularly affect first time home buyers

E. Down Payment Requirements In a period of rapid real estate inflation, lenders feel safe in making high loan-to-value (LTV) ratio home loans When real estate prices fall, subdivisions where buyers had low down payments will suffer abandonments and foreclosures Larger down payment requirements particularly affect first time home buyers

F. Size of Homes In a market that accommodates both small, moderately priced home AND large, expensive homes, builders who are economically motivated will build the more expensive, larger homes More expensive homes offer greater profit, but can also offer higher risk STRIPPED-DOWN HOMES are homes with a few amenities The median size of new homes is approximately 2, 438 square feet

F. Size of Homes In a market that accommodates both small, moderately priced home AND large, expensive homes, builders who are economically motivated will build the more expensive, larger homes More expensive homes offer greater profit, but can also offer higher risk STRIPPED-DOWN HOMES are homes with a few amenities The median size of new homes is approximately 2, 438 square feet

G. Lot Size 90% of consumers prefer single-family, detached homes Builders have been reducing lot sizes in many areas of the country ZERO BUILDING SETBACK means a building is built on the property line Z-SHAPED LOTS resemble a “Z shape” compared to normal, rectangle-shaped lot

G. Lot Size 90% of consumers prefer single-family, detached homes Builders have been reducing lot sizes in many areas of the country ZERO BUILDING SETBACK means a building is built on the property line Z-SHAPED LOTS resemble a “Z shape” compared to normal, rectangle-shaped lot

VI. New Home Speculation

VI. New Home Speculation

New Home Speculation p Whenever buying and selling any commodity offers profit potential, you will find speculators p When speculators purchase new homes, they also create a hidden supply of housing p This can hurt developers when the hidden supply is placed on the market p In 2004, the FDIC indentified 55 metropolitan areas where price increases had reached “boom” proportions because of what they perceive to be speculator purchases

New Home Speculation p Whenever buying and selling any commodity offers profit potential, you will find speculators p When speculators purchase new homes, they also create a hidden supply of housing p This can hurt developers when the hidden supply is placed on the market p In 2004, the FDIC indentified 55 metropolitan areas where price increases had reached “boom” proportions because of what they perceive to be speculator purchases

Chapter Summary ◦ ◦ ◦ ◦ ◦ Homeownership Statistics ◦ Benefits of Homeownership The Housing Marketplace ◦ Local Economic Conditions Affect Demand ◦ Filtering Down in Action ◦ Housing Demolitions The Rental Marketplace ◦ ◦ ◦ Rental Needs Competition in the Rental Market Vacancy Rate Family Rentals Present Rental Market Special Housing Markets Central City Unique Real Estate For Sale By Owners Illegal Alien Housing Auctions Minority Housing Foreign influence Residential Lots Fixer-Uppers Condos Facts About Home Buying ◦ ◦ ◦ ◦ Two-Income Families First-Time Homebuyers Low Down Home Purchases Housing Costs vs. Income Down Payment Requirements Size of Homes Lot Size

Chapter Summary ◦ ◦ ◦ ◦ ◦ Homeownership Statistics ◦ Benefits of Homeownership The Housing Marketplace ◦ Local Economic Conditions Affect Demand ◦ Filtering Down in Action ◦ Housing Demolitions The Rental Marketplace ◦ ◦ ◦ Rental Needs Competition in the Rental Market Vacancy Rate Family Rentals Present Rental Market Special Housing Markets Central City Unique Real Estate For Sale By Owners Illegal Alien Housing Auctions Minority Housing Foreign influence Residential Lots Fixer-Uppers Condos Facts About Home Buying ◦ ◦ ◦ ◦ Two-Income Families First-Time Homebuyers Low Down Home Purchases Housing Costs vs. Income Down Payment Requirements Size of Homes Lot Size